In order to provide an in-depth analysis of the macroeconomic consequences of circular economy-enabling policies, these modelling tools have been enhanced by linking physical material flows to specific economic activities, and integrating essential elements of a circular economy, not least because an explicit representation of the use of secondary inputs serve as substitutes for primary resource use (OECD, 2019[1]). This provides internally consistent and globally connected policy scenarios for primary and secondary materials use and their economic drivers as they evolve over time, as well as scenarios for the main sectors and materials where resource efficiency and circularity policies have an impact.

Economic Instruments for the Circular Economy in Italy

Annex B. Modelling methodology

Copy link to Annex B. Modelling methodologyThe ENV-Linkages model

Copy link to The ENV-Linkages modelThis report employs the OECD’s in-house dynamic Computable General Equilibrium (CGE) model “ENV-Linkages” as the basis for the assessment of the economic consequences of environmental impacts until 2050, as well as to study the economic consequences of environmental policies.

ENV-Linkages is a multi-sectoral, multi-regional model that links economic activities to energy and environmental issues. It is the successor to the OECD GREEN model for environmental studies (Oliveira Martins et al., 1992[2]). A more comprehensive model description is given in Chateau, Dellink and Lanzi (2014[3]), whereas a description of the baseline scenario construction procedure is given in Chateau, Rebolledo and Dellink (2011[4]). The Global Material Resources Outlook to 2060 (OECD, 2019[1]) gives an overview of how the model was enhanced to represent material flows and to model circular economy and resource efficiency policies.

The model is based on the Social Accounting Matrices (SAM) contained within the Global Trade Analysis Project (GTAP) 10 database (Center for Global Trade Analysis, Purdue University, 2019[5]). This database describes bilateral trade patterns, and the production, consumption and intermediate use of commodities and services, including capital, labour and tax revenues and use. The base year of the SAM and the model is 2014. Therefore, to obtain estimates for 2019, the ENV-Linkages model was run to 2019.

Production in ENV-Linkages is assumed to operate under cost minimisation with perfect markets and constant return to scale technology. The production technology is specified as nested Constant Elasticity of Substitution (CES) production functions in a branching hierarchy. This structure is replicated for each output, whereas the parameterisation of the CES functions may differ across sectors. The nesting of the production function for the agricultural sectors is further re-arranged to reflect substitution between intensification (e.g. more fertiliser use) and extensification (more land use) of crop production, or between intensive and extensive livestock production. The structure of electricity production assumes that a representative electricity producer maximizes its profit by using the different available technologies to generate electricity using a CES specification with a large degree of substitution. The structure of non-fossil electricity technologies is similar to that of other sectors, except for a “top nest” combining a sector-specific resource with a sub-nest of all other inputs. This specification acts as a capacity constraint on the supply of electricity technologies.

The model adopts a putty/semi-putty technology specification, where substitution possibilities among factors are assumed to be higher with new vintage capital than with old vintage capital. In the short term, this ensures inertia in the economic system, with limited possibilities to substitute away from more expensive inputs but, in the longer term, this implies relatively smooth adjustment of quantities to price changes. Capital accumulation is modelled as in the traditional Solow/Swan neo-classical growth model.

The energy bundle is of particular interest for the analysis of climate change issues. Energy is a composite of fossil fuels and electricity. In turn, fossil fuel is a composite of coal and a bundle of the “other fossil fuels”. At the lowest nest, the composite “other fossil fuels” commodity consists of crude oil, refined oil products and natural gas. The values of the substitution elasticities are chosen to imply a higher degree of substitution among the other fuels than with electricity and coal.

Household consumption demand is the result of static maximisation behaviour, which is formally implemented as an “Extended Linear Expenditure System”. A representative consumer in each region – who takes prices as given – optimally allocates disposal income among the full set of consumption commodities and savings. Savings is considered as a standard good in the utility function and does not rely on forward-looking behaviour by the consumer. The government in each region collects various kinds of taxes in order to finance government expenditures. Assuming fixed public savings (or deficits), the government budget is balanced through the adjustment of the income tax on consumer income. In each period, investment net-of-economic depreciation is equal to the sum of government savings, consumer savings, and net capital flows from abroad.

International trade is based on a set of regional bilateral flows. The model adopts the “Armington” specification, assuming that domestic and imported products are not perfectly substitutable. Moreover, total imports are also imperfectly substitutable between regions of origin. Allocation of trade between partners thus responds to relative prices at the equilibrium.

