This chapter provides an overview of the regulations on investors’ entry and operation in Egypt. It argues that, despite remarkable liberalisation reforms, structural transformation in Egypt has occurred at a slow pace. The creation of a more competition-friendly environment would allow for a better allocation of resources towards higher-productivity firms and would enable new entrants and incumbents to bring in new ideas and innovate. The chapter then examines the restrictions on cross-border investment and finds that restrictions on the entry and operation of foreign-controlled firms, while not particularly extensive in Egypt, place an additional toll on the development of a thriving business sector. Not only might they discourage foreign investment inflows in the first place, they may also hold back potential economy-wide productivity gains associated with FDI.

OECD Investment Policy Reviews: Egypt 2020

Chapter 2. Regulatory overview of investors’ entry and operations

Abstract

Summary and policy recommendations

A coherent investment policy is embedded in a regulatory framework that facilitates market entry, promotes fair competition and encourages international trade, including in services. The government of Egypt undertook impressive liberalisation in the past decades, but, despite these reforms, structural transformation of the economy has been limited, impeding a sustained increase in labour productivity. The wider business climate continues to face several regulatory hurdles that limit private sector firms’ entry and growth. Beyond complex (albeit improving) regulatory procedures, a pervasive state presence in the economy and regulatory protection of incumbent firms are more common in Egypt than in OECD and many emerging countries.

The creation of a more competition-friendly environment in Egypt would foster market dynamics and allow for a better allocation of resources towards higher-productivity firms. It would enable new entrants and incumbents to bring in new ideas and innovate and would encourage less productive firms to restructure or exit the market. The current reform project to strengthen the independence of the Egyptian Competition Authority (ECA) and increase its transparency and capacity is a positive development.

The government has recently implemented further reforms to pursue investment liberalisation. The 2017 Investment Law does not discriminate between foreign and domestic investors. Restrictions on the entry and operation of foreign-controlled firms are nonetheless present in sector-specific legislation. These restrictions, while not particularly extensive, place an additional toll on the development of a thriving business sector, not only by potentially discouraging foreign investment inflows in the first place, but also by holding back potential economy-wide productivity gains associated with FDI. Like most countries, Egypt has largely opened manufacturing industries to foreign investors, but a few backbone services are still partly off-limits to foreign investors.

The implications may go beyond forgone investments. By hindering contestability and competition in these sectors, restrictions may possibly contribute to raising services input costs, such as logistics, finance or real estate, for other economic sectors or thwart potential quality improvements. Access to world-class services inputs, including through FDI in these sectors, has been shown to be crucial for moving manufacturing up the value chain and boosting growth and jobs in the services sector (OECD, 2019, De Backer et al., 2013). In catching-up countries, lower productivity firms can achieve large productivity gains if they benefit from the expertise of foreign investors, if regulations do not impede the necessary restructuring (Kalemli-Ozcan et al., 2014).

Policy recommendations

Egypt could consider pursuing pro-competition reforms to further level the playing field between new entrants and incumbents firms, particularly SOEs, to allow for a better allocation of resources towards higher-productivity firms. Reforms include reassessing antitrust exemptions to incumbent firms, notably in commercial sectors and competitive markets against their policy objectives and, when relevant, removing them.

Egypt could benefit from adopting more transparent and less discretionary regulations on firms’ market entry, particularly in network sectors. Such policies would reduce the impact of undesirable practices, such as corruption and cronyism, on foreign and domestic investment prospects.

Egypt could consider reassessing existing restrictions to foreign investment, notably in services sectors, against their public policy objectives and, where relevant, streamline or remove them. Where such policies are deemed necessary, ensure that they are not more restrictive than needed to address identified risks and concerns.

