This chapter describes market developments and medium-term projections for world cereal markets for the period 2023-32. Projections cover consumption, production, trade and prices for maize, rice, wheat and other coarse grains. The chapter concludes with a discussion of key risks and uncertainties which could have implications for world cereal markets over the next decade.

OECD-FAO Agricultural Outlook 2023-2032

3. Cereals

Copy link to 3. CerealsAbstract

3.1. Projection highlights

Copy link to 3.1. Projection highlightsDemand growth is slowing down, yields drive production

Over the next ten years, the growth of cereal demand is expected to be slower than the past decade due to weaker growth in feed demand, biofuels and other industrial uses. Moreover, in many countries direct human per capita food consumption of most cereals is approaching saturation levels, thus constraining growth in overall demand. Most of the increase in food demand is linked to population growth, particularly in low- and lower middle-income countries. Population-driven increases in the consumption of wheat and rice are expected in Asia, and of millet, sorghum, and white maize in Africa, while the growing role of rice in African diets is projected to translate into continued increases in its per capita food use in that continent.

In the next decade, global cereal production growth will be due to higher yields and more intensive use of existing arable land. The expected increase is attributed to the wider availability and adoption of new and improved seed varieties, more intense and efficient use of inputs and improved agricultural practices. Furthermore, market turbulence could revive policies aimed at increasing domestic production to reduce exposure to global markets. On the other hand, growth in production might be limited by the impacts of climate change on yields, a lack of access to new technologies in certain countries as well as insufficient investments. Moreover, heightened environmental awareness and new environmental policies could dampen yield growth.

Global production of cereals is projected to increase from its current level by about 320 Mt to 3.1 bln t by 2032, largely from maize and rice. As over the past decade, the increase is expected to originate primarily in Asian countries, which will account for about 45% of global growth. Africa, where maize and other coarse grains will be the primary drivers of growth, is expected to contribute larger shares to global growth of cereal production than over the past decade. Latin America and the Caribbean will also generate a substantial portion of the increase, largely of maize. Under the assumption of average growing conditions, Oceania is not expected to maintain the record production levels experienced in the base period (Figure 3.1).

Overall, 17% of global cereal production was traded internationally in 2022. However, this share varies across the different cereals ranging from 10% for rice to 25% for wheat. This ratio is expected to remain stable over the next decade. Asia is projected to maintain its position as world largest rice exporting region, while countries in Latin America and the Caribbean will mostly import wheat and export maize. Many African and Asian countries are expected to become more reliant on cereal imports during the next decade.

It is projected that world cereal trade will increase by 11%, totalling 530 Mt by 2032. Wheat will contribute to 43% of this growth, while the rest is shared by maize (34%) and rice (20%) and other coarse grains (3%). The Russian Federation (hereafter “Russia”) is projected to remain the largest wheat exporter, supplying 23% of global exports in 2032. The United States will remain the leading exporter of maize closely followed by Brazil, while the European Union will remain the main exporter of other coarse grains. India, Thailand and Viet Nam will continue to be the leading rice exporters, with Cambodia and Myanmar playing an increasingly significant export role. As in the past years, Chinese feed demand is expected to be a key factor in cereal markets. The projections assume Chinese imports of maize and wheat stay below recent peaks and reach 19 Mt and 7.5 Mt respectively by 2032.

The 2023/24 season is expected to continue to see high nominal grain prices. However, assuming average yields and geopolitical stability, the long-term downward trend in real terms may resume and continue until 2032.

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

The COVID-19 pandemic restrictions (some still in place in the People’s Republic of China ‒ hereafter “China”), Russia’s war against Ukraine, animal diseases, reduced production in some countries due to extreme weather events, high fertiliser and transport costs, and the macroeconomic environment, including high inflation, have caused a surge in grain prices. These factors are expected to subside by 2024 but may still influence prices during the outlook period. Furthermore, trade disruptions due to political instability and attempts to control domestic inflation can also have a profound effect on markets. Certain countries have expressed their intent to develop strategies to manage domestic prices, such as stock building, export restrictions, import barriers and increasing subsidies for producers and consumers, but the implementation of these measures is often unclear and financially difficult to achieve.

3.2. Current market trends

Copy link to 3.2. Current market trendsWheat and coarse grain prices below recent peaks

The 2022/23 market situation of grains (wheat and coarse grains) is somewhat mixed compared to the preceding season. Global wheat production has reached unprecedented levels and global stocks are increasing. By contrast, production of maize and other coarse grains has not been sufficient to meet demand, leading to an expected drawdown of global coarse grain stocks by the close of season in 2023. Although the Black Sea Grain Initiative has facilitated the movement of more than 15 million tonnes of cereals until April 2023 which has helped to increase supplies and quell some of the uncertainty in grain markets, supplies from Ukraine remain constrained.

