This chapter covers the progress made by North Macedonia in implementing the Small Business Act (SBA) for Europe over the period 2019-21. It starts with an overview of North Macedonia’s economic context, business environment and status of its EU accession process. It then provides key facts about small and medium-sized enterprises (SMEs) in the North Macedonian economy, shedding light on the characteristics of the SME sector. It finally assesses progress made in the 12 thematic policy dimensions relating to the SBA during the reference period and suggests targeted policy recommendations.

SME Policy Index: Western Balkans and Turkey 2022

17. North Macedonia: Economy Profile

Abstract

Key findings

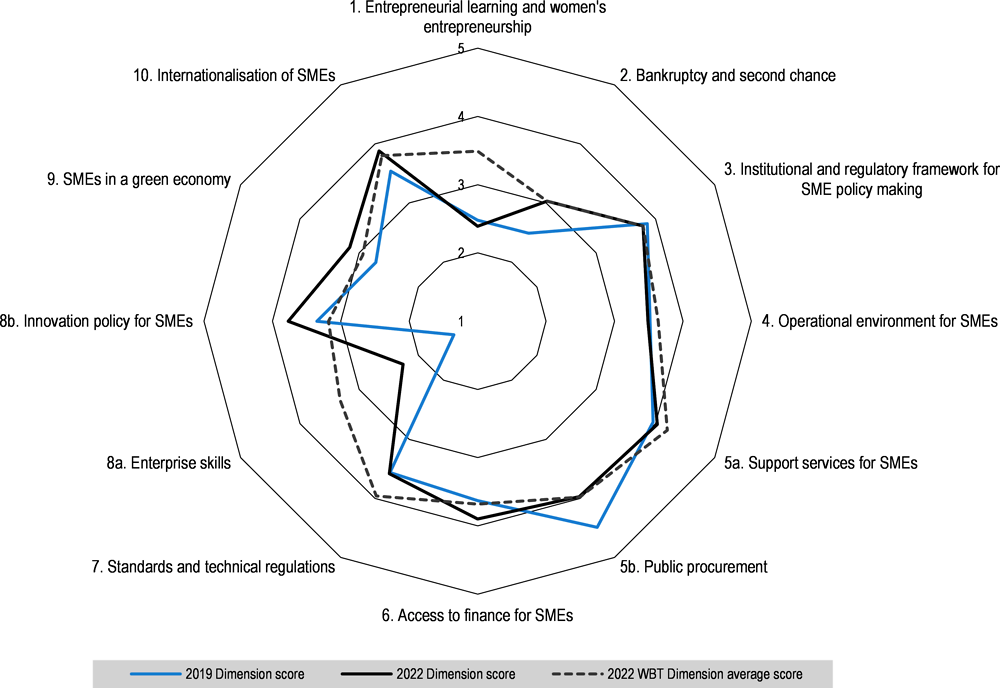

Figure 17.1. Small Business Act scores for North Macedonia (2019 and 2022)

Note: WBT: Western Balkans and Turkey.

The Republic of North Macedonia (hereafter “North Macedonia”) has made progress in implementing the Small Business Act (SBA) since the publication of the previous report – the SME Policy Index: Western Balkans and Turkey 2019 (Figure 17.1). North Macedonia has achieved its highest average scores in the following areas: support services for small and medium-sized enterprises (SMEs); public procurement; access to finance; innovation policy; and internationalisation of SMEs. While in access to finance, innovation policy and internationalisation, North Macedonia outperforms the WBT average, the economy still needs to step up its efforts in entrepreneurial learning and women’s entrepreneurship and enterprise skills.

Main achievements

The insolvency legislative framework has gradually been improving. In March 2021, the economy completed a new draft of the Insolvency Act, which is set to be enacted in 2022. The draft law features some positive developments, such as introducing preventive measures (pre-insolvency restructuring proceedings and an early warning system) and the inclusion of provisions for shortened and simplified bankruptcy proceedings for SMEs. In addition, North Macedonia is the only economy in the region that digitalises liquidation procedures, which has led to decreases in the amount of time taken for bankruptcy liquidation procedures, reducing the procedural costs and ensuring creditors’ claims recovery are valued at best market rates.

North Macedonia has a strong legal and strategic framework for government provisions of business support services (BSSs). The economy introduced various financial and non-financial support programmes targeting SMEs, aimed at improving their capacity and competitiveness. The private provision of BSSs is envisioned through additional support for business incubators and technology parks with the goal of creating an environment conducive to knowledge and technology transfers. In addition, the government introduced new co-financing schemes for SMEs seeking assistance from private-sector consultants.

Efforts to promote financial literacy have gained momentum. North Macedonia adopted its first Strategy for Financial Education and Financial Inclusion (2021-2025), which aims to develop special educational programmes for various target audiences, in line with a core competency framework that is currently under preparation. While the impact of the new strategy will only be seen in the medium term, the centralised one-stop-shop for financial support continues to provide information on financial and non-financial services for enterprises, serving as a useful and easily accessible platform.

SMEs’ greening efforts have been encouraged by facilitated access to finance. As recommended in the previous cycle, the Development Bank of North Macedonia has become an important factor in fostering green lending to SMEs’ projects, including as part of COVID‑19 recovery programmes. Moreover, the recently adopted Plan for Accelerated Growth (2022-2026) is expected to provide a stronger impulse to greening measures with the introduction of several instruments to promote and finance SMEs’ green projects, such as the Hybrid National Green and Digital Fund for SMEs.

Export promotion and SME integration into global value chains (GVCs) are highlighted in newly adopted strategic documents, further contributing to a stronger legal and strategic framework that encourages SME internationalisation. By adopting a new Law on Strategic Investment and simplifying company establishment within free economic zones, North Macedonia made noteworthy advancements in developing an attractive environment for foreign direct investment (FDI). Moreover, in order to further foment linkages between domestic SME suppliers and multinational enterprises (MNEs), the government launched an online business-to-business (B2B) portal to match local suppliers with international buyers, therefore contributing to North Macedonian SMEs’ participation in GVCs.

The way forward

Efforts are needed to boost entrepreneurship as a key competence across all levels of education, building on the positive reforms of the vocational education and training (VET) curriculum aligned to EntreComp. Strong leadership should be provided through a multi-stakeholder partnership, guiding concrete government-led actions with a committed budget that supports curriculum reform, embedding practical entrepreneurial learning, development of teacher guidance as well as actions to expand pre- and in-service teacher training. Monitoring and evaluation are required to track efficacy and impact.

Urgent action is required to monitor and evaluate the progress, efficacy and impact of actions taken to support women’s entrepreneurship, to underpin the implementation of the recent women’s entrepreneurship strategy. This should include a transparent monitoring and evaluation process, supported by urgent actions to enforce gender-disaggregated data via national statistics and government-funded programmes.

The institutional and regulatory framework for SME policy making has room for improvement. Namely, a comprehensive strategy for simplifying legislation with the goal of improving the business environment, as has been adopted by other economies in the region, is absent in North Macedonia. The use of regulatory impact assessments to measure the effects of policies on SMEs and of public-private consultations to involve SMEs in policy making could also be further improved, namely by ensuring stronger quality control by the relevant oversight institutions.

Systematic training needs analysis is still lacking in North Macedonia. Assessing the current SME landscape is done on an ad hoc basis without a strategic framework in place to ensure regular analysis of SMEs’ needs. Similarly, systematic monitoring and performance-based evaluation of both public and private BSSs also warrants intensified efforts from the government.

Improve information provision and support services for SMEs who seek certification according to national, European or international standards. While North Macedonia’s legislation is comparatively well aligned with the European Union’s technical regulations and quality infrastructure legislation, support services to firms should be expanded. One priority should be the establishment of a central web platform that lists all export-relevant sectoral and horizontal legislation and provides information about the standards and the conformity assessment procedures that firms need to follow to access the European Single Market. Furthermore, the creation of a larger programme (funded by international development co-operation partners or the government) to support SMEs that may not be able to self-finance investments related to conformity with standards would be important.

The lack of system-level skills intelligence remains a significant challenge. A co‑ordinated approach to understanding current and future skills needs could support policy planning and design toward better alignment of education to labour-market needs. Defined indicators for SME skills intelligence would guide future monitoring and evaluation related to SME skills at all levels.

Business-academia collaboration should be promoted with a systematic and targeted approach. Efforts should include both demand and supply-side aspects, including raising awareness about collaboration opportunities and providing a targeted infrastructure stimulating exchange and financial incentives to boost collaboration as well as strengthening academic research excellence. An evaluation of the pilot voucher scheme, as well as a clear approach to the design and function of the Science and Technology Park, will be important elements, as is a review of the scientific research sector more generally.

