This chapter first reviews the historical evolution of Spanish family law, the place of family policy in the Spanish constitution, and the role of the main family policy actors. For a long time, family policy remained one of the least developed areas of social policy, and it primarily focused on the special needs of families raising more children than the average. Spanish family law reacted slowly to the societal changes in family life, and since the mid‑2000s, many reforms placed the country in line with international developments in terms of divorce, same‑sex marriage, parental responsibilities, and child custody and support, among others. The chapter also describes the features and access conditions to the main transfer programmes, early childhood care services, and family leave and housing policies. It then reviews the overall public spending on family benefits and services in Spain and presents evidence on the redistributive impact of the Spanish welfare state.

Evolving Family Models in Spain

2. Family support and protection in Spain

Abstract

Family policy refers to social programmes conferring rights and benefits to family members to support them in raising and providing care to minor children and other dependent persons. The main instruments are cash benefits, in-kind services including childcare and tax breaks, and family leave benefits or working time flexibility to take care of children and relatives. Laws and their interpretation by courts and administrations define not only the scope of these transfers, tax breaks and services, but importantly also which households count as families that have access to these benefits.

Spain’s historical legacy hampered the development of a strong family support policy for several decades, but the national and regional governments have re‑discovered this policy area from the mid‑1990s and particularly mid‑2000s onwards. During Franco’s era (1939‑75), a pro-natalist policy was one of the regime’s grounding elements. Even if families’ benefits and social rights were weak and flawed, this ideological stance tainted the programmes of political parties that held power afterwards (Valiente Fernández, 1996[1]). As a result, Spanish Governments dismissed the possibility of developing a family support policy for many years. For a long time, family policy remained one of the least developed areas of social policy and was characterised by privatisation, an assistential rather than universal character and fragmentation (Meil, 2015[2]). Since the beginning of the century, regional public bodies started developing their powers in social assistance and taxation. More recently, successive central governments developed labour and social security family benefits, improved family taxation and promoted better co‑ordination of family-related measures in health, education, and social assistance. The modern legitimations for family policy have been the compensation of family burdens (Meil, 2002[3]); gender equality (Guillén, 2002[4]; Meil, 2002[3]; Valiente, 2003[5]) and more recently child well-being (CIIMU, 2007[6]; Marí-Klose et al., 2008[7]; Gómez-Granell and Mari-Klose, 2012[8]; Flaquer, Cano and Barbeta-Viñas, 2020[9]).

The structure of this chapter is as follows: After a brief review of the historical evolution of Spanish family law and of the role of family policy in the Spanish constitution, the chapter presents the role of the main family policy actors. It then describes the structure and coverage of different family benefits and services.

The evolution of Spanish family policy and its role in the Spanish Constitution

One of the main features of the Spanish model of family support is that it has primarily focused on the special needs of families raising more children than the average. In line with the falling fertility rates, what is defined as ‘larger than average’ has changed over the past century, from eight children in 1926 to three as of 1994. In addition, other circumstances that might mean that families need more support – such as a child’s or parent’s disability or working incapacity, the parent’s death or the break-up of parents’ marriage – have also come to be reflected in the law. The foundation of large family protection laws can be found in the natalism encouraged by the fascist movements that dominated Spanish politics for several decades, though the later continued focus was principally based in the acknowledgement that large families were often most at risk of poverty. The dictatorship led by Miguel Primo de Rivera (1923‑30) approved the first protective regulations for large families.1 Later, the regime that emerged from the civil war enacted a general act for the protection of large families,2 the preamble of which emphasised the Francoist regulation’s natalist goals. Later on, Act 25/1971,19.6.1971, on the protection of the large families, updated this regulation and moderated the discourse. The number of children was relevant, but also the protection of children with intellectual disabilities. The currently in force Law on the Protection of Large Families (LPFN) repealed this Act,3 and pointed to the specific problems large families face regarding the costs of children’s care and education and access to housing that needed to be remedied through public policy to satisfy the constitutional principle of real and effective equality.

A brief review of the history of Spanish family law

Traditional Spanish families were marriage‑based extended families living in households of several generations. They shared the ideas of patriarchy, family solidarity and independence from the state. These features also characterised Spanish family laws for decades and were enshrined in the 1 889 Civil Code and the 1960s Compilations of regional civil laws (which applied for example in Aragon, Catalonia, the Balearic Islands, the Basque Country, Galicia and Navarra). The Spanish family policy under Franco dictatorship was heavily inspired by the Roman Catholic Church. Parents and children were united by indissoluble ties under the patriarchal authority of the husband and father, while the wife and mother was separated from the labour market and confined to the home in order to give birth and to care for the children. Family policy in Spain was born strongly marked by the will to compensate for economic burdens from household responsibilities so that the family as an institution was able to fulfil its functions as they were defined by the ideology of the authoritarian political regime (Meil, 1994[10]; Meil, 2002[3]; Meil, 2006[11]). At the end of the 1970s, Spanish families still had many children (for a total fertility rate of 2.77), and the number of marriages was high. Extended families were on the wane, though there were regional differences: in areas of Northern Spain, Western Andalusia and Southern Extremadura, they continued to be more important while in other areas, families were increasingly nuclear (Flaquer, 1990[12]; Flaquer and Soler, 1990[13]). Although an increasing number of women studied, few had jobs outside the home, and even fewer were in liberal professions or leadership positions. Even from the legal point of view, married women did not have full legal capacity. Divorce did not exist, and even legal separation had to be based on one of the spouses’ fault. Spouses who were at fault lost their rights vis-a-vis their children and spousal support. Children born out of the wedlock had a lower legal status than children born within marriage, and single mothers had no rights.

Changes started to occur at the end of the 1950s with the opening of the Spanish economy to international markets and continued in the 1960s and early 1970s under the impression of inward tourism and massive emigration of Spaniards to higher-income European countries. The social and economic development after Franco’s death in 1975 and the passing of the new Constitution in 1978 opened the gate to the swift modernisation of customs. Since the 1980s, more and more Spanish women enrolled in higher education and participated in the labour market, leading to changes in traditional family life. At the beginning of the 20‑first century, later marriage and family formation, an increase of cohabitation and the number of children born out of wedlock, and more instability of both married and non-married intimate relations characterise Spanish society (Meil Landwerlin, 1999[14]).

Spanish family law only reacted slowly to the changes in family life. However, since 1981 and especially after 2005, many reforms have placed Spanish family law in line with international developments in divorce, same‑sex marriage, parenthood, parental responsibilities, child custody and support, de facto couples, adoption and child protection (Martín-Casals and Ribot Igualada, 2008[15]). One of the most important consequences of the turn away from conservative social policies is that the prior theme of family policy as a public compensation for family burdens as an explicit goal in public discourse has been reduced and complemented by the fight against childhood poverty and by the promotion of the reconciliation between family and working life (Meil, 1994[10]; Meil, 2002[3]; Meil, 2006[11]).

One of the main features of the modernisation of family life is the individualisation of family members’ legal position. Article 32 of the Constitution enshrines the principle of equality of husband and wife within marriage; and family law got rid of all remains of patriarchal regulations many years ago.4 Regarding the marital property regime, since the beginning of the century, a remarkable increase in marriage agreements has taken place that substitute the default marital property regime of community of acquisitions (sociedad de gananciales) [Article 1 316 of the Civil Code (CC)] by the separation of property regime. In the former, the couple’s community gains are liable for debts or other expenses linked to supporting family members, and assets remaining at death or divorce are divided equally between spouses. The optional separation of property regime [Article 1 435 to 1 444 CC] does not automatically create any common property, and a spouse who might have prioritised unpaid over paid work only has a legal right to an unspecified compensation. This compensation can even be waived, provided there is no duress or undue influence. The Spanish Civil Code lacks a specific regime for prenuptial agreements, but case law admits their validity based on freedom of contract [Article 1 255 and 1 321 CC]. Their usual content waives rights to which spouses may be entitled to upon separation or divorce. The Supreme Court declared void agreements that are seriously damaging for one of the spouses in its first ruling on the topic [Supreme Court Sentence (Sentencia del Tribunal Supremo – STS) 24.6.2015], but has recently taken a more liberal stance, for example declaring a prenuptial agreement as valid despite the wife’s protests that she knew little Spanish at the time of signing and that the agreement was highly detrimental to her [STS 30.5.2018].

Another feature of the modernisation is the opening of marriage to same‑sex couples through a 2005 reform of the civil code and the increasing role of civil marriage. Despite the explicit wording of Article 32 CE, the Constitutional Court rejected a literal translation and ruled that Act 13/2005 was constitutional [Constitutional Court Sentence (Sentencia del Tribunal Constitucional – STC) 198/2012] and in line with present-day legal culture. Although the legislature could have chosen to offer a different legal regime to same‑sex couples, it was also within its rights to introduce marriage as the only regime for all, regardless of sexual orientation. In 2019, there were around 5 000 same‑sex marriages, representing 3% of all marriages. Theoretically, opposite‑ and same‑sex couples alike can choose between a civil or religious marriage; but currently, no religious community in Spain offers same‑sex couples the option of a religious marriage. Since 2009, more couples have opted for a civil than for a religious marriage. In 2019, 79.1% chose a civil marriage, 20.5% a Catholic and 0.4% a non-Catholic religious marriage (INE, 2020[16]; INE, 2021[17]).

