The chapter reports on trends and conditions in SME access to finance. It first provides a brief overview of the developments of the macroeconomic conditions and business environment in the context of high inflation and a significant increase in policy interest rates and tightening lending conditions. It then analyses the provision of SME bank financing and credit conditions in 2022, as well as developments on asset-based finance, equity and Fintech. Trends in bankruptcies, payment delays and non-performing loans and recent developments in government policies are also assessed.

Financing SMEs and Entrepreneurs 2024

1. Recent trends in SME and entrepreneurship finance

Abstract

Business environment and macroeconomic context

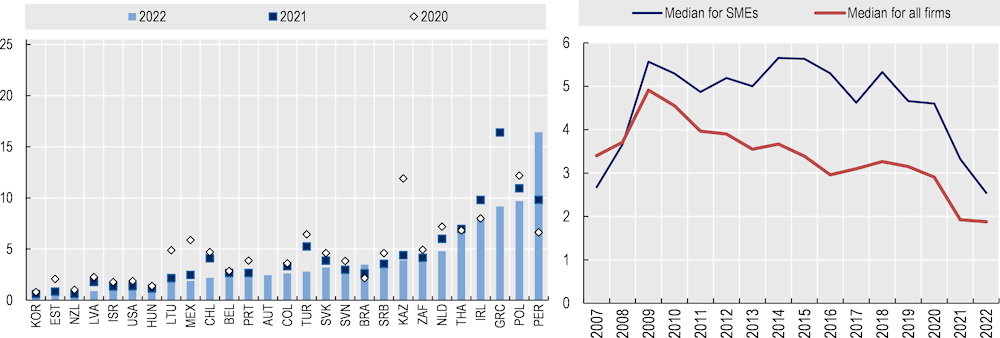

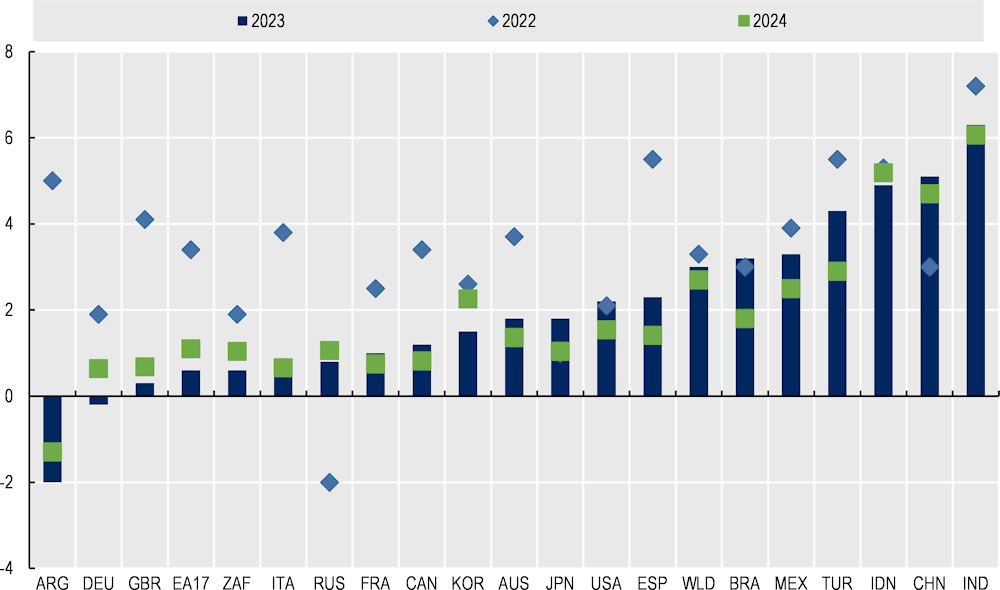

After weak global growth in the second half of 2022, figures for 2023 show signs of improvement, with global GDP rising to an annual growth rate of 3.1%, compared to 2.8% registered in the second half of 2022 (OECD, 2023[1]). This growth is, however, uneven across countries, with economic output picking up in Brazil, China, Japan and the United States. However, output slowed down in the Euro Area and the United Kingdom (Figure 1.1). In 2024, growth is projected to ease to 2.9% before recovering to 3.0% in 2025 (OECD, 2024[2]).

Figure 1.1. GDP growth in selected major economies

Year-on-year growth rate, as a percentage

Note: Calculation of World and Euro Area aggregates use nominal GDP weights, using purchasing power parities. Data from India refers to Fiscal Year.

Source: OECD Economic Outlook 113 database, and OECD Interim Economic Outlook 114 database (OECD, 2023[3]) (OECD, 2023[4]) (OECD, 2023[1]).

This uneven growth followed a year of macroeconomic disruptions that had a differential impact across countries. Geopolitical tensions and elevated uncertainty, rooted in Russia’s unprovoked aggression against Ukraine, compounded by high inflation, tightening monetary policy, supply chain disruptions and heightened labour shortages, had important impacts on consumer demand and business investment. This, in turn, contributed to a slowdown in most OECD economies, with GDP declining in 15 OECD economies in Q4 2022, predominantly in Europe and Asia Pacific. In 2022, China's GDP experienced a growth rate of only 3%, the lowest in 40 years, except for 2020 during the COVID-19 pandemic (OECD, 2023[3]). While growth in China is expected to pick-up it is expected to be historically subdued, reflecting low domestic demand and stress in the property market, with growth registered at 5.2% in 2023 and projected at 4.7% in 2024 (OECD, 2023[4]) (OECD, 2024[2]).

These macroeconomic developments strongly affected SMEs. In 2022, the sharp increase in inflation, and its consequences on energy and raw material prices, compounded by the phasing out of COVID-19 public financial support, impacted the operations of many SMEs around the world (OECD, 2023[3]). In Europe, for example, inflation-adjusted SME value added declined by 2.3% in 2022 compared to the previous year, with value added in medium-size enterprises experiencing the highest fall at 3% (while small firms declined by 2.6% and micro firms declined by 1.4%). Inflation-adjusted added value in large firms declined by 1% between 2021 and 2022. When compared to 2019, the decline was 2.5%, with medium-sized companies experiencing a stronger hit (‑3.9%) compared to small companies (-3.7%). Large firms’ inflation-adjusted added value declined by 0.7% in 2022 relative to 2019 (Bella, Katsinis and Laguera-Gonzalez, 2023[5]). When looking at the SME inflation-adjusted value added by sector, construction and manufacturing (where medium-sized enterprises are predominant) were the most affected between 2021 and 2022, declining 5.6% and 3.3%, respectively. When compared between 2022 and 2019, accommodation and food services experienced the largest fall declining 34.4%, as a result of the exceptional impact of the pandemic restrictions on this sector in particular. Manufacturing fell by 5% and transportation and storage by 2.4% (Bella, Katsinis and Laguera-Gonzalez, 2023[5]).

In the first half of 2023, there were signs of improvement as global growth began to rebound gradually. The improvements seen in the first half of 2023 can be explained in part by the decline in energy prices and the resulting lower retail prices, as well as more positive expectations in China thanks to the reversal of its zero-COVID policy in December 2022, along with the loosening of both fiscal and monetary policy (OECD, 2023[3]). This resulted in a recovery in consumer confidence in major economies and an improvement in activity indicators, in particular in the services sector (OECD, 2023[3]). However, despite this improvement in H1, global GDP growth closed 2023 at 3.1% and is projected to ease to 2.9% in 2024 (OECD, 2024[2]) The continuation of restrictive monetary policy, weak trade growth and projected lower growth in China, are expected to weigh on business and consumer confidence, affecting output growth. Furthermore, heightened geopolitical tensions rooted in the evolving conflict in the Middle East in Q4 2023 and its potential repercussions in energy markets is a latent near-term risk to activity and inflation (OECD, 2023[1]) (OECD, 2024[2]). As such, monetary policy continues to be restrictive to ensure inflationary pressures are contained. This continues to weigh on financial conditions and credit growth.

Trade and business investment

Despite the gradual easing of supply bottlenecks in 2022, persistent geopolitical tensions, tighter monetary policy, high commodity prices, slowing industrial production, and high inventory levels resulted in subdued growth in world merchandise trade 2.7% in 2022 (WTO, 2023[6]).

According to the WTO, goods trade was more resilient than expected for the first three quarters of 2022, with merchandise trade volume growing on average by 4.2% quarter-on-quarter (q-o-q) before 2.4% q-o-q decline in Q4, which pulled down the overall performance for the year (WTO, 2023[6]). Several factors contributed to the decline in trade during the last quarter of 2022, but the increase in global commodity prices was the most determinant one, with food and energy prices remaining historically high in Q4 2022, resulting in reduced real income and import demand. On the other hand, the high energy prices had the strongest impact on trade during the winter in the northern hemisphere, in particular in Europe, where gas supplies from Russia stopped (WTO, 2023[6]).

This decline reversed in Q1 2023 when trade volumes recovered partially, rising 1.8% (annualised quarterly rate). The easing of global supply bottlenecks and the reopening of China contributed to this growth. However, there continue to be some vulnerabilities, with transport prices and shipping volumes, as well as demand for manufactured goods and commodities, remaining weak (OECD, 2023[3]). In 2023, global trade growth slowed, in part explained by lagged effects of tight monetary policy, reduced real income and low consumer demand, and the slowdown in economic activity in China (OECD, 2023[4]). Disruptions in trade flows as a result of the attacks to ships in the Red Sea also weighed on trade growth in 2023. Trade flows have been re-routed, delivery times have lengthened and shipping costs have risen sharply, especially in Asia and Europe. In 2024, despite the projected ease of core inflation, higher shipping charges may increase costs once again, especially for goods. OECD research suggests that the recent 100% increase in shipping costs, if persistent, could raise annual OECD import price inflation by close to 5 percentage points, adding 0.4 percentage points to consumer price inflation after about a year (OECD, 2024[2]).

Business investment, on the other hand, remained high in 2022, in part explained by the delayed and indirect effect of inflation on business investment and, in some countries, the easing of the pandemic’s disruptions, which encouraged businesses to invest again to meet the backlog of consumer demand. In 2022, global business investment measured by gross fixed capital formation increased by 5.1% with respect to 2021 (UNCTAD, 2023[7]). This positive trend is expected to reverse, however, with high interest rates and perceptions of a negative economic outlook being associated with lower investment expectations, particularly for SMEs. According to the SME Performance Review by the EC, when interest rates increase by one percentage point, SMEs are 0.83 percentage points less likely to report positive investment expectations compared to 0.65 percentage points for large firms (Bella, Katsinis and Laguera-Gonzalez, 2023[5]). Furthermore, the perception of future economic uncertainty as a major obstacle to investment reduced the probability by 14% among SMEs to report positive investment expectations, versus 10% among large firms (Bella, Katsinis and Laguera-Gonzalez, 2023[5]).

Financial conditions

Credit conditions are increasingly showing the effects of tightening monetary policy. In 2022, policy rates increased, and this had a quick impact on money market rates and bank funding costs (also resulting in banks increasing capital and liquidity buffers, leading to stricter credit conditions for borrowers). In certain countries, interbank interest rates and deposit rates reached levels not seen since the peak of the 2008 global financial crisis. Financing conditions for companies are affected by these developments, as banks passed on the increased policy interest rates to the costs of corporate loans at almost the same pace. The pace of the transmission of these costs from banks to firms differs across countries. Between 2022 and the first quarter of 2023, the largest changes in new bank lending rates1 were experienced in Australia, Canada, New Zealand, Norway and Sweden, reflecting an earlier tightening of credit conditions (OECD, 2023[3]). In Q3 2023, bank lending slowed sharply in the Euro Area, and some countries are seeing rising loan and credit card delinquency rates and increases in corporate insolvencies (OECD, 2023[4]).

The increase in policy rates in 2022 also impacted corporate debt. Corporate bond yields increased in most advanced economies, but the impact of monetary policy on these yields was less pronounced than in bank lending rates. Corporate bond issuance has decreased significantly, and riskier firms have reduced their bond issuance more than other firms since June 2022, according to Euro Area firm-level data. (OECD, 2023[3]). In Q4 2023 and Q1 2024, as global financial conditions started to ease, financial market participants anticipated the reduction in policy rates could occur earlier and faster than previously expected. Nonetheless, financial conditions remain relatively restrictive in almost all countries and credit growth remains weak (OECD, 2024[2]).

