On 24 February 2022, the Russian Federation launched a large-scale military invasion of Ukraine, causing a human tragedy in Ukraine and sending shockwaves across the world. This chapter provides an overview of the economic sanctions introduced by the international community to increase the economic costs of the war by putting pressure on Russia’s real economy, isolating it from the global financial system and undermining its ability to finance military operations.

Assessing the Impact of Russia’s War against Ukraine on Eastern Partner Countries

1. Introduction

Abstract

Overview

On 24 February 2022, the Russian Federation launched a large-scale military invasion of Ukraine1. While Russian shelling directed at all major Ukrainian cities continued for months, including the capital Kyiv, Lviv and Odessa, the situation on the ground has been subject to rapid changes. As of late August, the areas under Russian military occupation covered most of the Donbas region and a significant portion of the Kharkiv oblast in the east, the largest parts of the Kherson and Zaporizhzhia oblasts in the south, as well as Crimea, which had already been occupied by Russia in 2014. In the first days of September, however, the Ukrainian army launched a counteroffensive in the east and south, which allowed it to regain control of most of the Kharkiv oblast (Institute for the Study of War; AEI's Critical Threats Project, 2022[1]).

Russia’s invasion of Ukraine is first and foremost a human tragedy. Estimates of the death toll in the first six months of the war were over 30 000, including more than 5 700 civilians (Reuters, 2022[2]) (U.S. News, 2022[3]). By early May, over 30% of the Ukrainian population was displaced, either within the country or abroad, including a majority of the country’s children (OHCHR, 2022[4]) (ACLED, 2022[5]).

The war also sent shockwaves through a world economy still struggling to recover from the COVID-19 pandemic. While it carries an inevitable economic shock on the countries directly involved in the war, the combined effects of Russia’s illegal attack on Ukraine and the international response are likely to have broad and deep negative economic consequences for the economies of the Eastern Partner (EaP) countries, which have close economic ties with both Russia and Ukraine.

Established human, financial and commercial links between EaP countries, Russia and Ukraine are being challenged or put under new stress by the war. They act as “transmission channels” through which the shocks of the war reverberate across the EaP region.

This paper aims to describe the exposure of EaP countries to these shocks, investigating how the war is affecting their economies through its impact on inflation, migration, remittances, investment, and trade. The primary focus of the analysis throughout is on the impact that the war is having on the region’s private sector, with a dedicated section exploring the specific exposure of small and medium-sized enterprises (SMEs), in particular, as these are often at a greater risk of disruption from exogenous shocks. The paper concludes with an overview of potential responses for policy makers and development partners to consider supporting households and firms in EaP economies in the short and medium term.

International sanctions against Russia and Belarus

In response to Russia’s invasion of Ukraine, and the support provided by Belarus, the United States, the European Union, the G7, and a number of other Western and non-Western partners imposed sanctions on Russia and Belarus, in order to increase the economic costs of the war by putting pressure on the real economy, isolating the two countries from the global financial system and undermining their ability to finance military operations.

Table 1.1. Overview of the main types of sanctions imposed on Russia

|

Targeted institutions and sectors |

|||||

|

Central Bank |

Financial sector |

Energy sector |

Technology sector |

Other |

|

|

Selected examples of sanctions |

No access to assets held at private institutions and central banks in the EU and US Ban on banks providing loans, services, or assistance to the government and CBR Ban on all transactions (asset transfers, foreign exchange transactions) with the CBR |

Asset freeze and prohibition to make funds and economic resources available to entities and individuals on the sanctions list Decoupling of major Russian banks from the SWIFT systems Prohibition of investments in projects of the Russian sovereign wealth fund |

EU import ban of Russian seaborne oil (90% of all oil imports from Russia to EU) US import ban on Russian oil, coal and LNG UK import ban on Russian oil and coal Opening of Nord Stream 2 on hold |

Western export ban in the defense, aerospace, marine, oil refining, aviation, transportation equipment, luxury and electronics sectors Export controls on dual-use technologies (e.g., microchips, semiconductors) with Western-made/designed chips |

Road and maritime transport sanctions for transport operators, airspace closure Russian oligarch and state official asset seizures Ban on Russian state-owned media outlets G7 countries ban imports of Russian gold |

|

Expected impact on the Russian economy |

Ruble exchange volatility, increased inflation and contraction of Russian economy Increased government debt servicing challenges |

