This chapter covers the progress made by Bosnia and Herzegovina in implementing the Small Business Act (SBA) for Europe over the period 2019‑21. It starts with an overview of Bosnia and Herzegovina’s economic context, business environment and status of its EU accession process. It then provides key facts about small and medium-sized enterprises (SMEs) in the economy, shedding light on the characteristics of the SME sector. It finally assesses progress made in the 12 thematic policy dimensions relating to the SBA during the reference period and suggests targeted policy recommendations.

SME Policy Index: Western Balkans and Turkey 2022

14. Bosnia and Herzegovina: Economy Profile

Abstract

Key findings

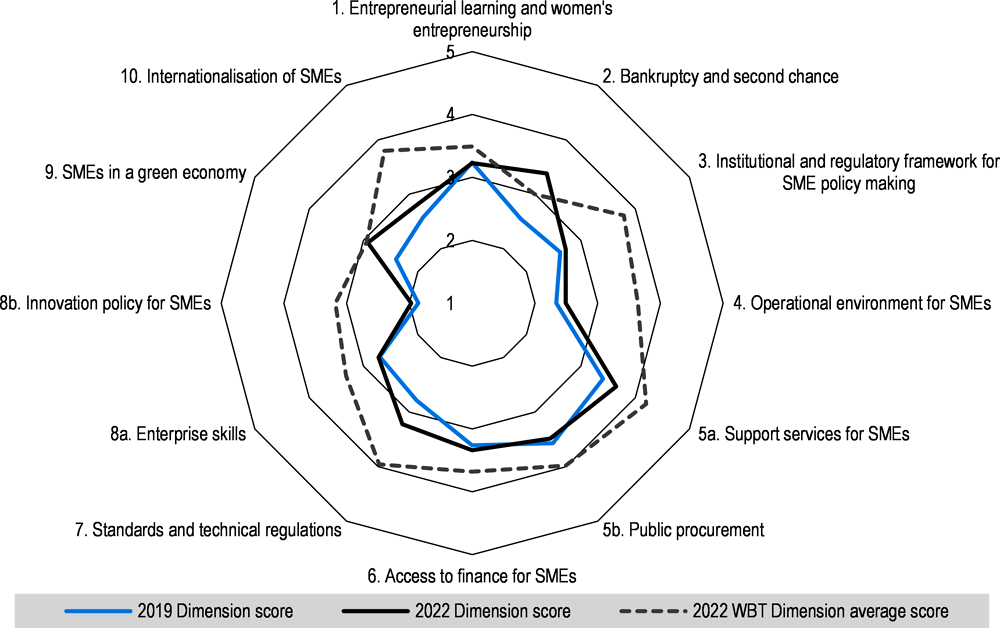

Figure 14.1. Small Business Act scores for Bosnia and Herzegovina (2019 and 2022)

Note: WBT: Western Balkans and Turkey

Bosnia and Herzegovina (BiH) has made certain progress in implementing the SBA since the publication of the previous report – the SME Policy Index: Western Balkans and Turkey 2019. The economy has achieved its highest average scores in the following areas: bankruptcy and second chance for small and medium-sized enterprises (SMEs), support services for SMEs, standards and technical regulations and SMEs in a green economy. However, the progress has been rather incremental, and the economy still needs to step up its efforts to build an environment conducive to business across a number of areas.

Main achievements

The insolvency framework has been harmonised across the entities in Bosnia and Herzegovina. Following a series of reforms in each entity, the regulatory framework was harmonised in 2021 for the first time across the entire territory in line with the United Nations Commission on International Trade Law (UNCITRAL) Legislative Guide on Insolvency Law. The overall legal framework’s main novelty is the introduction of pre-insolvency proceedings as preventive financial and operational restructuring based on an imminent insolvency threat. Overall, this important upgrade to the legislative process could be viewed as a major achievement in terms of the coherence of the insolvency framework within the economy.

Key developments were undertaken to optimise procedures to start a business. While the Federation of Bosnia and Herzegovina (FBiH) has adopted the long-awaited adjustments to its administrative laws as a legal basis for establishing a one-stop-shop for company registration in 2021, Republika Srpska (RS) established a single portal and payment slip system to enable e-registration. Moreover, applicants from Bosnia and Herzegovina have access to clear information on all licences and permits through online entity-level registers and streamlining reforms are ongoing to simplify licensing procedures in Republika Srpska.

SMEs have access to a wide range of public business support services (BSSs). In both entities, informational and educational workshops, trainings, tailored mentoring and advisory services in the area of management, sales and marketing are available to SMEs, in addition to facilitated access to incubators and business accelerators. Private BSSs have received more government incentives across entities with support ranging from co-financing to providing access to a reinforced network of private-sector consultants.

Some progress has been made regarding access to finance. Progress has been made in aligning regulations to EU standards, triggering harmonisation across entities, and the banking sector has weathered the economic downturn caused by the COVID‑19 pandemic relatively well amid strengthened resilience prior to the pandemic. The establishment of dedicated COVID‑19 sovereign credit guarantee schemes, complementing the existing public Guarantee Fund in Republika Srpska, have further helped soften the impact on lending. Legislative reforms have somewhat strengthened the framework for non-bank financial instruments, though limited data collection continues to hamper effective monitoring of non-bank financial institutions’ activity.

The access to standardisation and accreditation services in Bosnia and Herzegovina slightly improved compared to the last assessment, which helps to lower export barriers for SMEs whose products, processes and services need to conform with European standards and regulations. More specifically, the national standards body, the Institute for Standardisation of Bosnia and Herzegovina (ISBIH), expanded its outreach activities through additional webinars during the COVID‑19 pandemic, and the number of adopted standards translated into local language also increased. Altogether, while still lagging behind most of the WBT economies in the alignment of their quality infrastructure system and regulations, Bosnia and Herzegovina has expanded the access of these services to SMEs.

Environmental policies targeting SMEs are gaining momentum. Green measures targeting SMEs are included in Republika Srpska’s Strategy for Development of SMEs (2021-2027) and the Development Strategy of the Federation of Bosnia and Herzegovina (2021-2027), which both include ambitious sets of measures with corresponding budgets and activities. Business associations have slowly been involved in developing and implementing green measures, as well as promoting environmental management systems. Both entities’ environmental protection funds increasingly target smaller enterprises, facilitating their green access to finance, and additional financial instruments are planned under the recently adopted strategies.

The way forward

Embed entrepreneurship as a key competence across all education systems. The EU-funded Education for Employment programme offers opportunities to consider how to best develop key areas such as key competence-based curriculum, practical entrepreneurial experience and teacher competences. This can highlight the practical steps needed to improve the quality and frequency of entrepreneurial learning for learners in schools across the economy.

Improve and simplify the institutional and regulatory framework for SMEs. Further efforts could be made at all levels of governance to ensure that the regulatory environment is responsive to the needs of SMEs. Both entities should introduce regular quality control of regulatory impact assessments to ensure their consistency and proper examination of potential impacts of policies on SMEs. All levels of governance could do more to ensure the quality, consistency and effective SME participation in public-private consultations.

Enhance digital government services for SMEs. Digital government services throughout Bosnia and Herzegovina remain underdeveloped compared to other regional economies, and the implementation of the Strategic Framework for Public Administration Reform (2018-2022) was delayed. Disagreements and lack of alignment between the state level and the entities regarding the legal framework for electronic signatures lead to businesses experiencing additional hurdles for its use throughout the economy.

Reinforce the monitoring and evaluation mechanism of support programmes for SMEs across all levels of government. Both entities have monitoring mechanisms in place for publicly provided BSSs. However, while they both report on the implementation of their strategies and action plans using publicly available reports, systematic monitoring based on performance indicators is lacking. Moreover, there is no evidence that the results of evaluations have a direct impact on service provision.

Improve public procurement legislation, in particular by implementing missing provisions from the EU Public Procurement Directives, adopt new multi-year strategic documents (and related action plans) and finalise the establishment of electronic procurement tools. The administrative burden of participating in public procurement should be reduced, in particular by simplifying provisions for economic operators to prove their compliance with exclusion and qualification (selection) criteria. Bosnia and Herzegovina also needs to introduce anti-corruption mechanisms into the public procurement legislation, in particular regarding conflicts of interest, and reduce the frequency of application of non-transparent and non-competitive procurement procedures (direct award procedures).

Develop a state-wide quality infrastructure strategy or roadmap to improve inter-institutional co-operation and reduce inter-regional differences in the alignment with European legislation and standards. As the responsibilities of the implementation of technical regulation, accreditation and standardisation are mainly devolved to the entities in Bosnia and Herzegovina, companies in different parts of the economy may be subject to different laws and may be dealing with different quality infrastructure bodies. A strategy that clarifies central and local responsibilities in quality infrastructure and plans activities to align practices within Bosnia and Herzegovina would be an important step to further improve its quality infrastructure system and its accessibility for SMEs.

