This chapter lays out an approach for assessing the impact of carbon pricing on household budgets. It first maps the gains and losses at the household level in the short term and then considers possible compensatory government transfers that can be financed through carbon-tax revenues. Results confirm that direct burdens from higher fuel prices fall disproportionately on lower-income households. But indirect effects, from higher prices of goods other than fuel, are sizeable and broadly “flat” across the income distribution, which dampens regressivity. Low-income households are also found to respond more strongly to rising prices, reducing their burdens and, hence, regressivity. The total effect is only mildly regressive. Recycling carbon-tax revenues back to households allows considerable scope for offsetting losses for large parts of the population, in a way that facilitates majority support for carbon tax packages.

Reform Options for Lithuanian Climate Neutrality by 2050

6. Distribution of carbon tax burdens in Lithuania and social policy implications

Abstract

As part of strategies to tackle the causes of climate change, different forms of carbon pricing, such as carbon taxes, cap-and-trade systems and phase-outs of fossil-fuel subsidies, have been introduced to shift the marginal private cost of carbon towards its marginal social cost.1 These measures incentivise a reduction in emissions, as well as a substitution from dirtier to cleaner fuels. They are recommended for their environmental effectiveness, because they are administratively simple and economically efficient without being technologically prescriptive, and because they do not weigh on government budgets (High-level Commisssion on Carbon Prices, 2017[1]; Pigou, 1920[2]; Nordhaus, 1991[3]; Pearce, 1991[4]).

Drawing on an accompanying paper, this chapter applies a modelling framework to simulate the distributional impact of a carbon tax and applies it to study a prospective reform in Lithuania.2 Currently, Lithuania does not apply an explicit carbon tax. In 2021, CO2 emissions from energy use in Lithuania are partly priced, through the EU Emissions Trading System (ETS) and through (comparatively low) fuel excise taxes. Recently, the Lithuanian government has proposed to phase-in a tax based on the carbon intensity of fuels from 2025, but a final decision has yet to be approved by Parliament. The tax would start at EUR 10 per tonne of CO2 and rise by EUR 10 each year, rising to EUR 60 per tonne in 2030, though the carbon tax component in the current proposal does not apply to entities already subject to the EU ETS. EUR 60 per tonne corresponds to a low to midpoint estimate for the social cost of carbon in 2020 (High-Level Commission on Carbon Prices, 2017[5]), though more recent studies mostly support higher values. The US government currently relies on a mean value of USD 51/tCO2 (Interagency Working Group on Social Cost of Greenhouse Gases (IWG), 2021[6]), a recent report by the European Commission (2021[7]) suggests a central value of EUR 100/tCO2 through to 2030, while a recent comprehensive review indicates a preferred mean estimate of USD 185/tCO2, at 2020 prices (Rennert et al., 2022[8]).

The policy simulations in this chapter combine micro-level information on household expenditure and income, with input-output data that allow tracing the carbon content and associated tax burdens across sectors and through different stages of production. Using this approach, it is possible to approximate the effects of a carbon tax on the price of goods across all consumption categories, not just households’ direct use of carbon-rich energy products. The chapter quantifies the resulting net effects of the tax on household budgets, and disentangles its key drivers, including consumption of energy and other goods, as well as consumers’ responsiveness to price changes from the pass-through of carbon taxes to final products. The approach notably accounts for the effects of policies that seek to compensate selected population groups through government transfers or income-tax concessions, which can be financed through carbon-tax revenues (“revenue recycling”).

Beyond their effect on consumption expenditures, carbon taxes and other climate-change mitigation measures also alter the incomes of the owners of the different factors of production, including natural resources, “brown industry” equity and labour (Rausch, Metcalf and Reilly, 2011[9]), and may drive the pace and direction of innovation (Dechezleprêtre and Kruse, 2022[10]; Dechezleprêtre and Sato, 2017[11]). Relatedly, changing input prices and consumer demand trigger labour-market adjustments through a reallocation of jobs from high-carbon to low-carbon industries and activities. These gains and losses from labour-market adjustments can be difficult to quantify and are not reflected in the approach presented here. There will clearly be employment losses in firms that see reduced demand due to carbon-intensive technologies (Dussaux, 2020[12]). While this will affect specific population groups, such as older workers, available findings suggest that the net employment impact may be limited (OECD, 2021[13]; Metcalf and Stock, 2020[14]). Available estimates on the broader impact of employment changes on inequality also do not give clear-cut results and Chapter 3 suggests that that unemployment and wage losses resulting from a carbon tax in Lithuania may be less pronounced for low-skilled workers than for other groups (Barreto, Grundke and Krill, forthcoming[15]).3

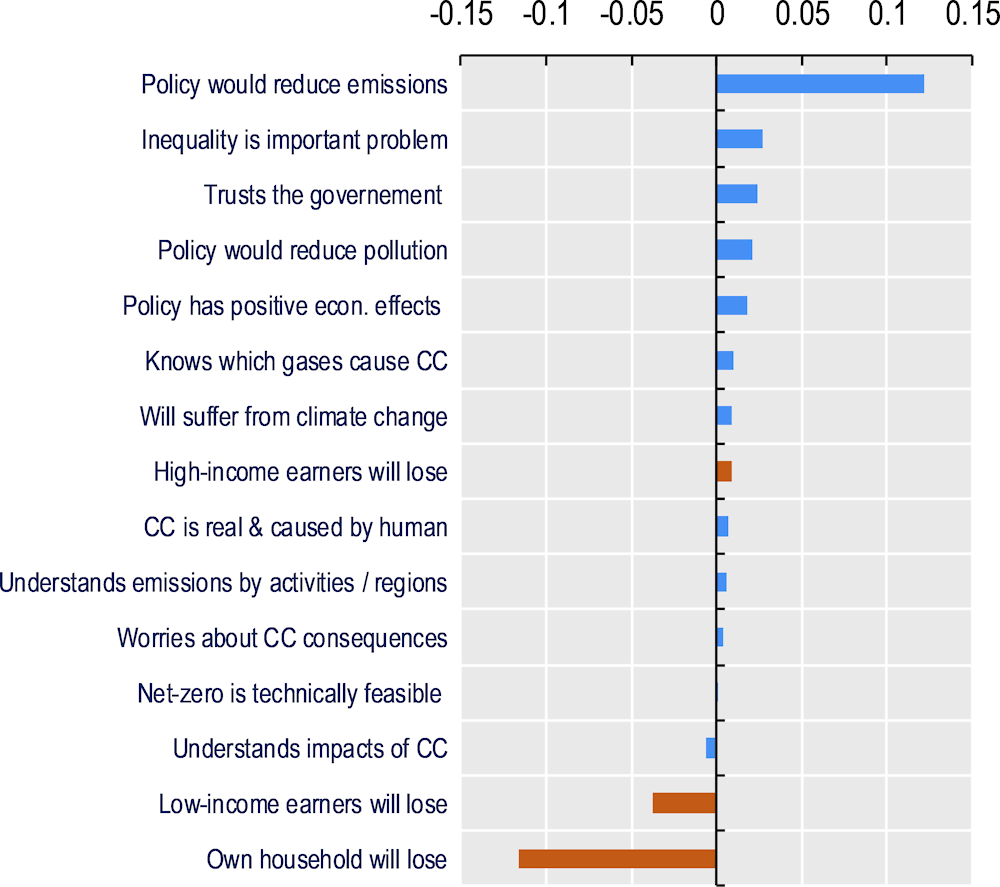

Across countries, current carbon prices are well below levels that are considered in line with national and international commitments, notably the targets affirmed in the Paris Agreement (OECD, 2022[16]). Numerous governments are therefore considering reforms to introduce or increase them. Yet, in the short term, there can be notable trade-offs between the intended incentives from higher carbon prices, and unintended distributional effects (Baumol and Oates, 1988[17]; Baranzini, Goldemberg and Speck, 2000[18]). The pattern of gains and losses from climate-change mitigation measures can be a key driver of public and political support for fighting climate change (Büchs, Bardsley and Duwe, 2011[19]; Tatham and Peters, 2022[20]). For instance, a recent large-scale survey of 40 000 people across 20 countries, shows that support for carbon taxes hinges on their perceived distributional impacts on lower-income households, and respondent’s own assessment of their household’s gains and losses (Figure 6.1).

Figure 6.1. Support for climate policies hinges on perceived gains and losses

Correlation between beliefs and support for carbon tax package with cash transfers

Note: Results of regressions of support on standardised variables measuring respondents’ beliefs and perceptions. Country fixed effects, treatment indicators, and individual socioeconomic characteristics are included but not displayed. The dependent variable is and indicator variables equal to 1 if the respondent (somewhat or strongly) supports each of the main climate policies. n=40 680, R2=0.378.

Source: Adapted from (Dechezleprêtre et al., 2022[21]).

In part, concerns about the distributional impacts of carbon taxes stem from the fact that home fuels in particular are, at the same time, necessities and a main source of household-level emissions. When prices go up, the poorest households may be ill-equipped to draw on savings or to cut back on other expenditures. As a result, low-income groups could bear a substantial burden from higher carbon taxes and their overall impact could be regressive, increasing inequality, and worsening key aspects of material deprivation and social exclusion, such as fuel poverty or food insecurity. The current cost‑of‑living crisis has dramatically heightened concerns over the economic burdens on households from rising living costs, and higher energy prices in particular.