Economic context and role of SMEs

Economic overview

North Macedonia is a small, upper-middle-income economy with a population of 2.07 million as of 2020 and a per capita gross domestic product (GDP) by purchasing power parity of USD 15 931 in 2020 (in constant 2017 international dollars), having shrunk by roughly USD 800 since 2019 (World Bank, 2022[1]). Compared to neighbouring economies, North Macedonia’s economic activity sectors are relatively well balanced, with the services sector accounting for 57% of GDP, industry for 22.6% and agriculture for 9.1% in 2020, with annual decreases of 2.6% for services and 6.8% for industry and annual increases of 1.7% for agriculture in 2021. The economy’s industrial sector is primarily based on manufacturing (13% of GDP), particularly in chemical products, basic iron, steel and ferro-alloys, machinery and textiles. North Macedonia’s top sectors in terms of employment are services (employing 55% of North Macedonia’s workforce), followed by industry (31% of the workforce) and agriculture (employing almost 14%) (MAKStat, 2021[2]).

North Macedonia’s economy has shown steady growth since 2012, driven mainly by domestic consumption and exports (notably basic metals and textile products), with a slight drop in 2017, followed by another bout of continued growth. However, like all WBT economies, North Macedonia’s economy was adversely impacted by the COVID‑19 pandemic (Box 17.1), with a 6.1% decrease in GDP growth for 2020 brought on by a sharp decrease in remittances, which impacted adversely on household spending and a fall in investment (Table 17.1). However, the economy rebounded with a 4.2% GDP growth in 2021, fuelled by a strong recovery in the production of automotive supplies, a recovery of private consumption and the implementation of government support measures, and is expected to remain at 3.2% in 2022 (IMF, 2022[3]; European Commission, 2022[4]; EBRD, 2022[5]).

After a positive decline in external debt stocks in 2018, public spending in North Macedonia grew by approximately 15.2% from 2019 to 2020 due to unforeseen spending on COVID‑19 mitigation measures and remains the second-highest in the region at 89.9% in 2020. Positive measures have been taken to alleviate public debt in recent years, including the repayment of a 2014 Eurobond in the amount of EUR 500 million in July 2021, reducing government and public debt by 4.46 percentage points and stabilising its position at under 60% in Q3 of 2021, a 3.1% reduction from Q2, thereby aligning itself with the Maastricht Criteria (Ministry of Finance, 2021[6]). North Macedonia is beginning to gear its public spending agenda towards energy efficiency projects, with plans to shut down all coal-fired thermal power plants, which account for approximately 50% of total electricity production and about one-third of consumption, by the end of 2027 under the National Energy and Climate Plan. In addition to being the first Western Balkan economy with structural plans to phase out coal, North Macedonia is also largely investing in renewables and gas-fired power capacity as a transitional fuel with a projected EUR 3.1 billion investment plan to establish approximately 1 600 MW of solar power plants, 600 MW of wind farms and 333 MW of hydropower plants. Other energy-efficient infrastructural projects are also on the agenda, such as a EUR 110 million investment for a 123 km-long gas interconnector pipeline with Greece that will have the capacity to transport roughly 1.5 billion cubic metres of natural gas annually (EBRD, 2022[5]).

Although the financial sector in North Macedonia saw poor performance in 2020 due to the pandemic, it sustained a decent recovery throughout 2021. Bank lending increased by 5.8% and 7% in Q3 and Q4, respectively, with credit growth during Q3 rising to 7.8% at the household level and 4% at the corporate level, while the non-performing loans ratio saw a minimal decrease of 0.2 percentage points since the previous year, settling at 3.1% in 2021 (European Commission, 2022[7]). Consumer prices increased by 8.8% month on month in March 2022, while the annual increase in 2021 was 3.2% compared to December 2020, influenced primarily by index increases on transport by 9%, restaurants and hotels by 5.9% and alcoholic beverages, tobacco and narcotics by 3.8%. Moreover, retail prices increased by 6% month on month in December 2021, while the annual increase was 4.3% compared to December 2020, primarily due to increases in non-food industrial products, tobacco and agriculture products (MAKStat, 2022[8]).

Table 17.1. North Macedonia: Main macroeconomic indicators (2018-21)

|

Indicator |

Unit of measurement |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|---|---|---|---|---|---|---|---|

|

GDP growth1 |

% year-on-year |

2.8 |

1.2 |

2.8 |

3.9 |

-6.1 |

4.2 |

|

National GDP2 |

EUR billion |

9.466 |

10.03 |

11.25 |

11.182 |

10.879 |

.. |

|

GDP per capita growth2 |

% year-on-year |

2.7 |

1 |

2.8 |

3.9 |

-6.1 |

.. |

|

Inflation1 |

% average |

-0.2 |

1.4 |

1.5 |

0.8 |

1.2 |

3.2 |

|

Government balance1 |

% of GDP |

-2.7 |

-2.7 |

-1.8 |

-2 |

-8.2 |

-5.4 |

|

Current account balance1 |

% of GDP |

-2.9 |

-1.0 |

-0.1 |

-3.3 |

-3.4 |

-3.5 |

|

Exchange rate MKD/EUR1 |

Value |

61.6 |

61.57 |

61.51 |

61.51 |

61.67 |

61.63 |

|

Exports of goods and services1 |

% of GDP |

50.9 |

54.9 |

60.2 |

61.9 |

58.9 |

65.9 |

|

Imports of goods and services1 |

% of GDP |

66.2 |

69 |

72.9 |

76.2 |

71.9 |

81.9 |

|

Net foreign direct investment (FDI)1 |

% of GDP |

3.3 |

1.8 |

5.6 |

3.2 |

1.5 |

3.7 |

|

External debt stocks2 |

% of gross national income (GNI) |

73.3 |

78.7 |

71.3 |

74.7 |

89.9 |

.. |

|

International reserves of the National Bank1 |

EUR million |

2 613 |

2 336 |

2 867 |

3 263 |

3 360 |

3 643 |

|

Gross international reserves1 |

Ratio of 12 months imports of goods and services moving average |

4.9 |

4.1 |

4.4 |

4.6 |

5.3 |

4.5 |

|

Unemployment1 |

% of the total population |

23.8 |

22.6 |

21.0 |

17.5 |

16.6 |

15.8 |

Despite the significant impact of the COVID‑19 pandemic on the economy, North Macedonia’s unemployment rate has continued to decrease, following a decade-long trend, settling at 16.6% in 2020 due in part to significant fiscal support provided to FDI and domestic companies in the post-pandemic period (OECD, 2021[10]). The unemployment rate further decreased to 15.3% ( (European Commission, 2022[7])) in the fourth quarter of 2021. However, continuous progress in the overall labour force participation shadows underlying disproportionalities and inequalities, particularly concerning employment setbacks of youth and women. The 0.6% rise in the labour force and 0.7% year-on-year rise in the activity rate of the working-age population in 2020 overshadows the ‑1% drop in the female workforce and a slight decline in overall female activity rates (European Commission, 2021[11]). Women in North Macedonia were also hit particularly hard during the pandemic due to high participation in some of the most affected sectors, such as healthcare and the informal economy, and disproportionally increased home responsibilities among the majority of women (United Nations, 2021[12]). Youth unemployment also faced setbacks in 2020, rising to 35.4% for those 15‑24 years, while employment declined by 16% year on year for the same age group (European Commission, 2021[11]). Unemployed youth in the 15‑19 year age group decreased to pre-pandemic levels in 2021 after almost doubling in 2020, while unemployed youth in the 19‑24 year age group remains approximately 50% higher than pre-pandemic levels in 2019 after a 150% increase in 2020 (Employment Service Agency, 2022[13]). Moreover, the share of long-term unemployed in North Macedonia is steep (74% of all unemployed in 2021), and the long-term unemployment rate as of 2017 was over six times higher than in the European Union (17.4% vs 2.4%) (Employment Service Agency, 2022[13]; MAKStat, 2018[14]; Eurostat, 2020[15]).

Box 17.1. North Macedonia’s COVID‑19 recovery programme

As part of its recovery, North Macedonia adopted five economic support packages to mitigate the impact of COVID‑19, the first having been launched in March and April 2020, with the last having been presented in April 2021 in the amount of EUR 17.8 million. The cumulative sum of economic support packages totalled approximately EUR 1 billion for both short and long-term fiscal measures to maintain the liquidity of companies and jobs and support the financial sustainability of the economy and municipalities. Since the start of the pandemic, the government has implemented 106 policy measures covering financial, macroeconomic, banking and trade interests as well as movement, sanitary and health infrastructure changes to mitigate the effects of the pandemic:

Subsidies: In order to preserve existing jobs and create new opportunities, North Macedonia provided financial assistance to companies affected by the crisis through monthly employment subsidies of between approximately EUR 235 and EUR 350 and 50% of salary contributions for employees in the tourism, transport, hospitality and other sectors affected by the pandemic.