Lending to SMEs

In 2022, lending to SMEs declined in most countries, driven by rising interest rates and reduced credit availability due to increased risk perception among banks. Latin American countries such as Brazil, Colombia and Mexico, however, registered a surge in the flow of credit to SMEs, reflecting a gradual recovery of this indicator after 2020. The stock of SME loans contracted, continuing the downward trajectory documented in 2021, when the stock grew slightly following the phase-out of COVID-19 support. However, there is also some heterogeneity across countries. Some countries maintained their growth, while others experienced a decline due to higher repayment rates and an increase in SME bankruptcies. Moving into 2023, the persistent stringent credit environment can be expected to lead to a continued downtrend in SME lending.

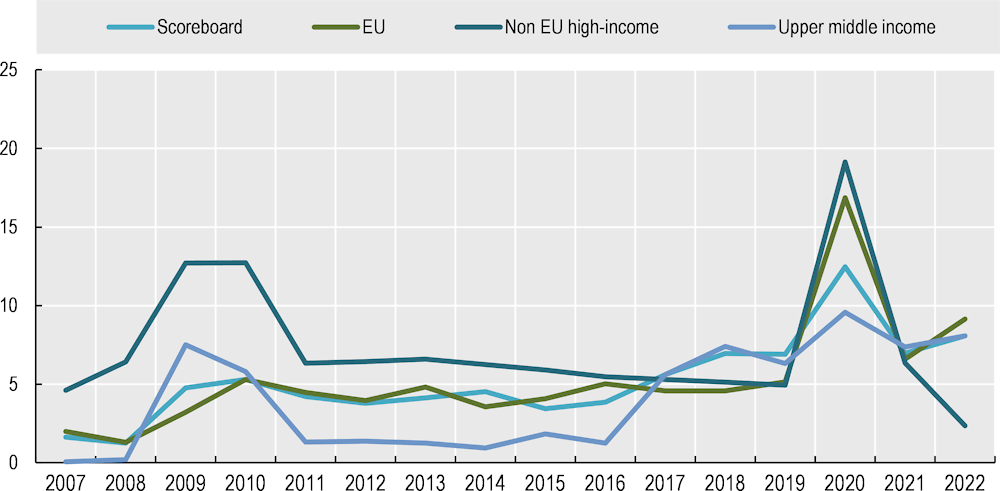

New SME loans

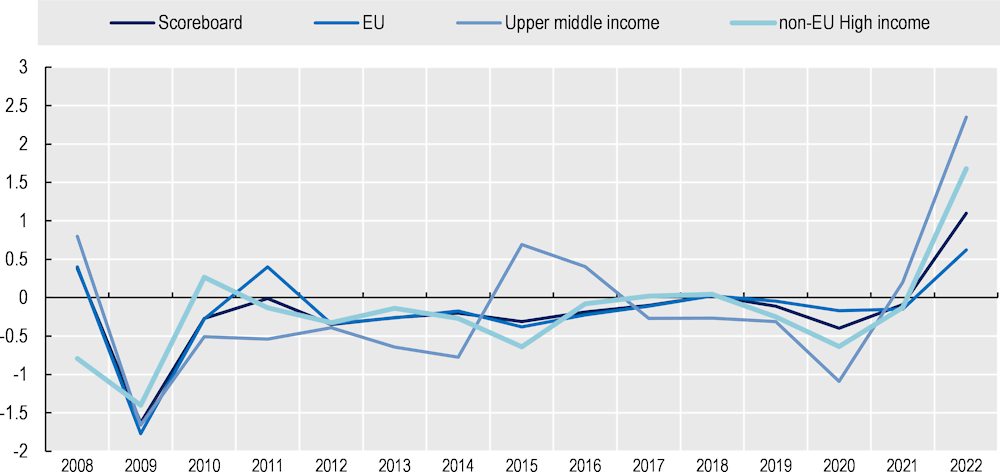

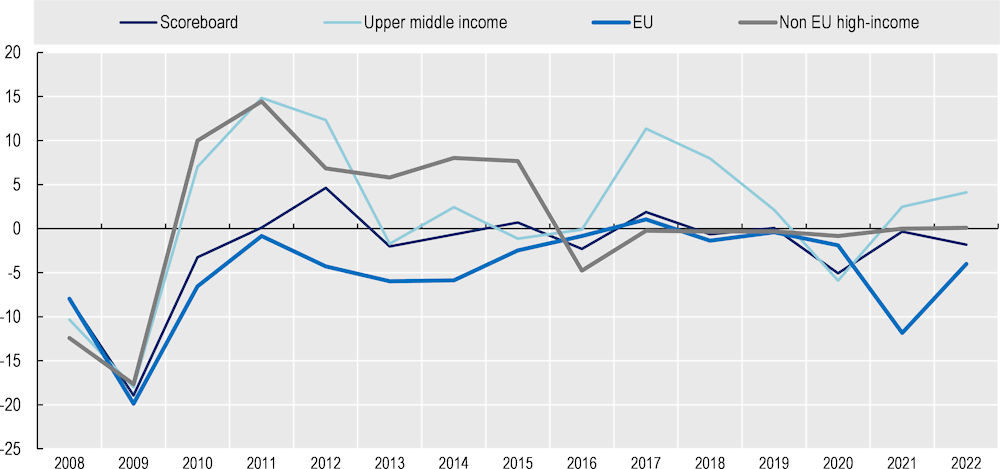

In 2022, the Scoreboard median of new SME loans registered a slight decline, although larger than the one registered in 2021. After declining in 2021 by 0.3%, it registered a 1.8% decline in 2022. The picture is mixed among groups of countries. While both the EU and non-EU high-income countries registered a decline in the median of new SME lending in 2022, with the EU declining by 4%, and non-EU high-income countries declining by 0.1%, upper-middle-income countries registered a increase in new lending, rising by 4% y-o-y. Looking at the developments between 2020 and 2022, the EU registered a large decline in new lending in 2021, with the median declining 12%, and then experienced a smaller drop in 2022 (-4%). In contrast, new lending in upper-middle-income countries declined by 6% in 2020, followed by an increase of 2.5% in 2021 and 4% in 2022.

The small decline in the Scoreboard median growth of new lending can be explained in part by the tighter lending environment, which has affected the supply of credit mainly due to an increased perception of risk among banks (ECB, 2023[8]). Supply-side surveys like the ECB’s Bank Lending Survey (BLS) in the EU indicate that banks’ risk perceptions have had the largest tightening impact (ECB, 2023[9]). In the United States, the Senior Loan Officer Opinion Survey points to a reduced tolerance for risk as one of the main reasons for tightening lending standards (Federal Reserve, 2023[10]).

Furthermore, the policy rate increases took place at an exceptional pace and magnitude, resulting in a significant increase in the costs of new loans. This implies greater vulnerabilities for firms to borrow in the current context, resulting in a decline in the uptake of loans. In the EU, for example, which registered the largest decline in new loans, the survey on access to finance of enterprises (SAFE) shows fewer firms indicating higher demand for bank loans and credit lines. However, the decline in loan demand has been more pronounced among large firms compared to SMEs (ECB, 2023[11]), reflecting stronger liquidity buffers in large firms compared to SMEs, and the heavy reliance of SMEs on debt finance. In 2022, the annual average of United Kingdom’s SMEs that reported that they were currently using external finance was 36%. This was 7 percentage points lower than in 2021 (43%) and the lowest since 2018 (also 36%) (BVA BDRC, 2023[12]).

On the other hand, the increase in the flow of lending in upper-middle-income countries was driven by Latin American countries, namely Mexico (35%), Colombia (16%) and Brazil (8%). The surge can be explained in part by the gradual economic recovery that the region experienced after the COVID-19 pandemic (which also experienced a more moderate impact of the energy crisis compared to other regions), and a rebound of business activity. In Mexico, survey data from SMEs reveal that more businesses acquired credit in 2022. Despite high inflation, they were able to access the credit they requested, although collateral and other requirements were stricter (Banco de México, 2023[13]). Another survey revealed that 62% of SMEs indicated that they were able to navigate inflation and higher input costs and maintain their businesses, and 24% were able to exceed their commercial expectations in 2022 (El Economista, 2022[14]). Colombia experienced a surge in application rates, rising 12 p.p. (see section on SME loan application rates). According to the Central Bank, this was more prevalent for medium-sized companies, but less for microentrepreneurs and small firms who reported reduced access to bank finance and turning instead to cooperatives (Banco de la República, 2022[15]).

Figure 1.2. Growth in new SME lending, 2008-22

Median year-on-year growth rate, as a percentage

Note: All data are adjusted for inflation using the GDP deflator of each country published in the OECD Economic Outlook database using base year 2007. GDP deflators for non-OECD countries were extracted from the World Development Indicators from the World Bank. Non EU High-income countries include Australia, Canada, Chile, the United Kingdom and the United States. Upper middle-income countries include Brazil, Colombia, Kazakhstan, Mexico and Serbia.

Source: Data compiled from individual country snapshot.

Outstanding stock of SME loans

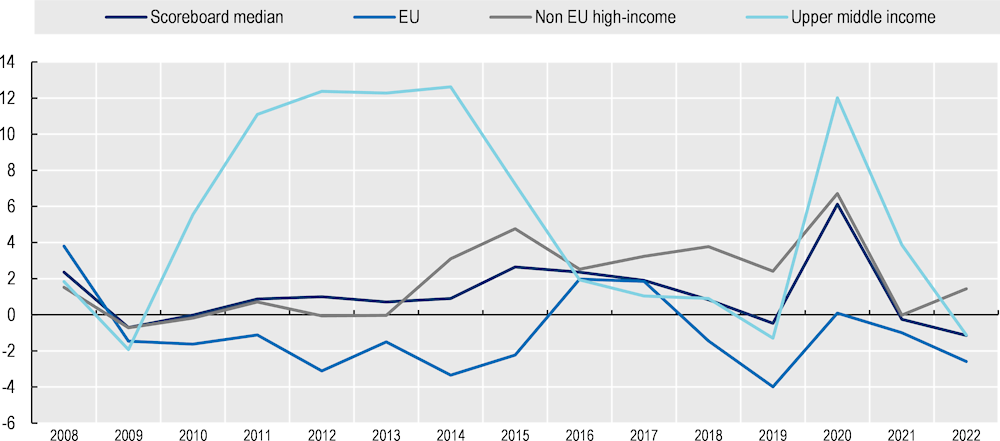

In tandem with the decline in new lending in 2022, the growth of the Scoreboard median of the outstanding SME loans dropped by -1.14%. This decline followed negligible growth of 0.25% in 2021, following robust growth of 6.13% in 2020. When looking at the median by group of countries, the EU registered negative growth in the stock of SME loans (-2.58%) continuing the negative trend registered in 2021 when it dropped by -1%. Upper-middle income countries also registered a decline in the stock of loans, dropping by 1.12% in 2022 compared to growth of 3.9% in 2021. Non-EU high-income Scoreboard countries, which include Australia, Canada, Chile, Israel, Japan, Korea, New Zealand, Norway, Switzerland, and the United Kingdom, registered growth of 1.4%, slightly higher than in 2021 (-0.02%).

In the EU, the decline in the stock of loans may also reflect an increase in repayment rates, with many SMEs trying to avoid higher borrowing costs, particularly in light of the repricing of floating-rate debt and the relatively high share of variable rates loans. In fact, in the Euro Area, the average share of variable interest rate loans compared to fixed term loans is 62% (Oesterreichische Nationalbank, 2023[16]) (see Austria country snapshot), prompting many SMEs to repay rather than face higher costs of repayment. According to the ECB, in the last quarter of 2022, the aggregate flow of bank lending became negative, indicating that more loans were maturing or being repaid than loans being issued (ECB, 2023[8]). Another explanation of the decline in this indicator is the increase in SME bankruptcy rates, as banks are required to write off loans, resulting in a decline of the outstanding stock loans.

