This chapter covers the progress made by Montenegro in implementing the Small Business Act (SBA) for Europe over the period 2019-21. It starts with an overview of Montenegro’s economic context, business environment and status of its EU accession process. It then provides key facts about small and medium-sized enterprises (SMEs) in the Montenegrin economy, shedding light on the characteristics of the SME sector. It finally assesses progress made in the 12 thematic policy dimensions relating to the SBA during the reference period and suggests targeted policy recommendations.

SME Policy Index: Western Balkans and Turkey 2022

16. Montenegro: Economy Profile

Abstract

Key findings

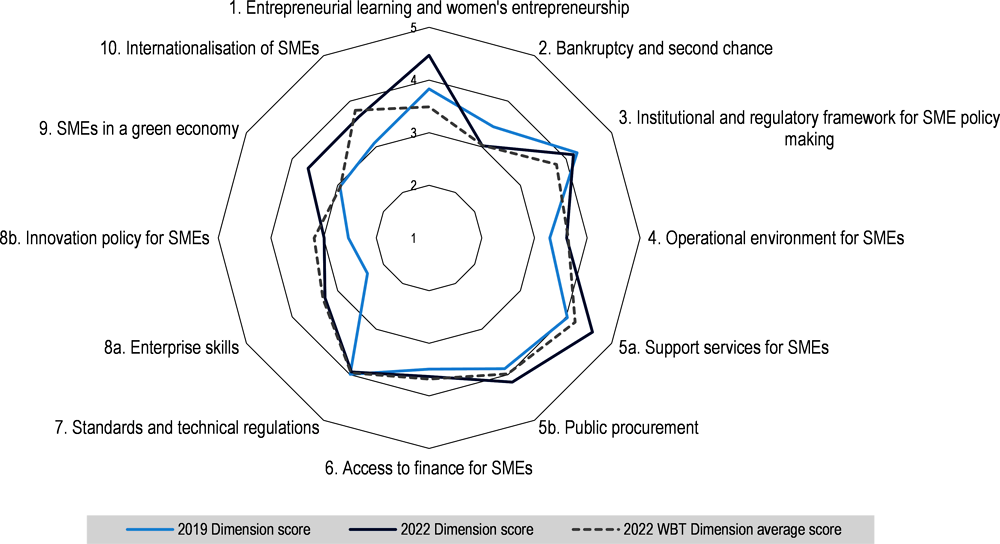

Figure 16.1. Small Business Act scores for Montenegro (2019 and 2022)

Note: WBT: Western Balkans and Turkey.

Montenegro has made progress in implementing the Small Business Act (SBA) since the publication of the previous report – the SME Policy Index: Western Balkans and Turkey 2019 (Figure 16.1). The economy continues to provide an environment conducive to business and is receptive to the needs of small and medium-sized enterprises (SMEs). Montenegro has achieved its highest average scores in the following areas: entrepreneurial learning and women entrepreneurship; institutional and regulatory framework for SME policy making; support services for SMEs; public procurement; and SMEs in a green economy, where it also outperforms the WBT average.

Main achievements

Strong emphasis has been placed on developing both policy and practical implementation of entrepreneurial learning at the system level, providing a clear progression in implementing entrepreneurial learning across all levels of lifelong learning in Montenegro. Steps have also been taken to establish system-level co-ordination in women’s entrepreneurship and to improve evaluation. The new strategy is driving continued improvement of women’s entrepreneurship, with a 4.6% increase in the share of women business owners from 2018 to 2020 and an increase of 10% in the share of women engaged in self-employment over the same period.

Implementation of the 2018 Strategy for the Development of Micro, Small and Medium-Sized Enterprises (2018-2022) advanced well despite the COVID‑19 pandemic. Co‑ordination of implementation and monitoring and evaluation has also been reinforced. The latter has been achieved through the creation of a dedicated Working Group for SMEs within the reformed Council for Competitiveness chaired by the Ministry of Economic Development, which is responsible for monitoring the strategy’s implementation.

Provision of business support services (BSSs) considerably advanced, augmenting the number and scope of support programmes for SMEs. New BSSs, such as grants, export financial support, information and communication technology (ICT) and resource efficiency trainings, are now available to SMEs. In addition, there was a considerable increase in the number of SMEs benefiting from these services since the previous assessment cycle.

Access to finance has been facilitated by a strong fiscal response of the Montenegrin authorities to soften the economic impact of the COVID‑19 pandemic. Access to credit has remained relatively stable amid a robust legal and regulatory framework, now fully aligned with Basel III requirements and ongoing consolidation of the banking sector. The state-owned Investment and Development Fund has continued to play a crucial role in facilitating lending, and plans are underway to establish a state Credit Guarantee Fund to help alleviate continued high-level risk perceptions by lenders, especially concerning smaller enterprises.

A stronger focus has been placed on implementing policies to improve enterprise skills, which has reaped benefits through increases in the provision of training for start-ups to drive the digital economy and support growth. In response to the COVID‑19 pandemic, there has been a rapid adaptation to online provision of training and increased investment in training to support SME digitalisation.

SMEs’ greening efforts have been further supported. Montenegro’s strategic framework has increasingly included environmental policies targeting SMEs, the implementation of which has been done in a timely fashion for the most part. The government has also adopted a whole-of-government approach to creating synergies between greening initiatives through its newly established Green Economy Working Group. Financial instruments have been made available to SMEs through the new Eco Fund, governmental initiatives and international partners’ support. Other tools have equally been introduced, such as awareness raising or assistance in implementing international environmental standards.

The strategic framework for export promotion and global value chains, with a special emphasis on cluster formation and development, has been strengthened. SMEs now have access to more capacity building, a broad range of information, as well as amplified financial support, aiming to improve the supplier base in the economy. However, these measures currently proposed by the government, though apt, might prove insufficient in reaching this objective, as they lack tangible support for overcoming technical barriers to trade.

The way forward

Develop insolvency prevention policy measures, including a fully-fledged early warning system. The revocation of the Law on Consensual Financial Restructuring of Debts to Financial Institutions left a gap in the insolvency framework dealing with preventive measures. This gap could be filled with an alternative law on out-of-court debt settlement or a hybrid preventive insolvency procedure based on a pre-packaged reorganisation plan agreed with creditors out of court and filed to court only for confirmation. Including a fully-fledged early warning system is also recommended as SMEs tend to underestimate the importance of maintaining a sound financial status and avoiding risky decisions.

Build the public administration’s capacity to understand businesses’ needs when designing digital services. While digitalising existing public services is an effective way to save time for businesses and improve the efficiency of existing administrative procedures, the government may wish to adopt a proactive approach to redesigning services around the needs of businesses, making services more efficient, delivering more public value and engaging in a broader digital transformation of the public sector. The full implementation of the “once-only” principle will allow this re-engineering of services to deliver their full benefits.

Improve monitoring and evaluation of digital services for businesses, including company registration. Low satisfaction rates of digital services for businesses, as well as limited monitoring and evaluation mechanisms, show a need for more targeted data collection. The government should look to make improved, regular and obligatory monitoring of satisfaction a key objective of the overall development plans for the e-Uprava and e-Firma portals, where services are concentrated. When improving feedback channels, it would be important to ensure differentiated data collection for feedback by businesses. To go a step further, production-related data can be collected to understand the underlying reasons for businesses’ satisfaction or dissatisfaction with a given service and identify areas for improvement.

Develop a comprehensive financial literacy strategy. The newly created National Committee for Financial Education Development should develop a financial literacy strategy in a timely fashion. It should be based on the findings of the regional assessment and include benchmarks and regular monitoring and evaluation mechanisms. This strategy should address both measures for entrepreneurs and the broader public, including students, and should suggest a clear implementation mechanism and body responsible for its execution. Finally, an action plan should be elaborated to accompany the strategy.

Introduce measures to stimulate collaboration between research institutions and the private sector. Further efforts to increase co-operation (and make it more visible) are needed to boost investments into research and development (R&D) and build the foundation for a knowledge economy. The operationalisation of the pilot technology transfer office, fully staffed and equipped, together with an action plan to expand the network and raise awareness about the opportunities of the services provided, would be an important milestone. Soft measures to incentivise researchers to engage with private businesses, such as opportunities for professional exchanges with the business community and evaluation of research and legislative incentives for commercialisation, should also be considered.

