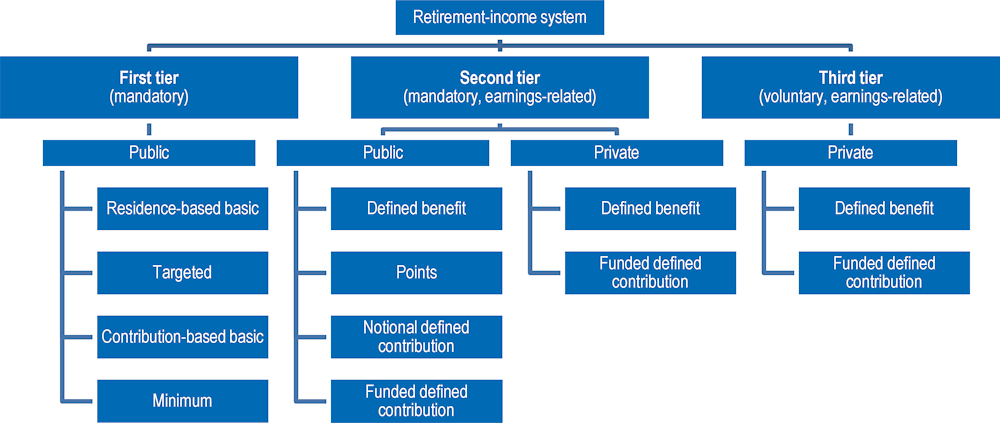

Retirement-income regimes are diverse and often involve a number of different programmes. The taxonomy of pensions used here consists of two mandatory “tiers”; the first generates retirement income independent of past earnings level with the second covering earnings-related components. Voluntary provision, be it personal or employer-provided, makes up a third tier.

Pensions at a Glance Asia/Pacific 2022

Architecture of national pension systems

Key results

Figure 1.1 is based on the role of each part of the system. The first tier comprises programmes offering the first layer of social protection in old age, and for which past earnings are irrelevant in the calculation of retirement income. Such schemes often target some absolute, minimum standard of living in retirement. Mandatory earnings-related components (second-tier) contribute to smoothing consumption, and therefore standards of living, between working life and retirement. Pensions at a Glance focuses mainly on these mandatory components, although information is also provided on some widespread voluntary, private schemes (third tier).

Table 1.1 shows the architecture of pension systems in Asian economies based on the rules that determine eligibility and benefit level while categorising mandatory earnings-related pensions as public or private in accordance with national accounts. Panel A describes the latest legislation applying to future retirees while Panel B shows where those rules have changed compared to current retirees.

Basic pensions can take two different forms: a residence‑based benefit or a benefit that is only available to those who contributed during their career. The level of the benefit may vary with the number of residence or contribution years but is independent of the earnings level during the career. Out of the Asian economies only Thailand has a residence‑based basic pension for future retirees, with payment rates that vary by age. Two of the listed OECD countries have such a scheme, namely Canada and New Zealand.

Eligibility for targeted plans requires meeting some residence criteria. In these plans, the value of the benefit depends on income from other sources and possibly also assets. Hence, poorer pensioners receive higher benefits than better-off retirees. All countries have general safety nets of this type but only those countries are marked in which full-career workers with very low earnings (30% of average) would be entitled. This does not hold for any of the Asian economies.

Minimum pensions can refer to either the minimum of a specific contributory scheme, or to all schemes combined and are currently found in six Asian economies. In most countries, the value of entitlements only takes account of pensions rather than testing for other income. Minimum pensions either define a minimum for total lifetime entitlements, which may increase in level once the length of the contribution period exceeds certain thresholds, or they are based on minimum pension credits that calculate year-by-year entitlements of low earners based on a higher earnings level.

For the Asian economies, they all have mandatory second-tier earnings-related pensions, with New Zealand being the only country shown that does not have such a system. There are four kinds of scheme.

For future retirees public pay-as-you-go schemes will follow a general defined benefit (DB) format in six Asian economies and five of the listed OECD countries, with pension’s dependent on the number of years of contributions, accrual rates and individual pensionable earnings.

There are no points schemes in any of the Asia economies and amongst the OECD countries shown only France has such a system. Workers earn pension points based on their earnings. At retirement, the sum of pension points is multiplied by a pension-point value to convert them into a regular pension payment.

There are notional defined contribution (NDC) schemes at the core of the pension system in one of the Asian economies, China, and one of the listed OECD countries, Italy. These are pay-as-you-go public schemes with individual accounts that apply a notional rate of return to contributions made, mimicking Funded defined contribution (FDC) plans. The accounts are “notional” in that the balances exist only on the books of the managing institution. At retirement, the accumulated notional capital is converted into a monthly pension using a formula based on life expectancy.

Funded defined contribution (FDC) plans are compulsory for future retirees in six Asian economies and two OECD countries. In these schemes, contributions flow into an individual account. The accumulation of contributions and investment returns is usually converted into a monthly pension at retirement.

Figure 1.1. Taxonomy: Different types of retirement-income provision

Table 1.1. Structure of future mandatory retirement-income provision

|

First tier |

Second tier |

First tier |

Second tier |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Residence‑ based |

Contribution-based |

Residence‑ based |

Contribution-based |

||||||||||||||

|

Basic |

Targeted |

Basic |

Minimum |

Public |

Private |

Basic |

Targeted |

Basic |

Minimum |

Public |

Private |

||||||

|

East Asia/Pacific |

|

|

|

|

|

|

OECD Asia/Pacific |

|

|

|

|

|

|

||||

|

China |

✓ |

NDC + FDC |

Australia |

|

✓ |

|

|

|

FDC |

||||||||

|

Hong Kong (China) |

✓ |

FDC |

Canada |

✓ |

✓ |

|

|

DB |

|

||||||||

|

Indonesia |

✓ |

DB + FDC |

Japan |

|

|

✓ |

|

DB |

|

||||||||

|

Malaysia |

FDC |

Korea |

|

|

✓ |

|

DB |

|

|||||||||

|

Philippines |

✓ |

✓ |

DB |

New Zealand |

✓ |

|

|

|

|

|

|||||||

|

Singapore |

FDC |

United States |

|

|

|

|

DB |

|

|||||||||

|

Thailand |

✓ |

DB |

|

|

|

|

|

|

|

||||||||

|

Viet Nam |

✓ |

DB |

Other OECD |

|

|

|

|

|

|

||||||||

|

|

France |

|

|

|

✓ |

DB + Points |

|

||||||||||

|

South Asia |

Germany |

|

|

|

|

Points |

|

||||||||||

|

India |

✓ |

DB + FDC |

Italy |

|

|

|

|

NDC |

|

||||||||

|

Pakistan |

✓ |

DB |

United Kingdom |

|

|

✓ |

|

|

FDC [q] |

||||||||

|

Sri Lanka |

FDC |

||||||||||||||||

Note: A tick for the column “Targeted” is only shown if a full-career worker at 30% of the average wage is eligible. [q] = Quasi-mandatory scheme based on collective agreements with very high coverage rate. DB = defined benefit, FDC = funded defined contribution, NDC = notional defined contribution.

Source: Chapter 4 for Asian economies and “Country Profiles” available at http://oe.cd/pag for OECD countries.