This chapter assesses the strategies, policies and instruments deployed across the Western Balkans and Turkey to facilitate access to finance for SMEs. It starts with an overview of the assessment framework and key developments since the last assessment, proceeding with assessing access to finance for SMEs along five sub-dimensions: 1) looking at the legal and regulatory framework fundamental for lending, such as creditor rights, credit information and registers, as well as banking regulations and capital markets; 2) discussing banking sector lending practices and the availability of credit enhancement and risk mitigation mechanisms; 3) considering the availability of non-bank finance instruments in support of SME lending, including microfinance, leasing and factoring; 4) reviewing the ecosystem in support of venture capital and 5) looking at efforts to promote financial understanding and awareness, both among businesses and the broader population. Each sub‑dimension concludes with a set of key recommendations to help address the outstanding challenges and, where applicable, provides best practices to enhance SMEs’ access to finance.

SME Policy Index: Western Balkans and Turkey 2022

7. Access to finance for SMEs (Dimension 6) in the Western Balkans and Turkey

Abstract

Key findings

Financial stability has been maintained. Owing to solid macroprudential measures across most Western Balkan and Turkey (WBT) economies in the years preceding the COVID-19 pandemic, access to credit has remained stable. Stability and confidence in local financial markets have further been supported by tightened regulation in line with European best practices, and banking supervision has increased.

Financial intermediation has remained resilient across all WBT economies amid large-scale liquidity measures, coupled with subsidised credit lines and scaled up state-backed credit guarantee schemes in response to the COVID-19 pandemic. As a result, SME lending has eased across the region, though the long-term effect of these temporary crisis response measures remains to be seen.

Credit guarantee funds have been vital to economies’ COVID-19 stimulus packages. All economies, except Montenegro where work is still ongoing, have either significantly strengthened existing credit guarantee funds or established new ones to ensure the supply of finance to enterprises. However, not all of these funds specifically focus on small and medium‑sized enterprises (SMEs), and some appear to be temporary without reflecting best practice.

Market penetration for some non-bank financial instruments has increased. This is particularly true for microfinance, where legal frameworks support this kind of activity. Leasing has also gained some traction, although from low levels, while factoring activity, except in Turkey, has dropped to marginal levels, despite improved legal frameworks in some economies.

Venture capital remains at an early stage across the Western Balkan region, though some economies have taken concrete steps to introduce dedicated legislation in support of developing ecosystems conducive to venture capital (VC). In contrast, in Turkey, VC investments have reached unprecedented levels, evidencing the impact of significant efforts made during previous assessment cycles.

Economies increasingly support financial literacy development. Some economies, notably Montenegro and North Macedonia, have undertaken benchmarked assessments of financial literacy levels, and have initiated or adopted dedicated financial education strategies. However, overall, measures to support financial literacy among entrepreneurs remain ad hoc and uncoordinated, with limited monitoring and evaluation.

Comparison with the 2019 assessment scores

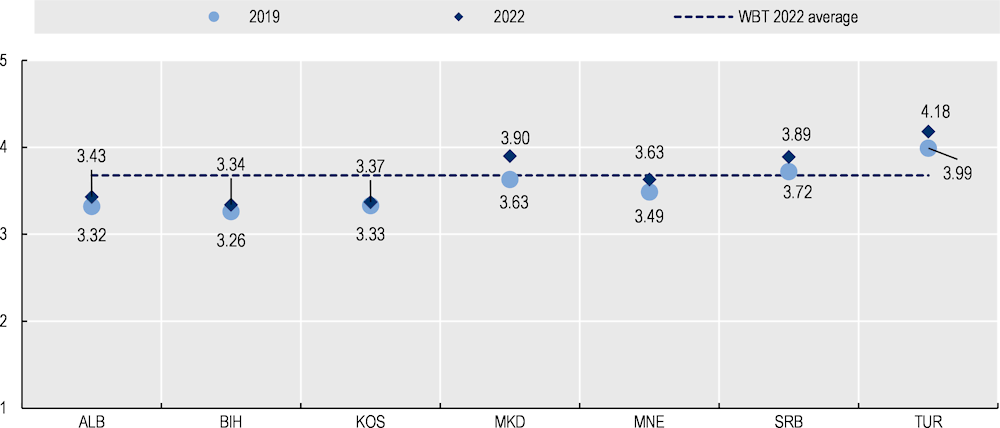

All WBT economies have progressed in Dimension 6, evident in particular with regard to bank and non‑bank finance (Figure 7.1). Turkey continues to be the best performer in this dimension, with North Macedonia and Serbia tied for second place. North Macedonia has advanced the most since the previous assessment, largely due to improvements in the VC ecosystem and financial literacy. The four remaining economies (Albania, Bosnia and Herzegovina, Kosovo, and Montenegro) remain below the WBT average of 3.67.

Figure 7.1. Overall scores for Dimension 6 (2019 and 2022)

Notes: WBT: Western Balkans and Turkey. Despite the introduction of questions and expanded questions to better gauge the actual state of play and monitor new trends in respective policy areas, scores for 2022 remain largely comparable to 2019. To have a detailed overview of policy changes and compare performance over time, the reader should focus on the narrative parts of the report. See the Policy Framework and Assessment Process chapter and Annex A for information on the assessment methodology.

Implementation of the SME Policy Index’s 2019 recommendations

Most of the recommendations made in the 2019 SME Policy Index have been addressed by at least some economies, but the speed of implementation remains mixed. Table 7.1 summarises progress made on the key recommendations for Dimension 6 since the previous assessment.

Table 7.1. Implementation of the SME Policy Index’s 2019 recommendations for Dimension 6 in the Western Balkans and Turkey

|

Regional 2019 recommendation |

SME Policy Index 2022 |

|

|---|---|---|

|

Main developments during the assessment period |

Regional progress status |

|

|

Continue efforts to strengthen collateral registries |

The coverage of the cadastre in Montenegro has expanded and been digitalised, but does not yet cover all of the economy’s territory, while Serbia has made improvements to its registry for pledges over immovable assets. However, the accessibility, accuracy and reliability of registers remain limited, in particular in Albania, Bosnia and Herzegovina, and Kosovo. |

Limited |

|

Strengthen and align data collection |

Systemic collection of financial market data, particularly with regard to non-bank financing, remains scattered in some economies. No progress has been made in enhancing efforts to participate in the OECD’s Financing SMEs and Entrepreneurs Scoreboard1 (OECD, 2020[1]), with only Serbia and Turkey participating. |

Limited |

|

Continue efforts to support banking sector recovery |

Macroprudential indicators had improved prior to the COVID-19 pandemic in all economies, although the Turkish banking sector was still recovering from the economic turbulences of 2018. Progress has also been made in de-euroising the financial sector in the Western Balkans. |

Moderate |

|

Work on establishing and strengthening credit guarantee schemes |

Progress has been made in all economies amid the COVID-19 pandemic, when operations of existing credit guarantee funds (CGFs) were expanded (Kosovo and Turkey) or new COVID-specific sovereign credit guarantee funds were established (Albania, Bosnia and Herzegovina, North Macedonia, and Serbia), though they do not all have an exclusive small and medium-sized enterprises (SME) focus. In Montenegro, the establishment of a credit guarantee fund is still ongoing. While this is a significant development, it remains to be seen whether these new CGFs will become lasting, sustainable instruments to facilitate SMEs’ access to finance. |

Strong |

|

Support the market penetration of factoring and leasing |

Leasing has grown substantially in all economies, in line with the overall trend of credit expansion during the assessment period. In contrast, factoring activity has only further grown in Turkey, while volumes have fallen dramatically from already low levels in Montenegro, North Macedonia and Serbia. Factoring remains non‑existent across Albania, Bosnia and Herzegovina, and Kosovo, and dissemination and awareness raising about the opportunities of these kinds of financial products remain limited. |

Moderate |

|

Embed microfinance into a supportive legal and regulatory framework |

In the Federation of Bosnia and Herzegovina, a dedicated Microfinancial Institutions Law developed in 2018 is still pending adoption. In Serbia and Turkey, where there is no legal framework in place to support the development of microfinance, no efforts have been made to establish dedicated legislation. |

Limited |

|

Continue efforts to build a business environment conducive to innovation |

North Macedonia and Republika Srpska have conducted a review of (legal) obstacles to the development of venture capital. As a result, North Macedonia introduced amendments to the Law on Investment in 2021. Serbia adopted a new Law on Alternative Investment Funds in 2020 which now regulates venture capital activity, and in Turkey, the legal framework has been further improved. A new Law on Collective Investment Funds in Albania in 2020 falls short of sufficiently regulating venture capital. At the time of writing, Republika Srpska was also preparing amendments to the Law on Investment Funds. All economies continue to implement measures to create an ecosystem for start-ups and innovation, though at varying speeds and scales. |

