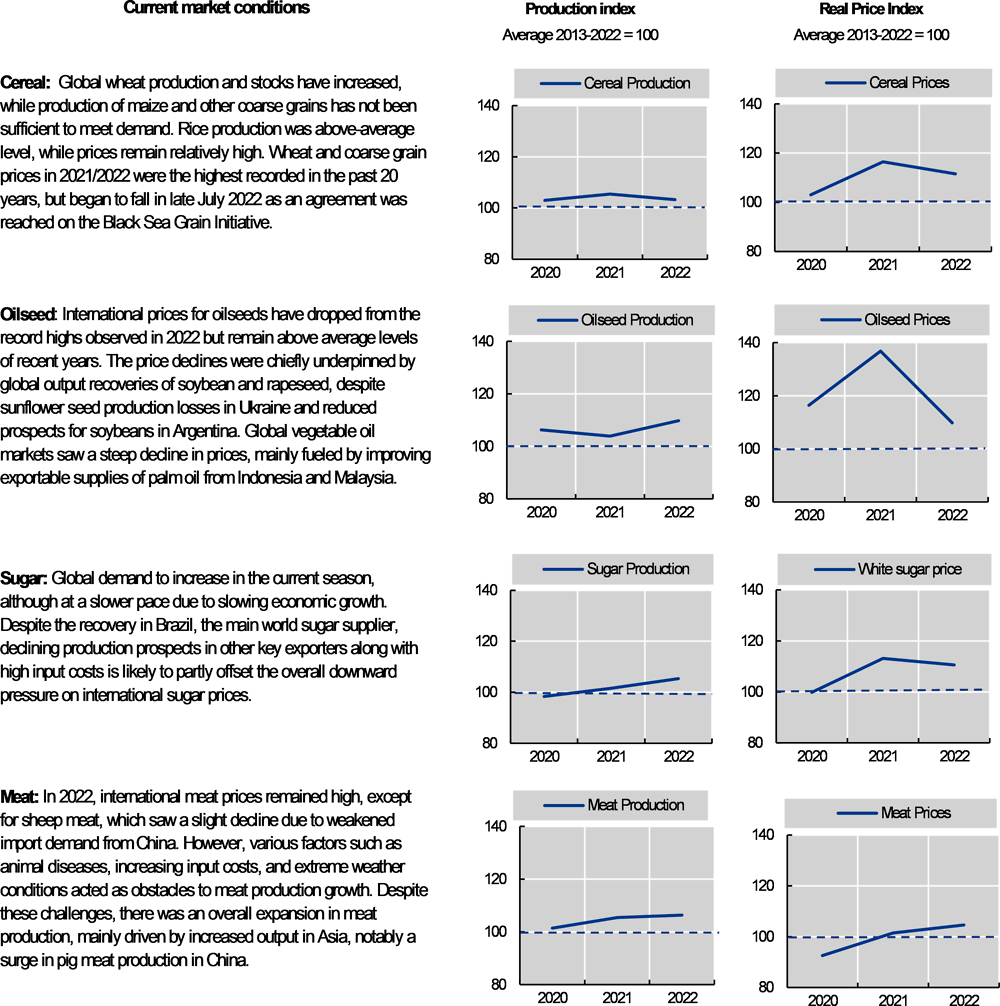

This chapter presents the trends and prospects of the OECD-FAO Agricultural Outlook 2023-2032 derived from the medium-term projections of the most globally produced, consumed and traded agricultural and fish commodities. Following a description of the macroeconomic and policy assumptions underlying the projections, it highlights the key findings for the consumption, production, trade, and prices of those commodities for the period 2023 to 2032. Agricultural demand is projected to grow more slowly over the coming decade due to the foreseen slowdown in population and per capita income growth. Production of agricultural commodities is also projected to grow at a slower pace. The reduced growth incentives are not only driven by a weakening global demand for agricultural products but by decelerating productivity growth resulting from increased input prices, notably fertilisers, and tightening of environmental regulations. The expected developments in global demand and supply will keep real agricultural prices on a slightly declining trend over the next decade. International trade will remain essential for food security in food-importing countries and for the livelihoods of workers along the food supply chains in food-exporting countries. There is a growing risk that weather variability, animal and plant diseases, changing input prices, macro-economic developments, and other policy uncertainties will lead to deviations in market outcomes from the current projections.

OECD-FAO Agricultural Outlook 2023-2032

1. Agricultural and food markets: Trends and prospects

Copy link to 1. Agricultural and food markets: Trends and prospectsAbstract

The OECD-FAO Agricultural Outlook is a collaborative effort of the Organisation for Economic Co-operation and Development (OECD) and the Food and Agriculture Organization of the United Nations (FAO). It presents a consistent baseline scenario for the evolution of agricultural commodity and fish markets at national, regional, and global levels for the period 2023 to 2032. This baseline scenario incorporates the commodity, policy, and country expertise of both organisations, as well as input from collaborating Member countries and international commodity bodies.

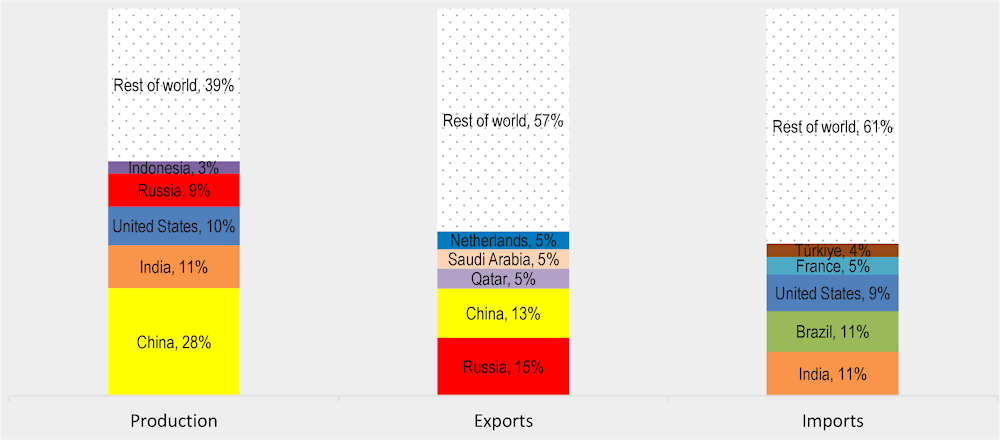

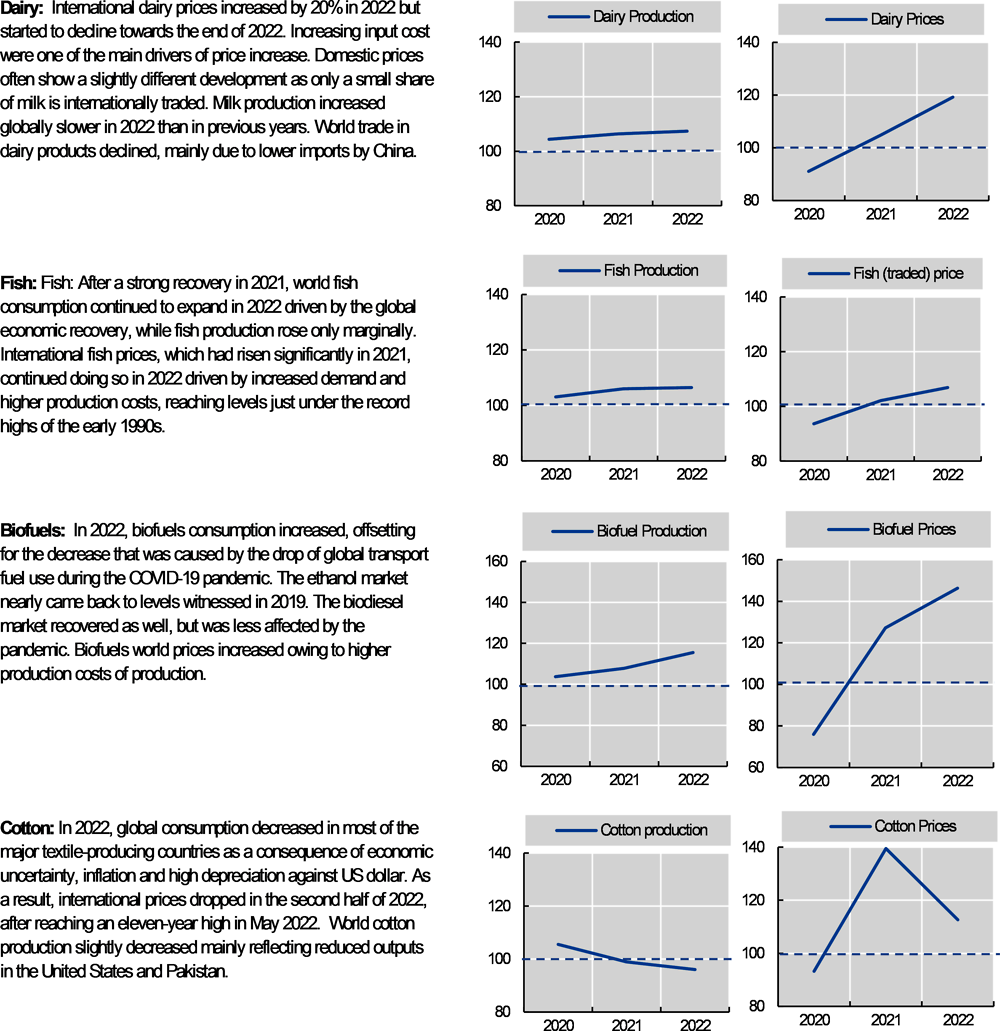

The baseline projections are based on the OECD-FAO Aglink-Cosimo model, which links sectors and countries covered in the Outlook to ensure consistency and global equilibrium across all markets. The projections are influenced by current market conditions (summarised in Figure 1.1), as well as assumptions about macroeconomic, demographic, and policy developments, which are detailed in Section 1.1.

The projections are based on a short-term assessment of the Russian Federation’s (hereafter “Russia”) war against Ukraine, no evaluation of medium-term market prospects in the region can be provided at this time.

The baseline of the Outlook serves as a reference for forward-looking policy planning and the underlying Aglink-Cosimo model allows simulation analysis, including the assessment of market uncertainties. A detailed discussion of the methodology of the projections, as well as documentation of the Aglink-Cosimo model, are available online at www.agri-outlook.org.

The Outlook contains four parts:

Part 1: Agricultural and food markets: Trends and prospects. Following the description of the macroeconomic and policy assumptions underlying the projections (Section 1.1), this chapter presents the main findings of the Outlook. It highlights key projections and provides insights into the main outcomes and challenges facing agri-food systems over the coming decade. The chapter presents trends and prospects for consumption (Section 1.2), production (Section 1.3), trade (Section 1.4), and prices (Section 1.5).

Part 2: Regional briefs. This chapter describes key trends and emerging issues facing the agricultural sector in the six FAO regions, i.e. Asia and Pacific, which is split into Developed and East Asia (Section 2.1) and South and Southeast Asia (Section 2.2), Sub-Saharan Africa (Section 2.3), Near East and North Africa (Section 2.4), Europe and Central Asia (Section 2.5), North America (Section 2.6), and Latin America and the Caribbean (Section 2.7). It highlights the regional aspects of production, consumption and trade projections and provides background information on key regional issues.

Part 3: Commodity chapters. These chapters describe recent market developments and highlight medium term projections for consumption, production, trade, and prices for the commodities covered in the Outlook. Each chapter concludes with a discussion of the main issues and uncertainties that might affect markets over the next ten years. This part consists of nine chapters: cereals (Chapter 3), oilseeds and oilseed products (Chapter 4), sugar (Chapter 5), meat (Chapter 6), dairy and dairy products (Chapter 7), fish (Chapter8), biofuels (Chapter 9), cotton (Chapter 10), and other products (Chapter 11).

Part 4: Statistical Annex. The statistical annex presents projections for production, consumption, trade, and prices for agricultural commodities, fish, and biofuels, as well as macroeconomic and policy assumptions. The evolution of markets over the outlook period is described using annual growth rates and data for the final year (2032) relative to a three-year base period (2020-22). The statistical annex is not part of the printed version of the Outlook but can be accessed online.

Figure 1.1. Market conditions for key commodities

Copy link to Figure 1.1. Market conditions for key commodities

Note: All graphs expressed as an index where the average of the past decade (2013-2022) is set to 100. Production refers to global production volumes. Price indices are weighted by the average global production value of the past decade as measured at real international prices. More information on market conditions and evolutions by commodity can be found in the commodity snapshot in the Annex and the online commodity chapters.

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

1.1. Macroeconomic and policy assumptions

Copy link to 1.1. Macroeconomic and policy assumptions1.1.1. The main assumptions underlying the baseline projections

This Outlook presents a consistent baseline scenario for the medium-term evolution of agricultural and fish commodity markets, based on a set of macro-economic, policy and demographic assumptions. The main assumptions underlying the projections are highlighted in this section. Detailed data are available in the Statistical Annex.

1.1.2. Population growth

The Outlook uses the Medium Variant set of estimates from the United Nations Population Prospects database.

Over the projection period, world population is expected to grow from 7.9 billion in 2022 to 8.6 billion people in 2032. This corresponds to an average annual growth rate of 0.8%, a slowdown compared to the 1.1% p.a. rate experienced over the last decade. Population growth is concentrated in low-income countries, particularly Sub-Saharan Africa which is expected to have the fastest growth at 2.4% p.a. over the coming decade. The population of the People’s Republic of China (hereafter “China”) declined for the first time in 2022 (according to the 2022 Revision of the United Nations Population Prospects)and is expected to decline further over the projection period to 1.41 billion inhabitants in 2032. With a population of 1.52 billion people in 2032, India is expected to overtake China in 2024 as the most populous country of the world. The populations of several European countries, Japan, and Korea are expected to decline during the projection period.

Figure 1.2. World population growth

Copy link to Figure 1.2. World population growthNote: SSA is Sub-Saharan Africa; LAC is Latin America and Caribbean; ECA is Europe and Central Asia; NENA stands for Near East and North Africa, and is defined as in Chapter 2; Rest of Asia is Asia Pacific excluding China and India.

Source: OECD/FAO (2023), "OECD-FAO Agricultural Outlook", OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

1.1.3. GDP growth and per capita income growth

National GDP and per capita income estimates for the coming decade are based on the IMF World Economic Outlook (October 2022). Per capita incomes are expressed in constant 2010 United States dollars.

Following a decline from 5.8% in 2021 to 3% in 2022, global GDP growth is expected to continue to slow down in 2023 and to stabilise at an average rate of 2.6% over the next decade. Over the period 2023-32, GDP will continue to grow the strongest in the Asia Pacific region, in particular in India, China and Southeast Asia. In Sub-Saharan Africa, and the Near East and North Africa, average GDP growth is projected to be higher than the global average, whereas that of Latin America and Caribbean and OECD countries is projected to be lower.