Existing studies highlight that net effects of carbon taxes vary strongly between countries and policy measures, depending not only on the features of the tax and consumption patterns, but also on population characteristics and existing inequalities (Ohlendorf et al., 2020[22]). Importantly, carbon taxes and fuel prices affect not only the cost of transportation and heating but, subject to the carbon intensity in the production process, also the prices of other goods. For each household, the overall impact depends on their consumption bundle, and on their propensity and ability to change consumption in response to price movements.

Any regressive effects or a concentration of losses among specific groups may call for accompanying measures to compensate losers, while maintaining the price signals from carbon pricing (Carattini, Carvalho and Fankhauser, 2018[23]). For instance, the carbon tax in Ireland includes a commitment to using the resulting revenues for preventing fuel poverty and ensuring a just transition. Compensation should be timely and may need to be suitably targeted in order to support the political feasibility and sustainability of climate-change mitigation initiatives. Policy models in combination with rich micro-level data (“microsimulation models”) allow exploring each of these mechanisms and their likely net effect on different households (Hynes and O’Donoghue, 2014[24]; Immervoll and O’Donoghue, 2009[25]; O’Donoghue, 2021[26]). They also facilitate the assessment of alternative reform scenarios or paths, and can provide timely input into policy debates as carbon taxes move up the policy agenda in many countries.

The remainder of this chapter is structured as follows. Section 2 gives an overview of past assessments of the distributional impact of carbon taxes, lays out a methodology of assessing environmental taxes in a microsimulation framework, and describes the input data that is available for Lithuania. Section 3 presents results, distinguishing between (i) direct effects (via fuel consumption by households); (ii) indirect effects (via household consumption of other goods and services with different carbon content); (iii) behavioural adjustments (rebalancing of consumption patterns in response to price signals); and (iv) revenue recycling (options for using carbon-tax revenues to compensate selected groups). The results section also presents estimates for the scope of emission reductions that can be achieved through an introduction of a carbon tax, via expected changes in consumption patterns towards less carbon intensive (and less expensive) goods.

Distributional effects of carbon taxes: Literature review

Much of the literature on the distributional impact of carbon taxes focuses on their initial impact, without revenue recycling. There is a common conjecture that carbon taxation is regressive in high-income countries (Klenert and Mattauch, 2016[27]). However, home fuel and electricity taxation tends to be more regressive than fuel taxation in the transport sector (Büchs, Ivanova and Schnepf, 2021[28]), which can be progressive, especially in countries with moderate car ownership and well-developed public transport systems (Wang et al., 2016[29]).

Households in countries with lower GDP levels, including within the OECD area, tend to face significantly higher risks of energy affordability (Flues and van Dender, 2017[30]), which tends to render carbon taxes less regressive overall. Outside the OECD, progressive impacts are also generally more common in poorer countries, where consumption baskets tend to be less carbon intensive, energy can be more difficult to access or less affordable for large shares of the population, and home fuels can be less important for heating due to climatic conditions (Ohlendorf et al., 2020[22]; Dorband et al., 2019[31]).

Taxation of both direct and indirect emissions tends to be more less regressive (or more progressive) than taxing direct emissions only, e.g., through excise taxes on fuel (Ohlendorf et al., 2020[22]).

The literature on net impacts, accounting also for revenue recycling, is smaller, though existing studies point to the quantitative importance of revenue recycling for overall distributional outcomes. This also holds for policies that raise effective carbon prices through a withdrawal of energy subsidies (Durand-Lasserve et al., 2015[32]). Notable results include the following:

lump-sum transfers (such as a basic income financed through carbon taxes) are progressive and poverty reducing (Berry, 2019[33]; Klenert et al., 2018[34]; Owen and Barrett, 2020[35]);

depending on their reach, social welfare payments support low-income earners and reduce inequality, while across-the-board income tax cuts benefit the top and are regressive (Callan et al., 2009[36]; Klenert and Mattauch, 2016[27]);

VAT tax reductions for specific goods, e.g. on public transport, can redistribute between regions (Brännlund and Nordström, 2004[37]);

energy cheques reduce fuel poverty (Berry, 2019[33]), while public transport vouchers are progressive and achieve sizeable emission reductions (Büchs, Ivanova and Schnepf, 2021[28]);

support for retrofitting residential buildings tends to be progressive (Bourgeois, Giraudet and Quirion, 2021[38]).

Table 6.1 illustrates the scope of modelling frameworks used in a range of distributional studies that employ micro-data and policy simulation. Existing frameworks variously incorporate the features that are desirable or required for informative distributional analyses of carbon taxes, namely the capacity to model carbon emissions associated with different consumption goods, the distributional impact of price changes, households’ behavioural response to price changes and resulting CO2 reductions, as well as policies that can offset unintended distributional effects via revenue recycling. Existing frameworks have generally not incorporated all these dimensions; some are stronger on distributional measures, while others incorporate more detail in relation to behavioural responses or include a comparative perspective across countries.

The modelling of accompanying policies to alleviate unintended distributional consequences, including through revenue recycling, has followed different approaches. The early UK study by (Pearson and Smith, 1991[39]) has used policy simulation in combination with detailed household-level information, similar to the illustration reported here. Other studies have been more approximate, without accounting for the full granularity of household information. This is, in part, due to the fact that models often either proceeded at an aggregate or semi-aggregate level, or relied on household expenditure data alone, without linking it to policy simulation models that require detailed information on household incomes. For example, (Callan et al., 2009[36]) compare carbon tax payments per income decile to revenue‑neutral transfers by decile, without modelling the granular incidence of carbon taxes or compensating policies on individual households.

The present chapter integrates revenue recycling with a careful analysis of the incidence of carbon taxes themselves. The objective is twofold. First, to further the discussion around broader policy packages in the context of climate change mitigation. Second, to enable detailed assessments of gains and losses from a carbon tax at the household level and across any population group that can be of interest from a political-economy, or a distributional point of view.

Table 6.1. Overview of existing distributional studies using microsimulation: Scope and modelling choices

|

Author |

Country coverage |

Scope |

Distributional impact |

Distributional metric |

CO2 emission reduction |

Taxes considered |

Multi-regional IO model |

Revenue recycling |

Behavioural response (consumption) |

|---|---|---|---|---|---|---|---|---|---|

|

UK (some results for other EU12 |

country |

Regressive |

Expenditure |

no |

Carbon tax |

Country IO |

(1) Lump-sum; (2) lower income tax |

Yes |

|

|

5 EU |

country |

Mixed |

Income |

no |

Direct and indirect |

no |

No |

no |

|

|

7 EU |

country |

Progressive |

Income and expenditure |

no |

Transportation fuel |

no |

No |

yes |

|

|

21 OECD |

20 country average, country |

Mixed |

Income and expenditure |

no |

Home heating, motor fuel and electricity |

no |

No |

no |

|

|

87 low and middle-income |

country |

Progressive |

Income |

no |

Transportation fuel |

yes |

No |

yes |

|

|

Latin America & Caribbean |

Cross-country |

Progressive |

Expenditure |

no |

Direct and indirect |

yes |

(1) Higher cash-transfers, (2) Higher coverage |

no |

|

|

27 EU |

EU-level |

Regressive across EU |

Income |

yes |

Direct and indirect |

yes |

(1) fuel rebates; (2) green vouchers + infrastructure |

Average elasticities by EU quintile |

|

|

23 EU |

EU-level, country |

Progressive across country/ regressive across EU |

Expenditure |

no |

Direct and indirect |

yes |

(1) National / EU lump sum; (2) Targeted to poor |

Average elasticities across countries |

|

|

8 Asian |

Cross-country |

Progressive |

Expenditure |

no |

Direct and indirect |

yes |

Lump-sum |

no |

|

|

Austria |

Country |

Progressive |

Income |

no |

Carbon tax |

Country IO |

Lump-sum, differentiated by region |

no |

|

|

China |

Country |

Regressive |

Income |

Yes, set to achieve 1.5 degree target |

Carbon tax |

Yes |

(1) Tax exemptions, (2) Subsidies |

yes |

Note: See also Immervoll et al. (2023[49]), Box 1.

Methodology and data

This section situates microsimulation modelling in relation to carbon taxes and environmental policies more broadly. It then presents the data for the present analysis, which is constructed from three main sources, the World Input-Output Database (WIOD), household budget survey (HBS), and the European Union Statistics of Income and Living Conditions (EU-SILC). The section starts by describing WIOD and the input-output analysis underpinning carbon-intensity estimates for each product category. WIOD is then combined with HBS data to estimate carbon-tax burdens at the household level. It also describes the consumption model used to derive households’ behavioural responses. The final steps are an imputation of expenditure patterns into the EU-SILC data and the simulation of selected revenue-recycling measures using the Lithuania module of the EUROMOD tax-benefit model (which requires EU-SILC as input).

There is growing literature on modelling the distributive impact of environmental taxes (see Immervoll et al. (2023[49]), Box 1) All models abstract from the full complexity of the real world. The present analysis makes a number of modelling choices to keep the empirical exercise transparent and tractable.

In addition to the introduction of carbon taxes, other climate-change mitigation measures are usually planned or introduced in parallel. These include changes in excise duties and changes in the parameters or scope of the Emissions Trading System (ETS). In order to identify the differential distributional impact of the carbon tax, it was decided to model this change in isolation. As there are limited interactions with these other measures, this arguably contributes to a better understanding of the carbon tax specifically.

