This chapter assesses the strategic framework, available infrastructure and policy measures to stimulate SME innovation to build a knowledge economy in the Western Balkans and Turkey. The chapter starts with an overview of the assessment framework and outlines the key developments since the last assessment. It then presents the four sub-dimensions of Dimension 8b: 1) policy framework for innovation, which reviews the framework in which innovation is embedded and progress implementing it; 2) government institutional support services for innovative SMEs, which looks at the institutional support structure to foster innovative entrepreneurship, both for early-stage and more mature small businesses; 3) government financial support services for innovative SMEs, which assesses the availability and scale of direct and indirect financial support schemes to enhance firm innovation, and 4) SME and research institution collaboration and technology transfer, which analyses the level of collaboration between SMEs and research institutions, and support measures that are in place to stimulate business-academia co-operation, technology transfer and commercialisation. Each sub-dimension concludes with a set of key recommendations to help address outstanding challenges.

SME Policy Index: Western Balkans and Turkey 2022

10. Innovation policy for SMEs (Dimension 8b) in the Western Balkans and Turkey

Abstract

Key findings

Most economies in the Western Balkans and Turkey have a comprehensive framework for innovation policy in place; however, some of the more advanced economies need to ensure that momentum is maintained and efforts are consolidated in a renewed strategic approach. Implementation continues to be somewhat impeded by complex co‑ordination mechanisms in most economies, reflecting the highly interdisciplinary nature of innovation.

Smart specialisation is advancing. In addition to Montenegro, the first Western Balkan economy to adopt a smart specialisation strategy (S3) during the previous assessment, both North Macedonia and Serbia are in the process of or have adopted smart specialisation strategies since the last assessment. Albania has started preliminary work while in Turkey, five regions have formulated an S3 approach. Inter-regional linkages could be further explored to maximise the available resources and capabilities.

The speed and scale of implementation are increasingly diverging. Those economies with well-established, clearly mandated institutions to support innovation development (North Macedonia, Serbia and Turkey) have further increased the scale and outreach of their support programmes, while in the remaining economies, implementation of innovation policy has progressed more slowly. In Montenegro, a major development was the creation of a new Innovation Fund, which is expected to increase the economy’s implementation capacity once it becomes operational in 2022.

Efforts to build an innovation ecosystem are progressing. Multiple incubators operate throughout the region, often supported by public funds or self-sufficient. Not all of them, however, have obvious links to innovation. Acceleration programmes have also been established, but overall support for more mature enterprises continues to be limited.

Financial support has expanded, in particular in economies with previously established dedicated innovation agencies. The allocation of the state budget for these agencies has increased, and dedicated COVID-19 programmes were introduced to help mitigate the impact of the COVID-19 pandemic. In other economies, small and medium-sized enterprises (SMEs) can access small-scale support. Indirect financial support in the form of fiscal support or demand-side incentives is increasingly available, but remains below potential.

Business-academia collaboration remains nascent. Financial support schemes specifically targeting co-operation in research and development (R&D) remain limited to a few economies (North Macedonia, Serbia and Turkey), while the emerging institutional support infrastructure does not always focus on stimulating linkages.

Despite improvements in intellectual property protection, enforcement remains low, thereby discouraging patenting. Almost all economies have strengthened their legal frameworks for intellectual property to align with the EU acquis and internationally recognised patents emerging from the region are gradually increasing, though remain significantly below potential.

Comparison with the 2019 assessment scores

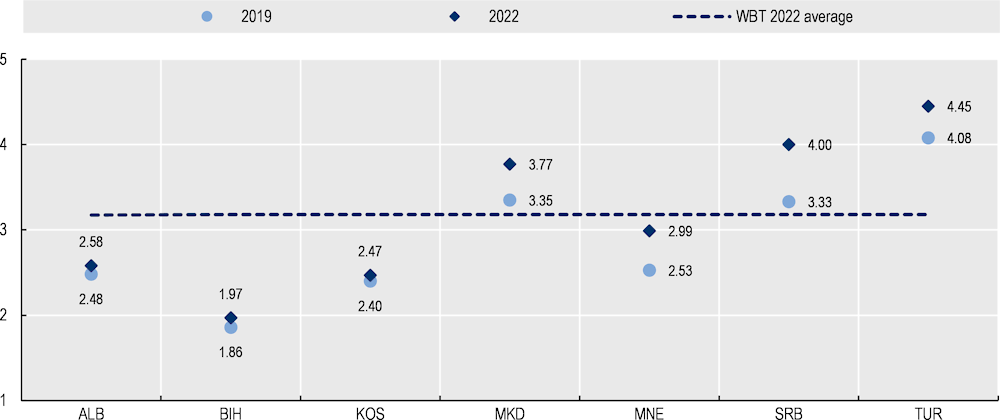

All economies have made progress in designing and implementing effective innovation policies for SMEs. However, the scale and speed of implementation have varied significantly, with those economies that were previously already more advanced in the area of innovation adopting additional measures, reflected in solid increases in their overall scores (Montenegro, North Macedonia, Serbia and Turkey). Gaps with the other economies have widened, increasingly suggesting two rates of development of innovation policy across the region (Figure 10.1).

Figure 10.1. Overall scores for Dimension 8b (2019 and 2022)

Notes: WBT: Western Balkans and Turkey. Despite the introduction of questions and expanded questions to better gauge the actual state of play and monitor new trends in respective policy areas, scores for 2022 remain largely comparable to those of 2019. To have a detailed overview of policy changes and compare performance over time, the reader should focus on the narrative parts of the report. See the Policy Framework and Assessment Process chapter and Annex A for information on the assessment methodology.

Implementation of the SME Policy Index’s 2019 recommendations

Across the Western Balkans and Turkey (WBT) region, some measures have been taken to address and implement the recommendations made in the 2019 assessment. Table 10.1 summarises the progress made in implementing the key recommendations made for this dimension in the previous assessment.

Table 10.1. Implementation of the SME Policy Index’s 2019 recommendations for Dimension 8b in the Western Balkans and Turkey

|

Regional 2019 recommendation |

SME Policy Index 2022 |

|

|---|---|---|

|

Main developments during the assessment period |

Regional progress status |

|

|

Take an overarching strategic view and co‑ordinate policies across the whole of government |

Co-ordination remains complex, with the involvement of multiple ministries, agencies and advisory bodies across all levels of government. Since the previous assessment, the number of stakeholders has even increased in most economies in the region. The exception is Montenegro, which established a dedicated Council for Innovation and Smart Specialisation in 2019, which has a unique and clear mandate to co-ordinate national innovation policy. |

Limited |

|

Develop sector-specific support and “smart specialisation” frameworks |

Following Montenegro in 2019, Serbia adopted a Smart Specialisation Strategy in 2020. North Macedonia’s Smart Specialisation Strategy is expected to be adopted in 2022. In Turkey, five regions have formulated smart specialisation approaches, while in Albania, work to develop one has also commenced, but remains at an early stage. In Bosnia and Herzegovina, a working group has been established to look preliminarily into the development of a smart specialisation strategy. All efforts are supported by the European Commission’s Joint Research Centre. |

Moderate |

|

Improve statistical data to formulate evidence-based policies |

Bosnia and Herzegovina and Montenegro participated in the European Innovation Scoreboard (EIS) for the first time during the assessment period, alongside North Macedonia, Serbia and Turkey. Albania is aligning the collection of statistical data to the Eurostat methodology in preparation for joining the EIS during the next assessment cycle. Further efforts are, however, needed overall to enhance statistical data collection and use for developing evidence-based policies. |

Moderate |

|

Explore cross-border collaboration and promote an ecosystems approach to innovation |

No actions have been taken. |

No progress |

|

Step up the efforts to accelerate technology diffusion among SMEs |

In Turkey, the number of technology development zones, which offer some sort of technology extension support, has expanded. In North Macedonia, following a dedicated technology extension programme implemented by the Fund for Innovation and Technology Development during the previous assessment, three providers now offer such services. |

