On average across OECD countries, 13.1% of children live in relative income poverty, a figure that becomes even larger for children living in single‑parent (32.5%) and jobless (63.9%) households. Given that the likelihood of growing up in poverty significantly varies across household types and socio‑economic situations, anti-poverty policies need to span a wide range of policy domains. This chapter analyses different anti-poverty policies across OECD countries, including employment policies, social benefits, and increased service delivery. The chapter also covers the “first 1 000 days” strategy, an approach that seeks to provide tailored support and continuous assistance to pregnant women and families with infants throughout early childhood development. It then sheds a light on fully comprehensive anti-poverty strategies of two countries in particular, France and Ireland.

Evolving Family Models in Spain

5. Tackling child poverty

Abstract

This chapter builds on the work by Thévenon et al. (2018[1]), “Child poverty in the OECD: Trends, determinants and policies to tackle it”, https://doi.org/10.1787/c69de229-en; and Riding et al. (2021[2]), “Looking beyond COVID‑19: Strengthening family support services across the OECD”, https://doi.org/10.1787/86738ab2-en.

On average across OECD countries, 12.9% of children live in relative income poverty (see Chapter 1, Figure 1.7). In five OECD countries (Chile, Costa Rica, Israel, Spain, and Turkey), more than 20% of children live in relative poverty, whereas in 12 other OECD countries less than 10% of children live in relative income poverty. The lowest child relative income poverty rates can be found in Denmark and Finland, at below 5%. In 26 of the 37 OECD member countries for which the statistic is available, relative poverty rates for children are higher than poverty rates for the total population, with an average gap of around 1.2 percentage points.

Despite considerable efforts and the introduction across OECD countries of policies aimed at tackling child poverty, child relative poverty rates have increased between 2006 and 2016 in 11 of the 21 OECD countries with available data.1 The likelihood of growing up in poverty also varies across different types of household and with the employment status of the household. The OECD average poverty rate in households with children and only a single adult is, at 32.5%, more than three times higher than the poverty rate in households with children and two or more adults (9.8%).2 Similarly, poverty rates tend to be much higher in jobless households than in households where at least one adult works.3 On average across the OECD, 63.9% of individuals living in jobless households with children also live in relative income poverty, compared to only 8.9% of individuals in working households with children.

Poverty typically results from a large number of interrelated factors that all need to be taken into account when designing policies (Thévenon et al., 2018[1]). The macroeconomic environment and policy settings affect people’s labour market outcomes and fertility decisions, which in turn influence household income. A country’s tax and benefit system and broader social policy settings can mitigate the effects of demographic and economic changes on disposable household income, and thus poverty.

As such, anti-poverty policies need to span a wide range of policy domains, including employment policies, education and training, cash transfers, housing support, food security, family planning etc. Interventions in these areas can be grouped into two main groups. The first approach consists of redistributive transfers in cash or kind, generally targeted to households who are deemed poor based on observable criteria. The second type of policy intervention tends to work more directly at the market and institutional failures, essentially by making the key factor markets (labour, credit, and land) work better from the perspective of poor people, and giving them better legal protection.

Policy makers need to find the right balance between protection and promotion. On the one hand, protection policies help people deal with uninsured risks and avoid transient poverty, by providing short-term support to avoid that current consumption does not fall below a crucial level, even when some people are trapped in poverty. On the other hand, promotion policies aim to help people escaping poverty permanently. Such policies permit a sufficiently large wealth gain to put people in poverty on a path to reach a higher and stable level of productivity and wealth. As there are limits to the extent to which redistributive taxes and transfers can be used to reduce poverty while maintaining work incentives, the use of protection policies must be accompanied by more structural promotion policies that act on risk factors in a more sustainable way.

Quality employment protects against poverty

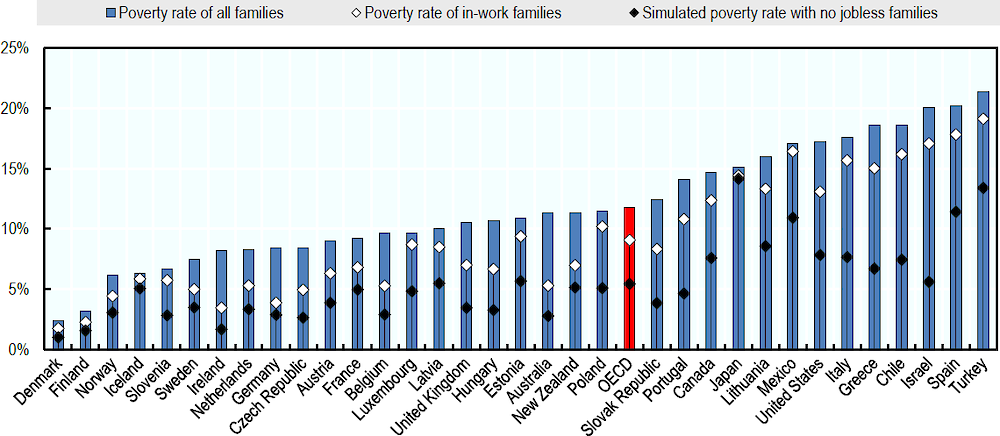

Increasing parental employment can be expected to lead to a major reduction in child poverty. A basic simulation presented in OECD (2018[3]) can serve to illustrate the point. If all parents were to be in paid employment (and assuming that poverty rates of working families remain at their current levels), the poverty rate in families with children would half, from an OECD average of 11% to 5.4% (Figure 5.1). In Spain, family poverty rates would fall from 20.2% to 11.4% if there were no jobless parents.

Figure 5.1. Poverty in Spain could be significantly reduced by raising parental employment

Notes: The scenario with no jobless families assumes no jobless single parents and all two‑parent families having two earners. The current poverty rates applying to families with working parents are then applied to all families with children to estimate the rate that would result if all parents were in employment. On average, the poverty rate for families with children would be halved (from 11 to 5.4%) if all parents had a job.

Source: OECD (2018[3]), “Poor Children in Rich Countries: Why We Need Policy Action”, using data of the OECD Income Distribution Database, http://oe.cd/idd.

However, employment is no guaranteed remedy against high poverty rates (Nieuwenhuis, 2020[4]). The quality of a job is an equally important determinant of poverty, in particular among Spanish households. Shorter working hours and lower real minimum wages in the aftermath of the global financial crisis significantly contributed to lower income of full-time working fathers in Spain. Helping parents gain good-quality employment is therefore crucial for reducing child poverty and reversing the decline in living standards experienced by many families. It involves enabling parents to have a stable and if possible full-time job.

Thévenon et al. (2018[1]) point towards four key policy tools that can help in addressing the different employment barriers that poor families face, including:

Ensuring that barriers to employment are removed, including for the most disadvantaged people whose health status, social problems or low skill levels keep them away from the labour market. It requires accompanying intensively hard-to-place unemployed people and adapt assistance to provide better opportunities for them to participate in the labour market and move up (OECD, 2015[5]).

Making work pay for both parents and ensuring that tax/benefit systems provide first and second earners in couple families with equally strong financial incentives to work. Tax and benefit systems should ensure that employment of the second earner in a two‑parent family or that of a single parent pays off, including after the costs of childcare have been paid and even if being employed results in the withdrawal of certain assistance benefits. Such policy settings encourage parental employment and durably protect children against poverty (OECD, 2011[6]).