Structural transformation has been slow, despite liberalisation

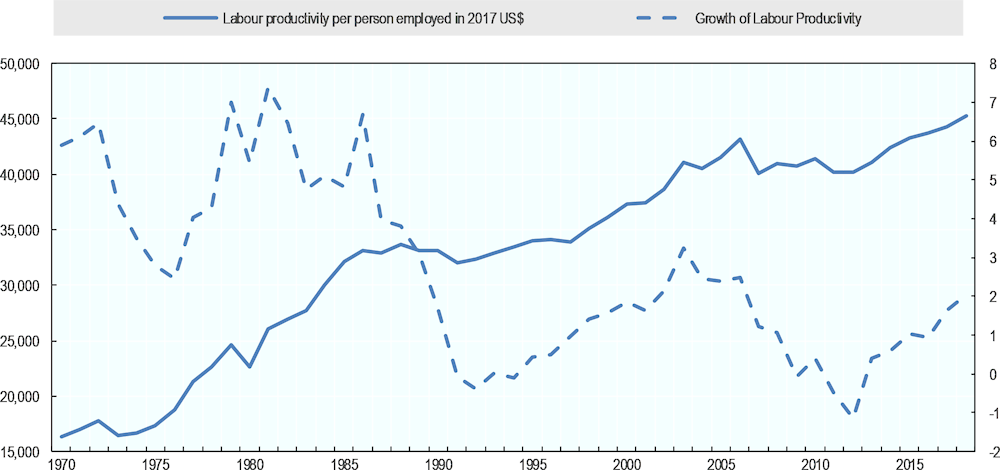

The history of the Egyptian economy encompasses different eras where the public and private sectors came to play each more or less central roles in the economy. Opening up to private sector investments began in the 1970s, a reform period referred to as Infitah (i.e. openness in Arabic). The radical shift in government policy contributed to strong, albeit volatile, economic performance: labour productivity doubled between the early 1970 and late 1980s (Figure 2.1). Since then, Egypt has been facing severe structural challenges impeding a sustained increase in labour productivity. The public sector continues to dominate the economy and productivity gains in the past profited only a small, often politically connected, set of businesses (Diwan et al., 2015). The global financial crisis in 2008 and the post-2011 regional events aggravated these structural challenges. The level of labour productivity only recovered its pre-crisis peak of 2006 a decade later.

Figure 2.1. Evolution of labour productivity in Egypt since the Infitah era

Note: The growth of labour productivity represents a five-years moving average.

Source: OECD calculations based on data from The Conference Board Total Economy database.

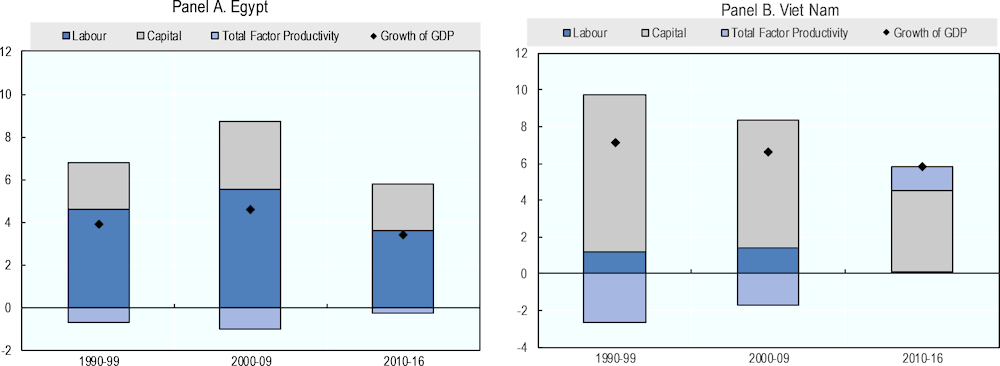

The productivity portrait depicted for Egypt becomes bleaker when examining total factor productivity (TFP) growth; corresponding to the residual of GDP growth that cannot be explained by pure production factor accumulation (labour and capital) and can thus be interpreted as firms' improvement in how these factors are combined to produce output. TFP growth in Egypt was, on average, negative throughout 1990-2016 (Figure 2.2, Panel A). The negative TFP trend suggests that structural transformation of the Egyptian economy has been occurring at a very slow pace. This is partly driven by the only slight adjustment over the last decades in the respective contributions of capital and labour to GDP growth. Other emerging countries that undertook similar market-based liberalisation reforms, such as Viet Nam in the 1980s (i.e. Doi Moi), were more successful in combining capital and labour to increase TFP, although the effects of reforms were only perceived after years (OECD, 2018).

Figure 2.2. GDP growth decomposition in Egypt and Viet Nam

Note: For methodological details, see: https://www.conference-board.org/data/economydatabase/

Source: OECD calculations based on data from The Conference Board Total Economy database.

Pro-competition regulatory reforms encourage investors’ entry and growth

Bolstering productivity growth sustainably in Egypt requires promoting fairer competition through countrywide and sector-specific regulatory reforms. A competition-friendly environment would help address the misallocation of resources within the Egyptian economy, both between low and higher productivity activities and between firms in the same sector. Regulatory reforms that encourage firm entry and development would enable new entrants and incumbents to bring in new ideas, innovate and raise productivity and living standards by increasing investment and employment (Alesina et al. 2005; Égert, 2016 and 2018). The reduction in regulatory barriers to market entry can also generate higher income gains for households at the lower end of the distribution compared with the average household, potentially narrowing income inequality (Causa et al., 2015).

Despite significant reforms over the last decade, the business climate in Egypt continues to face several regulatory hurdles that limit private sector firms’ entry and growth. The OECD Indicators of Product Market Regulation (PMR) benchmark countrywide regulations for more than 60 countries.1 According to Youssef et al. (2019), preliminary information for Egypt, collected in 2016 and based on the 2013 methodology2, show that unnecessary restraints to competition caused by the presence of the state in the economy and by excessive regulatory protection of incumbent firms, and complex regulatory procedures are strong impediments to private sector development.3 These regulatory impediments are considerably more important in Egypt than in OECD and other emerging countries, reducing potential cross-border investment (Fournier, 2015).

In Egypt, as in several other developing countries, state-owned enterprises (SOEs) dominate some markets and high levels of state control persist through regulations that protect current market structures (Ianchovichina and Mottaghi, 2013). State control over the economy in Egypt is characterised by the wide scope of public ownership in a variety of markets. Egyptian SOEs are concentrated in utilities sectors such as electricity, gas, transport and telecoms, as well as in the textile or extracting industries.4 According to Youssef et al. (2019), the Egyptian government holds higher stakes in its companies than does the average emerging economy.