Limited |

|

Map the innovation infrastructure |

North Macedonia, Serbia and Turkey have carried out an assessment of the start‑up ecosystem, though these did not have a specific focus on innovation. Progress has been made by some economies, notably Serbia, in conducting a research infrastructure road map under the umbrella of its membership in the European Strategy Forum on Research Infrastructure.1 |

Moderate |

|

Consolidate financial support measures and increase disbursements |

Public spending has increased across most of the region, albeit at significantly varying speeds and scales. In North Macedonia, Serbia and Turkey, availability and disbursement of funds have expanded further, while in Albania, despite temporary improvements (from very low levels) in 2019, all funding for innovation was halted at the onset of the COVID-19 pandemic. Funding remains scarce in Bosnia and Herzegovina, Kosovo* and Montenegro, but in Montenegro in particular, an increase in the availability of financial programmes is expected once the newly established Innovation Fund becomes operational. |

Moderate |

|

Diversify public support to business research and development (R&D) |

Serbia introduced tax relief for R&D activities and amended its procurement legislation to encourage innovation. Montenegro is also preparing tax breaks. In Republika Srpska, a new Law on Incentives supports investment in new technology and equipment, while in North Macedonia, research activities were excluded from value-added tax during the assessment period. |

Moderate |

|

Intensify co-operation between academia and the private sector |

Private sector investments in R&D are gradually increasing, albeit from very low levels. Several economies (Montenegro and North Macedonia) have introduced or are planning to deploy financial support programmes encouraging business-academia co-operation and efforts are being made to strengthen the institutional support infrastructure, particularly in the form of science and technology parks. However, the link to research is not always evident. Intellectual property protection is increasing, but enforcement remains an issue across the region. |

Moderate |

|

Scale up intellectual property rights support services for SMEs |

Small-scale support is provided in some economies for patent applications, and awareness-raising activities increased in the pre-COVID period, albeit from low levels. Some economies, for instance Serbia, have reduced fees for patent applications. |

Limited |

1. For more information on the WBT economies’ participation in the European Strategy Forum on Research Infrastructure and progress on mapping their research infrastructures, see OECD (2021[1]).

*This designation is without prejudice to positions on status, and is in line with United Nations Security Council Resolution 1244/99 and the Advisory Opinion of the International Court of Justice on Kosovo’s declaration of independence.

Introduction

Globalisation, technological development and growing markets have been major triggers for firm innovation in the last decade, and increasingly, SMEs have been recognised to play key roles in the development of innovation- and knowledge-based economies. In addition, there is also a clear link between firm innovation and economic output. Innovative practices and activities help firms expand and boost productivity, even if only a small percentage of them advance to the global technological frontier (EBRD, 2014[2]).

Recent developments and global trends have further emphasised the need for innovation and knowledge development and have demonstrated the incremental role innovation can play in tackling global social and economic challenges. Innovation and R&D have been at the forefront of the global response to the outbreak of COVID-19, including through the development of vaccines and medical treatments, but also by providing digital solutions to tackle social distancing, which has accelerated the automation and business adoption of other technologies and practices (Paunov and Planes-Satorrai, 2021[3]), and have often been driven by the private sector. At the same time, innovation is also seen as critical for fostering green growth and developing carbon-neutral business processes. Such “eco-innovations” reduce environmental impact, with or without intent, and distinctly can also include broader changes in social and institutional structures, with a long-lasting, sustainable impact. Although not all eco-innovations are driven by SMEs, in particular, relatively new market entrances are seen as pioneers of eco-innovations (OECD, 2013[4]).

Against this background, supporting innovation and creating adequate frameworks have become a policy priority for governments around the world. The development of innovative activities requires sound macroeconomic conditions. Analysing cross-country differences finds that robust output growth, low inflation and low real interest rates have a positive influence on the rate of growth of R&D (Jaumotte and Pain, 2005[5]). While creating broader innovation and knowledge systems, comprised of the flow of information between public research institutions, universities and enterprises, at the same time, it is imperative to also support and develop innovation capacity directly at the firm level, for instance in the form of financial and technical support schemes. As such, creating a sound framework for innovation is essential to boost private sector innovation activities.

The Small Business Act for Europe suggests a number of measures to support innovation for small businesses, and calls on governments to “encourage investment in research by SMEs and their participation in R&D support programmes, transnational research, clustering and active intellectual property management by SMEs” (European Commission, 2008[6]).

The following sections describe the progress WBT economies have made in achieving these principles, among others.

Assessment framework

Structure

Dimension 8b aims to assess the innovation policy framework, its implementation mechanism, and public support measures to support and enhance innovative entrepreneurship across the WBT region. The analysis is based on four sub‑dimensions:

Sub-dimension 8b.1: Policy framework for innovation looks at the overall strategic approach that SME innovation policy is based on, as well as co-ordination and implementation mechanisms.

Sub-dimension 8b.2: Government institutional support services for innovative SMEs assesses the physical, non-financial infrastructure available to SMEs, including for start-ups and early-stage companies as well as for more mature SMEs.

Sub-dimension 8b.3: Government financial support services for innovative SMEs evaluates the availability and scale of both direct financial support schemes and indirect financial incentives to stimulate innovation and R&D in firms.

Sub-dimension 8b.4: SME and research institution collaboration and technology transfer looks at policy measures to stimulate exchange and collaboration between academia and the business community, both in terms of financial and non-financial support, and also considers the legal framework for intellectual property protection and support to commercialisation.