The liberalisation of divorce laws is a third aspect of the modernisation of Spanish family law. Initially forbidden, divorce became a possibility through a model of no-fault divorce based on irretrievable marital breakdown, evidenced by long periods of legal separation (Martin-Casals, Ribot and Solé, 2003[18]). However, this model entailed a duplicity of procedures and delayed the solution of marital conflicts, increasing acrimony and costs for the parties and for the justice system as a whole. It even made it possible that disputes already closed during separation procedures could reopen in the subsequent divorce procedure (Carrasco Perera, 2004[19]). A 2005 reform (Act 15/2005) introduced divorce on demand. It can be requested and granted without recurring to any legal ground for divorce [Articles 81 and 82 CC]. These divorces can be filed unilaterally or by mutual consent; and can be fast-tracked when they are non-contested. In this case, the divorcing spouses are required to agree on the custody of joint children, the use of the family home, child and spousal support, and marital property division. This agreement must be approved unless it is harmful to any minor children or seriously damaging to one spouse. Since 2015, non-contested divorces can also be granted by secretaries of the court and public notaries, provided that no minor or incapacitated children are involved [Article 82.2 CC as amended by Final Provision 1.23 Act 15/2015].

In addition, there was a strong judicial and legislative trend towards recognising de facto partners’ rights and duties during the 1990s. Closely following the regulatory model established by the Catalan Act 1998 on Stable Unions, most Autonomous Communities passed specific statutes establishing legal effects of cohabitation. According to the Catalan and a few other regional Acts, legal effects apply automatically to partners who have lived together for at least two years or have a child together, while other regional acts on unmarried couples require registration of cohabitation arrangements in an administrative register. Until 2005, case law of the Spanish Supreme Court also showed a clear trend towards an approximation of de facto unions to marriage and fostered the recognition of economic effects in favour of the most vulnerable party after the union’s breakdown. The driving force behind legislation on de facto unions was the need to provide a legal framework for same‑sex couples. After marriage was opened to same‑sex couples in 2005, attempts to introduce a national regulation for de facto unions reached a deadlock. Case law also veered off under the assumption that “after same‑sex marriage and unilateral divorce have been introduced, it can be said that cohabitation involves persons who in no way want to enter into marriage with its legal effects” [STS 12.9.2005 (RJ 2005\7148)] and that the principle of contractual freedom should prevail. Following similar reasoning, in 2013, the Constitutional Court declared void the Navarre Act on Stable Couples, which allowed compensatory payments and maintenance obligations arising from the breakdown of unregistered de facto unions. In 2019, de facto couples accounted for 15.1% of all households formed by couples with or without children.

Legislation on custody evolved in line with changes in marriage and divorce. Parents have the right and the duty to live with their underage children. If the parents do not live together, their mutual agreement or a judicial decision define their duties. For separated parents, there used to be a distinction between custody and access or visitation rights. Due to fathers’ demands to be more involved in their children’s lives, the division between sole physical custody and shared physical custody was introduced in the Civil Code in 2005. In the beginning, the code’s rules pointed to shared physical custody being an exception. But since then, the hurdles existing in the first version have been removed, and case law is inclined to grant shared physical custody as default regime unless it is demonstrably harmful to children [among many others STS 29.4.2013]. Several regional Acts also give legal preference to shared physical custody. These changes have indeed led to a growth in shared physical custody, though their prevalence across different Autonomous Communities still varies (see Chapter 1, Figure 1.3).

As a result of societal and legal changes, family models that depart from the traditional nuclear family with a married mother and father are of growing relevance for family law. New family types, some of them resulting from divorce or couple breakdown, such as blended, reconstituted and single‑parent families, have become more common. Article 231‑1 of the Catalan Civil Code is devoted explicitly to recognising this heterogeneity. It recalls that families are entitled to protection under the law, without discrimination based on whether they arise from marriage, de facto unions or are formed by a single parent with their descendants (see also Article 50 of Navarre Compilation of Foral Law, as amended by Article 2 Act 21/2019, 4.4.2019.). Nonetheless, certain family structures continue to present challenges with regards to their legal situation:

Step-parenthood is an old family situation, though it traditionally resulted from widowhood in contrast to predominantly divorce, separation or single motherhood from the outset of the child’s life today. In blended families, both partners are step-parents since they bring their own children to the household that they share. From a legal standpoint, the status of step-parenthood is far from clear. Stepchildren’s support and education costs are to be shared by both spouses when they living in the same household. However, in most cases, the step-parent does not hold legal parental responsibilities over their stepchild. Exceptions occur in Aragon, where the so-called ‘family authority’ is exercised jointly by the step-parent and their spouse [Article 85.1 Aragon Foral Law Code (D-Leg 1/2011, 22.3.2011)], and to a lesser extent in Catalonia, where the Civil Code recognises a right to participate in decisions relating to step-children’s daily life [Article 236‑14.1 CCCat]. Adopting step-children is usually not an option because it severs the other biological parent’s legal ties with the child. When the couple in a reconstituted or blended family split up, step-parents owe no child support [STSJ Catalonia 23.2.2006]. They can ask for contact with stepchildren as ‘close friends’ or a new type of relatives (allegados) unless this is not in the stepchildren’s best interest [Article 160 CC = Article 236‑4.2 CCCat]. In exceptional situations, they can also be awarded custody. In the case of biological parent’s death, the step-parent may be appointed as a guardian. Step-children keep their original family name and do not have legal succession rights or duties with regards to their step-parent.

While adoptive parenthood is legally identical to biological parentage, foster family care does not create any link of filiation. Since there are fewer children who could potentially be adopted than prospective parents who would like to, Spain was one of the leading destinations for internationally adopted children some years ago, though more recently there has been a drop. In contrast, the number of children under child protection measures has grown. In most serious cases of child neglect or abuse, child protection authorities separate children from their parents and place them in the care of relatives or foster families [Article 172 CC]. Foster family care was introduced in a reform of the Civil Code in 1987. The placement of children in a foster family occurs through an administrative order or, in cases where the biological parents oppose the placement, through a judicial order. Care orders can be for emergency, temporary or permanent care [Article 173 bis 2 CC]. Although foster parents are neither parents nor legal guardians (the latter role belongs to the public authorities), they are treated as if they were and are required to “(…) guarantee the foster child’s full participation in their family life and (…) feed, educate and provide them with a comprehensive training in a caring environment” [Article 154 CC]. However, foster family carers are not the legal representatives of foster children, and only permanent foster family carers may be judicially granted full parental responsibilities. Foster family carers can be remunerated and compensated for the costs of raising foster children.

Family formation through medically assisted reproduction has been regulated in Spain since 1988 (Act 35/1988). The law allows the artificial insemination with a partner’s or donor sperm and in vitro fertilisation for couples and single women. Married women must have their spouse’s consent, in which case the partner is automatically the father, whether or not donor sperm is used. The male non-marital partner of the woman can also be the child’s legal father if he has given his consent. Each child can only have two parents and surrogates would legally be the mother. Currently, the law explicitly forbids surrogacy agreements, though some initiatives to repeal the prohibition have been introduced to the parliament. The issue remains highly controversial and a compromise is not in sight. Meanwhile, following the general criteria set up by the European Court of Human Rights, the Supreme Court admitted that if there is family life between commissioning couples and children, the former can use any available way to legalise the situation and register the children as theirs. Following this pragmatic view, social courts also decided in favour of granting parental leave and social allowances to commissioning parents.

Family policy in the Spanish Constitution The Spanish Constitution of 1978 includes a specific provision on family support policy. Article 39.1 of the Spanish Constitution states that “The public authorities shall ensure the social, economic and legal protection of the family.” The antecedents of Article 39.1 can be found in international texts highlighting the central role of families in social life, which entails the need for their protection and support.5 The preliminary version of the provision also clarified that the protection was meant to be “in particular, through social benefits, tax provisions and any other appropriate measures” (Espín Cánovas, 1996[20]; Gálvez, 1984[21]). Article 39 is the first of the so-called ‘Governing Principles of Economic and Social Policy’, enshrined in Chapter III of Part I of the Spanish Constitution. These principles shall be the basis of legislation, judicial practice and any public authority’s actions. Yet, they cannot be used by individuals in claims before the ordinary courts unless they have been developed by the corresponding statutes and regulations (Article 53.3 CE).

While legislators are occasionally accused of violating the principle enshrined in Article 39.1. through inaction, the Constitutional Court has clarified that the Governing Principles do not force lawmakers to create laws. The Court has stated that “the nature of the guiding principles of the social and economic policy contained in chapter III of Part I makes it unlikely that any legal provision can be considered unconstitutional by omission” (STC 45/1989, 20.2.1989). Therefore, it is the task of the legislator to articulate the normative or other instruments through which to make effective the constitutional mandate, “and none of them is a priori constitutionally required” (STC 222/1992, 11.12.1992). “The legislator enjoys the freedom to articulate measures that involve support to families through tax benefits, social benefits or a dual system that combines both techniques (…). From a constitutional point of view, the legislator must be recognised the freedom to use the means considered more suitable on the circumstances of each case” [STC 214/1994, 14.7.1994].6

The interplay of the different articles of the Constitution define the scope of action in family policy. Article 39.1 provides legitimacy to measures aimed at protecting the family even when they might contradict the principles of equal treatment and economic capacity for taxation purposes as enshrined by Article 31 [STC 209/1988, 10.11.1988]. Conversely, decisions that entail treating a person worse because they are part of a (large) family are unconstitutional because they violate Articles 14, 39.1 and 31 [STC 77/2015, 27.4.2015; STC 209/1988, 10.11.1988 and 45/1989, 20.2.1989].7 Similarly, legal measures that refer to the protection of the family cannot exclude non-married children because “this would amount to discrimination on the grounds of birth prohibited by Article 14 CE” [STC 74/1997, 21.4.1997]. New legislation was passed in 1981 to fully redraft the Civil Code provisions on parenthood to conform with the new legal constitutional principles that ruled that discriminating children born outside wedlock was unconstitutional.8

The Constitutional Court has adopted an open concept of family, but this does not preclude different legal treatment of diverse family types. The concept of family is independent of marriage (Roca Trías, 1990[22]) and of the existence of children [STC 222/1992, 11.12.1992; 116/1999, 17.6.1999 and 198/2012, 6.11.2012], and does not identify “the legal family only with the natural or biological family” [STC 116/1999,17.6.1999].9 However, the Court also noted that “public measures which grant a different and more favourable treatment to the family unit based on marriage shall not necessarily be incompatible with Article 39” [STC 184/1990, 15.11.1990; and also STC 60/2014, 5.5.2014].

