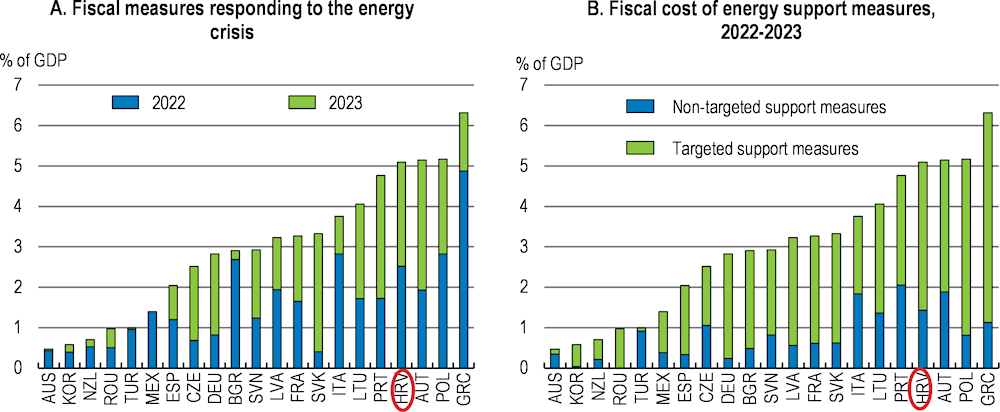

Croatia’s strong recovery from the COVID-19 crisis has been slowed by the surge in global energy and food prices following Russia’s war of aggression on Ukraine. Robust services exports led by tourism, a tightening labour market and rising investment, the latter fuelled by the implementation of the Recovery and Resilience Plan, are maintaining robust growth. Demand and access to finance are being bolstered by Croatia’s integration into the euro and Schengen areas. However, the surge in inflation is abating slowly, as capacity constraints and rising wages broaden cost pressures. Ensuring that fiscal policy does not add to demand pressures while inflation is high, and that new lending funds quality investments, can help maintain robust growth and moderate inflationary pressures. Reallocating public spending to areas that best support growth, raising more revenues from sources with lower burdens on activity, and encouraging greater formalisation of activity can help maintaining healthy and growth-supporting public finances. Implementing an ambitious programme to reduce greenhouse and other polluting emissions and to adapt to a changing climate would hasten the transition to a green economy and improve well-being.

OECD Economic Surveys: Croatia 2023

2. Key policy insights

Abstract

Challenges lie ahead for managing sustainable catch-up

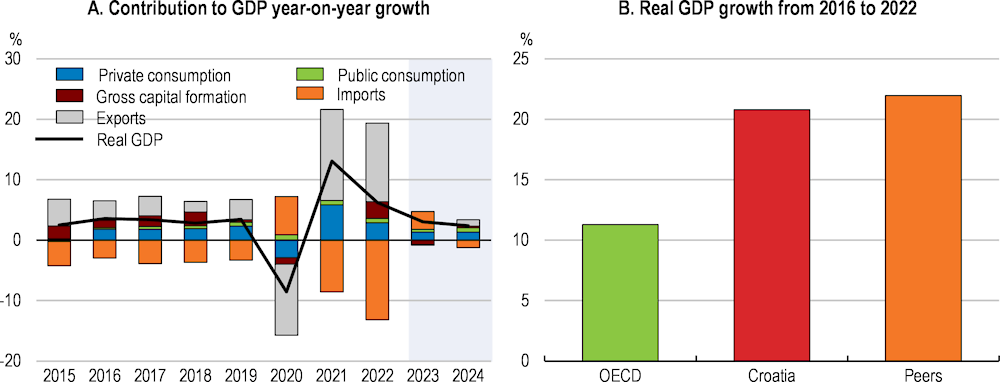

Croatia recovered strongly from the COVID-19 crisis, and output growth is now returning to the average rates of the late 2010s (Figure 2.1). In 2022, the surge in global prices and uncertainty, especially following Russia’s war of aggression on Ukraine slowed the recovery. However, robust tourism exports, fiscal support measures augmented by spending of the Recovery and Resilience Plan, and the boost to access to finance and external demand from Croatia’s integration in the euro and Schengen areas are supporting demand. Capacity limits, most notably for skilled workers in the labour market, are a growing barrier to expansion. These are contributing to rising wages and broadening inflation pressures, even as the headline rate abates from recent highs.

Looking ahead, robust growth is projected to be sustained by growing public investment spending, abating inflation, and the tight labour market and rising wages supporting households’ incomes. Integration into the euro area increases the importance of fiscal policy in managing demand pressures and acting promptly to balance the business cycle, while continuing to bring public debt down to below 60% of GDP. Improving the state’s spending effectiveness and tax mix would allow fiscal policy to be both prudent and to better support growth. Building fiscal buffers now is also important to prepare for the longer-term challenges, including reducing the economy’s emissions, improving the quality of the environment, and adapting to an ageing population and a changing climate.

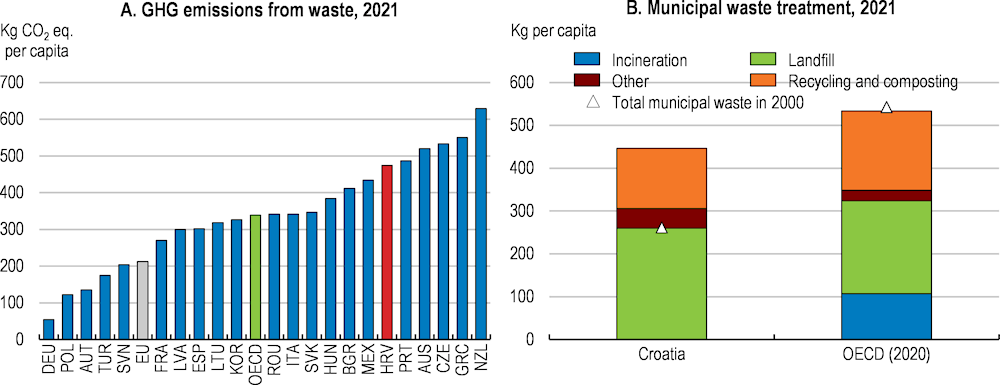

Figure 2.1. Consumption and exports have lifted GDP growth, while investment has lagged

Note: ‘Peers’ is the unweighted average of Czech Republic, Hungary, Slovak Republic, and Slovenia for the selected indicators (discussed in Box 1.3). Panel A: Components of GDP growth may not sum to aggregate GDP growth due to the statistical discrepancy and the non-additivity of chain-volume measures. Shaded area indicates projections.

Source: OECD Economic Outlook(database).

The surge in inflation has slowed growth

Croatia’s strong post-COVID-19 recovery has been slowed by surging prices

GDP expanded by 6.2% in 2022, following the post-COVID-19 rebound of 13.1% in 2021 (Figure 2.1). Growth slowed abruptly in the second half of 2022, following the shocks from the surge in energy costs, and the rise in international supply disruptions and uncertainty following Russia’s war of aggression against Ukraine. The slowdown was moderated by the late and mild winter, which supported construction activity and private consumption. Croatia’s limited economic relations with Russia as well as Ukraine limited the direct impact of the war (Box 2.1). Growth picked up in the first half of 2023 as strong services exports – largely tourism – and the tight labour market supported incomes and a recovery in consumers’ spending. Construction and investment activity, with the rebuilding of housing following the 2020 earthquakes (Chapter 4) and the implementation of the Recovery and Resilience Plan projects (discussed below) have also supported growth. Overall, Croatia’s post-COVID-19 recovery takes GDP growth back to its 2015-19 trend, with output growth near the rates of its peers.

Box 2.1. Croatia’s direct exposure to the war in Ukraine has been modest

Croatia’s trade and humanitarian exposure to the war in Ukraine has been limited. In 2021, Russia and Ukraine received respectively 1.1% and 0.3% of Croatia’s total goods exports, mostly chemicals and related products, machinery, and transport equipment. These markets jointly made up 2% of Croatia’s tourism nights in 2021. Russia and Ukraine were respectively sources of 1.6% and 0.2% of Croatia’s total goods imports.

Croatia’s energy supplies have been its main exposure to the war in Ukraine, though Croatia is less exposed than many of its peers thanks to its significant renewable energy and gas import capacity. In 2021, 9% of Croatia’s oil imports and 22% of its gas supply came from Russia, smaller shares than many of its neighbours, although the shares are likely to be higher through exports by Hungary of fuels refined from Russian-sourced oil. Croatia sourced 57% of its gas from imported liquified natural gas (LNG) and produced the remainder domestically. The capacity of the LNG import facilities on the island of Kirk, opened in 2021, are near Croatia’s total domestic demand, and the government has approved a project to more than double the terminal’s capacity to 6.1 billion m3 of gas a year as part of its plan to become a regional energy entrepot. New export pipelines are expected to be completed in 2025. In addition, Croatia’s Adria oil pipeline between the Croatian island of Krk and states in central and south-eastern Europe plays an increasingly important role in the region’s energy supply. Ensuring fair pricing of transit fees facilitates a level playing field in access to the pipeline.

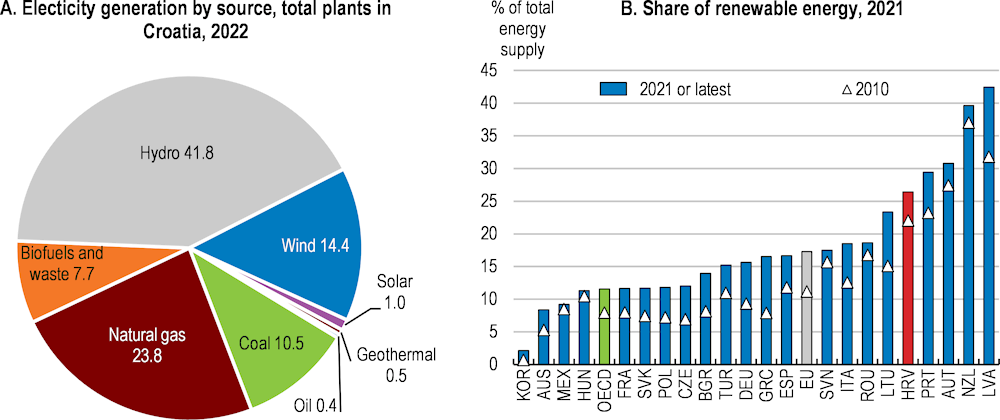

About one-quarter of Croatia’s domestic energy consumption is used by the petrochemical industry, which produces mineral fertiliser. Croatia generates 31% of its total energy needs from renewable sources, a higher share than most OECD countries, and investments in its Recovery and Resilience Plan and energy support packages are expanding this capacity (discussed below).

The humanitarian impact has also been limited. Croatia has provided over 21 000 refugees with temporary protection visas (UNHCR), about 0.5% of the population. Some social services and temporary accommodation arrangements have been established, for example making use of hotels in some northern and coastal cities. However, Croatia’s response capacity has been constrained by the ongoing support for the population displaced by the 2020 earthquakes (Box 4.3). Up to 6 000 refugees are assessed as being employable including in professions suffering shortages In Croatia. To date they have mostly been employed in low-skilled jobs as they lack language skills or due to the slow process to recognise their qualifications (Chapter 4).

Government support measures have mitigated the impact of inflation on real disposable income (Box 2.2). The surge in consumer prices in 2022 led to the strongest fall in households’ real incomes since the deep recession in the early 2010s. Strengthened in September 2022 and extended in March 2023, support measures have reduced energy and some other basic food costs. Price subsidises, via price ceilings for certain consumption volumes, reduced prices or tax reductions, have made up most of the cost of these measures. In addition, there have been increases in transfers to minimum income, minimum pension and several other categories of social support recipients. These follow substantial policy measures to support household incomes during the COVID-19 crisis (Christl et al., 2021[1]). Avoiding any further extension of announced measures, and instead developing the social protection system to provide an adequate and responsive safety net (Chapter 4) would better ensure support for the households at greatest risk of hardship while preserving fiscal space.