Moderate |

|

Prioritise financial literacy within existing policy frameworks |

North Macedonia adopted its first National Financial Education and Financial Inclusion Strategy in 2020, while in Montenegro, the development of a financial literacy strategy is well under way. In Albania, preliminary work on preparing a strategy has also commenced. In Serbia and Turkey, in contrast, strategic policy frameworks supporting financial literacy have expired, with no renewals in place. |

Moderate |

|

Improve analysis of financial literacy levels |

Montenegro and North Macedonia have both participated in a regional assessment on financial literacy in adults led by the OECD, which established important baseline assessments to monitor the impact and progress of their new/forthcoming financial literacy strategies. |

Limited |

1. The OECD Scoreboard provides a comprehensive framework for policy makers and other stakeholders to monitor access to finance by SMEs and entrepreneurs. It also constitutes a valuable tool to support the design and evaluation of policy measures, and to monitor the implications of financial reforms on access to finance and financing conditions for SMEs more generally (OECD, 2020[1]).

Introduction

Access to affordable finance is a key ingredient for economic growth, enabling companies to expand their operations, upgrade their equipment, and invest in innovation and modernisation, thus building and maintaining a competitive edge. A well-functioning and stable financial system is therefore critical for sustainable private sector development. However, the ease of accessing credit typically correlates with the size and maturity of a business. The smaller the company or the less mature it is, the more difficult and expensive it is to access funding. This can be due to many reasons, including a higher (perceived or actual) risk profile, business informality, limited collateral or asymmetries in available credit information, as well as limited creditworthiness and financial management capacity within a firm. According to the most recent EBRD-World Bank Business Environment and Enterprise Performance Survey (BEEPS VI)1, 45% of surveyed small businesses claim that they have either been rejected or discouraged from applying for a loan, compared to around 31% of corporates (EBRD, 2021[2]).

This situation was exacerbated at the onset of the COVID-19 pandemic in 2020. Smaller businesses are more vulnerable to market disruptions and the sudden economic shock following the outbreak of COVID‑19 reduced funding for many firms. Without significant financial back-up and amid plummeting revenues, collapsing cash flows and rapidly diminishing working capital, creditors became even more reluctant to lend.

Recognising the significance of closing the SME finance gap and addressing market failures, policy makers can play an important role in facilitating access to credit. Principle VI of the Small Business Act for Europe encourages governments to “facilitate SMEs’ access to finance and develop a legal and business environment supportive to payments in commercial transactions” (European Commission, 2008[3]). Such support can come in many forms. For instance, a legal framework that supports the enforcement of creditor rights, provides flexible collateral options and comprehensive, reliable information on credit history helps minimise lending risks and reduce asymmetries of information between borrowers and creditors. Dedicated SME support schemes further help address investors’ risk aversion and can stimulate lending. Notwithstanding, conventional lending instruments may be ill-suited for smaller businesses, particularly early-stage firms. The development of alternative sources of finance, such as microfinance, leasing or factoring, as well as equity or mezzanine finance, can be actively supported by embedding them into tailored legal frameworks to provide governance and long-term security for operators. Lastly, supporting SME financial management and education, including about the benefits and opportunities of non-bank financing instruments, may help to boost their investment readiness and make them attractive clients for financial service providers.

More than ever, the COVID-19 pandemic has demonstrated the need to strengthen the resilience of the private sector, and SMEs in particular. Without timely and wide-ranging governmental support, many businesses may not have withstood the economic shock that swept the globe in early 2020. Sustaining the liquidity of local financial markets and providing short-term credit to enterprises have been critical. However, as economies emerge from the crisis and fiscal policies are set to be tightened, it will be more important than ever to ensure that public measures in support of SME finance are designed to crowd in private sector financial service providers and remain additional.2

Assessment framework

Structure

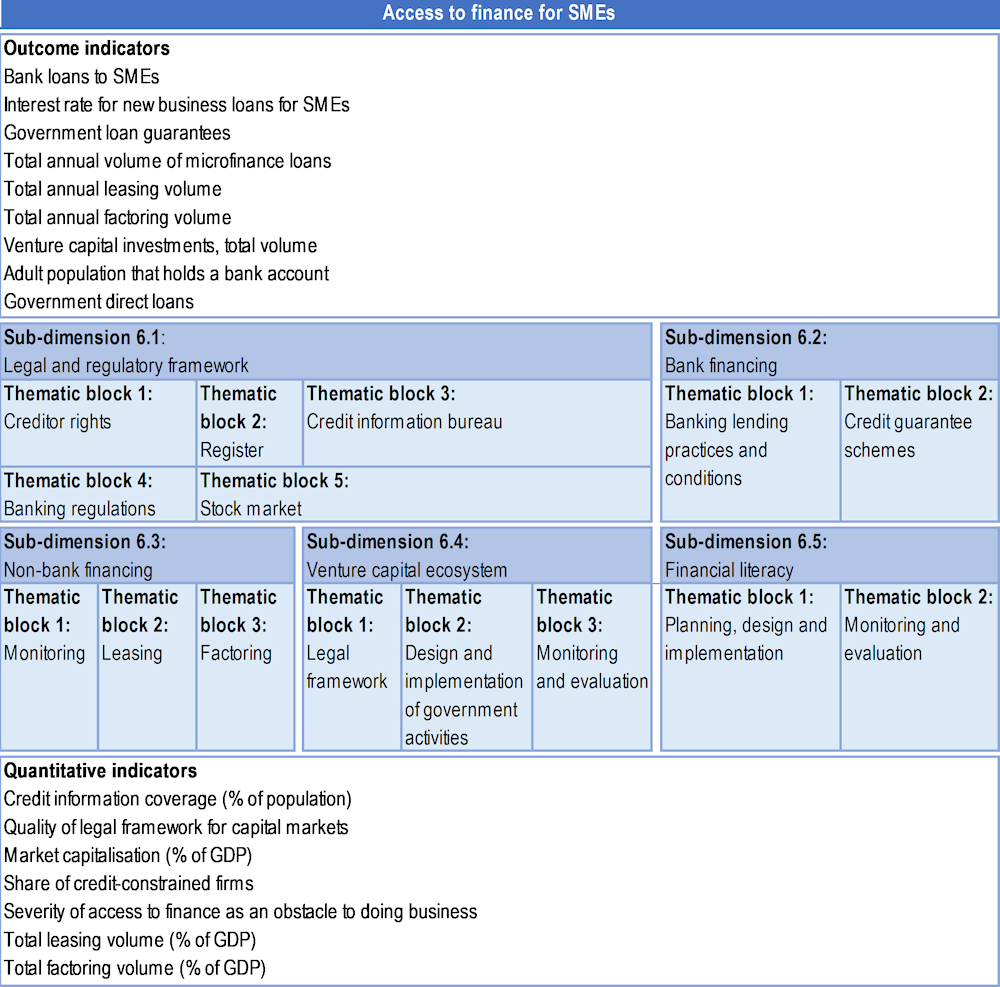

The assessment framework for this dimension has five sub-dimensions:

Sub-dimension 6.1: Legal and regulatory framework looks at the legislative and regulatory set‑up facilitating access to finance, including protecting creditor rights, the depth of credit information and collateral use, as well as banking and capital market regulations.

Sub-dimension 6.2: Bank financing assesses the lending practices in local banking sectors, including available SME finance support schemes and credit enhancement measures, such as credit guarantee schemes.

Sub-dimension 6.3: Non-bank financing reviews the legal framework and penetration levels of microfinance, leasing and factoring.

Sub-dimension 6.4: Venture capital ecosystem analyses the legal and support framework enabling VC finance, including the availability of business angel networks.

Sub-dimension 6.5: Financial literacy assesses measures promoting financial literacy among the business community and the wider population.

Figure 7.2 illustrates how the five sub-dimensions together make up the overarching assessment framework for this dimension. Ease of access to credit is the result of multiple, interconnected determinants, including the overall macroeconomic environment, the health of local financial markets and the investment readiness of enterprises. While these cannot all be captured in this assessment, the framework aims to look at the specific themes and indicators regarded to be disproportionally important for SMEs and within policy makers’ control.