National average per-capita income is approximated in this Outlook using per capita real GDP. This indicator is used to represent household disposable income, which is one of the main determinants of demand for agricultural commodities. As shown in the World Bank’s Poverty and Shared Prosperity 2022 report, national economic growth is unevenly distributed. This is particularly the case with Sub-Saharan countries, where the incomes of the poorest 40% of the population have lagged average income growth. For this reason, national average food demand projections in this Outlook can deviate from what might be expected based on average income growth. In addition, the COVID-19 pandemic has deepened income inequalities within countries; the percentage income losses of the poorest are estimated to be double those of the richest, thereby delaying access to high-value food products for the poorest populations whose primary source of calories is derived from staples.

After a recovery in 2021, global per capita income growth was 2% p.a. in 2022 and is expected to weaken in 2023 to 1% p.a. Over the next decade, an average annual growth rate of 1.7% p.a. in real terms is projected. Strong per capita income growth is expected in Asia, especially in Viet Nam (5.6% p.a.), India (5% p.a.), China (4.7% p.a.), the Philippines (4.5% p.a.), Indonesia (4% p.a.), and Thailand (3% p.a.). In Sub-Saharan Africa, average per capita incomes are projected to grow slowly at 1.1% p.a. over the coming decade. Strong population growth limits the real per capita income increase in Sub-Saharan Africa. Ethiopia is expected to experience robust growth at 4% p.a. due to a very low base and increasing economic stability. In Latin America and the Caribbean, average per capita income growth is projected at 1.6% p.a., with smaller regional variations. In the Near East and North Africa region, average per capita income growth is projected at 1.7% p.a., led by the Near East region and Egypt. In OECD countries, per capita income is projected to increase on average at around 1.4% p.a.

Figure 1.3 decomposes the GDP growth projections into per capita GDP and population growth for key regions and selected countries. Globally, economic growth will be mainly driven by per capita income growth. This is especially the case in OECD countries and China. By contrast, high population growth in Sub-Saharan Africa means that the relatively high rate of economic growth in the region (3.6% p.a.) corresponds to only a modest growth in per capita terms (at around 1.1% p.a.). The same applies to a lesser extent to the Near East and North Africa region. The modest economic growth in Europe at 1.5% p.a., where the population is expected to decrease over the next ten years, translates into a per capita income growth rate of 1.7% p.a. over the coming decade.

Note: SSA is Sub-Saharan Africa; LAC is Latin America and Caribbean; SEA is Southeast Asia; NENA stands for Near East and North Africa, and is defined as in Chapter 2. The graph shows per capita GDP in constant 2010 US dollars.

Source: OECD/FAO (2023), "OECD-FAO Agricultural Outlook", OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Note: SSA is Sub-Saharan Africa; LAC is Latin America and Caribbean; SEA is Southeast Asia; NENA stands for Near East and North Africa, and is defined as in Chapter 2.

Source: OECD/FAO (2023), "OECD-FAO Agricultural Outlook", OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

1.1.4. Exchange rates and inflation

Exchange rate assumptions are based on the IMF World Economic Outlook (October 2022). Some currencies are expected to appreciate in real terms compared to the United States dollar; this is the case for Brazil, Mexico, Chile, Argentina, and Paraguay, for which exports should be relatively less competitive on the international markets over the next decade. A very strong real appreciation is also expected in Nigeria, Ethiopia, and Ukraine, whereas a real depreciation is expected for South Africa, Japan, Korea, Norway, Australia, China, and the European Union.

Inflation projections are based on the private consumption expenditure (PCE) deflator from the IMF World Economic Outlook (October 2022). Despite high inflation rates in all countries in 2022, projected rates are expected to slow down in 2023 and over the next ten years through tighter monetary policies. In OECD countries, following an inflation rate of 13% in 2022, this is projected to ease at 4.4% p.a. over the coming decade, with an annual inflation rate of 2% p.a. for the United States, 2% p.a. for Canada, and 2.1% p.a. for the Euro zone. Among emerging economies, consumer price inflation is expected to remain high at 10.3% p.a. in Türkiye and 9.1% p.a. in Argentina, despite a strong decrease compared to the previous decade. Inflation should ease in India, from 4.8% p.a. to 3.8% p.a. and in Brazil, from 5.9% p.a. to 3.1% p.a. By contrast, China should experience the same rate of consumer price inflation (2% p.a.) as over the last decade. Inflation is projected to remain high in Sub-Saharan Africa, Ethiopia (12.6% p.a.), Nigeria (9.5% p.a.) and Ghana (6.9% p.a.). High inflation is also expected in Egypt (6.5% p.a.) and Pakistan (6.5% p.a.).

1.1.5. Input costs

Production projections in the Outlook incorporate a composite cost index which covers seeds and energy, as well as various other tradable and non-tradable inputs. It is based on historical cost shares for each country and commodity, and which are held constant for the duration of the outlook period. Energy costs are represented by the international crude oil price expressed in domestic currency. Costs of tradable inputs such as machinery and chemicals are approximated by the evolution of the real exchange rate, while the costs of non-tradable inputs (mainly labour) are approximated by the progress of the GDP deflator. Seed prices follow respective crop prices. Fertiliser costs, which are not included in the composite cost index, are explicit in yield and land allocation equations. Three fertiliser types are distinguished: nitrate, phosphate, and potassium. The quantities applied to single crops are decision variables, while prices are linked to crop and crude oil prices.

Historical data for world oil prices are based on Brent crude oil prices in 2021, taken from the short-term update of the OECD Economic Outlook N°112 (December 2022). For 2022, the annual average daily spot price in 2022 was used, while the December average daily spot price is used for 2023. For the remainder of the projection period, the reference oil price used in the projections is assumed to remain constant in real terms. After a decrease from USD 98/barrel in 2022 to USD 82/barrel in 2023 (USD 77/barrel and USD 63/barrel respectively in real terms), the oil price is assumed to increase to USD 98/barrel in nominal terms and USD 63/barrel in real terms in 2032.

1.1.6. Policy

Policies play a significant role in agricultural, biofuel, and fisheries markets, and policy reforms may therefore trigger changes in market structures. The Outlook assumes that policies currently in place will remain unchanged throughout the projection period, thus providing a useful benchmark for the evaluation and analysis of future policy changes.

The projections of the Outlook take into account the reform of the European Union (EU) Common Agricultural Policy (CAP) ‒ which came into force at the beginning of 2023 ‒ as EU Member States have submitted their CAP strategic plans to the Commission. However, several policy initiatives, notably under the European Green Deal and in particular the targets of the Farm to Fork and Biodiversity strategies and for which legislation is in preparation, are not reflected in the baseline because their objectives have not yet been quantified in detail. Therefore, in the case of the EU, only free trade agreements that had been ratified up to the end of September 2022 are considered, while others (e.g. EU-Mercosur) are pending.

The relationship between the EU-27 and the United Kingdom (UK) is based on the EU-UK Trade and Cooperation Agreement provisionally applied from 1 January 2021. A duty-free/quota-free trade relationship between the European Union and the United Kingdom is assumed.

The free trade agreements considered in the Outlook for regions other than the European Union are those ratified by the end of December 2022 (e.g. Association of Southeast Asian Nations, United States-Mexico-Canada Agreement (USMCA), African Continental Free Trade Area, Regional Comprehensive Economic Partnership).

The United States Inflation Reduction Act (IRA) of 2022, which includes funds for agriculture-related programs, is not considered in its entirety in the Outlook because the implementation of many provisions will not be effective immediately. However, the model considers the fact that the IRA has extended and increased production targets already in place in 2022 for renewable fuel programs and biomass-based diesel tax credits at both the state and federal levels.

1.2. Consumption

Copy link to 1.2. ConsumptionThe Outlook projects future trends in the use of the main crop commodities (cereals, oilseeds, roots and tubers, pulses, sugar cane and sugar beet, palm oil and cotton), livestock products (meat, dairy, eggs, and fish),1 and their by-products2 as food, animal feed, raw materials for biofuels and other industrial uses. The demand for food and non-food uses of agricultural commodities and their changing components is projected based on an assessment of the main driving factors: population dynamics, disposable incomes, prices, consumer preferences and policies. The baseline thereby covers the final use of minimally processed crops, but also includes first level processing, such as the crush of oilseeds and the subsequent use of the derived products as food, feed and biofuel. Accounting for direct feed use of cereals, as well as the use of processed products such as protein meal, fishmeal, cereal bran, and other by-products in the livestock sector allows the Outlook to identify the sector’s net contribution to human nutrition and to gauge the potential impact of developments on global food and nutrition security.

1.2.1. Population and income growth remain key drivers of demand for agricultural commodities

Over the decade to 2032, the evolving energy and nutrition requirements of a growing and increasingly affluent global population are expected to be the key drivers of demand for agricultural commodities. The macroeconomic assumptions underlying the projections suggest a slowdown in global population growth alongside a decline in the population of China. Meanwhile, global economic growth will result in per capita income growth in most parts of the world. Projected rates of inflation are expected to slow down in 2023 and over the next ten years. However, economic developments and their respective impacts will vary by country. Furthermore, while global reference prices are expected to decline slightly in real terms, there is uncertainty how international price signals will transmit to domestic consumer prices and thereby impact demand at the local level. In addition, diverging population dynamics in different countries and regions, income-driven divergences in consumer preferences, and rapid urbanisation in many emerging economies will mean that consumption trends will also vary by country and region. Policy developments and social factors, alongside risks and uncertainties, are similarly likely to affect consumption to differing extents and outcomes at the local level, most importantly as income growth and distribution will continue to remain uneven across and within regions and countries. For example, in low-income countries where the share of food in household expenditures is high, income and food price shocks will have disproportionately larger consequences for consumption than in high-income countries. Preferences shaped by local culture and tradition will continue to lead to differences in demand for agricultural commodities among different regions and income classifications. Health and sustainability concerns are expected to increasingly shape the demand for food in affluent and emerging regions.

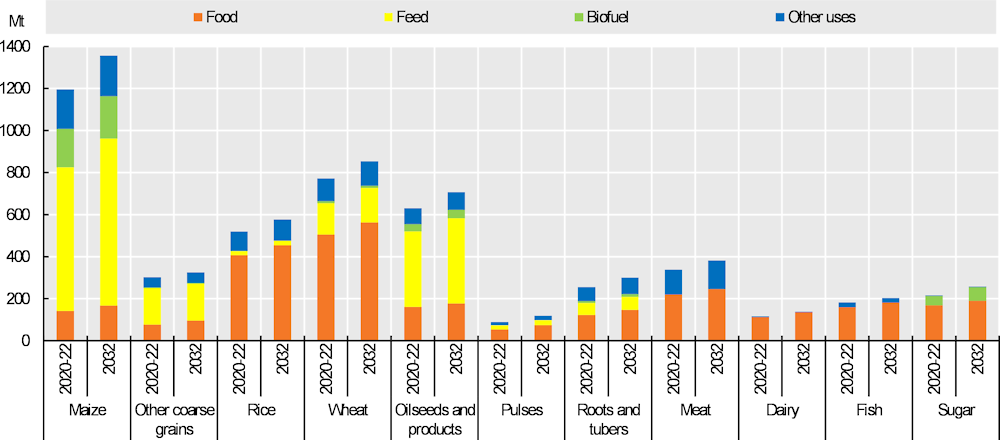

Food remains the primary use for basic agricultural crop commodities, currently accounting for 49% of quantities consumed at the global level. However, in recent decades feed and fuel uses have gained in importance. Prominently, growth in the global production of animal products has necessitated a substantially higher allocation of crops to feed, which currently accounts for 26% of total global use. Biofuels and industrial applications, meanwhile, currently consume an estimated 8% of global agricultural crop output.

Amidst a globally rising production of animal products over the Outlook period 2023-2032, growth in the non-food use of crops is expected to continue to outpace growth in food use, due to intensifying livestock practices and increasing demand for biofuel. Growth in feed use will be particularly pronounced in maize and oilseeds, the two foremost feed components (Figure 1.5).

Figure 1.5. Global use of major commodities

Copy link to Figure 1.5. Global use of major commodities

Note: Crushing of oilseeds is not reported as the uses of 'vegetable oil' and 'protein meal' are included in the total; Dairy refers to all dairy products in milk solid equivalent units; Sugar biofuel use refers to sugarcane and sugar beet, converted into sugar equivalent units.

Source: OECD/FAO (2023), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

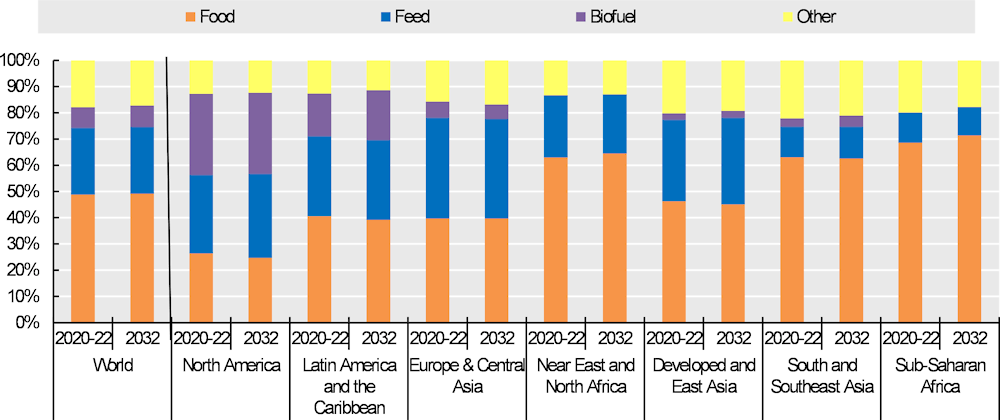

1.2.2. Geographic differences in using agricultural commodities

The use of agricultural commodities varies substantially by country and region (Figure 1.6). Most strikingly, the share of food use in Sub-Saharan Africa has remained above that of all other world regions, accounting for 69% of total use of agricultural commodities at present. This share is predicted to rise to 71% by the end of the Outlook period, as population growth is expected to have a larger effect on agricultural commodity demand than income growth, resulting in a larger expansion in the consumption of staple foods than of animal products across the region. At the other end of the spectrum is the distribution of agricultural commodities in North America, where food accounts for only 26% of total use, less than the share of feed or biofuels. The size as well as the feed-intensive production technology of the region’s livestock sector require a high use of agricultural commodities as feed. Increases in the feed use of agricultural commodities are also expected in Latin America and the Caribbean and the Near East and North Africa regions over the Outlook period, in part due to growth in production to satisfy the income-driven growth in the domestic consumption of animal products, but more importantly due to meat export growth.

Figure 1.6. Use of agricultural commodities by type and region

Copy link to Figure 1.6. Use of agricultural commodities by type and region

Note: the shares are calculated from the data in calories equivalent.

