Emeline Denis

Marie-Estelle Rey

Emeline Denis

Marie-Estelle Rey

This chapter presents an analysis of gender diversity on boards, in managerial and in leadership positions across 49 jurisdictions. It then takes stock of existing policies and practices to support better gender representation in such positions. It provides evidence and focuses on implications of policy measures related to disclosure requirements, quotas and targets, but also complementary initiatives to strengthen the pipeline of female talent for leadership positions.

Gender diversity on boards and in senior management in listed companies has shown some progress across OECD and G20 countries. However, there is still only a quarter of women on boards, a third of women in managerial positions and less than 10% of women in executive leadership positions.

Gender-related disclosures are increasingly a requirement for listed companies, but information gaps remain in many countries. While almost two‑thirds of jurisdictions require or recommend disclosing the gender composition of boards, only 28% require or recommend such disclosure for senior management. Noteworthy are some legislative efforts focusing on gender pay gap reporting.

Gender quotas or targets have been adopted by more than half of OECD and G20 countries, and evidence indicates that progress has been more rapid in these markets. Nonetheless, complementary government and/or private sector-led measures have shown their potential to expand the female talent pipeline, reach higher thresholds and avoid possible unintended side effects, such as multiple board memberships or family-related appointments. Cases of success in a number of jurisdictions without quotas and targets demonstrate the importance of such measures.

While women’s overall participation to private employment has been increasing over the past years, the leaky pipeline persists, with disparities between men and women increasing as one climbs the organisational ladder.

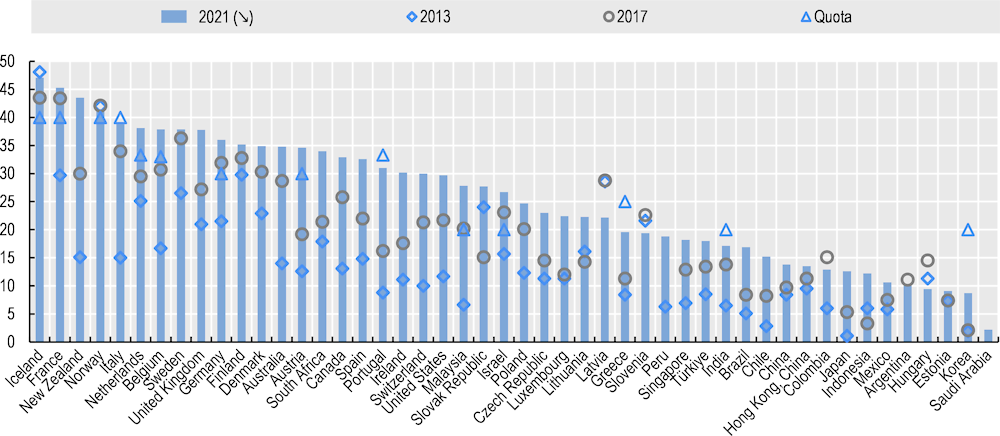

Although the percentage of women on boards has grown significantly over the past years, women continue to comprise less than a quarter of board members in listed companies globally. Based on data on a sample of listed companies from 49 jurisdictions that are covered by the OECD Corporate Governance Factbook (including all 38 OECD countries and Argentina, Brazil, China, Hong Kong (China), India, Indonesia, Malaysia, Peru, Saudi Arabia, Singapore and South Africa), women represented 25.4% of board directorships in 2021, up from 14.7% in 2013. In 2021, only four jurisdictions reached at least 40% of gender representation at board level – France, Iceland, New Zealand and Norway (OECD, 2021[1]).

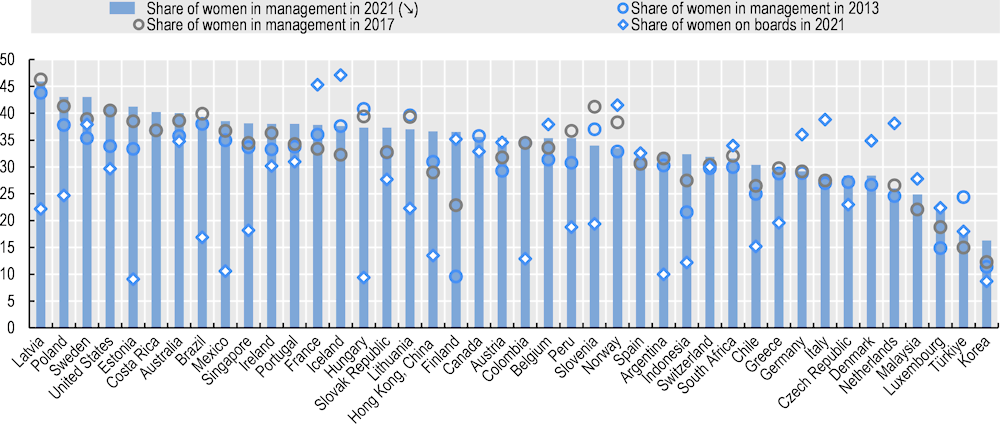

The percentage of women in company management has tended to be higher, but with slower progress than for women’s participation in boards. It grew from an average of 30.3% in 2013 to 33.7% in 2021 (Figure 17.1).