In its current version, the carbon-tax proposal in Lithuania does not cover installations that are already subject to emissions trading (Chapter 2). The calculations in this chapter ignore this variation and relate to a “flat” carbon tax that covers all sectors. This simplifies the analysis. It is also informative as non-ETS include transport and buildings, sectors where the effects of carbon taxes on prices are expected to be especially sizeable. Furthermore, by 2030, carbon prices will, to varying extents, also rise for ETS sectors, even if not through explicit carbon taxes. An average carbon price of 60 EUR per tonne probably presents a reasonably lower-bound value.

The reference period of the policy introduction and simulation is relevant, as household circumstances, consumption patterns and prices change over time, as do preferences, including for consumption. Modelling relies on the latest available microdata including on household expenditures (HBS 2015) and incomes (EU-SILC 2018). Income and price data are updated to 2022 in an attempt to reflect, in particular, large recent price changes. However, although the simulated carbon tax is to be introduced over a period up until 2030, a decision was made not to project household characteristics forward to 2030, but model them on the basis of 2022. The inflationary situation, in particular, is highly volatile and both prices and incomes therefore do not lend themselves to reasonably certain medium-term forecasts. Given this context, it appears more informative to rely on granular information on current or recently observed prices, consumption patterns and living standards, than to make speculative assumptions about the medium-term future. This choice should be kept in mind when interpreting results.

Relatedly, in terms of changes in the income distribution up until 2022, income levels are uprated uniformly, via price and income inflators, as is standard in the literature, rather than to undertake more ambitious now-casting approaches (O’Donoghue and Loughrey, 2014[50]; Immervoll, Mustonen and Riihelä, 2005[51]). Now-casting of microdata can be informative when the objective is to approximate broader or aggregate measures of inequality. They involve a range of data adjustments, however, which can be problematic when the resulting data are used as input into further modelling or analysis. Essentially, extensive data manipulations can obscure the results from the policy modelling exercise that are of primary interest.

(Immervoll et al., 2023[49]) provide details on each of the key parts of the modelling framework and how it was implemented in the context of this chapter. It describes:

the input-output model, which captures carbon emissions by sector and allows quantifying the pass-through of carbon taxes from inputs to the price of final consumer products and services;

the matching of input-output data with a household expenditure survey, which is needed to compute the carbon footprint from household consumption;

a consumption model that quantifies households’ behavioural responses to carbon-tax related price changes;

the linking of expenditure information (from household budget surveys) with other characteristics needed for distributional analysis (from the EU-SILC survey);

data adjustments to approximate the situation in the 2022 baseline year with earlier data (2015 for the household budget survey); and

the simulation of options for recycling carbon-tax revenues, drawing on output from the EUROMOD tax-benefit model.

Results

At carbon tax levels that countries currently apply or discuss, the impact on household living costs can be significant, as can be their distributional effects. At the outset, it is useful to put the resulting burdens into context, however. In Lithuania, the impact on living costs would be much smaller than the effects of high inflation rates seen across the OECD over recent months. A carbon tax at 60 EUR per tonne as currently discussed would increase the consumer price index by less than 5% in total, and over a period of several years (Immervoll et al., 2023[49]).

Consumption patterns across the income spectrum

The impact on different population groups depends upon a number of factors including notably the distribution of expenditures across the income spectrum. Carbon taxes affect household budgets directly through fuel consumption, and indirectly via the consumption of other goods and services that give rise to CO2 emissions during the production process.

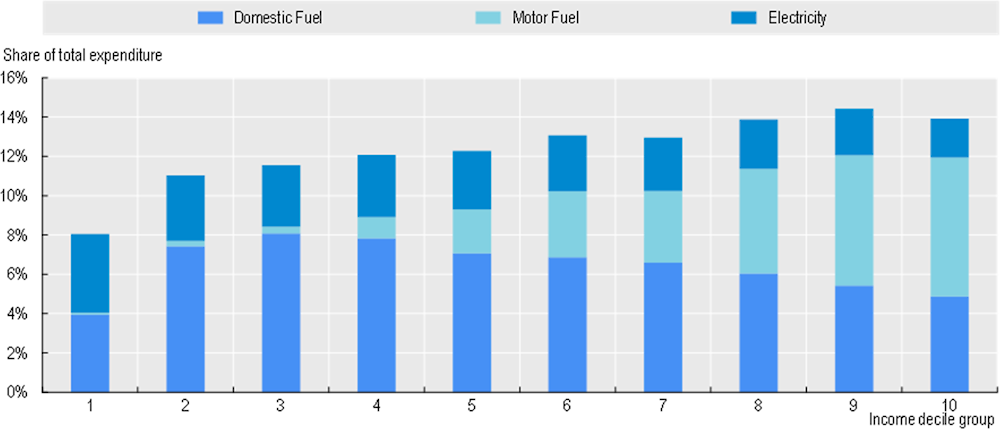

The direct incidence of carbon taxes across households is shaped by the pattern of fuel expenditures. Domestic heating fuels are necessities, i.e. people will buy them regardless of income. Low-income households therefore devote a larger share of their total income and expenditures to heating fuels than better-off households. An opposite pattern can emerge for motor fuels, reflecting higher rates of car ownership among middle and higher-income households.

Figure 6.2 describes the distributional shape of fuel expenditure patterns in Lithuania, along with electricity. Spending shares for heating fuel are highest in income deciles 2, 3 and 4. Overall, spending on heating fuels is quite regressive, with a large difference in shares between the bottom and the top. Nevertheless, shares are lowest in the poorest 10%, which may be related to budget constraints and the poorest households needing to prioritise other essentials over adequate heating. Expenditures on electricity are substantially lower than for heating fuel in all but the bottom decile and follow a mildly regressive pattern overall. Spending on motor fuels is very top-heavy, with almost no spending on this item in the bottom 30% but a higher share than heating fuels at the top. Taken together, overall fuel expenditure is clearly progressive relative to income in Lithuania, which is increasingly unusual in international comparisons. When adding spending on electricity, patterns are still progressive but less so than for fuel.4

Figure 6.2. High-income households spend large shares of their budgets on energy

Lithuania, approximations for 2022 using latest available spending data

Note: Domestic fuel includes expenditure on gas (natural gas and town gas), liquified hydrocarbons, liquid fuels, heat energy, coal and other solid fuels. Motor fuels includes expenditure on diesel and petrol for transportation.

Source: (Immervoll et al., 2023[49]), drawing on the household budget survey and 2022 price data.

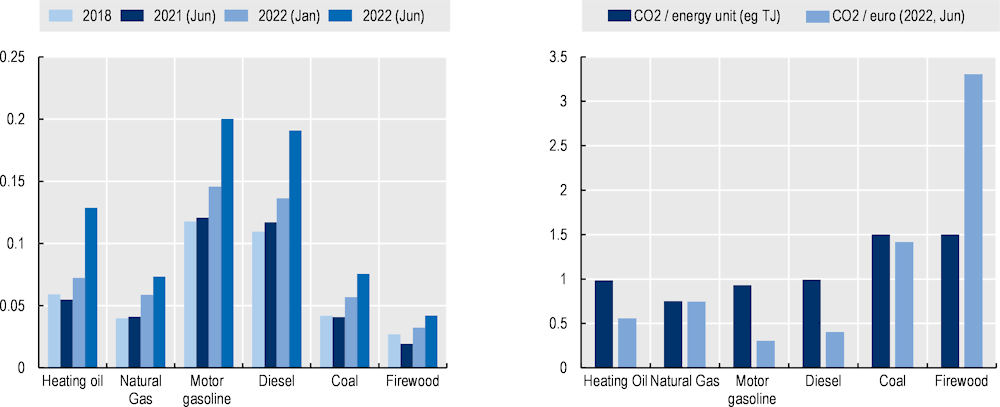

Figure 6.3. Fuel prices and CO2 emissions

Note: Firewood also includes wood waste.

Source: (Immervoll et al., 2023[49]), drawing on UNFCCC, Eurostat, EC Weekly Oil Bulletin.

Fuel prices and the specific composition of fuel consumption are additional factors that drive distributional outcomes. Population groups that use higher emitting “dirtier” fuels will see a greater absolute impact of carbon taxes on prices. The relative price change depends also on initial prices, with cheaper fuels affected more strongly by a given amount of carbon tax per unit. As is commonly the case, motor fuels in Lithuania are more expensive (due to higher taxation) than domestic fuels (Figure 6.3, Panel A). As a result, the energy usage and emissions per unit of fuel expenditure are higher for domestic fuels (which account for a large share of spending for low-income people) than for motor fuels (which are mostly consumed by higher-income groups). Domestic fuels include high shares of solid fuels (coal, coke, firewood), which have much higher emission than liquid fuel. Emission factors are lower for natural gas (Figure 6.3, Panel B).

Like the direct effects from fuel expenditure, the distribution of the indirect burden from carbon taxes on everything else is also driven by a range of factors, and their net effect is difficult to anticipate. Budget shares for goods other than fuel can be comparatively “flat”, with similar shares of total expenditures across income groups. But since poorer household save less, they spend a higher proportion of their income than better-off households. A relatively flat indirect impact of carbon taxes across households with low and high levels of total spending can therefore translate into a distributionally regressive impact across the income spectrum (with carbon tax burdens making up a larger share of income for low-income groups). Figure 6.2 illustrates this for electricity, which is a particularly sizeable category of non-fuel expenditure.