Financial support to citizens: The economy also implemented several cash support programmes to increase consumption and development of domestic economic activities, such as vouchers of MKD 3 000‑6 000 for domestic tourism and purchases of Macedonian products and services, as well as vouchers of up to MKD 30 000 for trainings and courses for information technology (IT) and digital skills for those aged 16‑29. Vulnerable groups, such as single parents, pensioners, passive job seekers, students, those over 64 years, independent artists, film workers, cultural workers and artists, also received payment cards worth a total of EUR 27.6 million.

Tax measures: North Macedonia’s tax response to COVID‑19 was largely in line with other European economies, with exemptions of personal and corporate income taxes for self-employed, SMEs and enterprises COVID‑19 susceptible sectors as well as reductions on import duties for sought after products like raw materials. The economy also implemented reductions of value-added tax (VAT) for restaurants, artisans, food and beverage services and exemptions of VAT for public donations, as well as a unique “weekend without VAT” under which more than 350 000 citizens were able to buy domestic products, services, computers and IT equipment worth up to MKD 30 000 without VAT for a period of three days, stimulating an injection of over EUR 170 million back into the economy.

Credit lines: The Development Bank of North Macedonia provided an interest-free credit line worth EUR 54 million to all micro and small companies, which also offered a 30% grant for those companies that are run or founded by women, employ young people, are export-oriented or introduce innovation and digitalisation in their operations. The Development Bank of North Macedonia initially set up a EUR 5.7 million credit support (KOVID‑1) option for SMEs in the form of interest-free loans with a 3-year repayment period and a grace period of 12 months. Under this scheme, microenterprises received loans between EUR 3 000 and EUR 5 000, small enterprises between EUR 10 000 and EUR 15 000 and medium enterprises between EUR 15 000 and EUR 30 000. A second credit line (KOVID‑2) worth EUR 8 million, a third credit line (KOVID‑3) co-funded by the European Union worth EUR 31 million, and a fourth credit line (KOVID‑4) worth EUR 10 million were later opened to all industries impacted over 30% of revenues by the pandemic, specifically targeting enterprises in the field of tourism, transport, catering and event industry, private health facilities, sole proprietors and craftspeople from all industries.

Although numerous short-term economic support measures helped mitigate immediate economic damage, structural issues were exacerbated by the pandemic and remain key areas in need of reforms. In this regard, COVID‑19 identified significant persistent challenges to North Macedonia’s structural reform agenda, primarily with regard to further integration into global chains of higher technological value, continued clarification of the regulatory environment, increased innovation and logistical framework for its support, and support for moving towards sustainable energy infrastructure.

Sources: OECD (2021[10]; 2021[16]); Government of North Macedonia (2022[17]); European Commission (2021[18]; 2021[19]).

Business environment trends

The business environment in North Macedonia has seen some improvement since the last assessment, notably in reducing and clarifying the para-fiscal fees imposed on businesses by establishing a consolidated digital register of charges based on a comprehensive catalogue of electronic services provided on its e-portal. In an effort to streamline the number and complexity of charges for businesses, the government established a dedicated website that contains a clear list and value of the 377 para-fiscal charges that exist in the economy, but the burden is still to be reduced (European Commission, 2021[11]). North Macedonia also upgraded its national e-portal to include a total of 184 services, increasing public access and moderately improving the overall regulatory environment, which remains one of the most open economies for investment according to the OECD FDI Regulatory Restrictiveness Index. Its score remained 0.026 in 2020, significantly lower than the OECD average of 0.064, indicating that the economy has lessened barriers to trade and maintains only a handful of reciprocity restrictions, notably in the real estate and legal sectors (OECD, 2020[20]). Moreover, as the government provided major support packages during the pandemic, changes to the transparency of finances were also implemented. Information on fiscal measures and transactions, including amounts and beneficiaries, were made available on line, as was a clear overview of the implementation of financial aid packages. The economy’s positive trend in public administration transparency has been reflected in its score in Transparency International’s Corruption Perception Index, which has increased four positions since 2021 and is now 89th place out of a total of 180 ranked economies (Transparency International, 2022[21]).

Although improving, the development of North Macedonia’s business environment is still hampered by several key structural deficiencies and obstacles, which are acknowledged in the latest Economic Reform Programme (2021-2023) (Box 17.2) as well as the national SME Strategy (2018-2023). North Macedonia’s legal and regulatory environment remains complex and difficult for enterprises and investors alike to navigate, leading to inefficiencies in business support and development services. Institutional factors such as over-burdensome time and costs of contract enforcement, inefficient customs, unfair competition and limited use of alternative dispute resolution mechanisms continue to adversely impact the ease of doing business in the economy (OECD, 2021[10]). Financial challenges remain a substantial impediment for businesses, particularly access to finance for SMEs, as credit risks remain high, alternative financing options remain limited and traditional financing institutions continue to require heavy collateral and credit histories. While North Macedonia has made progress in improving access to finance through the Fund for Innovation, the gap still remains significant, especially in the context of limited private-sector alternatives to bank finance (OECD, 2021[10]). Moreover, although a new bankruptcy law is under preparation, institutional and legal obstacles such as public administration transparency and unnecessary time and costs for dispute proceedings are still an impediment to a conducive business environment (European Commission, 2021[11]).

The informal economy in North Macedonia, notably in the agriculture, construction, household services, wholesale and retail trade sectors, is the predominant impediment to a hospitable business environment., with some estimates as high as 37.6% of GDP and putting informal employment as high as 43% (World Bank, 2017[22]). The skills, expertise and powers of tax officials, judicial efficiency, contract enforcement, transparency and lack of digital services remain key barriers to reducing the size of North Macedonia’s informal economy. The large grey economy creates strong competition for registered businesses and erodes a potential tax revenue base to fund public programmes. Employees in North Macedonia’s informal workforce also suffered disproportionally, particularly during the COVID‑19 pandemic, as businesses were excluded from support packages and the workforce did not qualify for wage subsidies. The impact of the North Macedonia’s informal economy, historically functioning through unregistered labour, partially undeclared wages, irregularities in the enforcement of the Labour Relations Act, non-issuance of tax receipts or invoices, and underreported turnover is now compounded by freelance work and digital services that remain difficult to follow. Although positive steps have been taken to increase the employability of the young workforce through the introduction of a dual VET project and plans to shorten the conversion period for contract permanence, the competitiveness of local companies will continue to be dependent on higher investments in human and physical capital (European Commission, 2021[11]).

Box 17.2. Economic Reform Programmes

Since 2015, EU accession candidates have been obliged to produce annual Economic Reform Programmes (ERPs) that outline clear policy reform objectives and policies necessary for participation in the economic policy co-ordination procedures of the European Union. The ERPs aim to produce concrete reforms that foster medium and long-term economic growth, achieve macroeconomic and fiscal stability and boost economic competitiveness. Since their initial launch, ERP agendas have been required to include structural reform objectives in key fundamental areas:

public finance management

energy and transport markets

sectoral development

business environment and reduction of the informal economy

trade-related reform

education and skills

employment and labour markets

social inclusion, poverty reduction and equal opportunities

In addition to these essential fields, and as the objectives of EU policies continue to evolve to include cross-cutting sustainable sectors, the structural reform agendas of ERPs have embraced new commitments to progressive policy reforms since the last assessment that also cover:

green transition

digital transformation

research, development and innovation

economic integration reforms

agriculture, industry and services

healthcare systems.

Once submitted by the governments, ERPs are assessed by the European Commission and European Central Bank, opening the door for a multilateral policy dialogue with enlargement candidates to gauge their progress and priority areas on their path to accession. Discussions and assistance on policy reforms take place through a high-level meeting between member states, EU institutions and enlargement economies, through which participants adopt joint conclusions that include economy-specific guidance for policy reform agendas.

The findings of the SME Policy Index 2022 provide an extensive technical understanding of the progress made on business sector-related policy reforms that are key to the ERPs of the EU accession candidates at both the regional and economy-specific levels. The SBA delves into the specific barriers to progress in ten policy areas essential to applying the larger objectives of the ERPs, like boosting competitiveness and economic growth to SMEs in the region.

