This chapter assesses progress made and challenges ahead in the three priority areas for reform identified in 2020, namely the investment climate, the operational environment for businesses, and taxation, considering the impact of the pandemic and Russia’s war on Ukraine. Progress has been made in particular in clarifying the regulatory framework for investment, making the business environment easier to navigate for firms, and digitalising tax services.

Improving the Legal Environment for Business and Investment in Central Asia

6. Uzbekistan

Abstract

Table 6.1. Summary of priority reform implementation and updated recommendations

|

2020 |

2023 |

||

|---|---|---|---|

|

Challenges identified |

Recommendations |

Implementation assessment |

Way forward |

|

Legal framework for investment: Improve implementation of investment legislation |

➢ Ensure proper implementation of the new investment law and remove sectoral restrictions ➢ Ensure consistent enforcement of ICSID judgments ➢ Continue to reduce the role of the state in sectors where its present has an indirect discriminatory effect |

➢ Significant reforms to increase investor protection rights were undertaken ➢ But a lack of transparency remains |

➢ Provide additional guarantees on the impartial treatment of investment projects ➢ Remove restrictions where relevant and level the playing field |

|

Operational environment for SMEs: Streamline business regulation |

➢ Streamline and consolidate legislation and licenses for firms and entrepreneurs ➢ Accelerate digitalisation of procedure for all firms ➢ Improve dispute resolution including in local courts and through ADR |

➢ The streamlining of procedures and legislation has made significant progress ➢ Yet the pace of reforms creates implementation challenges ➢ Market competition is limited |

➢ Improve the dialogue with the business community ➢ Pursue reforms to increase competition ➢ Increase the transparency of rulemaking |

|

Taxation: Improve tax administration |

➢ Ensure predictability of changes to tax requirements and improve tax administration for SMEs ➢ Complete the full digitalisation of tax procedures ➢ Streamline the tax code and ensure its implementation |

➢ Fiscal policy developments have reduced the tax and administrative burden on firms ➢ However, tax administration remains the most contentious issue mentioned by firms |

➢ Address implementation issues ➢ Work on improving relations between the Tax Committee and the taxpayers ➢ Review the incentive regime |

Source: (OECD, 2021[1]), OECD analysis (2023).

Introduction

Uzbekistan has shown resilience to the pandemic and war, but further structural reforms will prove necessary to navigate a volatile environment

Reform have recently supported robust economic growth

Uzbekistan has registered sustained growth since the mid-1990s: following the transition recession of 1990-1995, Uzbekistan’s real GDP has grown at an average annual rate of 5.7%, from 1995 to 2022, above the regional average of 5.3% (World Bank, 2023[2]). Growth during the early years of independence was driven by the state-led distribution of resources and outputs among state-owned enterprises and the export of commodities, especially gold (Brookings, 2022[3]). Development relied on the use of natural resources and physical capital, with little focus on productivity, efficiency and the employment and development of human capital.

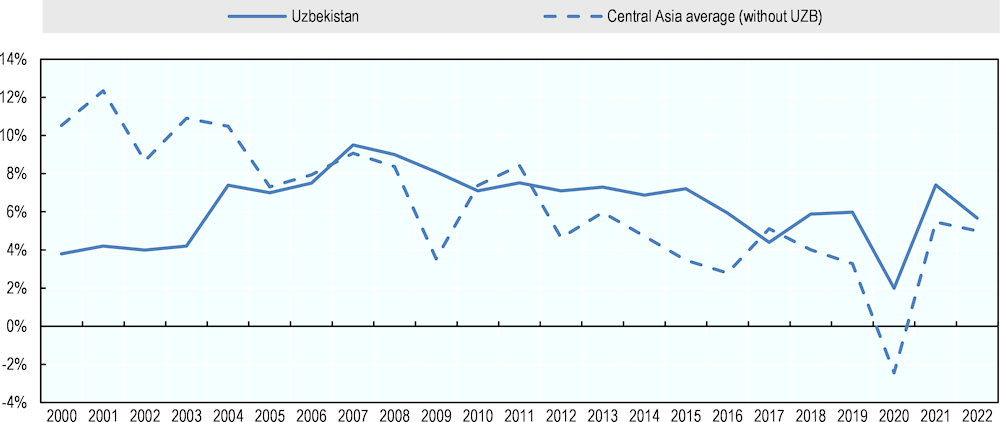

Uzbekistan’s economic transformation started in early 2017, when the country embarked on a wide-ranging reform programme launching the transition to a more open and competitive economy (World Bank, 2022[4]). The government’s initial efforts focused on liberalising the foreign exchange rate and prices, increasing expenditures in the social sector, revamping the tax system and increasing fiscal and debt transparency, with the aim of enabling the private sector to play a larger role in the economy and to reduce that of the state. Whilst the COVID-19 pandemic has arguably been one of the deepest economic shocks to hit Central Asia since independence (OECD, 2021[5]), Uzbekistan was one of the few countries worldwide to avoid recession in 2020 (Figure 6.1).

Figure 6.1. Real GDP growth (2002-2022)

The COVID-19 pandemic and Russia’s war in Ukraine have shifted the government’s focus to relief measures

Uzbekistan’s recent economic performance has been impressive, but the fundamentals of a market economy are still being created. A low public debt-to-GDP ratio (although it has risen significantly in recent years), significant inflows of remittances and high gold prices have allowed the country to mitigate the impacts of the COVID-19 pandemic and the war (OECD, 2023[7]). However, these two shocks seem to have also shifted the government’s focus to short-term relief and delayed more structural reforms to transform and reduce the size of the state in the economy. Privatisation and enterprise restructuring in particular have slowed, limiting the effectiveness of other reforms to improve the business climate and to create a level playing field for firms. Uzbekistan’s rate of new firm creation remains among the lowest compared with regional and income-level peers (World Bank, 2022[4]), due to the misallocation of resources towards less efficient firms and the lack of reward for firms with growth potential.