Box 2.2. Measures taken in response to the energy price shock

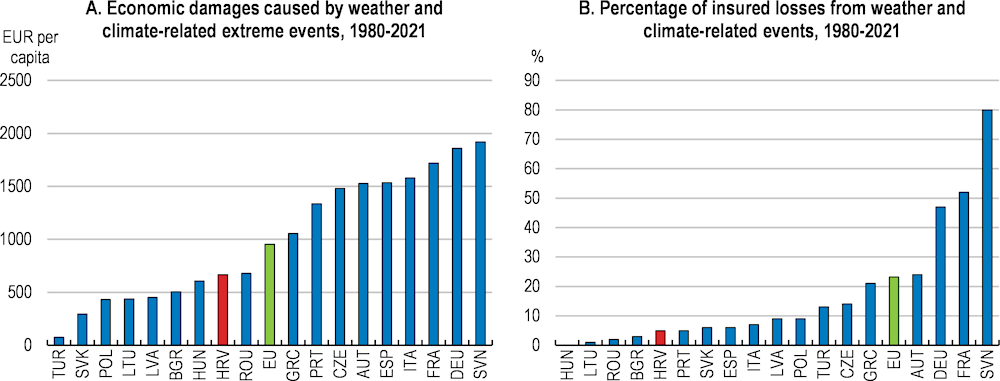

In March 2023 Croatia announced its fourth package of measures to offset the effects of the surge in energy prices. This package continued the goals of the earlier packages of mitigating energy price rises, limiting the effects of inflation, supporting real incomes, and reducing reliance on fossil fuels. Together, the value of these packages is substantial and larger than those introduced in many European OECD countries (Figure 2.2). The bulk of spending caps or reduces energy prices, in some cases with limits on the volume of energy products subject to the capped price for individual users or in total. Targeting is broad and a number of measures benefit business users. Income and other support measures targeting vulnerable households focus on existing social protection recipients, although targeting and take-up of social protection remain a challenge (Chapter 4).

The March 2023 package of EUR 1.7 billion (2.3% of 2023 GDP) is allocated to subsidising energy and other prices (EUR 1.2 billion), supporting the shift to renewable energies, and raising energy efficiency (EUR 0.3 billion) and income support (EUR 0.16 billion). Most of the measures are one-off transfers or are scheduled to terminate by October 2023 or April 2024.

These measures largely build on the September 2022 package, itself worth 3.7% of annual GDP, and that included tax relief and excise rate cuts (2.6% of GDP); income support for vulnerable groups (0.8% of GDP); and support for energy renovations (0.3% of GDP). That package also included support for loans and grants to businesses valued at 1.7% of GDP and raised social benefits for pensioners and other vulnerable groups, and public servant wage rates.

Figure 2.2. Croatia’s energy support measures are substantial and are largely price subsidies

Note: Panel B: Support measures are taken in gross terms, i.e., not accounting for the effect of possible accompanying energy-related revenue-increasing measures, such as windfall profit taxes on energy companies. Where government plans have been announced but not legislated, they are incorporated if it is deemed clear that they will be implemented in a form close to that announced. Gross fiscal costs reflect a combination of official estimates and assumptions on how energy prices and energy consumption may evolve when the support measures are in place.

Source: OECD calculations based on the OECD Energy Support Measures Tracker.

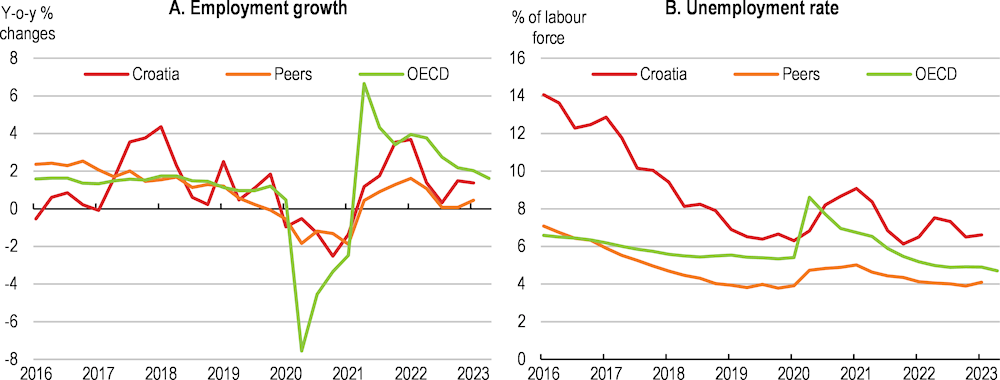

The improving labour market has supported households’ incomes. Employment growth has averaged 2.5% annualised from the start of 2021 to mid-2023 (Figure 2.3). This, and the declining working-age population, brought the unemployment rate to near historic lows in early 2023 and the participation rate among those aged between 15 and 74 years reached 60%, the highest rate on record. Rising numbers of immigrant workers have helped address labour shortages. Nevertheless, the number of positions advertised or open vacancies point to a tightening labour market. Nominal wages have increased. The national accounts measure of the wage rate increased by 7.5% in 2022 compared with 2021, while the statutory minimum wage rate was increased by 10.3% in 2022, and by 12% in 2023.

Job creation has varied across sectors and regions. Employment has risen in many sectors, with tourism-related and business services struggling to fill vacancies. Employment growth has been strongest in regions such as Zagreb and along the coast, and weaker in the interior and east, such as Slavonia, thus accentuating existing regional inequalities. The youth unemployment rate has declined less than the overall rate. It only partly recovered following the COVID-19 crisis and has been broadly stable near 18% since late 2021, several percentage points above the rates in most euro-area and OECD countries.

Figure 2.3. Stronger employment growth is making inroads into unemployment

Note: ‘Peers’ is the unweighted average of Czech Republic, Hungary, Slovak Republic, and Slovenia (discussed in Box 1.3).

Source: OECD Economic Outlook database.

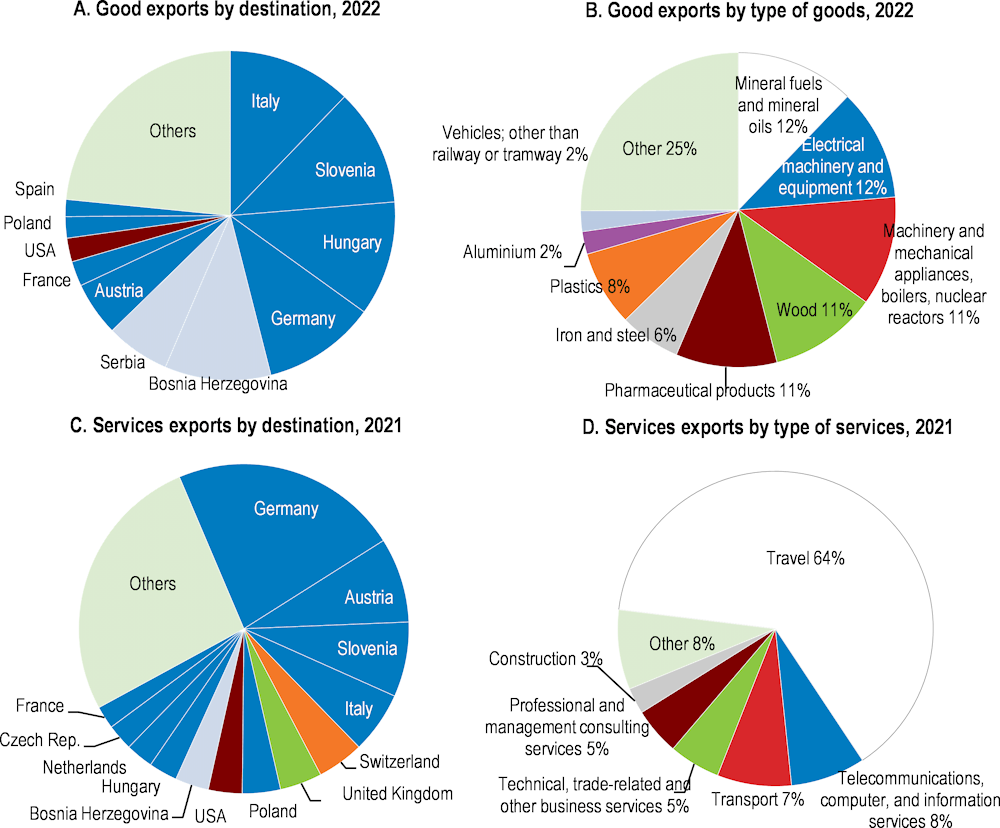

Strengthening exports of goods and services have contributed to GDP growth in recent years. In 2022, exports of both goods and services were above the historic highs of 2019 in real terms. Contributory factors include robust demand in other EU economies and for Croatia’s less technologically advanced manufactures, plus Croatia’s lower exposure to the disruptions in global supply chains than of many Central and Eastern European economies (CEE). Meanwhile, the increased cost of energy imports widened the trade deficit and pushed the current account into deficit in 2022. In most years Croatia runs a goods trade deficit, which is only partly offset by a surplus on services trade, about 70% of which is tourism. The increased inflows of European Union grants, notably from the NextGeneration EU facility, have supported the current account.

Box 2.3. Tourism leads exports, and more technologically advanced manufacturers have an emerging role

Exports of goods and services increased strongly after Croatia joined the European Union in 2013, from about 40% of GDP to about 50% in 2021. Trade is strongly linked to other EU countries. In 2022, about 60% of both goods and service exports went to EU member countries (Figure 2.4, Panel A and C), and about three quarters of imports came from EU countries.

Tourism services are the largest export category. Services make up almost two thirds of exports, of which 64% are travel (Figure 2.4, Panel D). After the sharp fall in 2020 during the initial phase of the COVID-19 crisis, tourism revenues partially recovered in 2021, reflecting incoming tourism by road and the attractiveness of Croatia for remote workers. In 2022, total travel receipts were 24% above their previous peak in 2019. The tourism sector contributed 11.3% to total gross value added in 2022, compared with 2% on average in Central and Eastern European countries, and 6.6% of employment (Eurostat, 2023[2]). Integration into the Schengen and euro areas is likely to have lifted demand by reducing costs of visiting Croatia. As a comparator, for France, being part of the Schengen area is estimated to add between 5% and 15% to tourism receipts (Aussilloux and Le Hir, 2016[3]).

Figure 2.4. European markets, tourism services and manufactures account for most exports

Note: Panel A and B: Data are collected on the basis of the Harmonised System 2017; Panel C and D: Data are collected according to the Balance of Payments methodology.

Source: United Nations Comtrade database.