Enhancing access to affordable all-day childcare after parental leave, to ensure low income parents can work full year and full-time and increase their earnings. In many countries, children from low-income families have a much lower access to formal childcare than wealthier families (OECD, 2020[7]). Children in single‑parent families are less likely than their counterparts in two‑parent families to be covered by childcare services, even though they lack the time partners spend on childcare. After-school care services are also needed for parents with school-aged children. Access to childcare services that are compatible with irregular or atypical hours is necessary for parents working outside standard schedules.

Granting learning and training opportunities to low-skilled parents. In order to combat chronic poverty and ensure upward mobility opportunities, parents from low-income families must be provided with opportunities to improve their skills and get access to better paid jobs (OECD, 2018[8]). Countries can encourage the vocational training market to develop a supply adapted to the needs of the least qualified and affordable for low-income families. In a longer term perspective, promoting high quality education system (including initial education and vocational training) is needed to prevent the risk of falling into chronic poverty.

Increasing the minimum wage may also be an option for reducing families’ risk of extreme poverty in the short term, but its long-run impact on poverty is likely to be limited due to the possible adverse effect on the employment rate of low skilled workers (OECD, 2015[5]; Bradbury, Jäntti and Lindahl, 2017[9]). The effect of raising the minimum wage on poverty depends on whether wage income is above or below the poverty line prior to the increase, as well as the incomes of other family members. Most US studies show that minimum wage increases would only have a small impact on poverty rates – though they nonetheless would tend to help families in the lower part of the income distribution (Bernstein and Shierholz, 2014[10]; Dube, 2019[11]; Sabia, 2014[12]; Moffitt, 2015[13]).

Returning to work is central to reducing the risk of poverty for families. However, having at least one parent working is not always a guarantee of getting out of poverty. On average across the OECD, slightly less than one in ten families with children and just one working parent lives on an income below the poverty line. For these families, as well as those where parents are not immediately employable, support with cash benefits and services is important.

Social transfers benefit poor children

In addition to employment-related measures, social benefits have an important role to play in reducing child poverty. In most OECD countries, per capita social expenditure has increased in recent decades. This growth in spending has coincided with a reduction in child poverty, with effects that appear particularly strong when the share of spending on low-income households increases. Estimations by Thévenon et al. (2018[1]), using data for 27 OECD countries from the mid‑1990s to 2013/14, show that, on average, a 1% increase in per capita social expenditure is associated with roughly a 1% reduction in the relative child poverty rate.

Not only the level of social spending matters, but also the way in which it is targeted at the poorest populations. At given expenditure levels, reductions in child poverty are larger when a larger share of expenditure is directed towards the poorest fraction of the population – in line with the existing literature despite some mixed results (Box 5.1). More detailed analysis by Thévenon et al. (2018[1]), on changes in the poverty rate by family type, suggests that higher rates of social assistance payments are particularly efficient in reducing the poverty rate for families with two parents, whereas housing benefits are successful in reducing poverty among one‑parent families and families with two jobless parents.

Box 5.1. Universal benefits versus targeting

The literature on the effectiveness of targeting social transfers to the poorest to reduce family poverty rates generates some contradictory results. Korpi and Palme (1998[14]) suggested the existence of a paradox in that benefits targeted at the poor achieve less redistribution than universal benefits, the main reason being that universal benefits receive wider popular support so that their payment rate can be set at a higher level than the targeted ones. Recent evidence suggests, however, that targeting is no longer necessarily associated with lower levels of redistribution (Kenworthy, 2011[15]; Marx, Salanauskaite and Verbist, 2013[16]; Jacques and Noël, 2018[17]).

From a child perspective, Van Lancker and Van Mechelen (2015[18]) pointed out, on the basis of cross-section data for 26 European countries, that targeting child benefits and child-related tax allowances towards lower incomes is associated with higher levels of child poverty reduction. Similarly, with short time series data from 2004 to 2011, Diris, Vandenbroucke and Verbist (2017[19]) found that increased pro-poorness leads often to lower poverty rates, but that the effect sizes are quite modest, and strongly dependent on how targeting is defined. In practice, countries very often have a family support system that is neither totally universal nor totally targeted towards the poor (Morissens, 2018[20]). Many countries are “targeting within universalism” when, for example, there is a universal family allowance supplemented by specific assistance for specific groups, particularly single‑parent families.

However, time series analyses do not always lead to the same findings. Some evidence suggests that within countries the reduction of income inequality and the incidence of poverty are generally lower during periods when net cash transfers – considering the whole of the tax and benefit system – have been more closely targeted on lower income households (Mcknight, 2015[21]).

Source: Thévenon et al. (2018[1]), “Child poverty in the OECD: Trends, determinants and policies to tackle it”, https://doi.org/10.1787/c69de229-en.

Nevertheless, the poverty rate of jobless single‑parent families does not appear to be affected by the level of payment rates for assistance and housing allowances, probably because their standard of living before tax and transfers is so low that increases in the payment rates of housing allowances have been not high enough to lift these families out of poverty. In addition, the erosion of the social protection floor over time has limited the impact of social transfers on poverty reduction. Although social assistance benefits (whether they are paid in the form of social assistance or housing benefits) are important levers to reduce poverty among certain groups of vulnerable families, they are nonetheless insufficient to lift the most economically disadvantaged families out of poverty. As argued in Thévenon et al. (2018[1]), closing the poverty gap would imply increasing social transfers for working and non-working households, while maintaining average financial participation incentives at the bottom of the income distribution. Such policy combination would require a significant increase in public spending.

That said, investment in families is most efficient if it starts when children are young. OECD analysis of early years’ tax and benefit policies shows that the greatest variation in household income occurs for families with children in the period from birth to around the age of four, which is a period critical for child development and parental career development (OECD, 2011[6]). During the early years, sole‑parent families generally face the highest risk of falling into poverty, compared with other family types. Starting to spend early on children is efficient, as it can yield a higher return than later investment for outcomes such as cognitive development. Spending early on children also contributes to equity as it reduces gaps between rich and poor families. The family environment not only plays a key role for a range of children outcomes but also lays the basis for long-term outcomes.

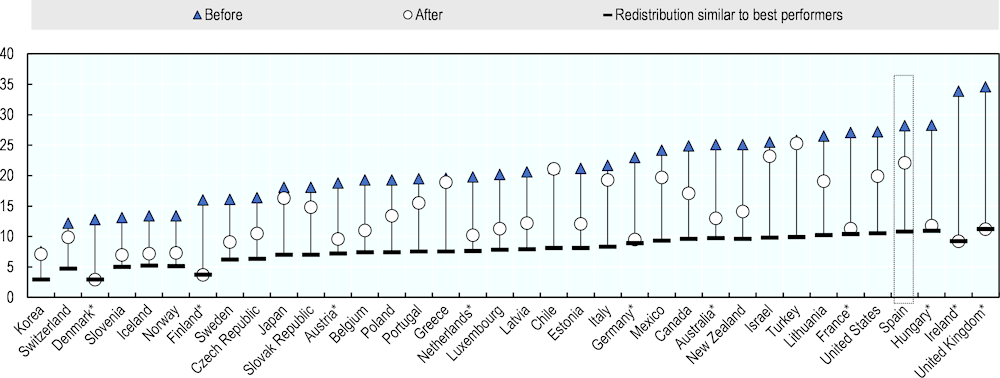

If Spain were to align its redistribution strategy to the ten OECD countries that reach the strongest reduction in family poverty through taxes and transfers, family poverty rates would reduce from 28% to about 11% (Figure 5.2). This scenario hypothesises a family poverty rate that Spain would reach if it were to achieve a poverty reduction similar to the ten best-performing OECD countries. If Spain were to reduce poverty as much as Denmark (the best-performing OECD country in reducing poverty through taxes and transfers), family poverty in Spain would only be 6.4%.

