Leia Achampong

European Network on Debt and Development

Development Co-operation Report 2023

3. In focus: Reforming climate finance

Abstract

Global North countries have failed to fulfil their 2009 commitment to mobilise USD 100 billion annually in new and additional finance for climate mitigation and adaptation in Global South countries. Escalating debt levels and increasing loss and damage both increase the urgency for adequate climate finance flows. The 2024 deadline for setting a new global climate finance target offers an opportunity to establish a financing architecture that limits indebtedness from climate finance; improves monitoring and reporting, including on gender-responsive finance; closes the financing gap; and sets a robust new global climate finance goal based on the needs of communities and countries.

The author would like to thank Maria Jose Romero, Jean Saldanha, Julia Ravenscroft, Nerea Craviotto, Iolanda Fresnillo (Eurodad), Tetet Lauron (Rosa-Luxemburg-Stiftung).

Key messages

In terms of both quality and quantity, climate finance remains inadequate to cover climate-related loss and damage, climate mitigation and adaptation, and the economic and social needs of climate‑vulnerable communities and countries in the Global South.

Global North countries must not only increase overall support but also foster climate justice by favouring grants over loans to already debt-burdened Global South countries and providing climate finance that is new and additional.

Countries in the Global South have historically contributed the least to climate change but are disproportionately impacted by its effects (Callahan and Mankin, 2022[1]; Callahan and Mankin, 2022[2]; Hickel, 2020[3]). This unequal distribution of climate impacts warrants a far greater public financing effort than currently seen. Not only has the global commitment for USD 100 billion annually in climate finance never been met, it also only covers mitigation (measures to avert, reduce or prevent greenhouse gas emissions) and adaptation (measures to minimise, prepare for, and adjust to current effects and predicted impacts). Only very recently, at the 27th Climate Change Conference (COP27) in November 2022, was it formally recognised that the costs of loss and damage increase debt burdens and impact the achievement of the Sustainable Development Goals (UNFCCC, 2022[4]). COP27 pledged to establish funding arrangements, in the form of a loss and damage fund, to address the consequences of climate change that cannot be reversed through mitigation or adaptation measures (IPCC, 2022[5]). This is a significant achievement that caps a 30-year struggle, during which the associated costs of loss and damage continued to escalate (Walsh and Ormond-Skeaping, 2022[6]).

Soaring climate costs underscore a critical need for “new and additional” finance

The United Nations (UN) estimates that Global South countries need between USD 5.8 trillion and USD 5.9 trillion to implement their (public and private sector) Paris Agreement climate action plans by 2030 (UNFCCC, 2020[7]). Yet, in 2020, aggregate climate finance flows totalled USD 83.3 billion, according to the OECD (2022[8]). Of this amount, USD 68.3 billion was public finance attributable to Global North countries. The goal of USD 100 billion a year was missed again, as it has been since the goal was established in 2009.

The United Nations estimates that Global South countries need between USD 5.8 trillion and USD 5.9 trillion to implement their Paris Agreement (public and private sector) climate action plans by 2030.

The pledge by Global North countries to finance climate adaptation and mitigation in poorer countries has its roots in the UN Framework Convention on Climate Change (UNFCCC). Adopted 30 years ago, this landmark agreement required the parties to provide “new and additional financial resources” to tackle the crisis (UN, 1992[9]). When the specific USD 100 billion goal was set in 2009, no baseline was established from which to count climate finance as new and additional (UNFCCC, 2010[10]). While finance that is “new and additional” has yet to be formally defined in this context, it is widely understood to mean climate finance that is not sourced or diverted from or double counted with other international financing streams such as official development assistance (ODA) and biodiversity finance.

Greater climate finance transparency can ensure promises are kept to the Global South

Global North countries should be providing new and additional climate finance while also increasing the overall envelope of international financing to guarantee that all countries have the means to address climate change and pursue sustainable development (Achampong, 2022[11]). Yet in 2020, climate-related ODA amounted to USD 44 billion, or 33.4% of total ODA flows1 (OECD, 2022[12]). Some climate-vulnerable countries are also middle- or high-income countries and so are not eligible either for ODA (OECD, 2022[13]) or for some forms of multilateral concessional finance such as from the International Development Association (International Development Association, 2021[14]). Thus, these countries have fewer opportunities than others to access the highly concessional climate finance they require to overcome escalating climate impacts and achieve sustainable development. While the International Development Association has created new funding windows to address eligibility issues, civil society actors argue that World Bank finance streams often do not cover all climate measures or adequately integrate climate vulnerability into project valuation models (Eurodad, 2021[15]). Therefore, meeting UNFCCC climate finance goals is not only a priority, it is crucial to ensuring that countries that are not eligible to receive ODA also have access to climate finance.