As for rice, after successive years of bumper harvests, inclement weather and hikes in production costs are set to lower world rice production in 2022/23, although a still robust level of plantings is expected to keep the global harvest at an above-average level. The season’s anticipated production reduction, combined with policy changes, may forestall further increases in global rice utilisation and reduce world trade in rice 2023. However, efforts to reconstitute stocks by some countries are expected to keep world rice stocks in 2022/23 at their second highest level on record.

3.3. Market projections

Copy link to 3.3. Market projections3.3.1. Consumption

Asian countries will lead demand growth of cereals for food and feed

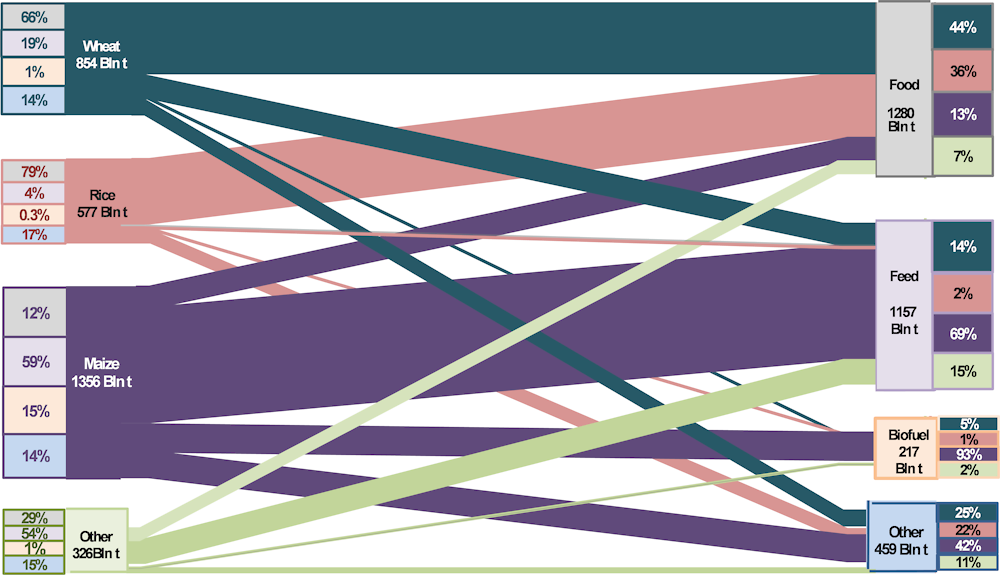

Cereal demand will continue to be dominated by food use closely followed by feed use. In 2032, 41% of all cereals will be directly consumed by humans, while 37% will be used for animal feeds. Biofuels and other uses are projected to account for the remaining 22% These shares, however, differ across the different cereal types. While wheat and rice is mainly used for food, feed use dominates maize and other coarse grains (Figure 3.2).

Figure 3.2. Global use of cereals in 2032

Copy link to Figure 3.2. Global use of cereals in 2032

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Between 49% and 65% of global cereal consumption occurs in the top 5 consumer countries of each commodity (Figure 3.3), which is clearly less concentrated than production (see Figure 3.4 below). Global use of cereals is projected to increase slightly from 2.8 bln t in the base period to 3.1 bln t by 2032, driven mainly by higher food use (+148 Mt), followed by feed use (+130 Mt). Asian countries will account for near half of the projected demand increase.

Increased global consumption of cereals for feed is expected to be dominated by maize (1.3% p.a.), followed by wheat (0.9% p.a.) and other coarse grains (0.6% p.a.) over the next decade. Consumption of cereals for food is expected to increase at a slower rate than in the previous decade.

Wheat consumption is expected to be 11% higher in 2032 than in the base period. Four countries account for two-fifths of this increase: India, Pakistan, Egypt, and China. Global use of wheat for food is projected to increase by 57 Mt but to remain stable at about 66% of total consumption; growth will be slower compared to the previous decade as the rate of increase in world population slows down.

Globally, the projected increase in consumption of wheat for food is more than three times larger than that for feed, especially in Asia where there is increasing demand for processed products, such as pastries and noodles. These products call for higher quality, protein rich wheat, produced in the United States, Canada, Australia and, to a lesser extent, in the European Union. Countries in the North Africa and Western Asia, such as Egypt, Türkiye, and the Islamic Republic of Iran, will remain major consumers of wheat with high levels of per capita consumption. Global production of wheat-based ethanol is expected to recover as production increases in India offsetting the reduction in other countries.