Figure 5.2. Spain could reduce family poverty considerably through redistribution

Note: The figure shows the actual poverty rates before and after taxes and transfers, as well as the simulated rates if all countries had the same reduction in child poverty as the mean of the ten best performing countries (i.e. those countries with a poverty reduction that is greater than the mean poverty reduction by 0.5 of a standard deviation). The top performing countries are marked with an asterisk. Countries that perform better than the benchmark are assumed to be unchanged.

Source: Simulation performed by Thévenon et al. (2018[1]), “Child poverty in the OECD: Trends, determinants and policies to tackle it “, https://doi.org/10.1787/c69de229-en, based on data from the OECD Income Distribution Database, http://oe.cd/idd.

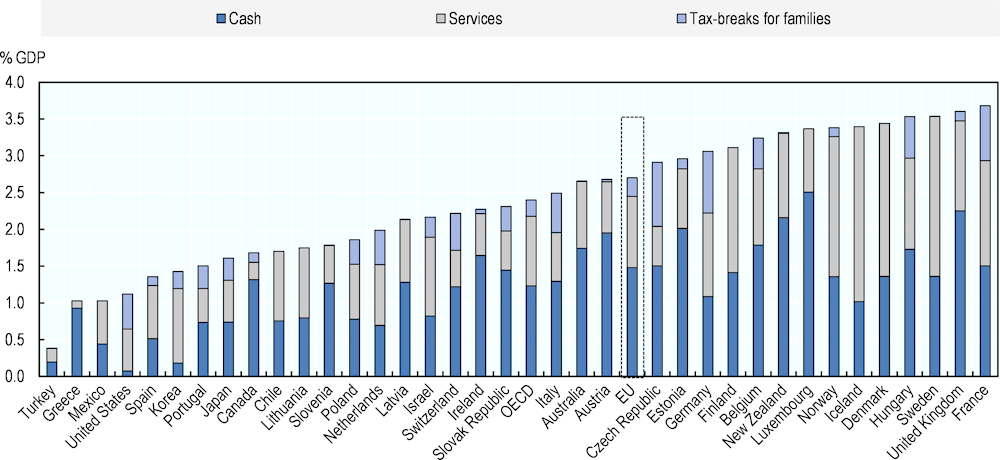

These simulations show that poverty can indeed be significantly reduced through the right set of social-fiscal policy settings. Even so, the approaches of these countries tend to differ significantly. For instance, Denmark devotes 61% of its spending on families to services, whereas countries like Austria and Ireland devote only 25% to services and instead heavily focus on cash benefits (Figure 5.3). Overall, all best-performing OECD countries devote considerable government budgets to families, and reducing family poverty through taxes and transfers would require a considerable increase in expenditure on families by the Spanish Government. Among the ten best performing OECD countries considered in this exercise, eight countries spend more on families than the OECD average – which stood at 2.4% of GDP in the mid‑2010s). To reach the OECD average, Spain would need to nearly double its spending on families (1.4% of GPD in the mid‑2010s). Especially the expenditure on cash benefits is very low compared with the OECD average.

The majority of OECD countries transfer at least 1% of GDP to families with children in the form of cash benefits, on average this amounts to about 1.2% (Figure 5.3). Spain, in contrast, devotes only 0.5% of GDP in cash benefits to families. Other OECD countries spends most of their family budget on family allowances, child benefits or working family payments, but also on maternity, paternity and parental leave payments and birth grants. A number of OECD countries also include one‑off benefits such as back to school supplements or social grants in these amounts (such as payments to support one‑off purchases for the home).

Figure 5.3. Spain spends very little on family benefits and services compared with OECD countries

Note: Public spending accounted for here concerns public support that is exclusively for families (e.g. child payments and allowances, parental leave benefits and childcare support). Spending in other social policy areas such as health and housing support also assists families, but not exclusively, and is not included here. Coverage of spending on family and community services in the OECD Social Expenditure data may be limited as such services are often provided and/or co-financed by local governments. The latter may receive general block grants to finance their activities, and reporting requirements may not be sufficiently detailed for central statistical agencies to have a detailed view of the nature of local spending. In Nordic countries (where local government is heavily involved in service delivery), this does not lead to large gaps in the measurement of spending, but it does for some countries with a federal structure, for example, Canada and Switzerland. Data for the Netherlands and New Zealand refer to 2011, for Poland to 2014. For Lithuania, data on tax breaks towards families are not available. For Switzerland, data on tax breaks for families are estimated by the national correspondent. The OECD‑32 average and EU average exclude Lithuania, the Netherlands, New Zealand, and Poland, where applicable.

Source: OECD Family Database, Indicator PF1.1 Public spending on family benefits, https://www.oecd.org/els/family/database.htm, based on the OECD Social Expenditure Database, http://www.oecd.org/social/expenditure.htm.

In-kind payments or public services for families, including childcare services, amount to 0.9% of GDP across the OECD on average. In-kind services can include childcare and day care services, home help for families, and a suite of family social services. The largest “service providers” are Denmark, Iceland and Sweden – which spend around three times as much on services as Spain, over 2% of their GDP in total. France also spends significant amounts on services for families (1.4% of GDP), compared to 0.7% of GDP in Spain.

While redistribution through tax breaks has been growing in OECD countries in recent years, the administration of child benefits through tax systems is not always straightforward (Box 5.2). Non take‑up can be substantial due to application obstacles, lack of awareness on eligibility or lack of trust. Administrative simplicity, flexibility for changing circumstances, ease of compliance and additional outreach efforts are crucial to reach all families that are eligible. Lessons learned from behavioural insights, automation and artificial intelligence can help to ensure that more people claim eligible tax benefits.

Box 5.2. Main ways to support families

The main ways in which families are supported in OECD social protection systems are through cash benefits (periodic and one‑off), in-kind service provisions including childcare (again periodic or one off), and tax breaks. Different spending choices by type may reflect different priorities in terms of family and children’s outcomes, administration and coverage, and broader policy goals.

Cash benefits

Cash benefits are popular tools in social protection systems due to their relative flexibility; they can be adapted relatively easily and so respond faster to needs or targets such as poverty rates, or the need to cut spending in times of budgetary constraint. Options to means-test cash benefits can add precision to interventions designed to raise minimum standards of living. Cash transfers are also more transparent; their costs can be quickly assessed, and outcomes can be evaluated over a shorter period than service interventions. Broadly, cash benefits can be categorised into two types: a “horizontal” transfer, which moves income from one group in society to another (such as universal family benefits) and “vertical” transfers which moves income from one point in a person’s lifecycle to another (such as social insurance‑ based leave policies). Efforts to influence how families spend their cash payments, by naming benefits as “child” benefits or paying them to the mother rather than to the father, add to the flexibility of this type of intervention. Moreover, there are examples of cash benefits being used in OECD countries as incentives to take‑up services, such as immunisations or other health services (e.g. the Australian immunisation allowance, the Finnish and Hungarian birth grants).