Economic context and role of SMEs

Economic overview

Montenegro is a service-based, upper-middle-income economy with a population of 621 306 as of 2021, making it the smallest of the Western Balkans and Turkey (WBT) economies. Its per capita gross domestic product (GDP) by purchasing power parity in stood at USD 18 259 in 2020 (in constant 2017 international dollars), having shrunk by roughly USD 3 300 since 2019, but remains the second-highest in the WBT region after Turkey (World Bank, 2022[1]). Montenegro is dominated by the services sector, employing approximately 74.1% of the population. In comparison, industry employs approximately 18.4% and agriculture only 7.5%, with the top sectors in terms of value added to GDP being retail trade (12.5%), agriculture (7.6%), the public sector (7.5%), real estate (6.4%) and construction (6.2%) (MONSTAT, 2021[2]). Montenegro depends on capital inflow to support its economy and particularly relies on its tourism industry, which contributes far more to GDP and employment in Montenegro than in the other WBT economies (32% of GDP compared to 14.9% Western Balkan average1 and 9.5% EU average) (OECD, 2021[3]). In 2018, Montenegro held the second-highest share of travel and tourism contributions to total employment in the region at 7.68%, more than double the WBT average of 3.4%. However, the World Bank projects that the share of tourism to total employment will slightly decline to 7.1% in 2022 (World Bank, 2022[4]).

Montenegro’s lack of an independent monetary policy after unilaterally adopting the Euro in 2002, coupled with its strong dependence on capital inflows, makes the economy highly vulnerable to external shocks and business cycle fluctuations. Both the 2008 financial crisis and the Eurozone crisis shed light on the economy’s market volatility, with GDP contractions at dramatically higher rates than neighbouring economies at 5.8% and 2.4% in 2009 and 2012, respectively (World Bank, 2021[5]). In 2020, heavy reliance on both domestic and foreign tourism made the economy greatly susceptible to the effects of COVID‑19 measures, such as border closures and mobility restrictions, causing an 83.2% drop in tourist arrivals (OECD, 2021[3]), ultimately leading to a 15.3% contraction in GDP for 2020, the steepest decline in Europe (Box 16.1). However, the economy rebounded with a striking 12.3% of GDP growth in 2021, fuelled by a strong recovery in foreign tourist overnight stays (nearly triple those in 2020), retail sales and manufacturing output (Table 16.1) (IMF, 2022[6]; European Commission, 2022[7]; EBRD, 2021[8]). Nevertheless, as Russian and Ukrainian citizens account for a large portion of tourism in Montenegro (28% of overnight stays in 2018 and remaining significantly high in 2021 at 21.3% in the wake of the pandemic), large losses in tourism are expected as a consequence of the war in Ukraine (MONSTAT, 2021[2]).

Box 16.1. Montenegro’s COVID‑19 recovery programme

In terms of economic impact, Montenegro, where tourism contributes far more to GDP and employment than in the other WBT economies (32% of GDP compared to 9.5% EU average), was hit especially hard by border closures and mobility restrictions caused by the pandemic, leading to an 83.2% drop in tourist arrivals. Driven by the acute losses in the tourism sector, Montenegro’s decline in GDP for 2020 was severe at ‑15.3%, with unemployment rising to a high of 18.4%.

As part of its recovery, Montenegro provided five economic support packages to mitigate the impact of the COVID‑19 pandemic, the first having been launched in March 2020 for the amount of EUR 100 million, with the last having been presented in April 2021 for the amount of EUR 166 million. The sum of the combined economic support packages totalled approximately EUR 1.85 billion for both short-term fiscal measures and long-term sustainable development goals envisioned until 2024. The government also provided specific economic support measures throughout the pandemic:

Subsidies: In order to preserve existing jobs and provide assistance for businesses during COVID‑19, Montenegro introduced support measures for employers, employees and the self-employed, including salary subsidies worth 50% to 100% of the gross salary of the employed until June 2021 and salary subsidies for new employment until December 2021. Montenegrin packages also targeted vulnerable populations with one-off financial assistance for pensioners on the lowest pension and beneficiaries of family material support.

Tax measures: Montenegro implemented a relatively wide set of responses to COVID‑19 with deferrals of tax payments and salary contributions and obligations for up to 90 days until June 2021, flexible tax-debt repayments including no interest for late payments of tax arrears, a 60-day deferral of payment for customs duty and value-added tax (VAT) for discontinued companies due to the pandemic, extended reduced VAT rate of 7% to catering and accommodation services and VAT exemptions for donations of medical goods to public entities.

Loans: Montenegro introduced loan repayment moratoriums for individuals and businesses in all banks, microcredit institutions and the Investment and Development Fund (IDF) between March 2020 and August 2021, further expanding the scope of eligible businesses in April 2021. The Central Bank also allowed individuals whose earnings dropped more than 10% due to the pandemic to extend the repayment period of their loans by up to five years.

Credit lines: A Credit Guarantee Fund was announced in 2021 and is expected to be established by the end of 2022 with an expected initial capital of EUR 10 million. The Fund’s services will be aimed at entrepreneurs; micro, small and medium-sized enterprises (MSMEs); and agricultural producers, which are recognised as the group with the most difficulties accessing financing by credit institutions.

Although numerous short-term economic support measures helped mitigate immediate economic damage, structural issues, primarily with regard to the public health sector, employment, social protection and private-sector support, were exacerbated by the pandemic and remain in need of reforms.

Table 16.1. Montenegro: Main macroeconomic indicators (2016-2021)

|

Indicator |

Unit of measurement |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|---|---|---|---|---|---|---|---|

|

GDP growth1 |

% year-on-year |

2.9 |

4.7 |

5.1 |

4.1 |

‑15.3 |

12.4 |

|

National GDP2 |

EUR billion |

3.88 |

4.298 |

4.882 |

4.917 |

4.23 |

.. |

|

GDP per capita growth2 |

% year-on-year |

2.9 |

4.7 |

5.1 |

4.1 |

‑15.2 |

.. |

|

Inflation1 |

% average |

0.1 |

2.8 |

2.9 |

0.5 |

‑0.8 |

2.5 |

|

Government balance1 |

% of GDP |

‑3.6 |

‑5.3 |

‑3.9 |

‑2 |

‑11.1 |

-1.9 |

|

Current account balance1 |

% of GDP |

‑16.2 |

‑16.1 |

‑17.0 |

‑14.3 |

‑26.1 |

-9.2 |

|

Exports of goods and services1 |

% of GDP |

40.6 |

41.1 |

42.9 |

43.8 |

26.0 |

43.2 |

|

Imports of goods and services1 |

% of GDP |

63.1 |

64.5 |

66.7 |

65.0 |

61.0 |

62.7 |

|

Net foreign direct investment (FDI)1 |

% of GDP |

9.4 |

11.3 |

6.9 |

6.2 |

11.2 |

11.2 |

|

External debt2 |

% of gross national income (GNI) |

141.0 |

146.0 |

144.1 |

148.8 |

200.6 |

.. |

|

International reserves of the National Bank1 |

EUR million |

753 |

847 |

1050 |

1367 |

1739 |

1749 |

|

Gross international reserves1 |

Ratio of 12 months imports of goods and services moving average |

3.6 |

3.7 |

4 |

5.1 |

8.2 |

6.8 |

|

Unemployment1 |

% of total active population |

18 |

16.4 |

15.5 |

15.4 |

18.4 |

16.9 |

Sources: 1. European Commission (2022[7]); 2. World Bank (2022[12]).

Montenegro’s limited room for discretionary fiscal spending and excessive reliance on the state to stimulate the economy have contributed to a widening of external and internal imbalances as well as indebtedness (World Bank, 2019[13]). Substantial imbalances existed before the pandemic, with current account deficits exceeding 14% of GDP for over a decade. However, the COVID‑19 crisis exacerbated them significantly, with the balance plummeting to ‑26.1% in 2020 due to increased COVID‑19-related public spending (European Commission, 2021[11]). Nevertheless, the economy saw strong rebounds in the wake of its economic recovery, with deficits decreasing to only ‑1.9% in 2021, which is stronger than pre-pandemic levels.

Although imports of goods and services decreased modestly by only 4 percentage points from 2019 to 2020, exports’ contribution to GDP plummeted by 17.8 percentage points as the tourism sector accounted for roughly half of total exports, leading to a 65.1% increase in Montenegro’s trade deficit of 35%. However, Montenegro’s exports recovered to roughly pre-pandemic levels in 2021, lowering the deficit to only 19.5% (European Commission, 2021[14]). The economy’s vulnerability to external shocks is compounded by its relatively undiversified export base, of which goods, mostly products susceptible to price fluctuations such as metals, machinery and equipment, accounted for 23% of total exports in 2020 (MONSTAT, 2021[2]). Moreover, Montenegro’s total service exports are typically dominated by travel and tourism services, which are also highly susceptible to external shocks, as witnessed during the latest crisis, which led to an approximate 43.7% decrease in travel-related services exports from 65% in 2019 to 21.3% in 2020 (World Bank, 2022[15]).