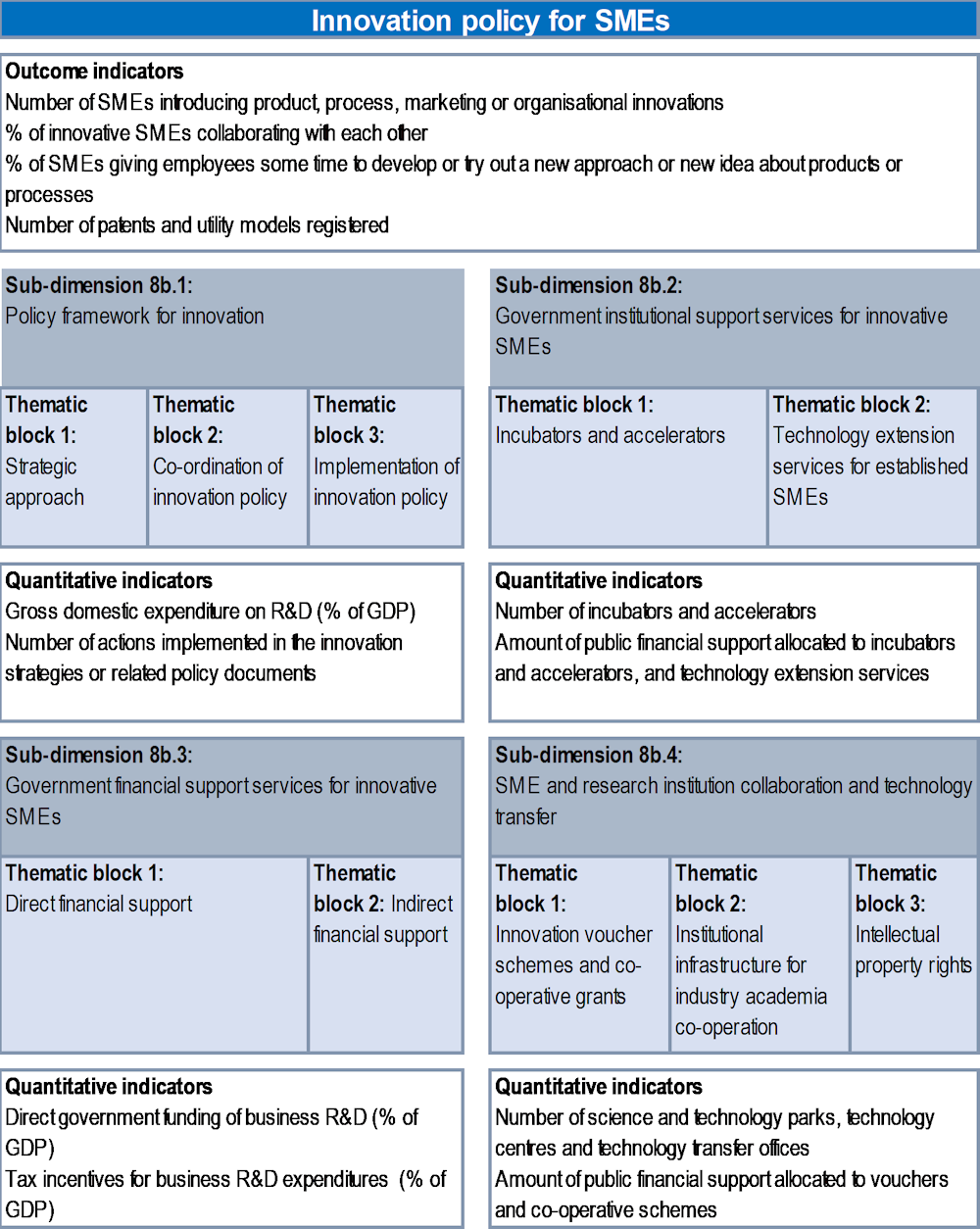

Figure 10.2 illustrates how these four sub-dimensions together make up the overarching assessment framework for this dimension. Innovation, and the development of a knowledge-based economy, are determined by both demand- and supply-side factors. While this assessment predominately looks at the policy framework to stimulate firm innovation and enhance the technological absorption capacity of SMEs, it recognises that the level of innovation is also linked to the quality and quantity of scientific research outputs, which is not specifically covered in this assessment.

Figure 10.2. Assessment framework for Dimension 8b: Innovation policy for SMEs

Note: SME: small and medium-sized enterprise; GDP: gross domestic product; R&D: research and development.

For more information on the methodology see the Policy Framework and Assessment Process chapter and Annex A.

Since the 2019 assessment, small adjustments have been made to the framework that gauges the inclusion of the green and digital aspects of policies and measures. The assessment also takes into consideration COVID-19 response measures, although no evaluation has been made in this regard.

Analysis

Following a trend already evident in the previous assessment, the WBT region has further progressed in creating an ecosystem conducive to SME innovation, reflecting the strong emphasis on innovation and the development of a knowledge economy in national policy agendas. However, regional discrepancies are becoming increasingly apparent.

Output indicators play an important role in assessing and evaluating the impact and effectiveness of policy measures. While the overall availability of reliable statistical data on key areas related to innovation and R&D remains limited, some progress has been made, and is well captured in the 2021 edition of the European Innovation Scoreboard (EIS) (see Box 10.1 for further details). Since the previous assessment, Montenegro and Bosnia and Herzegovina started participating in this pan-European comparative assessment in 2020 and 2021, respectively, in addition to North Macedonia, Serbia and Turkey.

Accordingly, the WBT region is catching up, but significant gaps remain compared to most of its European peers. All five participating economies are categorised as “emerging innovators”, suggesting that their performance is less than 70% of the EU average. Bosnia and Herzegovina, Montenegro and North Macedonia rank towards the bottom of this category, ahead of Ukraine and Romania. Turkey also sits in the bottom half, following a drop in its overall performance compared to the 2020 EIS assessment, whereas Serbia is positioned just behind the leaders within this group, Hungary and Croatia (EIS, 2021[7]).

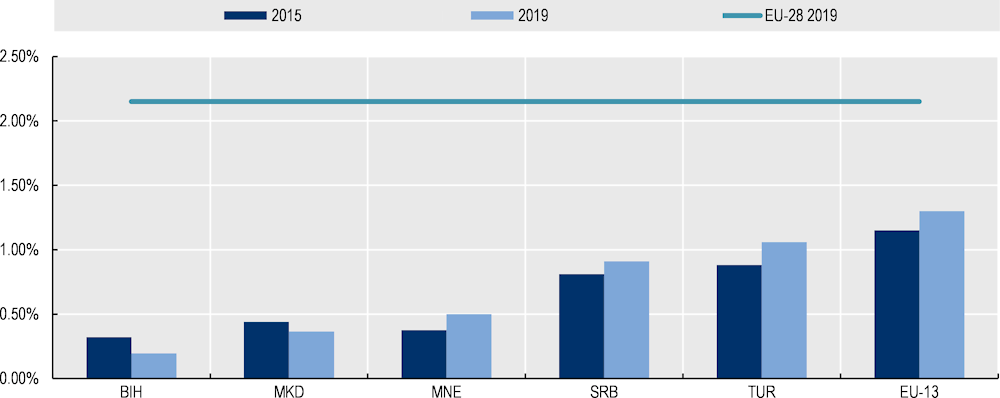

Other data support these findings. Spending on R&D as a percentage of gross domestic product (GERD) remains low across all WBT economies (Figure 10.3) and is even decreasing in some. Even where progress is tangible, particularly in Serbia and Turkey, spending remains well below the EU target of 3%. R&D investments continue to be mainly public sector driven, though private sector contributions have increased, particularly in Serbia.

As a result, patent application levels also remain very low in most economies, but are gradually increasing. Very few patents granted by the European Patent Office originate from the WBT region, suggesting limited high-quality research activity, but also a lack of awareness about the importance of intellectual property protection. In 2021, the European Patent Office granted 256 applications from the WBT region, 252 of which originated from Turkey, 2 from Serbia, and 1 from each Albania and North Macedonia. No patents were successfully filed that originated from Bosnia and Herzegovina, Kosovo, or Montenegro that year (EPO, 2021[8]).

All economies also continue to participate in the European Commission’s Horizon 2020 programme. However, the scope and scale of activities vary significantly across the region, and remain below potential. In total, 1 592 projects had received more than EUR 466 million in funding by the end of 2021. Serbia and Turkey, reflective of their size, have been the most active, but project participation has also increased in Kosovo amid increased promotion and awareness raising, albeit from very low levels (Table 10.2).

Figure 10.3. Gross domestic expenditure on R&D as a percentage of GDP (GERD) (2015 and 2019)

Note: Data for Albania are only available for 2008; data for Kosovo not available. The EU-13 refers to Bulgaria, Croatia, Cyprus, the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Malta, Poland, Romania, the Slovak Republic and Slovenia.

Note by Turkey: The information in this document with reference to “Cyprus” relates to the southern part of the Island. There is no single authority representing both Turkish and Greek Cypriot people on the Island. Turkey recognises the Turkish Republic of Northern Cyprus. Until a lasting and equitable solution is found within the context of the United Nations, Turkey shall preserve its position concerning the “Cyprus issue”.

Note by all the European Union member states of the OECD and the European Union: The Republic of Cyprus is recognised by all members of the United Nations with the exception of Turkey. The information in this document relates to the area under the effective control of the government of the Republic of Cyprus.

Sources: UNESCO Institute for Statistics (2020[9]); Eurostat (2020[10]).

Table 10.2. Horizon 2021 portfolio for Western Balkan and Turkey economies

|

|

ALB |

BiH |

KOS |

MKD |

MNE |

SRB |

TUR |

|---|---|---|---|---|---|---|---|

|

Number of participating projects |

48 |

70 |

106 |

92 |

39 |

414 |

823 |

|

Funding awarded (EUR million) |

5.79 |

8.72 |

17.35 |

14.8 |

4.62 |

135 |

280.5 |

Source: European Commission (2021[11]).

However, innovation goes well beyond R&D, as suggested by the OECD Oslo Manual (OECD/Eurostat, 2018[12]). Innovation also includes more incremental changes, such as adopting new business processes and technologies, products, or services, or introducing organisational change.

Against this background, when looking at self-reported firm-level data on innovation, a more positive trend emerges. According to the latest Business Environment and Enterprise Performance Survey (EBRD, 2021[13]), around one-third of surveyed enterprises report having introduced products of technological innovations to their business. However, amid limited investments in R&D, these innovations are likely to be limited to adopting existing technologies and products from abroad.