Table 6.2. Summary table of government support measures during the COVID-19 pandemic and at the beginning of Russia’s war in Ukraine

|

Relief measures |

COVID-19 |

Beginning of Russia’s war in Ukraine |

|

Monetary policy |

|

|

|

Fiscal policy |

|

|

|

Household support |

|

|

|

Firm support |

|

|

Source: (OECD, 2021[8]), (OECD, 2022[9])

Further structural reform is crucial for the economy to become more inclusive and resilient to climate change

Maintaining reform momentum is essential to ensuring that the benefits of Uzbekistan’s economic growth are more widely shared (World Bank, 2022[4]). In the current volatile environment, policymakers should focus on market-oriented structural reforms, such as the privatisation of state-owned enterprises (SOEs) and state-owned banks (SOBs), increasing competition and levelling the playing field for firms. Reforms are needed to foster firm and job creation and absorb a rapidly expanding labour force, which would ultimately serve to reduce vulnerabilities to external downswings in key external labour markets (OECD, 2023[7]). On the environmental front, continuing efforts to reduce the high levels of CO2 emissions and energy should contribute to reducing the social cost of inefficiency and emissions: the OECD Environment Directorate estimates that Uzbekistan has by far the highest level of premature deaths due to particulate matter 2.5 (PM2.5) exposure in Central Asia (around 800 per 1,000,000 inhabitants) (OECD, 2022[10]).

To help the government of Uzbekistan strengthen the business environment and create conditions to level the playing field between firms, the OECD conducted research in 2019-2020 in the legal environment for business that pointed to the importance of further structural reforms in three policy domains, namely the investment framework, the operational environment for businesses and tax administration (OECD, 2021[1]).

The OECD 2019-2020 research identified a need for improved implementation of investment legislation, the legislative framework for businesses and tax administration

Implementation of investment legislation

The Law on Investment and Investments Activity (LoI) passed in 2019 has served to clarify the investment framework by replacing obsolete legislation and systematising existing laws and by-laws (OECD, 2021[1]). It has also helped level the playing field for domestic and foreign investors, with a de jure impartial granting of investment protections to both types of investors. However, the (OECD, 2021[8]) report identifies the need to ensure enforcement of this new law and had also spotted several loopholes in this new framework, including, among others, (i) the exclusion of numerous forms of investments from the scope of the law, such as those under production-sharing agreements, concession contracts, public-private partnerships (PPPs), and special economic zones (SEZs). It was also pointed out that the legal hierarchy between laws governing these areas of activity and the LoI needed clarification to improve certainty, especially regarding the SEZ laws’ interactions with national legislation. In addition, (ii) stabilisation guarantees granted to investors, stating that detrimental regulatory changes would not apply for a period of ten years, appeared unfavourable to the government. Lastly, whilst Uzbekistan outperforms the rest of the region when it comes to regulatory openness to foreign investment, (iii) some sectoral restrictions, such as in the banking and business service sectors, could be re-evaluated.

Legislative consolidation for businesses

Reforms such as price liberalisation, the reduction of import tariffs, and foreign exchange liberalisation have contributed to improving the business environment and fostering private-sector development in Uzbekistan. However, the pace of legislative changes and their speedy enforcement has created difficulties for the administration and for firms to implement and adapt on time. In addition, a critical challenge identified in 2020 related to contradictions between primary and secondary legislation. It was suggested to the government to adopt a single coherent piece of legislation that would supersede and annul previous contradictory laws. Such legislation should also include a single, clear definition of SMEs to adapt legislation to the reality of the economic landscape of the country. Finally, it was recommended to speed up the digitalisation of procedures and to publish the Business Ombudsman’s reports of companies’ feedback to identify and address the most important bottlenecks.

Tax administration

Tax administration was identified as the most contentious issue for the private sector. Whilst several tax rates were reduced in the new version of the Tax Code, frequent tax changes were highlighted as a source of uncertainty for investors and businesses. A simplified regime was introduced for SMEs with a turnover below 1 billion UZS (roughly 79,000 EUR), but it created significant challenges to the tax administration when around 22,000 firms qualifying for the simplified regime registered under the standard one. Overall, it was recommended to ensure changes were more predictable, to improve tax administration, especially with regards to VAT refund, and to further digitalise tax procedures to reduce face-to-face interactions and red tape.

Assessing progress since 2020

The following sections provide an overview of implementation progress of since 2020, and suggest ways forward, taking into account new priorities following the pandemic and the changed regional context (Table 6.1).

Priority 1: The investment climate has improved but efforts should be pursued to create a level-playing field among investors

The government has prioritised investment dispute resolution reforms to improve the investment climate

A review of the LoI is underway

Recent legal developments have contributed to improving the investment environment. The 2019 LoI helped increase transparency and predictability for investors, with a streamlining of the law. The government has recently tasked itself to further review it with IFC support to provide additional clarity on investor protections and treatment standards, to align its provisions more closely with international legal frameworks and to address remaining ambiguous clauses (see above). Updating de jure provisions will however need to go hand in hand with proper implementation and enforcement.

The Tashkent International Commercial Court is to be established

The government recently announced the creation of the Tashkent International Commercial Court, with the aim of establishing a domestic court to settle international investment disputes (The Tashkent Times, 2023[11]). It will be part of the country’s court system, but will be independent in its regulation and proceedings, and should serve as a trusted and neutral platform for investors to solve their litigation cases with the government. The language spoken in the court and documentation will be English, and judges will be selected internationally based on their track records in dealing with investment disputes. International lawyers will be able to represent their clients and will be supported by locally registered lawyers, giving opportunities for the local legal community to benefit from international peer-learning. Whilst such an initiative is a positive development, the government should ensure regular exchanges of good practice with national courts to avoid the creation of a two-tiered justice system. As seen in the case of the AIFC Court in Kazakhstan, arbitration provided in English and the high costs associated with its procedures have not always proven accessible to domestic entrepreneurs.

Uzbekistan is becoming more integrated in the global investment and trade community

Uzbekistan’s increased engagement with the international trade and investment community has proved useful in boosting the country’s investment attractiveness. The creation of an annual foreign investor platform for the government and foreign companies has served to discuss and address challenges in the investment environment. In August 2021, the President chaired the first session of this platform with investors and businesses. Uzbekistan’s adhesion to the EU’s GSP+ Arrangement in 2021 has also enhanced the country’s investment attractiveness, as it now benefits from more favourable trade conditions. Domestic firms are eligible to a full removal of customs duties on two-thirds of tariffs lines when exporting to the EU in a wide range of sectors. The joining of the GSP+ also reflects the country’s progress in improving the business climate, the judicial system and labour conditions (UNCTAD, 2021[12]). Finally, aligning the country’s trade regime with WTO requirements should also serve to reduce trade barriers and further integrate Uzbekistan in regional and international trade.

