This chapter covers the progress made by Kosovo in implementing the Small Business Act (SBA) for Europe over the period 2019-21. It starts with an overview of Kosovo’s economic context, business environment and status of its EU accession process. It then provides key facts about small and medium-sized enterprises (SMEs) in the Kosovar economy, shedding light on the characteristics of the SME sector. It finally assesses progress made in the 12 thematic policy dimensions relating to the SBA during the reference period and suggests targeted policy recommendations.

SME Policy Index: Western Balkans and Turkey 2022

15. Kosovo: Economy Profile

Abstract

Key findings

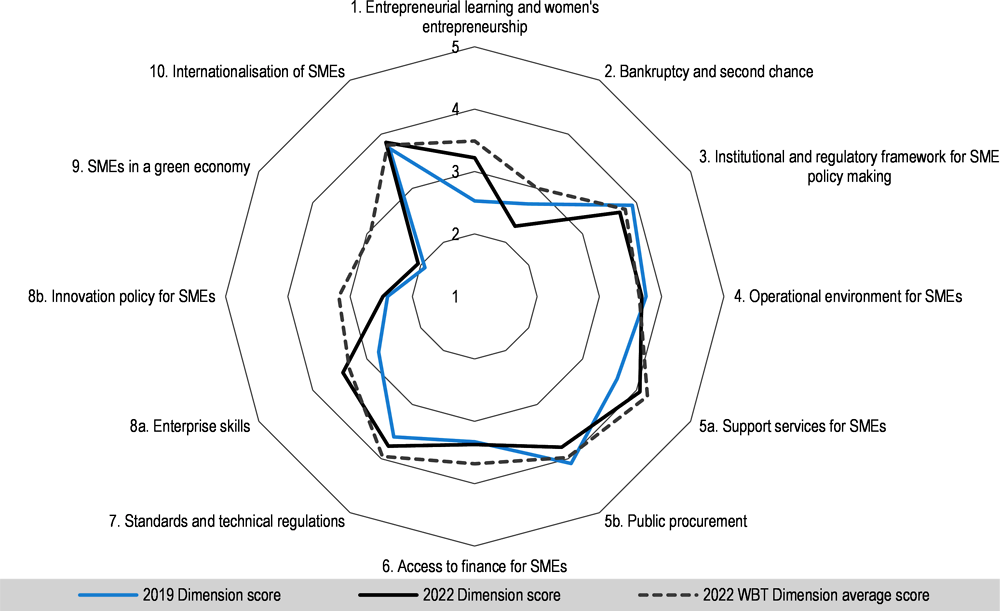

Figure 15.1. Small Business Act scores for Kosovo (2019 and 2022)

Note: WBT: Western Balkans and Turkey.

Kosovo1 has made progress in implementing the Small Business Act (SBA) since the publication of the previous report – the SME Policy Index: Western Balkans and Turkey 2019 (Figure 15.1). The main achievements that have helped the economy improve its performance in this assessment are as follows: support services for small and medium-sized enterprises (SMEs); internationalisation of SMEs; public procurement; and standards and technical regulations. However, the progress has been rather incremental, and the economy still needs to step up its efforts to build an environment conducive to business across a number of areas, namely bankruptcy and second chance; innovation; and SMEs in a green economy.

Main achievements

Education-business co-operation is being boosted through the University of Pristina for Competitiveness/Competencies/Co-operation (UPCO) cluster, bringing together the University of Pristina, the City of Pristina and the Kosovo Chamber of Commerce (KCC). This structured collaboration based on the triple-helix model has the potential to drive forward development of the entrepreneurial ecosystem to create social, cultural and economic value for the region.

The range of publicly provided business support services (BSSs) has expanded since the last assessment cycle. The government reinforced the Kosovo Investment and Enterprise Support Agency (KIESA)’s institutional capacity, which resulted in improved quality and range of its services. Moreover, due to the introduction of new support schemes, the uptake of BSSs provided by the government increased by 67.7%. In addition, to support services offered by the government, SMEs in Kosovo have access to a wide range of private BSSs. There are currently multiple online portals containing information on private consultants specialising in BSS provision, further raising awareness and facilitating access to private-sector BSSs among SMEs.

Financial intermediation has been increasing, albeit from low levels. A number of financial schemes (co-financing grant programmes and various financial support schemes) have been introduced recently, including for SMEs. The Kosovo Credit Guarantee Fund (KCGF) remains a key vehicle for the authorities to support access to finance for smaller enterprises, and the fund has increased its capacity significantly since the last assessment, almost doubling the number of guaranteed loans in 2021 compared to 2019.

Skills intelligence has been boosted through the development of three statistical barometers, with the Labour Market Barometer as an online statistics database, a vocational education and training (VET) Barometer providing analysis at the institutional level and the Skills Barometer reporting on current and future skills needs. These have the practical potential to be used as decision-making tools for policy and implementation.

Kosovo made considerable advancements in digitalising export promotion services by enabling SMEs to apply for export support on line, which greatly streamlines the procedures, further reducing the administrative burden. Cumbersome export support procedures were considered one of the main reasons behind weak export growth in the economy; therefore, this development is particularly noteworthy. Through the e-Kosova platform, Kosovo improved the availability of export promotion services for SMEs.

The way forward

Embed gender-disaggregated data and improve monitoring and evaluation of women’s entrepreneurship actions. While the policy and practical support for women’s entrepreneurship have seen general improvements, there remain severe challenges of data and evaluation to allow for a fuller understanding of the progress and impact of actions taken.

Promote second chance to honest entrepreneurs. Kosovo should promote a second chance as an option for honest entrepreneurs to have a fresh start and reduce the cultural stigma related to business failure. The legal framework should provide automatic debt discharge to honest entrepreneurs. The policy should be widely promoted through public awareness campaigns promoting a fresh start following bankruptcy.

Improve digital government services. A comprehensive policy framework for digital government is needed to ensure the rollout of digital government services and improve their quality in line with users’ needs. Such a framework should give a clear mandate to the Agency for Information Society to drive digital government reforms and especially to further develop the e-Kosova online portal into a digital one-stop-shop for government services and improve the quality of digital services through the adoption of common standards across all institutions.

Intensify efforts to match supply and demand for business support services among SMEs. Updating the training needs analysis performed in 2017 and assessing demand for particular support services would contribute to a higher uptake and effectiveness of government-provided BSSs. This is particularly important given the ever-changing SME landscape in Kosovo and across the region, and taking into account the onset of the COVID‑19 pandemic, as it is bound to reflect the changes in SMEs’ needs in the economy.

Enhance the strategic framework for innovation. Developing a detailed innovation policy framework, designed in consultation with all stakeholders, would enable Kosovo to prioritise innovation activities, identify existing bottlenecks in a targeted and tailored manner, and maximise resources. This should be coupled with an action plan that includes measurable targets as well as a clearly defined mandate for all the public developing the bodies involved to ensure implementation capacity and accountability. Swift progress in Smart Specialisation Strategy should also be a government priority.

Enhance financial support for SME greening. This can be done through the expansion of the scope of the National Energy Efficiency Fund, established in 2019, which could include specific financial programmes to support SME greening. The Fund could extend loans and loan guarantees to SMEs for energy efficiency measures or subsidise a share of consultancy costs to identify and implement resource efficiency measures. The government might consider facilitating SME access to green finance by connecting greening aspects to existing financial schemes. For instance, the newly introduced financial support to increase export readiness and job creation could include a green criterion, such as the possibility of a grant component if SMEs plan to implement eco-innovative projects or purchase new machinery intended to improve resource efficiency.

1. This designation is without prejudice to positions on status and is in line with United Nations Security Council Resolution 1244/1999 and the Advisory Opinion of the International Court of Justice on Kosovo’s declaration of independence

Economic context and role of SMEs

Economic overview

Kosovo is an upper-middle-income economy with a population of approximately 1.8 million as of 2021 and a per capita gross domestic product (GDP) by purchasing power parity of 10 707 in 2020 (in constant 2017 international dollars), having shrunk by roughly USD 600 since 2019, and remains the lowest in the region (World Bank, 2022[1]). Like most economies in the Western Balkans and Turkey (WBT) region, Kosovo is dominated by the services sector, accounting for 54% of GDP and employing approximately 56.6% of the population. However, industry in Kosovo overwhelmingly accounts for the highest share of value added to GDP in the region at 37.3%, nearly 10 percentage points higher than the following highest industry sector of North Macedonia, and employs roughly 24.8% of the labour force. While agriculture accounts for only 6.6% of GDP, albeit an increase of 0.5 percentage points from 2019, it forms 18.7% of Kosovo’s workforce, the highest proportion of agricultural employment in the region after Albania (KAS, 2022[2]).