Source: FAO (2023). FAOSTAT Food Balances Database, http://www.fao.org/faostat/en/#data/FBS; OECD/FAO (2023), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

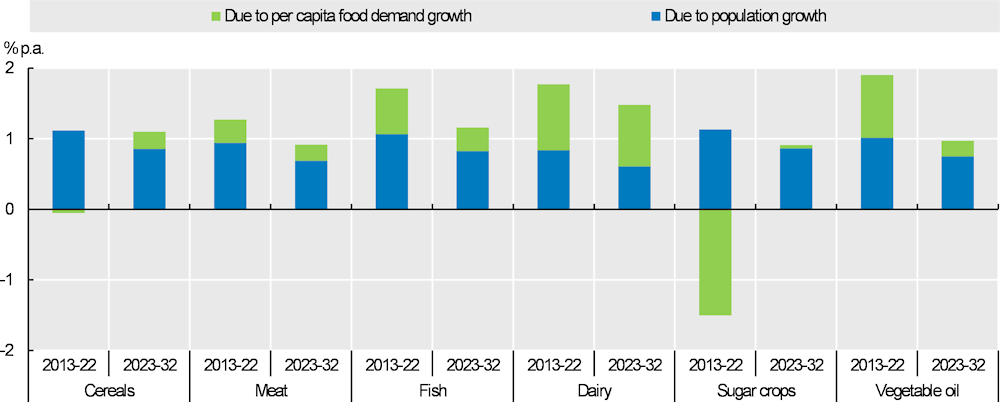

1.2.3. Key drivers of food demand for agricultural commodities

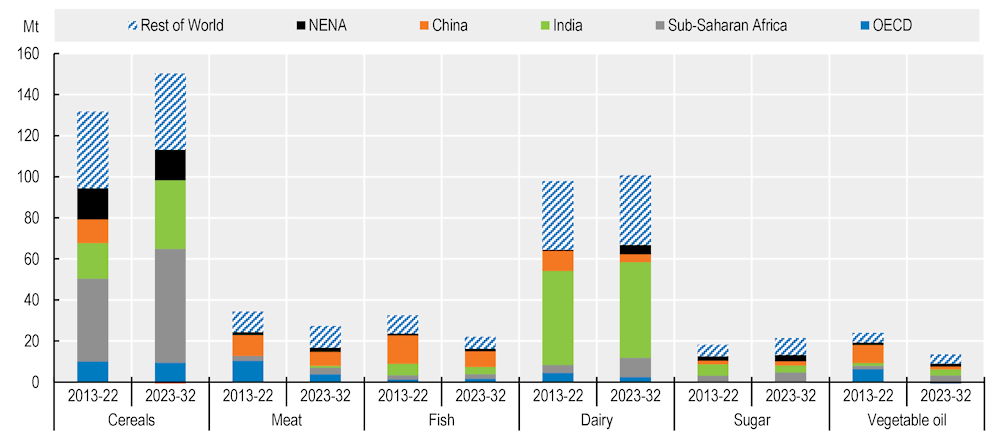

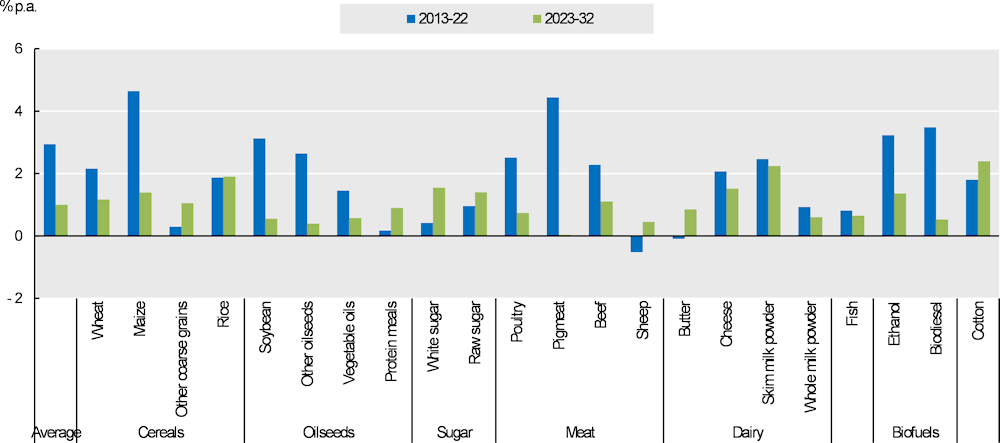

Under the baseline assumptions, population growth will continue to be the main factor shaping food demand at the global level, driven predominantly by the increasing consumption requirements of rising populations in Sub-Saharan Africa, India and the Near East and North Africa region. The projected developments in the global use of staples and fish will primarily be determined by population growth, while consumption growth of higher value products, especially fresh dairy, meat, and sugar will to large extent be fuelled by income-driven growth in per capita consumption (Figure 1.7). However, based on demographic and economic projections, global consumption of agricultural commodities, with the exception of sugar, is expected to expand less rapidly over the Outlook period than over the previous decade.

Figure 1.7. Average annual growth in demand for key commodity groups, 2013-22 and 2023-32

Copy link to Figure 1.7. Average annual growth in demand for key commodity groups, 2013-22 and 2023-32

Note: The population growth component is calculated assuming per capita demand remains constant at the level of the year preceding the decade. Growth rates refer to food demand.

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

1.2.4. Global outlook for food use of agricultural commodities

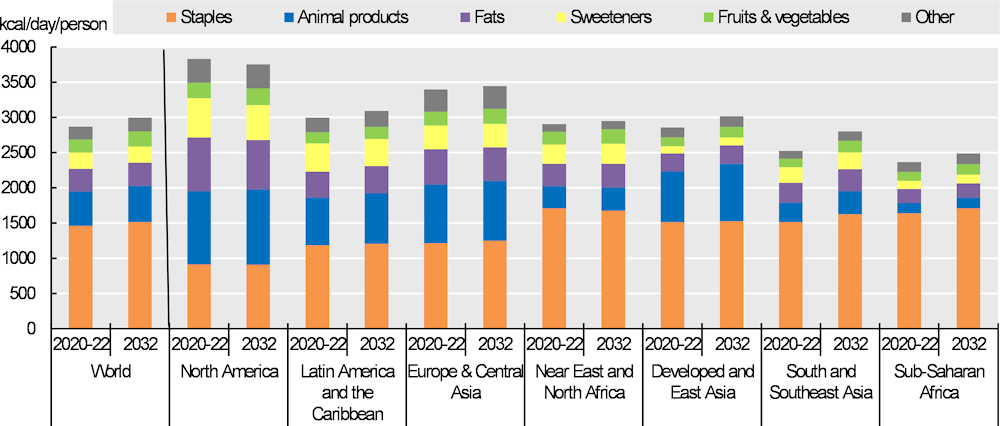

Due to the increase of the global population as well as gains in per capita income in all regions, total consumption of the food commodities covered in this Outlook is expected to rise by 15%. Overall, Asia will continue to play the most significant role in shaping global demand for food over the outlook period (Figure 1.9). The projected population increase in India as well as significant growth in per capita incomes in both India and China are expected to contribute significantly to growth in the consumption of all food commodities covered in the Outlook.

Global consumption of staples, the most significant source of calories, is expected to increase by 4% from the base period and account for just over half of total global food consumption in 2032, as measured in terms of daily per capita calorie availability (Figure 1.8). Since demand for staple foods is predominantly driven by population growth, the largest expansion in the consumption of staples is expected to take place in regions with the highest expected population growth. As such, the global consumption of staples will increase most importantly in Asia (lead by India), Sub-Saharan Africa, and the Near East and North Africa region.

However, globally, the growth of overall cereal demand, the most important staple, is expected to be slower over the next decade than it was in the past decade due to slowing growth in feed demand, biofuels, and other industrial uses. Moreover, in many countries direct human per capita food consumption of most cereals is approaching saturation levels, thus constraining gains in overall demand. Particularly in North America and Western Europe, per capita food use of cereals is expected to be stagnant, or even declining, due to low population growth and consumer preferences moving away from staple commodities.

Figure 1.8. Contribution of food groups to total daily per capita calorie food consumption by region

Copy link to Figure 1.8. Contribution of food groups to total daily per capita calorie food consumption by region

Note: Estimates are based on historical time series from the FAOSTAT Food Balance Sheets database which are extended with the Outlook database. Products not covered in the Outlook are extended by trends. The 38 individual countries and 11 regional aggregates in the baseline are classified into the four income groups according to their respective per-capita income in 2018. The applied thresholds are: low: < USD 1 550, lower-middle: < USD 3 895, upper-middle: < USD 13 000, high: > USD 13 000. Staples include cereals, roots and tubers and pulses. Animal products include meat, dairy products (excluding butter), eggs and fish. Fats include butter and vegetable oil. Sweeteners include sugar and HFCS. The category others includes other crop and animal products.

Source: FAO (2023). FAOSTAT Food Balances Database, http://www.fao.org/faostat/en/#data/FBS; OECD/FAO (2023), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Global consumption of higher value food will primarily expand in response to rising incomes in emerging markets in Asia, where approximately half of the increase will come from higher demand for meat and fish in China (Figure 1.19). India will account for most of the consumption growth for fresh dairy products and an important share of additional consumption of vegetable oil and sugar. In North America and Europe, income growth will similarly reduce per capita demand for basic foodstuffs, in particular for cereals, and thus facilitate a shift in consumption towards foods of higher nutritional value, most importantly in items that are dense in micronutrients such as fruits, vegetables, seeds, and nuts.

Figure 1.9. Regional contributions to food demand growth by region, 2013-22 and 2023-32

Copy link to Figure 1.9. Regional contributions to food demand growth by region, 2013-22 and 2023-32

Note: Each column shows the increase in global demand over a ten-year period, split by region, for food uses only. NENA stands for Near East and North Africa, and is defined as in Chapter 2.

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

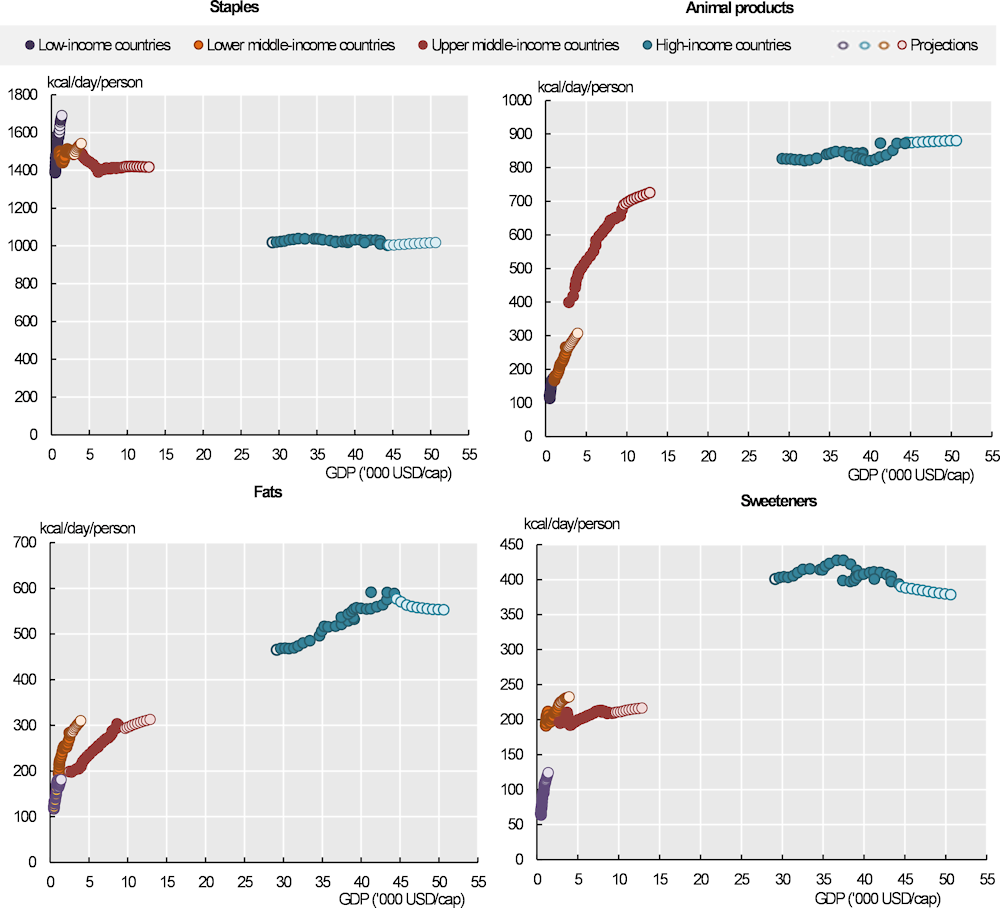

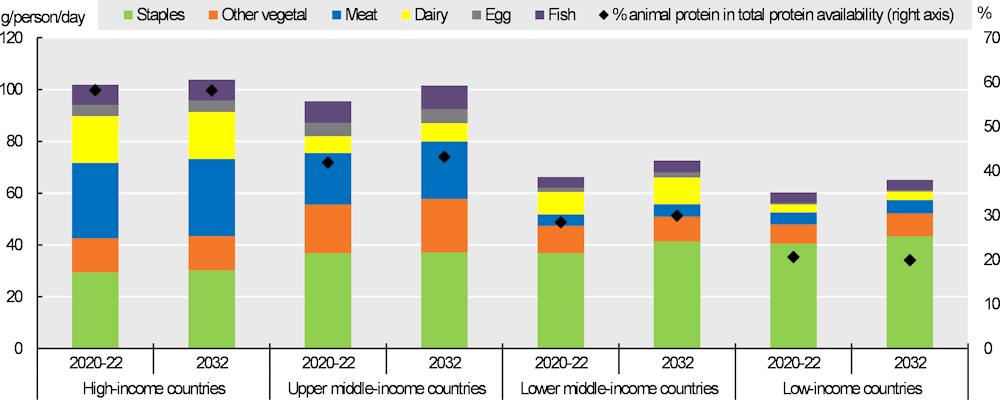

The consumption projections reflect varying developments in per capita incomes and their respective impact on food consumption patterns (Figure 1.10). As income rises, food consumption of the various food groups tends to increase rapidly, leading to a higher consumption of calories overall. At a certain income level, however, growth in food consumption begins to slow down. The level of income at which this takes place as well as the pace of the slowdown vary by food group. For example, the responsiveness of consumer demand to changes in income remains higher for animal products and some other higher priced items than for staple products.

In line with this, in high-income countries, per capita consumption of most food commodities is expected to level off due to saturation. Per capita consumption of sweeteners and fats are projected to decline over the coming decade due to growing health concerns and policy measures that discourage their excessive consumption.

In middle-income countries, the evolution towards the dietary patterns of high-income countries away from staples is expected to continue, with the consumption of animal products projected to increase at fast pace. Low-income countries, meanwhile, will continue to obtain most of their calories from staples. Due to income constraints, low growth in the consumption of animal products and other higher-value foods (e.g. fruits and vegetables) is expected in low-income countries.

Figure 1.10. Evolution of daily per capita calorie consumption, by food groups and income level

Copy link to Figure 1.10. Evolution of daily per capita calorie consumption, by food groups and income level

Note: Per capita consumption beyond 2032 is extended based on trends. The 38 individual countries and 11 regional aggregates in the baseline are classified into four income groups according to their respective per-capita income in 2018. The applied thresholds are low: < USD 1 550, lower-middle: < USD 3 895, upper-middle: < USD 13 000, high > USD 13 000.