The governance of SOEs in Egypt could be further improved. Beyond the scope and extent of public ownership, Egyptian SOEs are insulated largely from market discipline and the regulatory privileges they receive are relatively more important than observed elsewhere. Such insulation from market rules may be more severe in the case of SOEs in the utilities and network sectors as they have their own separate laws while a large proportion of commercial SOEs fall under the Law of Public Sector Company and are subject to the Companies Law (World Bank, 2014a).5 The governance framework of Egyptian SOEs can reduce their effectiveness and limit their incentives to upgrade their production and innovate. SOEs’ capacity to supply goods and services at competitive prices can have an adverse impact on private sector establishments, particularly SMEs, as it affects production costs over the entire supply chain (Chapter 3 provides further evidence on SOEs in Egypt).

The complexity of regulatory procedures in Egypt to obtain licences and permits and the existence of regulations protecting incumbents are other important barriers to investors’ entry and growth.6 The 2017 Investment Law and the enlargement of one-stop-shop services through the establishment of the Investment Services Centres (ISC) should help simplifying regulatory procedures (Chapter 4 provides further information on ISCs). There are no indications of recent or upcoming reforms aiming at narrowing the protection of incumbent firms, and more particularly reducing the numerous antitrust exemptions for public enterprises. Publicly controlled firms in Egypt are subject to an exclusion or exemption, either complete or partial, from the application of the general competition law. While this might justified for some sectors, such exemptions are a problem when SOEs activities are commercial in nature and in competitive markets. They distort the competitive neutrality between state-owned and private businesses.

More transparent and less discretionary regulations on firms’ market entry in Egypt would reduce the impact of undesirable practices, such as corruption and cronyism, on investment prospects. Evidence for Egypt, Lebanon, Tunisia or Indonesia has shown that crony behaviour by firms with special regulatory advantages lowers aggregate productivity, employment and innovation (Diwan and JI Haidar, 2016; Francis et al., 2018; Rijkers et al., 2014; Kochanova et al. 2018, World Bank, 2014b). Crony firms use and maintain their entrenched privileges thanks to preferential treatment or antitrust exemptions in network sectors. Their ties to the state, for instance through the presence of government individuals on the board of the companies, make them more likely to benefit from trade protection, energy subsidies, access to scarce land, or regulatory enforcement (Diwan et al., 2015). They can also hinder the entry of competitors by initiating de facto restrictions on the delivery of investment licences for domestic or foreign firms (World Bank, 2013; Chekir and Diwan, 2014). In Tunisia, connected firms were more likely to evade customs tariffs although this was reduced after 2011 (Rijkers, et al. 2014).

OECD indicators suggest that barriers to investment in Egypt are less an impediment to private sector development than are trade barriers, state control of businesses and regulatory protection of incumbents. Thanks to the successive waves of investment liberalisation reforms in previous decades, the entry and operations of foreign investors in Egypt are subject to less restrictive regulations than in other developing economies (see next section for a full analysis). Regulatory barriers affecting the flows of goods and services are relatively more important in Egypt than in other emerging countries, particularly those related to trade facilitation (e.g. the recognition of foreign regulations and the use of international standards). The requirements and procedures to obtain customs licences often represent an important challenge for companies, even more as several public entities are responsible for delivering those documents.

Pro-competition policy changes in Egypt may help unlock the expected impact of earlier liberalisation reforms on cross-border investment. The stringent laws regulating the access of new firms to markets and the expansion of their activities negatively affects the entry and retention of foreign investors despite moderate restrictions on cross-border investment. Even if moderate, FDI restrictions may still exacerbate the negative effect of market entry restrictions in network sectors on investment (Égert, 2016). In that context, investment liberalisation may not bear fruit, as some activities remain insulated from fair competition because of incumbents’ privileges. The current reform project aiming to strengthen the independence of the Egyptian Competition Authority and increase its transparency and capacity is a positive development.

Restrictions on inward cross-border investment are not extensive…

Egypt is an adherent to the OECD Declaration on International Investment and Multinational Enterprises. As such, it voluntarily commits to accord national treatment – i.e. to treat foreign-owned or -controlled enterprises operating on its territory no less favourably than domestic enterprises in like situations – to foreign investors in its territory, subject to a list of exceptions. Under the Declaration, Egypt is also encouraged not to backtrack with regard to existing measures contained in the list of exceptions to national treatment (OECD, 2017a).7