However, large infrastructure projects aimed at enhancing trade routes that can help diversify its GDP base have increased in the last decade and are expected to continue, particularly in the transport and energy sectors. For example, Montenegro’s train system is receiving a EUR 20 million loan from the European Investment Bank (EIB) to rehabilitate the line running from Bar to Vrbnica on Serbia’s border, improving trade links with Serbia and Romania while also promoting tourism (EIB, 2021[16]).

Despite the positive effects, the heavy public spending on infrastructural improvements burdened the economy’s debt, peaking in 2019 due in part to continued construction on the Bar-Boljare highway connecting Belgrade and the Adriatic port of Bar. Debt was initially expected to stabilise with a surplus of 5‑6% of GDP in 2020 following the completion of the first phase of construction and a thriving tourism sector. However, the collapse in GDP and the unavoidable increase in COVID‑19-related spending worsened the situation, ultimately steepening the economy’s external debt ratio to the fourth highest in the world, with a 59.6% increase since 2016 in terms of percentage of GDP, reaching 200.6% in 2020 (EBRD, 2017[17]; World Bank, 2022[12]).

The financial sector in Montenegro was hit hard by the pandemic but sustained a strong recovery throughout 2021. Bank loans increased 5.8% and 6.9% year on year in January and February 2022, respectively. Credit growth at the household and corporate levels also increased by 2% year on year, while the non-performing loan ratio was sustained at 6.2% in 2021, primarily due to an increase in bank loans. Although representing only 17.8% of the total credit, non-resident credit surged by 71% in 2021, while non-resident deposits accounted for 27% of the 24.3% year-on-year increase in commercial bank deposits, which reached a record high of EUR 4 billion (85.7% of GDP) in October 2021 (European Commission, 2022[7]), (European Commission, 2022[18]). Consumer prices increased by 0.3% month on month in December 2021, while the annual increase was 4.6% compared to December 2020, influenced primarily by prices for agricultural products, solid fuels and passenger transport by air. On average, consumer prices were 2.4% higher in 2021 than in 2020 (MONSTAT, 2022[19]).

Montenegro’s unemployment rate had been improving since 2016, driven by past GDP growth, having reached its greatest low in over a decade in 2019 at 15.4%. Still, COVID‑19 exacerbated underlying structural problems of the Montenegrin labour market, like high informality, with some estimates putting informal employment as high as 23‑33% or one in three jobs, and low employment of youth, women and low-skilled workers leading the unemployment rate to reach its highest level since 2013 in 2020 at 18.4% (World Bank, 2017[20]; MONSTAT, 2021[2]). However, unemployment rates have seen a new decline in 2021, standing at 16.9%. Montenegro’s youth unemployment rates of those between 15 and 24 have increased from 16.2% in 2018 to 21.2% in 2020 and remain significantly higher than the EU average of 16.8% (MONSTAT, 2021[2]; Eurostat, 2021[21]).

Although the percentage of women in the workforce is close to that of men at 45.3%, GDP per capita for women reached only 86% of the national average GDP, compared to 114% for men, revealing continued gender inequalities in the labour force. Women’s contributions to the economy in Montenegro are often unpaid, with estimates of unpaid work and domestic care exceeding that of men by 92% (UNDP, 2021[22]). Moreover, the share of long-term unemployed in Montenegro is very high (74.5% of all unemployed), and the long-term unemployment rate is over five times higher than in the European Union (13.4% vs 2.4%) (MONSTAT, 2021[2]; Eurostat, 2020[23]). Although an ageing population and high emigration rates also remain problematic for the region’s workforce, Montenegro holds the lowest emigration rate in the Western Balkans at 9% and is one of the two Western Balkan Six economies to attract migrants from neighbouring economies (OECD, 2022[24]). Only 15.8% of its population is over 65, moderately less than the European Union’s population over 65, which stands at 20.8% (World Bank, 2022[25]).

Business environment trends

Despite the difficult circumstances surrounding the COVID‑19 pandemic, significant reforms continued to be implemented that improved the business environment in Montenegro. Important progress was made in reducing local tax and fee burdens for businesses and establishing a registry of fiscal and para-fiscal charges to facilitate business processes and increase transparency (European Commission, 2021[14]). Digital services have continued to increase since the last assessment, with a total of 317 services offered through the e-Uprava portal for legal entities in 2021. New systems were established for the electronic registration of single-member limited liability companies, electronic fiscal invoices, digital management and security printing of excise stamps, which contribute to combating informality. The economy also introduced its first electronic public procurement system in 2021, allowing for increased quality and transparency in the public procurement process and improving the overall regulatory environment, which remains one of the most open economies for investment according to the OECD FDI Regulatory Restrictiveness Index. Its score has decreased from 0.028 in 2016 (OECD, 2018[26]) to 0.024 in 2020, significantly lower than the OECD average of 0.63, indicating that the economy has lessened trade barriers and maintains only a handful of restrictions, notably in the maritime, TV and radio broadcasting, and legal sectors (OECD, 2020[27]).

Furthermore, although corruption remains a hurdle for businesses across the WBT region, Montenegro has made some progress in its anti-corruption efforts. Under its new management, the Anti-Corruption Agency (ACA) demonstrated a more proactive approach to improving its communication and outreach activities toward the general public, media and civil society and in addressing the caseload pending from previous years (European Commission, 2021[14]). Since the last assessment, ACA’s headway has led Montenegro to rise from being perceived as the most corrupt of the WBT economies to the least corrupt in the region. Although its score of 46 (out of a possible 100) in Transparency International’s Corruption Perception Index has not changed, it is now the highest in the region: as of 2021, it remains in 64th place out of a total of 180 ranked economies (Transparency International, 2022[28]). However, corruption remains prevalent in many areas, and ACA’s priority-setting, selective approach and the quality of its decisions remain an issue of concern (European Commission, 2021[14]).

Although improving, Montenegro’s business environment still has several key impediments and obstacles to business development, which are acknowledged in the economy’s latest Economic Reform Programme (ERP) (Box 16.2). The pandemic negatively impacted the business environment, as evidenced by a 23% decline in the number of registered new businesses in 2020 and temporary efficient policy responses, such as those implemented to control the number of bankruptcies during the pandemic. Montenegro’s business environment is still adversely impacted by long-term structural deficiencies, such as informality, sub-optimal regulations (with inconsistent enforcement) and weak governance, all of which impede a hospitable business environment. Moreover, access to finance remains a substantial impediment for businesses, particularly for SMEs, as credit risks remain high, alternative financing options remain limited and traditional financing institutions continue to require heavy collateral and credit histories. Furthermore, although state influence on markets is diminishing in Montenegro, the economy still has a relatively large state-owned enterprise (SOE) sector compared to its neighbours, many of which are inefficiently run and rely on financing from the government and international banks, leading to greater financial losses for the government as well as market distortions and an uneven playing field for the private sector, particularly SMEs (OECD, 2021[3]). While the Agency for Protection of Competition has been progressive in halting state aid to sinking state-owned businesses, notably national airlines, and new mechanisms have been set up to supervise the implementation of reforms to improve SOE management, further investments in national holdings have been made while private investor interest in concessions has simultaneously contracted (European Commission, 2021[14]).

Box 16.2. Economic Reform Programmes

Since 2015, EU accession candidates have been obliged to produce annual Economic Reform Programmes that outline clear policy reform objectives and policies necessary for participation in the economic policy co-ordination procedures of the European Union. The ERPs aim to produce concrete reforms that foster medium and long-term economic growth, achieve macroeconomic and fiscal stability and boost economic competitiveness. Since their initial launch, ERP agendas have been required to include structural reform objectives in key fundamental areas:

public finance management

energy and transport markets

sectoral development

business environment and reduction of the informal economy

trade-related reform

education and skills

employment and labour markets

social inclusion, poverty reduction and equal opportunities.

In addition to these essential fields, and as the objectives of EU policies continue to evolve to include cross-cutting sustainable sectors, the structural reform agendas of ERPs have embraced new commitments to progressive policy reforms since the last assessment that also cover:

green transition

digital transformation

research, development and innovation

economic integration reforms

agriculture, industry and services

healthcare systems.

Once submitted by the governments, ERPs are assessed by the European Commission and European Central Bank, opening the door for a multilateral policy dialogue with enlargement candidates to gauge their progress and priority areas on their path to accession. Discussions and assistance on policy reforms take place through a high-level meeting between member states, EU institutions and enlargement countries, through which participants adopt joint conclusions that include economy-specific guidance for policy reform agendas.

