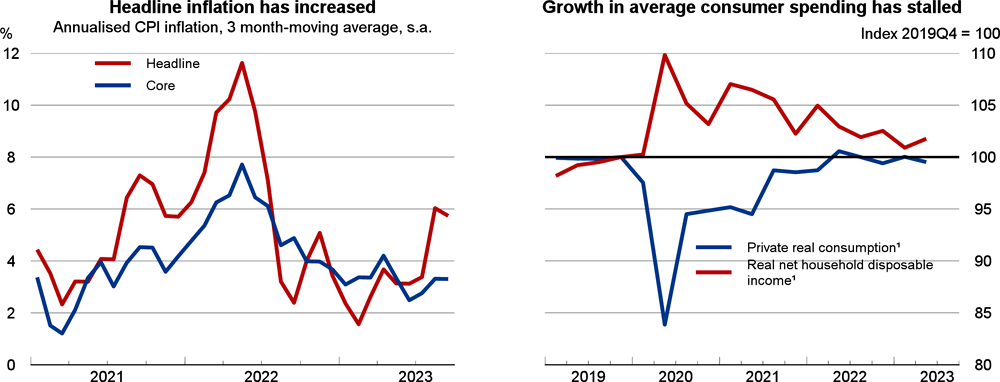

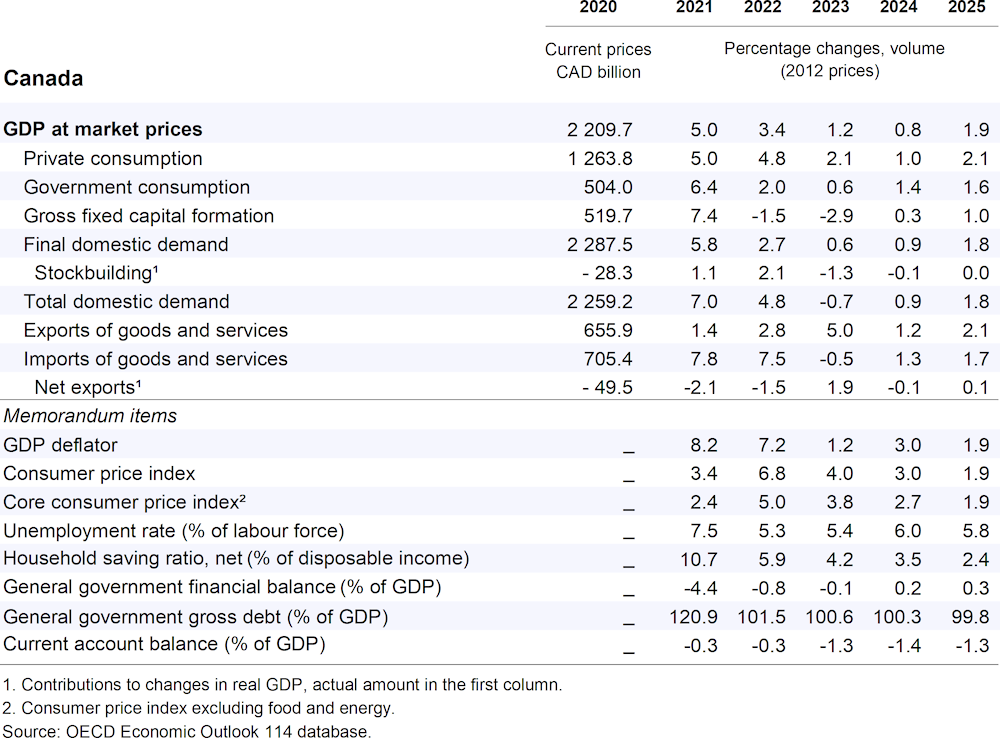

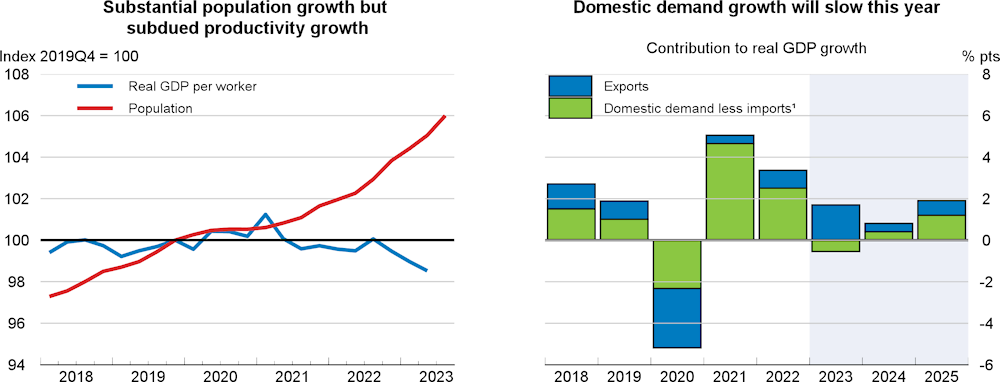

Real GDP growth will drop to 0.8% in 2024, reflecting slowing domestic demand in the wake of higher borrowing costs and weakening exports, before recovering to 1.9% in 2025 as improved global conditions strengthen exports. Immigration will continue to boost private spending and labour supply. Price pressures will ebb in the face of slowing demand and rising unemployment. Were unemployment to rise faster than expected, there could be a substantial fall off in households’ consumption demand and a deeper downturn.

The policy interest rate should be kept at its current level until inflation nears its target in 2024. Fiscal consolidation, partly due to the termination of cost-of-living relief, will also help cool the economy. Ensuring long-run fiscal sustainability while accommodating Canada’s multi-year spending pressures may require tax reforms and closer attention to spending efficiency. Further efforts to boost business productivity would expand the fiscal revenue base, alongside raising economic capacity and improving standards of living.