On the other hand, non-EU high-income countries maintained their growth in the stock of loans despite registering a decline in new loans in 2022. This is consistent with survey data in the United States and Canada, where the stock of outstanding stock of loans increased (Federal Reserve Bank of Kansas City, 2023[17]) (Government of Canada, 2023[18]), potentially reflecting a slower repayment rate due to the implementation of loan deferrals. In the United States, for example, in March 2022, SBA COVID-19 EIDL loan payments of principal and interest were extended for a total of 30 months. This deferment extension is effective for all COVID-19 loans approved in 2020, 2021 and 2022 (SBA, 2022[19]). On the other hand, in the United Kingdom in 2022, the outstanding stock of loans declined as many SMEs focused on repaying their loans to avoid facing higher borrowing costs, although many SMEs continue to hold large deposits (which affected the demand for new lending). At the same time, the stock of overdrafts rose as higher input costs increased SMEs’ demand for working capital products (British Business Bank, 2023[20]).

Figure 1.3. Growth in outstanding SME loans, 2008-22

Median year-on-year growth rate, as a percentage

Note: All data are adjusted for inflation using the GDP deflator of each country published in the OECD Economic Outlook database using base year 2007. Data for non-OECD countries were extracted from the World Development Indicators from the World Bank. Non-EU high-income countries include Australia, Canada, Chile, Japan, Korea, New Zealand, the United Kingdom and the United States. Upper middle-income countries include Brazil, Colombia, Kazakhstan, Malaysia, Mexico and Serbia.

Source: Data compiled from information received from individual country Scoreboards.

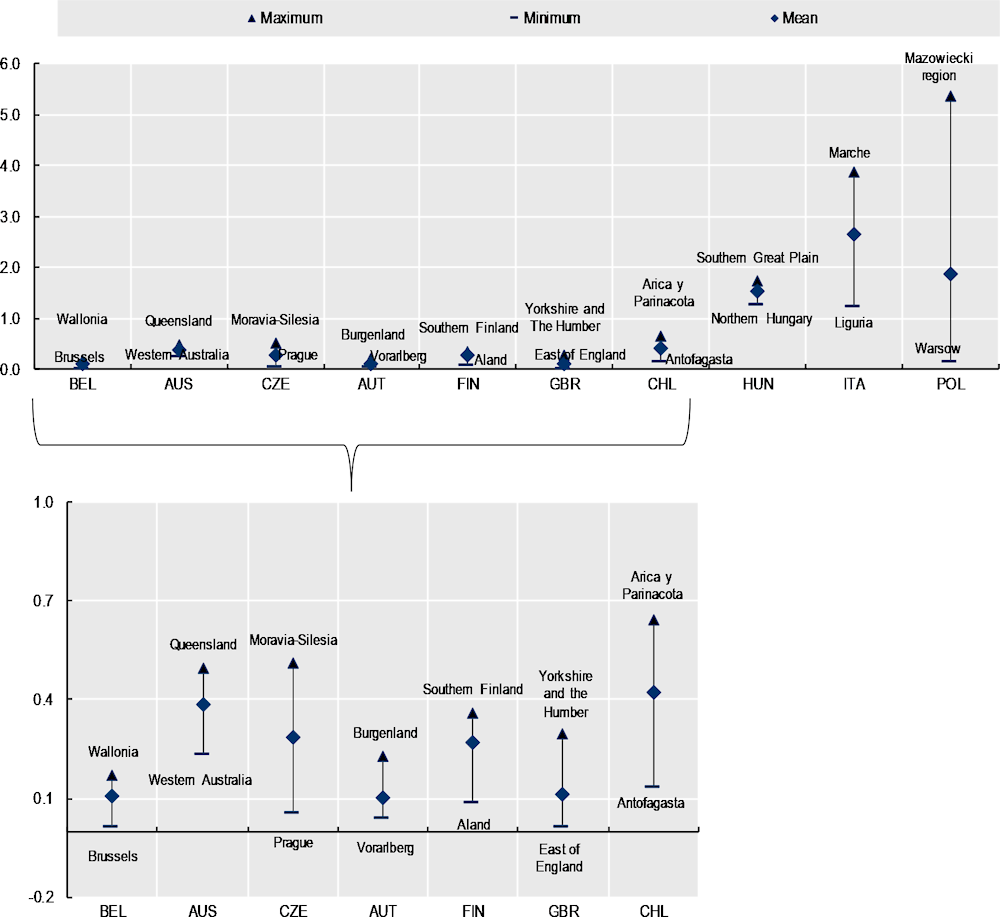

Developments at the subnational level

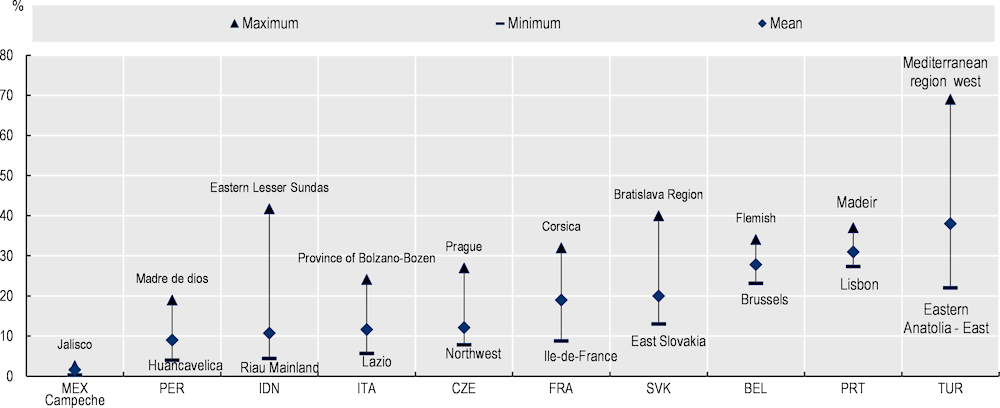

Turning to regional differences in outstanding SME loans in 2022, Figure 1.4 presents information on minimum, mean and maximum values in each country2. The mean value (i.e. the average of regional values) provides a good indication of the national aggregate value, showing that the volume of SME loans, as a share of GDP, is larger in Türkiye (38%), Portugal (31%) and Belgium (28%), while it is smaller in Indonesia (11%), Peru (9%), and Mexico (1.6%). These figures are affected by the number and size of SME loans, but also by the SME loan definition each country adopts3, cross-country comparisons should be made with caution. Interestingly, capital regions in the four Western European countries (Belgium, France, Italy and Portugal) feature at the bottom of this ranking, while they are at the top in the two Eastern European countries (Czech Republic and Slovak Republic). While it is difficult to provide a definitive explanation for this without further analysis, the size of regional GDP and the size of the large business sector in regions such as Ile de France (Paris), Lazio (Rome) or Lisbon may help explain the position of these regions at the bottom of the respective national rankings.

Figure 1.4. Outstanding SME loans in relation to regional GDP in selected countries

Percentage of Regional GDP

Note: SME loan definitions are not the same across all countries, including within the EU. This especially affects cross-country analysis, but within-country (i.e., regional) analysis is not fully insulated from this problem. Indeed, regional values in relation to GDP will be affected by the national definition of SME loan, as countries in which the SME loan definition is narrower (e.g. in terms of loan size or size of the firm receiving the loan) will tend to show lower national and regional values than those where the SME loan definition is larger. SME loan definitions for the countries covered in this graph are available in Table A A.2 of the 2022 edition of the Scoreboard (OECD, 2022[21]). The data for Belgium is for 2021.

Source: OECD Scoreboard on SME and Entrepreneurship Financing, subnational data collection process.

SME loan shares

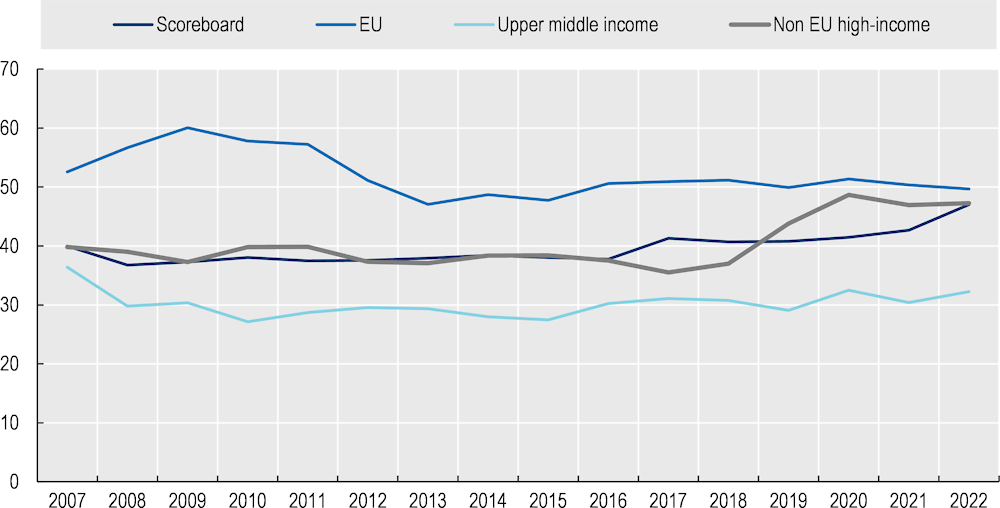

In 2022, the Scoreboard median of SME loan shares rose to 47% (up from 43% in 2021) as shown in Figure 1.4. This indicator, which shows the ratio of SME loans to total business loans, offers important information about SME debt financing within the broader business landscape. The four percentage point (p.p.) increase in 2022 shows a more rapid growth compared to the more modest increase experienced in the last five years (on average increasing 0.2 p.p.). The increase likely reflects a faster decline in the total business loans compared to SME loans, with many large businesses opting to repay their loans to avoid higher lending costs. In 2023, however, this is rapidly changing, with many companies facing funding needs in light of PE and bond market volatility (Reuters, 2023[22]).

The data by group of countries, show SME loan shares remaining at levels very similar to 2021. Both the EU and non-EU high-income countries registered a very modest decline in the SME loan share. Going forward, however, the SME loan share could be expected to register a more significant decline. In 2023, the ECB registered a more rapid reduction in the outstanding stock of SME loans relative to the total stock of loans (ECB, 2023[8]). In non-EU high-income countries, some countries registered a decline in the loan share. In the United Kingdom, two factors contributed to the drop in SME loan share: on the one hand, the increase in gross lending to large businesses was higher compared to SMEs, and on the other, gross repayments of bank lending by SMEs reached a record high in 2022, registering 12% increase from 2021 and amounting GBP 73.5 billion according to the Bank of England (see United Kingdom country snapshot). In Israel, the sharp rise in interest rates contributed to a lower flow of lending to SMEs and a lower share of SME loans relative to total loans (see Israel country snapshot). On the other hand, upper-middle-income countries exhibit a slight increase in the proportion of SME loans, rising to 32% (up from 30%).

Figure 1.5. Share of SME outstanding loans, 2008-22

As a percent of total outstanding loans

Note: All data are adjusted for inflation using the GDP deflator of each country published in the OECD Economic Outlook database using the base year 2007. Non-EU high-income countries include Australia, Canada, Chile, Israel, Japan, Korea, New Zealand, Norway, Switzerland, United Kingdom,and United States until 2020.

Source: Data compiled from information received from individual country Scoreboards.

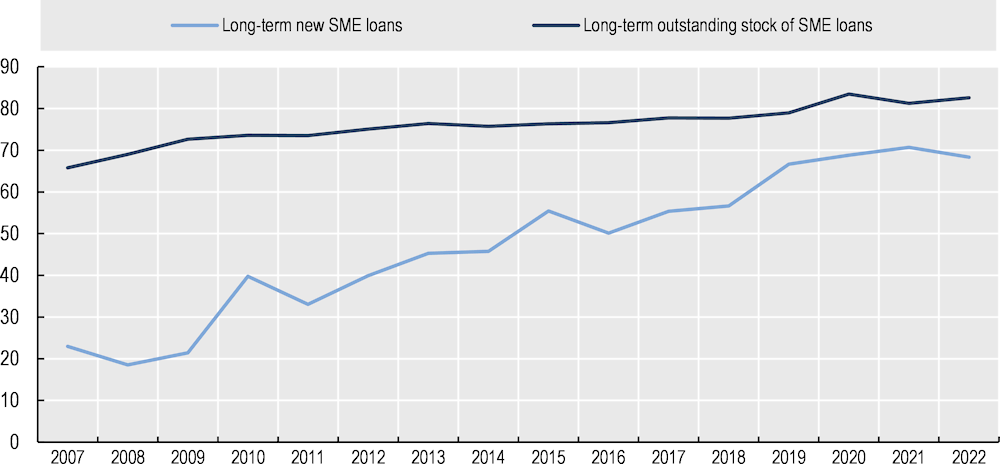

Short-term versus long-term lending

Previous editions of the Scoreboard have shown that since 2009 there has been a gradual shift in the SME loan portfolio from short-term loans4 to loans with longer maturities. Data from 2022 shows a mixed picture, however, with the share of new SME long-term loans declining by 2 p.p. to reach 68%, a first since 2016. On the other hand, the share of the long-term outstanding stock of SME loans increased 2 p.p. to reach 83% in 2022.