Tax breaks

Tax breaks are seen as more efficient for encouraging work in comparison to cash benefits. However, they may not be as easily applied to directly improving family outcomes, such as child poverty targets, if work is not readily available or paid at a low wage. As with cash benefits, the costs and effects of tax break policies can be quickly assessed. Over the past decades, this type of redistribution has been growing in the OECD, reflecting the evolution of tax and benefit systems designed to encourage welfare through work.

The administration of child benefits through tax systems can be challenging. Non take‑up can be substantial due to application obstacles, lack of awareness on eligibility or lack of trust. Lessons learned from the Child Tax Credit in the United Kingdom (phased out in the meanwhile) and the Family Tax Benefit in Australia (initially managed by the Taxation Office) show that certain elements are crucial to reach all families that are eligible, including administrative simplicity (e.g. an online application platform), flexibility for changing circumstances (possibility to make regular updates), ease of compliance (avoiding duplicate verification) and additional outreach efforts (e.g. through information sharing across agencies) (Hammond and Koggan, 2021[22]). Behavioural insights, automation and artificial intelligence can also help to ensure that more people claim eligible tax benefits (OECD, 2019[23]).

Services

In the case of services, issues of flexibility and short-term outcomes may not be the priorities. As opposed to cash transfers, which can be used for anything once paid to the family, services are earmarked for specific purposes. Family services can be categorised into the following policy areas: basic material needs; health care; family functioning support services; parenting support and early intervention; child protection services; and specialised services to address specific or complex needs. The well-established “cascading approach” of social services develops family support services along universal supports at a very early age, which help to identify special needs to be addressed by specialised services. Since each family is unique, the family support system needs to flexible in its approach to working with children and families. Countries with relatively high commitments to in-kind spending are often countries with good outcomes as measured in terms of child well-being. The challenge for all countries is to deliver services efficiently.

Source: OECD (2011[6]), Doing Better for Families, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264098732-en; and OECD (2021[24]), Looking beyond COVID‑19: Strengthening family support services across the OECD, OECD Publishing, Paris, https://www.oecd.org/els/family/fss2021-brief-covid.pdf.

Addressing complex needs through increased service capacity

Many of the OECD countries that perform well in comparisons of poverty and child well-being are strong investors in service delivery (OECD, 2011[6]). Addressing the needs of families in poverty indeed requires dealing with different issues that often intersect (OECD, 2021[24]). Case management of vulnerable families can be particularly complex for service providers as multiple issues such as poverty, addiction, domestic violence, or health issues have to be addressed for family support to be effective. Vulnerable families with the highest service needs are often those least likely to access mainstream services (OECD, 2015[25]). Matching families with services that meet their needs thus requires close co‑ordination between various organisations delivering services.

A first step towards the development of an integrated approach of service delivery are whole‑government initiatives and co‑ordinated national strategies targeting parents and children or vulnerable families. For example, Lithuania’s Action Plan for Complex Family Services (2016‑20) is implemented in collaboration with 60 municipalities throughout the country (OECD, 2021[24]). The plan aims to ensure access to community support services for families in case of emergency, as well as supports towards the reconciliation of work and family commitments.

Another way to build integrated family support systems are inter-governmental working groups and committees that bring together various levels of governments and ministries. Public family support agencies can join their efforts through funding, co‑ordinated guidelines, and collaboration of monitoring and assessment of services. Australia is a working example of prioritising integration and joining-up services. Over the past decades, the Australian Government has made specific funds available for improving collaboration between service providers, community members, non-government organisations, businesses and all levels of government (OECD, 2015[25]).

The co‑ordination of services across sectors through case‑management is a third way to enhance service coherence. In this case, a case manager, also called family support worker, community development worker or project worker, helps families address key issues and connect with various support services. Case managers typically focus on building a long-term working relationships with the family to provide ongoing support and information. A key point of a client-centred approach to making family services successful is to treat the family as one whole unit and to consider the needs of all family members through approaches that may vary (Box 5.3).

Finally, the most comprehensive form of integration is the provision of services within one organisation. For example, the YMCA in Halifax is the largest multiservice organisation for women in Atlantic Canada (Riding et al., 2021[2]). Their services include housing, anti-human trafficking support, emergency employment programmes, childcare and early learning, microloans, financial literacy, income tax clinics, and peer leadership training. They work with multidisciplinary teams and use a co‑ordinated plan of support to engage in joint problem solving. When the necessary resources to develop such a comprehensive approach are not available, an alternative to multiservice organisations is case conferencing. This approach allows practitioners from various organisations working with the same family to periodically come together to discuss a co‑ordinated support plan, preferable with the family present.

The combination of conditional cash transfers and support services can be an effective way to increase service take‑up and enhance their impact on family outcomes. For instance, the payment of a cash benefit can be made conditional on the participation in a specific programme, like medical screening, school meals or parenting classes. The evidence from experimental studies on “Cash+” suggest this combination attains better outcomes than when supports and cash transfers are provided separately (Bastagli et al., 2016[26]). The recent OECD report on Strengthening family support services across the OECD show that this approach is increasingly popular in OECD countries (Riding et al., 2021[2]). About half of capital cities support families in need who are taking up services through conditional cash transfers.

Box 5.3. Delivering services that prioritise families

Practitioners who work with families as a unit rather than only supporting one member of the family provide opportunities for more holistic interventions. Service providers can utilise various strategies to support families who are facing multiple issues.

Two-generation approach

Supporting families through a two‑generation approach aims to improve family outcomes through access to services which enhance human capital and provide programming for adults and children (Lindsay Chase-Lansdale and Brooks-Gunn, 2014[27]; Acquah and Thévenon, 2020[28]). Two-generation programmes support children by investing in parents and increasing their capabilities by way of financial literacy programmes, postsecondary education, and job training. Two-generational programming also include health and education services, early childhood education, programmes addressing issues related to childhood trauma, parenting programmes, literacy, addressing mental health issues and prevention of child abuse or domestic violence.

Home visiting

Through various in-home support programmes, trained practitioners work within the family home to target a range of outcomes including improved maternal and child health, prevention of child abuse or maltreatment and improved school readiness and reduce barriers of accessing service. Delivering services at home represents a number of advantages: these approaches can effectively address some of the barriers related to vulnerable families’ take up of services, including issues such as affordability and physical accessibility to services. Home‑based models of family support address issues such as transport, child care or lack of motivation and can enhance families’ feelings of security when dealing with service providers. Seeing the families’ home environment also allows professionals to gain better understanding of the needs of parents and their children, and tailor their services (Michalopoulous et al., 2017[29]).

Wraparound services

Wraparound supports aim to provide services to families with complex needs while collaborating with all areas of a client’s environment such as schools or workplaces, family and natural supports, and community-based supports (Thomson et al., 2017[30]; Vandenberg et al., 2003[31]; Silva et al., 2020[32]). For example, in Ireland the Family Matters: Area Based Childhood (ABC) programmes provide individualised wraparound supports to parents living in homeless or emergency accommodation. In addition, their home visiting support services are provided to expectant mothers to prepare them for the birth, reduce anxiety and encourage parents to engage with the relevant maternity services. Practitioners from the Family Matters programmes work collaboratively with various community specialists, social workers and public health nurses in order to support the family’s needs.