Figure 7.2. Assessment framework for Dimension 6: Access to finance for SMEs

Notes: For more information on the methodology, see the Policy Framework and Assessment Process chapter and Annex A.

Compared to the 2019 assessment, small adjustments have been made to the framework that gauges the inclusion of the green and digital aspects of policies and measures, which, within the context of access to finance, relate specifically to credit enhancement and risk mitigation measures. The assessment also takes into consideration COVID-19 response measures, although no evaluation has been made in this regard.

Analysis

Following the global economic and financial crisis in 2008/09, when financial markets across the globe experienced turbulence and dramatically reverted years of positive credit growth across most of the WBT region, access to finance had eased in the years preceding the COVID-19 crisis.

Financial intermediation has deepened across the WBT region since 2019, albeit from relatively low levels in most economies. Private sector credit has grown substantially across the region, particularly in Turkey and Montenegro, where credit growth stood at 37.1% and 24.4% at the end of 2021, respectively (CEIC Data, 2022[4]). However, while this is a welcome development, overall, average private sector credit, expressed as a percentage of gross domestic product (GDP), despite growth, stood at 55% in 2020, remaining well below the EU average of 94% (World Bank, 2021[5]).

In addition, efforts have been stepped up to increase financial markets’ resilience to external shocks. As a result, non-performing loans have declined significantly in recent years from their peak in 2010-16, ranging from just 2.2% in Kosovo to 6.2% in Montenegro at the end of 2021 (CEIC Data, 2022[4]). However, considering ongoing regulatory measures, including loan moratoria and temporary relaxation of loan restructuring in response to the COVID-19 economic crisis, a full assessment of the level of impaired loans across the financial markets of the WBT economies is not fully possible, and an increase in the level of non-performing loans may become evident once the temporary measures are phased out.

Reflecting these financial sector indicators, the most recent BEEPS, which is based on enterprise survey data collected between 2018 and 2020, also suggests that credit constraints for the majority of WBT economies is less of an obstacle for enterprises seeking a loan.

Table 7.2 summarises the recent trends in financial markets across the region, outlining key banking sector indicators.

Table 7.2. Key banking sector indicators in the Western Balkans and Turkey (2012-2020/21)

|

Private sector credit, % of GDP |

Credit constrained firms, % of firms needing a loan |

Non-performing loans, % of gross loans |

Bank assets, % of total financial sector assets |

||||||

|---|---|---|---|---|---|---|---|---|---|

|

2014 |

2016 |

2020 |

2012-14 |

2018-20 |

2014 |

2016 |

2021 |

2020 |

|

|

Albania |

39.3 |

36.6 |

38.6 |

62.4 |

36.9 |

22.8 |

18.3 |

5.6 |

89.4 |

|

Bosnia and Herzegovina |

60.2 |

57.9 |

58.5 |

24.7 |

42.8 |

14.0 |

11.8 |

5.7 |

88.8 |

|

Kosovo |

37.0 |

38.9 |

51.6 |

43.3 |

39.8 |

8.3 |

4.9 |

2.2 |

67.6 |

|

Montenegro |

52.0 |

49.3 |

60.0 |

57.0 |

57.7 |

15.9 |

11.5 |

6.2 |

92.5 |

|

North Macedonia |

50.5 |

49.0 |

56.2 |

67.6 |

49.0 |

10.8 |

6.3 |

3.4 |

82.0 |

|

Serbia |

40.8 |

40.9 |

45.5 |

51.9 |

23.2 |

21.5 |

17.0 |

3.6 |

90.0 |

|

Turkey |

63.5 |

69.4 |

75.1 |

13.3 |

65.4 |

2.8 |

3.2 |

3.0 |

91.0 |

While these trends are critically important for facilitating access to finance, conventional bank lending continues to be the predominant source of external financing for businesses, and accounts for the vast majority of financial market assets across the entire region. In contrast, non-bank finance continues to play a marginal role, even though its share of total assets has increased substantially since the previous assessment in some economies. Overall market penetration rates (as a percentage of total assets) – where data are available – remain below 1% of total assets in all of the economies (well below EU levels), except for Turkey.

This analysis aims to assess the overall health of financial systems of the WBT economies and evaluate policy makers’ performance in creating the right conditions enabling, and encouraging, access to finance for smaller businesses.

Legal and regulatory framework (Sub-dimension 6.1)

An efficient and well-implemented legal and regulatory framework provides legal certainty and confidence for investors in local financial systems, while strong institutional supervision helps to ensure financial sector stability to withstand external economic shocks. A credible and comprehensive legal framework addressing secured transactions is important to encourage lending in particular to smaller businesses, as these are inherently perceived as being a higher risk. Such a framework should aim to reduce information asymmetries and provide guarantees that can be easily enforced in case of impairment. Comprehensive and reliable credit information systems further enable the collection and dissemination of credit information on borrowers, and, where including information beyond credit history, can be particularly important for less mature businesses and first-time borrowers. Allowing different types of collateral can further reduce lenders’ risk aversion, while the effective realisation of collateral in case of non-payment is crucial to keep enforcement time and costs low.

Table 7.3 summarises the performance in this sub-dimension and suggests that access to finance is embedded in a solid and relatively advanced legal and regulatory framework across the WBT region, with a high average score of 4.20 and only slight discrepancies across economies.

Table 7.3. Scores for Sub-dimension 6.1: Legal and regulatory framework in the Western Balkans and Turkey

|

ALB |

BIH |

KOS |

MKD |

MNE |

SRB |

TUR |

WBT average |

|

|---|---|---|---|---|---|---|---|---|

|

Creditor rights |

4.00 |

3.90 |

4.00 |

4.80 |

5.00 |

4.20 |

4.00 |

4.27 |

|

Registers |

4.60 |

4.50 |

4.80 |

4.60 |

4.90 |

4.40 |

4.60 |

4.63 |

|

Credit information bureaus |

4.00 |

4.50 |

3.30 |

5.00 |

4.00 |

5.00 |

4.80 |

4.37 |

|

Banking regulations |

4.00 |

3.20 |

3.60 |

4.40 |

3.60 |

4.80 |

5.00 |

4.09 |

|

Stock market |

2.00 |

3.00 |

2.00 |

3.80 |

4.00 |

3.80 |

4.00 |

3.23 |

|

Weighted average |

3.86 |

3.94 |

3.68 |

4.60 |

4.40 |

4.47 |

4.48 |

4.20 |

Note: See the Policy Framework and Assessment Process chapter and Annex A for information on the assessment methodology.

A solid legal framework for secured transactions is in place across the region, though enforcement remains problematic

A well-designed legal and regulatory framework for secured transactions encourages lending at acceptable conditions and provides guarantees to investors for regulated payouts in case of default. Across the WBT region, solid frameworks are generally in place in all economies, except for Albania and Bosnia and Herzegovina, where delayed amendments to the Law on Investment Funds continue to impede the full application of creditors’ rights.

Notwithstanding, enforcement remains an issue, despite ongoing efforts to improve efficiency in some economies (see Dimension 2). Bankruptcy procedures remain lengthy, particularly in Turkey, where there has been a significant backlog of insolvency procedures, and outcomes often remain suboptimal. For instance, according to the World Bank, the recovery rate in insolvency procedures in the region has deteriorated further since the last assessment to around 33 cents to the dollar, compared to 65 across the European Union in 2019 (World Bank, 2022[6]).

Registers for pledges of security assets are inconsistently used across the region, while collateral requirements remain high

Within the framework of secured transactions, access to comprehensive and reliable registers that facilitate the use of immovable and movable assets as collateral is critical. Combined with a legal framework that allows for an easy repossession process in case of default, such systems can ease lending. Across many WBT economies, collateral requirements by lenders remain high, impeding particularly smaller companies and suggesting continued shortcomings in the economies’ registries for security assets.

A cadastre enables land and real estate to be registered, including their value, ownership and existing pledges over these assets. All WBT economies have cadastres in place; accessibility, reliability and usage, however, vary. For instance, in Montenegro, the cadastre only covers 93% of the territory, even though coverage has increased compared to the previous assessment and has been digitalised. In Albania, Bosnia and Herzegovina, and Kosovo, concerns over the reliability of data, due to reporting discrepancies and continued undocumented, illegal construction, continue to impede its usage. Access also remains limited in Serbia, despite some improvements. To complement immovable assets, registers for security interests over movable assets can help broaden the range of assets used for collateralisation. This is particularly important for smaller businesses, which usually possess limited property or land. Like with the cadastre, such systems exist across all WBT economies, but usage remains mixed. In Turkey, immovable assets are widely accepted by the banking sector, and security interest over movable assets can even be extended to future proceedings. In Serbia, in 2019, the registry of movable assets was also expanded, but is not yet fully digitalised. In Bosnia and Herzegovina, the central bank operates a national registry of movable assets (unlike for the cadastres), while access is somewhat cumbersome in Albania, Kosovo, Montenegro and North Macedonia.