Among WBT economies, Kosovo was one of the hardest hit by the COVID‑19 pandemic, with a 5.3% decrease in GDP, the highest loss in the region after Montenegro and North Macedonia. In 2020, heavy reliance on both domestic and foreign tourism made the economy greatly susceptible to the effects of COVID‑19 mitigation measures, such as border closures and mobility restrictions (Box 15.1). Kosovo’s lack of an independent monetary policy after unilaterally adopting the euro in 2002, coupled with its strong dependence on capital inflows, makes the economy highly vulnerable to external shocks and business cycle fluctuations. However, the economy rebounded with a 10.5% GDP growth, fuelled by strong diaspora inflows from remittances, tourism, compensation of seasonal migrants, and real estate investments that averaged approximately 43% of GDP and are expected to increase 2.8% in 2022 (IMF, 2022[3]; 2022[4]; European Commission, 2022[5]).

Box 15.1. Kosovo’s COVID‑19 recovery programme

After several support packages worth over EUR 200 million allocated until May 2020, Kosovo established an all-encompassing Economic Recovery Plan in the amount of EUR 1.1 billion to distribute funds to individuals and firms in the form of loans, grants and subsidies as part of its COVID‑19 recovery plan. By the end of the programme in December 2021, 2 105 enterprises benefited from a total of roughly EUR 106 million in loans and EUR 77 million in guarantees, with underrepresented beneficiaries, such as women in business and start-ups, targeted (Table 15.1).

Table 15.1. Kosovo’s Economic Recovery Package loan and guarantee results (2021)

|

Windows within the Economic Recovery Package |

Number |

Loan amount (EUR) |

Guarantee amount (EUR) |

Average loan amount (EUR) |

Average guarantee amount (EUR) |

|---|---|---|---|---|---|

|

Total Economic Recovery Package |

2 015 |

105 555 405 |

76 948 973 |

52 385 |

37 196 |

|

Women in Business window |

269 |

11 736 215 |

8 592 222 |

43 629 |

31 941 |

|

Agro window |

152 |

6 971 200 |

5 226 910 |

45 863 |

34 388 |

|

Manufacturing window |

394 |

28 719 074 |

19 943 859 |

72 891 |

50 619 |

|

Service window |

593 |

25 453 740 |

17 956 255 |

42 924 |

30 280 |

|

Trade window |

572 |

31 840 876 |

22 572 077 |

55 666 |

39 462 |

|

Start-up window |

35 |

834 600 |

657 650 |

23 846 |

18 790 |

The plan also provided professional support for businesses to help them operate effectively during the pandemic, including guidance on moving operations on line, working from home and digitising key business practices. The government also provided specific economic support measures throughout the pandemic:

Subsidies: In order to preserve existing jobs and provide assistance for businesses during COVID‑19, the government-provided subsidies in the amount of EUR 130 for those who lost their jobs due to the COVID‑19 crisis and allocated EUR 67 million to increase employment, with a specific focus on groups of workers with a lower probability of finding employment during the crisis. Eligible firms received EUR 170 per month for each employee on their payroll and EUR 206 for each new employee hired on a minimum one-year contract during the crisis. The government also subsidised up to 50% of rent costs for SMEs during the crisis and allocated EUR 20 million to public enterprises with access to interest-free loans until December 2020.

Tax measures: The Tax Administration of Kosovo began extending the deadline to file and pay tax liabilities and pension contributions in March 2020 and allowed taxpayers affected by the crisis to apply for an extension of tax payment deadlines for up to three years. The Ministry of Finance and Transfers suspended all interest on unpaid property taxes until 2021. As part of the August 2020 Plan for the Implementation of the Economic Recovery Package, the government allocated EUR 15 million to ease the tax burden on firms to improve enterprises’ short-term liquidity. The government also postponed tax obligations for specific firms, covered 5% of pension contributions that firms pay employees, exempted firms from penalties for late tax payments due to the pandemic, and provided tax breaks for firms operating in strategic sectors.

Credit: The KCGF also provided SMEs with one-use guarantees in the amount of EUR 250 000‑500 000. Guarantees were provided for up to 50% at the start of the Economic Recovery Package and were later raised to 80% of the principal loan with a one-year inclusion period that expired at the end of 2021. Likewise, the reserve capital of the Development Finance Institution, ALTUM, was increased to enable firms affected by the crisis to access support instruments such as credit guarantees and loans. Microenterprises and self-employed workers were able to apply to receive credit guarantees valued up to EUR 10 000.

Loans: At the start of the pandemic, the Central Bank suspended loan repayments for individuals and businesses and began reviewing requests for the suspension of credit repayments and frozen individual credit ratings to assist borrowers during the crisis. Additionally, the interest rate on loans for SMEs operating in the tourism sector was cut by 50%, while the interest rate on loans for large companies was cut by 15%. To ensure financial liquidity and continued access to financing for micro, small and medium-sized enterprises (MSMEs), the KCGF provided loans for long-term investments as well as working capital in the amount of EUR 1 million with a repayment period of up to 84 months.

Sector-specific support: At the start of the COVID‑19 pandemic, the Ministry of Agriculture, Forestry and Rural Development allocated EUR 5 million for grants and subsidies to increase agricultural production during the crisis, which was complimented by an additional EUR 26 million in August 2020 to increase domestic agricultural production and rural employment. In the same month, the government allotted EUR 5 million to subsidise wages for new employees hired to work in specific sectors or categories of employment and allocated EUR 10 million to enable the manufacturing and service sectors to access the equipment and machinery needed for automation processes. Publicly owned enterprises were also able to access EUR 14 million to support basic operations as well as EUR 17 million for capital investments.

Although numerous short-term economic support measures helped mitigate immediate economic damage, structural issues primarily with regard to the public health sector, employment, social protection and private-sector support were exacerbated by the pandemic and remain in need of reforms.

Overall investment levels in Kosovo have remained high. However, net foreign direct investment (FDI) flows have reached a plateau since 2016, with marginal increases over time. The majority of FDI comes from the diaspora through the real estate market and has not supported the growth of the domestic production base or the tradable sector (OECD, 2021[6]). Investment in the construction sector has been stable, particularly in the last three years, occupying 77.25% of investments in 2020 alone. SMEs are the largest recipients of investment at approximately 92.5%, with microenterprises accounting for 15.7%, small enterprises for 35.8% and medium enterprises for 41%. The source of these investments varies, with roughly 57.4% of the value of investments realised from the enterprises’ own funds; 22.27% using local bank loans; 11.40% by foreign creditors; 2.64% by local co-investors; and 1.88% by foreign co-investors (KAS, 2021[10]). Investment domains also vary significantly among enterprise size, with agriculture comprising the highest proportion of investments in companies with 10‑49 employees in both 2018 and 2020, while investments in tangible assets make up the largest share in medium-sized enterprises (KAS, 2022[11]).

Despite the positive effects, the heavy public spending on infrastructural improvements, coupled with unforeseen spending on COVID‑19 mitigation measures, burdened the economy’s debt which peaked in 2020 at 39.4% of GDP after reaching its lowest point in 2018 at 29.4% of GDP (European Commission, 2021[8]) (Table 15.2). Nevertheless, Kosovo is beginning to gear its public spending agenda towards energy efficiency projects, with plans to increase renewable energy sources in electricity consumption, which currently stands at around 5‑6%, to 25% or 30% by 2031 under the National Energy Strategy (2021-2030), which was under preparation at the time of drafting. Public investments in infrastructure, particularly with regard to the green agenda, are moving forward with three new agreements on renewable energy projects in wind and solar power signed in 2020 (EBRD, 2022[12]). In addition to introducing a simplified one-stop-shop administrative procedure for renewable energy projects, Kosovo, in partnership with the European Bank for Reconstruction and Development (EBRD) and private investors, completed the Selac Winpark in March 2022, comprising 27 turbines with an installed capacity of 105 megawatts per hour, or 10% of the economy’s installed capacity, reducing CO2 emissions by 247 000 tonnes (OECD, 2021[6]; Ministry of Economy, 2022[13]). Further energy efficiency investments included the construction of a substation in Bajgora and an upgrade of the KOSTT substation in Vushtrri, as well as a 19.4 km overhead line network. Kosovo has also largely invested in upgrading public buildings with energy efficiency measures, 87 projects of which have been implemented in the amount of EUR 4.2 million and 15 additional projects that will be funded with another EUR 2.4 million (Ministry of Economy, 2022[13]). The economy has also contributed EUR 3 million to the World Bank and EU co-financed Kosovo Energy Efficiency Fund, which recently authorised the release of EUR 1 million to improve energy efficiency in primary and secondary schools, family medicine buildings and other municipal facilities (Ministry of Economy, 2021[14]).