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

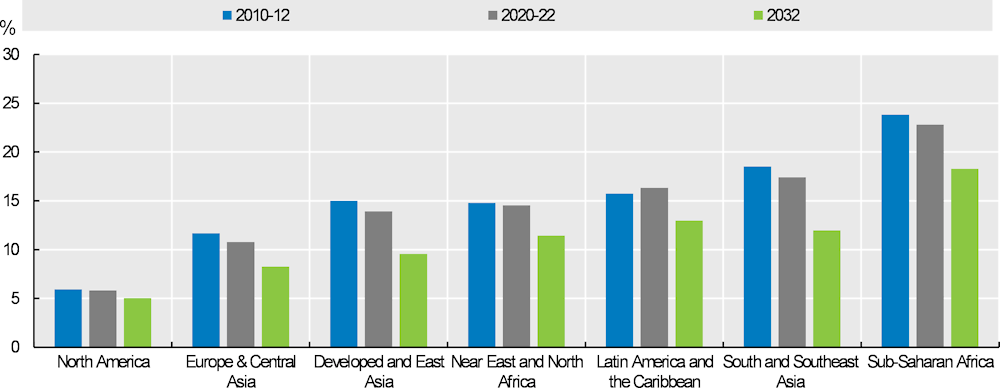

1.2.5. Share of income spent on food continues to fall in emerging economies, but remains high in Least Developed Countries

The share of disposable household income spent on food is expected to continue to fall in all regions (Figure 1.11), with the largest declines foreseen in the emerging economies in Asia. Average expenditures on food are projected to fall to 10% of total household expenditures in Developed and East Asia by 2032, from 14% in the base period 2020-2022, and from 17% in the base period to 12% in 2032 in South and Southeast Asia.

In Sub-Saharan Africa, a similar development is expected but the region remains with highest share of food in household expenditure at 18% in 2032 (Figure 1.11). Particularly in the least developed countries of the region, the share of food in household expenditures is set to remain high, reflecting a vulnerability of households to income and food price shocks in the most food insecure countries.

Figure 1.11. Food as a share of household expenditures by region

Copy link to Figure 1.11. Food as a share of household expenditures by region

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

1.2.6. Accounting for loss and waste along the food value chain

Another issue of increasing concern to the efficiency of the global food system are food losses along the value chain including food wasted in households and retail establishments. Across the globe, approximately 14% of the world's food, valued at USD 400 billion is lost on an annual basis between harvest and the retail market. At the same time, an estimated further 17% of food is wasted at the retail and consumer levels. Reducing food loss and waste is a significant lever for broader improvements of food systems’ outcomes, including improving food security and sustainability as well as increasing efficiency. Box 1.1 examines the current and projected state of food loss and waste along the value chain at the retail stage and by households.

Box 1.1. Food loss and waste: Definitions, global estimates and drivers

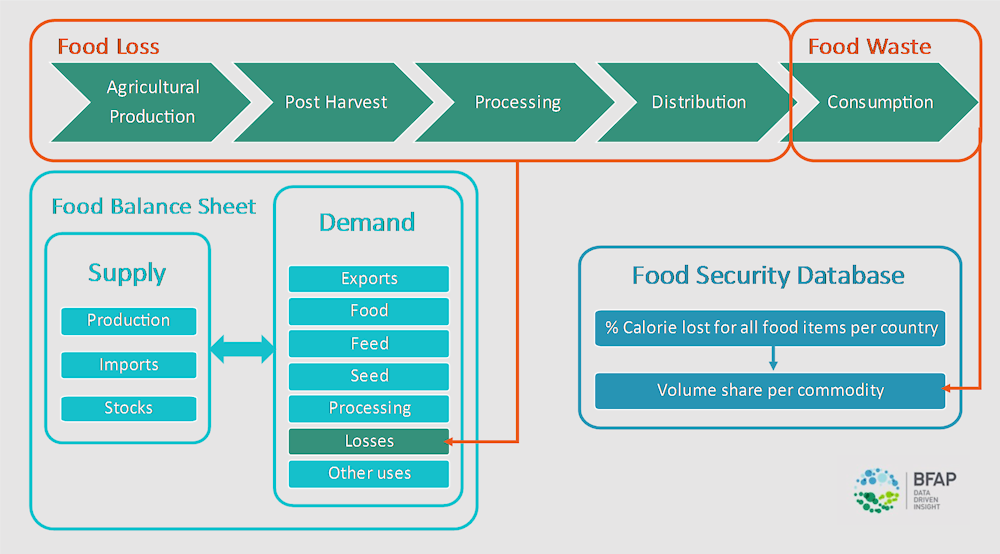

Copy link to Box 1.1. Food loss and waste: Definitions, global estimates and driversLiterature provides several definitions of food loss and waste (FLW), which complicates the analysis thereof (FAO, 2019[1]). Food waste and losses include plants and animals produced or harvested for human consumption but not ultimately consumed by people (Lipinski et al., 2013[2]); this excludes materials for non-food purposes such as crops for biofuels (FAO, 2011[3]) (FAO, 2019[1]). Since agricultural produce is classified as food when it is ready to be harvested or slaughtered, yield losses resulting from weather events or diseases are excluded (Beausang, Hall and Toma, 2017[4]). Some studies have defined these terms relative to the stage at which the loss or waste occurs in the food value chain (Figure 1.14). Studies by the FAO (2011[3]); (Kummu et al., 2012[5])and (Parfitt, Barthel and Macnaughton, 2010[6])have highlighted that food is lost at the early stages of the value chain, specifically at primary production, post-harvest, and processing, while food is wasted at a later stage, in retail and consumption by end-consumers. Food that was intended for human consumption but is diverted to animal feed is excluded from the definition (waste) where the animals remain part of the food value chain (Beausang, Hall and Toma, 2017[4]).

Although the definitions provided by the literature differentiate between food loss and waste, there is not one database that measures food loss or waste separately over time. Moreover, the available data does not explicitly distinguish between food loss and food waste. Food loss or waste data is mostly presented as a percentage loss or in quantity (tonnes). Most literature providing FLW estimates contains data from 2005 onwards, with the most publications only post-2015. According to The State of Food and Agriculture report by the (FAO, 2019[1]) only 39 countries have officially reported FLW data on an annual basis between 1990 and 2017. Case studies may cover losses at specific nodes in the value chain, but these differ from case to case. The UNEP Food Index Report (2021[7]) and the Sustainable Development Goals (SDG) Report (2022) prepared by the FAO are examples of sources that provide global estimates for FLW. According to the UNEP (2021[7]), global food waste amounts to 931 Mt per annum ‒ generated from households (61%), and the distribution (26%) and food service industries (13%). According to the SDG Progress Report (2022), global food loss remained stable from 2016 to 2020, with substantial variations across regions and subregions. The percentage of food lost in 2020 was 13.3%, compared to 13% in 2016 (FAO, 2022[8]).

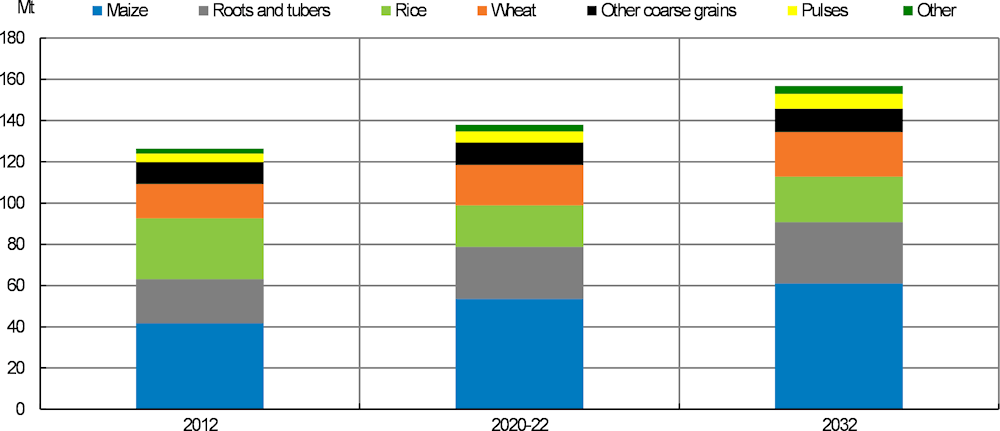

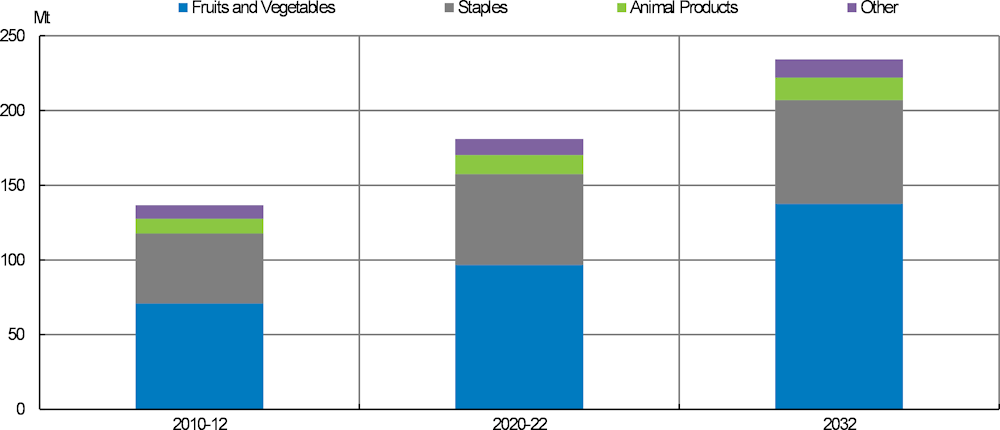

Figure 1.12 presents losses along the value chain for major crops. Total value chain losses of major crops are estimated at 137.9 Mt in the base period and are estimated to increase up to 157 Mt by 2032.

Figure 1.12. Global staples and other field crop losses along the value chain

Copy link to Figure 1.12. Global staples and other field crop losses along the value chain

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Figure 1.13 illustrates retail waste of major food commodities. Fruits and vegetables contribute more than half of total distribution waste. Rice and wheat as major staples contribute also substantially to total distribution waste (22% during the base period), which is estimated to increase from 180 Mt in the base period to 234 Mt by 2032.

Literature broadly accounts for six main factors that generate food loss and waste. These are: economic factors, e.g. globalisation, urbanisation, industrialisation, increasing incomes and consequently dietary transitions; post-harvest losses and value chain inefficiencies in the form of limited access to infrastructure, technology and markets; marketing specifications, including product quality and retailer standards; natural or environmental factors, e.g. climate change and perishability of products; legislation, e.g. agricultural and food safety policies; and technical inefficiencies, poor management, planning and handling.

Figure 1.13. Global distribution waste

Copy link to Figure 1.13. Global distribution waste

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

In order to account for food losses and waste, the first step was the compilation of a database trough that combined existing FLW data sources. Figure 1.14 illustrates how the losses quoted in the FAO food balance sheet database (FBS) relate to the definitions of food loss and waste throughout the food value chain as discussed above. The losses set out in the FBS are assumed to cover all food loss up to the retail point of the food value chain.

Figure 1.14. Food loss and waste along the food value chain

Copy link to Figure 1.14. Food loss and waste along the food value chain

Different approaches were used to estimate the share of food losses and waste at the distribution level. For each food group, we derived an equation relating food loss share to relevant macroeconomic variables (selected to represent drivers of food loss identified in literature) to estimate a share of food loss for each country.

The FAO Food Security database includes a percentage of total calories lost of all food items per country. This was used to estimate the consumption waste share for each commodity using the study by Oelosfe et al. (2021[9]) to “translate” the total calorie loss share per food item to a food waste volume share per food group.

1.2.7. Developments in sugar consumption

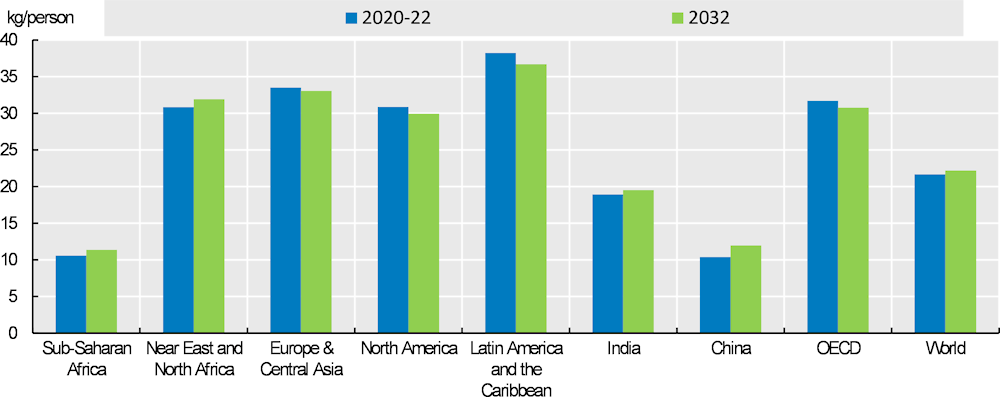

World sugar consumption is expected to continue to rise primarily in regions with significant population growth, notably Sub-Saharan Africa, Asia and the Near East and North Africa region (Figure 1.15). In high-income countries a decline in per capita consumption is projected, reflecting rising health concerns among consumers and measures implemented by countries to discourage sugar consumption. The pace of growth in consumption is expected to slow down in nearly all regions compared to the previous decade.

Figure 1.15. Evolution in per capita food consumption of sugar, by world region, 2020-22 to 2032

Copy link to Figure 1.15. Evolution in per capita food consumption of sugar, by world region, 2020-22 to 2032

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

1.2.8. Developments in protein consumption

In response to changing dietary preferences among increasingly affluent and health-conscious consumers in high-income and emerging countries, total per capita availability of protein sources is expected to rise at the global level to 88.4g per day in 2032, from 83.9g per day in the base period. However, regional differences in the composition of protein sources will persist, with Sub-Saharan Africa and the Near East and North Africa region expected to remain heavily dependent on proteins from crop sources, given their substantially lower average household incomes (Figure 1.16). Protein from animal sources will continue to account for the bulk of protein consumption in the high-income regions of North America, Europe, and Central Asia.

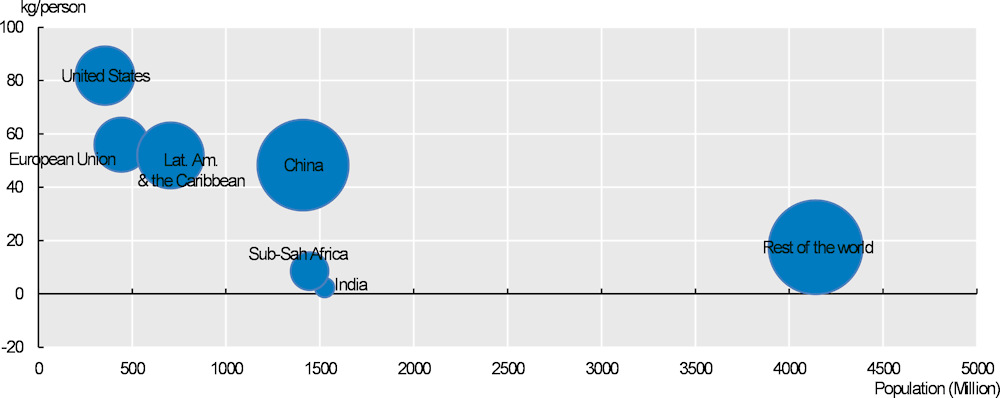

About two-thirds of meat is expected to be consumed by one-third of the world’s population in 2032, which is only a slight improvement from the base period. The high per capita use in high-income countries is the main reason for this. In some countries such as China, despite per capita consumption being comparatively low, total meat consumption will be substantial given their large population sizes (Figure 1.17).