The competitive field remains distorted, and dispute resolution still needs strengthening

Further progress could be made to increase the transparency of public procurement and privatisation

The creation of a transparent environment for investors is nonetheless taking time to materialise. The selection process for large investment or privatisation projects is not always made on the basis of a public tender due to the government’s desire to attract investment and the cumbersomeness of the public procurement system. Capital flows are directed towards major export-oriented or import-substituting industries, while investments in import-consuming projects generally see limited support from the government (U.S. Department of State, 2022[13]). This also results in little investment in knowledge-intensive sectors (World Bank, 2022[14]).The government scrutinises investments, but there is no standard screening mechanism in place to assess, authorise and condition FDI based on a range of clearly stated criteria. This can challenge the creation of a level playing field and increase the risk of corruption, as firms may need to negotiate individually the terms of the screening mechanism as well as special decrees to obtain authorisations for investment projects. Such practices also disadvantage SMEs, which do not have in-house capacity to address gaps in the law with ad-hoc agreements with the government.

The need for greater transparency also applies to investments in the privatisation process. The government has announced an ambitious privatisation programme which plans to reduce the number of SOEs by 75% by 2025. However, this effort seems to precede the spelling out of a rationale for privatisation and the establishment of a strong legal foundation to pursue those objectives and create an attractive investment framework (World Bank, 2022[4]). In particular, the government has not thoroughly updated its asset valuation law since 1992. Setting an appropriate firm valuation method requires the establishment of specific criteria for the evaluation process in the context of competitive bidding, especially as valuing a firm aways involves a certain degree of subjectivity. The valuation method would allow the government of Uzbekistan to justify the share price it offers, ensure value for money and maintain a high quality of privatisations. In some OECD countries such as France, Italy, Poland, Spain and Türkiye, valuation prior to privatisation is mandated by law (OECD, 2019[15]). Another gap identified in the investment legislation relates to the persistence of restrictions on (i) private investment in SOE-dominated sectors, such as equity restrictions - there is currently a 49% share limit in the charter capital of SOEs being opened to privatisation. (ii) capital movement transactions, as transfers of funds above 10,000 USD outside of Uzbekistan require according to a Central Bank of Uzbekistan regulation, approval from the Cabinet of Ministers or the President (Lex.uz, 2013[16]).

The channelling of preferences and incentives distorts the level-playing field

There seems to be a gap between de jure equal treatment and de facto selected incentive allocation. Current legislation states that equal opportunities should be granted to domestic and foreign investors alike. Several incentives and benefits are nonetheless still given to legal entities involving private foreign direct investment and specialising in manufacturing products and services, depending on the share of FDI, and on a case-by-case basis. Tax breaks are granted in the form of exemption from land tax, property tax and tax for the use of water resources under certain conditions, such as a minimum 15% foreign stake in a legal entity. Such customs exemptions, subsidies and tax breaks offered according to the LOI, the Tax Code and investment contracts, contradict other legislation, which states that the granting of opportunities should be made equal between foreign and domestic investors. Conversely, protectionist measures to support domestic production and limit foreign competition remain, such as a ban from the public procurement process of a list of specified imported items, preferential access granted to SOEs to land, infrastructure, credit, state support, contracts, and cheaper business establishment procedures for domestic firms; which also contribute to distorting market entry.

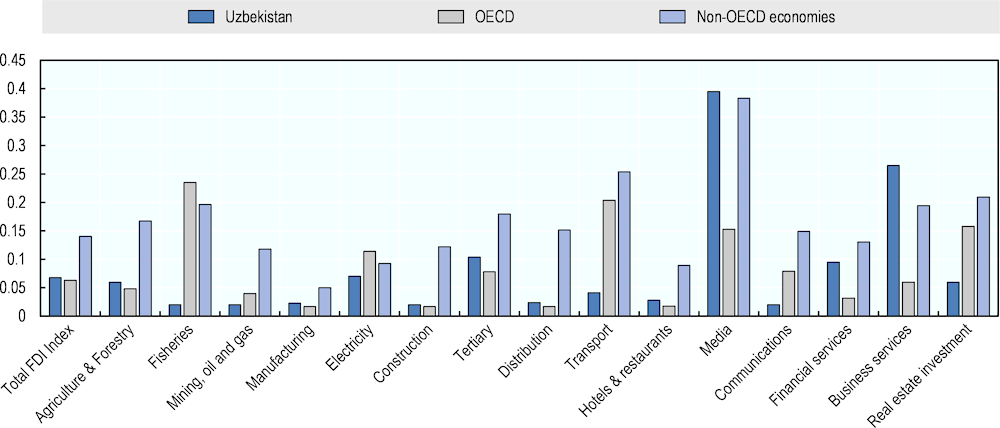

Statutory sectoral restrictions on foreign investment are few but not so clearly stated

Sectoral restrictions for foreign investment de facto remain, such as in agriculture, transport, media and banking (Figure 6.2). For instance, land ownership in the agriculture sector is not allowed, but leases can be granted to both domestic and foreign entities. While these are stated in legislation, they are scattered across different laws, and can be issued by ministries or government agencies which could define an up-to-date negative list of sector-specific restrictions on FDI while restrictions mentioned in the LOI under a negative list are not publicly available (World Bank, 2022[14]). Similarly, market entry and operational restrictions remain in some commercial sectors, such as aviation, chemicals, and telecoms. SOEs’ persisting influence over regulation and policies in energy, transport and telecoms have contributed to higher prices, less innovation, fewer services and lower quality (World Bank, 2022[4]).

Figure 6.2. OECD FDI Regulatory Restrictiveness Index for Uzbekistan (2020)

Note: Open = 0, closed = 1.

Source: OECD (2020).

Dispute resolution mechanisms are not fully aligned with international best practices and commitments, despite the creation of the Tashkent International Arbitration Centre (TIAC)

Uzbekistan has not fully aligned its dispute settlement legislation with international treaties and agreements. The country is a signatory to both the Convention on the Settlement of Investment Disputes between States and Nationals of Other States and the United Nations Convention on the Recognition and Enforcement of Foreign Arbitral Awards (New York Convention). However, it has not fully aligned its procedural legislation with the latter. Old bilateral investment treaties are still in place, which include ambiguous formulations that expose the country to a high risk in investor-state disputes (World Bank, 2022[14]), and may create complexities with the enforcement of arbitral awards in domestic courts (Dentons, 2023[17]).

Alternative dispute resolution mechanisms exist, including mediation and conciliation, and are increasingly used in commercial disputes. The LOI introduced a dispute-resolution mechanism based on four steps, where an investor may only seek to commence international arbitration proceedings against the state if he has first attempted to resolve a dispute through negotiations, mediation and litigation in Uzbek courts (OECD, 2021[8]). However, the stage at which it is deemed impossible to resolve the dispute following negotiations and mediation is not clearly defined. In the absence of clear investor grievance and dispute resolution mechanisms, the government exposes itself to an immediate resort to international arbitration procedures, with significant cost and reputation implications. The Spanish company Maxam’s recent filing to an international arbitration court following an unresolved dispute with Uzkimyosanoat poses a major test for the government’s efforts to attract Western FDI.