The divergence between the two curves can be explained by different factors. First, as explained in the 2023 Scoreboard Highlights, the significant number of loans with long-term durations issued in the years leading up to 2022 has contributed to keeping the proportion of the stock of SME loans high. Second, the implementation of new support measures to help SMEs refinance or extend their existing loans can explain the slight increase in the proportion of long-term outstanding SME loans. The decline in new long-term loans, on the other hand, reflects firms being discouraged from being locked into more expensive long-term loans (in particular in the EU, considering the high share of SMEs that acquire variable-rate loans). As a result, SMEs have used more short-term lending in the hope that longer term rates will begin to fall. Another factor is the increase in SME short-term financing needs5 in the first half of 2022 due to supply chain disruptions and an increase in input costs (ECB, 2022[23]). This shift is also reflected in the use of credit guarantees, which have moved towards working capital guaranteed loans, which tend to be shorter-term. Indeed, the share of long-term investment capital loan guarantees decreased from more than 80% pre-pandemic to around 50% in the years 2020, 2021 and 2022 (AECM, 2023[24]).

Figure 1.6. Share of long-term SME loans, 2007-22

Percentage of total SME loans, median value

Note: All data are adjusted for inflation using the GDP deflator of each country published in the OECD Economic Outlook database using base year 2007.

Source: Data compiled from information received from individual country Scoreboards.

Credit conditions

This section examines credit conditions for SMEs and entrepreneurs based on data on bank finance costs, collateral requirements and rejection rates. In 2022, many Central Banks moved to increase their policy interest rates, resulting in an increase in the cost of SME finance unprecedented in Scoreboard history (i.e. since 2007). Survey data for 2022 and the first half of 2023 show a significant proportion of SMEs indicating a marked decline in the affordability and accessibility of financing. This has impacted loan demand, even as a growing number of SMEs indicated an increased need for finance. Survey data from banks also indicate tightening terms and conditions due to the increased perception of a more uncertain economic outlook and reduced tolerance for risk.

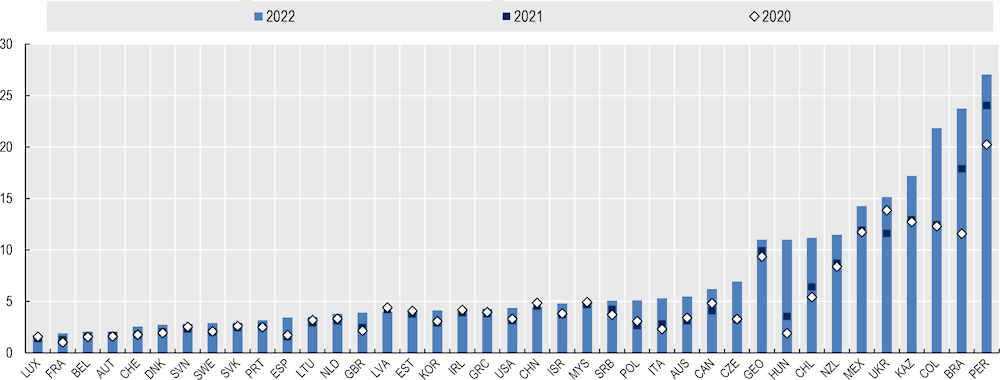

SME interest rates

In 2022, the cost of finance increased sharply, as governments around the world tightened monetary policy. Years of low interest rates were challenged by rising inflationary pressures which incited a strong response by Central Banks. The rise in policy interest rates was transmitted almost one to one to the real economy and corporate interest rates, including for SME loans, rose accordingly (OECD, 2023[3]). The Scoreboard median increased by 1.1 percentage points, a pace never registered in the Scoreboard history. It is notable that even in 2008, during the great financial crisis, SME interest rates increased by only 0.38 percentage points. In other words, interest rates rose 1.7% in 2008 relative to 2007, while they rose 29% in 2022 relative to 2021. Thus 2022 can be considered to mark the end of a long period of highly accommodative lending, with negative implications for the borrowing costs for SMEs. The rise in interest rates is expected to weigh on the recovery of SME liquidity after the repeated disruptions in the last two years. Empirical analysis from the EC suggests that for every percentage point rise in interest rates in 2021, the profit margins of SMEs is expected to decrease by 0.35 percentage points6 (European Commission, 2023[25])

Figure 1.7. Changes in SME interest rates

Median value, nominal rates, percentage points

All country groups followed the trend of the Scoreboard median, registering hikes in 2022. The highest increase was registered in upper-middle income countries, by 2.3 percentage points, and non-EU high-income countries, by 1.7 percentage points. EU countries also registered an increase in interest rates, although of a lesser magnitude, by 0.6 percentage points. Neither group of countries had registered such an increase in the Scoreboard history. In February 2023, Euro Area firms were paying on average 250 basis points more in interest on new loans than they were at the end of 2021 (ECB, 2023[8]). As of December 2023, forward-looking real interest rates were positive in most major economies, and longer-term interest rates and government bond spreads have also risen in most emerging market economies. Going forward, it is likely that monetary policy will remain restrictive until there are clear signs that inflationary pressures are abating (OECD, 2023[1]).

Figure 1.7 shows the SME interest rates by country. In contrast with 2021, all countries registered an increase in SME interest rates. The highest increases were registered in Colombia (9 p.p.), Hungary (7.5 p.p.), Brazil (5.8 p.p.), Chile (4.8 p.p.) and Kazakhstan (4.3 p.p.). Going forward, the increase in interest rates is expected to reduce the probability of SMEs’ reporting positive investment expectations (European Commission, 2023[25]).

Figure 1.8. SME interest rates

Nominal rates, as a percent

Note: All data are adjusted for inflation using the GDP deflator of each country published in the OECD Economic Outlook database using the base year 2007.

Source: Data compiled from individual country Scoreboards.

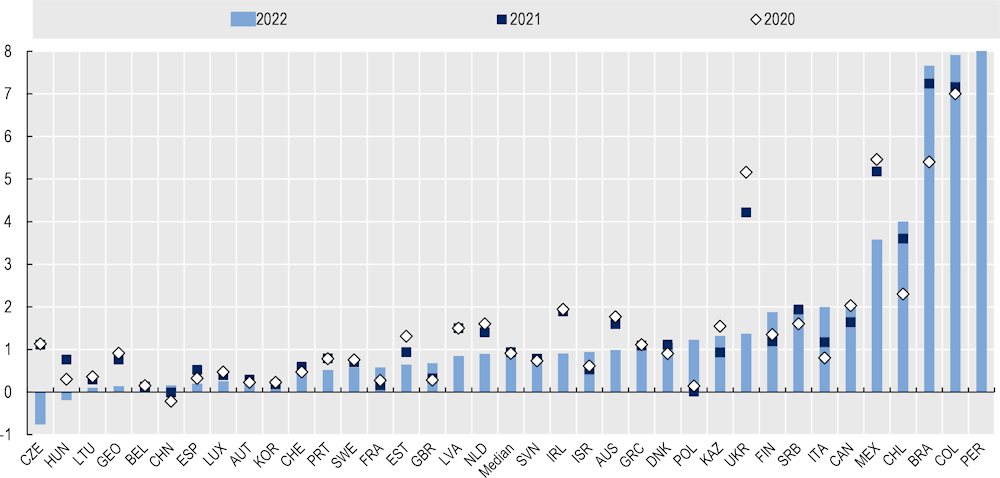

Interest rate spreads

The significant increase in interest rates across the board did not translate into a sharp increase in interest rate spreads7, indicating that borrowing conditions for SMEs in 2022 did not deteriorate more than for large firms. In fact, the Scoreboard median declined, passing from 0.93 percentage points in 2021 to 0.90 percentage points in 2022. Looking at the developments by country, in 2022, 19 out of 36 countries that provided data for this indicator registered narrower interest rate spreads. The largest declines were registered in Ukraine (-2.8 p.p.), the Czech Republic (-1.87 p.p.), Mexico (-1.6 p.p.), Ireland (-0.98 p.p.) and Hungary (-0.95 p.p.), reversing the increase in spreads registered in 2021.

The highest spreads were registered in Peru, Colombia, Brazil, and Chile and the largest increase spreads between 2021 and 2022 was observed in Poland (+1.2 p.p.), Italy (+0.83 p.p.) and Finland (+0.69).

One explanation for the slight decline in interest rate spreads, against the backdrop of increases in interest rates across the board, is the increased perception on the risk to lend to large firms as a result of the negative implications of the interest rate hikes in bond and equity markets, which is causing funding shortages for these firms (S&P Market Intelligence, 2022[26]). In fact, the financial vulnerability indicator, developed within the framework of the SAFE survey to measure firms’ financial situation, shows that in 2022, the increase in the share of large firms facing difficulties in running their businesses and servicing their debt was higher compared to the share of SMEs in the same situation (ECB, 2022[27]). However, it is likely that interest rate spreads will increase going forward, with many banks increasingly reporting tighter conditions to SMEs in 2023 to further reduce risk in their operations (ECB, 2023[9]).

Figure 1.9. Interest rate spreads between loans to SMEs and to large firms

Nominal rates, percentage points

Note: Data from Peru do not enter the graph due to the scale used. In 2020, the interest rate spread was 15.84 p.p. and, in 2021 20.2 p.p. and in 2022 19.85 p.p.

Source: Data compiled from individual country Scoreboards.

Collateral requirements

Data on collateral requirements comes from demand and supply-side surveys, which may differ in methodology, sampling, and questions asked across different countries. Therefore, cross-country comparisons should be made with caution.

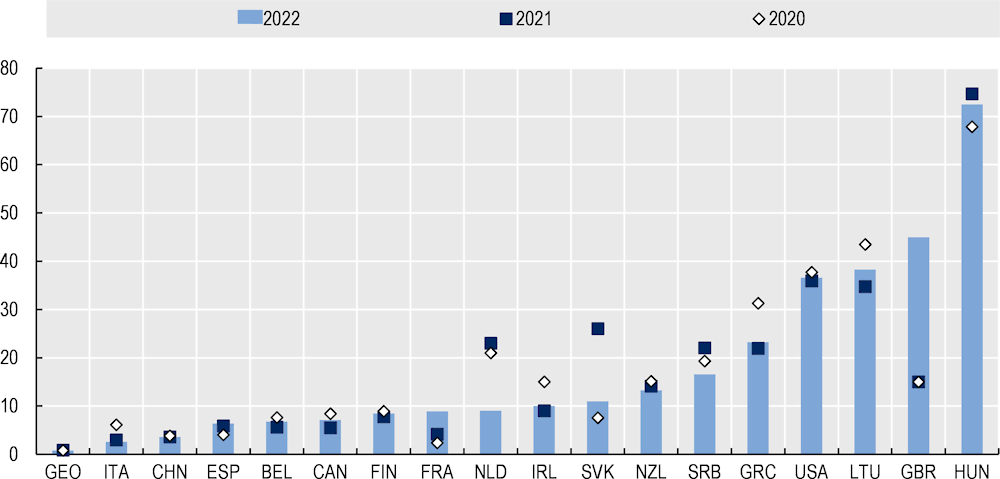

In 2022, the share of SMEs requiring collateral increased by 1.17 p.p., driven by the rise in interest rates and overall tightening of lending conditions. Nonetheless, the increase did not reach the pace experienced in 2008, when the share of SMEs requiring collateral increased by 7.2 p.p. The countries that experienced the largest increase in the share of SMEs requiring collateral include Lithuania (+28.4 p.p.), Greece (+15 p.p.), Ireland (+11 p.p.), the Netherlands (+9 p.p.) and the United Kingdom (+8 p.p.).