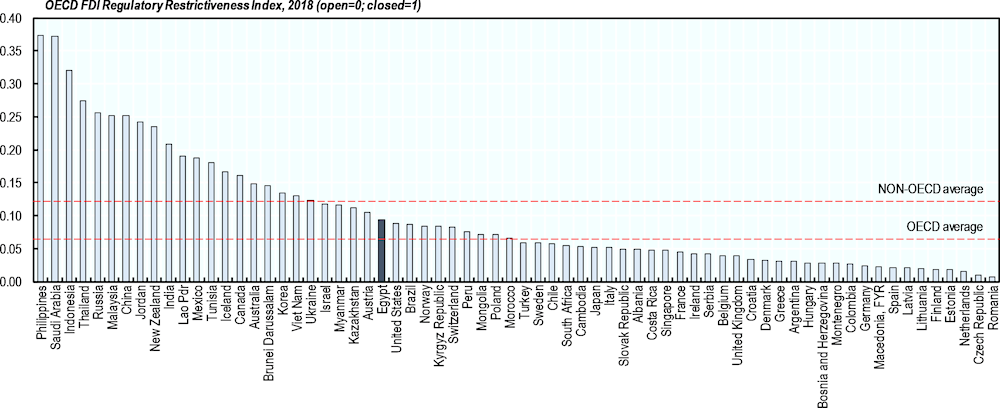

In common with most adherents to the Declaration, Egypt maintains only a handful of statutory restrictions on FDI. The relative openness of its investment regime is attested by its position under the OECD FDI Regulatory Restrictiveness Index (Box 2.1). The extent of statutory discrimination against foreign investors in Egypt is higher than typically observed in the average OECD economy but remains below the average level of non-OECD economies included in the indicator (Figure 2.3) and is also only slightly higher than the average for non-OECD adherent economies.

Box 2.1. The OECD FDI Regulatory Restrictiveness Index

The OECD FDI Regulatory Restrictiveness Index seeks to gauge the restrictiveness of a country’s FDI rules. The FDI Index is currently available for all OECD countries and over 30 non-OECD countries, including all G20 members and non-OECD countries adhering to the OECD Declaration on International Investment and Multinational Enterprises. It is used on a stand-alone basis to assess the restrictiveness of FDI policies in reviews of candidates for OECD accession and in OECD Investment Policy Reviews, including reviews of new adherent countries to the OECD Declaration.

The FDI Index does not provide a full measure of a country’s investment climate since it does not score the actual implementation of formal restrictions and does not take into account other aspects of the investment regulatory framework which may also impinge on the FDI climate. Nonetheless, FDI rules are a critical determinant of a country’s attractiveness to foreign investors and the Index, used in combination with other indicators measuring various aspects of the FDI climate, contributes to assessing countries’ international investment policies and to explaining the varied performance across countries in attracting FDI.

The FDI Index covers 22 sectors, including agriculture, mining, electricity, manufacturing and main services (transport, construction, distribution, communications, real estate, financial and professional services). Restrictions are evaluated on a 0 (open) to 1 (closed) scale. The overall restrictiveness index is a simple average of individual sectoral scores. For a detailed description of the scoring methodology, please refer to the technical working paper by Kalinova et al. (2010). For each sector, the scoring is based on the following elements:

the level of foreign equity ownership permitted,

the screening/approval procedures applied to inward foreign direct investment;

restrictions on key foreign personnel; and

other restrictions, e.g on land ownership, corporate organisation (branching).

The measures taken into account by the Index are limited to statutory restrictions on FDI typically reflected in official OECD instruments on investment or identified in OECD Investment Policy Reviews and yearly monitoring reports. The FDI Index does not assess actual enforcement and implementation procedures. The discriminatory nature of measures, i.e. when they apply to foreign investors only, is the central criterion for scoring a measure. State ownership and state monopolies, to the extent they are not discriminatory towards foreigners, are not scored. Preferential treatment for special-economic zones and export-oriented investors is also not factored into the FDI Index score, nor is the more favourable treatment of one group of investors as a result of preferential treatment under international agreements.

Existing restrictions are mostly concentrated in a few services sectors: in construction, and maritime transport, foreign investment is only allowed in the form of joint ventures where foreign equity does not exceed 49%. Likewise, foreign investment in air transport is allowed up to 49% in companies involved in regular international and domestic flights (for both passenger and cargo services). Foreign investment is also limited in the case of commercial agency and import-trading businesses to only 49% of the equity or to natural persons who have had Egyptian nationality for at least 10 years.8 Foreign participation in professional services, such as legal, accounting, architectural and engineering services is also subject to limitations.9

Foreign investors are also restricted from acquiring land and real estate in the Sinai Peninsula, which can only be owned by natural persons holding Egyptian nationality and by legal persons whose capital is totally owned by Egyptians. Even under a lease agreement, an equity limit of 49% applies for foreign investors in the Sinai region.

Figure 2.3. OECD FDI Regulatory Restrictiveness Index, 2018

Note: The OECD FDI Regulatory Restrictiveness Index covers only statutory measures discriminating against foreign investors (e.g. foreign equity limits, screening & approval procedures, restriction on key foreign personnel, and other operational measures). Other important aspects of an investment climate (e.g. the implementation of regulations and state monopolies, preferential treatment for export-oriented investors and SEZ regimes among other) are not considered. Data reflect regulatory restrictions as of end-December. Please refer to Kalinova et al. (2010) for further information on the methodology.