Note: Presented numbers refer to shares in world totals of the respective variable

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Global maize consumption is projected to increase by 1.2% p.a., a much slower pace compared to 2.3% p.a. in the previous decade. This increase is principally driven by higher incomes that translate into higher feed demand, which accounts for the largest share of total utilisation, rising from 57% in the base period to around 59% by 2032. 52% of the increase in feed consumption will be in Asian countries (more than half of this in China) due to fast expanding livestock and poultry sectors. Feed demand globally is expected to rise by 110 Mt to 794 Mt, mainly in China, the United States, Brazil, Indonesia, Argentina, India, Viet Nam, and Egypt. Consumption in Southeast Asia will increase due to its fast-expanding poultry industry.

The use of maize as food is expected to increase primarily in Sub-Saharan Africa where population growth is strong. White maize1 will remain an important staple, accounting for about a quarter of total caloric intake. Growth in maize consumption as food in African countries is expected at about 2.7% p.a. on average.

Globally, maize use for biofuel production is expected to increase at a much slower rate than in the past two decades as national ethanol markets of key producers are constrained by biofuel policies. Brazil and the United States together account for more than 80% of the increase.

World utilisation of other coarse grains – sorghum, barley, millet, rye, and oats ‒ is projected to increase by nearly 23 Mt, or 0.8% p.a., over the next ten years, compared to 0.2% p.a. in the previous decade, driven by additional use in African and Asian countries, while consumption is expected to remain stable in high-income countries. The food share of total consumption is projected to increase from about 26% in the base period to 29% by 2032. Sub-Saharan African countries, especially Ethiopia, rely heavily on millet as a food source owing to its resistance to droughts and the diverse climate conditions in the region.

Rice is primarily consumed as food and is a major food staple in Asia, Latin America and the Caribbean, and increasingly in Africa. World rice consumption is expected to increase by 1.1% p.a., compared to 0.9% p.a. during the last decade, with Asian countries accounting for 66% of the projected increase, largely due to population rather than per capita consumption growth (Table 3.1). Across the various regions, only Africa is projected to see notable increases in per capita food intake of rice. At the global level, the average per capita food use of rice is projected to increase by 0.9 kg to around 53 kg per year.

Table 3.1. Rice per capita food consumption

Copy link to Table 3.1. Rice per capita food consumptionkg/person/year

|

2020-22 |

2032 |

Growth rate (% p.a.) |

|

|---|---|---|---|

|

Africa |

26.5 |

30.0 |

1.01 |

|

North America |

11.9 |

12.7 |

0.33 |

|

Europe |

7.2 |

7.2 |

0.33 |

|

Oceania |

19.7 |

20.1 |

0.05 |

|

Latin America and the Caribbean |

25.7 |

25.2 |

-0.02 |

|

Asia |

74.2 |

75.5 |

0.27 |

Source: OECD/FAO (2022), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

3.3.2. Production

Improved technology and cultivation practices sustain yield and production growth

The global area harvested to cereals is expected to grow by 14.6 Mha (2%) by 2032. It will expand mainly in Latin American and the Caribbean countries by about 5 Mha, notably in Argentina and Brazil. Globally, wheat, maize and rice areas are projected to increase respectively by 1%, 5% and 1%, while other coarse grains areas are expected to remain unchanged. Decreasing harvested areas of rice in China, Japan and Brazil will be offset by gains in India, Thailand and African countries. Land availability compared to the previous decade is going to be limited in the future, as many governments place constraints on converting forest or pasture into arable land, as well as ongoing urbanisation, so increased global production is expected to be largely driven by intensification. This growth in yields from improving technology and cultivation practices, in middle-income countries in particular, is expected to sustain future cereals production. Globally, yields are projected to grow about 8% for wheat and other coarse grains, 9% for maize and 10% for rice.

Global wheat production is expected to increase by 76 Mt to 855 Mt by 2032, of which 40 Mt will be in Asia (Figure 3.1), a slower growth rate than in the last decade.