Family policy actors and the structure of the family support system

The role of the central government and regional authorities

There is no clear-cut distribution of the regulatory powers on family policy among the state, the regions and local authorities. Being interdisciplinary, family policy relates to different areas where the state and the regions have exclusive or shared constitutional entitlements to lay down rules. Basic social security regulation belongs to the state (Article 149.1,17 CE), whereas social assistance remains a regional policy area (Article 148.1,20 CE). Local authorities apply the regulatory framework provided by the state or by the regions; but have also been allowed to develop particular rules in certain particularly important areas, such as the requirements to have access to early childhood education and childcare services. In other family policy areas, the state and the regions share the regulatory powers. For example, the state provides the basic legal framework for education, and the regions execute their programs. The regions collect several taxes, and may in some cases provide tax breaks. They can also introduce variations in the income tax to accommodate their policies in many areas of life and the economy.

Bearing in mind the complex distribution of substantive competences among these actors, inter-institutional co‑operation is essential in this field. Regional framework regulations have been enacted to comply with Article 39.1 on the protection of the family of the Spanish Constitution. Yet, the Autonomous Communities have sought to reinforce their competence to enact these legal measures by invoking their powers in related matters, notably in the field of assistance and social services, child protection, housing and transportation. On the other hand, the central government competences in some areas are crucial for the development of effective policies to protect the family, particularly in matters of labour law and social security protection and taxation issues. The state’s competences are a limitation for regional instruments, most of which simply mention benefits that are regulated by the state.

National level

At the national level, government action in family support has taken two directions. Some governments have favoured the approval of co‑ordination plans but have focused less on taking substantial steps forward in introducing changes in the legal framework for family support policy. Other governments have enacted specific legal measures aimed at triggering social changes in the areas of parental leave, work-family reconciliation measures and updating family protection within social security. There have also been initiatives regarding early education and care, though they are often conceptualised as educational rather than as family policy. This conceptualisation as a policy falling into a different area than family policy is also the case for the 2006 Law promoting the autonomy and care of people in a situation of dependence. This section focuses on comprehensive support plans and the national legal framework, while later sections discuss more targeted legal measures.

There have been two co‑ordination plans on family policy within the areas of state competence:

Comprehensive Family Support Plan: From the 1990s onwards, there was a change in attitude towards state family policy, prompted by the 1994 declaration of the International Year of the Family by the United Nations. The Popular Party Government reached an agreement with the Catalan centre‑right party Convergència i Unió in December 1997, joined by left-wing political forces. The Comprehensive Family Support Plan that was the product of this negotiation was approved in 2001 (Ministerio de Trabajo e Inmigración, 2002[23]). In terms of legislation, this plan improved families’ taxation and renewal the legal framework of large families (see below). However, the plan itself did not activate other measures that would allow Spain to start converging with other Western countries.

Second Comprehensive Family Support Plan: After its return as the governing party in 2011, the Popular Party began preparing a second plan approved for the period 2015‑17 (MSCBS, 2015[24]). The plan’s main goal was to co‑ordinate the actions of different ministries whose policies affected families and their well-being in a context of significant socio‑economic challenges. It assigned families a central role that would only be supported by public policies in cases where this was necessary. It did not yet see the growing family diversity as a defining element of the contemporary family but rather as an exception (Comas d’Argemir, Marre Cifola and San Roman Sobrino, 2016[25]). The plan generally did not establish new rights but rather scheduled reforms, the majority of which were already in motion (Arriba González de Duran and Moreno Fuentes, 2015[26]). The plan defined four basic lines of action:

1. Social and economic protection of families following active inclusion strategic lines: Prioritising unemployed individuals with children in activation programmes, offering fiscal support and improving cash transfers for families, and giving priority to families in social housing schemes.

2. Improving work-family balance: Reform labour market practices to increase flexibility in working hours, facilitate the reconciliation of work and family life, etc.

3. Supporting maternity: Offering support to socio‑economically vulnerable pregnant women and children, and higher old-age pensions for women with two or more children.

4. Promoting positive parenthood: Setting up educational programmes to promote good parenthood practices, fighting school dropout, co‑ordinating social services and third sector organisations working on family issues.

With the accession to power of the Socialist Party in 2003, family policy shifted to a gender focus, including strong emphasis in setting new family law provisions (Acts 15/2005, 8.7.2005, modifying the Civil Code and the Act for civil procedure regarding separation and divorce) and tackling gender-based violence against women (Organic Act 1/2004. 28.12.2004, on integrated protection measures against gender-based violence). Concerning social security protection, the period between 2007 and 2009 saw new measures promoting the effective equality of women and men, including new paternity leave10 and an allowance for the birth of children (Act 35/2007, 15.11.2007), though the latter was repealed shortly after due to the budget difficulties linked to the global financial crisis. In the field of early childhood education and care (ECEC), the 2008 Plan Educa3 aimed to expand the public ECEC offer and coverage for children under 3 years old in co‑operation with Autonomous Communities and municipalities.

More recently, after the Socialist Party once again became the governing party in 2018, substantive reforms aimed at increasing fathers’ involvement in childrearing were introduced, particularly with regard to new parental leaves that are equal and non-transferable for mothers and fathers (RD-Act 6/2019, 1.3.2019, on urgent measures to guarantee equal treatment and opportunities between women and men in employment and occupation). Early Childhood Education and Care for children under three‑year olds, which had been placed outside educational regulation since 2013, has been included again in new education-related laws and regulations. In practice, the Autonomous Communities have had some scope to develop these services either as falling under education or other regulations, such as those related to social services.

The only national legal framework on family policy currently in force is Act 40/2003, 18.11.2003, regarding the protection of large families [Ley de Protección a las Familias Numerosas – LPFN]. The First Final Provision of LPFN stipulates that the act “defines the basic conditions to guarantee the social, legal and economic protection of large families in accordance with the provisions of Articles 39 and 53 of the Constitution, [and] it is of general application following subsections 1, 7 and 17 of Article 149.1 of the Constitution”. These subsections of Article 149.1 lay down the state’s exclusive competence for regulating “the basic conditions that guarantee the equality of all Spaniards in the exercise of rights and the fulfilment of constitutional duties”, and the “basic legislation and economic regime of the Social Security”. Based on this constitutional framework, title I of LPFN sets forth general provisions on the concept of a large family, the conditions that its members must meet, the categories of this type of families, and the procedures for recognition, renewal, modification or loss of the legal status as a large family. According to the national legislature, most components of the LPFN are deemed basic law and have direct application throughout Spain. Prevailing case law also confers basic nature to § 1 of the Additional Provision 2 LPFN, which states that “the benefits established under this Act for family units that are recognised as large families have the nature of a minimum and shall be compatible with or accumulated to any others that, for whatever reason, the members of these families enjoy”.

The definition of families that get treated as large under the law depends on the family size but also accounts for special situations. Article 2 LPFN provides that a large family comprises one or two parents with three or more children, whether or not they are joint children of the spouses. Between the parents, there must exist a marital bond: if they are not married, the large family status can only be granted to one of the parents [STSJ Murcia (Administrative Chamber, Section 1) 417/2001, 16.6.2001 (RJCA\2001\856)]. However, disability and loss of parents can also confer the status of large family. For example, families with two children can be counted as large when one of the following conditions apply: one of the children is disabled or unable to work; both parents are disabled or unable to work or one parent suffers from a disability of a degree equal to or greater than 65%; one of the parents has died, or the children are orphaned siblings living with a foster family.11 The separated or divorced parents of three or more children can keep the status provided that the children are under their economic dependence.12 Parents who do not live with the children must prove that they have been ordered to pay child support. At any rate, if parents disagree, the custodial parent is the beholder of the large family title. Special large families are families with five or more children or four children, of whom three are from multiple childbirth or adoption or permanent or pre‑adoption foster family care; or four children but whose income falls below an income threshold.13 The children who get counted normally need to be younger than 21, though there is no age limit for disabled individuals and the limit can be extended to 25 for students, single, and living with their parents or sibling and depending financially on them (Article 4 LPFN).14

Although single‑parent family may likewise have specific needs, there is no state regulatory framework on single‑parent families, but there are significant references to single parenthood in other regulations. These include for example personal income tax regulation and some social security benefits. The personal income tax regulation grants access to joint family taxation to a type of family unit consisting of father or mother and all the children who live with him or her “in cases of legal separation, or when there is no marriage bond” (Article 82.1 LIRPF). There are also specific state tax deductions for single‑parent families. In 2008, the social security legislation added a reference to the single‑parent family in the context of social benefits regulation in case of birth or adoption. The definition provided is different from the one used by tax law and points to the family formed by a single parent with whom the child lives and who constitutes the family’s sole breadwinner. Other references to single parenthood may also be found in housing programmes and the regulation of education scholarships.

Regional level

Since 2003, Spain’s Autonomous Communities have developed an extensive array of legal instruments on family policy. Some Autonomous Communities enacted specific Framework Acts for Family Support that defined benefits and basic principles of administrative actions in the sphere of family support (Table 2.1). Others approved Strategic Multiannual Family Support Plans to guide government policy and implementation, which may or may not stipulate a need for evaluation reports.15 In some Autonomous Communities, these plans or acts were one‑offs, while in others (such as in the Basque Country), there have been several consecutive Family Support Plans. In some regions, family support measures focus on specific benefits or services, or target special needs or family types. Besides the general or specific protective instruments, most regions have defined family-specific tax breaks in their regional tax codes. In addition to the legal instruments, regions may also implement analyses to better help them plan policies and programmes. For example, in 2020 the Secretariat General of Families of the Andalusian regional government started working in parallel on a diagnostic report on the situation of families as well as on a new family plan; and the Basque Country accompanied its four Family Support Plans aside from the first one with evaluations.