Over the outlook period, animal proteins are expected to make further advances in their contribution to total daily per capita availability due to rising per capita incomes globally. Growth in animal protein consumption will be particularly pronounced in Asia and the Latin America and Caribbean region, where daily per capita meat and fish availability is expected to rise by 11-13% and 6-4%, respectively. Income-driven growth in consumption of meat and fish in China, which is respectively expected to see an 12% and 14% total increase in daily per capita availability by 2032, will be the main contributor. However, regarding the projected increase in meat consumption in China, it is important to note that this will be from a lower base following the recent shock caused by the outbreak of African Swine Fever.

Figure 1.16. Contribution of protein sources to total daily per capita food consumption

Copy link to Figure 1.16. Contribution of protein sources to total daily per capita food consumption

Note: Staples include cereals, pulses, and roots and tubers.

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Figure 1.17. Meat consumption in the largest consuming countries, 2032

Copy link to Figure 1.17. Meat consumption in the largest consuming countries, 2032

Note : The size of the bubbles represents total meat consumption (Mt).

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

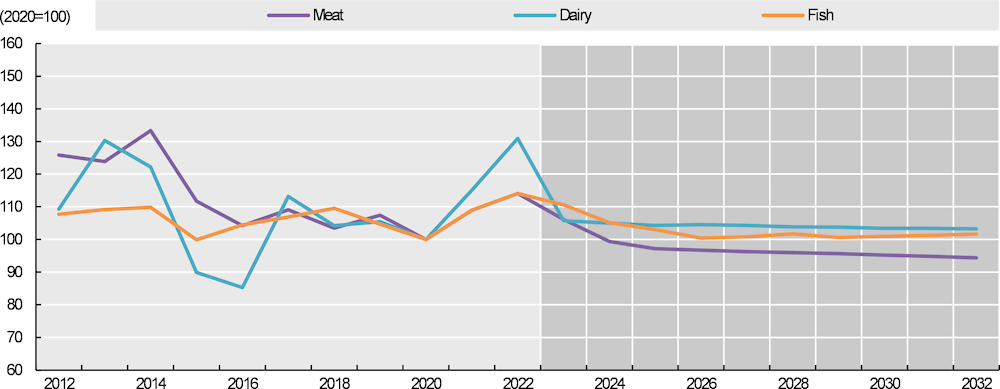

Overall, growth in global average consumption of meat is expected to increase by 2.5% over the outlook period, amounting to an increase of 0.7 kg/per capita/year in boneless retail weight equivalent, to reach 29.5 kg/year by 2032. Consumption growth in middle-income countries, as outlined above, will account for a significant share of this increase. However, against high and rising consumer expenses and weaker income growth, the Outlook expects growth in global meat demand to be slower than over the last decade. Expenditures on meat constitute a sizeable share of the food basket in middle- and high-income countries. In view of strong inflationary pressures and reduced purchasing power, consumers are expected to increasingly shift their spending towards cheaper meats and meat cuts, as well as potentially reduce their overall consumption and out-of-home consumption of meat.

In terms of substitution between meat and aquatic foods, mounting environmental and health concerns are expected to continue to shift consumer preferences away from red and processed meat, notably beef, towards leaner and allegedly more environmentally friendly alternatives, notably poultry and fish. These shifts will be particularly pronounced in Europe and North America. Demand for poultry in Sub-Saharan Africa will be primarily driven by the higher affordability of poultry compared to beef.

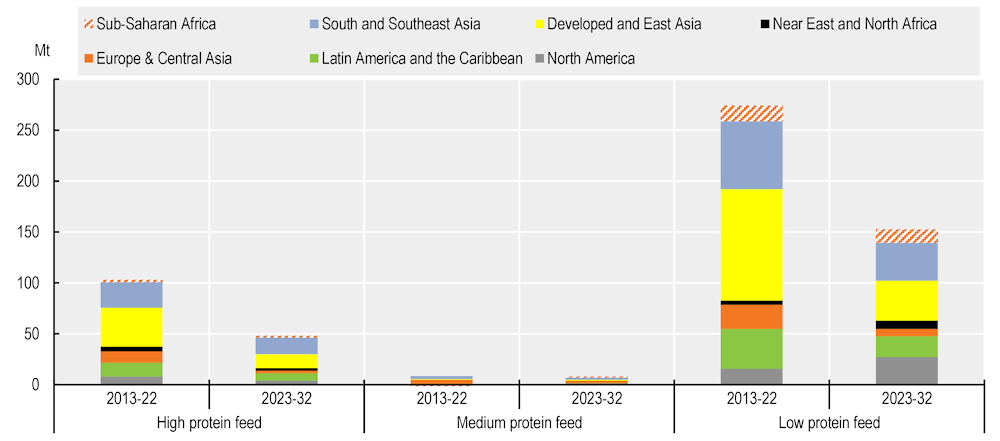

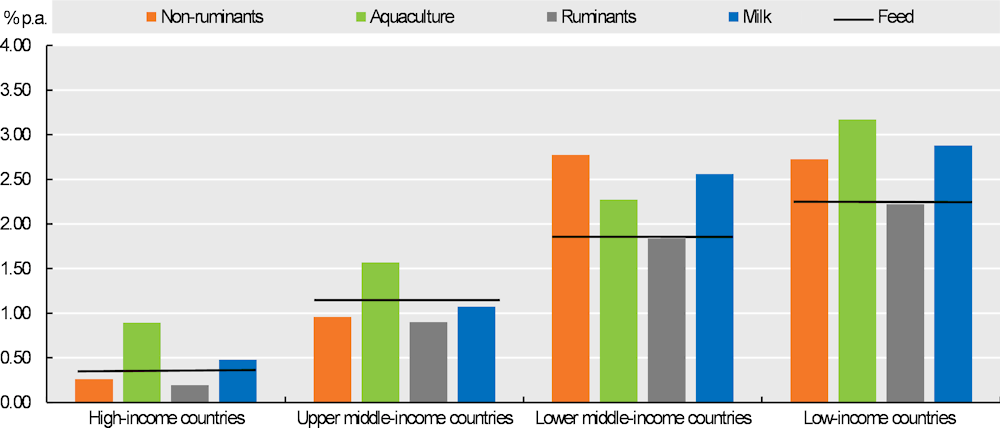

1.2.9. Global outlook for feed use of agricultural commodities

Demand for feed is driven by two factors: the number of farm animals and the feed use per animal. Over the projection period, the expanding animal herds and the continuing intensification of the livestock sector will drive an increase in feed demand in most world regions (Figure 1.18). Low- and middle-income countries are expected to account for the bulk of the increase as moderate to strong growth in feed consumption is projected over the coming decade, in line with or exceeding the growth in animal production, as these countries move to more commercialised and feed-intensive production systems. Particularly in Southeast Asia, increasing animal production is projected to raise demand for mostly imported protein meal. By contrast, demand growth in China is expected to slow down considerably, driven by improved feed efficiency combined with efforts to achieve lower protein meal shares in livestock feed rations.

In high-income countries, higher production efficiency resulting in herd reductions, especially in dairy production, means feed consumption of both protein meal and cereals is expected to grow slowly as improvements in animal genetics, feed technology and herd management will continue to generate substantial efficiency gains in livestock and dairy production. Notably in the European Union, the second-largest user of protein meal, consumption is expected to decline as growth in animal production slows and other protein sources are increasingly used in feed (Figure 1.19).

Figure 1.18. Feed demand by component and by region, 2013-22 and 2023-32

Copy link to Figure 1.18. Feed demand by component and by region, 2013-22 and 2023-32

Note: Low protein feed includes maize, wheat, other coarse grains, rice, cereal brans, beet pulp, molasses, roots and tubers. Medium protein feed includes dried distilled grains, pulses, whey powder. High protein feed includes protein meal, fish meal, and skim milk powder.

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Figure 1.19. Annual change in feed use and in livestock production, 2023-2032

Copy link to Figure 1.19. Annual change in feed use and in livestock production, 2023-2032

Note: Ruminants include beef and veal and sheepmeat. Non-ruminants include poultry and pigmeat. The bars show annual changes in production volumes for the different livestock products. The black line shows annual changes in feed use.

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

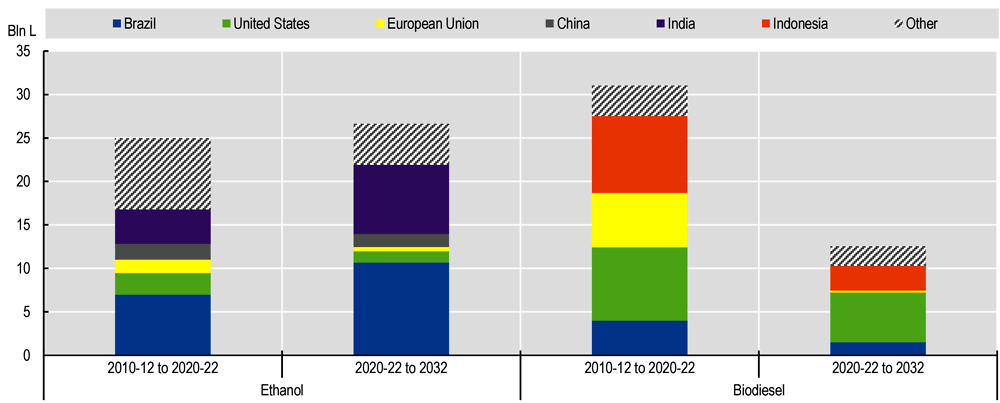

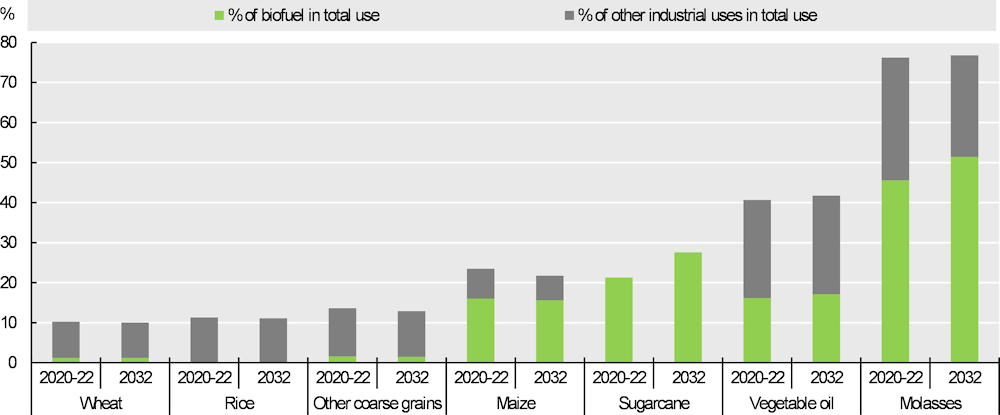

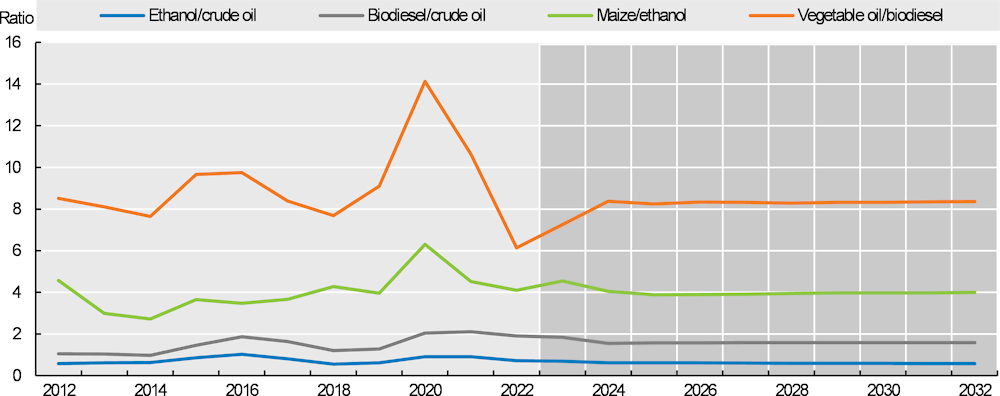

1.2.10. Global outlook for industrial use of agricultural commodities

Biofuels have become the dominant industrial use of agricultural commodities in recent years. Their production uses cereals and sugar crops, but also processed products such as molasses and various vegetable oils. Demand for biofuels is largely determined by transport fuel demand and domestic support policies. Over the next decade, global biofuel use is projected to continue to expand substantially, driven mainly by additional demand for biofuels in middle-income countries, where higher blending rates are being implemented, supported by subsidies for domestic production and blended fuel use (Figure 1.20). A substantial increase in biodiesel production in the United States due to increasing targets and the increased application of state and federal renewable fuel programmes and biomass-based diesel tax credits (under the IRA of 2022) will further generate additional demand. By contrast, in other high-income countries, notably in the European Union, demand growth will be constrained by declining transport fuel demand and reduced policy incentives. In the European Union, the RED II (Renewable Energy Directive) has classified palm oil-based biodiesel in the high ILUC (Indirect Land Use Change) risk category. As a result, the use of palm oil-based biodiesel is expected to decrease, thereby slightly reducing total biodiesel use in the European Union. Nevertheless, the share of biodiesel in total diesel use is expected to grow over the coming decade.

Transport fuel consumption is expected to expand in Brazil, Argentina, Colombia, and Paraguay over the coming years, with ethanol and biodiesel usage projected to increase accordingly. Indonesia's diesel use is set to rise and the blending rate is assumed to stay above 30% (B30). In South and Southeast Asia, biodiesel is expected to become more popular due to the growth in transport fuel demand and for industrial use. In India, sugarcane-based ethanol is projected to contribute significantly towards the goal of achieving an ethanol blend rate of 16% by 2025, whereas the E20 target should be met by 2032.

Agricultural commodities are also used as feedstock for other industrial applications, including in the material (plastic, clothing, paint), bio-chemical, and bio-pharmaceutical industries. “Other” uses, mostly industrial applications of agricultural commodities for commercial production such as grains for industrial starch production, have become increasingly important in recent years and are expected to gain importance in absolute terms.

Figure 1.20. Changes in biofuel consumption in key consuming countries

Copy link to Figure 1.20. Changes in biofuel consumption in key consuming countries

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Figure 1.21. Share of biofuel and other industrial uses in total use of agricultural commodities

Copy link to Figure 1.21. Share of biofuel and other industrial uses in total use of agricultural commodities

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

1.2.11. Uncertainties affecting global demand for agricultural commodities

The medium-term projections presented in the Outlook assume a fast recovery from inflationary pressures, no change to policies in place, and an on-trend evolution in consumer preferences over the coming decade. These assumptions introduce some uncertainty into the projections of agricultural commodity demand.