The percentage of women in executive leadership positions such as CEOs is much lower. Overall, very few women reach the highest positions in large listed companies, as fewer than 1 in 10 companies in the European Union and the United States have a female CEO. In 2021, women accounted for 7.1% of CEOs in a review of large, listed companies in the EU countries, although up from just 2.4% in 2013 (EIGE, 2021[2]).

Note: Data unavailable for Australia, China, Israel, New Zealand and the United Kingdom. Data for 2021 on share of women in management positions is unavailable for Hong Kong (China); India, Japan, Malaysia, Türkiye and Saudi Arabia, and as such 2020 data is used in these countries.

Source: OECD analysis based on data from ILO (2021[3]), ILOSTAT explorer; EIGE (2021[2]), Gender Equality Statistic Database; MSCI (2022[4]; 2020[5]; 2015[6]), Women on Boards: Progress Report 2022; 2020; Women on Boards: Global Trends in Gender Diversity. For details, see Denis (2022[7]), Enhancing gender diversity on boards and in senior management of listed companies, https://doi.org/10.1787/22230939.

Countries have promoted various types of initiatives to support women’s representation on boards and in leadership, strengthen the female talent pipeline and expand the pool of qualified candidates. Key approaches encompass disclosure requirements, quotas and targets, as well as complementary measures to reinforce other policy measures aimed at enhancing board and management diversity.

A growing number of jurisdictions require or recommend listed companies to disclose the gender composition of boards and of senior management. As of the end of 2020, 60% of the 49 jurisdictions had such provisions for boards, up from 49% in 2018. However, the disclosure of the composition of senior management is much less common, and was required or recommended in only 28% of jurisdictions in 2020 (OECD, 2021[1]).

Gender diversity disclosure is also encompassed in the recent and increasing movement supporting enhanced human capital management disclosure. This is intended to inform investors’ investment and voting decisions, in line with market and regulatory trends relating to environmental, social and governance (ESG) matters. For instance, a 2020 amendment to a US Securities and Exchange Commission regulation requires listed companies to provide a description of their human capital resources to the extent such disclosures would be material to an understanding of the company’s business (SEC, 2020[8]). Some jurisdictions have also focused legislative efforts on the implementation of gender pay gap reporting systems targeting all employees as a means to level the playing field.

Overall, investor pressure on companies to disclose comprehensive human capital management and diversity, equity and inclusion (DEI) data can enable greater public scrutiny and in turn help foster diversity on company boards and management. Institutional investors also play a role in this trend, for instance, by exerting public pressure on companies that do not disclose such data (Denis, 2022[7]).

Fourteen of 49 jurisdictions have established mandatory quotas for female participation on boards in private companies, ranging from “at least one” to 40%, with varying applicability. While four jurisdictions require at least 40% of women on boards (France, Iceland, Italy and Norway), six require between 20% and 35%, and four require “at least one” female director (India, Israel and Korea). Targeted entities also vary across jurisdictions. A common criterion is the company size, based on the number of employees and/or level of assets, whereby quotas are only applicable to companies above certain thresholds. Sanctions for non-compliance exist in almost all jurisdictions that have introduced quotas and take various forms such as warning systems, fines, board seats remaining vacant, void nomination and delisting for non-compliant companies.

Another 13 jurisdictions have introduced targets in their respective corporate governance codes, applicable on a comply-or-explain basis, which are generally set at a higher threshold than quotas. In 2022, the European Parliament adopted a directive to improve gender balance among directors, which will increase this number once transposed in national laws (Box 17.1).

In November 2022, the European Parliament formally adopted the Directive on improving the gender balance among directors of listed companies and related measures. First proposed by the European Commission 10 years ago, the Directive sets targets for large‑listed EU companies (more than 250 employees): at least 40% among non-executive board members or 33% among all directors of the under-represented sex by 30 June 2026. Member States will have two years to transpose the Directive’s provisions into national law.

