Jon Pareliussen

OECD Economics Department

David Crowe

OECD Economics Department

Daniela Glocker

OECD Economics Department

Tobias Kruse

OECD Economics Department

Jon Pareliussen

OECD Economics Department

David Crowe

OECD Economics Department

Daniela Glocker

OECD Economics Department

Tobias Kruse

OECD Economics Department

The United Kingdom is among world leaders in reducing domestic greenhouse gas emissions, and a broad political consensus supports the target to reduce net emissions to zero by 2050. The UK’s strong institutional framework is an inspiration to countries around the world, and the country is pioneering work to embed climate considerations in the financial sector. Achieving carbon neutrality will require policy to match ambition. Emission reductions so far were largely driven by electricity generation, a sector targeted by explicit pricing instruments and a cost efficient renewables auction-design subsidy scheme. Expanding pricing instruments across the economy is an essential building block to reach targets. Such measures will be more effective if complemented by well-designed sectoral regulation and subsidies, and more acceptable if implemented once energy prices have started to come down from historically high levels. Britons are conscious of the need to act. However, winning their acceptance of the needed policies may require targeting carbon revenue to compensate low-income households and investments in green infrastructure and new technologies. A mechanism defusing fears that effective policies undermine competitiveness, preferably internationally agreed, would facilitate effective policies towards emission intensive trade exposed industries.

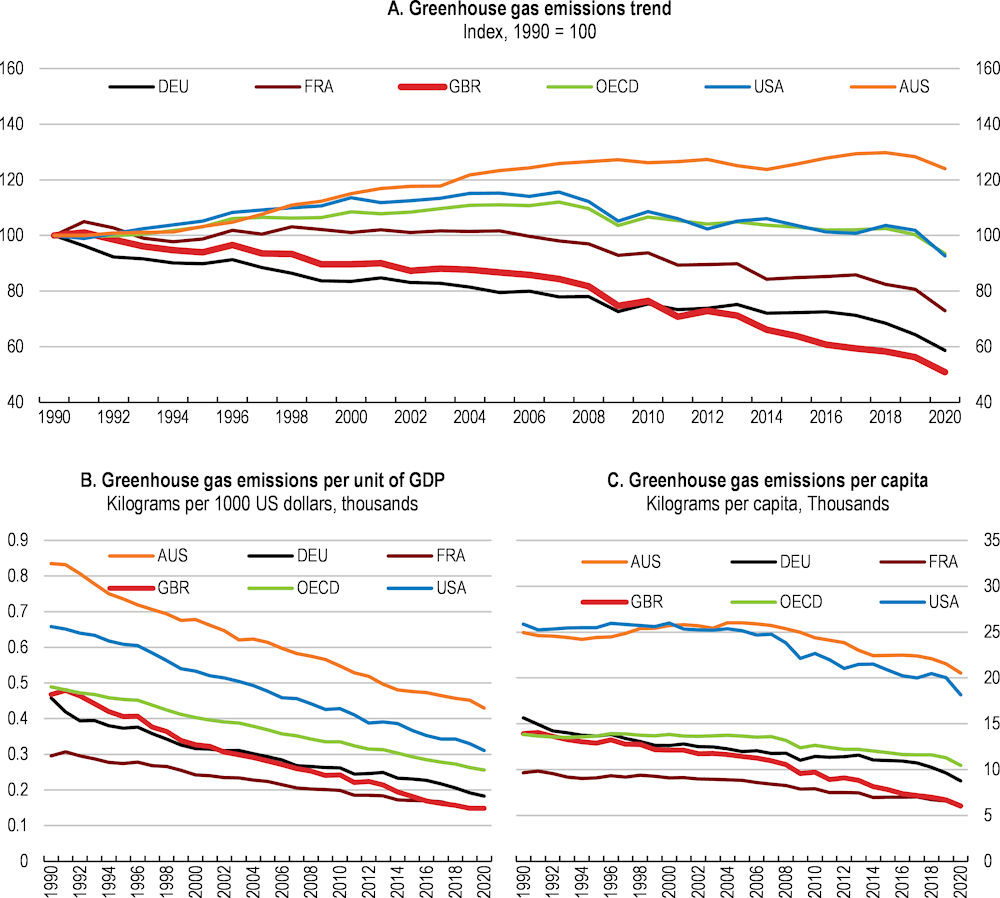

The United Kingdom reduced emissions by 40% from 1990 to 2019, among the largest reductions in the OECD (Figure 2.1, Panel A) and the largest among G20 countries, while GDP increased by 78%. Greenhouse gas emissions per unit of GDP were reduced almost by a factor of three since 1990 (Figure 2.1, Panel B). Emissions per capita have also fallen considerably (Figure 2.1, Panel C). In 2019, it was the first G7 country to create a legally binding target to bring net GHG emissions to zero by 2050 to deliver on the Paris Agreement. This ambition is supported by a strong institutional framework, which has inspired similar climate legislation across the world (Caselli, Ludwig and Van Der Ploeg, 2021[1]), and broad political and public support. In 2021, the UK was also the first among advanced economies to set a net zero strategy (BEIS, 2021[2]).

Note: Total greenhouse gas emissions excluding land use, land-use change and forestry.

Source: OECD (2022), Environment database.

The United Kingdom is experiencing widespread climate change. The average temperature is around 1.2°C warmer than in the pre-industrial period (1850-1900). The sea level has risen by 16 centimetres above pre-industrial levels, and episodes of extreme heat, intense rainfall and associated flooding have become more frequent. The United Kingdom is expected to experience warmer, wetter winters and hotter, drier summers, along with more frequent and intense extremes. The continued sea level rise will increase risks of coastal flooding and affect the functioning of coastal infrastructure (Climate Change Committee, 2021[3]; OECD, 2022[4]). While not within the scope of this chapter, adaptation measures also need to be stepped up to increase resilience against inevitable climate change. Progress in adaptation has been slow, with high levels of risk from climate change in most sectors of the economy (Box 2.1).

The Climate Change Committee’s (CCC) progress report on adaptation (2021[3]) concludes that the UK Government’s National Adaptation Programme has not improved resilience to the changing climate to the extent intended under the UK Climate Change Act. Of the 34 priority areas assessed in the 2021 progress report on adaptation, not one was demonstrating strong progress in adapting to climate risk. Policies developed without sufficient recognition of the need to adapt to climate change undermine their goals, steer behaviour in directions that lock in climate risks, and store up costs for the future. The CCC recommends a robust plan for adaptation with measurable targets to assess progress. They also gave 50 concrete recommendations, of which the following key actions were highlighted:

Restore 100% of upland peat by 2045, including through a ban on rotational burning.

Bring forward proposed plans to address overheating risk in homes through building regulations.

Make the Government’s next round of adaptation reporting mandatory for all infrastructure sectors.

Build a strong emergency resilience capability for the United Kingdom against climate shocks, learning from the COVID-19 response.

Implement a public engagement programme on climate change adaptation.

Source: Climate Change Committee (2021[3]).

Overall, the future cost to the United Kingdom from climate change has been estimated to 3%-9% of GDP by 2050 (Guo, Kubli and Saner, 2021[5]). Nonetheless, the most severe consequences of climate change will come after 2050, and are expected to be severe even if very challenging to predict. Furthermore, the extent of damage depends heavily on adaptation policies in the United Kingdom and on efforts to reduce emissions globally (HMT, 2021[6]). Key adaptation measures in the UK include improving land use and soil health; building buildings in places and with qualities, such as better insulation, that make them resilient to climate change, and retrofitting existing ones; investing in flood defences; implementing nature-based solutions; and upgrading the resilience of supply chains and infrastructure such as electricity transmission. For comparison, the cost of reaching Net Zero by 2050 is estimated at 0.6-2% of GDP by 2050, depending on sources (OBR, 2021[7]; OECD, 2022[4]).

COVID-19 and associated restrictions on mobility reduced emissions by around 13% in 2020, but very little of this reduction is set to be permanent, as structural changes to the underlying economy are expected to be relatively limited. Some changes to working and consumption patterns might persist beyond COVID-19, but their effects on emissions are uncertain and may go in both directions. For example, more teleworking reduces emissions, while a shift away from public transit towards more private car use increases them (Climate Change Committee, 2021[3]). Since March 2020, the United Kingdom has introduced successive packages of support measures equivalent to 15% of 2020 GDP, one of the largest fiscal responses to the COVID-19 crisis globally. As part of this package, green measures are estimated at 1.2% of GDP. Support for public transport services, cycling and walking is prominent (OECD, 2022[4]).

Russia’s invasion of Ukraine and subsequent sanctions have led to increasing energy prices and will likely increase the use of coal in electricity generation in the short term. The cost-of-living shock is best handled by supporting low-income households, as energy price support is regressive and runs counter to climate targets. In the longer term, the combination of high fossil fuel prices and a re-assessment of the economic and political costs of energy import dependency boosts the case for domestic clean energy and energy efficiency.

Moving towards net zero is compatible with continued strong GDP growth and prudent fiscal policy, but will be challenging. For instance, climate policies will change the sectoral composition of the economy, boost investment, inflation and interest rates (Pareliussen, Saussay and Burke, 2022[8]). Some sectors are highly responsive to price signals while various market failures such as coordination failures, bounded rationality and liquidity constraints hold back action in others. Clean technologies are readily available and price competitive in some cases, unaffordable, on the testing stage, or not yet developed in others. Furthermore, the green transition will create winners and losers, and may challenge peoples’ attitudes and beliefs. This difficult political economy has played an important role in limiting the coverage of effective and efficient policies in the UK. Explicitly pricing emissions assigns the cost transparently, while benefits from lower emissions, public revenues and considerable co-benefits are distributed thinly across the population. Explicit pricing is therefore often less favoured politically than other less transparent policies, such as subsidies where costs are distributed thinly across taxpayers, or regulations carrying hidden and unevenly distributed costs (D’Archangelo et al., 2022[9]).

Important challenges to take into account in the transition include:

managing the overall economic effects of mitigation action, including concerns about productivity, unemployment, inflation and public debt,

transforming the energy system and boosting clean energy supply at unprecedented speeds,

managing the risk of emission-intensive, trade-exposed industries losing competitiveness if one country’s action is not followed up internationally, and

avoiding negative distributional effects and building public acceptance of efficient policies.

Against this background, this chapter outlines a cost-effective, inclusive and comprehensive strategy to reach carbon neutrality by 2050, in line with the United Kingdom’s ambitions. The analyses and recommendations are informed by new OECD research on the macroeconomic and distributional consequences of different policy options (Pareliussen, Saussay and Burke, 2022[8]) as well as on people’s attitudes towards climate change and climate policies (Dechezleprêtre et al., 2022[10]). The chapter is structured as follows: the next section gives a brief overview of UK climate targets and institutional set-up. The third section discusses policy options to reduce greenhouse gas emissions in the context of multiple market failures. The fourth section discusses how to improve political acceptability of ambitious climate policy. The fifth and last section discusses concrete climate policy options in their sector-specific context.

The United Kingdom has a strong institutional framework emphasising evidence-based policy making, which has inspired countries around the world. The 2008 Climate Change Act was adopted based on a cross-party consensus. It defines the 2050 net zero target and defines a process to legislate 5-year carbon budgets – the cumulative volume of greenhouse gas emissions allowed at the national level for a 5 year period – 12 years ahead of time. These targets are statutory and open the Government to litigation if not met. The Act directs that these targets should be established by the Government based on advice from an independent expert body, the Climate Change Committee (CCC), which reports on progress to meet the targets to the Parliament. In addition to advising and monitoring compliance with the targets, the Climate Change Committee has become a trusted knowledge broker and has contributed to a more constructive debate on climate change issues (Caselli, Ludwig and Van Der Ploeg, 2021[1]). The Act also requires the Government to publish a climate change risk assessment every five years and to develop a National Adaptation Programme to respond to the risk assessment.

The permanent nature of the CCC has helped to ensure that the United Kingdom’s overall direction of travel on climate change remains focused on the long-term target (Climate Change Committee, 2020[11]). The UK framework has inspired institutional set-ups in other countries, including Denmark, France, Germany, Mexico, New Zealand and Sweden. For example, France’s 2015 Law on Energy Transition for Green Growth instituted five-year carbon budgets complemented by the creation of the High Council on Climate (HCC), a climate policy watchdog, in 2018 (OECD, 2021[12]).