Increase the scale of financial incentives to foster innovation. To ensure the success of the SME innovation action plans, a sufficient budget should be allocated to design meaningful and co-ordinated financial support schemes. These schemes should be designed in consultation with the private sector and build on lessons learnt from existing initiatives funded by international development co-operation partners and should include regular monitoring and evaluation practices. Funding needs and sources should also be identified when preparing the Smart Specialisation Strategy.

Develop a legal framework for the adoption and promotion of e-commerce. Bosnia and Herzegovina does not have a legal framework governing e-commerce across all three levels of government. Without a well-developed legal framework and incentives for SMEs to increase e‑commerce uptake and build capacity in this area, Bosnia and Herzegovina faces lagging behind in their efforts on digitalisation. Having a dedicated institution governing e-commerce legislation and support programmes would greatly facilitate the adoption of the digital sales channel for SMEs, further developing their capacity and streamlining their operations.

Economic context and role of SMEs

Economic overview

Bosnia and Herzegovina is a small upper-middle-income economy with a population of roughly 3.28 million as of 2021. Its gross domestic product (GDP) purchasing parity power in current USD stood at 15 623 in 2020, having shrunk by only USD 105 since 2019, despite the challenges posed by the COVID‑19 pandemic (World Bank, 2022[1]). While Bosnia and Herzegovina’s production and export base is diverse in comparison to the region, services continue to account for the largest share of the economy, contributing 55.7% to GDP and 50.3% of employment, while industry accounts for 23.9% of GDP and 31.7% of employment. Bosnia’s main services sector is trade, followed by business services, transport and construction and, albeit being hampered by the COVID‑19 pandemic (Box 14.1), a growing tourism sector for which overnight stays increased by 78% in the first 11 months of 2021 compared to the previous year. Production of raw materials such as steel, coal, iron ore, lead, zinc and aluminium, as well as wood, is the economy’s highest portion of industry and industrial exports. While agriculture represents only 6.2% of GDP, the economy’s 1.6 million hectares of arable land accounts for the highest contributions to employment in the region at 18%, showing the potential of the labour reallocation from the agricultural sector as a way to boost productivity gains in the economy.

Economic growth in Bosnia and Herzegovina has diversified over the last decade, with export as a share of GDP growing to 44.1% in 2021 due to growth in machinery and power exports, as well as higher service exports, including construction and tourism (Table 14.1). Increases in exports along with surges in private consumption, which stood at 76% in 2019, and public consumption, representing 19.5% in 2019, have led to steady improvements in the current account deficit, decreasing from 9% of GDP in 2011 to 2.8% in 2019, increasing by only 1% in 2020 in light of the pandemic and further decreasing in 2021 (Table 14.1). Bosnia and Herzegovina witnessed one of the lowest contractions of GDP in the Western Balkans and Turkey (WBT) region, after Turkey and Serbia, at only ‑3.2% for 2020 (Table 14.1). The economy rebounded with a 7.1% GDP growth in 2021, raised from an expected 3.4% growth earlier in the year, fuelled by increased exports and household consumption, and is expected to increase between 3.3% and 3.9% in 2022 and another 3% in 2023, depending on political stability in the coming years (IMF, 2022[2]; European Commission, 2022[3]; EBRD, 2021[4]). Real sector recovery was also driven by rising investments, which increased by 16.2% year on year, while private consumption increased by 3.9%, contributing 3.8% and 2.4% to overall growth, respectively.

Bosnia and Herzegovina has slowly been increasing infrastructure projects aimed at green priorities. Notably, transitioning away from coal has started, but concerns remain about environmental sustainability. One of the three public-owned power utilities in the economy has agreed with the miners’ union on a restructuring plan, but there are concerns regarding Bosnia and Herzegovina’s compliance with Energy Community acquis regarding environmental standards.1 Although public spending on infrastructural improvements has contributed to growing public debt, the deficit remains the third lowest in the region. While public investment in the economy is relatively high, the contribution of private investment to GDP has been stagnant at below 20% over the last decade and remains the lowest recipient of foreign direct investment (FDI) in the region, accounting for 2% of GDP between 2015 and 2019. The largest share of FDI inflows went into the non-tradable sector, including financial services, wholesale and retail trade, energy, and real estate, while export-oriented FDI went mainly to raw materials with limited value added.

Monetary and fiscal developments in the economy saw stable post-pandemic outcomes, with a slight 2% increase in inflation for 2021 and a decline in non-performing loans and an increase in bank deposits at 5.7% and 10.1%, respectively, in 2021. Tax revenues were also a part of Bosnia and Herzegovina’s post-pandemic recovery, recording a collection of indirect taxes 21.5% higher in 2021 than the previous year, primarily due to value-added tax (VAT) revenues. Like all WBT economies, with the exception of Turkey, Bosnia and Herzegovina’s general government balance decreased as a result of the pandemic but remained the second-highest in the region at ‑5.3% of GDP in 2020, albeit having declined by 7 percentage points from 2.2% of GDP in 2019. The economy also holds the second-lowest public debt ratio in the region at 35.5% of GDP in 2021, decreasing from 36.6% in 2020 but increasing slightly in Q4 2021 due to an increase in long-term foreign debt. Although the annual consumer price index in Bosnia and Herzegovina saw a decrease of 1.1% in 2020, consumer prices increased by 2.4% year on year in Q3 of 2021, 5.3% in Q4 2021, to 7% and 8.1% in January and February 2022 respectively, due to higher costs for transport and rising prices for food and non-alcoholic beverages.

Table 14.1. Bosnia and Herzegovina: Main macroeconomic indicators (2016-21)

|

Indicator |

Unit of measurement |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|---|---|---|---|---|---|---|---|

|

GDP growth1 |

% year-on-year |

3.4 |

3.0 |

3.3 |

2.8 |

-3.2 |

7.1 |

|

National GDP2 |

EUR billion |

15 |

16 |

17.9 |

17.9 |

17.7 |

|

|

GDP per capita growth2 |

% year-on-year |

4.5 |

4.2 |

4.6 |

3.5 |

-2.6 |

.. |

|

Inflation1 |

% average |

-1.1 |

1.3 |

1.4 |

0.6 |

-1.1 |

2.0 |

|

Government balance1 |

% of GDP |

1.2 |

2.5 |

2.1 |

1.9 |

-5.3 |

.. |

|

Current account balance1 |

% of GDP |

-4.8 |

-4.8 |

-3.3 |

-2.8 |

-3.8 |

-2.1 |

|

Exchange rate BAM/EUR1 |

Value |

1.96 |

1.96 |

1.96 |

1.96 |

1.96 |

1.96 |

|

Exports of goods and services1 |

% of GDP |

35 |

40.9 |

42.6 |

40.6 |

34.5 |

44.1 |

|

Imports of goods and services1 |

% of GDP |

51 |

57.1 |

57.3 |

55.2 |

48.5 |

56.4 |

|

Net FDI1 |

% of GDP |

1.8 |

2.3 |

2.9 |

1.5 |

1.7 |

2.1 |

|

External debt stocks2 |

% of gross national income (GNI) |

68.7 |

72.7 |

66.1 |

65.5 |

72.1 |

|

|

International reserves of the National Bank1 |

EUR million |

4 884 |

5 398 |

5 943 |

6 441 |

7 091 |

8 359 |

|

Gross international reserves1 |

Ratio of 12 months imports of goods and services moving average |

7.2 |

7.1 |

7.3 |

7.8 |

10 |

9.3 |

|

Unemployment1 |

% of total active population |

25.4 |

20.5 |

18.4 |

15.7 |

15.9 |

17.4 |

Unemployment in Bosnia and Herzegovina has been steadily decreasing since 2015, with particular improvements in the manufacturing, tourism and trade sectors, but remains significant at 17.4% in 2021. The COVID‑19 pandemic exacerbated labour market challenges by aggravating already high proportions of informality, with the International Labour Organisation (ILO) estimates putting the informal sector at 30.5% of total employment, as well as low employment of youth, women and low skilled workers (ILO, 2019[7]). Despite efforts to raise the region’s consistently low rates of labour force participation, youth unemployment rose to 37.7% in 2021, up 5.4 percentage points from June 2020, significantly higher than the EU average of 16.8% and further worsening youth employment prospects (European Commission, 2022[3]; Eurostat, 2021[8]). Meanwhile, the ILO Labour Force Survey indicated that the youth unemployment rate of those ages 15‑24 stood at 37.8% in Q3, compared to 34.5% the previous year and remains significantly higher than the EU average of 16.8% (Eurostat, 2021[8]). Addressing bottlenecks causing persistent long-term unemployment, such as enhancing formal labour market participation, especially for women, and reducing skills mismatches for youth, will be a key part of longstanding institutional reforms. Moreover, Bosnia and Herzegovina will need to address its high emigration rate (at 20%, it is the third highest of the Western Balkans Six economies for emigration to OECD countries), which leads to deficiencies of human capital in the labour market.