Aside from conflict and geopolitical tensions, at present the most severe threat to the consumption of agricultural commodities – and the consumption of food in particular – is posed by the adverse economic repercussions of persistently high inflation rates and a potential global recession. At the time of writing, global reference prices in real terms were expected to decline slightly over the coming decade; however, consumer prices may spike in response to severe economic, political or environmental events, as further described in the prices section. Uncertainty further arises from the fact that many additional factors along the food value chain may contribute to food price inflation, including market power in the processing and retailing sectors. The war in Ukraine has demonstrated its global economic implication and potentially threatens the proper functioning of local and global food systems. Coupled with other uncertainties such as climate change, the negative ramifications of all these factors for global economic growth may result in a global recession, suggesting that the income growth projections underlying the Outlook may not materialise. In this regard, the reduced prospects would likely result in a downward adjustment in global food demand, with different adjustment for different commodities. Furthermore, the last revision of the UN’s population projection resulted in a downward revision of population growth in some countries (e.g. China), and while not significant, does point to the possibility of lower-than-expected population growth in the future, with direct implications for lower growth in global demand for food. Income and food price shocks, especially in countries where the share of food in expenditures is high, pose an additional threat, as does the risk of further disease outbreaks that may disrupt human health or the production of agricultural commodities.

Mounting environmental and health concerns, as well as animal welfare concerns, are expected to increasingly influence consumer choices and to drive growing demand for higher value items, such as poultry, fish, fruits, vegetables, nuts and seeds, as well as for alternative food stuffs, such as dairy alternatives, gluten free foods, and vegan meat substitutes. These ongoing developments could have a significant impact on agricultural commodity demand in the future, especially regarding the consumption of products with large environmental footprints or purportedly adverse health effects, such as palm oil, cotton, beef, and sugar. In contrast, demand for certified food as well as vegetarian and vegan alternatives, often touted as more nutritious and environmentally friendly, may increase. However, the potential trade-offs between healthier and more sustainable diets based on Life Cycle Analysis need to be considered. For example, while an increase in the consumption of fruits and vegetables may be desirable from a health point of view, the typically intensive use of agro-chemicals and water in their cultivation as well as the high emissions from cold chains and transport may not be desirable from an environmental perspective. On the other hand, a reduction in meat and dairy consumption in populations where it is very high may provide net benefits.

1.3. Production

Copy link to 1.3. ProductionProjections for the production of crops, livestock and fish products covered by the Outlook are presented. This section also examines the underlying drivers of production, namely crop yields, cropping intensity, and agricultural land use in the crop sector, and the number of farm animals and output per animal in the livestock sector.

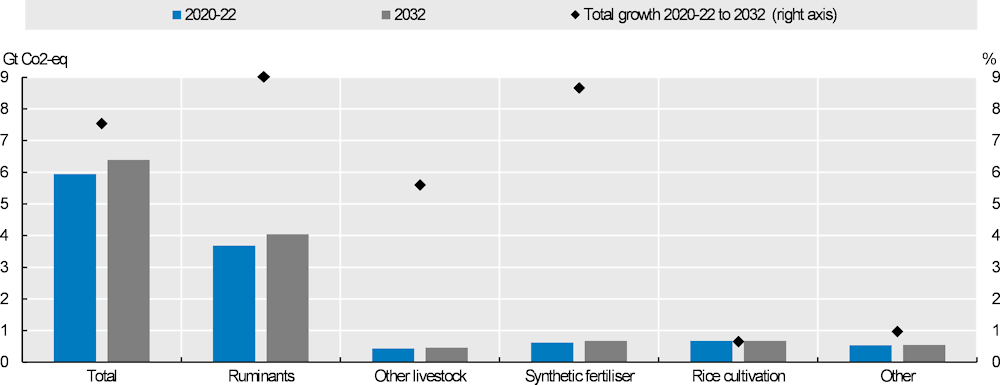

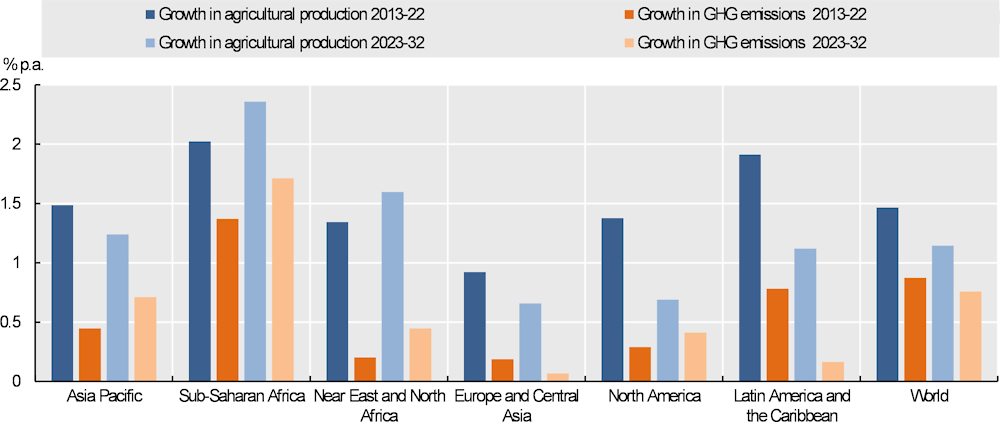

Over the coming decade, the global production (measured in constant prices) of crops, livestock and fish commodities covered by the Outlook is expected to increase by 1.1% p.a., a slower rate than in previous decades. The reduced growth incentives are driven by a weakening of expected gross returns for producers from both sales and due to costs developments. The proceeds of production sales are not expected to follow a sustained growth because of projected flat or slightly declining trends of world prices in real terms and slower population growth. Input costs are expected to increase, notably because of the nexus between energy and fertiliser prices and tightening of environmental regulations.

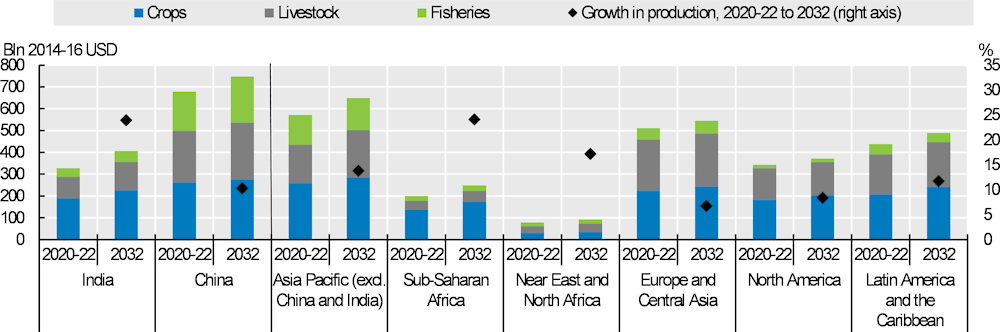

Middle- and low-income countries, including China, India and other Asian countries, will continue to drive growth (Figure 1.22). By 2032, the whole Asian region is expected to account for more than half of global crop production, almost half of livestock production, and almost three-quarters of fish production. Production growth will be driven almost entirely by productivity in this resource-constrained region.

Production in Sub-Saharan Africa and Near East and North Africa is expected to grow significantly, although from a low base. In these regions, the bulk of agricultural output comes from crops production, but higher value livestock production is expected to grow faster over the coming decade in response to a rapid population increase and urbanisation. In Sub-Saharan Africa, growth in crop production will be underpinned by a combination of area expansion, changing crop mix, and productivity gains; dairy will drive much of the growth of livestock production. In Near East and North Africa, growth in crop production will be derived mainly from productivity gains as the region is faced with severe constraints in the availability of arable land and water. Poultry will drive most of the increase in livestock production.

Europe and Central Asia is expected to be the region with the slowest production growth, mostly driven by Central Asia and Eastern Europe. Growth will mainly be derived from productivity gains as the long-term decline in agricultural land-use is expected to persist, but tighter regulations related to environmental sustainability and animal welfare will place downward pressure on yield improvements.

Production growth in North America is expected to be limited. Crop production is expected to grow faster than livestock production, reversing the trend of the past decade. Production growth will be driven by productivity gains.

In Latin America and the Caribbean, production growth is projected to slow down compared to the last decade. Growth is expected to come predominantly from crop production. The region’s land abundance contributes to strong crop production growth, which is derived from a combination of expansion and intensification, but yield gains are expected to play a bigger role because of an expected rapid increase in fertiliser application. Despite slower growth in livestock production, the region will continue to be a large contributor to global production.

Figure 1.22. Trends in global agricultural production

Copy link to Figure 1.22. Trends in global agricultural production

Note: Estimates are based on historical time series from the FAOSTAT Value of Agricultural Production domain which are extended with the Outlook database. Remaining products are trend-extended. The Net Value of Production uses own estimates for internal seed and feed use. Values are measured at constant USD of the period 2014-2016.

Source: FAO (2023). FAOSTAT Value of Agricultural Production Database, http://www.fao.org/faostat/en/#data/QV; OECD/FAO (2023), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

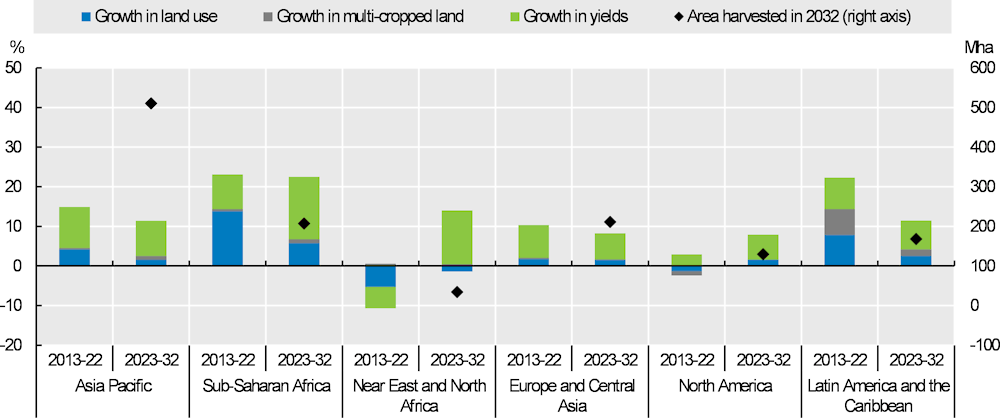

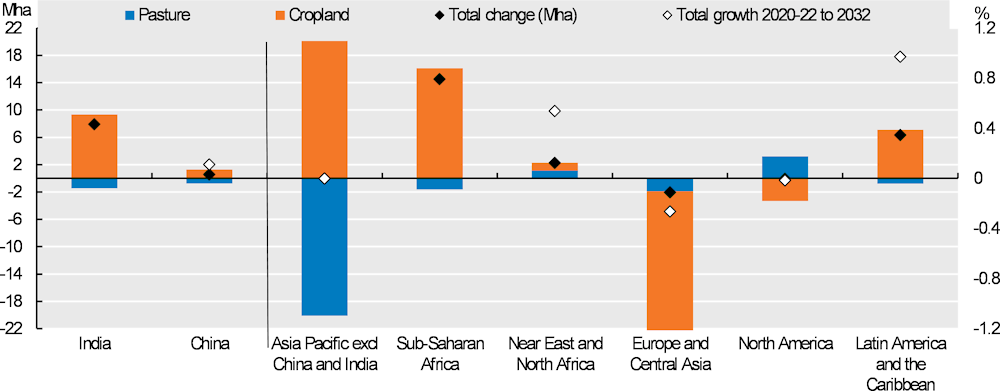

1.3.1. Productivity improvements drive crop production growth

Overall, crop production is projected to expand slightly faster (1.2% p.a.) than livestock or fish production (each at 1.1% p.a.). This result is driven by productivity, mostly from yield developments and to a lesser extent crop intensification rather than from land use, but with important regional and sectoral variations (Figure 1.23).

Figure 1.23. Sources of growth in crop production

Copy link to Figure 1.23. Sources of growth in crop production

Note: Figure shows the decomposition of total production growth (2013-22 and 2023-32) into growth in land use, land intensification through growth in multi-cropped land, and growth in yields. It covers the following crops: cotton, maize, other coarse grains, other oilseeds, pulses, rice, roots and tubers, soybean, sugar beet, sugarcane, wheat and palm oil.

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook OECD Agriculture statistics (database)'', http://dx.doi.org/10.1787/agr-outl-data-en.

In Sub-Saharan Africa, yield growth is expected to almost double to 16% over the next decade compared to 8% over the previous one. Investments in locally adapted and improved crop varieties, increased access to fertilisers, and consolidation of land holdings that has allowed for more large-scale and mechanised farming will spur growth in crop production. Sub-Saharan Africa is the region with the largest untapped agricultural land and the expansion of the area harvested has been an important driver of production growth over the last decade. However, the role of land expansion in production growth is projected to decrease because it is increasingly difficult to convert land for agriculture in what remains largely unreachable areas, conflict zones, or conservation areas. Growth in the Near East and North Africa region is entirely based on yield growth because of the decline in the harvested area.

In Western Europe, yield growth is projected to slow down due to stricter environmental regulations, whereas in North America it will be underpinned by investment in innovations and wider biotechnological options.

Crop yield variations

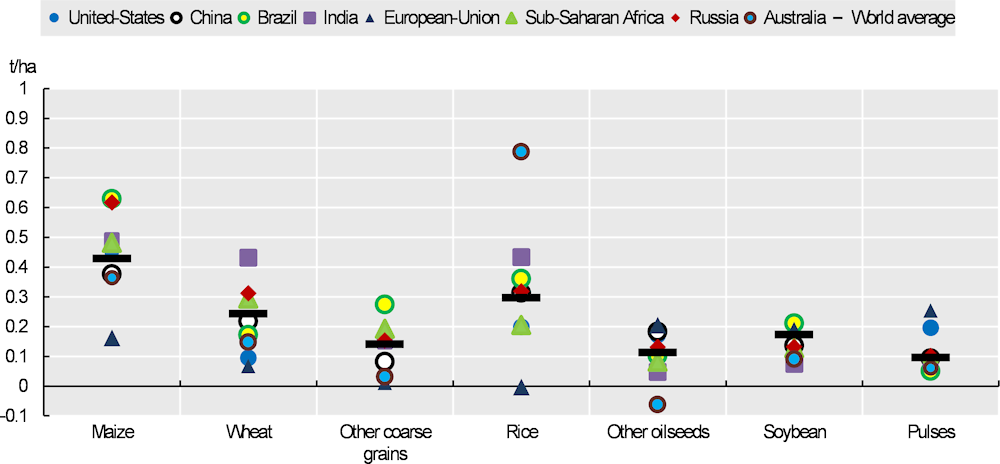

Over the coming decade, yield growth is projected to contribute 79% on average to global production growth of the main crops covered by the Outlook. Projected rates differ across regions and countries due to differences in production technologies, management practices, natural resource endowment, and local climatic conditions (Figure 1.24).

Farmers in low- and middle-income countries, notably Brazil and India, are projected to achieve growth rates above the world average for maize, wheat and rice through better adapted seeds and improved crop management. Notable yield increases in Sub-Saharan Africa are also projected, but average cereal yields in 2032 are expected to remain at less than a third of high-income countries.