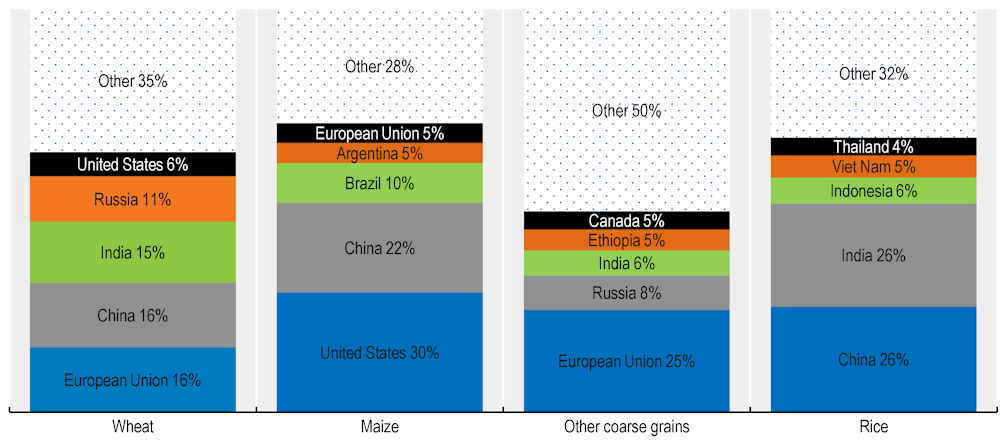

India, the world’s third largest wheat producer, is expected to provide the largest share of the additional wheat, accounting for more than a quarter of the global production increase, driven by yield improvements and area expansion in response to national policies to improve self-sufficiency. There will also be significant production increases in Russia, Canada, Argentina and Pakistan. The European Union is projected to become the largest producer of wheat by 2032 (Figure 3.4), overtaking China, where wheat production is responding to demand decreases from negative population growth.

Figure 3.4. Global cereal production concentration in 2032

Copy link to Figure 3.4. Global cereal production concentration in 2032

Note: Presented numbers refer to shares in world totals of the respective variable

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Global maize production is expected to grow by 165 Mt to 1.36 bln t by 2032, with the largest increases in the United States and China, followed by Brazil, Argentina and India. Increased production in Brazil will be largely driven by higher second-cropped maize following the soybean harvest. Production growth in the United States is expected below the global average of 1.2% p.a., at 0.6% p.a. over the next ten years.

In Sub-Saharan Africa, total maize output is projected to increase by 24 Mt, of which white maize will account for the largest share. Increases in maize production are expected to stem primarily from yield improvements.

Maize production in China decreased between 2015 and 2018 due to policy changes in 2016 that reduced price support to end stock piling; these were replaced with market-oriented purchasing policies combined with direct subsidies to farmers. In 2015, the stock-to-use ratio of maize was estimated at almost 80%, falling to about 52% in the past three years, which is very close to the ratio estimated for the period 2007 to 2009 before stocks started to accumulate. This indicates that the temporary stocks were depleted by 2019. A stock-to-use ratio of about 50% is assumed during the outlook period. With Chinese farmers adapting to the new policy, maize production should gain in competitiveness. Indeed, China is projected to contribute almost a fourth to increases in global maize output.

Global production of other coarse grains is projected to reach 330 Mt by 2032, up 23 Mt from the base period. African countries will contribute almost 75% to this increase. Africa has the fastest growing population and relies on grains such as millet and sorghum, mainly for food. On a single country basis, Ethiopia, India, Nigeria, and Argentina will contribute most to global production growth. Output in the European Union will decrease compared to the base period, which includes the record harvest of 2020, due to slower growth in feed demand.

Global rice production is expected to grow by 55 Mt to reach 577 Mt by 2032. Yield improvements are expected to drive this growth. Production expansions in Asian countries, which account for the bulk of global rice output, are expected to be robust. The highest growth is expected in India, followed by the LDC Asian region, Viet Nam, Thailand and China. India will remain a major producer of indica and basmati rice.

China, the world’s largest rice producer, is expected to increase production at a similar pace to the last ten years. As most other major rice producers, projected output gains in China are expected to rely on yield improvements, amid expectations that efforts to move least productive land out cultivation will continue, as part of broader efforts to improve the quality of rice production. Production in high-income countries, such as the Korea, Japan is expected to remain on a downward trend. While output in the European Union will remain close to base period levels, in the United States and Australia it will expand by about 0.7% and 1.7% p.a. respectively.