The findings of the SME Policy Index 2022 provide an extensive technical understanding of the progress made on business sector-related policy reforms that are key to the ERPs of the EU accession candidates at both the regional and economy-specific levels. The SBA delves into the specific barriers to progress in ten policy areas essential to applying the larger objectives of the ERPs, like boosting competitiveness and economic growth to SMEs in the region.

Source: European Commission (2021[11]).

EU accession process

Montenegro began its EU accession journey in 2008 when it submitted its application for EU membership. The Stabilisation and Association Agreement (SAA) came into force in September 2010, and Montenegro was granted EU candidate status in December 2010. Since then, Montenegro has advanced relatively rapidly along the accession path compared to most Western Balkan economies. Accession negotiations began on 29 June 2012, and as of January 2022, Montenegro has opened 33 out of 35 negotiating chapters, of which 3 chapters (Chapter 25 on Science and Research, Chapter 26 on Education and Culture and Chapter 30 on External Relations) have been provisionally closed. No changes in the degrees assigned to Montenegro’s preparation of the chapters have been noted since the 2020 enlargement report; however, at the Intergovernmental Conference held in June 2021, Montenegro officially accepted the revised enlargement methodology that emphasises credible fundamental reforms, stronger political steer, increased dynamism and predictability of the process (European Commission, 2021[29]).

According to the European Union’s 2021 enlargement report for Montenegro, the economy is moderately prepared on enterprise and industrial policies that help encourage a hospitable environment for SMEs. Since the last enlargement report, Montenegro has made some progress on aligning its Industrial Policy (2019-2023) on combating late payments with the EU acquis through amendments to the Law on Deadlines for Settlement of Monetary Obligations, which are expected during 2022. However, Montenegro still needs to reinforce efforts to ensure inter and intra-ministerial co-operation on a technical and political level, which can help avoid overlapping mandates and inconsistencies within national strategies and programmes, including the Industrial Policy of Montenegro (2019-2023), the Smart Specialisation Strategy of Montenegro (2019-2024) and the ERP (2021-2023) (European Commission, 2021[14]). In this regard, Montenegro should concentrate on:

focusing on the continued implementation of the revised Industrial Policy (2019-2023), in co‑operation with relevant stakeholders and in view of the COVID‑19 special measures

accelerating legal alignment with the acquis, notably by adopting amendments to the Law on Deadlines for Settlement of Monetary Obligations

enhancing efforts to ensure continuous co-ordination of the revised Industrial Policy (2019-2023) with other national key strategies.

Further progress in the accession process and Montenegro’s eventual joining of the European Union will strongly depend on the economy further aligning itself with the benchmarks concerning the rule of law set out in Chapters 23 and 24 on Judiciary and Fundamental Rights and Justice, Freedom and Security, respectively. The closing of chapters will be provisionally halted until both chapters are addressed. The findings and recommendations published in the SME Policy Index 2022 can help provide the monitoring and guidance needed for Montenegro to meet the requirements related to several critical chapters of the acquis and ultimately further its negotiations for accession to the European Union.

EU financial support

The European Union remains the largest provider of financial assistance to Montenegro, helping the economy realise its reform processes and endeavours that bring it closer to the acquis. The European Union’s financial support to the economy and the region has been provided through both temporary support, such as COVID‑19 assistance packages, as well as long-term investment programmes and funds through the Instrument for Pre-accession Assistance (IPA), EIB loans, Western Balkans Investment Framework grants and more.

In addition to a total of EUR 504.9 million provided to Montenegro by the European Union between 2007 and 2020 under the Instrument for Pre-accession Assistance I and II, the European Union is providing an additional EUR 22.2 million under IPA III for the period 2021‑27 to upgrade environmental management systems, improve transport systems by promoting environmentally friendly transport modes, and provide technical assistance for the management, monitoring, evaluation, information and control of IPA-related activities (European Commission, 2021[30]). Of this funding, 6.3% (EUR 1.4 million) has been allocated to a joint EU, European Bank for Reconstruction and Development (EBRD), and Government of Montenegro project to help SMEs access know-how to develop their competitiveness and address their immediate business needs. The project will also fund the establishment of a Single Access Point (SAP) for SMEs in Montenegro and strengthen the capacity of the Ministry of Economic Development to better serve SMEs through policy development, enhancing SME support programmes, and launching a one-stop-shop web portal.

In 2020, the European Union pledged EUR 9 billion for the Western Balkans as part of a new economic and investment plan to support sustainable connectivity, human capital, competitiveness and inclusive growth, and the twin green and digital transitions. In addition to infrastructural funding for Montenegro’s rail and road routes with Serbia and Albania, the economic and investment plan also foresees a Trans-Balkan Electricity Transmission Corridor that will provide electricity transmission to Montenegro and updated waste management systems for the economy. Montenegrin SMEs will also be able to benefit from the scheme’s increased funding to the Western Balkans Guarantee Facility (European Commission, 2020[31]).

The European Investment Fund has also played a key role in financing the business landscape in Montenegro. It has invested EUR 100 million to support Montenegrin companies since the start of the pandemic and invested an additional EUR 50 million at the end of 2021 to support the faster recovery of the local economy from COVID‑19 and help accelerate the green transition and climate adaptation of SMEs (EIB, 2021[32]).

The European Union has been crucial in financially supporting Montenegro in the wake of COVID‑19. The economy received EUR 60 million of the European Commission’s EUR 3 billion Macro-Financial Assistance (MFA) package for enlargement and neighbourhood partners, which aims to help them limit the economic fallout of the COVID‑19 pandemic. Montenegro received the second MFA payment in June 2021 after fulfilling the programme’s policy conditions in the areas of public finance management, financial stability, good governance and the fight against corruption, improvements in the business environment, and social protection (European Commission, 2020[33]). The economy has also received EUR 130 million of the European Union’s Team Europe EUR 3.3 billion COVID‑19 economic recovery support package to the region (European Commission, 2021[34]).

Montenegro was also the first candidate economy to join the European Union’s Competitiveness of Enterprises and Small and Medium-Sized Enterprises Programme (COSME) in 2014, under which it benefits from support for entrepreneurship and entrepreneurial culture, access to finance for SMEs and access to markets (European Commission, 2021[35]). The economy has participated in the European Union’s Research and Innovation programmes since 2008 and is part of the Horizon 2020 programme, allowing it access to the project’s EUR 95.5 billion budget to help develop projects and technologies and conduct research and activities that will contribute to tackling global challenges. Its participation in the SME portion of Horizon 2020 is high for the economy’s size, with 323 applications, 122 participants and 64 signed grants for a total of EUR 4.62 million of EU funding distributed primarily to higher or secondary education institutions (30.9%), followed by public bodies (28.4%) and private, for-profit enterprises (23.4%) (European Commission, 2021[36]). In 2021, the economy signed an additional Association Agreement to the Horizon Europe programme, promoting closer research and innovation co-operation with the European Union.

SMEs in the domestic economy

Although the Law on Accounting of Montenegro was updated in 2021, the classification of SMEs, as defined by Article 6 of the law, has remained unchanged since the last assessment (Government of Montenegro, 2021[37]). The categories conform to the EU standard definition of SMEs by employee size but diverge on the other criteria concerning annual income and assets (Table 16.2).

Table 16.2. Definition of micro, small and medium-sized enterprises in Montenegro

|

|

EU definition |

Montenegro definition |

|---|---|---|

|

Micro |

< 10 employees = EUR 2 million turnover or balance sheet |

≤ 10 employees ≤ EUR 700 000 total annual income or ≤ EUR 350 000 total assets |

|

Small |

< 50 employees = EUR 10 million turnover or balance sheet |

< 50 employees ≤ EUR 8 million total annual income or ≤ EUR 4 million total assets |

|

Medium-sized |

250 employees = EUR 50 million turnover = EUR 43 million balance sheet |

< 250 employees ≤ EUR 40 million total annual income or ≤ EUR 20 million total assets |

Source: Government of Montenegro (2021[37]).

