This chapter reports on the results of modelling carried out to assess the socio-economic impacts of various policy mixes for achieving the 2030 GHG emissions reduction targets. The modelling compares two possible policy scenarios to a reference scenario that reflects the ambition of Lithuania’s current nationally determined contribution (NDC). Results show that the NDC is not ambitious enough to meet Lithuania’s targets, but that enhancing price signals, either through establishing a national carbon price, or through a second EU Emissions Trading System (EU ETS2), would make significant progress on reducing emissions. Results also show that the economic costs of these policies are minimal, indicating that even before accounting for climate damages and potential co-benefits, climate objectives can be reconciled with economic growth.

Reform Options for Lithuanian Climate Neutrality by 2050

3. Choosing a policy mix to achieve carbon neutrality – a modelling exercise

Abstract

Against the background of increasing climate policy ambition at the EU level and domestically in Lithuania, it is necessary to assess the costs and benefits associated with reaching climate neutrality by 2050. The transition to a climate-neutral economy will require policy reforms, new public expenditure, and private investment across key economic sectors, in particular energy, transport, industry, and agriculture. Complementary policy actions will be necessary to facilitate the transition, mitigate potential negative effects and foster the economic opportunities offered by clean technologies.

This chapter reports on the results of a quantitative analysis using a computable general equilibrium (CGE) model applied to the Lithuanian economy to evaluate, under different scenarios, the impact of policies implemented in Lithuania, the EU, and the rest of the world to reach emissions reduction targets for 2030, with a view to meeting the Paris Agreement goal of climate neutrality by 2050. The scenarios modelled focus specifically on pricing initiatives, providing policy makers with important insights on their socio‑economic impacts.1

By modelling current and planned policy scenarios, the model provides insights into the extent to which these policies suffice to reach 2030 emissions reduction targets and what the socio-economic impact of these policy pathways will be. These results are detailed in this chapter. Second, the model provides insights into long-term policy pathways that are consistent with climate neutrality by 2050. These results are detailed in Chapter 7.

To develop these decarbonisation pathways, the model considers the effect of planned policies in Lithuania and at the EU level relative to a baseline, or reference scenario.2 The reference scenario consists of currently active policies globally, as detailed in Lithuania’s NECP, the EU’s 2030 climate and energy framework and Nationally Determined Contributions (NDCs) submitted by countries in the context of the Paris Agreement.

The model further considers two policy scenarios to 2030 based on planned policies in Lithuania and the EU that are not yet implemented, assuming all other countries remain at reference scenario levels of climate policy ambition.

FIT55 scenario. Domestically, Lithuania implements the proposed excise duty amendment which includes the introduction of a carbon tax component for certain fuels/sectors (see section on economy-wide policies in Chapter 2). At the EU level, member states implement measures to meet the EU’s 55% emissions reduction target by 2030, in particular through proposed reforms to the EU ETS and the European Tax Directive (ETD) as detailed in the Fit for 55 package (including for Lithuania), as well as through implementing a carbon price in non-ETS sectors to meet the EU’s proposed targets (excluding Lithuania).

ETS2 scenario. In addition to the reforms to the EU ETS and ETD modelled in the first scenario, the EU (including Lithuania) establishes a further ETS for the road transport and buildings sectors (also under discussion as part of the Fit for 55 package – see Chapter 2), replacing carbon prices for non-ETS sectors from the FIT55 scenario in other member states.

In addition to modelling climate policy trajectories to 2030, the model also considers the impact of the invasion of Ukraine by Russia and the response of governments globally. Specifically, it considers a scenario whereby a selection of OECD countries restrict imports of fossil fuels from Russia. Results are to 2030 and consider the impact of fossil fuel import restrictions both on the reference scenario, labelled Import Ban and the FIT55 scenario, labelled Import Ban+FIT55.

The table below summarises the scenarios modelled to 2030.

Table 3.1. Summary of policies included in scenarios to 2030

|

Scenario Name |

Reference scenario policies: EU ETS 43% reduction (w.r.t 2005), Regional carbon prices consistent with NDCs, 2014 excise tax rates, Assumptions on electrification, renewable energy price trajectories and renewable energy preferences. |

Lithuanian Excise Duty Amendment and Carbon Component |

EU ETS ambition increase (61% reduction w.r.t. 2005) |

ETD ambition increase |

ETS II for transport and buildings |

Non-ETS sector carbon price consistent with 43% reduction (w.r.t. 2005)(excluding Lithuania) |

Russian fossil fuel import ban |

|---|---|---|---|---|---|---|---|

|

reference |

Yes |

No |

No |

No |

No |

No |

No |

|

FIT55 |

Yes |

Yes |

Yes |

Yes |

No |

Yes |

No |

|

ETS2 |

Yes |

Yes |

Yes |

Yes |

Yes |

No |

No |

|

Import Ban |

Yes |

No |

No |

No |

No |

No |

Yes |

|

Import Ban + FIT55 |

Yes |

Yes |

Yes |

Yes |

No |

Yes |

Yes |

The modelling results illustrate the impact of the transition to climate neutrality on:

GDP and other main macroeconomic variables (i.e. employment, productivity, investment, welfare, debt trajectories);

energy/climate-specific impacts such as energy consumption and GHG emissions;

relocation of economic activity, including job reallocation across skills levels and sectors;

public finance, including revenue and government expenditure;

international competitiveness and trade flows.

Modelling pathways to net zero: General considerations for a policy mix for carbon neutrality

Achieving climate neutrality will require a broad climate policy mix including pricing initiatives, other economic incentives, regulatory reforms, and complementary policies such as education, infrastructure development, and behavioural demand-side policies (D’Arcangelo et al., 2022[1]). Such a policy mix should focus not only on reducing emissions to the extent necessary, but also on doing so at least cost to society. This includes ensuring economic cost effectiveness, but also a just transition minimising the impact on domestic firms and households wherever possible (OECD, 2021[2]).

Price signals are an imperative part of this climate policy toolbox, in particular as many countries still subsidise fossil fuel use, lacking market-based signals to reduce emissions. Removing such subsidies and implementing additional carbon pricing initiatives not only provides economic incentives for emissions reductions, but also promotes innovation in low-emissions technologies. As such, price signals address two of the primary externalities of the climate problem (OECD, 2021[2]). Carbon pricing is further considered a cost-effective mitigation option because pricing initiatives: 1) equalise marginal abatement costs across emitters, ensuring economy-, or (sub)sector-wide cost-effectiveness, depending on the scope of the pricing initiative and 2) decentralise abatement decisions, overcoming information asymmetries between governments and polluters exhibited in regulatory measures (OECD, 2018[3]).

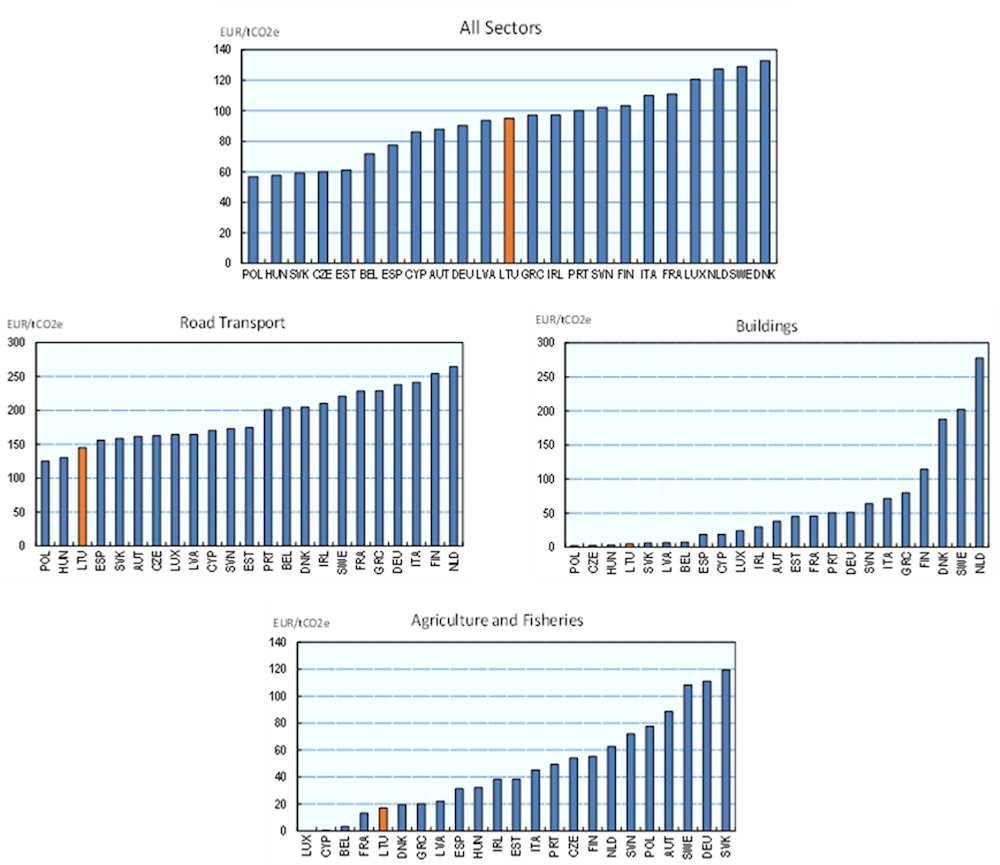

Existing carbon pricing initiatives have been shown to be effective at reducing emissions (Arlinghaus, 2015[4]; Martin, Muûls and Wagner, 2016[5]). Price signals are particularly effective where prior prices remain low, and therefore relative price increases are high (D’Arcangelo et al., 2022[6]). In addition to explicit carbon prices through carbon taxes and emissions trading systems, fuel excise taxes also send price signals regarding fuels use, and indirectly, CO2 emissions as well. Together these three forms of explicit and implicit prices can be combined into an effective carbon rate (ECR) (see also Chapter 4) (OECD, 2018[3]). Although Lithuania’s ECR across all economic sectors remains average amongst EU countries, the transport, buildings and agriculture and fisheries sectors in particular retain low price signals when compared with other EU countries (Figure 3.1). As such there remains scope for increasing prices, especially in these sectors.

Considering this, CGE models are particularly adept at modelling pricing initiatives and their socio‑economic impacts over long timeframes. The CGE model employed for this chapter thus considers various price-based policy scenarios in Lithuania. The reference scenario concerns the current policy landscape, reflecting current excise duties on fossil fuels in Lithuania and carbon prices under the EU ETS. Two further scenarios (FIT55 and ETS2) expand on these, including planned reforms to pricing initiatives, both at the EU level under the Fit for 55 package, and domestically within Lithuania.

Beyond these scenarios, non-price-based policy options remain an imperative part of the policy mix for reaching climate neutrality. Chapter 2 of this report provides a more comprehensive stocktake of existing and planned policies in Lithuania and at the EU-Level, looking beyond the pricing initiatives depicted in this chapter. This include good-practice insights from other OECD countries, and recommendations for where the Lithuanian policy mix could be expanded, or reformed. These recommendations are further elaborated on in the concluding chapter of this report, taking into account both the output of the quantitative assessment of pricing initiatives depicted in this chapter, and more qualitative assessments of the broader policy mix throughout the rest of the report.

Figure 3.1. Lithuania's economy-wide effective carbon rate remains average amongst EU countries, but road transport, buildings, agriculture and fishery sectors retain amongst the lowest rates

Effective Carbon Rate (Emissions-Weighted Average), Across the EU, 2021

Scenarios to 2030

Reference scenario

The reference scenario considers already existing policies as detailed in Lithuania’s NECP, the EU’s 2030 Climate and Energy Framework and the unconditional targets detailed in Nationally Determined Contributions (NDCs) submitted by countries to the UNFCCC for the rest of the world. To reach the NDC targets, it is assumed that all countries, excluding the EU and China, implement carbon prices both in ETS and non-ETS sectors. Carbon prices in the non-ETS sectors could be interpreted as an explicit representation of the costs of mitigation in the corresponding activities. Two exceptions are the EU and China, where carbon prices are imposed on ETS sectors only based on the current practices. The price trajectory for the EU ETS is calculated endogenously within the model, based on meeting the EU’s 2030 target for ETS sectors under the climate and energy framework (-43% compared to 2005 levels). Table 3.2 below provides an overview of the carbon prices imposed under NDC scenario in 2030 across regions.