Meeting UNFCCC climate finance goals is not only a priority, it is crucial to ensuring that countries that are not eligible to receive ODA also have access to climate finance.

Development financing is under increasing pressure from climate emergencies. As Tiedemann et al. (2021[16]) noted, “Quasi-continuous post-disaster reconstruction and emergency repairs of climate-vulnerable infrastructure also impose strains on the availability of financing for other development goals.” Nevertheless, some estimates suggest that over the period 2011-18, only 6% of Global North countries’ climate finance was on top of, or additional to, their commitment to provide 0.7% gross national income as ODA (Hattle and Nordbo, 2022[17]) – a target that, incidentally, most Development Assistance Committee members have never reached (Craviotto, 2022[18]). Comprehensive monitoring and reporting frameworks on climate finance covering bilateral, multilateral, intermediary and private finance flows would facilitate greater transparency on the additionality of finance flows.

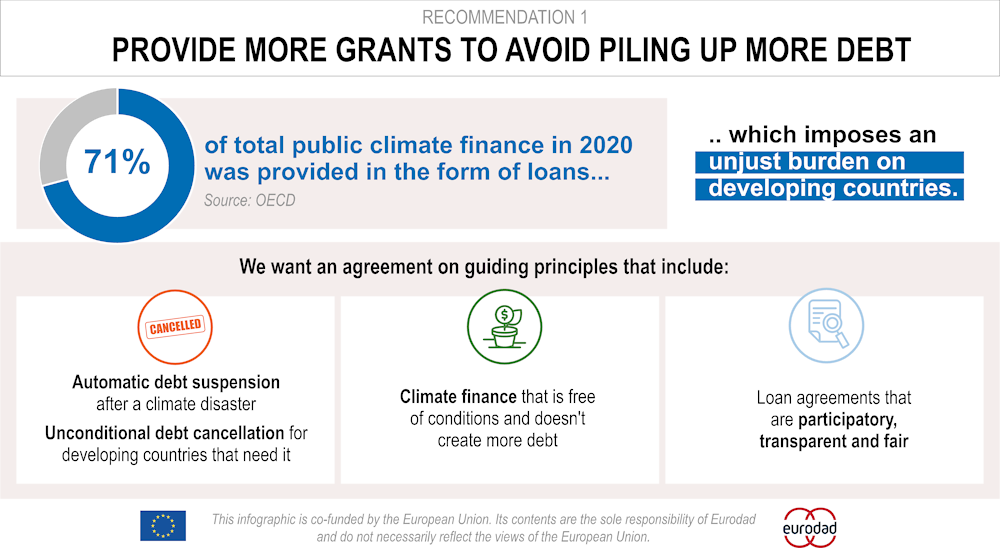

Debt-free climate finance must become the norm

Global South countries’ increasing climate vulnerability has burdened them with additional debt. Their exposure to climate impacts increases their need to borrow as well as their borrowing costs (Donovan, 2018[19]), which in turn reduces their long-term fiscal stability and capacity to invest in climate-resilient public services. Therefore, it is imperative that the financial mechanisms used to provide climate finance are suited to the specific circumstances of a country and do not create even more unsustainable debt levels. Research for the International Monetary Fund has found that debt levels of small climate-vulnerable developing states quickly increase following climate-related disasters – not only because of the impact on their economies, but also because they must take on new debt to finance reconstruction (Tiedemann et al., 2021[16]). In addition, the great majority of climate finance is provided as loans, which also increases debt burdens. In 2020, USD 48.6 billion, or 71%, of public climate finance attributable to Global North countries was channelled through concessional and non-concessional loans while grants amounted to just USD 17.9 billion (26%) of climate finance (OECD, 2022[8]). The cost is substantial: Low- and middle‑income countries spent USD 372 billion on total debt repayments in 2020 (Eurodad, 2021[20]), more than four times the total 2020 climate finance flows. High volumes of debt repayments choke off available fiscal finance to implement climate measures (Fresnillo, 2020[21]).

High volumes of debt repayments choke off available fiscal finance to implement climate measures.