The financial sector in Kosovo was severely affected by the pandemic but sustained a strong recovery throughout 2021. Bank lending saw a 14.7% increase year-on-year driven by household and non-financial corporation lending which grew at 13.2% year-on-year. Due to the cessation of COVID‑19 related loan moratoriums in September, the non-performing loan ratio amounted to 2.2% in February 2022, showing a 0.5% decrease since November 2021. Commercial bank deposits decreased by roughly 2.3% in the same period, a 4.1% increase in the loan-to-deposit ratio which stood at 79.1% before returning to 76.5% at the end of 2021. Financial soundness indicators remained stable and satisfactory as the ratio of liquid assets to short-term liabilities for the banking sector decreased by 2.6% from September to November 2021, while the capital adequacy ratio saw a slight decline of 0.6% over the same period, remaining well above the regulatory minimum of 12% (European Commission, 2022[5]). The annual inflation rate increased by 7.5% year on year compared to February 2022, primarily due to increases in consumer prices of food products, gas, fuels and electricity, the price of which had decreased in the first half of 2021, in line with the Law on Economic Recovery for COVID‑19. Nevertheless, decreases in prices of fruit and clothing were noted during the same period, with a consolidated impact of ‑0.3% on the Harmonised Index of Consumer Prices (KAS, 2022[15]). Construction costs, import prices and producer prices also saw notable year-on-year surges in Q4 2021, with increases of 16%, 19.6% and 7.2%, respectively (KAS, 2022[16]; 2022[17]; 2022[18]). Kosovo’s interest rate spread remained unchanged at 4.5 percentage points (European Commission, 2022[5]).

Table 15.2. Kosovo: Main macroeconomic indicators (2016-21)

|

Indicator |

Unit of measurement |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|---|---|---|---|---|---|---|---|

|

GDP growth1 |

% year-on-year |

5.6 |

4.8 |

3.4 |

4.8 |

-5.3 |

10.5 |

|

National GDP2 |

EUR billion |

5.9 |

6.4 |

7.0 |

7.0 |

6.8 |

.. |

|

GDP per capita growth2 |

% year-on-year |

6.2 |

4.0 |

3.1 |

5.2 |

-4.6 |

.. |

|

Inflation1 |

% average |

0.3 |

1.5 |

1.1 |

2.7 |

0.2 |

3.3 |

|

Government balance1 |

% of GDP |

-1.1 |

-1.3 |

-2.9 |

-2.9 |

-7.6 |

-1.4 |

|

Current account balance1 |

% of GDP |

-8 |

-5.5 |

-7.6 |

-5.7 |

-7.0 |

-9.2 |

|

Exports of goods and services1 |

% of GDP |

23.8 |

27.3 |

29.1 |

29.3 |

21.6 |

33.7* |

|

Imports of goods and services1 |

% of GDP |

51.2 |

53.1 |

57.3 |

56.4 |

53.6 |

63.8* |

|

Net FDI1 |

% of GDP |

2.9 |

3.3 |

3.4 |

2.7 |

4.2 |

5.0* |

|

External debt2 |

% of gross national income (GNI) |

31.4 |

34.2 |

29.0 |

30.1 |

39.3 |

.. |

|

International reserves of the National Bank1 |

EUR million |

895.2 |

939.4 |

933.9 |

937.1 |

969.1 |

1 060.6 |

|

Gross international reserves1 |

Ratio of 12 months imports of goods and services moving average |

3.5 |

3.3 |

2.9 |

2.8 |

3.2 |

3.0* |

|

Unemployment1 |

% of total active population |

27.5 |

30.5 |

29.6 |

25.7 |

25.9 |

.. |

Note: *data is only available for Q3 2021.

Sources: 1. European Commission (2022[19]; 2022[5]); 2. World Bank (2022[20]).

While having improved overall in the last two decades, Kosovo’s unemployment rate has been highly volatile, reaching an all-time high of 57% in 2001 and a record low of 25.7% in 2019, averaging 33.4% during this period. Despite the notable progress since the millennium, the economy maintained the highest unemployment rate in the WBT region in Q1 of 20211 at 25.8% of the total active population. COVID‑19 exacerbated underlying structural problems of the Kosovo labour market, such as high informality, with some estimates putting informal employment as high as 33%, and low employment of youth, women and low-skilled workers (World Bank, 2017[21]). Kosovo’s youth unemployment rate of individuals aged 15‑24 increased from 16.2% in 2018 to 21.2% in 2020 and remains significantly higher than the EU average of 16.8% (Eurostat, 2021[22]). High rates of emigration also remain problematic for the region’s workforce (OECD, 2022[23]), to which Kosovo is no exception, holding the highest emigration rate in the Western Balkans at 15%. However, Kosovo’s population is among the youngest in Europe, with only 15.8% of its citizens over 65, moderately less than the European Union’s population over 65, which stands at 20.8% (World Bank, 2022[24]).

Business environment trends

Despite the difficult circumstances surrounding the COVID‑19 pandemic, reforms have continued to take place, albeit at a slower pace. Kosovo continues to have a well-developed Credit Guarantee Fund (KCGF), which has facilitated the continued expansion of financial intermediation that started at a comparatively low base. In spite of the pandemic, bank lending increased in 2020, rising to 11.2% in 2021 from 7.1% the previous year (European Commission, 2022[19]). Loan growth was facilitated decreasing lending rates, albeit remaining significant at 6.2% in 2020, a continued increase of deposits since 2015 to 1.5% in 2020, improved contract enforcement, and increased guarantees extended by the KCGF for lending to MSMEs to cushion the impact of the crisis (Eurostat, 2022[25]). One of the targets of Kosovo’s support measures is its large diaspora, having implemented its first-ever “diaspora bond” issuance during the summer of 2021 through commercial banks in collaboration with the Ministry of Finance.

Privatisation of state-owned enterprises (SOEs) is advancing, albeit slowly. Both governments in the last reporting cycle took decisions to dismiss several boards of publicly owned enterprises due to poor performance and replace them with temporary boards in order to better the efficiency of SOEs. The Ministry of Trade and Industry’s Business Registration Agency offers 29 one-stop-shops for registration at the municipal level. Additionally, the Kosovo Investment and Enterprise Support Agency (KIESA) provides the necessary information during the pre-investment phase and facilitates interactions with other government agencies/departments in the process of obtaining all the necessary licences and permits. It also provides assistance for SMEs using one-stop-shop services. This improved the overall regulatory environment in Kosovo, which remains one of the most open economies for investment according to the OECD FDI Regulatory Restrictiveness Index. Its score amounts to 0.05 in 2020, significantly lower than the OECD average of 0.063, indicating that the economy has reduced barriers to trade and maintains only a handful of restrictions, notably in the maritime, TV and radio broadcasting, and legal sectors (OECD, 2020[26]).

Although improving, Kosovo’s business environment still has several key impediments and obstacles to business development, which are acknowledged in the economy’s latest Economic Reform Programme (ERP) (Box 15.2). The private sector development remains constrained by widespread informality, slow and inefficient judiciary, high prevalence of corruption and an overall weak rule of law. Due to pandemic-induced challenges, little progress has been achieved in improving the business environment. The general inspection reform aiming to reduce the number of overlapping and parallel inspections from 36 to 15 stalled in 2020, but the new government is committed to completing the process. Within the Administrative Burden Reduction Programme (2020-2027), aiming to achieve a 30% reduction of the administrative burden over the next eight years, Kosovo initiated a baseline measurement identifying all administrative hurdles for businesses. The structural reorganisation of KIESA remains behind schedule. In addition, the lack of a coherent policy for industry development throughout supply chains undermines the competitiveness of SMEs (European Commission, 2021[27]).

Box 15.2. Economic Reform Programmes

Since 2015, EU accession candidates have been obliged to produce annual ERPs that outline clear policy reform objectives and policies necessary for participation in the economic policy co‑ordination procedures of the European Union. The ERPs aim to produce concrete reforms that foster medium and long-term economic growth, achieve macroeconomic and fiscal stability and boost economic competitiveness. Since their initial launch, ERP agendas have been required to include structural reform objectives in key fundamental areas:

public finance management

energy and transport markets

sectoral development

business environment and reduction of the informal economy

trade-related reform

education and skills

employment and labour markets

social inclusion, poverty reduction and equal opportunities.

In addition to these essential fields, and as the objectives of EU policies continue to evolve to include cross-cutting sustainable sectors, the structural reform agendas of ERPs have embraced new commitments to progressive policy reforms since the last assessment that also cover:

green transition

digital transformation

research, development and innovation

economic integration reforms

agriculture, industry and services

healthcare systems.

Once submitted by the governments, ERPs are assessed by the European Commission and European Central Bank, opening the door for a multilateral policy dialogue with enlargement candidates to gauge their progress and priority areas on their path to accession. Discussions and assistance on policy reforms take place through a high-level meeting between member states, EU institutions and enlargement countries, through which participants adopt joint conclusions that include economy-specific guidance for policy reform agendas.