Table 3.2. Carbon prices under the NDCs in the reference scenario, $2014/tCO2

|

|

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

USA |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

2.2 |

4.4 |

6.6 |

8.7 |

10.9 |

13 |

15.1 |

17.2 |

|

CHN |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

9.5 |

10.5 |

11.6 |

12.9 |

14.3 |

15.8 |

17.5 |

19.3 |

|

RUS |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

1.2 |

1.9 |

2.6 |

3.4 |

4.1 |

4.8 |

5.5 |

6.2 |

|

LTU |

8.5 |

6 |

6.9 |

19.8 |

29.5 |

30 |

44 |

57 |

69 |

82 |

95 |

107 |

120 |

132 |

145 |

157 |

|

X16 |

8.5 |

6 |

6.9 |

19.8 |

29.5 |

30 |

44 |

57 |

69 |

82 |

95 |

107 |

120 |

132 |

145 |

157 |

|

E10 |

8.5 |

6 |

6.9 |

19.8 |

29.5 |

30 |

44 |

57 |

69 |

82 |

95 |

107 |

120 |

132 |

145 |

157 |

|

XOE |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

23.2 |

28.6 |

33.9 |

39.3 |

44.7 |

50 |

55.4 |

60.7 |

|

XEC |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

1.3 |

2.7 |

4.1 |

5.5 |

6.9 |

8.3 |

9.7 |

11.1 |

|

HYA |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

3.9 |

9.2 |

14.5 |

19.7 |

25 |

30.7 |

36.5 |

42.2 |

|

XEA |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

2.5 |

4.5 |

6.5 |

8.5 |

10.5 |

12.4 |

14.4 |

16.3 |

|

SAS |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

1.4 |

2.4 |

3.4 |

4.5 |

5.5 |

6.4 |

7.3 |

8.2 |

|

MNA |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

3.1 |

5.6 |

8.1 |

10.5 |

13 |

15.1 |

17.1 |

19.2 |

|

LAC |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

1.9 |

3.7 |

5.5 |

7.4 |

9.2 |

10.9 |

12.6 |

14.3 |

|

SSA |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0.6 |

1.1 |

1.6 |

2 |

2.5 |

2.9 |

3.3 |

3.7 |

Note: For all regions except EU and China, the reported carbon prices are imposed on all emitting activities. For the case of EU and China carbon prices are imposed on ETS sectors only. Regional construction:

USA United States of America (USA)

CHN China (CHN)

RUS Russian Federation (RUS)

LTU Lithuania (LTU)

X16 (EU-16+EFTA+Great Britain) Austria (AUT), Belgium (BEL), Cyprus (CYP), Denmark (DNK), Finland (FIN), France (FRA), Germany (DEU), Greece (GRC), Ireland (IRL), Italy (ITA), Luxembourg (LUX), Malta (MLT), Netherlands (NLD), Portugal (PRT), Spain (ESP), Sweden (SWE), United Kingdom (GBR), Switzerland (CHE), Norway (NOR), Rest of EFTA (XEF)

E10 (Transition economies w/o Lithuania) Czech Republic (CZE), Estonia (EST), Hungary (HUN), Latvia (LVA), Romania (ROU), Poland (POL), Slovakia (SVK), Slovenia (SVN), Bulgaria (BGR), Croatia (HRV)

XOE (Other HIY OECD) Australia (AUS), New Zealand (NZL), Canada (CAN), Israel (ISR), Rest of the World (XTW)

XEC (Rest of Europe and Central Asia) Albania (ALB), Belarus (BLR), Ukraine (UKR), Rest of Eastern Europe (XEE), Rest of Europe (XER), Kazakhstan (KAZ), Kyrgyzstan (KGZ), Tajikistan (TJK), Rest of Former Soviet Union (XSU), Armenia (ARM), Azerbaijan (AZE), Georgia (GEO), Turkey (TUR)

HYA (High income Asia) Hong Kong (HKG), Japan (JPN), Korea (KOR), Taiwan (TWN), Singapore (SGP)

XEA (Rest of East Asia) Mongolia (MNG), Rest of East Asia (XEA), Brunei Darussalam (BRN), Indonesia (IDN), Malaysia (MYS), Philippines (PHL), Thailand (THA), Viet Nam (VNM), Cambodia (KHM), Laos (LAO), Rest of Southeast Asia (XSE)

XSA (Rest of South Asia) India (IND), Pakistan (PAK), Sri Lanka (LKA), Bangladesh (BGD), Nepal (NPL), Rest of South Asia (XSA)

MNA (Middle East and North Africa) Bahrain (BHR), Iran (IRN), Jordan (JOR), Kuwait (KWT), Oman (OMN), Qatar (QAT), Saudi Arabia (SAU), United Arab Emirates (ARE), Rest of Western Asia (XWS), Egypt (EGY), Morocco (MAR), Tunisia (TUN), Rest of North Africa (XNF)

LAC (Latin America & Caribbean) Mexico (MEX), Rest of North America (XNA), Argentina (ARG), Bolivia (BOL), Brazil (BRA), Chile (CHL), Colombia (COL), Ecuador (ECU), Paraguay (PRY), Peru (PER), Uruguay (URY), Venezuela (VEN), Costa Rica (CRI), Guatemala (GTM), Honduras (HND), Nicaragua (NIC), Panama (PAN), El Salvador (SLV), Rest of Central America (XCA), Rest of South America (XSM), Dominican Republic (DOM), Jamaica (JAM), Puerto Rico (PRI), Trinidad and Tobago (TTO), Rest of Caribbean (XCB), Rest of Oceania (XOC)

SSA Sub-Saharan Africa) Benin (BEN), Burkina Faso (BFA), Guinea (GIN), Senegal (SEN), Togo (TGO), Rest of Western Africa (XWF), Central Africa (XCF), South-Central Africa (XAC), Ethiopia (ETH), Madagascar (MDG), Malawi (MWI), Mauritius (MUS), Mozambique (MOZ), Rwanda (RWA), Tanzania (TZA), Uganda (UGA), Zambia (ZMB), Rest of Eastern Africa (XEC), Rest of South African Customs Union (XSC), Cameroon (CMR), Côte d'Ivoire (CIV), Ghana (GHA), Nigeria (NGA), Kenya (KEN), Zimbabwe (ZWE), Botswana (BWA), Namibia (NAM), South Africa (ZAF).

Excise taxes across fuels and uses are held fixed at the base year level (2014 - in ad valorem equivalent). A comparison of the petroleum excise taxes for 2014 (base-year) and currently observed 2022 gasoline prices shows that EU-average excise tax rates in both years equal to around 25%.

In addition to the above detailed price-based policies, a number of key policies detailed in Lithuania’s NECP, the EU’s climate and energy framework, and the NDCs, are already being implemented, including (for a more comprehensive stocktake of existing policies see Chapter 2):

At the domestic level in Lithuania, as detailed in the current NECP

Support for EV purchases and the development of charging infrastructure

Support for RE deployment through auction schemes and feed-in tariffs

Support for energy efficiency retrofitting and renovation of public and private buildings

At the EU level, as detailed in the EU’s Climate and Energy Framework

Multiple regulatory initiatives at the EU level, including, for example, targets for renewable energy deployment under the renewable energy directive (RED) or fuel efficiency standards under the energy efficiency directive (EED).

The CGE model used cannot explicitly include such non-price-based policies. However, in order to account for their effect, they are reflected in the reference scenario’s policy assumptions. Specifically, this includes three key assumptions:

First, the reference scenario assumes autonomous electrification throughout sectors, including, for example, an increase in the share of electric vehicles and the switch from gas-based cooking to electric stoves. This is in line with historical trends.

Second, the reference scenario assumes continuing decreases in the price of renewable energy technologies, following historical trends.

Finally, in the reference scenario, an autonomous non-price shift towards renewable energy supply is exogenously applied. In particular, in the case of Lithuania, assumptions regarding the development of solar and wind power generation capacity until 2030 are based on data provided by the Lithuanian Energy Agency, with the broader energy mix development until 2030 calibrated to the Lithuanian Energy Agency’s projections.

The discussed reference scenario is broadly consistent with the EU’s first NDC commitment (reducing GHG emissions by 43% by 2030 compared to 1990’s levels). For more information on the specific assumptions employed in the model, see Annex A.

Planned policy scenarios: FIT55 and ETS2

The model implements two further policy scenarios, the FIT55 and ETS2 scenarios, reflecting planned policies in Lithuania and the EU. Rest of the world climate ambition is assumed to remain at reference scenario levels.

These two scenarios were chosen to reflect 1) a scenario that provides leeway to member-states in determining the policy mix needed to reach the EU’s stated targets, and whether the policies proposed in Lithuania suffice in this regard (FIT55), and 2) a scenario where an EU-wide policy approach is taken (ETS2). Under both scenarios, all revenues generated through carbon pricing are recycled back to households through lump-sum transfers.

Both scenarios include the following common components. The first concerns a planned amendment to domestic excise duties in Lithuania that includes a carbon price component. The planned amendment has been submitted to parliament and remains subject to parliamentary approval. It proposes a gradual increase in excise duties for all sectors and fuels from 2023-2024 (Table 3.3). The proposed changes notably phase-out various exemptions for certain fuels in certain sectors, although the agricultural sector remains broadly exempt from these (see Chapter 2 for more detail). In addition to the staggered increase in excise duties, the proposal suggests implementing a carbon price component from 2025, based on the carbon content of different fuels. The carbon price would start at 10 EUR/tCO2e in 2025 and steadily rise to 60 EUR/tCO2e in 2030 (Table 3.4). Installations covered by the EU ETS are exempt from this carbon component.

Table 3.3. Proposed excise duty amendment in Lithuania

|

Energy products |

Current rates of excise duty |

Excise duty rates from 01/01/2023 |

Excise duty rates from 01/01/2024 |

Excise duty rates from 01/01/2025 |

|

|---|---|---|---|---|---|

|

Gas oils, energy products1 and liquid fuels (fuel oils) not intended for heating2, EUR / 1 000 l |

372 |

410 |

466 |

500 |

|

|

Gas oils for heating purposes (domestic heating fuels, energy products and liquid fuels (fuel oils))3, EUR / 1 000 l |

21.14 |

140 |

372 |

372 |

|

|

Gas oils used in agriculture (including aquaculture or commercial fishing in inland waters), EUR / 1 000 l |

60 |

60 (restriction - used in agricultural machinery (including tractors), engines of fishing vessels) |

60 (limit - 100 thousand litres of fuel) |

60 (limit - 50 thousand litres of fuel) |

|

|

Petroleum gases and gaseous hydrocarbons for domestic use, EUR / t |

0 |

304.1 |

304.1 |

304.1 |

|

|

Coal, EUR / t |

Not for business use |

7.53 |

7.53 |

15 |

30 |

|

For business purposes |

3.77 |

7.53 |

15 |

30 |

|

|

Peat for heating, EUR / t |

0 |

10 |

20 |

20 |

|

|

Coke and lignite, EUR / t |

Not for business use |

8.98 |

8.98 |

15 |

30 |

|

For business purposes |

4.63 |

8.98 |

15 |

30 |

|

|

Natural gas supplied to household natural gas consumers and beneficiaries, EUR / MWh |

0 |

0 |

0 |

0.50 |

|

|

Natural gas used as heating fuel other than for commercial purposes, EUR / MWh |

1.08 |

1.08 |

1.08 |

1.50 |

|

|

Natural gas used as heating fuel for commercial purposes, EUR / MWh |

0.54 |

0.54 |

0.54 |

1 |

|

Note: 1) falling within subheadings 2710 19 91 to 2710 19 99 of the CN, 2) referred to in Article 38 (2) of the Law on Excise Duties, 3) falling within CN codes 2710 19 91 to 2710 19 99.

Source: Government of Lithuania.

Table 3.4. Proposed carbon tax in Lithuania

|

Energy products |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

|---|---|---|---|---|---|---|

|

CO2 component, EUR / CO 2 t |

10 |

20 |

30 |

40 |

50 |

60 |

|

Petrol, EUR / 1 000 l |

24 |

48 |

72 |

96 |

120 |

144 |

|

Kerosene, EUR / 1 000 l |

27.1 |

54.2 |

81.3 |

108.4 |

135.5 |

162.6 |

|

Gas oils1 and liquid fuels2, EUR / 1 000 l |

26.2 |

52.4 |

78.6 |

104.8 |

131 |

157.2 |

|

Liquid fuel (fuel oil)3, EUR / t |

31.2 |

62.4 |

93.6 |

124.8 |

156 |

187.2 |

|

Petroleum gases and gaseous hydrocarbons (excluding natural gas), EUR / t |

30.6 |

61.2 |

91.8 |

122.4 |

153 |

183.6 |

|

Coal, EUR / t |

21.8 |

43.6 |

65.4 |

87.2 |

109 |

130.8 |

|

Coke and lignite, EUR / t |

32 |

64 |

96 |

128 |

160 |

192 |

|

Peat for heating, EUR / t |

16.6 |

33.2 |

49.8 |

66.4 |

83 |

99.6 |

Note: 1) referred to in Article 37 (1) and (2) of the Law on excise duties, CN Subheadings 2710 19 91 to 2710 19 99 classified energy products, 2) referred to in Article 38 (2) of the Law on Excise Duties, 3) referred to in Article 38 (1) of the Law on Excise Duties.

Source: Government of Lithuania.

The second component of both the FIT55 and ETS2 scenarios concerns proposals under the EU’s Fit for 55 package. Specifically, they consider the European Commission’s proposed reform of the ETD and EU ETS legislations, incorporating new minimum tax rates from the ETD for an overview of these, see Table 3.5), and increasing the EU ETS emissions reduction target to -61% by 2030 (compared with 2005 levels). The minimum rates under the ETD only apply if the new tax rates under the proposed Lithuanian Excise Duty Amendment remain lower than the minimum rates. The EU ETS price trajectory is again determined endogenously, based on a least-cost pathway to meeting the updated emissions reduction target.