Sources: OECD (2021[24]) “Looking beyond COVID‑19: Strengthening family support services across the OECD”, Employment, Labour and Social Affairs Policy Briefs, OECD, Paris,

The first 1 000 days of children’s life

A growing body of evidence suggests that the period of pregnancy and the first 1 000 days of a child’s life are particularly important for their development and future outcomes (Riding et al., 2021[2]). This approach seeks to provide tailored supports to pregnant women and families with infants, identifying their individual needs, and addressing them before small problems turn into serious issues. The “first 1 000 days” strategy, used in countries like Australia, New Zealand, Finland, France and the United Kingdom, puts an emphasis on providing continuous assistance throughout early childhood development, as well as on the ability of the health care and social systems to do wellness checks, identify families’ needs and detect problems early and guide families to appropriate services (Box 5.4).

Box 5.4. Strong foundations: Getting it right in the first 1 000 days

The earliest stages of child development – from conception to the child’s second birthday – has become known in policy and research circles as the “First 1 000 Days” and has helped frame the type of supports very young children and their families need in order to give children the best possible start to life ( (Moore, 2018[33]; Gradovski et al., 2019[34]). The special focus on the first 1 000 days comes from the growing body of scientific evidence showing the importance of the early life experiences for long-term healthy development and well-being. The first 1 000 days of life are regarded as the period in people’s lives when public policy can have the most positive impact as brain plasticity is at its highest (Moore, 2018[33])

All OECD countries provide pregnant women and parents of new-born babies and small children supports with regards to health care, and work and caring commitments (e.g. parental leave and childcare), or additional income support where needed. However, the perspective of the First 1 000 Days would add several dimensions to this policy mix by putting an emphasis on (Moore, 2018[33]; Pentecost and Ross, 2019[35]; Cyrulnik, 2020[36]):

The continuous support that is needed from pregnancy and throughout the early years of life to make parent’s work commitments compatible with early child development;

Screening and preventive measures from the pre‑natal period to ensure that possible child health issues do not accumulate over time, but are addressed through early intervention;

The important roles of parents and the community in helping children reach their potential is leveraged. Providing parents with information and support around developing positive parenting practices and nurturing children’s development is key.

The provision of personalised supports plans, adjusted to the needs of children and parents, and help for families to navigate the system.

A whole‑of-government approach ensures that measures adopted in different policy areas are based on a common framework and shared objectives for enhancing early child development.

A few OECD countries, for example, Australia, Finland, France, New Zealand and the United Kingdom have put forward a First 1 000 Days approach to structure policies for families with very young children. These initiatives share common features, such as measures to combat family poverty and help parents reconcile work and family commitments, support for good maternal and paternal physical and mental health, enhancing parents’ awareness of good nutrition practices, improving the quality of parent-child interactions and reducing family stress, and improving the quality of childcare.

Services around childbirth can also include some kind of coaching to help expectant parents become parents. In Helsinki (Finland), for instance, multi-professional family-coaching is offered to first-time fathers and mothers, including family coaching and physiotherapy groups at maternity clinics prior to childbirth as well as family activities at playgrounds upon childbirth.

Some countries focus their programmes on particular groups of children, for example, in Australia and New Zealand, on improving the well-being of Indigenous children (Arabena, Panozzo and Ritte, 2016[37]). In France, part of the First 1 000 Days approach is the extension of paternity leave from 14 to 28 days to encourage fathers to spend more time caring for their babies to help support the bond between father and child that develops in the first year of life through the caregiving relationship (Cyrulnik, 2020[36]).

Source: Riding et al. (2021[2]), “Looking beyond COVID‑19: Strengthening family support services across the OECD”, https://doi.org/10.1787/86738ab2-en.

A comprehensive anti-poverty strategy for families

The variety of factors driving the evolution of family income suggest that only a range of policies addressing all these factors can significantly and durably improve children’s standard of living and reduce their exposure to poverty. Labour market-oriented policies can and should play a crucial role in reducing poverty, but adequate income protection schemes and family-oriented benefits remain also important instruments for improving the effectiveness of poverty alleviation. It involves measures with different objectives and means to either prevent poverty (by in particular raising parental employment and/or raising income gains from employment) or protect children and families (by ensuring that the assistance provided by financial aid covers all poor children and that it responds to the changing characteristics of poor families).

Some OECD countries tend to focus on prevention, particularly through activation policies aimed at reducing poverty by empowering parents to return to stable employment. In this case, a protective component may be missing for families whose jobs do not pay enough to get out of poverty or for whom there are many obstacles before they can work. Conversely, other OECD countries provide a relatively generous package of financial transfers to reduce poverty without, however, developing enough support for parents to get a job and reconcile work and family life. These two pillars are therefore important to develop simultaneously.

A successful anti-poverty strategy requires policies not only to reduce the incidence of income poverty or to prevent it, but also to mitigate many of the consequences that come with income poverty, including material deprivations and barriers to meet basic needs in health, housing and education. Thévenon et al. (2018[1]) highlight various elements that need to be considered in order to break the intergenerational transmission of disadvantages and improve opportunities for children from low-income families, including:

Health issues can act as an obstacle to education and result in poor physical and/or educational achievements, adding to the challenges faced by families. Promoting universal access to health care and public health policies that benefit poor children can ensure that children’s basic needs in nutrition, medical supervision and health care are met. Such a provision is especially important for the poorest segments of children who are most at risk of experiencing deprivation in nutrition.

Food insecurity can lead to serious physical growth problems and influence children’s school attendance and performance as well as the development of social skills. National school meal programmes are used in several OECD countries as a way to reach food-insecure school-age children directly and offset hunger and insufficient nutrition. Evaluation of the Healthy Start programme in England suggests that food vouchers can also provide an important nutritional safety net and potentially improve nutrition for pregnant women and young children living on low incomes (McFadden et al., 2014[38]). Finally, nutrition assistance can help direct practices towards healthy diets to combat the high risk of overweight and obesity in children from low-income families (Inchley et al., 2016[39]).

Children from disadvantaged backgrounds are disproportionately likely to miss out on formal early childhood education and care (OECD, 2020[7]). Yet, early interventions in childcare and education are effective policy tools to create level playing fields and to reduce gaps among children. The evidence suggests that the benefits of high quality childcare programmes on child and young adult outcomes are positive and often stronger for children from disadvantaged families than for those of wealth families. To foster the use of childcare services by low-income families and reduce inequalities across children, the availability and affordability of childcare places, as well as perceptions of service quality are crucial.

Economically advantaged parents display more optimal parenting behaviours across a range of domains, including more time spent with children, authoritative parenting, more sensitive and responsive mother-child interactions, greater language stimulation and better parent management. These parenting skills can make a difference for children’s cognitive and non-cognitive skills and underlines the importance of early childhood home education programmes that aim to improve the parenting skills and children’s socio‑emotional skills among disadvantaged groups. Programmes such as the “Thirty Million Words” project in the United States or “Parler Bambin” in France increased conversations and resulted in increased language development.