Source: OECD FDI Regulatory Restrictiveness Index, www.oecd.org/investment/fdiindex.htm.

In other regions, foreign investment in land and real estate is forbidden except for business purposes or personal use. Non-Egyptian persons, including a locally incorporated company where Egyptian nationals do not own the majority of its capital, are allowed to own real estate needed for activities licensed by the government. They can also own up to two residential real estate units for family accommodation purposes, in an area not in excess of 4 000m2 and not located in an historical site. They may not sell acquired properties for a minimum period of five years from the date of purchase, except if the property is located in certain touristic and new development areas specified in the legislation. Exemptions from such regulations are possible subject to the approval of the Prime Minister or the Cabinet of Ministers for properties located in touristic and new development areas (see section on land in Chapter 3).10

…but remaining restrictions may still curb foreign investments and hold back potential economy-wide productivity gains

Despite being relatively open to foreign investment, the effects of remaining restrictions in Egypt can still be sizeable. To some extent, it is tautological to say that when foreign investment is prohibited, an economy will receive no investment, but the evidence suggests that even partial restrictions can significantly curtail inward investment into both advanced and emerging economies (Nicoletti et al., 2003; Kalemi-Özcan et al., 2014; Fournier, 2015; Mistura and Roulet, 2019).

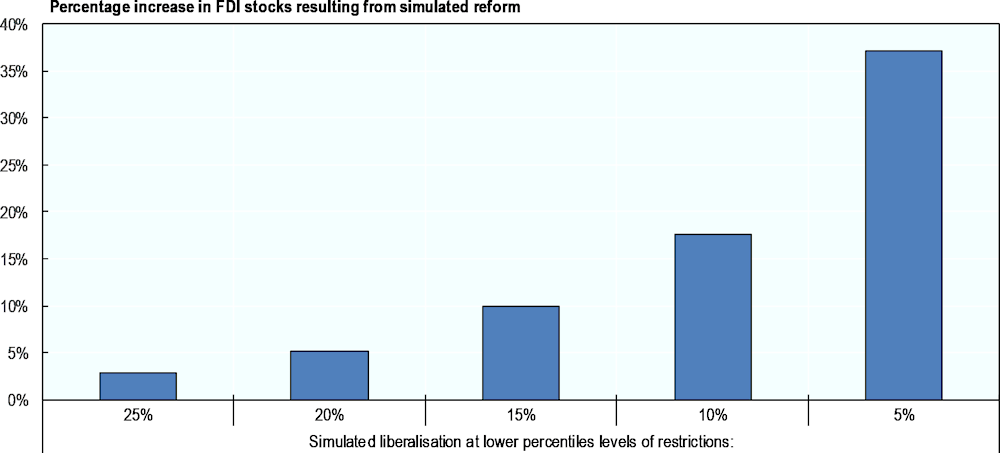

Recent OECD research (Mistura and Roulet, 2019) shows that the introduction of reforms leading to a 10% reduction in the level of FDI restrictiveness, as measured by the OECD FDI Regulatory Restrictiveness Index, could increase bilateral FDI inward stocks by around 2.1% on average across all countries. An illustrative simulation exercise, drawing on the baseline model, suggests that if Egypt were to reduce FDI restrictions to the level of Czech Republic, for instance, which is among the 5% most open economies in the sample, Egypt’s bilateral inward FDI stocks could be expected to increase, all else equal, by up to 37% (Figure 2.4). The simulation is illustrative and, therefore, should be interpreted with caution.11 Nonetheless, the exercise provides a sense of the importance of restrictions as barriers to investment.

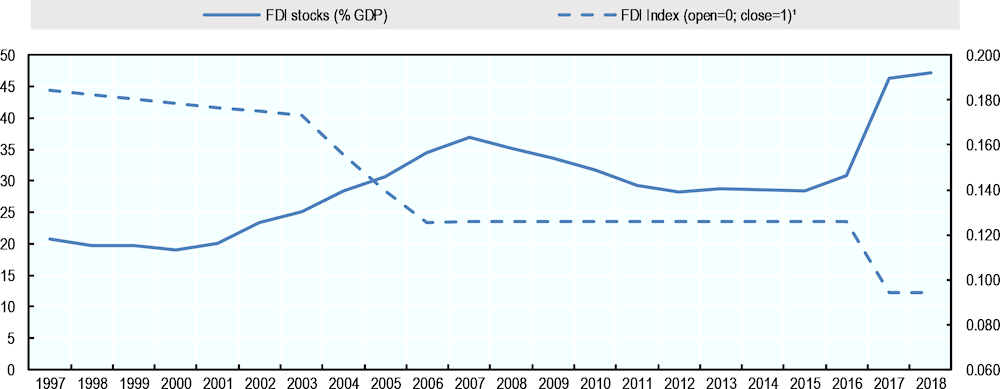

Egypt’s own experience seems to confirm that foreign investors tend to respond favourably to regulatory reforms enabling a level playing field between domestic and foreign-owned investors. The more recent wave of liberalisation reforms was accompanied by a significant rise in the participation of foreign investors in the Egyptian economy, although reforms were concomitant with a rise in FDI worldwide (Figure 2.5).