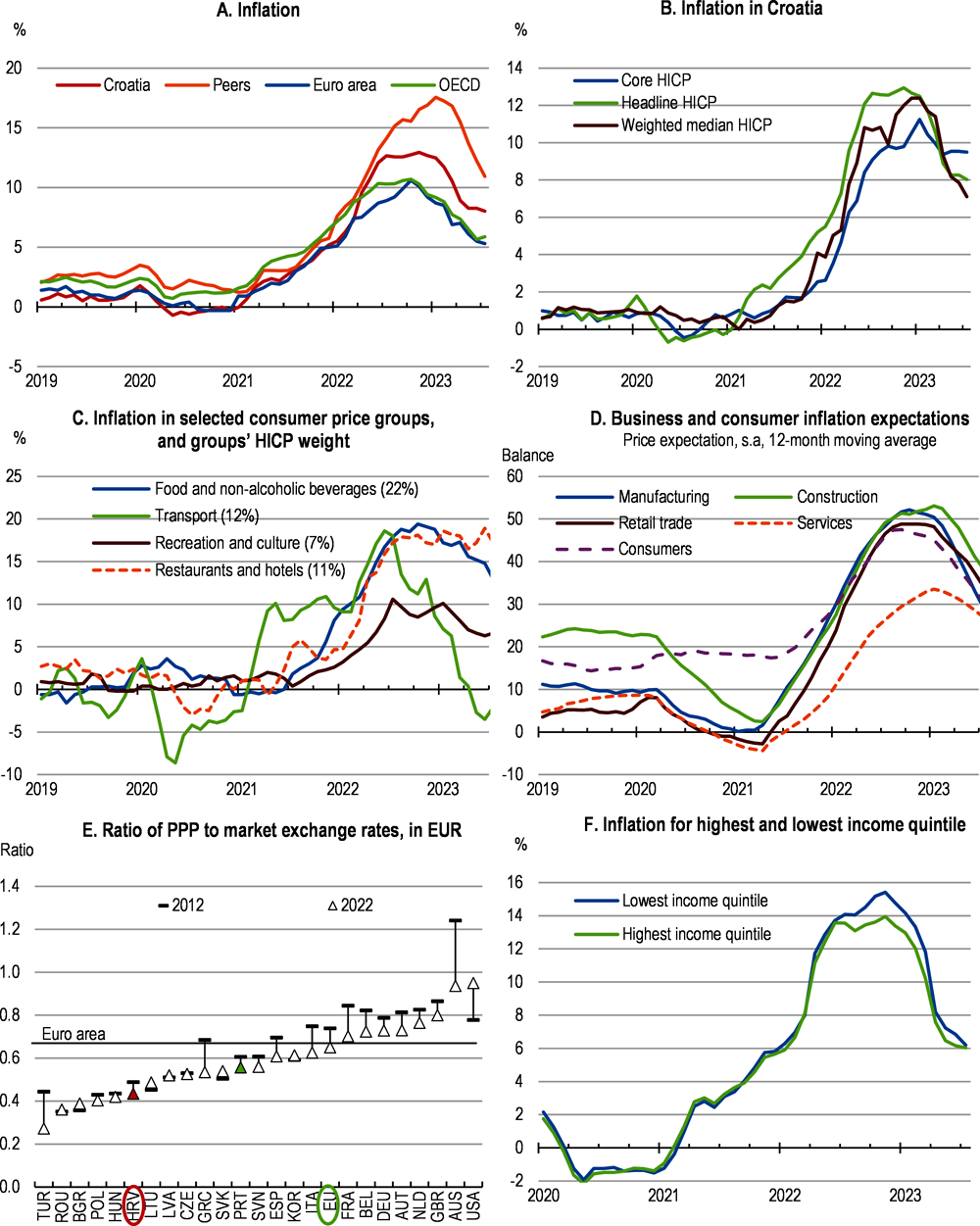

Inflation is gradually abating

Inflation surged in in 2022, by more than in most OECD countries but by less than in many of Croatia’s peers in Central and Eastern Europe (Figure 2.5). Harmonised consumer price inflation peaked at 13.0% in November 2022, the highest rate since the 2000s, led by energy prices. With the latter having retreated headline inflation has been abating very gradually; as of August 2023 it was 8.5%. However, price pressures broadened over this period, with many non-energy prices, notably of food and services items, rising fast, lifting some measures of underlying inflation above the headline rate. For example, prices were up by 20.4% for hotels and other accommodation and by 12.9% for food and beverages in July 2023 from a year earlier. The relatively strong increases in food and heating prices particularly harm the well-being of poorer households due to the higher share of their incomes spent on such items (Figure 2.5, Panel F).

Inflation expectations of businesses across different sectors and of consumers progressively retreated from their peaks of 2022 but remain well above levels associated with low and stable inflation (Figure 2.5, Panel D). The retreat of industrial businesses’ inflation expectations has been more pronounced than of services businesses’ expectations, reflecting the falls in many international industrial input prices on the one hand, and rising wage and food costs and demand pressures in services on the other. While the price level in Croatia is similar to many of its peers (Figure 2.5, Panel E), swiftly restoring price stability will be key to maintain the country’s competitiveness for foreign investment and export production, and to support real incomes.

The episode of high inflation coincided with Croatia shifting to the euro for everyday transactions on 1 January 2023. Consumer surveys report a perception that retailers have used the currency change to round prices higher. This is despite requirements that prices be displayed in both currencies until the end of 2023, rules on the rounding of prices, and increased inspections for compliance with pricing rules. An analysis of detailed price data by the European Central Bank and the Croatian National Bank found evidence only of moderate price increases in some service sectors that could be linked to euro adoption. The analysis estimated that the currency changeover added 0.4 percentage points to overall inflation (Falagiarda et al., 2023[4]). This is consistent with the experience of other countries that joined the euro area earlier on (e.g., (Mastrobuoni, 2004[5])).

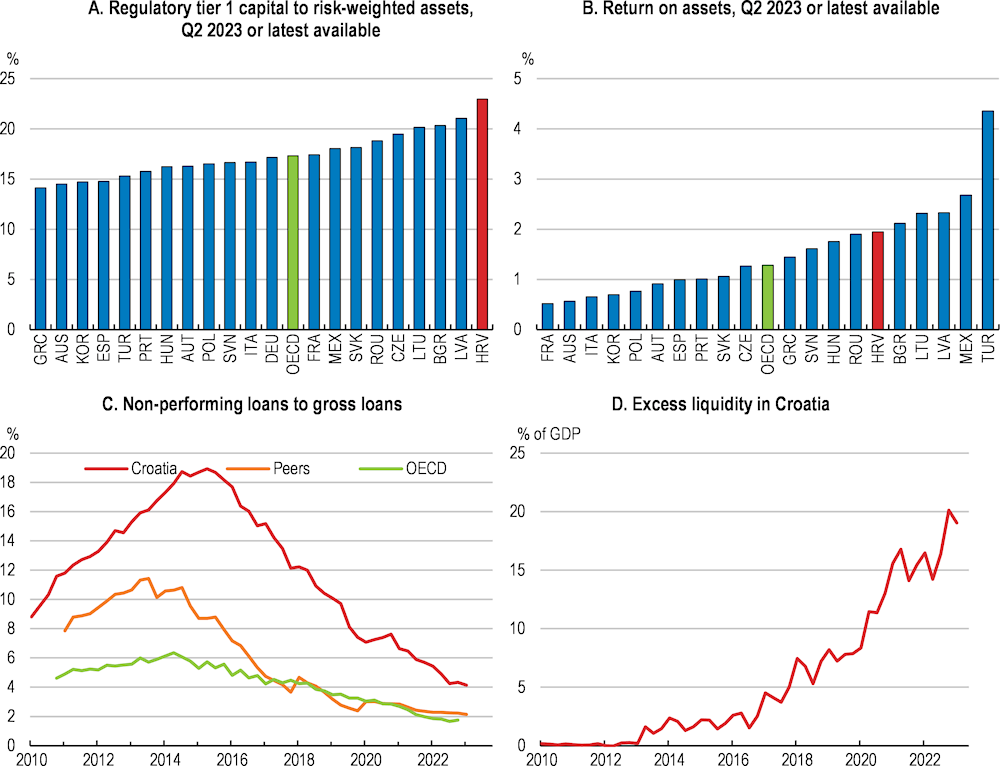

The financial sector appears robust but ongoing vigilance is warranted

Croatia’s banks appear to be in sound shape prudentially. Their liquidity coverage ratio increased to 229% in March 2023 compared with 164% on average in the European Union and with 199.3% in March 2022 in Croatia (EBA, 2023[6]). Overall, banks appear reasonably well protected from spillovers due to bank failures elsewhere. There have been no significant consequences from the failure of some US or European banks in early 2023 (ECB, 2023[7]). Banks’ profitability has been relatively high, with returns on equity of 4.5% in in March 2023 almost double the EU average for the same period (ECB, 2023[8]). The ratio of non-performing loans to total loans decreased from 5.7% at the end of 2021 to 4.1% in March 2023 – though still above the EU average of 2.5% at the end of 2022 (Figure 2.6, Panel C). Despite these healthy indicators, a close watch is needed on the financial sector, in particular the quality of new lending, and the spillover risks in the event of further difficulties in banks elsewhere.

Integration into the euro area has had various implications for the banking sector (Croatian National Bank, 2023[9]). The switch to the euro entailed an estimated short-term loss of 20% of banks’ total profits, through reduced foreign-exchange transactions and fees and lower interest income, along with one-off transition costs. Meanwhile, there are reduced foreign exchange risks and lower costs from regulatory requirements. Before the switch to the euro, about half of Croatian bank deposits and loans were denominated in euros and subject to currency risks. Adopting the euro has freed EUR 5 billion of foreign exchange currency buffers, and EUR 4.5 billion of liquidity – as the minimum reserve requirement protecting against currency risks has declined from 9% to 1%, supporting liquidity (Figure 2.6, Panel D).

Figure 2.5. Inflation is abating from the recent surge, although price pressures have broadened

Note: Panel A: ‘Peers’ is the unweighted average of Czech Republic, Hungary, Slovak Republic, and Slovenia (discussed in Box 1.3). Panel B: Headline and core inflation are based on the harmonised consumer price index. Core inflation excludes energy and food products. The weighted median inflation is the price change of the item at the middle of the distribution of price changes, accounting for the items’ expenditure weights. Panel C: 2023 annual expenditure weights of the expenditure group are shown in brackets. Panel D: Inflation expectations are obtained from business and consumers opinion surveys on price expectation for the next 3 months for businesses, and for the next 12 months for consumers. Data are expressed as the balance between weighted percentages of positive and negative replies. ‘Services’ excludes retail trade and banking. Panel F: inflation rates by income quintile are calculated by applying the 2020 COICOP subgroup consumption weights for each income quintile to the corresponding price index in June 2020, and then applying the monthly change in the respective subgroup price index. This approach does not allow for substitution across different items in the consumption basket.

Source: OECD Analytical database; Eurostat; European Commission Directorate General for Economic and Financial Affairs via Refinitiv; and OECD calculations.

To support capital reserves, the Croatian National Bank will increase the countercyclical buffer rate to 1.0% from 31 December 2023 and to 1.5% from 20 June 2024, following an increase from 0.0% to 0.5% in March 2023. It motivated these increases by the upturn in the financial cycle, with increasing lending for mortgages and to non-financial corporations, mostly reflecting rising property prices and operating expenses for businesses (Croatian National Bank, 2023[9]). As financial institutions generally have surplus capital, the central bank does not expect this adjustment to significantly affect the costs and availability of bank credit. In other respects, Croatia is less exposed than other countries to current financial sector risks. Among the relatively few households that have mortgages, 34% were at variable rates in December 2022. Among new mortgages, 6.6% had variable interest rates in December 2022, compared to the euro-area average of 25.4%. To maintain financial stability, ongoing monitoring and precautionary policy actions, such as adjusting risk weights on certainty types of lending, can ensure that banks maintain the quality of their lending and other assets as they manage their increased liquidity.

Figure 2.6. The banking sector’s health appears solid

Note: OECD is the unweighted average across OECD countries. Panel C: 'Peers' is the unweighted average of Czech Republic, Hungary, Slovak Republic, and Slovenia (discussed in Box 1.3). Panel D: Excess liquidity is computed as the sum of the banks' current account balances (in excess of the minimum reserve requirement) and the deposit facility.

Source: IMF, Financial Soundness Indicators database; and Croatian National Bank (HNB).

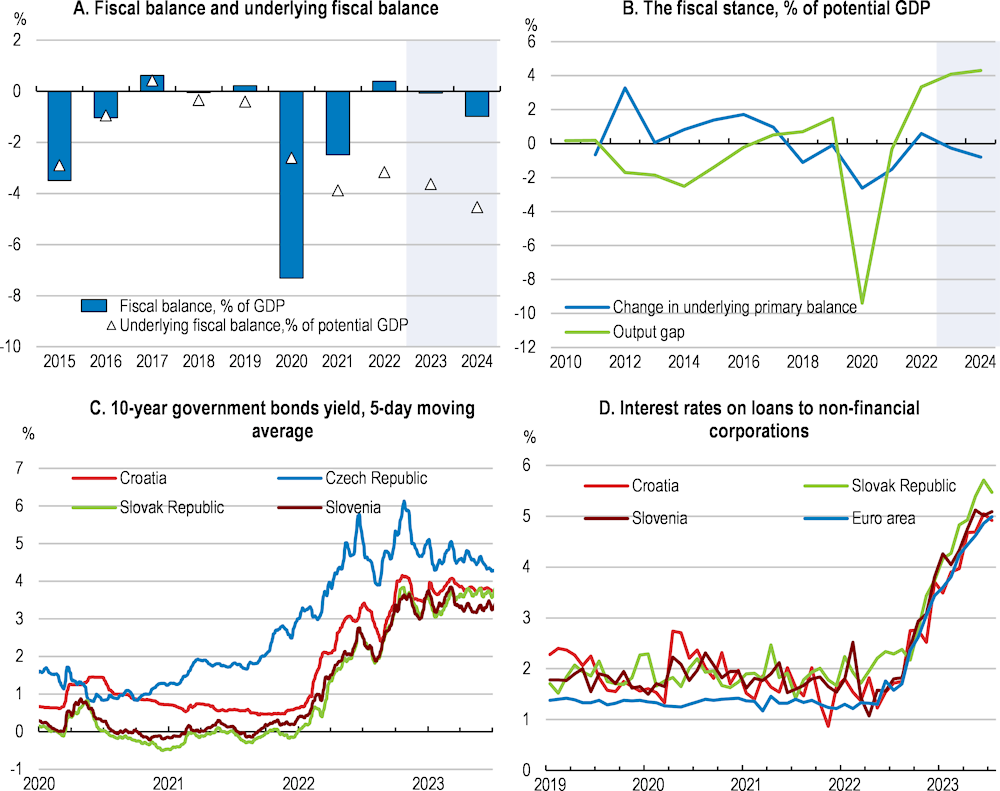

The budget will return to deficit, while monetary conditions are tightening

The budget balance shifted to an unexpected surplus in 2022 of 0.4% of GDP, following the substantial deficits of the COVID-19 period (Figure 2.7). Stronger-than-expected activity and price growth bolstered revenues. Spending fell short of plans, most notably for public investment, which fell by 6.8% from 2021 in nominal terms, to 3.8% of GDP, although this remains above the average of OECD countries relative to GDP. After accounting for the business cycle, the 2022 surplus represented a modest tightening in fiscal policy (Figure 2.7).