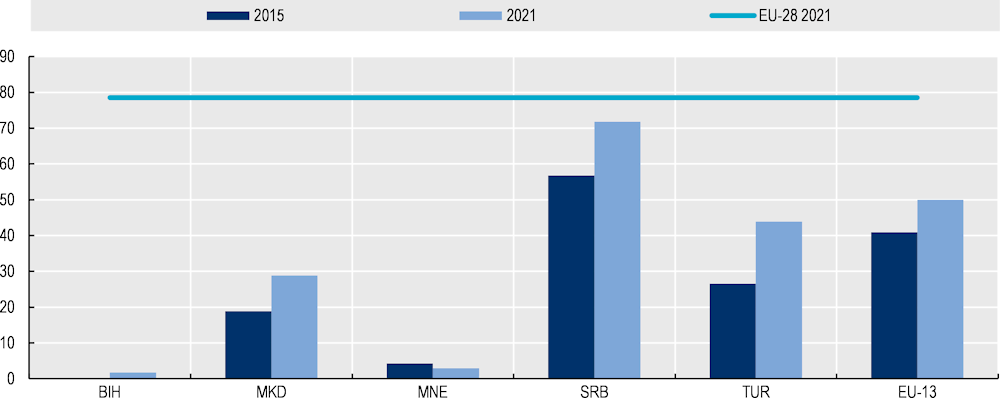

Lastly, the region’s limited yet gradually growing innovation capacity is reflected in its performance in high value-added exports. For these predominately service-oriented economies, particularly in the Western Balkans, the share of knowledge-intensive exports can serve as a solid indicator for assessing their capacity to generate a high level of value added, typically stemming from innovation and participating in knowledge-intensive global value chains. Data from the EIS, where available, also confirm the regional trend. Overall, performance in the region is improving, although at varying levels, but remains significantly below the EU average. The COVID-19 pandemic is likely to have further contributed to an increasing level of innovation, including through more active e-commerce. At the same time, however, the gap is narrowing compared to the EU-13 average or, in the case of Serbia, even exceeding it, though this is likely the result of the increasing share of ICT in Serbia’s export mix (Figure 10.4).

Figure 10.4. Knowledge intensive service exports, European Innovation Scoreboard (2015 vs 2021)

Notes: Data indicate normalised performance of economies in 2021 relative to that of the European Union in 2021. Data are unavailable for Albania and Kosovo. The EU-13 refers to Bulgaria, Croatia, Cyprus, the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Malta, Poland, Romania, the Slovak Republic and Slovenia.

Source: EIS (2021[7]).

The analysis confirms an overall positive trend for the WBT region, but also the significant catch-up potential. This can be further leveraged and supported with well‑designed and targeted policy measures, as discussed below.

Policy framework for innovation (Sub-dimension 8b.1)

An overarching strategic framework to support innovation is critical to guide the design, implementation and impact evaluation of policy in this inherently interdisciplinary area, which covers a wide range of topics, from science and technology, education, and industrial policy to entrepreneurship development.

Due to the cross-cutting nature of innovation policy, the strategic framework should outline the overall innovation objectives for the economy and define the roles of the different public institutions. It should also incorporate an effective co-ordination mechanism to ensure buy-in across government and complementarity of the proposed policy measures, to maximise impact and address existing gaps in policy frameworks. Lastly, an effective and impactful innovation system should include strong, sufficiently funded implementation bodies with a clear mandate, thereby ensuring that policy priorities are not compromised amid competing agendas.

The policy framework is best designed to cover both technological and non-technological innovations and should include specific measures to enhance firm-level innovation and absorption capacity, building an innovation system, R&D, and technology transfer as well as collaboration between the research and business communities. In addition, a strong focus should be placed on supporting innovation for SMEs, a segment that typically faces proportionally higher obstacles to innovate. As for all policy frameworks, a concrete action plan for implementation, as well as quantifiable indicators to measure progress and impact, are essential.

Table 10.3 summarises the performance of the WBT region in this sub-dimension, assessing the economies’ progress in developing best-practice, comprehensive policy frameworks for innovation. Most of the economies across the region have a solid policy framework in place and have made further progress since the last assessment; however, shortcomings remain in particular with regard to co-ordination and ineffective implementation. Turkey, Serbia and North Macedonia continue to be the top performers in this dimension, while Montenegro is increasingly closing the gap.

Table 10.3. Scores for Sub-dimension 8b.1: Policy framework for innovation in the Western Balkans and Turkey

|

ALB |

BIH |

KOS |

MKD |

MNE |

SRB |

TUR |

WBT average |

|

|---|---|---|---|---|---|---|---|---|

|

Strategic approach |

3.72 |

2.40 |

3.20 |

4.08 |

4.04 |

4.62 |

4.60 |

3.81 |

|

Implementation of innovation policy |

2.60 |

1.92 |

2.52 |

4.32 |

3.00 |

4.40 |

4.44 |

3.31 |

|

Co-ordination of innovation policy |

2.60 |

1.52 |

2.52 |

3.80 |

3.52 |

4.12 |

5.00 |

3.30 |

|

Weighted average |

2.94 |

1.98 |

2.72 |

4.14 |

3.42 |

4.41 |

4.60 |

3.46 |

Note: See the Policy Framework and Assessment Process chapter and Annex A for information on the assessment methodology.

Policy frameworks have further advanced, but efforts are needed to maintain momentum

Overall, the WBT region has made further progress in enhancing policy frameworks for innovation, increasingly reflecting key socio-economic challenges such as brain drain, climate change and inclusion. In Serbia, the new “Power of Knowledge” strategy (2021‑2025) has replaced the previous innovation strategy. In Montenegro, North Macedonia and Turkey, work has commenced to develop successor strategies after the expiration of old ones. In contrast, in Kosovo, the strategic framework for innovation remains at a high level, without concrete actions or targets, while in Bosnia and Herzegovina, where innovation is a competency of the entities, the economy’s complex constitutional set-up has thus far impeded the development of a comprehensive policy approach altogether. However, both entities have innovation action plans in place, though implementation results are mixed.

Progress has been made in some economies to introduce S3, with support from the European Commission’s Joint Research Centre. Smart specialisation enables economies to leverage existing resources and assets to identify competitive advantages and opportunities for growth. In 2020, Serbia followed Montenegro, which adopted its S3 in 2019 as the first WBT economy to do so, while work has also commenced in Albania and North Macedonia, though it remains at an early stage in Albania. In Turkey, five regions have formulated S3 approaches, while in Bosnia and Herzegovina, a working group at the federal level tasked with developing an S3 has been established.

Policy frameworks are implemented at varying speeds and scales

Implementation progress remains uneven, partially impacted by continuing complex co‑ordination mechanisms across most economies. Reflecting the highly interdisciplinary nature of innovation, numerous ministries, agencies and advisory bodies are often involved in the design, implementation and oversight of innovation approaches, while a single and uniquely mandated body only seems to be present in Montenegro in the form of the Council for Innovation and Smart Specialisation, established in 2019.

In addition, implementation capacity varies significantly across the region. In Turkey, both the Small and Medium-sized Enterprises Development Organisation KOSGEB and the Scientific and Technological Research Council TUBITAK implement large-scale, fully state-funded support schemes and other measures. The Fund for Innovation and Technology Development (FITD) in North Macedonia and the Serbian Innovation Fund have further scaled up operations, increasingly with state budgets, while Serbia has also established a dedicated Science Fund since the last assessment. Montenegro established an Innovation Fund in 2021, but it had not yet become fully operational at the time of writing. In stark contrast, little progress has been made in Albania, Bosnia and Herzegovina, or Kosovo, where implementation capacity remains limited amid limited resources and sometimes competing priorities.

Monitoring and evaluation are gradually improving

Some progress has been made in collecting statistical data relevant for innovation, which helps to inform policy actions. During the assessment period, both Bosnia and Herzegovina and Montenegro participated in the EIS for the first time in 2021 and 2020, respectively, alongside North Macedonia, Serbia and Turkey. In Albania, the collection of innovation-related statistics has expanded as the economy prepares for participation in future rounds of the EIS. Efforts should be maintained to fill outstanding gaps in data collection for the EIS, and will greatly enhance the monitoring and evaluation of national innovation frameworks.