The findings of the SME Policy Index 2022 provide an extensive technical understanding of the progress made on business sector-related policy reforms that are key to the ERPs of the EU accession candidates at both the regional and economy-specific levels. The SBA delves into the specific barriers to progress in ten policy areas that are essential to applying the larger objectives of the ERPs, like boosting competitiveness and economic growth to SMEs in the region.

Source: European Commission (2021[8]).

EU accession process

Kosovo remains one of the WBT economies designated as a potential candidate for EU accession, having been assigned said status in 2008. The Stabilisation and Association Agreement (SAA) between the European Union and Kosovo entered into force in 2016, replacing the Stabilisation Tracking Mechanism enacted by the European Union in 2002 to ensure that the economy could continue to gradually integrate its domestic policies on legal, economic and social matters with the European Union. Kosovo’s implementation of the new comprehensive framework aimed at establishing a free trade area and closer political dialogue between the European Union and Kosovo has since been administered through the National Programme for Implementation of the Stabilisation and Association (NPISAA), which was adopted the same year for the period 2017‑21 (Government of Kosovo, 2017[28]). A new NPISAA for the period 2020‑24 was adopted in July 2020 and aims to determine further measures and priorities for institutions to implement the SAA and enable the fulfilment of its obligations (Office of the Prime Minister, 2020[29]). Kosovo has made some progress in general harmonisation with EU standards. In its fourth report on progress on the implementation of the remaining benchmarks of the Visa Liberalisation Roadmap by Kosovo, the Commission confirmed that all benchmarks had been fulfilled, and the Decision on the Commission’s proposal remains pending in the European Parliament and the Council (European Commission, 2018[30]).

According to the European Union’s 2021 enlargement report for Kosovo, the economy is moderately prepared on enterprise and industrial policies that help encourage a hospitable environment for SMEs. Kosovo made some progress in aligning its industrial policy by making the National Council for Economy and Investment a more systematic and efficient forum for public-private business dialogue. The economy also did well to maintain a functioning business environment during the COVID‑19 crisis and lockdowns, which was particularly facilitated by Kosovo’s well-established Credit Guarantee Fund, which was able to efficiently provide additional financing by increasing its coverage of credit guarantees for loans. Nevertheless, Kosovo needs to reinforce stagnant efforts to remove structural barriers to businesses as attention was focused on mitigating the immediate effects of the pandemic (European Commission, 2021[27]). In this regard, Kosovo should concentrate on:

adopting and implementing a strategy to support Kosovo’s business environment and industrial development

reorganising the KIESA to improve its support schemes and provision of advisory services to SMEs and add an investor aftercare unit.

Although Kosovo has shown a firm commitment to aligning its policies with the European Union, further progress towards opening negotiations will strongly depend on improved bilateral relations and co‑operation with neighbouring economies as well as further simplification of the regulatory environment for businesses and enabling better access to finance for SMEs. The findings and recommendations published in the SME Policy Index 2022 can help provide the monitoring and guidance needed for Kosovo to meet the remaining requirements related to harmonisation of enterprise and industrial policy with the EU acquis.

EU financial support

The European Union remains the largest provider of financial assistance to Kosovo, helping the economy realise its reform processes and endeavours, bringing it closer to the acquis. The European Union’s financial support to the economy and the region has been provided through both temporary support such as COVID‑19 assistance packages as well as long-term investment programmes and funds through the Instrument for Pre-accession Assistance (IPA), European Investment Bank loans, Western Balkans Investment Framework grants and more.

In addition to a total of EUR 1.2 billion provided to Kosovo by the European Union between 2007 and 2020 under the IPA I and II, the European Union is providing funds under IPA III for the period 2021‑27 to upgrade environmental management systems, improve transport systems by promoting environmentally friendly transport modes, and provide technical assistance for the management, monitoring, evaluation, information and control of IPA-related activities (European Commission, 2021[31]).

In 2020, the European Union pledged EUR 9 billion for the Western Balkans as part of a new economic and investment plan to support sustainable connectivity, human capital, competitiveness and inclusive growth, and the twin green and digital transition. The European Commission has been integral in providing infrastructural funding for the Peace Highway connecting Kosovo to Nis in Serbia and the upgrading of a railway route connecting Belgrade with Pristina. The European Commission has also been helping the economy move away from coal and transition to renewable energy sources through further preparations for the construction of the Ibër-Lepenc Hydro System Phase II and starting a gas interconnection between Kosovo and North Macedonia. Kosovar SMEs will also be able to benefit from the scheme’s increased funding to the Western Balkans Guarantee Facility (European Commission, 2020[32]).

The European Union has been crucial in financially supporting Kosovo in the wake of COVID‑19. The economy received EUR 100 million of the European Commission’s EUR 3 billion Macro-Financial Assistance (MFA) package for enlargement and neighbourhood partners that aims to help them limit the economic fallout of the COVID‑19 pandemic. Kosovo received the second MFA payment in January 2021 after fulfilling the programme's policy conditions to improve the sustainability of public finances, enhance financial stability, strengthen good governance and the fight against corruption, as well as initiatives to increase youth employment (European Commission, 2020[33]).

The European Investment Bank (EIB) has also played a key role in financing the business landscape in Kosovo, having invested EUR 280 million to support Kosovo’s companies since 1999. The EIB also provided EUR 11 million for the construction of a wastewater plant in the municipality of Gjilan, which will serve more than 90 000 people in Kosovo. The economy also continues to participate in the European Union’s Competitiveness of Enterprises and Small and Medium-Sized Enterprises Programme (COSME), under which it benefits from support to entrepreneurship and entrepreneurial culture, access to finance for SMEs and access to markets (European Commission, 2021[34]). The economy has participated in the European Union’s Research and Innovation programmes since 2008 and is part of the Horizon 2020 programme, allowing it access to the project’s EUR 95.5 million budget to help develop projects and technologies and conduct research and activities that will contribute to tackling global challenges.

SMEs in the domestic economy

The classification of SMEs in Kosovo remains enshrined in the Law on Foreign Investments adopted in 2014 (Assembly of Kosovo, 2014[35]), which replaced the 2006 Law on Support to Small and Medium Enterprises and its subsequent amendment in 2008. The only criterion remains employment size, which conforms to the EU standard definition of SMEs (Table 15.3).

Table 15.3. Definition of micro, small and medium-sized enterprises in Kosovo

|

|

EU definition |

Kosovo definition |

|---|---|---|

|

Micro |

< 10 employees = EUR 2 million turnover or balance sheet |

≤ 10 employees |

|

Small |

< 50 employees = EUR 10 million turnover or balance sheet |

< 50 employees |

|

Medium-sized |

250 employees = EUR 50 million turnover = EUR 43 million balance sheet |

< 250 employees |

Note: For purposes related to the Law on Bankruptcy, an SME is defined as a business organisation that has an annual turnover of up to EUR 1 million or has up to 25 employees. This definition is only applied in bankruptcy cases.

Source: Assembly of Kosovo (2014[35]).

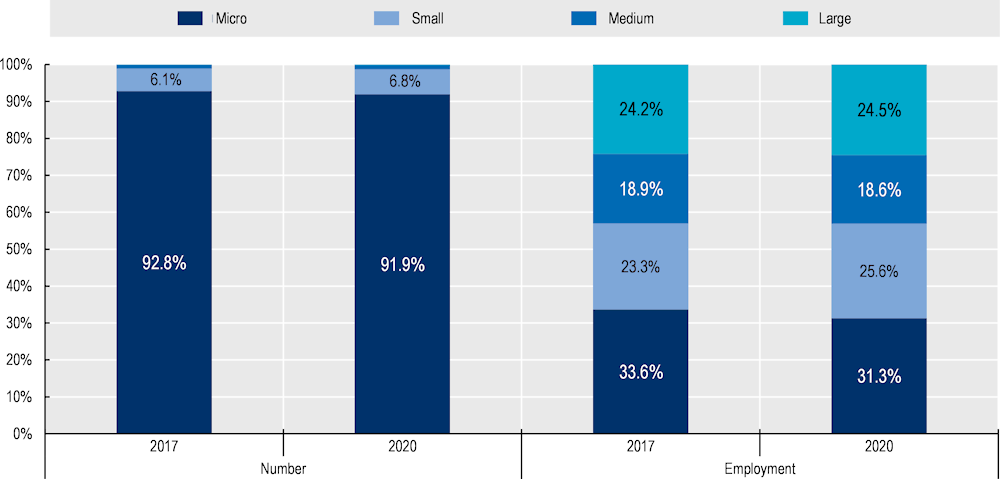

In 2020, Kosovo’s 42 881 MSMEs accounted for 99.84% of all enterprises in the economy, increasing by about 4 850 since 2017. MSMEs also increased employment by approximately 27 000 people in the same period, accounting for 75.5% of total employment in the economy. The breakdown of enterprises by size in Kosovo was 91.9% microenterprises, 6.8% small, 0.15% medium and only 0.66% large enterprises in 2020. The number of microenterprises decreased by roughly 0.9% since 2017, which was partially absorbed by a 0.63% increase in small enterprises. Employment in SMEs experienced larger fluctuations, with micro, medium and large enterprises witnessing decreases in employment at 2.4%, 0.4% and 1.1%, respectively, while small enterprises noted a 2.3% increase in employees between 2017 and 2020 (Figure 15.2).

