[30] ACR+ (2014), Regions for Recycling: Good practice Flanders PAYT, https://www.acrplus.org/images/project/R4R/Good_Practices/GP_OVAM_PAYT.pdf (accessed on 30 June 2022).

[49] Alhola, K. et al. (2017), Circular Public Procurement in the Nordic Countries, Nordic Council of Ministers, Copenhagen, https://doi.org/10.6027/tn2017-512.

[41] BMJV Germany (2019), Gesetz über das Inverkehrbringen, die Rücknahme und die hochwertige Verwertung von Verpackungen (Verpackungsgesetz-VerpackG), http://www.gesetze-im-internet.de/verpackg/VerpackG.pdf (accessed on 9 September 2020).

[24] Brown, A. and P. Börkey (2024), Plastics recycled content requirements, OECD Environment Working Papers, No. 236, OECD Publishing, Paris, https://doi.org/10.1787/b311ee60-en.

[43] California Legislative Information (2020), PUBLIC RESOURCES CODE-PRC DIVISION 30. WASTE MANAGEMENT [40000-49620] ( Division 30 added by Stats, https://leginfo.legislature.ca.gov/faces/codes_displayText.xhtml?lawCode=PRC&division=30.&title=&part=3.&chapter=20.&article=.

[39] CITEO (2019), The 2020 rate for recycling household packaging, https://www.citeo.com/le-mag/le-tarif-2020-pour-le-recyclage-des-emballages/ (accessed on 7 October 2020).

[23] Cornago, E., P. Börkey and A. Brown (2021), “Preventing single-use plastic waste: Implications of different policy approaches”, OECD Environment Working Papers, Organisation for Economic Co-Operation and Development (OECD), https://doi.org/10.1787/c62069e7-en.

[32] De Jaeger, S. and J. Eyckmans (2015), “From pay-per-bag to pay-per-kg: The case of Flanders revisited”, Waste Management & Research: The Journal for a Sustainable Circular Economy, Vol. 33/12, pp. 1103-1111, https://doi.org/10.1177/0734242x15610422.

[22] De Muelenaere, M. (2014), Honnie et jugée piètre gagneuse, la «taxe pique-nique» est morte, http://www.lesoir.be/679195/article/demain-terre/developpement-durable/2014-10-13/honnie-et-jugee-pietre-gagneuse-taxe-pique-nique-est-morte.

[26] Dijkgraaf, E. and R. Gradus (2004), “Cost savings in unit-based pricing of household waste”, Resource and Energy Economics, Vol. 26/4, pp. 353-371, https://doi.org/10.1016/j.reseneeco.2004.01.001.

[42] EEQ (2020), Credit for post-consumer recycled content, https://www.eeq.ca/en/faq/prepare-report/am-i-entitled-to-the-credit-for-post-consumer-recycled-content/ (accessed on 28 November 2018).

[16] Ettlinger, S. (2017), Aggregates Levy in the United Kingdom, IEEP, https://ieep.eu/uploads/articles/attachments/5337d500-9960-473f-8a90-3c59c5c81917/UK%20Aggregates%20Levy%20final.pdf?v=63680923242.

[35] Eunomia (2022), Circular Taxation: A policy approach to reduce resource use and.

[21] Eunomia and IEEP (2016), Packaging taxes in Belgium.

[46] European Commission (2022), Environmnet - Green Public Procurement - What is GPP?, https://ec.europa.eu/environment/gpp/what_en.htm.

[48] European Commission (2020), Benchmarking of R&D procurement and total innovation procurement investments in countries around Europe, https://ec.europa.eu/newsroom/dae/document.cfm?doc_id=69920.

[47] European Commission (2008), “Public procurement for a better environment”, http://eurlex.europa.eu/LexUriServ/LexUriServ.do?uri=COM:2008:0400:FIN:EN:PDF.

[14] European Environmental Agency (2008), Effectiveness of environmental taxes and charges for managing sand, gravel and rock extraction in selected EU countries, https://www.eea.europa.eu/publications/eea_report_2008_2/file.