Box 14.1. COVID‑19 in Bosnia and Herzegovina

Bosnia and Herzegovina was adversely affected by the COVID‑19 pandemic and the lockdown measures taken in response to it. GDP contracted by 3.2% in 2020, and while this contraction was less severe than in other regional economies, such as Montenegro, for instance, due to its high reliance on tourism, it has still produced negative economic consequences and necessitated policy responses from all levels of government.

As part of its recovery, Bosnia and Herzegovina provided several economic support packages to mitigate the impact of COVID‑19, the first having been launched in March 2020 with the last having been presented in April 2021. The sum of the combined economic support packages totalled approximately EUR 65 million with specific provisions at both the state and entity levels:

Subsidies: With the aim to provide assistance for workers and businesses during the pandemic, both entities provided subsidy contributions. Businesses in the Federation of Bosnia and Herzegovina were entitled to subsidies in the amount of BAM 245 (approximately EUR 120) per person until one month after the state of emergency was abolished. In Republika Srpska, approximately EUR 29 million was allocated to cover minimal salary, contributions and taxes through the Compensation Fund, which sources funds through voluntary contributions, the RS budget and tax revenues under special laws and donations. On 7 April 2020, the Federation of Bosnia and Herzegovina also announced the allocation of a total of BAM 7 million (~EUR 3.5 million) to the Federal Civil Protection Administration and the Federal Civil Protection Headquarters. The Federation of Bosnia and Herzegovina allocated around EUR 50 million to support the tourism and catering sectors, purchase and export of market surpluses, and support for the export-oriented agricultural production, measures in the field of road, railway and air transport, support to companies in the field of energy, mining and industry for maintaining current liquidity, working capital and completion of investments started before the pandemic, and support to the health sector.

Tax measures: The obligation to make advanced payments on corporate income tax for businesses and self-employers was abolished during the pandemic, while lease amounts were decreased by 50% for business premises managed by the FBiH Office of Joint Affairs. Corporate income tax liabilities in Republika Srpska were postponed until June 2020. All borrowers from the Republika Srpska Investment-Development Bank (IRBRS) were granted three-month repayment moratoriums, and deadlines for filing tax returns and salary specifications were extended to June 2020 in both entities. In Republika Srpska, the taxes were covered by the government for those subjects who were the most affected by the crisis (merchants, caterers and small entrepreneurs).

Loans: The RS Ministry of Agriculture has also allocated BAM 2.2 million (~EUR 1.1 million) in loans to encourage agricultural output for small producers. Support for the tourism sector was also announced by Republika Srpska. Starting from 15 June 2020, citizens benefited from a BAM 100 (around EUR 50) voucher that can be used to co-finance accommodation costs at any destination in Republika Srpska, provided that the stay lasts a minimum of three nights. All borrowers from the IRBRS are granted a three-month repayment moratorium.

Credit lines: The FBiH Development Bank established a Guarantee Fund with total reserves of around EUR 50 million. In June 2020, released the first injection of funds under the Programme of Economic Stabilisation of the Federation of Bosnia and Herzegovina (2020-2021) of around EUR 50 million to provide guarantees to commercial banks for loans destined to companies whose activities are characterised as those in the strategic development sectors. Republika Srpska announced the establishment of the Fund for Economy Aid, which became operational in May 2020. Namely, together with the European Bank for Reconstruction and Development and the Guarantee Fund of Republika Srpska, BAM 50 million (~EUR 25 million) was provided as a guarantee for loans (ranging from BAM 5 000 or around EUR 2 500 to BAM 500 000 or around EUR 250 000), which business entities will be able to obtain through commercial banks. In June 2020, the Minister of Finance of Republika Srpska held a meeting with the representatives from the banking sector and micro-credit institutions, during which the Guarantee Programme to support the economic recovery and its Guarantee Fund were presented.

Although numerous short-term economic support measures helped mitigate immediate economic damage, structural issues primarily with regard to the public health sector, employment, social protection and private-sector support were exacerbated by the pandemic and remain in need of reforms.

Sources: OECD (2021[9]; 2021[10]); European Commission (2021[11]).

Business environment trends

Bosnia and Herzegovina has made strong progress in improving the framework for bankruptcy proceedings by aligning and strengthening the regulatory framework throughout its entire territory, ensuring that firms may exit the market more efficiently and with less risk for creditors and debtors. Efforts to harmonise banking regulations with the EU acquis at the level of both entities have been recognised by the European Commission. Some progress was also seen regarding business registration procedures. The Register of Business Entities and Natural Persons and the Federation of Bosnia and Herzegovina’s clearing system have been upgraded since the last assessment, further aligning the business environment with EU standards. Republika Srpska also finalised the fourth phase of its e-registration project in May 2021, reducing the time and costs of business procedures by opening digital registration options (Directorate for Economic Planning, 2021[12]). Meanwhile, although the informal labour market remains significant, some progress was made in improving the degree of registration in the workforce through better labour market controls. The economy also made some efforts at the entity level to proceed with the implementation of electronic registrations of businesses and to facilitate foreign investment, continuing to be one of the most open economies for investment according to the OECD FDI Regulatory Restrictiveness Index. Its score remained 0.037 in 2020, significantly lower than the OECD average of 0.063, indicating that the economy has low barriers to trade and maintains only a handful of restrictions, notably in the media, radio and broadcasting sectors (OECD, 2020[13]).

Despite these achievements, Bosnia and Herzegovina’s business environment still has several key impediments and obstacles to business development which are acknowledged in the economy’s latest Economic Reform Programme (ERP) (Box 14.2). Overall, the economy’s business environment continues to be hampered by numerous and lengthy regulatory procedures, political discord, a lack of co-operation and diverging rules between entities, complicating the operation of companies. Businesses are required to navigate through multiple registration processes, increasing the costs of establishing a company and protecting incumbent companies from competition. The economy’s judicial branch remains a difficult barrier for businesses to function, particularly weak contract enforcement, problematic commercial dispute settlement, a large court case backlog, complicated real estate procedures and unreliable property rights.

Furthermore, corruption remains a hurdle for businesses across the WBT region, and Bosnia and Herzegovina has made little progress in its anti-corruption efforts. The poor functioning of the judicial system undermines a fair business environment, particularly when it comes to selective and non-transparent prosecution and judicial follow-up of corruption cases which negatively affects business operators and investors (European Commission, 2021[14]). Consequently, Bosnia and Herzegovina’s score in Transparency International’s Corruption Perception Index has continuously deteriorated since 2013, decreasing from a score of 42 to 35 (out of a possible 100) in 2021. As of the same year, it remains in 110th place out of a total of 180 ranked economies, the lowest in the WBT region along with Albania (Transparency International, 2022[15]).

Box 14.2. Economic Reform Programmes

Since 2015, EU accession candidates have been obliged to produce annual ERPs that outline clear policy reform objectives and policies necessary for participation in the economic policy co-ordination procedures of the European Union. The ERPs aim to produce concrete reforms that foster medium and long-term economic growth, achieve macroeconomic and fiscal stability and boost economic competitiveness. Since their initial launch, ERP agendas have been required to include structural reform objectives in key fundamental areas:

public finance management

energy and transport markets

sectoral development

business environment and reduction of the informal economy

trade-related reform

education and skills

employment and labour markets

social inclusion, poverty reduction and equal opportunities

In addition to these essential fields, and as the objectives of EU policies continue to evolve to include cross-cutting sustainable sectors, the structural reform agendas of ERPs have embraced new commitments to progressive policy reforms since the last assessment that also cover:

green transition

digital transformation

research, development and innovation

economic integration reforms

agriculture, industry and services

healthcare systems.

Once submitted by the governments, ERP programmes are assessed by the European Commission and European Central Bank, opening the door for a multilateral policy dialogue with enlargement candidates to gauge their progress and priority areas on their path to accession. Discussions and assistance on policy reforms take place through a high-level meeting between member states, EU institutions and enlargement economies, through which participants adopt joint conclusions that include economy-specific guidance for policy reform agendas.

The findings of the SME Policy Index 2022 provide an extensive technical understanding of the progress made on business sector-related policy reforms that are key to the ERPs of the EU accession candidates at both the regional and economy-specific levels. The SBA delves into the specific barriers to progress in ten policy areas that are essential to applying the larger objectives of the ERP programmes like boosting competitiveness and economic growth to SMEs in the region.

