This chapter describes recent market developments and highlights the medium-term projections for world fish markets for the period 2023-32. Price, production, consumption and trade developments for fish from capture fisheries and aquaculture are discussed. The chapter concludes with a discussion of important risks and uncertainties that might affect world fish markets over the next ten years.

OECD-FAO Agricultural Outlook 2023-2032

8. Fish

Copy link to 8. FishAbstract

8.1. Projection highlights

Copy link to 8.1. Projection highlightsFish production, consumption and trade will grow slower than in last decade

Fish1 consumption for food is expected to grow over the next decade but at a slower rate than in the previous decade, largely due to a softening of demand in Asian countries, the main consumers of aquatic food. The slow-down in Asian countries reflects the already high per capita fish consumption levels on average, and increased competition from meats with a recovery in pig meat consumption in the People’s Republic of China (hereafter “China”). Apparent2 food fish consumption per capita is expected to increase in all continents except Africa, the region with the fastest growing population. By 2032, apparent food fish consumption is projected to reach 21.2 kg per capita globally – up from 20.4 kg in the base period (average 2020-2022). Differences across continents will persist and increase, as the strongest growth is expected in Asia, which already has the highest per capita consumption. Conversely, a decline is projected in Africa where per capita consumption is the lowest. The share of food fish consumption in total fisheries and aquaculture production is expected to remain broadly stable at about 90% over the outlook period. The remaining 10% of production will be utilised for non-food purposes, primarily for fishmeal and fish oil.

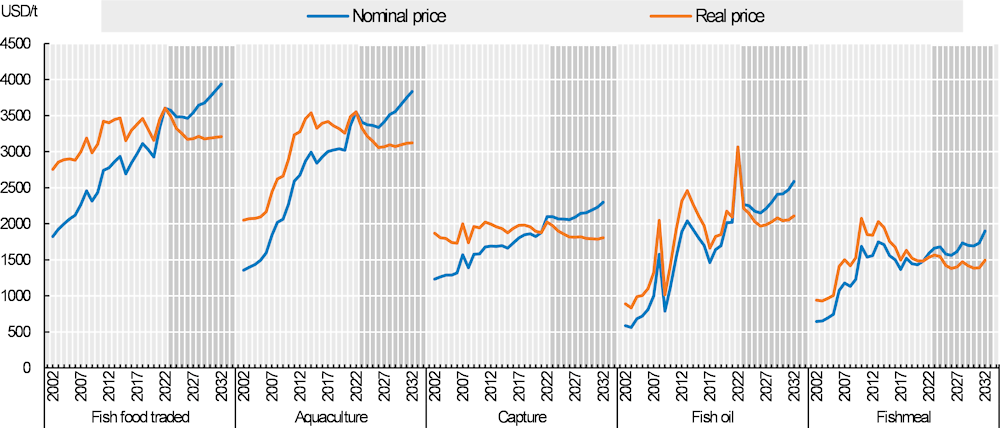

Fish prices will all decrease in real terms over the outlook period, down from the high levels reached in the base period (Figure 8.1). However, the subdued growth in fish production will prevent prices from falling significantly. Fish oil prices are expected to experience the greatest decline over the period, reflecting a downward correction from the exceptionally high levels in 2022. Despite stable supplies, fish oil prices grew by over 50% in 2022 compared with 2021, supported by the high prices of vegetable oils. The decrease in fishmeal prices in real terms is expected to be marginal and less than other categories over the outlook period due the ongoing tight supplies and strong demand. The world prices for traded fish, aquaculture species, and capture species are all expected to decrease at similar rates in real terms over the next decade.

Figure 8.1. World fish prices

Copy link to Figure 8.1. World fish prices

Note: Fish food traded: world unit value of trade (sum of exports and imports) of fish for human consumption. Aquaculture: FAO world unit value of aquaculture fisheries production (live weight basis). Capture: FAO estimated value of world ex-vessel value of capture fisheries production excluding for reduction. Fishmeal: 64-65% protein, Hamburg, Germany. Fish oil: N.W. Europe. Real prices are nominal world prices deflated by the US GDP deflator (2022=1).