3.3.3. Trade

Trade in cereals will remain buoyant but with changing country shares

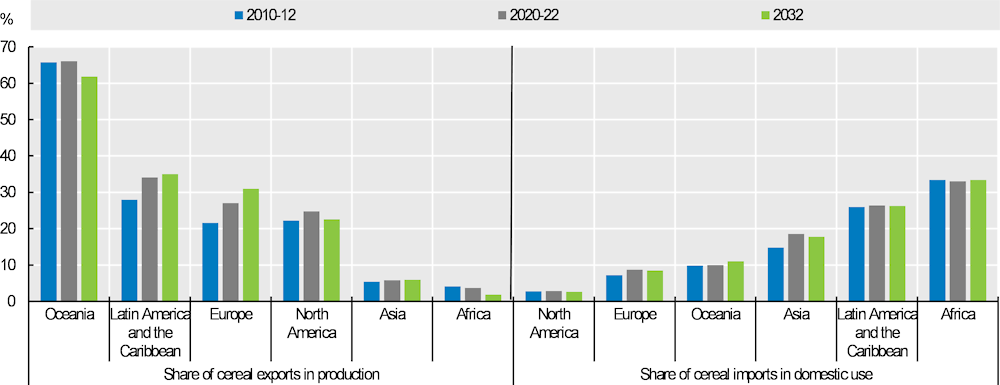

Trade in cereals presently accounts for about 17% of global consumption and this share is projected to stay at a similar level until 2032. Traditionally, the Americas and Europe supply cereals to Asia and Africa, where growing demand for food and feed from rising populations and expanding livestock sectors is rising faster than domestic production. This buoyant trend is expected to continue over the next decade with exports of cereals increasing by 11% from the base period to 2032. Figure 3.5 illustrates how important cereal trade is relative to production and consumption. Net trade of cereals is low for Oceania and Latin America and the Caribbean, although the two regions are expected to have among the highest shares of grain exports in national production, 62% and 35% respectively by 2032. Amongst all regions, it is Africa where imports of cereals contribute most to domestic consumption and by 2032 almost 34% of domestic cereal use in Africa will originate from non-African countries.

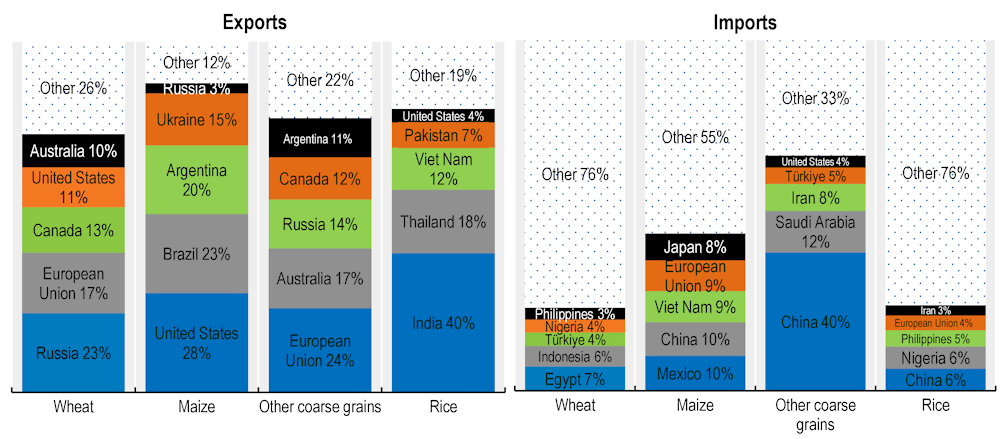

Wheat exports are expected to grow by 20 Mt to 214 Mt by 2032, with Russia expected to maintain its position as the main exporter, accounting for 23% of global exports by 2032 (Figure 3.6).

The European Union, the second largest wheat exporter, will account for 17% of global trade in 2032, although exports are projected below the record volumes of 2019 and 2022. Compared to the base period, the European Union is expected to maintain international market shares mainly due to constrained growth in the Black Sea region. For the same reason, and due to the harvest failure of 2021 that reduced the base period trade volume, Canada is expected to gain export shares and reach 13% of global wheat exports by 2032. The United States, Canada, Australia and the European Union are expected to retain the higher quality protein wheat markets, particularly in Asia. Russia and Ukraine may play a role in these markets, but will be more competitive in soft wheat markets, such as East Africa and the Middle East. Wheat imports by the North African and the Near East regions are set to slightly increase the share of their imports in total trade from 25% currently to 26% over the next decade.

Figure 3.5. Trade as a percentage of production and consumption

Copy link to Figure 3.5. Trade as a percentage of production and consumption

Note: These estimates include intra-regional trade except for the European Union.

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Figure 3.6. Global cereal trade concentration in 2032

Copy link to Figure 3.6. Global cereal trade concentration in 2032

Note: Presented numbers refer to shares in world totals of the respective variable

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Maize exports are expected to grow by 18 Mt to 202 Mt by 2032. The export share of the top five exporters – the United States, Brazil, Argentina, Ukraine and Russia (overtaking the European Union as fifth largest maize exporter) – will account for 88% of total trade towards the end of the projection period. The United States is expected to remain the top maize exporter, although below the peak in 2020 and its export share will drop to 28%. Increasing export shares are expected for Brazil (23%) as production of second-crop maize increases. The LDC Sub-Saharan African region is expected to remain virtually self-sufficient in maize, with white maize continuing to play a key role for food security as a mainstay in local diets. South Africa will remain a regional supplier, but expansion will be limited as they produce genetically modified organisms (GMO) varieties that face import restrictions in neighbouring countries.

Mexico is projected to become the largest maize importer as import growth in the European Union is slowing down and China’s imports are projected to stay below the large volumes in 2020 and 2021 which made the country the top-importer.(Figure 3.6). However, current policy discussion to ban imports of GMO maize may alter these projections (Box 3.1).