Finally, children from poor families have a higher risk than others of living in poor quality housing and/or in an environment with noise, pollution, vandalism or crime problems. Low-income families tend to live in less affluent areas with lower quality housing, transport infrastructure, medical and childcare services, schools and sports and leisure facilities. Addressing spatial segregation would help to increase opportunities for children from disadvantaged backgrounds, but requires a range of well-co‑ordinated local development and urban planning policies, including measures for housing and transport.

The remainder of this section sheds a light on the anti-poverty strategies of two countries in particular, France and Ireland:

France has taken a number of actions to prevent and fight poverty of families and children. First, the National Strategy to Prevent and Fight Poverty strengthens social investments in areas of education and training as well as support services and social emancipation through employment. Second, the National Child Protection Strategy (2020‑22) gives priority to preventative measures and in treating children equally through ensuring equal access to opportunities and protections for all children. Third, the French First 1 000 Days approach aims to build children’s resilience by starting in the earliest stages of life. Box 5.5 describes each of these strategies in detail.

In Ireland, the Child and Family Agency was established in 2014 and is now the dedicated State agency responsible for improving well-being and outcomes for children. It represents the most comprehensive reform of child protection, early intervention and family support services ever undertaken in Ireland. It was an ambitious move bringing together over 4 000 staff and an operational budget of over EUR 750 million. More information on Ireland’s anti-poverty strategy can be found in Box 5.6.

Box 5.5. France’s anti-poverty strategies

National Strategy to Prevent and Fight Poverty

France commits EUR 8.5 billion between 2018‑22 to its National Strategy to Prevent and Fight Poverty to grant equal opportunities to all children and guarantee their fundamental rights on a daily basis (Délégation interministérielle à la prévention et à la lutte contre la pauvreté, 2018[40]). Through this strategy, social investments are made in areas of education and training as well as support services and social emancipation through employment. The strategy calls for further investment in public services, such as crèches, schools, social centres, associations to ensure equal opportunities from the very first steps of life, in addition to amplify existing educational effort, supporting parents, strengthen local social action, preventing isolation, guaranteeing access to rights and essential services for the most vulnerable. This ambitious strategy dedicates more than EUR 2.1 billion to social investment and poverty prevention, more than EUR 2.5 billion for support towards employment and EUR 3.9 billion for the revaluation of the activity allowance. Specific targets include:

Providing equal chances from the start (EUR 1.24 million) through training and hiring 600 000 more professionals in early childhood education and as kindergarten aids, and achieving social diversity in childcare facilities with 90 000 places allocated to a ‘social mix’ bonus and the introduction of a third-party payment method. These measures also include the development of childcare facilities, particularly in vulnerable areas, with the creation of a “territory” bonus to reduce the remaining costs to less than 10% for municipalities, creating 300 new social centres dedicated to the support of parenthood in priority areas, strengthening the transparency of the allocation of day-care places, and supporting communities in 60 priority neighbourhoods with two adults per kindergarten class.

Guaranteeing children’s fundamental rights on a daily basis (EUR 271 000) through subsidised school meal programmes in targeted areas, social services specialising in child protection mechanisms and dedication to developing and adapting the supply of accommodation and housing including following a Housing First strategy.

Obligatory schooling for children under 18 (EUR 439 000) in order to prevent school drop outs and programmes to identify, re‑engage and (re)mobilise young people at risk of exclusion to lead them towards a support and training pathway. These measures include calls for projects and additional permanent funding for youth drop-in centres and specialised prevention associations as well as dedicated to solutions to help all young people find employment, in addition to an extension of the Youth Guarantee (500 000 beneficiaries between 2018 and 2022).

Equal access to social rights (EUR 4.97 million) by simplifying the system of minimum social and health benefits towards a universal activity income and access to health care services. This measure includes modernising the delivery of social benefits by promoting the exchange of information between actors, by making procedures automatic and by promoting payment of the right amount, and by generalizing data mining to identify potential beneficiaries.

Investing in employment opportunities for all (EUR 1.04 million) through the creation of an activity guarantee combining reinforced social support and integration into employment for 300 000 beneficiaries per year and additional support for vulnerable populations.

National Child Protection Strategy

In addition to an economic focus on reducing the impacts of poverty of children, France has taken a number of actions to promote the well-being of vulnerable children. Through stakeholder consultation with families and children as well as with social workers and departmental officials, the Ministry of Solidarity and Health developed the National Child Protection Strategy (2020‑22), which gives priority to preventative measures and treating children equally (Ministère des solidarités et de la santé, 2019[41]).

The National strategy’s four main goals aim to guarantee children their rights to health, education, emotional security and autonomy after 18 years of age. These goals include responding to the needs of children and their families as early as possible such as obligatory prenatal check-ups, carrying out children’s health checks in kindergarten for children ages 3‑4, increasing the number of home visits for pre and post-natal care in addition to increasing health consultations for children 0‑6 years old; securing the pathways of protecting children and preventing family ruptures such as reinforcing the process of referrals and access to relevant information in order to better reach parents facing particular situations of vulnerability; promoting methods in which children can be informed of their rights and enabled to act on behalf of their best interest; providing children solid foundations in order to secure their future.

The strategy increases dialogue between the State and the relevant departments on subjects such as deadlines for the execution of justice measures, assessing the multiple displacements that certain children undergo, follow-up in access to health services, and addressing the responsibility of child protected matters for the more vulnerable including children with disabilities and mental health issues. It also aims to give children a voice in order to better take into account their opinions and experiences.

First 1 000 Days

In September 2020, France announced its “First 1 000 Days” approach to build children’s resilience by starting in the earliest stages of life (Ministère des solidarités et de la santé, 2020[42]). The aim of this approach is to promote equal opportunities for good physical, mental and social health through a policy of prevention and support aimed at improving the quality of life, starting during pregnancy until a child’s third anniversary. The French First 1 000 Days approach is built around five axes: (1) formulating a coherent public health discourse for the first 1 000 days; (2) offering personalised support to parents through the 1 000‑day pathway; (3) providing an individualised response throughout the process, adapted to the fragility and specificities of the child and its parents; (4) giving families and their young children the time and space they need through birth leave and childcare facilities; and (5) translating this unprecedented ambition into research, evaluation of practices and training of professionals.

Four concrete policy measures have been taken:

The extension of paternity leave from 14 to 28 days, of which 7 days compulsory. This measure came into force on 1 July 2021. In the case of twin or triplets, fathers benefit from 35 days of paternity leave (instead of 18 days previously). These extensions are only a first step, as the report by the Ministry of Solidarity and Health recommended 9 weeks of paternity leave (Ministère des solidarités et de la santé, 2020[42]).

The generalisation of the early prenatal interview. Until 2020, this interview was simply offered to future parents, but a survey showed that only 27% of couples took advantage of it. The midwife or doctor now must inform their patient as soon as the pregnancy is declared in order to schedule the interview before 4 months of pregnancy. It should allow for an exchange with the couple and identify any health or social weaknesses. A personalised 1 000‑day course can then be proposed, with maternity support at home.

Key messages for parents. During stakeholder consultation for the report, parents expressed difficulties in finding their way through the sometimes contradictory information given by professionals, on the internet, on social networks or by friends and family. The aim is therefore to convey ten (or so) key messages on breastfeeding, exposure to screens and ordinary educational violence. This information is now specified in the child’s health record and an application entitled “1 000 first days” has been created.

Better support after the birth of the child, in particular for the couples who need it most. Home visits after the birth will be set up, and resources of maternity wards and Maternal and Child Protection (PMI) centres will be increased. Ten new units and 20 additional mobile teams in perinatal psychiatry are to be created.