Notwithstanding an overall strong institutional framework, a broad range of actors at different levels of government share responsibility for environmental outcomes and policies, broadly or in specific sectors. This may stand in the way of policy coherence. The Department of Business Energy and Industrial Strategy (BEIS) has the overall coordinating responsibility for climate change, complementary to the Climate Change Committee’s role as a climate policy watchdog. The responsibility for environmental policy and regulation resides with the devolved administrations of England (served by the UK Government), Scotland, Wales and Northern Ireland. HMT is responsible for taxes, and a UK ETS authority with representatives from the UK and devolved governments is responsible for the UK ETS. Bank of England and the Financial Conduct Authority together play a leading role internationally to improve the way the financial sector can support the transition toward a sustainable economy. Line ministries are responsible for their respective sectors, coordinated by the Cabinet Committees on Climate Strategy and Climate Action (Climate Change Committee, 2021[3]). Building on existing structures to improve coordination between institutions and a shared understanding of each institution’s role will be essential to achieve broad and deep emission reductions while minimising negative side effects.

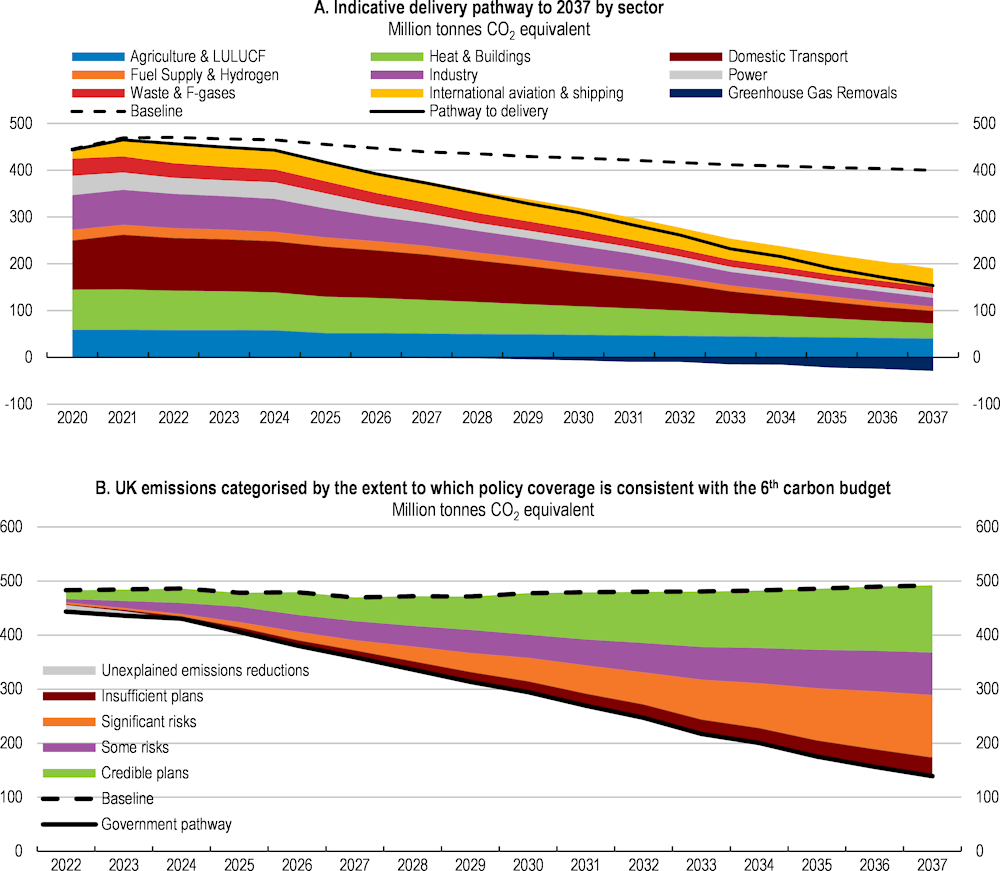

Carbon budgets contribute to a stable and credible institutional framework for the government and the private sector. The United Kingdom met its first and second carbon budgets (2008-12 and 2013-17) and is on track to reduce emissions more than mandated by its third budget (2018-22) (Figure 2.2) (Climate Change Committee, 2021[3]). In 2021, following CCC’s recommendations, the Government set the sixth carbon budget (CB6, 2033–37) to cut emissions by 78% by 2035 in order to set the United Kingdom on the path to net zero. For the first time the target also includes the United Kingdom’s share of international aviation and shipping emissions.

Million tonnes of CO2 emissions

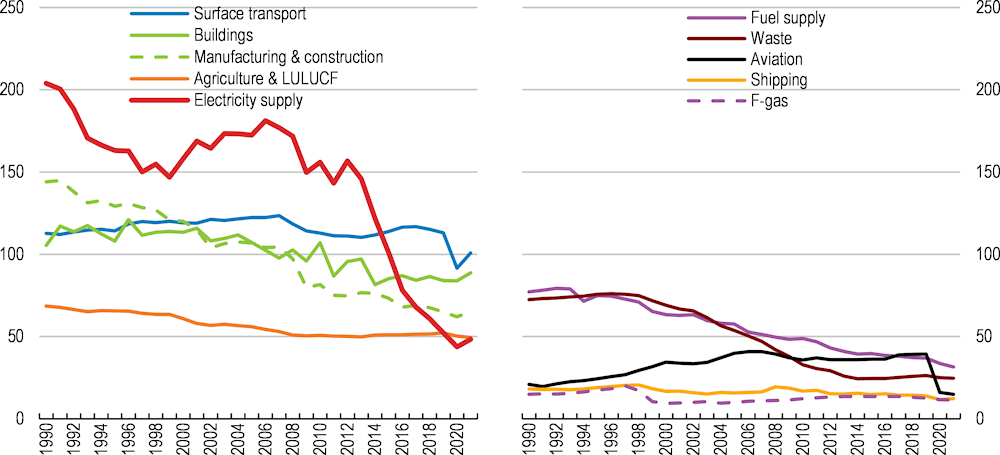

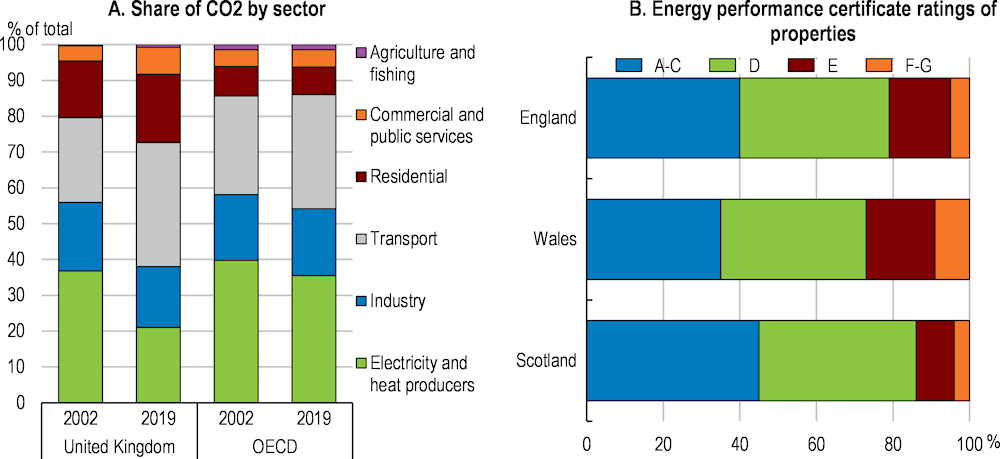

Continuing this success in the future will require considerable efforts. Electricity production has so far been the largest source of emission reductions, with the shift in electricity generation from coal to gas and, in the past decade, to renewable energy. Sectoral shifts away from heavy industry towards services and higher value-added, less polluting manufacturing have also contributed (Figure 2.3) (Caselli, Ludwig and Van Der Ploeg, 2021[1]).

Annual historical emissions in million tonnes of CO2 by sector in the United Kingdom

Note: LULUCF is an abbreviation for land use, land-use change and forestry. Fluorinated gases (F-gases) is a family of human-made gases used in a range of everyday products as well as industrial applications. The sectoral emissions for aviation and shipping include the United Kingdom’s share of international aviation and shipping emissions, and are CCC estimates.

Source: Climate Change Committee, 2022 Progress Report to Parliament.

Progress is slower in other sectors and projections show that without additional policies the UK is not yet on track to meet the fourth (2023 to 2027), the fifth (2028-2032) and the sixth budget (2033-2037), as well as the net zero target (Climate Change Committee, 2021[3]). This uneven progress reflects to a large extent the uneven coverage of effective policy instruments. In the past, it was possible to successfully concentrate policy action and emission reductions on particular sectors while shielding others. Such differentiation is no longer an option with the target of reaching net zero emissions. All sectors will need to be covered by effective policies going forward and early policy action will make the transition more gradual and less costly. Energy security concerns and surging fossil fuel prices related to Russia’s invasion of Ukraine add to the urgency of the transition.

A successful transition to net zero requires a strategic, system-wide approach targeting all emitting sectors and new policy measures, building on the Net Zero Strategy, with further concrete deadlines, policies and priorities in line with legal targets. Sectors including buildings, transport and agriculture will also need to accelerate their decarbonisation to meet the target (Table 2.1). Moreover, some sectors, such as industry, agriculture and aviation are difficult to decarbonise completely, and greenhouse gas removals (GGR), like land use and forestry and carbon capture and storage are therefore essential to compensate for the residual emissions arising from these sectors (Figure 2.4, Panel A).

|

Sector |

Sector share of 2019 emissions |

Reductions 1990-2019 |

2019-2030 reduction target |

Main policies in place |

Key recommendations as they apply to individual sectors |

|---|---|---|---|---|---|

|

Electricity generation |

11% |

72% |

71-76% |

UK ETS, Carbon Price Support (tax), Contract for difference auctions in renewable energy, transmission network investments. |

Boost public investment in transmission networks, green infrastructure, research, development and deployment, preferably through further expanding the use of competitive auction designs. |

|

Transport |

23% (in addition 4% in international aviation and shipping) |

5% |

35-45% |

Excise duty on transport fuels, zero emission vehicle mandate planned phased in from 2024 to 2035 for cars and trucks, technology development support to manufacturers, public investment in charging infrastructure and tradable performance standards. |

Include transport fuels in the UK ETS. Phase in zero-emission vehicles by regulation, as planned. Boost public investment in green infrastructure and public transit, preferably through competitive auction designs. |

|

Heat and buildings |

17% |

17% |

25-37% |

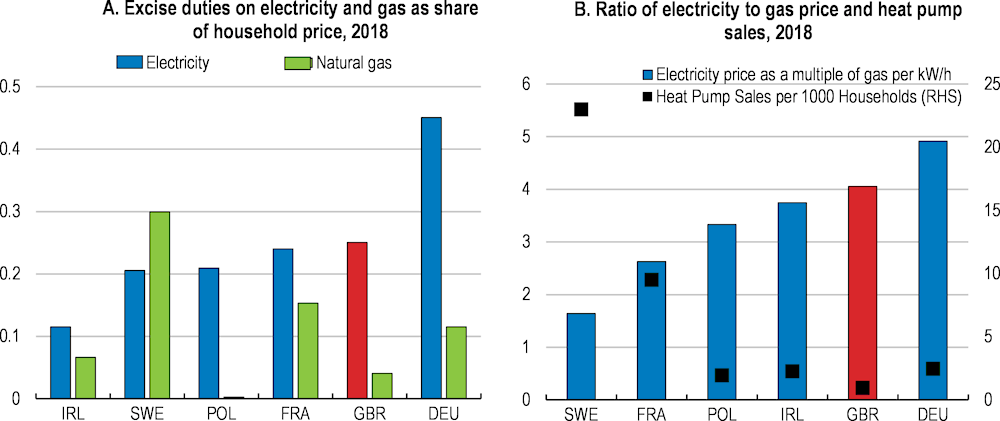

Environmental and social charges on electricity are not matched for gas, which is the dominant heating source, building standards, various schemes to support energy efficiency and heat pumps, plan to phase out new fossil heating systems by 2035. |

Include heating fuels in the UK ETS. Support investments in residential energy efficiency and clean heating systems, preferably through competitive auction designs. Increase energy efficiency requirements in building standards and introduce minimum requirements in rental housing, as planned. Accelerate the phasing-out of new fossil fuel heating systems. Boost public investment in research and development in residential energy efficiency and clean heating systems. |

|

Agriculture, forestry and land use |

12% |

24% |

17-30% |

Support for tree planting and peat restoration, on-going agricultural support review to tilt support towards environmentally sustainable actions. |

Include agricultural emissions and natural emission removals in the UK ETS. Tilt support towards competitive auctions and payments for ecosystem services. Boost public investment in research, development and deployment. |

|

Fuel Supply |

5% |

61% |

37-45% |

UK ETS and extensive regulatory framework. Hydrogen clusters designated. |

Boost public investment in research, development and deployment, preferably through competitive auction designs. Coordinate and support green infrastructure to transport hydrogen and carbon dioxide, |

|

Manufacturing and refining |

15% |

53% |

40-50% |

UK ETS (large emitters). |

Engage with the EU to avoid further trade barriers from its planned carbon border adjustment mechanism. Boost public investment in green infrastructure, research, development and deployment, preferably through competitive auction designs. |

|

Waste and f-gases |

5% (waste), 3% (f-gases) |

61% |

50-57% |

Landfill charge, F-gas import quotas. |

Include waste treatment, notably incineration, in the UK ETS. |

|

Emission removals |

N/A |

1-12m tonnes per year by 2030 |

Support available for R&D and demonstration projects. Carbon capture and storage is in principle covered by the UK ETS if it relates to an ETS-covered emission source. |

Include engineered emission removals in the UK ETS. Boost public investment in green infrastructure, research, development and deployment, preferably through competitive auction designs. |

Note: The Government is consulting on the potential inclusion of emission removals and waste incineration in the UK-ETS (UK ETS Authority, 2022[13]).