This is illustrated by Grenada, a small island developing state. It is in debt distress, with debt amounting to more than 70% of its gross domestic product (GDP) in 2021 (IMF, 2022[22]) and its ability to tackle climate change is severely constrained due to, among other factors, a lack of financial resources, technology and data (World Bank, 2021[23]). The government is required by law to maintain significant primary surpluses until the public debt is reduced to below 55% of GDP (IMF, 2022[24]). In 2021, Grenada paid USD 54.14 million to its external creditors, or 15.6% of total government revenue (Fresnillo and Crotti, 2022[25]). However, the country’s 2015 Fiscal Responsibility Law exempted grant-financed capital spending from the primary expenditure growth cap (IMF, 2022[26]). In 2021, Grenada spent the equivalent of USD 9.2 million in total capital expenditure for climate resilience and disaster management, and almost entirely financed (USD 8.8 million) by an external grant.2 While this is a fraction (approximately 1%) of the USD 800.6 million that the International Monetary Fund estimates Grenada needs for climate change adaptation and mitigation (IMF, 2022[26]), grants do allow countries in debt distress to continue pursuing climate action (Figure 3.1). Grenada will need access to further climate finance to implement all the required climate measures, highlighting that overall climate finance flows must increase to meet the needs of Global South countries.

Figure 3.1. Provide more grants to avoid piling up more debt

Note: This infographic is part of an infographic series.

Source: Achampong and Stokes (2022[27]), Six Recommendations to Ensure the New Global Climate Finance Goal is Effective, https://www.eurodad.org/six_recommendations_effective_climate_finance_goal.

Grenada highlights how important it is for all finance providers to assess the suitability of a particular finance instrument (Mustapha, 2022[28]). When they provide loans, it is also critical that they follow responsible lending and borrowing principles such as those developed by the United Nations Conference on Trade and Development (UNCTAD, 2012[29]) and other guidelines promoted by civil society organisations (Wijesekara, 2022[30]). Using these principles should also help increase countries’ absorptive capacity for climate finance and avoid compounding debt vulnerabilities.

Some borrowing countries, among them Barbados, are already adding climate clauses to their debt issuance to enable a debt service suspension.

In addition to increasing the use of grants, providers should also provide an automatic debt service payment suspension after a climate event. Some borrowing countries, among them Barbados, are already adding climate clauses to their debt issuance to enable a debt service suspension (Cleary Gottlieb, 2020[31]). Some lenders are also exploring this option, including, for example, the Inter-American Development Bank (Waithe, 2019[32]) and the government of the United Kingdom (2022[33]).

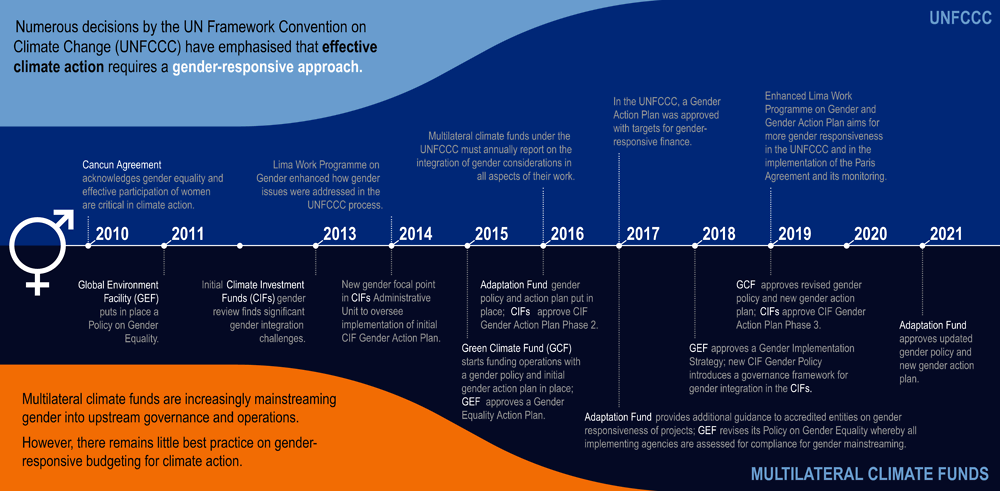

Tracking gender-responsive finance is key to measuring impact and equity

More finance is not enough. Climate finance must reach and benefit vulnerable groups including women, children, indigenous peoples and racialised communities that are disproportionately impacted by climate change (Birkmann et al., 2022[34]). Women account for 43% of the agricultural labour force in Global South countries (UN Women, 2012[35]). But in 2019, only 2% of global climate finance reached small farmers, indigenous peoples and local communities in the Global South (FAO, 2022[36]), demonstrating that climate finance is not truly economy wide as these communities benefit less from climate finance effects. Global North countries’ submissions on climate finance to the OECD and the UNFCCC, however, often lack specific and disaggregated data on gender, race and intersectionality. Figure 3.2 illustrates how the UNFCCC and different climate funds have attempted to integrate gender considerations into their operations and strategies.