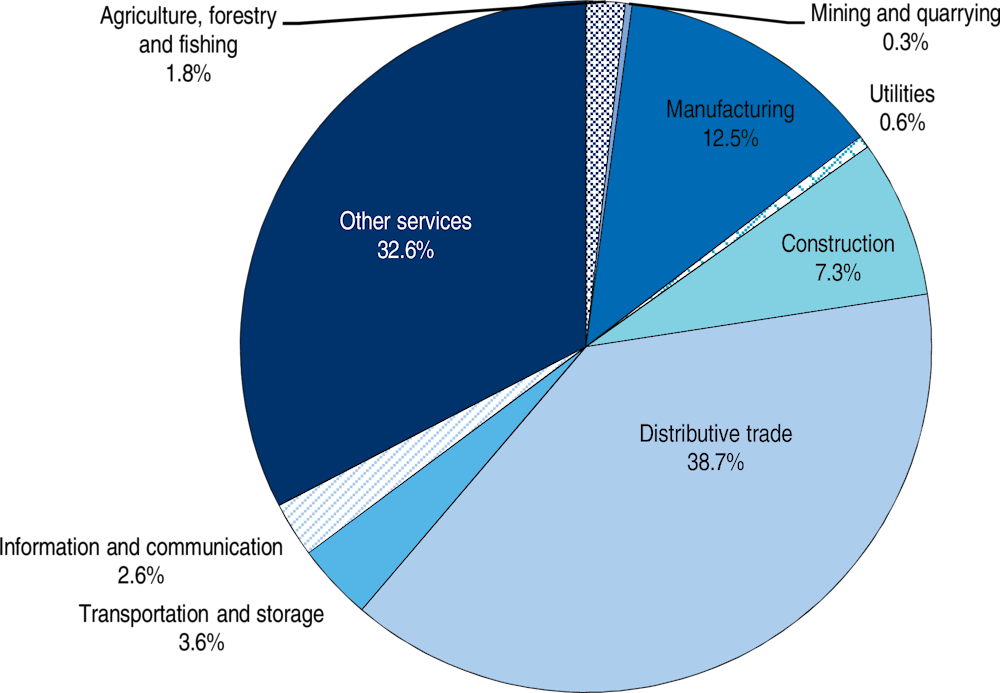

The sectoral distribution of SMEs in Kosovo has experienced slight changes since 2016 (Figure 15.3). The distributive trade sector, which includes wholesale, retail trade, and the repair of motor vehicles and motorcycles, remains the overwhelming industry of SMEs in the economy at 38.68% but saw the greatest decrease in the number of enterprises since 2016, at a 5.4% decline. Other services follows as the second-highest number of SMEs in Kosovo and witnessed the most notable increase in the number of enterprises since 2016, at a 5.5% increase. Slight increases of between 0.2% and 1% were also noted in the agriculture, construction, information and communication, utilities, and transport sectors, while manufacturing remained unchanged. A small decrease of 0.1% was noted for the mining industry.

Figure 15.2. Business demography indicators in Kosovo (2020)

Source: Statistical Office of Kosovo.

Figure 15.3. Sectoral distribution of SMEs in Kosovo (2020)

Note: The sector classification generally follows the Statistical Classification of Economic Activities in the European Community (NACE) Rev.2 classification of productive economic activities with the following exceptions: “Utilities” represents the sum of “Electricity, gas, steam and air conditioning supply” (D) and “Water supply, sewerage, waste management and remediation activities” (E); “Distributive Trade” covers “Wholesale and retail trade; repair of motor vehicles and motorcycles” (F); and Other Services here consists of (I) Accommodation and food service activities, (L) Real estate activities, (M) Professional, scientific and technical activities, (N) Administrative and support service activities as well as (S) Other service activities. For more information, consult NACE Rev. 2 Classification

Source: Statistical Office of Kosovo

Geographically, about 31.7% of enterprises were located in Pristina in 2021, followed by 9.7% in the municipality of Ferizaj and 7% in Prizren (Table 15.4). The number of enterprises in Pristina decreased by only 0.72% from 2019 to 2021, while the municipalities of Prizren, Mitrovicë and Vushtri also saw decreases of approximately 1% during the same period. On the other hand, the municipality of Ferizaj saw a notable 3.1% surge since 2019, while the municipalities of Lipjan, F. Kosove and Pejë also saw increases of around 1% during the same period.

Table 15.4. Number of registered companies in Kosovo by municipality (2019-21)

|

Municipality |

Total number of enterprises |

Share of total number of enterprises |

||||

|---|---|---|---|---|---|---|

|

2019 |

2020 |

2021 |

2019 |

2020 |

2021 |

|

|

Deçan |

31 |

31 |

16 |

1.21% |

1.08% |

0.66% |

|

Gjakovë |

75 |

95 |

93 |

2.92% |

3.31% |

3.85% |

|

Gllogoc |

53 |

53 |

66 |

2.07% |

1.85% |

2.73% |

|

Gjilan |

132 |

161 |

136 |

5.14% |

5.61% |

5.63% |

|

Dragash |

13 |

19 |

4 |

0.51% |

0.66% |

0.17% |

|

Istog |

41 |

22 |

18 |

1.60% |

0.77% |

0.75% |

|

Kaçanik |

37 |

31 |

21 |

1.44% |

1.08% |

0.87% |

|

Klinë |

44 |

27 |

35 |

1.71% |

0.94% |

1.45% |

|

F. Kosovë |

93 |

126 |

117 |

3.62% |

4.39% |

4.84% |

|

Kamenicë |

34 |

30 |

16 |

1.33% |

1.05% |

0.66% |

|

Mitrovicë |

91 |

118 |

59 |

3.55% |

4.11% |

2.44% |

|

Leposaviq |

9 |

3 |

2 |

0.35% |

0.10% |

0.08% |

|

Lipjan |

55 |

63 |

83 |

2.14% |

2.20% |

3.44% |

|

Novobërdë |

6 |

8 |

4 |

0.23% |

0.28% |

0.17% |

|

Obiliq |

22 |

27 |

41 |

0.86% |

0.94% |

1.70% |

|

Rahovec |

39 |

27 |

36 |

1.52% |

0.94% |

1.49% |

|

Pejë |

103 |

132 |

125 |

4.01% |

4.60% |

5.17% |

|

Podujevë |

119 |

125 |

90 |

4.64% |

4.36% |

3.73% |

|

Pristina |

831 |

897 |

765 |

32.39% |

31.28% |

31.66% |

|

Prizren |

209 |

200 |

169 |

8.14% |

6.97% |

7.00% |

|

Skenderaj |

38 |

52 |

30 |

1.48% |

1.81% |

1.24% |

|

Shtime |

27 |

12 |

17 |

1.05% |

0.42% |

0.70% |

|

Shtërpce |

7 |

9 |

1 |

0.27% |

0.31% |

0.04% |

|

Suharekë |

40 |

52 |

42 |

1.56% |

1.81% |

1.74% |

|

Ferizaj |

169 |

254 |

234 |

6.59% |

8.86% |

9.69% |

|

Viti |

54 |

35 |

32 |

2.10% |

1.22% |

1.32% |

|

Vushtrri |

89 |

119 |

60 |

3.47% |

4.15% |

2.48% |

|

Zubin Potok |

5 |

1 |

1 |

0.19% |

0.03% |

0.04% |

|

Zveqan |

9 |

3 |

3 |

0.35% |

0.10% |

0.12% |

|

Malishevë |

42 |

37 |

37 |

1.64% |

1.29% |

1.53% |

|

Juniku |

2 |

2 |

1 |

0.08% |

0.07% |

0.04% |

|

Mamushë |

1 |

11 |

2 |

0.04% |

0.38% |

0.08% |

|

Hani i Elezit |

11 |

22 |

7 |

0.43% |

0.77% |

0.29% |

|

Graçanica |

22 |

29 |

31 |

0.86% |

1.01% |

1.28% |

|

Ranillug |

1 |

8 |

2 |

0.04% |

0.28% |

0.08% |

|

Partesh |

2 |

4 |

11 |

0.08% |

0.14% |

0.46% |

|

Kllokot |

0 |

8 |

1 |

0.00% |

0.28% |

0.04% |

|

Mitr. Veriore |

10 |

15 |

8 |

0.39% |

0.52% |

0.33% |

|

Total |

2 566 |

2 868 |

2 416 |

100.00% |

100.00% |

100.00% |

Note: Data from 2021 Q4 business registrar records.

