Pablo Antolín

Romain Despalins

Elsa Favre-Baron

Diana Hourani

Jessica Mosher

Stéphanie Payet

Pablo Antolín

Romain Despalins

Elsa Favre-Baron

Diana Hourani

Jessica Mosher

Stéphanie Payet

This chapter assesses gender gaps in asset-backed pension arrangements, where contributions are invested to finance future retirement income. It first evaluates the contribution of these arrangements to the overall gender pension gap. It then analyses the drivers of the gender gap in asset-backed pension arrangements stemming from labour market and other factors. Finally, it provides policy guidelines focusing on asset-backed pension arrangements that would contribute to reducing the overall gender pension gap.

On average in the OECD, women aged 65 and older receive 26% less income than men from pension systems.

Part of this gap originates from asset-backed pension arrangements (where contributions are invested to finance future retirement income), as women participate less in these plans and build up lower pension assets and entitlements.

Beyond labour market drivers, behavioural, cultural, and societal factors may influence the decisions taken by men and women about retirement savings, contributing to the gender gap in asset-backed pension arrangements.

The design of asset-backed pension arrangements is not always gender neutral and may disadvantage women compared to men.

The gender pension gap, or the fact that women tend to live on a lower income in retirement than men, is well-known and is usually measured by combining all sources of pension income, whether public or private, pay-as-you-go or asset-backed. However, little is known about the specific contribution of asset-backed pension arrangements to this gap. Asset-backed pension arrangements are pension plans including occupational defined benefit, occupational defined contribution and personal pension plans. They cover public and/or private‑sector workers.

Given the growing weight of asset-backed pension arrangements in the provision of retirement income around the world, understanding how they may contribute to the gap today and into the future is of paramount importance. This chapter examines the contribution of asset-backed pension arrangements to the gender pension gap and provides policy makers with options to improve outcomes for women and to help close this gap.

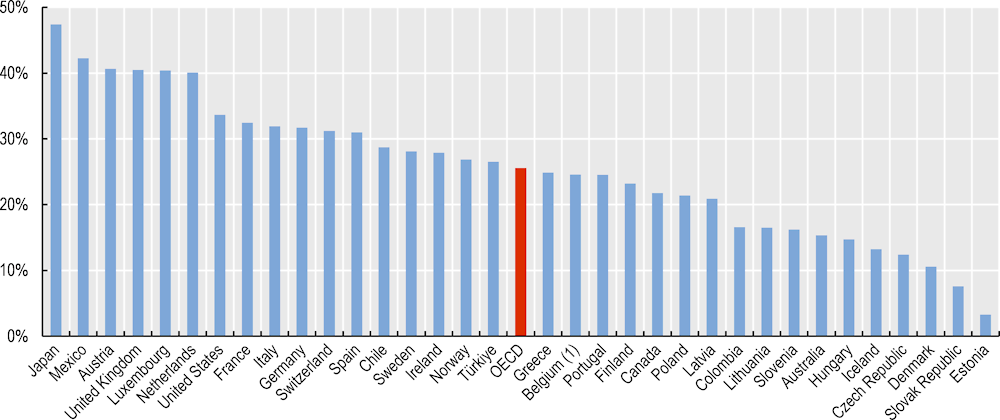

There is still today a gender pension gap in most OECD countries, with women receiving a lower retirement income than men on average. The gender pension gap is calculated here as the difference between the average total retirement income of men and women, expressed as a percentage of men’s average retirement income, taking into account both public and private sources of income. The gap ranges from 3% of men’s average retirement income in Estonia to 47% in Japan (Figure 22.1). On average in the OECD, women aged 65+ receive 26% less retirement income than men.

1. In Belgium when partner A’s pension rights are less than 25% of those of partner B, the pension of A is not paid out and B receives a family pension (calculated at 75% of wages instead of 60%).