Levelling the playing field, more communication on existing restrictions and the strengthening of dispute resolution mechanisms will enhance the investment climate

Additional measures should be taken to level the playing field among firms

Further transparency around the existing incentive regime should be provided. Detailed communication around the criteria for, and the beneficiaries of, exemptions and breaks is lacking, increasing the risk of corruption and capture by vested interests (World Bank, 2022[4]). Current practices grant SOEs favourable access to inputs and regulatory preferences, impeding private sector market entry, while individually negotiated resolutions provide large foreign investors more favourable terms than to smaller ones. The government should publish in a more consistent manner a list of the beneficiaries of such exemptions and consider performing a cost-benefit and impact analysis of the regime, given its implications in terms of forgone public revenue. On that basis, it could decide whether to perpetuate the system, and ground the granting of selected, clearly communicated preferences on sound economic arguments. This would serve to increase the transparency of the investment environment, which would have a positive effect on attracting and retaining FDI: only 15% of the OECD’s latest business climate assessment survey respondents in Uzbekistan highlighted incentives and special services to foreign investors as a main reason for doing business in the country (OECD, 2023[7]), suggesting that incentives only play a marginal role in an investor’s decision to set up activity in a country.

Explicit statutory restrictions on foreign investment could add clarity to the investment framework

Whilst statutory restrictions are comparatively low in Uzbekistan, explicitly stating which sectors are subject to FDI restrictions, and what the screening mechanisms are, would prove useful. At the time of writing, such information did not seem to be available on the Investment Promotion Agency’s website or in the LOI. Although not needed to be enshrined in a legal act, providing guidance in an implementing regulation and on freely accessible online resources as to what considerations, including restrictions, are taken into account when assessing an investment project would mitigate perceived risks and increase investor confidence (OECD, 2017[18]). Beyond the immediate impact on inflows, the government should also evaluate how these restrictions affect downstream industries and consumers. Attention should also be paid to ensuring that the lifting of restrictions and privatisation do not result in merely replacing public with private monopolies.

Involving foreign investors in SOB privatisation is a welcome initiative that should be pursued. Notwithstanding the potential risks associated with foreign bank entry (increased vulnerability of an inter-connected cross-border banking system to international financial crises) (IMF, 2000[19]), clarifying the bank licensing environment and lifting restrictions on foreign investments in the financial sector and on the establishment of foreign-owned banks would make it possible to expand the role banks can play as financial intermediaries and increase competition in the financial sector. Studies show that a greater presence of foreign banks in a banking system has a positive spillover effect on loan growth (EBRD, 2002[20]). Foreign banks can also spur innovation by increasing competitive pressure on the market and introducing better technologies, skills and products, in a context where the government has expressed its intent to privatise eight out of the twelve state-owned commercial banks by 2025, which would increase the share of private banking assets from 15% to 60% of the total (World Bank, 2022[21]). The recent privatisation and acquisition of Ipoteka Bank by Hungarian OTP Bank is a significant step in that regard (OTP Group, 2022[22]).

The government should consider lifting restrictions on the opening of branches of foreign legal entities. Legislation does not explicitly prohibit the establishment of branches of foreign entities, but in practice Uzbek authorities do not register such branches (EY, 2021[23]). Relaxing this provision would allow foreign companies and banks to conduct operations in Uzbekistan.

Further align dispute resolution mechanisms with international best practices

The authorities should build awareness across the public administration of the international commitments taken to ensure that domestic courts recognise and enforce decisions accordingly. This would also serve to resolve the issue of conflicting interpretations of legislation which may arise between government officials, attorneys, and judges. The Ministry of Justice could publish internal guidelines and conduct trainings and capacity building in courts to inform attorneys and judges of Uzbekistan’s commitments with regards to international conventions.

In parallel, spelling out a clear investor grievance mechanism would serve to process and conciliate issues between investors and the state, and prevent escalation to legal proceedings. It would also contribute to increasing the retention of existing investment projects in the country (World Bank, 2022[14]). The government could initiate the creation of an investor grievance committee, detail its design and functioning processes, and publish informal guidelines on its expectations and examples of its operations in practice. It could also create an interactive electronic platform for investors to submit and follow their grievances easily. The Foreign Investors’ Council could play such a role and formulate proposals to update and revise policies for investment protection, but this would require an independent status.

Despite the importance of non-judicial mechanisms, an independent judiciary is a critical foundation for law enforcement that affects investment, as firms need an impartial mechanism to resolve disputes. Whilst the government’s recent governance reforms have focused on improving judicial and law enforcement services, judges’ ability to decide cases autonomously could still be improved. Uzbekistan could look at Kazakhstan’s ‘’Seven Pillar Strategy’’, which aims to raise the quality and coherence of judgments, and businesses and citizens’ trust in judicial bodies. The Supreme Court developed a decision template to guide the process of drafting judgments and increase its reliability and developed a new system of judicial recruitment to select competent judges trained in accordance with international standards (OECD, 2021[1]). The draft law to appoint Constitutional Court judges for a ten-year term without the right to re-election is a positive development to increase the independence of the judiciary (Kun.uz, 2023[24]).

Priority 2: The operational environment for businesses has improved through digitalisation and simplification but could benefit from impact assessment and more competition

The government is working to make the operational environment simpler for businesses

The streamlining of procedures and legislation has made significant progress

A wide array of government services has been digitalised and is now available online. According to the government, around 50% of public services have been digitised (President of the Republic of Uzbekistan, 2023[25]), with plans to raise that figure to 80%. The licensing regime update in July 2021 has made it possible to streamline the obtention of licenses, permits and notification procedures (World Bank, 2022[4]). Respondents to the latest OECD business climate survey in Uzbekistan reported the digitalisation of procedures and the removal of redundant licenses and permits as the two most useful measures implemented to assist foreign companies (OECD, 2023[7]).

Another important development is the drafting of a new Entrepreneurship Code which streamlines and consolidates existing business legislation, clearly defines the rights and obligations of firms, and clarifies the process of opening and closing a business (Box 6.1). It proposes to divide business entities into several categories depending on their average annual turnover and number of employees. The concept of social entrepreneurship is also introduced. The Ministry of Justice reported that 73 types of documents previously required in licensing procedures had been withdrawn, and that the fees charged have been reduced for several types of services. The drafting of the code involved consultations with the private sector and international community, although most OECD interviewees were not aware of its existence.