Complication of international payments Reduction of investments and economic activity Exclusion of Russia from global markets |

Reduced economic activity and tax revenue |

Supply chain difficulties |

Supply chain difficulties Increased cost of supporting regime |

Note: as of September 2022

By early October, the EU had issued eight sanctions packages against Russia. While countries targeted specific individuals and entities by freezing their assets and imposing travel bans, the major restrictive measures against Russia target exchanges in specific sectors. In the financial sector, the main sanctions consist of a ban on transactions involving the administration of reserves of the Central Bank of Russia, which implies the inability to convert assets held in US dollars and euros into rubles, hence a freeze of a large part of the Bank’s foreign-exchange reserves. Furthermore, major Russian banks have been excluded from the Society for Worldwide Interbank Financial Telecommunication (SWIFT) system,2 all transactions with certain state-owned enterprises have been banned, issuance of transferable securities and money-market instruments has been restricted, and new investments in the Russian energy sector have been prohibited (European Commission, 2022[8]) (European Council, 2022[9]).

Trade restrictions have also been imposed, with the most relevant measures concerning the energy sector, as various western countries are limiting, to different degrees, their imports of oil and gas, as well as exports of goods and technology suited for use in oil refining. In early June, the EU adopted a sixth package of sanctions, introducing an embargo on imports of all Russian seaborne crude oil and petroleum products (90% of the EU’s current oil imports from Russia). A temporary exemption was granted to EU Member States with a particular pipeline dependency on Russia (e.g., Hungary, Czech Republic), as well as Bulgaria (due to its specific geographical exposure) and Croatia (which needs vacuum gas oil for its refinery). However, Member States benefiting from these exemptions will not be able to resell such crude oil and petroleum products to other Member States or third countries (European Commission, 2022[10]). The eight package of sanction approved in early October also lays the basis for the required legal framework to implement a price cap on Russian-origin crude oil and petroleum products envisaged by the G7 (European Commission, 2022[8]) (G7, 2022[11]).

Moreover, the export to Russia of high-tech products, luxury goods, and dual-use goods, including chemicals and lasers, has been banned. Further export bans involve goods and technology suited for the aviation and space industries, as well as those that could contribute to Russia's military, defence and security sector. On the other hand, restrictions on imports have also been imposed. Commodities affected by the bans include imports of iron, steel, coal, timber, cement, and liquor to the EU (Bown, 2022[7]).

Other sanctions include an airspace ban on aircrafts operated by Russian air carriers, a prohibition to Russian warships from entering EU ports and Russian and Belarusian automobiles from driving on EU roads, and the suspension of the broadcasting activities in the EU of the Russian state-owned outlets Sputnik and Russia Today (Funakoshi, Lawson and Deka, 2022[12]).

The United States joined in levying full blocking sanctions on Russia’s largest financial institutions, banks, state-owned enterprises, elites, and family members, as well as by prohibiting new investments in the country. Overall, US sanctions include prohibiting the import of Russian oil, natural gas, and coal, sanctions on more than 200 individuals and entities, and various restrictions on Russian financial institutions, as well as a prohibition on the export of US dollar banknotes and many US technologies to Russia. The US also increased import taxes on goods from Russia to erase World Trade Organisation (WTO) membership advantages and suspended the “Normal Trade Relations with Russia and Belarus” act, effectively raising considerably US tariffs against both countries (US Department of the Treasury, 2022[13]).

The United States, the EU and other actors also condemned the involvement of Belarus in the invasion of Ukraine and imposed a number of sanctions against Minsk. The main measures mirror the ones imposed against Russia and envisage a prohibition on transactions with the Central Bank of Belarus and a SWIFT ban on three Belarusian banks. There are also sanctions against individuals, restrictions on trade, and a ban of a range of financial transactions with Belarus.