Source: European Commission (2021[11]).

EU accession process

Five years after the recognition of Bosnia and Herzegovina as a potential candidate for EU membership at the Thessaloniki European Council Summit in 2003, the economy signed its Stabilisation and Association Agreement (SAA) with the European Union in 2008, which entered into force in 2015, establishing a free trade area and closer political dialogue with the European Union. Shortly afterwards, Bosnia and Herzegovina became the last WBT economy to have applied for EU accession, having been granted potential candidacy status in 2016 (OECD, 2021[9]). After the self-assessment questionnaire, provided to all potential EU accession candidates, was sent to Bosnia and Herzegovina, the economy returned the finalised answers to the European Commission in 2018. The European Commission Opinion of May 2019 established 14 key priorities in the areas of democracy, institutional functionality, the rule of law, fundamental rights and public administration reform that Bosnia and Herzegovina needs to implement in order for the Commission to recommend the opening of EU accession negotiations (European Commission, 2019[16]). Bosnia and Herzegovina has made some recent progress in the 14 key priorities, namely by holding municipal elections in Mostar in 2020, holding the Stabilisation and Association Parliamentary Committee in 2021 and starting discussions on constitutional and electoral reforms and public administration reform (European Commission, 2021[14]).

While chapters on EU accession are not open for the economy as the negotiation procedures have not yet commenced, the status of Bosnia and Herzegovina’s implementation of each criterion is still assessed on an annual basis. However, the economy remains in the early stages for 14 of 33 assessed acquis chapters, with no progress on preparations having been made since the 2020 EC report. Positively, between the 2019 and 2020 reports, the economy did advance to “some level of preparation” in the areas of social policy and employment and transport policy while moving forward to ‘moderately prepared’ in the area of financial services (European Commission, 2021[14]).

According to the European Commission’s 2021 enlargement report for Bosnia and Herzegovina, the economy remains at an early stage of preparation on enterprise and industrial policies that help encourage a hospitable environment for SMEs. Since the last enlargement report, Bosnia and Herzegovina has only made limited progress in aligning its industrial policy with that of the European Union. Although the Federation of Bosnia and Herzegovina, Republika Srpska and the Brcko District have each adopted new industrial development strategies for the period 2021‑27, the economy continues to lack coherence between development strategies as well as a state-level monitoring body to promote consistency among policies that concern industrial competitiveness (European Commission, 2021[14]). In this regard, Bosnia and Herzegovina should concentrate on:

simplifying and harmonising business registration in both entities in order to reduce the administrative burden on entrepreneurs by centralising company registration and licensing under one-stop-shops and by broadening online registration

updating the industrial policy strategies and action plans at various levels of government, ensuring co‑ordination and involvement of industrial enterprises in policy formulation and implementation

assessing the needs of businesses, particularly SMEs, when it comes to modernising skills and adopting strategic guidelines for harmonisation of SMEs and entrepreneurship support.

Further progress towards opening negotiations will strongly depend on the political commitment of authorities at all levels to co‑operate on implementing harmonised policies toward European integration, which continues to be hampered by unconstructive internal political disputes (European Commission, 2021[14]). Meanwhile, Bosnia and Herzegovina will be unable to open accession negotiations until the 14 key priorities are implemented. The findings and recommendations published in the SME Policy Index 2022 can help provide the monitoring and guidance needed for Bosnia and Herzegovina to meet the requirements related to the harmonisation of enterprise and industrial policy with the acquis.

EU financial support

The European Union remains the largest provider of financial assistance to Bosnia and Herzegovina, helping the economy realise its reform processes and endeavours that bring it closer to the acquis. The European Union’s financial support to the economy and the region has been provided through both temporary support such as COVID‑19 assistance packages as well as long-term investment programmes and funds through the Instrument for Pre-accession Assistance (IPA), European Investment Bank loans, Western Balkans Investment Framework grants and more.

In addition to a total of EUR 1.9 billion provided to Bosnia and Herzegovina by the European Union between 2007 and 2020 under the Instrument for Pre-accession Assistance I and II, the European Union is providing additional financing to Bosnia and Herzegovina as part of EUR 14.2 billion allocated to the Western Balkans Six economies under IPA III for the period 2021‑27 to upgrade environmental management systems, improve transport systems by promoting environmentally friendly transport modes, and provide technical assistance for the management, monitoring, evaluation, information and control of IPA-related activities (European Commission, 2021[17]).

In 2020, the European Union pledged EUR 9 billion for the Western Balkans as part of a new economic and investment plan to support sustainable connectivity, human capital, competitiveness and inclusive growth, and the twin green and digital transition. One of the most ambitious projects remains the Bosnian section of Corridor Vc, supported by the European Investment Bank with over EUR 1 billion in financing to date. This important Pan-European Corridor will link Bosnia and Herzegovina with Hungary, eastern Croatia and the Adriatic Sea, as well as shortening the commutes of 1.5 million people. In addition, the economic and investment plan foresees investments into a Trans-Balkan Electricity Transmission Corridor that will provide electricity transmission to Bosnia and Herzegovina, and a gas interconnection with Croatia will facilitate energy supply diversification. Local SMEs will also be able to benefit from the scheme’s increased funding to the Western Balkans Guarantee Facility (European Commission, 2020[18]). The European Investment Fund has also played a key role in financing the business landscape in Bosnia and Herzegovina, having invested EUR 860 million to support businesses since the start of its operations, sustaining around 100 000 jobs (EIB, 2022[19]).

The European Union has played a key role in financially supporting Bosnia and Herzegovina in the wake of COVID‑19. The European Commission allocated EUR 250 million of its EUR 3 billion Macro-Financial Assistance (MFA) package for enlargement and neighbourhood partners that aims to help them limit the economic fallout of the COVID‑19 pandemic. Bosnia and Herzegovina received the first MFA payment of EUR 125 million in October 2021, upon signing of a memorandum of understanding outlining measures to improve economic governance, financial sector stability, transparency, better functioning of the labour market and the fight against corruption. The disbursement of the second payment will be conditional on the implementation of these reforms (European Commission, 2021[20]). The economy has also been the recipient of EUR 330 million of the European Union’s Team Europe EUR 3.3 billion COVID‑19 support to the region (European Commission, 2021[21]).

Bosnia and Herzegovina joined the European Union’s Competitiveness of Enterprises and Small and Medium-Sized Enterprises Programme (COSME) in 2016, under which it benefits from support for entrepreneurship and entrepreneurial culture, access to finance for SMEs and access to markets (European Commission, 2021[22]). Bosnia and Herzegovina is part of the Horizon 2020 programme, allowing it access to the programme’s budget of nearly EUR 80 billion to help develop projects and technologies and conduct research and activities that will contribute to tackling global challenges. Its participation in the SMEs portion of Horizon 2020 has been rather low (European Commission, 2021[23]). In 2022, the economy signed an additional Association Agreement to the Horizon Europe programme, promoting closer research and innovation co‑operation with the European Union.

SMEs in the domestic economy

The classification of SMEs in Bosnia and Herzegovina varies throughout the economy, with each entity providing its own definition under two pieces of legislation. Both entities define SMEs under the Law on Accounting and Auditing, which defines enterprises by the number of employees for purposes of accounting and financial reporting, in addition to the Law on Fostering Small Business Development in the Federation of Bosnia and Herzegovina (Table 14.2) and the Law on SME Development in Republika Srpska (Table 14.3). The categories conform to the EU standard definition of SMEs by employee size, with the exception of microenterprises under the Law on Accounting and Auditing in the Federation of Bosnia and Herzegovina, Republika Srpska and the Brcko District, but diverge on the other criteria concerning annual income and assets.

In October 2019, Republika Srpska amended its Law on SME Development by substantially increasing the turnover and balance sheet thresholds. The thresholds increased from a maximum BAM 1 million turnover and BAM 2 million balance sheet total for small enterprises to a common threshold of BAM 19.55 million. For medium enterprises, the threshold was raised from a maximum of BAM 4 million to BAM 97.79 million for turnover and from BAM 8 million to BAM 84 million for balance sheet total (Table 14.2).

