This chapter identifies policy options to strengthen sustainable investments in West Africa’s agri-food sector. The sector is chosen due to its large contribution to employment and economic growth in West Africa. The chapter first discusses how investments flow into and out of the region and how they are distributed across sectors and countries (Benin, Burkina Faso, Cabo Verde, Côte d’Ivoire, Gambia, Ghana, Guinea, Guinea-Bissau, Liberia, Mali, Niger, Nigeria, Senegal, Sierra Leone and Togo). It then analyses in detail the potentials and limitations of West Africa’s agri-food sector. The chapter concludes with concrete suggestions for West African policy makers on how to attract more sustainable investment.

Africa's Development Dynamics 2023

Chapter 7. Investing in agri-food value chains for West Africa’s sustainable development

Abstract

In Brief

Recent global crises have slowed down growth, increased debt and dampened investment in West African countries. These developments have also reduced sustainable investments in the region’s agri-food sector (covering agriculture, food processing, packaging, transportation, distribution and retail) despite its vast potential for employment creation, poverty reduction and productive transformation.

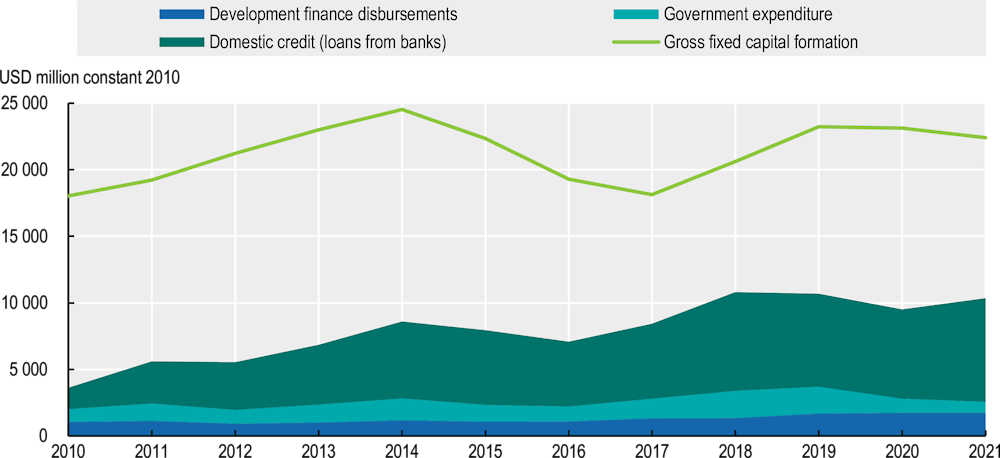

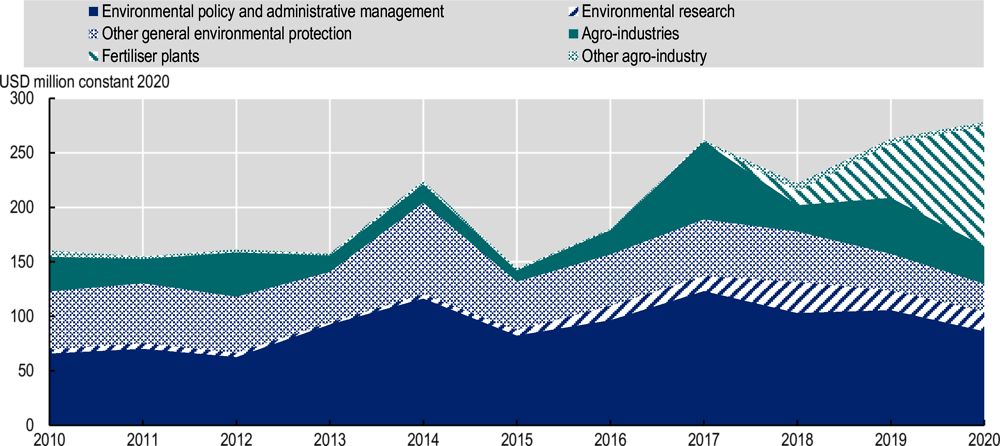

Growing domestic and intra-regional demand for processed food products continues to offer the potential to develop West Africa’s agri-food value chains. However, funding from domestic credit, development finance institutions and governments for the region’s agricultural sector has stagnated, totalling USD 10.3 billion in 2021 and thus remaining below the pre-COVID-19 level of USD 10.8 billion in 2018. Foreign direct investment into agribusinesses, despite their importance for capital-intensive investments, amounted to less than USD 1.8 billion per year between 2017 and 2022. Between 2010 and 2020, only 4% of development finance for the agricultural sector went to agro-industrial activities and 12% to environmental protection. Compared with other African regions, informal private investments play a more significant role in West Africa; yet these have limited productivity effects and can introduce risks and vulnerabilities for informal suppliers. The agri-food sector’s vast potential to drive industrialisation and contribute to job creation, livelihoods, food security and enhanced regional value chains remains vastly underexploited.

Policy makers can prioritise three sets of actions. First, public financial institutions can improve smallholder farmers’ access to productivity- and sustainability-focused financial products. Second, regional integration policies and place-based programmes can fulfil complementary roles in strengthening agri-food value chains. Third, agro-poles, support organisations, international funders and technical partners that directly improve the capacities of small and informal businesses and strengthen linkages in agri-food value chains can be expanded.

West Africa (infographic)

West Africa regional profile

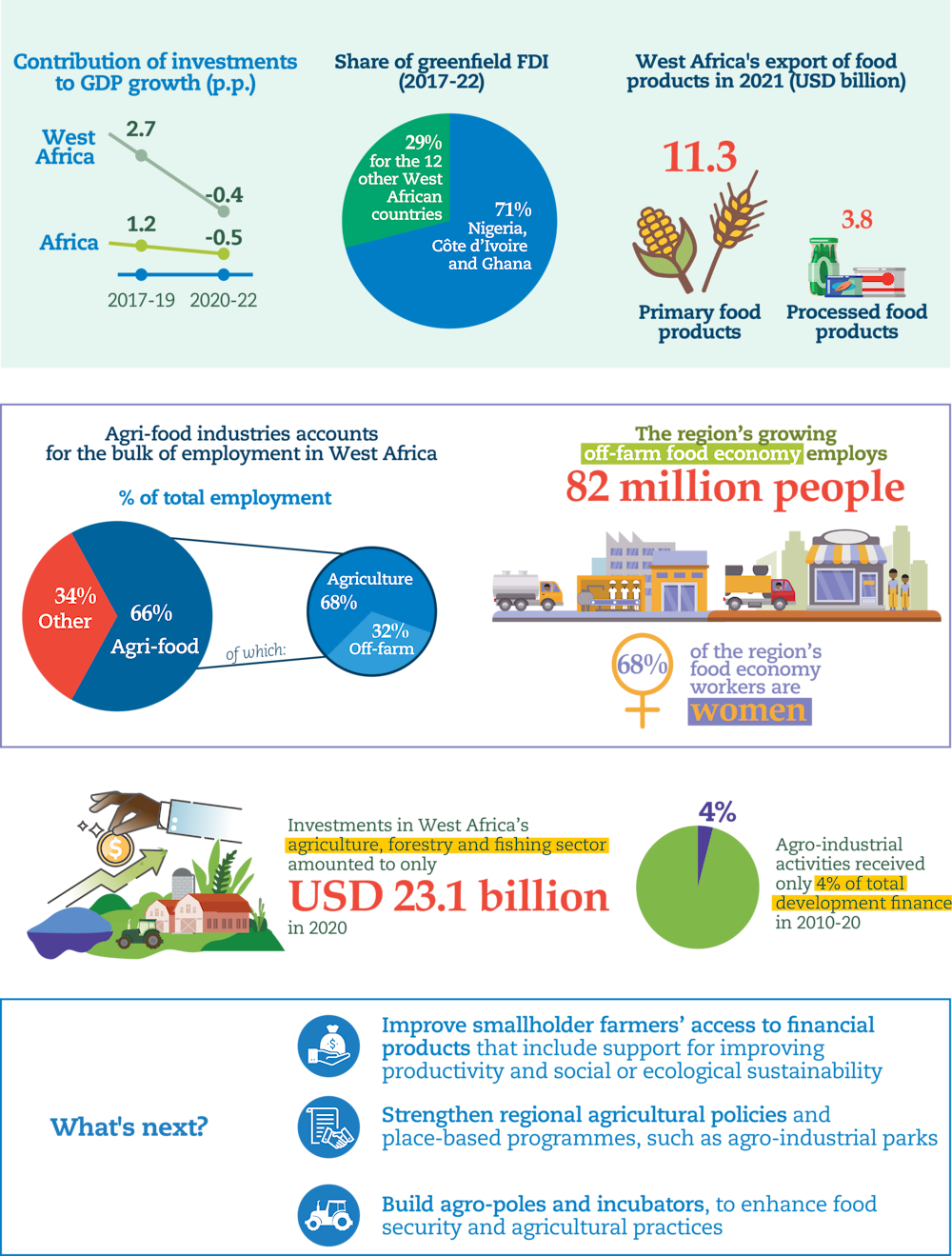

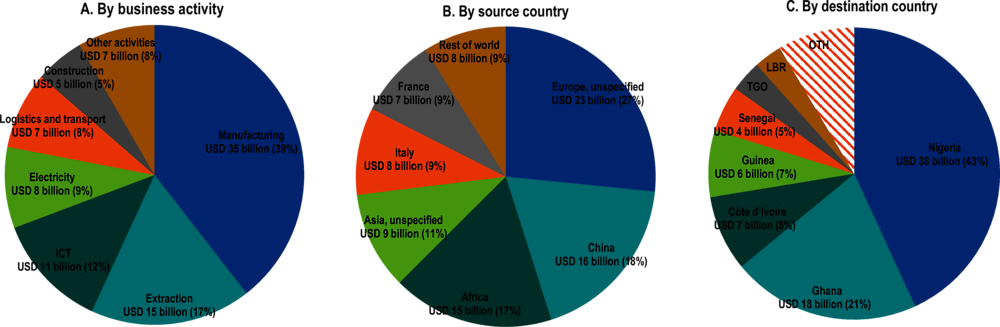

Figure 7.1. Components of economic growth and sources of financing in West Africa

Note: The components of gross domestic product (GDP) growth are calculated on an annual basis by using real annual GDP growth to estimate the increase in real US dollars. Aggregate figures are calculated by taking the average of the national figures weighted by GDP in purchasing-power-parity dollars. The components of GDP growth over three-year periods were calculated by taking the difference between the geometric average of the annual real GDP growth over the period and the real GDP growth when setting each component to zero for individual years. Foreign balance is the difference between imports and exports. Imports contribute negatively to GDP. “High-income countries” refers to countries classified as “high-income” according to the World Bank Country and Lending Groups outside of Latin America and the Caribbean. Government revenues include all tax and non-tax government revenues minus debt service and grants received. Capital inflows include foreign direct investment, portfolio investment and other investment inflows reported by the International Monetary Fund under asset/liability accounting. Figures for capital inflows should be interpreted with some caution as some figures for 2021 and for portfolio inflows are missing.