Figure 3.2. Gender policy development in major multilateral climate changes funds

Source: Schalatek (2022[37]), “Gender and climate finance”, https://climatefundsupdate.org/wp-content/uploads/2022/03/CFF10-Gender-and-CF_ENG-2021.pdf.

The UNFCCC (2018[38]) has urged climate finance providers “to improve tracking and reporting on gender‑related aspects of climate finance, impact measuring and mainstreaming”. However, data gaps remain and UNFCCC finance reporting tables do not have a specific place to report gender-responsive climate finance (UNFCCC, 2022[39]; 2022[40]). Some countries voluntarily collect such data. Canada, for instance, has committed to integrate gender equality into 80% of its climate finance programming and to follow a rights-based, gender-responsive and intersectional approach; it also has developed a framework for project implementers to track gender equality outcomes (Government of Canada, 2022[41]). Gender also is part of reporting on ODA. Climate finance providers reported that gender was integrated into USD 18.9 billion of climate-related ODA in 2018-19 (OECD, 2022[42]). This suggests that Global North countries have structures in place to collect such data, though it is not clear if tracking these data is a priority. The overall data gaps make it difficult to identify trends, best practices and the effectiveness of climate finance within communities. Relatedly, Global North countries need to conduct intersectional gender analyses to determine the differing needs, interests and accessibility to finance mechanisms of vulnerable and often marginalised groups, as well as their societal power dynamics. These can help support a more equitable distribution of finance within communities and strengthen the Global North’s understanding of the social and intersectional additionality of climate finance, for instance as a means to create more equitable societies (Castellanos et al., 2022[43]; Gender and Development Network, n.d.[44]).

A new global climate finance goal is an opportunity to commit to climate justice

The biggest opportunity to address current shortcomings on climate finance is the ongoing process to set a new global post-2025 climate finance goal by the end of 2024 (UNFCCC, 2022[40]). This is the first opportunity in over ten years to set a new goal that is commensurate with the rapid action needed. The process must produce agreement on a financing architecture for climate finance that limits indebtedness, improves monitoring and reporting, ensures new and additional climate finance, and sets a robust new global climate finance goal based on the needs of communities and countries in the Global South. Global North countries must also urgently achieve the current USD 100 billion annual goal: Doing so will help restore trust in the global climate finance process.

Additionally, reporting on the grant equivalence and gender-responsiveness of climate finance must become obligatory under the UNFCCC. Currently, UNFCCC reporting on these elements is voluntary (UNFCCC, 2022[40]). Knowing the grant equivalent of finance is crucial in that it enables a better understanding of the economic impact of the climate finance flow. Collecting such data should also help create greater comparability with other reporting structures such as those of the OECD, since it is mandatory to report against gender indicators and the grant equivalent for climate-related ODA. All these data should feed into regular reviews of existing and future climate finance goals to evaluate progress and ensure that goals can address evolving needs.

For their part, countries in the Global South should institutionalise engagement processes that include traditionally marginalised groups such as women, gender minorities, indigenous peoples, racialised and ethnic groups, climate-displaced migrants, and the disabled community. This is particularly important given that the Intergovernmental Panel on Climate Change (2022[5]) has found that effective responses to climate change impacts for one group could impose higher costs and negative consequences for other groups, in terms of shifts in exposure and vulnerability”. Moreover, the attitudes, behaviours and power differences among stakeholders, coupled with specific narratives, have an impact on the extent to which priorities and agendas are prioritised (Shawoo et al., 2020[45]). Institutionalising engagement processes should help ensure that climate finance is able to address the needs of society as a whole and is not driven by the external interests of climate finance contributors.

Without these actions on the part of countries in both the Global North and the Global South, climate change, and indeed climate finance, will perpetuate uneven development and further entrench structural inequalities between and within countries.