The international trade volume of other coarse grains, dominated by barley and sorghum, is much smaller than for maize or wheat. Global exports are expected to remain stable compared to the base period level at 50 Mt in 2032. The top five exporters – the European Union, Australia, Russia, Canada and Argentina are projected to account for 78% of global trade by 2032, 3 percentage points above the volume in the base period and mainly driven by export increases in Russia. The five major importers – China, Saudi Arabia, the Islamic Republic of Iran, Türkiye, and the United States – absorb almost 67% of global trade, with China expected to account for 40% by 2032.

As it is assumed that maize production in China will increase more significantly than in the past decade, the net-feed deficit will decrease over the medium term. However maize imports are assumed reach 19 Mt through by the end of the projection period, well above the WTO agreed TRQ level, while imports of sorghum and barley are as well projected to increase to 19 Mt.

As during the past decade, rice trade is projected to grow at 1.9% p.a. over the next ten years, with overall export volumes rising by 12 Mt to reach 63 Mt by 2032. The export share of the top five major rice exporters – India, Thailand, Viet Nam, Pakistan, and the United States – is expected to increase from 77% to 81%. India is projected to remain the world’s leading supplier of rice, while ongoing changes in the varietal make up of production and the increased focus on cultivating higher quality strains could help Viet Nam expand its market share in regions other than Asia. Thailand is projected to remain the second largest rice exporter but is to continue facing strong competition for markets.

Less developed countries in Asia, particularly Cambodia and Myanmar, are projected to register strong export expansion, with their rice shipments collectively increasing by 29% from 4.0 Mt in the base period to 5.2 Mt by 2032, amid expectations that large exportable supplies will allow these countries to capture a greater share of Asian and African markets. Historically, Indica rice has accounted for the bulk of rice traded internationally. However, demand for other varieties is expected to continue to grow over the next decade.

Imports by China, the largest importer of rice, are expected to drop from 5 Mt in the base period to 4 Mt in 2032, well below the peak in 2015. Imports are projected to increase significantly in African countries, where growth in demand continues to outpace production growth. Nigeria is projected to become the second largest importer of rice, increasing imports by 2.4 Mt to 4.0 Mt, or the equivalent of 38% of domestic consumption by 2032. Overall, imports by African countries are expected to increase from 18 Mt in the base period to 29 Mt by 2032, increasing Africa’s share of world imports from 34% to 45%. In addition to China and Nigeria, the group of five major importers in 2032 is projected to include the Philippines, the European Union and the Islamic Republic of Iran, which overall would account for 25% of global rice imports by 2032.

3.3.4. Prices

Prices for cereals in real terms are expected to decline over the next decade

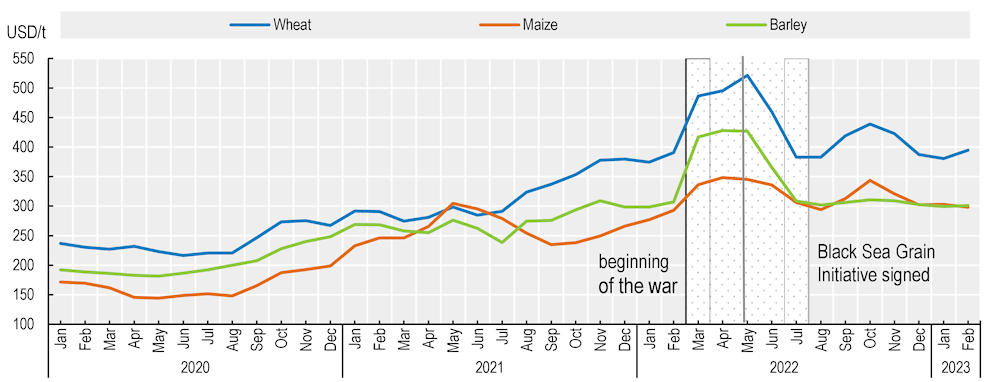

The world wheat price averaged USD 319/t in the 2022 calendar year, the highest recorded in the past 20 years. Prices increased sharply when Russia’s war against Ukraine started in February and remained high for several months mainly driven by the uncertainty about supplies to international markets. With increased seasonal supplies from harvests in the northern hemisphere and an agreement reached on the Black Sea Grain Initiative, prices started to fall before the agreement was signed in late July 2022. By early 2023 international wheat prices had fallen to their pre-war levels but remain elevated. Market prices for maize and barley have shown similar patterns since 2020 (Figure 3.7).

Figure 3.7. Monthly prices for wheat, maize and barley

Copy link to Figure 3.7. Monthly prices for wheat, maize and barley

Note: Wheat: US wheat, No.2 Hard Red Winter, fob Gulf; maize: US Maize, No.2 Yellow, fob Gulf; barley: France, feed barley, fob Rouen

Source: Food Price Monitoring and Analysis (FPMA) Tool.