Regional laws try to ensure that sector-specific regional policies respect the constitutional principle of family support and protection and establish basic principles for the operation of family protection and support policies. These instruments seek to comply with the constitutional mandate not only through promotion policies but also through mechanisms that promote family life and place emphasis on the reconciliation of work and family life. Regional laws also aim to cover areas where the central government’s protection is lacking or insufficient (Palomar Olmeda and Terol Gómez, 2017[27]). They often lay out services aimed at vulnerable families, including in access to housing, educational resources, transportation, parenting abilities, leisure activities, tax measures and financial benefits. The laws usually also set up advisory bodies, as well as channels for stakeholders’ participation. Generally, regional family support laws only refer to programs, services, and benefits provided by the administrations linked to the territory of the corresponding autonomous community. Often, however, there are ambiguities, so that the protection granted to the families embraces services or benefits provided by the central state administration or the local authorities.

Table 2.1. Almost all Autonomous Communities have a legal instrument on family policy

|

Autonomous Community |

Type of instrument |

Instrument |

|---|---|---|

|

Andalusia |

Other |

Decree 137/2002, 30.4.2002 on the support of Andalusian families |

|

Aragon |

Family Support Act |

Act 9/2014, 23.10.2014, on the support of families from Aragon |

|

Asturias |

Other |

Comprehensive childhood plan of the Principality of Asturias (2013‑16) |

|

Basque Country |

Family Support Act |

IV Interinstitutional Plan for Family Support of the Autonomous Community of the Basque Country (2018‑22) |

|

Cantabria |

Other |

Comprehensive Support Program for Families (2017) |

|

Castile‑La Mancha |

Family Support Plan |

Comprehensive Family Support Plan in Castile‑La Manche (2007) |

|

Castile‑Leon |

Family Support Act |

Act 1/2007, 7.3.2007, on the support of families from Castile‑Leon |

|

Catalonia |

Family Support Act and Plan |

Act 18/2003, 4.7.2003, on the support of families from Catalonia Plan Interdepartamental de Apoyo a las Familias 2018‑21 |

|

Valencian Community |

Family Support Plan |

II Comprehensive Family and Childhood Plan (2007‑10) |

|

Extremadura |

Family Support Plan |

Plan integral de familias, infancia y adolescencia de Extremadura (2017‑20) |

|

Galicia |

Family Support Act |

Act 3/2011, 30.7.2011, on support of the Family and the living in common in Galicia |

|

Balearic Islands |

Family Support Act |

Act 8/2018, 31.7.2018, on the support of families |

|

Canary Islands |

Family Support Plan |

Canary Islands strategy for childhood, adolescence and family (2019‑23) |

|

La Rioja |

|

|

|

Madrid |

Family Support Plan |

Support strategy for the family of the Community of Madrid 2016‑21 |

|

Murcia |

|

|

|

Navarre |

Family Support Plan |

II Comprehensive support plan for the family, childhood and adolescence in the Community of Navarre 2017‑23 |

Leave arrangements for working parents is one example of a family policy area in which many Autonomous Communities have introduced supplementary measures since 2000. A number of regional governments introduced payments to parents taking unpaid parental leave or reducing their working hours. For example, the Basque Country, Navarre, La Rioja, Galicia, Castilla La Mancha or Castilla-León have provided flat-rate payments proportional to the working time reduction. However, Navarre abolished these payments in 2011, and Castilla La Mancha and Castilla-León in 2012. This latter region has implemented a new benefit in 2020. Catalonia introduced additional benefits for the leave of public-sector employees in 2002. For example, these workers were able to reduce their working hours by a third or one half while only seeing their pay reduced by 20 or 40%, respectively, if they have a child under six years of age or had to care for a disabled relative (Meil, Escobedo and Lapuerta, 2021[28]).

In terms of the relationship between regional and state laws, regional legislatures cannot reduce the benefits existing at the entry into force of the Law on the Protection of Large Families, but could only modify or replace them by measures equivalent to those that existed before the LPFN. Some scholars have noted that “the comprehensive regional laws for family support have assumed the validity [of LPFN] by referring to it or by assuming its regulation within the broader protection framework that they have created” (Palomar Olmeda and Terol Gómez, 2017[27]).16

There is a question whether regional legislatures may modify the large family’s definition by adding instances to the ones set up by basic state law (Article 2 LPFN). For example, Article 3.1 D (Catalonia) 151/2009, 29.9.2009, defines large families as those “determined by current legislation”, but also includes unmarried cohabitating couples.17 Another example is Article 6 Act (Balearic Islands) 8/2018, 31.7.2018, which also defines large families as those “determined by current state legislation”, but immediately adds “single‑parent families with a child with a recognised disability of 33% or higher”. In contrast, according to Article 2.2 LPFN, to be the holder of a large family’s title, the single‑parent must live with two children, and at least one of them must be a person with a disability or unable to work. The issue arose indirectly in a case where the Constitutional Court rejected a question of unconstitutionality about a regional provision stipulating that children in mother’s womb were counted when ranking families in case of shortage of public-school places. The state objected that the regional legislature had modified the basic rule of Article 2 LPFN, as large family definition applies to parents and already-born children. The Constitutional Court held that “the contested provision [was to be deemed valid because it] does not introduce a general and abstract rule on how to count the members that make up a family, which would modify the requirements to obtain the status of a large family” (STC 271/2015, 17.12.2015). If that is the constitutional threshold, the regional provisions mentioned above would be unconstitutional because they amend the definition of large family laid down by state basic rules by adding other family arrangements. The development by the Autonomous Communities of regulation for other family types, such as single‑parent families, may also give rise to further doubts, especially if regional provisions equate the protection afforded to single‑parent families with that of large families.18 At any rate, the Autonomous Communities did not challenge the constitutionality of the LPFN in 2003. And the state has not questioned the above‑mentioned regional developments regarding large families and single‑parent families. It seems plausible to conclude that the state has not reacted because regional laws modify basic concepts only to supplement rather than diminish the scope of the protection afforded by basic state law. Moreover, the application of regional rules is limited to their territories and competences and does not impinge upon state allowances or benefits.

The lack of a national framework on single‑parent families equivalent to the regime for large families prompted some regional legislatures to enact legal frameworks at the regional level (Table 2.2). They referred to the constitutional principle of the family’s social, economic and legal protection and pointed to the growing number of single‑parent families and their typical greater vulnerability. For example, in Navarra, legislators mentioned the more frequent problems of single parents to access employment.

Table 2.2. About half of Autonomous Communities have provisions on single‑parent families

|

Autonomous Community |

Instrument |

|---|---|

|

Aragon |

Order of the Department of Citizenship and Social Rights 384/2019, 4.4.2019 |

|

Basque Country |

Article 2.3 Decree 164/2019, 22.10.2019, on allowances for the reconciliation of family and work life |

|

Cantabria |

Council Decree 26/2019, 14.3.2019, on accreditation of single‑parent families in the Autonomous Community of Cantabria |

|

Catalonia |

Article 4 and 5 Decree of the Department of Social Action and Citizenship no 151/2009, 29.9.2009 |

|

Valencian Community |

Council Decree 19/2018, 9.3.2018 on the recognition as a single‑parent family in the Valencian Community |

|

Galicia |

Article 13 Act 3/2011, 30.7.2011, on support of the Family and the living in common in Galicia |

|

Balearic Islands |

Article 7 Act 8/2018, 31.7.2018, on the support of families |

|

Navarre |

Foral Act 5/2019, 7.2.2019, on accreditation of single‑parent families in the Autonomous Community of Navarre |

Most regions followed the template provided by the state legislation for the protection of large families. Catalonia approved the first regulation that defined single‑parent status (Article 2 Act 18/2003, 4.7.2003) as a “family with minor children who live and depend economically on a single person” (Vela Sánchez, 2005[29]). Years later, however, the regulation broadened the definition to include children of legal age, provided that the children meet some specific requirements equivalent to those laid down by the LPFN. On occasion, the regional provisions point out that “the other parent does not contribute financially to their maintenance” (Article 13 (Galicia) 3/2011, 30.6.2011) or that “in no case families those in which shared physical custody have been established by court order shall be deemed single‑parent” (Article 2.3 Decree (Basque Country) 164/2019, 22.10.2019). All regional provisions emphasise that single parenthood means that the parent is no longer living with their spouse or de facto partner (see for example Article 46 (Aragon) 9/2014, 23.10.2014), and has not remarried or entered into a de facto union.19 Some regions also treat some families with two parents as being in the situation of single parenthood, when one parent cannot count on the support of the other due to severe dependency or disability, lengthy imprisonment or hospitalisation.20 Another example of the influence of the LPFN on regional legislation on single‑parent families is the decision to establish special categories among the latter for families with disabled children or parents, low income or whose mother was the victim of gender-based violence (see also Box 2.1).21 Single parent large families may not cumulate applicable benefits unless specific provisions state otherwise. 22

Other policy actors

Aside from the state, regional and local governments, other policy actors that have a role in shaping family policy or in delivering services and benefits for families include advisory and observatory bodies, non-governmental advocacy and service provider organisations, the social partners and private companies.