Sources: Délégation interministérielle à la prévention et à la lutte contre la pauvreté (2018[40]), Stratégie nationale de prévention et de lutte contre la pauvreté, https://solidarites-sante.gouv.fr/IMG/pdf/strategie_pauvrete_vfhd.pdf; and Ministère des solidarités et de la santé (2019[41]), Stratégie nationale de prévention et de protection de l’enfance 2020‑22, https://solidarites-sante.gouv.fr/IMG/pdf/dossier_de_presse_-_strategie_nationale_de_prevention_et_protection_de_l_enfance_vf.pdf.

Box 5.6. Ireland’s anti-child poverty strategy

Since 1997, when the first National Anti-Poverty Strategy was published, Ireland has developed various national strategies and frameworks to address child poverty. Ireland’s detailed sectoral plans for social inclusion and reduction in poverty have historically targeted various sectors individually with specific key objectives related to poverty including strategies focused on improving outcomes for children and young people.

The Better Outcomes, Brighter Futures: the National Policy Framework for Children and Young People 2014‑20 represents the first overarching national children’s policy framework comprehending the age ranges spanning children and young people (0 – 24 years) (Department of Children and Youth Affairs, 2014[43]). It adopts a whole of government approach to tackling child poverty and is underpinned by a number of constituent strategies in the areas of early years, youth and participation. The framework set a target of lifting at least 70 000 children out of poverty by 2020 mainly through commitments to improve rates of parental employment and reduce the number of jobless households, and increase investment in evidence‑based, effective services that can improve child poverty outcomes.

Additionally, Ireland has a cross-departmental strategy to support babies, young children and families called the First 5: A Whole‑of-Government Strategy for Babies, Young Children and their Families (2019‑28) (Government of Ireland, 2019[44]). It provides a range of policy options to balance work and family commitments, for example, developing new parental leave scheme for mothers and fathers and greater flexible working arrangements. The Strategy aims to promote positive health behaviours, develop a dedicated child health workforce, reform the early learning and care system through an affordable childcare scheme, and address poverty in early childhood. Overall, the Strategy aims to make significant enhancements to early childhood itself in Ireland and important contributions over short, medium and long term to the lives of young children, their parents, and society and the economy (Riding et al., 2021[2]).

Ireland’s Department of Social Protection holds overall responsibility for the development of a whole‑of-government policy focusing on reducing poverty and improving social inclusion. Their publication of the Roadmap for Social Inclusion 2020‑2025 (Government of Ireland, 2020[45]) aims to move away from a traditional focus on income poverty towards a more inclusive view of methods to tackle poverty. The Roadmap provides a framework for the activities of various Government Departments. Currently, each Government Department addresses poverty reduction and social inclusion in their own strategies. The role of the Roadmap is to provide a broader framework for this work and to set the medium-term direction on a whole‑of-Government basis, identifying the inter-linkages and dependencies across the various stakeholders. The Roadmap presents 7 high-level goals, 22 targets and 66 unique commitments. The high-level goals include supporting families and reducing child poverty through prioritizing increases in family related payments and introducing and extending new family supports.

Sources: Department of Children and Youth Affairs (2014[43]), Better Outcomes, Brighter Futures: the National Policy Framework for Children and Young People 2014‑20, https://www.gov.ie/en/publication/775847-better-outcomes-brighter-futures/; Government of Ireland (2019[44]), First 5: A Whole‑of-Government Strategy for Babies, Young Children and their Families (2019‑28), https://first5.gov.ie/; Government of Ireland, (2020[45]), Roadmap for Social Inclusion 2020‑2025, https://www.gov.ie/pdf/46557/?page=1.

References

[28] Acquah, D. and O. Thévenon (2020), “Delivering evidence based services for all vulnerable families”, OECD Social, Employment and Migration Working Papers, No. 243, OECD Publishing, Paris, https://doi.org/10.1787/1bb808f2-en.

[37] Arabena, K., S. Panozzo and R. Ritte (2016), The First 1000 Days Policy and Implementers Symposium Report, The University of Melbourne, https://www.researchgate.net/publication/305852145_The_First_1000_Days_Policy_and_Im (accessed on 29 October 2020).

[26] Bastagli, F. et al. (2016), “Cash transfers: what does the evidence say. A rigorous review of programme impact and the role of design and implementation features. London: ODI, 1(7).”, ODI, Vol. 1/7.

[10] Bernstein, J. and H. Shierholz (2014), “The minimum wage: A crucial labor standard that is well targeted to low- and moderate-income households”, Journal of Policy Analysis and Management, Vol. 33/4, pp. 1036-1043, https://doi.org/10.1002/pam.21791.

[9] Bradbury, B., M. Jäntti and L. Lindahl (2017), “Labour income, social transfers and child poverty”, LIS Working Paper Series, No. 707, http://www.lisdatacenter.org/wps/liswps/707.pdf (accessed on 6 December 2021).

[36] Cyrulnik, B. (2020), Les 1000 premiers jours, Ministère des Solidarités et de la Santé, Paris, https://solidarites-sante.gouv.fr/IMG/pdf/rapport-1000-premiers-jours.pdf (accessed on 29 October 2020).

[40] Délégation interministérielle à la prévention et à la lutte contre la pauvreté (2018), Stratégie nationale de prévention et de lutte contre la pauvreté, Ministère des solidarités et de la santé, Paris, https://solidarites-sante.gouv.fr/IMG/pdf/strategie_pauvrete_vfhd.pdf (accessed on 17 August 2021).

[43] Department of Children and Youth Affairs (2014), Better Outcomes, Brighter Futures: the National Policy Framework for Children and Young People 2014-2020, https://www.gov.ie/en/publication/775847-better-outcomes-brighter-futures/ (accessed on 17 August 2021).

[19] Diris, R., F. Vandenbroucke and G. Verbist (2017), “The impact of pensions, transfers and taxes on child poverty in Europe: the role of size, pro-poorness and child orientation”, Socio-Economic Review, p. mww045, https://doi.org/10.1093/ser/mww045.

[11] Dube, A. (2019), “Minimum Wages and the Distribution of Family Incomes”, American Economic Journal: Applied Economics, Vol. 11/4, pp. 268-304, https://doi.org/10.1257/app.20170085.

[45] Government of Ireland (2020), Roadmap for Social Inclusion 2020 - 2025, https://www.gov.ie/pdf/46557/?page=1 (accessed on 17 August 2021).

[44] Government of Ireland (2019), First 5: A Whole-of-Government Strategy for Babies, Young Children and their Families (2019-2028), https://first5.gov.ie/ (accessed on 17 August 2021).

[34] Gradovski, M. et al. (2019), The First 1000 Days of Early Childhood, Springer Singapore, Singapore, https://doi.org/10.1007/978-981-32-9656-5.

[22] Hammond, S. and D. Koggan (2021), Administering a Child Benefit Through the Tax Code: Lessons for the IRS from Abroad, https://www.niskanencenter.org/administering-a-child-benefit-through-the-tax-code-lessons-for-the-irs-from-abroad/ (accessed on 10 December 2021).

[39] Inchley et al. (2016), Growing Up Unequal: Gender and Socioeconomic Differences in Young People’s Health and Well-being, Health Behaviour in School-aged Children, WHO Regional Office for Europe, Geneva.