Table 14.2. Definition of micro, small and medium-sized enterprises in the Federation of Bosnia and Herzegovina

|

. |

EU definition |

Law on Accounting and Auditing |

Law on Fostering Small Business Development |

|---|---|---|---|

|

Micro |

< 10 employees = EUR 2 million turnover or balance sheet |

No definition in place |

< 10 employees ≤ BAM 400 000 (~EUR 204 000) turnover and/or balance sheet |

|

Small |

< 50 employees = EUR 10 million turnover or balance sheet |

< 50 employees < BAM 1 million (~EUR 0.51 million) circulating assets < BAM 2 million (~EUR 1.02 million) turnover |

< 50 employees ≤ BAM 4 million (~EUR 2.04 million) turnover and/or balance sheet |

|

Medium-sized |

< 250 employees = EUR 50 million turnover = EUR 43 million balance sheet |

< 250 employees < BAM 4 million (~EUR 2.04 million) circulating assets < BAM 8 million (~EUR 4.08 million) turnover |

< 250 employees ≤ BAM 40 million (~EUR 20.41 million) turnover and/or ≤ BAM 30 million (~EUR 15.30 million) balance sheet |

Table 14.3. Definition of micro, small and medium-sized enterprises in Republika Srpska

|

EU definition |

Law on Accounting and Auditing |

Law on SME Development |

|

|---|---|---|---|

|

Micro |

< 10 employees = EUR 2 million turnover or balance sheet |

< 5 employees < BAM 250 000 (~EUR 128 000) balance sheet |

< 10 employees |

|

Small |

< 50 employees = EUR 10 million turnover or balance sheet |

< 50 employees < BAM 1 million (~EUR 0.51million) balance sheet < BAM 2 million (~EUR 1.02 million) turnover |

< 50 employees < BAM 19.55 million (~EUR 9.95 million) turnover or balance sheet |

|

Medium-sized |

< 250 employees = EUR 50 million turnover = EUR 43 million balance sheet |

< 250 employees < BAM 4 million (~EUR 2.04 million) balance sheet < BAM 8 million (~EUR 4.08 million) turnover |

< 250 employees ≤ BAM 97.79 million (~EUR 49.73 million) turnover and/or ≤ BAM 84 million (~EUR 42.71 million) balance sheet |

Table 14.4. Definition of micro, small and medium-sized enterprises in the Brcko District

|

EU definition |

Law on Accounting and Auditing |

|

|---|---|---|

|

Micro |

< 10 employees = EUR 2 million turnover or balance sheet |

No definition in place |

|

Small |

< 50 employees = EUR 10 million turnover or balance sheet |

< 50 employees < BAM 2.8 million (~EUR 1.43 million) turnover < BAM 1.4 million (~EUR 0.71 million) circulating assets |

|

Medium-sized |

< 250 employees = EUR 50 million turnover = EUR 43 million balance sheet |

< 250 employees < BAM 4 million (~EUR 2.04 million) turnover ≤ BAM 8 million (~EUR 4.08 million) circulating assets |

Note: BAM: Bosnia and Herzegovina convertible mark; exchange rate as of December 2021.

Source: Brcko District (2011[28]).

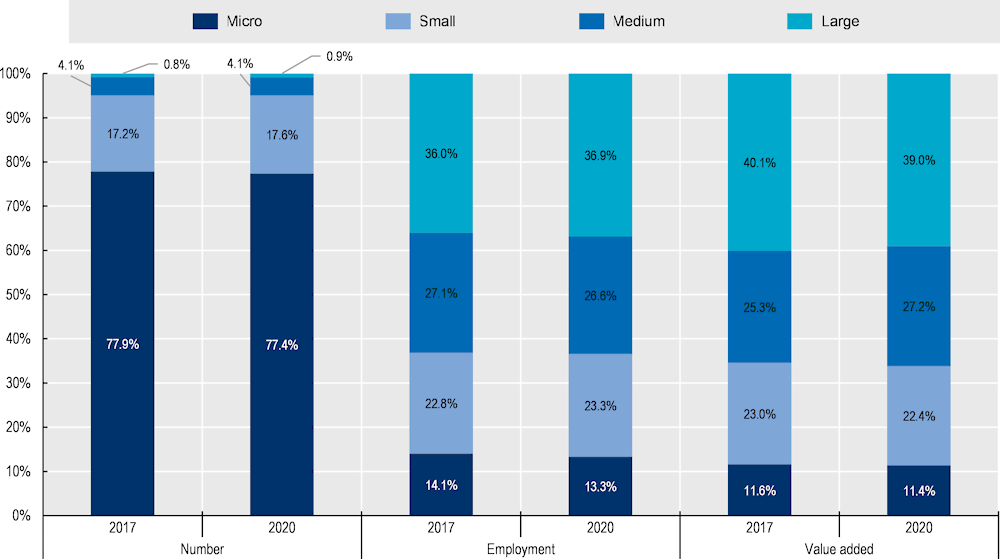

In 2020, Bosnia and Herzegovina’s 31 726 SMEs accounted for 99.46% of all enterprises in the economy, with their number increasing by 0.05 percentage point since 2017. The number of small enterprises increased by 1 percentage point since 2017, while the number of micro and medium-sized enterprises decreased by 0.5 and 0.05 percentage point. The number of persons employed by small enterprises increased the most among SMEs, by 8.93 percentage points from 2017 to 2020, while the number of persons employed by medium-sized enterprises increased by 4.97 percentage points over the same period. In 2020, SMEs represented 63.14% of employment in the business sector, an increase of 5.59 percentage points since 2017 (Figure 14.2).

Figure 14.2. Business demography indicators in Bosnia and Herzegovina (2017 and 2020)

Note: Latest data for the FBiH are from 2019. Unincorporated enterprises are not included. Due to unavailability of state-level data for micro-enterprises, data for Bosnia and Herzegovina have been calculated by aggregating the data from the Fedaration of Bosnia and Herzegovina and the Republika Srpska.

Source: Statistical offices of the FBiH and the RS.

The economy’s total value added in 2020 was approximately EUR 720 million more than in 2017. SMEs in Bosnia and Herzegovina accounted for 60.97% of value added by businesses in 2020, a 16-percentage-point increase from 2017.

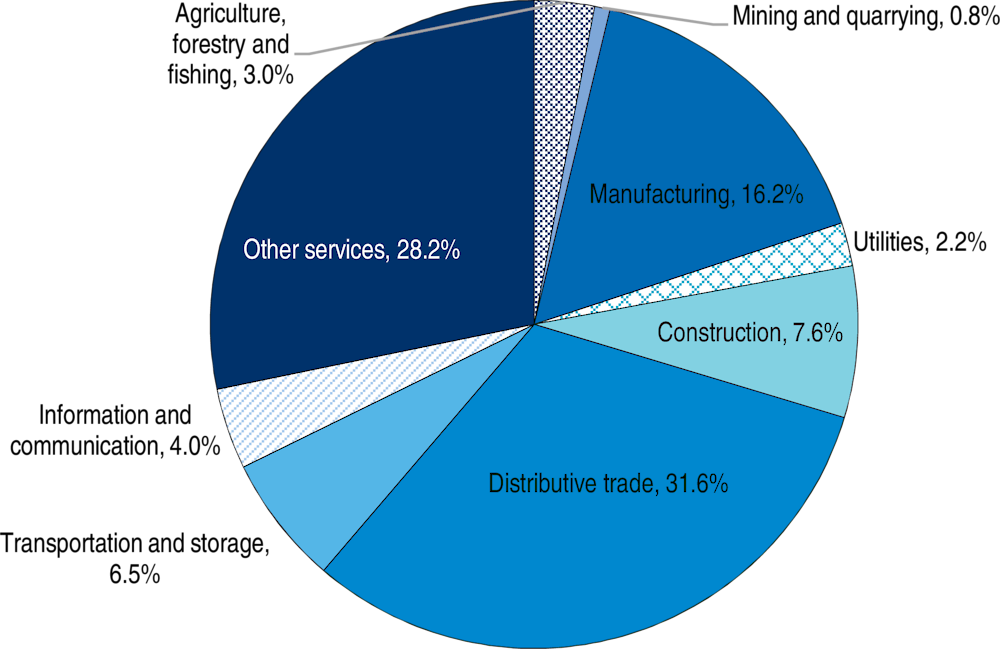

The makeup of SMEs by sector in Bosnia and Herzegovina has seen slight changes in the sectoral distribution since 2017 (Figure 14.3). The distributive trade sector, which includes wholesale, retail trade, and the repair of motor vehicles and motorcycles, remains the overwhelming industry of SMEs in the economy at 31.63%. At 16.18%, the manufacturing sector follows as the second-highest number of SMEs in Bosnia and Herzegovina, followed by the construction (7.55%) and transportation and storage (6.47%) sectors.