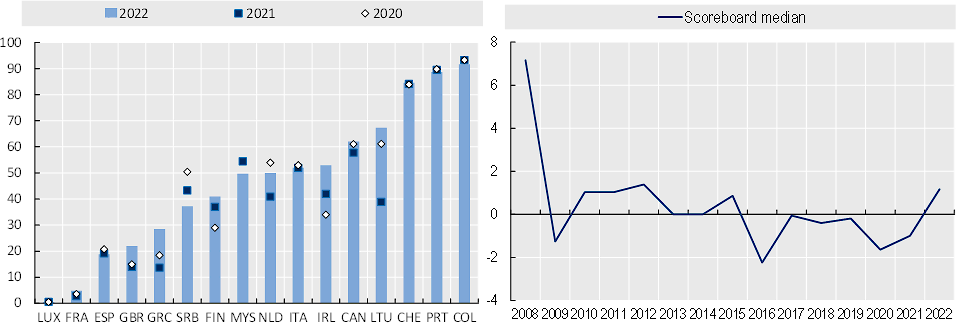

Figure 1.10. Collateral requirements

Percentage of SMEs requiring collateral by country (left), median growth rate (right)

The increase in the share of SMEs requiring collateral reflects the rise in the cost of finance and the increased perception of risk from banks. On one hand, higher interest rates are typically associated with a decline in asset prices, which results in a decline in the value of collateral (ECB, 2023[8]). This can lead to immediate adjustments, with lenders requiring more collateral to account for potential price drops to ensure that the value of the collateral does not fall below the loan amount. On the other hand, a higher cost of finance implies higher probabilities of default, as many borrowers may struggle to meet their repayment obligations, leading to higher collateral required for new loans. For example, in the Euro Area, since the end of 2021, firm-level probabilities of default, as reported by banks have increased more strongly for SMEs (ECB, 2023[8]).

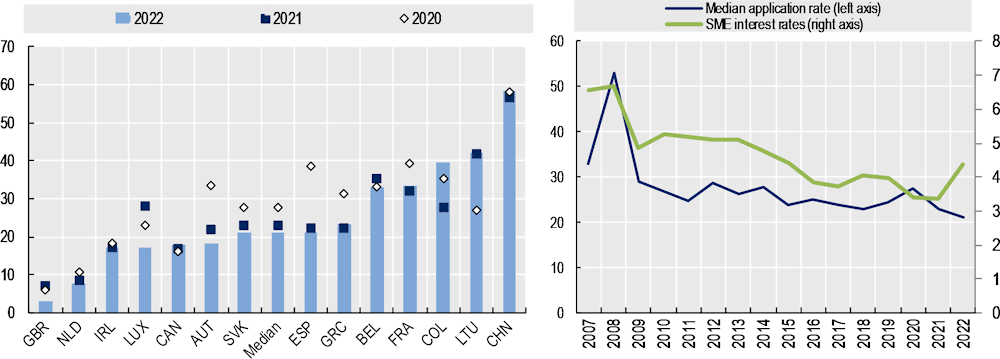

SME loan application rates

Since the COVID-19 crisis, lending conditions have experienced notable shifts compared to the more stable evolution after the great financial crisis. In 2021 and 2022, the high inflation environment and subsequent tightening of lending conditions resulted in an increase in SME interest rates of 1.1 p.p., while the application rates of SME loans declined by 2 p.p. in the same period. Half of the countries that provided data for this indicator (7 out of 14) show that SME demand for credit, expressed as the share of SMEs that applied for loans over the total number of SMEs, declined in 2022. The largest declines in SME loan applications were experienced in Luxembourg (-11 p.p.), the United Kingdom (-4 p.p.), and Austria (-3.5 p.p.). On the other hand, the largest increase in application rates was experienced in Colombia (12 p.p.), followed by Slovakia (2 p.p.). In Colombia, access to bank finance was predominant among medium-sized enterprises compared to other size classes (Banco de la República, 2022[15]).

Demand-side surveys of 2022, indicate that the escalating costs of credit have acted as a deterrent for SMEs, discouraging them from seeking debt finance. This is in strong contrast to trends observed in previous years. The left panel of Figure 1.11 shows the evolution of SME interest rates against SME application rates since 2007. The graph shows that after the 2008 crisis, both SME interest rates and loan applications showed a marked decline. From 2009 to 2019, loan applications remained relatively stable, varying from 23% to 28%. During this period, SME interest rates exhibited a gradual decline in response to an accommodative monetary policy, declining from 4.8% in 2009 to 3.9% in 2019 (a decline of 23% relative to the rates in 2009). In 2020, after the shock of the COVID-19 pandemic, the swift policy response to inject liquidity into the economy, and in particular to safeguard SMEs, resulted in a further decline in SME interest rates (-14% relative to rates in 2019), and in an increase in SME loan applications (+13% relative to rates in 2019). In 2022, on the other hand, interest rates rose by 29% while application rates declined by 8%, relative to 2021.

Figure 1.11. SME application rates, 2007-22

By country (left), SME application and interest rates (right), as a percent

Source: Data compiled from individual country Scoreboards. All data come from demand-side surveys except for China.

Rejection rates

Rejection rates provide insights into SME credit supply and overall financing conditions. Higher rates of rejection indicate constraints in the supply of credit and suggest that demand for loans is not being met because the terms and conditions of the loan offers are deemed unacceptable, the average creditworthiness of loan applications has deteriorated, or banks are rationing credit. Nevertheless, rejection rates should be analysed in the context of new lending trends, in order to have a more comprehensive perspective on SME access to finance. Data on rejection rates are usually gathered from demand-side surveys, with limited comparability across countries, however.

The median growth of rejection rates for SMEs in 2022 increased slightly in 2022 by 0.6 p.p., and 11 out of 18 countries that provided data for this indicator registered an increase. The largest increase was experienced in the United Kingdom with a 30 p.p. increase, followed by France (+4.7 p.p.) and Lithuania (+3.5 p.p.). The increase in United Kingdom is likely driven by a number of factors including the end of the Bounce Back Loan Scheme (BBLS) in 2021, which required borrowers to self-declare they met the schemes’ eligibility criteria and lenders were not required to assess the affordability or viability of the business. The steep rise in rejection rates was also driven by concerns about businesses’ ability to repay debts given deteriorating economic conditions, in particular as a result of a sharp increase in energy costs, with banks looking at the energy rates a business was paying, and profit after energy bills. Rejection rates were also driven by an increase in collateral requirements (Figure 1.10) following the closing of applications for BBLS, which required no collateral, in 2021. Similarly, in France and Lithuania, the increase in rejection rates reflects the tightening of credit standards (ECB, 2022[27]).

Figure 1.12. Rejection rates

As a percentage of loans requested by SMEs

Source: Data compiled from individual country Scoreboards. All data come from demand-side surveys except for China and Giorgia.

Additional evidence on credit conditions from survey data

Euro Area

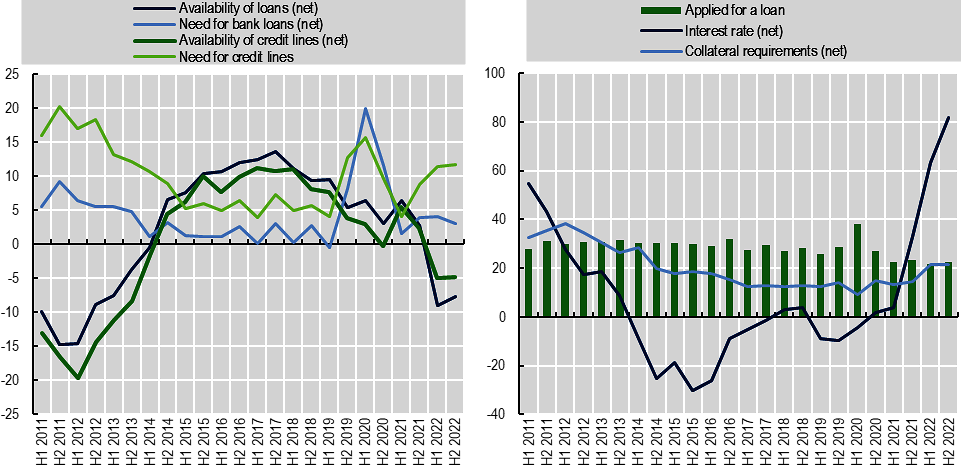

The SAFE survey gathers information about the financial situation of European firms, along with the need for and availability of external financing. It is conducted twice a year in spring and fall. The survey conducted in Spring 2023, covering the period from October to March 2023, shows that business activity continues to recover, with firms indicating improvements in turnover but the rebound being stronger for large firms compared to SMEs. Profitability, however, continues to weaken for SMEs, with these companies indicating a more significant decline in their profits (-16%) compared to large firms, which indicated no change in profits. This decline is in part due to an increase in labour, energy and other input costs (ECB, 2022[27]) (ECB, 2023[11]).

With respect to access to finance and financing conditions, firms’ responses reflect the monetary policy tightening implemented in the last year. The left panel of Figure 1.13 shows the perceptions of SMEs about the developments in credit conditions (interest and collateral requirements) in the Euro Area. A significant share of firms (the highest levels observed since the survey began in 2009) reported increases in bank interest rates and a significant deterioration in the cost of financing: 87% of firms reported rises in interest rates, from 71% in the previous survey round (Figure 1.13 panel B). This reflects the rapid transmission of monetary policy tightening to costs of corporate lending (see section on Financial conditions).

The tightening of lending conditions has resulted in a decline in demand for finance. In net terms, fewer firms in the Euro Area reported higher demand for external financing across instruments. This decline in demand was predominant for bank loans and credit lines, which is consistent with the overall slowdown in the provision of bank lending to companies registered in Q4 2022 and Q1 2023 of the EC Bank Lending Survey. The decline in demand was also seen for alternative finance instruments such as trade credit, leasing and hire purchases and equity. The deceleration in demand was, however, more predominant in large firms compared to SMEs (ECB, 2023[11]).

The tighter lending environment is also affecting the availability of debt financing. The right panel of Figure 1.13 shows SMEs reporting a decline in the availability of bank loans and credit lines for the second survey round in a row, after several rounds in which firms reported a wide availability (Figure 1.13 panel A). Across size classes, more SMEs reported lower availability compared to large firms.

Figure 1.13. ECB Survey on SME access to finance

Selected indicators as a percentage of total SMEs surveyed

Note: The net percentage is the difference between the percentage of firms reporting that the given factor has improved and the percentage reporting that it has deteriorated, or the difference between the percentage reporting that it has increased and the percentage reporting that it has decreased. H1 2022 refers to round 27 (April to September 2022), published in November 2022. H2 2022 refers to round 28 (October 2022 to March 2023), published in May 2023.

Source: European Central Bank, 2022

United States

The Senior Loan Officer Opinion Survey provides information on the opinion of senior bank officials on lending practices in the United States. In Q1 2023, respondents indicated tightening of lending standards and a decline in the demand for commercial and industrial (C&I) loans across all firm sizes. The most reported areas of tightening were premiums charged on riskier loans, spreads of loan rates over the cost of funds, and costs of credit lines. Additionally, a significant proportion of banks reported having tightened the maximum size of credit lines and collateralisation requirements to firms of all sizes (Federal Reserve, 2023[10]).

A significant share of banks that reported having tightened standards cited a less favourable or more uncertain economic outlook, reduced tolerance for risk, worsening of industry-specific problems, and deterioration in their current or expected liquidity position as important reasons for doing so. Although banks of all sizes cited the same reasons for tightening, mid-sized and other banks more frequently cited the bank’s liquidity position, industry-specific problems, and reduced risk tolerance (Federal Reserve, 2023[10]).

The Small Business Lending Survey is conducted every quarter to gather commercial banks’ perceptions of their small business lending activities in the United States. In the first quarter of 2023, small business commercial and industrial (C&I) lending declined sharply, falling by 15.9% compared to the same period in 2022, and by 6.8% relative to the previous quarter. This survey round was the fourth consecutive quarter of low loan demand, with the largest proportion of respondents reporting this since the inception of the survey. The weakening of loan demand aligns with the Federal Reserve’s stance of monetary policy tightening since mid-2022 (Federal Reserve Bank of Kansas City, 2023[17]).