Significant efforts have also been pursued to reduce the regulatory burden on firms. Several government and Presidential Decrees have aimed at streamlining existing legislation. For instance, the parliament and the government reported the adoption of 35 laws and over 100 regulations or amendments to legislation, which abolished nearly 1,000 laws and regulations in 2020 (Lex.uz, 2020[26]) (Lex.uz, 2020[27]). In late 2022, a presidential decree aiming to simplify the state regulation of business activities was signed and defined the limits of state regulation of entrepreneurial activity, limiting them to the registration of business entities, tariff and non-tariff regulation, compulsory liability insurance, and the protection of competition, among others (Lex.uz, 2022[28]). The number of business inspections is to be cut in half, required licences and permits reduced by 30% and exclusively performed online. Starting from January 1, 2024, the Chamber of Commerce and Industry and the Business Ombudsman, in collaboration with industry representatives, will introduce an open entrepreneur rating. Those with high ratings will be exempt from all forms of tax audits, and any excess value-added tax will be returned to them within a day. The modalities for running the rating system are yet to be defined. Among other important initiatives, a Unified Electronic Registry of Mandatory Requirements in the Field of Entrepreneurship to reduce the regulatory burden on firms will be launched in July 2025 and operated by the Ministry of Justice. The aim of this registry is to make an inventory of all established requirements for business regulation and make proposals to review them. The first stage of creating this registry includes forming a list of mandatory requirements for firms in the areas of construction, trade, public catering, education and transport. The second stage should encompass more sectors. However, it remains to be seen whether this register will simplify the operational environment or add complexity and layers of administrative requirements for firms. The latest update of the Centre for Economic Research and Reforms (CERR)’s business climate indicator showed an improvement in the business environment, driven by less difficulties in accessing financing and a better assessment of the tax administration (Trading Economics, 2023[29]).

Box 6.1. Drafting a new Entrepreneurship Code

The OECD provided comments to the draft Entrepreneurship Code (EC), which aims to consolidate all business-related laws and regulations, at the request of the Ministry of Justice. The draft EC included key sections that are organised in line with international standards. These include a definition of:

businesses, in particular of SMEs with associated thresholds and a time-bound reference period, as well as a clear distinction between the definition and purpose of business entities and social enterprises;

their rights and obligations;

the provisions needed for a sound regulatory framework for businesses, in particular the definition of the procedure for business registration and closure, an important step for enterprise formalisation; and

the rules concerning the nature and modalities of state support to businesses.

In addition, the document spells out a hierarchy of normative acts between international treaties and national laws, as it gives primacy to international treaties ratified by Uzbekistan over the Entrepreneurship Code, and primacy of the Entrepreneurship Code over all other legal acts related to entrepreneurship. Some instances of a duplication of laws and regulations, however, remain to be addressed.

Source: OECD analysis (2022)

Communication on legislative changes has improved

The government has significantly enhanced communication of legislative changes through more systematic publication of draft laws and decrees. Draft legislative changes are published and submitted for public consultation on regulation.gov.uz. Laws and decrees adopted are accessible online and for free on Lex.uz. The Ministry of Justice communicates these on its official Telegram channel, in the press and on TV. The Ministry also launched an online platform called ‘’Advice for Business’’ (b-advice.uz), where entrepreneurs can receive free legal advice and consultations online. Services include a listing of free land plots, information on the issuance of licenses and authorisations, credit access, and connecting to the telecom network.

Market competition is limited

Competition remains a long-standing issue

Lack of institutional capacity to foster competition, preferential treatment granted to SOEs, and the latter’s regulator role in their own sectors impede the creation of competitive market conditions and private firm entry (World Bank, 2022[4]) (OECD, 2022[30]). Whilst Uzbekistan has a strong de jure competition law regime (OECD, 2022[30]), 56% of a recent OECD survey respondents considered that competition policies are weak, and none reported that they were strong (OECD, 2023[7]). For each of the sub-indicators for competition policy, monopoly practices were reported as weak by the largest number of respondents, followed by control of market dominance and measures in place against cartels and concerted practices (ibid). Many SOEs enjoy monopolies in activities that are otherwise carried out by the private sector and, in sectors where they co-exist with private firms, the former benefit from preferential access to financing and land and are responsible for regulatory policy.

Reform of the operational environment should prioritise impact assessment and market competition

Pursue legislative simplification involving RIAs and public-private consultations

The review of business-related legislation can take the form of legislative simplification initiatives, ex ante reviews through regulatory impact assessments (RIAs) and a mapping of fiscal and parafiscal charges paid by SMEs with the view to rationalising them. With regards to legislative simplification, a regulatory guillotine approach can be applied to abolish previous laws and remove contradictions between old and new legislation. This method can help contribute to regulatory offsetting (OECD, 2019[31]) and should be paired with regulatory impact assessment before implementation to evaluate the impact of new legislation. To ensure RIAs are not a “box-ticking exercise”, they should be initiated early in the conceptualisation of new legislation rather than when the draft legislation has already been prepared (OECD, 2022[32]). Oversight bodies, independent from line ministries, should perform binding quality controls for RIAs, to ensure that the government criteria for conducting RIAs are respected.

Major regulatory changes should systematically involve a formal public-private consultation. The government should ensure that SMEs are well represented and engaged in those consultations, and that they can raise comments and concerns regarding changes that apply to them. To the extent possible, urgent procedures bypassing consultations should be avoided. Prior to enacting, the relevant authorities should ensure clear communication on implementation and resolve issues related to the interpretation of new provisions. Monitoring and evaluating those consultations would allow to evaluate the degree to which key stakeholders are involved in the process and identify areas where further outreach or capacity building is needed (OECD, 2022[32]).

Box 6.2. Serbia’s e-Papir programme

The government of Serbia adopted a Programme for the Simplification of Administrative Procedures and Regulations (2019-2021), called e-Papir, which aims to identify and simplify administrative procedures for businesses. Within the framework of the programme, a register of administrative procedures for businesses was created and linked to the government’s portal of digital public services.

In setting up the Unified Electronic Registry of Mandatory Requirements in the Field of Entrepreneurship, the government of Uzbekistan could take inspiration from Serbia’s programme which combines the process of simplifying administrative procedures with their digitalisation, processes which are often considered independently. The overall benefit of the programme once fully implemented is estimated at around EUR 4.5 million. This parallel digitalisation and simplification can be seen as a first step toward designing digital services with the end user’s experience and needs in mind.