Table 3.5. Minimum taxation rates under the EU Energy Taxation Directive

|

Fuel |

Minimum levels of taxation applicable to motor fuels for the purposes of Article 7 (EUR/GJ) |

Minimum levels of taxation applicable to motor fuels used for the purpose set out in Article 8(2)1 (EUR/GJ) |

Minimum levels of taxation applicable to heating fuels (EUR/GJ) |

Minimum levels of taxation applicable to electricity (EUR/GJ) |

|---|---|---|---|---|

|

Petrol |

10.75 |

0.9 |

- |

- |

|

Gasoil |

10.75 |

0.9 |

0.9 |

- |

|

Kerosene |

10.75 |

0.9 |

0.9 |

- |

|

Non-sustainable biofuels |

10.75 |

0.9 |

- |

- |

|

LPG; Natural Gas; Non-sustainable biogas; Non-renewable fuels of non-biological origin |

7.17 |

0.6 |

0.6 |

- |

|

Sustainable food and feed crop biofuels and biogas |

5.38 |

0.45 |

0.45 |

- |

|

Sustainable biofuels |

5.38 |

0.45 |

- |

- |

|

Sustainable biogas |

5.38 |

0.45 |

0.45 |

- |

|

Low-carbon fuels; renewable fuels of non-biological origin; advanced sustainable biofuels and biogas |

0.15 |

0.15 |

0.15 |

- |

|

Heavy fuel oil; coal and coke; non-sustainable bioliquids; non-sustainable solid products falling within CN codes 4401 and 4402 |

- |

- |

0.9 |

- |

|

Sustainable food and feed crop bioliquids; sustainable bioliquids; sustainable solid products falling within CN codes 4401 and 4402 |

- |

- |

0.45 |

- |

|

Electricity |

- |

- |

- |

0.15 |

Note: 1) Article 8(2) applies to motor fuels used for the following purposes: (a) agricultural, horticultural or aquaculture works, and in forestry; (b) stationary motors; (c) plant and machinery used in construction, civil engineering and public works; (d) vehicles intended for use off the public roadway or which have not been granted authorisation for use mainly on the public roadway.

Beyond these two common components, the two scenarios differ in their treatment of policies for non-ETS sectors (for an overview of scenario components see Table 3.1 above).

FIT55

Under the FIT55 scenario, the model assumes that all EU countries (except Lithuania) implement concurrent policies to meet the EU’s climate targets. In order to model this, a carbon price consistent with the EU’s 43% emissions reduction target by 2030 (compared with 2005 levels) for non-ETS sectors is implemented in all countries barring Lithuania.

ETS2

The ETS2 scenario includes the same policies as under the FIT55 scenario, but also introduces an EU‑wide (including Lithuania) ETS for the road transport and buildings sectors (additional to the EU ETS), or ETS II. This replaces the non-ETS sector carbon prices in other EU countries implemented in the FIT55 scenario. As part of the proposed Fit for 55 package, the European Commission has suggested the establishment of an emissions trading scheme for the buildings and road transport sectors in addition to the current EU ETS (Chapter 2). Specific details on how such an ETS II could be structured remain under discussion. However, given the centrality of the transport sector to Lithuanian emissions reduction efforts, an ETS for the road transport sector would have significant implications for Lithuania’s climate policy pathways.

The ETS2 scenario assumes that an EU-wide ETS covering the road transport and buildings sectors comes into effect from 2025, with the goal of reducing emissions in the sector by 43% by 2030 (compared with 2005 levels), as per the proposal for an ETS II in the Fit-for 55 package. The carbon tax component of the Lithuanian Excise Duty Amendment for fuels in the road transport and buildings sectors would be replaced by the ETS II under this scenario.

Restriction on the imports of Russian fossil fuels

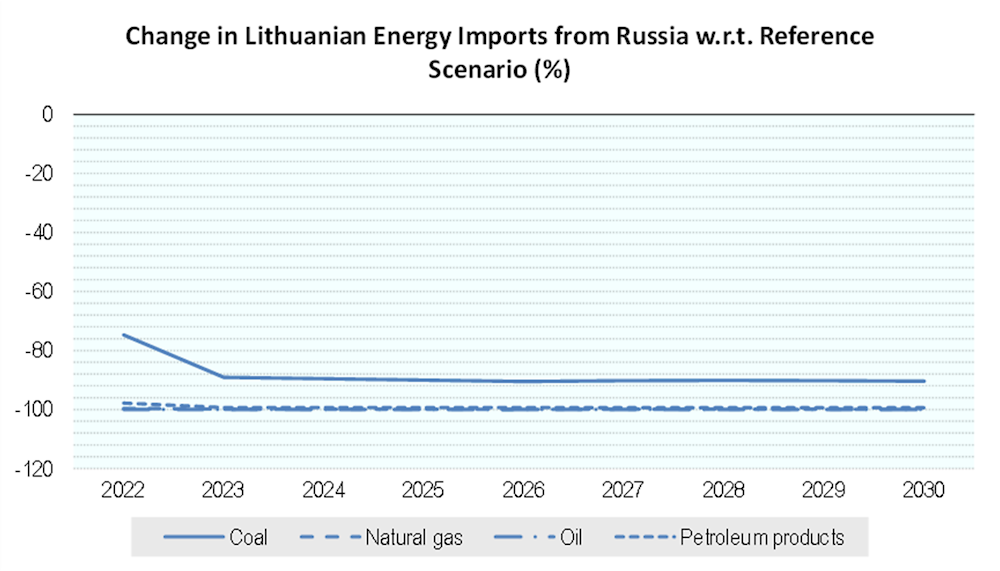

In addition to the reference, FIT55 and ETS2 scenarios detailed above, the model will also take into consideration the impacts of proposed and discussed restrictions on Russian fossil fuel exports imposed by OECD countries in response to Russia’s invasion of Ukraine. Under the Import Ban and Import Ban+FIT55 scenarios, countries/regions imposing a ban on Russian energy exports include Lithuania3, the EU, EFTA and UK, as well as other high-income OECD countries such as Australia, New Zealand, Canada, Israel (for more information see Annex A). Restrictions are imposed on the imports of all fossil fuels, including coal, oil, gas and petroleum products4, and are implemented via imposition of the import taxes following an approach introduced in Chepeliev et al. (Chepeliev, Hertel and Mensbrugghe, 2022[8]). The Import Ban scenario applies the detailed restrictions to the reference scenario. The Import Ban+FIT55 scenario applies them to the FIT55 scenario, providing an indication of the effect of such a ban on carbon prices needed to meet the EU’s 55% emissions reduction target (Figure 3.2) below shows the level of import restrictions introduced by Lithuania relative to the reference NDC scenario. Restrictions are introduced starting from 2022 and are implemented until the end of the analysed period. Starting from 2023 weighted average reductions in fossil fuel imports from Russian by Lithuania exceed 99%.

Figure 3.2. Under the Russian fossil fuel embargo scenario Lithuanian imports of Russian fossil fuels would reduce almost entirely

Results to 2030

The following sections detail the model results to 2030. All results depicted are specifically for Lithuania, unless otherwise stated.

Reference scenario results

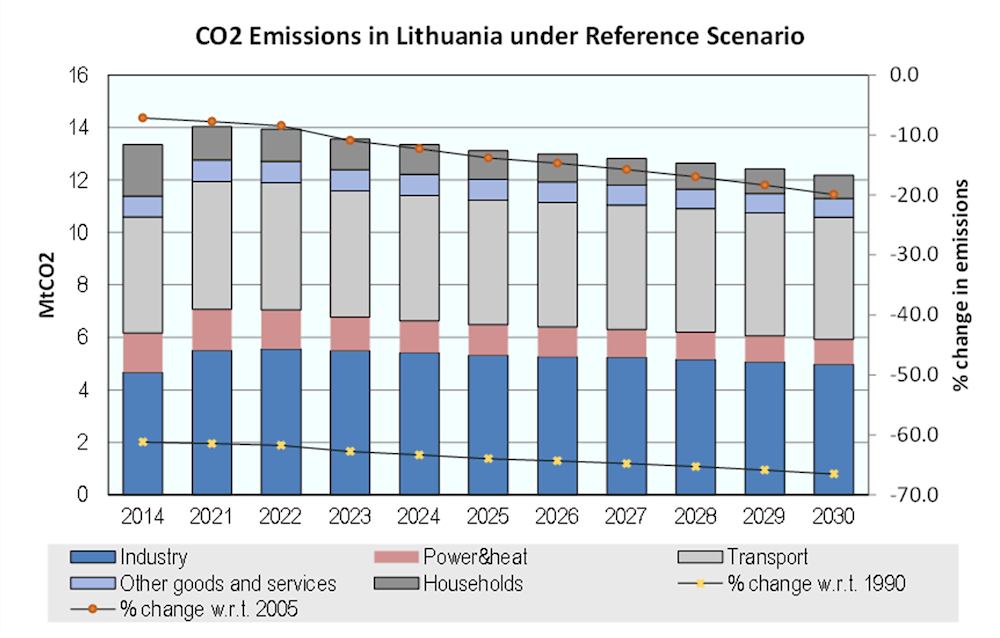

CO2 emissions

Under the reference scenario, CO2 emissions in Lithuania decline significantly, almost 20% w.r.t. 2005 levels, or 66.5% w.r.t. 1990 levels (Figure 3.3). This reflects the EU’s achievement of its previous emissions reduction target of 40% by 2030 (w.r.t. 1990 levels), and broader implementation of targets set out in the NDCs. The emissions reductions here are for CO2 only and do not include other greenhouse gases (GHG).5 As such, emissions reduction levels provided by the model are not directly comparable with Lithuania’s GHG emissions reduction targets depicted in Chapter 2. CO2 emissions from power and heat decline most significantly, with emissions from households and services also declining. By contrast, emissions from industry and transport remain stable, indicating further policy measures may be required in these sectors (Figure 3.3).

Figure 3.3. CO2 emissions in Lithuania decline under the reference scenario, but transport and industry emissions remain high

ETS and Non-ETS CO2 emissions remain equally important, making up around half of total emissions in Lithuania under the reference scenario to 2030. CO2 emissions in the ETS sector, however, decrease more quickly than those in non-ETS sectors. Importantly, transport sectors emissions make up more than half of non-ETS sector emissions in Lithuania under the reference scenario to 2030.

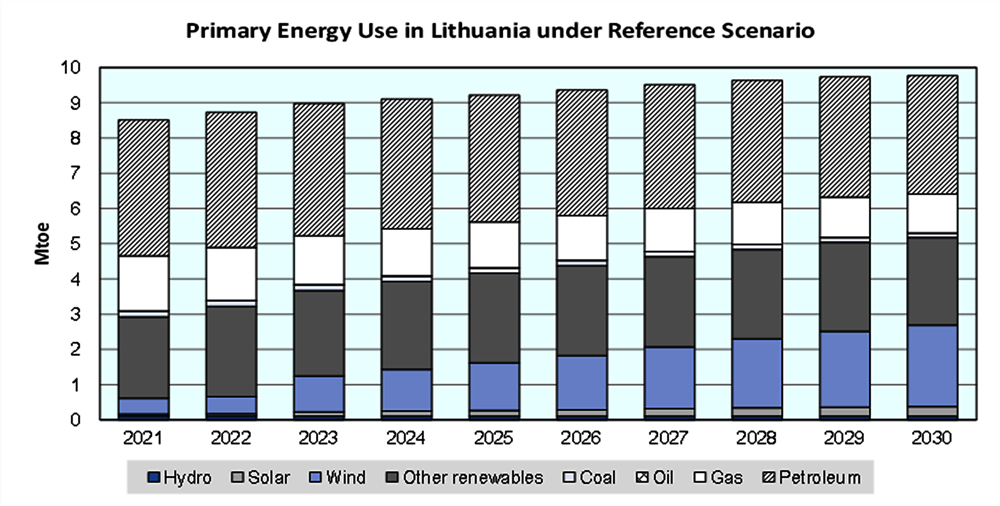

Energy use and power generation

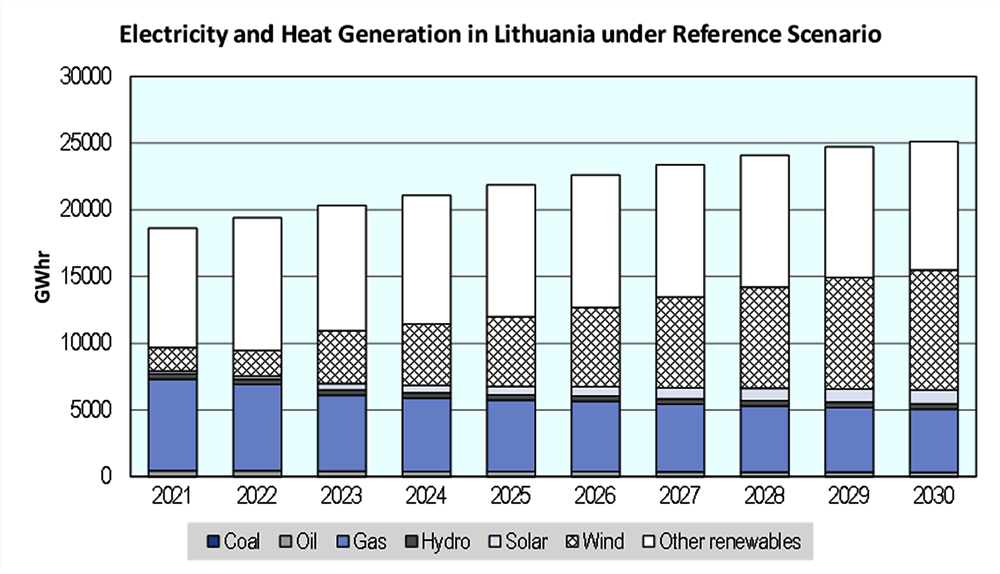

Under the reference scenario, overall primary energy demand increases by 1.5% per year between 2021‑2030. This demand is met through growing renewable energy generation, particularly wind and solar, also making up for a decline in the use of refined oil and gas (Figure 3.4).

Figure 3.4. Under the reference scenario, primary energy use in Lithuania increases, with particular use of wind energy growing considerably

Note: The other renewables category refers to other renewable energy sources such as hydropower and bioenergy. In the case of Lithuania this comprises primarily biomass.

Domestic electricity and heat generation also grows, at a rate of around 3.4% per year from 2021‑2030, contributing to increasing energy security. Solar and wind generation grow at 18% and 20% respectively, with biomass (presented in the figures as “other renewables”) also growing, albeit more slowly (biomass already constituted a major share, particularly of heat generation, in 2021). Gas use for heat and electricity generation declines considerably, at around 4% per year, reflecting increasing costs due to imposed carbon prices and also the increasing competitiveness of renewable energy sources.