[40] EY (2016), Exploration of the Role of Extended Producer Responsibility for the circular economy in the Netherlands, https://kidv.nl/exploration-of-the-role-of-epr-for-the-circular-economy-in-nl (accessed on 16 November 2018).

[20] HM Revenue & Customs (2022), Excise Notice LFT1: a general guide to Landfill Tax, https://www.gov.uk/government/publications/excise-notice-lft1-a-general-guide-to-landfill-tax/excise-notice-lft1-a-general-guide-to-landfill-tax (accessed on 26 January 2022).

[12] HM Revenue & Customs (2022), Rates and allowances: Aggregates Levy, https://www.gov.uk/government/publications/rates-and-allowances-aggregates-levy/rates-and-allowances-aggregates-levy (accessed on 16 March 2022).

[36] HM Revenues & Customs (2022), Guidance: Landfill Tax Rates, https://www.gov.uk/government/publications/rates-and-allowances-landfill-tax/landfill-tax-rates-from-1-april-2013 (accessed on 1 December 2022).

[18] HM Treasury (2020), Review of the Aggregates Levy: summary of responses to the discussion paper and government next steps, https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/902351/2020.07.20_Review_of_the_Aggregates_Levy_summary_of_responses_to_the_discussion_paper_and_government_next_steps.pdf.

[15] HM Treasury (2019), Review of the Aggregates Levy: discussion paper, https://www.gov.uk/government/publications/review-of-the-aggregates-levy/review-of-the-aggregates-levy-discussion-paper.

[11] International Resource Panel (2020), Resource Efficiency and Climate Change: Material Efficiency Strategies for a Low-Carbon Future, International Resource Panel. United Nations Environment Programme, Nairobi, Kenya, https://www.resourcepanel.org/reports/resource-efficiency-and-climate-change (accessed on 11 May 2021).

[37] Laubinger, F. et al. (2021), “Modulated fees for Extended Producer Responsibility schemes (EPR)”, OECD Environment Working Papers, No. 184, OECD Publishing, Paris, https://doi.org/10.1787/2a42f54b-en.

[9] Lifset, R., A. Atasu and N. Tojo (2013), “Extended Producer Responsibility”, Journal of Industrial Ecology, Vol. 17/2, pp. 162-166, https://doi.org/10.1111/jiec.12022.

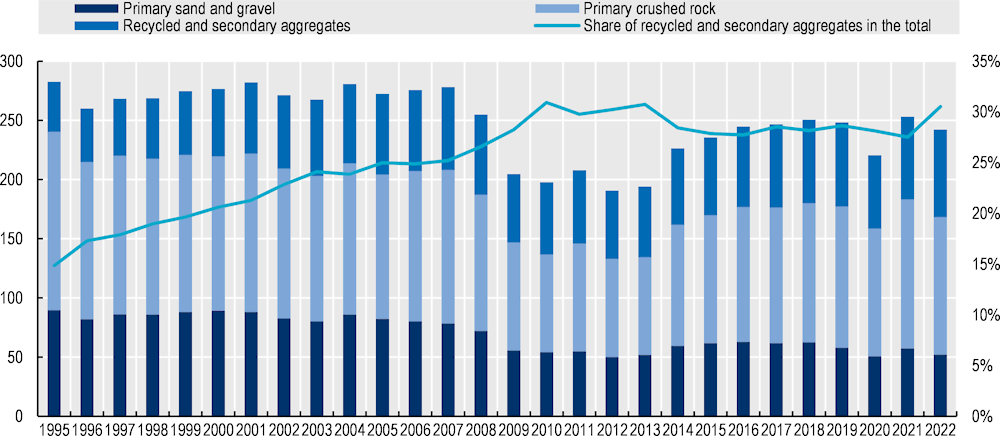

[19] Mineral Products Association (2023), Profile of the Mineral Products Industry: Statistical Workbook.

[44] Ministerio del Medio Ambiente Chile (2021), Decreto-12: Establece Metas de Recolección y Valorización y Otras Obligaciones Asociadas de Envases y Embalajes, Ley Chile, https://www.bcn.cl/leychile/navegar?idNorma=1157019 (accessed on 7 June 2021).