References

[11] Achampong, L. (2022), “How lessons from development finance can strengthen climate finance”, in Cash, C. and L. Swatuk (eds.), The Political Economy of Climate Finance: Lessons from International Development, Palgrave Macmillan Cham, London, https://doi.org/10.1007/978-3-031-12619-2_2.

[27] Achampong, L. and M. Stokes (2022), Six Recommendations to Ensure the New Global Climate Finance Goal is Effective, European Network on Debt and Development, Brussels, https://www.eurodad.org/six_recommendations_effective_climate_finance_goal (accessed on 6 December 2022).

[34] Birkmann, J. et al. (2022), “Poverty, livelihoods and sustainable development”, in Pörtner, H. et al. (eds.), Climate Change 2022: Impacts, Adaptation and Vulnerability, Cambridge University Press, Cambridge, https://doi.org/10.1017/9781009325844.010.

[2] Callahan, C. and J. Mankin (2022), “Globally unequal effect of extreme heat on economic growth”, Science Advances, Vol. 8/43, https://doi.org/10.1126/sciadv.add3726.

[1] Callahan, C. and J. Mankin (2022), “National attribution of historical climate damages”, Climatic Change, Vol. 172/40, https://doi.org/10.1007/s10584-022-03387-y.

[43] Castellanos, E. et al. (2022), “Central and South America”, in Climate Change 2022: Impacts, Adaptation and Vulnerability. Contribution of Working Group II to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change, Intergovernmental Panel on Climate Change, Cambridge University Press, https://www.ipcc.ch/report/ar6/wg2.

[31] Cleary Gottlieb (2020), “Government of Barbados in $774 million external debt restructuring”, https://www.clearygottlieb.com/news-and-insights/news-listing/government-of-barbados-in-774-million-external-debt-restructuring (accessed on 16 November 2022).

[18] Craviotto, N. (2022), An Assessment of ODA in 2021: Rise in Overseas Aid Still Fails to Meet Needs of Global Crises, European Network on Debt and Development, Brussels, https://assets.nationbuilder.com/eurodad/pages/2953/attachments/original/1654167170/oda-assessment-2021-final.pdf?1654167170.

[19] Donovan, C. (2018), Developing Countries Are Paying Twice for Climate Change, Imperial College Business School, London, https://www.imperial.ac.uk/business-school/ib-knowledge/finance/developing-countries-are-paying-twice-climate-change (accessed on 16 November 2022).

[20] Eurodad (2021), Eurodad Submission to the Call for Contributions on International Debt Architecture Reform and Human Rights, European Network on Debt and Development, Brussels, https://www.ohchr.org/sites/default/files/Documents/Issues/IEDebt/Int-debt-architecture-reform/Eurodad-input-IDAreform-EN.pdf.

[15] Eurodad (2021), “Eurodad’s proposals for a WB IDA20 replenishment package that delivers for the most vulnerable”, European Network on Debt and Development, https://www.eurodad.org/eurodad_s_proposals_for_a_wb_ida20_replenishment_package_that_delivers_for_the_most_vulnerable (accessed on 5 December 2022).

[36] FAO (2022), The State of the World’s Forests 2022: Forest Pathways for Green Recovery and Building Inclusive, Resilient and Sustainable Economies, Food and Agricultural Organization, Rome, https://doi.org/10.4060/cb9360en.

[25] Fresnillo and I. Crotti (2022), Riders on the Storm: How Debt and Climate Change Are Threatening the Future of Small Island Developing States, European Network on Debt and Development, Brussels, https://www.eurodad.org/debt_in_sids.

[21] Fresnillo, I. (2020), A Tale of Two Emergencies: The Interplay of Sovereign Debt and Climate Crises in the Global South (webinar), European Network on Debt and Development, Brussels, https://www.eurodad.org/a_tale_of_two_emergencies_-_the_interplay_of_sovereign_debt_and_climate_crises_in_the_global_south.

[44] Gender and Development Network (n.d.), “Intersectionality, race and decolonisation”, https://gadnetwork.org/issues/intersectionality (accessed on 15 December 2022).

[41] Government of Canada (2022), “Canada’s climate finance for developing countries”, web page, https://www.international.gc.ca/world-monde/funding-financement/climate-developing-countries-climatique-pays-developpement.aspx?lang=eng (accessed on 17 November 2022).