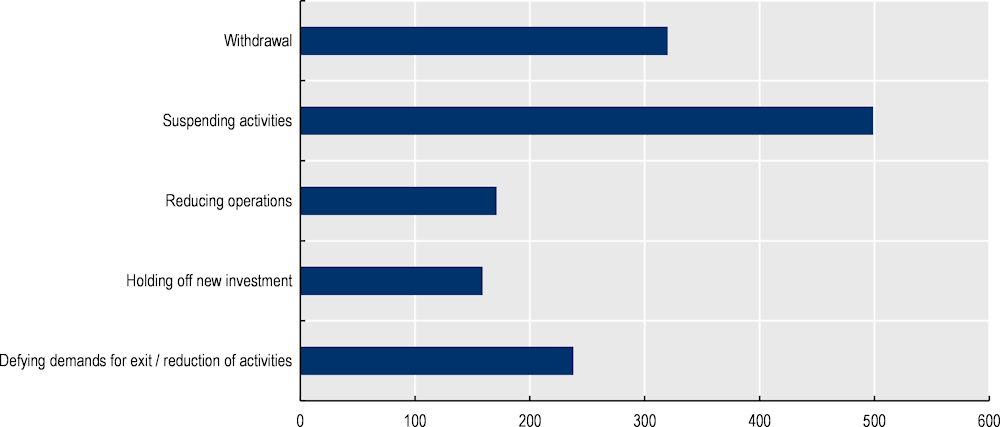

Furthermore, in addition to the sanctions imposed by countries, a multitude of private companies and organisations joined the international effort to put pressure on Russia and announced the suspension or termination of their businesses on Russian territory. As of mid-October, 320 companies had withdrawn from Russia, completely halting operations or exiting the country, and another 829 had curtailed their operations at least to some extent (Yale SOM, 2022[14]). The private players withdrawing from the Russian business environment include energy companies, aviation and industrial firms, credit card companies, media companies, management firms, tech giants, and banks. While it remains to be seen how lasting and complete these withdrawals will be, it is evident that Russia’s aggression of Ukraine and the deterioration of its domestic business environment have pushed many multinationals to reconsider the scale of their operations in the country.

Figure 1.1. Multinational companies’ responses to Russia’s war against Ukraine

Russia’s response to international sanctions

Russia responded to Western sanctions by imposing retaliatory economic measures against so-called “unfriendly countries”3 and companies that are trying to comply with the United States, European Union, United Kingdom and other sanctions regimes against Russia and Belarus.

The most wide-ranging set of responses from Russia are capital controls aimed at stabilising the ruble. The Russian Central Bank imposed severe restrictions on foreign exchange markets and capital movements in an attempt to prevent the depreciation of the ruble. One of the most significant of these is the limitation of the amount that Russian citizens can withdraw in dollars and euros to USD 10 000 (increased on 16 May to USD 50 000) per calendar month (Bank of Russia, 2022[16]). Further, all Russian exporters were initially required to convert at least 80% of their foreign currency revenue into rubles, a threshold lowered to 50% on 23 May. Other measures include allowing Russian debtors to pay off debts exceeding 10 million rubles to non-Russian creditors based in “unfriendly” states only in Russian rubles, prohibiting companies from “unfriendly countries” from buying non-ruble currency in Russia and demanding all international payments for gas in rubles. The efforts to strengthen the ruble have subsequently been tempered by the Russian Central Bank’s moves to cut interest rates, from a high of 20% in March to 7.5% on 16 September (Bank of Russia, n.d.[17]).

Beyond capital controls aimed at stabilising Russian currency markets, Russia has banned exports of certain goods – to “unfriendly countries” and, in some cases, even to allies. On 8 March, Russia issued a decree listing over 200 items that can no longer be exported from Russia (except to EAEU member countries) including pharmaceutical products, agricultural machinery, manufacturing equipment, machine tools and hand tools, electrical devices, vehicles and their components. Russia even temporarily banned the export of wheat, meslin, rye, barley, and corn to Eurasian Economic Union (EAEU) member states4 until 31 August.

Finally, Russia has sanctioned specific senior members of government in “unfriendly countries” and limited access to Western media channels and social media networks.

Notes

← 1. This note reflects facts, forecasts, and analysis based on the geopolitical, social and economic situation in the EaP region as of 15 October 2022.

← 2. Russian banks excluded from SWIFT are Bank Otkritie, Novikombank, Promsvyazbank, Bank Rossiya, Sovcombank, VNESHECONOMBANK (VEB), VTB BANK, and Sberbank. (European Commission, 2022[174])

← 3. “Unfriendly countries” include the United States, all EU member states, Albania, Andorra, Australia, Canada, Iceland, Japan, Liechtenstein, Micronesia, Monaco, Montenegro, New Zealand, North Macedonia, Norway, San Marino, Singapore, South Korea, Switzerland, Taiwan, Ukraine and the United Kingdom.

← 4. The EAEU member states are Armenia, Belarus, Kazakhstan, Kyrgyzstan and Russia.