Advisory bodies and Family Observatories

The sixth additional provision of the Law for the Protection of Large Families stipulated that a Family Observatory (Observatorio de la familia) should be established as a unit integrated in the Ministry of Labour and Social Affairs. Its functions were to create knowledge on the situation of families and their quality of life, monitor social policies that have an impact upon them, make recommendations in relation to public policies and carry out studies and publications that contribute to a better understanding of the needs of the family. A 2007 decree (RD 613/2007, 11.5.2007) created the State Council on Families (Consejo Estatal de Familias) and the State Observatory on Families (Observatorio Estatal de Familias) as inter-ministerial collegiate bodies of an advisory and consultative nature intended to act as a stable framework for the participation and collaboration of family associations with the general state administration. In addition to the tasks above mentioned, the state council can issue reports, opinions and reports on the regulatory projects of the General State Administration related to its purposes, and engage in any initiative in the area of family policy that may be submitted for its consideration (Article 2.1).

In practice, the Family State Council and its Observatory were effectively operational between 2007 and 2011. During this time, they produced various reports and supporting campaigns. In 2011, its personal member’s mandate expired and was subsequently not renewed. Even while they were operational, they did not tackle the issue of monitoring and evaluation in a systematic way.

Similarly to the provision of the Law for the Protection of Large Families, the Autonomous Communities’ family support plans and laws also often set up advisory bodies to support follow-up and evaluation, as well as channels for stakeholders’ participation. These bodies may include representatives from the main concerned policy departments, including regional statistical bodies; from local entities; social partners; general and family-specific NGOs; youth councils and academic experts. For example, the Basque Observatory of Families, created by Decree 309/2010 (BOPV 02 December 2010), aims to analyse the reality, the situation and the problems of families in the Autonomous Community of the Basque Country, and the impact of the policies developed in application of Law 13/2008 to support families (Observatorio de las Familias, n.d.[30]). The Catalan Family Observatory was created in 1997 and its regulation has been updated various times. However, its website does not show recent activity (Departament de Drets Socials, n.d.[31]).

NGO’s representing and providing services to families with children

Research on family associations and representation in Spain (Ayuso, 2007[32]; Ayuso, 2009[33]) traced their historical developments and created a typology of these associations. The categories refer to their primary function, distinguishing between family organisations that respectively focus on advocacy, research or service provision. Other categorisations focus on their ideological stance, that is, whether they support more conventional or traditional family forms or whether they work towards a recognition of the pluralisation of family forms and new living arrangements. A more recent analysis (Ayuso, 2017:114) of the typology of family associations shows that in accordance with the diversification of family models, there has also been a shift in the types of family associations that exist. For example, there are now more associations representing new family models or advocating for children’s representation and rights, while there are fewer representing the interests of widowed parents.

In addition to associations focusing on families in general, organisations related to education have also been historically and quantitatively relevant in Spain. Even though they use to focus in education practical issues, they may have a broader potential. Catalan research showed that nearly all public and most private schools had such family organisations. Most families using any of its services ranging from lunch services to out-of-school care services, sports or cultural or leisure activities were in fact participants of such associations (Comas et al., 2013[34])

NGOs representing and working with families and children are also a relevant piece of local welfare systems, offering community participation and support services (Fraisse and Escobedo, 2014[35]; Flaquer, Escobedo and Anton, 2014[36]). In some sectors such as education, health and social services, they are particularly relevant. In addition to providing services at the local level, parents’ school organisations also have regional and national-level representation. They mainly seek to influence education policies, but have the potential to contribute in other areas of family support such as positive parenting. With lower general representation potential, but high specific agency, there is also the case for the associations of families with children or people with disabilities or chronic diseases, including mental health issues, which participate in some forums (e.g. Health or Patient’s regional councils).

Social Partners and Companies

Social partners are crucial in the implementation of policies and programmes related to the reconciliation of work and family life. This is particularly true since the 2007 Gender Equality Law introduced the requirement that initially large companies with more than 500 but since the 2019 reform also medium-sized companies with more than 50 employees have to create Gender Equality Plans. As in other countries, those plans require a diagnosis and negotiated measures in different aspects, including work-family measures. While there has been a good deal of research on the impact of the 2007 reform (Meil et al., 2008[37]), which has recently focused on the effects of fathers (Abril Morales et al., 2020[38]; Meil, Romero-Balsas and Castrillo-Bustamante, 2019[39]), a comprehensive follow-up and evaluation of the policy and of the work-family measures in particular does not exist. The tripartite state‑level Consejo Económico y Social has published reports and recommendations related to the quality of work and of reconciliation between work and family life. Similar councils also exist at the level of the Autonomous Communities.

Companies can play a dual role in affecting outcomes related to family policy. On the one hand, as employers, they can institute practices that favour work-life balance, gender equality and diversity. On the other hand, they also provide goods and service to families and households. So far, private organisations and companies in the field of household and family service and goods provision have not participated in research and development clusters to the same extent as for example health or engineering companies do. As a result, they have benefited from research funds and partnerships to the same extent, which could add adaptability to address challenges related to social and environmental sustainability, where households and families play a relevant role. Two initiatives that deserve attention in this respect are the Catalan Kid’s Cluster created in 2010 and the ‘Zero Child Poverty Country Alliance’ started in 2021. The Kid’s Cluster brings together Catalan companies and non profit organisations, including the Bosch i Gimpera University of Barcelona Foundation, in a common space where they can obtain more resources to boost their business and services focused to the children’s sector. Currently the cluster is made up of more than 80 private and public entities (Kid’s Cluster, n.d.[40]). The Zero Child Poverty Alliance was launched by the Spanish High Commissioner against Child Poverty. It includes more than 75 public and private companies and organisations, “whose objective is to change the path of child poverty in Spain through collaboration between the Administration, companies, foundations and the third sector” (Alto Comisionado para la lucha contra la pobreza infantil, n.d.[41]).

Box 2.1. Families with particular needs

Two categories of families that are recognised as needing additional support are those with disabled family members or where the mother is a victim of gender-based violence.

Family member disability

Families with persons with disability are identified as deserving support, because they largely take care of and provide attention to family members with disabilities. From a policy standpoint, special treatment of families with persons with disabilities focuses on the guarantee of equal opportunities for all children and their families. Disability shall not compromise the possibilities for personal fulfilment of children, nor destroy the personal life of their parents or other family members who care for them.

The main practical difficulty in dealing with family support measures aimed at families caring for children or other family members with a disability lies in the concept of disability used by the corresponding legal provision, and the criteria to assess the severity of the situation of the person with a disability:

The General Act on the Rights of Persons with Disabilities and their Social Inclusion defines disability as the “situation that results from the interaction between persons with predictably permanent deficiencies and any type of barriers that limit or prevent their full and effective participation in society, on equal terms with others”. Persons with disabilities are those “with physical, mental, intellectual or sensory deficiencies, predictably permanent, which, by interacting with various barriers, may prevent their full and effective participation in society, on equal terms with others”. In addition, “for all purposes, the persons who have been recognised as having a degree of disability equal to or greater than 33% shall be considered persons with disabilities”.

The recognition of the degree of disability is carried out by the competent body as stipulated by the regulations that develop the General Act (Royal Decree 1971/1999, 23.12.1999, on the procedure for the recognition, declaration and qualification of the degree of disability). The certification of the degree of disability is valid throughout Spain. Between 1 and 24%, the disability is mild because the symptoms, signs or sequelae make it difficult but not impossible to carry out activities of daily living. Moderate disability is between 25 and 49%, and the symptoms, signs or sequelae entail a significant decrease or inability of the person to perform some of the activities of daily life, but he or she is independent in the self-care activities. A disability between 50 and 74% is deemed to be severe disability.

Mother victim of gender-based violence

Mothers or female partners who have suffered gender-based violence may have to rely on the aid of the state to escape their situation. As recognised victims of gender-based violence, they can receive benefits and services usually awarded to large and single‑parent families, among others. In addition, special legislation awards several subjective rights regardless of whether they live with their children or not, as well as specific monetary allowances whose amount increases when the woman is in charge of children or dependent persons (see Article 27 Organic Act 1/2004).

Family benefits and services

Public expenditures that benefit families can take different forms. Individuals can receive cash benefits that specifically target families, such as child benefits, or that are open to single individuals as well, such as unemployment benefits. In addition, governments provide in-kind benefits and services such as day care, public schools, health care, tax breaks, etc. This section first provides overviews of the features and access conditions to the main transfer programmes, of early childhood care services, of family leave and housing policies. It then reviews the overall public spending on family benefits and services in Spain and presents evidence on the redistributive impact of the Spanish welfare state.

Transfers and tax benefits

Monetary family benefits

Family benefits in Spain are generally relatively modest and not universal. The crucial turning point was the restriction of family cash benefits from the Social Security to families with lower incomes or with disabled children following the Ley 26/1990, which pushed family policy towards a social assistance logic (Meil, 1995[42]). The Act converted the modest but universal Social Security child benefits into an allowance targeted towards low-income families or families with disabled children (Obiol Francés, 2006[43]). The lion’s share of expenditure was destined for children and adults with disabilities, while the low benefits levels for children without disabilities hardly increased over the nearly 30 years of the existence of the allowance.

A universal monetary benefit linked to the birth or adoption of a child was available from 2007 to 2011, but has since been restricted to selected situations. The monetary benefit was supposed to offset some of the initial costs associated with a new child and aimed at parents who could not apply the tax deduction based on childbirth or adoption because of their low income. The benefit consisted of a single payment of EUR 2 500 for each adopted or born child. It was abolished to reduce the public deficit (Blasco Lahoz and López Gandía, 2020[44]). Currently, the birth or adoption of a child only gives the right to a lump-sum payment in the event of multiple births or adoptions (Article 351 c) General Act on Social Security [LGSS]) or if it occurs in large or single‑parent families or involves a mother with disabilities (Article 351 b) LGSS). For single‑parent and large families, the benefit consists of a lump-sum payment of EUR 1 000 (Article 358.1 LGSS) and subject to an income limit that depends on the size of the family. Currently, this limit is set at EUR 13 508 per year for single‑parent families and EUR 19 782 for large families. As a point of comparison, the average wage of a full-time employee in Spain was equal to EUR 27 468 in 2019. Each additional child increases the limit by 15%. For multiple births and adoptions, the benefit is equal to four times the monthly interprofessional salary (EUR 950 in 2020) for twins/two adopted children; eight times for three children and twelve times for four or more children.