[33] Government of the United Kingdom (2022), “UK Export Finance launches new debt solution to help developing countries with climate shocks”, press release, https://www.gov.uk/government/news/uk-export-finance-launches-new-debt-solution-to-help-developing-countries-with-climate-shocks (accessed on 16 November 2022).

[17] Hattle, A. and J. Nordbo (2022), That’s Not New Money: Assessing How Much Public Climate Finance Has Been “New and Additional” to Support for Development, CARE Denmark, Copenhagen, https://www.care-international.org/sites/default/files/2022-06/That%27s%20Not%20New%20Money_FULL_16.6.22.pdf.

[3] Hickel, J. (2020), “Quantifying national responsibility for climate breakdown: An equality-based attribution approach for carbon dioxide emissions in excess of the planetary boundary”, The Lancet Planetary Health, Vol. 4/9, pp. e399-e404, https://doi.org/10.1016/S2542-5196(20)30196-0.

[24] IMF (2022), Grenada: 2022 Article IV Consultation-Press Release; Staff Report; and Statement by the Executive Director for Grenada, International Monetary Fund, Washington, DC, https://www.imf.org/en/Publications/CR/Issues/2022/05/10/Grenada-2022-Article-IV-Consultation-Press-Release-Staff-Report-and-Statement-by-the-517768 (accessed on 17 November 2022).

[26] IMF (2022), Grenada: Disaster Resilience Strategy, International Monetary Fund, Washington, DC, https://www.imf.org/en/Publications/CR/Issues/2022/03/16/Grenada-Disaster-Resilience-Strategy-515246 (accessed on 17 November 2022).

[22] IMF (2022), List of LIC DSAs for PRGT-Eligible Countries As of September 30, 2022, International Monetary Fund, Washington, DC, https://www.imf.org/external/Pubs/ft/dsa/DSAlist.pdf.

[14] International Development Association (2021), “IDA graduates: Borrowing countries”, World Bank Group, Washington, DC, https://ida.worldbank.org/en/about/borrowing-countries/ida-graduates (accessed on 5 December 2022).

[5] IPCC (2022), Climate Change 2022: Impacts, Adaptation and Vulnerability, Cambridge University Press, Cambridge, and New York, NY, https://www.ipcc.ch/report/ar6/wg2 (accessed on 16 November 2022).

[28] Mustapha, S. (2022), Using the Right Mix of Financial Instruments to Provide and Mobilize Climate Finance: Lessons for the Global Stocktake, iGST Discussion Series, ClimateWorks, San Francisco, CA, https://www.climateworks.org/wp-content/uploads/2022/11/Using-the-Right-Mix-of-Financial-Instruments-to-Provide-and-Mobilize-Climate-Finance_iGSTFinance_Nov2022.pdf.

[8] OECD (2022), “Climate finance and the USD 100 billion goal”, web page, https://www.oecd.org/climate-change/finance-usd-100-billion-goal (accessed on 17 November 2022).

[12] OECD (2022), Climate-related Official Development Assistance: A Snapshot, OECD, Paris, https://www.oecd.org/dac/climate-related-official-development-assistance-update.pdf.

[13] OECD (2022), DAC List of ODA Recipients, OECD, Paris, https://www.oecd.org/dac/financing-sustainable-development/development-finance-standards/daclist.htm (accessed on 16 November 2022).

[42] OECD (2022), Development Finance for Gender-Responsive Climate Action, Gender Equality Perspectives Series, OECD, Paris, https://www.oecd.org/dac/development-finance-gender-climate-action.pdf.

[37] Schalatek, L. (2022), “Gender and climate finance”, Climate Finance Fundamentals, No. 10, Heinrich Böll Stiftung/Overseas Development Institute, Washington, DC/London, https://climatefundsupdate.org/wp-content/uploads/2022/03/CFF10-Gender-and-CF_ENG-2021.pdf.

[45] Shawoo, Z. et al. (2020), “Increasing policy coherence between NDCs and SDGs: A national perspective”, SEI Policy Brief, Stockholm Environment Institute, https://www.sei.org/publications/increasing-policy-coherence-between-ndcs-and-sdgs (accessed on 15 December 2022).

[16] Tiedemann, J. et al. (2021), “Meeting the Sustainable Development Goals in small developing states with climate vulnerabilities: Cost and financing”, IMF Working Paper, No. 2021/062, International Monetary Fund, Washington, DC, https://www.imf.org/en/Publications/WP/Issues/2021/03/05/Meeting-the-Sustainable-Development-Goals-in-Small-Developing-States-with-Climate-50098.