The selection of the best qualified candidates for election or appointment to board positions should be made on the basis of a comparative analysis of the qualifications of candidates by applying clear, neutrally formulated and unambiguous criteria to ensure that applicants are assessed objectively based on their individual merits, irrespective of gender. In addition, large‑listed companies will also have to undertake individual commitments to reach gender balance among their executive board members. Companies that fail to meet the objective of the Directive must report the reasons and the measures they are taking to address this shortcoming. Member states will be required to set up a penalty system for companies that fail to meet the new standards by 2026. Penalties must be effective, proportionate and dissuasive. They could include fines and annulment of the contested director’s appointment. Member States will also publish information on companies that are reaching targets, which may serve as peer-pressure to complement enforcement.

Source: European Commission (2012[9]), Proposal for a Directive of the European Parliament and the Council on improving the gender balance among non-executive directors of companies listed on stock exchanges and related measures, COM/2012/0614 final – 2012/0299 (COD), https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A52012PC0614.

In terms of outcomes, as of 2021, nine jurisdictions had reached or exceeded their prescribed quota, while only three jurisdictions had reached their recommended target. While the fact that four jurisdictions are lagging behind their mandated quota can be explained by their recent introduction, the same explanation does not hold for all jurisdictions lagging behind their recommended targets. Regardless of the provisions in place, many countries have achieved significant progress since 2013 (Figure 17.2).

Note: Data unavailable for Costa Rica. Data for 2013 unavailable for Argentina and Saudi Arabia, and data for 2017 unavailable for Peru and Saudi Arabia. India, Israel, Korea and Malaysia have introduced a quota mandating “at least one” woman on boards of listed companies, which is indicated at 20% in this Figure, but may differ across companies depending on the size of the board. Of note, since 2022, Malaysia has both a quota and a target. While Germany has also adopted both a quota and a target, the target is not indicated as it does not have a specified threshold and only applies to the board of co-determined or listed companies which are not subject to the mandatory quota. For the United States, the target of at least two diverse directors is not included, as it is only applicable to NASDAQ-listed companies. For countries with higher indicated shares of women on boards in 2013 and 2017 than in 2021, this might be explained by the composition of the samples, which may vary over time to reflect changes in the market capitalisation of companies and/or volumes of shares traded.

Source: OECD analysis based on data from EIGE (2021[2]), Gender Equality Statistic Database; and MSCI (2022[4]; 2020[5]; 2015[6]), Women on Boards: Progress Report 2022; 2020; Women on Boards: Global Trends in Gender Diversity. For details, see Denis (2022[7]), “Enhancing gender diversity on boards and in senior management of listed companies”, https://doi.org/10.1787/22230939.

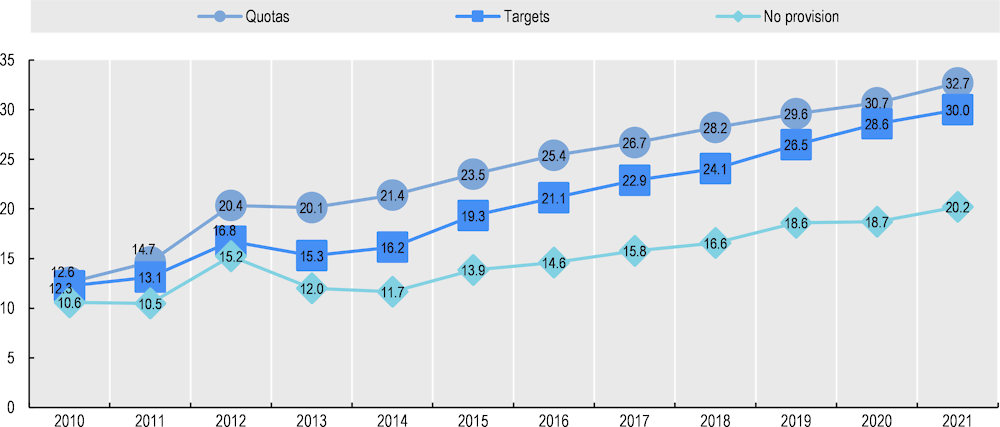

Overall, improvements in the representation of women on the boards of listed companies have been most significant in jurisdictions that have imposed binding quotas and/or voluntary targets (Figure 17.3). In 2021, the 14 jurisdictions with binding quotas had 32.7% of women on boards on average, and have seen this proportion rise by 20.1 percentage points since 2010. Progress in the 12 jurisdictions with voluntary targets has closely tracked those with quotas, with the percentage of women reaching 30% in 2021, an increase of 17.7 percentage points since 2010. The 21 jurisdictions with no provisions in place had just 20.2% of women on boards in 2021, with more modest progress of 9.6 percentage points over the period.