Figure 2.4. Simulated effects of FDI liberalisation in Egypt

Note: The simulations are based on the partial elasticity of FDI to regulatory restrictions estimated in an augmented gravity model of bilateral inward FDI positions using a poisson pseudo-maximum likelihood estimator. Typical gravity variables and a series of other policy and non-policy factors are included (distance, contiguity, the existence of a common language, colonial ties, market size, economic growth, real exchange rates, similarity in size and factor resource endowments, trade openness, natural resource endowments, institutional maturity, FDI restrictions, participation in free trade areas, corporate tax and country and time-specific effects. The regressions cover bilateral FDI relationships between 60 countries over the 1997-2012 period.

Source: author’s calculations based on Mistura and Roulet (2019).

Figure 2.5. Wave of liberalisation reforms and FDI stocks in Egypt

Note: ¹Index scores linearly interpolated over missing periods.

Source: author’s calculations based on the OECD FDI Regulatory Restrictiveness Index and IMF World Economic Outlook and International Financial Statistics databases.

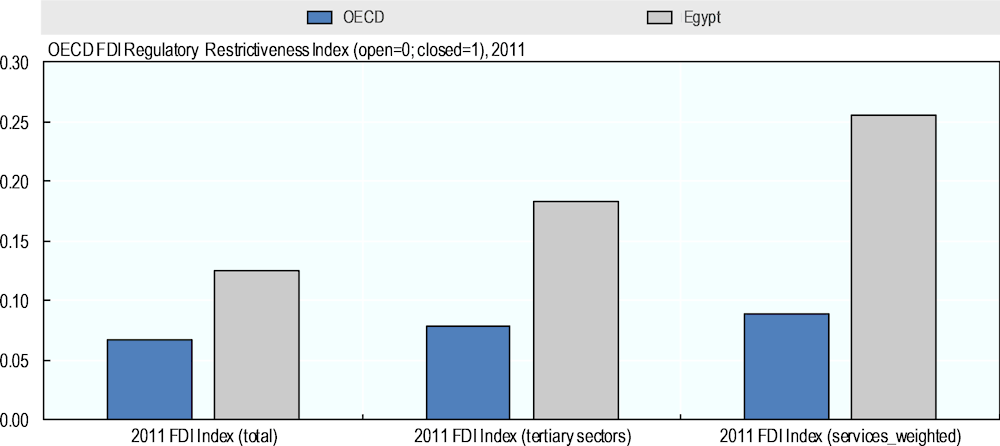

Figure 2.6. Remaining FDI restrictions place a larger toll on downstream manufacturing industries in Egypt

Note: The services weighted measure of FDI restrictiveness refers to the weighted average of the scores for nine services sectors covered by the Index (construction, transport, telecommunications, electricity, wholesale and retail distribution, financial and business services), where the weights are given by their respective shares in the total input costs of manufacturing sector. Data are from 2011. It is constructed as: , where rest is the weighted FDI restrictiveness index faced by manufacturing sector s in country c; w is the share of service sector j in total inputs of manufacturing sector s in country c; and Index is the score of the OECD FDI Regulatory Restrictiveness Index of service sector j in country c.Source: author’s calculations based on the OECD FDI Regulatory Restrictiveness Index, the OECD Input-Output Tables and EORA World Input-Output Tables.

In addition, remaining restrictions may be more constraining for the development of the Egyptian economy than they might initially appear. Figure 2.6 compares Egypt’s scores under the OECD FDI Regulatory Restrictiveness Index with the OECD average for the entire economy, tertiary sectors and as a weighted measure of services inputs to manufacturing sectors. Because of data limitations regarding inter-sector relationships across countries, the assessment is based on data from 2011, which is the latest available in a more consistent manner. As can be seen, the level of FDI statutory restrictiveness in Egypt then was already above the OECD average at the economy-level and was even higher across tertiary sectors too. This difference was even stronger when comparing the level of restrictiveness weighted by services inputs to manufacturing sectors. This suggests that manufacturing industries in Egypt tend to rely much more intensively on inputs from restricted services sectors than is the case across OECD economies, indicating that restrictions may have greater productivity-hindering effects in the Egyptian economy.

Worldwide, services have proved to be a significant channel for value added generation, including in manufacturing industries. The value created by services as intermediate inputs represents over a third of the total value added in manufacturing in over 60 countries spread across the Americas, Europe and Asia (De Backer et al., 2013). Improved services typically allow for relatively greater efficiency and lower transaction costs, facilitating firms’ access to potential new markets and the expansion of their portfolio of products and services. The increased fragmentation of production chains across regions and globally has contributed to exacerbate the role played by network industries and complementary business services in supporting manufacturing operations.

A number of empirical studies have demonstrated the negative relationship between manufacturing productivity levels and barriers to competition and foreign participation in services sectors.12 Market access reforms enable greater competitive pressures in services sectors and, consequently, higher productivity. In turn, this allows downstream manufacturers to benefit from higher quality services inputs or lower services input costs.