Nominal wheat prices are expected to remain below the 2022 level but remain elevated for another season before returning to their medium-term trend. After dropping, the price is projected to increase to USD 293/t by 2032. For maize and other coarse grain prices it is also expected that they return to the medium-term path by 2025. Over the medium term the global maize price is expected to reach USD 226/t and the price for other coarse grains (measured by the feed barley price fob Rouen) is projected to reach USD 255/t (Figure 3.8).

The reference export price for milled rice (FAO All Rice Price Index normalised to India 5%) moved within a narrow band of USD 387/t and USD 420/t between 2018 and 2022. In 2023, international rice prices are expected to increase, largely owing to tighter exportable supplies stemming from production contractions in some important exporters. Over the medium term, demand from countries in Far East, Africa, and the Middle East is expected to grow, but supply increases in exporters are expected to generate only a small increase in nominal prices to USD 459/t by 2032

Over the medium-term, prices for wheat, maize, other coarse grains and rice are expected to decline to 2032 when adjusted for inflation (real terms).

Figure 3.8. World cereal prices

Copy link to Figure 3.8. World cereal pricesNote: Wheat: US wheat, No.2 Hard Red Winter, fob Gulf; maize: US Maize, No.2 Yellow, fob Gulf; other coarse grains: France, feed barley, fob Rouen; rice: FAO all rice price index normalised to India, indica high quality 5% broken average 2014-2016. Real prices are nominal world prices deflated by the US GDP deflator (2022=1). Rice on secondary axis. Prices refer to marketing years.

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

3.4. Risks and uncertainties

Copy link to 3.4. Risks and uncertaintiesA much more volatile market and policy environment in the next decade?

More than most other commodities, grain markets have been and could continue to be markedly affected by the outcome of the Russia’s war against Ukraine given their strong participation in international markets, especially for wheat and maize, as well as fertilisers and fossil fuels. The production and export expectations for cereals from both countries, especially for Ukraine, would be lower than presented in this Outlook with a prolonged duration of the crisis. Moreover, with a continuing crisis, countries in East Africa and the NENA region that depended on cereal imports from the Black Sea region in the past have already started to find new sources of supply, but this process is not finished. The Black Sea Grain Initiative has eased the tense situation, but the extension of this deal is subject to many uncertainties. Rising fertiliser prices due to ongoing supply disruptions, the Russia’s war against Ukraine, and other factors may lead to decreased yields in the short term, particularly in low-income countries. The resulting increase in commodity prices could exacerbate an already potentially difficult international food security situation.

Several other factors could impact on the cereals market that are not reflected in the current projections. While normal assumptions for weather lead to positive production prospects for the main grain-producing regions, extreme weather events accentuated by climate change may cause higher volatility in cereal yields, thereby affecting global supplies and prices. There are heightened risks in some regions of water scarcity constraining production.

The policy environment will be crucial. The reinforcement of food security and the focus on increased sustainability in anticipated reforms (e.g. the Farm to Fork Strategy in the European Union) as well as policies favouring biofuels (Brazil and India) will heighten competition in the demand for cereals. China’s domestic policies, which are an increasing influence on domestic production and import demand, are also crucial for future developments in cereal markets. Trade restrictions could provoke market reactions and changes in trade flows such as the past export measures applied to grains and rice. Relaxing policies related to GMO and gene editing could have a significant impact on the potential for cereal production globally, as could the speed of adoption of available conventional technologies and improved farm practices. These policy changes could also go in the opposite direction if countries become more GMO-unfriendly (Box 3.1).

Crop pests and animal diseases are a continuing risk that could disrupt markets. On the supply side, this is the case in regions with limited resources to mitigate the impacts of such events. Examples are the recent locust and fall army worm outbreaks, which have undermined food security in several Asian and African countries. Animal diseases could reduce feed demand, as seen recently with the effects of the African Swine Fever (ASF) outbreak in SE Asia.

