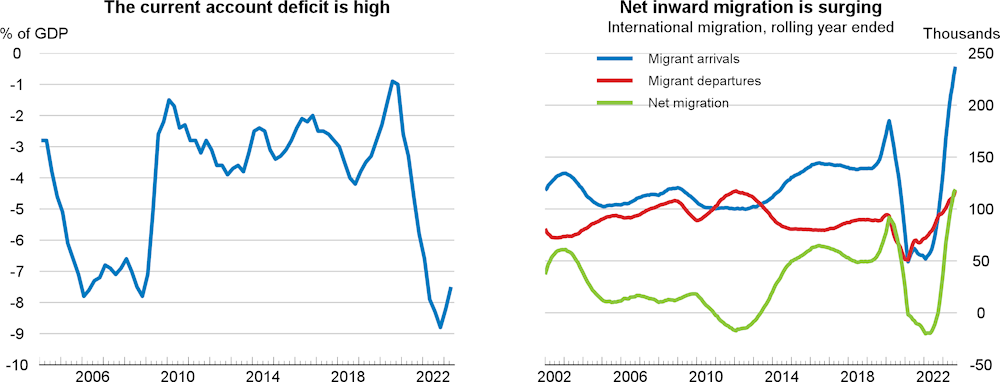

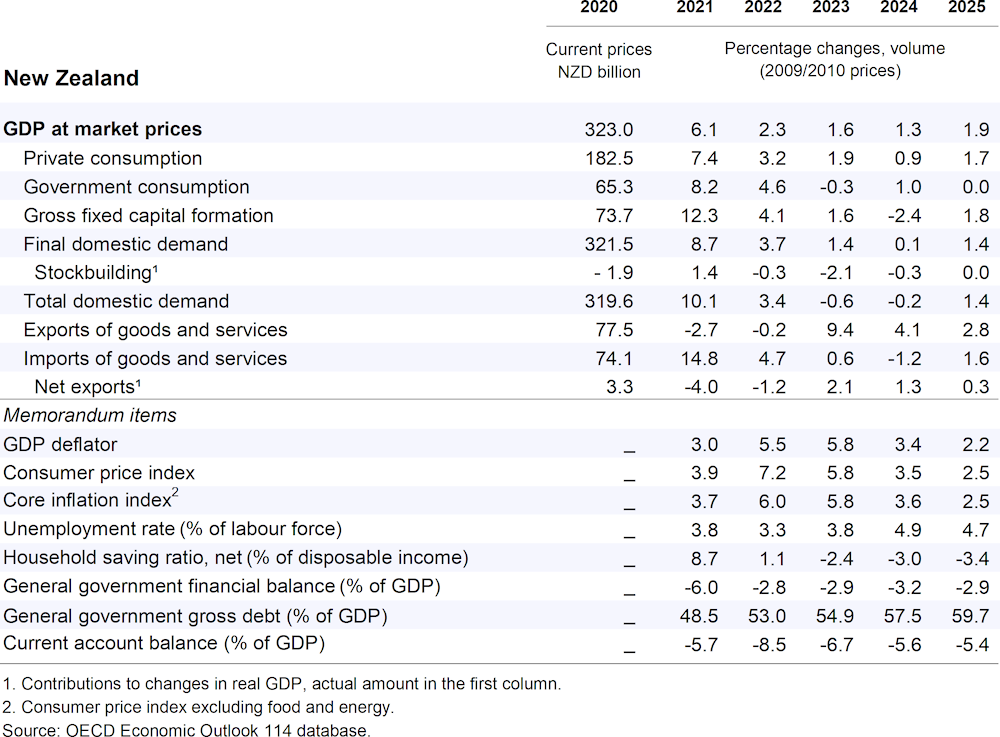

Real GDP growth is projected to ease to 1.3% in 2024 before picking up to 1.9% in 2025. Higher interest rates are weighing on consumption and housing investment, while lower global growth is restraining inbound tourism and reducing the price of commodity exports. Strong net inward migration is set to put a floor under aggregate growth. Many of the migrants are of working age, and labour force growth has been strong, easing labour market tensions. However, employment growth recently turned negative and the unemployment rate is rising.

In line with weaker growth and ebbing labour market tensions, inflation is projected to fall to 3.5% in 2024 and 2.5% in 2025 if monetary policy remains restrictive for an extended period. Sticking to a moderate fiscal consolidation path is important for reducing inflation and maintaining the credibility of fiscal policy. Reforms to boost competition, as well as labour, skills and housing supply, are essential to resolve imbalances in the economy and to sustainably raise productivity and growth.