Pursue reforms to increase competition

Several measures can serve to increase market competition. The OECD had already recommended that the Consumer Protection and Competition Promotion Committee benefit from more operational independence to allow for more effective enforcement and is ensured a sufficient and stable budget to execute its mandate effectively (OECD, 2022[30]). In addition, it appears essential that the government pursues the splitting of operation, policy, and regulatory responsibilities within SOEs to reduce the risk of conflicts of interests. Lastly, as discussed above, preferential access to land and inputs to SOEs should be reviewed.

Priority 3: Taxation has become more digital and less burdensome, but tax administration could be improved to increase compliance

The fiscal regime has been recently overhauled

The tax burden on firms has been reduced

The overhaul of the tax policy has led to a decrease in the tax burden, reduced complexity and lowered mandatory social contributions (World Bank, 2022[4]). The latest version of the Tax Code has optimised the types and number of taxes and levies, as well as special tax regimes (Box 6.3). In particular, the number of taxes for firms was reduced to ten and a special tax regime was introduced for small companies with a turnover of up to UZS 1 billion (about 75,000 EUR), which must pay a single turnover tax. The reduction of the value-added tax (VAT) was intended to provide fiscal relief to businesses and consumers. Several measures, such as the simplification of the VAT refund procedure with the removal of additional checks, the automatic inclusion of businesses with a turnover of UZS 1 billion without verification, and the provision under which taxpayers in high-risk areas will be notified before the VAT certificate is suspended, have reduced the administrative burden. In addition, a new resolution introduced the prohibition of applying the tax gap coefficient in cases of negative VAT reimbursement (podrobno, 2023[33]). The period for in-house audits related to the validity of VAT amounts was shortened from 60 to 30 days (Foreign Investors Council under the President of the Republic of Uzbekistan, 2023[34]), and certain actions such as accessing the taxpayer’s territory, requesting or seizing documents and inspecting premises have been forbidden during criminal tax audits. Businesses report that this has made Uzbekistan’s tax regime the most attractive in the region. The accountability of the tax authorities was also strengthened with the introduction of a new mechanism that provides for payment of interest to the taxpayer by the tax authority for each day of overdue tax refund, with excessively recovered amounts of taxes and financial penalties refunded in the form of interest calculated based on the refinancing rate of the Central Bank. Overall, tax reforms have supported record increases in new business and personal taxpayer registrations, and a 7.4% increase in tax revenues collected for H1 2023 compared with the same period in 2022 (World Bank, 2022[4]) (UzDaily, 2023[35]).

Box 6.3. Recent fiscal policy developments in Uzbekistan

The new Tax Code, effective on 1 January 2020, lowered corporate and individual income taxes by almost 50% and simplified taxation procedures for private entrepreneurs. It also abolished outdated methods of determining the tax base based on the cost of goods and services sold.

Key changes since 2020 include:

firms with a turnover below 1 Bn UZS do not pay VAT;

the 8% social security contributions and all mandatory payments to various state funds were abolished;

corporate and individual income taxes were reduced from a progressive rate of up to 24% to a single flat rate of 12%;

the income tax rate on dividends was reduced from 10% to 5% for residents, 10% for non-residents;

the VAT tax rate also decreased from 20 to 12% effective in 2023;

a 0% corporate (profit) tax rate on profit from the sales of goods (services) for export was introduced;

a 50% corporate (profit) tax rate reduction was introduced for taxpayers that change from the single turnover tax regime to the corporate (profit) tax regime after 1 September 2022;

tax losses can be carried forward indefinitely, thus reducing the taxable income of the respective year; and

13 forms of tax inspections were consolidated into two.

Source: OECD analysis

The digitalisation of tax procedures has made substantial progress

Taxation has also widely benefitted from investments in digitalisation according to the Uzbek authorities, including investments in data centre infrastructure and the procurement of servers, telecommunications, software upgrades, the switching online of more than 40 types of tax services and plans to rely on big data and AI to better analyse tax revenue trends in the future. All those measures also serve to improve tax administration and create easier conditions for firms to pay tax. The Tax Committee introduced an online cashback system for individuals at retail, catering and consumer services purchases upon the scanning of the QR code of the receipt on the Soliq application, which has led to an increase of income reporting from businesses and tax compliance.

Nonetheless, tax administration remains the most contentious issue mentioned by firms

Tax administration has not simplified

OECD interviewees have complained about issues in tax administration, such as the added complexity of new tax registration procedures, VAT refund delays and the hasty introduction of digital instruments not always ready on time. The government itself has reported that several resolutions of the Cabinet of Ministers have made the VAT refund system more complex (Lex.uz, 2020[36]) (Lex.uz, 2021[37]). Exporting firms are now subject to in-house and desk tax audits to be eligible for expedited VAT refund, which reduces working capital available. The government also requires firms to ensure that suppliers have active VAT payer certificates, no tax arrears, a good colour grade in the risk assessment, and mandatory digital labelling, among other requirements. These new requirements have led to the creation of an atmosphere of mistrust among firms, which refuse to conduct business with enterprises classified as red in the risk assessment system.

Tax compliance is further challenged by mutual mistrust between the Tax authorities and the taxpayers

A complex system based on a dual tax regime (based on the 1 bn UZS threshold, around 77k EUR), frequent changes, conflicting referential acts and resulting interpretation issues have all been mentioned as roadblocks to voluntary tax compliance. While the Tax Code stipulates that all ambiguities and contradictions in the law should be interpreted in favour of the taxpayer, OECD interviewees mentioned lack of customer-oriented approach and a sense of suspicion from the tax authorities with respect to the taxpayers’ good will. The number of business inspections doubled between 2021 and 2022, with more than 70% of inspections coming from the tax authorities in 2022 (Gazeta.uz, 2023[38]). To address issues and inconsistencies with tax and regulatory measures, foreign investors often resort to government benefits through special cabinet of minister resolutions or presidential decrees, including tax holidays for land taxes, property taxes and water use taxes granted to some companies with foreign direct investments on a case-by-case basis. These can however be revoked (U.S. Department of State, 2022[13]).

Further improving tax administration requires building more trust and engagement between the tax authorities and the taxpayers

Legislation changes need to be predictable

The tax authorities should ensure the stability and clarity of tax legislation. To do so, new legislation should systematically be based on prior consultations to identify the additional net costs and burdens on taxpayers from the changes. Consultative documents should be published and be accompanied by a call for responses to ensure the largest number of stakeholders has the opportunity to provide comments. Consultations can also take the form of “town hall” consultations led in specific locations. It could be particularly useful to conduct such consultations in areas where firms have not necessarily gone digital. Changes should limit the references to norms and by-laws to avoid contradictions, and be consistently interpreted across government institutions, to avoid conflicting communication to businesses.