Coverage and availability of credit information remain largely unchanged across the region

Credit information asymmetries are a major obstacle for SME access to finance, limiting lenders’ ability to assess the creditworthiness of borrowers. Comprehensive public credit registries or private credit bureaus can help alleviate limited credit information by compiling data on loan repayments, while additional financial performance data sought from retailers and utility providers particularly help first-time borrowers and businesses with a limited credit history.

In the WBT, data coverage of public or private credit information systems has only grown marginally since the last assessment and remains below its full potential in most economies (Table 7.4). Most registries are limited to data collected from financial service providers, though some, notably North Macedonia’s private credit bureau, include data from retail and utility providers. Compared to the previous system, in Turkey, the registry has commenced the collection of arrears from telecommunication providers. Lastly, in an attempt to increase coverage and usage of its registry, in 2020, Kosovo introduced new legislation to require lenders to actively use the system.

Table 7.4. Credit information coverage in the Western Balkans and Turkey (2012-19)

|

Public credit registry coverage (% of adults) |

Private credit bureau coverage (% of adults) |

|||||

|---|---|---|---|---|---|---|

|

2013 |

2016 |

2019 |

2014 |

2016 |

2020 |

|

|

Albania |

13.1 |

38.9 |

56.2 |

n/a |

n/a |

n/a |

|

Bosnia and Herzegovina |

39.1 |

37.6 |

47.1 |

4.9 |

10.4 |

14 |

|

Kosovo |

22.2 |

38.1 |

41.4 |

n/a |

n/a |

n/a |

|

Montenegro |

25.2 |

30.8 |

41 |

n/a |

n/a |

n/a |

|

North Macedonia |

34.8 |

40 |

41.7 |

77.1 |

94.5 |

100 |

|

Serbia |

n/a |

n/a |

n/a |

100 |

100 |

100 |

|

Turkey |

23.5 |

76.6 |

80.2 |

71.7 |

n/a |

n/a |

Note: n/a indicates that institution is non-existent in the economy.

Source: World Bank indicators.

Strong macroprudential performance and increased supervision have contributed to financial stability throughout the COVID-19 pandemic

In the years preceding the COVID-19 pandemic, efforts had been made across all WBT economies to increase financial stability. Therefore, in 2020, the financial sector entered the economic crisis with solid capital and liquidity buffers, maintaining financial stability throughout the crisis.

Further progress has been made to align regulatory frameworks to Basel III requirements, though at different speeds, and non-performing loans have continued to fall in most economies except Turkey, where the financial sector had still been somewhat recovering from the economic turmoil of 2018/19 (see Table 7.2). As during the previous assessment cycle, across most of the region, the banking sector remains dominated by foreign subsidiaries, accounting for 85% of all banking assets in Montenegro and Serbia, for instance. At the same time, increasing supervision led to some consolidation of the industry, with smaller, less competitive local banks closing (for instance, in Montenegro).

Foreign-currency denominated or indexed loans remain systemic in some economies, averaging 51.5% in the Western Balkans (excluding Kosovo and Montenegro, which have unilaterally adopted the euro) in 2020, but falling, particularly in North Macedonia and Serbia, which continued to implement de‑euroisation strategies. All affected economies require banks to disclose foreign currency risks, which is particularly important for smaller borrowers who typically are not hedged against exchange rate fluctuation. In Turkey, to curb the weakening of the Turkish lira, foreign currency lending to individuals and unhedged borrowers is prohibited since May 2018, and foreign-currency indexed loans are banned. The share of foreign-currency loans has increased more recently, although this was mainly driven by the significant lira depreciation since 2021.

Capital market access remains nascent across the Western Balkans, while capital market finance has gained momentum in Turkey

Access to capital markets as a means of raising equity-based finance has become increasingly popular in recent years and can provide finance to more mature SMEs in the form of an initial public offering or corporate bond issuance. However, capital market finance imposes stringent requirements on enterprises and entails detailed and frequent disclosure of financial performance beyond the capacity of smaller businesses. To make SME listings more attractive, there have been several attempts across developed and emerging markets to establish dedicated SME listing platforms, with requirements adjusted to meet the demand and capacity of smaller enterprises.

Within the WBT region, only Turkey has a well-developed and well-capitalised stock exchange, Borsa Istanbul. In 2020, its Emerging Companies Market, targeting SMEs, was expanded into a larger sub-market to attract more companies, listing 42 businesses at the end of 2021. In other economies, capital market development remains subdued or non‑existent. In Serbia, a new capital market development strategy aims to simplify listings, while a project aimed to support SME listings and raise awareness about capital market opportunities has not yet yielded results. In North Macedonia, forthcoming legislation also envisages the establishment of a dedicated listing platform for smaller companies, while Albania has also introduced a new Law on Capital Markets since the previous assessment.

The two stock exchanges in Bosnia and Herzegovina – namely the Sarajevo and Banja Luka stock exchanges, North Macedonia, and Serbia, together with Bulgaria, Croatia and Slovenia, continue to participate in the pan-regional SEE Link. In 2020, with the support of the European Bank for Reconstruction and Development (EBRD), it launched a dedicated SME Research Hub,3 which provides equity reports on listed SMEs and aims to boost investor interest.

The way forward for the legal and regulatory framework

Increase enforcement capacity to protect creditor rights. Across the WBT region, creditors benefit from well-defined legal frameworks to protect their security interests. However, enforcement remains an issue in most jurisdictions. Efforts should be placed on increasing enforcement capacity to effectively realise collateral in case of default, including through promoting alternative, out‑of‑court settlements for small claims or financial mediation facilities. This would provide creditors additional securities while minimising the costs and duration of otherwise sometimes lengthy enforcement procedures, thereby increasing lenders’ appetite to provide finance to smaller businesses.

Increase access to bank lending by strengthening systems to support lending decisions. Collateralised lending remains expensive amid a lack of reliable information on immovable and movable assets. At the same time, the increased coverage of credit information bureaus witnessed during previous assessment cycles has somewhat stagnated. Further measures are needed to improve the quality and reliability of the information in cadastres and facilitate the collateralisation of movable assets. In addition, expanding the type of data collected to assess borrowers’ creditworthiness, for instance by including data from utility providers, would help to overcome credit information asymmetries and encourage lending to smaller businesses.

Bank financing (Sub-dimension 6.2)

Bank financing remains critical for SME access to finance, while the health and soundness of the local banking sector are equally essential for an economy’s macroeconomic stability and growth. Many factors influence the availability of bank financing. In addition to the legal and regulatory environment, discussed above, governments can provide direct support to encourage banks to on-lend. Such measures typically come in the form of credit enhancement or risk mitigation measures and may include the provision of state‑backed credit lines, either via dedicated development banks or public or private sector lenders, as well as interest rate subsidies, caps and guarantees.

The mix and choices of instruments depend on various factors. It is, however, important that measures are designed to be complementary to existing market products and aligned to market decision making and risk profiling, with a view to avoiding distortion and crowding out of the private banking sector.

During the COVID-19 pandemic, many governments implemented enormous stimulus packages, often including all or many of the above instruments to safeguard financial stability, boost market liquidity and pre-empt waves of business bankruptcies (OECD, 2021[7]). While these measures have been instrumental to weather the economic impact of the pandemic, they have also increased the risks of over-indebtedness of already highly leveraged firms, which could, if unaddressed, increase financial instability in the medium to long term (Bircan et al., 2020[8]). In the context of this analysis, numerous support measures implemented amid the response to the COVID-19 crisis, often temporary, may limit a full assessment of sustained progress and development in the bank financing sub‑dimension.

All economies have made progress with regard to SME bank financing, and comprehensive support packages have ensured financial stability across the region, resulting in an increase in this sub-dimension (Table 7.5). In particular, most economies have introduced credit guarantee funds, except for Montenegro, which is reflected in its significantly lower than average score.