Source: Authors’ calculations based on IMF (2022a), World Economic Outlook Database, www.imf.org/en/Publications/WEO/weo-database/2022/October; OECD (2022a), OECD Development Assistance Committee (database), https://stats-1.oecd.org/Index.aspx?DataSetCode=TABLE2A; World Bank (2022a), World Development Indicators (database), https://data.worldbank.org/products/wdi; IMF (2022b), Balance of Payments and International Investment Position Statistics (BOP/IIP) (database), https://data.imf.org/?sk=7A51304B-6426-40C0-83DD-CA473CA1FD52; IMF (2022c), Investment and Capital Stock Dataset (ICSD) (database), https://data.imf.org/?sk=1CE8A55F-CFA7-4BC0-BCE2-256EE65AC0E4; and World Bank-KNOMAD (2022), Remittances (database), www.knomad.org/data/remittances.

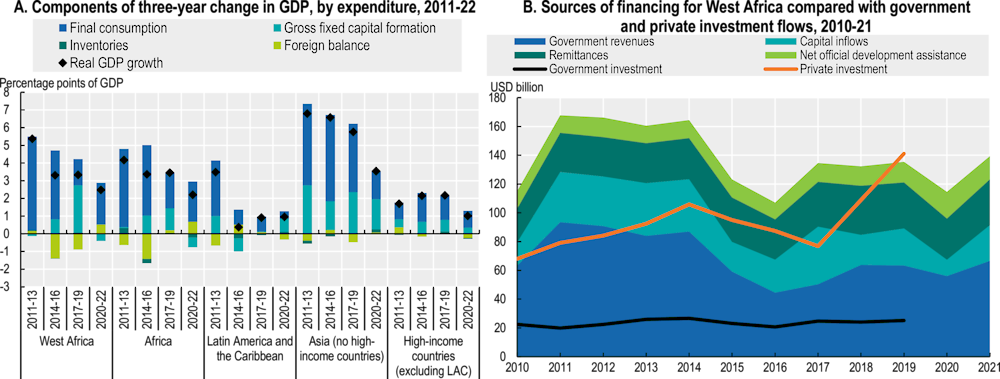

Figure 7.2. Greenfield foreign direct investment flows into West Africa, by activity, source and destination, 2017-22

Note: The fDi Markets database is used only for comparative analysis. Actual investment amounts should not be inferred, as fDi Markets data are based on upfront announcements of investment projects, including a share of projects that do not actually materialise. ICT = information and communications technology, TGO = Togo, LBR = Liberia and OTH = other.

Source: Authors’ calculations based on fDi Intelligence (2022), fDi Markets (database), www.fdiintelligence.com/fdi-markets.

Recent crises have dampened investment into West Africa, and sustainable investments target few countries and sectors

COVID-19 temporarily thwarted investments and growth while increasing sovereign debt

The COVID-19 pandemic slowed down investments and growth in West African countries, and the recovery has yet to stabilise. In 2020, at the onset of the COVID-19 pandemic, West Africa’s gross domestic product (GDP) shrunk by 0.6%, before rebounding to 4.4% in 2021 when the initial economic shock subsided. In 2022 – while disruptions in international trade, food and energy price inflation, and tightening fiscal conditions slowed the recovery – growth was still projected to remain robust at 3.9% (IMF, 2023a). Before the pandemic, private investments had surged, almost doubling from USD 76.8 billion in 2017 (7.9% of GDP) to USD 141.1 billion (9.6% of GDP) in 2019 (Figure 7.1, Panel B). Accordingly, investment (gross fixed capital formation) became the dominant driver of GDP growth during the 2017-19 period, contributing 2.7 percentage points. However, during the pandemic, disinvestments negatively affected the region’s GDP, lowering it by 0.4 percentage points from 2020 to 2022 (Figure 7.1, Panel A).

In 2020, all external financial flows except official development assistance (ODA) contracted, but in 2021, flows rebounded to pre-crisis levels. External financial inflows to West Africa fell from USD 72 billion in 2019 to USD 60 billion in 2020. In contrast, ODA increased by 29% to USD 18.4 billion (2.8% of GDP), its highest level since 2011 (Figure 7.1, Panel B). In a reversal, all external flows rebounded in 2021, with foreign direct investment (FDI) reaching a nine-year peak of USD 13.8 billion in 2021 and portfolio investment climbing to USD 9.1 billion, matching the level of 2017 (Figure 7.1, Panel B).

Fiscal deficits and sovereign debt pressures are increasing in West Africa. In response to the COVID-19 pandemic, many governments implemented policies such as tax relief or social assistance programmes to support vulnerable populations and economic activities during and after lockdowns. Domestic revenue mobilisation in 2021 increased slightly from 10% to 11% of GDP, while expenditures increased by 4%, bringing the fiscal deficit to 47% of GDP for the region. Concerns over sovereign debt permeate West Africa, though less so than in other African regions. According to the International Monetary Fund (IMF, 2023b), 4 out of 15 countries – Gambia, Ghana, Guinea-Bissau and Sierra Leone – are at a high risk of debt distress. In particular, Ghana faces significant debt pressure, with the country engaging in negotiations with the IMF to obtain financial support in early 2023 (AfricaNews, 2023).

The allocation of sustainable investments is skewed towards a few countries and sectors

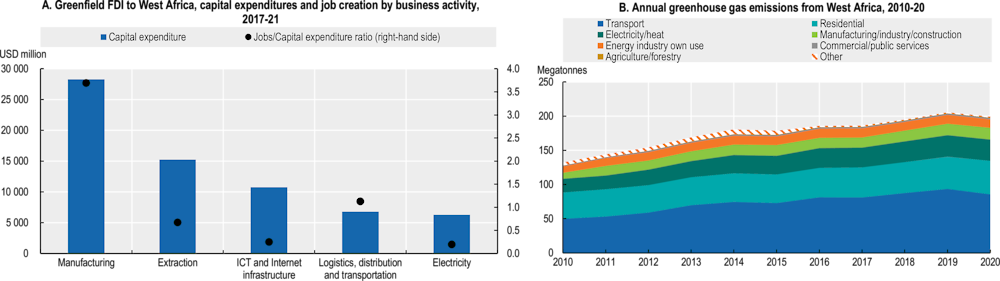

Greenfield FDI offers opportunities for job creation but targets sectors with mixed environmental outcomes. Nigeria, Côte d’Ivoire and Ghana received 71% of greenfield FDI to the region between 2017 and 2022 (Figure 7.2, Panel C). Thirty-nine per cent went to the manufacturing sector, a significant driver of employment, creating about four jobs per USD thousand invested, a higher ratio than any other sector (Figure 7.3, Panel A). Extraction and mining activities attracted the second-most FDI within the same period. Over the last decade, the transport sector received an important share of FDI but contributed more than any other sector to the overall increase in greenhouse gas emissions. Nigeria, the largest recipient of West Africa’s FDI in 2017-22, contributed 68% to the region’s total emissions (Figure 7.3, Panel B).

Figure 7.3. Sectoral job creation of greenfield foreign direct investment and greenhouse gas emissions for economic activities in West Africa

Note: ICT = information and communications technology.

Source: Authors’ calculations based on fDi Intelligence (2022), fDi Markets (database), www.fdiintelligence.com/fdi-markets and IEA (2022), Data and Statistics (database), www.iea.org/data-and-statistics/data-tools/greenhouse-gas-emissions-from-energy-data-explorer.

The majority of greenfield FDI in West Africa comes from outside the region and continent. Fifty-six per cent of greenfield FDI between 2017 and 2021 originated from high-income countries, followed by Asia (21%), mostly due to significant investments from the People’s Republic of China (hereafter “China”). Investment from other African regions accounted for 17% of total greenfield FDI, mainly from Southern and North Africa, with a large share going to Nigeria. Togo received the largest share of intra-regional investments, most of which flowed from Nigeria (Figure 7.6).

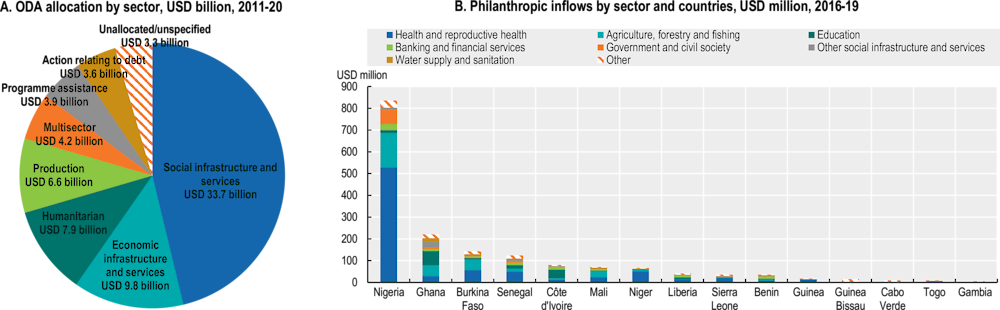

ODA and philanthropic inflows complement limited public investment in social sectors but concentrate in one country. Public health expenditures accounted for only 0.8% of GDP in 2019, lower than in any other African region except Central Africa. Similarly, public investment in education represented only 1.6% of GDP, lower than in any other African region. In contrast, 46% of the USD 72 billion ODA over the 2011-20 period went to social infrastructure and services (health, education, civil society, and water supply and sanitation) (Figure 7.4, Panel A). About 48% of philanthropic flows allocated between 2016 and 2019 targeted the health and reproductive sector (Figure 7.4, Panel B). However, ODA and philanthropy remained heavily focused on Nigeria.

Figure 7.4. Allocation of official development assistance and philanthropic inflows to West Africa

Note: The eight largest sectors are displayed. “Other” captures the remaining sectors.