The way forward for policy framework for innovation

Complete innovation policy frameworks. Economies with recently expired innovation policies should swiftly adopt successor strategies to maintain momentum, comprehensively applying lessons learnt from previous implementation cycles. This should be coupled with steady progress in completing the development of smart specialisation strategies. In economies with a limited strategic focus, notably Bosnia and Herzegovina and Kosovo, further efforts are needed to identify clear innovation policy priorities and implementation frameworks. Continuous efforts to strengthen the collection of statistical data, ideally aligned to the EIS methodology, will help to design policy measures and monitor progress against pre-defined targets and objectives (Box 10.1).

Further strengthen implementation and co-ordination capacity. Clearly mandated co‑ordination and implementation bodies can maximise complementarity of policy measures, track progress and consolidate the implementation of innovation policy, which is especially helpful following governmental restructuring or the establishment of new public agencies that may have overlapping objectives and responsibilities. Furthermore, continuous capacity building of implementation agencies and regular monitoring and impact evaluation of policy measures, including lessons learnt, strengthen delivery capacity. For more information on data that WBT governments could consider collecting in this area, please see Annex C.

Increase regional linkages in the context of smart specialisation. Leveraging the newly developed smart specialisation strategies, explore opportunities for increased cross‑border and inter-regional co-operation. Regional capabilities are a core pillar of smart specialisation strategies, and increased linkages with regions with similar capabilities or complementary resources would help develop economies of scale and maximise impact.

Box 10.1. European Innovation Scoreboard

The European Innovation Scoreboard (EIS), released annually by the European Union, provides a comparative assessment of the research and innovation performance of EU member states as well as 11 associated economies1 and the relative strengths and weaknesses of their research and innovation systems, thereby helping participating economies to concentrate their efforts to boost innovation performance. The framework also includes ten benchmark global economies.

In 2021, the assessment framework for the EIS was revised, now incorporating four main dimensions: 1) the innovation framework conditions, aimed at capturing external factors to firm innovation; 2) investments, including both public and private; 3) innovation activities, such as the introduction of innovative products or processes, linkages, and patents; and 4) impact, looking at spillovers to employment, sales and environmental impact.

Based on a quantitative assessment, participating economies are benchmarked against the 2014 EU average, and categorised into four categories, ranging from:

emerging innovators (performance below 70% of the EU average)

moderate innovators (performance between 70% and 100% of the EU average)

strong innovators (performance between 100% and 125% of the EU average)

innovation leaders (performance above 125% of the EU average).

In total, the EIS captures 32 different indicators, sourced mainly from Eurostat, but also from other internationally recognised sources, such as the OECD and the United Nations.

Within the context of the five WBT economies participating in the 2021 EIS, only Serbia submitted all 32 indicators, followed by North Macedonia and Turkey, for which 30 indicators were used. Montenegro provided 29 indicators, though these are unofficial and collected via a separate survey. The analysis for Bosnia and Herzegovina is based on only 25 indicators.

1. These include, in addition to the Western Balkans and Turkey economies mentioned, Iceland, Israel, Norway, Switzerland, Ukraine and the United Kingdom.

Source: European Union (2021[14]).

Government institutional support services for innovative SMEs (Sub‑dimension 8b.2)

A vibrant ecosystem that nourishes entrepreneurship and creative thinking is essential for an effective innovation system. Incubators and accelerators are core to this system of innovation support, providing support to create and develop innovative businesses.

Incubators typically support companies at the start-up stage, providing workspace, utilities and support services. Accelerators are related to incubators; however, they typically target start-ups with significant growth potential, and a preliminary, innovative business idea already in place, aimed at accelerating business creation and provision (or preparation for) early-stage or seed financing. Short-term accelerator programmes usually offer beneficiaries intensive entrepreneurial training and access to local and international mentorship networks, often concluding with a pitching event to potential investors.

Both incubators and accelerators can be publicly or privately run and managed, though given the nature of accelerators, they are usually commercially motivated. However, while incubators usually target a broader segment of start-up companies and can offer support over several years, they do not typically provide capital. In contrast, accelerators are highly selective, usually sector focused and ultimately, aim to prepare beneficiary firms for future investments.

While early-stage support is crucial to nurture creative business ideas, innovation is not exclusive to start‑ups. Many enterprises, particularly smaller ones, import knowledge into their companies instead of developing it in-house. In addition, incremental firm innovations often emerge from adopting existing technologies, which, even if not at the global technological frontier, positively contribute to developing the knowledge and productivity of local economies. Therefore, dedicated technology extension and diffusion services targeting more mature enterprises are instrumental to comprehensive institutional support infrastructure for innovation, helping to both develop “new to firm” innovation and facilitate access to existing innovative products and processes.

Many WBT economies have progressed substantially in this sub-dimension, in particular in establishing a solid ecosystem for start-ups (Table 10.4). In contrast, only a few economies, notably North Macedonia and Turkey, offer comprehensive innovation support services for more mature SMEs. As a result, Turkey continues to outperform the rest of the region in this sub-dimension, though the previous wide gap is gradually closing.

Table 10.4. Scores for Sub-dimension 8b.2: Government institutional support services for innovative SMEs in the Western Balkans and Turkey

|

ALB |

BIH |

KOS |

MKD |

MNE |

SRB |

TUR |

WBT average |

|

|---|---|---|---|---|---|---|---|---|

|

Incubators and accelerators |

2.04 |

2.40 |

2.71 |

3.86 |

3.24 |

3.96 |

4.71 |

3.27 |

|

Technology extension services for established SMEs |

2.33 |

1.00 |

1.40 |

3.00 |

1.04 |

2.55 |

3.67 |

2.14 |

|

Weighted average |

2.16 |

1.84 |

2.19 |

3.51 |

2.36 |

3.40 |

4.30 |

2.82 |

Note: See the Policy Framework and Assessment Process chapter and Annex A for information on the assessment methodology.

Institutional support services continue to expand across the region, but they mainly focus on start-ups

The scope and scale of institutional support for early-stage companies have expanded across the WBT region since the previous assessment. Economies such as Kosovo, Serbia and Turkey are increasingly prioritising the development of an ecosystem conducive to start-ups, especially in the ICT sector.

Albania adopted a new Law on the Support and Development of Start-ups in March 2022, which envisages a state budget allocation in support of the innovation ecosystem. North Macedonia has established a National Start-up Committee, tasked to strengthen the start-up ecosystem. One of its first projects is commissioning a review of the economy’s start-up support infrastructure. Similar assessments have also taken place in Serbia and Turkey over the assessment period.

Numerous incubators operate across all economies. Turkey continues to lead in this area, with more than 80, mainly operating out of dedicated technological development zones (TDZs), which have further expanded since the previous assessment with government support. Incubation services are also available via KOSGEB’s technology incubators, the TEKMER programme, which, following some restructuring, has further expanded, particularly in more urban areas.

Incubators are also present across the Western Balkans, though many are limited to basic incubation services, without an obvious link to innovation. In Serbia, the ecosystem review suggested that more than 40 active incubators are operating throughout the economy and particularly in university hubs. In North Macedonia, several well-established incubators offer comprehensive incubation services to innovative start-ups. In Kosovo, the government has supported the development of several regional innovation centres. Two additional centres have been created since the last assessment, although not all of them are fully operational. A notable development is also the inauguration of the Innovation and Training Park in Prizren in 2020, which, with support of the Kosovar authorities and Germany, aims to provide training, incubation, and R&D facilities. In Bosnia and Herzegovina, incubators in both entities receive financial support, particularly the Innovation Centre Banja Luka, but there are suggestions that especially in the Federation of Bosnia and Herzegovina, some incubators host long-term tenants and no longer serve their original purpose. Incubation in Montenegro is mainly provided through the entrepreneurship centre Tehnopolis in Nikcic, meant to become one of three decentralised hubs under the auspices of the economy’s new science and technology park, once it is operational. In Albania, incubators are largely dependent on external support from international partners, or based on private small‑scale initiatives. However, the newly adopted Law on the Support and Development of Start-ups is expected to develop the local start-up ecosystem more systematically with public funds. This will be assessed in the next assessment round.