Egypt’s strategy to channel investments into the Suez Canal Economic Zone (SCZone) may help to soften some of the potential constraints arising from restrictions on foreign investors, but it is not fully clear at this stage if they do so (Box 2.2). According to the government, there are no statutory differences between domestic and foreign investors inside the SCZone. In any case, such a strategy carries the cost of favouring some investors over others (i.e. foreign investors over domestic investors), which in itself should warrant an assessment of whether Egyptian investors would not be better off if the less stringent regulatory environment of SCZones applied countrywide.

Box 2.2. Transparency of FDI restrictions in the Suez Canal Economic Zone

The scope of restrictions on FDI in zones could be more transparent.

Investments inside the SCZone are regulated by the Law on Special Economic Zones. According to the SCZone website, there is no difference in treatments between national and foreign investors, i.e. companies are entitled to 100% foreign ownership, although the SEZ law is silent in this respect. In fact, according to the law, companies inside the zones remain subject to the provisions of other laws (e.g. sector-specific laws) unless if provided otherwise or inconsistently with provisions under the SEZ law. It remains, therefore, unclear if foreign investors operating from inside the Zones would be exempted, for instance, from nation-wide regulatory restrictions in the construction and maritime transport sectors, where foreign equity cannot exceed 49% of the capital. In the case such restrictions do apply in the SCZone, efforts should be made to assess whether they may discourage the development of the priority sectors targeted by the SCZone, i.e. manufacturing, transport and logistics and maritime-related services.

It is also important to examine the extent of state control on market access in the SCZone. If badly designed, regulations that protect current market structures, such as the preponderance of SOEs, may lead to de facto restrictions on foreign investment. On the legal front, Egypt made some improvements aiming at reducing anti - competitiveness practices. When they still exist in practice, such practices can hamper new foreign investors’ entry.

Other countries have sometimes exempted SEZ investors from the application of national legislation or clarified in which sectors restrictions apply to FDI in SEZs. For instance, in several Asian countries, equity restrictions do not apply if the foreign investor located in the SEZ exports all or most of its output. In Indonesia, a negative list indicates all exceptions to national treatment, i.e. restrictions or other discriminatory measures that apply to foreign investors in general or in specific sectors or economic activities. One of the provisions of the negative list clearly stipulates that foreign investors in SEZs are entitled to 100% ownership. In China, a foreign investment negative list was issued in 2015 exclusively for the three pilot Free Trade Zones (Fujian, Guangdong and Tianjin). The negative list includes all the limitations and restrictions on foreign investment, including those stipulated in other laws, making it more intelligible for foreign investors. The Chinese FTZ example may be particularly relevant for Egypt, as they share the objective of using the zones as a laboratory for reforms that, if successful, could be replicated nationally.

Besides equity limitations, countries may sometimes regulate the entry and behaviour of foreign investors, including in SEZs, through screening and approval mechanisms. Although the number of countries resorting to screening for this purpose has substantially declined over time, such measures have not yet been completely eliminated. The SEZ law, while not explicitly making any distinction between foreign and domestic investors, stipulates, in art. 13, line 2b, that the Zone Authority shall define the requirements for delivering a licence. Projects may not be established in SEZs unless a prior written approval from the board of the SEZ Authority is obtained. More clarity on the criteria applied in such situations is warranted in implementing regulations, as well as regarding the possibility for investors to have recourse against authority decisions.

References

Alesina, A., Ardagna, S., Nicoletti, G., & Schiantarelli, F. (2005), Regulation and investment, Journal of the European Economic Association, 3(4), 791-825.

Chekir, H., & Diwan, I. (2014), Crony capitalism in Egypt, Journal of Globalization and Development, 5(2), 177-211.

De Backer, K. and S. Miroudot (2013), “Mapping Global Value Chains”, OECD Trade Policy Papers, No. 159, OECD Publishing, Paris. http://dx.doi.org/10.1787/5k3v1trgnbr4-en.

Diwan, I., & Haidar, J. I. (2016), Do political connections reduce job creation? Evidence from Lebanon, In Economic Research Forum Working Paper (No. 1054).

Diwan, I., Keefer, P., & Schiffbauer, M. (2015), Pyramid capitalism: political connections, regulation, and firm productivity in Egypt, World Bank.

Égert, B. (2016), Regulation, institutions, and productivity: new macroeconomic evidence from OECD countries, American Economic Review, 106(5), 109-13.

Égert, B. (2018), Regulation, institutions and aggregate investment: new evidence from OECD countries, Open Economies Review, 29(2), 415-449.

Fournier, J. (2015), “The Heterogeneity of Product Market Regulations”, OECD Economics Department Working Papers, No. 1182, OECD Publishing. http://dx.doi.org/10.1787/5js7xhxwrnwd-en

Francis, D., Hussain, S., & Schiffbauer, M. (2018), Do politically connected firms innovate, contributing to long-term economic growth? Policy Research Working Paper 8502, Washington D.C.

Kalemli-Ozcan, S., Korsun, V., Sorensen, B. E. and Villegas-Sanchez, C. (2014), “Who Owns Europe’s Firms? Globalization and Foreign Investment in Europe”.