Similarly, social security used to pay a means-tested non-contributory monetary allowance for dependent underage children from 1990 to 2020 (Article 351 a) LGSS), but now the allowance only applies to dependent children with a disability. The Final Provision 4 of RD-Act 20/2020 removed the monetary allowance for underage children in the context of the creation of the ingreso mínimo vital (minimum income scheme), a new social security non-contributory benefit addressing poverty, which has been established in May 2020. The next sub-section on other transfers will give more details on this benefit. The social security child allowance is thus now available only to parents of minors with a disability above 33% and dependent adult children with a disability above 65% (Article 351 a) LGSS). The benefit amount is EUR 1 000 per year and child, increased to EUR 4 747, with higher amounts for adult children with severe degrees of disability.23

While the abolishment of the more general (though not universal) benefit for dependent underage children could be seen as a loss for families, these benefits only played a residual role among transfers that families received. The benefits levels for children without disabilities were very low and not frequently updated: In 1990, the amount of the annual basic benefit was PTA 36 000 per child, amount to around EUR 18 per month. In 2019, a few months before the programme was discontinued, the last update of the benefit brought the monthly amount to EUR 28.4. Furthermore, the means test excluded most working families, including poor ones. The observed impact on child poverty was thus residual residual in comparison to other non-family related schemes such as unemployment benefits, which have much more impact on families with children (Marí-Klose, Julía and Redondo, 2019[45]).

Since 2016, childbirth and adoption lead to a benefit for women holding rights to contributory pensions of the social security system (Article 60 LGSS). This so-called ‘maternity pension supplement’, one of the measures of the Second Comprehensive Family Support Plan, increased the pension awarded to any woman who has had two or more biological or adopted children equal to 5% if she had two, 10% if she had three and 15% if she had four or more children.24 In their motivation for the law, the legislator pointed to the fact that mothers continued to do a large part of the care work and took the bulk of parental leave, and that the average pension of women was substantially lower than the average pension of men.

The European Court of Justice declared that the provision violates Council Directive 79/7/EEC of 19 December 1978, on the progressive implementation of the principle of equal treatment for men and women in matters of social security. This Directive precludes national legislation that makes provision for the right to a pension supplement for women while men in an identical situation do not have this right. The provision was deemed to be flawed because it makes no connection with the problems that women may have encountered in the course of their careers.25 However, until now, Article 60 has not been repealed. As a result, men are filing claims against the National Institute for Social Security on the basis that they have had two or more children.26 However, RD-Act 3/2021 substantially amended Article 60 LGSS. Since 2.2.2021, any woman who has had one or more biological or adopted children is entitled to a supplement to her contributory pensions, whose amount – currently EUR 378 per year and child – is to be defined each year by the General State Budget Act. Former beneficiaries of the right do not lose the supplement already granted. But now fathers are also entitled to claim the new supplement, provided they meet a number of (quite stringent) requirements proving that paternity and childcare harmed their contribution career. At any rate, the recognition of the supplement to the second parent entails the termination of the entitlement already recognised to the first parent.