Note: The gender pension gap is calculated as the difference between the average retirement income of men and women (aged 65+) over the average retirement income of men (aged 65+), among pension beneficiaries. Calculations are based on the Luxembourg Income Study (LIS), except for: France, Latvia, and Portugal where the Household Finance and Consumption Survey (HFCS) (Wave 3) was used; and Iceland, Sweden, and Türkiye where results come from the European Union Statistics on Income and Living Conditions (EU-SILC) (published on Eurostat’s website). Data come from the survey conducted in: 2013 for Japan, Luxembourg, the Netherlands, Norway and the Slovak Republic; 2014 for Australia; 2015 for Hungary and Slovenia; and after 2015 for all the other countries. Data refer to 2017 for Iceland and 2018 for Türkiye.

Source: OECD (2021[1]), Towards Improved Retirement Savings Outcomes for Women, https://doi.org/10.1787/f7b48808-en.

Most of the gender pension gap observed for today’s pensioners comes from public pension arrangements, because asset-backed pension plans currently provide a regular stream of income only to a small portion of old-age people in most countries. In countries where asset-backed pension arrangements are more prevalent, there are already signs of a gender gap for such arrangements. For example, the proportion of women receiving an asset-backed pension is much smaller than that of men in Germany (17% for women versus 29% for men), Ireland (37% for women versus 51% for men) and the Netherlands (46% for women versus 61% for men). And in these three countries, when focusing on individuals aged 65+ receiving an income from their asset-backed pension plan (occupational or personal, see note to Table 22.1 for definitions), women are found to receive 44% less income than men in Germany, 24% less in Ireland and 36% less in the Netherlands.

There are also signs that the gender pension gap from asset-backed pension arrangements will persist and is likely to grow for future generations. The first step to accumulate savings for retirement is to be a member of an asset-backed pension plan. However, the proportion of women participating in asset-backed pension plans is usually lower than that of men when it comes to both occupational and voluntary personal plans. Table 22.1 confirms this for most EU countries, except for Finland where participation in occupational plans is mandatory for all workers and therefore similar for men and women. In addition, evidence in some countries show that women tend to contribute less than men to their asset-backed pension plans (OECD, 2021[1]), therefore accruing less.

As a percentage of the working-age population

|

Mandatory or voluntary occupational/ employment-related plan |

Voluntary personal plan and life insurance |

Total |

||||

|---|---|---|---|---|---|---|

|

Men |

Women |

Men |

Women |

Men |

Women |

|

|

Austria |

12% |

8% |

16% |

14% |

24% |

20% |

|

Belgium |

27% |

18% |

43% |

41% |

52% |

48% |

|

Estonia |

.. |

.. |

14% |

18% |

.. |

.. |

|

Finland |

85% |

86% |

18% |

22% |

86% |

87% |

|

France |

5% |

3% |

26% |

26% |

28% |

28% |

|

Germany (1) |

25% |

18% |

44% |

43% |

55% |

49% |

|

Greece |

0% |

0% |

1% |

0% |

1% |

0% |

|

Hungary |

.. |

.. |

13% |

13% |

.. |

.. |

|

Ireland |

23% |

16% |

13% |

9% |

33% |

23% |

|

Italy |

8% |

4% |

7% |

5% |

15% |

9% |

|

Latvia |

.. |

.. |

11% |

19% |

.. |

.. |

|

Lithuania |

.. |

.. |

9% |

9% |

.. |

.. |

|

Luxembourg |

10% |

7% |

15% |

12% |

20% |

15% |

|

Netherlands |

61% |

59% |

28% |

19% |

73% |

68% |

|

Poland |

4% |

4% |

43% |

42% |

44% |

43% |

|

Portugal |

2% |

1% |

10% |

9% |

11% |

10% |

|

Slovak Republic |

26% |

27% |

13% |

10% |

33% |

32% |

|

Slovenia |

9% |

11% |

10% |

10% |

18% |

20% |

1. The HFCS survey may underestimate the coverage of occupational pension plans, potentially due to an underreporting of enrolment in occupational plans and the classification of occupational plans for the public sector as statutory pensions.