Sources: European Commission (2021[19]); IMF (2019[23]).

EU accession process

North Macedonia was the first Western Balkan economy to sign a Stabilisation and Association Agreement (SAA) with the European Union in 2001, setting higher political, economic, trade and human rights reform principles that paved the way for the economy to align itself with the EU standards. Although the European Council had continuously recommended opening accession negotiations with North Macedonia since 2009, efforts to move the economy past candidate status, which it has held since 2005, were hindered by bilateral challenges concerning cultural, historical and linguistic disputes with Greece and Bulgaria.

After demonstrating its determination to advance the EU reform agenda and delivering tangible and sustained results, North Macedonia was the last of the five WBT economies to enter accession negotiations in March 2020, followed by a presentation of a draft negotiating framework to the member states in July 2020 (European Commission, 2021[11]). Although North Macedonia has yet to open any EU acquis negotiating chapters, bilateral co-operation with the European Union is expected to result in five working groups to establish a roadmap to accelerate the process of holding the first Intergovernmental Conference of North Macedonia with the European Union to open the chapters for memberships. Aside from a moderate increase in the level of preparation regarding Judiciary, and Fundamental Rights from some level of preparation to moderately prepared, no changes in the degrees assigned to North Macedonia’s preparation of the chapters have been noted since the 2018 enlargement report. In 2021, the European Union adopted a revised enlargement methodology that emphasises credible fundamental reforms, stronger political steer, increased dynamism and predictability of the process, which will automatically apply to the negotiation procedures of the most recent accession candidates, North Macedonia and Albania (European Commission, 2020[24])

According to the European Union’s 2021 enlargement report for North Macedonia, the economy is moderately prepared on enterprise and industrial policies that help encourage a hospitable environment for SMEs. The economy has done well to support the business sector during the COVID‑19 pandemic with EUR 1.2 billion in assistance and restructured 370 para-fiscal changes that adequately supported the business sector’s recovery. However, North Macedonia’s enterprise and industrial policies are often overlapping in legislation and mandates of competent authorities leading to a complex and inefficient regulatory environment, while the Economic Growth Plan lacks impact indicators as well as systematic evaluation mechanisms that help reflect the needs of the business community (European Commission, 2021[11]). In this regard, North Macedonia should concentrate on:

consolidating the institutional structure and mandates of the public bodies to ensure effective implementation, monitoring and evaluation of the strategies and policy measures

continuing to implement, assess and renew the strategy and action plan to formalise the informal economy, with specific attention to its business environment component

developing measures to increase the capacity of domestic companies to integrate into GVCs.

Further progress in the accession process will strongly depend on improved bilateral relations and co-operation on the 2017 Friendship Treaty with Bulgaria, as well as further alignment on benchmarks concerning the internal market and resource management set out in Chapters 2 and 33 on Freedom of Movement for Workers and Financial and Budgetary Provisions, respectively. The findings and recommendations published in the SME Policy Index 2022 can help provide the monitoring and guidance needed for North Macedonia to harmonise its regulatory framework with that of the acquis, meet the requirements of the accession chapters once they are officially opened and ultimately further its negotiations for entry to the European Union.

EU financial support

The European Union is the largest provider of financial assistance to North Macedonia, helping the economy in implementing reforms that bring it closer to the acquis, particularly concerning strengthening the rule of law and improving public administration. The European Union’s financial support to the economy and the region has been provided through both temporary support such as COVID‑19 assistance packages as well as long-term investment programmes and funds through the Instrument for Pre-accession Assistance (IPA), European Investment Bank loans, Western Balkans Investment Framework grants and more.

In addition to a total of EUR 1.2 billion provided to North Macedonia by the European Union between 2007 and 2020 under the IPA I and II, the European Union is providing an additional EUR 14.2 billion to the region under IPA III for the period 2021‑27 to improve rule of law, fundamental rights and democracy; increase good governance, acquis alignment, good neighbourly relations and strategic communication; speed up the green agenda transition and sustainable connectivity; increase competitiveness and inclusive growth; and support territorial and cross-border co-operation (European Commission, 2021[25]). The new IPA funding also contributes to the joint European Union and European Bank for Reconstruction and Development (EBRD) Western Balkans SME Competitiveness Support Programme that assists privately owned North Macedonian SMEs in meeting new EU regulations and understanding the improvement requirements in the field of environmental protection, occupational health and safety and product quality and safety through financing options (EBRD, 2021[26]). In addition to loan and grant opportunities under the programme, SMEs benefit from tailor-made technical assistance and know-how for project preparation and implementation, as well as grant incentives worth up to 15% of the total loan amount on successful project completion.

In 2020, the European Union pledged EUR 9 billion for the Western Balkans as part of a new economic and investment plan to support sustainable connectivity, human capital, competitiveness and inclusive growth, and the twin green and digital transition. In addition to infrastructural funding for North Macedonia’s rail corridors with Serbia, Croatia and Bulgaria, significant wind park and solar power plant investments will be advanced in an effort to present North Macedonia’s renewable energy landscape as a potential replicable example for the region. Furthermore, the European Union’s support on a gas interconnection with Kosovo1 and Serbia will help the economy’s transition from coal, while funding for updated waste management systems will support sustainable and green infrastructure solutions. North Macedonian SMEs will also be able to benefit from the scheme’s increased funding to the Western Balkans Guarantee Facility with the aim to strengthen the competitiveness of SMEs, enhance employment creation for youth in particular, and support innovation and green growth (European Commission, 2020[27]).

The European Union has been crucial in financially supporting the Western Balkans and North Macedonia in the wake of COVID‑19. North Macedonia received EUR 220 million in grants and financing from the European Commission’s EUR 3 billion Macro-Financial Assistance (MFA) package for enlargement and neighbourhood partners that aims to help them limit the economic fallout of the COVID‑19 pandemic. The economy received the second MFA payment in June 2021 after fulfilling the programme’s policy conditions to strengthen fiscal governance and transparency, fight corruption, enhance financial sector supervision, improve the business environment, and tackle youth unemployment (European Commission, 2020[28]). North Macedonia has also been the recipient of EUR 144 million of the European Union’s Team Europe EUR 3.3 billion COVID‑19 economic recovery support package to the region (EIB, 2021[29])

North Macedonia was also the third candidate economy to join the European Union’s Competitiveness of Enterprises and Small and Medium-Sized Enterprises Programme (COSME) in 2015, under which it benefits from support for entrepreneurship and entrepreneurial culture, access to finance for SMEs and access to markets (European Commission, 2020[30]). The economy has also participated in the European Union’s Research and Innovation programmes since 2007 and is part of the Horizon 2020 programme, allowing North Macedonia access to the project’s EUR 95.5 million budget to help develop projects and technologies and conduct research and activities that will contribute to tackling global challenges. The economy has ramped up investments in the set-up of Technology Parks and Business Accelerators and possesses particular strengths in the fields of energy and health innovation. North Macedonia’s participation in the SMEs portion of Horizon 2020 is particularly high, with 909 applications, 122 participants and 92 signed grants for a total of EUR 14.8 million of EU funding distributed primarily to private for-profit enterprises (35.4%), followed by higher or secondary education institutions (26.3%), and research organisations (18.6%). In 2021, the economy signed an additional Association Agreement to the Horizon Europe programme, promoting closer research and innovation co-operation with the European Union (European Commission, 2021[31]).

SMEs in the domestic economy

The classification of SMEs in North Macedonia remains unchanged since the last assessment and is defined by Article 470 of the Law on Trade Companies (Official Gazette of the Republic of North Macedonia, No. 215/21). The categories conform to the EU standard definition of SMEs by employee size but diverge on the other criteria concerning annual income and assets (Table 17.2).

Table 17.2. Definition of micro, small and medium-sized enterprises in North Macedonia

|

|

EU definition |

North Macedonia definition |

|---|---|---|

|

Micro |

< 10 employees = EUR 2 million turnover or balance sheet |

< 10 employees ≤ EUR 50 000 gross annual income |

|

Small |

< 50 employees = EUR 10 million turnover or balance sheet |

< 50 employees < EUR 2 million annual income or < EUR 2 million average total assets |

|

Medium-sized |

250 employees = EUR 50 million turnover = EUR 43 million balance sheet |

< 250 employees < EUR 10 million annual income or < EUR 11 million average total assets |

Source: Assembly of North Macedonia (2021[32]).