The government’s 2023 Stability Programme projects the budget shifting back to deficits from 2023, representing a fiscal stimulus (Figure 2.7 and Table 2.1). The widening reflects, in part, increases in personal income tax thresholds and credits, and increased tax allowances for business cost deductions. Slower growth in activity and abating inflation are also slowing revenue growth. A temporary extra profits tax, at a rate of 33% applied to large companies with profits at least 20% above recent years’ average, is likely to support revenues in 2023. Social spending is projected to increase markedly in 2023 in some areas, notably pensions as the number of recipients and pension rates increase and reductions introduced in the early 2010s are unwound, but also maternity and family benefits and support services for the disabled. Increases in wage and intermediate costs (e.g., costs of medicine and energy for government operations) are also projected to raise spending. Capital expenditures are projected to increase, also supporting demand, although these are largely financed through European grants, limiting their impact on the budget balance.

Table 2.1. With lower revenues, the budget is projected to return to deficit

Per cent of GDP

|

|

2020 |

2021 |

2022¹ |

2023¹ |

2024¹ |

|---|---|---|---|---|---|

|

Spending and revenue |

|

|

|

|

|

|

Total revenue |

46.8 |

46.2 |

45.5 |

43.9 |

43.4 |

|

Income tax |

6.5 |

5.7 |

6.8 |

6.5 |

6.4 |

|

Social contributions |

11.6 |

11.1 |

10.9 |

10.6 |

10.4 |

|

Other receipts |

28.7 |

29.4 |

27.8 |

26.8 |

26.7 |

|

Total expenditure |

54.1 |

48.7 |

45.1 |

44.0 |

44.4 |

|

Of which: |

|

|

|

||

|

Government consumption |

24.0 |

22.2 |

20.7 |

20.0 |

20.6 |

|

Social transfers |

14.5 |

13.0 |

12.1 |

12.4 |

12.3 |

|

Gross fixed capital formation |

5.5 |

4.7 |

3.8 |

3.9 |

4.0 |

|

Gross interest payments |

2.0 |

1.5 |

1.4 |

1.6 |

1.7 |

|

Budget balance |

|

|

|

||

|

Fiscal balance |

-7.3 |

-2.5 |

0.4 |

-0.1 |

-1.0 |

|

Primary fiscal balance |

-5.5 |

-1.1 |

1.6 |

1.3 |

0.5 |

|

Cyclically adjusted fiscal balance2 |

-2.6 |

-2.4 |

-1.0 |

-1.7 |

-2.7 |

|

Underlying primary fiscal balance2 |

-1.0 |

-2.5 |

-1.9 |

-2.2 |

-3.0 |

|

Public debt |

|

|

|

||

|

Gross debt (Maastricht definition) |

86.9 |

78.3 |

68.8 |

63.8 |

61.0 |

|

Gross debt (national accounts definition)3 |

107.0 |

98.3 |

89.6 |

85.6 |

84.5 |

|

Gross financial assets (EUR billion) |

3.0 |

3.2 |

3.5 |

4.0 |

4.2 |

|

Net debt |

47.9 |

42.6 |

36.8 |

32.8 |

31.7 |

1. OECD estimates unless otherwise stated.

2. As a percentage of potential GDP.

3. National Accounts definition includes state guarantees, among other items.

Source: OECD (2023), OECD Economic Outlook 113 (database), updated.

In 2024, the government plans to widen the budget deficit, before reducing it in 2025. Revenue growth is projected to slow with slower growth in activity and prices, and with tax and social contribution rate cuts valued at 0.5% of GDP (discussed below and Box 2.4). Expenditures will be supported by increased public sector salaries and social spending, including pensions, by increased investment spending under the Recovery and Resilience Plan, and by the delivery of defence equipment. The government plans to partly finance this increased spending by drawing some of its allocation of credits in the EU Recovery and Resilience Facility. The scheduled termination of the energy support measures in late 2023 and early 2024 will reduce some spending pressures.

Box 2.4. The planned 2024 tax reforms

The government is preparing a package of tax and social contribution cuts in 2024, reducing revenues by up to 0.5% of GDP. The measures are likely to include:

Reduced personal income tax through increased values of tax rate brackets, increased values of certain types of incomes, such as bonuses or tips, that are not taxable, and the suppression of the income tax surcharge

A reduced pension contribution rate at low wages to boost disposable income among low wage earners, with the government contributing the difference with the standard contribution rate to the pension accounts. This is expected to benefit 1.52 million out of the 2.84 million taxpayers in total.

An increase in local governments' fiscal autonomy by allowing them to independently prescribe the tax rate for taxes on income from independent work, independent activity and other income.

Tighter euro-area monetary policy is feeding through only partially. Indeed, in the interbank money market, one of the key transmission channels of monetary policy to the real economy, the increase in interest rates has been lessened by limited turnover, as banks’ high liquidity reduces their use of the market. Even so, interest rates have risen on loans to businesses and households and banks have tightened their lending conditions, contributing to slowing lending growth (Figure 2.7). Yields on long-term government bonds have increased by less than elsewhere in the euro area following the tightening in monetary policy, as spreads narrowed following the confirmation in June 2022 that Croatia would join the euro area (Box 2.5). Croatia’s sovereign debt rating is two or three steps above investment grade, depending on the rating agency, and agencies’ outlook has been stable since they upgraded their ratings in mid-2022. The ECB’s quantitative tightening policies do not affect the country directly, as it was outside the euro system before 2023 so was not included in the purchase programmes.

Box 2.5. Croatia became the twentieth member of the euro area in 2023

Since its independence Croatia has pegged its exchange rate first to the Deutsche Mark, followed by the euro. On 1 January 2023 Croatia officially joined the euro area, at an exchange rate of 7.53450 Croatian kuna per euro. This followed the European Commission and the ECB concluding in July 2022 that Croatia had fulfilled the four nominal convergence criteria of price stability, public finances sustainability, exchange rate and long-term interest rate alignment and that its legislative framework was fully compatible with the relevant treaties. The downward trend in public debt towards 60% of GDP following its increase during the COVID-19 pandemic was assessed to be adequate. Preparing for integration into the euro area required some important legislative reforms, which have better aligned Croatia’s institutions and governance with those of euro-area countries. Many of these reforms address the issues discussed in this Survey, notably around improving the business environment (Chapter 3).

The physical changeover of currencies was assessed by the Commission to have proceeded smoothly, supported by preparation of euro reserves, distribution of the new currency and information campaigns ahead of time. Communications, a voluntary code of ethics for businesses, plus a monitoring campaign helped largely prevent abusive re-pricing practices with the changeover, and Croatia’s approach offers lessons for countries adopting the euro in the future. However, pricing practices remain a concern for many citizens, even after inflation data were published showing a limited impact of the euro adoption on prices (European Commission, 2023[10]).

Joining the euro area means that Croatia’s Central Bank becomes part of the Eurosystem, the Ministry of Finance participates in the Eurogroup meetings, and that Croatia integrates into the Banking Union and the European Stability Mechanism. This will support prudential supervision of Croatia’s banks by eliminating parallel supervision of Croatia’s banking sector and integrate crisis management and bank resolution.

The government’s plans for widening budget deficits and the temporarily slower, albeit improving, transmission of tighter euro-area monetary policy to Croatia’s economy suggest that growth in demand may continue to outpace growth of the economy’s capacity for some time. This will accentuate capacity constraints and price and wage pressures. Given current projections of inflation remaining above target, maintaining the budget near 2022’s surplus rather than providing a fiscal stimulus would better support macroeconomic stability, sustain growth and reduce inflation pressures. Such a counter-cyclical fiscal stance need not entail lower spending on productivity-enhancing or social policy goals. Transfers and subsidies that are poorly targeted or that encourage inefficient consumption, such as fossil fuel price subsidies, can be cut while protecting spending that expands productive capacity and supports inclusiveness, such as in education and skills, infrastructure, and in public service delivery. If revenue outperforms projections, these funds can repay debts and build fiscal buffers.

Figure 2.7. Fiscal policy remains supportive while monetary conditions are tightening

Note: Panel A: the underlying fiscal balance measures the governments fiscal stance once cyclical variation in revenues and spending are taken into account and excludes net one-off operations. Panel B: The fiscal stance is illustrated by the change in the underlying primary balance.

Source: OECD Economic Outlook 113 (database), updated; Refinitiv, Datastream; and ECB (database).

Growth is projected to remain robust

Output growth is projected to remain at robust rates, having rebuilt in the first half of 2023 after the slowdown thein the second half of 2022. Annual growth is projected to be 3.0% in 2023, and 2.4% in 2024 (Table 2.2). Rising growth in consumer spending is expected to support growth, with ongoing wage increases and jobs growth expected to outpace inflation to support households’ real disposable incomes. Improved global supply conditions and the large share of imports in domestic consumption are expected to reduce the pass-through of rising wages into consumer price inflation. Government spending, including energy price support measures, will support demand in 2023, adding to price pressures. Croatia’s integration in the euro and Schengen areas at the start of 2023 and higher disbursement by the government of European funds are expected to bolster investment and exports, adding to demand and to pressures on capacity, especially in construction.

However, continued inflationary pressures and narrowing spare capacity are projected to partially counter improving demand so as to slow output growth. Inflation is projected to abate only gradually from current high rates. While the retreat in energy and some other international prices subtract from inflationary pressures, ongoing large increases in wholesale prices in many sectors and rising wages and limited spare capacity in some service sectors are expected to slow the disinflation process. The expiry of energy support measures, scheduled for October 2023 and April 2024, will temporarily lift headline inflation.

Table 2.2. Growth is projected to remain robust

|

|

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

|---|---|---|---|---|---|---|

|

|

Current prices (EUR billion) |

Percentage change, volume (2015 prices) |

||||

|

Gross domestic product (GDP) |

55 |

-8.5 |

13.1 |

6.2 |

3.0 |

2.4 |

|

Private consumption |

31 |

-5.1 |

9.9 |

5.1 |

2.3 |

2.3 |

|

Government consumption |

11 |

4.3 |

3.0 |

3.2 |

2.0 |

3.5 |

|

Gross fixed capital formation |

12 |

-5.0 |

4.7 |

5.8 |

2.6 |

2.6 |

|

Housing |

2 |

-4.5 |

6.7 |

7.4 |

10.8 |

2.9 |

|

Final domestic demand |

54 |

-3.1 |

7.4 |

4.8 |

2.3 |

2.6 |

|

Stockbuilding1,2 |

1 |

0.0 |

-1.1 |

1.6 |

-1.3 |

-0.3 |

|

Total domestic demand |

55 |

-0.8 |

9.8 |

5.6 |

1.2 |

2.3 |

|

Exports of goods and services |

28 |

-23.3 |

36.4 |

25.4 |

-0.2 |

1.9 |

|

Imports of goods and services |

28 |

-12.4 |

17.6 |

25.0 |

-4.6 |

2.2 |

|

Net exports1 |

|

-5.4 |

6.6 |

-0.2 |

2.9 |

-0.1 |

|

Other indicators (growth rates, unless specified) |

|

|

|

|

|

|

|

Employment |

. . |

-1.3 |

1.3 |

1.7 |

2.7 |

1.2 |

|

Unemployment rate (% of labour force) |

. . |

7.5 |

7.6 |

7.0 |

6.0 |

5.8 |

|

GDP deflator |

. . |

0.7 |

2.0 |

8.2 |

9.1 |

4.2 |

|

Harmonised consumer price index |

. . |

0.0 |

2.7 |

10.7 |

8.5 |

4.3 |

|

Harmonised core consumer price index |

. . |

0.4 |

1.3 |

7.6 |

9.0 |

4.7 |

|

Terms of trade |

. . |

-1.6 |

-2.0 |

-4.7 |

1.7 |

-1.3 |

|

Household saving ratio, net (% of disposable income) |

. . |

9.2 |

7.6 |

-0.4 |

7.3 |

7.5 |

|

Trade balance (% of GDP) |

. . |

-7.0 |

-1.5 |

-4.7 |

-0.6 |

-1.5 |

|

Ten-year government bond yield, average |

. . |

0.8 |

0.4 |

2.7 |

3.8 |

4.0 |

1. Contributions to changes in real GDP. 2. Including statistical discrepancy.

Source: OECD (2023), OECD Economic Outlook 113 (database), updated.