[9] UN (1992), United Nations Framework Convention on Climate Change, United Nations, New York, NY, https://unfccc.int/files/essential_background/background_publications_htmlpdf/application/pdf/conveng.pdf.

[35] UN Women (2012), “Facts & figures”, web page, https://www.unwomen.org/en/news/in-focus/commission-on-the-status-of-women-2012/facts-and-figures (accessed on 5 December 2022).

[29] UNCTAD (2012), Principles on Promoting Responsible Sovereign Lending and Borrowing, United Nations Conference on Trade and Development, Geneva, https://unctad.org/system/files/official-document/gdsddf2012misc1_en.pdf.

[39] UNFCCC (2022), Biennial Assessment and Overview of Climate Finance Flows, United Nations Framework Convention on Climate Change, New York, NY, https://unfccc.int/topics/climate-finance/resources/biennial-assessment-and-overview-of-climate-finance-flows (accessed on 16 November 2022).

[4] UNFCCC (2022), Funding Arrangements for Responding to Loss and Damage Associated with the Adverse Effects of Climate Change, Including a Focus on Addressing Loss and Damage, United Nations Framework Convention on Climate Change, New York, NY, https://unfccc.int/documents/624440.

[40] UNFCCC (2022), Report of the Conference of the Parties Serving as the Meeting of the Parties to the Paris Agreement on its Third session, held in Glasgow from 31 October to 13 November 2021, United Nations Framework Convention on Climate Change, New York, NY, https://unfccc.int/documents/460951 (accessed on 16 November 2022).

[7] UNFCCC (2020), First Report on the Determination of the Needs of Developing Country Parties Related to Implementing the Convention and the Paris Agreement (NDR), United Nations Framework Convention on Climate Change, New York, NY, https://unfccc.int/topics/climate-finance/workstreams/determination-of-the-needs-of-developing-country-parties/first-report-on-the-determination-of-the-needs-of-developing-country-parties-related-to-implementing (accessed on 16 November 2022).

[38] UNFCCC (2018), Summary and Recommendations by the Standing Committee on Finance on the 2018 Biennial Assessment and Overview of Climate Finance Flows, United Nations Framework Convention on Climate Change, New York, NY, https://unfccc.int/sites/default/files/resource/51904%20-%20UNFCCC%20BA%202018%20-%20Summary%20Final.pdf.

[10] UNFCCC (2010), Report of the Conference of the Parties on its Fifteenth Session Held in Copenhagen from 7 to 19 December 2009, United Nations Framework Convention on Climate Change, New York, NY, https://unfccc.int/resource/docs/2009/cop15/eng/11a01.pdf#page=4 (accessed on 16 November 2022).

[32] Waithe, K. (2019), “Avoiding a debt disaster”, IADB Caribbean Dev Trends blog, https://blogs.iadb.org/caribbean-dev-trends/en/avoiding-a-debt-disaster (accessed on 16 November 2022).

[6] Walsh, L. and T. Ormond-Skeaping (2022), Cost of Delay: Why Finance to Address Loss and Damage Must Be Agreed at COP27, Loss and Damage Collaboration, https://uploads-ssl.webflow.com/605869242b205050a0579e87/6355adbb4f3fdf583b15834b_L%26DC_THE_COST_OF_DELAY_.pdf.

[30] Wijesekara, D. (2022), Developing Best Practice Guidelines for Responsible Private Investments in Sovereign Debt Investment, Debt Justice Norway, Oslo, https://slettgjelda.no/assets/docs/SLUG-rapport-digital-oppslag-050122.pdf.

[23] World Bank (2021), “Grenada – Vulnerability”, Climate Change Knowledge Portal for Development Practitioners and Policy Makers, web page, https://climateknowledgeportal.worldbank.org/country/grenada/vulnerability (accessed on 5 December 2022).

Notes

← 1. Global North countries report the share of their ODA that is climate related to the OECD using the Rio Markers. These are policy markers used to monitor and report on how environmental objectives are mainstreamed into ODA flows. The Rio marker on climate change mitigation was introduced in 1998; the marker on climate change adaptation was introduced in 2010. There is no marker on climate change loss and damage.

← 2. The Oanda smarter trading currency converter was used to convert Eastern Caribbean dollars to US dollars. See: https://www.oanda.com.