Source: Net Zero Strategy; Author’s compilation based on various sources.

The government’s ten point plan for a green industrial revolution and the Net Zero Strategy (2021[2]) outlines a direction to reach net zero and intermediate targets, and signal a number of policy actions to come. The Net Zero Review (2021[6]) analyses key issues to take into account in policy design, and various sectoral strategies go more in-depth sector by sector, as discussed throughout this chapter. These strategies are significant steps toward net zero, but urgently need to be followed up by concrete and comprehensive policies in sectors where policy coverage is inconsistent with targets, as identified by the Climate Change Committee (Figure 2.4, Panel B).

Note: Panel A: For more information on the assumptions of the baseline model see the technical appendix to the Net Zero Strategy report in the source. Panel B: The baseline is an adjustment to the Government’s Net Zero Strategy baseline, with the impact of some policies removed so that they can be assessed. The unexplained emissions reduction is emissions reduction that could not be attributed to a plan published by the Government.

Source: UK Government (2021), Net Zero Strategy: Build Back Greener; and Climate Change Committee, 2022 Progress Report to Parliament.

This section argues that emissions pricing should remain an important element of such an ambitious package of climate policy. Further improvement in financial sector regulations and more consistent use of shadow pricing in the public sector can help. Flanking measures will continue to be needed to complement carbon pricing such as regulation, standards, public investment, innovation incentives and other institutional reforms (Table 2.2). Education, good and easily accessible information, policy transparency and consistency can increase the efficiency and effectiveness of any of the policy options outlined below and reduce the overall cost of reaching emission targets (HMT, 2021[6]; D’Archangelo et al., 2022[9]).

|

Policy instrument |

Cost efficiency |

Acceptability |

Implementation in the United Kingdom |

|---|---|---|---|

|

Greenhouse gas taxes and emissions trading schemes. |

Highly cost efficient. Dynamic incentives for continuous improvement and innovation. Revenue raising. Administrative costs depend on if the tax base is already measured and other structures are in place. |

Prices and impact on the cost of living are visible, which may lower acceptability. Revenue recycling can increase acceptability. Emissions trading scheme might be slightly more acceptable than a tax |

The UK emissions trading scheme covers emissions in manufacturing, fuel supply, refining and air transport corresponding to around a quarter of domestic emissions. The Carbon Price Support is a carbon tax acting as a price floor alongside the ETS for electricity generation. |

|

Taxes on polluting goods or activities. |

Low to high depending on how broadly it is applied and to which extent the tax base is a close proxy to GHG emissions. Revenue raising. |

Low acceptability because prices and impact on the cost of living are visible. |

A landfill tax, a transport fuel excise duty and a climate change levy (not based on fuels’ carbon content) exist. Charges on electricity consumption favour untaxed fossil fuels for residential heating. |

|

Shadow prices in public procurement and cost-benefit analyses. |

Potentially high, depending on implementation. |

High acceptability, as it is financed by general taxation. |

Carbon values are mandatory for public sector cost-benefit analyses. |

|

Green financial policy, including updating policy to reflect systemic risks and strengthening disclosure requirements. |

High to the extent that it contributes to correctly price and reduces financial risks and helps investors act on preferences for green investment. |

High. |

The Bank of England and the Financial Conduct Authority are at the international frontier of efforts to green financial sector regulation and supervision. |

|

Environmental regulation |

Low to high. High monitoring costs to identify most effective actions. Command and control regulations give little encouragement to innovate, but regulatory design can increase efficiency, for example with tradable performance standards. |

Moderate. |

Energy efficiency requirements in the building code. Input requirements in transport fuels. Tradable performance standards in car manufacturing. Hydrofluorocarbon import quotas. |

|

Environmental subsidies |

Low to high. Competitive design can boost cost-efficiency. Tends to pick winners and penalise entrants. Has a role to play to support research, development and deployment. |

High. |

Contract for Difference renewable energy auction scheme. GBP 26 billion of public spending on net zero planned from 2021 to 25. |

Note: The table shows a subset of major policies. It is neither a complete list of policy options nor a complete list of existing UK policies.

Source: Adapted from Pisu et al. (2022[9]).

Effective climate policies are fully compatible with continued economic growth, but will have a number of economic consequences. Redesigning production processes or reallocating resources within firms could trigger productivity increases that are larger than those predicted by usual macroeconomic models. At the same time, resources might need to be shifted from consumption to investments, some capital might be scrapped ahead of its useful service time, and some economic activities would consume more resources for the sole benefit of reducing emissions. Empirical evidence indicates that larger, more productive, low-emission and well-managed firms are better equipped to respond to more stringent policies and are thus able to raise their productivity and gain market share, while other firms can suffer negative effects (OECD, 2021[14]). Furthermore, market-based instruments minimise the social costs of reducing emissions by making it expensive to pollute while giving the polluter flexibility to reduce emissions in the least costly way (OECD, 2021[15]; Albrizio, Kozluk and Zipperer, 2017[16]).