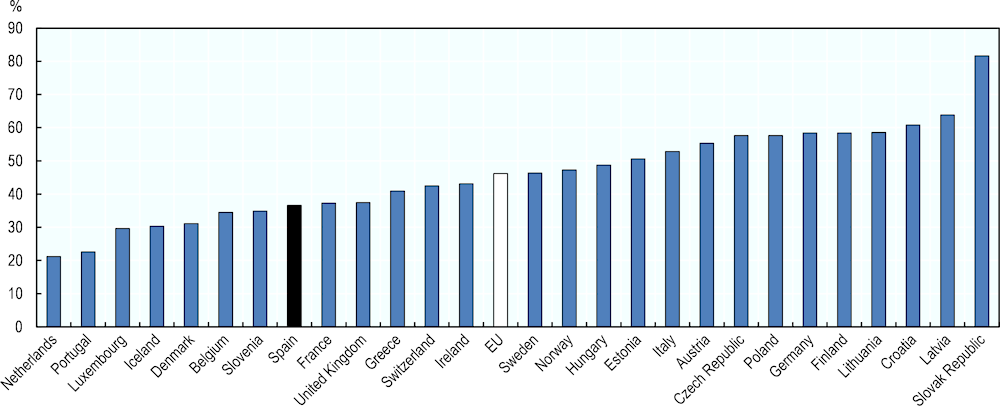

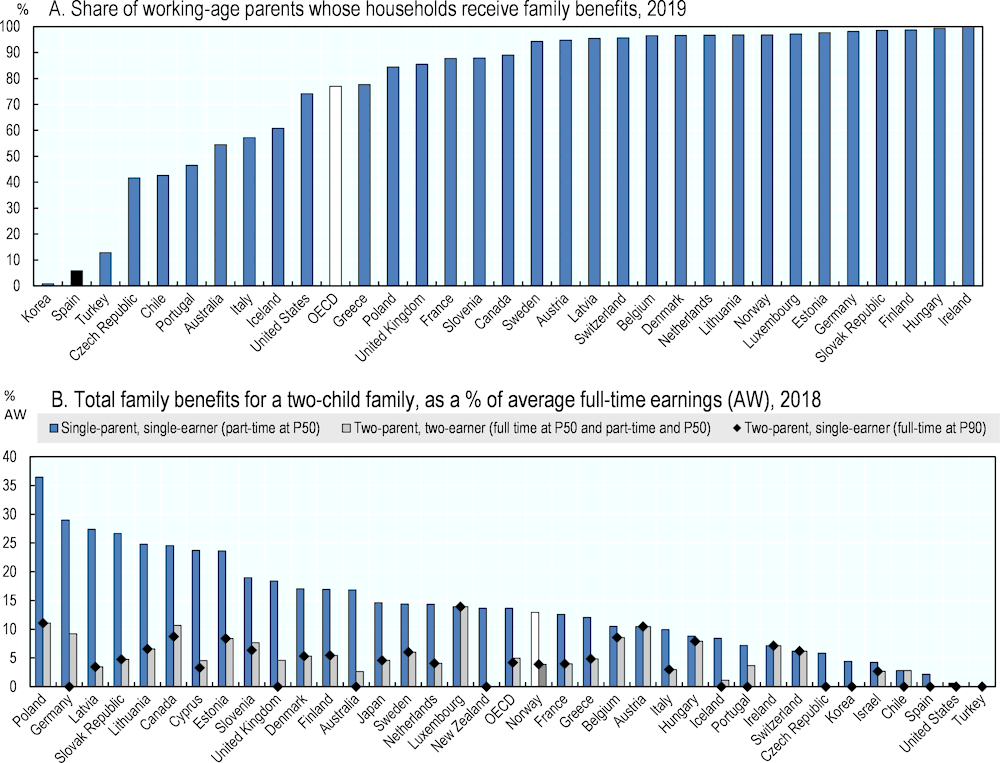

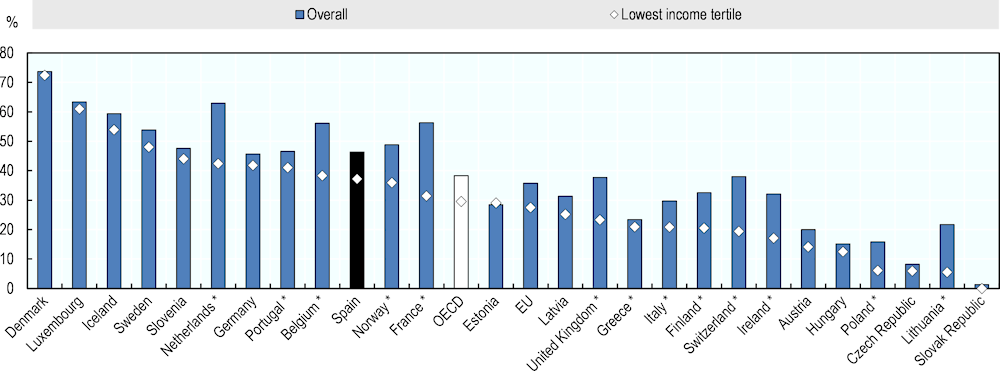

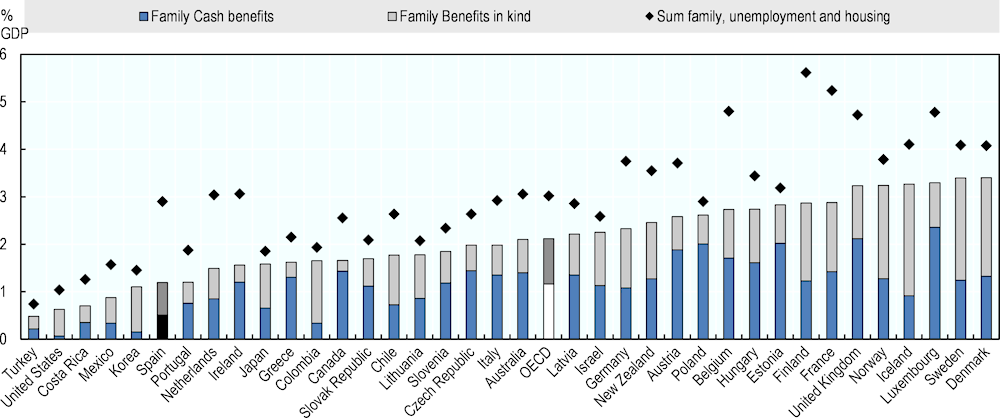

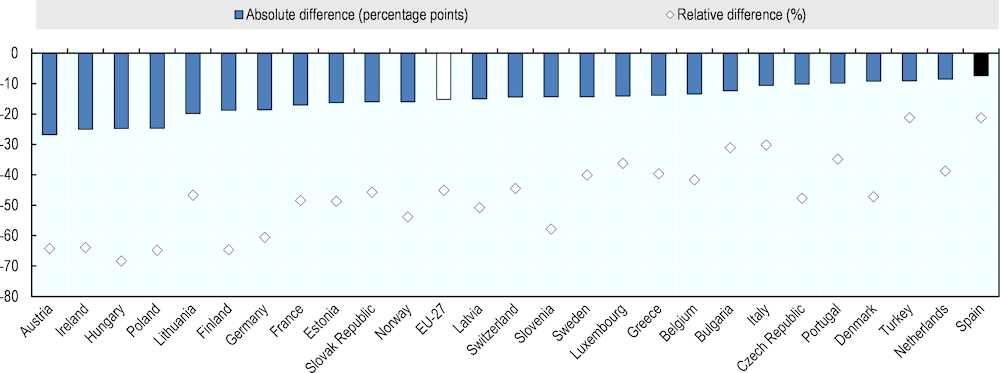

The relatively smaller importance of family benefits within the Spanish social protection system can be seen in the low number of families that receive family benefits and the low amounts a family with average income levels receives in comparison to other OECD countries. First, the share of working-age parents who live in a household receiving family benefits was the second lowest among OECD countries for which data were available (Figure 2.1, Panel A). Second, in 2018, a single parent in Spain who worked half-time on a wage at the median of the full-time earnings distribution would receive family benefits equal to 2.2% of the average full-time earnings (Figure 2.1, Panel B). In contrast, the OECD average is equal to 13.7%; and the benefits even exceed 35% in Poland. Single‑earner or double‑earner two‑parent families do not receive any family benefits in Spain. This stands in contrast with most other OECD countries, where these family types are also eligible for family benefits, though usually at a lower level (except in a few countries with flat benefits per children, such as Austria, Ireland and Switzerland).

Accordingly, family benefits are only residual component in public transfers received by families with children. After the abolishment of the universal birth allowance, family benefits as a share of all benefits received by families with minor children dropped from 6% to approximately 3%; and the proportion of recipients of family benefits nearly halved between 2007 and 2016 in most income quintiles with the exception of the lowest one. Paradoxically, while the share of recipients is highest in the lowest income quintile, it is higher in the fourth and fifth (i.e. the households with the highest 40% of incomes) than in the second and third ones. The average amount received families in the first quintile receive is about half of the amount households with higher income levels receive (Marí-Klose, Julía and Redondo, 2019[45]).

Figure 2.1. Family benefits in Spain are among the lowest across the OECD

Note: A: The reference year is 2015 for Turkey, 2016 for Korea, 2017 for Australia, Chile and Slovenia, and 2018 for Iceland, Latvia and the United States. B: Estimates based on a family with two children aged 9 and 12. “Full time at P50” means working 40 hours per week on wages at the median of the full-time earnings distribution; “part time at P50” means working for 20 hours per week on a wage at the median of the full-time earnings distribution; and “full time at P90” means working 40 hours per week on wages at the 90th percentile of the full-time earnings distribution. Average full-time earnings/the average full-time wage (AW) refers to the average gross wage earnings paid to full-time, full-year workers, before deductions of any kind (e.g. withholding tax, income tax, private or social security contributions and union dues). See the OECD Tax and Benefit Systems website, http://www.oecd.org/social/benefits-and-wages/, for more detail on the methods and assumptions used and information on the policies modelled for each country. Data for Chile refer to 2016.

Source: A: Own estimates based on household surveys. B: OECD (n.d.[46]), “PF1.3 Family cash benefits”, OECD Family Database, http://www.oecd.org/els/soc/PF1_3_Family_Cash_Benefits.xlsx.

Unemployment benefits

Unemployment protection is structured as contributory and non-contributory benefits.

The contributory unemployment allowance intends to provide substitutive income in the case of a job loss, a temporary contract suspension or the reduction of working time (Article 264 LGSS). The applicant must meet the requirements of affiliation and minimum contribution stipulated by Articles 266 and 269.1 LGSS. The total duration of the allowance depends on the type of contract and the prior work history, but is capped at 720 days (Article 269.1 LGSS). The initial allowance during the first 180 days is equal to 70% of the medium of the coverage amount during the 180 days before the contract termination or suspension, and 50% afterwards (Article 270.1 LGSS). However, there are also minimum and maximum amounts. If the unemployed worker is childless, the minimum amount is set at 80% of the monthly public multiple‑effect income indicator (IPREM) (EUR 538 in 2020) increased by one‑sixth, and the maximum at 175%. When the applicant has one or more dependent children, the minimum amount is set at 107%, and the maximum at 200% (one child) or 225% (two or more children).

Once the worker has exhausted the unemployment allowance, he or she may be eligible for a non-contributory unemployment subsidy. The amount and duration of the subsidy vary according to the age, duration of previous contributions and type of prior contract of the unemployed worker. The maximum amount is 80% of IPREM. The applicant receives the benefit for six months, but the duration can be extended for further six‑months periods, up to 24 months. It is only available under exceptional circumstances laid out in Article 274 LGSS to those whose income is than 75% of the monthly minimum interprofessional salary, excluding the proportional part of two special payments (EUR 713). One of these circumstances, which applies regardless of the applicant’s age, is that he or she bears “family responsibilities”. The application of this requirement is not without issues. First, for the family means-test to be passed, the total family income, divided by number of family members, has to be lower than 75% of the minimum interprofessional salary on a per-capita basis; but if the other family member(s) earn an income and are thus not dependent on the unemployed worker, their income would also individually need to fall below the 75% ceiling (STS (Social Chamber) 30.5.2000 (RJ\2 000\5893). More recently, 2.3.2015 (RJ 2015\1635)). Second, relatives other than incapacitated children or children younger than 26, foster children, step children (if their maintenance is covered by the family unit) and spouses who are living under the same roof are not considered to belong to the family unit.27 This means that for example parents or grandparents, nieces or nephews and unmarried partners are not considered as part of the family unit.