Table 7.5. Scores for Sub-dimension 6.2: Bank financing in the Western Balkans and Turkey

|

ALB |

BIH |

KOS |

MKD |

MNE |

SRB |

TUR |

WBT average |

|

|---|---|---|---|---|---|---|---|---|

|

Banking lending and practices and conditions |

3.00 |

2.80 |

3.20 |

3.60 |

2.60 |

3.50 |

3.90 |

3.23 |

|

Credit guarantee schemes |

2.80 |

2.40 |

3.10 |

2.40 |

1.40 |

2.60 |

3.60 |

2.61 |

|

Weighted average |

2.92 |

2.64 |

3.12 |

3.14 |

2.12 |

3.15 |

3.79 |

2.98 |

Note: See the Policy Framework and Assessment Process chapter and Annex A for information on the assessment methodology.

Financial intermediation has deepened throughout the region amid comprehensive policy measures to ensure liquidity and sustain lending in the short term

Bank lending continues to remain the prevailing source of finance, accounting for close to or over 90% of total financial sector assets in all economies but Kosovo and North Macedonia, and the industry remains dominated by subsidiaries of foreign banks in most cases. Despite relatively small markets, in some cases, for instance in Montenegro, the number of operating banks remains high, increasing competition and sometimes running the risk of undermining sound banking practices.

As described above, credit growth has been strong in recent years, fuelled further by extensive government support during the pandemic in 2020 (following a temporary drop) and 2021. As a result, private sector credit, expressed as a percentage of GDP, expanded significantly across all WBT economies in 2020, notably in Montenegro and Turkey, suggesting increasing financial intermediation even if accounting for a lower GDP denominator. While the gap compared to the EU average is gradually narrowing, the overall financial mediation of the private sector remains low, especially in Albania but also Serbia, where private sector credit remains below 50% of GDP (World Bank, 2021[5]).

Average interest rates have continued to fall in recent years, but access to finance remains expensive, particularly for smaller enterprises, amid high collateral requirements. According to the BEEPS VI, collateral requirements for SMEs mainly range between 150% and 200% of the total loan value. In Kosovo, requirements reach 250%, while in contrast, only in Serbia do collateral requirements account for less than 100% of total loans.

In response, many economies offer a subsidised lending programme, which have been significantly ramped-up during the COVID-19 pandemic, channelling large-scale subsidised credit facilities mainly via public development banks and state-owned banks, and often undercutting market conditions. For instance, in Turkey, the government-backed credit impulse amounted to nearly one-fifth of the economy’s entire stimulus package, while in Montenegro and North Macedonia, the public Investment and Development Fund and the Development Bank of North Macedonia have made available credit lines at, or close to, 0%, temporarily easing access to finance for SMEs. The sustainability and impact of government support schemes on private sector lending will only be evident during the next assessment cycle.

Sovereign credit guarantee funds have been critical in governments’ responses to the COVID-19 pandemic

Credit guarantee funds are an effective tool to facilitate SME lending, aimed at reducing risks for commercial lenders without artificially distorting market conditions.

Pre-COVID, only a few WBT economies, notably Turkey, had a comprehensive credit guarantee scheme in place to support SME lending. Small-scale guarantee funds were also operative in Albania, Kosovo, North Macedonia and Republika Srpska, though with limited uptake. Amid the pandemic, however, all economies but Montenegro have introduced or significantly expanded their operations of sovereign credit guarantee funds, though not all focus specifically on SMEs. In Turkey, the credit limit of the Credit Guarantee Fund was doubled and its mandate expanded to households, while in Kosovo, operations of the Kosovo Credit Guarantee Fund have significantly increased. Albania created two public credit guarantee funds, combined accounting for around 1% of GDP, supporting salary payments and working capital. North Macedonia also established a sovereign CGF. In Bosnia and Herzegovina, both entities established temporary funds; a new fund in Republika Srpska complements an existing one, although it no longer has an SME focus, unlike during the first months of its operation. In Serbia, two new SME CGFs include special provisions for local currency lending, thereby contributing to the economy’s dinarisation strategy. Lastly, in Montenegro, the creation of a state guarantee scheme is still underway, supported by the EBRD.

The establishment of these credit guarantee schemes is a significant development since the previous assessment, and important policy measures to facilitate sustainable access to finance. However, the impact and longevity of these newly created CGFs will only become fully evident in the next assessment. For instance, the Turkish Credit Guarantee Fund remains the only CGF with some element of private ownership, as recommended as best practice by the World Bank (see Box 7.1), while in Kosovo, for instance, key international development co-operation partners continue to participate in the Kosovo Credit Guarantee Fund’s board.

Under the auspices of the Western Balkans Enterprise Development and Innovation Facility (WB EDIF) platform, an EU-supported regional credit guarantee facility has been implemented via commercial banks since 2013, providing nearly EUR 40 million until the end of 2020 and demonstrating good utilisation rates. In addition, in 2018, the first national EDIF guarantee facility was launched in Serbia for EUR 20 million, followed by another regional one, dedicated to support SMEs by providing employment and training opportunities for youth, later that year. Until end-2020, over 4 000 SMEs had benefited from these facilities. SMEs can also benefit from the COSME Loan Guarantee Facility available in all WBT economies, but awareness about these products remains somewhat limited.

The way forward for bank financing

Ensure the additionality and sustainability of credit enhancement measures. As economies gradually phase out temporary COVID-19 measures, subsidised lending schemes should be reviewed and adjusted to maximise the impact of budgetary support schemes, expected to be tightened amid increased financial austerity post-COVID. Measures should be designed and limited to support those segments of the private sector requiring the most support and aimed at crowding in and leveraging existing financing provided by commercial lenders.

Transition temporary COVID-19 credit guarantee funds into a more permanent support mechanism. Building on the initial lessons learnt and preliminary framework that helped establish or expand public credit guarantee schemes across the region, establish more sustainable structures that allow for public-private co-ownership, clear additionality and sound risk assessment, in line with international best practice (Box 7.1). Yet, to ensure that the additional support does not induce a material misallocation of resources over the medium to longer term, guarantee schemes would need to be fine-tuned and further targeted, for instance through redesigning the main covenants of the loans (e.g. portion of the loan backed by the government guarantee or a fee to access the programmes) to diminish the risk of moral hazard and adverse selection (Demmou and Franco, 2021[9]).

Box 7.1. Common principles of state credit guarantee schemes

In response to the COVID-19 pandemic, many governments have established state credit guarantee schemes to help address urging liquidity problems and support recovery. If well-designed, these public schemes can be an effective, sustainable crisis response measure, particularly when they leverage the private sector financial system. The mechanism allows for quick deployment while keeping budget implications relatively low, especially compared with other tools such as subsidised lending and grants.

In 2015, the World Bank established a set of common principles to guide the structure, mandate and governance of sovereign credit guarantee funds, around four main pillars:

1. legal and regulatory framework: ensure legal and regulatory independence and promote private sector participation

2. corporate governance and risk management: clearly define the mandate and establish sound corporate governance structures, including an independent board, internal control frameworks and a risk management framework

3. operational framework: clearly define eligibility criteria and ensure the approach balances outreach, additionality and financial sustainability, and establish transparent risk-based pricing

4. monitoring and evaluation: set stringent reporting requirements and conduct regular external audit, and systematically conduct performance and impact assessments.

Source: World Bank (2015[10]).

Non-bank financing (Sub-dimension 6.3)

As financial markets mature, diversification of financial instruments can facilitate SME access to finance and enhance the financial inclusion of businesses for which conventional bank finance may be less appropriate.

Microfinance, for instance, can help finance smaller enterprises and sole proprietors who are typically not covered by commercial banks. Where microfinance activities tie into a credit information system, this can also help these borrowers build a credit history, which may eventually help them to become more bankable. Other non-bank financial instruments (NBFIs) include assets-based financial leasing and factoring, both of which facilitate access to finance for enterprises struggling with collateral or credit history requirements. Leasing can be used as an alternative to debt financing for upgrading equipment or technology, for example based on a temporary leasing contract. Factoring, in contrast, is based on the sales of accounts receivable from a firm with a good performance track record and credit history, thereby reducing short‑term liquidity constraints for suppliers and enabling them to have off-balance sheet access to working capital, which is priced against the credit risk of their customers instead of their own.

Overall, the WBT region has progressed in developing non-bank financing, and in line with the general trend of credit expansion since the last assessment, take-up of most of these types of finance has accelerated, albeit at different speeds and levels. Table 7.6 summarises the economies’ performance in this sub-dimension, suggesting that a solid legal framework is in place in particular in Albania, Kosovo, Montenegro and Serbia and, with the exception of microfinance, also in Turkey.