Several state-supported accelerators have been launched in the Western Balkans, while in Turkey accelerators increasingly focus on more mature companies

Progress has also been made in establishing local accelerators. As before, Turkey significantly outperforms the Western Balkan economies, with 70 operational accelerators, up from 47 in the last assessment, particularly focusing on e-gaming. In addition, TUBITAK continues to support accelerators through its BIGG programme. Accelerators in Turkey appear to increasingly focus on the internationalisation of beneficiaries and are willing to look beyond the initial start-up stage, suggesting a gradual shift towards more mature companies. In North Macedonia, with support of the FITD, three new accelerators were created during the assessment period, while in Serbia, the Innovation Fund also initiated an accelerator programme. Small-scale state-supported acceleration programmes were also launched in Albania and Montenegro, though somewhat resemble business angel activities.

Innovation support to mature SMEs remains limited

While the support infrastructure for start-ups has greatly expanded, more mature innovative firms remain underserved across all WBT economies, largely limited to general consultancy services (see Chapter 5 on support services for SMEs).

Some form of technology extension and diffusion support is only available in North Macedonia and Turkey. In Turkey, the TDZs and technology development centres offer some technology support to more established companies, while in North Macedonia, following an FITD initiative during the previous assessment cycle, three providers are now equipped to offer technology extension services.

The way forward for government institutional support services for innovative SMEs

Build an innovation ecosystem beyond start-up support. Enterprise creation and development are critical to building a knowledge economy. A balanced policy mix to support both start-ups more generally and those that have the ability or potential for innovation and knowledge development in particular would help to ensure that ecosystems are designed to truly support innovative ideas and build technology absorption capacity. For instance, some incubators could introduce more selective eligibility criteria for tenants, based on their potential and business vision to innovate and offer more tailored support to develop those objectives.

Introduce more targeted services to support technology absorption in more established SMEs. As start-up ecosystems become more mature, governments should seek to expand their support structure to serve more mature enterprises. Dedicated technology extension services, for instance targeting specific sectors, would help increase the technology absorption capacity of such enterprises, contributing to new-to-firm innovation and increasing capability for future innovations (see Box 10.2for a sectoral approach). A regional approach for key sectors may help maximise impact and resources.

Box 10.2. United States Manufacturing Extension Partnership Program

The Manufacturing Extension Partnership (MEP) Program, implemented under the auspices of the US Institute of Standards and Technology, is a publicly financed initiative aimed at providing industrial services for small and medium-sized enterprises (SMEs) operating in manufacturing. It provides companies with the information and tools they need to improve productivity, strengthen quality assurance, accelerate the transfer of manufacturing technology and infuse innovation into production processes. The programme is available via 51 MEP centres across the United States and Puerto Rico, supported by a Foundation of Manufacturing Excellence, as well as more than 1 400 advisers and experts at 450 MEP service locations. An Advisory Board provides advice on the MEP’s overall activities, strategic direction and policies while monitoring overall performance.

When the programme was launched in 1988, its original aim was to transfer state-of-the-art technology to manufacturers, but it soon adapted its approach to adjust to local conditions, offering a more customised set of services, including quality systems, ICT, human resources and support to product development. This pragmatic approach to technology extension, driven by the needs and demands of companies rather than by research targets set by the state, has made the MEP one of the most successful technology extension programmes to date.

The MEP is based on a public-private partnership, designed as a cost-share programme to ensure the commitment of its beneficiaries. The federal government covers around half of the budget, with the remaining 50% covered by local governments, private entities and fees. In 2020, the federal budget for the MEP exceeded USD 150 million, with an additional USD 50 million provided to support COVID‑related projects.

An impact assessment published in 2020 suggests that the MEP has generated substantial economic and financial returns of nearly 13.4:1 for the federal budget in 2019. It also found that total US employment was over 217 000 higher than without the programme, and that it had generated nearly USD 23 billion.

Source: NIST (2020[15]).

Government financial support services for innovative SMEs (Sub‑dimension 8b.3)

Access to finance remains a key obstacle to company growth, productivity and innovation (see Dimension 6 on access to finance). High growth potential and innovative SMEs are typically even more financially constrained, as these companies are usually at an early stage of development and have only a few tangible assets and collateral, making them unattractive for conventional lenders.

Technological development and innovation, however, are expensive, often requiring significant upfront investments into research, prototyping and equipment, but also to fund high-skilled employees and patent fees. Lack of guaranteed returns on investment and risks of failure further limit investor appetite for innovative firms.

Public sector support schemes can help address these externalities and provide financial support for the development of innovative business ideas and to engage in R&D activities. This support can come in the form of grants, subsidised loans or guarantees, for instance. However, governments can also provide indirect financial incentives. These include tax relief for investments in R&D, employing researchers or purchasing innovative equipment. Other forms of indirect financial support include demand-side instruments such as prioritising innovation in public procurement, which, if carefully designed to ensure competitive selection, can encourage the commercialisation of innovation to deliver public goods and services, and champion early adoption.

Significant progress has been made in those economies which already performed relatively well in the previous assessment, notably North Macedonia, Serbia and Turkey, all of which have expanded further direct financial support programmes. In contrast, less progress is evident in the other economies, where the scale and availability of financial support continue to be limited, as illustrated in Table 10.5. Notwithstanding, most economies have made some progress in offering indirect financial incentives.

Table 10.5. Scores for Sub-dimension 8b.3: Government financial support services for innovative SMEs in the Western Balkans and Turkey

|

ALB |

BIH |

KOS |

MKD |

MNE |

SRB |

TUR |

WBT average |

|

|---|---|---|---|---|---|---|---|---|

|

Direct financial support |

3.09 |

2.60 |

3.26 |

4.60 |

3.56 |

4.68 |

4.88 |

3.81 |

|

Indirect financial support |

1.80 |

1.60 |

1.20 |

2.70 |

2.32 |

2.60 |

3.60 |

2.26 |

|

Weighted average |

2.57 |

2.20 |

2.44 |

3.84 |

3.06 |

3.85 |

4.37 |

3.19 |

Note: See the Policy Framework and Assessment Process chapter and Annex A for information on the assessment methodology.

The scale and range of financial support have advanced at different speeds

When it comes to direct financial support, the increasing divergence of the WBT region is particularly evident. In North Macedonia, Serbia and Turkey, direct financial support schemes have continued to be available and have increased further since the last assessment.

Turkey has made over EUR 70 million available to support innovation since 2019, channelled via multiple co-finance grant schemes from both KOSGEB and TUBITAK. Support targets start-ups, R&D, commercialisation, and technology transfer for enterprises at different stages of development. Turkey’s regional development agencies provide additional financial support for innovative projects. In Serbia, the Innovation Fund now operates seven programmes, including its flagship mini- and matching-grant programmes, and had awarded over EUR 43 million by the end of 2021, including via contributions from the state budget since 2017. The new Science Fund has also started to provide financial incentives for R&D. In North Macedonia, the FITD has significantly expanded its operational capacity and has played a key role in the government’s Economic Growth Plan. Funding for the FITD has increased, too, up from just EUR 4 million in 2018 to EUR 12 million in 2021, including with state budget contributions. For 2022, even though the key World Bank project that supported the FITD until 2021 has expired, the FITD has an allocated budget of EUR 18.5 million.

All three economies have also leveraged these institutions in their response to the COVID‑19 crisis and have introduced dedicated COVID-19 programmes linked to innovation. In Turkey, TUBITAK launched two specific calls under the umbrella of its SME R&D start‑up support programme, offering financial support to an additional 48 projects. In Serbia, a new programme was introduced to support innovative ideas focused on health and well-being, awarding 12 projects. In North Macedonia, the FITD launched two new programmes linked to the pandemic.

All programmes undertake regular internal monitoring and evaluation; however, only the Serbian Innovation Fund has undertaken an independent external performance evaluation to date. In North Macedonia, some FITD programmes were evaluated as part of a broader impact assessment of state-supported programmes, indicating that the level of grant intensity offers should be closely monitored.