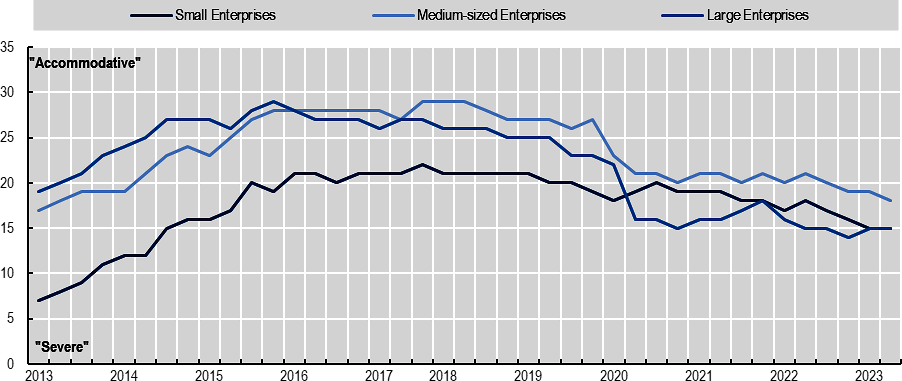

Japan

The Bank of Japan’s Tankan survey reports business confidence and lending attitudes on a quarterly basis. In 2022, lending attitudes tightened for all firm sizes, but in particular for SMEs. This may reflect adjustments after a period of interest-free loans and an increase in the leverage of SMEs (Bank of Japan, 2023[28]).

Figure 1.14. Lending attitudes in Japan

Diffusion Index, in percentage points

Note: Diffusion index of “Accommodative” minus “Severe”, percentage points.

Source: (Bank of Japan, 2023[28])

This tightening has occurred in a period where monetary policy has remained accommodative despite inflation exceeding the 2% target in April 2022, and the Bank of Japan announcing that there would be no change in its monetary policy stance (OECD, 2023[3]). This has resulted in exceptionally high uncertainty around baseline inflation projections (IMF, 2023[29]).

In the first quarter of 2023 however, speculation about a potential tightening of monetary policy resulted in companies shifting towards bank loans for longer-term funding. Anecdotal evidence suggests that Japanese loan rates had become more favourable than the cost of selling long-term bonds for businesses capital investment and refinancing needs, which typically decrease in value if interest rates rise. This shift in preference towards loans over bonds for longer-term funding needs indicates a significant change in the business lending landscape in Japan, influenced by the anticipation of potential changes in the country's monetary policy (The Japan Times, 2023[30]).

Asset-based finance

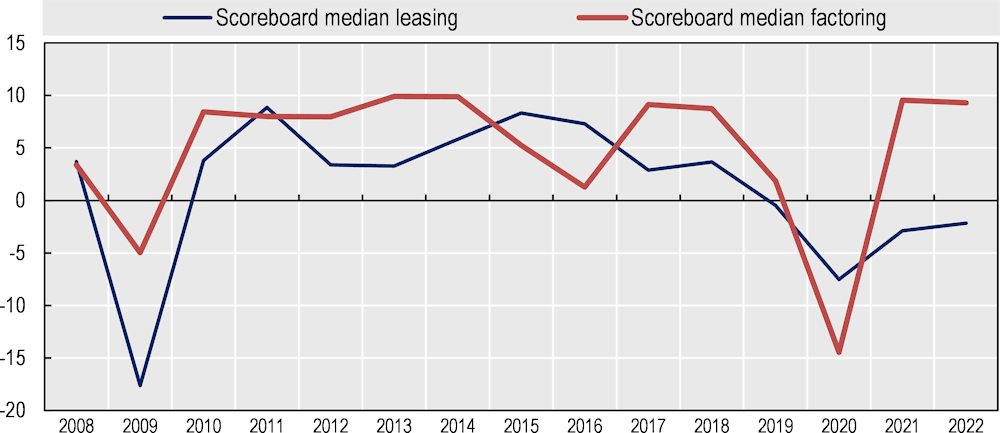

Leasing and hire purchases

Data from the country Scoreboards reveal that in 2022, leasing activities declined by 2.15%. This decline is, however, smaller than the one experienced in 2021, when leasing activities declined by 4%, indicating a gradual recovery of this type of finance (

Figure 1.15). From the 21 countries that provided data for this indicator, 15 experienced a decline in leasing volumes, with Ukraine (-77%), Peru (-34%) and Türkiye (-28%) registering the largest declines.

Information from Leaseurope, the trade association representing the European leasing industry, on the other hand, show positive developments in 2022, with new business volumes growing by 7.3% and the outstanding portfolio expanding by 5.2% compared to 2021 (Leaseurope, 2023[31]). Although the data from Leaseurope are not adjusted for inflation and need to be interpreted with caution considering the large surge in price levels in Europe in 2022, they indicate that leasing activities are recovering from the decline experienced in 2020 and 2021 when many businesses had to pause their activities and opted to use debt finance through COVID-19 government support channelled through banks. Despite the prospects of a gradual recovery in leasing, the rebound is not homogenous across asset classes: while new business volumes for equipment grew by 8.7% in 2022, real state leasing contracted by 6.5% (Leaseurope, 2023[31]). This can be explained in part by the fact that real estate leasing often involves longer-term commitments compared to equipment leasing and tends to be high value transactions (Leaseurope, 2023[32]), which may disincentivise businesses in a tight lending environment.

Going forward, tightening conditions may impose constraints on investment, affecting the demand for leasing. According to the ECB Survey on Access to finance for Enterprises, in Q4 2022 and Q1 2023, firms reported a deceleration in demand for leasing, although it was more pronounced in large firms compared to SMEs (ECB, 2023[11]).

Factoring

In 2022, factoring activities maintained the positive growth pace registered in 2021. After the impact of the COVID-19 pandemic, factoring activities recovered strongly and in 2022 continued to grow at 9.3% y-o-y (

Figure 1.15). Of the 17 countries that provided data for this indicator, 13 registered positive growth. Countries with the strongest growth were Hungary (32%), the United Kingdom (24%) and Belgium (18%). Data from Factors Chain International (FCI), the global association of the factoring, receivables and supply chain finance industry, also show an important growth of factoring activities in 2022. According to FCI, EUR 3 659 billion was transacted globally in 2022, compared to EUR 3 069 billion in 2021, which represents the single biggest increase ever reported in a given year (Factor Chain International, 2023[33]).

Going forward, factoring activities are expected to continue to grow as tightening lending conditions and high borrowing costs can incentivise many SMEs to opt for this alternative finance instrument. On one hand, the increase in the cost of raw materials and operational expenses amid tightening lending criteria may increase the demand for factoring, which can provide working capital more easily than bank finance. On the other hand, as banks are more risk averse, overindebted businesses might be unable to access debt finance to maintain operations, and selling their account receivables at a discount can be a viable option to continue their business activities. In addition, high inflation increases the likelihood that firms will delay payments to their suppliers. Factoring can help firms fill the gap of capital and mitigate the negative effect of late payments on SME liquidity.

Figure 1.15. Leasing and hire purchases and factoring activities

Median growth rate

Equity finance for SMEs

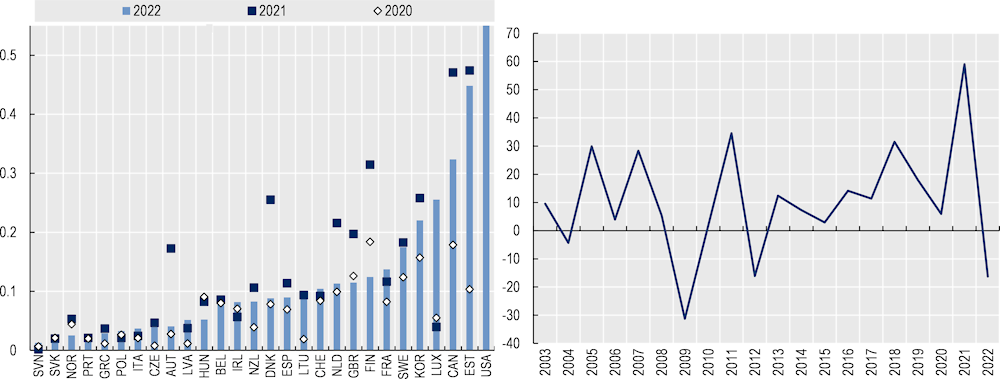

Venture capital

Venture capital (VC) investments continued to experience strong volatility (Figure 1.16 right panel). They declined sharply in 2022, by 16.2%, after the historic growth experienced in 2021, when VC investment activities increased by 60%. This sharp decline was driven by several events. First, as reported in the 2023 Scoreboard Highlights (OECD, 2023[34]), interest rate hikes, or in some cases the anticipation of interest rate increases, contributed to the decision by large-scale investors including pension funds to turn their investments towards less volatile fixed-return asset classes. This is confirmed by recent survey data from European VC fund managers from Q3 2023, which shows that for 79% of respondents, a prolonged increase in interest rates is impacting investor appetite to invest in VC funds (EIF, 2023[35]).

This shift resulted in a decline in start-up valuations which put further downward pressure on VC fundraising. Data from Preqin show that in 2022 VC down rounds8 made up 8.6% of all deals worldwide, compared to 6.8% between 2017 and 2021. Down rounds varied across stages, with more down rounds seen in later-stage series C and D (Preqin, 2023[36]).

With many valuations down and VC investors pulling out, VC fund returns suffered. According to Pitchbook data, the rolling one-year IRR for VC dropped to 2.8% in Q2 2022 (its lowest level since Q4 2016), and Q4 2022 registered a sixth consecutive quarter of decline in the IRR (Pitchbook, 2022[37]) (Pitchbook, 2023[38]).

Figure 1.16 show VC investment activities by country, expressed as a share of GDP. 18 out of 28 countries showed a decline in VC investments. In the US, VC volumes as a percent of GDP fell to 0.7% in 2022, down from 1.1% registered in 2021; in Canada they fell to 0.3%, down from 0.5%, and in Finland they fell to 0.1% in 2022, down from 0.3% in 2021. In the US, although the first quarter of 2023 saw a rebound with an increase in VC fundraising of 37% q-o-q growth, fund formation remained subdued (EY, 2023[39]). In Canada, data on investments by the Business Development Bank of Canada showed a marked decline in up rounds between Q2 2022 and Q2 2023, indicating that investors were seeking protection through a lower valuation entry point, resulting in projections indicating a slowing down in capital deployment for 2023 (BDC, 2023[40]). As VC investments decline, women and minority groups are particularly vulnerable. Box 1.1 shows data of VC fundraising performance of female and other demographic groups of entrepreneurs.

Going forward, a number of challenges need to be overcome to support a durable recovery and growth in VC activity. In Europe, for example, there is a need to incentivize more private long-term investors to stay in the market, even in economic downturns, to improve exit markets and to strengthen the availability of funds for VC-backed companies that aim to scale up (EIF, 2023[35]). In other geographies like the US, challenges include limited exit opportunities with rising inability of companies to go public, high geographic concentration of VC activities in the country, as well as a gradual drop in angel and seed rounds provoked by an uncertain market environment (NVCA and Pitchbook, 2023[41]).

Figure 1.16. Venture capital volumes by country

Volumes as a percent of GDP (left), median growth rate (right)

Note: As the volumes are expressed as a share of GDP, precaution on the interpretation of the graph is needed considering the impact of the COVID-19 crisis on GDP. Data from the United States do not appear in the graph due to the scale used. In 2020, the VC volume as a percentage of GDP was 0.6%., in 2021 1.1% and in 2022 0.7%.

Source: OECD Entrepreneurship Finance Database.