Figure 14.3. Sectoral distribution of SMEs in Bosnia and Herzegovina (2020)

Note: Due to unavailability of state-level data for micro-enterprises, data for Bosnia and Herzegovina have been calculated by aggregating the data from the Federation of Bosnia and Herzegovina and the Republika Srpska. Data for FBiH are from 2019.The sector classification generally follows the Statistical Classification of Economic Activities in the European Community (NACE) Rev.2 classification of productive economic activities with the following exceptions: “Utilities” represents the sum of “Electricity, gas, steam and air conditioning supply” (D); “Water supply” comprises “Sewerage, waste management and remediation activities” (E); “Distributive Trade” covers “Wholesale and retail trade; repair of motor vehicles and motorcycles” (F); and Other Services here consists of (I) Accommodation and food service activities, (L) Real estate activities, (M) Professional, scientific and technical activities, (N) Administrative and support service activities as well as (S) Other service activities. For more information, consult NACE Rev. 2 Classification.

Source: SBA Assessment questionnaire

Most of Bosnia and Herzegovina’s companies (over 70%) are located in the FBiH entity, with around 30% in the RS entity (Table 14.5), and are concentrated around the main commercial hubs of the economy, particularly the Sarajevo canton (over 24% of total enterprises in 2020 and 2021).

Table 14.5. Number of registered companies in Bosnia and Herzegovina, by enterprise size class and entity and FBiH canton (2021 or the latest available year)

|

Entities |

Cantons (FBiH) |

Enterprise size class, by employment |

Total |

Share of total number of enterprises |

||||

|---|---|---|---|---|---|---|---|---|

|

0-9 |

10-49 |

50-249 |

250+ |

2020-21 |

2017 |

|||

|

Federation of Bosnia and Herzegovina |

Bosnian Podrinje |

135 |

41 |

8 |

4 |

188 |

0.54% |

0.57% |

|

Herzegovina-Neretva |

2 260 |

413 |

77 |

16 |

2 766 |

7.93% |

7.86% |

|

|

Canton 10 |

556 |

92 |

16 |

2 |

666 |

1.91% |

2.00% |

|

|

Sarajevo canton |

7 234 |

1 084 |

245 |

64 |

8 627 |

24.73% |

23.18% |

|

|

Posavina canton |

279 |

55 |

14 |

2 |

350 |

1.00% |

1.14% |

|

|

Central Bosnia canton |

1 410 |

305 |

98 |

26 |

1 839 |

5.27% |

5.58% |

|

|

Tuzla canton |

3 113 |

653 |

195 |

36 |

3 997 |

11.46% |

11.72% |

|

|

Una-Sana canton |

1 625 |

332 |

63 |

6 |

2 026 |

5.81% |

6.02% |

|

|

Western Herzegovina canton |

1 069 |

183 |

50 |

11 |

1 313 |

3.76% |

3.83% |

|

|

Zenica-Doboj canton |

2 308 |

547 |

166 |

28 |

3 049 |

8.74% |

8.47% |

|

|

Total FBiH |

19 989 |

3 705 |

932 |

195 |

24 821 |

71.16% |

70.40% |

|

|

Republic of Srpska |

|

7 700 |

1 839 |

425 |

96 |

10 060 |

28.84% |

29.60% |

|

Bosnia and Herzegovina |

|

27 689 |

5 544 |

1 357 |

291 |

34 881 |

100.00% |

100.00% |

Note: Data for Republika Srpska are from 2020. Data from this table were collected from entity governments, using different methodologies from those used by the Bosnia and Herzegovina Institute for Statistics, which is the source of the data mentioned in the main text.

Source: SBA assessment government questionnaires.

Assessment

Description of the assessment process

The Small Business Act (SBA) assessment cycle was virtually launched on 7 July 2021, when the OECD team shared the electronic assessment material – questionnaires and statistical sheets, accompanied by explanatory documents.

Following the virtual launch, the Ministry of Foreign Trade and Economic Relations distributed the link to the assessment material to the appropriate ministries and government agencies at the state level and the statistical sheets to the National Statistical Office of the Federation of Bosnia and Herzegovina. In parallel, the link to the assessment material and the statistical sheets were also shared with the entity representatives: in the Federation of Bosnia and Herzegovina, the Ministry of Development, Entrepreneurship and Craft; and in Republika Srpska, the Ministry of Economy and Entrepreneurship. These institutions compiled the data and documentation between July and September 2021 and completed the questionnaires. Each policy dimension was given a self-assessed score accompanied by a justification. The completed questionnaires and statistical data sheets were received by the OECD team on 1 October 2021, following which the OECD team began an independent review.

The OECD reviewed the inputs and requested additional information on certain elements from the state Ministry of Foreign Trade and Economic Relations, Ministry of Development, Entrepreneurship and Craft of the Federation of Bosnia and Herzegovina and the Ministry of Economy and Entrepreneurship of Republika Srpska. For several dimensions, virtual consultation meetings with key dimension stakeholders were organised from end-October to mid-November. The meetings aimed to close any remaining information gaps in the questionnaires.

A virtual preliminary findings meeting with Bosnia and Herzegovina was held on 24 November 2021 with an aim to present and discuss the preliminary SME Policy Index 2022 assessment findings and initial recommendations for Bosnia and Herzegovina. At the same time, it served as an opportunity to seek the views of a broad range of policy stakeholders on how SMEs are affected by current policies and to gauge what more can be done across different policy areas to improve SMEs’ performance and competitiveness in Bosnia and Herzegovina, especially in the post-COVID context.

The meeting allowed the OECD to validate the preliminary assessment findings. The draft SME Policy Index publications and the Economy Profile of Bosnia and Herzegovina were made available to the government of Bosnia and Herzegovina for their review and feedback in March 2022.

Scoring approach

Each policy dimension and its constituent parts are assigned a numerical score ranging from 1 to 5 according to the level of policy development and implementation, so that performance can be compared across economies and over time. Level 1 is the weakest and Level 5 the strongest, indicating a level of development commensurate with OECD good practice (Table 14.6). For further details on the SME Policy Index methodology and how the scores are calculated, as well as the changes in the last assessment cycle, please refer to Annex A.

Table 14.6. Description of score levels

|

Level 5 |

Level 4 plus results of monitoring and evaluation inform policy framework design and implementation. |

|

Level 4 |

Level 3 plus evidence of a concrete record of effective policy implementation. |

|

Level 3 |

A solid framework addressing the policy area concerned is in place and officially adopted. |

|

Level 2 |

A draft or pilot framework exists, with some signs of government activity to address the policy area concerned. |

|

Level 1 |

No framework (e.g. law, institution) exists to address the policy topic concerned. |

Entrepreneurial learning and women entrepreneurship (Dimension 1)

Introduction

Entrepreneurial learning raises learners’ skills and develops the mindsets needed to change their lives and the world around them through entrepreneurial action for social and economic impact. It is the basis for empowering learners to know they can generate the creative ideas needed in the 21st century.

Women’s entrepreneurship should be prioritised to support women’s economic and social empowerment and drive improved stability and social and economic growth. It can also enable closing gender gaps in the workforce, supported by equality and gender impact analysis of policies affecting family care and social protection.

The overall score for Bosnia and Herzegovina has remained constant since the 2019 assessment. There have been good developments at the state and entity levels across both sub-dimensions (Table 14.7). Some actions remain under development, such as focusing on the entrepreneurship key competence within pre-service teacher training at the state level and practical integration of entrepreneurial learning developments into entity-level policy and implementation within education and training systems. Women’s entrepreneurship remains an area where progress is seen, but overall development is fragmented. There is also a strong need to improve the policy area’s statistical base, as evidence of the progress and efficacy of actions taken at the state and entity levels is lacking.

Table 14.7. Bosnia and Herzegovina’s scores for Dimension 1: Entrepreneurial learning and women’s entrepreneurship

|

Dimension |

Sub-dimension |

Thematic block |

Bosnia and Herzegovina |

WBT average |

|---|---|---|---|---|

|

Dimension 1: Entrepreneurial learning and women’s entrepreneurship |

Sub-dimension 1.1: Entrepreneurial learning |

Planning and design |

3.13 |

3.43 |

|

Implementation |

2.90 |

3.51 |

||

|

Monitoring and evaluation |

2.17 |

2.73 |

||

|

Weighted average |

2.82 |

3.33 |

||

|

Sub-dimension 1.2: Women’s entrepreneurship |

Planning and design |

4.20 |

3.97 |

|

|

Implementation |

3.49 |

3.83 |

||

|

Monitoring and evaluation |

4.25 |

3.11 |

||

|

Weighted average |

3.85 |

3.73 |

||

|

Bosnia and Herzegovina’s overall score for Dimension 1 |

3.23 |

3.49 |

||

Note: WBT: Western Balkans and Turkey.