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'' OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Global fish production will continue to expand to meet rising demand reaching 202 Mt by 2032, but at a slower rate than in the last decade. This slowdown in growth reflects the impact of policy changes in China, which have slowed the expansion of production, the higher costs for inputs, particularly energy, and the assumption that 2032 will be an El Niño year leading to lower production, mainly in South America. Most of the additional production will be generated by the aquaculture sector. By 2032, aquaculture production is projected to account for 55% of total fish production, compared with 50% in the base period. On average, the capture fisheries sector will provide about 92 Mt of fish every year, with lower levels in the years of El Niño.3 World production of fishmeal is expected to expand over the next decade with the proportion of fishmeal obtained from fish residues as the main driver, reflecting an increased capacity of the sector to utilize by-products. World production of fish oil is projected to rise at a rate similar to total fish production.

Global trade of fish for human consumption is projected to continue growing over the coming decade, but at a slower rate than in the past decade. Asia, and to a lesser extent Europe, will be driving the expansion of exports. By 2032, Asia will account for 51% of all food fish exports compared with 47% in the base period. Exports from Africa, Oceania and America are projected to decline by 2032, reflecting the slowdown in production growth across these continents and the assumed El Niño in the case of the Americas. The European Union, the United States and China will remain the top three importers, with rising imports for the European Union and the United States, while Chinese imports are expected to decrease by 21% by 2032. This decline reflects the efforts China is making to meet increasing food demand through domestic production.

The fisheries and aquaculture sectors are expected to face significant uncertainties over the coming decade. Capture fisheries production and related prices might be impacted by the recently concluded negotiations of the World Trade Organization (WTO) on fisheries subsidies, but also by improved fisheries management. Climate change represents a source of both environmental and regulatory risk for the capture fisheries and aquaculture sectors. Finally, Russian Federation’s (hereafter “Russia”) war against Ukraine and the related sanctions will continue to impact fish trade given the Russia’s position as an important capture fisheries producer.

8.2. Current market trends

Copy link to 8.2. Current market trendsPrice surge supported by limited supply growth and increased demand from global recovery

After a strong recovery in 2021, world fish production rose marginally in 2022 to an estimated 183 Mt. The rise in Asian production was partly offset by a reduction in Peruvian catches after a high production year in 2021. Higher production costs (energy and fuel) hampered profitability in the aquaculture and capture fisheries sectors, despite a significant rise in fish prices.

Increased demand, driven by the global economic recovery following the COVID-19 recession, combined with supply disruptions, including geopolitical conflicts, and weather-related disasters, led to higher inflation in 2021 and 2022. According to the FAO Fish Price Index,4 international fish prices were 19% higher in 2022 compared to 2021, following a 7% rise in 2021. The index peaked to 135 in June 2022 and since then has been on a downward trend.

World food fish exports were marginally down in 2022 compared with 2021 and are estimated to have reached 42 Mt. Higher exports from Chile, Korea and India were partly offset by reduced exports from Peru, the European Union and Norway.

8.3. Market projections

Copy link to 8.3. Market projections8.3.1. Consumption

Growth in fish consumption is expected to slow over the next decade

Fish can be consumed in different forms for either food or non-food uses. Fish not consumed as food is processed into fishmeal and fish oil or serves other non-food uses, such as for ornamental fish, culturing, fingerlings and fry, bait, pharmaceutical inputs, and as direct feed for aquaculture, livestock and other animals. Over the next decade, the bulk of fisheries and aquaculture production is expected to continue to be directed to human consumption. It is projected that 90% of fish production will be consumed as food in 2032, compared with 88% in the base period (2020-22 average). This mainly reflects a reduction in the quantities of fish used for fishmeal and fish oil production due to the El Niño phenomenon, assumed to occur in 2032.

