Members of traditional defined benefit plans are generally guaranteed to receive a benefit based on the length of employment, an accrual rate and their final or average salary. A decline in the value of pension assets is not expected to have a direct impact on the benefits that people will receive in defined benefit (DB) pension plans. The sponsor of the plan (generally the employer) is responsible for covering any gap or shortfall between the amount of assets in the plan and the liabilities arising from the promise, generally through additional contributions.

Changes in inflation, interest rates and labour market developments can affect the present value of the benefit promise that some sponsors offer in the pension plan they set up for their employees. The evolution of employment rates and wages can affect entitlements and future benefit payments when the benefit formula is based on the length of employment and wages. Also, these future payments are liabilities for DB plans and need to be expressed in today’s terms to calculate the amount to be held as technical reserves to cover these promises. The lower the discount rate is to express these future payments in today’s terms, the higher the estimation of liabilities is. This discount rate can be tied to the evolution of interest rates.

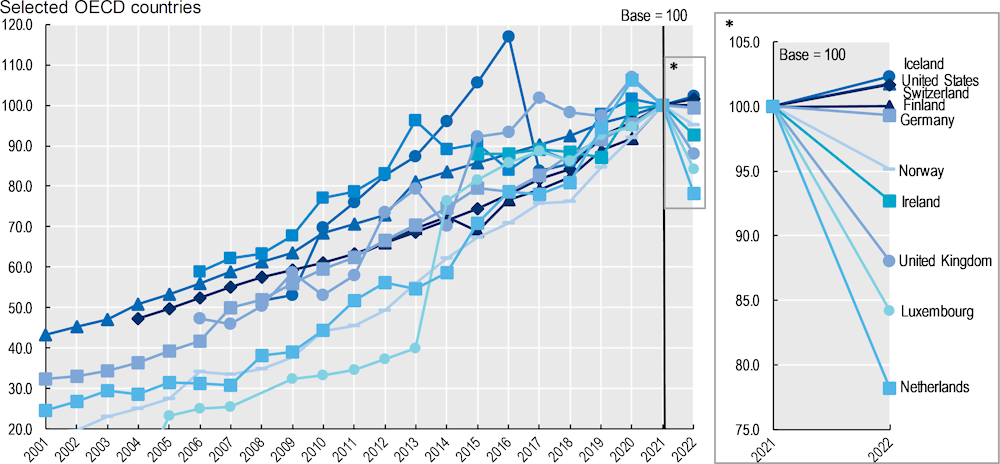

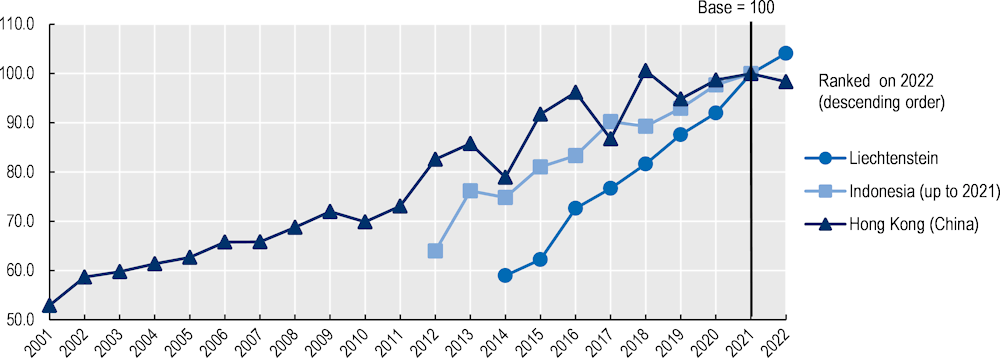

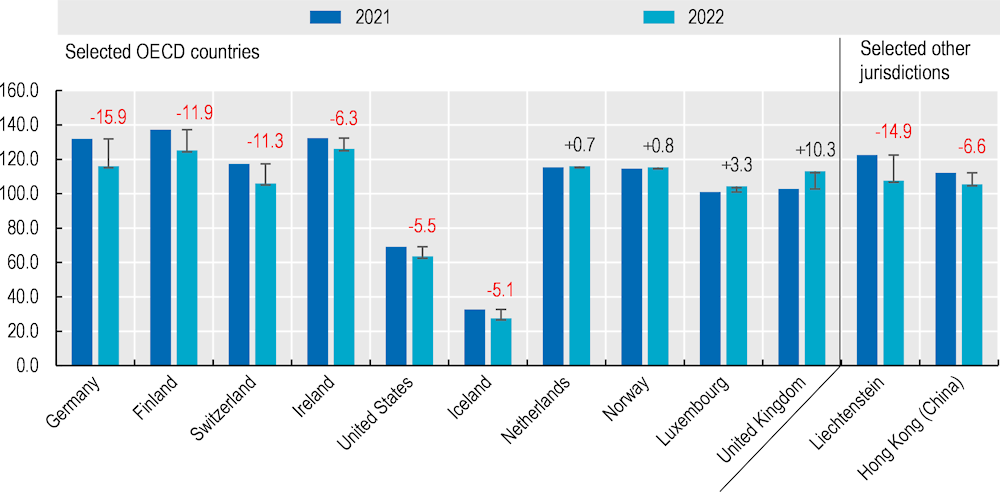

Liabilities of DB plans have been rising over the last two decades as interest rates fell. Figure 4.1 shows the increase in liabilities and their volatility. They are volatile when they are sensitive to changes in the parameters and assumptions underlying their calculations. However, in a context of low and falling interest rates for many years, the liabilities tended to rise for DB plans in all reporting jurisdictions.