Risks to this outlook remain pronounced with both downside risks and the challenge of managing upside surprises. In the short term, high inflation is a key source of risks. If inflation in Croatia remains above the euro-area average, or if inflation across the euro-area stays above the policy target, sharper policy responses will be needed, by fiscal policy in Croatia in the former case and by euro-area monetary policy in the latter. This could lead to a more abrupt downturn. The adjustment of global financial markets and economies to higher interest rates also brings negative risks to external demand. A renewed surge in energy prices and disruption in energy supply among trading partners, especially if the 2023/24 winter is exceptionally cold or long, would extend inflationary pressures, and weaken competitiveness, external demand and public finances. In the medium term, the potential boost to investment and demand from integration into the euro and Schengen areas bring risks of low-quality investments and lending, and greater price pressures. This would require responsive macroeconomic management, especially from fiscal and macroprudential policy, to ensure that demand growth remains sustainable and raises the economy's productive capacity. Conversely, integration could bring an extended period of stronger-than-expected growth. Into the longer term, the potential disruptions from a changing climate present significant risks, as infrastructure and other physical investments could be made redundant or production and demand patterns could shift markedly. Adaptation policies will reduce these risks. Table 2.3 presents some risks that could lead to major changes to the longer-term outlook.

Table 2.3. Events that could lead to major changes to the outlook

|

Shock |

Possible impact |

Policy response options |

|---|---|---|

|

A colder 2023/24 winter and limited supplies of gas or alternative energy sources cause a new surge in energy prices and slowdown among external markets. |

Inflation ramps up driven by energy price increases, destabilising inflation expectations. Renewed public support measures weaken the government’s fiscal position, diverting resources from more growth-supporting spending. Weaker activity among Croatia’s trading partners cuts export demand. |

Support vulnerable households’ incomes. Continue efforts to improve energy efficiency and reduce fossil fuel needs. |

|

Price and wage inflation are not contained. |

Wages growth remains elevated in response to high inflation, further entrenching higher inflation. |

Ensure that the fiscal stance is counter-cyclical, prioritising cuts in poorly-targeted transfers while continuing efforts to expand the economy’s productive capacity. Seek to improve coordination in wage setting between export-oriented and domestic sectors. |

|

Geopolitical tensions emerge and deepen in Croatia’s region. |

Trade flows, including tourism visits, and foreign direct investment inflows weaken, slowing growth. Higher rates of out-migration resume. |

In the short term, ensure that firms can access financing to cover cash flow needs. In the medium term, encourage diversification of export markets and activities. Continue to improve the business environment and skills to attract foreign investment and migration. |

|

Global monetary conditions tighten for longer to reduce inflation, weakening global financial conditions and leading to more bank failures. |

Financing becomes scarcer and more expensive, slowing lending growth and foreign investment. External demand weakens. Higher interest costs lead to an increase in domestic non-performing loans, weakening banks’ balance sheets and lending. |

Align domestic policies with the efforts of European authorities to restore liquidity and confidence in financial markets, including, as necessary, through adjustments to banking regulation. |

Healthy public finances to sustain stronger growth

Croatia’s fiscal stance is its major tool of macroeconomic stabilisation, especially now that it is a full member of the euro area. It was highly responsive to the COVID-19 crisis, with a large deficit in 2020 progressively unwound in 2021 and 2022 to support the economy through the crisis and sustain the recovery. In earlier years it was less consistently counter cyclical (Figure 2.7, Panel B). Improving automatic stabilisers can improve the responsiveness of fiscal policy to the economic cycle (World Bank, 2020[11]). Revenue and social protection reforms can improve automatic stabilisers. For example, improving the targeting of social protection, as current efforts to better identify households in need and to strengthen the guaranteed minimum income, work in this direction (Chapter 4). They will better support incomes and spending through downturns, and reduce overall social spending as employment recovers. Ensuring that any future reforms to personal income tax rates maintain their progressivity would similarly help to stabilise households’ disposable income through the economic cycle. Designing policy responses to exceptional shocks so as that they cease once conditions pass thresholds, such as energy prices falling below a prescribed level, would ensure that exceptional measures remain in place only temporarily. Some OECD countries, such as Ireland, have found this approach effective (OECD, 2022[12]).

Croatia’s medium-term fiscal stance is guided by European fiscal rules and institutions, which are currently being reassessed (discussed in the 2023 OECD Economic Survey of the European Union). The new framework is expected to still require Croatia to establish a credible medium-term path to reduce the debt-to-GDP ratio below 60% of GDP. It is expected that medium-term expenditure rules will be required to guide that path, accounting for long-term expenditure pressures, including those relating to ageing and to reducing greenhouse gas emissions and adapting to climate change. Croatia is developing the institutions that help achieve these fiscal goals. The 2021 Budget Act raises the role of a medium-term perspective on Croatia’s budgeting. Institutions such as the Fiscal Policy Commission will have a permanent staff from 2023. These institutions can strengthen the design, implementation and sustainability of the government budget and track compliance with fiscal rules (Box 2.6).

Box 2.6. The Fiscal Policy Commission can help fiscal policy achieve its goals

Croatia has been developing its fiscal policy framework and associated institutions over the past decade. The Fiscal Policy Commission started operating in 2014 as a parliamentary committee, and started functioning independently in 2021. From 2023, is gained the resources for a full-time staff and research capacity. Such institutions can provide effective support for the design and implementation of the government budget, and can help ensure that fiscal policy aligns with the government’s medium-term objectives and with fiscal rules. They can improve the quality of the economic assumptions and analysis underlying the budget, and the general discussion of economic trends and policy responses. The Fiscal Policy Commission has found that Croatia has broadly complied with its national fiscal rules, an improvement on earlier periods when that was the case in less than half of the years between 1998 and 2019 (Manescu et al., 2023[13]).

A particular challenge to developing such independent fiscal institutions is scarce human resources, with many of those with the right mix of economic and policy analysis skills already contributing through other public institutions or think tanks. In other smaller euro-area countries, such as Estonia or Ireland, the office is made up of part-time academics or policy experts, including members of the country’s diaspora, and a small staff of several experts and support staff. In some euro-area countries, such as Estonia, it is attached to the central bank. This can help pool resources and establish the office’s expertise in macroeconomic analysis.

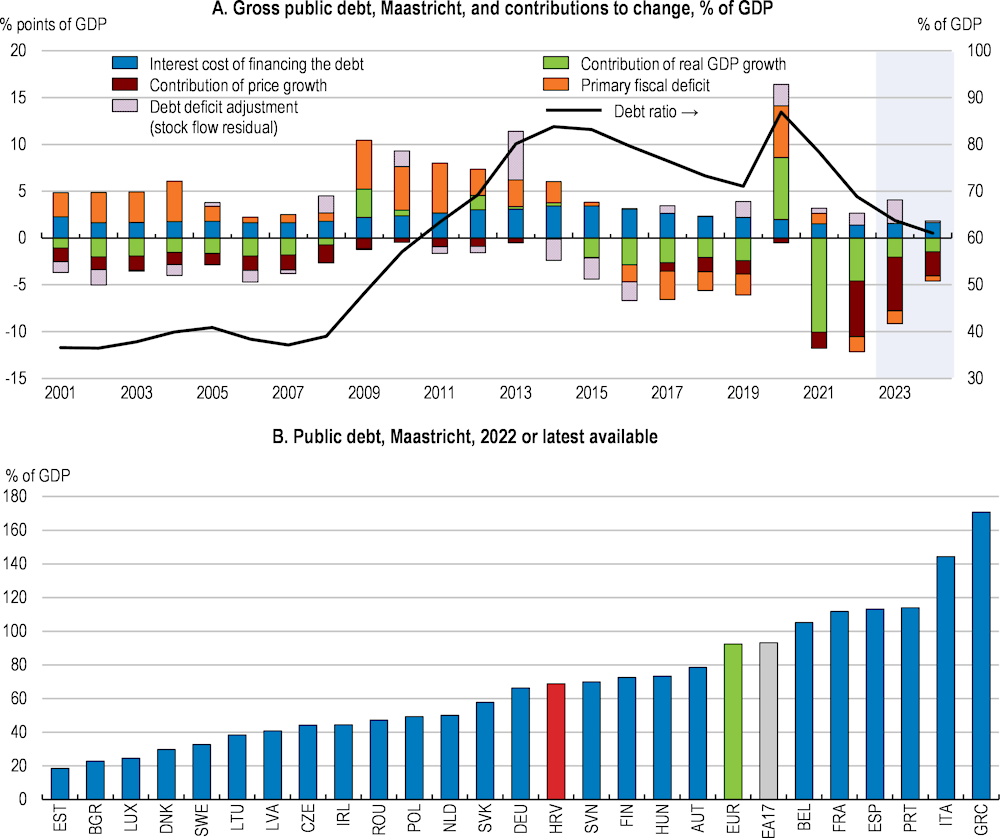

The public debt ratio fell below 70% of GDP in 2022, its lowest level since the protracted recession of the early 2010s although still higher than many of Croatia’s peers (Figure 2.8). The rebound in activity and surge in prices since the COVID-19 crisis, adding to the low interest rates of recent years, have dramatically reduced Croatia’s public debt-to-GDP ratio, as in many OECD countries. These factors are projected to be temporary, as inflation abates and output growth moderates in the coming years. Achieving the government’s medium-term fiscal plans will enable Croatia to reduce and maintain the public debt ratio to the Maastricht objective of less than 60% of GDP in the coming years. This would support Croatia’s sovereign debt rating, reducing the cost of financing for both the public budget and private investors, and would build a buffer to finance responses to future shocks or contingent liabilities.

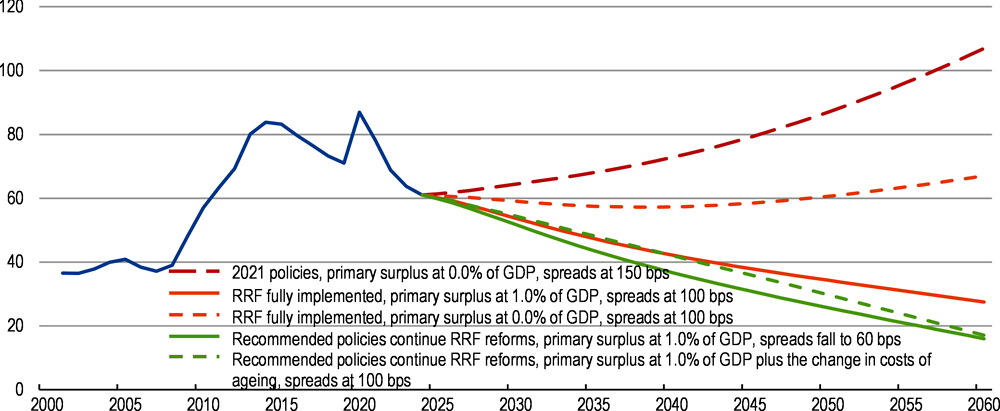

Further reducing the public debt-to-GDP ratio will require maintaining primary budget surpluses, while fully implementing the government’s current reform programme (Figure 2.9). For instance, maintaining the average primary budget surplus near 1% of GDP and then near 0.5% from 2040 would stabilise the public debt ratio near 55% of GDP. Extending the reform and investment programme, as recommended in this Survey, and achieving primary budget surpluses averaging 1.0% of GDP is likely to see improvements in financial markets’ risk assessment of Croatian debt and a narrowing in interest rate spreads on government debt, and would enable the public debt-to-GDP ratio to fall further. Conversely, in a negative scenario with reforms stalling, smaller primary budget surpluses, and a modest widening of spreads on Croatia’s bonds, the public debt ratio would rise above 100% of GDP. The reforms recommended in this Survey would generate fiscal savings, which can be used to sustain a larger budget surplus or to lower Croatia’s overall tax burden (Box 2.7).

Figure 2.8. Rising prices and growth have reduced the public debt ratio

Note: Panel A: Values for 2023 and 2024 are projected. Negative ‘primary fiscal deficit’ indicates a surplus. Panel B: EA17 refers to euro-area countries that are members of the OECD.

Source: OECD Economic Outlook 113 (database), updated.