Market goods equilibria imply that, on the one side, the total production of any product or service is equal to the demand addressed to domestic producers plus exports, and, on the other side, the total demand is allocated between the demands (both final and intermediary) made by domestic producers and the import demand.

CO2 emissions from energy combustion are directly linked to the use of different fuels in production. Other GHG emissions are linked to output in a way similarly described by Hyman et al. (2003[6]). The following non-CO2 emission sources are considered: i) methane from rice cultivation, livestock production (enteric fermentation and manure management), fugitive methane emissions from coal mining, crude oil extraction, natural gas and services (landfills and water sewage); ii) nitrous oxide from crops (nitrogenous fertilisers), livestock (manure management), chemicals (non-combustion industrial processes) and services (landfills); iii) industrial gases (sulphur hexafluoride [SF6], perfluocarbons [PFCs] and hydrofluorocarbons [HFCs]) from the chemicals industry (foams, adipic acid, solvents), aluminium, magnesium and semi-conductors production.

ENV-Linkages is fully homogeneous in prices and only relative prices matter. All prices are expressed relative to the numéraire of the price system that is arbitrarily chosen as the index of OECD manufacturing exports prices. Each region runs a current account balance, which is fixed in terms of the numéraire. One important implication from this assumption, in the context of this report, is that real exchange rates immediately adjust to restore current account balance when countries start exporting/importing emission permits.

As ENV-Linkages is recursive-dynamic and does not incorporate forward-looking behaviour, price-induced changes in innovation patterns are not represented in the model. The model does, however, imply technological progress through an annual adjustment of the various productivity parameters in the model, including e.g. autonomous energy efficiency and labour productivity improvements. Furthermore, as production with new capital has a relatively large degree of flexibility in choice of inputs, existing technologies can transfer to other firms. Thus, within the CGE framework, firms choose the least-cost combination of inputs, given the existing state of technology. The capital vintage structure also ensures that such flexibilities are greater in the long term than in the short term.

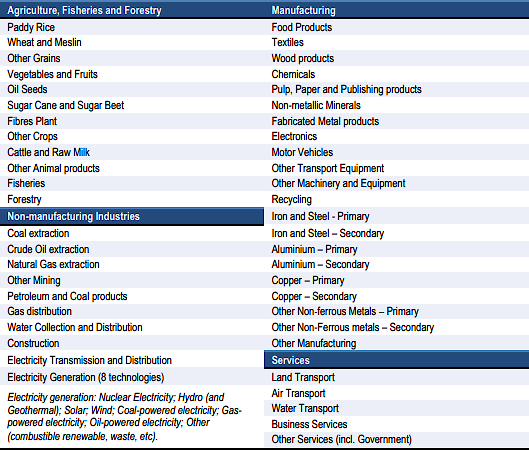

The sectoral aggregation of the model adopted in this report is given in Figure A B.1.

Figure A B.1. Sectoral aggregation of ENV-Linkages used for this report

Copy link to Figure A B.1. Sectoral aggregation of ENV-Linkages used for this report

Modelling economic instruments in the ENV-Linkages model

Copy link to Modelling economic instruments in the ENV-Linkages modelPolicies modelled in this report are taxes and subsidies on primary and secondary materials. These fiscal instruments are representative of material taxes and subsidies implemented by governments (national and local), but can also serve as a proxy to project the consequences of similar policies intended to promote resource efficiency and the transition to a circular economy.

Many instruments can be modelled using fiscal tools in a CGE model. One example is the representation of recycled content standards, where any product containing a metal has a required minimal content of secondary metal, or economic instruments with a recycled content threshold (e.g. subsidies or corporate tax credits for products with a recycled content above a certain threshold). In a CGE model, a recycled content standard or threshold translates to a mathematical relationship between primary and secondary material production, similar to that of a tax. Nevertheless, different policy instruments have different outcomes in terms of their implementation, costs and effectiveness. Not all can be represented through fiscal tools. For instance, in the absence of robust macroeconometric studies on their effects, information campaigns are difficult to represent well in CGE.

The subsidies modelled in this report aim to stimulate an increase in the production and use of secondary materials, by targeting two steps in the secondary material production process:

1. the supply of secondary raw materials (targeting the input cost in the production process); and

2. the production of secondary metals (targeting the output price, i.e. the price of refined metals).