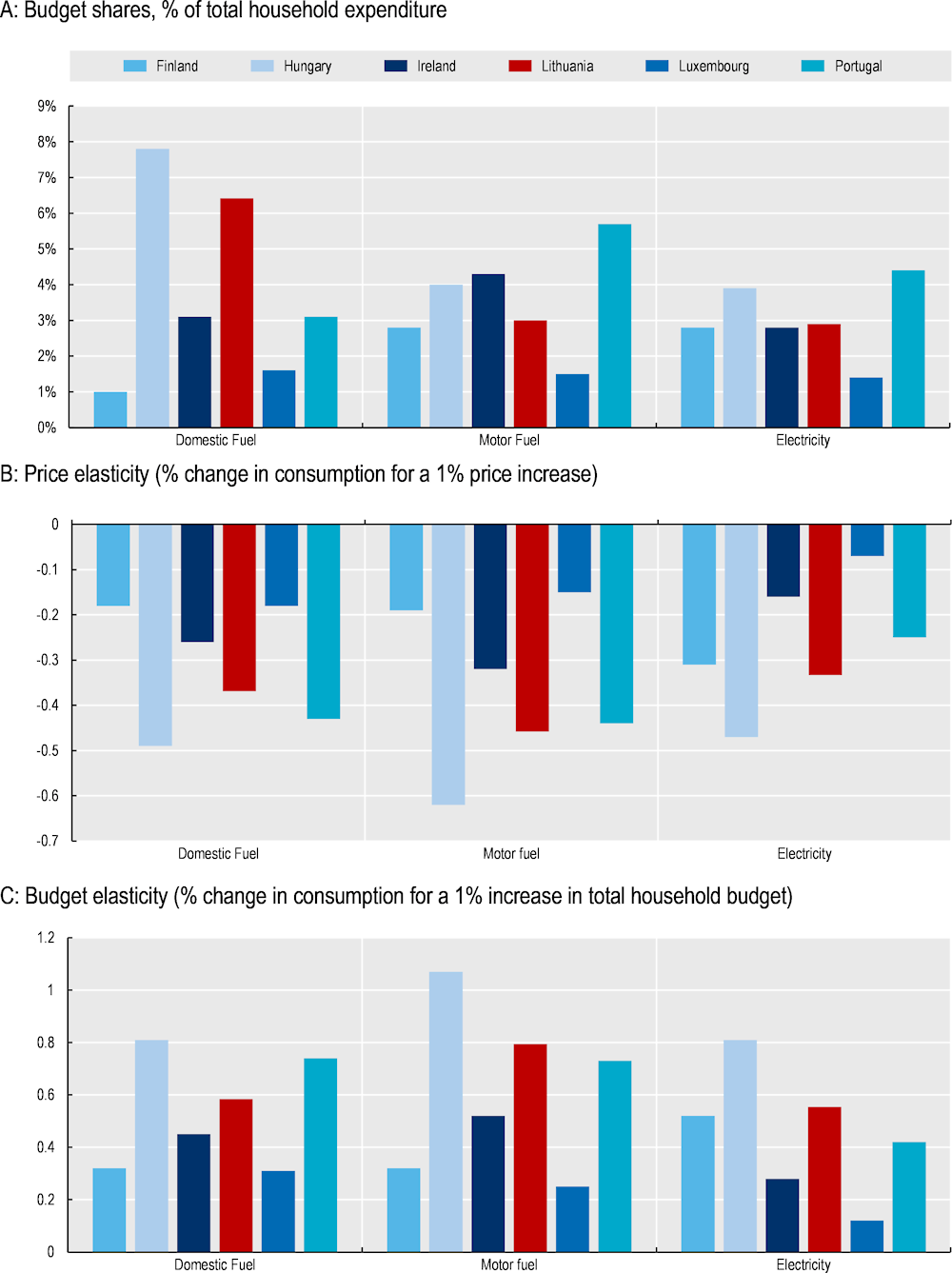

Budget shares and households’ responses to price changes in comparative perspective

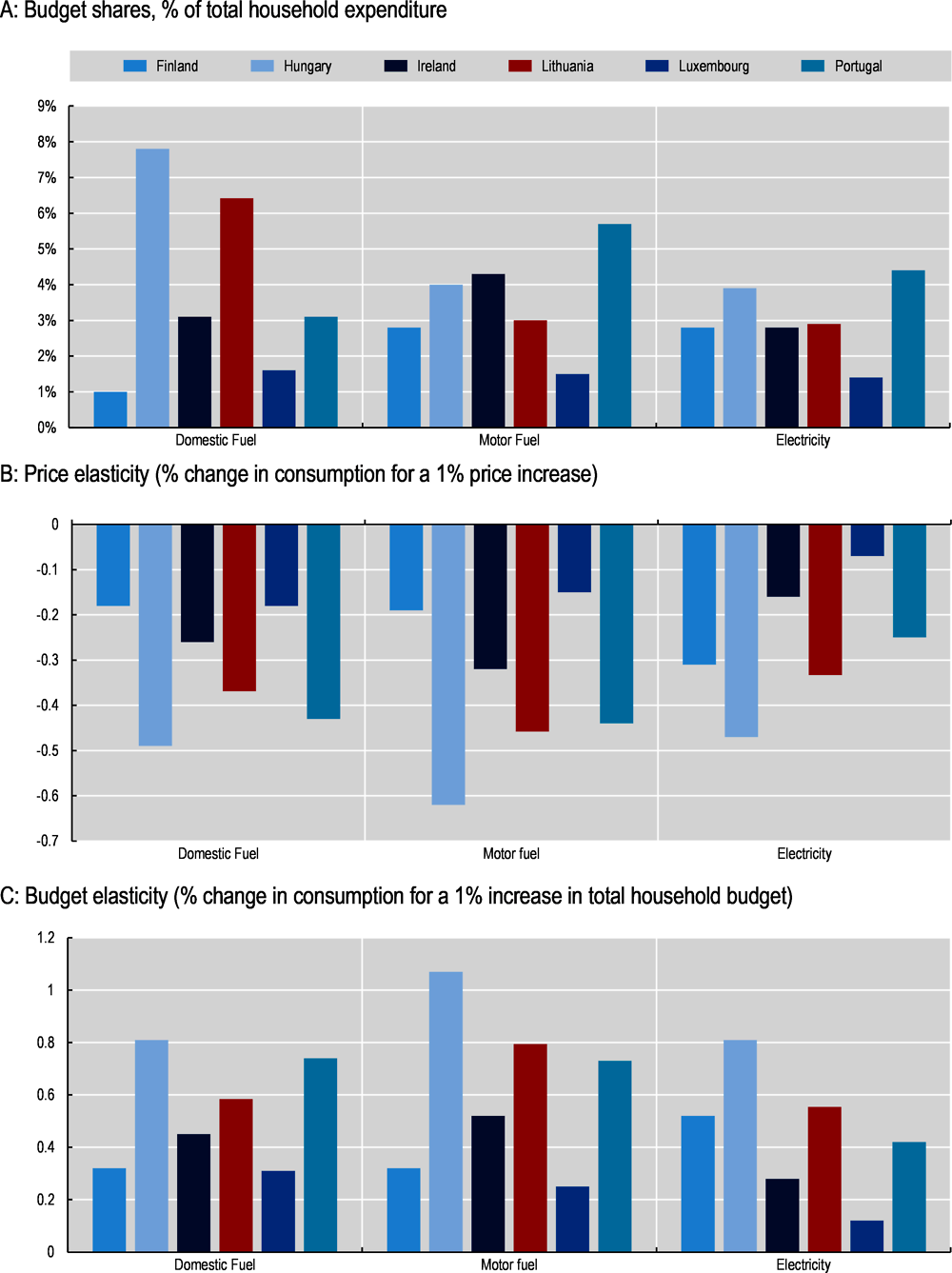

Along with budget shares, behavioural responses to carbon taxes are central determinants of both distributional results and CO2 emission reductions. This paper accounts for behavioural changes by estimating a full demand system, including budget elasticities (expenditure changes for a specific good category in response to variations in total expenditure), a broad set of (own- and cross-) price elasticities (expenditure changes for a specific good category in response to price variation), and allowing for different elasticities across expenditure items and household types (Immervoll et al., 2023[49]). Results for Lithuania are presented below, along with comparisons against existing estimates for other European countries. Across all countries, estimates show households’ responsiveness based on preferences that are implicit in the budget surveys that were available for this analysis (data from 2015). The five countries (Finland, Hungary, Ireland, Luxembourg, Portugal) were chosen as relevant data and consistent estimates are available as part of a recent related study (see source of Figure 6.4).

Budget shares for domestic fuels are higher in Lithuania (ca. 6.4%) than in four of the comparator countries and slightly lower than in Hungary (Figure 6.4, Panel A). Budget shares for electricity and motor fuel vary less across countries, and Lithuania’s share is around 3% in both these categories, which is close to the country average. The Lithuanian shares for motor fuels are however lower than in most countries, except Finland and Luxembourg, where incomes are substantially higher. This is in part explained by very low usage at the bottom of the distribution. Overall patterns broadly resemble Hungary’s though spending on all three types of energy is somewhat lower in Lithuania.