Table 7.6. Scores for Sub-dimension 6.3: Non-bank financing in the Western Balkans and Turkey

|

ALB |

BIH |

KOS |

MKD |

MNE |

SRB |

TUR |

WBT average |

|

|---|---|---|---|---|---|---|---|---|

|

Microfinance institutions |

4.90 |

4.40 |

4.00 |

2.00 |

4.00 |

2.00 |

2.30 |

3.37 |

|

Leasing |

2.40 |

3.00 |

3.00 |

3.40 |

3.20 |

3.70 |

4.00 |

3.24 |

|

Factoring |

2.90 |

1.60 |

2.00 |

2.00 |

3.00 |

3.50 |

4.00 |

2.71 |

|

Weighted average |

3.38 |

2.99 |

2.98 |

2.45 |

3.38 |

3.04 |

3.42 |

3.09 |

Note: See the Policy Framework and Assessment Process chapter and Annex A for information on the assessment methodology.

Microfinance has gained significant momentum

Microfinance has gained significant traction in some WBT economies in recent years, although it is mainly used for private consumption. Microcredit accounts for the largest share in the NBFI portfolio in Albania, where statistics also include the activities of savings and loan associations, accounting for nearly two-thirds of all NBFI loans. Shares also expanded in Kosovo and Bosnia and Herzegovina (based on statistics mainly from Republika Srpska) by 25 percentage points (CBBH, 2021[11]) and 17 percentage points (CBRK, 2020[12]), respectively, between 2018 and 2020, despite significant legal shortcomings for microfinance institutions in Kosovo, which can only operate as non-governmental organisations and a pending Microfinance Institutions Law in the Federation of Bosnia and Herzegovina. In Montenegro, microfinance has also continued to grow, though less substantively.

In contrast, microfinance remains subdued in North Macedonia, Serbia and Turkey, primarily owing to limited legal and regulatory guidance, but also to the relative maturity of local financial systems. In Turkey, most commercial banks already serve smaller businesses, while dedicated microfinance institutions are mainly run by non-governmental organisations and only target the economy’s least developed regions. In Serbia, despite plans to introduce a legal framework for non-deposit credit institutions and the formation of a working group to monitor trends in microfinance, no progress has been made to introduce such legislation, thereby limiting microfinance institutions’ activity in Serbia. In North Macedonia, microfinance is not regulated by the central bank, though a number of specialised microfinance institutions support otherwise unbankable, mainly informal, businesses.

Steps have been taken to strengthen the legal framework for leasing and factoring, but spill‑over effects are yet to materialise, especially for factoring

Building on the momentum during the previous assessment cycle, most economies have further progressed in strengthening the legal framework for leasing and factoring, thereby increasing regulatory oversight and legal certainties for NBFI service providers for these sometimes complex financial transactions.

Following the adoption of new laws on factoring and leasing in Kosovo and Montenegro in 2018, both developed with support of the EBRD, Albania introduced amendments to its legal framework for factoring in 2019 and Republika Srpska adopted a Law on Factoring in 2020, while in the Federation of Bosnia and Herzegovina, a dedicated Factoring Law has been in place since 2016. In Turkey, legislation for leasing and factoring has also been consolidated since the last assessment, while in Serbia, even though changes were introduced in 2018, they do not fully reflect the EBRD’s recommendations on factoring. Lastly, in North Macedonia, dedicated legislation for factoring has been pending adoption since 2018.

Leasing activity has increased since the last assessment across all WBT economies for which data are available, even though it continues to be used mainly for vehicle leasing. For instance, in Serbia, leasing accounted for 2.2% of total financial market assets. In Albania, it stood at 0.95% of NBFI assets, while in Montenegro and Turkey, leasing amounted to 0.8% each.

In contrast, market penetration of factoring remains well below potential and has even fallen in most economies since the last assessment. This suggests that despite robust legislation, awareness about the opportunities and use of factoring, as well as absorption capacity, remain limited and require further support to ensure uptake. In addition, in light of economic uncertainties and disruptions to supply chains during the COVID-19 pandemic, demand for factoring may have temporarily dropped. Factoring is largely non‑existent in Albania, Bosnia and Herzegovina, and Kosovo, while volumes have dropped significantly in Montenegro, North Macedonia and Serbia. Only in Turkey has factoring grown since the last assessment, at an annual rate of around 20%.

The way forward for non-bank financing

Raise awareness about the opportunities of alternative finance. Despite robust legal frameworks, the uptake of factoring remains subdued. This suggests limited understanding and awareness about this financial product, both among providers and potential users, thereby requiring more systemic dissemination efforts and outreach to the private sector. This could be done, for instance, through joint awareness-raising activities with factoring service providers or aggregators, or the launch of dedicated state-backed initiatives in support of factoring. Box 7.2 presents one example of a public-backed initiative to promote factoring.

Box 7.2. Supply chain finance initiative to encourage factoring in Mexico

In the early 2000s, Mexico’s development bank, NAFIN, pioneered and promoted reverse factoring through the launch of the Production Chains Programme (“Cadenas Productivas”), aimed at facilitating access to working capital for small suppliers via receivables from larger buyers under a reversed factoring scheme.

While NAFIN did not factor in receivables directly, it helped co-ordinate factoring services through a dedicated e-platform, requiring all factoring transactions it brokers to be offered without additional collateral and service fees. Besides its role as a broker, NAFIN also offers assistance and financial management training to small and medium-sized enterprises (SMEs), while the digital nature of the system enables SMEs to build a credit history, reduces costs and transaction time, and fosters inclusion.

The programme is ongoing, with over 70 Mexican bank and non-bank financial providers participating and supporting over 18 000 small suppliers and distributing nearly MXN 180 million (approximately EUR 8 million) in 2020, alone.

Sources: OECD (2015[13]); NAFIN (2020[14]).

Venture capital ecosystem (Sub-dimension 6.4)

Venture capital provides financing opportunities for early-stage companies with high growth potential, typically focused on innovative projects or technological development, for which traditional debt financing is particularly ill-suited. Venture capitalists – typically business angels or dedicated VC funds – invest in start-ups and support their development with additional expertise and capacity building throughout the early stages of the business’ development. VC funds can provide large sums for upfront, long-term investments in innovative products or technologies that have a higher risk, but also higher returns, while business angel investments are usually much smaller in size and driven by high net-worth individuals. Governments can encourage the development of these equity-based sources of finance by creating adequate legal and regulatory environments to support investor protection, taxation and corporate governance while creating an innovation ecosystem to create investment opportunities.

While the development of the VC ecosystem remains at an early stage across the Western Balkan economies, further good progress has been made in Turkey, consolidating the economy’s top position in this sub-dimension. Good progress has also been made in North Macedonia and Serbia, as both economies advanced their respective legal framework, as outlined in Table 7.7.

Table 7.7. Scores for Sub-dimension 6.4: Venture capital ecosystem in the Western Balkans and Turkey

|

ALB |

BIH |

KOS |

MKD |

MNE |

SRB |

TUR |

WBT average |

|

|---|---|---|---|---|---|---|---|---|

|

Legal framework |

2.00 |

2.00 |

2.10 |

2.30 |

2.00 |

3.70 |

5.00 |

2.73 |

|

Design and implementation of government activities |

1.80 |

1.40 |

2.30 |

2.90 |

1.70 |

3.00 |

4.90 |

2.57 |

|

Monitoring and evaluation |

1.00 |

1.00 |

1.00 |

1.00 |

1.00 |

1.00 |

4.30 |

1.47 |

|

Weighted average |

1.71 |

1.53 |

1.97 |

2.31 |

1.65 |

2.83 |

4.81 |

2.40 |

Note: See the Policy Framework and Assessment Process chapter and Annex A for information on the assessment methodology.

Venture capital remains at an early stage in most economies, but efforts have been stepped up to introduce dedicated legislation

As in previous assessments, VC activity remains limited across the Western Balkan region, but is available at scale in Turkey, where a dedicated framework regulating venture capital was further strengthened in 2020 when the definition of VCs was extended to allow more funds to be registered. Large-scale support programmes, some of which were initiated in the mid-2000s, including state-backed direct VC funds and “fund of funds”, have yielded results and encouraged other investors. Between 2017 and 2020, despite some market turbulence, overall investment volumes doubled to over USD 140 million, reaching unprecedented levels at USD 1.2 billion in 2021, when two Turkish tech start-ups attracted significant investments.