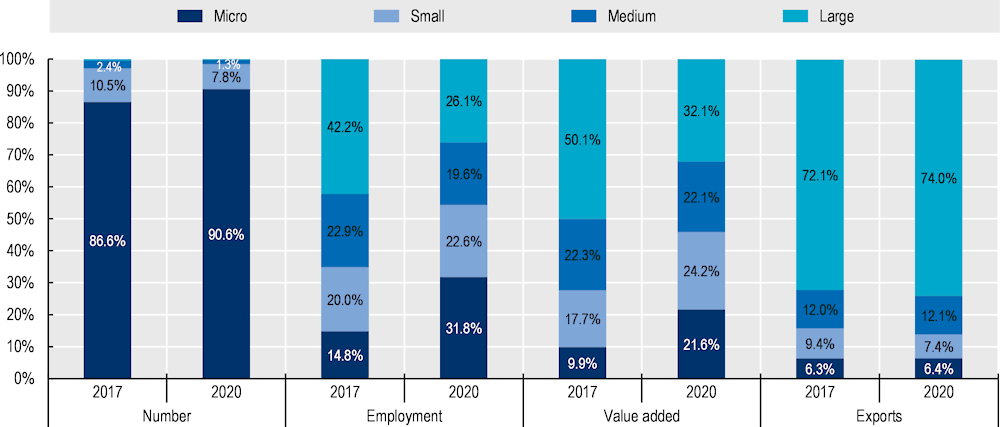

The breakdown of North Macedonian enterprises by size was 99.3% micro and small enterprises, 0.6% medium enterprises and only 0.1% large enterprises in 2020 (MAKStat, 2021[2]). In terms of enterprise size, microenterprises with fewer than ten employees dominate (90.6%), and most of them are in the field of trade. With 31.8% of the total employees hired, they created 21.6% of the total value added (Figure 17.2). Large enterprises with a share of only 0.3% and with engaged 26.1% of the employees generate 32.1% of the total added value within the business sector, mainly in the manufacturing sector (14.0%). However, small and medium enterprises hired 42.1% of the employees and created 46.3% of the total value in the business sector. In 2020, 74% of North Macedonia’s formal workforce was employed by micro, small and medium-sized enterprises (MSMEs) and created approximately 68% of the total value in the business sector, a 2% increase from 2019 and 7% increase from 2018 (MAKStat, 2021[2]).

Regarding fluctuations in business demography, the number of enterprises by size and employment remained largely stable between 2017 and 2020. On the other hand, micro and small enterprises increased their value added to GDP since the last assessment, albeit slightly by roughly 11.7 and 6.5 percentage points respectively. Medium enterprises noted a small contraction of 0.2 percentage points, while the value-added to GDP generated by large enterprises decreased by approximately 20 percentage points since 2017. Exports by enterprise size saw small but mixed changes, with microenterprises recording a 0.1 percentage point increase while large enterprises saw a rise of approximately 2 percentage points in exports from 2017 to 2020. Conversely, small enterprises noted a contraction of 2 percentage points, while medium enterprises’ share of exports remained relatively constant. The role of women in the North Macedonian business environment is improving, with 20% of owners or managers in the IT sector being women, followed by engineering and food processing with 12% and all other industries with numbers below 7% (Innovation and Technology Fund, 2021[33]).

Figure 17.2. Business demography indicators in North Macedonia (2017 and 2020)

Source: Statistical Office of North Macedonia.

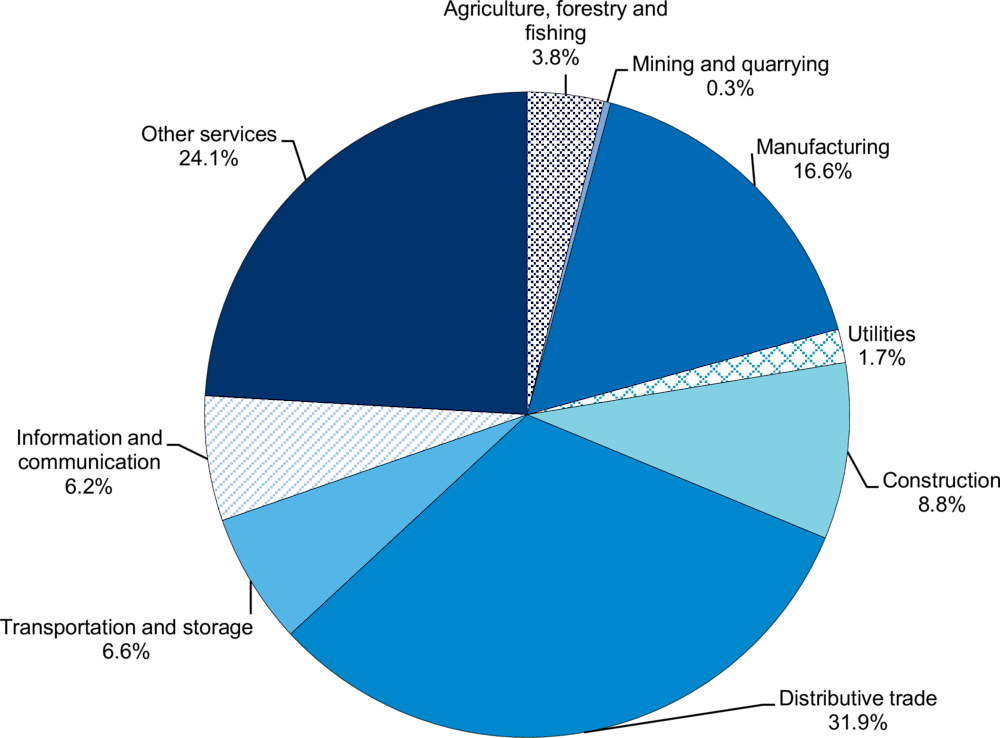

North Macedonia has seen slight changes in the sectoral distribution of SMEs since 2017 (Figure 17.3). The distributive trade sector, which includes wholesale, retail trade, and the repair of motor vehicles and motorcycles, remains the overwhelming industry of SMEs in the economy at 36.40% but saw the greatest decrease in the number of enterprises since 2017, at a 2.6% decline. Other services follows as the second-highest number of SMEs in North Macedonia and witnessed a slight 1% increase in the number of enterprises since 2017. Minor increases were also noted in the information and communication, manufacturing, utilities, and mining and quarry sectors, albeit all under a 1% difference.

Figure 17.3. Sectoral distribution of SMEs in North Macedonia (2020)

Note: Data for agriculture was unavailable for the year 2020. The sector classification generally follows the Statistical Classification of Economic Activities in the European Community (NACE) Rev.2 classification of productive economic activities with the following exceptions: “Utilities” represents the sum of “Electricity, gas, steam and air conditioning supply” (D) and “Water supply, sewerage, waste management and remediation activities” I; “Distributive Trade” covers “Wholesale and retail trade; repair of motor vehicles and motorcycles” (F); and Other Services here consists of (I) Accommodation and food service activities, (L) Real estate activities, (M) Professional, scientific and technical activities, (N) Administrative and support service activities as well as (S) Other service activities. For more information, consult NACE Rev. 2 Classification.

Source: Statistical Office of North Macedonia

Geographically, about 39% of enterprises were located in Skopje in 2020, followed by 11.51% in the municipality of Polog and 10.95% in Pelagoina (Table 17.3). The number of enterprises in Skopje increased by approximately 1 600 from 2017 to 2020, a growth of 5.9%. With the exception of Polog, where the number of enterprises increased by 3.45%, the share of businesses in other districts remained largely unchanged between 2017 and 2020, with variations of under 1.8%. Nevertheless, the number of microenterprises in the entire territory of North Macedonia increased by approximately 1 460, or 90% of the total increase in businesses since 2017.