Source: Authors’ calculations based on OECD (2022a), OECD Development Assistance Committee (database), https://stats-1.oecd.org/Index.aspx?DataSetCode=TABLE2A; and OECD (2021a), Private Philanthropy for Development: Data for Action Dashboard (database), https://oecd-main.shinyapps.io/philanthropy4development/.

Additional sources of private finance such as impact investments and domestic institutional investors are growing in West Africa. Interventions by development finance institutions accounted for about 97% of impact investment in the region between 2005 and 2015 (GIIN, 2015). Regulatory changes in Nigeria, such as the Regulation of Pension Fund Assets in 2006, have allowed pension funds to increase assets under management (Juvonen et al., 2019; National Pension Commission, 2006), reaching USD 32.3 billion in 2020 (OECD, 2021b). Ghanaian pension funds have also grown steadily, accumulating USD 4.7 billion as of 2021, making Ghana the second-largest pension fund market in the region (Nyang`oro and Njenga, 2022; OECD, 2021b). The Nigerian Sovereign Wealth Authority had USD 3 billion in assets under management in 2021, the highest amount of any sovereign wealth fund in West Africa. This was followed by the Senegalese Sovereign Wealth Fund for Strategic Investments (FONSIS) and the Ghana Heritage Fund, with assets under management of USD 0.8 and USD 0.7 billion respectively (SWFI, n.d.).

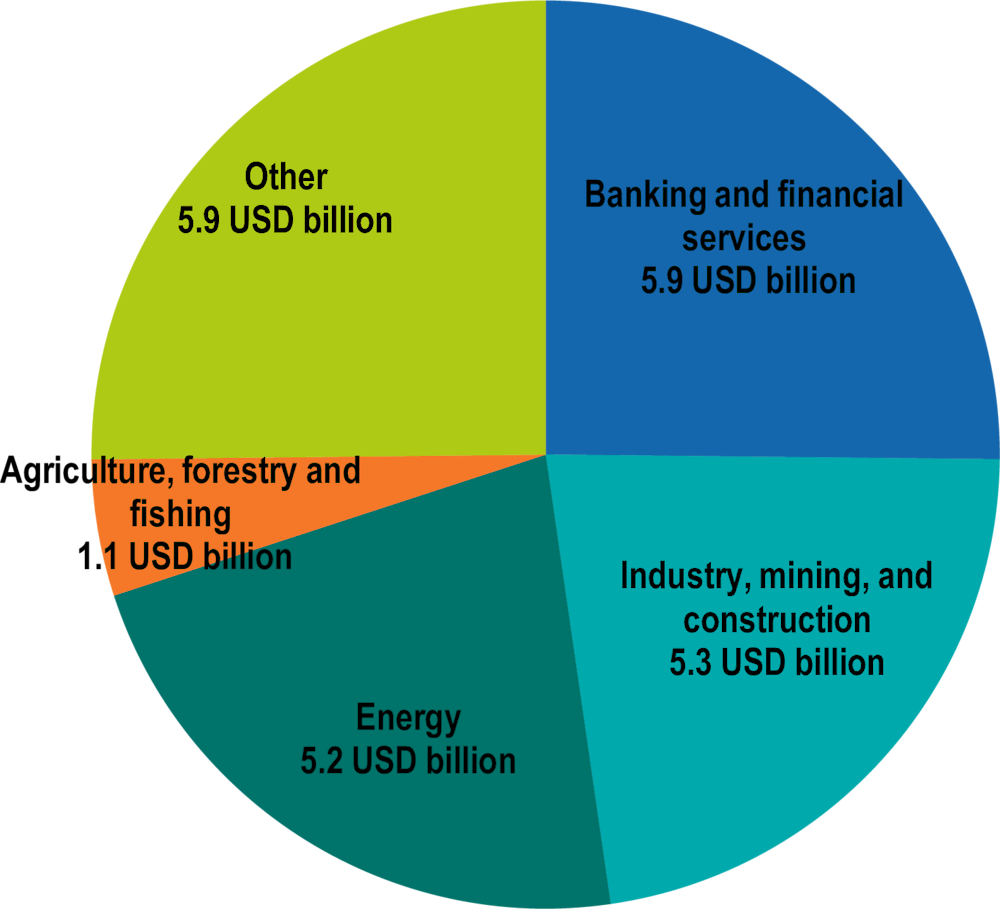

West Africa mobilised large amounts of blended finance, targeting sectors with both high and low sustainability potential. Over the 2012-20 period, on average USD 2.4 billion per year of private finance were mobilised through development finance institutions or development banks, more than in any other African region other than Southern Africa. Mirroring the allocation of greenfield FDI, most blended finance went to Nigeria (37%), Ghana (24%) and Côte d’Ivoire (15%), followed by Senegal (7%) and Guinea (6%). While significant shares went to sectors with high overall sustainability potential (e.g. energy, banking and financial services and agriculture, forestry and fishing), a sector with a poor environmental and social sustainability record – industry, mining and construction – attracted the second-highest amount (Figure 7.5; see Chapter 1).

Figure 7.5. Private finance in West Africa mobilised through official development finance by sector, USD billion, 2012-20

Note: “Other” includes (by order of magnitude): government and civil society; trade policies and regulations; multi-sector/cross-cutting; water supply and sanitation; education; health; business and other services; tourism; other social infrastructure and services; unspecified allocation; population policies/programmes and reproductive health and humanitarian aid.

Source: Authors’ calculations based on OECD (2022b), “Mobilisation”, OECD.Stat (database), https://stats.oecd.org/Index.aspx?DataSetCode=DV_DCD_MOBILISATION.

West Africa is less integrated into intra-African investments and exports than other African regions

Intra-regional and intra-African exports are less significant in West Africa than in Southern Africa. About 57% of total formal exports from West African countries to other African countries remained within the region between 2014 and 2016. For comparison, intra-regional exports constituted about 85% of the total exports from Southern African Development Community (SADC) countries to other African countries in the same period. Before the COVID-19 pandemic, Senegal was the only West African country among the top ten intra-African exporters, while three West African countries were among the bottom ten (UNCTAD, 2019).

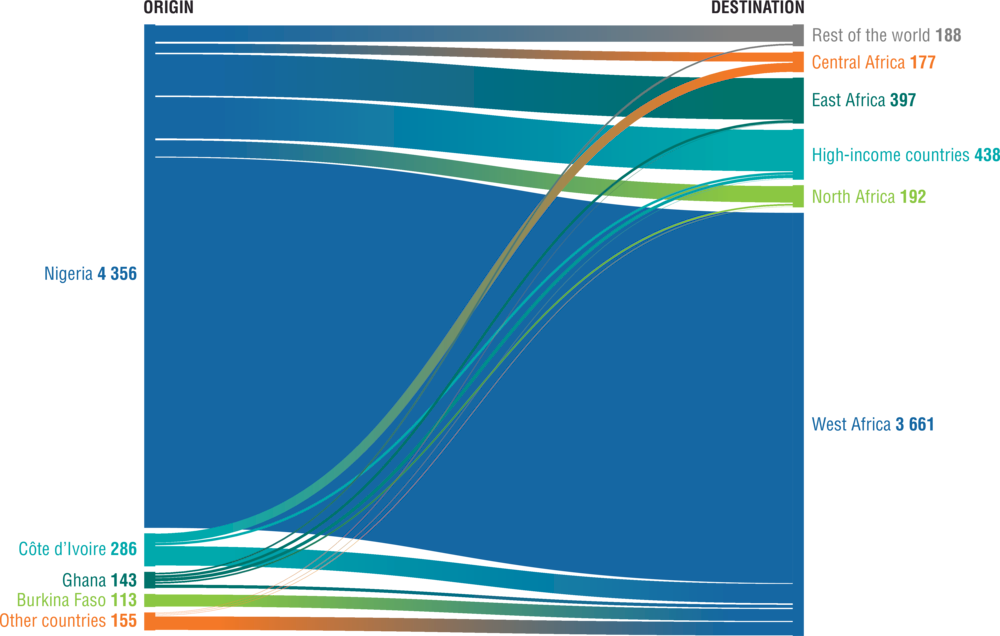

Nigeria dominates intra-regional investments and has the most listed companies in the region. Greenfield FDI outflows from West African countries mostly target other West African countries (40%), followed by high-income countries (29%) and East Africa (14%). Nigeria accounts for 86% of the region’s outward FDI (Figure 7.6). Nigeria is also home to 15 of the top 20 publicly listed private companies by market capitalisation in West Africa, 8 of which are in the finance and insurance sector.

Figure 7.6. Greenfield foreign direct investment outflows from West African countries, by destination regions, 2017-21, USD million

Note: “Other countries” includes Togo (USD 76 million), Senegal (USD 46 million) and Mali (USD 34 million) while “Rest of the world” includes countries in Southern Africa (USD 50 million), Developing Asia (USD 137 million) and Latin America and the Caribbean (USD 1 million).

Source: Authors’ calculations based on fDi Intelligence (2022), fDi Markets (database), www.fdiintelligence.com/fdi-markets.

Sustainable investments into the agri-food sector can drive West Africa’s productive transformation

West Africa’s agri-food sector supports employment and livelihoods across the region, especially for rural populations, suggesting that it should be prioritised for sustainable investment. Average agriculture, forestry and fishing value-added was 24.4% of GDP in 2021, compared to 16.5% for Africa and 4.3% for the world (World Bank, 2021). At the end of 2020, the agricultural sector accounted for around 25% of the region’s GDP and 45% of employment. The agri-food sector as a whole (i.e. agriculture plus food processing, packaging, transportation, distribution and retail) accounts for around 66% of the region’s total employment. The off-farm food economy employs 82 million people, mostly in retail and wholesale (68%), followed by food processing (22%), a segment projected to keep growing (Allen, Heinrigs and Heo, 2018). Investments in the agri-food sector and its workforce offer West African countries the opportunity to achieve long-term synergies between economic, social and environmental sustainability and resilience (Ali et al., 2020). Around 53% of the West African population lives in rural areas where most agricultural activities take place. Sixty-eight per cent of all employed women work in the food economy, and women make up 88% of employment in food-away-from-home services, 83% in food processing and 72% in food marketing (Allen, Heinrigs and Heo, 2018).