At the global level, fish for human consumption is projected to continue rising but at a slower pace than that experienced in previous decades. This slowdown in growth is mainly due to sluggish production expansion, higher fish prices, in particular in the first years of the projection period, and to a softening of demand in some Asian countries. Fish for human consumption is projected to increase by 14% to reach 182 Mt by 2032, expanding on all continents. However, the magnitude of the rise will vary from one continent to another, reflecting different consumption baseline levels and population growth rates. Africa is projected to experience the strongest growth rate in fish available for food consumption by 2032 (+25%), and Europe the lowest (+4.6%). At +14%, Asia does not have the highest growth rate but is, by far, the largest fish consumer. Consequently, Asia will account for 74% of the additional fish consumed by 2032. China on its own will account for 34% of that additional volume. Aquaculture will provide a growing share of the total fish available for human consumption rising from 57% in the base period to 61% by 2032.

World apparent food fish consumption is expected to increase over the next decade, reaching 21.2 kg in 2032 in per capita terms, up from an average of 20.4 kg in 2020-22 (Figure 8.2). The growth rate will be lower in the second half of the outlook period when fish prices will increase. In per capita terms, fish consumption will increase in all continents except Africa, where it is projected to decline from 9.8 kg in 2020-22 to 9.6 kg in 2032, with a larger decrease in Sub-Saharan Africa (down from 8.8 kg in 2020-22 to 8.3 kg in 2032). Nevertheless, rising incomes and near saturation in consumption levels of some Asian countries are leading to a more even evolution of fish consumption per capita across continents. The decline in the African per capita fish consumption will be relatively smaller than in the prior decade, while the rise in the Asian per capita fish consumption will be about half that of the prior decade.

Middle-income countries will drive growth in apparent food consumption per capita over the outlook period, followed by high-income countries. However, low-income countries are expected to experience negative growth over the outlook period.

Consumption of fishmeal and fish oil will be constrained by their generally stable production. Markets will continue to be characterised by the traditional competition between aquaculture and livestock for fishmeal, and between aquaculture and dietary supplements for direct human consumption for fish oil. The reduction in fishmeal use in feed rations, due to its high price and major innovation efforts, will continue to expand the market for oilseed meals in the aquaculture industry, where oilseed meal use is anticipated to reach about 11.4 Mt in 2032. China will be the country utilizing the highest quantity of fishmeal as feed with a share of 42% of total consumption in 2032. Fish oil is still expected to predominantly be used in aquaculture, but direct human consumption will remain an important market, where prices are generally higher.

Note: data are expressed in live-weight equivalent.

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'' OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

8.3.2. Production

Aquaculture to drive production growth

Global fish production (capture fisheries and aquaculture) is expected to increase to 202 Mt by 2032, up from 181 Mt in the base period (Figure 8.3). While global fish production is still increasing (+12% over the outlook period), the rate of growth is substantially lower than the 22% increase achieved over the previous decade. This is the consequence of a lower growth rate in the aquaculture sectors when compared to the previous decade. In general, the pattern of the previous decade where capture fisheries production remained broadly stable while aquaculture production grew is expected to continue.

Capture fisheries production is projected to grow marginally, reaching 91 Mt by 2032, an increase of just under one Mt. However, this slow growth is partly influenced by the assumed El Niño event in 2032, which reduces capture fishery production in South America, resulting in world capture production falling by about 2 to 3 Mt in these periods. Growth in capture fisheries production is expected to come largely from improved fisheries management, from technological improvements and reduction of discards and waste. The bulk of production will originate from Asian countries, which share in world capture fisheries is expected to rise slightly to 53% by 2032.

Note: Data are expressed in live-weight equivalent.

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'' OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

The vast majority (96%) of additional growth in global fish production will originate from increasing aquaculture production. Aquaculture production is projected to be 111 Mt by 2032, an increase of 22% (or +20 Mt) relative to the base period, compared with 55% (or +33 Mt) in the previous decade. This anticipated slowdown in aquaculture production growth will be mainly caused by continued lower productivity gains related to environmental regulations, animal diseases related to high stocking densities and a reduced availability of optimal production locations. China, in particular, is expected to experience a substantial slowing of growth in farmed fish production due to regulations aimed at increasing the sustainability of the sector and targeting growth in species for domestic consumers. Nevertheless, China will continue dominating world aquaculture production with an expected share of 56% in 2032, representing a marginal decline to the base period.