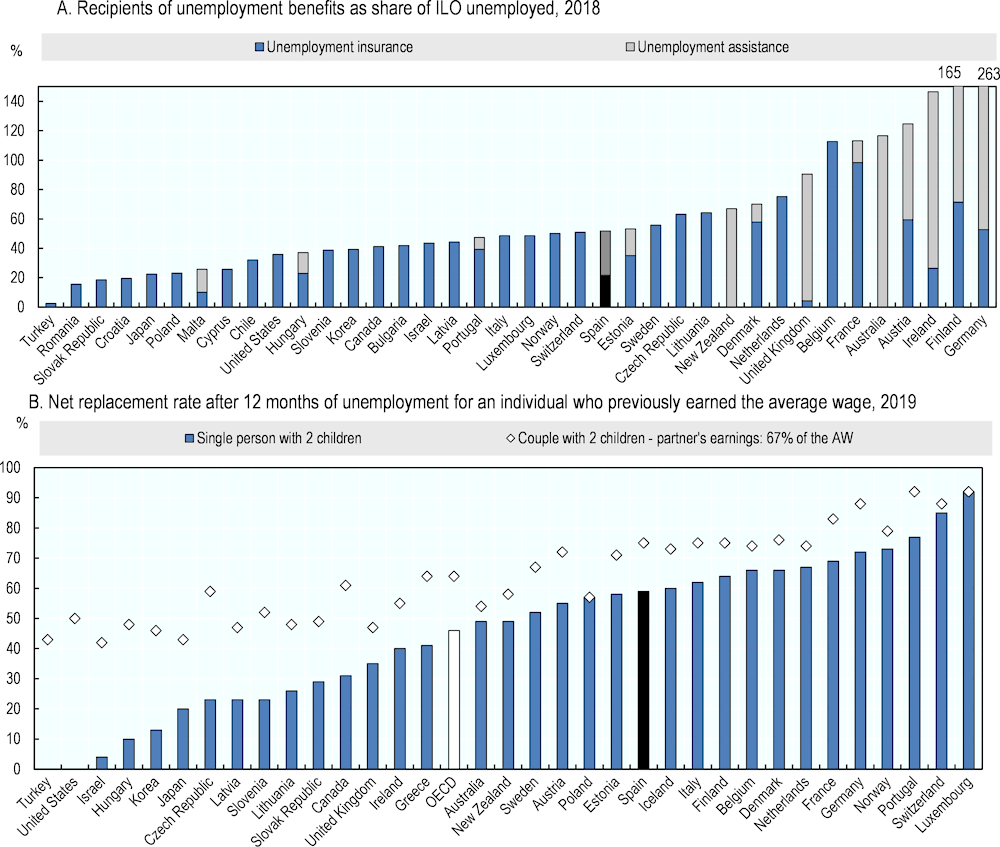

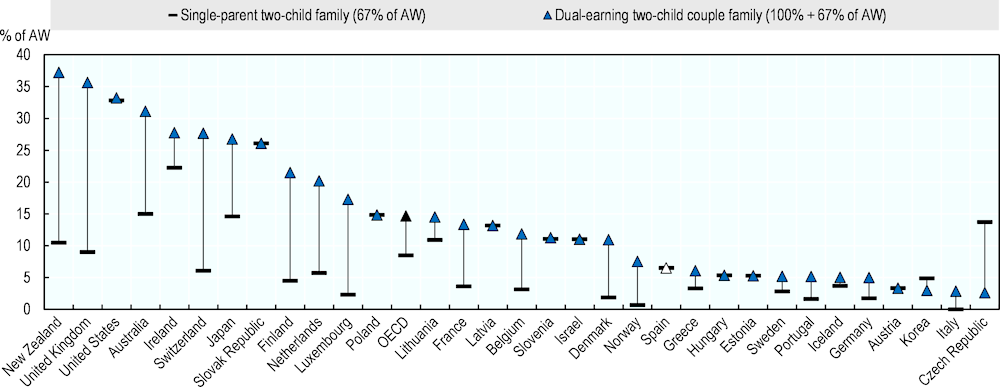

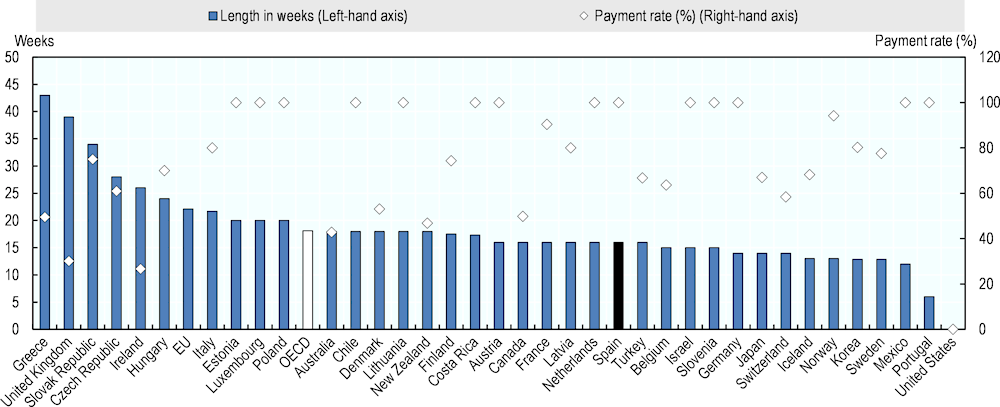

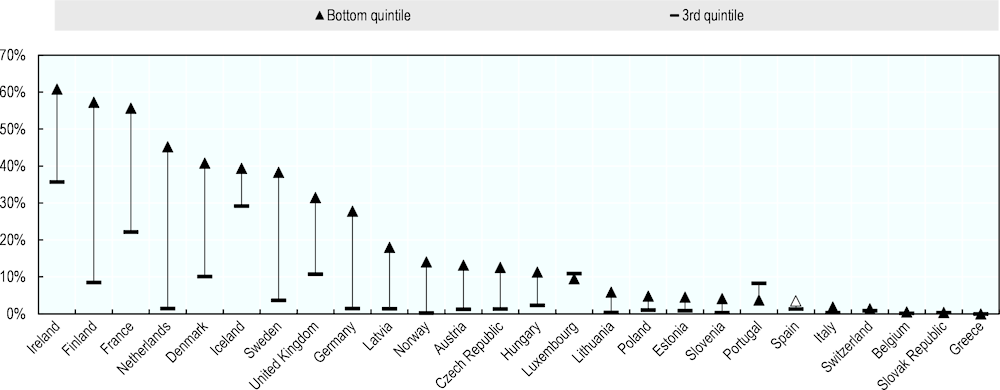

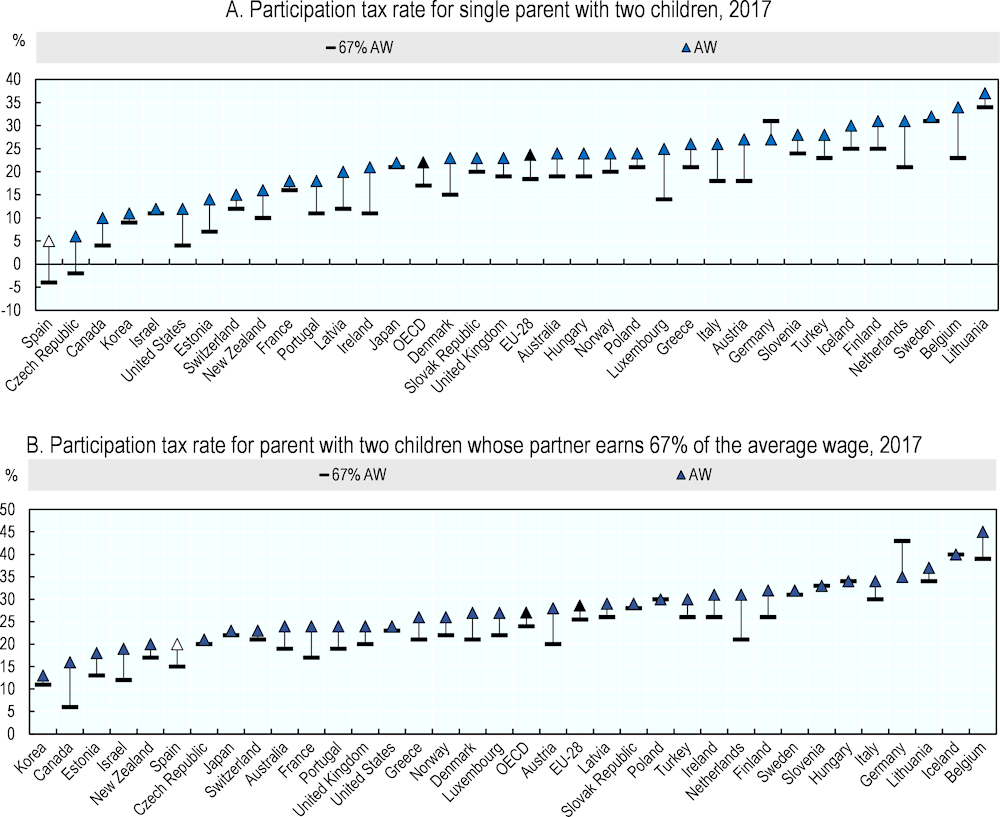

Unlike family benefits, unemployment benefit levels are comparatively high in Spain; but coverage is average. A person who previously earned the average full-time wage and has been unemployed for a year has a net replacement equal to 59% (if they are single with two children) or 75% (if they are married with two children and their partner earns two‑thirds of the average full-time wage) (Figure 2.2, Panel B). These replacement rates are more than 10 percentage points higher than the respective OECD averages. Nonetheless, several OECD countries have considerably higher net replacement rates. As is clear from the various eligibility conditions mentioned above, not all individuals who currently do not have a job but are actively searching for one and could start work within the next fortnight (the ILO definition of unemployment) are also eligible for the unemployment allowance or subsidy. In 2018, the ratio of unemployment insurance and assistance recipients to those that were unemployed according to the ILO definition in Spain was 52, below the OECD average of 68 (that however also includes countries where the ratio suggests a coverage rate well above 100%) (Figure 2.2, Panel A). Though direct evidence is not available, it is likely that parents and in particular mothers, who took time out of the labour force over part of the years prior to their unemployment, as well younger people are less likely to meet the contribution requirements and therefore to be uncovered. Nevertheless, among families with minor children, unemployment benefits made up 46.5% of the public transfers they received in 2013, though it had decreased by more than 10 percentage points by 2016 (Marí-Klose, Julía and Redondo, 2019[45]).

Figure 2.2. Unemployment benefits in Spain are comparatively generous

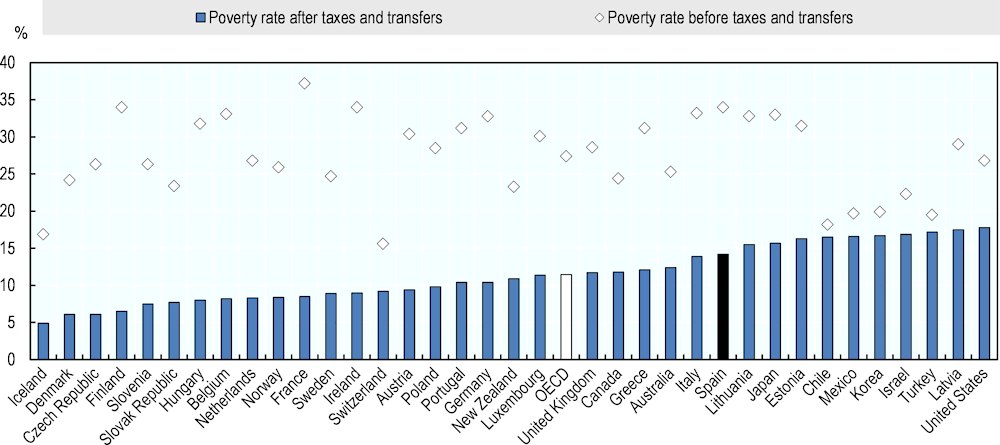

Note: A: The numerator of the rates shown in the Figure is the number of beneficiaries of earnings-related unemployment benefits (unemployment insurance, UI) and of non-contributory benefits (unemployment assistance, UA) for jobseekers who have exhausted their UI benefit or were not entitled to it to start with. The denominator is the number of unemployed individuals (over 15 years old) according to the ILO definition. These rates are commonly referred to as “pseudo” coverage rates as the population in the numerator, and denominator may not fully overlap. For instance, in some countries, significant numbers of people who are not ILO unemployed may be able to claim benefits categorised under the unemployment heading in SOCR data provided by countries. As a result, pseudo coverage rates can exceed 100% (e.g. Australia, Austria, Belgium, France, Finland, Germany, and Ireland). On the other hand, some unemployed are not entitled or do not claim unemployment benefits. B: The indicator is the ratio of net household income during a selected month of the unemployment spell to the net household income before the job loss. The calculations exclude social assistance and housing benefits but do include relevant family benefits. Calculations refer to a jobseeker aged 40 with an uninterrupted employment record since age of 19 until the job loss. If benefit receipt is subject to activity tests or other behavioural requirements, e.g. active job-search and being available for work, it is assumed that these requirements are met. The statistics for Cyprus are for 2016.