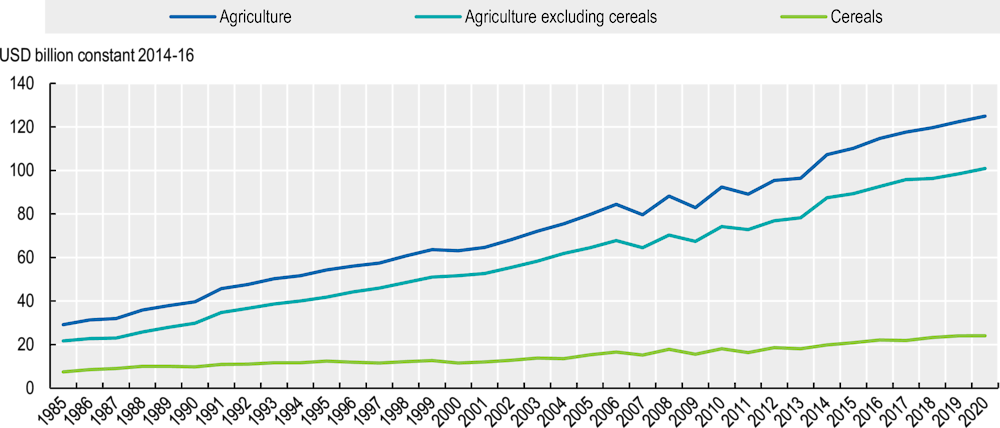

West Africa leads the world in primary agricultural production across a range of products, while export rates remain low. Since the 1980s, the value of agricultural production in West African countries has consistently grown, mostly driven by non-cereal agricultural products (Figure 7.7). In 2020, the total value of agricultural production in Africa reached about USD 319 billion. West Africa contributed almost USD 125 billion to this total (39%).1 Several West African countries rank among the world’s top producers of agricultural products (AUC/OECD, 2019). Over 2019-21, the bulk of the world’s yams (95%) and cowpeas (85%) were produced in West Africa, and seven of the region’s top 15 agricultural products accounted for 50% of Africa’s total production. However, for most of West Africa’s food products, only a fraction (less than 1%) is exported, with the notable exception of cocoa beans at 73% (Table 7.1).

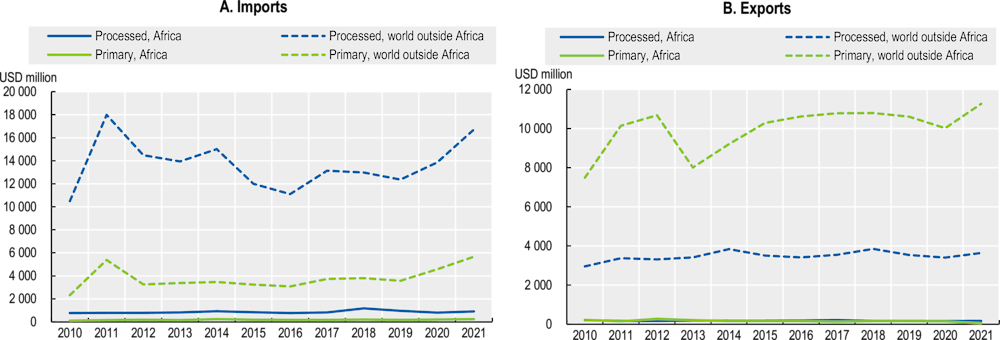

Trade of food and beverage products between West African and other countries has stagnated since 2010, while imports of processed products from non-African countries have recently increased. Between 2010 and 2020, West African countries’ imports and exports of food and beverage products remained at` a constant level, and far more of that trade was with non-African than with other African countries. Even though West Africa is a major exporter of primary food products to non-African countries, the region imports a large share of processed products from them (Figure 7.7). Between 2016 and 2020, West African countries imported close to USD 60 billion worth of food products, about 67% of which was semi-processed or processed (Badiane et al., 2022). The top imported products include cereal and cereal-based products, meat and dairy products, processed sugar and non-alcoholic beverages.

Figure 7.7. Imports and exports of primary and processed food and beverage products for West African countries, 2010-21, USD million

Source: Authors’ calculations based on CEPII (2023), BACI: International Trade Database at the Product-Level (database), www.cepii.fr/CEPII/en/bdd_modele/bdd_modele_item.asp?id=37.

West African agri-food output for some products is falling, while staple food prices are increasing globally. Recent crises have foregrounded West Africa’s dependence on imports of some agri-food products and inputs, especially cereals (Figure 7.8). For instance, in some parts of the rural Sahel, cereal production fell by roughly one-third in 2022, in part due to fertiliser shortages (Oxfam, 2022), while international conflicts induced supply chain shocks that sent wheat prices soaring, jumping 60% in June 2022 compared to January 2021 (World Bank, 2022b).

Figure 7.8. Gross value of agricultural and cereal production in West Africa, 1985-2020, constant 2014-16 USD

Source: Authors’ calculations based on data from FAOSTAT (2022a), Production (database), www.fao.org/faostat/en/#data/QV.

Table 7.1. Top 15 agricultural products in West Africa by production volume, 2019-21

|

Agricultural product |

Total production in 2019-21 (million tonnes) |

Share in Africa’s production |

Share in global production |

Country with highest production volume (share of the region’s production) |

Percentage exported |

Share in Africa’s exports |

Share in global exports |

|---|---|---|---|---|---|---|---|

|

Cassava, fresh |

303 |

52% |

33% |

Nigeria (59%) |

0% |

0% |

0% |

|

Yams |

215 |

97% |

95% |

Nigeria (71%) |

0.1% |

100% |

37% |

|

Maize (corn) |

79 |

29% |

2% |

Nigeria (48%) |

1% |

5% |

0% |

|

Fresh eggs |

70 |

29% |

1% |

Nigeria (66%) |

0.002% |

3% |

0% |

|

Rice |

62 |

56% |

3% |

Nigeria (40%) |

0.01% |

13% |

0% |

|

Oil palm fruit |

53 |

77% |

4% |

Nigeria (56%) |

n.a. |

n.a. |

n.a. |

|

Sorghum |

39 |

47% |

22% |

Nigeria (51%) |

0% |

11% |

0% |

|

Plantains and cooking bananas |

32 |

33% |

24% |

Ghana (45%) |

1% |

55% |

3% |

|

Other fresh vegetables, n.e.c. |

29 |

46% |

3% |

Nigeria (70%) |

0.3% |

14% |

1% |

|

Groundnuts, excluding shelled |

28 |

57% |

18% |

Nigeria (48%) |

1% |

76% |

15% |

|

Millet |

28 |

70% |

31% |

Niger (32%) |

0.2% |

67% |

4% |

|

Dry cowpeas |

23 |

88% |

85% |

Nigeria (48%) |

0.03% |

8% |

2% |

|

Sugar cane |

22 |

8% |

0% |

Côte d’Ivoire (28%) |

0.01% |

2% |

0% |

|

Sweet potatoes |

17 |

20% |

6% |

Nigeria (70%) |

0.3% |

18% |

2% |

|

Tomatoes |

16 |

25% |

3% |

Nigeria (68%) |

0.2% |

1% |

0% |

Note: n.a. = not available. n.e.c. = not elsewhere classified.

Source: Authors’ calculations based on data from FAOSTAT (2022b), Trade (database), www.fao.org/faostat/en/#data/TCL and FAOSTAT (2022c), Production (database), www.fao.org/faostat/en/#data/QCL.

West Africa is experiencing population growth, high food expenditure and an increasing demand for processed foods

The region’s population is growing, and household expenditure on food is significant. West Africa’s working-age population has grown at an annual average of 2.8%, compared to 1.2% in Southeast Asia and 1.3% in Latin America and the Caribbean. By 2030, West Africa will be home to 520 million people. Household food expenditures in West Africa remain high: in 2021, 59% of Nigerian and 39% of Ghanaian and Ivorian consumers’ expenditures went to food, compared to 56% in Kenya, 50% in Angola, 45% in Cameroon, 44% in Uganda, 41% in Ethiopia, 27% in Tanzania and 20% in South Africa (USDA ERS, 2021).

West Africa’s rising urban middle class increases the demand for processed and industrially produced food products, many of which are currently imported. In 2020, the region’s 75 large urban agglomerations (i.e. cities with at least 300 000 inhabitants) had a total of over 93 million inhabitants, the largest of any African region (OECD/UN ECA/AfDB, 2022). Higher purchasing power in the urban middle class creates a large demand for processed foods which are relatively easier to transport, store and prepare (Allen and Heinrigs, 2016). For instance, focus group discussions held in Lagos (Nigeria) and Accra (Ghana) revealed that urban consumers prefer local foods but take issue with the packaging, presentation, food safety and quality of locally processed food items, ultimately choosing imported products that are more convenient to prepare (Badiane et al., 2022; Hollinger and Staatz, 2015; Box 7.1).

Box 7.1. The promise of the infant food value chain in Africa

Africa’s demand for infant food is poised to keep expanding across the continent, while the dependence on imports remains high. African countries currently import ten times more food for infants under three years of age than they export. Current imports are valued at EUR 570 million and are expected to exceed EUR 1.1 billion by 2026. A study conducted between 2021 and 2022 showed that 16% of surveyed firms along the infant food value chain received inputs from African producers (ITC, 2022a).

With environmentally friendly packaging, African producers would be more competitive. Although products by African infant food producers are often better suited to local consumers’ preferences and more affordable than imported brands, lower-quality processing and packaging can limit their attractiveness. Biodegradable packaging and refund schemes for packaging (such as bottles) represent an untapped opportunity for infant food production. An International Trade Centre survey shows the infant food value chain to be the only one of the four value chains it examined for which business clients and consumers are willing to pay a premium for more environmentally friendly products (ITC, 2022a).

Access to credit, transport logistics and difficulties in retaining skilled professionals constitute key bottlenecks for African infant food producers to scale. Local actors are beginning to challenge the dominant market position of multinational enterprises such as Nestlé, which currently accounts for 52-55% of the infant food market in West Africa. For instance, Nigeria’s BabyGrubz, a female-led company, offers products for premature and malnourished babies. While 100% of its sourcing and processing takes place within Nigeria, the company plans to export to neighbouring countries in the near future. However, in Nigeria as elsewhere on the continent, infant food producers struggle with talent retention, the absence of robust food safety assessments, and fragmented regulations for labelling, packaging and shelf life (ITC, 2022a).