The production of all species groups is projected to rise over the outlook period, though at different rates, resulting in a change in the composition of aquaculture production by 2032. The share of carp, the main farmed species, is expected to decline by 2032, while the share of all other species groups will rise. This represents the continuation of a downward trend that started in the late 1990’s and corresponds, particularly in China, to the diversification of production largely in response to local demand. It is worth noting that the share of China in total carp production is projected to decline, reflecting stronger growth in other countries such as India. The shares of shrimps and prawns and of freshwater and diadromous fish (excluding tilapia and salmonoids the shares of which are projected to remain broadly stable) will increase.

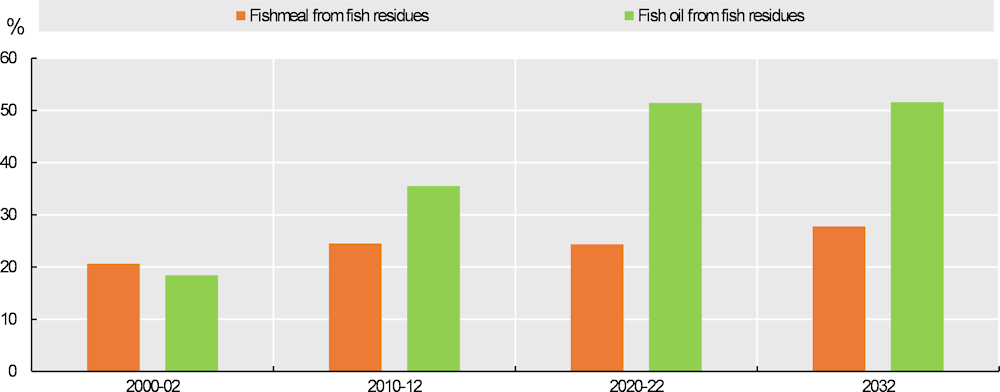

Over the next decade, it is expected that the quantity of capture fisheries production for fishmeal and fish oil will fluctuate between lows of 15.9 Mt in El Niño years and highs of 18.3 Mt in the best fishing years. This represents a drop compared to an average quantity of wild fish used for reduction of 26 Mt in the 1990’s. In parallel, the use of fish residue and by-products to produce fishmeal and fish oil is anticipated to continue increasing as growing market demand for fillets results in more residues being produced (Figure 8.4). The absolute level of world fishmeal and fish oil produced will reach 5.4 Mt and 1.3 Mt (in product weight) respectively in 2032, with a corresponding growth of 4.0% and 11%, compared to the base period. A notable consequence of the relatively limited ability for fishmeal production to increase and the continued growth of aquaculture is that oilseed meals are increasingly used to make up the shortfall in aquaculture feed. The observed price differential between fish and vegetable oil, and the increasing difference between fishmeal and oilseed meals suggest that crushing fish is likely to remain a profitable activity. Fishmeal and fish oil are expected to be used selectively at specific stages of production, such as for hatchery, brood stock and finishing diets as considered the most nutritious and most digestible ingredients for farmed fish.

Figure 8.4. Share of fishmeal and fish oil obtained from fish residues

Copy link to Figure 8.4. Share of fishmeal and fish oil obtained from fish residues

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'' OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