The longer-term fiscal pressure from population ageing is expected to be contained under current policies, although the projections may under-estimate these pressures. The total costs of population ageing, including costs for pension, health and long-term care will rise slightly to 22.2% of GDP in 2030 and then gradually decline under current policies, according to the European Commission’s most recent Ageing Report exercise (European Commission, 2021[16]), despite the increasing retiree population and rising care costs. Figure 2.9, inter alia, illustrates the effect on the ratio of public debt to GDP if the primary balance reflects no absorption of the change in the projected fiscal cost of ageing from its level in 2024. The decline largely reflects projected falls in the fiscal costs of pensions, as more retirees transition into the self-funded regime (Chapter 4), more than offsetting rising health and long-term care costs. Disability pension payments, currently predominantly awarded to Croatia's war veterans, are expected to decline by 1.2 percentage points of GDP by 2070. Improvements in the coverage ratio (the number of pensioners relative to the population aged over 65) will also reduce public pension spending, as more retirees accumulate sufficient pension savings to fund their retirements, and as women’s official retirement age is aligned with men’s by 2030. The projections also assume that the benefit ratio will decline, despite existing challenges of low incomes and poverty among the elderly. Improving incentives for workers to work to the official retirement age would further improve the retirement incomes and reduce the fiscal cost of pensions into the longer term. Pressures to support retirees’ incomes suggest that the fiscal costs of ageing may be substantially higher than these projections, especially if there is little progress in increasing employment among older adults (Chapter 4).

Figure 2.9. Modest primary surpluses and stronger growth through continued reforms will reduce the debt ratio to below 60%

Public debt, Maastricht definition, percent of GDP

Note: Policy scenarios are described in Table 1.1. Market interest rates are assumed to remain at 3.3% through the projection period. The GDP deflator is projected to increase by 2.0% annually from 2025. The scenario incorporating the change in costs of the ageing adds to the primary budget surplus of 1.0% of GDP the change in the total cost of ageing relative to the projected value for 2024, from the European Commission’s 2021 Costs of Ageing (European Commission, 2021[16]) exercise with annual values interpolated linearly.

Source: Simulations based on the OECD’s Global Long-Term Model, and OECD Economic Outlook 113 (database), updated.

Box 2.7. The recommended reforms would generate fiscal savings

Table 2.4 presents the estimated fiscal impact of the recommended reforms with significant fiscal effects, allowing for limited behavioural responses. Many of the recommended reforms have small overall fiscal impacts. The recommendation to progressively introduce a price on greenhouse gas emissions consistent with the emission trading scheme price foresees this being fully offset by increased transfers to vulnerable households and support for investments reducing emissions. The overall balanced fiscal impact is consistent with maintaining a primary budget surplus averaging near 1% of GDP.

Table 2.4. The recommended reform package would free resources for reducing taxes or debt

Fiscal savings (+) and costs (-), % current year GDP

|

Policy measure: |

2025 |

2030 |

|---|---|---|

|

Progressively remove fossil fuel subsidies |

0.6 |

1.4 |

|

Support inclusive employment opportunities by raising in-kind family spending by an additional 0.5% of GDP by 2030 |

0.0 |

-0.5 |

|

Expand active labour market policies, raising spending by an additional 0.5% of GDP by 2030 |

0.0 |

-0.5 |

|

Increase R&D support |

0.0 |

-0.3 |

|

Overall budget impact of specific measures of recommended reform package |

0.6 |

0.0 |

|

Expected revenue gains not included in assessment of policy recommendations: |

||

|

Boosting tax compliance and enforcement |

0.3 |

0.5 |

|

Revenue gain from higher growth following recommended reform package |

0.0 |

0.4 |

|

Memo: GDP % difference from scenario of full implementation of RRF |

0.01% |

0.90% |

1) Only measures with significant ongoing fiscal implications are included.

2) Potential revenue gains from reducing tax evasion and improving collections are based on OECD estimates of the gap between realised and potential VAT revenues, adjusted for projected nominal GDP growth, and given revenue gains from past compliance measures.

Source: OECD secretariat estimates. Fossil fuel subsidy values are sourced from the IMF Energy Subsidy Template.

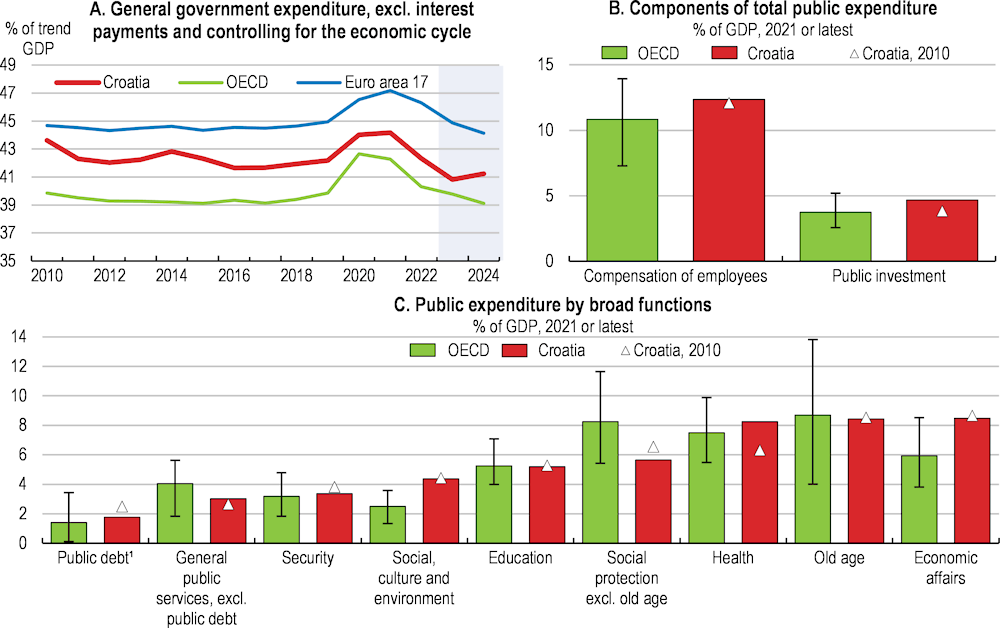

Improving the allocation and execution of spending

Public spending relative to GDP is similar to European OECD countries, but higher than in most of Croatia’s peers or other countries near Croatia’s level of income per capita (Figure 2.10). The resources allocated to the more growth-supporting broad categories of spending, such as public investment and education, are comparable to the average of OECD countries. Important shares of spending are in areas where spending cannot be readily adjusted, such as personnel expenses, interest payments or various welfare transfers, restricting the extent to which public finances can respond to changing conditions or priorities.

Public spending reviews can be an effective tool to reallocate resources to areas that best support a government’s objectives. Croatia has developed experience in spending reviews first through a comprehensive review in the mid-2010s, followed by sector-specific reviews. Incorporating such reviews regularly and early in the annual budget cycle can help budgets reallocate funding. Spending reviews can be more effective when they engage with expertise in the parts of government responsible for spending and implementing programmes, including line ministries, agencies and sub-national governments. A specialised unit in a central finance agency, such as the Ministry of Finance, working collaboratively with delivery bodies to assess and improve spending could be an effective approach, given the diffused responsibilities and the thin spread of technical and analytical capacity.

Figure 2.10. Overall spending is near OECD countries, although the public payroll is high

1. Public debt expenditure includes interest payments and outlays for underwriting and floating government loans.

Note: Panels B and C: The whiskers show the range between the first and last (unweighted) decile of the OECD countries. The figure shows public expenditure by broad function. The OECD averages are not weighted and do not include Canada, Mexico, New Zealand and Türkiye.

Source: OECD Economic Outlook 113 (database), updated; OECD National Accounts Statistics (database).

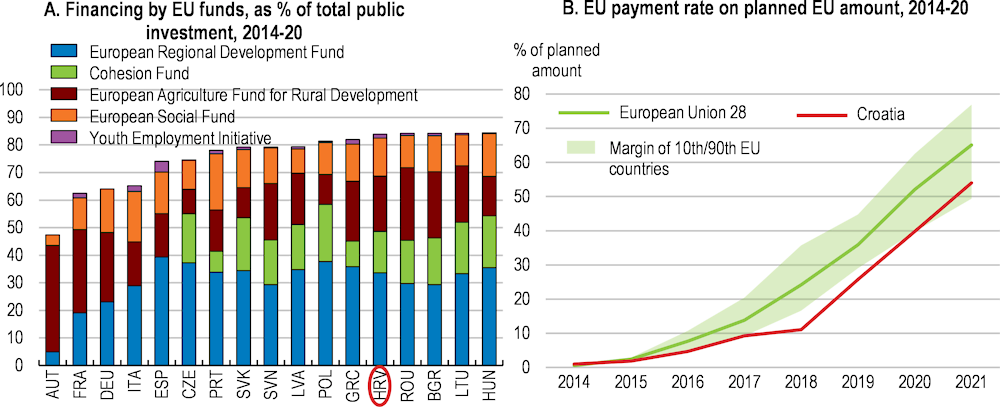

Croatia has accessed substantial volumes of European Union funds relative to its GDP over the past decades and they have made up a larger share of overall public investment spending than in most other EU countries (Figure 2.11, Panel A). The funds have enabled Croatia to accelerate its reconstruction, and achieve a quality of infrastructure and public policies and programmes comparable to many OECD countries. The importance of European support in funding public investment and reform programmes can lead the priorities agreed at European level to dominate Croatia’s development agenda. While these priorities broadly tally with the reform objectives needed for Croatia’s further development, there is a need to fine-tune with nationally-driven initiatives. In light of this, developing greater national capacity to fund investments and implement the national reform programme would help Croatia to address a broader range of the constraints to its growth, complementing European Union resources.

In the current European funds programming period, Croatia is among the leading countries in accessing its Recovery and Resilience Facility grants (Box 2.8). This is a marked improvement from previous EU funds programme periods, when Croatia’s absorption rate lagged other EU countries (Figure 2.11, Panel B). To improve disbursement, it has developed ministries and bodies dedicated to managing and implementing European funds. Still, challenges remain. The fall in nominal investment spending in 2022, despite the increased funds available and investment projects’ rising costs, is an example of the impact of such disbursement challenges. Drawing on the effective practices supporting implementation of the Recovery and Resilience Programme to better prepare and track projects and improve coordination between the different levels of government, could raise the disbursement rate of Croatia’s total public investment.

Figure 2.11. Public investment is highly reliant on European funds

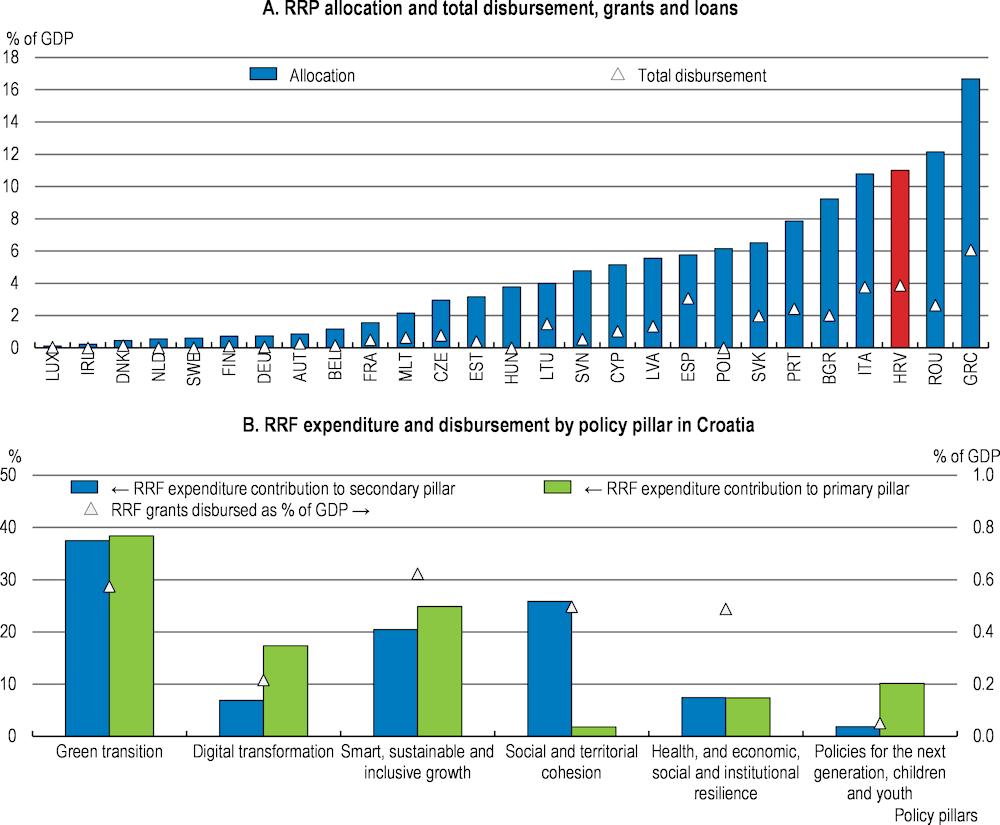

Box 2.8. Croatia is making good progress implementing its Recovery and Resilience Plan

Croatia’s Recovery and Resilience Plan provides an ambitious and detailed programme of reforms and investments focused on supporting the country’s resilience and accelerating the green and digital transitions. As Croatia progresses through the 372 milestones in its plan, it is gaining access to tranches of its allocation of EUR 5.5 billion in grants from the EU’s NextGeneration facility. At 9.5% of 2021 GDP, Croatia’s allocation is the second largest allocation relative to GDP of any country (Figure 2.12, Panel A). Activities funded through the Recovery and Resilience Plan must be completed by August 2026.