In contrast, while progressing, the Western Balkan economies remain in the early stages of developing VC ecosystems. Both North Macedonia and Serbia have taken steps to strengthen their legislative framework to explicitly address VC activities. Serbia adopted a new Law on Alternative Investment Funds in 2020, detailing venture capital, while following an assessment aimed at identifying legal obstacles, North Macedonia introduced amendments to the Law on Investments in 2021. In addition, a new Law on Alternative Investments is under preparation. In Albania, a new Start-up Law was adopted in March 2022 and a new Law on Collective Investments was adopted in 2020; however, legislation falls short of effectively regulating venture capital. Lastly, some progress has also been made in Republika Srpska, where a study assessing obstacles to VC has led to amendments to the Law on Investment Funds, which were under preparation at the time of drafting. No progress was observed in Kosovo or Montenegro.

The Enterprise Innovation Fund, under the auspices of the World Bank’s EDIF platform and backed by significant support from international and bilateral financial institutions such as the EBRD, the European Investment Fund and the KfW, as well as the European Commission, remains the only VC fund active in the region. Since 2016, the fund has invested EUR 30 million, or around 75% of committed capital, into 29 early-stage companies across the region,4 with the exception of Albania and Bosnia and Herzegovina. Reflecting the size of its economy, most investments were made in Serbian start-ups (14), followed by North Macedonia (5), Kosovo (2) and Montenegro (1) (EIF, 2020[15]).

Business angel investments remain nascent

Progress identified in the previous assessment with regards to the availability of angel investors has somewhat been reversed amid limited support for business angel investments. According to the European Business Angel Network’s data for 2020, just over EUR 2 million in angel investments were made across Montenegro, North Macedonia and Serbia in 2020 across eight investments, down slightly from EUR 2.4 million in 2019. In Kosovo, where business angels had been fairly active, no investments were recorded in 2020 at all. In contrast, angel investments more than doubled in Turkey compared to 2019, totalling more than EUR 32 million.

FinTech solutions, such as crowdfunding, are gaining traction

Crowdfunding remains at an early stage of development, with most economies reporting no such activity, except for Turkey. With the support of the EBRD, in 2019, Turkey adopted new legislation on crowdfunding, which enabled equity-based crowdfunding in addition to the previously existing reward-based model, all under the auspices of the regulator. Subsequently, a new unified crowdfunding platform was launched in 2021 and has reported its first successful investments.

Across the rest of the region, some economies have initiated the development of dedicated crowdfunding legislation. In Serbia, legislation on crowdfunding is at the drafting stage and expected to be adopted in 2022, while in Montenegro, preliminary work on developing legislation has also commenced. In North Macedonia, the stock exchange has established a co-operation with Funderbeam SEE, a leading crowdfunding platform within the European Union, to support this type of finance for Macedonian start-ups. To date, one Macedonian company has initiated fundraising.

Initial coin offerings and crypto currencies are also being explored across the region as a means to facilitate access to finance, but efforts remain at an early stage of development.

The way forward for the venture capital ecosystem

Further build on efforts to create an environment conducive to venture capitalists. Where legislation is not yet in place, introduce a dedicated legal and regulatory framework to regulate and incentivise venture capital, based on consultation with practitioners and on gap analyses. This should be linked with continuous efforts to strengthen the investment readiness of local high growth potential enterprises, for instance through targeted support schemes to boost innovation, research and development (see Dimension 8b).

Financial literacy (Sub-dimension 6.5)

Limited access to finance is not only a supply-side issue. Entrepreneurs often are not aware of the different financing options available, and limited financial management and understanding, including appropriate accounting, may impede the investment-readiness of their business.

The importance of financial awareness and skills of SMEs is recognised by the G20/OECD High-level Principles for SME Finance (G20/OECD, 2015[16]) as a critical component for access to finance. Against this background, the OECD, under the guidance of its International Network on Financial Education (INFE), has adopted a set of recommendations on financial literacy, centred around (OECD, 2020a[17]):

the establishment of a national strategy for financial literacy, based on evidence and analysis

the development of a road map with a clearly mandated body to oversee implementation and to ensure consistency and synergy of programmes

monitoring and evaluation.

In addition, the recommendations suggest identifying and focusing on clear target groups, including entrepreneurs, while ensuring measures address both current and future generations.

Progress in this sub-dimension has been made by some economies, albeit from low levels. North Macedonia, in particular, and Montenegro have progressed, but little progress is evident in Bosnia and Herzegovina or Kosovo. The average WBT score remains low, at 2.50 (Table 7.8).

Table 7.8. Scores for Sub-dimension 6.5: Financial literacy in the Western Balkans and Turkey

|

ALB |

BIH |

KOS |

MKD |

MNE |

SRB |

TUR |

WBT average |

|

|---|---|---|---|---|---|---|---|---|

|

Planning, design and implementation |

2.40 |

1.40 |

3.00 |

3.60 |

3.20 |

3.00 |

3.20 |

2.83 |

|

Monitoring and evaluation |

1.00 |

1.00 |

1.00 |

1.00 |

1.00 |

1.00 |

2.30 |

1.19 |

|

Weighted average |

2.12 |

1.32 |

2.61 |

3.08 |

2.75 |

2.60 |

3.02 |

2.50 |

Note: See the Policy Framework and Assessment Process chapter and Annex A for information on the assessment methodology.

Some economies have undertaken concrete steps to introduce a more strategic approach to financial literacy

Following the results of an assessment of financial literacy in adults in seven South East European economies in 2019, conducted by the OECD/INFE and supported by the Netherlands (Box 7.3), Montenegro and North Macedonia have initiated work on developing a financial literacy strategy. North Macedonia adopted its first strategy for financial education and financial inclusion in 2021, and preparatory work is progressing well in Montenegro. Similarly, in Albania, where the central bank conducts periodic surveys on financial literacy, preliminary work on developing a financial education strategy has commenced with support from the World Bank. In contrast, the implementation of Kosovo’s five-year financial literacy plan, adopted by the economy’s central bank in 2017, has stagnated amid limited resources and capacity. In Turkey and Serbia, which had adopted the WBT region’s first dedicated Financial Literacy Strategy in 2014 and 2016, respectively, action plans have expired without clear successors in place. No strategic approach to financial literacy is evident in Bosnia and Herzegovina.

Learning opportunities remain fragmented and lack co-ordination, alignment and sufficient impact monitoring

All economies offer some level of training opportunities for entrepreneurs and awareness‑raising campaigns, either implemented directly by the regulator or SME and development agencies. In some economies, private sector providers, usually financial sector associations or affiliated foundations, also offer training opportunities. However, these efforts remain largely ad hoc and lack a strategic focus, while COVID-19 restrictions have further reduced output. Some economies operate dedicated online platforms that provide e-learning, general guidance on finance and savings, as well as information on available support schemes. Such examples include North Macedonia’s konkurentnost platform or Serbia’s Tvoj Novac. In Bosnia and Herzegovina, however, the portal U plusu has become largely inoperative. While these platforms serve as a good outreach tool, they could be further leveraged to raise awareness about different types of finance opportunities, such as leasing and factoring.

Box 7.3. Financial literacy in adults in South East Europe: An OECD/INFE assessment

In 2019, the OECD’s International Network on Financial Education commissioned a survey of over 7 000 adults between the ages of 18 and 79 across 7 selected economies in South East Europe: Bulgaria, Croatia, Georgia, Moldova, Montenegro, North Macedonia and Romania. Around 10% of respondents were small and medium-sized enterprise (SME) entrepreneurs. The survey assessment, in line with the International Network on Financial Education’s vetted methodology, covered questions about financial knowledge, financial behaviour and attitude to finance. Questions were also included to evaluate financial inclusion and well-being.

Overall, adults in South East Europe scored on average about 57% of the maximum possible, lower than comparable scores obtained through the same methodology from surveys of European Union and OECD member countries, at 64% and 65%, respectively. North Macedonia and Montenegro both scored below the SEE average, at 56% and 55%, respectively, only ahead of Romania. In North Macedonia, adults performed equally strong across all three main dimensions, whereas in Montenegro they performed the strongest in relation to financial knowledge.

Entrepreneurs scored consistently higher across all dimensions and economies, with scores for Montenegro and North Macedonia aligned to the South East Europe average. While Macedonian SME owners demonstrated a slightly higher level of financial knowledge, with a score of 73% compared to 71% on average across the surveyed economies, they performed somewhat worse with regards to attitudes (56%, compared to an average of 58%). Montenegrin entrepreneurs received a lower score for financial knowledge (69%).