In high-income countries, the growth in yields is projected to be smaller than the world average for the main crops, except for pulses. Yields in these countries are already close to the production frontier and further increases are constrained by stricter environmental regulations. However, production and investment in nitrogen-fixing crops known for their productivity-increasing properties are expected to expand to meet sustainable food production objectives.

Figure 1.24. Change in projected yields for selected crops and countries, 2023 to 2032

Copy link to Figure 1.24. Change in projected yields for selected crops and countries, 2023 to 2032

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

1.3.2. The role of fertiliser prices in driving food prices

Fertilisers provide essential nutrients for maintaining agricultural crop yields and quality, and for growth in production. The three most important nutrients are nitrogen (N), phosphorus (P), and potassium (K). Nitrogen is the most fundamental nutrient for crop yields because it ensures that plants remain healthy as they develop and are nutritious once they are harvested. Phosphorus supports a plant’s ability to use and store energy, and helps with normal development. Potassium strengthens a plant’s resistance to disease and its overall quality. The application of N-based fertilisers is critical for crop yields in the short run and the effectiveness depends on the timing of its application. Application of N-based fertilisers cannot be delayed in response to price changes, in contrast to the application of P and K fertilisers which can be in order to optimise variations in overall input costs since P and K nutrients remain in the soil for a longer period of time.

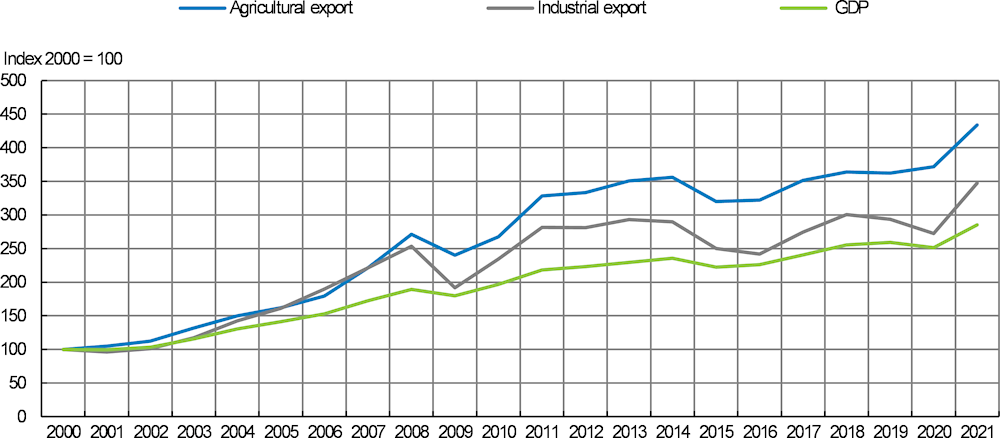

The production of N-based mineral fertilisers is dependent on the availability of natural gas both as a raw material and to power the synthesis process. Given this link, the production of nitrogen fertilisers is concentrated in countries that have access to natural gas: China, India, the United States, and Russia (Figure 1.25). Over the period 2016-2020, Russia was the main exporter of N-based fertilisers, responsible for 15% of global exports, followed by China (13%). Key importers of nitrogen fertilisers over the same period were India and Brazil, both accounting for 11% of global imports.

Figure 1.25. Main producers and traders of nitrogen-based fertilisers (average 2016-2020)

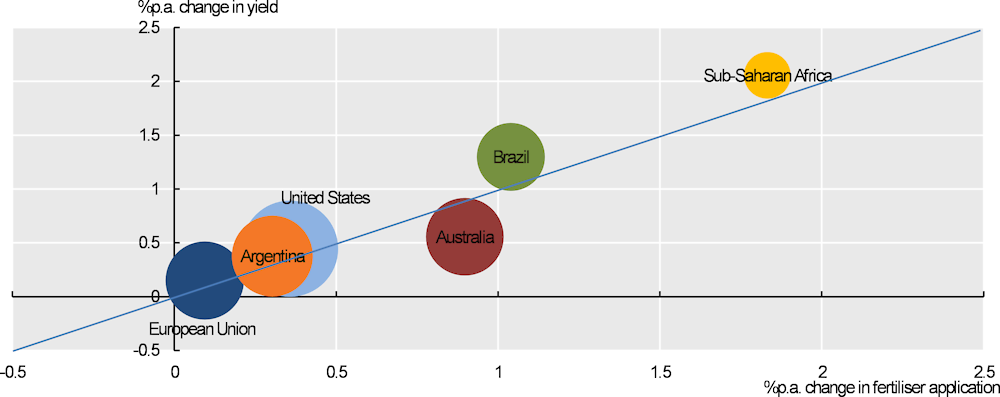

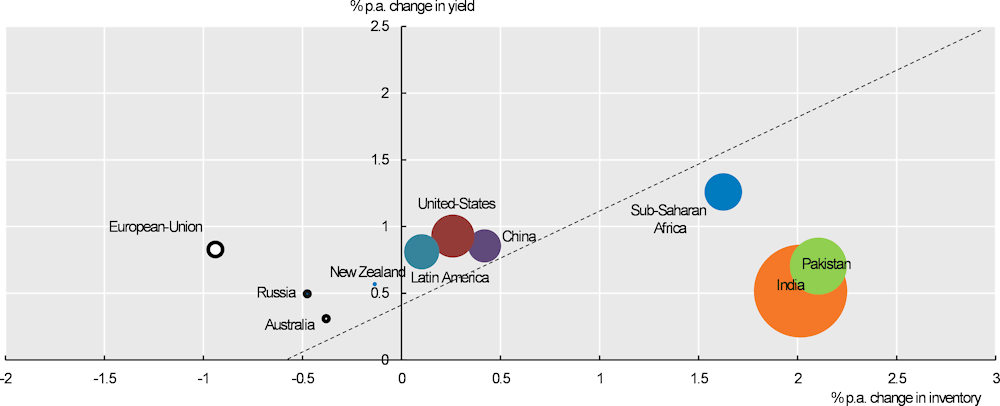

Copy link to Figure 1.25. Main producers and traders of nitrogen-based fertilisers (average 2016-2020)In this context, focusing on the application of N-fertilisers per hectare of planted crop in relation to output per hectare can provide elements to qualitatively explain the observed variation in production efficiency across regions. Figure 1.26 shows how the projected per annum changes in N-fertiliser application compare to the corresponding per annum changes in yield in selected countries or regions for maize.

Figure 1.26. Change in N-fertiliser application per hectare and yields for maize, 2023 to 2032

Copy link to Figure 1.26. Change in N-fertiliser application per hectare and yields for maize, 2023 to 2032

Note: The size of each bubble reflects yield in 2032

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

In the European Union and the United States, where yields are high, future development in production practices will be limited compared to other countries but changes in yields are expected to be greater than changes in fertiliser application. High-income countries are rolling out various incentives to curb the use of synthetic fertilisers, notably by increasing their efficiency through better management practices or expanding the use of nutrient alternatives such as biofertilisers. In Australia, the relatively limited increase in yields can be explained by physical and climatic constraints.

In Brazil, the use of N-fertilisers is expected to grow significantly due to the increase in production, and yield increase should outpace N-fertiliser application over the projected period. While several factors such as progress in breeding can play a role in future yield developments, improvements in crop management, use of nitrogen-fixing crops or biofertilisers will play a critical role in the increase of maize production yields. Sub-Saharan Africa is also expected to experience significant increases in both N-fertiliser application and yields, but from a low base.

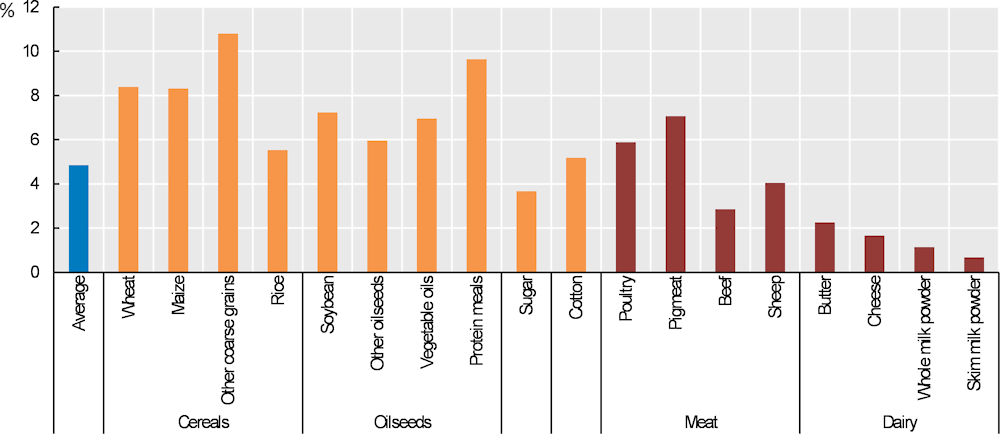

A scenario analysis was undertaken to examine the impact of a 25% increase of N-, P- and K-fertiliser prices on fertiliser application, resulting crop production and commodity prices, while keeping oil price constant. Factors underpinning such fertiliser price increases other than an oil shock would include, for example, market access restrictions, tighter environment regulations, or increases in other manufacturing costs such as labour or minerals.

Figure 1.27 shows the percentage change of selected commodity prices from the baseline projections in 2032 to those of the scenario projections in 2032. On average, agricultural commodity prices would increase by 5%. The impact would be greater on crops that use fertilisers as direct inputs than on livestock products that use them indirectly through feed. Among livestock products, the increase in prices is greater for poultry and pigmeat than it is for ruminants because the former relies more on compound feed.

Figure 1.27. Change in agricultural commodity prices due to 25% increase in fertiliser prices

Copy link to Figure 1.27. Change in agricultural commodity prices due to 25% increase in fertiliser prices

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

This scenario illustrates how changes in fertiliser prices readily translate into changes of product prices and hence food prices. Consumers who spend a high share of their household budget on food and fuel would be particularly impacted. The impact on producers is mixed, as only the most efficient users of fertilisers would benefit from higher product prices and increase their margins. Rising costs for agricultural inputs will inevitably translate into higher food prices unless new models of production can be found to make agriculture less dependent on conventional fertilisers.

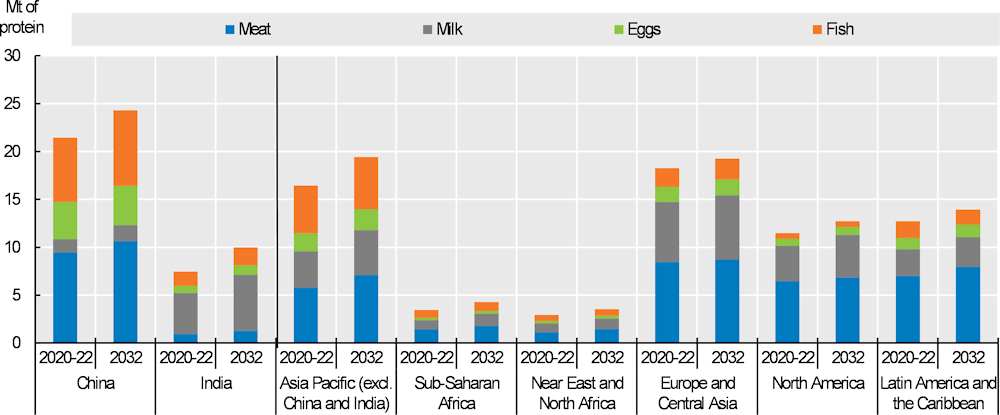

1.3.3. Growth in livestock and fish production varies in intensity across region

Global production of livestock and fish is projected to expand by 10% over the next decade, almost half the rate of the previous decade. A significant share of this growth will be driven by production in China (13%), India (34%), and other middle- and low-income countries (Figure 1.28). In China, the expansion will be largely underpinned by the recovery from African Swine Fever (ASF) and in India by sustained growth in diary production.

In Sub-Saharan Africa and Near East and North Africa, livestock and fish production is expected to increase by more than 20%, mostly because of the expansion of the dairy and poultry meat sectors. The rising demand for high value food spurred by the ongoing urbanisation of these regions is expected to be mainly met by local production rather than by imports. Insufficient infrastructures and associated elevated transport and logistic costs will remain major impediments to trade in these regions.

In high-income countries, overall growth will be limited. In Europe, factors such as the current African Swine Fever outbreaks, stricter environmental laws, and animal welfare regulations in some EU countries will exert pressure on production growth. In North America, the intensive production system is expected to recover slowly from recent high feed prices and labour costs. Almost all production of animal proteins will experience single-digit growth over the coming decade, except for the dairy sector in North America which will grow by 20% by 2032. Improvements in dairy cow milk yields will be the main contributor to milk production in the region.

Figure 1.28. Global livestock and fish production on a protein basis

Copy link to Figure 1.28. Global livestock and fish production on a protein basis

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

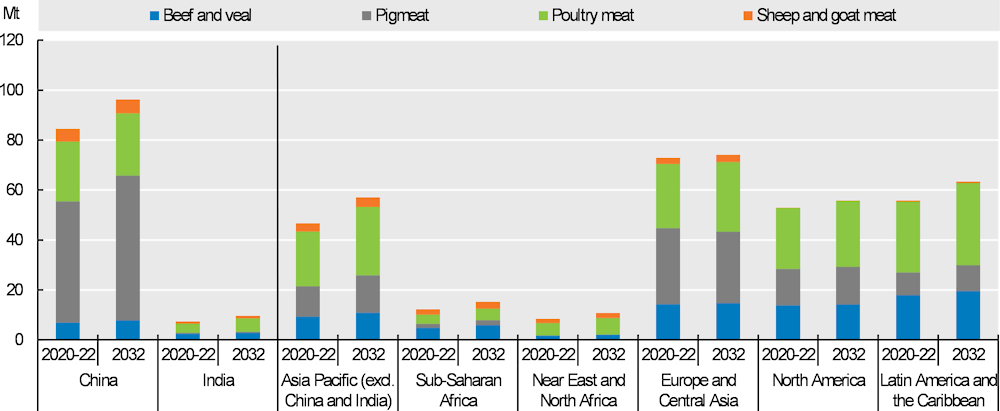

Meat production

Over the coming decade, increased global meat production is expected to originate mainly in middle-income countries (Figure 1.29), supported by global herd and flock expansion and improved per-animal performance through higher feed intensity, and continuous improvement in animal breeding, management, and technology.

Poultry meat will be the fastest growing segment of animal protein production (14%) and is projected to account for 48% of the increase in total meat production over the coming decade. The greatest increase in production will occur in Asia Pacific, notably in India, largely as a result of increased feed intensity and breeding improvements. Poultry meat will significantly expand in Sub-Saharan Africa and Near East and North Africa, albeit from a low base. In North America and Europe and Central Asia, poultry meat will be driven by its greater attractivity for consumers compared to bovine meat and its improved profitability in the medium term due to shorter production cycles.

Figure 1.29. Global meat production in carcass weight equivalent

Copy link to Figure 1.29. Global meat production in carcass weight equivalent

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Pigmeat production is expected to recover in Asian ASF-affected countries, growing by 19% in China, the largest producing country, and 23% in other Asian countries over the coming decade. In Europe, pigmeat production will decline over the next decade mainly because of stricter environmental regulations and animal welfare standards.