Figure 3.5. Overall electricity and heat generation increases in Lithuania under the reference scenario, driven by large growth in renewables

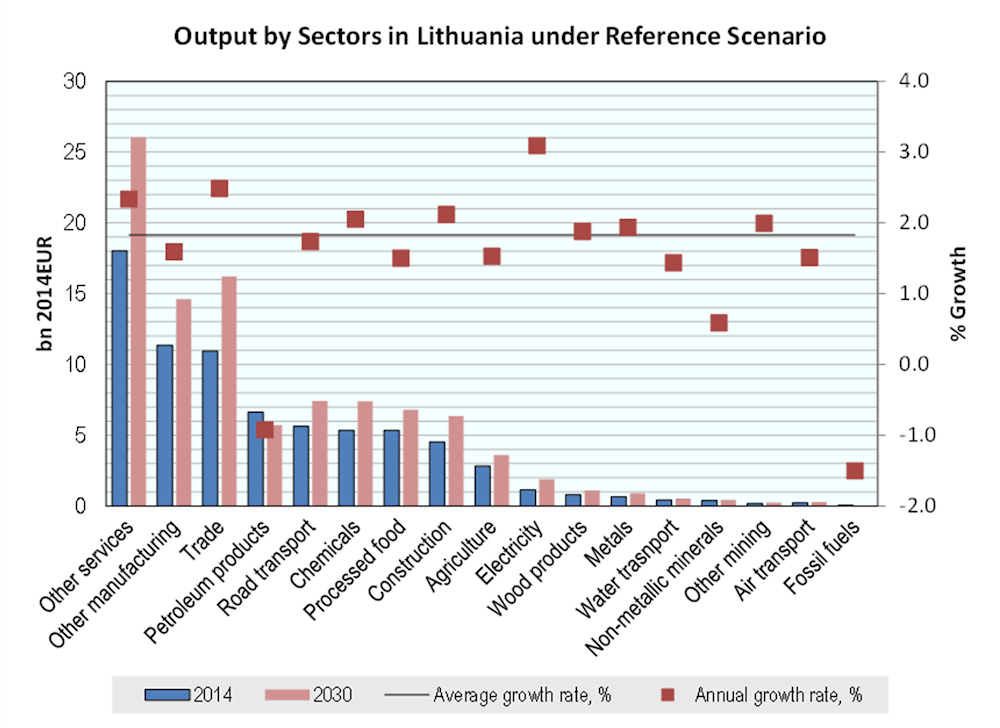

Economic output

Under the reference scenario, all sectors except petroleum products and fossil fuels are projected to continue growing. The electricity sector is projected to grow fastest, at 3.1 % (compared to 1.8% on average). This is driven by the climate policies enacted under the reference scenario such as the EU ETS, autonomous electrification trend and renewable energy preference. By contrast, the petroleum product and fossil fuel sectors contract due to reduced demand for fossil fuels under the reference scenario. The services, trade, chemicals, and construction sectors also grow at above average rates (Figure 3.6).

Figure 3.6. Output in non-fossil fuel sectors will continue to grow, with particularly energy generation growing above average

Planned policies results under the FIT55 and ETS2 scenarios

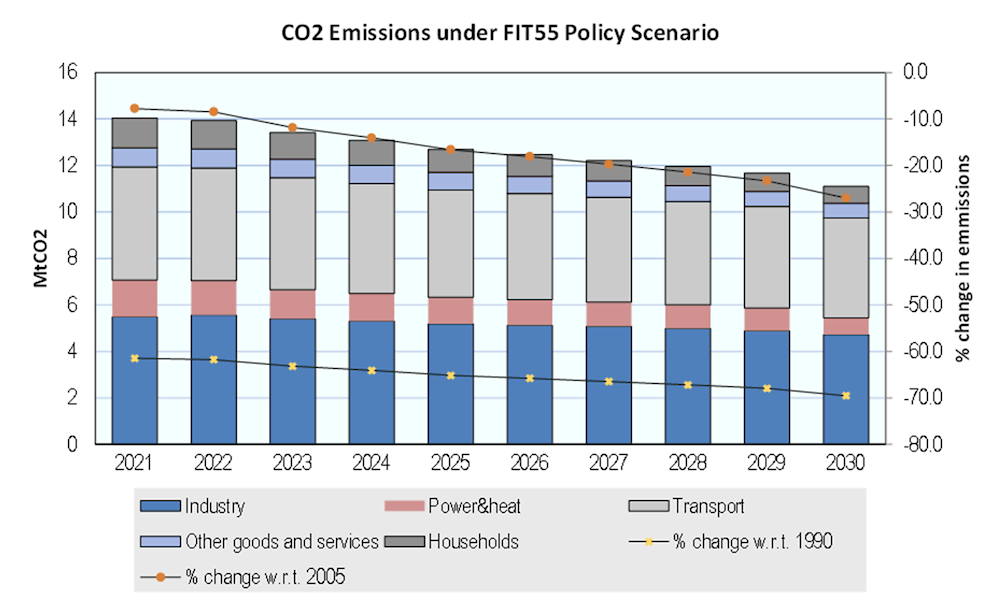

CO2 emissions

Both scenarios exhibit substantial further emissions cuts in Lithuania with respect to the reference scenario. In the FIT55 scenario, 2030 emissions fall by 27% compared with 2005 levels, 7.1% more than under reference. This indicates that the combination of the increased ambition of the EU ETS and the implementation of the proposed Lithuanian Excise Tax Amendment and carbon price component has a considerable effect on emissions levels. Transport emissions in particular decrease substantially more than in the reference scenario. Industry emissions, however, remain relatively stable, as the excise amendment does not include natural gas and process emissions are not priced in the model.

Figure 3.7. The Lithuanian Excise Tax Amendment, coupled with increasing ambition in the EU ETS, would have a considerable downward effect on emissions

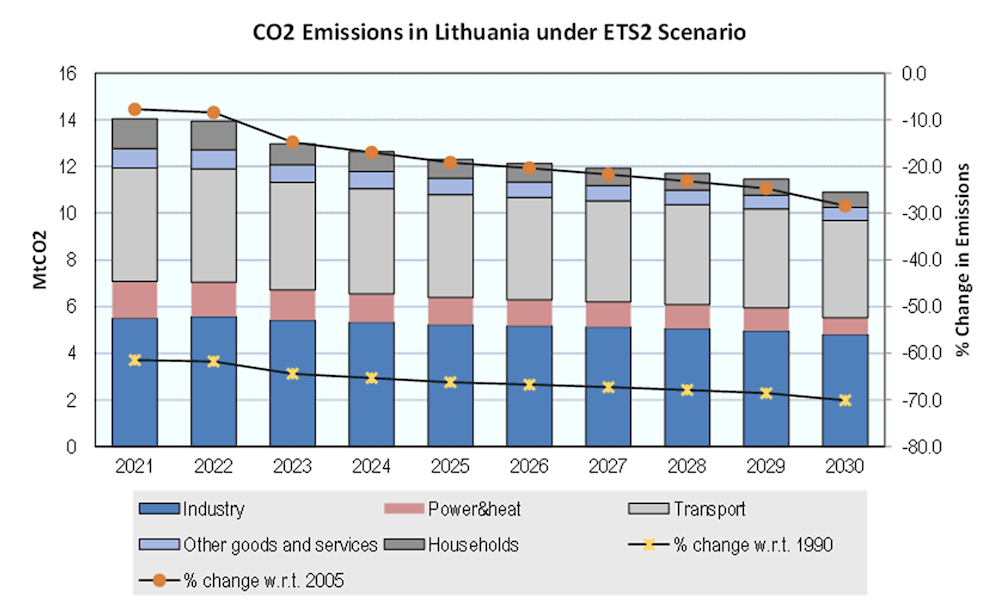

The ETS2 scenario further decreases emissions as carbon prices in the road-transport and buildings sectors increase when compared to the Lithuanian Excise Tax Amendment. Under this scenario, emissions in 2030 fall by 28.5% compared to 2005 levels, 8.5% more than in the reference scenario. In particular, emissions reductions by households and in the transport sector decrease more than in the FIT55 scenario due to higher prices in the ETS2. Industry emissions, as with the FIT55 scenario, remain stable due to the aforementioned limitations in the pricing policies and the model’s scope.

Figure 3.8. The implementation of an ETS2 for the transport and buildings sector would lead to considerable emissions reductions by 2030

Carbon price trajectories

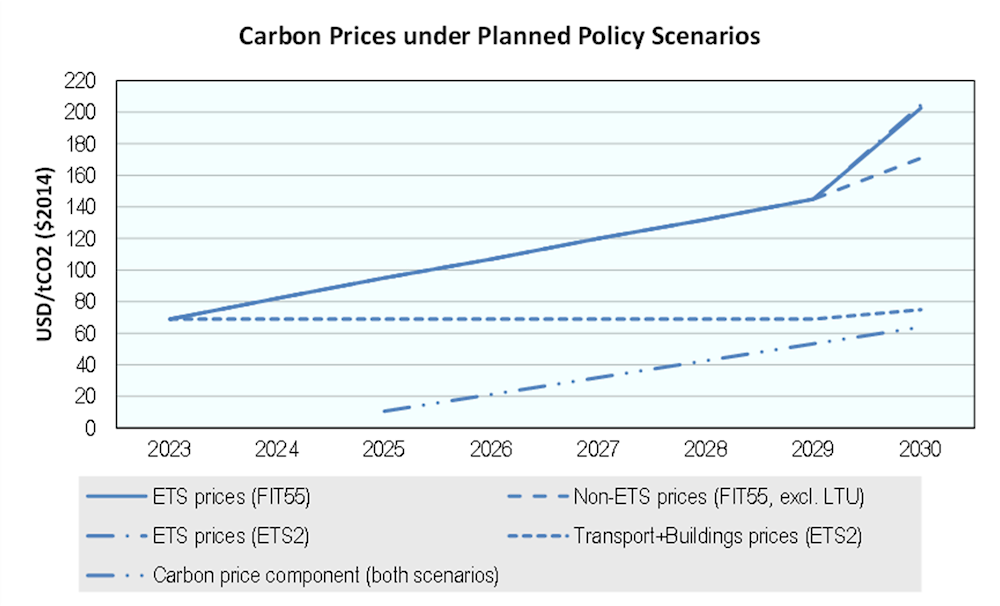

In order to reflect planned increases in policy ambition, the two scenarios considering planned policies both implement carbon prices or indirect excise tax increases in addition to those depicted in the reference scenario (see previous section). Both the FIT55 and ETS2 scenarios increase the ambition of the EU ETS to reflect the proposal of the Fit for 55 package, setting an emissions reduction target in EU ETS sectors of 61%. As a result, EU ETS prices in both scenarios follow the same trajectory, starting at 69 USD/tCO2 in 2023 and steadily increasing to 204.5 USD/tCO2 in 2030. This is almost 50 USD/tCO2 more than the EU ETS price in the reference scenario.

The scenarios differ, however, in their treatment of non-ETS sectors. Here the FIT55 scenario applies a carbon price trajectory to non-ETS sectors, compatible with reaching the 43% emissions reduction target proposed by the EU’s Fit for 55 package. The resulting price trajectory follows that of the EU ETS, which is consistent with the least cost emissions reduction approach, while the 2030 carbon price is endogenously determined to achieve the pre-specified emissions reduction target for non-ETS sectors (- 43%), resulting in a price level of 170.9 USD/tCO2 for non-ETS sector in 2030. This provides an indication of non-ETS prices necessary to meet the EU’s targets.6

By contrast, the ETS2 scenario restricts its non-ETS carbon price to the road transport and buildings sectors only, again targeting a 43% emissions reduction in these. With these two sectors making up more than 70% of Non-ETS CO2 emissions in Lithuania between 2022-2030 under reference scenario, targeting these sectors specifically is integral to reducing emissions.

Resulting carbon prices are flat at 69 USD/tCO2, rising only slightly, to around 75 USD/tCO2, in 2030. The reason for this decidedly lower price trajectory for the ETS2 than for non-ETS sectors in the FIT55 scenario is that the reference scenario assumptions already include quite ambitious climate policies for the road transportation and buildings sectors (e.g. the autonomous electrification assumption and renewable energy preferences). This is further compounded by the fact that the model cannot price certain GHG emissions sources such as process-based CO2 emission in the industry sector, or non-CO2 emissions in Industry and Agriculture. As such, reaching the 43% emissions reduction target for all non-ETS sectors in the FIT55 scenario requires substantially higher prices than when focusing only on road transport and buildings. Considering this, results are not comparable with other modelling of the EU ETSII proposal7 as these assume a business-as-usual reference scenario.

Figure 3.9. Carbon prices needed to meet EU ETS and non-ETS targets are substantial but current policies under reference scenario assumptions help reduce prices for ETS2

Note: Carbon prices here are only applied to CO2 emissions, but reduction targets are for all GHG, thus prices may be somewhat inflated. The model also does not consider emissions removals from LULUCF and is unable to price process-based CO2 emissions. This also contributes to higher prices. Finally, prices seen are relative to the reference scenario which already includes substantial climate action as detailed in the NDCs, thus results are not comparable with those relative to a no-policy baseline.