Source: Kosovo Agency of Statistics (2022[36]).

Assessment

Description of the assessment process

The SBA assessment cycle was virtually launched on 7 July 2021, when the OECD team shared the electronic assessment material – questionnaires and statistical sheets, accompanied by explanatory documents.

Following the virtual launch, KIESA, which acts as the SBA Co-ordinator nominated by the European Commission, distributed the link to the assessment material to the appropriate ministries and government agencies and the statistical sheets to the Kosovo Agency of Statistics. These institutions compiled the data and documentation between July and September 2021 and completed the questionnaires. Each policy dimension was given a self-assessed score accompanied by a justification. The completed questionnaires and statistical data sheets were received by the OECD team on 22 October 2021, following which the OECD team began an independent review.

The OECD reviewed the inputs and requested additional information on certain elements from KIESA. For several dimensions, virtual consultation meetings with key dimension stakeholders were organised in December. The meetings aimed to close any remaining information gaps in the questionnaires.

A virtual preliminary findings meeting with Kosovo was held on 14 January 2022 with an aim to present and discuss the preliminary SME Policy Index 2022 assessment findings and initial recommendations for Kosovo. At the same time, it served as an opportunity to seek the views of a broad range of policy stakeholders on how SMEs are affected by current policies and to gauge what more can be done across different policy areas to improve SMEs’ performance and competitiveness in Kosovo, especially in the post-COVID context.

The meeting allowed the OECD to validate the preliminary assessment findings. The draft SME Policy Index publications and the Economy Profile of Kosovo were made available to the KIESA for their review and feedback during February 2022.

Scoring approach

Each policy dimension and its constituent parts are assigned a numerical score ranging from 1 to 5 according to the level of policy development and implementation, so that performance can be compared across economies and over time. Level 1 is the weakest and Level 5 the strongest, indicating a level of development commensurate with OECD good practice (Table 15.5). For further details on the SME Policy Index methodology and how the scores are calculated, as well as the changes in the last assessment cycle, please refer to Annex A.

Table 15.5. Description of score levels

|

Level 5 |

Level 4 plus results of monitoring and evaluation inform policy framework design and implementation. |

|

Level 4 |

Level 3 plus evidence of a concrete record of effective policy implementation. |

|

Level 3 |

A solid framework addressing the policy area concerned is in place and officially adopted. |

|

Level 2 |

A draft or pilot framework exists, with some signs of government activity to address the policy area concerned. |

|

Level 1 |

No framework (e.g. law, institution) exists to address the policy topic concerned. |

Entrepreneurial learning and women’s entrepreneurship (Dimension 1)

Introduction

Entrepreneurial learning raises learners’ skills and develops the mindsets needed to change their lives and the world around them through entrepreneurial action for social and economic impact. It is the basis for empowering learners to know they can generate the creative ideas needed in the 21st century.

Women’s entrepreneurship should be prioritised to support women’s economic and social empowerment and drive improved stability and social and economic growth. It can also enable closing gender gaps in the workforce, supported by equality and gender impact analysis of policies affecting family care and social protection.

Education and training quality and relevance are a significant challenge for Kosovo (European Training Foundation, 2020[37]), and entrepreneurial learning is integral to both. While there has been some improvement during this assessment period, the education and training system is yet to ensure that entrepreneurial learning and the development of entrepreneurial competences is a reality within learning experiences for young people in Kosovo.

The score for women’s entrepreneurship has increased during this assessment period (from 2.53 in 2019 to 3.22 in this cycle), driven by the launch of the programme for gender equality, which includes a set of actions for women’s entrepreneurship (Table 15.6).

Table 15.6. Kosovo’s scores for Dimension 1: Entrepreneurial learning and women’s entrepreneurship

|

Dimension |

Sub-dimension |

Thematic block |

Kosovo |

WBT average |

|---|---|---|---|---|

|

Dimension 1: Entrepreneurial learning and women’s entrepreneurship |

Sub-dimension 1.1: Entrepreneurial learning |

Planning and design |

2.75 |

3.43 |

|

Implementation |

3.67 |

3.51 |

||

|

Monitoring and evaluation |

2.34 |

2.73 |

||

|

Weighted average |

3.13 |

3.33 |

||

|

Sub-dimension 1.2: Women’s entrepreneurship |

Planning and design |

3.40 |

3.97 |

|

|

Implementation |

3.49 |

3.83 |

||

|

Monitoring and evaluation |

3.00 |

3.11 |

||

|

Weighted average |

3.36 |

3.73 |

||

|

Kosovo’s overall score for Dimension 1 |

3.22 |

3.49 |

||

Note: WBT: Western Balkans and Turkey.

State of play and key developments

For entrepreneurial learning, the challenge remains to co-ordinate policy and actions at the government level and ensure that policy commitments are fully translated into practical implementation through training and guidance for educators and education organisations. The potential for excellence shines through advances in education-business co-operation, opening up the entrepreneurial ecosystem to embrace municipalities, academia and business.

Support for women’s entrepreneurship has improved in terms of policy and design, but implementation is reliant on actions funded by international partners. Monitoring and evaluation remain under-developed for both sub-dimensions, resulting in a lack of understanding of the progress and impact of actions and a loss of qualitative and quantitative data that could feed into skills intelligence to drive system-level change (Table 15.7).

Table 15.7. Kosovo’s implementation of the SME Policy Index 2019 recommendations for Dimension 1

|

2019 recommendation |

SME Policy Index 2022 |

|

|---|---|---|

|

Main developments during the assessment period |

Progress status |

|

|

Strengthen appropriation of entrepreneurship as a cross-cutting competence |

There has been limited progress in strengthening the integration of the entrepreneurship key competence across curricula. Teacher professional development training remains limited at pre-service and in-service levels. |

Limited |

|

Facilitate education-business co-operation for the purposes of entrepreneurial learning |

During this assessment period, the new government identified education-business co-operation as a top priority within the Kosovo Government Programme (2021-2025). This has been further developed through new education-business co-operation in UPCO (University of Pristina for Competitiveness/Competencies/Co-operation) – a triple-helix co-operation model confirmed in a recent Memorandum of Understanding between the University of Pristina, the City of Pristina and the Kosovo Chamber of Commerce (KCC). This co-operation will also include a focus on the entrepreneurial ecosystem. The implementation plan is under development. |

Moderate |

|

Facilitate education-business co-operation through teacher training and reward mechanisms |

Progress in this area is linked to the development of the UPCO collaboration between the University of Pristina, the City of Pristina and the KCC, which has the potential to link university educators into this triple-helix co-operation. However, the memorandum of understanding was signed at the end of 2021; practical approaches to how the triple-helix co-operation will be developed are still being planned. |

Limited |

|

Build up decentralised capacity to connect business and education and training providers |

Considerable potential remains to implement this recommendation, but no practical actions appear to have been taken. The recent Economic Reform Programme 2021-2023 identified the Council for Education and Vocational Training (CVETA) as a channel for discussions and consultation between business and ministry representatives on developing professional standards as the basis for drafting new curricula. This co-operation within CVETA could be expanded to identify further opportunities. |

No progress |

|

Develop a co‑ordinated framework for monitoring and evaluation in order to bring about positive change |

Monitoring and evaluation have improved during this assessment. However, there continue to be areas of weakness, such as a comprehensive report explaining the progress of specific actions taken and the change created as a result. There is no clearly defined lead body for this work across entrepreneurial learning or women’s entrepreneurship, which impacts the ability to implement or collate data and results from monitoring and evaluation. |

Limited |

|

Renew the National Strategy for Entrepreneurship Education and Training |

There has been no progress on renewing the strategy for entrepreneurship education and training, and this is not currently planned in the Kosovo Government Programme (2021-2025) (Government of Kosovo, 2021[38]). |

No progress |

|

Formalise co‑ordination on women’s economic empowerment |

The launch of the Kosovo Programme for Gender Equality (2020-2024) is now the primary document underpinning the development of women’s entrepreneurship. While there is evidence of activities happening in the economy, as yet, there is no multi-stakeholder partnership identified as having lead responsibility for women’s economic empowerment to support and co-ordinate this work. |

Moderate |

Entrepreneurial learning is highlighted across policy but lacks system-level co‑ordination

Entrepreneurial learning can be seen across a number of government strategies and documents. However, it is fragmented with little cross-government co-ordination to support the practical implementation of the vision and commitments. The Kosovo Education Strategic Plan (2017-2021) (Government of Kosovo, 2017[39]) highlights the importance of entrepreneurial learning without any focus on implementation.2 Planning for the new version for 2022‑2025 is now underway.