Croatia’s Plan includes 146 investments and 76 reforms, similar numbers as in much larger countries. Forty per cent of its funds are allocated to green objectives, 20% to the digital transition and 26% to social spending, mostly welcome investments in general and early childhood education (Chapter 4) (Figure 2.12, Panel B). Support for rebuilding following the 2020 earthquakes makes up the main regional development component.

Croatia has made strong initial progress, thanks to the development of a specialised implementation structure, led by senior officials at the centre of government and with consistent, high-level political support. A steering committee is responsible for the Plan’s overall management and monitoring. The committee meets regularly, informed by implementation reports prepared by a dedicated coordination body. An implementation committee brings together the different central government bodies responsible for putting the Plan into action and for obtaining and disbursing payments. This body then works with the government authorities responsible the respective components of the Plan, and for auditing and for the management of payments. Ongoing monitoring of progress, identifying blockages and having channels to address those impediments have contributed to improved disbursements

Croatia’s Plan was among the first submitted and approved for access to the NextGenerationEU Facility and Croatia is among the leading countries in the approval of its disbursement requests (Figure 2.12, Panel A). By mid-2023 it will have received 53% of its fund allocation, through a series of biannual instalments of EUR 700 million (1% of GDP). Croatia has created a dedicated body at the centre of government focused on delivering the Recovery and Resilience Plan reforms and investments. As other countries have found with such dedicated bodies for exceptional projects, this body has been instrumental in overcoming coordination challenges between different units and levels of government.

The government estimates that, fully implemented, the Plan will directly raise GDP by between 1.9% and 2.9% by 2026, and employment by 1.2%. While capital investments will absorb most of the funds, some of the administrative and policy reforms funded from the Plan or linked to access to the funds will bring more enduring benefits for Croatia’s investment climate, labour markets and social welfare.

Figure 2.12. Croatia’s Recovery and Resilience Plan is substantial

Note: Panel A: the chart shows the funding allocated to each endorsed recovery and resilience plan (RRP) to this date and the disbursements made under the RRF as a share of 2021 GDP. For those Member States whose RRPs have not yet been endorsed, the amount displayed is the maximum allocation in grants according to the RRF Regulation.

Source: EC, Recovery and Resilience Scoreboard.

Delivering public goods and services across many government agencies and levels

A wide distribution of decision and implementation responsibilities across central government ministries, and between central and subnational government is often cited as a barrier to the delivery of public goods and services and as a source of regulatory complexity. The overall number of subnational governments (21 countries and 556 towns and municipalities), their average size or the number with very small populations is comparable to many OECD countries. However, the allocation of responsibilities and resources appears to create barriers to delivering quality public goods and services and for approving investments, as many are devolved to subnational governments with differing approaches and service quality. For example, differences in social support can be great between the several larger cities, led by Zagreb, and other localities, while different regulatory approaches in different municipalities can add to investors’ challenges.

Effective allocation of responsibilities across layers of government entails balancing localised expertise and accountability with the efficiency of scale and coordination (OECD, 2019[17]). Legislation in 2015 provided for voluntary mergers of local governments but it was not accompanied by financial incentives and its use has been limited. Croatia adopted a Public Administration Development Strategy 2015-2020 that encourages inter-municipal co-operation but without supporting this with funding or an institutional framework. Cooperation is most common among larger local governments on strategic planning to attract economic development, and in joint ownership of municipal companies and service delivery agencies. Investments in the Recovery and Resilience Plan will develop a digital platform for monitoring the capacity of subnational governments, to assess their capacity to meet their public goods and service delivery responsibilities, and with the goal of encouraging greater joint service provision. Other investments will expand subnational governments’ access to information via new digital platforms. Developing support in the central government for subnational governments’ digitalisation, for example by creating standard platforms, can also help achieve higher quality and more consistent digitalisation of public goods and services across Croatia. Building bodies and practices, such as regular conferences of different agencies engaged on a particular topic, supported by a secretariat, could help different government bodies to better collaborate. Longer-term, a broad review of the responsibilities and resources of the different levels of government could improve their allocation and delivery.

Local governments rely on transfers from the central government for part of their budgets. The planned 2024 tax reforms (Box 2.4) will increase subnational governments’ fiscal autonomy. At the same time, Croatia is improving its approach to these transfers and the Recovery and Resilience Plan investments will provide additional data to better inform these transfers. Croatia could draw on Italy’s experience with fiscal equalisation mechanisms to adjust grants to subnational government for differences in the cost of service delivery and needs, for example for remoter or poorer areas. The mechanism assesses the cost of delivering particular public services, the actual costs incurred, and the needs and capacity of each government body to provide those services.

Better managing public investment and procurement

Strengthening public procurement and public investment management would improve spending efficiency and disbursement rates. Public procurement spending is slightly above the average of OECD countries, at 13.2% of GDP in 2021 (Ministry of Economy and Sustainable Development, 2021[18]). Croatia has been improving many aspects of its public investment management, for example by expanding the role of cost-benefit analysis in informing selection and design of projects ranging from entrepreneurial zones, to wastewater treatment investments, and to a new energy efficiency renovation financing model (OECD, 2019[19]; World Bank, 2019[20]; European Commission, 2021[21]). Investments in its Recovery and Resilience Plan will expand the use of digital platforms to support more efficient and responsive public procurement by some agencies. Still, challenges in investment management and procurement have contributed to delays in starting priority projects, such as the reconstruction works following the 2020 earthquakes. Much procurement, especially for non-standard purchases, is fragmented across the different agencies and levels of government responsible for spending. While the large role of European funds greatly expands the range of investments Croatia can finance, their implementation can complicate procurement, for example by adding uncertainty over when funds will be available and by adding additional verification requirements.

Croatia is seeking to better use public procurement to support policy goals such as achieving a greener and more innovative economy, at the same time as it targets the still-significant corruption risks (Chapter 3). The Recovery and Resilience Plan includes measures to improve procurement. It is consolidating into one specialised agency more public procurement, including for non-standard purchases. This is a welcome step. Currently this agency is mostly engaged in bulk procurement of standardised goods and services for the public sector. Experience in OECD countries suggests that this approach can develop the expertise to engage in more sophisticated procurement processes. These agencies are able to assess bids on more sophisticated grounds than on simply the lowest cost criterion. This can help achieve the government’s broader goals. By having a better overview of all the government’s purchases, it is able to give the market more information about future demand, and work with suppliers on improving the goods and services they supply.

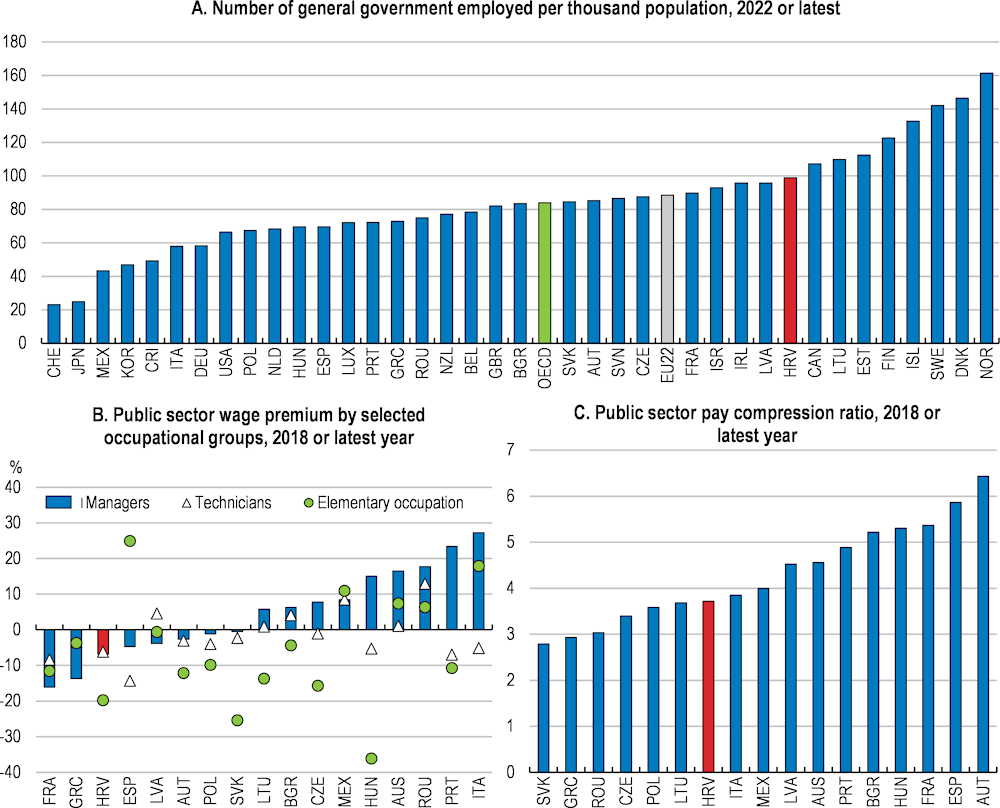

Staffing a high-performing public service

Delivering quality, timely and cost-effective public goods, services and investments requires having sufficient public servants with the necessary technical skills in place. Overall, Croatia has a similar number of public servants relative to its population and its overall workforce as most OECD countries (Figure 2.13, Panel A). They are on average more educated than their private sector counterparts – over half of workers have completed tertiary education, compared with 20% in the private sector – although this share lags many OECD countries. Nonetheless, shortages of skills are often identified as a barrier to delivering public goods and services or implementing reforms. Efforts to digitalise the public sector in particular have been slowed by shortages of advanced IT skills. The relatively large number of different public bodies is likely to spread staff skills thinly. Rather than general increases in staff numbers and wage rates, ensuring that staff are in the positions where their skills can be best used, and ensuring that specialised skills are rewarded competitively, can help Croatia better use its public sector resources.

The wage bill is higher as a share of GDP than in many OECD countries, but in the central government public servants receive less than their private sector counterparts for equivalent skills (Figure 2.10, Panel B; Figure 2.13, Panel B). Private employers who can offer better wages and other working conditions, especially for workers with specialised skills, can attract workers from the public sector. For example, the large taxpayer office established in the 2010s has had difficulties retaining staff skilled in functions such as audit, due to uncompetitive pay (World Bank, 2020[22]). The government and social partners have agreed to substantial increases in public servants’ nominal pay rates in 2022, 2023 and 2024. An overall review of the public service pay system is underway. Future reforms should seek to ensure that pay rates are competitive with the private sector for specialised skills, while ensuring that workers’ performance is also comparable and that pay rates do not distort the overall labour market or incentives within the public sector.

Figure 2.13. Overall public service numbers are above most OECD countries, but some wage rates are lagging

Note: Panel A: EU22 and OECD are unweighted averages. OECD excludes Australia, Chile, Colombia, and Costa Rica. Panel B: Public sector wage premium as compared to formal wage employees. Panel C: Ratio of 90th/10th percentile earners in the public sector.

Source: OECD Economic Analytical (database); OECD National Accounts (database); ILOSTAT; World Bank, Worldwide Bureaucracy Indicators (database).

Filling staffing gaps while containing the wage bill is likely to require a mix of improved, more agile and competitive public servant recruitment and staff allocation. Reforms are underway with a focus on digitalising and standardising public administration recruitment processes, and focusing selection more on candidates’ competencies rather than their knowledge of administrative law. A recalibration of pay rates and the introduction of performance-based pay rewards can improve the competitiveness of public service careers in the job market. Deeper reforms are being prepared, which can re-allocate existing staff to fill gaps. Croatia could make greater use of temporary staff to meet short-term needs, while ensuring that rules are in place so as that temporary staff do not become a parallel cadre of staff.