In modelling exercises, material taxes on minerals generally take the form of taxes per tonne of primary materials paid by the firms/sectors when they use the corresponding material in their production processes. The technical implementation of such taxes is straightforward in ENV-Linkages, as material uses are linked to economic flows. This link allows the calculation of the material inputs (in tonnes) for each sector to be taxed directly (in value per tonne).

In this study, the tax rates result from a careful calibration by material. Materials are different from one another, and their extraction and use are associated to different environmental impacts. Hence, there is a case for differentiating tax rates on primary materials. The global level of metal tax rates in 2040 have been calibrated following standard theoretical principles of optimal taxation. In this setting, the levels of the tax rate for each metal are calculated, at the global level, to target the same ratio for the marginal environmental benefit to its (GDP) costs.1 Given that the different environmental impacts calculated are not comparable (e.g. SO2 emissions as a proxy for acidification and tonnes of ethylene as a proxy of photochemical oxidation cannot be added), each environmental impact has been assigned the same weight in the evaluation of overall environmental implications.2

Furthermore, the methodology takes into account existing taxes on mining extraction and royalties or fees, which already influence material use across countries. To harmonize the fiscal burden across countries, in the model, the material tax rates at the country level were adjusted to incorporate the pre-existing tax levels to reach similar (and higher) levels of taxes between countries. Bibas, Chateau and Lanzi (2021[7]) compares the effect of differentiated taxes, to reach a similar fiscal burden in each country to the effect of uniform taxes, where the environmental share of the burden is the same for all countries.

As environmental benefits associated with the reduction of non-metallic minerals are difficult to compare with those associated with the reduction of primary metals use, the choice of USD 5 per tonne for the former has been determined differently. At the global level, this tax rate is determined such that the total amount of extra tax revenues from taxing non-metallic minerals is equivalent to extra revenues from taxing all primary metals (as a percentage of GDP).

References

[7] Bibas, R., J. Château and E. Lanzi (2021), “Policy scenarios for a transition to a more resource efficient and circular economy”, OECD Environment Working Papers, No. 169, OECD Publishing, Paris, https://doi.org/10.1787/c1f3c8d0-en.

[5] Center for Global Trade Analysis, Purdue University (2019), “The GTAP Data Base: Version 10”, Journal of Global Economic Analysis, Vol. 4/1, pp. 1-27, https://doi.org/10.21642/jgea.040101af.

[3] Chateau, J., R. Dellink and E. Lanzi (2014), “An Overview of the OECD ENV-Linkages Model: Version 3”, OECD Environment Working Papers, No. 65, OECD Publishing, Paris, https://doi.org/10.1787/5jz2qck2b2vd-en.

[4] Château, J., C. Rebolledo and R. Dellink (2011), “An Economic Projection to 2050: The OECD “ENV-Linkages” Model Baseline”, OECD Environment Working Papers, No. 41, OECD Publishing, Paris, https://doi.org/10.1787/5kg0ndkjvfhf-en.

[6] Hyman, R. et al. (2003), “Modeling non-CO2 Greenhouse Gas Abatement”, Environmental Modeling and Assessment, Vol. 8/3, pp. 175-186, https://doi.org/10.1023/a:1025576926029.

[1] OECD (2019), Global Material Resources Outlook to 2060: Economic Drivers and Environmental Consequences, OECD Publishing, Paris, https://doi.org/10.1787/9789264307452-en.

[2] Oliveira Martins, J. et al. (1992), “The Costs of Reducing CO2 Emissions: A Comparison of Carbon Tax Curves with GREEN”, OECD Economics Department Working Papers, No. 118, OECD Publishing, Paris, https://doi.org/10.1787/018813821426.

Notes

Copy link to Notes← 1. Technically-specific scenarios, which implement taxes on each metal separately, have been simulated and allowed finding tax rates that imply a ratio of global environmental benefits to GDP cost that is roughly equivalent across the different types of primary metals.

← 2. Terrestrial ecotoxicity was excluded from this calculation as for this indicator, some secondary metals can have higher per unit impact than primary metals (see the OECD Global Material Resources Outlook (2019[1]) for more details). Thus, the effect of the tax would be ambiguous and make it difficult to calibrate.