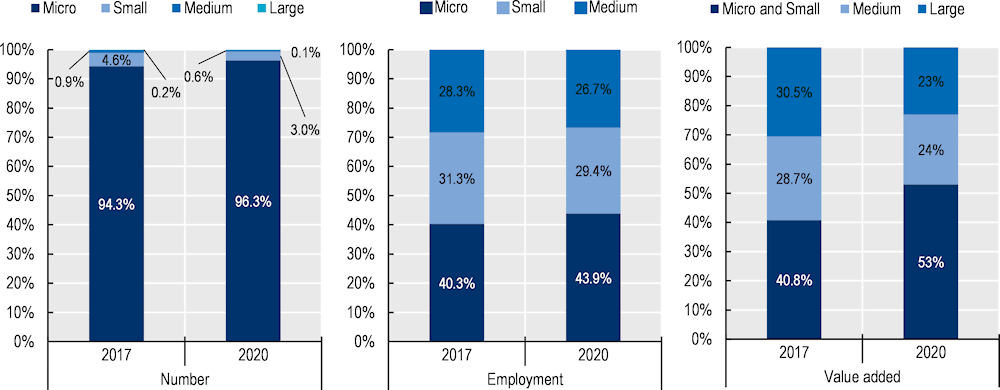

In 2020, Montenegro’s 37 217 MSMEs accounted for 99.9% of all enterprises in the economy, increasing by almost 7 000 since 2017 and roughly 12 100 since 2013 (MONSTAT, 2021[38]). The breakdown of Montenegrin enterprises by size was 96.3% micro and small enterprises, 2.98% small enterprises, 0.6% medium enterprises and only 0.1% large enterprises in 2020 (MONSTAT, 2021[38]). The number of microenterprises increased by roughly 2 percentage points since 2017, absorbing the 1.5-percentage-point decrease in small enterprises and the 0.3-percentage-point decrease in medium enterprises. Large businesses also decreased during the same period, albeit slightly, at a 0.1-percentage-point reduction. The same trend was noted regarding employment in SMEs, with microenterprises noting a 3-percentage-point increase in employment, while small enterprises saw an approximate 2-percentage-point decrease and medium enterprises saw a 1.5‑percentage-point decrease between 2017 and 2020 (Figure 16.2).

Figure 16.2. Business demography indicators in Montenegro (2017 and 2020)

Note: Data for the share of employment in large enterprises was not provided by the Government of Montenegro.

Source: Data received by the Government of Montenegro in this assessment cycle - Customs Administration of Montenegro, (MONSTAT, 2021[38])

Although the economy’s total gross value added in 2020 was approximately EUR 385 million less than in 2019 due to the effects of the COVID‑19 pandemic on businesses, MSMEs in Montenegro accounted for 77% of the economy’s gross value added in 2020, a 4-percentage-point increase from 2019 and a 7.5-percentage-point increase compared to 2017 (MONSTAT, 2021[2]). The role of women in Montenegro’s business environment has continuously increased over the last decade: SMEs owned by women in Montenegro increased by 4.6% from 2018 to 2020, with a 10% increase in the share of women engaged in self-employment over the same period.

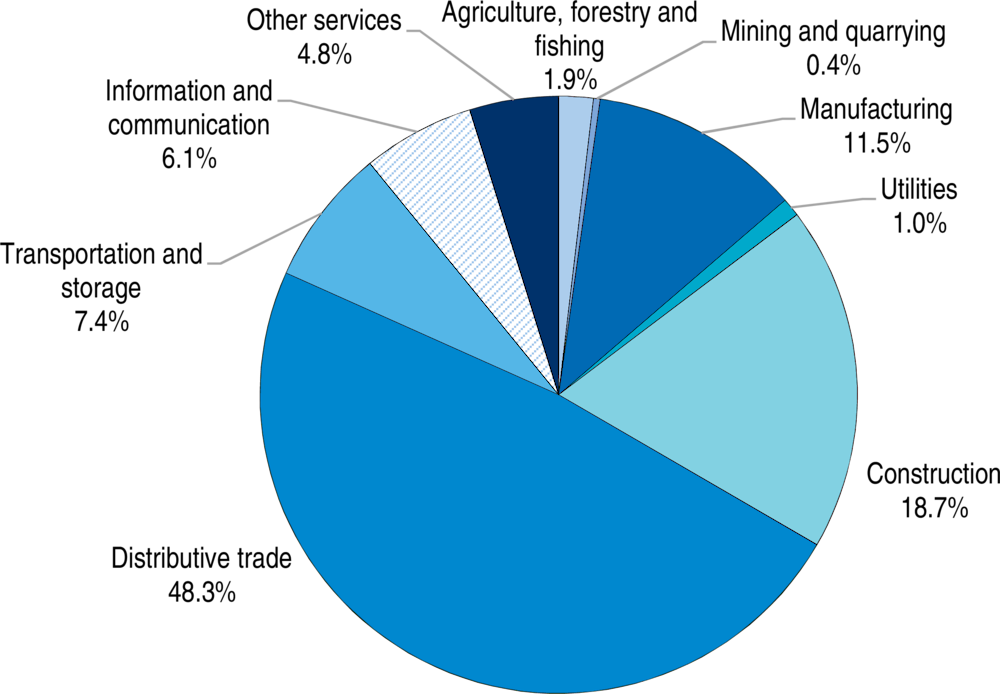

The makeup of SMEs by sector in Montenegro has seen slight changes in the sectoral distribution of SMEs in Montenegro since 2017 (Figure 16.3). The distributive trade sector, which includes wholesale, retail trade, and the repair of motor vehicles and motorcycles, remains the overwhelming industry of SMEs in the economy at 48% but saw the greatest decrease in the number of enterprises since 2017 at a 2.6‑percentage-point decline. The construction sector follows as the second-highest number of SMEs in Montenegro and witnessed the most notable increase in the number of enterprises since 2017, at a 2.2‑percentage-point increase. Slight decreases were also noted in the manufacturing, utilities, mining and quarry sectors, while small increases were noted in information and communication; other services; and agriculture, forestry and fishing sectors.

Geographically, about 36% of enterprises were located in Podgorica in 2020, followed by 15.5% in the municipality of Budva and 9.2% in the port city of Bar (Table 16.3). The number of enterprises in Podgorica decreased by approximately 2 200 (1% of total businesses in the capital) from 2017 to 2020. On the other hand, the municipality of Budva saw a remarkable surge of about 2 200 businesses, a 3.7-percentage-point increase since 2017. Microenterprises accounted for most new companies in Budva, increasing by 65% alone. The number of microenterprises in the municipalities of Petnjica, Tivat and Gusinje also saw notable increases of 56%, 37.4% and 30%, respectively.

Figure 16.3. Sectoral distribution of SMEs in Montenegro (2020)

Source: Data received by the Government of Montenegro in this assessment cycle - Customs Administration of Montenegro.

Table 16.3. Number of registered companies in Montenegro by municipality and size (2020)

|

Municipality |

Enterprise size, by number of persons employed |

Share of the total number of enterprises |

|||||

|---|---|---|---|---|---|---|---|

|

0-9 |

10-49 |

50-249 |

250+ |

Total |

2017 |

2020 |

|

|

Andrijevica |

68 |

0 |

0 |

- |

71 |

0.24% |

0.19% |

|

Bar |

3 350 |

79 |

9 |

- |

3 440 |

9.48% |

9.23% |

|

Berane |

564 |

12 |

6 |

- |

582 |

1.71% |

1.56% |

|

Bijelo Polje |

1 236 |

45 |

7 |

- |

1 290 |

3.60% |

3.46% |

|

Budva |

5 650 |

101 |

13 |

- |

5 768 |

11.75% |

15.48% |

|

Cetinje |

740 |

26 |

0 |

- |

768 |

2.35% |

2.06% |

|

Danilovgrad |

604 |

27 |

8 |

- |

639 |

1.77% |

1.72% |

|

Gusinje |

30 |

0 |

0 |

- |

31 |

0.08% |

0.08% |

|

Herceg Novi |

2 709 |

60 |

12 |

- |

2 780 |

7.65% |

7.46% |

|

Kolašin |

231 |

13 |

0 |

- |

244 |

0.74% |

0.65% |

|

Kotor |

1 365 |

47 |

8 |

- |

1 420 |

4.15% |

3.81% |

|

Mojkovac |

160 |

0 |

0 |

- |

164 |

0.49% |

0.44% |

|

Nikšic |

1 881 |

76 |

19 |

- |

1 979 |

6.16% |

5.31% |

|

Petnjica |

28 |

0 |

0 |

- |

30 |

0.07% |

0.08% |

|

Plav |

126 |

0 |

0 |

- |

128 |

0.35% |

0.34% |

|

Pljevlja |

588 |

22 |

0 |

- |

615 |

1.95% |

1.65% |

|

Plužine |

31 |

0 |

0 |

- |

32 |

0.11% |

0.09% |

|

Podgorica |

12 780 |

486 |

129 |

24 |

13 419 |

37.00% |

36.02% |

|

Rožaje |

629 |

15 |

0 |

- |

646 |

1.92% |

1.73% |

|

Šavnik |

36 |

0 |

0 |

- |

38 |

0.13% |

0.10% |

|

Tivat |

1 709 |

42 |

0 |

- |

1 754 |

4.30% |

4.71% |

|

Tuzi |

76 |

0 |

0 |

- |

83 |

0.12%1 |

0.22% |

|

Ulcinj |

1 159 |

29 |

0 |

- |

1 193 |

3.44% |

3.20% |

|

Žabljak |

135 |

6 |

0 |

- |

141 |

0.45% |

0.38% |

|

Montenegro |

35 885 |

1 103 |

229 |

38 |

37 255 |

100.00% |

100.00% |

Notes: Although municipal-specific data on large enterprises of more than 250 employees are unavailable for some regions, Montenegro has a total of 38 large enterprises, 24 of which are located in Podgorica.