Formal investments in the agri-food sector have stagnated and insufficiently target downstream activities

Financing from domestic credit, development finance disbursements and government expenditure for West Africa’s agricultural sector has remained largely unchanged. Albeit volatile, domestic credit (i.e. loans provided by local banks) represents by far the largest formal source of finance for the agriculture, forestry and fishing sector in West Africa (USD 6.7 billion in 2020). Development finance disbursements and government expenditure are smaller (USD 1.7 billion and USD 1.1 billion in 2020) (Figure 7.9).

Figure 7.9. Financing provided to West Africa’s agriculture, forestry and fishing sector through various formal channels, compared to gross fixed capital formation, 2010-21

Note: 2021 figures for development finance disbursements are unavailable; 2020 values are used.

Source: FAOSTAT (2022d), Investment (database), www.fao.org/faostat/en/#data/CISP.

Public investment in the agricultural sector has not grown and has been volatile. According to the monitoring of the Comprehensive Africa Agriculture Development Programme (CAADP) by the African Union Development Agency-New Partnership for Africa’s Development, West Africa scores 3.47 out of 10, indicating that the region is not on track in implementing the CAADP’s goal of allocating 10% of public budgets to agriculture, as it was reconfirmed in the Malabo Declaration on Agriculture transformation in Africa (AU/AUDA-NEPAD, 2020; AUC/OECD, 2022).2 Across most countries of West Africa, the share of government budgets allocated to agriculture has been unstable or declining since 2001. Only Senegal and Burkina Faso have surpassed the 10% target, allocating 11% and 10.5% respectively (AUDA-NEPAD, 2017). Côte d’Ivoire (1.9%), Nigeria (2.2%) and Sierra Leone (4.9%) rank lowest in public spending on agriculture, while Benin stands at 9.3% (AUDA-NEPAD, 2017).

Compared with other African regions, informal private investments play a more significant role than credit or development finance in West Africa, limiting productivity and introducing risks for informal suppliers. Gross fixed capital formation (GFCF) – a measure of the total fixed assets that overall investments have financed – in the region’s agriculture, forestry and fishing sector was more than double the amounts of domestic credit, development finance disbursements and government expenditure combined in 2020 (USD 23.1 billion vs. USD 9.5 billion; Figure 7.9). This suggests that informal private investments are the single largest source of financing for agricultural production in the region. GFCF has also grown much faster in West Africa than elsewhere on the continent, and West Africa’s share of Africa’s total GFCF is far greater than its shares of credit and development finance for agricultural production (Table 7.2). Most private domestic investments are mobilised by farmers’ organisations, concentrating largely on the upstream (production) end of agri-food value chains. While informal private financing is an important channel for smallholder farmers, it does not typically support productivity upgrades and can create risks, for instance, through excessive interest rates or low financial accountability.

Table 7.2. Domestic credit, development finance disbursements and gross fixed capital formation in the agriculture, forestry and fishing sector, Africa and West Africa, 2010-20

|

|

Africa |

West Africa (share of Africa total) |

|---|---|---|

|

Domestic credit |

|

|

|

Total (USD billion) |

186.2 |

55.9 (30.0%) |

|

Average annual growth rate |

7.5% |

14.9% |

|

Development finance disbursements |

|

|

|

Total (USD billion) |

49.6 |

13.5 (27.3%) |

|

Average annual growth rate |

6.9% |

18.2% |

|

Gross fixed capital formation |

|

|

|

Total (USD billion) |

411.9 |

232.8 (56.5%) |

|

Average annual growth rate |

3.9% |

6.5% |

Source: Authors’ calculations based on data from FAOSTAT (2022d), Investment (database), https://www.fao.org/faostat/en/#data/CISP.

FDI and blended finance are volatile and focus on large West African economies, suggesting a widespread shortage of financing for capital-intensive investments in agricultural productivity and downstream activities, such as processing. Large-scale and formal private sector investments are typically needed to establish downstream activities (transportation, processing, logistics, retail) but remain scarce in West Africa (Box 7.2). For instance, FDI to agribusinesses in West Africa is smaller than government expenditure for agricultural production, with announced capital expenditures for FDI projects amounting to USD 9 billion from 2017-22, or USD 1.8 billion per year on average. Over that same period, FDI to West Africa went almost entirely to agribusinesses in Nigeria (52%), Togo (22%), Côte d’Ivoire (15%) and Ghana (10%), with less than 1% going to all other countries in the region combined.3 The role of blended finance is increasing but remains small as a share of overall investment amounts: an average of USD 228.8 million per year of private finance for the agriculture, forestry and fishing sector was mobilised through development finance from 2017 to 2020.4

Box 7.2. Poultry production and processing in West Africa

Poultry is a staple source of protein in West Africa, but its production and consumption are concentrated in only a few countries. Poultry meat accounts for over 70% of West Africa’s total meat consumption, while demand is increasing with population growth. The top three producers in 2021 (Côte d’Ivoire, Nigeria and Senegal) accounted for 58% of production volumes; three countries (Benin, Ghana and Nigeria) accounted for 52% of consumption. In the past, Nigeria produced 68% of egg tonnage in the entire Sahel and West Africa region (SWAC-OECD/ECOWAS, 2008).

Demand for value-added poultry products in West Africa is rising, but production cannot match domestic demand. Across the region, consumer spending is shifting from basic towards higher-value poultry products. However, small-scale farmers dominating the poultry sector lack access to inputs, equipment and infrastructure (Adeyonu et al., 2021). The livestock sector receives little support in the form of public investment in processing and packaging infrastructure and lacks policies to stimulate regional trade in animal products (Amadou et al., 2012). The sector struggles with high production costs, capacity constraints and low productivity (Boimah et al., 2022). Investments can upgrade the poultry value chain by addressing gaps in production, processing, commercialisation and equipment/input (Salla, 2017). As a result, West African countries rely on imports to fulfil their domestic demand for poultry products (SWAC-OECD/ECOWAS, 2008).

Solutions exist to raise the productivity and competitiveness and to lower the production costs of West Africa’s poultry sector. Removing infrastructural bottlenecks and enhancing input supply will increase productivity. Developing value-added poultry products, such as processed meats, can help to improve the sector’s competitiveness (Eeswaran et al., 2022). The West African region imports a large amount of poultry inputs, such as feed and day-old chicks, to meet its demand. Developing these inputs’ local production can also help to improve competitiveness. Increasing access to other quality inputs, such as feed, hatching eggs and vaccines, will help to reduce production costs (Boimah et al., 2022).

Large-scale investments are often missing, especially in the downstream segments of the value chain. Investments in the West African poultry sector are often local, small-scale and informal. Large-scale investments, where present, typically focus on upstream input supply. For instance, the Rearing for Food and Jobs (RFJ) programme in Ghana provided 729 smallholder farmers with a total of 72 967 cockerels at a 50% subsidised price. In a related intervention, the RFJ supplied an additional 25 poultry farmers with 43 183-day-old chicks at a 50% subsidised price (Boimah et al., 2022).

Development finance for agriculture is heavily skewed towards primary agricultural production and neglects downstream activities and environmental protection. West Africa’s agro-industrial activities, such as processing, dairy production and fertiliser plants, received only USD 546 million in development finance from 2010-20, equivalent to 4% of the region’s total development flows to agriculture. Over the same period, environmental protection received close to USD 1.7 billion (or 12%) of such development funding.5 While fertiliser production has recently been bolstered, development funding for processing and other agro-industrial activities has stagnated. Environmental activities have mostly focused on research and administration rather than on direct interventions in supply chains (Figure 7.10).

Figure 7.10. Development flows into West Africa’s agro-industry and general environmental protection, 2010-20, USD million constant 2020

Note: “Agro-industries” refers to staple food processing, dairy products, slaughterhouses and equipment, meat and fish processing and preserving, oils/fats, sugar refineries, beverages/tobacco, and animal feed production. “Other agro-industry” includes cottage industries and handicrafts, textiles, leather and substitutes, forest industries, and fertiliser minerals. “Other general environmental protection” includes bio-diversity, biosphere protection, environmental education/training and site protection.

Source: Authors’ calculations based on FAOSTAT (2022e), Investment (database), www.fao.org/faostat/en/#data/EA.

Current investments often remain inaccessible to smallholder farmers and are hampered by informality, fragmentation and land rights

Smallholder farmers face significant barriers to accessing financing that would allow them to improve their productivity and product quality. Physical distance is no longer the main barrier separating small-scale producers from urban consumption centres. Rather, the main constraint is the degree of sophistication demanded by a growing share of consumers – more ready-to-cook or ready-to-eat products (Badiane et al., 2022). However, smallholder farmers – mostly informal enterprises – face a number of barriers in accessing the financing necessary for them to upgrade production value (Box 7.3). The impact of mitigating those barriers can be substantial: in Nigeria, over 80% of farmers are classed as smallholders (Mgbenka and Mbah, 2016). Barriers include:

High collateral requirements for loans lock out smallholder farmers and agri-food entrepreneurs, preventing them from investing in improved farming practices and technologies. Smallholder farmers and agri-food entrepreneurs often struggle to find adequate collateral to secure loans (e.g. lack of clarity on land rights can be an obstacle, in particular for women when they face discriminatory social norms [OECD, 2021c]). Consequently, bank financing for increasing productivity and innovation remains low (IFC, 2019). In Burkina Faso, where smallholders dominate the agri-food industry, less than 4% of loans provided by banks target the agricultural sector, despite agriculture comprising 27% of the country’s GDP (IFC, 2019).

Shortages and increased prices of inputs, such as fertiliser, affect smallholder farmers. The ripple effects of international conflicts in 2022 have tripled the cost of fertiliser (World Bank, 2022b). West Africa depends on fertiliser imports, with Russia having supplied over 50% of potash to Côte d’Ivoire, Mali, Niger, Senegal and Sierra Leone in 2021. As of April 2022, just 46% of fertiliser needs were met in West Africa and the Sahel (WFP, 2022). The high cost and fertiliser shortages risk decreasing fertiliser use, hence lowering yields (WFP, 2022; World Bank, 2022b). Smallholder farmers, rural communities and family farms, that struggle to access finance and are located far from major urban areas, are particularly vulnerable (Oxfam, 2022).

Limited information on financial products and market research hamstrings small actors in the agri-food value chains’ ability to transform production. Language barriers hinder the utilisation of available sustainable financing. Information related to green funds is often provided solely in English, hampering the dissemination of information on available financing (Lipton, 2022). Small and medium-sized enterprises (SMEs) often lack the investments they would need to scale up data and market research on food consumption trends, preventing them from designing strategies to capture demand (FAO, 2015).