Table 17.3. Number of registered companies in North Macedonia by enterprise size and district (2020)

|

District |

Year |

Enterprise size, by employment |

Share of total number of enterprises |

||||

|---|---|---|---|---|---|---|---|

|

0*-9 |

10-49 |

50-249 |

250+ |

Total |

|||

|

Skopje |

2017 |

23 908 |

2 333 |

564 |

142 |

26 947 |

37.73% |

|

2020 |

25 393 |

2 405 |

607 |

143 |

28 548 |

39.07% |

|

|

Vardar |

2017 |

4 913 |

352 |

106 |

12 |

5 383 |

7.54% |

|

2020 |

4 851 |

350 |

104 |

13 |

5 318 |

7.28% |

|

|

East |

2017 |

4 950 |

464 |

180 |

21 |

5 615 |

7.86% |

|

2020 |

4 906 |

474 |

168 |

17 |

5 565 |

7.62% |

|

|

Southwest |

2017 |

6 711 |

408 |

109 |

10 |

7 238 |

10.13% |

|

2020 |

6 743 |

399 |

115 |

11 |

7 268 |

9.95% |

|

|

Southeast |

2017 |

5 365 |

483 |

110 |

12 |

5 970 |

8.36% |

|

2020 |

5 231 |

512 |

110 |

12 |

5 865 |

8.03% |

|

|

Pelagoina |

2017 |

7 392 |

515 |

131 |

26 |

8 064 |

11.29% |

|

2020 |

7 330 |

512 |

131 |

24 |

7 997 |

10.95% |

|

|

Polog |

2017 |

7 612 |

398 |

100 |

8 |

8 118 |

11.37% |

|

2020 |

7 849 |

451 |

101 |

7 |

8 408 |

11.51% |

|

|

Northeast |

2017 |

3 695 |

302 |

82 |

5 |

4 084 |

5.72% |

|

2020 |

3 710 |

302 |

74 |

6 |

4 092 |

5.60% |

|

|

North Macedonia |

2017 |

64 546 |

5 255 |

1 382 |

236 |

71 419 |

100.00% |

|

2020 |

66 013 |

5 405 |

1 410 |

233 |

73 061 |

100.00% |

|

Assessment

Description of the assessment process

The SBA assessment cycle was virtually launched on 7 July 2021, when the OECD team shared the electronic assessment material, comprised of questionnaires and statistical sheets, accompanied by explanatory documents.

Following the virtual launch, the Ministry of Economy, which acts as the SBA Co-ordinator nominated by the European Commission, distributed the link to the assessment material to the appropriate ministries and government agencies and the statistical sheets to the Statistical Office of North Macedonia (MAKSTAT). These institutions compiled the data and documentation between July and September 2021 and completed the questionnaires. Each policy dimension was given a self-assessed score accompanied by a justification. The OECD team received the completed questionnaires and statistical data sheets on 15 October 2021 and then began an independent review.

The OECD reviewed the inputs and requested additional information on certain elements from the Ministry of Economy. For several dimensions, virtual consultation meetings with key dimension stakeholders were organised from end-October to mid-November 2021. The meetings aimed to close any remaining information gaps in the questionnaires.

A virtual preliminary findings meeting with North Macedonia was held on 2 December 2021 to present and discuss the preliminary SME Policy Index 2022 assessment findings and initial recommendations for North Macedonia. At the same time, it served as an opportunity to seek the views of a broad range of policy stakeholders on how SMEs are affected by current policies and to gauge what more can be done across different policy areas to improve SMEs’ performance and competitiveness in North Macedonia, particularly in the post-COVID‑19 context.

The meeting allowed the OECD to validate the preliminary assessment findings. The draft SME Policy Index publication and the Economy Profile of North Macedonia were made available to the Government of North Macedonia for their review and feedback during February and early March 2022.

Scoring approach

Each policy dimension and its constituent parts are assigned a numerical score ranging from 1 to 5 according to the level of policy development and implementation, so that performance can be compared across economies and over time. Level 1 is the weakest and Level 5 the strongest, indicating a level of development commensurate with OECD good practice (Table 17.4). For further details on the SME Policy Index methodology and how the scores are calculated, as well as changes in the last assessment cycle, please refer to Annex A.

Table 17.4. Description of score levels

|

Level 5 |

Level 4 plus results of monitoring and evaluation inform policy framework design and implementation. |

|

Level 4 |

Level 3 plus evidence of a concrete record of effective policy implementation. |

|

Level 3 |

A solid framework addressing the policy area concerned is in place and officially adopted. |

|

Level 2 |

A draft or pilot framework exists with some signs of government activity to address the policy area concerned. |

|

Level 1 |

No framework (e.g. law, institution) exists to address the policy topic concerned. |

Entrepreneurial learning and women’s entrepreneurship (Dimension 1)

Introduction

Entrepreneurial learning raises learners’ skills and develops the mindsets needed to change their lives and the world around them through entrepreneurial action for social and economic impact. It is the basis for empowering learners to know they can generate the creative ideas needed in the 21st century.

Women’s entrepreneurship should be prioritised to support women’s economic and social empowerment and drive improved stability and social and economic growth. It can also enable closing gender gaps in the workforce, supported by equality and gender impact analysis of policies affecting family care and social protection.

North Macedonia scored 2.39 for this dimension. During this assessment period, the economy has seen forward development in some areas, notably in the planning and designing of women’s entrepreneurship. However, the progress was more limited in the area of entrepreneurial learning resulting in a slightly lower score than in the previous assessment when it achieved a score of 2.48 (Table 17.5).

Table 17.5. North Macedonia’s scores for Dimension 1: Entrepreneurial learning and women’s entrepreneurship

|

Dimension |

Sub-dimension |

Thematic block |

North Macedonia |

WBT average |

|---|---|---|---|---|

|

Dimension 1: Entrepreneurial learning and women’s entrepreneurship |

Sub-dimension 1.1: Entrepreneurial learning |

Planning and design |

3.11 |

3.43 |

|

Implementation |

2.42 |

3.51 |

||

|

Monitoring and evaluation |

1.00 |

2.73 |

||

|

Weighted average |

2.34 |

3.33 |

||

|

Sub-dimension 1.2: Women’s entrepreneurship |

Planning and design |

2.60 |

3.97 |

|

|

Implementation |

2.96 |

3.83 |

||

|

Monitoring and evaluation |

1.00 |

3.11 |

||

|

Weighted average |

2.46 |

3.73 |

||

|

North Macedonia’s overall score for Dimension 1 |

2.39 |

3.49 |

||

Note: WBT: Western Balkans and Turkey.

State of play and key developments

The lagging development of education and training connected to entrepreneurial learning, as observed during the last assessment period, has continued. Some positive developments include reforms of the VET curriculum, which has seen enhanced inclusion of the entrepreneurship key competence, underpinned by EntreComp. The Innovation and Technology Fund has also introduced new support to expand programmes that foster entrepreneurial learning. Other developments are more limited, with little practical guidance available for teachers and fragmented pre-service and in-service training. There is also no evidence of an expanded focus on career guidance or higher education.

Progress can be seen in women’s entrepreneurship with the launch of a new Strategy for Women Entrepreneurship Development (2019-2023) (Government of North Macedonia, 2018[36]) alongside a Memorandum of Co-operation between the government and the new National Platform for Women’s Entrepreneurship. There is limited evidence, however, of active engagement through this memorandum and no regular monitoring or evaluation of actions set out in the new strategy (Table 17.6).

Table 17.6. North Macedonia’s implementation of the SME Policy Index 2019 recommendations for Dimension 1

|

2019 recommendation |

SME Policy Index 2022 |

|

|---|---|---|

|

Main developments during the assessment period |

Progress status |

|

|

Reactivate the established co‑ordination mechanisms |

There have been no developments during this assessment period in re-establishing co‑ordination mechanisms relevant to entrepreneurial learning. |

No progress |

|

Build teachers’ capacity to provide competence-oriented education |

In 2019, the Bureau for Development of Education provided training for 2 000 teachers, and there is more recent evidence of teacher training to support the recent VET curriculum reforms. Wider examples are fragmented and are not system-level. |

Moderate |

|

Enhance the ability of career guidance professionals to provide entrepreneurship-oriented advice |

There is evidence of integrating career guidance content into VET programmes. Progress does not appear to have been made at other levels of education. |

Limited |

|

Establish a formal co‑operation mechanism for women’s entrepreneurship |

Progress has been made through the signing of a Memorandum of Co-operation with the new National Platform for Women’s Entrepreneurship formed in 2020 to support the new Strategy for Women Entrepreneurship Development (2019-2023). |

Moderate |

A national policy focus on lifelong entrepreneurial learning should be reactivated

An Entrepreneurial Learning Strategy (2014-2020) (Government of North Macedonia, 2014[37]) was developed through a multi-stakeholder approach with the National Partnership for Entrepreneurial Learning. However, there has been no active implementation of this strategy since the last assessment period, and the mandate of the National Partnership expired in 2016. This has had a negative impact on the implementation of wider policies that highlighted this strategy as the main implementation route supporting actions for entrepreneurship education. The entrepreneurship key competence is highlighted within the 2018-2025 Education Strategy (Government of North Macedonia, 2018[38]), but there are no concrete actions attached to this area of work and the narrative within this document was linked to the now-defunct Strategy for Entrepreneurial Learning. More recent developments have also included reference to the entrepreneurship key competence.