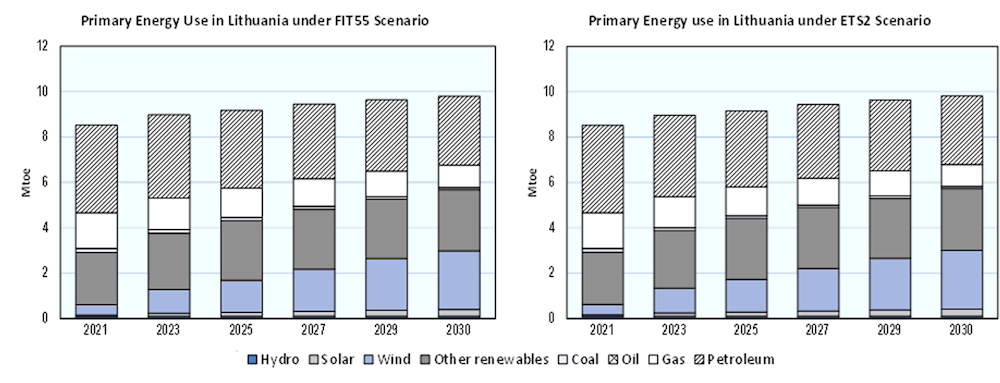

Energy use and supply and electricity and heat generation

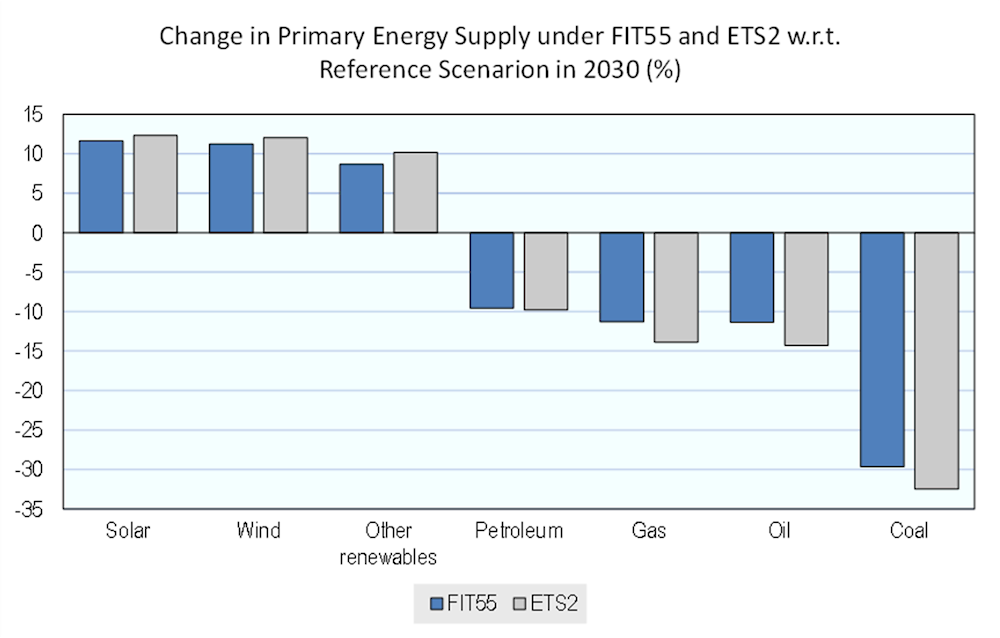

Both FIT55 and ETS2 scenarios exhibit a further shift away from fossil fuels to renewable energy. Compared with the reference scenario, petroleum product use decreases around 10%, with energy supply from gas and oil decreasing a little more (between 10-15%) particularly in the ETS2 scenario. Energy supply from solar, wind and biomass increases in both scenarios by around 10%.

Figure 3.10. Under both FIT55 and ETS2 scenarios fossil fuel supply decreases considerably and is replaced by renewable energy sources

The primary difference between the two scenarios regarding energy use lies in the use of natural gas. Under the proposed Lithuanian Excise Duty Amendment modelled by the FIT55 scenario, natural gas is exempt from the carbon pricing component, whereas it is included in the ETS2 (primarily in the buildings sector). As a result, the ETS2 decreases natural gas use by 2.9% in 2030 compared with the FIT55 scenario.

Figure 3.11. Under both FIT55 and ETS2 scenarios overall energy use increases driven by an expansion in renewables

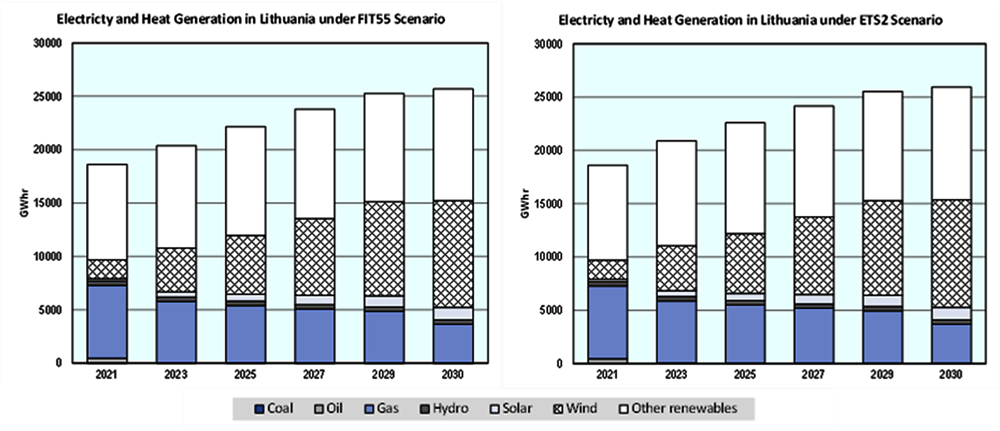

In both scenarios overall heat and power generation increases, with gas and coal power exhibiting considerable cuts, and wind, solar and biomass considerable increases. Differences between the two planned policy scenarios here remain minimal, with most electricity being generated by renewable sources by 2030 in both cases, with residual gas use (Figure 3.12).

Figure 3.12. Under both FIT55 and ETS2 scenarios overall power generation increases with gas and coal generation increasingly displaced by renewable energy sources

Macroeconomic Impacts

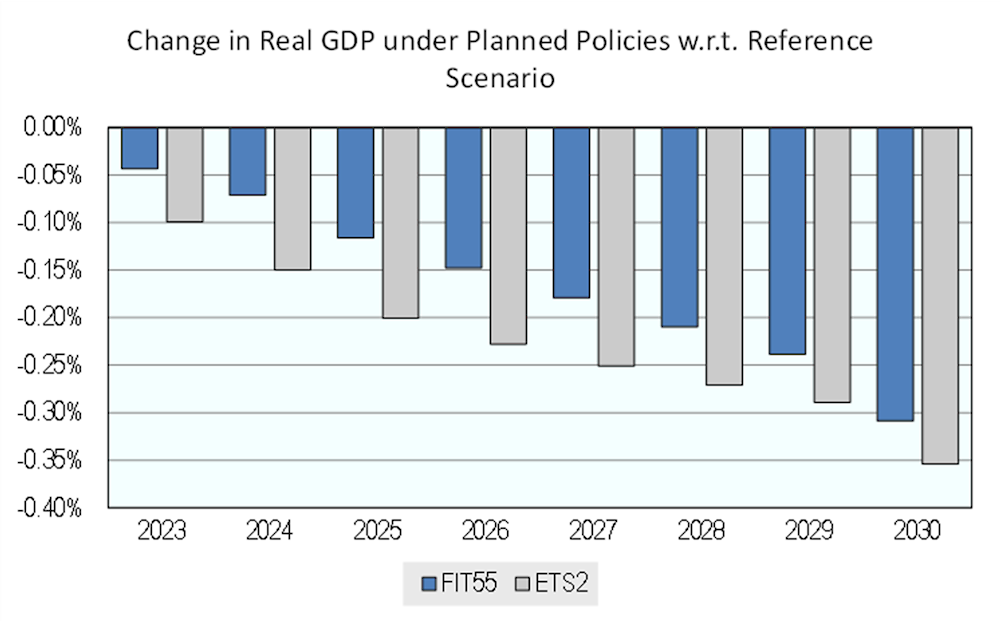

The economic cost of both policy scenarios remains moderate, with the FIT55 scenario leading to a reduction in real GDP of 0.3% in 2030 with respect to the reference scenario, and the ETS2 scenario to a 0.35% reduction. When translated to annual growth rates this implies a moderate slow-down of around 0.04% in both cases. Here it should be noted that these estimates do not take into-account co-benefits that might arise from lower emissions such as improved air quality, ecosystem services, etc.

Figure 3.13. Under both planned policy scenarios annual GDP growth slows only minimally

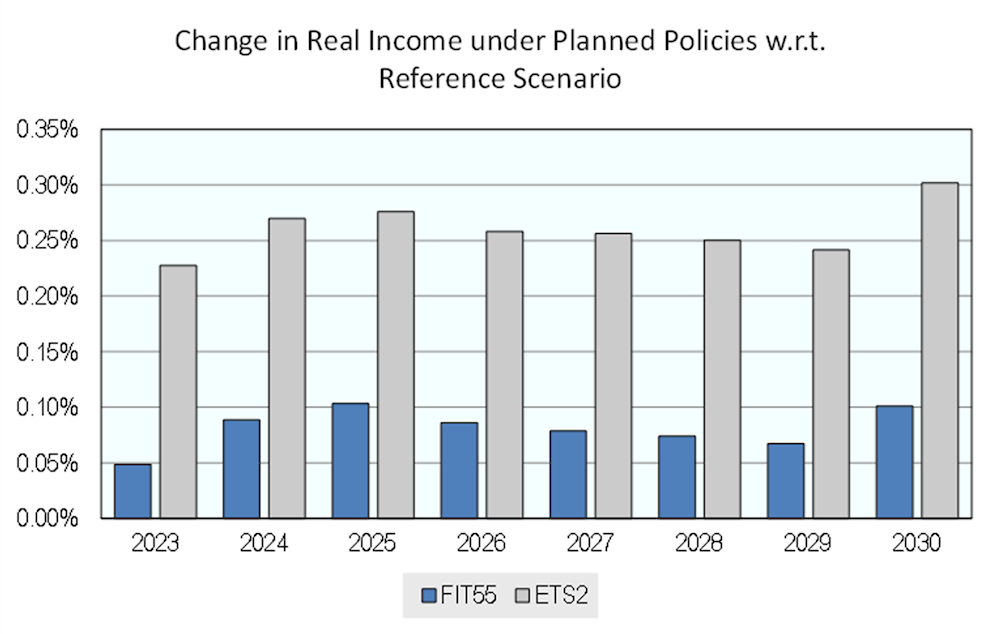

In terms of welfare impacts, the results indicate slight increases in consumer welfare with increases in real income of 0.1-0.3% in 2030 with respect to the reference case. This is driven primarily by revenue recycling effects (all carbon pricing revenues are recycled back to households in the form of lump-sum transfers) as well as competition effects driven by the low initial carbon intensity of the Lithuanian economy compared with other EU states, particularly under the ETS2 scenario.

Figure 3.14. FIT55 and ETS2 scenarios indicate potential welfare gains if carbon pricing revenues are redistributed to households

Sectoral impacts

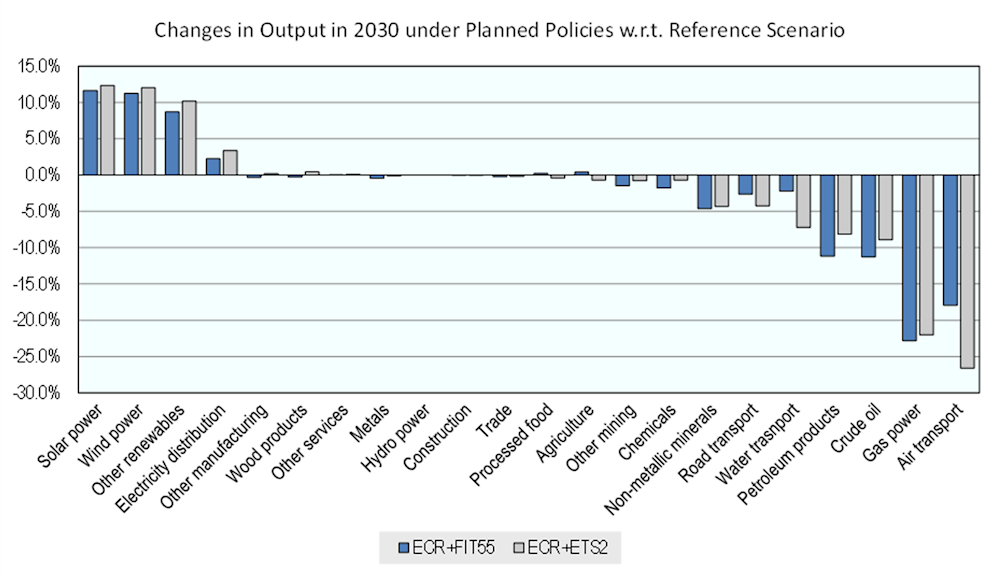

Both scenarios see a structural shift in output from polluting sectors such as transportation, fossil fuel production and distribution, chemical production, and mining, to renewable energy and electricity distribution, resulting in a less emissions intensive economy. The higher carbon prices and broader scope of the ETS2 scenario in Lithuania (when compared with the Excise Duty Amendment and Carbon Component under the FIT55 scenario) make these effects more pronounced (Figure 3.15). This broad structural shift is also exhibited in changes in output prices, with transport and fossil fuel sector prices increasing. Prices for other goods and services, including for renewable energy and electricity distribution, decrease, albeit at very low rates (below 1.5% in 2030 w.r.t. reference scenario).