The Kosovo Government Programme (2021-2025) has more explicit commitment actions related to entrepreneurial learning, including exploring the possibility of including entrepreneurship subjects in lower secondary education, building additional laboratories to support student internships, developing a Fund for Young Entrepreneurs and encouraging entrepreneurial collaborations between young people and diaspora (Government of Kosovo, 2021[38]).

The National Strategy for Innovation and Entrepreneurship (2019-2023) (Government of Kosovo, 2019[40]) was adopted during the current assessment cycle, which includes actions to boost innovative spirit and awareness among young people and a commitment to revising the curriculum. However, there is no associated action plan, and the linked Law on Innovation and Entrepreneurship has been delayed.3 Alongside this is the Strategy for Youth (2019-2023) (Government of Kosovo, 2019[41]), which has a strong focus on entrepreneurship for young people4 but no information on the progress of planned actions.

Relevant co-ordination bodies include the Council for Vocational Education and Training and the Digital Coalition (previously called the National Council for Innovation and Entrepreneurship), but there is little recent information on their activity or specific information on their work linked to entrepreneurial learning. There is more information on the Council for Vocational Education and Training,5 which appears functional and benefits from the active involvement of representatives from the business community.

The lack of co-ordination and information on practical implementation reflects the ongoing challenge of limited government capacity to fully implement the vision of the above-mentioned strategies (European Training Foundation, 2020[37]). Data collection on implementing entrepreneurial learning is not widely collected and affects Kosovo’s ability to monitor and evaluate impact. Strategy evaluations are undertaken, but conclusions may not be directly used in designing the next steps.

Entrepreneurship is included in Kosovo’s key competences framework, but practical implementation is not yet widespread

Pre-university curriculum frameworks6 in Kosovo include six key competences, with elements of the entrepreneurship key competence included within the Kosovan key competence for life, work and the environment. Entrepreneurial education is highlighted as a cross-curricular priority.7 During this assessment period, a new student assessment framework was created (Government of Kosovo, 2020[42]) that emphasises the assessment of these key competences. However, there is limited system-level guidance for teachers on teaching, learning and assessment of key competences. Therefore, entrepreneurship as a key competence is not yet translated into practical implementation at the level of learners. Practical entrepreneurial experiences are not widely implemented8 and are not a system-level commitment.

To support a wider understanding of the entrepreneurship key competence beyond the traditional economic focus, the EntreComp framework (European Commission, 2016[43]) has been translated9 into Albanian and Serbian. It was also launched at an event with the Minister of Industry, Entrepreneurship, and Trade and the Minister of Education, Science, Technology and Innovation.10

Driving change in curriculum delivery, a new VET curriculum that includes entrepreneurship as a mandatory module is awaiting formal approval. EntreComp was used to inform the curriculum review process.

Teacher training is not widely available at pre-service or in-service levels

The Kosovo Education Strategic Plan (2017-2021) highlighted the need to harmonise pre-service teacher training with the needs of the Ministry of Education, Science and Technology (MEST) policies, which highlight entrepreneurial education as a cross-curricular requirement. However, there is no available evidence of progress in including entrepreneurial competence development, either as an elective or a compulsory topic for new teachers during pre-service teacher training.

For existing teachers, there is limited access to training. MEST has published a new catalogue of approved teacher training, but few options explicitly address the entrepreneurship key competence. Those included are training offers linked to existing entrepreneurial learning actions, such as the innovative Upshift “Entrepreneur with Social Impact” teacher training linked to citizenship and democratic education, and Smartbits,11 which includes entrepreneurial competences for career orientation.

Progress has been made in developing education-business co-operation

Structured collaboration using the triple-helix model has been established in Kosovo for the first time, bringing together the University of Pristina, the City of Pristina and the KCC into the UPCO cluster (ALLED2, 2022[44]). Supported by the ALLED2 (Aligning Education for Employment) project, this work aims to drive forward the development of an entrepreneurial ecosystem linked to creating social, cultural and economic value for the region through structured university-business co-operation. Strengthening co‑operation through a formal memorandum of understanding will improve links between higher education and the labour market, the development of entrepreneurship and the promotion of lifelong learning. This is enabled through the legal framework established within the Law on Higher Education12 (Government of Kosovo, 2011[45]). The involvement of municipalities, higher education and the private sector, is essential to advance the implementation of education reform, and this development can be a first step toward wider business co-operation for other universities as well at VET.

There is a stronger policy focus on women’s entrepreneurship, but improvement is still needed, including dedicated monitoring and evaluation

The Kosovo Programme for Gender Equality (2020-2024) (Government of Kosovo, 2020[46]) was launched with an associated action plan that includes specific actions to encourage women’s entrepreneurship and support start-ups by women entrepreneurs. However, there is a lack of cross-linkages between this programme and wider relevant strategies, such as the Private Sector Development Strategy (2018-2022) and the National Strategy for Innovation and Entrepreneurship (2019-2023), where there is little mention of focused actions supporting women’s entrepreneurship.

A challenge remains regarding monitoring and evaluation. As yet, there is no comprehensive economy-level evaluation of actions and impact related to women’s entrepreneurship and little sharing of practice. Compounding this is the low availability of gender-sensitive data on engagement in specific actions, such as training or start-up programmes.

The National Strategy for Innovation and Entrepreneurship (2019-2023) highlights the lack of gender-disaggregated data and commits to providing specific funding programmes. A practical Gender Impact Assessment Manual (Kosovo Agency for Gender Equality, 2019[47]) was published to support the review of all new legislative initiatives;13 however, there is no clear evidence of the adjustments made based on the evaluation results and use of this manual.

Support for women entrepreneurs is not yet well developed

Direct grant support for start-up entrepreneurs is not yet well developed in Kosovo, with support programmes available from the Employment Agency (active labour market measures) that target women participants but are not tailored to them.14 However, a range of non-government-led programmes supports women’s entrepreneurship, including those financed using government funding, such as the Kosovo Women’s Chamber of Commerce, Women in Business and the EBRD. Private-sector stakeholders also lead programmes, such as Procredit Bank, TEB Bank, and the Institute for International Cooperation of the Deutscher Volkshochschul-Verband eV (DVV). Nevertheless, there is not yet a dedicated online portal for accessing information, funding opportunities and training offers related to women’s entrepreneurship.

Multi-stakeholder co-ordination to support women’s entrepreneurship is being strengthened

Government funds, through grants, have been made available to strengthen the capacity of non-governmental organisations (NGOs) supporting women’s entrepreneurship in Kosovo.15 There is evidence of interesting practices from diverse stakeholders, such as women’s entrepreneurship support and green transformation16 (TEB Bank), the COVID‑19 response provided by Women in Business and She-Era to support women-owned businesses, and the training offer on digital transformation through the Kosovo Women’s Chamber of Commerce.17 In response to the COVID‑19 crisis, resources were put in place targeting women entrepreneurs and working women, linked to the Programme for Economic Recovery and Agency for Gender Equality.18 Lessons learned show that measures did positively impact women entrepreneurs, despite the added impact of family responsibilities on women; however, there was a negative impact on certain groups of women, including those informally employed, single mothers and informal women farmers.19

The way forward for Dimension 1

Identify new or existing multi-stakeholder policy partnerships to co-ordinate and strengthen efforts across different strategies for, firstly, entrepreneurial learning and, secondly, women’s entrepreneurship. Consider including these as explicit responsibilities of existing multi-stakeholder partnerships. For entrepreneurial learning, this would need to be a multi-stakeholder body linked to the MEST. For women’s entrepreneurship, this could be an explicit responsibility of the National Council for Economy and Investment or as a sub-group of this body and with the direct involvement of the Agency for Gender Equality to ensure gender representation within this important economic council. Box 15.3 provides a relevant good practice example from Montenegro.

Box 15.3. Building a national policy partnership in Montenegro

Montenegro has successfully brought together and sustained a multi-stakeholder policy partnership that drives co-ordination and the development of entrepreneurial lifelong learning. The partnership has gradually increased the focus on this policy area, resulting in progress in the practical implementation of entrepreneurial learning at all levels of lifelong learning.

The consistent partnership between government ministries and key national stakeholders was linked to the design and implementation of national strategies. The relevance and importance of participation were clear to each partner organisation and closely aligned to their organisational objectives, with a named representative from each partner. The partnership was initially informal, and organisations worked together to place the focus on increasing the profile of entrepreneurial lifelong learning at the policy level and gaining recognition for their partnership approach. This finally resulted in formal recognition by the government in 2021 as a working group of the National Council for Competitiveness led by the Ministry of Economy.