Published estimates of price elasticities of the demand of fuel vary markedly across countries and studies (see Immervoll et al. (2023[49]), Box 2). In a comparison of results using a cross-nationally consistent estimation method, Lithuania’s price elasticities are in a plausible range (Figure 6.4, Panel B). Households in Lithuania are comparatively responsive to changes in the price of domestic fuel, though the elasticity still ranks mid-way between the other countries. Consumption of motor fuel is more responsive to price changes than domestic fuel, and electricity consumption somewhat less so. For both electricity and motor fuel, elasticities are lower than in Hungary, but higher than in the other countries.

Lithuania’s budget elasticities for domestic fuels and electricity rank mid-way between the five other countries (Figure 6.4, Panel C). Consistent with the large observed differences in expenditure shares for motor fuels between the bottom and top end of the income distribution, the estimated budget elasticity for motor fuel is significantly higher than for domestic fuel and electricity.

Figure 6.4. Average budget shares and behavioural response: Lithuania and other countries

Note: (Immervoll et al., 2023[49]) provides details on the method used for estimating a demand system, including price and cross-price elasticities, and budget elasticities. Domestic fuel includes expenditure on gas (natural gas and town gas), liquified hydrocarbons, liquid fuels, heat energy, coal and other solid fuels. Motor fuels includes expenditure on diesel and petrol for transportation.

Note: (Immervoll et al., 2023[49]) provides details on the method used for estimating a demand system, including price and cross-price elasticities, and budget elasticities. Domestic fuel includes expenditure on gas (natural gas and town gas), liquified hydrocarbons, liquid fuels, heat energy, coal and other solid fuels. Motor fuels includes expenditure on diesel and petrol for transportation.

Source: (Immervoll et al., 2023[49]) and (Sologon et al., 2022[52]).

Distribution of carbon tax burdens across income groups

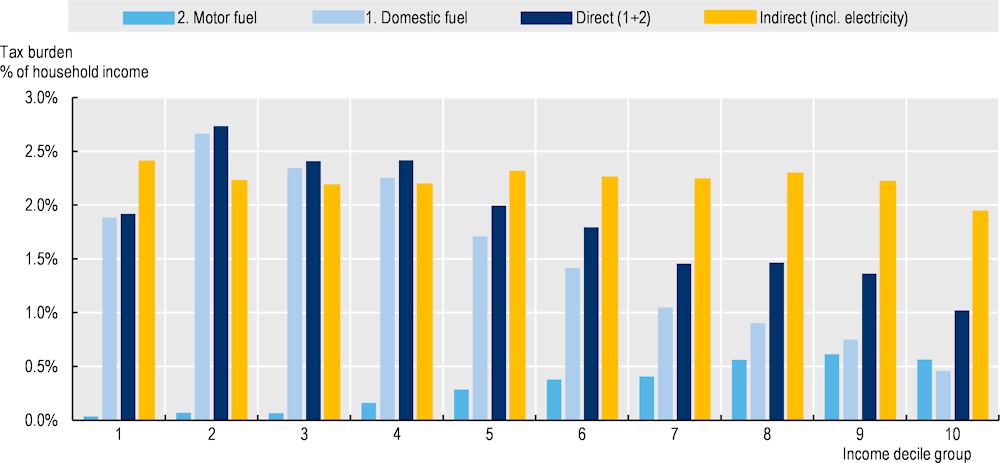

The overall incidence of the carbon tax is shaped by (i) the distributional patterns of households’ fuel expenditures, (ii) the modelling of indirect effects of a EUR 60 carbon tax on the cost of other goods, based on emissions released during production in different parts of the value chain, and (iii) households’ behavioural responses to the resulting price changes.

To aid transparency, it is useful to first consider results without behavioural responses. On this basis, the carbon-tax burden on domestic fuels (ca. +1.3% of household Income on average across all income groups) is much higher than for motor fuels (+0.3% on average). This reflects the higher expenditure on heating, as well as the higher emissions per unit of domestic fuel. In line with fuel expenditure profiles, the direct carbon tax burden for domestic fuels is concentrated in the bottom half (regressive), while carbon taxes on motor fuels are progressive. The direct burden on households from overall fuel expenditures (just below +2.3% of expenditure on average) is regressive, though burdens are higher for deciles 2-5 than for the bottom 10%.

At close to +2.0% of household income on average, the costs from indirect emissions related to the production of other goods and services exceed the direct effects (1.6% on average). This highlights the quantitative importance of a careful Input-Output analysis. The scale of the indirect effect is partly driven by spending on electricity, and the carbon intensity of electricity generation. Although the lowest-income households spend somewhat greater shares of total expenditure on electricity than higher-income groups (Figure 6.3) the carbon content of electricity is lower than for other energy sources, and overall indirect effects are essentially flat as a share of income.5

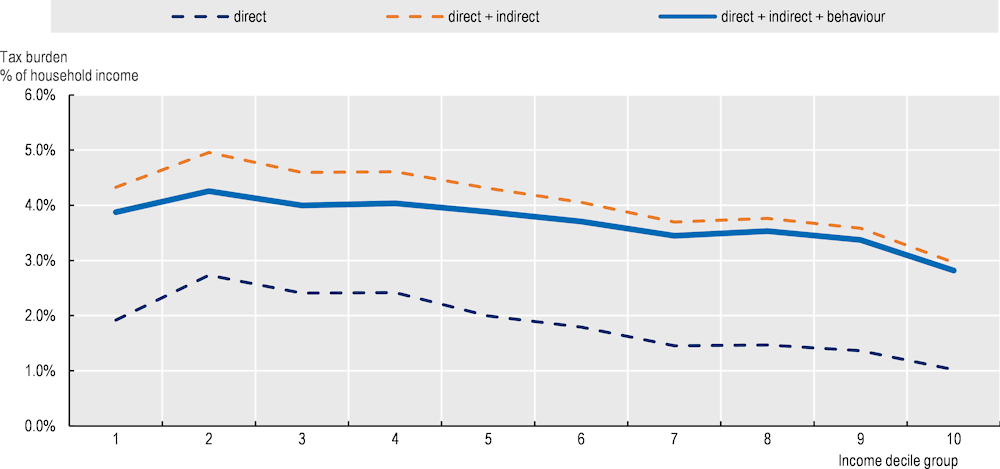

As households respond to the incentives from higher prices and rebalance expenditures towards less carbon intensive products, behavioural adjustments reduce effective tax burdens. Estimates indicate a reduction by up to 16% (Figure 6.6).6 Consumption responses lead to a bigger reduction in carbon-tax burdens in the bottom half of the distribution, as prices of cheaper goods (and dirtier fuels) are more strongly affected by a given carbon tax than expenditure categories with significant shares of more expensive and luxury products. Reductions are, however, smaller for the poorest 10%, who are likely to have fewer margins for adjusting consumption without cutting into essentials (compare distance between the results with and without behavioural response).

Overall losses for households are remarkably flat, with around 4% of income for the bottom half of the distribution, and 3.5% for the top half. The largest burdens are found for decile 2, and the smallest for decile 10. The “flatness” is arguably a striking finding given the granularity of the analysis, accounting for 56 sectors, 35 expenditure categories, and the full heterogeneity of consumption patterns found in the HBS micro-data. As discussed above, multiple drivers and country idiosyncrasies shape this result for Lithuania. There is no a-priori reason to expect it to carry over to other country settings or, e.g., to other distributional dimensions, such as age or region.

Figure 6.5. Incidence of a €60/t carbon tax, without behavioural response

Share of household income

Source: Immervoll et al. (2023[49]), using data on household expenditure, emission levels and industry inputs and outputs.

Figure 6.6. Incidence of a €60/t carbon tax, with and without behavioural response

Share of household income

Source: Immervoll et al. (2023[49]) , using a consumption model in conjunction with data on household expenditures, emission levels, industry inputs and outputs.

Revenue recycling

The carbon tax generates revenue, which can be used to shape its overall distributive impact via revenue recycling. This section illustrates the scope for redistribution measures as part of a broader carbon-tax policy package and analyses the resulting gains or losses for different income groups.

Each revenue recycling option has strengths and weaknesses (Nachtigall, Ellis and Errendal, 2022[53]). In what follows, three stylised compensation measures are considered. All three are budget-neutral and can thus be fully financed through the carbon tax. In addition to the options considered here, there are clearly many other possible uses of carbon-tax revenues, including those that do not immediately benefit households but may do so indirectly and in later periods (such as increasing investment or paying off public debt).

Option 1 is a stylised lump-sum transfer, paid at the same individual rate to all residents (same rate for adults and children). Similar to a universal basic income, a lump-sum payment is often less redistributive than established social transfers. When conceived as a standalone benefit that replaces other transfers, a basic income is difficult to finance without a substantial tax increase (Browne and Immervoll, 2017[54]). However, in the context of a carbon tax, lump-sum compensation can be an attractive option, as it is built around a novel revenue source, and can be introduced “on top of” existing transfers, without needing to substitute for them. It is also simple to communicate and, as everyone receives a recurring payment, it may act as a signal that the carbon tax aims to alleviate climate change, without creating an additional overall burden for households. The universal lump-sum payment to everybody is indeed sometimes argued to be the optimal revenue recycling option (Klenert et al., 2018[34]).