[17] Jacques, O. and A. Noël (2018), “The case for welfare state universalism, or the lasting relevance of the paradox of redistribution”, Journal of European Social Policy, Vol. 28/1, pp. 70-85, https://doi.org/10.1177/0958928717700564.

[15] Kenworthy, L. (2011), Progress for the Poor, Oxford University Press, https://doi.org/10.1093/acprof:oso/9780199591527.001.0001.

[14] Korpi, W. and J. Palme (1998), “The Paradox of Redistribution and Strategies of Equality: Welfare State Institutions, Inequality, and Poverty in the Western Countries”, American Sociological Review, Vol. 63/5, p. 661, https://doi.org/10.2307/2657333.

[27] Lindsay Chase-Lansdale, P. and J. Brooks-Gunn (2014), Two--Generation Programs in the Twenty--First Century.

[16] Marx, I., L. Salanauskaite and G. Verbist (2013), “The Paradox of Redistribution Revisited: And that it May Rest in Peace?”, No. 7414, IZA, http://ftp.iza.org/dp7414.pdf (accessed on 18 January 2022).

[38] McFadden, A. et al. (2014), “Can food vouchers improve nutrition and reduce health inequalities in low-income mothers and young children: a multi-method evaluation of the experiences of beneficiaries and practitioners of the Healthy Start programme in England”, BMC Public Health, Vol. 14/1, p. 148, https://doi.org/10.1186/1471-2458-14-148.

[21] Mcknight (2015), ““A fresh look at an old question: is pro-poor targeting of cash transfers more effective than universal systems at reducing inequality and poverty?”, No. 191, CASE, http://sticerd.lse.ac.uk/dps/case/cp/casepaper191.pdf (accessed on 10 April 2018).

[29] Michalopoulous et al., C. (2017), Evidence on the Long-Term Effects of Home-Visiting Programs: Laying the Groundwork for Long-Term Follow-up on the Mother and Infant Home Visiting Program Evaluation (MIHOPE), http://www.acf.hhs.gov/programs/opre (accessed on 18 July 2020).

[42] Ministère des solidarités et de la santé (2020), Les 1000 premiers jours - Là où tout commence, https://solidarites-sante.gouv.fr/IMG/pdf/rapport-1000-premiers-jours.pdf (accessed on 17 August 2021).

[41] Ministère des solidarités et de la santé (2019), Stratégie nationale de prévention et de protection de l’enfance 2020-2022, https://solidarites-sante.gouv.fr/IMG/pdf/dossier_de_presse_-_strategie_nationale_de_prevention_et_protection_de_l_enfance_vf.pdf (accessed on 17 August 2021).

[13] Moffitt, R. (2015), “The Deserving Poor, the Family, and the U.S. Welfare System”, Demography, Vol. 52/3, pp. 729-749, https://doi.org/10.1007/s13524-015-0395-0.

[33] Moore, T. (2018), Constructing a new narrative of our first 1000 days: Synthesising the evidence and framing the messages, Centre for Community Child Health, http://www.rch.org.au (accessed on 18 June 2020).

[20] Morissens, A. (2018), “The role of universal and targeted family benefits in reducing poverty in single-parent families in different employment situations”, in The triple bind of single-parent families, Bristol University Press, https://doi.org/10.2307/j.ctt2204rvq.22.

[4] Nieuwenhuis, R. (2020), “Directions of thought for single parents in the EU”, Community, Work & Family, https://doi.org/10.1080/13668803.2020.1745756.

[24] OECD (2021), “Looking beyond COVID-19: Strengthening family support services across the OECD”, OECD, Paris, https://www.oecd.org/els/family/fss2021-brief-covid.pdf.

[7] OECD (2020), “Is Childcare Affordable?”, OECD, Paris, http://oe.cd/childcare-brief-2020.

[23] OECD (2019), Tax Administration 2019: Comparative Information on OECD and other Advanced and Emerging Economies, OECD Publishing, Paris, https://dx.doi.org/10.1787/74d162b6-en.

[8] OECD (2018), A Broken Social Elevator? How to Promote Social Mobility, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264301085-en.

[3] OECD (2018), “Poor Children In Rich Countries: Why We Need Policy Action”, OECD, Paris, https://www.oecd.org/els/family/Poor-children-in-rich-countries-Policy-brief-2018.pdf.

[5] OECD (2015), “Activation policies for more inclusive labour markets”, in OECD Employment Outlook 2015, OECD Publishing, Paris, https://dx.doi.org/10.1787/empl_outlook-2015-7-en.

[25] OECD (2015), Integrating Social Services for Vulnerable Groups: Bridging Sectors for Better Service Delivery, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264233775-en.

[6] OECD (2011), Doing Better for Families, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264098732-en.

[35] Pentecost, M. and F. Ross (2019), “The First Thousand Days: Motherhood, Scientific Knowledge, and Local Histories”, Medical Anthropology, Vol. 38/8, pp. 747-761, https://doi.org/10.1080/01459740.2019.1590825.

[2] Riding, S. et al. (2021), “Looking beyond COVID-19: Strengthening family support services across the OECD”, OECD Social, Employment and Migration Working Papers, No. 260, OECD Publishing, Paris, https://dx.doi.org/10.1787/86738ab2-en.

[12] Sabia, J. (2014), “Minimum wages: An antiquated and ineffective anti-poverty tool”, Journal of Policy Analysis and Management, Vol. 33/4, pp. 1028-1036, https://doi.org/10.1002/pam.21796.

[32] Silva, D. et al. (2020), “Increasing Resilience in Youth and Families: YAP’s Wraparound Advocate Service Model”, Child & Youth Services, Vol. 41/1, pp. 51-82, https://doi.org/10.1080/0145935X.2019.1610870.

[1] Thévenon, O. et al. (2018), “Child poverty in the OECD: Trends, determinants and policies to tackle it”, OECD Social, Employment and Migration Working Papers, No. 218, OECD Publishing, Paris, https://dx.doi.org/10.1787/c69de229-en.

[30] Thomson, R. et al. (2017), “A Dual-Factor Approach to Exploring Wraparound Outcomes in Children with Serious Emotional Disturbance within Community-Based Mental Health Settings”, International Journal of Psychological Studies, Vol. 9/1, p. 107, https://doi.org/10.5539/ijps.v9n1p107.

[18] Van Lancker, W. and N. Van Mechelen (2015), “Universalism under siege? Exploring the association between targeting, child benefits and child poverty across 26 countries”, Social Science Research, Vol. 50, pp. 60-75, https://doi.org/10.1016/j.ssresearch.2014.11.012.

[31] Vandenberg et al., J. (2003), “History of the Wraparound Process”, Focal Point: A National Bulletin on Family Support and Children’s Mental Health: Quality and Fidelity in Wraparound, Vol. 17/2, pp. 4-7.

Notes

← 1. OECD Family Database, Indicator CO2.2.B. Child relative income poverty rates, https://www.oecd.org/els/family/database.htm.

← 2. OECD Family Database, Indicator CO2.2.C. Poverty rates in households with children by household type, https://www.oecd.org/els/family/database.htm.

← 3. OECD Family Database, Indicator CO2.2.D. Poverty rates in households with children by household employment status, https://www.oecd.org/els/family/database.htm.