Lastly, the survey also found that across all surveyed economies, financial literacy is significantly higher among men than women, and among those in more urban areas, with the exception of Montenegro. Here, levels appear to be equal between those located in urban and rural areas, likely reflecting the small size of the economy and population.

Source: OECD (2020[18]).

Lastly, some economies have taken steps to incorporate financial education into the national curriculum, though these remain voluntary. For instance, in Kosovo, the central bank signed a memorandum of understanding with the Ministry of Education in 2020 to raise financial awareness among pupils, and materials have been developed for primary schools. In Serbia, an initiative launched in 2018 between the Ministry of Science, Technology and Education with VISA has resulted in a comprehensive handbook for teachers to introduce financial education in the classroom.

The way forward for financial literacy

Introduce or renew strategic frameworks to enhance financial literacy. Such strategies should be designed in close consultation with public and private stakeholders and mandate an implementation body. Measures should target both the broader population, and businesses in particular, and aim to raise understanding of financial management and finance options, with a view to boost the investment-readiness of local enterprises and engage in grass root activities to raise entrepreneurial and financial skills.

Box 7.4. Financial literacy and education at higher education institutions in the United States

Higher education institutions (HEIs) in the United States play an important role in society and the economy by developing educated citizens and skilled workers who are vital to the country’s long-term economic sustainability. Along with preparing the workforce, HEIs can prepare their students to make financial choices throughout their lives, which enable them to effectively participate in the economy, build wealth and attain their goals. This starts by ensuring students avoid the pitfalls associated with financing higher education.

Against this background, in 2019, the US Financial Literacy and Education Commission prepared a set of guidelines for HEIs for teaching financial literacy, by providing best practice methods of teaching financial literacy and information to assist students with borrowing decisions.

The Financial Literacy and Education Commission’s recommendations were twofold, centred around recommendations for delivering financial education to the public and specifically for post-secondary education:

1. Best practices for delivering financial literacy to the public

Know the individuals and families to be served, and tailor content and delivery to the users’ circumstances and needs.

Provide actionable, relevant and timely information.

Improve key financial skills. Financial literacy and education can be more effective when they help develop skills, rather than transmitting knowledge of particular facts about financial products and services.

Build on motivation.

Make it easy to take good decisions and follow through. The environment or context can make it easier for people to carry out their intentions and bridge the gap between intentions and actions.

Develop standards for professional educators. Financial literacy and education providers should demonstrate a high level of quality, including knowledge of the content and how to deliver it effectively.

Provide ongoing support. Financial literacy and education providers should provide ongoing support, including one-on-one financial coaching.

Evaluate for impact. Financial literacy and education programmes need to be assessed for impact and develop a culture of continuous improvement.

The Financial Literacy and Education Commission also recognised that in addition to best practices for delivery and content for financial education trainings, HEIs should play a proactive role to channel and implement financial education and disseminate information among HEIs, and identified the following actions for HEIs:

2. Best practices for higher education institutions

Provide clear, timely and customised information to inform student borrowing.

Effectively engage students in financial literacy and education – for example, when introducing mandatory financial literacy courses, deploy well-trained peer educators and integrate financial literacy into core curricula.

Target differences in populations – understanding students’ personal and financial circumstances and goals, consistent with appropriate privacy practices, to better know the population they intend to serve.

Communicate the importance of graduation and major on the repayment of student loans – provide incentives that spur students toward completion, including banded tuition, reduced summer tuition and extended enrolment periods.

Prepare students to meet financial obligations upon graduation – for example, help students understand loan repayment options and obligations, build a budget to set a repayment goal, identify and connect with their student loan servicer, and assess the costs and benefits of graduate and professional studies.

Source: FLEC (2019[19]).

Improve monitoring and analysis of levels of financial awareness and understanding. Linked to a dedicated framework, economies should undertake a baseline assessment of financial literacy levels, ideally based on a best practice methodology, and disaggregated by specific demographics, such as age, gender, entrepreneurs. This would contribute to developing impactful measures to close existing gaps and allow for systemic monitoring against pre-set targets. For more information on data that WBT governments could consider collecting in this area, please see Annex C.

References

[8] Bircan, Ç. et al. (2020), “Coronavirus credit support: Don’t let the liquidity lifeline become a golden noose”, VOX EU CEPR, https://voxeu.org/article/coronavirus-credit-support-don-t-let-liquidity-lifelines-become-golden-noose.

[11] CBBH (2021), Central Bank of BiH Bulleting #3, Cengtral Bank of BiH.

[12] CBRK (2020), Annual Report, Central Bank of Kosovo.

[4] CEIC Data (2022), Global Economic Data, Indicators, Charts and Forecast, https://www.ceicdata.com/en.

[9] Demmou, L. and G. Franco (2021), “From hibernation to reallocation: Loan guarantees and their implications for post-Covid-19 productivity”, VOX EU CEPR, https://voxeu.org/article/loan-guarantees-and-their-implications-post-covid-19-productivity.

[2] EBRD (2021), BEEPS VI, European Bank for Reconstruction and Development, https://www.beeps-ebrd.com/data.

[15] EIF (2020), Annual Report 2020, European Investment Fund, Luxembourg, https://doi.org/10.2867/900548.

[3] European Commission (2008), Small Business Act for Europe, Commission of the European Communities, Brussels, http://ec.europa.eu/enterprise/admin-burdens-reduction/home_en.htm.

[19] FLEC (2019), Best Practices for Financial and Education at Institutions of Higher Education, Financial Literacy and Education Commission, https://home.treasury.gov/system/files/136/Best-Practices-for-Financial-Literacy-and-Education-at-Institutions-of-Higher-Education2019.pdf.

[16] G20/OECD (2015), G20/OECD High-level Principles on SME Financing, Antalya, https://www.oecd.org/finance/G20-OECD-High-Level-Principles-on-SME-Financing.pdf.

[14] NAFIN (2020), Annual Report 2020, Nacional Financiera, Mexico City, https://www.nafin.com/portalnf/files/secciones/normatividad/pdf/informes_anuales/2020/Informe_anual_2020_ING.pdf.

[7] OECD (2021), COVID-19 Government Financing Support Programmes for Business, OECD, Paris, https://www.oecd.org/finance/COVID-19-Government-Financing-Support-Programmes-for-Businesses.pdf.

[18] OECD (2020), Financial Literacy of Adults in South East Europe, OECD, Paris, https://www.oecd.org/finance/Financial-Literacy-of-Adults-in-South-East-Europe.pdf.

[1] OECD (2020), Financing SMEs and Entrepreneurs 2020: An OECD Scoreboard, OECD Publishing, Paris, https://doi.org/10.1787/061fe03d-en.

[13] OECD (2015), New Approaches to SME and Enterpreneurship Financing: Broadening the Range of Instruments, OECD, Paris, https://www.oecd.org/cfe/smes/New-Approaches-SME-full-report.pdf.

[17] OECD (2020a), Recommendation of the Council on Financial Literacy, OECD, Paris, https://www.oecd.org/finance/OECD-Recommendation-on-Financial-Literacy.htm.

[6] World Bank (2022), “GCI 4.0: Insolvency recovery rate”, GovData 360, World Bank, Washington, DC, https://govdata360.worldbank.org/indicators/h6f945767?country=BRA&indicator=41451&viz=line_chart&years=2017,2019.

[5] World Bank (2021), World Development Indicators (database), https://databank.worldbank.org/source/world-development-indicators.

[10] World Bank (2015), Principles for Public Credit Guarantee Schemes for SMEs, World Bank, Washington, DC, https://documents1.worldbank.org/curated/en/576961468197998372/pdf/101769-REVISED-ENGLISH-Principles-CGS-for-SMEs.pdf.

Notes

← 1. The Business Environment and Enterprise Performance Survey is a joint initiative of the European Bank for Reconstruction and Development and the World Bank Group. It is a firm-level survey of a representative sample of an economy’s private sector whose objective is to gain an understanding of firms’ perception of the environment in which they operate. BEEPS covers a broad range of business environment topics including access to finance, corruption, infrastructure, crime, competition and performance measures. Its findings can be used to help policy makers better understand how businesses experience the business environment and identify, prioritise and implement reforms of policies and institutions that support efficient private economic activity.

← 2. Alongside Transition and Sound Banking, one of the three founding principles for driving the multilateral development banks work is additionality – that multilateral development banks’ support to the private sector should make a contribution beyond what is available in the market, and it should not crowd out the private sector. For more information, see: https://www.ebrd.com/our-values/additionality.html.

← 4. Includes seven investments in companies in Croatia.