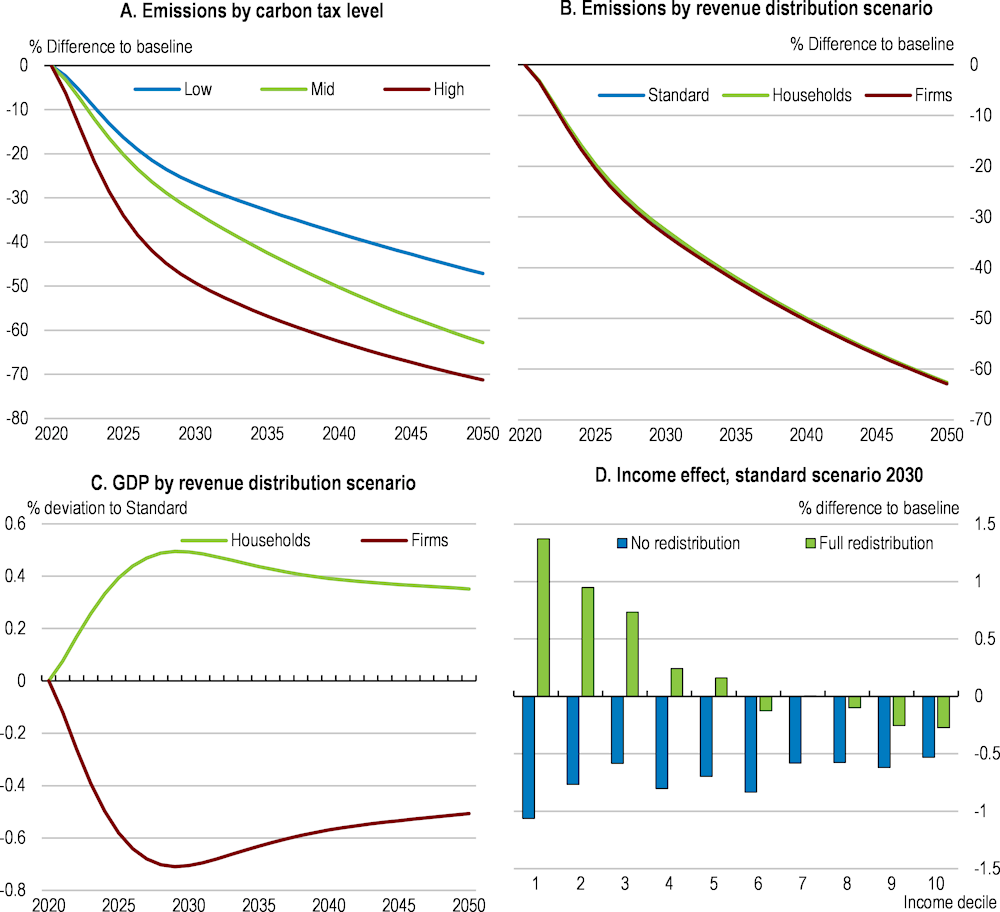

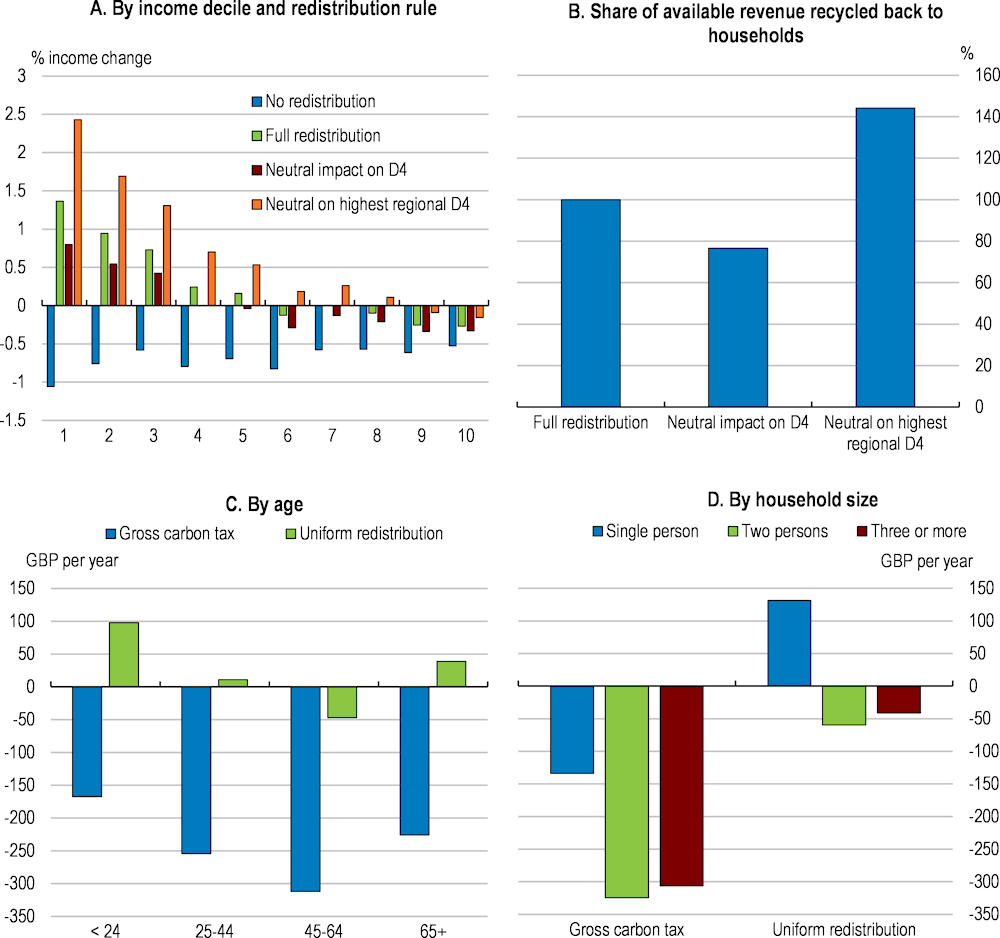

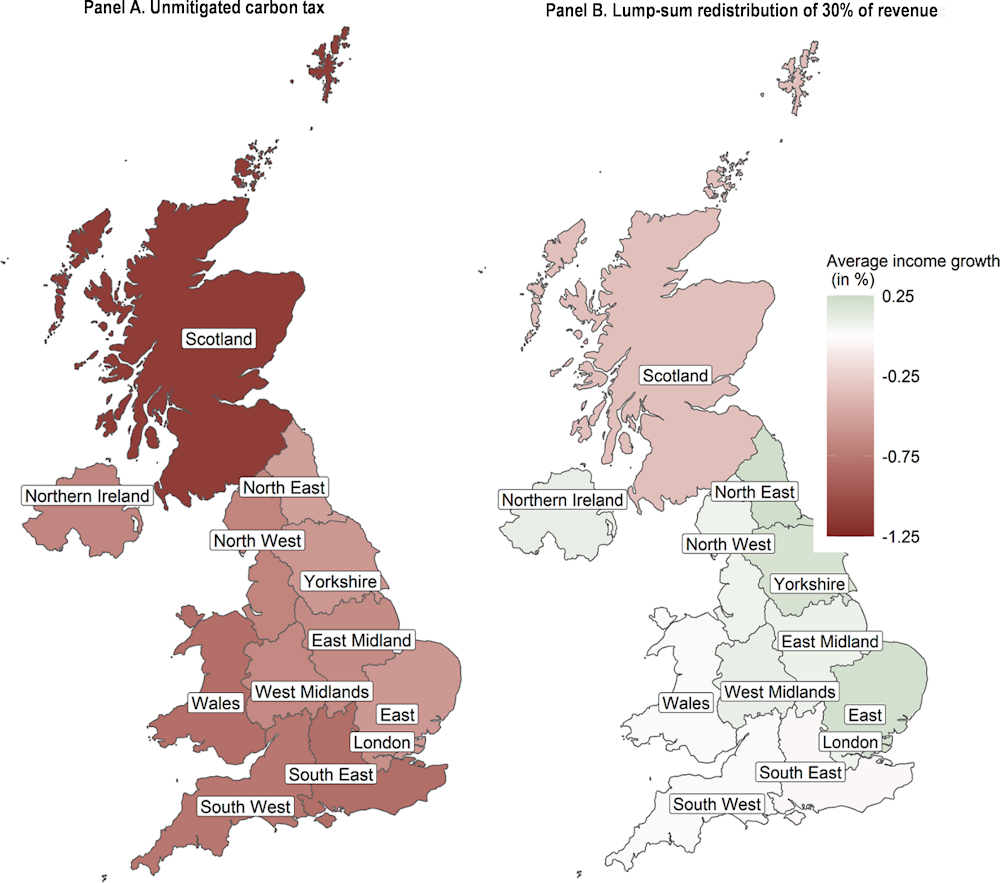

New UK-specific integrated macro- and microeconomic modelling illustrates some of the economic and distributional consequences of an economy-wide policy package (Box 2.2). The most striking result of these simulations is that large emission reductions are realised regardless of the scenario considered, with higher carbon prices resulting in larger reductions, with fairly limited macroeconomic (Figure 2.5, Panel A) and distributional consequences.

The OECD and LSE’s Grantham Research Institute modelled UK-specific policy scenarios to move towards net zero in an integrated macro-micro framework. Results are presented as differences from a baseline of unchanged policies. Macroeconomic simulations feed into a microsimulation model to map macro-consistent distributional effects and redistribution packages.

The ThreeME model is a Computable General Equilibrium (CGE) model of neo-Keynesian inspiration with hybrid economy-energy features developed by OFCE (French Economic Observatory at Sciences Po), since 2008 with the support of the French Environmental Agency, ADEME and Netherlands Economic Observatory (ThreeME, 2022[17]). While the current study is the first time the model has been calibrated to the United Kingdom, it has earlier been used in French, Mexican, Indonesian, Tunisian and Dutch studies.

Three carbon price scenarios (low, medium and high) are modelled, converging over time towards the UK government’s official shadow price trajectories (“carbon values”) in their high, medium and low variants, with the following assumptions:

Low carbon price: GBP 100 in 2030, GBP 189 in 2050.

Medium carbon price: GBP 140 in 2030, GBP 378 in 2050.

High carbon price: GBP 280 in 2030, GBP 568 in 2050.

The shadow price on emissions represents how much more profitable the sum of climate policies makes green production and consumption compared to polluting activities. It is modelled as a uniform carbon (equivalent) tax, but could in principle come from an emission trading scheme, regulations, subsidies or a combination of instruments. For reference, UK ETS allowances traded between GBP 68 and 88 in the first three months of 2022, but is complemented by renewable energy subsidies. One notable difference to price signals from regulations and subsidies is that the model operates with carbon tax revenues, which are redistributed to households and businesses according to different scenarios:

“Standard” scenario: Redistribution to households and business sectors without transfers between firms and households. However, transfers can occur from carbon-intensive sectors to the rest of the economy.

“Households” scenario: Total receipts are distributed to households.

“Firms” scenario: Total receipts are distributed to firms.

“Export exposure” scenario: As in the standard scenario, but the distribution of receipts among firms is adjusted to distribute more to sectors with high trade exposure (measured by the ratio of exports to output).

“Neutral GDP” scenario: A share of revenue is withheld so that the overall GDP impact from 2040 to 2050 is zero. Remaining revenues are distributed as in the “Standard” scenario.

Residual emissions remain in all scenarios. This reflects three important features of the ThreeME model and of the scenarios considered: the model does not consider negative emissions, which will be needed to reach net zero; it is built around carbon pricing. the rigidity of demand for carbon intensive goods is governed in the model by elasticities of substitution that are calibrated on historical data – as such they may underestimate the potential for future adjustments.

Microsimulations are built on the ONS household expenditure survey (the Living Costs and Food Survey). For each revenue redistribution and carbon tax scenario in the macro model, four distribution scenarios are explored:

Unmitigated impacts of the carbon tax.

Uniform lump-sum redistribution of available tax receipts across all households.

Calibrating a lump-sum redistribution to all households equal to the average carbon tax paid by households in decile 4, measured at the national level. This translates into a net gain for deciles 1-3, who pay less carbon taxes (but a larger share of their income) than higher-income households.

Calibrating a lump-sum redistribution so that not a single decile 4 household in any region experiences a loss.

The two models are linked by disaggregating household consumption by the representative household in ThreeME using microdata from the expenditure survey, along with its corresponding carbon footprint. Macroeconomic outputs include GDP, investments, fiscal balance, inflation and labour market outcomes, as well as sectoral shares, while distributional consequences are available by income level, household type and geography.

Source: Pareliussen, Saussay and Burke (2022[8]).

A second main finding is that how proceeds are distributed have almost no effect on emissions (Figure 2.5, Panel B). How proceeds are handled within the broader fiscal stance and how they are distributed does play an important role in offsetting undesired macroeconomic and distributional effects. Indeed, the United Kingdom’s experience in the 1980s and 90s when market reforms and rapid structural change boosted productivity and employment growth at the cost of rising unemployment (Card et al., 2004[18]) underscores the importance of sound macroeconomic policies supporting the transition.

Redistribution of carbon tax revenues affects GDP, with a higher fiscal multiplier if these revenues are distributed to households rather than firms (Figure 2.5, Panel C). The revenue is more than enough to offset negative income effects in the bottom half of the income distribution (Figure 2.5, Panel D).

Note: The carbon price signal is here modelled as uniform carbon (equivalent) tax, but could in principle come from an emissions trading scheme, regulations, subsidies or a combination of instruments. The low carbon price starts at GBP 100 in 2030 and rises to GBP 189 in 2050. The medium carbon price starts at GBP 140 in 2030, rising to GBP 378 in 2050. The high carbon price starts at GBP 280 in 2030, rising to GBP 568 in 2050. Revenues are redistributed with shares equal to sector shares in output in the “Standard” scenario. All revenues are distributed to households and firms in the “Household” and “Firm” scenarios, respectively. Firms’ proportional share of revenue is redistributed to firms according to their export exposure in the “Export exposure” scenario. The “Neutral GDP” scenario holds back a share of revenue (45%) to achieve average GDP growth as in the baseline from 2040 to 2050. Remaining revenues are distributed as in the “Standard” scenario. Panel D “full redistribution” implies lump-sum transfers to all households, summing up to carbon taxes paid by households.

Source: Pareliussen, J., A. Saussay and J. Burke (2022), “Macroeconomic and distributional consequences of net zero policies in the United Kingdom”, OECD Economics Department Working Papers (forthcoming).

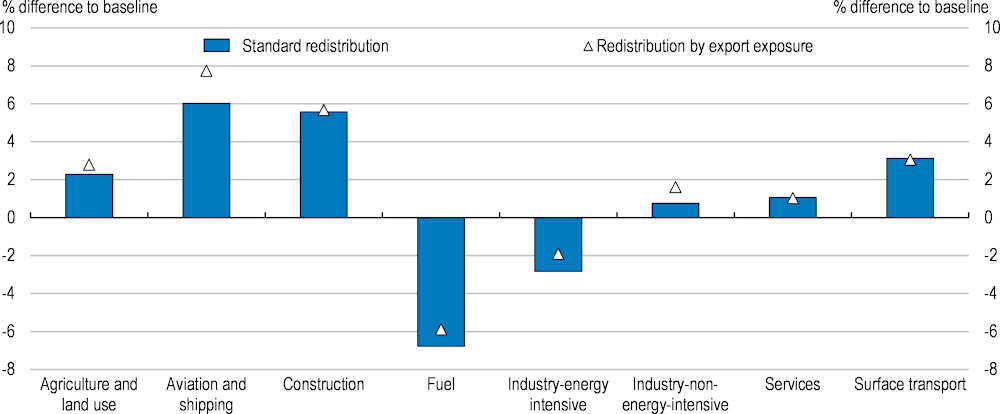

Regardless of the overall GDP and distributional effects, the policies needed to reach net zero are set to trigger a large change in the industrial structure, with the transition in general benefitting those sectors and firms able to adapt and seize opportunities in the green economy. Sectors of the economy will be affected differently, as illustrated in Table 2.3, with notable output and employment losses in fuel supply and energy-intensive industries contrasting gains in employment and output in most other sectors. However, much of the structural change will take place within sectors. For example, construction, aviation and shipping are set to reduce emissions by 60-70% compared to the baseline while boosting output by 3-4%. This will require investments, notably in energy efficiency, zero emission energy and compatible equipment. In the GDP neutral scenario, annual investments are set to increase to 6% above baseline by 2050, not accounting for notable investments outside the scope of the model. Investments in major emitting sectors are set to increase considerably, from 10% in buildings to 39% in agriculture and land use, while the simulations do not point to a need for additional investments in the services sector, accounting for two-thirds of UK output, but less than 10% of emissions.

% difference from baseline, 2050

|

Sector |

Emissions |

Output |

Investment |

Employment |

Wages |

|---|---|---|---|---|---|

|

Agriculture and land use |

-42% |

-3.11% |

39% |

1.19% |

6% |

|

Aviation and shipping |

-63% |

3.28% |

27% |

4.68% |

6% |

|

Construction |

-70% |

3.74% |

10% |

3.96% |

6% |

|

Fuels |

-60% |

-35.52% |

33% |

-7.64% |

-8% |

|

Industry-energy intensive |

-51% |

-6.93% |

22% |

-3.63% |

7% |

|

Industry-non-energy-intensive |

-65% |

-1.81% |

28% |

-0.30% |

6% |

|

Services |

-63% |

-1.66% |

0% |

-0.33% |

6% |

|

Surface transport |

-58% |

0.92% |

24% |

1.59% |

6% |

|

Economy-wide |

-63% |

0.06% |

6% |

-0.03% |

5% |

Note: The carbon price signal is here modelled as uniform carbon (equivalent) tax, but could in principle come from an emissions trading scheme, regulations, subsidies or a combination of instruments. Results based on a “Medium carbon price” starting at GBP140 in 2030, rising to GBP378 in 2050. The “Neutral GDP” scenario holds back a share of revenue (45%) to achieve average GDP growth as in the baseline from 2040 to 2050. Remaining revenues are distributed proportionately to sectors as in the “Standard” scenario.

Source: Pareliussen, Saussay and Burke (2022[8]).

The green economy will change the composition of the labour market, with falling employment and wages in some sectors offset by increases in others (Table 2.3) and changing skill needs also within sectors. This will only translate into a durable net employment gain to the extent labour supply meets demand in terms of both skills and location. There is a risk that unemployment increases throughout the transition if skills supply does not match demand. The United Kingdom has a resilient economy with flexible regulations in labour- and product markets that are likely to limit the pain of the transition. High-skilled people are more likely to be employed, adapt more easily to changing skill needs and have more access to training. The average level of education and skills is high in the United Kingdom, but a considerable share of the population also lacks basic literacy and numeracy skills strongly correlated with employment and the ability to learn new skills and adapt to a changing labour market.