Note: Data unavailable for Argentina, Costa Rica and Saudi Arabia. Although as of 2022 Malaysia has both a quota and a target, it is only counted once under the “target” category, as it has a more ambitious threshold. The United States is counted under the “no provision” category, as the future target of at least two diverse directors is only applicable to NASDAQ-listed companies and will be gradually phased in through 2025.

While quotas mandating high shares of women on boards can drive significant progress over the short-term, evidence suggests that further progress may be difficult to sustain over time. Some research also suggests that quotas and targets sometimes yield unintended side effects, and may not be sufficient by themselves to solve issues related to the pipeline of women available to serve on boards that may hinder them from accessing leadership positions. For instance, one study has found that the increased share of women on boards did not ultimately translate to more women holding board director positions, but rather to more women serving on multiple boards (i.e. the “golden skirts” or board interlocking effect) (Rigolini and Huse, 2021[10]). Studies also found mixed evidence on whether companies appointed more female directors, or if decisions were made to reduce the board size to facilitate compliance with the mandated threshold (Seierstad and Huse, 2017[11]).

The impact of non-binding targets may also yield unintended side effects, as a study has found that the introduction of targets had paved the way for family-related appointments, rather than supporting broader diversity based on merit and smoothing the access to the boardroom for all qualified women (University of Copenhagen, 2021[12]). Some jurisdictions have noted that regulations concerning quotas and targets may include provisions to address some of the above concerns, such as by limiting the number of boards on which a director may serve simultaneously, or by excluding directors affiliated with the controlling shareholders from being counted as part of a target or quota.

Despite the overall increase in the share of women on boards across countries since 2013, executive positions within boards are still rarely filled by women. In 2021, women held with 32.2% of non-executive director positions in boards, but only 20.4% of executive positions on average. As this disparity remains significant, a few jurisdictions have recently introduced quotas or targets underpinning women’s representation on management boards. For instance, Germany passed a law in 2021 mandating at least one woman on management boards of listed companies. France adopted a similar law in 2022 which also mandates at least 30% of women among senior executives and management board members of companies with more than 1 000 employees. Finland and Switzerland have also recently introduced targets on a comply-or-explain basis (Denis, 2022[7]).

Some jurisdictions with no reported provision in place have also achieved significant progress since 2010, which underlines the importance of additional initiatives besides quotas or targets, such as government networks, private‑sector initiatives and relevant listing rules. For example, New Zealand displays one of the highest shares of women on boards in 2021 (43.5%) and is the only jurisdiction to have achieved such a threshold without the use of a quota or target. Such advancements may have been supported by advocacy initiatives from associations and independent bodies, such as Women on Boards New Zealand. Institutional investor pressure, including votes against the re‑election of directors in companies that fail to encourage diversity, has also had an important influence in some jurisdictions without quotas or targets (OECD, 2020[13]).

Complementary initiatives also exist in jurisdictions where quotas and targets have been adopted, and mainly relate to the development of a diverse pipeline as a lever for supporting progress. For instance, the major business associations of Italy and Spain launched specific programmes to strengthen women leadership skills and positioning. In regions with historically low representation of women in managerial and leadership positions (such as Asia and the Middle East and North Africa (MENA), see Chapter 33), public-private initiatives – in the form of advocacy and awareness-raising initiatives – may also play an important role. Specific examples include gender diversity guidelines for companies in Saudi Arabia or the establishment of the Council for Board Diversity in Singapore (OECD, 2020[13]).

Governments can also incentivise companies to accelerate progress through various tools. For instance, some governments have sought to support progress by highlighting excellence in gender equality practices in the private sector through tools such as certificates, labels, or awards. Likewise, companies can implement measures to promote a more conducive environment for the advancement of women in leadership positions. They can implement practices to strengthen the pipeline of female talent, such as through the establishment of diversity and inclusion committees, tailored hiring practices, promotion and retention policies and processes, as well as training, mentorship and networking programmes (OECD, 2020[13]). Nomination committees can also play an important role in enhancing gender diversity. Following the COVID‑19 crisis, many companies are assessing how the pandemic has changed their business and working models and how to adapt their human resources. Hence, nomination committees may be called upon to rethink talent management, review recruitment methods, diversify the pool of board members and executives, ensure turnover and exercise transparency.

There is also some evidence that different jurisdictions at different stages of progress may need to adapt differing measures, for example, where more emphasis may be required to achieve a cultural shift and receptiveness to women in leadership positions before other measures may be fully successful.