Note: Access to occupational pension plans is linked to an employment or professional relationship between the plan member and the entity that establishes the plan (the plan sponsor). Occupational plans may be established by employers or groups thereof (e.g. industry associations) and labour or professional associations, jointly or separately. By contrast, access to personal pension plans does not have to be linked to an employment relationship. The plans are established and administered directly by a pension fund or a financial institution acting as pension provider without any intervention of employers.

This table is based on data available in Wave 3 of the HFCS for all countries except Finland (Wave 2). “..” means not available.

Source: OECD (2021[1]), Towards Improved Retirement Savings Outcomes for Women, https://doi.org/10.1787/f7b48808-en.

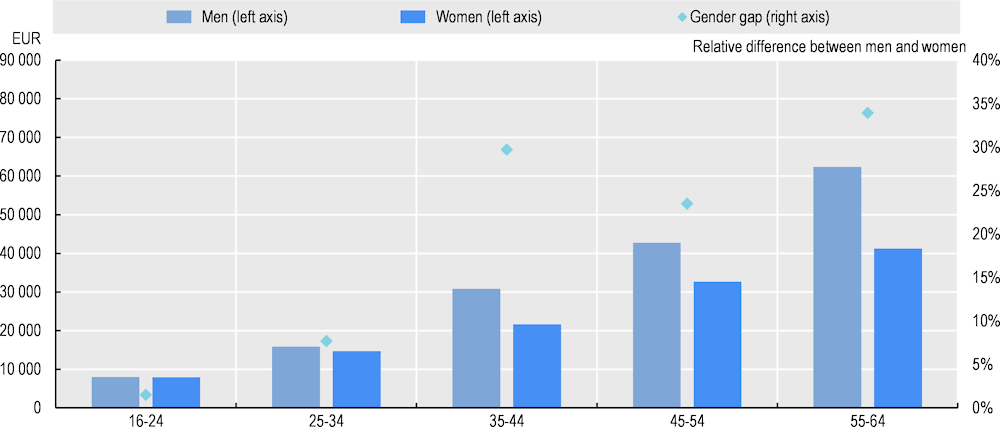

The gap between the pension assets that men and women accumulate first emerges in the 25‑34 age group and widens afterwards (Figure 22.2). Moreover, women’s longer average life expectancy means that in many defined contribution plans (see note to Figure 22.2 for definitions) they will receive a lower retirement income per month than men for a given level of assets accumulated (but for longer). Given these observations, and the fact that asset-backed pension arrangements are playing a growing role in retirement income provision in many countries, the contribution of these arrangements to the overall gender pension gap is expected to increase in the future.

Note: This chart shows the average amount of assets in occupational defined contribution and personal pension plans and the present value of all expected future benefit payments from defined benefit plans for men and women among asset owners in a group of OECD countries on average (on the left axis). Occupational defined contribution plans are occupational pension plans under which the plan sponsor pays fixed contributions and has no legal or constructive obligation to pay further contributions to an ongoing plan in the event of unfavourable plan experience. Occupational defined benefit plans are occupational plans other than defined contribution plans.

The chart also shows the difference between this average (of average pension assets) for men and for women relatively to men (on the right axis). The countries included in the calculations are Austria, Belgium, Estonia, Finland, France, Germany, Hungary, Ireland, Italy (except for the age group 16‑24), Latvia, Lithuania (except for the age group 16‑24), Luxembourg, the Netherlands, Poland, Portugal (except for the age group 16‑24), the Slovak Republic and Slovenia. This indicator is calculated over the working-age population, based on data available in Wave 3 of the HFCS for all countries except Belgium and Finland (Wave 2).

Source: OECD (2021[1]), Towards Improved Retirement Savings Outcomes for Women, https://doi.org/10.1787/f7b48808-en.