Beef production is expected to expand by 9% and contribute to 16% of the total increase in global meat production. Overall, beef production will increase with higher carcass weights as feed costs decline and animal genetics improve, although in the fastest growing African regions the increase will be driven by higher herd numbers. In Europe and North America, beef production will adjust to stricter environmental sustainability standards for the former and severe pressure on the profitability of the intensive model of production for the latter.

Sheepmeat production will contribute only 6% to the overall growth in meat production and is expected to expand by 15% over the coming decade. Increased availability in the global sheepmeat market will be due to flock rebuilding and increased lambing rates in Asia and Sub-Saharan Africa. Production in the European Union is projected to increase slightly due to income support and favourable producer prices. Sheep and goat meat production in Sub-Saharan Africa will grow by almost 30% despite pressure on pasture land due to desertification.

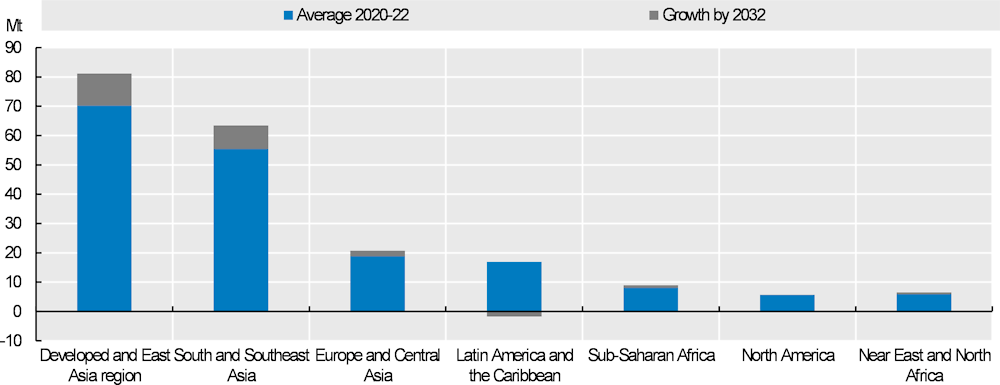

Dairy production

Dairy will remain the fastest expanding livestock sector over the next decade, with global milk production projected to increase by 17%. In low- and middle-income countries, milk production will be driven by an increase in inventory and yields, while in high-income countries it will be almost entirely supported by improvements in yields due to optimisation, improved animal health, and better genetics.

Population growth in the main consuming middle- and low-income regions, as well as per capita consumption growth for fresh and processed dairy products will incentivise investments in dairy production.

India and Pakistan are projected to rank first and second, respectively, in terms of absolute growth of milk production and to generate over half of the increase in global milk production; they will jointly account for 30% of production by 2032. In these countries, the increase in milk production will be due primarily to herd expansion (Figure 1.30).

In Sub-Saharan Africa, the 33% growth in milk production is projected to originate from an increase in the number of milk-producing animals. The region will also experience some yield improvement, albeit from the lower levels produced by ovine animals that are mainly used to provide milk.

Production in the European Union, the second largest global milk producer after India, is expected to decline slightly in response to the ongoing transition towards environmentally sustainable production, the expansion of organic production, and the shift from intensive to pasture-based production systems.

Figure 1.30. Changes in inventories of dairy herds and yields, 2020-2022 to 2032

Copy link to Figure 1.30. Changes in inventories of dairy herds and yields, 2020-2022 to 2032

Note: The size of the bubble reflects absolute growth in dairy production between 2020-22 and 2032.

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Fish production

Global fish production is projected to grow by 12% over the coming decade, albeit at a slower rate compared to the previous decade. This slowdown in growth reflects the impact of policy changes in China toward more sustainable fisheries, the higher costs for fuel inputs, and the assumption that 2024, 2028 and 2032 will be El Nino years that will result in lower production, mainly in Latin America and the Caribbean (Figure 1.31). Most of the increase in fish production is expected to come from Asia, which will account for more than 70% of global production by 2032. The largest contributors to output growth are expected to be China, India, Indonesia, and Viet Nam.

Production will be driven by continuing but slower progression in aquaculture production and broadly stable capture fisheries production, except during the years of El Nino. By 2032, aquaculture production is projected to account for more than half of total fish production.

The increase in aquaculture production is expected to be largely achieved by productivity gains and technological improvements related to spatial planning, breeding, feed, and disease management.

Figure 1.31. Regional fish production

Copy link to Figure 1.31. Regional fish production

Note: The regions Developed and East Asia, and South and Southeast Asia are defined as in Chapter 2.

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

1.3.4. Investments and human capital are vital for productivity gains

Investments in agricultural infrastructure, research and development, wider access to more productive agricultural inputs, improved farm management practices, including the adoption of digital automation technologies are important factors that enhance productivity.

The availability of human capital employed in the agricultural sector is a key determinant of production growth. Nevertheless, there remain important barriers for human capital to thrive within the current food systems. For instance, the lack of access to finance for youth or smallholders, or the insufficient attention to the constraints faced by women in food systems (Box 1.2) are impediments to productivity gains. A recent FAO report on the status of women in agrifood systems (FAO, 2023[10]) shows that inequalities related to land tenure, credit, training, and technology create a 24% gender gap in productivity between women and men farmers on farms of equal size. In September 2021, the United Nations Food Systems Summit urged for the greater integration of women in food systems, notably calling for solutions that narrow the gender gap and support women entrepreneurship. Subsequently, in adopting the Ministerial Declaration on Transformative Solutions for Sustainable Agriculture and Food Systems in November 2022, Ministers of Agriculture of OECD countries and partner economies worldwide committed to promoting and measuring progress towards inclusive food systems and to reinforce measures that foster greater opportunity for women in the agricultural sector.

Box 1.2. Gender and food systems

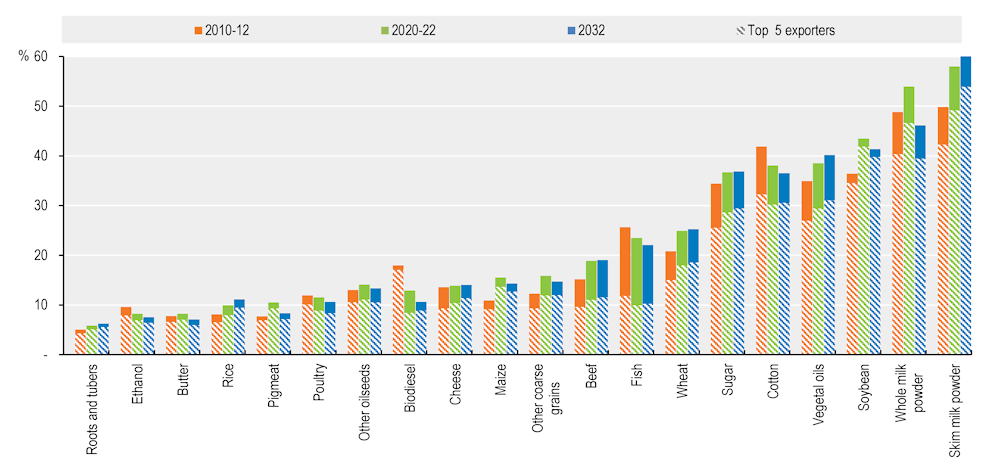

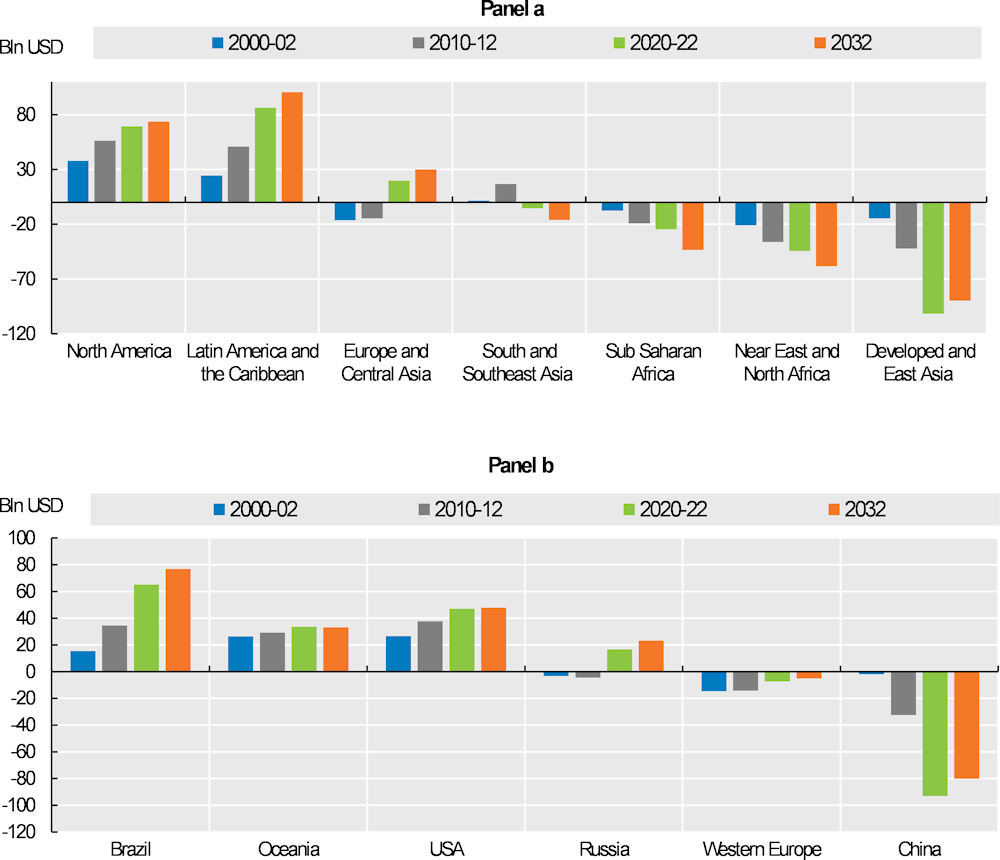

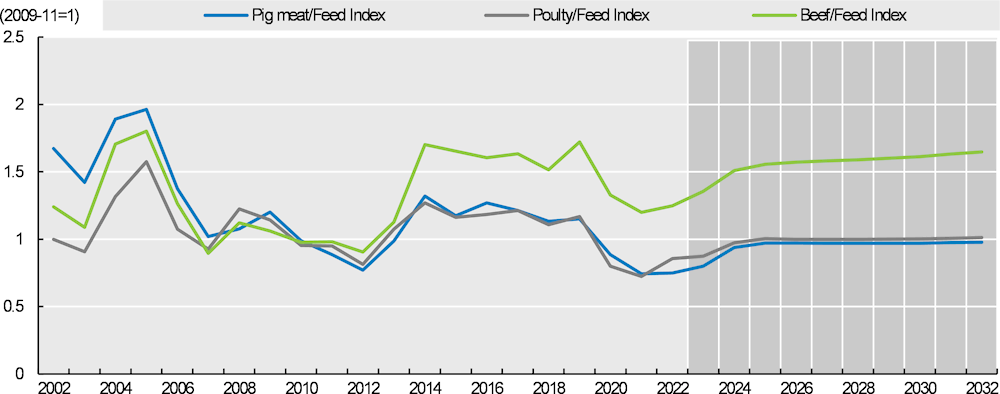

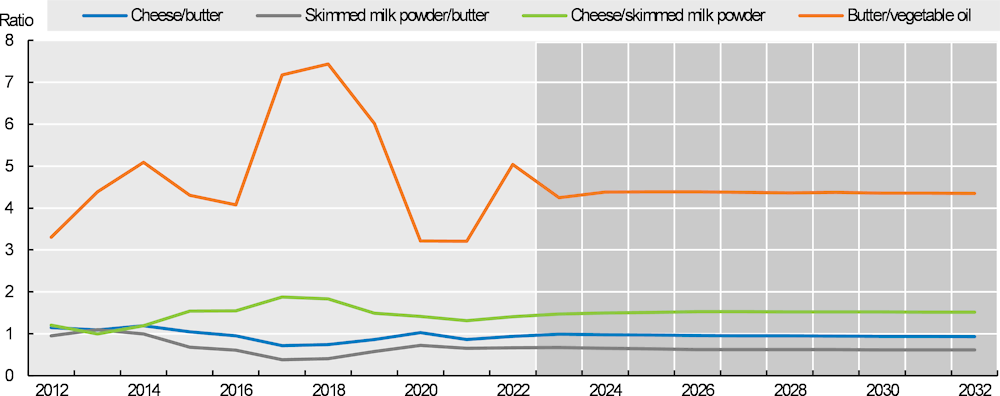

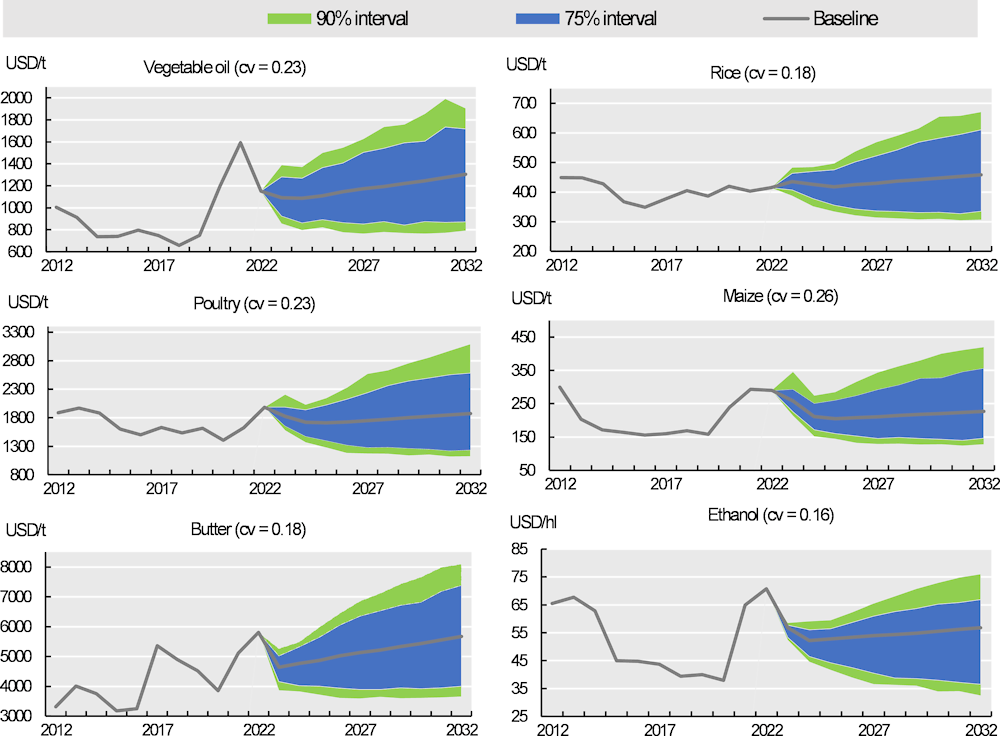

Copy link to Box 1.2. Gender and food systemsUnderstanding the role of women in food systems