The personal tax system plays an important role in old-age support. Pensioners do not pay social security contributions in any of the Asian economies. Personal income taxes are progressive and pension entitlements are usually lower than earnings before retirement, so the average tax rate on pension income is typically less than the tax rate on labour income. In addition, most of the Asian economies give additional tax concessions to pensioners through either increased personal allowances or extra tax credits or pension income is completely exempt from taxation.

Pensions at a Glance Asia/Pacific 2022

Tax treatment of pensions and pensioners

Key results

Most Asian economies provide either higher personal allowances or extra tax credits to older people. This relief is irrespective of the source of income and so will include earned income at older ages. Beyond this over half of the economies do not tax pension income.

In addition, some OECD countries have specific tax rules for income from pensions, from either public or private schemes. For example, between 15% and 50% of income from public pensions in the United States (social security) is not taxed, depending on the total income of the pensioner. In Australia, benefits derived from pension contributions and investment returns, which have both been taxed, are not taxable in payment for over 60s. This applies to the mandatory defined contribution scheme and voluntary contributions to such plans.

Virtually all OECD countries levy employee social security contributions on workers: Australia and New Zealand are the only exceptions.

Empirical results

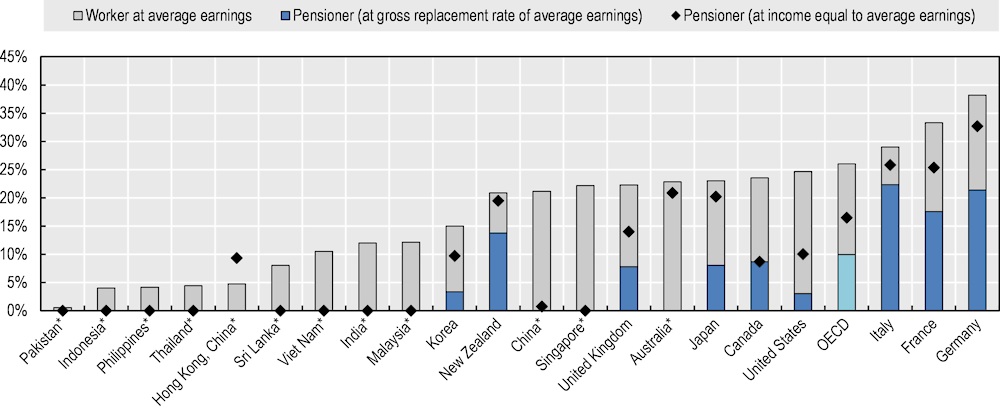

Figure 2.3 shows the percentage of income paid in taxes and contribution by workers and pensioners. Starting with workers, countries have been ranked by the proportion of income paid in total taxes (including social contributions paid by employees) at the average‑wage level. This is then compared to the total tax rate paid by a pensioner after a full-career at the average wage, hence receiving the gross replacement rate in the base case (Table 2.1, as set out in the indicator “Gross pension replacement rates” above).

In all Asian economies, such a pensioner would not pay any tax in retirement. In most cases this is because pensions are not taxable. In others, such as India, for example, it is because the pension income would be less than the income‑tax personal allowance offered to older people. Pensioners with the gross replacement rate of a full-career average earner would pay 10% of their income in taxes and contributions on average across the OECD. By comparison, taxes and contributions paid by an average earner – so not including any contributions from the employer – average 26% of the gross wage in OECD countries and 9% in the Asian economies.

The last series in the chart shows how much a pensioner would pay if her income before tax is equal to the gross average wage. The total tax rate is 16% on average in OECD countries, some 10 percentage points lower than what workers pay with the same level of income. For the Asian economies the average is 1%, but only China at 1% and Hong Kong (China) at 9% actually have any payments.

The difference between this 16% rate for pensioners with an income equal to average earnings and the 10% paid in taxes and contributions paid on the income which is equal to the gross replacement rate for an average earner illustrates the impact of progressivity in income‑tax systems for pensioners.

Table 2.2. Treatment of pensions and pensioners under personal income tax and mandatory public and private contributions

|

Extra tax Allowance/ credit |

Full or partial relief for pension income |

Mandatory contributions on pension income |

Extra tax Allowance/credit |

Full or partial relief for pension income |

Mandatory contributions on pension income |

||||

|---|---|---|---|---|---|---|---|---|---|

|

Public scheme |

Private scheme |

Public scheme |

Private scheme |

||||||

|

East Asia/Pacific |

OECD Asia/Pacific |

||||||||

|

China |

None |

Australia |

✓ |

✓ |

✓ |

None |

|||

|

Hong Kong (China) |

✓ |

None |

Canada |

✓ |

✓ |

✓ |

None |

||

|

Indonesia |

✓ |

None |

Japan |

✓ |

✓ |

✓ |

Low |

||

|

Malaysia |

✓ |

None |

Korea |

✓ |

✓ |

None |

|||

|

Philippines |

✓ |

None |

New Zealand |

None |

|||||

|

Singapore |

✓ |

None |

United States |

✓ |

✓ |

None |

|||

|

Thailand |

✓ |

✓ |

None |

||||||

|

Viet Nam |

None |

Other OECD |

|||||||

|

France |

Low |

||||||||

|

South Asia |

Germany |

✓ |

✓ |

Low |

|||||

|

India |

None |

Italy |

✓ |

✓ |

None |

||||

|

Pakistan |

✓ |

✓ |

None |

United Kingdom |

✓ |

None |

|||

|

Sri Lanka |

✓ |

✓ |

None |

||||||

Source: See online “Country Profiles available at http://oe.cd/pag.

Figure 2.3. Personal income taxes and social security contributions paid by pensioners and workers

Note: *Pensioners at the gross replacement rate of average earnings have zero income tax and social security.

Source: OECD pension models; OECD tax and benefit models.