1. 2019 data used in place of 2017 data for the municipality of Tuzi.

Source: MONSTAT (2021[39]).

Assessment

Description of the assessment process

The SBA assessment cycle was virtually launched on 7 July 2021, when the OECD team shared the electronic assessment material, comprised of questionnaires and statistical sheets, accompanied by explanatory documents.

Following the virtual launch, the Ministry of Economic Development, which acts as the SBA Co-ordinator nominated by the European Commission, distributed the link to the assessment material to the appropriate ministries and government agencies and the statistical sheets to the Statistical Office of Montenegro (MONSTAT). These institutions compiled the data and documentation between July and September 2021 and completed the questionnaires. Each policy dimension was given a self-assessed score accompanied by a justification. The OECD team received the completed questionnaires and statistical data sheets on 1 October 2021 and then began an independent review.

The OECD reviewed the inputs and requested additional information on certain elements from the Ministry of Economic Development. For several dimensions, virtual consultation meetings with key dimension stakeholders were organised from end-October to mid-November 2021. The meetings aimed to close any remaining information gaps in the questionnaires.

A virtual preliminary findings meeting with Montenegro was held on 26 November 2021 to present and discuss the preliminary SME Policy Index 2022 assessment findings and initial recommendations for Montenegro. At the same time, it served as an opportunity to seek the views of a broad range of policy stakeholders on how SMEs are affected by current policies and to gauge what more can be done across different policy areas to improve SMEs’ performance and competitiveness in Montenegro, particularly in the post-COVID‑19 context.

The meeting allowed the OECD to validate the preliminary assessment findings. The draft SME Policy Index publication and the Economy Profile of Montenegro were made available to the Government of Montenegro for their review and feedback in February 2022.

Scoring approach

Each policy dimension and its constituent parts are assigned a numerical score ranging from 1 to 5 according to the level of policy development and implementation, so that performance can be compared across economies and over time. Level 1 is the weakest and Level 5 the strongest, indicating a level of development commensurate with OECD good practice (Table 16.4). For further details on the SME Policy Index methodology and how the scores are calculated, as well as changes since the last assessment cycle, please refer to Annex A.

Table 16.4. Description of score levels

|

Level 5 |

Level 4 plus results of monitoring and evaluation inform policy framework design and implementation. |

|

Level 4 |

Level 3 plus evidence of a concrete record of effective policy implementation. |

|

Level 3 |

A solid framework addressing the policy area concerned is in place and officially adopted. |

|

Level 2 |

A draft or pilot framework exists, with some signs of government activity to address the policy area concerned. |

|

Level 1 |

No framework (e.g. law, institution) exists to address the policy topic concerned. |

Entrepreneurial learning and women’s entrepreneurship (Dimension 1)

Introduction

Entrepreneurial learning raises learners’ skills and develops the mindsets needed to change their lives and the world around them through entrepreneurial action for social and economic impact. It is the basis for empowering learners to know they can generate the creative ideas needed in the 21st century.

Women’s entrepreneurship should be prioritised to support women’s economic and social empowerment and drive improved stability and social and economic growth. It can also enable closing gender gaps in the workforce, supported by equality and gender impact analysis of policies affecting family care and social protection.

Montenegro has placed a strong emphasis on developing both policy and practical implementation of entrepreneurial learning at the system level, providing a clear progression in the implementation of entrepreneurial learning across all levels of lifelong learning.

Montenegro’s entrepreneurial learning and women’s entrepreneurship score has increased to 4.47 (Table 16.5) from 3.83 in the last assessment. This high score results from Montenegro further strengthening the depth and quality of entrepreneurial learning, building on its role as one of the regional leaders in this area. In women’s entrepreneurship, it has taken steps to establish system-level co-ordination and improve evaluation.

Table 16.5. Montenegro’s scores for Dimension 1: Entrepreneurial learning and women’s entrepreneurship

|

Dimension |

Sub-dimension |

Thematic block |

Montenegro |

WBT average |

|---|---|---|---|---|

|

Dimension 1: Entrepreneurial learning and women’s entrepreneurship |

Sub-dimension 1.1: Entrepreneurial learning |

Planning and design |

4.75 |

3.43 |

|

Implementation |

4.62 |

3.51 |

||

|

Monitoring and evaluation |

4.34 |

2.73 |

||

|

Weighted average |

4.61 |

3.33 |

||

|

Sub-dimension 1.2: Women’s entrepreneurship |

Planning and design |

5.00 |

3.97 |

|

|

Implementation |

4.11 |

3.83 |

||

|

Monitoring and evaluation |

3.50 |

3.11 |

||

|

Weighted average |

4.26 |

3.73 |

||

|

Montenegro’s overall score for Dimension 1 |

4.47 |

3.49 |

||

Note: WBT: Western Balkans and Turkey.

State of play and key developments

There have been significant developments in both policy and practice across both sub-dimensions. In entrepreneurial learning, the new Strategy for Lifelong Entrepreneurial Learning (2020-2024) (Government of Montenegro, 2020[40]) plots the path forward to build on and increase the quality of existing good practices, with a renewed focus on co-working entrepreneurship with wider European key competences, modernisation of the higher education curriculum, developing more and stronger education-business partnerships at all levels and ensuring a clear career pathway into entrepreneurship.

For women’s entrepreneurship, the new Strategy for the Development of Women's Entrepreneurship of Montenegro (2021-2024) (Government of Montenegro, 2021[41]) is driving continuous improvement, with a 4.6% increase in the share of women business owners from 2018 to 2020 and an increase of 10% in the share of women engaged in self-employment over the same period2 (Table 16.6).

Table 16.6. Montenegro’s implementation of the SME Policy Index 2019 recommendations for Dimension 1

|

2019 recommendation |

SME Policy Index 2022 |

|

|---|---|---|

|

Main developments during the assessment period |

Progress status |

|

|

Expand teacher training on entrepreneurship key competences to cover all teachers at all levels of education |

Significant efforts have been made to expand teacher training and provide high-quality guidance on entrepreneurial learning, supporting training for teachers and school directors across primary, secondary and vocational education and training (VET) to introduce entrepreneurship key competences using EntreComp. All materials supporting key competence development in compulsory education and training are now accessible via a centralised website – www.ikces.me.1 |

Strong |

|

Share good practices to create a positive image of entrepreneurship among young people |

The visibility of entrepreneurial learning has increased through multiple actions, such as the database of practices available at www.ikces.me and a range of multi-stakeholder national events to promote lifelong entrepreneurial learning. The third National Strategy for Lifelong Entrepreneurial Learning (2020-2024) places a specific priority on further actions to promote visibility and exchange of good practices.2 |

Strong |

|

Ensure that public universities modernise their curriculum by integrating entrepreneurship competences |

New practices to develop entrepreneurship competences have been introduced, though more work remains to impact all areas of the curriculum. The higher education sector is involved in several projects focusing on entrepreneurial learning, such as REBUS (REady for BUSiness) involving the University of Montenegro,3 which has supported integration into technical and information and communication technology-related courses, or the Student Business Hub4 programme led by the careers centre of the University of Montenegro. |

Moderate |

|

Institutionalise the National Partnership for Lifelong Entrepreneurial Learning |

The National Partnership is now formally recognised by the government as a working group of the National Competitiveness Council led by the Minister for Economic Development. |

Strong |

|

Foster an ecosystem for women’s entrepreneurship |

Multi-stakeholder policy partnership has been formalised through the Council for Competitiveness Working Group on the Economic Empowerment of Women. The structure provides evidence of broad-based institutional and stakeholder engagement, and it is explicitly supporting the implementation of the Strategy for the Development of Women's Entrepreneurship of Montenegro (2021-2024). |

Strong |

|

Strengthen the monitoring and evaluation of women’s entrepreneurship support initiatives |

At the strategy level, there is an evaluation report on the implementation of the 2015-2020 Strategy, and this was used to develop the new 2021-2024 Strategy. While good practice can be seen in initiatives funded by international partners and future actions are identified in the new strategy, there remains insufficient programme-level evaluation and an overall lack of gender-disaggregated statistical data at the system level. |

Limited |

1. This website has been developed through the Integration of Key Competences into Education and Quality Assurance Systems in Montenegro project, implemented within the framework of the EU-Montenegro Joint Programme for Education, Employment and Social Policy, as part of Action 2 to improve the education system and Activities 2.1 to improve the quality of education through key competences and quality determination, with a particular focus on science, technology, engineering and mathematics disciplines. For more information, see http://eesp.me/o-programu/ (accessed on 21 January 2022).