Box 7.3. West Africa’s cassava value chain

West Africa is a major cassava producer, and the crop plays an essential role in the region’s food security. Cassava is a staple food crop in West Africa that can mitigate food security risks because of its resilience to drought and to poor soil conditions (Hershey et al., 2000; Howeler et al., 2013). Accordingly, cassava production in the region mainly focuses on capturing domestic food demand. In Nigeria’s Niger Delta area, for example, roughly 80% of cassava demand is domestic (PIND, 2011). In Ghana, cassava is the most consumed food crop, with a per capita annual consumption of 152 kg (Acheampong et al., 2021). West Africa’s cassava production represented 33% and 52% of global and African production volumes in 2020, respectively (AUC/OECD, 2022). Nigeria is the world’s largest producer, accounting for 23.5% of global production. Despite high output, the region struggles to capture international demand, in part coming from the diaspora. West African cassava represents just 0.33% of global cassava exports (ITC, 2022b).

A lack of affordable credit prevents the realisation of cassava’s yield potential. In Sierra Leone, for example, just 2% of farmers can access credit, even through informal means. Moreover, 80% of farmers who can access credit are delayed by complicated administrative processes (Coulibaly et al., 2014). Overcoming financing difficulties, through the expansion of micro-finance institutions and development finance, can help fund the adoption of higher-yield cassava varieties and fertiliser, pesticides and other farming equipment (Coulibaly et al., 2014; MoFA of Ghana, 2019). For example, Ghana has the highest productivity rates in the region, with an average yield of 21 metric tonnes per hectare (Mt/ha) (Acheampong et al., 2021). However, despite its regional proficiency, productivity remains below the estimated yield potential of 45 Mt/ha (MoFA of Ghana, 2019). Developing credit access to farmers could increase production and support food security.

Increased regional production of value-added cassava derivatives can replace imports. Cassava cannot only be used as an input in many food products (including noodles, traditional desserts and sweeteners) but also in non-food industries. Yet, most of the starch for industrial use in West Africa is imported, totalling USD 51.3 million in 2020 (OECD, 2020). High-quality cassava flour (HQCF) can act as a replacement for wheat flour, which is largely imported to the region (CABRI, 2019; ITC, 2022b). Similarly, while ethanol for the beverage, food, manufacturing and pharmaceutical sectors is largely imported, cassava-based ethanol has been successfully integrated into processing by Allied Atlantic distilleries in Nigeria and the YUEN alcohol factory in Benin (ITC, 2022b).

Investment in agricultural equipment, post-harvest facilities and transport services along the cassava value chain can help alleviate price uncertainty and supply disruptions. Market price volatility, low access to financing for equipment, and a lack of disease and pest control services are major obstacles for smallholder farmers to upscale production (Adebayo and Silberberge, 2020; Coulibaly et al., 2014). Market price volatility, in particular, amplifies producers’ needs for storage facilities to store the crop until favourable prices return. The induced volatility in domestic supply forces the import of derivatives, hindering the emergence of new, industrial processing centres (Adebayo and Silberberge, 2020). Underinvestment in road infrastructure can result in transportation delays that cause cassava to perish, as it is often harvested in the wet season (CABRI, 2019). Furthermore, the cost of transporting fresh cassava accounts for 5-10% of the total variable cost of processing (ITC, 2022b). Solving transport issues by upgrading roads to better withstand difficult seasonal weather and locating producers and processors close to markets would help in moving cassava along the value chain. Programmes such as the Root and Tuber Improvement and Marketing Programme in Ghana have achieved some success in working with cassava producer groups to improve productivity-enhancing practices, despite challenges related to financing and effectiveness (MoFA of Ghana, n.d.).

Firms in food processing and distribution are mostly small, informal and fragmented and do not represent attractive targets for investments. Africa’s food processing sector is characterised by a small number of large firms with high labour productivity and a large number of lower-productivity informal micro and small firms (ReSAKSS, 2022). For instance, in Ghana, over 70% of agro-processing is done by small informal enterprises: 85% of the country’s agro-processing firms are micro-enterprises, 7% are very small firms, 5% are small and only 3% are medium-sized. Also West Africa’s informal distribution networks are ill-equipped to handle growing demand and supply. Informal market players dominate food distribution – such as vendors in small shops, street markets and food stalls, hawkers, and street food sellers (Allen, Heinrigs and Heo, 2018). These informal firms and microenterprises do not represent viable investment opportunities in themselves, and they limit capacity increases further up the chain.

Informal enterprises mostly have limited market experience and formal expertise, which lowers profits and hinders product innovation. The pervasiveness of informal enterprises limits technical innovations, knowledge transfer, quality control, value addition and linkages along agri-food value chains (Owoo and Lambon-Quayefio, 2018). While co-operatives offer one means to organise informal firms, they cannot achieve the same economies of scale and efficient application of technologies as larger, formal firms. Most staple food processing value chains in West Africa are currently in the initiation phase or about to enter a phase of expansion. Without innovation in production technology and improved business practices, the number of enterprises continues to rise and profits decline. A critical mass of firms with capabilities in product innovation, production methods, internal management, sales and marketing has yet to emerge (Badiane et al., 2022).

West Africa suffers from gender inequality in land rights, including agricultural land. Three of the eight African countries (Côte d’Ivoire, Equatorial Guinea and Guinea-Bissau) where, by law, the husband as the family head has control and ownership over the management of assets and properties, including agricultural plots and land, are located in West Africa (OECD, 2021c).

Irrigation projects offer a large potential for sustainable investments. For a long time, only large-scale irrigation projects in Africa were deemed viable to provide high returns on investment and drive agricultural productivity growth. However, recent estimates show that, in large parts of Africa, the internal rate of returns of investment for large-scale irrigation projects ranges from only 7% to 17%, while that for small-scale projects is 26-28% (Abebrese, 2017).

Good interactions between leading supermarkets and local producers can increase productivity and sustainability in West Africa’s agri-food value chains

Supermarkets can contribute to transforming West Africa’s agri-food value chains, but the right components must be present. Agri-food value chains are the interface between agricultural producers in rural areas and the increasing population of urban food consumers whose demand for food products is continuously evolving (Barret et al., 2022). Four central market actors are required for the transformation of agri-food value chains: producer organisations, the public sector, agribusiness and finance (Elbehri, 2013). Sophisticated retailers, particularly supermarkets, occupy a strategic position while also acting as a financing intermediary. Reardon, Liverpool-Tasie and Minten (2021) highlight the lead role that supermarkets, alongside large agribusinesses, played in transforming the agri-food sector in Latin America, Central and Eastern Europe, and Asia. While market opportunities for supermarkets exist in abundance in West Africa, two components – a stable macroeconomic environment and reliable contract enforcement – are often missing.

Supermarkets can orchestrate local value chains, thereby reducing fragmentation and driving supply chain efficiency. West Africa’s agri-food value chains are fragmented, causing inefficiencies that limit labour productivity. For instance, although Ghana’s wholesale and retail trade sector increased its employment share from 17% in 2000 to 25% in 2010, this did not create a corresponding rise in economic output (AfDB/OECD/UNDP, 2016). Supermarkets often create backward linkages with agricultural producers, which can remove intermediary costs and connect them directly to urban markets (Barrett et al., 2022; Reardon, Liverpool-Tasie and Minten, 2021). Supermarkets buy products in bulk directly from the primary producers (farmers) and make them available in their outlets at a relatively affordable price, while reducing transportation costs, which can contribute to reducing the ecological footprint of the agri-food value chain. They also sometimes directly invest in processing. The Dairy Development programme of Friesland Campina WAMCO, a multinational subsidiary in Nigeria, illustrates this point. The large dairy manufacturer provides technological interventions directly to local farmers to improve yield per cow, raw milk quality and hygiene as well as feeding, breeding and farm management.

The interaction of supermarkets with local producers can result in enhanced quality. Supermarkets typically have quality requirements. This is connected to the visibility of supermarket chains to regulators and quality standards agencies. Some supermarkets act as export intermediaries for local raw foods, such as yam and cassava, that are demanded globally but only grow in limited areas, including West Africa. Consequently, local producers are incentivised to meet higher quality standards, in order to satisfy the standards of the domestic procurement systems of supermarkets and the product requirements of export markets. While the quality requirements for different segments of the domestic market may vary, the safety certification is common for all the items of a given type (AfDB/OECD/UNDP, 2014; Weatherspoon and Reardon, 2003).

Supermarkets may pose risks for sustainability, in particular for social inclusion, but mitigation strategies are available.

Exclusion of producers that lack efficient scale: As supermarkets engage in bulk buying, they may expect discounted prices and scale efficiencies that small-scale producers and input suppliers cannot deliver. Tailored policy solutions are required to disincentivise the liability of size and to ensure that agri-food value chains are inclusive of vulnerable smallholder farmers. One policy option is to set benchmarks for supermarkets’ backward integration (i.e. the inclusion of producers into the supermarkets’ operations, for example through combined stock management). Benchmarks may be calibrated according to the size of supermarkets and would help to minimise supermarkets’ passing costs to producers once they have a stake in their success. Co-ordinated market and tax regulations by West African governments could boost the investments in and patronage of local producers by large supermarkets, some of which may prefer to import products from outside West Africa.

Crowding-out effects of quality standards: As supermarkets introduce more stringent quality standards, small producers risk being excluded, as they often cannot meet the costs of compliance with standards without external help. Public-private alliances can support capacity building among small actors in the agri-food value chain to help mitigate this risk. Investments are less effective in the absence of knowledge, skills and capabilities. Thus, targeted interventions are required to develop the skills of farmers, strengthen formal educational programmes linked to agriculture (such as agricultural engineering, food preservation and nutrition) and invest in agricultural research and development.

Productivity pressure: As supermarkets demand more volume from small-scale producers, some may be suppressed from the more developed downstream end of the agri-food value chains if they are unable to meet required production levels. Network-oriented policies will help to mitigate the risk of smallholder exclusion. First, such policies will incentivise smallholders to pool output in order to meet production targets. Second, they will discourage supermarkets from monopsony behaviour (i.e. exploiting the fact that they are the only buyer) by encouraging them to become embedded with their suppliers. Small neighbourhood or district-level markets are a common place for daily commercial business in many West African countries. Implementing policies that aggregate these fragmented markets would raise the standards, quantity and quality of products and would create more efficient markets.