Koske, I. et al. (2015), “The 2013 update of the OECD's database on product market regulation: Policy insights for OECD and non-OECD countries”, OECD Economics Department Working Papers, No. 1200, OECD Publishing, Paris. http://dx.doi.org/10.1787/5js3f5d3n2vl-en

Mistura, F. and C. Roulet (2019), "The determinants of Foreign Direct Investment: Do statutory restrictions matter?", OECD Working Papers on International Investment, No. 2019/01, OECD Publishing, Paris, https://doi.org/10.1787/641507ce-en.

Nicoletti, Golub, S., et al. (2003), “The Influence of Policies on Trade and Foreign Direct Investment”, OECD Economic Studies, vol. 2003/1, https://doi.org/10.1787/eco_studies-v2003-art2-en.

OECD (2019), OECD Investment Policy Reviews: Southeast Asia, www.oecd.org/investment/oecd-investment-policy-review-southeast-asia.htm.

OECD (2018), OECD Investment Policy Reviews: Viet Nam 2018, OECD Investment Policy Reviews, OECD Publishing, Paris, https://doi.org/10.1787/9789264282957-en.

OECD (2017a), “National Treatment for Foreign-Controlled Enterprises: Including Adhering Country Exceptions to National Treatment”, Paris, https://www.oecd.org/daf/inv/investment-policy/national-treatment-instrument-english.pdf.

OECD (2017b), The Size and Sectoral Distribution of State-Owned Enterprises, OECD Publishing, Paris. http://dx.doi.org/10.1787/9789264280663-en.

OECD (2015), Policy Framework for Investment, 2015 Edition, OECD Publishing, Paris, https://doi.org/10.1787/9789264208667-en.

Rijkers, B., Freund, C., & Nucifora, A. (2014), All in the family: State capture in Tunisia, The World Bank.

World Bank (2013), Investing in turbulent times, World Bank: Washington D.C., October.

World Bank (2014a), Corporate Governance of State-Owned Enterprises: A toolkit, The World Bank Group, Washington D.C.

World Bank (2014b), Jobs or Privilege: Unleashing the Employment Potential of the Middle East and North Africa, World Bank: Washington D.C.

Youssef, H., Alnashar, S. Bahaa Hamed; Erian, J., Elshawarby, A., Zaki, C. (2019), Egypt Economic Monitor: From Floating to Thriving – Taking Egypt's Exports to New Levels, Washington, D.C., World Bank Group.

Notes

← 1. See www.oecd.org/economy/reform/indicators-of-product-market-regulation/ for further information on the OECD Indicators of Product Market Regulation.

← 2. In 2018, the methodology used to collect the information and calculate the OECD PMR indicators was considerably modified.

← 3. See Youssef et al. (2019) for a preliminary overview of the PMR Indicators in the Egypt’s Economic Monitor of the World Bank.

← 4. Based on statistics from 40 OECD and non-OECD countries, together, the electricity and gas, transportation, telecoms and other utilities sectors account for 51% of all SOEs by value and 70% by employment (OECD, 2017). Chapter 3 provides some data on SOEs prevalence in Egypt.

← 5. Law of Public Sector Company's No. 203 of 1991 and Companies Law no. 159 of 1981.

← 6. See Chapter 4 for a review of the procedures to obtain investment licences in Egypt.

← 7. A list of these measures is provided during the adherence process and any new measure affecting foreign investment if formally required to be notified to the OECD Investment Committee.

← 8. Registration in the Register of Commercial Agents and Intermediaries or in the Register of Importers is a condition for engagement in these activities. Until the entry into force of Law No. 7 of the year 2017 concerning the Importers Registry, only Egyptian nationals and fully owned and managed Egyptian companies were admitted into the Register of Importers. Since then, the registration of a legal entity, where the majority of its capital is held by Egyptians or naturalized Egyptians after the lapse of 10 years as of the date of their acquiring the Egyptian nationality, has also been permitted.

← 9. The provision of professional services is largely restricted to Egyptian nationals. Incorporation is not permitted in most professional services, largely precluding the participation of foreigners as capital investors in such businesses. In legal services, a foreign firm may set up a representative office to advise clients on foreign and international law, but it cannot provide legal advice on the law of represent clients in Egyptian courts or advice. Only Egyptian nationals are allowed to appear before a court.

← 10. Non-Egyptians may acquire vacant real estate in Egypt conditioned upon building within a period of five years from the date their ownership becomes effective (the date on which the realty is recorded at the competent Notary Public Office). Please refer to the following legislation for more information: Law 230 of 1996 Regulating the Ownership of Built Real Estate and Vacant Land by Non-Egyptians, and the Prime Ministerial Decree No. 548/2005.

← 11. The effects of such a simulation depend logically on how restrictive is Egypt in relation to the simulated policy level. It also depends on many other conditions, such as the specification of the estimated model, the configuration of policies, and many exogenous elements. For instance, it neglects the needed efforts to implement any of the simulated policies.

← 12. See OECD (2016) for empirical evidence and a review of the literature.