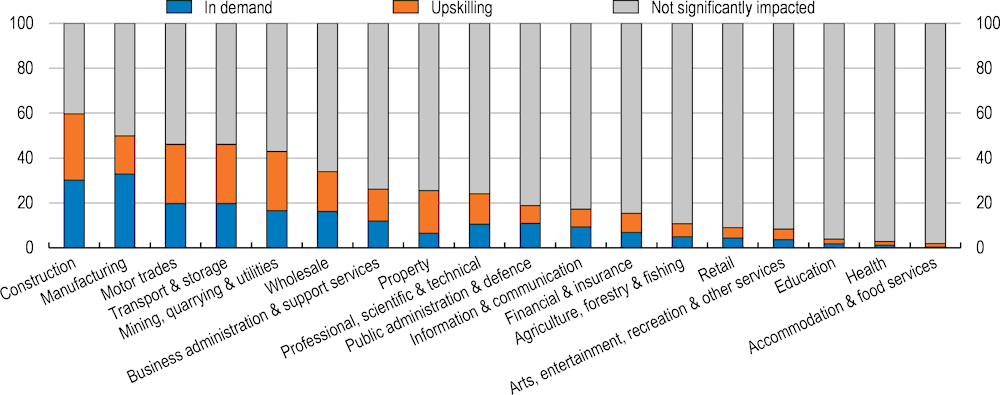

The transition to net zero will provide new job opportunities and require new skills. Anticipating emerging skill needs and providing the up-skilling and re-skilling needed to limit labour market exclusion therefore should be an integrated part of policy measures to transit to net zero (OECD, 2021[19]). Supplying the skills needed for the green transition notably within housing energy efficiency and clean heating and to ensure resilience of energy supply is all the more challenging in the context of current labour shortages and structural change following the pandemic, leaving the EU single market and on-going trends of digitalisation and automation. The UK’s ability to address existing skill shortages and rapidly approaching future skill needs will depend partly on reskilling the existing workforce, but participation in continuing education and training is low (Chapter 1). As the economy transitions to net zero, some sectors will be affected disproportionally by the demand for specific skills (Figure 2.6). New economic activities and technology will need new skills and many existing occupations and sectors will experience a “greening” of their jobs, requiring workers to adapt (HM Government, 2021[20]). Some of the demand will rise quickly. For example, to meet the net zero target, the government aims to install 600 000 heat pumps per year by 2028 (HM Government, 2020[21]), but there were only 900 heat pump installers in the United Kingdom in 2019. It is estimated that between 7 500 and 15 000 heat pump installers need to be trained every year for the next seven years (HM Government, 2021[20]). Training opportunities should be of high quality and respond to identified skill needs, with increased use of guidance, counselling and statistical tools to target training and match it to identified skill needs (Chapter 1).

Jobs affected by net zero transition by sector, % of total jobs

Note: Jobs requiring upskilling: These are existing jobs that require significant changes in skills and knowledge. These include specialised jobs in the manufacturing and extractive sectors, such as petroleum engineers and heavy equipment operators, whose skills need to be adapted to a net-zero economy. Jobs in demand: These are existing jobs that are expected to be in high demand due to their important role in the net-zero economy. These include specialised positions in the green economy, such as wind turbine installers, but also the skills and expertise of welders, builders and engineers already working to build the infrastructure of a green economy.

Source: Place Based Climate Action Network (PCAN), Just Transition Jobs Tracker.

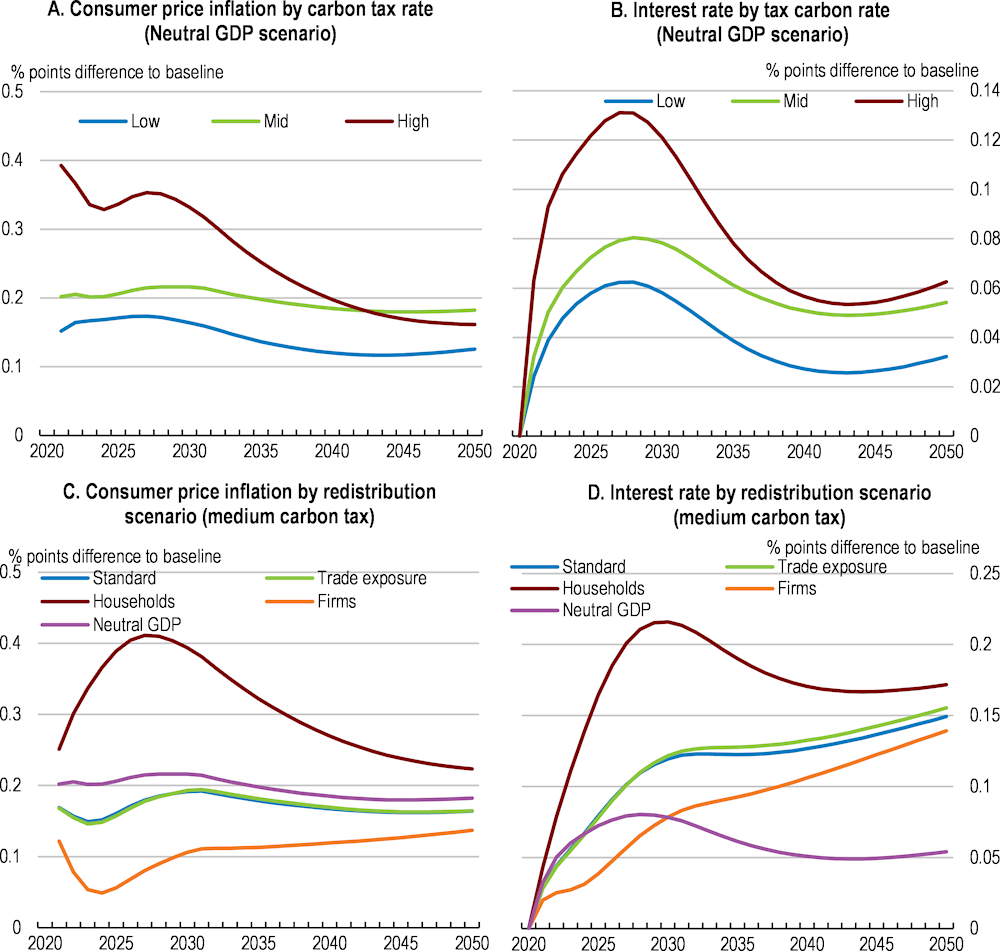

Structural change will drive competition for skills, and increasing investments boost the competition for capital resulting in higher wages, inflation and interest rates. Inflation and interest rates will increase with policy stringency (Figure 2.7, Panels A and B). Furthermore, inflation and interest rates will be sensitive to the overall macroeconomic stance and to which extent revenue is recycled to parts of the economy with high fiscal multipliers (Figure 2.7, Panels C and D). However, the inflationary effects of the green transition are likely to be moderate compared to recent price increases.

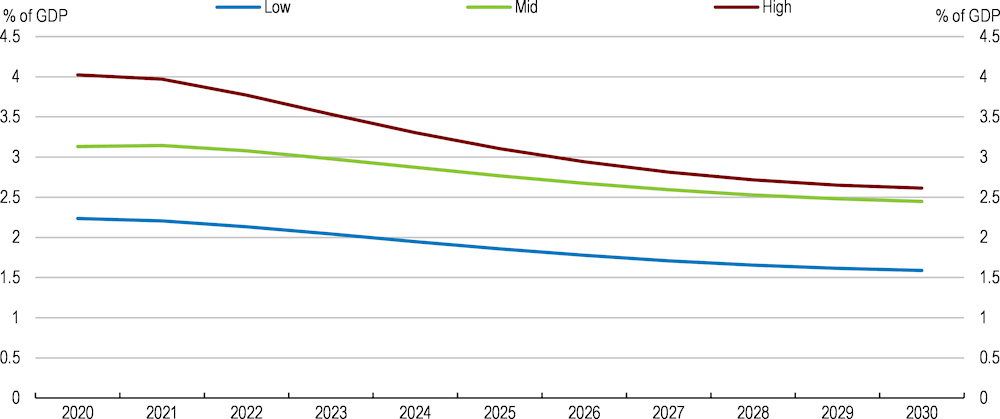

Fiscal effects of the transition depend largely on the policy instruments used. Fiscal effects include direct expenditures, indirect effects as people and businesses adapting production and consumption change the tax base, eligibility for transfers and public services, and direct effects on tax revenue. Direct pricing instruments generate revenues, but a diminishing tax base will over time erode these as well as current revenues charged on fossil fuels. OBR (2021[7]) estimates carbon tax revenues to peak immediately at 1.5% of GDP and gradually decline towards 0.5% in 2050 (despite a steadily increasing tax rate) as the tax base shrinks. The impact of regulations also depends on how they affect tax bases. For example, the base for the fuel excise duty will erode as fossil fuel cars are phased out over the next couple of decades, with a potential revenue loss corresponding to 1.6% of GDP (OBR, 2021[7]). Findings by Pareliussen, Saussay and Burke (2022[8]) support the OBR’s finding that the tax base erodes over time, but with considerable initial revenue gain (Figure 2.8). A temporary increase in greenhouse gas related revenues from the UK ETS or a carbon tax may coincide with the need to subsidise positive externalities and compensate those most affected by the transition (HMT, 2021[6]). However, given the current environment of historically high energy prices, implementation should be delayed until energy prices show signs of normalisation.

Note: The carbon price signal is here modelled as uniform carbon (equivalent) tax, but could in principle come from an emissions trading scheme, regulations, subsidies or a combination of instruments. The low carbon price starts at GBP 100 in 2030 and rises to GBP 189 in 2050. The medium carbon price starts at GBP 140 in 2030, rising to GBP 378 in 2050. The high carbon price starts at GBP 280 in 2030, rising to GBP 568 in 2050. Revenues are redistributed with shares equal to sector shares in output in the “Standard” scenario. All revenues are distributed to households and firms in the “Household” and “Firm” scenarios, respectively. Firms’ proportional share of revenue is redistributed to firms according to their export exposure in the “Export exposure” scenario. The “Neutral GDP” scenario holds back a share of revenue (45%) to achieve average GDP growth as in the baseline from 2040 to 2050. Remaining revenues are distributed as in the “Standard” scenario.

Source: Pareliussen, J., A. Saussay and J. Burke (2022), “Macroeconomic and distributional consequences of net zero policies in the United Kingdom”, OECD Economics Department Working Papers (forthcoming).

Carbon revenues by tax rate

Note: The carbon price signal is here modelled as uniform carbon (equivalent) tax, but could in principle come from an emissions trading scheme, regulations, subsidies or a combination of instruments. The “Neutral GDP” scenario holds back a share of revenue (45%) to achieve average GDP growth as in the baseline from 2040 to 2050. Remaining revenues are redistributed with shares equal to sector shares in output. The low carbon price starts at GBP 100 in 2030 and rises to GBP 189 in 2050. The medium carbon price starts at GBP 140 in 2030, rising to GBP 378 in 2050. The high carbon price starts at GBP 280 in 2030, rising to GBP 568 in 2050.

Source: Pareliussen, J., A. Saussay and J. Burke (2022), “Macroeconomic and distributional consequences of net zero policies in the United Kingdom”, OECD Economics Department Working Papers (forthcoming).

The main policy instruments available to price greenhouse gas emissions directly are taxes on greenhouse gas emissions and “cap-and trade” emissions trading schemes. The United Kingdom and other OECD countries rely on both emissions trading schemes and CO2 (equivalent) taxes. Emission pricing has been essential for the United Kingdom to nearly eliminate coal from electricity production, as discussed below. In an emissions trading scheme, tradable emissions permits, summing up to the overall cap on emissions, are issued and sold or allocated for free to participants who can trade them freely. The cap is reduced over time to meet emission reduction targets. An emissions trading scheme sets the quantity of emissions (“the cap”) and lets the market find the price, while a tax sets the price and lets the market set the quantity (D’Archangelo et al., 2022[9]). The two systems share their tax base, so systems and requirements for measuring and reporting are similar. In addition, an ETS requires market infrastructure already existing in the United Kingdom, and similar to other financial and commodity markets. The environmental effectiveness of these two instruments is largely equivalent, as the ETS cap can be adjusted over time to hit a desired price level, and a tax can be adjusted over time to hit a desired quantity. For these reasons, the policy choice between a CO2 equivalent tax and an ETS should be a pragmatic one.

The United Kingdom set up the world’s first multi-industry carbon trading system in 2002 as a pilot for the EU Emissions Trading Scheme (EU ETS). The UK Emissions Trading Scheme (UK ETS) – a spin off from the EU ETS upon departure from the EU – is the main explicit pricing instrument in the United Kingdom. The scheme covers approximately 25% of current emissions, including electricity generation, manufacturing, refineries, petroleum extraction, and domestic, UK-EEA, and UK-Gibraltar aviation. It follows similar rules to the EU ETS with a few differences, such as a slightly different cost containment mechanism and a carbon tax (the Carbon price support) acting as a price floor which is seen as instrumental in near-eliminating coal from electricity supply, as explained below. A transitional auction reserve price of GBP 22 per allowance representing one metric tonne of CO2e might be replaced by a supply adjustment mechanism in the future. The Government has issued consultation that includes proposals to align the ETS cap with the net zero objective by January 2024 and the future of free allocations, as well as calling for evidence on expanding the scope of the ETS within existing sectors and to additional sectors such as domestic shipping, and energy-from waste as well as greenhouse gas removals (UK ETS Authority, 2022[13]). Moreover, other price-based measures target other sectors. The fuel excise duty incentivises emission reductions in road transportation, the climate change levy is a tax charged on business and public sector energy use. The waste sector is subject to a landfill tax, and import quotas of F-gases create scarcity reflected in market prices.