In contrast, financial support schemes remain limited in the remaining economies. In Montenegro, a pilot Innovation Programme for Grants and Innovative Projects in 2018 continued to be implemented, awarding over EUR 800 000 to companies developing innovative products, services or technologies between 2019 and 2020. In 2021, the economy also established an Innovation Fund, which is expected to become fully operational in 2022. Financial assistance measures for implementing the S3 are also being designed. In Albania, budget support for the Innovation Fund and the Start-up Fund, both established in 2018 under the auspices of the SME agency AIDA, increased significantly in 2019, though from very low levels, and absorption capacity has increased. However, in 2020 and 2021, all AIDA funds were repurposed to tackle the COVID-19 pandemic, thereby effectively halting all innovation support activities, except for some small‑scale support by international development co-operation partners. Funding is expected to resume in 2022. Little progress has been made in Bosnia and Herzegovina and Kosovo. While both economies (Republika Srpska in the case of Bosnia and Herzegovina) have established preliminary plans to establish an Innovation Fund, enterprises receive little financial support for innovation activities to date. As part of a broader initiative to support the export readiness and job creation of SMEs, in 2021, the Kosovan authorities allocated EUR 1.15 million to support start-ups, spin-offs and innovative projects. The exact scope, however, remains somewhat unclear. In Bosnia and Herzegovina, small-scale support is available via international development co-operation partners, especially from Sweden.

Indirect financial support is largely limited to fiscal support, without specifically targeting SME innovation

Progress has been made to introduce more indirect financial support measures in most economies. Fiscal measures, such as tax incentives for R&D activities or the purchase of equipment or technology in support of innovation development, enable firms to prioritise activities themselves and are usually a more market‑oriented policy tool compared to grants, but limit the impact of monitoring and evaluation.

In North Macedonia, research activities are now excluded from value-added tax, while in Montenegro, a new Law on Financial Incentives Measures for Research and Innovation foresees tax breaks for certain research activities, though guidelines to define exact eligibility are yet to be published. In Turkey, tax breaks continue to be in place for enterprises receiving state support for R&D, while companies and their employees located in the TDZs are fully exempt from corporate and income tax. In Albania, Bosnia and Herzegovina, and Serbia, tax relief also applies to the purchase of ICT equipment or some research activities (in Serbia).

On the other hand, demand-side policy measures to stimulate innovation remain limited and significantly below potential. Serbia introduced changes to its public procurement framework to encourage innovation, while in Turkey, R&D-based procurement methods have been in place since 2005, but are not fully compliant with the acquis as they favour local suppliers.

The way forward for government financial support services for innovative SMEs

Scale up and consolidate financial support. For economies with large-scale direct financial support schemes in place, comprehensive monitoring and evaluation, including via external performance assessments, will help identify existing bottlenecks and consolidate measures. Lessons learnt could be shared with those economies that have not yet, or are in the process of, establishing dedicated agencies. Within this context, sufficient funding will be critical for those economies with early-stage plans, including to build enterprise absorption capacity and firm readiness for financial support schemes.

Further diversify public support measures and disseminate information on indirect financial support for R&D to increase take-up. While the focus remains strongly on direct financial support in the form of grants, more flexible and demand-driven policy tools could help ease pressure on budgets and dependency on external partners, particularly in the form of R&D favouring public procurement policies (see Box 10.3for innovative public procurement solutions). This should be coupled with targeted awareness-raising campaigns, for instance via the platforms of the innovation funds or equivalent agencies.

Box 10.3. Eco-innovation through public procurement in Poland

The Regional Centre for Water and Sewage Management in the town of Tychy used to have the reputation of being one of the dirtiest in the region. Amid high levels of pollution, the plant required significant modernisation, given impetus to include environmental, innovative and societal benefit considerations in public procurement.

Today, the Regional Centre for Water and Sewage Management of Tychy has become one of the leading innovative facilities of this type in the entire country, and a large-scale producer of co-generated renewable energy, hereby significantly contributing to Tychy’s goal of becoming a smart city.

These innovative environmental benefits were achieved by introducing environmental requirements into the description of the subject matter of procurement that had to be achieved during the contract performance stage. By working with eco-innovators in areas such as wastewater treatment and renewable energy generation via biogas and management, the plant has become 100% energy self‑sufficient.

By implementing green, innovative and pro-social public procurement, the centre has gained the status of a leader in eco-innovation and a pioneer of pro-eco solutions in the field of wastewater treatment, generation and the management of energy from renewable sources, as evidenced by the number of awards received in environmental and quality competitions.

Sources: Brandt (2018[16]); Public Procurement Office of Poland (2020[17]).

SME and research institution collaboration and technology transfer (Sub‑dimension 8b.4)

A strong partnership between businesses and research institutes is a critical component of the knowledge economy and can help accelerate the value creation of innovation and research.

In a linear model, knowledge is created by researchers, typically universities or research institutes, in basic research, which is then followed by applied research resulting in a patent. This knowledge is then adopted and commercialised by businesses, that use it to introduce new or optimised products, services, processes or other methods of doing business.

In reality, however, the transfer of knowledge is rarely linear, and there are several practical challenges. Most notably, exchange between academia and the business community is often limited, meaning that research may not be demand-driven and not known to businesses, and little feedback is given on its commercial viability. Researchers may also not be encouraged or receive sufficient support from their organisations to collaborate with companies, while diverging priorities may mean that researchers focus more on publishing while the business community seeks patenting and commercialisation.

Governments can play a crucial role in overcoming these obstacles and enhancing knowledge transfer mechanisms. In a “triple helix” approach – describing the interplay between governments, academia and industry – governments can acquire insights into the obstacles preventing effective knowledge transfer and commercialisation, which helps to design policy measures to encourage more collaboration between researchers and businesses (OECD, 2013[18]).

Such support can take various forms. To alleviate funding barriers for R&D, financial support schemes can incentivise joint research. For instance, innovation vouchers enable businesses to engage with research institutes for small-scale services such as laboratory testing or preliminary research and can create further collaboration. Co-operative grants, on the other hand, aim at co-financing larger research projects, involving joint business-academia consortia, and are awarded based on competitive merit.

Other tools include creating a physical infrastructure for industry-academia linkages, including technology transfer offices and competency centres, which offer R&D services or access to equipment. In addition, dedicated science and technology parks (STPs) provide a platform for co-innovation and more long-term collaboration engagements.

Lastly, the legal framework for intellectual property can encourage collaboration and the commercialisation of intellectual property by clearly regulating ownership and the split of royalties of publicly funded research outputs.

Table 10.6 outlines the performance of the WBT region in Sub-dimension 8b.4. Overall, business-academia collaboration remains below potential in all WBT economies and constitutes the weakest link in the regional innovation system, with an average score of 2.95. However, some economies, notably Serbia and Turkey, have made some progress, particularly in providing financial support to incentivise business-academia collaboration, and efforts are underway throughout most of the economies to strengthen the institutional support infrastructure, though the link to scientific research is not always evident.

Table 10.6. Scores for Sub-dimension 8b.4: SME and research institution collaboration and technology transfer in the Western Balkans and Turkey

|

ALB |

BIH |

KOS |

MKD |

MNE |

SRB |

TUR |

WBT average |

|

|---|---|---|---|---|---|---|---|---|

|

Innovation voucher schemes and co-operative grants |

2.00 |

1.72 |

2.00 |

3.50 |

2.52 |

4.00 |

4.20 |

2.85 |

|

Institutional infrastructure for industry-academia co‑operation |

2.36 |

1.68 |

2.48 |

3.04 |

2.92 |

3.88 |

4.60 |

2.99 |

|

Intellectual property rights |

2.72 |

2.48 |

2.52 |

3.00 |

2.52 |

3.80 |

4.33 |

3.05 |

|

Weighted average |

2.29 |

1.86 |

2.30 |

3.22 |

2.68 |

3.91 |

4.39 |

2.95 |

Note: See the Policy Framework and Assessment Process chapter and Annex A for information on the assessment methodology.

