The most immediate short-term challenge for Thailand is the phase-out of special policy support measures introduced during the pandemic amidst high inflation. Fiscal and monetary policies should work hand in hand to rebuild fiscal buffers while closely monitoring remaining inflationary pressures.

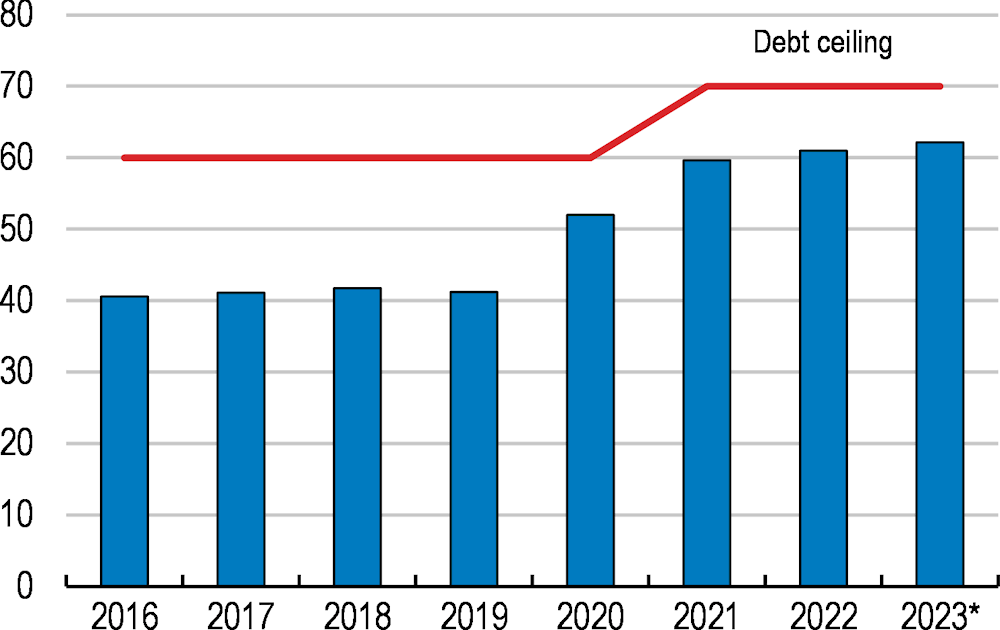

Public debt has increased rapidly during the pandemic, and fiscal consolidation should continue at a gradual pace (Figure 1). Support for the most vulnerable population segments may be needed on a permanent basis. But it should be narrowly targeted to those most in need, for example by building on the recently expanded State Welfare Card benefit or non-contributory old-age pensions from the Old Age Allowance. A medium-term fiscal strategy should include a plan to lower the debt ceiling.

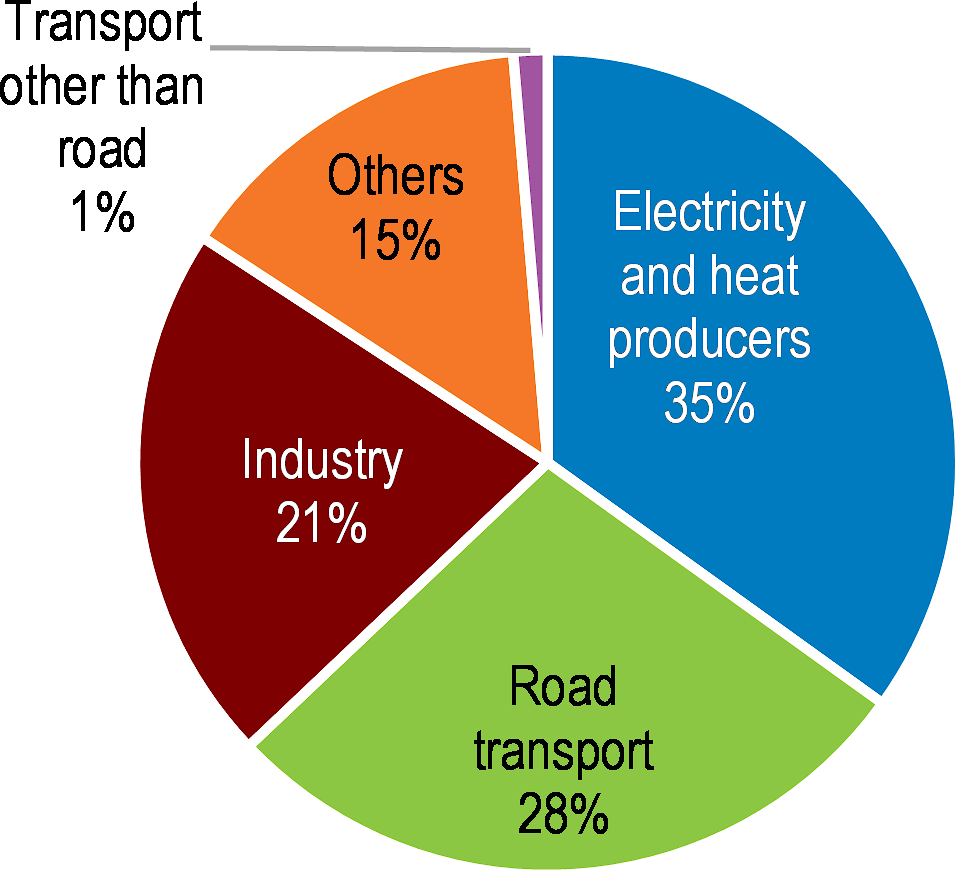

Current tax revenues of 16% of GDP will be insufficient to address future spending pressures. Rising social demands, population ageing and the green transition will likely call on additional public resources. A newly introduced property tax still awaits full implementation, personal income taxes could be expanded in a progressive manner and the reduction of the VAT rate from 10% to 7%, originally meant to be temporary, could be undone. Broadening the personal income tax base can also help increase tax revenues.

Maintaining the current monetary policy stance will help to anchor inflation expectations. Inflation has eased, after exceeding 6% in 2022 amid high energy and commodity prices. But demand pressures from the ongoing recovery will remain significant, and real interest rates remain low.