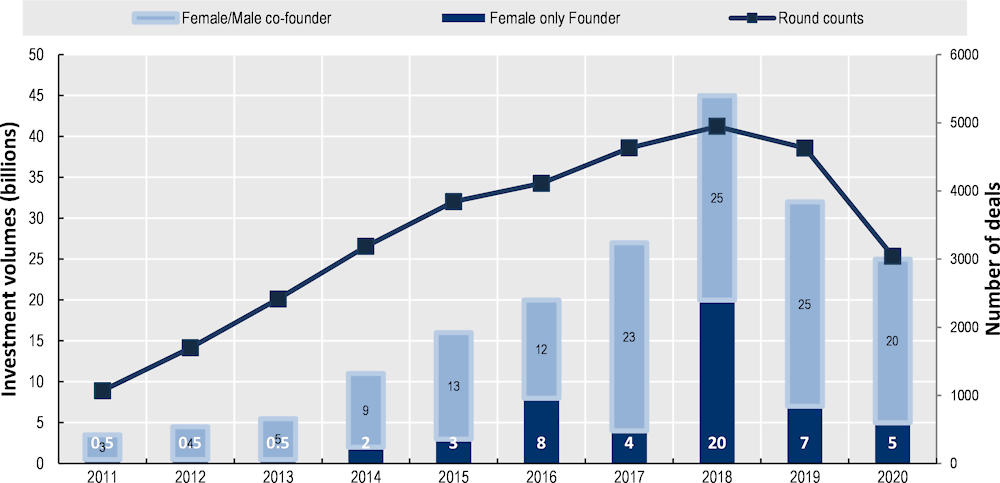

Box 1.1. Gender and minority imbalances in access to venture capital

A persistent issue in VC activities is the unequal access to equity funding for female entrepreneurs compared to their male counterparts. In the United Kingdom just 2% of the total of equity investment in 2022 went to SMEs with all female teams (British Business Bank, 2023[42]) . In Finland, in 2021, women accounted for 11% of the board seats in PE-backed companies and 6% of VC-backed companies (see Finland country snapshot). Worldwide in 2020, businesses owned or led by women received only about 2% of total venture capital investments and the women entrepreneurs who were able to acquire funding received on average only about 70% of the funding that men received (Crunchbase, 2020[43]; OECD, 2023[44]). The problem stems in part from underrepresentation of women in the VC and PE investor base. In Europe, women occupy about 23% of European VC roles, and only one in seven of senior VC investors is a woman. Of those, nine in ten works in male majority teams (EIF, Invest Europe, 2023[45]).

Furthermore, when VC investments decline, women-owned businesses tend to be the most affected, with their VC investments dropping more prominently compared to businesses that have male and female co-founders (Figure 1.17) (Crunchbase, 2020[43]). This also holds true for other demographic groups. In the United States, while total VC investments dropped by 36% in 2022, VC investments to black entrepreneurs dropped by 45% in the same period (Crunchbase, 2023[46]). In the United Kingdom, less than 2% of VC investment value in 2022 went to all ethnic minorities, while 43% of seed stage funding went to graduates from “elite” universities (British Business Bank, 2023[42]). In response to this persistent issue, governments are increasingly taking action to address these gaps in access to finance, in particular with respect to gender gaps (see section Evolution of government policy responses).

Figure 1.17. Global Venture Deal volume to female-only and female/male co-founded companies

Investment volumes Billion USD (left axis), and number of deals (right axis)

Note: Start-ups without founders listed in Crunchbase and private equity are excluded.

Source: Global VC funding to female founders dropped dramatically this year, (Crunchbase, 2020[43])

Fintech developments

In recent years, the Fintech industry has experienced remarkable development, contributing to reshaping the SME financing landscape. Online finance solutions have become more mainstream, with many traditional lenders partnering with online platforms, and with governments expanding the range of institutions they use to channel SME financing support. Furthermore, the growing use of open banking frameworks has contributed to the offer of more innovative products and services, fuelling the growth of digital banks and online alternative finance platforms, which have demonstrated their usefulness in reaching underserved segments of the SME population.

As documented by previous editions of this Scoreboard, online alternative platforms9 have seen continued and accelerated growth in recent years, and including during the pandemic when volumes of funding transacted through online alternative finance grew 57% y-o-y (OECD, 2023[34]). Such platforms have demonstrated their ability to reach underserved segments of the SMEs. The trend is becoming more prevalent in countries where banks tend to be more risk-averse, and where borrowing costs are high. For example, survey data from Southeast Asian countries10 show that most users of these platforms are sole traders (78%) and young companies, 1 to 5 years old (56%). Of the MSMEs that raised funding through platforms 65% had previously approached banks for funding. (Cambridge Centre for Alternative Finance, 2022[47]). Similar findings were seen in Latin America11, where 76% of respondents who secured finance from alternative platforms were sole traders. From the total of respondents, about 80% tried a bank provider but 70% were unable to finance their business through this source (Cambridge Centre for Alternative Finance, 2022[48]).

Furthermore, open banking, which refers to the practice of sharing banking data via standardised and secure interfaces at the request of clients (OECD, 2023[49]), has been gaining traction, as a way to enhance SME access to finance and streamline application procedures. This allows for the secure sharing of SME financial information with financial institutions or with service providers, with the entrepreneurs’ consent. According to a new study on open banking frameworks, 25 out of 31 OECD countries taking part in the survey have established such frameworks (OECD, 2023[49]). The implications for SME access to finance are substantial, as such frameworks can ease loan application processes and reduce information asymmetries between SMEs and financial institutions, thanks to availability of real-time transaction data to assess financial health. This allows SMEs to access finance at more beneficial terms and conditions. Empirical studies from Germany found higher probabilities of loan approval and reduced interest rates from riskier borrowers when they shared their data thanks to open banking frameworks (Nam, 2022[50]). In the UK, more than 660 000 SMEs were benefitting from open banking-enabled products in 2022, and it is estimated that these services will create GBP 6 billion of potential benefits for SMEs. In 2022, it was estimated that 10-11% of digitally enabled consumers and small businesses used Open Banking (a 6.57% increase from 2021) (Open Banking Implementation Entity, 2023[51]) (OECD, 2023[49]).

The establishment of open banking frameworks have contributed to the development of more innovative financial services, fostering the growth of digital banks. These are defined as banks that acquire and serve customers primarily through digital touchpoints such as mobile apps. They offer financial services at a low cost and with a better user experience than traditional banks, which has led to a widespread adoption and rapid growth. In the UK, challenger and specialist banks lent GBP 35.5 billion, exceeding lending by the major UK banks, and concentrating 55% of the market (British Business Bank, 2023[52]). In the Netherlands, 40% of the companies which attract external finance do so through alternative financial providers, especially for loans of less than EUR 250 000. In some countries, digital banks have reached market capitalisation nearly as large as some of the largest traditional banks (IMF, 2022[53]).

Payment delays, bankruptcies, and non-performing loans

Enterprise distress indicators reacted to the heightened cost of credit and the uncertain economic environment in 2022, but they also reflect governmental measures aimed at counteracting the negative effects of inflation and credit tightening. Payment delays remained relatively stable due to initiatives streamlining payment periods in some countries, and non-performing loans (NPLs) have continued their long-term downward trend, thanks to constant NPL deleveraging, as well as the implementation of debt restructuring measures. On the other hand, bankruptcy rates increased in almost all group of countries, in part due to the resumption of court activities and adjustments.

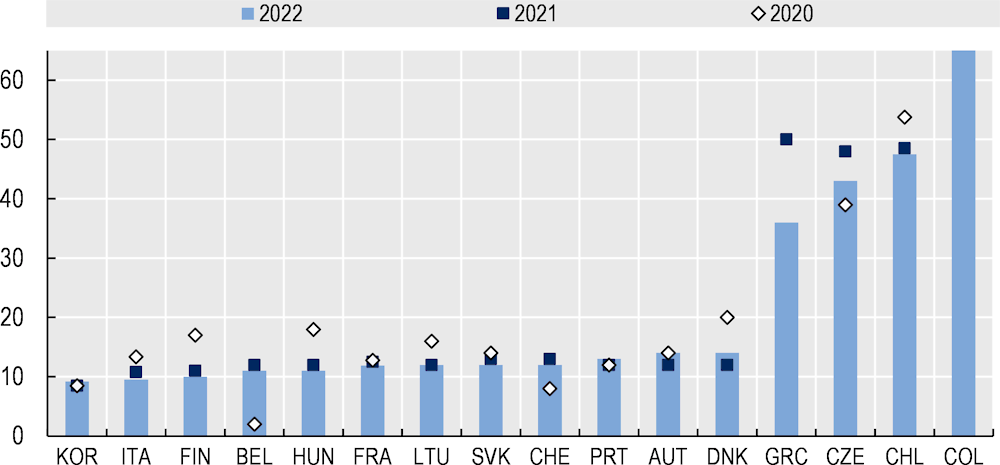

Payment delays

In 2022, the Scoreboard median of payment delays stood at 12 days, the same median registered in 2021. Looking at specific country developments, payment delays remained stable in 2022, despite the detrimental effects that rising costs generally have on payment periods. Policy measures to reduce payment periods might have in part contributed to these developments (see section on the Evolution of government policy responses). In 2022, 11 out of 16 countries reduced the payment delays for business-to-business (B2B) transactions (compared to 9 in 2021), 4 countries increased the number of days and one country did not register any change. The countries that increased the number of days are, however, among the group of countries that registered shorter payment periods (ranging from 9 to 14 days), namely Austria, Denmark, Korea, Portugal. From the countries that registered the longest payment periods, including Colombia (97 days), Chile (47 days) and Czech Republic (43 days), Colombia and the Czech Republic appeared to have made progress, reducing the number of payment periods by 16 and 5 days accordingly between 2021 and 2022.

In 2023, if costs continue to increase, the likelihood that firms would experience late receipt of payments and subsequently pay their own suppliers late may materialise. A study from the European Commission, exploring the effects of inflation and decline of GDP on late payments in 2022, estimates that across the EU, the number of days that SMEs will take to collect payments increased by 1.5 due to inflation and 1.6 days due to the reduction in the 2022 GDP growth rate (Bella, Katsinis and Laguera-Gonzalez, 2023[5]). These developments have important implications for firm growth. Already by the end of 2022, 40% of European companies reported that late payment diminished their growth, and 26% indicated it was threatening their survival (Intrum Justicia, 2022[54]). Furthermore, according to the European Commission, late payments are a factor in a quarter of SME bankruptcies (European Commission, 2023[55]). In response to these developments governments are taking action to reduce payment periods (see section on Evolution of government policy responses).

Figure 1.18. Payment delays

By country, number of days

Note: Data from Colombia do not appear in the graph due to the scale used. In 2020, the payment period was 103 days, in 2021 113 days and in 2022 97 days.

Source: Data compiled from individual country Scoreboards.

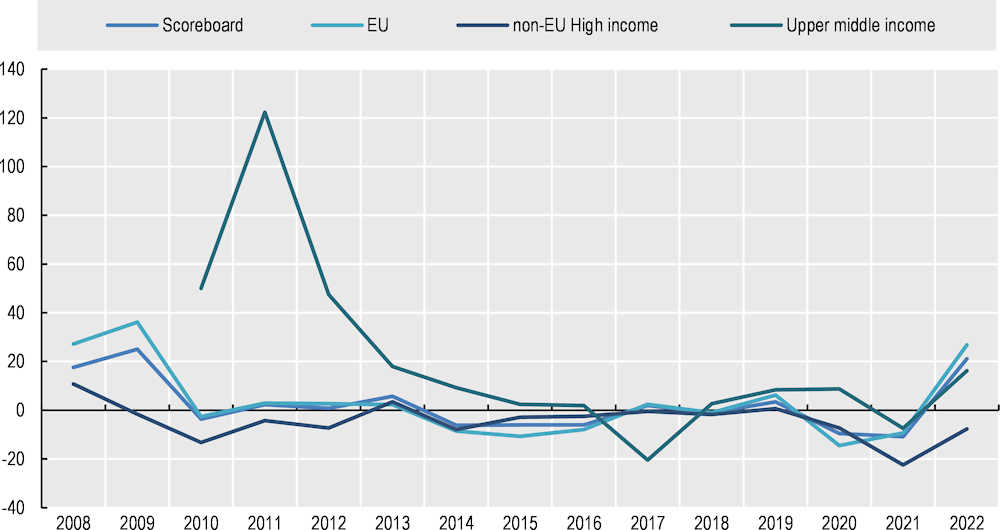

Bankruptcies

In 2022, almost all country groups registered an increase in bankruptcies, with the Scoreboard median rising by 21%. EU country bankruptcies increased by 27%, upper-middle economies grew by 16% while non-EU high-income countries declined by 8%.