Ensuring that senior positions are filled by technical and managerial experts can support public sector effectiveness, help retain and motivate capable staff and build the public’s confidence in the public sector by countering concerns over politicisation (Koprić, 2019[23]). In most smaller OECD countries, political appointments extend to the second level of the public sector hierarchy. Experience across OECD countries suggests that in a context such as Croatia, a hybrid appointment process where the political decision-maker selects candidates from a shortlist prepared by an independent body, with a focus on technical and managerial skills, can balance political responsiveness with operational needs. Appointing senior officials under performance agreements, including measurable and realistic outcome or output indicators, and supported by 360⁰ reviews, can support a focus on results and professionalism (OECD, 2019[24]; OECD, 2021[25]).

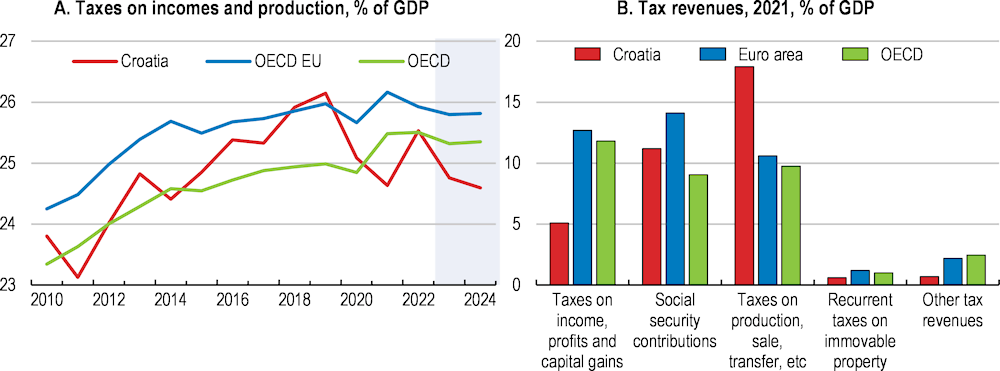

Broadening the tax base to support revenues

Overall, Croatia collects a slightly smaller share of GDP through taxes and social contributions than most OECD countries (Figure 2.14). Indirect taxes generate a larger share of total revenues than in most OECD countries, reflecting the relatively high rate, while income taxes and property taxes make up relatively modest shares, reflecting rates that are near or below the averages of OECD and European countries in most situations (Table 2.5) (Eurostat, 2023[26]). This follows cuts in rates over recent years. The government is planning a package of further reductions in tax and contribution rates in 2024, worth up to 0.5% of GDP (Box 2.4).

Croatia currently applies low recurrent taxes to property values. As discussed in Chapter 4, these taxes are among the most economically efficient. Progressively introducing a general recurrent tax on property values, supported by digital tools to keep property valuations up-to-date, while ensuring arrangements are in place for asset-rich but vulnerable households, can support government revenues and encourage property owners to put dwellings to their full use.

Reviewing and reducing tax expenditures and tax-free exemptions on certain income sources would broaden the tax base, which would allow the more distortionary tax rates to be reduced. Tax exemptions, tax-free allowances and reduced rates distort investments and business decisions. A prime example is a flat fee applied to tourism accommodation income, rather than applying the standard income tax system. This encourages owners to let out their properties as a source of supplementary income, discouraging the development of hotels or other larger facilities that would be better positioned to lengthen the tourism season into more of the year. Further, tourism tax receipts are allocated to tourism boards, rather than contributing to general revenue. Similarly, not taxing tips or bonus payments below relatively generous thresholds, which will be raised in 2024 under planned reforms (Box 2.4), weakens the tax base and workers’ retirement savings and incomes, and distorts how employers pay workers. Undertaking a comprehensive review of existing tax expenditures and assessing their fiscal costs relative to their economic benefits can drive reform. Tax expenditures may also be more effective if they are designed and implemented by one expert agency, rather than fragmented through different, at times competing, agencies.

Table 2.5. Croatia’s personal income tax wedge is near OECD averages, corporate income rates are lower, and indirect rates are relatively high

|

Croatia |

OECD |

European Union |

Euro area |

||||

|---|---|---|---|---|---|---|---|

|

Net personal income tax wedge, % (2022): |

|

||||||

|

Household type: |

Wage rate, % of average wage: |

|

|

|

|||

|

Primary earner |

2nd earner |

|

|

|

|||

|

One-earner couple |

100 |

0 |

35.4 |

35.6 |

37.1 |

37.3 |

|

|

One-earner couple, two children |

100 |

0 |

27.8 |

28.4 |

29.2 |

30.2 |

|

|

Two-earner couple |

100 |

67 |

37.4 |

36.5 |

38.0 |

38.2 |

|

|

|

100 |

100 |

39.1 |

38.1 |

39.7 |

40.3 |

|

|

One-earner couple, two children |

100 |

67 |

32.1 |

32.5 |

33.6 |

34.1 |

|

|

|

100 |

100 |

34.6 |

34.8 |

36.0 |

36.8 |

|

|

Single |

67 |

– |

31.3 |

30.8 |

31.7 |

30.5 |

|

|

|

100 |

– |

35.0 |

34.1 |

35.6 |

35.3 |

|

|

|

167 |

– |

39.1 |

38.1 |

39.7 |

40.3 |

|

|

Single parent, two children |

67 |

– |

42.5 |

42.2 |

43.6 |

44.7 |

|

|

Corporate income and indirect tax rates, %: |

|

|

|||||

|

Statutory corporate income tax (2022): |

18.0 |

23.1 |

21.5 |

23.3 |

|||

|

Composite effective average tax (2021): |

16.5 |

22.1 |

19.3 |

21.2 |

|||

|

Composite effective marginal tax (2021): |

7.3 |

10.8 |

8.0 |

8.7 |

|||

|

Value added tax (2022): |

25 |

19.2 |

21.8 |

21.1 |

|||

Note: OECD, European Union and euro-area averages are unweighted averages of the countries with available data. The Tax Wedge measures net taxes (i.e. income tax plus social security contributions paid minus benefits received) as a % of total labour cost for the employer.

Source: “OECD Tax and Benefit Model, preliminary results: http://oe.cd/TaxBEN; OECD (2022). OECD Tax Database; OECD (2022), Consumption Tax Trends 2022: VAT/GST and Excise, Core Design Features and Trends, OECD Publishing, Paris.

Figure 2.14. Tax revenues are moderate, and are weighed towards indirect taxes

Note: Panel A: OECD EU is the unweighted average of OECD countries also currently European Union members. Figure does not include social security contributions. Taxes on incomes and production include direct taxes on income, wealth and other recurrent taxes, and indirect taxes on production and imports. OECD unweighted average excludes Chile and Türkiye.

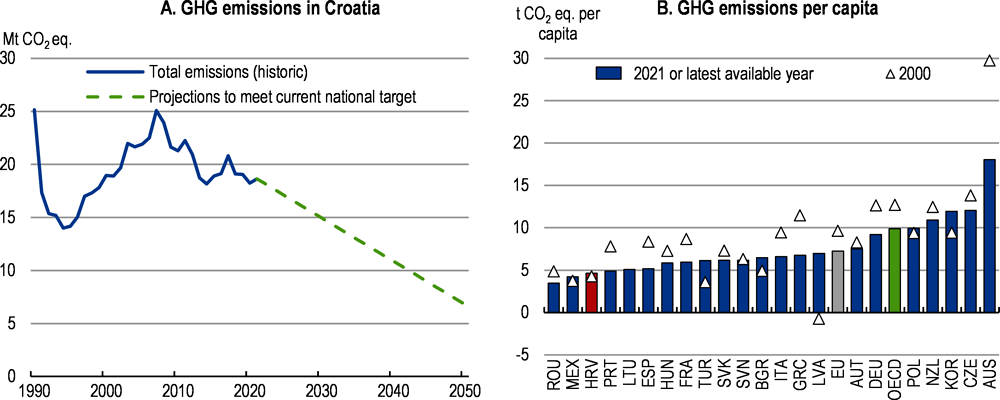

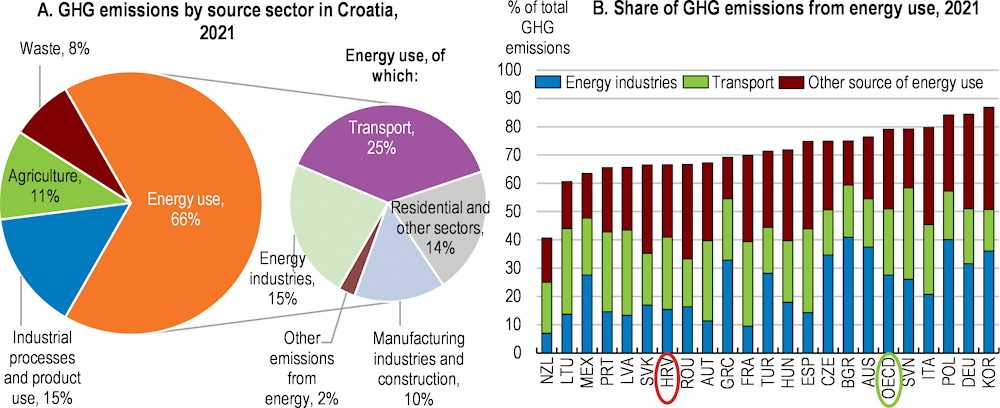

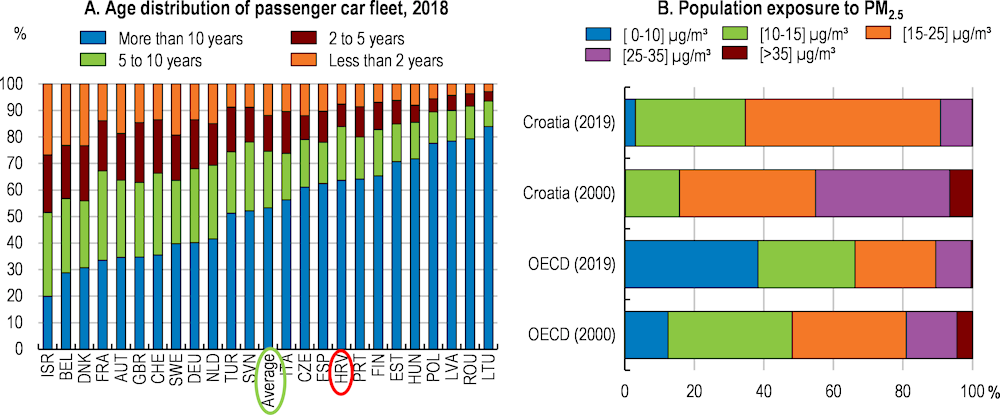

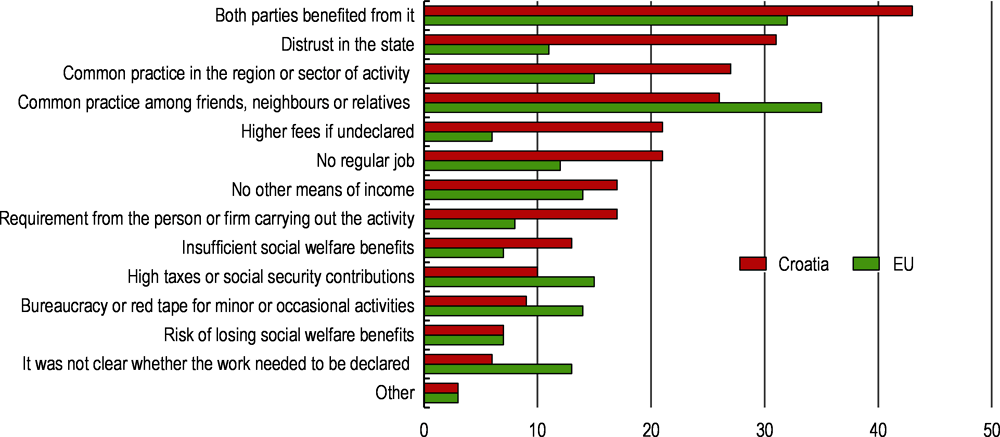

Source: OECD Economic Outlook 113 (database), updated; OECD (2022), OECD Global Revenue Statistics (database); Eurostat; and OECD calculations.