Alternatively, carbon-tax revenues can be used to compensate households more selectively, e.g. by adapting/expanding existing transfers or introducing new targeted support payments. The specific reform considered here is a proportional increase of all social benefits (Option 2). A uniform increase can be attractive if existing social transfers are seen as a suitable vehicle for targeting support to those in need. The approach has similarities to strategies that seek to alleviate the impact of price increases by indexing benefits for inflation (OECD, 2022[55]).

Option 3 is a cut in labour taxes (all income taxes and workers’ social insurance contributions). As in Option 2, taxes are reduced by the same proportion for everybody. Packaged with a carbon tax, this type of scenario is commonly discussed under the heading of “environmental tax reform” (Metcalf, 1999[56]). A common argument for environmental tax reforms is that they may create a “double dividend”, by simultaneously improving environmental and economic conditions, through lowering harmful emissions and distortionary labour taxation (Pearce, 1991[4]; Ekins et al., 2011[57]; Antosiewicz et al., 2022[58])

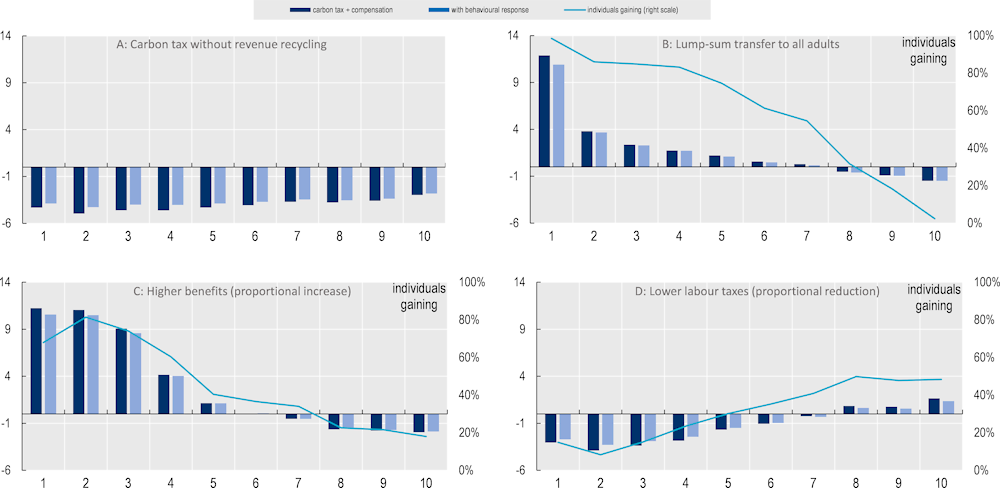

For each option, Figure 6.7 reports different measures of gains/losses by income group:

average gain or loss of a carbon tax with revenue recycling;

average gain or loss after accounting for households’ consumption responses to the carbon-tax package (including revenue recycling);

share of individuals with net gains.

In addition to income, further distributional dimensions can be important. These can be explored in future work and some of them may be of specific interest also in Lithuania (e.g. differential impact by age, region or activity status, including employees, self-employed or micro-enterprises).

Two types of behavioural response enter the results. First, and similar to the earlier analysis, the price response stems from the price change triggered by the carbon tax. Second, the income change from revenue recycling induces a change in expenditures on different items, in line with the estimated budget elasticities.7

Figure 6.7, Panel A first shows losses without any compensating transfers as a baseline, to facilitate assessing the impact of revenue recycling. The results are the same as those shown earlier in Figure 6.6 and can be interpreted as a scenario where the government does not spend the carbon-tax revenue. The overall revenue from the carbon tax amounts to around 1.35% of GDP, after accounting for consumers’ responses to higher prices. The exact scale of these resources will depend on implementation of the carbon tax, and will be smaller if it is not applied uniformly (Section 3). It is clear, however, that revenues are sizeable and provide the government with considerable scope to cushion losses and shape the distributional profile as part of a broader policy package. In addition, knock-on effects on other taxes, such as VAT, can create significant additional revenue effects, which are not currently included in the estimates.8

When all carbon-tax revenues are channelled back to individuals via a lump-sum transfer (Figure 6.7, Panel B), most people are better off than without the carbon-tax package. Revenues are sufficient for financing a per-capita lump-sum of EUR 22 per month. All households in the bottom decile gain, and at least half do throughout deciles 1 to 7. Low-income households pay smaller absolute amounts in carbon tax than better-off households because they spend less. With everybody receiving the same flat-rate payment, the overall carbon-tax package creates a sizeable income boost at the very bottom. As a percentage of household income, gains then quickly decline as one moves up the income spectrum.

Average gains do not turn negative until the 8th decile (i.e., well above the income of the “median voter”). Even for high-income earners in the top decile, the lump-sum payment cuts the average net carbon-tax burdens in half (compare Panels A and B). The lump-sum scenario examined here is very simple and its distributional properties could be further tailored, e.g. by making it taxable. Instead of a uniform per-capita amount for all, the compensation could also feature differentiation by age, or provide supplements to those with greater energy needs, see e.g. the “climate bonus” adopted recently in Austria (Budgetdienst, 2022[47]).

A pro-rata increase of all existing social transfers (Figure 6.7, Panel C) redistributes the entire carbon-tax revenue to benefit recipients only. Because carbon taxes are paid by everybody and then distributed to a smaller group, average gains would be large for recipients of existing benefits. Lithuania currently spends about 9.2% of GDP on (cash) social benefits, including pensions. Carbon-tax revenues are therefore sufficient to finance a benefit increase of around 16%, well in excess of the adjustment that would result from straight inflation indexing of social transfers (which is below 5%, see Immervoll et al. (2023[49])). The gains are spread across fewer beneficiaries than in the lump-sum scenario, and gains are more concentrated among the bottom deciles, which comprise most benefit recipients.

Unlike in the lump-sum scenario, not all poor households are better off. This reflects coverage gaps in the existing benefit system and, in particular, the commonly high degree of non-take-up of means-tested benefits. Both these factors explain the substantial share (>30%) of net losers in the bottom decile. Furthermore, and also in contrast to the lump-sum compensation, even the highest-income group includes some people (ca. 18%) who are better-off than without a carbon tax package. While there are fewer recipients of social benefits among high-income households, benefit entitlements (e.g. from pensions) among some of them are sufficiently large to ensure that a pro-rata increase outweighs their carbon-tax burden, resulting in a net gain. Across all middle and upper-income deciles, however, fewer than half gain from such a carbon-tax package. This is relevant when considering political support for such a policy. Without accompanying measures, significantly higher benefits for lower-income earners may also weaken work incentives.

Lowering taxes on labour (Figure 6.7, Panel D) has the opposite effect of a benefit increase, with net gainers concentrated at the top of the distribution. Lower labour taxes can strengthen work incentives (the “double dividend” argument). Tax reductions provide support for low-income groups, by easing income tax burdens for some of them, and reducing losses from the carbon tax itself (compare Panels A and D). But more than 85% of the poorest third of Lithuania’s population would be worse off with such a carbon-tax package. By contrast, close to half of the top 30% would gain from with this reform package. Even for high-income groups, gains are modest in percentage terms, however (<2%). Compared with the other two revenue-recycling scenarios, the patterns of gains and losses for the labour tax reduction therefore appear less favourable for building strong voter support.

From a broader inclusiveness point of view, the carbon tax combined with additional transfers reduces inequality. The redistributive effect is stronger for the proportional increase of existing benefits (a reduction by 2 Gini points) than for the lump-sum transfer (a reduction by 1 point). The package with lower labour taxes is regressive (an increase by 0.5 Gini points), though without accounting for possible positive employment effects.

Figure 6.7. Carbon tax package with revenue recycling

Different scenarios for revenue recycling. Gains and losses by income group (deciles)

Source: Immervoll et al. (2023[49]), drawing on a consumption model and EUROMOD, in conjunction with data on household expenditure, emission levels and industry inputs and outputs.

Environmental impact

Greenhouse gas (GHG) emissions in Lithuania declined steeply between 1990 and 2000 but have since stabilised at around 20 MtCO2eq, which accounted for around 0.55% of total EU emissions in 2019 (Jensen, 2021[59]), and around 0.04% of global emissions (Global Carbon Project, 2021[60]). Although emissions per capita are increasing, they remain below the OECD average. Emissions have largely decoupled from economic growth, with emissions intensity per unit of GDP decreasingly steadily since 2005 (OECD, 2021[61]). Transport, agriculture and industry make up two thirds of Lithuanian GHG emissions. The transport sector in particular is the biggest and fastest growing contributor to total emissions, accounting for over 30% of emissions in 2019, up from less than 20% in 2005 (OECD, 2021[61]).