The overall surge can be attributed to the adjustment after two years of declining bankruptcy rates during the pandemic, as a result of changes in bankruptcy procedures, cessation of court activity and unprecedented financial support provided to SMEs. In 2022, almost all countries had phased out support and resumed court activities. For example, in France, the resumption of legal proceedings in early 2022 led to a 50% jump in cases compared to the same period in 2021 (Le Monde, 2023[56]). Similarly, in the United States, a decrease in the debt threshold for SMEs to declare bankruptcy under the specialized provision known as subchapter V saw a corresponding rise in this indicator (Reuters, 2022[57]). Despite these adjustments, bankruptcies in France and the United States remained below pre-pandemic levels in 2022. In Australia, permanent reforms, including a new formal debt restructuring process and a simplified liquidation pathway, came into effect on 1 January 2021, which are available to incorporated businesses with liabilities of less than AUD 1 million (see Australia country snapshot).

Despite SMEs entering in 2023 with relatively strong liquidity positions, the increase in bankruptcies can also be indicative of a growing number of SMEs that find it difficult to maintain operations amid elevated borrowing and input costs, and increased difficulties in accessing finance. Nevertheless, bankruptcies generally did not exceed pre-COVID levels.

Figure 1.19. SME bankruptcies by group of countries

Median year-on-year growth rate, as a percentage

Non-performing loans

NPLs are overall more prevalent among SMEs than in the general business population. However, the long-term trend shows that, since the 2008 crisis, NPLs have experienced a decline in SMEs and in all firms. Specifically, between 2021 and 2022, despite the tightening of lending conditions for corporate loans, the median of SME NPLs declined to 2.4% (down from 3.3% in 2021) and for all firms dropped to 1.8% (down from 1.9% in 2021)Figure 1.20 (right panel). The negative trend is also evident when looking at the share of SME NPLs by country between 2021 and 2022. From the 25 countries that provided data for this indicator, 18 registered a decline. The most significant drops were experienced in Greece (-7.22%), Türkiye (-2.4%), Chile (-1.9%), Ireland (1.7%), Poland (1.2%) and the Netherlands (1.2%) Figure 1.20 (left panel).

In Greece, NPLs have been declining for eight consecutive years due to the Hercules Programme, which assists commercial banks in securitising and removing them from their balance sheets (see Greece country snapshot). In Türkiye, temporary regulation changes in the definition of NPLs and the increase in the total amount of SME loans resulted in a decline of the SME NPL ratio (see Türkiye country snapshot). In Chile, while the NPL ratio for total businesses increased, the SME NPL ratio declined in part explained by the implementation of debt restructuring measures, as well as interest and fines forgiveness, and payment extensions (see Chile country snapshot) (Ministerio de Economía, Fomento y Turismo, 2022[58]). In Europe, according to the European Banking Authority, the downward trend of SME NPL ratios is due to a constant NPL deleveraging as a result of regulatory changes on the management of non-performing and forborne exposures (European Banking Authority, 2018[59]). This has resulted in banks entering well-prepared to face weaker asset quality due to higher borrowing costs (KPMG, 2022[60]). In addition, European banks have gradually built up provisions for non-performing loan books. In Q3 2022, the NLP coverage ratio of EU banks12, which indicates the ability of banks to absorb future losses, amounted to 45.5% (European Commission, 2023[61]).

Figure 1.20. Non-performing loans

Volumes as a percent of total SME loans (left), median growth rate (right)

Evolution of government policy responses

Governments around the world have responded to the high inflation environment by implementing a diverse range of strategies, with the aim of ensuring SMEs have access to the finance they need. Some immediate measures included supporting SMEs to absorb the rise in prices of energy and raw materials and strengthening SME lending amid tight lending conditions. Efforts to alleviate the adverse effects of inflation on SMEs are also being concentrated on minimising late payments in both government-to-business and business-to-business deals and facilitating access to a diverse set of instruments and sources of finance to sustain SME investments, in particular in the green and digital transitions. Measures to promote gender equality in access to capital have also increasingly been implemented.

Table 1.1 summarises the government policies in place in 2021 and 2022 for participating countries. This is not a comprehensive overview of policy initiatives, but rather an overview of broad categories. More information about the policy landscape can be found in the individual country snapshots.

Table 1.1. Government policy instruments to foster SME access to finance, 2021-22

|

Support for start-up finance |

|

|||||||

|---|---|---|---|---|---|---|---|---|

|

Country |

Government loan guarantees |

Direct lending to SMEs |

Subsidised interest rates |

Special guarantees and loans for start-ups |

Venture Capital funds (direct) |

Funds of funds |

Business Angel co-investments |

Non-financial support for SMEs |

|

Australia |

X |

X |

||||||

|

Austria |

X |

X |

X |

X |

X |

|||

|

Belgium |

X |

X |

||||||

|

Brazil |

||||||||

|

Canada |

X |

X |

X |

X |

X |

|||

|

Chile |

X |

X |

X |

|||||

|

China |

X |

X |

X |

|||||

|

Colombia |

X |

X |

X |

|||||

|

Czech Republic |

X |

X |

X |

X |

X |

|||

|

Denmark |

X |

X |

X |

X |

||||

|

Estonia |

X |

X |

||||||

|

Finland |

X |

X |

X |

X |

||||

|

France |

X |

X |

||||||

|

Georgia |

X |

|||||||

|

Germany |

X |

X |

X |

X |

X |

X |

X |

|

|

Greece |

X |

X |

X |

X |

X |

X |

X |

|

|

Hungary |

X |

X |

X |

|||||

|

Indonesia |

||||||||

|

Ireland |

X |

X |

X |

X |

X |

X |

||

|

Israel |

X |

X |

X |

X |

||||

|

Italy |

X |

X |

||||||

|

Japan |

X |

X |

||||||

|

Kazakhstan |

X |

X |

X |

X |

||||

|

Korea |

X |

X |

X |

|||||

|

Latvia |

X |

X |

X |

X |

X |

|||

|

Lithuania |

X |

X |

X |

X |

X |

X |

X |

|

|

Luxembourg |

X |

X |

X |

|||||

|

Malaysia |

X |

|||||||

|

Mexico |

X |

X |

X |

|||||

|

Netherlands |

X |

X |

X |

X |

X |

|||

|

New Zealand |

X |

X |

X |

X |

||||

|

Peru |

X |

X |

||||||

|

Poland |

X |

X |

X |

|||||

|

Portugal |

X |

X |

||||||

|

Serbia |

X |

|||||||

|

Slovak Republic |

X |

X |

X |

X |

X |

|||

|

Slovenia |

X |

X |

X |

X |

X |

|||

|

South Africa |

||||||||

|

Spain |

X |

X |

||||||

|

Sweden |

X |

X |

||||||

|

Switzerland |

X |

|||||||

|

Thailand |

X |

|||||||

|

Turkey |

X |

X |

X |

X |

X |

X |

X |

|

|

Ukraine |

X |

X |

||||||

|

United Kingdom |

X |

X |

X |

X |

X |

X |

X |

|

|

United States |

X |

X |

X |

X |

||||

Note: Country snapshots may not contain references to all initiatives.

Source: Individual Scoreboard country snapshots.

Based on information from participating countries, a number of broad emerging trends can be discerned and are presented below along with recent policy examples. Full country snapshots provide more detailed information on policy initiatives.

Financial support targeted SMEs affected by inflation and high energy costs

SMEs have been facing a number of shocks in recent years that have threatened their development, growth and even survival. On the heels of the COVID-19 crisis, SMEs were hit by a significant increase in input costs, resulting in soaring inflation rates. This challenge was exacerbated in regions that have, at the same time, been hit hard by the energy crisis caused by Russia’s aggression against Ukraine. Governments have moved to provide support to SMEs, especially those in regions or sectors heavily dependent on Russian energy imports, or those that are finding difficult to navigate the steep increase in input and energy costs (OECD, 2023[62]).

Australia is progressing in several initiatives to improve the operating environment for SMEs, for example, reducing energy price pressures. These initiatives include the provision of electricity bill relief to eligible small businesses and households through the Energy Bill Relief Fund, in partnership with state and territory governments, with approximately one million small businesses projected to receive support through this fund. In addition, Australia introduced the Small Business Energy Incentive, a bonus 20% tax deduction for eligible assets to help small and medium businesses with an annual turnover of less than AUS 50 million electrify and save on their energy bills. Subject to the passage of legislation, the incentive would apply from 1 July 2023 until 30 June 2024. This builds on the Energy Efficiency Grants Program committed in 2021-22 (see Australian country snapshot).

In Austria, a series of relief packages have been implemented to support SMEs facing high energy costs. In May 2023, the fourth package was approved, which includes EUR 400 million to extend the suspension of electricity and natural gas taxes until the end of 2023 for SMEs. In parallel, the Federal Government implemented an energy cost subsidy covering 30% of the price difference compared to the previous year for electricity, gas and fuel. Furthermore, an additional relief package, which subsidises high energy costs (the so-called “EKZ 2”) was introduced in 2023. For SMEs a flat rate subsidy is offered in addition to the energy cost subsidy (see Austria country snapshot). In the Belgian region of Flanders, SMEs facing liquidity needs as a result of the Ukraine crisis and the energy crisis can benefit from a bridge loan raging from EUR 10 000 to EUR 2 million. The maximum loan amount is limited to 15% of the average annual turnover of 3 calendar years prior to the application. The programme started in Q1 2022 until the end of 2023 (see Belgium country snapshot). Going forward, and as global energy prices start to decline, it is expected that these measures will be phased out in 2024.

Targeted government guarantees are being put in place to strengthen SME lending in light of tighter conditions

With many SMEs finding difficult to access the necessary capital to maintain operations in the current context, a number of governments are launching new financial support measures, including credit guarantees targeted to specific objectives, purposes and profiles of firms.

Despite the overall decline in the use of government credit guarantees after the pandemic, with the Scoreboard median of credit guaranteed loans declining by 21% in 2022, the contribution of government guaranteed loans to the SME loan stock has increased to reach 8% (up from 6.9% in 2021) Figure 1.21. This indicates that, despite the decline in the total stock of SME loans, a larger volume of this was backed by government guarantees in 2022. Looking by group of countries, the increase is more marked in the EU, where it rose to reach 9% (up from 6.6% in 2021). Similarly, in upper-middle-income economies, the median increased to 8% (up from 7.4% in 2021). In non-EU high-income countries, however, the median continued its downward trend since 2020.

Figure 1.21. The median contribution of government guaranteed loans to SME loan stock

Median year-on-year growth rate, as a percentage

In Belgium, the European Investment Fund (EIF) has signed four new guarantee agreements backed by the Invest EU programme. The new schemes will unlock EUR 608.5 million in new financing for Belgian SMEs ranging from microfinancing to small mid-caps. In particular for SMEs in Brussels, finance&invest.brussels will receive EUR 78 million in new lending. The InvestEU backing for this transaction focuses on SME competitiveness and sustainability. The focus is also on supporting seed financing and backing start-ups with subordinated lending. In Flanders, a direct EIF guarantee with PMV Group will cover a loan portfolio of EUR 132.5 million (EIF, 2023[63]). In Chile, the guarantee fund for SMEs (FOGAPE) has included flexible payment agreements for tax owed by SMEs affected by high interest rates and higher input prices, as well as SMEs that have not yet received support from other FOGAPE programmes. The objective will be the financing of working capital, refinancing and investment with guarantees of up to 95% for microenterprises, 90% small and 85% for medium, with a maximum rate of TPM + 5% (see Chile country snapshot).

At the subnational level, Figure 1.20 shows that among countries for which information is available, government loan guarantees were more common in Hungary, Italy and Poland, where there is indeed a strong tradition in the use of this policy instrument. Regional variance, measured through the standard deviation of regional values (i.e. regional government loan guarantees in relation to regional GDP), is stronger in Poland (0.9 percentage points) and Italy (0.6 percentage points). Government loan guarantees as a share of GDP are larger in less well-off regions in the case of Poland (Mazoweicki region) and Hungary (Southern Great Plain). However, this is not the case in Italy, where the top six regions are all from the better-off north and centre of the country13 , which might signal risk aversion among Italian banks as well as especially difficult financing conditions in Italy’s South.

Figure 1.22. Government Loan Guarantees for SMEs at the regional level, 2022

Percentage of Regional GDP

Additional efforts to reduce late payments are part of the policy mix to strengthen SME liquidity