State of play and key developments

There has been significant progress at the state level in entrepreneurial learning, with the launch of the strategy, Priorities for the Integration of Entrepreneurial Learning and Entrepreneurship Key Competence into Education Systems in Bosnia and Herzegovina (2021-2030) (Council of Ministers of Bosnia and Herzegovina, 2021[29]). There is evidence of progress on strategy actions at the state level, supported by state-level EU funding. Implementation at the entity level varies, with evidence of policy co-ordination and integration within the education and training system in the Federation of Bosnia and Herzegovina.

For women’s entrepreneurship, progress has been mixed, with a new strategy in Republika Srpska and no renewal of the Women’s Entrepreneurship Strategy that was previously in place in the Federation of Bosnia and Herzegovina.

Table 14.8. Bosnia and Herzegovina’s implementation of the SME Policy Index 2019 recommendations for Dimension 1

|

2019 recommendation |

SME Policy Index 2022 |

|

|---|---|---|

|

Main developments during the assessment period |

Progress status |

|

|

Update the entrepreneurial learning strategy |

Recent progress can be seen via the launch of a new state-level strategy in 2021 addressing the integration of entrepreneurial learning and key competence into education and training systems. EU international partners funding is supporting further developments related to strategy actions at the state level, while the level of practical implementation differs across entity-level education systems. |

Strong |

|

Embed women’s entrepreneurship within economic reform plans |

No significant progress has been made in this area. There is limited reference to women’s entrepreneurship in the 2021-2023 ERP, though there are broad actions relating to SME development, but without specific priority placed on women entrepreneurs. |

Limited |

There has been good progress in developing entrepreneurial learning as a key competence at the state level

Bosnia and Herzegovina has established a strong framework for the development of entrepreneurial learning at the state level, supported by inter-institutional co-ordination and in direct response to the recommendations made in previous SBA assessments. The recently published strategy on Priorities for the Integration of Entrepreneurial Learning and Entrepreneurship Key Competence into Education Systems in Bosnia and Herzegovina (2021-2030) (Council of Ministers of Bosnia and Herzegovina, 2021[29]) is a positive step forward, with priorities echoed across wider government documents, including Improvement of Quality and Relevance of Vocational Education and Training (VET) in Bosnia and Herzegovina in the Light of Riga Conclusions (2021-2030) (Ministry of Civil Affairs of Bosnia and Herzegovina, 2021[30]). The 2021-2030 strategy offers a comprehensive and detailed development pathway for lifelong entrepreneurial and key competence development at the state level. However, there is a lack of insight into how this will be implemented at the entity level, and a budget has not been allocated to the actions.

Funding from international development co-operation partners, through the EU-funded Education for Employment programme,2 has been shaped to support the implementation of the state strategy, particularly through working groups on entrepreneurial/digital competences and teacher training. Seven working groups were launched in June 2021,3 including the Working Group on Digital and Entrepreneurship Learning (WGDEL), the Career Guidance Working Group, the Teacher Training Competence Expert Working Group and the Working Group for Continuous Professional Development. Within its first six months, WGDEL defined learning outcomes for ISCED (International Standard Classification of Education) Levels 1‑3 based on EntreComp and DigComp,4 through an extensive state-wide consultation process involving teachers and experts from all levels of education and pedagogical institutes.5 Building on this, there is also interest by the Ministry of Civil Affairs in opening dialogue with BiH education systems on ways to integrate the new European Sustainability Competence Framework (GreenComp). The work being undertaken at the state level offers an opportunity and can be translated into all education systems in the economy, reinforcing the drive for more developed competence-based education systems across Bosnia and Herzegovina and supporting the need to improve the quality of education at all levels (European Training Foundation, 2021[31]; OECD, 2019[32]).

There remains a need to fully integrate entrepreneurship key competence development into all learner experiences at the entity level

The Federation of Bosnia and Herzegovina has continued its commitment to this policy area through government funding programmes and entity-level policy co-ordination. A multi-stakeholder policy partnership was established in 2016, but there has been less visibility of its activity since the last assessment. However, government-financed programmes (Official Gazette of Bosnia and Herzegovina, 2020[33]) have been put in place to support projects aimed at integrating key competences into preschool, primary and secondary schools, based on the European key competence framework.6 There is evidence of learning outcomes relating to the entrepreneurship key competence at all levels of education and training except higher education in the Federation of Bosnia and Herzegovina, in line with the state-level common core curriculum where entrepreneurship is included as a cross-curricular competence.7

In Republika Srpska, practical implementation of the entrepreneurship key competence at the curriculum level is still developing, while entrepreneurship has been an element of the secondary school curriculum since 2006. The Education Development Strategy of Republika Srpska places a priority on actions to embed entrepreneurship key competence into the education system, with a particular focus on vocational and higher education in the Education Development Strategy Action Plan until 2020 (Government of Republika Srpska, n.d.[34]). Recent advances in the VET sector include further work to develop the dual education model alongside guidelines to support business-education co-operation, developed in collaboration with regional chambers of commerce and businesses (Chamber of Commerce and Industry of Republika Srpska, 2021[35]). In higher education, a university entrepreneurial ecosystem is being developed through business support centres within universities.8

Practical entrepreneurial experiences are not yet fully integrated as a feature of the core curriculum in Bosnia and Herzegovina. In the Federation of Bosnia and Herzegovina, these are widespread across all levels of education but on an ad hoc basis that is not monitored or evaluated. While there are interesting examples, including those addressing green and digital themes,9 there remains a lack of practice sharing on effective approaches to improve learning and increase quality. In Republika Srpska, practical entrepreneurial experiences are not yet an explicit feature across all levels of education. At the VET level, there is an ad hoc provision, and there has been recent development of the dual education approach,10 which can support practical entrepreneurial learning. Both business co-operation and practical entrepreneurial experiences appear to happen primarily in VET and higher education sectors, and there is an opportunity to increase the availability of these opportunities to all students, including those in primary and secondary levels in Republika Srpska.

There has been less development of the entrepreneurship key competence at the level of pre-service teacher training, but there is a renewed commitment to take this forward

In-service teacher training is ongoing through engagement in the EU-supported Education for Employment programme, government-financed actions in the Federation of Bosnia and Herzegovina with ad hoc training opportunities across both entities.11 There has been less progress in developing the entrepreneurship key competence within pre-service training provision to support entrepreneurial learning. Pre-service teacher training is, however, a priority within the state-wide strategy (Council of Ministers of Bosnia and Herzegovina, 2021[29]), and it appears that the EU Education for Employment programme is taking this forward through the Expert Working Group on Teacher Training Competence. The work of this expert group started in mid-2021, and while there is a strong vision toward the quality provision of both pre-service and in-service teacher training for entrepreneurial learning, progress is not yet visible.12

Monitoring and evaluation of entrepreneurial learning is lacking at the state level and across both entities

There is a lack of comprehensive monitoring and evaluation of the actions outlined in the state-level strategy (Council of Ministers of Bosnia and Herzegovina, 2021[29]) and no clear indication of how this will be taken forward in line with constitutional competences. While the previous state-level strategies were evaluated, the new strategy emphasises entity-level actions to monitor and evaluate implementation. There are school-level inspections and evaluations across both entities, but the extent to which these place an explicit focus on learning related to the entrepreneurship key competence is unclear.

Overall, there are stronger co-ordination efforts to promote and develop women’s entrepreneurship, but these are more evident at the entity level

There is an increased focus on developing women’s entrepreneurship at both entity and state levels. At the state level, the focus is on gender equality, and within this, there are clear actions to promote and support women’s entrepreneurship. At the state level, the Agency for Gender Equality in Bosnia and Herzegovina leads the work and is supported by the Commission for Gender Equality of the Parliamentary Assembly of Bosnia and Herzegovina. These structures are mirrored at the entity level, with entity-specific gender centres13 working alongside the Commission for Gender Equality in the Federation of Bosnia and Herzegovina and the Equal Opportunities Committee in Republika Srpska. Women’s entrepreneurship is highlighted as a priority for women’s social and economic empowerment through actions within the Gender Action Plan of Bosnia and Herzegovina (2018-2022)14 co-ordinated by the Agency for Gender Equality and entity-level gender centres. In contrast, women entrepreneurs are only briefly mentioned in the ERP 2021-2023 (Council of Ministers of Bosnia and Herzegovina, 2021[36]), and there is no currently active state-level group or partnership addressing women’s entrepreneurship.

This policy area is more visible at the entity level through strategies that focus more closely on women’s entrepreneurship and SME development. However, the level of policy co‑ordination and practical implementation of women’s entrepreneurship differ between the Federation of Bosnia and Herzegovina and Republika Srpska.