Financial incentives for collaboration remain very limited, though plans to introduce dedicated financial support are gaining momentum

Only a few economies offer innovation vouchers or competitive co-operation grants. In Serbia, the Innovation Fund introduced such grants in 2017, and had awarded over 840 vouchers by the end of 2021. Similarly, the FITD also introduced a pilot innovation voucher scheme in 2020. Montenegro has also introduced a small-scale innovation voucher programme with support from international development co-operation partners, though it mainly focuses on digitalisation and general consultancy services in support of innovation. In Kosovo, an innovation voucher scheme implemented throughout 2018 and 2019 was discontinued amid limited absorption capacity and repurposing of the funds during the COVID-19 pandemic. In Bosnia and Herzegovina, a small-scale pilot innovation voucher scheme has been implemented with support by international development co-operation partners. Only Serbia offers a dedicated co‑operative grant scheme and has awarded more than 50 projects since 2016. It is expected that the new Science Fund will introduce further financial measures to support research collaboration between academia and the industry. In North Macedonia, plans to establish a dedicated programme are still underway, while in Montenegro, similar plans were announced in 2019, but there is no evidence of progress or implementation to date.

In Turkey, TUBITAK runs several financial support schemes to stimulate collaboration and commercialisation of research, even though traditional innovation vouchers and co‑operative grants are not available. For example, the “Support Programme for University-Industry Co-operation” offers up to EUR 50 000 to support commercialisation, while a dedicated e-platform promotes university-industry collaboration and technology transfer. In 2020, TUBITAK further introduced new programmes to support patent- and order-based research projects.

The institutional infrastructure is being strengthened, but opportunities for collaboration remain below potential

Progress has been made in some economies to accelerate plans for or expand the operations of STPs. In Serbia, the STP network has expanded significantly since the previous assessment, while in Turkey, the TDZs offer similar services. A focus on academia and R&D is not always evident. In Montenegro and North Macedonia, the construction of such STPs is still ongoing. In Bosnia and Herzegovina, some technology parks, mainly focusing on incubation, operate throughout the Federation of Bosnia and Herzegovina, while there are plans to establish a dedicated STP in Republika Srpska. In Albania and Kosovo, institutional support also remains limited, though the newly established Prizren Training Centre in Kosovo is expected to offer services similar to an STP.

Several economies also offer technology transfer services, even though take-up from SMEs remains mixed. Multiple technology transfer offices exist across Turkey, and TUBITAK implements a dedicated Technology Transfer Support Programme. Similarly, in Serbia, the Innovation Fund runs a technology transfer facility and several universities offer similar services. In North Macedonia, the Centre for Technology Transfer and Innovations, which also hosts the accelerator, has offered technology transfer services since 2018. Technology transfer services remain limited in the remaining economies, even though Montenegro’s S3 envisages the establishment of a technology transfer office and in Bosnia and Herzegovina, a pilot programme offered some technology transfer services in 2019, but there is no recent information available.

Intellectual property legislation typically does not encourage collaboration, and enforcement remains a key obstacle

Several economies have introduced amendments to their intellectual property legislation during the assessment period to better align legal frameworks to European standards. However, with the exception of Serbia, legislation does not explicitly regulate the spilt of royalties, thereby discouraging business-academia collaboration and commercialisation. Overall, awareness about the importance of intellectual property and patenting capacity remains low across the WBT region, albeit the number of patents granted by the European Patent Office originating from the region is gradually increasing.

Notwithstanding, annual progress reports provided by the European Commission continue to emphasise the limited enforcement capacity, despite some improvements, thereby significantly risking to undermine policy efforts to stimulate business-academia collaboration.

The way forward for SME and research institution collaboration and technology transfer

Identify existing bottlenecks for business-academia collaboration. Such a mapping should include a review of the available financial support to stimulate co‑operation, the infrastructure in place to enable exchange and soft measures to encourage commercialisation, such as intellectual property legislation, awareness raising and support to individual researchers to collaborate with the business community, for instance via the Marie Skłodowska-Curie Actions.1

Emphasise the link between scientific research and academia in the design of the institutional infrastructure for innovation and R&D. If designed well, science and technology parks can be an effective platform to increase linkages between businesses and academia. This includes geographic proximity to university hubs, access to solid infrastructure, and onsite research facilities and dedicated co‑creation spaces, going beyond basic incubation services. A regional approach to establishing STP infrastructure could be a more cost-efficient alternative.

Strengthen the enforcement of intellectual property protection. Limited enforcement capacity of intellectual property remains a major impediment to the development of a knowledge economy across the WBT region. Awareness-raising activities to inform businesses and researchers about the importance and benefits of intellectual property protection should resume as economies emerge from the COVID-19 pandemic to increase patent applications, while better co-ordination of enforcement bodies, coupled with training, would help increase enforcement capacity.

References

[16] Brandt, N. (2018), “Strenghtening innovation in Poland”, OECD Economics Department Working Papers, No. 1479, OECD Publishing, Paris, https://doi.org/10.1787/abf2c877-en.

[13] EBRD (2021), Business Environment and Enterprise Performance Survey 2018-2020, European Bank for Reconstruction and Development, London, https://www.beeps-ebrd.com/data/2018-2020.

[2] EBRD (2014), Transition Report 2014: Innovation in Transition, European Bank for Reconstruction and Development, https://www.ebrd.com/publications/transition-report-2014-english.pdf.

[7] EIS (2021), European Innovation Scoreboard Statistics, European Commission, Brussels, https://ec.europa.eu/research-and-innovation/en/statistics/performance-indicators/european-innovation-scoreboard/eis.

[8] EPO (2021), European Patent Office Statistics, European Patent Office, Munich.

[11] European Commission (2021), “Horizon 2020 country profiles”, web page, https://ec.europa.eu/info/funding-tenders/opportunities/portal/screen/opportunities/horizon-dashboard.

[6] European Commission (2008), Small Business Act for Europe, web page, Commission of the European Communities, Brussels, http://ec.europa.eu/enterprise/admin-burdens-reduction/home_en.htm (accessed on 13 August 2018).

[14] European Union (2021), European Innovation Scoreboard.

[10] Eurostat (2020), “Gross domestic expenditure on R&D (GERD) at national and regional level”, https://ec.europa.eu/eurostat/data/database.

[5] Jaumotte, F. and N. Pain (2005), “From Ideas to Development: The Determinants of R&D and Patenting”, OECD Economics Department Working Papers, No. 457, OECD Publishing, Paris, https://doi.org/10.1787/702226422387.

[15] NIST (2020), Manufacturing Extension Programme Annual Report, National Institute of Standards and Technology, US Department of Commerce, Gaithersburg, MD, https://www.nist.gov/mep/about-nist-mep.

[1] OECD (2021), OECD Competitiveness in South East Europe 2021: A Policy Outlook, Competitiveness and Private Sector Development, OECD Publishing, Paris, https://doi.org/10.1787/dcbc2ea9-en.

[18] OECD (2013), “Green enterpreneurship, eco-innovation and SMEs”, OECD, Paris, https://one.oecd.org/document/CFE/SME(2011)9/FINAL/en/pdf.

[4] OECD (2013), Triple Helix Partneship for Innovation in Bosnia and Herzegovina, Private Sector Development Policy Handbook, OECD, Paris, https://www.oecd.org/south-east-europe/programme/Triple%20Helix%20English%20Version.pdf.

[12] OECD/Eurostat (2018), Oslo Manual: Guidelines for Collecting, Reporting and Using Data on Innovation 4th Edition, OECD Publishing, Paris/Eurostat, Luxembourg, https://doi.org/10.1787/9789264304604-en.

[3] Paunov, C. and S. Planes-Satorrai (2021), “What future for science, technology and inovation after COVID-19?”, OECD Science, Technology and Industry Policy Papers, No. 107, OECD Publishing, Paris, https://doi.org/10.1787/de9eb127-en.

[17] PPOOP (2020), Public Procurement of Innovation.

[9] UNESCO Institute for Statistics (2020), Science Technology and Innovation Database, http://data.uis.unesco.org.