[34] National Audit Office (2021), “Environmental tax measures”, Press Release, https://www.nao.org.uk/press-releases/environmental-tax-measures/ (accessed on 30 November 2022).

[13] OECD (2022), “Closing the loop in the Slovak Republic: A roadmap towards circularity for competitiveness, eco-innovation and sustainability”, OECD Environment Policy Papers, No. 30, OECD Publishing, Paris, https://doi.org/10.1787/acadd43a-en.

[5] OECD (2021), “Towards a national strategic framework for the circular economy in the Czech Republic: Analysis and a proposed set of key elements”, OECD Environment Policy Papers, No. 27, OECD Publishing, Paris, https://doi.org/10.1787/5d33734d-en.

[7] OECD (2019), Waste Management and the Circular Economy in Selected OECD Countries, OECD Environmental Performance Reviews, OECD Publishing, Paris, https://doi.org/10.1787/9789264309395-en.

[50] OECD (2017), Policy Instruments for the Environment Database, https://www.oecd.org/environment/tools-evaluation/PINE_database_brochure.pdf.

[6] OECD (2016), Policy Guidance on Resource Efficiency, OECD Publishing, Paris, https://doi.org/10.1787/9789264257344-en.

[8] OECD (2014), “Innovative economic instruments for sustainable materials management”, Working paper for the Working Party on Resource Productivity and Waste, OECD, Paris, https://one.oecd.org/document/ENV/EPOC/WPRPW(2014)8/en/pdf (accessed on 7 November 2021).

[1] OECD (2007), “Market-based instruments”, OECD Glossary of Statistical Terms, https://stats.oecd.org/glossary/detail.asp?ID=7214.

[29] OECD (2006), “Impacts of Unit-based Waste Collection Charges”, OECD Papers, No. 8, https://doi.org/10.1787/oecd_papers-v6-art30-en (accessed on 30 June 2022).

[27] OECD (2006), “Impacts of Unit-based Waste Collection Charges”, OECD Papers, Vol. 6/8, https://doi.org/10.1787/oecd_papers-v6-art30-en.

[2] OECD (2001), “Economic Instruments (Environmental Protection Policy)”, Glossary of Statistical Terms, https://stats.oecd.org/glossary/detail.asp?ID=723.

[4] OECD (1972), Recommendation of the Council of 26 May 1972 on the Guiding Principles Concerning International Economic Aspects of Environmental Policies [C(72)128].

[45] OECD (June 2022), OECD - Public Procurement.

[31] Sasao, T., S. De Jaeger and L. De Weerdt (2021), “Does weight-based pricing for municipal waste collection contribute to waste reduction? A dynamic panel analysis in Flanders”, Waste Management, Vol. 128, pp. 132-141, https://doi.org/10.1016/j.wasman.2021.04.056.

[10] Söderholm, P. (2011), “Taxing virgin natural resources: Lessons from aggregates taxation in Europe”, Resources, Conservation and Recycling, Vol. 55/11, pp. 911-922, https://doi.org/10.1016/j.resconrec.2011.05.011.

[3] Svatikova, K., A. Brown and P. Börkey (Forthcoming), “Economic instruments for a resource efficient and circular economy”.

[17] UEPG (2019), “Estimates of Aggregates Production”, Union Européenne des Producteurs de Granulats, https://uepg.eu/pages/figures# (accessed on 26 January 2022).

[28] Watkins, E. et al. (2012), Use of Economic Instruments and Waste Management Performances, https://www.researchgate.net/publication/281293830_Use_of_Economic_Instruments_and_Waste_Management_Performances (accessed on 30 June 2022).

[38] Wijayasundara, M. (2021), 5 barriers to using recycled materials to boost the circular economy, The European Sting, https://europeansting.com/2021/12/13/5-barriers-to-using-recycled-materials-to-boost-the-circular-economy/ (accessed on 22 March 2022).

[33] Yu, K. (n.d.), Pay as you throw system of Seoul, https://seoulsolution.kr/sites/default/files/policy/2%EA%B6%8C_Environment_Pay%20as%20you%20throw%20system%20of%20Seoul.pdf (accessed on 30 June 2022).

[25] Zero Waste Europe (2018), Research paper on a European tax on plastics.