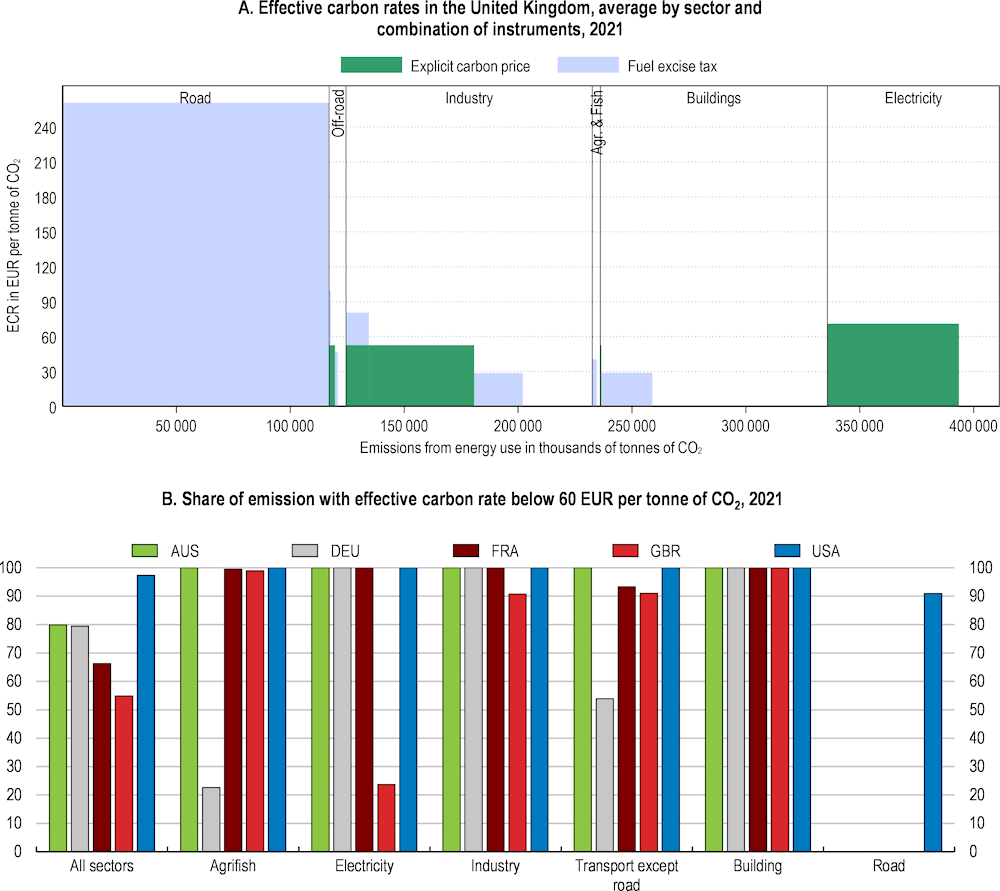

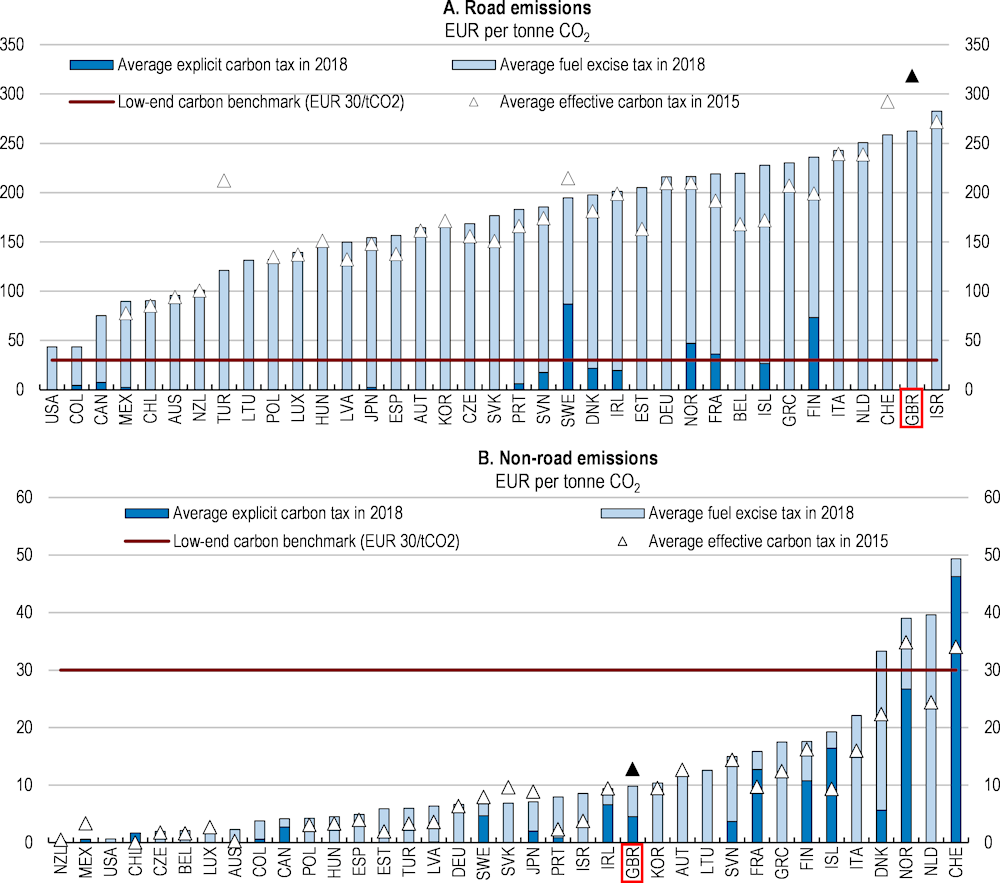

The main problem in the United Kingdom, as in most other countries, is that a considerable amount of emissions are not covered by pricing instruments at all, or only by very weak instruments (Figure 2.9). Reduced VAT rates, tax reliefs and other supports subsidise amongst others fossil fuel consumption on domestic fuel and power supply, domestic passenger transport, diesel used in off-road vehicles and kerosene for heating (NAO, 2021[22]). The “Ring-fence” corporate income tax enables a 100% first year allowances for capital expenditure by the oil and gas sector. In addition, operators can fully deduct decommissioning costs from their corporate profits in the year in which they are incurred. However, contrary to some other G7 countries, the United Kingdom is not tracking support measures with potential environmentally harmful impacts. Going forward, the United Kingdom should systematically track and quantify support measures with potential environmentally harmful impacts and adjust policy accordingly.

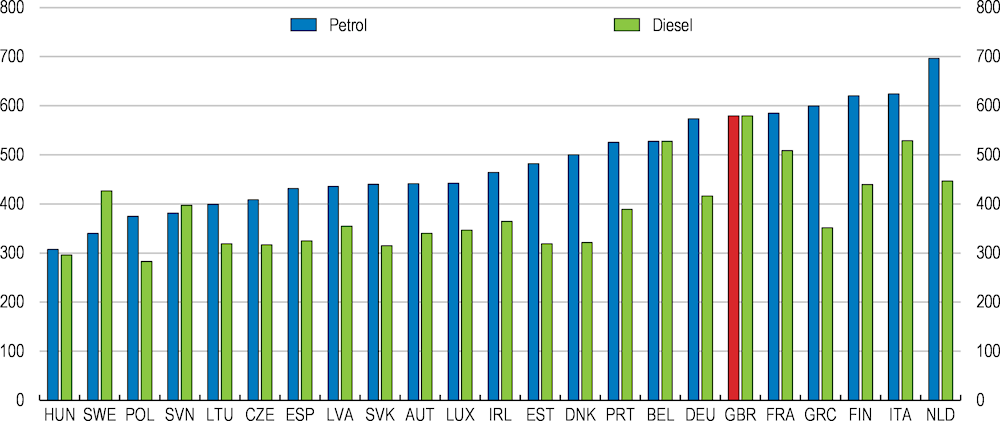

Compared with other European OECD countries, the price signals from the sum of tradeable emission permit prices, carbon taxes and fuel excise taxes (“effective carbon rates”) are high in the road transport and electricity sectors but low in others, especially in the residential and commercial sectors (Figure 2.9, Panel A). In 2021, only 45% of carbon emissions from energy use were priced above EUR 60 per tonne of CO2. The complex system of explicit (ETS, Carbon price support) and implicit (climate change levy, fuel duty and different tax treatments) carbon prices sends inconsistent signals across sectors and fuels (Figure 2.9, Panel B) (OECD, 2022[4]). Departments have a limited understanding of the environmental impact of their policies (NAO, 2021[22]). Moreover, renewed freezes of the fuel duty and vehicle excise duty for heavy goods vehicles, suspension of the heavy goods vehicle road user levy and reduced rates for air passenger duty for domestic flights run counter to climate objectives (OECD, 2022[4]). More recently, the fuel duty was temporary cut (until March 2023) by GBP 0.05 per litre, corresponding to GBP 22 per tonne CO2 for petrol and GBP 19 for diesel, to respond to soaring prices in the context of Russia’s invasion of Ukraine.

Note: Emissions-weighted average by sector and combination of instruments (explicit carbon price only, fuel excise only, both, none) in each country. The ETS price is the average ETS auction price for the first semester of 2021, with the exception of the UK where it is based on information for the period in which they were operational (UK: 19/05/2021-30/06/2021). Where applicable, ETS coverage estimates are based on the OECD’s Effective Carbon Rates 2021, with ad-hoc adjustments to account for recent coverage changes. Emissions refer to energy-related CO2 only and are calculated based on energy use data for 2018 from IEA, World Energy Statistics and Balances 2020. The figure includes CO2 emissions from the combustion of biomass and other biofuels. For more information, see source.

Source: OECD (2021), Carbon Pricing in Times of COVID-19: What Has Changed in G20 Economies?, OECD, Paris, https://www.oecd.org/tax/tax-policy/carbon-pricing-in-times-of-covid-19-what-has-changed-in-g20-economies.htm.

The United Kingdom is considering expanding the scope of the UK ETS in existing sectors, such as: calling for evidence on the inclusion of upstream oil and gas venting sectors, and to sectors currently not subject to an explicit carbon price, including domestic shipping, and energy-from waste. Expanding ETS coverage across domestic sectors can increase policy efficiency and reduce volatility, as factors driving emissions vary across different sectors of the economy. Such expansion should also be technically straightforward for some major emission sources not covered by the Government’s proposal. Notably, fuels for transportation, machinery and heating could be included upstream in the value chain based on the carbon content of refined products, as was done in Quebec, California and the German carbon pricing system that became operational in January 2021 (D’Archangelo et al., 2022[9]). Including upstream emissions directly in the UK-ETS would necessitate legal amendments, as ETS emissions are currently defined at the point of emissions. Other sources, such as livestock and dairy farming and land-use emissions would be more challenging to include due to technical and measurement issues, some of which could be resolved. The government does not currently propose to include agricultural emissions, but is calling for evidence on monitoring and reporting of emissions from agriculture. The New Zealand emissions trading scheme does for example include forestry, and agricultural emissions are set to be included in the ETS or in a separate pricing mechanism from 2025 (See Box 2.4 below). Going forward, the United Kingdom should commit to gradually expand the UK ETS to all emitting sectors and tighten the emissions cap in line with targets. In case it proves difficult to expand the ETS across sectors as envisioned, carbon taxation is an equivalent alternative from the environmental perspective. A carbon tax could be phased in with a gradually increasing tax rate to give businesses and households time to adapt. The timing of implementing carbon pricing also matters. The government should consider the pressures on the cost of living when phasing in price signals.

Linking the UK ETS to the EU ETS remains an option to “give serious consideration”, as stated in the EU-UK Trade and Cooperation Agreement (European Commission, 2021[23]). Linking the UK to the EU ETS carries advantages and disadvantages, but is technically straightforward. It can be done by full participation, as is the case with EFTA countries in the EU ETS, or by formal linking through a bilateral or international agreement. In an international agreement, countries mutually accept each other’s emission certificates. A third option is indirect linking in which both schemes unilaterally accept a common asset, for example external offsets governed by the Paris agreement or allowances from a third-party ETS.