The entrepreneurship key competence is not consistently introduced across all levels of education, training policy or curricula

Entrepreneurship education is delivered through a mix of mandatory or elective courses or as a cross-curricular competence. At the primary level, including lower secondary, the 2021 National Standard for Primary Education for first to ninth grades includes Technics, Technology and Entrepreneurship as the seventh cross-curricular competence area. It states that this competence should be delivered by being transformed into learning outcomes and associated assessment standards and included within most mandatory and elective courses. However, the Innovation course introduced in 20152 has been removed from the elective courses mentioned within this standard (Government of North Macedonia, 2021[39]).3 There is a lack of information on how the cross-curricular competence defined in the new National Standard will be practically implemented into primary school teaching and learning through the cross-curricular approach.

In upper secondary education, entrepreneurship education continues to be included in elective courses for the first to third year and as a compulsory course in the fourth year, which is unchanged since the previous assessment period. In VET, the entrepreneurship key competence continues to be included in both professional and career education courses. Recently, this was expanded with the design of a new elective course providing practical entrepreneurial experiences through student engagement in student companies (Centre for Vocational Education and Training, 2021[40]), which used EntreComp to assist in developing the entrepreneurial learning outcomes. This offers a link to the themes of social innovation, social entrepreneurship and citizenship and was designed to allow active co-operation with municipalities and the business sector. The Junior Achievement Company Programme is now accessible for all VET schools.4 There is limited evidence of new developments within the higher education curriculum.

Alongside these core curriculum approaches, new support for entrepreneurship education has been introduced through the Innovation and Technology Fund, set up by the government to drive innovation activity. The Innovation and Technology Fund also set up The Young Minds Fund5 to expand education programmes that develop innovation, creativity, and technology skills. It also funded established programmes, such as the innovative UpShift6 programme, which delivers Sustainable Development Goals impact and social entrepreneurship learning through extra-curricular non-formal education in association with the United Nations Children’s Fund (UNICEF); and Junior Achievement,7 a programme supporting companies run by students in secondary education and VET. Junior Achievement collaborates with system-level stakeholders, including the Ministry of Education and the Bureau for Development of Education, and delivers student company programmes alongside teacher and leadership training. These programmes are not present in all schools, however, and the impact of this work is not reported.

Practical guidance should support the introduction of entrepreneurship as a cross-curricular competence

Alongside training, there is a need for system-level guidance to support teachers in the practical implementation of the entrepreneurship key competence as a cross-curricular key competence. Previously, the entrepreneurship key competence was introduced through stand-alone courses linked to innovation and entrepreneurship with textbooks available to support the curriculum.8 The move to entrepreneurship as a cross-curricular competence entails a new focus on teachers to deliver this within most or all curricular areas, but there is limited evidence of plans to develop practical guidance to support this.

Pre-service and in-service teacher training to support the entrepreneurship key competence is fragmented

Training provision has been fragmented at all stages of teacher professional development. There is no current evidence of plans to introduce system-level training available to all teachers to support them in implementing entrepreneurship education. Previously, the Bureau for Development of Education9 provided training in 2019 for 2 000 teachers on key competences, including the entrepreneurship key competence. Supported by the Innovation Fund, Junior Achievement North Macedonia delivered teacher training, but it was not available to all educators. European Erasmus+-funded initiatives, such as EntreCompEdu, also provided time-limited, online training for teachers during the COVID‑19 pandemic.10 There is no evidence of training available to higher education educators during the assessment period.

There are no clear mechanisms to influence the learning content of pre-service teacher training provision at the system level. The Pedagogical Faculty at the University St. Kliment Ohridski in Bitola includes one obligatory course on innovation and entrepreneurship for trainee teachers who will teach first to fifth grades of primary education.11 While entrepreneurship is a priority at the education policy level, a learning process to develop an awareness of this key competence and how to implement it in teaching is not yet widely found among pre-service teacher training providers.

Women’s entrepreneurship policy and stakeholder engagement have improved, but more work is needed

The Strategy for Women Entrepreneurship Development (2019-2023) (Government of North Macedonia, 2018[36]) was launched in 2019 with an Action Plan (Government of North Macedonia, 2019[41]) supporting these years. Non-government stakeholders were extensively involved in the design of the new strategy, and this strategy presented a significant step forward for the development of this policy agenda in the economy. However, there have been no multi-stakeholder national policy partnership meetings since 2020, and no insight on progress or results has been reported since its launch.

There is an ongoing strong informal partnership bringing together non-government stakeholders. Key stakeholders formed the new National Platform for Women’s Entrepreneurship,12 which was formally launched in May 2021 with support from European funding. In October 2021, the platform signed a formal Memorandum of Co-operation with the Ministry of Economy. This identifies the platform as the main social partner for policy-making and reform processes supporting women’s entrepreneurship and identifies actions that the platform will implement to contribute to the implementation of the strategy, including an annual summit and awards for women’s entrepreneurship. However, there does not appear to be ongoing engagement, consultation or shared decision making linked to implementing the strategy between the government and platform partners.

Key statistical data for women’s entrepreneurship is not yet disaggregated by gender

It is not yet possible to identify gender among all population groups working as self-employed individuals or founders at the national level. The Action Plan for Implementing the Strategy for Women Entrepreneurship Development (2019-2023) targets the availability of gender-disaggregated data, addressing the founding of businesses and relevant registers for grants or other financial or non-financial support by 2019 to a complete database for women’s entrepreneurship by 2020. This is still outstanding, with the lack of gender-disaggregated data having a significant impact on the evidence base through which decisions to support women’s entrepreneurship can be made.

Strategies relating to women’s entrepreneurship and entrepreneurial learning have not been monitored or evaluated

Across both the strategies for entrepreneurial learning and women’s entrepreneurship, there is no evidence of monitoring or evaluation of the progress, results or impact of each strategy. The Entrepreneurial Learning Strategy (2014-2020) does not appear to have been implemented since 2017, and there is no evidence of evaluation since the strategy period ended in 2020. The Strategy for Women Entrepreneurship Development (2019-2023) is more recent, yet no public information is available on the progress of actions in the first few years of implementation. Planned actions, such as improving gender-disaggregated data by 2019, have not been achieved.

The way forward for Dimension 1

Reactivate the previously established policy and co-ordination mechanisms to support consistent development of entrepreneurial learning. There is a need to create consistency and coherence across the implementation of entrepreneurial learning at different levels of education and ensure that there is a clear progression for learners to build on their development of the entrepreneurship key competence at each stage of their education. To achieve this, there should be clear co-ordination between all providers, both government and non-government, to communicate actions, map activity and share learning on implementation along different levels of lifelong learning, linked to different national strategies and led by different stakeholders. This work should contribute to and work towards a new strategic document shaping the development of lifelong entrepreneurial learning (see Box 17.3 for a relevant example from Montenegro).

Box 17.3. Building a national policy partnership in Montenegro

Montenegro has successfully brought together and sustained a multi-stakeholder policy partnership that drives the co-ordination and development of lifelong entrepreneurial learning, gradually increasing the focus on this policy area and resulting in progress on the practical implementation of entrepreneurial learning at all levels of lifelong learning.

The consistent partnership between government ministries and key national stakeholders was linked to the design and implementation of national strategies. The relevance and importance of participation were clear to each partner organisation and closely aligned to their organisational objectives, with a named representative from each organisation. The partnership was initially informal, and organisations worked together to place the focus on increasing the profile of lifelong entrepreneurial learning at the policy level and gaining recognition for their partnership approach. This finally resulted in formal recognition by the government in 2021 as a working group of the National Council for Competitiveness led by the Ministry of Economy.

The previously recognised national policy partnership in North Macedonia brought together a full range of partners and was linked to the national strategy, similar to Montenegro. While a new strategy may not be immediately possible, partners can still be brought together; they can link work to the different strategies that place a focus on actions supporting lifelong entrepreneurial learning, enhance the work of all partners in the field and work toward further recognition of a partnership approach at the national and governmental levels.

Sources: Government of Montenegro (2020[42]) and McCallum et al. (2018[43]).

Provide accessible training courses and guidance for educators on the entrepreneurship key competence across pre-service and in-service training. Current provision is fragmented, and there is a potential that new policy developments in primary and VET education may not be sufficiently supported without clear educator guidance on implementation alongside comprehensive pre-service and in-service teacher training.