8.3.3. Trade

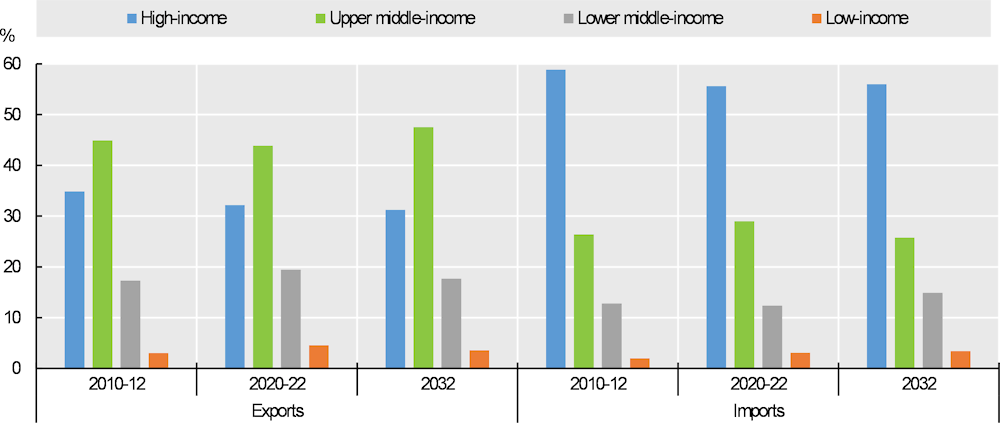

Over half of the food fish imports will continue to be concentrated in high-income countries

According to the projections, aquatic products (for food and non-food items) will remain highly traded, with about 33% of total fish production including intra-EU trade (30% excluding intra-EU trade) exported in 2032, reflecting the sector’s degree of openness to, and integration in, international trade. The aquaculture and capture fisheries supply chain is expected to remain complicated as aquatic products often cross national borders several times before final consumption due to the outsourcing of processing to countries with relatively lower labour and production costs.

World trade of fish for human consumption is projected to be 5.0% higher in 2032 than in the base period. This represents a slowdown compared to the 10% growth observed in the previous decade. High transportation costs, slower expansion of fish production and desire to fulfil domestic demand with local production in some key countries, including China, are the main drivers behind this slowdown in growth. By 2032, exports of fish for human consumption are projected to reach 44 Mt, up from 42 Mt in the base period.

By 2032, upper middle-income countries are the only income class expected to experience an increase in its share of global food fish exports, increasing to 48% from 44% in the base period. High-income countries will account for 31% of total food fish exports by 2032, lower middle-income countries for 18%, and low-income countries for the remaining 4% (Figure 8.5). China will consolidate its leading role as the major exporter of fish for human consumption, with a share of 22% of world exports in 2032 (up from 17% in 2020-22), followed by Norway and Viet Nam (stable at 7% and 6%, respectively).

Figure 8.5. Trade of fish for human consumption by income regions

Copy link to Figure 8.5. Trade of fish for human consumption by income regions

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'' OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

The share of lower middle-income countries in global food fish imports is set to rise over the outlook period, while that of upper middle-income countries will decline. By 2032, the shares of food fish imports of lower middle-income and upper middle-income countries are expected to reach 15% and 26% of world food fish imports respectively, from 12% and 29% respectively in the base period. This trend reflects the rise in income in lower middle-income countries allowing them to increase their access to international markets. It also reflects the relocation of the fish processing industry from upper middle-income countries, such as China, to countries with relatively lower production costs, such as India, Indonesia or Viet Nam, thus leading to a rise in imports of raw material in lower middle-income countries. The share of high-income countries in world food fish imports will remain stable at 56% during the next decade. High-income countries will continue to be highly dependent on imports of fish for human consumption to meet their demand. By 2032, food fish imports are projected to account for 75% of total fish consumption in high-income countries.

In 2032, exports of fishmeal are projected to reach 3.3 Mt product weight, a quantity comparable to the one observed in the base period. However, it is worth noting that 2032 is assumed to be an El Niño year, leading to lower fishmeal production and trade. Peru will remain the leading exporter of fishmeal, with a share of global exports oscillating between 26% and 34% depending on the presence or not of the El Niño phenomenon. China is expected to have a 55% share of world fishmeal imports by 2032, increasing from 46% in 2020-22, to satisfy the needs of its aquaculture and pig industries. Fish oil exports are expected to increase slightly to 0.9 Mt product weight by 2032. With a combined share of 44%, the European Union and Norway will remain the main importers of fish oil, reflecting the use of fish oil for salmon farming and as a dietary supplement for human consumption.