Linking emissions trading schemes in general enhances overall welfare, since it increases the price in the scheme with lower-cost abatement available (or a more generous cap) and lowers it in the system with a high marginal cost of abatement (or a tighter cap). The marginal emission reduction determining the market price in an ETS is often realised by switching electricity production from coal to gas. Since coal and gas are internationally traded, this fuel switching cost will act in the direction of convergence even in the absence of linking. This mechanism has led prices in the UK ETS and EU ETS to largely move in tandem since the UK’s departure. Industry expectations about a future link between the two systems might play a role as well. An additional advantage of linking is that it would make it easier for the UK financial sector to continue to play an important role in a growing market. While in general being favourable, linking can be politically difficult, since it will mean a transfer from the high-price to the low-price system where permit holders can sell their surplus for a profit until prices align. Formal linking also reduces the scope to unilaterally expand and develop the ETS or related policies like a UK specific approach to carbon leakage in line with domestic policy targets in future years.

Both the UK ETS and the EU ETS have built-in market stabilisation mechanisms to avoid extremely high or low prices. When the UK ETS Cost containment mechanism (CCM) is triggered, the UK ETS Authority, made up of HM Government, the Scottish Government, Welsh Government and Northern Ireland Executive, work together to consider what intervention, if any, HM Treasury should authorise. The ETS Authority decided not to release any additional allowances into the market when CCM was triggered for the first time in December 2021. This decision was prudent, as high prices reflected commodity market fundamentals, notably a shortage of natural gas. A release of additional allowances would not have changed this and would only have limited effects on energy bills, of which ETS compliance constitutes a small share.

The United Kingdom has a robust framework for monitoring and evaluating public spending programmes. The Government’s ‘green book’ describes how major public sector investment projects are assessed and helps government officials appraise the costs and benefits of policies, projects and programmes. A review of the green book in 2020, however, concluded that it had failed to support the Government’s objectives of reaching net zero (HMT, 2020[24]). The new green book requires all projects to consider their impacts on carbon emissions, whether or not they directly target the net zero objective, it provides further guidance on how emissions should be assessed and clearer objectives (OECD, 2022[4]), which is a significant step forward.

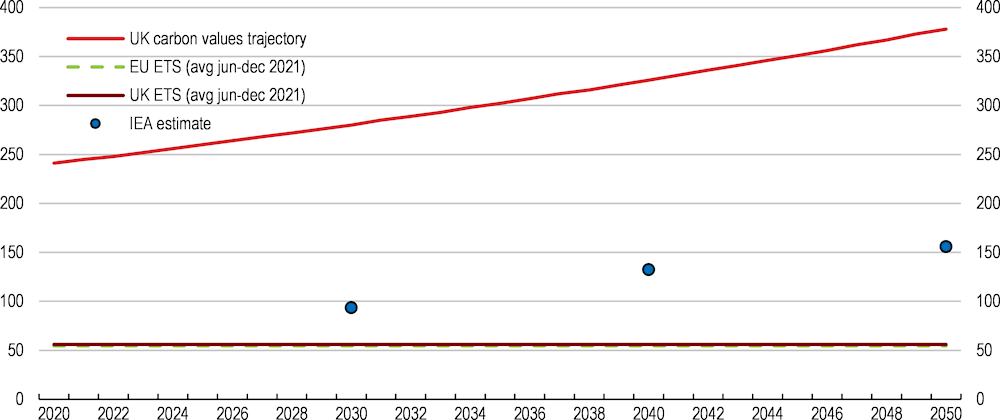

Greenhouse gas emissions values (“carbon values”) are used across the government for valuing impacts on GHG emissions resulting from policy interventions. The United Kingdom first integrated carbon values in green book cost benefit policy appraisals and ex-post policy evaluations in 2002. Since 2009, a ‘target consistent’ approach has been used to estimate the values, where these are calculated as the marginal abatement cost of meeting domestic targets, rather than a “(global) social cost of carbon” approach. The cost trajectory published in 2021 and set to be updated every five years extrapolates IPCC estimated carbon values in 2040 (GBP 326 in 2020 prices) with a 1.5% growth rate (BEIS, 2021[25]; HMT, 2020[26]). A social cost of carbon approach to shadow pricing, the approach followed by for example the United States, is in principle better aligned with climate science and the global nature of climate change. However, the target consistent approach is appropriate in the UK context, as it aligns the official cost trajectory with national legally binding ambition and the cost of reducing emissions under national jurisdiction. The transparent methodology is also appropriate, as true carbon values are inherently uncertain and a more complex methodology would likely not improve accuracy.

Carbon values could be used more actively to coordinate and speed up policy development across government. A clear mandate and clear expectations for Departments to bring sectoral policies in line with the carbon values would help optimise investment decisions and reduce uncertainty and cost for the private sector (HMT, 2021[6]). However, carbon values are very high compared to current carbon prices in the United Kingdom and elsewhere (Figure 2.10). This indicates that the combined incentives facing the private sector from carbon pricing, regulation and subsidies will need to increase considerably to reach net zero. It also calls for phase-in periods in the case of explicit pricing instruments and regulations to allow people and businesses to adapt.

The Climate Change Committee recommended a “net zero test” for new policy initiatives, as today’s decisions on for example road building, fossil fuel production, planning and expansion of waste incineration may be incompatible with net zero and may send mixed messages to the public (Climate Change Committee, 2021[3]). Cost-benefit analyses integrating carbon values are already in principle testing whether new policy initiatives align with the net zero target. Instead of another net zero test, additional efforts should ensure that target-consistent carbon values are consistently applied in all cost-benefit analyses across government and systematically considered in decision-making, and that the projects with the highest net benefits are pursued.

Note: UK carbon values represent net zero consistent marginal abatement cost. IEA estimates for net zero consistent CO2 prices for electricity, industry and energy production in selected advanced country regions, consider the effects of other policy measures alongside CO2 pricing, such as coal phase-out plans, efficiency standards and renewable targets. These policies interact with carbon pricing; therefore the marginal cost of abatement can be considerably higher than the CO2 price shown in the figure. More information can be found in the World Energy Outlook table B.2.

Source: UK Government: Valuation of greenhouse gas emissions: for policy appraisal and evaluation; Ember Climate, Daily Carbon Prices; IEA World Energy Outlook; and OECD (2022), Economic Outlook: Statistics and Projections database.

The United Kingdom has been at the forefront of global efforts to green the financial system. The financial sector has an important role to play in financing the green transition, and the United Kingdom’s role as a global financial hub extends the benefits of greening finance well beyond national borders. However, the financial sector does not work in isolation; it can only be a facilitator, delivering climate-friendly investment in response to effective policies. A clearer transition policy path would allow the financial sector to better support the green transition.

Demand for more environmentally friendly investment portfolios combined with insufficient emission reduction policies and lacking climate risk assessment and disclosure has left a vacuum in the United Kingdom and elsewhere. There is a need for the public sector to step in to channel finance to its best uses and avoid counterproductive market dynamics such as blanket portfolio exclusions of firms or sectors on simple criteria including their current emission intensity. These firms provide valuable products and services, and they can potentially play an important part in reducing emissions if spurred by conscious shareholders and policy action (BoE, 2021[27]). From April 2022, over 1 300 of the largest UK-registered companies, including traded companies, banks and insurers and private companies with over 500 employees and GBP 500 million in turnover will be mandated by law to disclose climate-related financial information. There is also scope to develop new financial products and scale up existing ones, such as “green mortgages” explicitly taking into account savings from residential energy efficiency investments (HMT, 2021[6]).

The United Kingdom is working actively to improve the UK’s financial sector resilience by better assessing and disclosing risks from climate change and transition risks from a changing policy and investor landscape, and integrating these risks into the supervisory framework. Such efforts, along with a taxonomy of environmentally friendly activities will make environmentally friendly investment opportunities more attractive relative to polluting ones. In 2021, HM Treasury extended the remits of the Monetary Policy, Financial Policy and Prudential Regulations Committees of the Bank of England to also include supporting net zero and the green transition (HMT, 2021[28]; HMT, 2021[29]; HMT, 2021[30]). A similar extension was made to the recommendations for the Financial Conduct Authority (HMT, 2021[31]). The United Kingdom also issued its first green bonds in 2021, raising GBP 16 billion for clean transportation, renewable energy, energy efficiency, pollution prevention and control, living and natural resources and climate change adaptation in accordance with the Green Financial Framework (HMT, 2021[32]).

The Bank of England and the Financial Conduct Authority were the first central bank and regulator to set supervisory expectations for banks and insurers on how to manage climate-related financial risks in 2019. These expectations covered governance, risk management, scenario analysis and disclosure (BoE, 2019[33]). This was followed by a letter to regulated firms in 2020 and guidance on climate-related financial risk management by the end of 2021. A subsequent report discusses consequences for the regulatory capital framework (PRA, 2021[34])The Financial Conduct Authority and the Bank established the Climate Financial Risk Forum (CFRF) in 2019, bringing together representatives of banks, insurers and asset managers to build capacity and share best practices. In June 2020, the CFRF published its guide to help the financial industry approach and address climate-related financial risks (CFRF, 2020[35]), with more detailed guides focussing on risk management, scenario analysis, disclosure, innovation and climate data and metrics following in 2021.

Following an exploratory stress test covering insurance companies in 2019 (BoE, 2019[36]), the Bank launched the Climate Biennial Exploratory Scenario on financial risks from climate change (CBES) in 2021, with results expected in May 2022. This stress test explores the resilience of the UK financial system to the physical and transition risks associated with three scenarios (Table 2.4), with the aim of capturing and understanding climate related risk across the financial system and interactions between banks and insurers. It will not be used by the Bank to inform capital requirements (BoE, 2021[37]). Results from the CBES revealed notable data gaps and large variation in individual banks and insurance companies climate risk assessment capabilities. The exercise shows that climate risks are likely to create a drag on the profitability of UK banks and insurers, with the lowest cost associated with the scenario with early, well-managed action. Insufficient action will hit businesses and households vulnerable to physical risk hard. At the same time it is in the interest of the financial sector to manage climate-related financial risks in a way that supports the green transition over time (BoE, 2022[38]). The Bank is also working to climate-proof its operations by publishing its own climate-related financial disclosure annually, aligned with the Task Force on Climate-Related Financial Disclosures recommendations; by taking steps to greening their corporate bond holdings (BoE, 2021[27]; BoE, 2021[39]); and by reducing the climate footprint of its physical operations. The United Kingdom should adapt financial sector regulation and supervision as climate-related risks and vulnerabilities are uncovered by stress-tests and related activities.

Summary of impacts in 2021 Climate Biennial Exploratory Scenarios

|

Early action |

Late action |

No additional action |

|

|---|---|---|---|

|

Transition risks |

Medium, with an early and orderly transition starting in 2021 and shadow prices peaking at USD 900. |

High, with a late and disorderly transition starting in 2031 and shadow prices peaking at USD 1100. |

Limited, with limited transition happening and shadow prices remaining low at USD 30. |

|

Physical risks |

Limited, with mean global warming up 1.8 degrees Celsius and UK sea level rising 16 cm by 2050. |

Limited, with mean global warming up 1.8 degrees Celsius and UK sea level rising 16 cm by 2050. |

High, with mean global warming up 3.3 degrees Celsius and UK sea level rising 39 cm by 2050. |

|

Impact on output |

Temporarily lower, with UK growth rates averaging 1.4% year 6-10, 1.5% year 11-15 and 1.6% year 26-30. |

Sudden contraction, with UK growth rates averaging 1.5% year 6-10, 0.1% year 11-15 and 1.6% year 26-30. |

Permanently lower, with UK growth rates averaging 1.4% year 6-10, 1.4% year 11-15 and 1.2% year 26-30. |

Note: Colour codes correspond to different levels of risk: green = limited; orange = medium; red = high. Shadow prices relate to the United Kingdom, and are expressed in 2010 USD. Scenarios run from 2021 to 2050. Early Action: the transition to a net-zero economy starts in 2021 so carbon taxes and other policies intensify relatively gradually over the scenario horizon. Late Action: The implementation of policy to drive the transition is delayed until 2031 and is then more sudden and disorderly, with material short-term macroeconomic disruption. No Additional Action: no new climate policies are introduced beyond those already implemented.

Source: Bank of England (2021[37]).

The United Kingdom engages to promote best practices to address climate risks to the financial sector and furthering understanding of the macroeconomic impacts of climate under different transition paths in various international fora including the OECD, G7, the IMF, the Basel Committee on Banking Supervision (BCBS), the Sustainable Insurance Forum (SIF) and the Financial Stability Board (FSB). The Bank of England founded the Network of Central Banks and Supervisors for greening the Financial System (NGFS) together with Banque de France and six other central banks and financial supervisory authorities in 2017. This group aims to share best practices and contribute to the development of environment and climate risk management in the financial sector. Its purpose is to define and promote best practices to be implemented within and outside of the membership of the NGFS and to conduct or commission analytical work on green finance. NGFS has since grown to 114 members and 18 observers (as of 13 April 2022), including the Financial Conduct Authority (NGFS, 2021[40]). It has issued six core recommendations covering financial stability monitoring and supervision, own-portfolio management, bridging data gaps, awareness and intellectual capacity, internationally consistent disclosure and supporting the development of a taxonomy of economic activities.