Figure 3.15. Sectoral output under both planned policy scenarios shifts from fossil fuel and energy intensive industries to renewable energy and electricity distribution

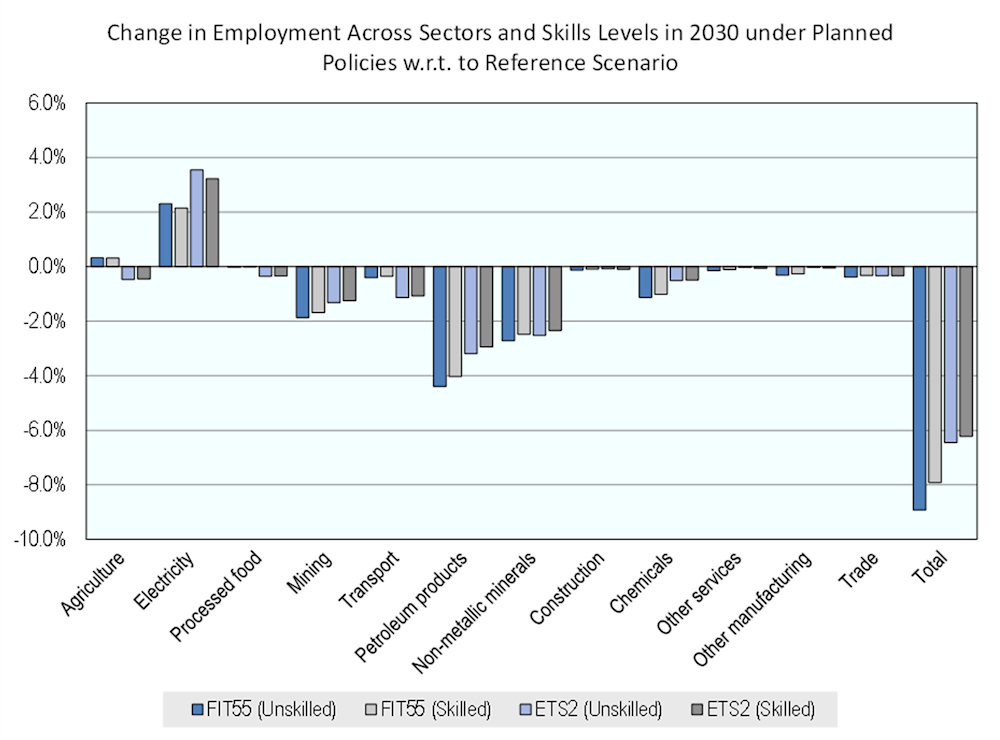

The observed structural changes lead to a reallocation of labour across sectors and skills levels, with an increase in labour demand in electricity generation (including renewables) and a decrease in all other sectors. The most substantial declines in employment, relative to the reference scenario, occur in the petroleum and mining and non-metallic minerals sectors (Figure 3.16).

Figure 3.16. Both FIT55 and ETS2 scenarios would lead to job creation in electricity generation driven by growth in renewables and energy demand but jobs would also be lost in other sectors, notably in fossil fuel reliant and energy intensive sectors

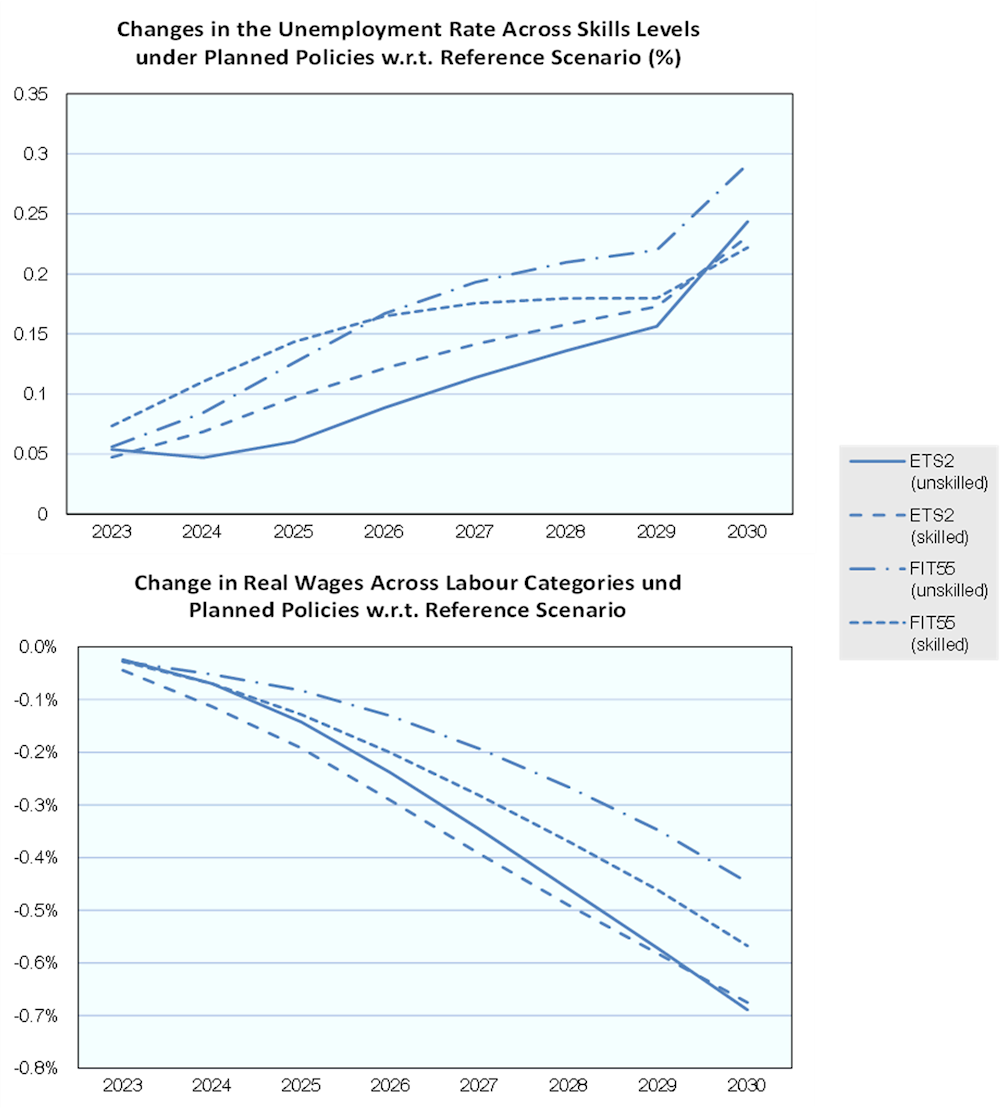

Increasing costs of production lead to moderate increases in the unemployment rate, and a slight decline in real wages across all skills categories in both scenarios compared with the reference case. However, given continued economic growth in the reference scenario, this translates to only a moderate decline in the growth rate of wages in absolute terms. Considering the distributional effects of the two policy scenarios, there is some evidence of the progressive impact of the FIT55 scenario with both unemployment and wage effects less pronounced for unskilled workers (Figure 3.17). Difference between skills levels in the ETS2 scenario are less significant.

Figure 3.17. Both FIT55 and ETS2 scenarios result in moderate declines in the growth rate of absolute wages and unemployment, however, under the Lithuanian Excise Tax Amendment wages for low-skilled labour would decline less

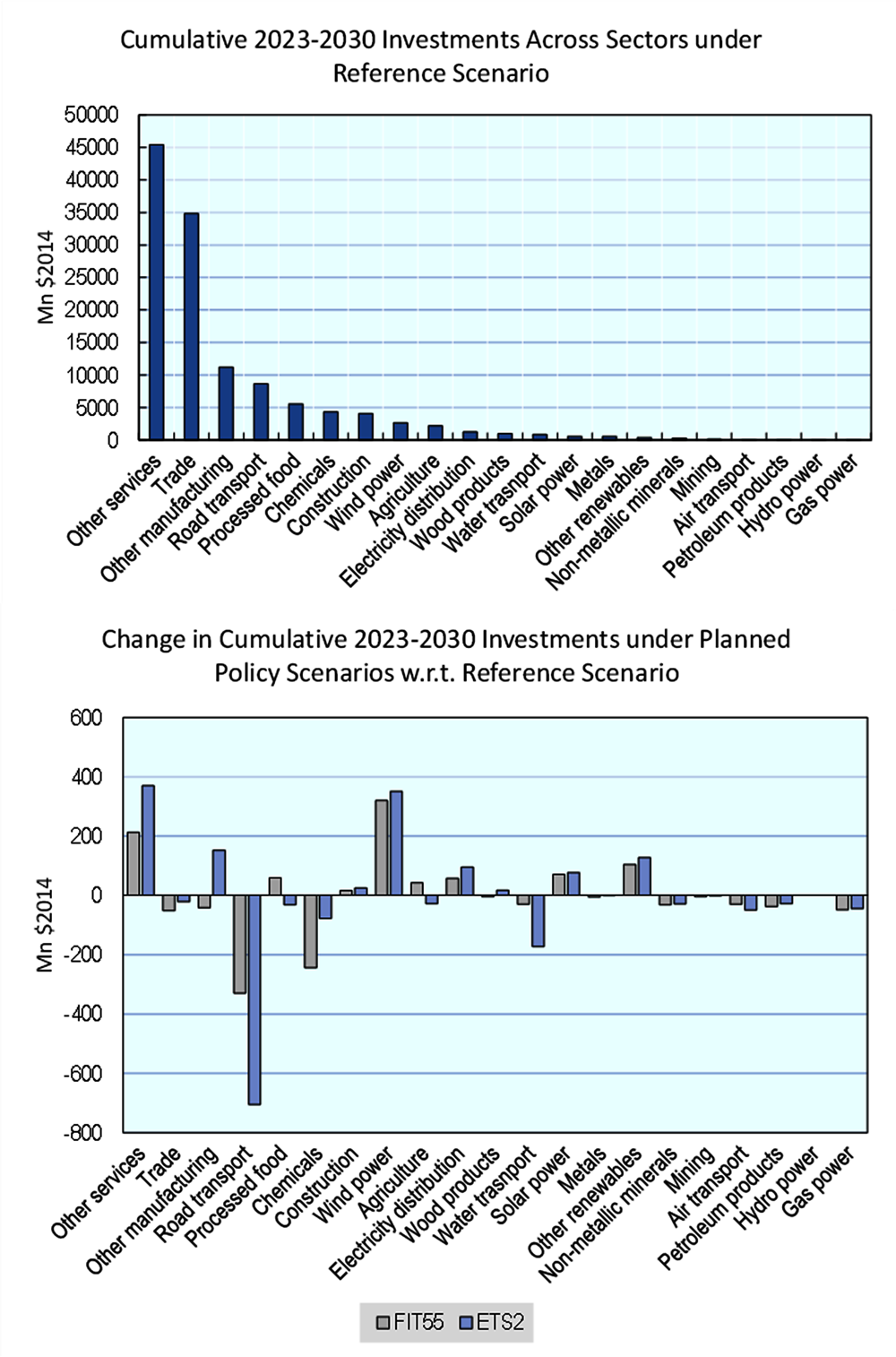

Considering investment effects, cumulative investments do not change across either scenario, although investment is reallocated across sectors following output patterns. Expanding sectors such as renewable energy generation attract new investment, with investments in wind and solar power increasing by 12-14% compared with the reference scenario, whereas manufacturing and transport activities lose investment flows. Effects are more pronounced under the ETS2 scenario, particularly with respect to transport activities and manufacturing, driven by higher carbon prices and competitiveness effects.

Figure 3.18. Both planned policy scenarios lead to considerable increases in renewable energy investments, but particularly the ETS2 leads to reduced investment flows in transport

In terms of trade, fossil fuel products such as petroleum and crude oil witness the most substantial reductions in exports (14% and 9% in 2030 respectively compared with the reference case). There is some substitution of transport exports for imports in the ETS2 scenario, as outside of the EU, carbon prices are not specifically levied on the transportation sector (for more detail see Annex A).