Environmental footprint: Estimates suggest that supermarkets are a major source of certain environmental hazards. They indicate extremely high per capita consumption rates of single-use plastics in West Africa, arising mainly from packaging in retail outlets (Jambeck et al., 2018; Miezah et al., 2015). Against this background, policies must incentivise supermarkets to rally investments in environmental sustainability. For instance, by investing in waste management systems and working with other value chain actors, including financiers, supermarkets can make agri-food value chains more environmentally friendly (Adam et al., 2020). Such a transformation would require not only waste management but also other aspects in which agri-food value chains have an environmental footprint. The Shoprite Group is an example: in August 2022, it obtained sustainability-linked loans totalling approximately USD 208 million to invest in its broad-based sustainability strategy. The strategy includes the increase of energy from renewable sources as a share of total electricity consumption, the recycling of cardboard and plastic, sustainable packaging, and energy efficiency.

Policies supporting the productive transformation of West Africa’s agri-food sector can catalyse sustainable investment

The vast and growing local and regional demand for high-quality food products offers a unique policy opportunity to drive the sustainable transformation of West Africa’s agri-food sector. It allows countries to focus on improving efficiency and sustainability standards of production and supply chains and to strengthen West Africa’s resilience towards global shocks through regional integration (AUC/OECD, 2022). The region’s agri-food sector provides a unique setting for achieving synergies between economic, social and environmental sustainability goals.

To transform agri-food value chains in West Africa’s diverse economies, customised and co-ordinated policy approaches will be required. Countries will need to mobilise private investments where possible while using development and public finance where necessary. This chapter has shown stark intra-regional differences in production capacity (e.g. Table 7.1), which should inform how to tailor policy approaches. The suitable emphasis on private versus public investments will vary by country:

Currently, private investment flows largely to agribusinesses in the economies of Côte d’Ivoire, Ghana, Nigeria and Togo, which attract the lion’s share of the FDI flowing to the region. These countries can pursue public-private co-financing and risk sharing, as well as scale-oriented measures benefiting from their larger markets and attractiveness for FDI.

Benin, Burkina Faso, Gambia, Guinea, Guinea-Bissau, Liberia, Mali, Niger, Senegal and Sierra Leone represent the Least Developed Countries with mostly smaller domestic markets. These economies will need to pursue product specialisation and integration with larger countries’ markets and value chains (for example through Mali’s dry mango value chain in Koulikoro and Sikasso). They can be supported by preferential access to development assistance, strategic public investments and partnerships with the Economic Community of West African States (ECOWAS) and larger economies in the region (for instance, for skill exchange programmes).

The island nation of Cabo Verde can make use of its marine endowments.

Domestic financial institutions can improve smallholders’ access to financing for downstream activities and insurance

Despite governance challenges, public financial institutions remain important sources of financing for agricultural producers. State-financed agricultural development banks and agricultural credit guarantee schemes became popular in the 1970s, though many underperformed and had to close. The factors that account for their poor performance include preferential treatment given to large-scale farmers and politically connected persons, embezzlement, poor loan repayment rates, and heavily skewed spending towards the purchase of agricultural inputs and outputs (Domke, 2022; Salami and Arawomo, 2013). Nonetheless, governments implemented reforms to ensure that agricultural development banks are viable and sustainable providers of financial services to all segments of the rural populations. National, regional, continental and global financial institutions – such as Ghana’s Agricultural Development Bank, the West African Development Bank, the African Development Bank (AfDB) and the International Fund for Agricultural Development (IFAD) – continue to provide essential financial services to agricultural producers whom commercial banks often consider as not creditworthy.

Examples of agricultural financing programmes in West Africa that couple credit with productivity training and sustainability requirements include:

IFAD co-financed the Shared-risk Agricultural Financing Incentive Mechanism Support project (ProMIFA) in Togo, which offers agricultural financing for SMEs and smallholder farmers between 2019 and 2025. Starting with key agropastoral value chains (including rice, market gardening, maize and poultry raising), the project seeks to improve financial literacy and business plan drafting among its beneficiaries, mainly women and youth. It is aligned with the country’s Five-year National Development Plan for 2018-22 and implements one of the strategic pillars of the Ministry of Agriculture’s 2025 roadmap: acceleration of the agricultural financing mechanism (IFAD, 2018).

NSIA Banque Côte d’Ivoire and the Development Bank Ghana offer examples of attaching sustainability criteria to agricultural financing. They integrate credit with social and environmental criteria assessments at all stages of lending, including in the agricultural sector (Anesvad Foundation, 2020; MoF of Ghana, 2022).

The West African Initiative for Climate-Smart Agriculture (WAICSA) is a unique example of a West Africa-led blended finance fund focusing on climate-smart agriculture (CSA). It has encouraged smallholder farmers to employ CSA practices. The fund pools public and concessional capital to offer loans of up to USD 1 million at subsidised interest rates to farmers’ organisations and agribusinesses. WAICSA has been estimated to improve the food security of up to 90 000 farming households across the region (Climate Finance Lab, n.d.).

Financing instruments that provide comprehensive support for downstream activities along agri-food value chains should be strengthened. To address value chain gaps comprehensively, large amounts of funding and extensive co-ordination between funders and recipients can be necessary (Box 7.4). Here are three current financing instruments:

The Africa Food Security Fund (AFSF) was launched to address the needs of agricultural SMEs that are outside of the scope of larger private equity funds and commercial banks. It focuses primarily on processing, distribution and provision of agricultural inputs such as fertiliser and agronomic services. AFSF invests in potential high-growth SMEs operating in the agri-food value chains with a view to enhancing food security in Africa. The fund’s USD 100 million portfolio is managed by Zebu Investment Partners and supported by investments from the African Development Bank, British International Investment and the European Investment Bank. Much of AFSF’s interventions take place in West Africa – given the size of its population relative to the rest of the continent – particularly in underserved countries such as Mali and Senegal. At least 20 direct jobs are expected to be created for each USD 1 million invested, benefiting over 14 000 small-scale farmers, mainly women (AfDB, 2019; BII, n.d.).

In Ghana, the Outgrower and Value Chain Fund, effective since 2011, provides affordable credit for medium- and long-term investments through the banking sector, involving an outgrower association, a technical operator or buyer, and a participating bank. Outgrower schemes refer to contractual agreements between individual or collectives of farmers and firms that require a stable supply of agricultural products (Felgenhauer and Wolter, 2009). These co-ordinated commercial relations between producers, processors and traders allow integration into the agricultural value chain.

In 2022, the AfDB approved a USD 127 million package to improve transport links to areas with potential for agriculture, forestry and livestock farming in Niger’s Eastern region. The project includes support to farming value chains through farmers’ centres and the installation of dairy units (AfDB, 2022).

Agriculture insurance can improve farmers’ resilience to weather shocks and natural disasters while improving their access to credit. Insurance can help producers expand and upgrade their businesses, as financial institutions are more willing to lend to farmers who are insured. Africa represents a mere 0.5% of the world’s agricultural insurance industry. By way of comparison, North America (55%), Europe and Asia (20% each) account for nearly the totality of the world’s agricultural insurance premiums (Fonta et al., 2018). Instead of being based on claimed losses, weather index insurance payouts are based on predetermined rates against extended periods of droughts, floods, hurricanes, etc. Although the uptake is low on the continent – due to the poor involvement of farm households in the early stages of pilot initiatives – the reach of such products is increasing in West Africa. For example, OKO Mali was established in 2019 as a maize and cotton index insurance for unbanked smallholder farmers. Accessible via a mobile interface, it provides affordable insurance to farmers in Côte d’Ivoire, Mali and Uganda and delivers instant claim settlements (OKO, n.d.).

Digital avenues offer new pathways to make agricultural credit accessible for smallholder farmers. Given relatively high digital access rates among smallholder farmers, digital solutions offer untapped potential for financial institutions to reach informal agricultural producers and agro-processors with credit and insurance products. National efforts to incorporate digital channels include Sterling Bank’s SABEX in Nigeria, a blockchain solution that allows farmers to use their produce as collateral, store harvested crops in dedicated facilities and trade agricultural commodities (Sterling, n.d.). Partnerships with digital platforms such as Thriv’Afric in Nigeria, which collect comprehensive credit-relevant transaction data, can improve farmers’ credit scores and avoid the need for collateral.

Box 7.4. The role of public-private alliances in improving value addition in Senegal’s rice production

By combining policy and practical support, public-private alliances can be effective in achieving competitive and inclusive agri-food value chains. One example is the rice value chain. Local rice production covers only around 60% of local demand in the 15 ECOWAS member countries. In 2021, drained foreign reserves with rice imports cost West Africa around USD 3.7 billion (Dione and Toto, 2022).

Supporting local production is essential, especially in countries where local demand is high, like Senegal. The country’s average annual consumption of rice per capita is 85 kg (CFC, 2022). The government supported the founding of a consortium-led private processing and distribution company of local rice. The consortium includes a network of import marketers, producer organisations and processors. Improved rice quality and processing capacity were two of the short-term results of investments (Elbehri, 2013). Complementing investments in processing, Senegal’s Common Fund for Commodities (CFC) offers USD 1.46 million in financial support to local rice millers and their smallholder suppliers while also building irrigation channels and modernising equipment (CFC, 2022).

Regional integration policies and place-based programmes can fulfil complementary roles in strengthening agri-food value chains

The gradual elimination of intra-African trade tariffs through the African Continental Free Trade Area offers an opportunity for West African countries not only to trade more but also to encourage more investment in the downstream segments of agri-food value chains. Overall, West Africa exhibits a higher level of forward integration in agri-food value chains for exports outside than within the region. This means that a higher share of its exports functions as inputs for non-West African countries’ exports, reflecting the predominant role of agricultural commodities in West Africa’s exports (AUC/OECD, 2022). Returns on strategic investments in specialised national agri-food value chains (including in processing) stand to increase as a result of reduced intra- and extra-regional trade barriers.

The ECOWAS provides a regional agricultural policy framework. Initially adopted in 2005, the Economic Community of West Africa Agricultural Policy (ECOWAP) supports the development of agricultural programmes in the region. It features a web-based monitoring and evaluation system that eases data collection, analysis and knowledge-sharing. The implementation of ECOWAP relies on three complementary mechanisms: i) the formulation of national agricultural investment plans; ii) a regional agriculture investment plan that puts in place regional programmes focused on issues such as the management of shared natural resources, and iii) specific regional policies and policy instruments (ECOWAS, n.d.). Assessments during the ECOWAP+10 review process questioned the coherence and co-ordination of agricultural policy implementation and called for greater emphasis on the post-harvest and commercialisation segments of the agricultural value chains (Oxfam, 2015; SWAC/OECD, 2015).