In Republika Srpska, there is strong co-ordination of women’s entrepreneurship through a comprehensive strategy approach in the Women’s Entrepreneurship Strategy (2019-2023) (Government of Republika Srpska, 2019[37]), adopted in October 2019, and which includes a detailed analysis of the state of play alongside broad-based actions on areas impacting women’s entrepreneurship. The strategy is supported by the multi-stakeholder Council for Women’s Entrepreneurship,15 led by the Chamber of Commerce and Industry16 and includes representation from the Ministry of Economy and Entrepreneurship, women entrepreneurs and a range of stakeholders. Actions included addressing financial, networking and training support for women entrepreneurs, in addition to actions to ensure equality for working mothers and make it easier for them to run their businesses. Other actions work to include women as decision makers within regulatory structures, such as business councils and other decision-making bodies that have an impact on women’s entrepreneurship. The broad nature of these strategy actions is important to address the change needed to achieve social and economic equity across genders.

The strategy for women’s entrepreneurship in the FbiH ended in 2020, and a follow-up strategy has not yet been developed. However, actions continue, and there is evidence of a range of government-financed support available to encourage women’s entrepreneurship, supported by the Ministry of Education and Science. These include programmes to support women entrepreneurs in digitalisation, leadership and online business development following the impact of the COVID‑19 pandemic.17 These function alongside actions to share good practice and provide skills development programmes, primarily as partnership actions between the FBiH Gender Centre and the Chamber of Commerce, which are also active in developing and implementing the state-level Gender Action Plan.

A range of online portals promote access to information, support and networks for women’s entrepreneurship

Several entrepreneurship portals are available in the economy, including those targeting all entrepreneurs as well as portals providing women-specific information. The Poduzetna portal for women’s entrepreneurship is led by the Bosnia and Herzegovina Association of Women Entrepreneurs and supported through European Bank for Reconstruction and Development (EBRD) funding.18 This is a new initiative that provides information from across the economy and engages a range of stakeholders in the sources of information and training it draws from, including information on financial support, micro-credit,19 legislation changes affecting women entrepreneurs, training opportunities and women’s networks. The Zeda Development Agency in the City of Zenica provides a regional portal, including information relevant to the region, such as networks, events, incubation centres and available support projects, including those specific to women entrepreneurs. In Republika Srpska, there is a government-led entrepreneurship portal with information on public calls, available support, news and events relevant to all entrepreneurs.20 To provide a specific focus on women’s entrepreneurship, the Council for Women’s Entrepreneurship website provides insights into policy development, activities, and training through a dedicated online portal.21

Monitoring and evaluation actions in the area of women's entrepreneurship exist, but these are limited in scope, while statistical data sources are lacking

Republika Srpska reports on the implementation of its Women’s Entrepreneurship Strategy through annual reports on SME development, prepared by the Ministry of Economy and Entrepreneurship and the Development Agency (Government of Republika Srpska, 2020[38]). These reports bring together data from wider stakeholders22 involved in developing women’s entrepreneurship. Data collected are intended to form the basis of a database on women’s entrepreneurship accessible through the Council for Women’s Entrepreneurship website,23 but this is not yet active.

In the Federation of Bosnia and Herzegovina, there is less focus on monitoring and evaluation. This may be linked to the expiration of the strategy focusing on this policy area and reports relating to the evaluation of women’s entrepreneurship not being publicly available.

The Agency for Gender Equality at the state level and the gender centres at the entity level are drivers of the initiatives and measures toward gender equality and mainstreaming in Bosnia and Herzegovina. Comprehensive evaluation and data collection on the progress and impact of actions relating to women’s entrepreneurship needs to be developed further across the economy. Progress is already seen in Republika Srpska, where there is an annual report on gender statistics to provide the evidence base needed to analyse and monitor gender equality,24 offering a starting point to move forward towards analysing trends, women-owned SME growth pathways and considering this data as part of the smart specialisation mapping processes. Moving forward, consistent evaluation and data collection will be vital to understanding the efficacy and impact of different actions on women’s entrepreneurship.

The way forward for Dimension 1

Build a multi-stakeholder policy partnership for entrepreneurial learning, as set out in the new state-level strategy. Consolidating and formalising this partnership can drive ongoing commitment to strategy implementation at state and entity levels. With multiple actors involved in the work of actions funded by international partners, such as Education for Employment, it is important to use a state-level partnership to drive practical implementation at the entity level toward increasing the cross-curricular developments and overall quality of entrepreneurial learning that students experience during their education and training pathways. A good practice example from Montenegro is found in Box 14.3.

Box 14.3. Building a national policy partnership in Montenegro

Montenegro has successfully brought together and sustained a multi-stakeholder policy partnership that drives the co-ordination and development of lifelong entrepreneurial learning, gradually increasing the focus on this policy area and resulting in progress on the practical implementation of entrepreneurial learning at all levels of lifelong learning.

The consistent partnership between government ministries and key national stakeholders was linked to the design and implementation of national strategies. The relevance and importance of participation were clear to each partner organisation and closely aligned to their organisational objectives, with a named representative from each organisation. The partnership was initially informal, and organisations worked together to place the focus on increasing the profile of lifelong entrepreneurial learning at the policy level and gaining recognition for their partnership approach. This finally resulted in formal recognition by the government in 2021, as a working group of the National Council for Competitiveness led by the Ministry of Economy.

The nascent policy partnership at the state level of Bosnia and Herzegovina has the potential to inform and guide the development of entrepreneurial learning, with actors from both entities involved in the strategy development as well as the ongoing Education for Employment programme. Bringing partners together can place a focus on actions supporting lifelong entrepreneurial learning, enhance the work of all partners in this field and lead to further recognition of the importance of this policy area across both entities.

Sources: Government of Montenegro (2021[39]) and McCallum et al. (2018[40]).

Match pre-service teacher training provision to the needs of the core curricula, the newly developed entrepreneurial and digital learning outcomes developed through the Education for Employment programme, and support the new entrepreneurial learning strategy. This should be achieved through the ongoing work of the Expert Groups on Teacher Competence and Continuing Professional Development, with a strong focus on ensuring that pre-service teacher training is future-proofed to include explicit reference to entrepreneurship key competence development. A good practice example from the United Kingdom is presented in Box 14.4.

Box 14.4. Matching initial and continuing teacher education to the needs of the new Curriculum for Wales (United Kingdom)

In the United Kingdom, the University of Wales Trinity Saint David has successfully integrated the development of the entrepreneurship key competence into pre-service teacher training programmes and a new Education Doctorate supporting continuing professional development for experienced educators. Participant feedback shows that those who participate in the programme go on to use EntreComp to underpin their own teaching or wider teacher training initiatives, such as head-teacher training for the new curriculum led by Wales’ National Academy for Educational Leadership.

The approach taken first places explicit focus on teachers’ professional and entrepreneurial competences, using learning outcomes from EntreComp, to build an understanding of the relevance of this key competence. The courses developed also introduce knowledge and practical application of the entrepreneurship key competence for learners across diverse subject areas and with cross-curricular relevance. The university has embraced the EntreComp framework as a guide for this work, matching it with the new Curriculum for Wales, which emphasises four purposes of learning, including supporting learners in becoming “enterprising, creative contributors, ready to play a full part in life and work.”1

One of the recommendations in this assessment is that universities and pedagogical institutes realign their training provision to match the needs of the national curriculum to the content of university-based training of new teachers. Through the Education for Employment programme, Bosnia and Herzegovina has developed learning outcomes encompassing the DigComp and EntreComp framework competences. The opportunity now is to integrate these new developments, alongside the existing focus on entrepreneurship as a cross-curricular key competence within the economy’s state-level core curriculum, into pre-service teacher training to ensure new teachers are equipped to deliver the innovative pedagogies and approaches required for the future.

1. For more information on the Curriculum for Wales, see https://hwb.gov.wales/curriculum-for-wales (accessed on 20 January 2022).

Sources: Welsh Government (2021[41]); Penaluna, Penalune and Polenakovikj (2021[42]); Weicht and Jónsdóttir (2021[31]); McCallum et al. (2018[40]).

Strengthen the commitment to the practical implementation of the 2021-2030 strategy for entrepreneurial learning at the entity level. It will be important to clearly show how the actions of the strategy will be implemented across each education and training system, to ensure it supports the specificities of each system and context/stage of development of entrepreneurial learning. This should include a confirmed budget allocation to implement the state-level strategy and a clearly defined pathway for monitoring and evaluation. Progress should be reported annually with the education chapter of the ERP.

Ensure there are active women’s entrepreneurship strategies covering all areas of the economy addressing actions related to financial support, training, leadership, inclusion of women in key decision-making bodies and actions that support women who are primary carers in accessing entrepreneurship as a valid career pathway. Consideration should be given to creating effective actions to support practice sharing and learning between key government, private sector and non-governmental organisation (NGO) stakeholders who are active in the delivery of women’s entrepreneurship policy and practice at all levels.