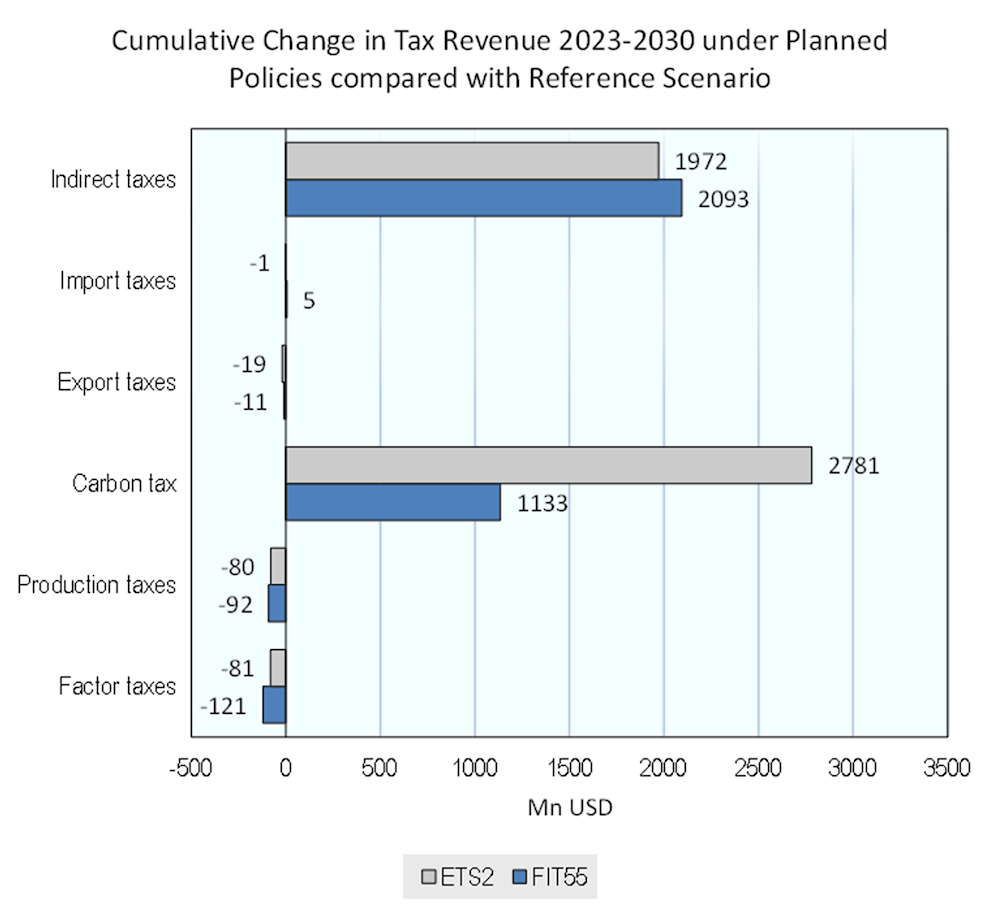

Both scenarios produce significant government revenue streams through increasing excise taxes and carbon prices. In the FIT55 scenario, the increase in excise taxes and the introduction of a carbon price component from 2025 results in a cumulative tax revenue of 3.2 Bn USD between 2023-2030. The ETS2 scenario sees a further increase in tax revenue from both indirect taxes and the implemented carbon prices, amounting to 4.8 Bn USD cumulatively over the 2023-2030 period.8

It is important to note here that due to a number of factors, base-erosion is not a significant concern in the model results. First, the results depicted are cumulative changes with respect to the reference scenario. Given the reference scenario already includes mitigation ambition, some base-erosion effects may already be occurring in the reference case. Second, the economic effect of the modelled scenarios is minimal, thus production tax revenues, for example, do not fall significantly. Moreover, under the short time-horizon being studied, energy remains an inelastic commodity, with price increases in gasoline, for example, not leading to commensurate decreases in distance driven. While over the long-term (2050) ambitious climate policies (net zero) would have a significant effect on tax revenues, for example with fuel excise-duty revenues drying up as consumers switch to electro-mobility, this is not yet a factor here.

Figure 3.19. Both planned policy scenarios result in considerable revenue generation from carbon prices

Russian fossil fuel ban results: Import Ban and Import Ban + FIT55 scenarios

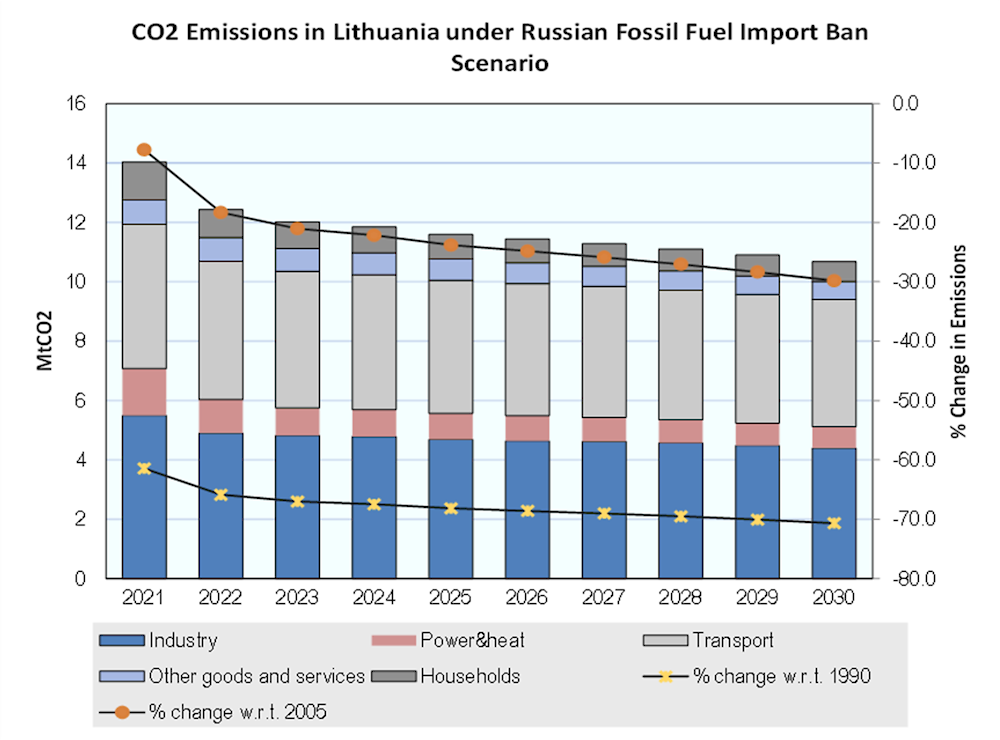

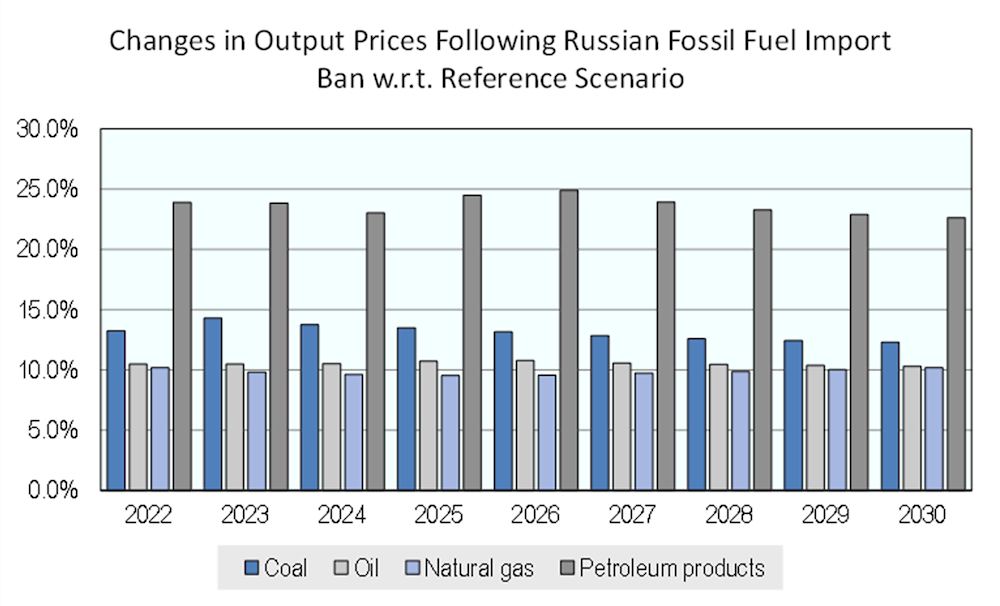

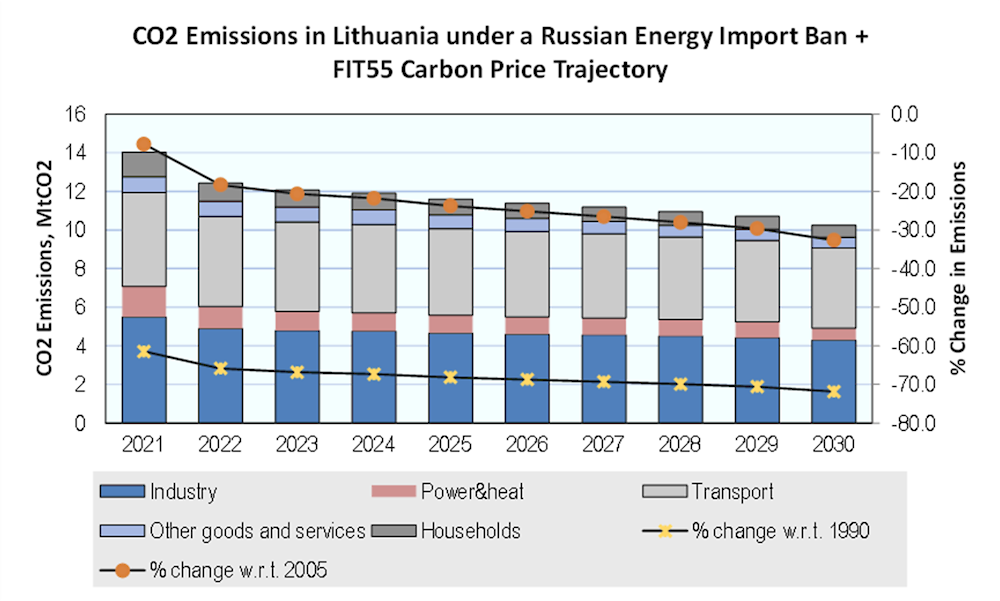

Imposed restrictions on fossil fuel imports from Russia result in considerable emissions reductions in Lithuania (when applied to the reference scenario), achieving a 29.8% reduction in CO2 emissions in 2030 compared to 2005 levels Figure 3.20). This surpasses emissions reductions under the two planned policy scenarios detailed above, highlighting the large impact such a ban would have. In particular the ban leads to emissions reductions from industrial processes (11.4% in 2030 w.r.t. reference scenario), which are not covered by the ETS or non-ETS carbon prices in the planned policy scenarios. This is due to rising energy prices as a result of reduced energy supply and a contraction in economic activity. In particular, estimates suggest that the ban on Russian fossil fuel imports could lead to an increase in the price of crude oil and natural gas in a range of 10%, for coal in a range of 12%-14% and for petroleum products by 23%-25% (Figure 3.21). It should be noted that these effects are dependent on all countries included in the scenario implementing the ban. Although Lithuania has already effectively banned all Russian energy imports, without commensurate action from other OECD members this will not have the same impact on emissions (or economic factors) depicted here.

Figure 3.20. An embargo of Russian fossil fuel imports would lead to considerable emissions reductions

Figure 3.21. An embargo on Russian fossil fuel imports would lead to considerable price increases for fossil fuels in Lithuania

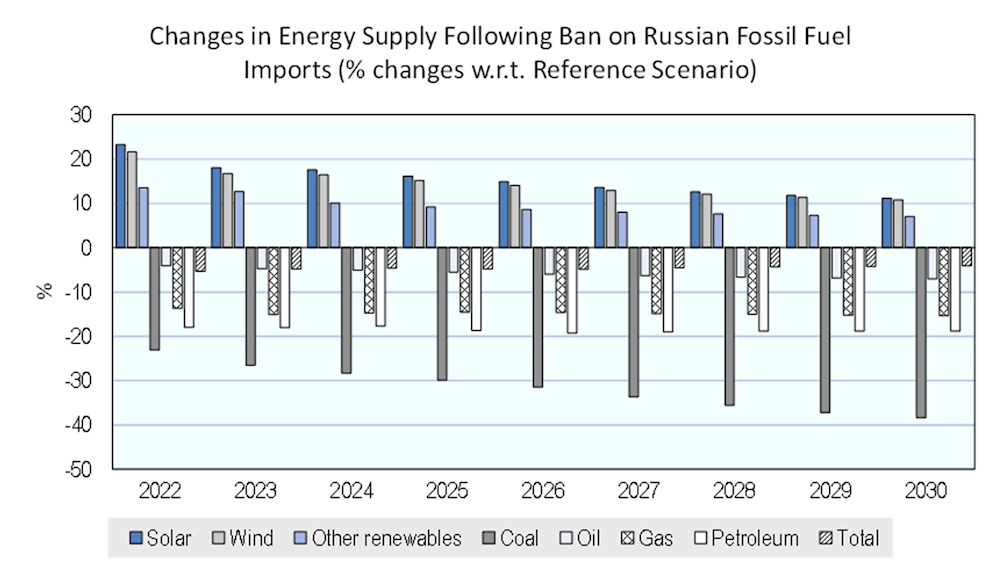

Although there is some substitution of energy imports from other sources, overall energy demand in Lithuania also falls – by around 4%-5% - driven by increasing prices. Solar and wind energy benefit from this, seeing an additional growth of around 11-12% in 2030 compared with the reference scenario. Indeed, in the years immediately following implementation of the ban, growth in renewables is even higher (above 20% for solar and wind (Figure 3.22).

Figure 3.22. Renewable energy supply increases considerably under a Russian fossil fuel import ban

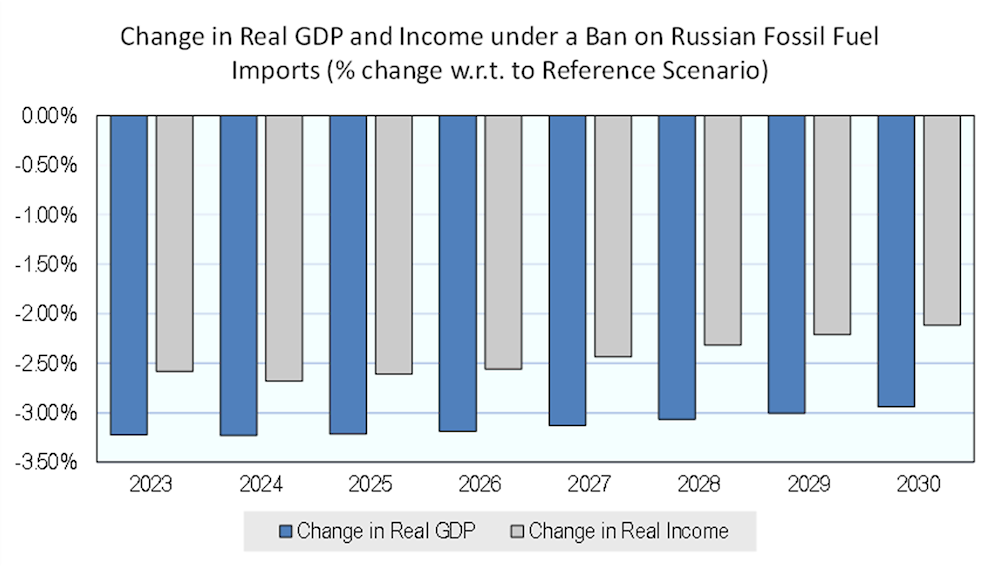

Considering the ban’s macro-economic impacts, cost estimates are higher than for the planned policy scenarios. Real GDP is estimated to be around 3% lower in 2030 than in the reference case, with real income also 2.1% lower. Although these impacts are more substantial than in the planned policy scenarios, they still correspond to only a minor slow-down of economic growth in absolute terms, with effects felt more acutely directly after the ban is imposed before recovering somewhat (Figure 3.23).