The way the tax administration engages and communicates with businesses could be improved

The approach to increasing tax compliance should focus more on encouraging formal activity than on discouraging informal activity. An enforcement-based approach is likely to lead to a cycle of inspections, sanctions and closing of activities, and encourages hide-and-seek strategies. On the other hand, policies supporting firm productivity can encourage the latter to formalise and support the transition to the formal sector. Such policies can also create positive examples for other firms (OECD, 2021[39]).

The Tax authorities could also conduct targeted educational campaigns aimed at improving communication and ultimately increasing the number of people meeting filing and payment deadlines and taxpayer registration in the informal economy (OECD, 2023[40]). The tax authorities have already been relying on social media such as a Telegram channel to relay information to SMEs. The style of messages should be targeted, action-oriented, goal driven, easy to understand and engaging. The State Committee could also consider publishing detailed guides with step-by-step instructions on life cycle events (registering for tax, employing staff, reaching VAT thresholds, audits or closing a business) and conducting virtual or in-person workshops. Given the size of Uzbekistan’s informal sector, the authorities should design targeted programmes to widen the tax base. Taxpayer workshops have been identified as having a positive impact on the relationship with the tax authority: following the attendance at a workshop, there was near unanimous acceptance of the legitimacy of the tax authority and a widespread commitment to increase compliance (OECD, 2021[41]). Such a measure would prove more cost-effective than targeting many small taxpayers owing only negligible amounts of tax. Campaigns for formalisation could also target customers rather than the informal businesses directly (Box 6.4), as when people avoid buying goods from the informal sector, sellers will start to comply with tax laws (OECD, 2021[41]). The cash-back system introduced on the Soliq application is a case in point.

Box 6.4. Türkiye’s tax week

The government of Türkiye has been organising a yearly tax week aiming at enhancing tax awareness among children, taxpayers and the society at large. During the week, campaigns are run across the country to invite citizens to pay taxes and help tackle the informal economy. 500 tax officials participate across the country.

Campaigns include:

visits to taxpayers at their workplaces to collect their opinions and suggestions;

visits to civil society organisations to collect their opinions and suggestions;

stands at universities providing students with information on tax awareness, the dangers of the

informal economy employment, career opportunities, etc.;

seminars at universities; and

posters on tax awareness for the general public and children.

Source: (OECD, 2021[41])

Such initiatives should go together with efforts to increase trust and dialogue with and among the private sector. Tax authorities should pursue transparency efforts and publish more exhaustive data on large taxpayer contributions and civil servants’ income declarations to develop understanding of the purpose of tax. Another measure to consider could be the reformulating of tax authorities’ KPIs, currently based on tax amounts collected, to help define a more collaborative relationship between the latter and the private sector. The recent announcement to abolish all tax inspections from 1 January 2024 for firms with a high openness rating should already serve to reduce physical interactions between entrepreneurs and tax authorities. Lastly, given the negative impact of the new risk-assessment system on business-to-business operations, the system should probably be re-evaluated.

References

[3] Brookings (2022), High expectations in Uzbekistan, https://www.brookings.edu/blog/future-development/2022/02/08/high-expectations-in-uzbekistan/.

[17] Dentons (2023), Doing Business Guide - Uzbekistan 2023, https://www.dentons.com/en/insights/articles/2023/march/31/doing-business-in-uzbekistan-2023?utm_source=substack&utm_medium=email.

[43] Dentons (2020), Reforms in the investment legislation of Uzbekistan, https://www.dentons.com/en/insights/alerts/2020/january/9/reforms-in-the-investment-legislation-of-uzbekistan.

[20] EBRD (2002), “Banking reform and development in transition economies” Working Paper 71.

[42] Eurasianet (2023), Uzbekistan woos investors as dispute with Western firm goes to arbitration, https://eurasianet.org/uzbekistan-woos-investors-as-dispute-with-western-firm-goes-to-arbitration.

[23] EY (2021), Doing Business in Uzbekistan - An introductory guide to tax and legal issues, https://assets.ey.com/content/dam/ey-sites/ey-com/en_uz/home/doing-business-in-uzbekistan-ey-2021.pdf.

[34] Foreign Investors Council under the President of the Republic of Uzbekistan (2023), Brief Investor Handbook - Taxation in Uzbekistan, https://drive.google.com/file/d/1QfqZ1VV0gSbkQ9RZgdAQJPFy-hlj6_wU/view?usp=sharing.

[38] Gazeta.uz (2023), Количество проверок бизнеса в Узбекистане удвоилось в 2022 году, https://www.gazeta.uz/ru/2023/06/29/business-checks/ (accessed on 18 July 2023).

[6] IMF (2023), World Economic Outlook Database, April, https://www.imf.org/en/Publications/WEO/weo-database/2023/April.

[19] IMF (2000), “International Capital Markets. Developments, Prospects and Key Policy Issues”, World Economic and Financial Surveys, p. 225, https://doi.org/10.5089/9781557759498.083 (accessed on 9 October 2023).

[24] Kun.uz (2023), Konstitutsiyaviy sudning vakolatlari kengayadi, https://kun.uz/uz/news/2023/07/25/konstitutsiyaviy-sudning-vakolatlari-kengayadi (accessed on 25 July 2023).

[48] Lechner, M. and M. Schnitzer (2008), “Entry of foreign banks and their impact on host countries”, Journal of Comparative Economics, Vol. 36/3, pp. 430-452, https://doi.org/10.1016/j.jce.2008.02.002 (accessed on 9 October 2023).

[28] Lex.uz (2022), О мерах по упрощению государственного регулирования предпринимательской деятельности, https://lex.uz/ru/docs/6279884 (accessed on 8 June 2023).

[37] Lex.uz (2021), О мерах по дальнейшему совершенствованию учета налогоплательщиков и упрощению порядка возмещения налога на добавленную стоимость, https://lex.uz/docs/5660085.

[26] Lex.uz (2020), О внесении изменений и дополнений в некоторые законодательные акты республики узбекистан в связи с дальнейшим сокращением бюрократических барьеров и внедрением современных управленческих принципов в деятельность государственных органов и организаций, https://lex.uz/ru/docs/5020304 (accessed on 8 June 2023).

[36] Lex.uz (2020), О мерах по соверщенствованию налогового администрирования, связанного с зарубежными юридическими лицами и налогом на добавленную стоимость, https://lex.uz/docs/4948600.