8.3.4. Prices

Prices are expected to decline slightly but remain high over the projection period

Prices across all categories increased in 2022 as the ongoing economic recovery from the COVID-19 pandemic continued to drive strong demand combined with the general inflationary environment. In nominal terms, the prices of all product groups are expected to decline until 2026 before continuing to rise again as demand stabilises in the wake of the COVID-19 recovery. Prices will decline over the projection period but will remain high relative to historic levels across all product groups. Real prices, however, will fall across all product groups in the projection period, in part due to increased competition from other protein sources (Figure 8.1).

The prices of both capture fisheries and aquaculture products are impacted by increased competition from other protein sources, predominantly pig meat and poultry. Increased production and falling prices of other protein sources will lead to a softening of demand and reduced prices of both aquaculture and capture fisheries products in real terms. However, aquaculture production growth is expected to be slower than the previous decade (see production section), limiting the expected price decline across the projection period.

Capture fisheries prices are expected to grow 19% (+1.1% p.a.) in nominal terms. However, in real terms this equates to a decline of 6.6% (-0.9% p.a.). This differs from the previous decade where prices grew by 27% in nominal terms and 1.8% in real terms. As with other product groups the growth in prices over the previous decade is an artefact of strong growth in prices following the COVID-19 pandemic in the base period. In nominal terms, prices are expected to decline from the high point in 2022 until 2026 before returning to growth from 2027. In real terms, capture fisheries prices will follow a similar pattern, but will continue to decline after 2027, albeit at a slower rate than between 2022 and 2026.

Aquaculture prices are expected the follow similar patterns to capture fisheries, with nominal growth of 16% (+1.5% p.a.), and real declines of 9.0% (-0.5% p.a.). Growth in aquaculture prices is projected to be significantly lower than the previous decade when prices grew 41% in nominal terms and 13% in real terms. As with capture fisheries, the price trend is characterised by a decline between 2022 and 2026 as prices come down from COVID-19 recovery driven highs, followed by growth from 2027 to 2032. Unlike capture fisheries, growth in prices is expected in both nominal and real terms in the second half of the projection period.

Fish oil prices are expected to grow by 9.2% (+1.7% p.a.) in nominal terms but in real terms are expected to decline by 14% (-0.3% p.a.), the greatest decline seen in all product groups. This decline is in part due to the exceptionally high prices in the base period when the fish oil price grew by over 50% in 2022 compared with 2021, despite stable supplies and was caused by the very high price of vegetable oils. The exceptionally high prices in 2022, mean the price of fish oil in 2032 is projected to be below the 2022 price in both nominal and real terms, despite continued strong demand as a feed input for aquaculture and for human consumption. The decline in prices contrasts strongly with the previous decade where prices grew by 102% (+2.8% p.a.) in nominal terms and 63% (+0.9% p.a.) in real terms. Fishmeal prices are expected to grow by the largest amount in nominal terms, 26% (+1.3% p.a.), and experience the smallest decline in real terms, -0.6% (-0.7% p.a.). The marginal decline in fishmeal prices reflects ongoing tight supplies and strong demand, bolstered by an increase in demand for fishmeal relative to other protein meals in aquaculture production.

8.4. Risks and uncertainties

Copy link to 8.4. Risks and uncertaintiesEnvironmental uncertainty and regulatory risks could significantly impact fish production

The fisheries and aquaculture sectors will continue to face significant uncertainties over the next decade, including challenges related to the environment, policy changes and effectiveness of governance. While much of the production growth is expected to come from aquaculture, shifting government policies, particularly related to environmental impacts could alter the distribution and rate of growth. Any policy shifts in China, the world’s largest producer of both aquaculture and capture fisheries, will have significant impacts on global production and the 15th Five-Year plan 2026-2030 represents a source uncertainty for the second half of the projection period.

Climate change will have both direct and indirect impacts on both capture fisheries and aquaculture and is perhaps one of the largest sources of uncertainty for fish production over the next decade, which is difficult to capture in the projections. The direct impacts of climate change on capture fisheries include the shifting geographic distribution of stocks, and changes to species composition, turnover, abundance and diversity in marine ecosystems. Climate change will not only impact the resources available to fishers, but also complicate the job of fisheries managers, and increase the number of shared stocks heightening the need for co-operative management regimes. On aquaculture, climate-driven changes in temperature, precipitation, ocean acidification, incidence and extent of hypoxia and sea level rise, availability of wild seed as well as reducing precipitation leading to increasing competition for freshwater, amongst others, are expected to have long-term impacts. The impacts of climate change will not be evenly distributed, with larger changes expected in tropical regions when compared to temperate zones.