The estimated adjustments of household consumption in response to the carbon tax and revenue recycling can be translated into an equivalent estimate of CO2 emissions. This approach applies the same input-output model used to trace carbon emissions, and the resulting carbon tax, from different stages of production to consumer goods. Reversing this approach gives emissions reductions from re‑balanced final household consumption of around 9.5% resulting from price changes alone. This relates to emissions released in all parts of the value chain, including foreign production of goods and inputs imported into Lithuania, but is limited to the direct consequences of changing final household consumption. 9

Revenue recycling increases household income and spending in line with estimated budget elasticities and, hence, lowers emission reductions somewhat. Altogether, and depending on the revenue recycling scenario, overall emission reductions are estimated to range between 7 and 8% for carbon-tax policy packages that redistribute tax receipts back to households.10

The policy implications from these findings are twofold. First, at current consumer preferences and the tax rates currently considered, emission reductions are relatively modest, even for a comprehensive carbon levy that does exempt specific industries or products. At existing or proposed levels, carbon taxes alone are not sufficient for meeting national and international climate commitments. Second, the type of revenue recycling strongly shapes the distributional outcome of a carbon-tax package, but the choice makes only a very modest difference in terms of environmental objectives. This suggests that there is no major immediate trade-off between achieving social and environmental objectives.

However, the sizeable share of gainers in some of the revenue recycling scenarios implies that it may be possible to limit direct compensation measures to less than the total carbon tax revenue. This could allow financing other forms of government expenditures. Some authors have explored combining transfers with scaling back other distortionary taxes, in line with the “double dividend” arguments (García-Muros, Morris and Paltsev, 2022[62]). An alternative would be scaling up of programmes that support and accelerate a green transition. This includes measures that tackle households’ underinvestment in energy efficiency, e.g., through subsidies for home insulation or installations such as heat pumps (D’Arcangelo et al., 2022[63]), or that facilitate a reallocation of jobs towards less carbon-intensive production (unemployment insurance and active labour-market policies).

References

[58] Antosiewicz, M. et al. (2022), “Distributional effects of emission pricing in a carbon-intensive economy: The case of Poland”, Energy Policy, Vol. 160, p. 112678, https://doi.org/10.1016/j.enpol.2021.112678.

[18] Baranzini, A., J. Goldemberg and S. Speck (2000), “A future for carbon taxes”, Ecological Economics, Vol. 32/3, pp. 395-412, https://doi.org/10.1016/s0921-8009(99)00122-6.

[15] Barreto, C., R. Grundke and Z. Krill (forthcoming), “The Social Cost of the Green Transition: Displacement Effects in Carbon Intensive Sectors”, OECD Economics Department Working Paper.

[17] Baumol, W. and W. Oates (1988), The theory of environmental policy, Cambridge University Press.

[33] Berry, A. (2019), “The distributional effects of a carbon tax and its impact on fuel poverty: A microsimulation study in the French context”, Energy Policy, Vol. 124, pp. 81-94, https://doi.org/10.1016/j.enpol.2018.09.021.

[38] Bourgeois, C., L. Giraudet and P. Quirion (2021), “Lump-sum vs. energy-efficiency subsidy recycling of carbon tax revenue in the residential sector: A French assessment”, Ecological Economics, Vol. 184, p. 107006, https://doi.org/10.1016/j.ecolecon.2021.107006.

[37] Brännlund, R. and J. Nordström (2004), “Carbon tax simulations using a household demand model”, European Economic Review, Vol. 48/1, pp. 211-233, https://doi.org/10.1016/s0014-2921(02)00263-5.

[54] Browne, J. and H. Immervoll (2017), “Mechanics of replacing benefit systems with a basic income: comparative results from a microsimulation approach”, The Journal of Economic Inequality, Vol. 15/4, pp. 325-344, https://doi.org/10.1007/s10888-017-9366-6.

[19] Büchs, M., N. Bardsley and S. Duwe (2011), “Who bears the brunt? Distributional effects of climate change mitigation policies”, Critical Social Policy, Vol. 31/2, pp. 285-307, https://doi.org/10.1177/0261018310396036.

[28] Büchs, M., D. Ivanova and S. Schnepf (2021), “Fairness, effectiveness, and needs satisfaction: new options for designing climate policies”, Environmental Research Letters, Vol. 16/12, p. 124026, https://doi.org/10.1088/1748-9326/ac2cb1.

[47] Budgetdienst (2022), Verteilungswirkung des ersten und zweiten Teils der Ökosozialen Steuerreform, Parliament of the Republic of Austria.

[36] Callan, T. et al. (2009), “The distributional implications of a carbon tax in Ireland”, Energy Policy, Vol. 37/2, pp. 407-412, https://doi.org/10.1016/j.enpol.2008.08.034.

[23] Carattini, S., M. Carvalho and S. Fankhauser (2018), “Overcoming public resistance to carbon taxes”, WIREs Climate Change, Vol. 9/5, https://doi.org/10.1002/wcc.531.

[63] D’Arcangelo, F. et al. (2022), “A framework to decarbonise the economy”, OECD Economic Policy Papers, No. 31, OECD Publishing, Paris, https://doi.org/10.1787/4e4d973d-en.

[65] D’Arcangelo, F. et al. (Forthcoming), “Estimating the CO2 emission and revenue effects of carbon pricing: new evidence from a large cross-country dataset”, OECD Economics Department Working Paper Series.

[21] Dechezleprêtre, A. et al. (2022), “Fighting climate change: International attitudes toward climate policies”, OECD Economics Department Working Papers, No. 1714, OECD Publishing, Paris, https://doi.org/10.1787/3406f29a-en.

[10] Dechezleprêtre, A. and T. Kruse (2022), “The effect of climate policy on innovation and economic performance along the supply chain: A firm- and sector-level analysis”, OECD Environment Working Papers, No. 189, OECD Publishing, Paris, https://doi.org/10.1787/3569283a-en.

[11] Dechezleprêtre, A. and M. Sato (2017), “The Impacts of Environmental Regulations on Competitiveness”, Review of Environmental Economics and Policy, Vol. 11/2, pp. 183-206, https://doi.org/10.1093/reep/rex013.

[31] Dorband, I. et al. (2019), “Poverty and distributional effects of carbon pricing in low- and middle-income countries – A global comparative analysis”, World Development, Vol. 115, pp. 246-257, https://doi.org/10.1016/j.worlddev.2018.11.015.

[32] Durand-Lasserve, O. et al. (2015), “Modelling of distributional impacts of energy subsidy reforms: an illustration with Indonesia”, OECD Environment Working Papers, No. 86, OECD Publishing, Paris, https://doi.org/10.1787/5js4k0scrqq5-en.

[12] Dussaux, D. (2020), “The joint effects of energy prices and carbon taxes on environmental and economic performance: Evidence from the French manufacturing sector”, OECD Environment Working Papers, No. 154, OECD Publishing, Paris, https://doi.org/10.1787/b84b1b7d-en.

[57] Ekins, P. et al. (2011), “The implications for households of environmental tax reform (ETR) in Europe”, Ecological Economics, Vol. 70/12, pp. 2472-2485, https://doi.org/10.1016/j.ecolecon.2011.08.004.

[7] European Commission (2021), Green taxation and other economic instruments - Internalising environmental costs to make the polluter pay.

[45] Feindt, S. et al. (2021), “Understanding regressivity: Challenges and opportunities of European carbon pricing”, Energy Economics, Vol. 103, p. 105550, https://doi.org/10.1016/j.eneco.2021.105550.

[43] Flues, F. and A. Thomas (2015), “The distributional effects of energy taxes”, OECD Taxation Working Papers, Vol. No. 23, pp. https://doi.org/10.1787/5js1qwkqqrbv-en.

[30] Flues, F. and K. van Dender (2017), “The impact of energy taxes on the affordability of domestic energy”, OECD Taxation Working Papers, No. 30, OECD Publishing, Paris, https://doi.org/10.1787/08705547-en.

[62] García-Muros, X., J. Morris and S. Paltsev (2022), “Toward a just energy transition: A distributional analysis of low-carbon policies in the USA”, Energy Economics, Vol. 105, p. 105769, https://doi.org/10.1016/j.eneco.2021.105769.

[60] Global Carbon Project (2021), Lithuania: CO2 Country Profile - Our World in Data, Supplemental Data of Global Carbon Project 2021, https://doi.org/10.18160/gcp-2021.

[5] High-Level Commission on Carbon Prices (2017), Report of the High-Level Commission on Carbon Prices, High-Level Commission on Carbon Prices, Washington DC, https://static1.squarespace.com/static/54ff9c5ce4b0a53decccfb4c/t/59b7f2409f8dce5316811916/1505227332748/CarbonPricing_FullReport.pdf (accessed on 28 March 2022).

[1] High-level Commisssion on Carbon Prices (2017), Report of the high-level commission on carbon prices, https://doi.org/10.7916/d8-w2nc-4103.

[24] Hynes, S. and C. O’Donoghue (2014), “Environmental Models”, in Handbook of Microsimulation Modelling, Contributions to Economic Analysis, Emerald Group Publishing Limited, https://doi.org/10.1108/s0573-855520140000293014.

[49] Immervoll, H. et al. (2023), “Who pays for higher carbon prices? Illustration for Lithuania and a research agenda”, OECD Social, Employment and Migration Working Papers.

[51] Immervoll, H., E. Mustonen and M. Riihelä (2005), “Accounting for population changes in tax-benefit microsimulation models. A note on static data ’ageing’ techniques”, EUROMOD Working Paper, University of Cambridge.

[25] Immervoll, H. and C. O’Donoghue (2009), “Towards a multi-purpose framework for tax-benefit microsimulation: Lessons from EUROMOD”, International Journal of Microsimulation, Vol. 2/2.