Potential efficiency gains from better aligning carbon prices do not stop at national borders. Engaging in international cooperation and market mechanisms can enhance welfare by reducing emissions where it is less expensive. Linking to the EU ETS is a concrete option under consideration, with advantages and disadvantages as outlined above. The Paris agreement allows offsetting residual emissions by emission reductions abroad. Any emission rights transferred will be added to the transferring country’s emission cap (National determined contribution, NDC). This eliminates in principle the concerns of the Kyoto Protocol that project-based emission reductions might be inaccurately measured, and therefore indirectly increase emissions outside of the project boundaries (Box 2.3).

In the Kyoto Protocol, countries with quantified commitments (Annex 1 countries) could pool their emission reduction commitments and reach them collectively, as was done by members of the European Union. Alternatively, deficit countries could buy emission quotas from countries with a surplus, or from certified emission-reducing projects abroad. Similar mechanisms to reach national targets (National determined contributions, NDCs) in cooperation, or by trading emission reductions in an international framework supervised by the Conference of the Parties (COP), exist in the Paris agreement Article 6. COP 26 in Glasgow operationalised these mechanisms with more detailed rules (“The Paris Rulebook”).

A central principle to avoid double-counting is that if emission rights (Internationally Transferred Mitigation Outcomes, ITMOs) are transferred, these count tonne for tonne as emissions in the transferring country. A hypothetical example illustrates how this works: Should the United Kingdom decide to accept European Union Allowances (EUAs, the emission rights traded in the EU ETS) as valid currency in the UK ETS, and to assign zero allowances to UK ETS entities, these entities would need to buy EUAs equal to their emissions. Their emissions would in this case count towards the EU NDC, while the UK ETS sector would have achieved net zero emissions.

The United Kingdom, including its financial sector, has considerable experience in developing and participating in carbon markets, and should continue to engage constructively, evolving the international rulebook and facilitating private sector involvement. However, such trade should be handled with care to ensure that it does not contribute to higher global emissions. If trading with countries whose NDCs are inconsistent with net zero, the prospect of selling emission rights might discourage them from tightening their targets. Furthermore, such trade depends on trust that trading partners will indeed fulfil their net zero-consistent NDCs, demonstrated by clear plans and timely policy action (Climate Action Tracker, 2021[43]). Going forward, the United Kingdom should engage in cooperative approaches established under the Paris agreement, including the potential linking of the UK-ETS to other emission trading schemes, conditional on credible commitments aligned with net zero in partner countries.

Regulation and subsidies can be valuable components of the policy mix where cost-effective measures are targeted. However, ill-designed and uncoordinated regulations, subsidies and pricing instruments may increase the cost of decarbonisation by complicating performance monitoring, blurring price signals and blunting economy-wide incentives. Furthermore, traditional subsidies and command and control regulations give weaker “dynamic” incentives to research, develop and go above and beyond set standards (D’Archangelo et al., 2022[9]), and they risk being less effective and more costly than assumed before implementation (HMT, 2021[6]). Ex-post performance reviews and evaluations can help, and should be an integral part of policy planning and design (OECD, 2014[44]). Given these pitfalls, regulations and subsidies need to be well-designed and selectively targeted to specific well-identified cases of market failure. These are often sector-specific and therefore discussed in their sector context below. Some considerations nonetheless apply across sectors:

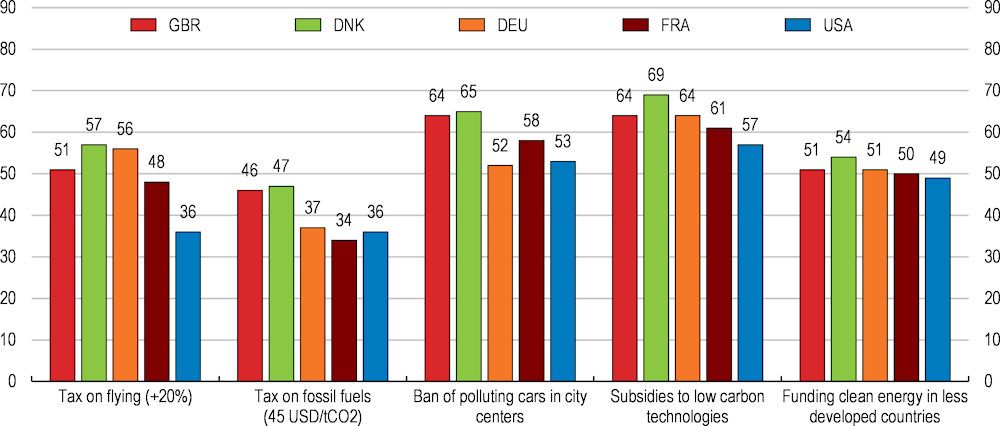

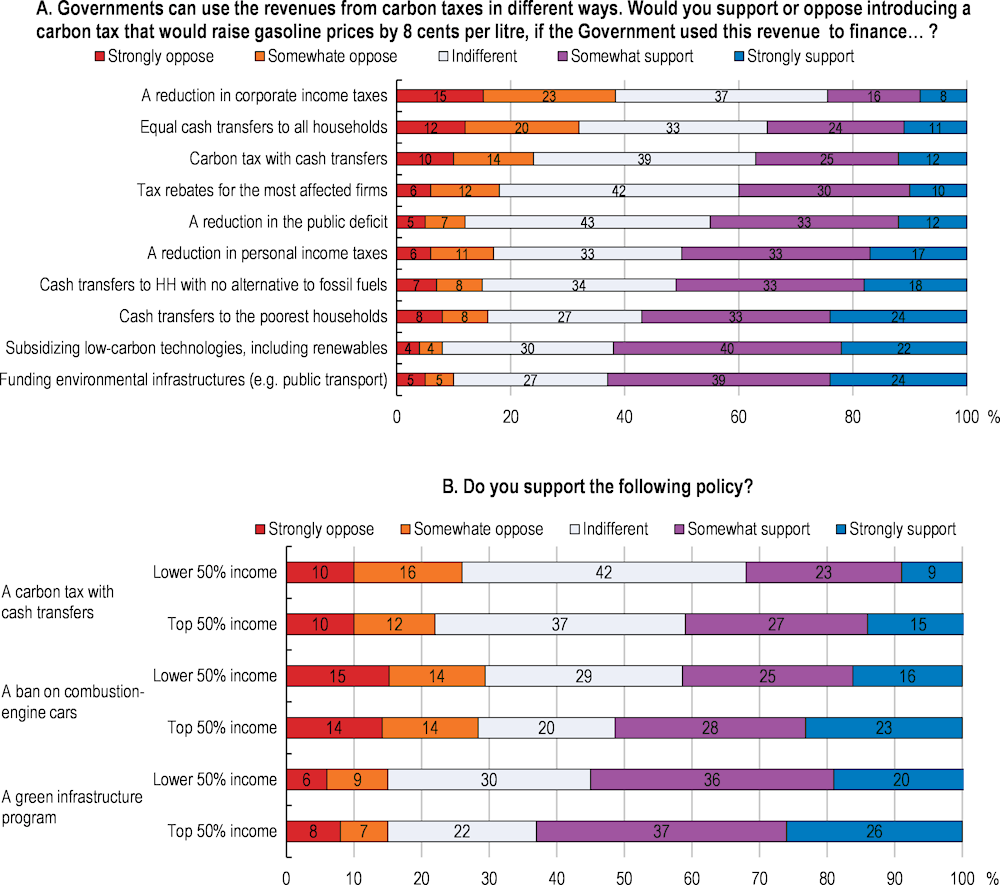

Some sectors and emissions sources, like aviation, shipping, heavy goods transportation and meat production will require considerable technological development to decarbonise (IEA, 2021[45]). The necessary research and development (R&D) will be underfunded absent policies assigning a cost on greenhouse gas emissions. R&D funding suffers an additional major market failure, as the social value of R&D exceeds the private value in general (positive externality). Asymmetric information between the technology developer and potential lenders can lead to liquidity constraints. Subsidising green R&D can help overcome these market failures. There is also a role for policy to take on the risk to bring to market untested and uninsurable solutions, and steepening technology learning curves by scaling up more developed technologies. Policy support can also help overcome other market failures putting new technologies at a disadvantage, such as a bias towards status quo (inertia) and a poor understanding of the benefits from new technologies (information failures). Coordination failures may prevent network effects, which occur when the value of a service increases with the number of people using the service, form being realised (Dechezlepretre and Cervantes, 2022[46]). This can for example happen in the case of electric vehicle charging stations, hydrogen and CO2 pipelines (HMT, 2021[6]). However, the risk of public intervention distorting competition is higher for technologies at or close to commercialisation, and these risks need to be properly understood and addressed in policy design. Subsidies to low-carbon technologies are systematically the most favoured climate policy compared to carbon pricing, bans or regulations. Similarly, support for a carbon tax is largest if its revenues are used to fund green infrastructure or to subsidise low-carbon technologies (Dechezleprêtre et al., 2022[10]).

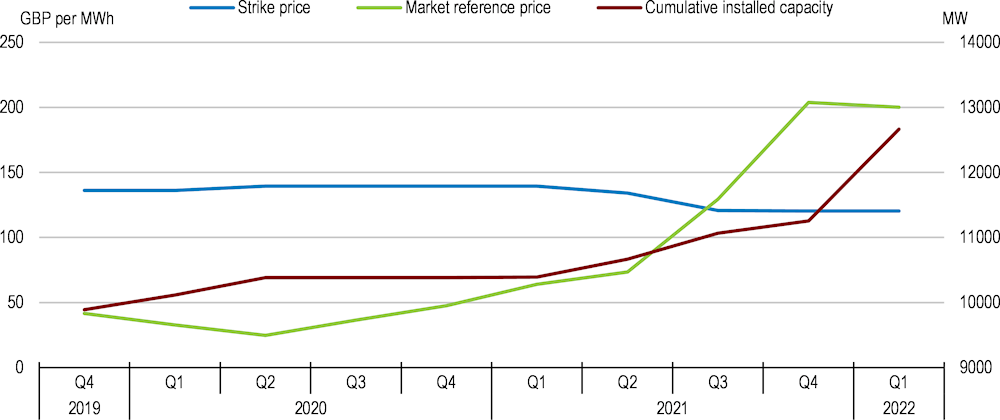

The United Kingdom Contract for difference (CfD) auctioning scheme for renewable energy licences is a good practice example of cost efficient subsidy schemes (LCCC, 2021[47]). Reaching net zero and reducing dependence on imported fossil fuels call for accelerating CfD auctions and lifting the 5GW cap on solar and onshore wind in the coming auction round. The CfD could also serve as a model to expand the use of competitive auction designs to maximise value for money of public support policies across sectors of the economy. Other prominent public support vehicles, including the new UK Infrastructure Bank and the Scottish National Investment Bank, will help mobilise green private investment and promote green finance. All in all, the 2021 Autumn Budget and Spending Review outlines the public spending contribution to Net Zero (GBP 26 billion) and other green objectives (GBP 4 billion) over 2021-25 (OECD, 2022[4]).

Regulation can be particularly useful to target households’ energy use to phase in higher energy efficiency, clean heating and zero-emission vehicles. While businesses unresponsive to explicit pricing signals will lose market share and responsive ones will grow in a competitive market, the case is less clear for households. Market imperfections including information failures, liquidity constraints, inertia, split incentives and hyperbolic discounting will therefore blunt households’ behavioural responses even in cases where explicit emission prices make it profitable to go green (HMT, 2020[48]). Well-designed regulations and standards can also help overcome coordination failure and realise network effects, for example by setting technical standards for electric vehicle charging stations and connectors (D’Archangelo et al., 2022[9]).

The UK building code already sets energy efficiency requirements, but these can be tightened. Minimum energy efficiency requirements have been in place for social housing for some time, and are planned implemented also for private rentals. Minimum performance standards coupled with energy labels have contributed to increasing energy efficiency in new buildings and appliances in the United Kingdom and the EU. The United Kingdom also uses fleet-wide performance standards, where car producers need to meet maximum tailpipe emissions, averaged over all cars sold in a given year, to reduce average emissions per car. Such policies have also reduced tailpipe emissions in the EU and the United States, amongst others, and are more efficient if they are tradable and tightened over time.

Even though the need to reduce greenhouse gas emissions is widely recognised and supported by a broad majority of the UK population and across the OECD (Dechezleprêtre et al., 2022[10]), concrete policies often fail to gain political traction or are hollowed out by exemptions, reduced ambition and compensatory measures blunting incentives for necessary structural change. Political economy hurdles to national policy action often revolve around industry’s fear of losing competitiveness and households’ fear of the increased cost of living. Local resistance can also be an issue, notably to investments in renewables.