This is a multi-stakeholder partnership body that is integrated into the equivalent of the National Council for Economy and Investment, allowing for the involvement of a full range of partners. In Kosovo, this could be directly linked to the National Strategy for Innovation and Entrepreneurship (2019-2023). It could be used as a model for both entrepreneurial learning and women’s entrepreneurship. Such a partnership approach can bring partners together, link work to the different strategies that focus on actions supporting entrepreneurial lifelong learning, enhance the work of all partners in this field and gain further recognition of a partnership approach at the national and government levels.

Sources: Government of Montenegro (2020[48]) and McCallum et al. (2018[49]).

Provide accessible training courses and current guidance for educators on how to integrate entrepreneurship as a cross-curricular key competence in teaching and assessment, including the “hard to reach” entrepreneurial competences (or “soft skills”) highlighted in the key competences of the Kosovo pre-university curriculum framework.

Prioritise the harmonisation of university teacher training programmes with the needs of the curriculum framework and key competences, including the entrepreneurship competence underpinned by EntreComp. This needs to provide a future-proofed approach to the training of new teachers by learning from cutting-edge practices and ensuring they are trained to be adaptable and resilient to changing contexts and learning environments as they enter a profession undergoing systemic reform.

Launch an online portal that provides information and advice for women’s entrepreneurship, bringing together finance provision and support actions from government and non-government providers. This could be a dedicated portal or a specific section within an existing government entrepreneurship portal such as My Business.20

Improve system-level monitoring and evaluation of government-financed programmes related to entrepreneurial learning and women’s entrepreneurship. This will allow for a fuller understanding of the progress and impact of these actions across policy and implementation.

Bankruptcy and second chance for SMEs (Dimension 2)

Introduction

Firms enter and exit the market as a natural part of the business cycle, and policies can ensure that such transitions occur in a smooth and organised manner. Well-developed insolvency procedures and regimes can protect both debtors and creditors, striking the right balance between both parties, for example. This is particularly relevant for smaller firms as they lack resources compared to bigger firms. Therefore, governments need to ensure that bankruptcy proceedings are efficient, ease reorganisation procedures (instead of bankruptcies) and ensure that those starting again have the same opportunities in the market they had the first time.

In Kosovo, similarly to other Western Balkan economies where SMEs represent a large part of the economy, effective liquidation and discharge procedures can allow entrepreneurs to reintegrate into the market. This was particularly relevant in the context of the COVID‑19 pandemic, where a number of firms faced financial difficulties or were at risk of financial distress, particularly in the tourism sector (OECD, 2021[50]).

Kosovo is one of two WBT economies, alongside Montenegro, that regressed in this dimension during this assessment period mainly due to weaker performance under the bankruptcy procedures sub-dimension and continuously disregarding promotion of second-chance policies in its strategic framework. Its score fell from 2.71 to 2.30 (Table 15.6) and is performing below the regional average of 3.03 (Table 15.8).

Table 15.8. Kosovo’s scores for Dimension 2: Bankruptcy and second chance

|

Dimension |

Sub-dimension |

Thematic block |

Kosovo |

WBT average |

|---|---|---|---|---|

|

Dimension 2: Bankruptcy and second chance |

Sub-dimension 2.1: Preventive measures |

2.20 |

2.74 |

|

|

Sub-dimension 2.2: Bankruptcy procedures |

Design and implementation |

2.70 |

3.47 |

|

|

Performance, monitoring and evaluation |

2.30 |

3.23 |

||

|

Weighted average |

2.54 |

3.38 |

||

|

Sub-dimension 2.3: Promoting second chance |

1.50 |

1.96 |

||

|

Kosovo’s overall score for Dimension 2 |

2.30 |

3.03 |

||

Note: WBT: Western Balkans and Turkey

State of play and key developments

During the assessment period, Kosovo implemented the provisional law on the economic recovery, which provides support measures for companies having financial difficulty, in addition to the existing insolvency laws. Kosovo is among the few economies in the region that allows a simplified and expedited reorganisation procedure for SMEs. However, fast-track simplified liquidation proceedings for SMEs, and automatic debt discharge rules are still lacking in Kosovo’s legal framework. Moreover, second-chance programmes for SMEs are nascent, limiting the reintegration of honest entrepreneurs into the economy and changing the current perception of a cultural stigma linked to entrepreneurial failure (Table 15.9).

While there are no available data on the number of backlog cases, the number of bankruptcy cases remained very low compared to other WBT economies. Since 2017, the economy has recorded only eight resolved cases.21 The insolvency results reflect to a great extent the way the economy is performing and informally resolving its disputes and collective settlements.

Table 15.9. Kosovo’s implementation of the SME Policy Index 2019 recommendations for Dimension 2

|

2019 recommendation |

SME Policy Index 2022 |

|

|---|---|---|

|

Main developments during the assessment period |

Progress status |

|

|

Develop a fully-fledged early warning system |

A fully-fledged early warning system is still missing. The existing warning tools used by the Kosovo Tax Administration are based on annual financial statements, which could potentially be too late to prevent bankruptcies, leading to involuntary liquidations. |

Limited |

|

Further reduce the average cost and duration of bankruptcy proceedings by simplifying parts of the bankruptcy legislation |

During the assessment period, no simplification measures have been adopted. The duration of proceedings and associated costs remain high, as in the previous assessment. Furthermore, there are no plans to streamline liquidation processes. |

No progress |

|

Improve the legal framework and develop initiatives to reduce the cultural stigma attached to entrepreneurial failure |

No progress has been recorded in reducing the cultural stigma of entrepreneurial failure. The Insolvency Law provides clear rules for treating cases where the debtor files a petition with intent to deceive, defraud or subvert the creditors. However, no regulation distinguishes fraudulent from honest entrepreneurs. |

No progress |

|

Make the existing mediator system available before the opening of bankruptcy cases |

No progress has been observed in this regard. The mediation system has not been extended to enable meditation to take place immediately upon receiving a signal from the tax administration or a well-designed early warning system before a court case is actually initiated. |

No progress |

Little progress has been made regarding Kosovo’s insolvency legislative framework

Kosovo’s insolvency framework comprises two laws: the Insolvency Law, adopted in 2016, and the Law on Business Organisation, adopted in 2018. The latter includes provisions relating to initiating insolvency proceedings for limited liability companies and joint-stock companies. In 2020, during the COVID‑19 pandemic, the government adopted the Provisional Law on Economic Recovery, which provides support measures for companies having financial difficulties.

Overall, the regulatory framework provides a solid basis for insolvency regimes and regulates procedures for expedited SME reorganisation and pre-agreed plans, regular reorganisation of companies, liquidation of companies, discharge of debt and cross-border insolvency. Although the United Nations Commission on International Trade Law (UNCITRAL) Model Law on Cross Border Bankruptcy (CBB) has not been adopted, Chapter IX of the Insolvency Law regulates CBB according to the UNCITRAL Model Law. Furthermore, the Insolvency Law is partially compliant with the EU Regulation 2015/848 on insolvency proceedings (European Parliament and the Council of the European Union, 2015[51]; EBRD, 2022[52]).

The expedited SME reorganisation is a voluntary procedure, possible for companies with an annual turnover of up to EUR 1 million or with up to 25 employees. The debtor can submit the reorganisation plan in 30 days upon the initiation of the formal procedure, which needs to be assessed by the insolvency practitioner. There is also a possibility of submitting a pre-agreed plan with the creditors and requesting immediate court confirmation. Furthermore, the court holds an expedited hearing to determine if the debtor’s pre-filing solicitation of votes discloses all required information and whether voting conditions were met (EBRD, 2022[52]).

The debtor who faces imminent insolvency can initiate the regular reorganisation procedure. The debtor is obliged to submit a reorganisation plan in 120 days upon petition filing under the supervision of the court. The procedure provides an automatic stay against the enforcement of creditors’ claims until its final completion. However, the court may remove the debtor’s management in the case of fraud or if the debtor cannot manage financial affairs in a profitable manner, which could trigger various compensation measures, like the reverse of discharge or the conversion of reorganisation into liquidation.

In addition to the aforementioned laws, the Law on Mediation also tackles potential disputes that might arise in bankruptcy procedures. Although an out-of-court settlement remains non-existent in Kosovo, the legal framework allows creditors and debtors, once the insolvency proceedings are initiated, to go into mediation to resolve disputes under the supervision of a neutral mediator.

Some aspects that could streamline the bankruptcy procedures are yet to be addressed in the legislation, such as fast-track liquidation through digitalisation to shorten proceedings, the need to enhance their effectiveness, the need to ensure the protection of debtors’ and creditors’ rights and better monitor and evaluate insolvency proceedings. Current liquidation proceedings are burdensome; they involve clearance by a board of creditors, the selection of appraisers and method of assets’ sales, and allow for appeals, including on distribution. All of this could be avoided, shortened and improved with the introduction of e‑auction sales.

Preventive measures are yet to be implemented