[6] Interagency Working Group on Social Cost of Greenhouse Gases (IWG) (2021), Technical Support Document: Social Cost of Carbon, Methane, and Nitrious Oxide: Interim Estimates under Executive Order 13990.

[59] Jensen, L. (2021), Climate Action in Lithuania, European Parliamentary Research Service, Brussels.

[27] Klenert, D. and L. Mattauch (2016), “How to make a carbon tax reform progressive: The role of subsistence consumption”, Economics Letters, Vol. 138, pp. 100-103, https://doi.org/10.1016/j.econlet.2015.11.019.

[34] Klenert, D. et al. (2018), “Making carbon pricing work for citizens”, Nature Climate Change, Vol. 8/8, pp. 669-677, https://doi.org/10.1038/s41558-018-0201-2.

[56] Metcalf, G. (1999), “A distributional analysis of Green Tax Reforms”, National Tax Journal, Vol. 52/4.

[14] Metcalf, G. and J. Stock (2020), The Macroeconomic Impact of Europe’s Carbon Taxes, National Bureau of Economic Research, Cambridge, MA, https://doi.org/10.3386/w27488.

[53] Nachtigall, D., J. Ellis and S. Errendal (2022), “Carbon pricing and COVID-19: Policy changes, challenges and design options in OECD and G20 countries”, OECD Environment Working Papers, No. 191, OECD Publishing, Paris, https://doi.org/10.1787/8f030bcc-en.

[64] Nordhaus, W. (2017), “Revisiting the social cost of carbon”, Proceedings of the National Academy of Sciences, Vol. 114/7, pp. 1518-1523, https://doi.org/10.1073/pnas.1609244114.

[3] Nordhaus, W. (1991), “A sketch of the economics of the greenhouse effect”, Amercian Economic Review, Vol. 81/2, pp. 146-150.

[26] O’Donoghue, C. (2021), Practical Microsimulation Modelling, Oxford University Press, https://doi.org/10.1093/oso/9780198852872.001.0001.

[50] O’Donoghue, C. and J. Loughrey (2014), “Nowcasting in Microsimulation Models: A Methodological Survey”, Journal of Artificial Societies and Social Simulation, Vol. 17/4, https://doi.org/10.18564/jasss.2635.

[55] OECD (2022), Coping with the cost-of-living crisis: Income support for working-age individuals and their families, OECD, https://www.oecd.org/social/Income-support-for-working-age-individuals-and-their-families.pdf.

[16] OECD (2022), Towards a sustainable recovery? Carbon pricing policy changes during COVID-19, http://oecd.org/coronavirus.

[13] OECD (2021), Assessing the Economic Impacts of Environmental Policies: Evidence from a Decade of OECD Research, OECD Publishing, Paris, https://doi.org/10.1787/bf2fb156-en.

[61] OECD (2021), OECD Environmental Performance Reviews: Lithuania 2021, OECD Environmental Performance Reviews, OECD Publishing, Paris, https://doi.org/10.1787/48d82b17-en.

[22] Ohlendorf, N. et al. (2020), “Distributional Impacts of Carbon Pricing: A Meta-Analysis”, Environmental and Resource Economics, Vol. 78/1, pp. 1-42, https://doi.org/10.1007/s10640-020-00521-1.

[35] Owen, A. and J. Barrett (2020), “Reducing inequality resulting from UK low-carbon policy”, Climate Policy, Vol. 20/10, pp. 1193-1208, https://doi.org/10.1080/14693062.2020.1773754.

[4] Pearce, D. (1991), “The role of carbon taxes in adjusting to global warming”, Economic Journal, Vol. 101/407, pp. 938-948.

[39] Pearson, M. and S. Smith (1991), The European carbon tax: An assessment of the European Commission’s proposals, Institute for Fiscal Studies, https://discovery.ucl.ac.uk/id/eprint/17288/1/17288.pdf.

[40] Pearson, M. and S. Smith (1991), The European carbon tax: An assessment of the European Commission’s proposals, Institute for Fiscal Studies, https://discovery.ucl.ac.uk/id/eprint/17288/1/17288.pdf.

[2] Pigou, A. (1920), The economics of welfare, Macmillan.

[9] Rausch, S., G. Metcalf and J. Reilly (2011), “Distributional impacts of carbon pricing: A general equilibrium approach with micro-data for households”, Energy Economics, Vol. 33, pp. S20-S33, https://doi.org/10.1016/j.eneco.2011.07.023.

[8] Rennert, K. et al. (2022), “Comprehensive evidence implies a higher social cost of CO2”, Nature, Vol. 610/7933, pp. 687-692, https://doi.org/10.1038/s41586-022-05224-9.

[52] Sologon, D. et al. (2022), Welfare and Distributional Impact of Soaring Prices in Europe, IZA Discussion Paper Series.

[46] Steckel, J. et al. (2021), “Distributional impacts of carbon pricing in developing Asia”, Nature Sustainability, Vol. 4/11, pp. 1005-1014, https://doi.org/10.1038/s41893-021-00758-8.

[42] Sterner, T. (2012), “Distributional effects of taxing transport fuel”, Energy Policy, Vol. 41, pp. 75-83, https://doi.org/10.1016/j.enpol.2010.03.012.

[41] Symons, E., S. Speck and J. Proops (2002), “The distributional effects of carbon and energy taxes: the cases of France, Spain, Italy, Germany and UK”, European Environment, Vol. 12/4, pp. 203-212, https://doi.org/10.1002/eet.293.

[20] Tatham, M. and Y. Peters (2022), “Fueling opposition? Yellow vests, urban elites, and fuel taxation”, Journal of European Public Policy, pp. 1-25, https://doi.org/10.1080/13501763.2022.2148172.

[44] Vogt-Schilb, A. et al. (2019), “Cash transfers for pro-poor carbon taxes in Latin America and the Caribbean”, Nature Sustainability, pp. 941–948. https://doi.org/10.1038/s41893-019-0385-0.

[29] Wang, Q. et al. (2016), “Distributional effects of carbon taxation”, Applied Energy, Vol. 184, pp. 1123-1131, https://doi.org/10.1016/j.apenergy.2016.06.083.

[48] Zhao, S. et al. (2022), “Poverty and inequality implications of carbon pricing under the long-term climate target”, Sustainability Science, pp. 2513–2528. https://doi.org/10.1007/s11625-022-01206-y.

Notes

← 1. (Nordhaus, 2017[64]) defines the social cost of carbon as the economic cost caused by an additional tonne of CO2 emissions or its equivalent; it rests on the concept of internalising externalities, considering both inter- and intra-generation equity.

← 3. Emerging results using micro-data illustrate that losses for displaced workers in carbon-intensive sectors can be sizeable (Barreto, Grundke and Krill, forthcoming[15]). These studies are informative but necessarily based on past layoff events, with dismissals in “brown” sectors largely driven by globalisation and offshoring. The associated restructuring patterns and subsequent re-employment opportunities are imperfect indicators of the pattern of employment gains and losses that may result from climate-change mitigation measures and a green transition.

← 4. These consumption patterns are a snapshot at a single point in time. It should be noted that Lithuania has changed very significantly in terms of its economic and consumption structure over recent years. It is likely that Lithuania will continue to converge towards European patterns over the planning period for the Carbon Tax which may affect medium term conclusions.

← 5. As for all goods except fuel, carbon tax payments for electricity are calculated using the WIOD input-output data, resulting in CO2 emissions per euro for 24 expenditure categories and then applying the EUR 60 per tonne tax accordingly (Immervoll et al., 2023[49]). The WIOD reflects Lithuania’s use of nuclear, gas, coal and renewable in 2014. The carbon intensity of electricity generation changed since then (less than 10%, from 227 gCO2/kwh in 2014 to 209 gCO2/kwh in 2021).

← 6. It is worth noting that the reduction of carbon-tax burdens in Figure 6.6 exceeds the adjustment one would obtain through a straight price elasticity. The reason is an assumption of unchanged savings; in the context of a price increase, unchanged savings imply a fall in consumption over and above the pure price elasticity. The suitability of this assumption can be questioned, especially in the very short term, where dissaving can provide a cushioning mechanism for households confronted with rising prices. The present version assumes unchanged savings, as the methodology cannot reliably incorporate inter-temporal decision making in relation to savings.

← 7. The expenditure changes for each consumption category are calculated assuming that households spend the entire additional income that they receive from revenue recycling, i.e. savings remain unchanged, in line with Footnote 6.

← 8. For illustration purposes, it was decided to limit revenue recycling to the carbon tax itself, also because additional revenues from other taxes may be more difficult to earmark in practice.

← 9. Noting that the model keeps the savings rate constant (see Footnote 6). Using a pure price elasticity (with overall savings allowed to respond to prices, and expenditure shares increasing when prices go up) would result in a smaller reduction in emissions, though differences are likely to be minor (perhaps less than 0.5 percentage points).

← 10. This reduction is derived from consumption adjustments by households in Lithuania and, hence, relates to domestic consumption by households only. It is therefore lower than recent estimates of more encompassing emission reductions from higher carbon prices (D’Arcangelo et al., Forthcoming[65]). Those estimates point to a reduction of 3.7% per 10 EUR increase on average across countries. Their scope is quite different, however, as they rely on a large cross-country dataset, look at long-term reductions for the economy as a whole, notably including adjustments on the production side. They also consider carbon taxes alongside other forms of carbon pricing, and do not account for revenue recycling.