2. See Strategic Objective 3.2 of the National Strategy for Lifelong Entrepreneurial Learning (2020-2024).

3. For more information, see https://www.ucg.ac.me/objava/blog/10/objava/50064-projekat-rebus- (accessed on 20 January 2022).

4. For more information, see https://www.ucg.ac.me/objava/blog/1025/objava/115513-dodijeljeni-sertifikati-polaznicima-programa-student-bussines-hub (accessed on 20 January 2022).

Stronger national prioritisation of entrepreneurial learning in education and training has been observed

The focus on entrepreneurial learning continues in Montenegro with the launch of the third National Strategy for Lifelong Entrepreneurial Learning (2020-2024). This new strategy builds on a comprehensive evaluation of the 2015-2019 strategy, which demonstrates the value of the continued approach to embedding entrepreneurship as a key competence at all levels of education and training, and quickly aligning to the EntreComp framework to guide and underpin national curriculum developments since it was launched in 2016.

The National Partnership is now formally recognised, which is a significant step forward. An informal multi-stakeholder National Partnership for Entrepreneurial Learning was first established in 2008, bringing together representatives from public, private and non-governmental organisation (NGO) sectors to support the successful and ongoing implementation of national strategies for entrepreneurial learning. Key national stakeholders have remained strongly committed to the National Partnership and practical implementation of the actions of the national strategies since the first strategy was launched in 2008, and the list of representatives in the new working group of the Competitiveness Council reflects this and includes both public sector, education, private sector, civil society and international partners agencies.3 Since April 2021, this partnership is now officially recognised by the government as a working group of the Council for Competitiveness led by the Minister for Economic Development. This recognition is now leading to an expanded role for the National Partnership in developing the National Action Plan for Financial Literacy, explicitly linked to entrepreneurship and digital key competences.4

Montenegro made good progress on the integration of key competences into education and training

This assessment period has seen the launch and close of an EU-Montenegro Integration of Key Competences into the Education System of Montenegro project from 2019 to 2021, which has seen the development of a key competence framework, modularised programmes for secondary schools, teacher manuals and extensive supporting training programmes on the entrepreneurship competence for teachers and school directors across primary, secondary and VET. Evaluation of the 2015-2019 strategy shows that the entrepreneurship key competence has been introduced into the curriculum in 100% of primary, lower secondary and upper secondary schools and 50% of vocational secondary schools. This is supported by in-service training that has reached nearly 100% of all preschool, primary, lower secondary and upper secondary teachers. This impressive reach echoes the policy priority placed on entrepreneurial learning at the national level. The national strategy indicates support to sustain provision beyond the lifetime of the funded project, which ended in December 2021, and to address the lack of widespread provision of training on entrepreneurial learning within pre-service teacher training. Wider stakeholders are actively supporting this integration of entrepreneurship with a focus on closing skills gaps. The Chamber of Economy runs a range of actions,5 including promoting and supporting the development of the dual education system. This encompasses both research and practical projects such as Erasmus+ funded student exchanges where students have opportunities to grow and practice their skills and knowledge in their field of studies at foreign companies.6

Graduate tracking mechanisms are still lacking at the system level

In Montenegro, the national labour force survey collates data on employment and unemployment rates by level of education, and tracking surveys have been piloted in both vocational and higher education (European Training Foundation, 2018[42]). However, there remains no co-ordinated approach at the level of the education and training system that collates data across all learners and graduates in the economy, either from the institution-level, national statistical data sources or via tracking surveys sent to students at regular intervals following graduation. This lack of a system-level approach creates a gap in skills intelligence linked to learning outcomes, employability of graduates, skills gaps and mismatches, and social inclusion, which could otherwise be used to regularly inform and shape the development and labour market alignment of the education and training system.

Practical implementation of entrepreneurship key competence in public universities is improving, but more is needed

Some progress has been made concerning the recommendations from the previous cycle (Table 16.6). Developing the entrepreneurship key competence in higher education continues to be emphasised through successive national strategies for both entrepreneurial learning and those more specifically addressing higher education (Government of Montenegro, 2021[43]). Pockets of excellence can be seen through projects such as REBUS and e-VIVA, while the recent DigNest project aims to embed digital and entrepreneurial learning into the curriculum and involves both public and private universities alongside multiple stakeholders from the higher education ecosystem in Montenegro.7 At the system level, there is now a requirement to include 25% practical education as a compulsory proportion of all study programmes in higher education; with this, there is an important opportunity to embed entrepreneurial learning outcomes into the practical curriculum content. The new strategy will monitor this to reach a target of 25% of non-economic courses at the public University of Montenegro that include the required 25% of practical education in study programmes and 55% of study programmes in the private University of Donja Gorica that include the compulsory proportion by 2024.

Co-ordination of the policy and implementation frameworks supporting women’s entrepreneurship has been strengthened

An Expert Group on the Economic Empowerment of Women was established in April 20218 as one of the eight working groups under the National Council for Competitiveness. The main purpose of this group is to strengthen co-ordination of strategic documents related to the economic empowerment of women, particularly the new Strategy for the Development of Women's Entrepreneurship of Montenegro (2021‑2024) (Government of Montenegro, 2021[41]). It builds on the 2015‑2020 strategy, using a comprehensive evaluation of the past strategy to inform future direction and priorities. This new strategy links across to other relevant policies, including the new National Strategy for Gender Equality (2021‑2025) (Government of Montenegro, 2021[44]), which highlights the importance of increasing the number of women entrepreneurs while emphasising the need to address wider social and economic barriers to gender equality. While system-level evaluation is following a positive trajectory, there is work remaining to address the lack of gender-disaggregated data relevant to women’s entrepreneurship to provide a fuller understanding of the progress and impact of initiatives. As a positive step, the working group has adopted IWA34,9 a set of global definitions for women’s entrepreneurship developed by the International Organisation for Standardisation. To support practical implementation, the Competitiveness Council working group has translated this into the local language and developed national guidelines10 on how these common definitions can guide and support work at the national and local levels.

Emphasis has been put on increasing access to women’s entrepreneurship, particularly through digitalisation

Increased digitalisation of the economy is highlighted as an enabler for women’s entrepreneurship in Montenegro through a recent United Nations Development Programme (UNDP) report (2020[45]). The new Strategy for the Development of Women's Entrepreneurship of Montenegro (2021‑2024) (Government of Montenegro, 2021[41]) builds on previous work on the digital, green and creative economy sectors alongside plans to improve the digital literacy of women in business. Enhanced incentives for women-led businesses have been included in government finance programmes for small investments; there has been an introduction of international standards and support for digitalisation; and an increase in the financial grant intervention rate from 50% to 80% for businesses that are at least 50% women-owned (Government of Montenegro, 2021[46]). A national digital portal is now under development to co-ordinate and share knowledge and opportunities on actions supporting women’s economic empowerment and is expected to be on line by mid-2022, through a collaboration between the Ministry for Economic Development and the UNDP,11 linked to the Expert Group on the Economic Empowerment of Women.

The way forward for Dimension 1

Match pre-service teacher training provisions to the needs of the new framework for key competences to consolidate and embed the work of the EU-Montenegro Integration of Key Competences into the Education System of Montenegro project. A focus on harmonising the new developments within pre-service teacher training would ensure future-proofing of teacher competences. A good practice example from the United Kingdom is presented in Box 16.3.

Box 16.3. Matching initial and continuing teacher education to the needs of the new Curriculum for Wales (United Kingdom)

In the United Kingdom, the University of Wales Trinity Saint David has successfully integrated the development of the entrepreneurship key competence into pre-service teacher training programmes and a new Education Doctorate supporting continuing professional development for experienced educators. Participant feedback shows that those who participate in the programme go on to use EntreComp to underpin their own teaching or wider teacher training initiatives, such as head-teacher training for the new curriculum led by Wales’ National Academy for Educational Leadership.