While women account for higher share of management positions than of board members, there seems to be no correlation between the two. Jurisdictions with a high level of participation of women on boards are in many cases not the ones with a high share of women in management, and vice versa. While this might be due to imperfect proxies, this may also suggest that pipelines of female talent for leadership positions may be under-developed in some countries.

While it may be argued that the low share of women on boards might be explained by a smaller pool of qualified female candidates, some evidence suggests that this hypothesis may not hold. Conversely, some studies have also found that companies that have a female CEO or more women on their boards better access the female talent pool. When there is a female CEO, the pool of boardroom candidates might be wider and more diverse, and the company’s culture might be more amenable to female leadership in general. The appointment of a female CEO might also break an institutional barrier against women ascending to the top ranks of leadership and play a leadership role model (MSCI, 2015[6]).

Binding quotas and voluntary targets show tangible results in the representation of women on the boards of listed companies. However, they sometimes yield unintended side effects and progress may be difficult to sustain over time. In addition, disclosure requirements, imposed by a growing number of jurisdictions, enhance transparency, accountability and monitoring.

Complementary public and/or private measures are equally important to support effective implementation of diversity objectives. Governments and the private sector can usefully consider implementing diversity and inclusion policies, training and mentorship programmes, networks, role model schemes, peer-to-peer support and advocacy initiatives to help raise awareness, overcome biases and cultural resistance, and develop the female talent pipeline to achieve better gender balance in boards and senior management. Differentiated measures may be called for to support progress in jurisdictions operating under differing market conditions or at differing stages of progress.

The G20/OECD Principles of Corporate Governance, currently under review, already highlight the value of gender diversity on boards and in senior management. Nevertheless, there is scope to expand and strengthen related provisions. The Principles may usefully reinforce the importance of disclosure of both women on boards and in senior positions, as well as of complementary measures to strengthen the female talent pipeline and other policy measures aimed at enhancing gender diversity, while also taking into consideration and evaluating other diversity factors, such as experience, age and other demographic characteristics.

[7] Denis, E. (2022), “Enhancing gender diversity on boards and in senior management of listed companies”, OECD Corporate Governance Working Papers, No. 28, OECD Publishing, Paris, https://doi.org/10.1787/22230939.

[2] EIGE (2021), Gender Equality Statistic Database, https://eige.europa.eu/gender-statistics/dgs (accessed on 13 March 2023).

[9] European Commission (2012), Proposal for a Directive of the European Parliament and the Council on improving the gender balance among non-executive directors of companies listed on stock exchanges and related measures, COM/2012/0614 final - 2012/0299 (COD), https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A52012PC0614.

[3] ILO (2021), ILOSTAT explorer, https://www.ilo.org/shinyapps/bulkexplorer9/.

[4] MSCI (2022), Women on Boards: Progress Report 2021, https://www.msci.com/www/women-on-boards-2020/women-on-boards-progress-report/02968585480.

[5] MSCI (2020), Women on Boards: 2020 Progress Report, https://www.msci.com/www/women-on-boards-2020/women-on-boards-2020-progress/02212172407.

[6] MSCI (2015), Women on Boards: Global Trends in Gender Diversity, https://www.msci.com/www/research-paper/research-insight-women-on/0263428390.

[1] OECD (2021), OECD Corporate Governance Factbook 2021, OECD, Paris, https://www.oecd.org/corporate/OECD-Corporate-Governance-Factbook.pdf.

[13] OECD (2020), Policies and Practices to Promote Women in Leadership Roles in the Private Sector, OECD, Paris, https://www.oecd.org/corporate/OECD-G20-EMPOWER-Women-Leadership.pdf.

[10] Rigolini, A. and M. Huse (2021), “Women and Multiple Board Memberships: Social Capital and Institutional Pressure”, Journal of Business Ethics, Vol. 169/3, pp. 443-459, https://doi.org/10.1007/s10551-019-04313-6.

[8] SEC (2020), “SEC Adopts Rule Amendments to Modernize Disclosures of Business, Legal Proceedings, and Risk Factors Under Regulation S-K”, https://www.sec.gov/news/press-release/2020-192.

[11] Seierstad, C. and M. Huse (2017), “Gender Quotas on Corporate Boards in Norway: Ten Years Later and Lessons Learned”, in Gender Diversity in the Boardroom, Springer International Publishing, Cham, https://doi.org/10.1007/978-3-319-56142-4_2.

[12] University of Copenhagen (2021), “Companies recruit more female board members through family ties”, https://news.ku.dk/all_news/2021/10/companies-recruit-more-female-board-members-through-family-ties/.