Climate change also creates several regulatory risks for both capture fisheries and aquaculture. As governments come under increasing pressure to reduce GHG emissions from the food system and transition to net zero, the prices of key energy inputs into capture fisheries (e.g. diesel fuel) and aquaculture (e.g. electricity) may change altering the profitability of some activities, with impacts on the types of production and the structure of the fleet. The impact of those policies on the agricultural markets is another source of uncertainty. The risks posed by the transition to net zero depends on both the energy intensity of production and the nature of the policies put in place, making them both hard to predict and heterogenous across countries and fleet segments. To help governments understand these challenges and share best practices the OECD has two new initiatives: one related to the impacts of climate change on policy making for capture fisheries and, another looking at the role of aquaculture can play in meeting the challenges faced by food systems globally.

To help vulnerable states mitigate the often-devastating effects of climate change, the FAO Blue Transformation can provide a pathway for hunger reduction and sustainable management of oceans, seas, and marine resources through reconciling environmental sustainability, food security and livelihood priorities. The Blue Transformation focuses on more efficient, inclusive, resilient and sustainable blue food systems, from both capture fisheries and aquaculture, promoted through improved policies and programmes for integrated science-based management, technological innovation, and private-sector engagement. It has three main objectives: sustainable aquaculture expansion and intensification; effective management of all fisheries; and upgraded value chains. Achieving the objectives of Blue Transformation requires holistic and adaptive approaches that consider the complex interaction between global and local components in food systems and support multi-stakeholder interventions to secure and enhance livelihoods, foster equitable distribution of benefits and provide for an adequate use and conservation of biodiversity and ecosystems.

In 2022, the international community agreed binding discipline on fisheries subsidies at the WTO, and its application represents another source of uncertainty for capture fisheries production. The agreement inter alia prohibits subsidies to fishing activity on overfished stocks, to illegal unreported and unregulated fishing and, to fishing on the high seas outside the area of competence of an RFMO. An analysis of government support to fisheries presented in the OECD Review of Fisheries 2022 suggests that over 60% of support (2018-2020 average) presents a high or moderate risk of encouraging unsustainable fishing in the absence of effective management. This suggests that when the WTO agreement enters into force (once two-thirds of members have accepted the agreement), the impacts on capture fisheries production may be significant if governments are required to alter their subsidy programmes to ensure compliance. The agreement also contains provisions for adopting more comprehensive disciplines within four years of the initial agreement entering into force, potentially resulting in another, more stringent, set of disciplines being applied in the projection period, introducing further uncertainties.

Finally, from a trade perspective, future policy decisions could impact the projections. For example, while sanctions remain in place on Russia following the invasion of Ukraine, any changes to this situation are difficult to predict and may impact the expected trading relationships. Ongoing tensions between the United States and China, may have increasing impacts on the trade in fisheries products, particularly if trade and fishing activities in the Pacific are affected. The imposition of sanctions, tariffs and trade restrictions over the long term could alter established markets, leading to reduction in trade and higher consumer prices in some regions.

Notes

Copy link to Notes← 1. In this chapter and publication the term “fish”, “seafood”, “fisheries and aquaculture production/products” or “aquatic products” are used to indicate fish, crustaceans, molluscs and other aquatic animals, but exclude aquatic mammals, crocodiles, caimans, alligators and aquatic plants. All quantities are expressed in live weight equivalent, except those of fishmeal and fish oil.

← 2. The term “apparent” refers to the amount of food available for consumption, which is not equal to the edible average food intake. The amount is calculated as production + imports – exports - non-food uses, +/- stocks variations, all expressed in live weight equivalent.

← 3. The years of the El Niño are set in the model to occur in 2024, 2028 and 2032.

← 4. Calculated in nominal terms, and covering fisheries and aquaculture products.