The approach taken first places explicit focus on teachers' professional and entrepreneurial competences, using learning outcomes from EntreComp, to build an understanding of the relevance of this key competence. The courses developed also introduce knowledge and practical application of the entrepreneurship key competence for learners across diverse subject areas and with cross-curricular relevance. The university has embraced the EntreComp framework as a guide for this work, matching it with the new Curriculum for Wales, which emphasises four purposes of learning, including supporting learners in becoming “enterprising, creative contributors, ready to play a full part in life and work.”1

Montenegro has been an early pioneer of the EntreComp framework and has placed a significant focus on the development of the entrepreneurship key competence across lifelong learning. Yet, no pre-service teacher training includes this as an explicit focus. This example illustrates how the design, delivery and assessment of pre-service and in-service teacher training courses can be matched to the needs of a new national curriculum framework.

1. For more information on the Curriculum for Wales, see https://hwb.gov.wales/curriculum-for-wales (accessed on 20 January 2022).

Sources: Welsh Government (2017[47]); Penaluna, Penalune and Polenakovikj (2020[48]); Weicht and Jonsdottir (2021[49]); McCallum et al. (2018[50]).

Develop a system-level approach to graduate tracking from vocational and higher education, identifying a designated lead institution to move this forward. This should take account of the EU roadmap towards European-level graduate tracking in support of the European Education Area by 2025, including the recommendation for a European Graduate Survey and linked administrative data (European Commission, Directorate-General for Education, Youth, Sport and Culture, 2021[51]). An example from Finland could provide a roadmap on how to develop this (Box 16.4).

Box 16.4. Higher education graduate tracking measures in Finland

In Finland, responsibility for higher education graduate tracking lies with both the government and universities.

There is clear co-ordination of the tracking data, pulling information from both administrative and survey sources. The tracking is created from a combination of administrative data co-ordinated by Vipunen (Education Statistics Finland), while universities lead the implementation of graduate tracking surveys co-ordinated through the Aarresaari network of university career services. The information gathered is also used as the evidence base for policy decisions. Since 2021, the results of the graduate survey data are also used to inform public funding decisions, with graduate tracking determining 2% of performance-based funding for universities and 3% for universities of applied sciences.

Using graduate tracking to understand the employment and social outcomes of graduates from vocational and higher education can offer powerful evidence on the alignment of the education and training system to the needs of the labour market, in particular in smart specialisation priority sectors. In turn, it enables informed decisions to be made on updating learning programmes, improving career guidance, and reducing skills gaps.1

1. For more information on the European Commission Expert Group on Graduate Tracking, see https://education.ec.europa.eu/education-levels/higher-education/quality-and-relevance (accessed on 20 January 2022).

Source: European Commission (n.d.[52])

Develop a system-level approach to monitoring women’s entrepreneurship, including gender-disaggregated data co-ordinated in partnership with the Statistical Office of Montenegro. This process should harmonise with relevant international standards, including UN gender indicators12 and Eurostat. Measuring the rate, form, and growth of women’s entrepreneurial activity is crucial to achieving a more complete understanding of how women entrepreneurs contribute to the economy and society and supporting evidence-based public policy (Meunier, Krylova and Ramalho, 2017[53]).

Launch a single portal for women’s entrepreneurship in Montenegro to bring together information and resources at the national level. This would increase access and visibility of the support for this career option available to women. The portal could be a part of a wider portal addressing entrepreneurship and enterprise skills (see a related recommendation in Dimension 8a on enterprise skills) or be a bespoke portal. It should bring together information and resources from across all types of relevant stakeholders and providers, which can also support a greater understanding of gaps or duplications of provisions. A portal in Germany could serve as a good example in this regard (Box 16.5).

Box 16.5. Germany provides a national portal that gathers support for women entrepreneurs from a wide range of actors

In Germany, the Bundesweite gründerinnenagentur (BGA) is a federal agency that acts as a national one-stop-shop offering support and information on women’s entrepreneurship, widely regarded as the primary voice and policy lead for women’s entrepreneurship.

Established by three federal ministries,1 BGA gathers offers from across the public, political, business and academic sectors for female-focused support services from all sectors and stages of business development, collating these into a centralised online portal available in six languages. This comprehensive portal2 gives users access to a database of trusted and evaluated advisory services, sources of financing, online training, an events calendar, regional networks and a wide range of regularly updated resources and guides on themes relevant to women entrepreneurs.

This example offers a practical demonstration of a comprehensive government-level approach to increasing access to and visibility of women’s entrepreneurship by developing a multi-stakeholder portal that might collate support and services offered by government and non-government providers across Montenegro.

1. BGA is a joint project of the German Federal Ministry for Education and Research, the Federal Ministry for Family, Senior Citizens, Women and Youth and the Federal Ministry of Economy and Technology.

2. See https://www.existenzgruenderinnen.de/ (accessed on 20 January 2022).

Bankruptcy and second chance for SMEs (Dimension 2)

Introduction

Firms enter and exit the market as a natural part of the business cycle, and policies can ensure that such transitions occur in a smooth and organised manner. Well-developed insolvency procedures and regimes can protect both debtors and creditors, striking the right balance between both parties, for example. This is particularly relevant for smaller firms as they lack resources compared to bigger firms. Therefore, governments need to ensure that bankruptcy proceedings are efficient, ease reorganisation procedures (instead of bankruptcies) and ensure that those starting again have the same opportunities in the market they had the first time.

In Montenegro, as in other Western Balkan economies where SMEs represent a large share of the economy, effective liquidation and discharge procedures can allow entrepreneurs to reintegrate into the market. This was particularly relevant in the context of the COVID‑19 pandemic, where a number of firms faced financial difficulties or were at risk of financial distress, particularly in the tourism sector (OECD, 2021[54]).

Montenegro regressed slightly in this dimension during the assessment period and is now scoring 3.02, which is at the regional average (Table 16.7). Although the amendments were made to improve the insolvency framework, the government revoked the Law on Consensual Financial Restructuring of Debts to Financial Institutions, leaving the legal framework for SMEs without the possibility of a formal out-of-court settlement.

Table 16.7. Montenegro’s scores for Dimension 2: Bankruptcy and second chance

|

Dimension |

Sub-dimension |

Thematic block |

Montenegro |

WBT average |

|---|---|---|---|---|

|

Dimension 2: Bankruptcy and second chance |

Sub-dimension 2.1: Preventive measures |

2.50 |

2.74 |

|

|

Sub-dimension 2.2: Bankruptcy procedures |

Design and implementation |

3.37 |

3.47 |

|

|

Performance, monitoring and evaluation |

3.40 |

3.23 |

||

|

Weighted average |

3.38 |

3.38 |

||

|

Sub-dimension 2.3: Promoting second chance |

2.00 |

1.96 |

||

|

Montenegro’s overall score for Dimension 2 |

3.02 |

3.03 |

||

Note: WBT: Western Balkans and Turkey.

State of play and key developments

Montenegro has backtracked somewhat since the 2019 assessment. A fully-fledged early warning system, which serves as a basis for fostering a financially healthy ecosystem for SMEs and might help potentially distressed SMEs during the post-COVID‑19 context, is still missing (Table 16.8). In May 2019, the Law on Consensual Financial Restructuring of Debts to Financial Institutions was revoked. No new preventive policy measure was enacted, leaving a legislative gap in the prevention of the financial restructuring of SMEs.

The economy continued to work on insolvency prevention by introducing new support measures to SMEs (business advisory and mentoring services to improve SME financial management) during the COVID‑19 pandemic. While there are no available data on the backlog cases, the number of bankruptcies totalled 785 cases in 2020, which is practically the same number as in 2019, reflecting, to some extent, the efficacy of the policy response to keep the private sector alive during the recession (Directorate-General for Neighbourhood and Enlargement Negotiations, 2021[55]). According to the assessment results, among the backlog cases for 2019 and 2020, around 81% were completed within six months, while 3% were completed in more than a year.

Shortened, simplified reorganisation proceedings for SMEs and debt discharge rules are still lacking in the legal framework on bankruptcy proceedings. Moreover, second-chance programmes for SMEs are nascent, limiting both the reintegration of honest entrepreneurs into the economy and the opportunity to change the current cultural stigma linked to entrepreneurial failure.

Table 16.8. Montenegro’s implementation of the SME Policy Index 2019 recommendations for Dimension 2

|

2019 recommendation |

SME Policy Index 2022 |

|

|---|---|---|

|

Main developments during the assessment period |

Progress status |

|

|

Develop a fully-fledged early warning system |

An early warning system is still missing. However, Montenegro succeeded during the assessment period in reducing non-performing loans (NPLs)1 thanks to the Law on Consensual Financial Restructuring of Debts, which improved the prevention of bankruptcies. Moreover, the government-provided advisory and mentoring services to SMEs regarding their long-term sustainable growth, even though these did not directly target the prevention of bankruptcies. |

Limited |

|

Further simplify parts of the bankruptcy legislation |