Countries can co-ordinate their agro-industrial strategies via ECOWAP. Countries have pursued export-oriented industrial strategies in various ways. Cash crops targeting exports, such as the cotton industry in Burkina Faso, have proven useful to generate foreign earnings in poorer economies but have had limited impact in reducing poverty, owing to insufficient local transformation. Senegal provides an example of how a Least Developed Country can establish resilient food value chains (such as rice and fresh vegetables), catering to both local consumer needs and growing regional demand for agricultural exports. The country has employed policies targeting local entrepreneurs and developed public-private alliances and centres of intensive agricultural services. At the same time, duplicating strategies can come with risks. For instance, through the 2000s, most West African countries relied on cheap poultry imports from the European Union, which destabilised their national production capacity. Using ECOWAP can help the region’s countries avoid trade conflicts and enable scaling and specialisation.

Place-based programmes to encourage sustainable investments in downstream agri-food value chain activities should be at the core of national development plans and regional strategies. Place-based programmes offer policy makers a toolbox to support the industrialisation of agri-food value chains through economies of scale and specialisation (e.g. large-scale production infrastructure and knowledge exchange) and multi-sectorial synergies (e.g. through the creation of shared infrastructure) (Table 7.3). Such programmes should be embedded in regional and continental strategies, such as the African Union’s Common African Agro-Parks Programme (CAAPs). The CAAPs is one of the concrete initiatives to implement the Comprehensive Africa Agriculture Development Programme in support of Agenda 2063 and the Malabo commitment to triple intra-African trade in the agriculture and services sectors (AU, 2021).

Table 7.3. Investment promotion tools in the agricultural sector

|

Investment promotion tool |

Overall objective |

Geographic focus |

Roles for public investment |

Profile of target group |

|---|---|---|---|---|

|

Agro-clusters |

|

Regional or provincial, close to production area |

Growth of agglomeration economies and promotion of collective action |

Multinational and domestic agribusiness/agro-industry firms and construction companies |

|

Agro-industrial parks (including agro-techno parks, science parks and agro-eco-industrial parks) |

|

Urban, easily accessible to production area |

Common infrastructure, logistics facilities and dedicated services |

Agribusiness/agro-industry firms, specialised service providers and logistics companies |

|

Special agro-industrial processing zone |

|

Urban, often near port area |

Advantageous economic and regulatory frameworks, common infrastructure and services |

Agribusiness/agro-industry firms, specialised service providers and logistics firms |

|

Agro-incubators |

|

Urban |

Common infrastructure and dedicated services to create and coach new agribusiness firms |

Agribusiness/agro-industry startups, venture capital and angel investors |

|

Agro-corridors |

|

Regional, national or supranational; linear agglomeration spanning across hundreds or thousands of kilometres |

Infrastructure investments, trade and regulatory policy reforms, and sectoral development plans |

Multinational and domestic agribusiness/agro-industry firms, construction companies, etc. |

Source: Authors’ compilation based on FAO (2017), Territorial Tools for Agro-industry Development: A Sourcebook, www.fao.org/3/i6862e/i6862e.pdf.

National strategies in West Africa can further develop special agro-industrial processing zones. Such zones offer an opportunity for countries to produce higher value-added exports. Efficiency and productivity can be bolstered by improving linkages between post-harvest production and value addition in the agro-cluster. The SKBo Triangle cross-border zone, launched in 2018, comprises the areas of Bobo Dioulasso (Burkina Faso), Korhogo (Côte d’Ivoire) and Sikasso (Mali). The zone is set to attract private investment in agro-industry and the mineral industry, across more than 6 million ha of land (AUC/OECD, 2019; UNCTAD, 2021). The USD 538 million Special Agro-Industrial Processing Zone programme and the Lekki Free Trade Zone in Nigeria are further examples.

Addressing infrastructure constraints is foundational to improving intra-regional trade within agri-food value chains (AUC/OECD, 2022). Infrastructure gaps in West African countries are large, and they vary widely (PPIAF, 2022). Agricultural investment promotion tools (Table 7.3) can be a viable approach to fill agri-food-specific infrastructure gaps, as they serve different value chains by providing centrally managed infrastructure and supporting services. For example, the Northern Agro-Industrial Pole Project in Côte d’Ivoire is designed to establish five sites to operate as storage, secondary packaging and primary processing centres for agricultural products; the project also includes dams, rural roads, healthcare centres and schools, and infrastructure for fisheries and livestock production (AfDB, 2023; OPEC Fund, 2021).

National agricultural investment plans (NAIPs) can increase focus on agro-processing and rural-urban supply chains, especially through distribution and logistics networks in intermediary cities. NAIPs that follow ECOWAS frameworks are currently in their second iteration (they expire around 2025-26). Forthcoming iterations could better target investments in downstream activities of agri-food value chains. Connecting the rural-urban supply chains via the NAIPs could transform value-added sectors such as agro-processing, branding and marketing. For instance, in its second generation NAIP (2018-21), Ghana’s target was to increase domestic secondary and tertiary processing of cocoa beans to 50% of the annual output, from 30% in 2017-18 (MoFA of Ghana, 2018). Within NAIPs, strategically located intermediary cities can be destined as logistics hubs (e.g. storage facilities for perishable rural goods). The cities can increase the productivity of industrial and agricultural value chains by providing infrastructure such as roads and transportation networks (AfDB/OECD/UNDP, 2015; OECD/PSI, 2020).

Agro-poles, support organisations, international funders and technical partners can help improve food security and agricultural practices

Agro-poles can be a viable means to support food security, as shown in Benin. Since the early 2000s, roughly 40 agro-poles have been established across Africa both to ensure food security and accelerate the shift from subsistence farming to agro-industrial development. A success story emerges from agro-poles in Benin. As part of the Government of Benin’s strategy to transform its agricultural sector, the country has designated 13 priority agricultural products. Since 2016, the country’s Programme National de Développement de la Filière Ananas has promoted the sustainable production and competitiveness of pineapple in agro-poles to value its local potential (Jones, 2021). In 2021, Pain de Sucre pineapple from Benin’s Allada Plateau became the country’s first protected geographical indication by the African Intellectual Property Organization. Although this is an achievement, most countries in the region either have no dedicated food safety agency that provides oversight to the pineapple processing industry or lag behind in product certification (e.g. International Organization for Standardization [ISO]) (Schreinemachers et al., 2022).

With additional funding, support organisations such as agricultural research, agro-incubators and interprofessional associations could refocus support for smallholder farmers towards productivity and sustainability-related practices. Agricultural research could play a critical role in enhancing the product development of agro-processors (Owoo and Lambon-Quayefio, 2018). Agro-incubators can promote product quality: they are conducive to agricultural innovation given their combination of entrepreneurs and multidisciplinary, experienced teams of experts and mentors, together with knowledge and research organisations and investors (FAO, 2017). Interprofessional associations in West Africa’s francophone countries can help to pool resources and information for SMEs, but they face financing issues (Shepherd et al., 2009). These interprofessional associations would benefit from public support, which in turn could aid SMEs in scaling up. Programmes such as the Fertilizer and Seed Recommendation Map for West Africa, an online platform that provides information on seeds of improved varieties, appropriate fertiliser recommendations and good agricultural practices specific to an agro-ecological zone (FeSeRWAM, n.d.), can help disseminate to West African farmers the most up-to-date farming practices.

A well-known case is the Shonga Farms in Nigeria’s Kwara State. They invited 13 commercial farmers from Zimbabwe to develop dairy, poultry farming and commercial crops, with financial resources from five Nigerian banks through the Special Purpose Vehicle Shonga Farms Holding Limited (SFH). Its success mainly owes to the efficient balance between public support and majority private investment. The farms employ up to 4 500 workers in off-peak agricultural periods and 7 000 workers in peak periods. They process 40 000 chickens and 50 000 litres of milk per day, mainly for the regional Kwara market. Shonga Farms boast one of the continent’s highest cassava yields, which they process for export outside of Africa (AUC/OECD, 2019; Mickiewicz and Olarewaju, 2020).

International funders and technical partners can support programmes that ensure food security and upgrade agricultural practices, but local ownership needs to be ensured. The New Alliance for Food Security and Nutrition (NAFSAN), established in 2012 under the auspices of the G8, aimed to encourage food security initiatives by catalysing private investment and accelerating private capital flows to African agriculture. However, evaluation assessments conducted at the national level pointed to mixed results due to lack of co-ordination, lack of ownership and leadership, and poor NAFSAN management and governance (Badiane et al., 2018). The case illustrates the importance of local ownership which can transform financial resources into local assets and skills. A collaboration between international funders and local technical partners has increased food security and improved agricultural practices at a shrimp farm in Cabo Verde (Box 7.5).

Box 7.5. Shrimp farms in Cabo Verde

In the late 2000s, aquaculture was introduced in Calhau (São Vicente Island) to help meet the local demand for shrimp consumption. At the time, all shrimp consumed in the country was imported (PSI, 2009).

The initial project deployed funding from a national banking institution and co-financing from the Dutch Privat Sector Investment programme. Current stakeholders include the local partner SUCLA, known for its canned tuna; Brazil’s Universo, a company specialised in the wholesale and retail market of seafood; and Germany’s SINN Power, which focuses on renewable energy solutions.

In 2022, one shrimp farm, the Fazenda do Camarão, produced approximately 40 tonnes of shrimp, aiming to double production by 2023. The total consumption of shrimp in Cabo Verde is roughly 115 tonnes per year. While there is a potential for export, the intention is to prioritise the domestic market.

The farm has been certified with quality and environmental labels such as Global GAP, HACCP and BAP, as it operates mostly on wind and solar energies. It also promotes a circular economy approach and is self-sufficient in the production of larvae. The shrimps are fed corn flour and fish meal from the neighbouring island of São Nicolau. With nearly 40 employees – mostly women – the farm is the largest employer in the village of Calhau.

References

Abebrese, F. K. A. (2017), “Investing in irrigation for agriculture productivity in Africa”, Africa Up Close blog, Wilson Center, 4 October, https://africaupclose.wilsoncenter.org/investing-in-irrigation-for-agriculture-productivity-in-africa/.