Provide formal recognition to a national partnership for women’s entrepreneurship to strengthen cross-government and stakeholder engagement and co-ordination. Women’s entrepreneurship is a powerful driver for women’s social and economic empowerment. In this light, there should be formal engagement of stakeholders and active informal networks brought together into a recognised national policy partnership involving government and non-government stakeholders. This can be achieved through regular and consistent engagement of the national multi-stakeholder government working group established during the strategy creation process, as well as wider action designed to bring this policy area into the heart of government decision making, such as including a gender-focused social partner linked to women’s economic empowerment as an additional national representative engaged in policy dialogue through the National Economic and Social Council.13

Establish a transparent monitoring and evaluation process to support current and future women’s entrepreneurship strategies. This process should be implemented in line with the proposals in the current strategy, collated annually and reported on publicly, with explanations of where actions are not yet achieved, identifying sources of funding and contributing to an updated action plan to support improved implementation. This work should be the designated responsibility of a recognised national policy partnership body involving government and non-government stakeholders.

Prioritise the introduction of gender-disaggregated data sources to support women’s entrepreneurship. This should implement the actions already defined in the current Strategy for Women Entrepreneurship Development (2019-2023) and should be in line with requirements for harmonisation with Eurostat.

Bankruptcy and second chance for SMEs (Dimension 2)

Introduction

Firms enter and exit the market as a natural part of the business cycle, and policies can ensure that such transitions occur in a smooth and organised manner. Well-developed insolvency procedures and regimes can protect both debtors and creditors, striking the right balance between both parties, for example. This is particularly relevant for smaller firms as they lack resources compared to bigger firms. Therefore, governments need to ensure that bankruptcy proceedings are efficient, ease reorganisation procedures (instead of bankruptcies) and ensure that those starting again have the same opportunities in the market they had the first time.

In North Macedonia, as in other Western Balkan economies where SMEs represent a large share of the economy, effective liquidation and discharge procedures can allow entrepreneurs to reintegrate into the market. This was particularly relevant in the context of the COVID‑19 pandemic, where a number of firms faced financial difficulties or were at risk of financial distress (OECD, 2021[44]).

North Macedonia’s performance on bankruptcy and second-chance policies has improved since 2019, mainly due to its simplified bankruptcy reorganisation and liquidation procedures that have started to bring first results. Its overall score improved from 2.49 to 3.03 and is performing at the WBT average (Table 17.7).

Table 17.7. North Macedonia’s scores for Dimension 2: Bankruptcy and second chance

|

Dimension |

Sub-dimension |

Thematic block |

North Macedonia |

WBT average |

|---|---|---|---|---|

|

Dimension 2: Bankruptcy and second chance |

Sub-dimension 2.1: Preventive measures |

2.80 |

2.74 |

|

|

Sub-dimension 2.2: Bankruptcy procedures |

Design and implementation |

3.30 |

3.47 |

|

|

Performance, monitoring and evaluation |

3.40 |

3.23 |

||

|

Weighted average |

3.36 |

3.38 |

||

|

Sub-dimension 2.3: Promoting second chance |

2.00 |

1.96 |

||

|

North Macedonia’s overall score for Dimension 2 |

3.03 |

3.03 |

||

Note: WBT: Western Balkans and Turkey.

State of play and key developments

North Macedonia has made progress since the 2019 assessment. In March 2021, the economy completed a new draft of the Insolvency Act (Government of North Macedonia, 2021[45]) in co-operation with the World Bank’s International Finance Corporation (IFC), which is planned to be enacted in 2022. The draft act features some positive developments, such as introducing preventive measures (pre-insolvency restructuring proceedings and an early warning system) and includes provisions for shortened and simplified bankruptcy proceedings for SMEs. However, it does not refer to SMEs’ access to a second chance (Table 17.8).

During the assessment period, the Government of North Macedonia introduced interim economic response measures to deal with the COVID‑19 crisis (Government of North Macedonia, n.d.[46]). In particular, it made it impossible for a debtor to initiate a bankruptcy procedure during the state of emergency and six months afterwards. The government also amended the Law on Obligations by regulating default interest rates (OECD, 2020[47]). In addition, it revised the credit risk regulation to encourage banks to temporarily restructure loans and relaxed the loan classification standards for non-performing loans. According to the State Statistical Office of North Macedonia, the number of concluded bankruptcies has been declining, while reorganisation remains an underused alternative (Table 17.9).

Table 17.8. North Macedonia’s implementation of the SME Policy Index 2019 recommendations for Dimension 2

|

2019 recommendation |

SME Policy Index 2022 |

|

|---|---|---|

|

Main developments during the assessment period |

Progress status |

|

|

Develop a fully-fledged early warning system |

A fully-fledged early warning system is not implemented yet. However, the new draft proposal for the Insolvency Act includes its definition and a regulatory basis to develop it. |

Moderate |

|

Finish drafting and implement the insolvency framework recommended by the IPA Project |

The Bankruptcy Department at the Ministry of Economy of North Macedonia, supported by IFC/World Bank, drafted a new bankruptcy act. The public discussion procedure on the draft act was completed at the end of March 2021. Final discussion on the law is to be conducted in parliament. |

Moderate |

|

Conduct awareness campaigns to promote out-of-court settlements as a less expensive alternative to file for bankruptcy |

No public awareness campaigns on promoting the benefits of out-of-court settlements were conducted during the assessment period. However, due to the COVID‑19 pandemic, the government introduced interim measures to halt bankruptcy enforcement, limiting the potential impact/validity of this recommendation for the 2022 assessment. |

n.a. |

|

Enhance monitoring and evaluation processes of bankruptcy and second-chance policies |

No changes have been introduced in monitoring and evaluation during the assessment period. However, monitoring and evaluation procedures are expected to be introduced as sub-law regulations of the new draft act. |

No progress |

|

Introduce policy measures granting a second chance for honest entrepreneurs |

Second-chance policies for honest entrepreneurs were not developed during the assessment period. The legal framework still does not distinguish fraudulent bankruptcies from honest ones. |

No progress |

Note: n.a.: not applicable.

Table 17.9. Number of concluded bankruptcies and reorganisations in North Macedonia, 2017‑21

|

2017 |

2018 |

2019 |

2020 |

2021 |

|

|---|---|---|---|---|---|

|

Number of concluded bankruptcies |

1 853 |

1 054 |

826 |

508 |

616 |

|

Number of reorganisations |

14 |

18 |

5 |

5 |

9 |

Note: It should be noted that the lower cases in 2020 and 2021 could be due to the economic response measures adopted during the COVID‑19 pandemic.

Source: Information provided by the government in the SME Policy Index 2022 questionnaire.

The insolvency legal framework has been gradually improving

North Macedonia’s insolvency legal framework is based on the 2006 Insolvency Act, as amended until 2013, and the 2014 Law on Out-of-Court Settlement, which reflects best practices summarised in the United Nations Commission on International Trade Law (UNCITRAL) Legislative Guide on Insolvency Law (UNCITRAL, n.d.[48]). Bankruptcy proceedings may be initiated with regard to a debtor’s property but may not be implemented with regard to a public legal entity or property owned by the state.

An accelerated out-of-court settlement procedure is currently available only “for small values”, which does not require the appointment of a board of creditors if the value of a debtor’s bankruptcy assets is under MKD 1 million (approximately EUR 16 200) and SMEs with fewer than ten employees. However, the number of beneficiaries has not been collected during the assessment period indicating that the use and efficiency of the accelerated settlement are yet to be determined. The shortened procedure must end within 60 days of its initiation and does not require the appointment of an insolvency practitioner.

The current framework allows a reorganisation procedure when the debtor is insolvent or where its inability to pay is imminent. The reorganisation plan does not require a pro-vote – instead, a judge convenes the creditors’ assembly to discuss and vote on the proposed reorganisation plan. Alternatively, a plan may be filed after the main insolvency proceedings have been opened, at the latest, within 15 days prior to holding the first creditors’ assembly (EBRD, 2021[49]). Moreover, if the creditors decide to liquidate the company, the bankruptcy assets are sold by e-auction.

North Macedonia is the only economy in the region that digitalises liquidation procedures (Box 17.4).

Box 17.4. The digitalisation of bankruptcy liquidation procedures in North Macedonia

The 2015 amendment of the Insolvency Act in North Macedonia introduced the option of e‑auction sales of assets from bankruptcy estates. Following seven years of implementation of e-auction sales, evidence shows that the amount of time taken by bankruptcy liquidation procedures has decreased, and creditors’ claims recovered at best market rates.1 The main sale principles are defined in Articles 98‑100 and Articles 189‑196 as follows:

The sale of the assets from the bankruptcy is done through e-auctions with public bidding.

Parties interested in participating in e-auctions are required to pay a 10% bond/deposit of the book value of the asset. They then receive a Participant ID with which to bid. The ID is anonymous.

The e-auction starts at a previously announced time and finishes in 30 minutes. All participants are automatically and electronically informed of the results of the auction.