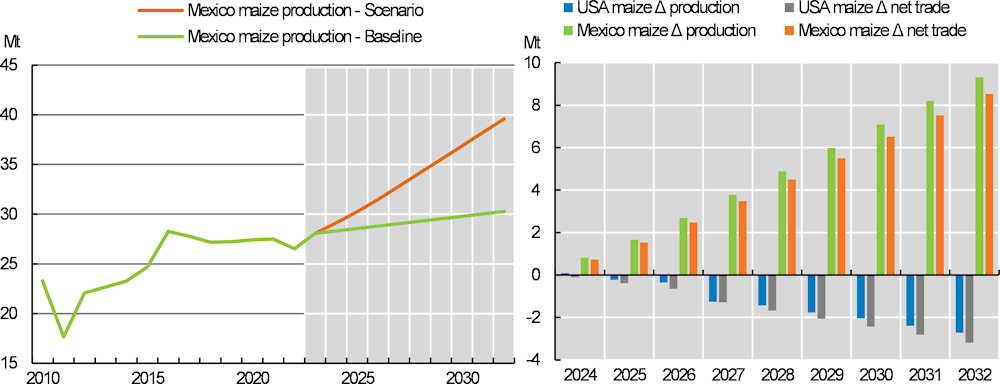

Box 3.1. Mexico’s National Development Plan

Copy link to Box 3.1. Mexico’s National Development PlanIn December 2020, the Mexican Government issued a decree with the aim of eliminating the use of glyphosate and GMO maize by the year 2024 in order to meet objectives set out by the National Development Plan (Plan de Desarrollo Nacional). This decree was revised in February 2023 to meet the requirements of the USMCA free trade agreement, allowing the use of GMO crops in the feed and industry sectors, but prohibiting their use for human consumption, such as in maize flour and tortillas.

The Mexican Government also launched the programme “Sembrando Vida” in an effort to foster food self-sufficiency and alleviate rural poverty and environmental degradation in specific areas. Additionally, the government is attempting to reduce dependence on global grains markets, particularly maize, which represented 17% of the total value of agricultural imports in 2021.

In 2022, Mexico was the sixth largest maize producer globally, producing 27 Mt, yet it has been among the largest maize importers for years, importing 17 Mt in 2022. Production has increased by an average of 1.8% per year over the past decade, matching food demand at 1.28% per year, but imports have grown even faster, at 8.5% p.a., due to the surge in demand for feed, which has increased by almost double in the last decade. The majority of Mexico's maize imports come from the United States and are mainly GMO yellow maize.

In Mexico, maize production is not limited to certain regions like it is in many other large maize-producing countries; instead, it is spread across the entire country and covers different agroecological zones. As a result, 62% of the total maize production is from federal states with yields below the national average. The southern region, which makes up around half of Mexico's total maize production area, has below-average incomes and lacks infrastructure compared to more developed regions such as the centre and north. To address this discrepancy, the National Development Plan 2019-2024 aims to close the gap between the wealthy and poorer regions in the country, including the difference in income and productivity among farmers in the south.

The following scenario has been conducted with the Aglink-Cosimo model which assumes an increase in the average yield in Mexico of 23% with respect to the baseline value. Rather than assuming an immediate increase, this ambitious target is assumed to be gradually met by 2032 (Figure 3.9). This estimate was calculated by identifying the states included in the “Sembrando Vida” programme in which maize yields are below the country average and then increasing their yield to the country average yield in 20201 according to “Sistema de Información Agralimentaria y Pesquera” (SIAP) data in Mexico.2

The scenario results imply that if yields are improved this way, maize production in Mexico could be raised by 10.5 Mt, with imports decreasing by about the same amount. Despite this, Mexico will still be a net importer at 12.5 Mt. To become self-sufficient also for feed markets, yields need to be increased even further. The expected lower Mexican maize imports would decrease United States maize production by 2.7 Mt or -0.7%, compared to the baseline in 2032. Nevertheless, the decline in United States maize exports is smaller compared to the decline in Mexican imports. Global maize prices would be 2.5% lower than in the baseline.

This analysis assumes that yield improvement is attainable. Technically, it is feasible to reach such yields; experiments conducted by the Centro Internacional de Mejoramiento de Maíz y Trigo (CIMMYT) in Chiapas, Mexico ‒ a state with one of the lowest maize yields ‒ showed that with adequate agronomic practices, yields could reach approximately 4 t/ha3, close to the target yield assumed in this scenario. Nonetheless, the discussion and analysis on the efforts required to achieve such a goal are beyond the scope of this scenario.

Figure 3.9. Effects of maize yield increases in Mexico on production and trade in Mexico and the United States

Copy link to Figure 3.9. Effects of maize yield increases in Mexico on production and trade in Mexico and the United States

Note: Right panel shows absolute changes between scenario and baseline

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Notes

1. Chiapas, Oaxaca, Puebla, Veracruz, Guerrero, México, Hidalgo, Durango, San Luis Potosí, Tabasco, Campeche, Querétaro, Tlaxcala, Aguascalientes, Quintana Roo, Morelos, Yucatán, Nayarit and Colima.

Note

Copy link to Note← 1. White maize and yellow maize are the most prevalent colours of maize globally. The Outlook does not distinguish maize by colour though. Nutritionally, there is no difference between differently coloured types of maize, yet regional preferences and domestic availability drive demand.