[27] Lex.uz (2020), О мерах по улучшению деловой среды в стране путем внедрения системы пересмотра утративших свою актуальность актов законодательства, https://lex.uz/ru/docs/5019108 (accessed on 8 June 2023).

[47] Lex.uz (2020), Об организационных мерах по сокращению теневой экономики и повышению эффективности деятельности налоговых органов, https://lex.uz/ru/docs/5073461.

[16] Lex.uz (2013), On the approval of the regulation on the procedure for the implementation of certain foreign exchange operations related to the movement of capital, https://lex.uz/docs/2296324.

[40] OECD (2023), Communication and Engagement with SMEs: Supporting SMEs to Get Tax Right, https://doi.org/10.1787/f183d70a-en.

[7] OECD (2023), Insights on the Business Climate in Uzbekistan, https://doi.org/10.1787/317ce52e-en.

[30] OECD (2022), An introduction to competition law and policy in Uzbekistan, https://www.oecd.org/competition/an-introduction-to-competition-law-and-policy-in-uzbekistan.htm.

[10] OECD (2022), Green Economy Transition in Eastern Europe, the Caucasus and Central Asia, OECD Publishing, https://doi.org/10.1787/22229523.

[32] OECD (2022), SME Policy Index: Western Balkans and Turkey 2022: Assessing the Implementation of the Small Business Act for Europe,, https://doi.org/10.1787/b47d15f0-en.

[9] OECD (2022), Weathering Economic Storms in Central Asia: Initial Impacts of the War in Ukraine, https://doi.org/10.1787/83348924-en.

[5] OECD (2021), Beyond COVID-19: Prospects for Economic Recovery in Central Asia, https://www.oecd.org/eurasia/Beyond_COVID%2019_Central%20Asia.pdf.

[41] OECD (2021), Building Tax Culture, Compliance and Citizenship, https://doi.org/10.1787/18585eb1-en.

[1] OECD (2021), Improving the Legal Environment for Business and Investment in Central Asia, OECD Publishing, https://www.oecd.org/eurasia/Improving-LEB-CA-ENG%2020%20April.pdf.

[8] OECD (2021), Improving the Legal Environment for Business and Investment in Central Asia, https://www.oecd.org/eurasia/improving-legal-environment-business-central-asia.htm#:~:text=The%20Improving%20the%20Legal%20Environment,%2C%20Kyrgyzstan%2C%20Tajikistan%2C%20Turkmenistan%20and.

[39] OECD (2021), Informality and COVID-19 in Eurasia: The Sudden Loss of a Social Buffer, https://www.oecd.org/eurasia/COVID-19-informality-Eurasia.pdf.

[46] OECD (2020), Investment Policy Reviews: Georgia, https://doi.org/10.1787/0d33d7b7-en.

[15] OECD (2019), Chapter 4. Organising the process of privatisation, OECD Publishing, Paris, https://doi.org/10.1787/ea4eff68.

[31] OECD (2019), ONE-IN, X-OUT,Regulatory offsetting in selected OECD countries.

[18] OECD (2017), OECD Investment Policy Reviews: Kazakhstan 2017, https://doi.org/10.1787/9789264269606-en.

[22] OTP Group (2022), Contract signed: OTP Bank acquires Uzbekistan’s Ipoteka Bank, https://www.otpgroup.info/news/uzbekistan-ipoteka-bank.

[33] podrobno (2023), Мирзиёев утвердил меры по совершенствованию налогового законодательства. Рассказываем, что изменится, https://podrobno.uz/cat/obchestvo/mirziyeev-utverdil-mery-po-sovershenstvovaniyu-nalogovogo-zakonodatelstva-rasskazyvaem-chto-izmenits/ (accessed on 6 September 2023).

[25] President of the Republic of Uzbekistan (2023), Обсуждены задачи в сфере информационных технологий, https://president.uz/ru/lists/view/5943 (accessed on 11 October 2023).

[11] The Tashkent Times (2023), An international commercial court to be set up in Uzbekistan, says president Mirziyoyev, http://tashkenttimes.uz/national/10960-an-international-commercial-court-to-be-set-up-in-uzbekistan-says-president-mirziyoyev (accessed on 11 October 2023).

[29] Trading Economics (2023), Uzbekistan Business Confidence, https://tradingeconomics.com/uzbekistan/business-confidence (accessed on 4 September 2023).

[13] U.S. Department of State (2022), 2022 Investment Climate Statements: Uzbekistan, https://www.state.gov/reports/2022-investment-climate-statements/uzbekistan/.

[44] U.S. Department of State (2021), Investment Climate Statements: Uzbekistan, https://www.state.gov/reports/2021-investment-climate-statements/uzbekistan.

[12] UNCTAD (2021), Report on the Implementation of the Investment Policy Review - Uzbekistan, https://unctad.org/system/files/official-document/diaepcb2021d3_en.pdf.

[35] UzDaily (2023), Июнь ойида Ўзбекистоннинг қайси вилоятлари энг юқори ишбилармонлик фаоллигини кузатилди, https://eur02.safelinks.protection.outlook.com/?url=http%3A%2F%2Fuzdaily.uz%2Fuz%2Fpost%2F8325%2520&data=05%7C01%7CCeleste.LAPORTETALAMON%40oecd.org%7Cdaacc338842c4383a94808db8cfc5acf%7Cac41c7d41f61460db0f4fc925a2b471c%7C0%7C0%7C638258787715461779%7CUnkno (accessed on 25 July 2023).

[2] World Bank (2023), World Bank Development Indicators, https://databank.worldbank.org/source/world-development-indicators.

[21] World Bank (2022), Project Appraisal Document on a Proposed Credit in the Amount of USD 15 Million to the Republic of Uzbekistan for a Uzbekistan Financial Sector Reform Project.

[14] World Bank (2022), Recommendations for a National Foreign Direct Investment Strategy and Roadmap for Uzbekistan: New Sources of Growth, https://documents1.worldbank.org/curated/en/099430406302241587/pdf/P17672901802190a108e00089316ad3dc7e.pdf.

[4] World Bank (2022), The Second Country Diagnostic for Uzbekistan, https://documents1.worldbank.org/curated/en/933471650320792872/pdf/Toward-a-Prosperous-and-Inclusive-Future-The-Second-Systematic-Country-Diagnostic-for-Uzbekistan.pdf.

[45] World Justice Project (2022), Rule of Law Index 2022, https://worldjusticeproject.org/rule-of-law-index/global/2022.