Figure 3.23. A ban on Russian fossil fuel imports would have more substantial impacts on GDP and income than planned policy scenarios

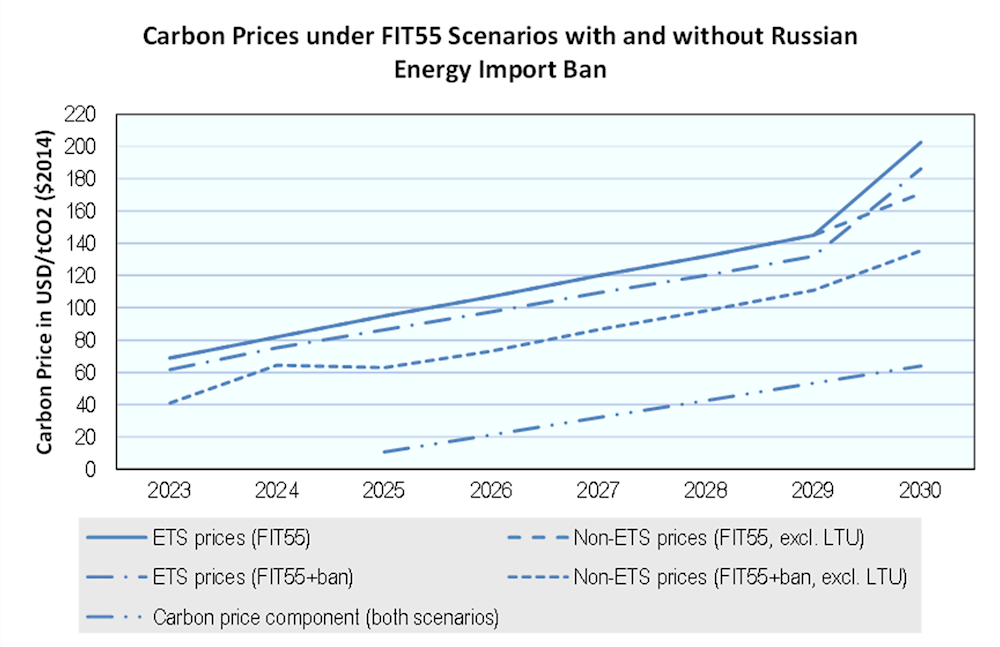

If combined with carbon pricing policies needed to reach the EU’s 55% reduction target (FIT55 scenario), restrictions on the imports of Russian fossil fuels could significantly lower carbon price levels in both ETS and non-ETS sectors. Results indicate that under this scenario ETS prices would reach USD 171/tCO2 in 2030, more than USD 30/tCO2 lower than the FIT55 scenario without the fossil fuel import ban. Non-ETS prices would reach USD 135/tCO2, USD 35/tCO2 lower than without the ban. As both the ban and carbon price measures are implemented at the EU level, emissions reductions in Lithuania would also be higher than under just the mitigation policy scenario, with particularly process-based emissions in the industry sector decreasing, driven by increasing fossil fuel prices.

Figure 3.24. A ban on Russian fossil fuel imports would reduce carbon prices needed to reach Fit for 55 targets

Figure 3.25. If combined with a ban on Russian fossil fuel imports, stringent carbon pricing to meet the Fit for 55 targets would result in even lower CO2 emissions in Lithuania

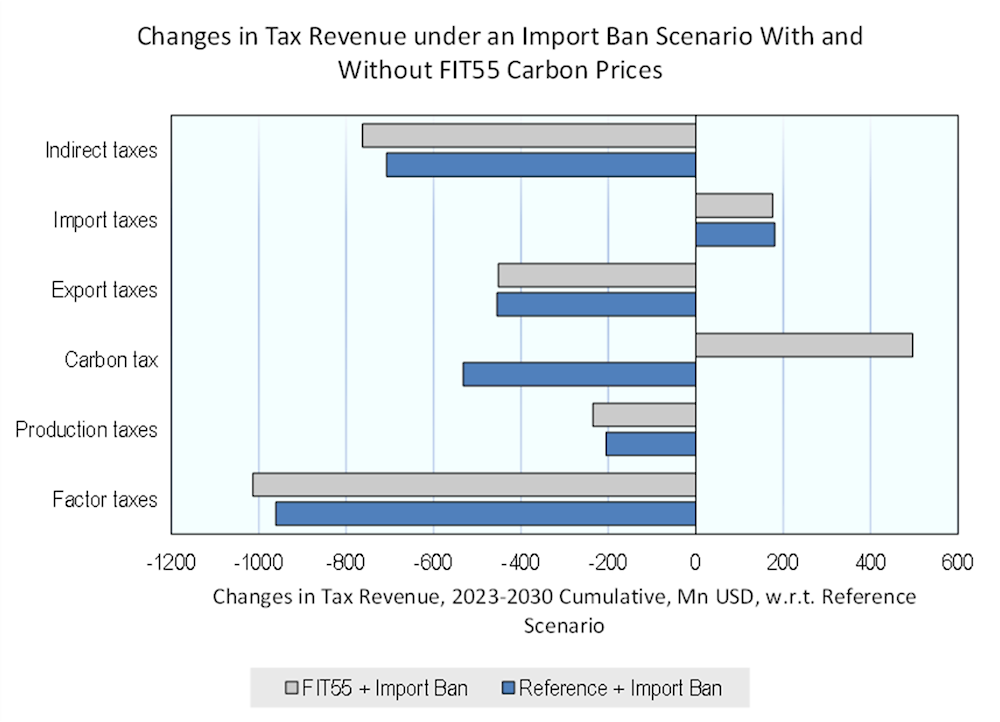

No major changes in macro-economic effects are seen when combining the fossil fuel ban with stringent carbon pricing. Introducing carbon pricing does, however, balance out negative tax revenue effects as, under a less stringent mitigation policy scenario the reduction in energy demand due to increasing fossil fuel prices leads to a loss of carbon pricing revenue (Figure 3.26).

Figure 3.26. Introducing carbon prices commensurate with meeting the Fit for 55 targets balances out negative tax effects of banning Russian fossil fuel imports

Assessment and recommendations for 2030 climate policy actions

The reference scenario results show that under current policies, CO2 emissions in Lithuania will fall considerably by 2030, almost 20% compared to 2005 levels. At the same time, economic growth remains stable, with growth in electricity and renewable energy balancing out contractions in fossil fuel industries. With the model limited to CO2 emissions, a direct assessment of whether this will suffice to meet the broader GHG emissions reduction target of 30% in 2030 (compared to 2005 levels) set in the NCCMA is not possible. Considering historic GHG emissions data (Chapter 1), significant emissions removals through land-use, land-use change and forestry can be expected in addition to the CO2 emissions reductions estimated by the model. Lithuanian emissions reduction projections based on current policies further indicate that emissions will fall only marginally short of the targets set in the NCCMA, particularly if the EU ETS target is increased as proposed in the Fit for 55 package (Chapter 2) (Government of Lithuania, 2020[9]).

Considering sectoral trends, the results indicate that additional measures are needed in the transport and industry sectors in order to further decarbonisation efforts in Lithuania. Despite high growth in renewables, the share of petroleum for energy use, and of gas for electricity and heat generation, remain high in the reference scenario. This is driven by the lack of pricing measures targeting these two sectors, with the EU ETS currently not covering the transport or buildings sectors, and process-based emissions in the industry sector not priced in the model. As a result, and despite autonomous electrification and renewable energy preference assumptions, fossil fuel prices do not increase by enough to break inelastic demand in these sectors.

The results of the two planned policy scenarios indicate that additional pricing mechanisms are effective in further reducing emissions at low economic cost. The FIT55 scenario shows that the proposed amendment to the Lithuanian Excise Duty Law, including a carbon price component, would be a particularly effective tool for reducing emissions in the transport sector. However, its exemption of natural gas remains a considerable shortcoming that should be revisited. Should an ETS II at the EU level materialise as is currently being discussed, this would also significantly reduce both transport and buildings sector emissions in Lithuania.

Together, the results indicate Lithuania should further pursue carbon pricing, particularly for the transport and industry sectors, either directly through ETS or carbon taxes, or indirectly through excise duties. Due to projected welfare benefits, an EU-wide ETS2 may be preferable to each EU member state setting individual policies in non-ETS sectors.

The results of modelling a wide-spread ban on Russian fossil fuel imports in OECD countries indicate that, despite short-term economic costs, this would entail considerable climate co-benefits, significantly reducing emissions and carbon price levels necessary to meet climate targets. Although the scope and scale of the modelled scenario may be unrealistic, Russia’s threat of withholding fossil fuel exports may result in similar costs and climate opportunities.

References

[4] Arlinghaus, J. (2015), “Impacts of Carbon Prices on Indicators of Competitiveness: A Review of Empirical Findings”, OECD Environment Working Papers, No. 87, OECD Publishing, Paris, https://doi.org/10.1787/5js37p21grzq-en.

[8] Chepeliev, M., T. Hertel and D. Mensbrugghe (2022), “Cutting Russia’s fossil fuel exports: <scp>Short‐term</scp> economic pain for <scp>long‐term</scp> environmental gain”, The World Economy, https://doi.org/10.1111/twec.13301.

[1] D’Arcangelo, F. et al. (2022), “A framework to decarbonise the economy”, OECD Economic Policy Papers, No. 31, OECD Publishing, Paris, https://doi.org/10.1787/4e4d973d-en.

[6] D’Arcangelo, F. et al. (2022), “Estimating the CO2 emission and revenue effects of carbon pricing: new evidence from a large cross-country dataset”, Working Party No. 1 on Macroeconomic and Structural Policy Analysis, No. ECO/CPE/WP1(2022)7, OECD, Paris.

[10] Government of Lithuania (2022), Lithuania’s National Inventory Report to the UNFCCC, Government of Lithuania, Vilnius, https://unfccc.int/documents/461952 (accessed on 21 February 2022).

[9] Government of Lithuania (2020), Policies and Measures and Projections of Greenhouse Gas Emissions in Lithuania, Ministry of Environment of the Republic of Lithuania, Lithuanian Environmental Protection Agency, State Forest Service, https://am.lrv.lt/uploads/am/documents/files/Klimato_kaita/2020%20PaM%20projections%2004%2019%20final.pdf (accessed on 7 March 2022).

[5] Martin, R., M. Muûls and U. Wagner (2016), “The Impact of the European Union Emissions Trading Scheme on Regulated Firms: What Is the Evidence after Ten Years?”, Review of Environmental Economics and Policy, Vol. 10/1, pp. 129-148, https://doi.org/10.1093/reep/rev016.

[7] OECD (2021), Effective Carbon Rates 2021: Pricing Carbon Emissions through Taxes and Emissions Trading, OECD Publishing, Paris, https://doi.org/10.1787/0e8e24f5-en.

[2] OECD (2021), Policies for a Carbon-Neutral Industry in the Netherlands, OECD Publishing, Paris, https://doi.org/10.1787/6813bf38-en.

[3] OECD (2018), Effective Carbon Rates 2018: Pricing Carbon Emissions Through Taxes and Emissions Trading, OECD Publishing, Paris, https://doi.org/10.1787/9789264305304-en.

Notes

← 1. Achieving net-zero climate targets will require a policy mix that goes beyond carbon-pricing. However, the focus of this chapter is the socio-economic impacts of various emissions reductions pathways based on concurrent carbon price trajectories. This is discussed in more detail in the subsequent section below.

← 2. In macroeconomic modelling the baseline typically refers to a no (new) policy trajectory. The baseline employed here, however, includes further ambition, assuming countries continue to implement current policies in line with targets set in their NDCs. It is therefore referred to as a reference rather than baseline scenario.

← 3. Lithuania has, in fact, already entirely stopped all imports of Russian energy products.

← 4. For a more valid representation of the natural gas trade patterns, imports of natural gas by Lithuania were adjusted (compared to 2014 bilateral sourcing) to reflect a more recent (post-2015) trends of LNG imports by Lithuania and falling share of imports from Russia.

← 5. In 2020, CO2 emissions comprised roughly 70% of total GHG emissions in Lithuania (Government of Lithuania, 2022[10]).

← 6. Note here that in the FIT55 scenario modelled, Lithuania is excluded from this EU-wide non-ETS price trajectory. However, given Lithuania’s small size and minimal contribution to EU-wide emissions levels, its exclusion is not expected to alter carbon prices necessary to reach the 43% reduction target at the EU level. As such, the given price trajectory provides an indication of prices necessary to reach the EU’s non-ETS sector targets even when including Lithuania.

← 7. https://ariadneprojekt.de/news/ueber-die-co2-preisgestaltung-zum-europaeischen-klimaziel-2030/.

← 8. Note that specific revenue recycling regulations for the ETS II proposal in the Fit for 55 Package such as the Social Climate Fund are not modelled here.