Labour market differences between men and women are the main drivers of the gender pension gap (Chapter 13). This is particularly the case for asset-backed pension arrangements, as the labour market status of individuals directly affects their access to these arrangements, as well as the retirement benefit entitlements they can accumulate in them. Such labour market differences include:

Women’s lower labour market participation compared to men. This implies that fewer women have access to employment-related asset-backed pension plans (i.e. occupational plans and personal plans that can only be accessed by workers).

Women’s shorter careers compared to men, for instance as a consequence of career breaks following childbirth and/or caring responsibilities, which tend to fall more heavily on women. This means that women will contribute fewer years to an asset-backed pension plan compared to men, thereby reducing their retirement benefit entitlements.

Women’s overrepresentation among part-time workers. Working part-time implies lower wages and therefore lower retirement benefit entitlements; moreover, it may exclude the worker from participating in asset-backed pension plans in some countries.

Women’s average lower incomes compared to men. Since the average gender pay gap for full-time employees in the OECD currently stands at 12% (OECD Employment database) (Chapter 16), for a given contribution rate, women will contribute lower amounts than men to their asset-backed pension plan.

An econometric analysis on Germany, Finland and the United States shows that men and women have similar levels of pension assets and entitlements in their occupation plans, after controlling for labour market factors (OECD, 2021[1]). For these three countries, this confirms that labour market differences between men and women are the main drivers of the gender gap in occupational pension entitlements among plan members.

Beyond labour market factors, other secondary factors contribute to the gender gap in asset-backed pension arrangements. In particular, behavioural and cultural factors may affect individual decisions linked to retirement saving, while social interactions may influence retirement outcomes by gender.

Women frequently demonstrate higher levels of risk aversion than men, which can translate into a preference for lower-risk investments and therefore lower returns on average for their retirement savings. This seems to be linked to differences in attitudes towards gambling and competition, as well as lower levels of financial education (OECD, 2021[1]).

Lower levels of financial literacy may also lead women to engage less in retirement planning. Given their average lower level of financial knowledge compared to men (OECD, 2020[2]) (Chapter 12), women have lower knowledge of concepts like time value of money, simple and compound interest, and risk diversification that are crucial to make informed decisions about long-term savings and pensions.

Women also demonstrate different attitudes towards saving compared to men. They may prioritise current spending for themselves or others over saving for retirement (OECD, 2021[1]). This may be linked to the fact that women may feel more vulnerable to short-term financial hardship, or that they are more likely to spend their income on family members.

Marital status may represent another factor in the gender pension gap, as there is a possible shift in the decision-making process among couples for financial matters. Additionally, couples may be able to mutualise their pension savings in order to manage their consumption smoothing. However, single retirees cannot, and the consequences of divorce or widowhood over retirement savings may be worse for women than for men (OECD, 2021[1]).

Gender stereotyping and gendered expectations may also play a role in several choices that can affect retirement savings (OECD, 2021[1]). They condition educational and career choices, with women being underrepresented in the fields of Science, Technology, Engineering and Mathematics (STEM) (Chapter 9). They may also partially explain why women often are the primary family caregiver. Women’s higher involvement in unpaid work compared to men contributes to the labour market differences mentioned above. Women’s higher risk aversion may also be reinforced by financial advisors who may be influenced by gender stereotypes and assume an even greater risk aversion, leading to overly conservative investment options for women.

Finally, communication campaigns and approaches may fail to engage women in retirement planning. Men and women may react differently to information depending on its context and how it is framed. For example, women tend to be more influenced by information going against their preconceived notions in their annuitisation decision (Agnew et al., 2008[3]). Additionally, the content of the communication may need to be different for men and women, given that their needs regarding retirement savings tend to be different.

An econometric analysis on Germany and Finland shows that behavioural, cultural, and societal factors may partly explain why women save less in their personal plans than men do. In both countries, women contribute less to and accumulate lower assets in their personal plans. This result proved true even after accounting for potential labour market differences between men and women (OECD, 2021[1]). The results suggest that something else, such as a behavioural disparity, might be at play.

The design of the asset-backed pension arrangement itself may bear some responsibility in the gender pension gap. Some rules and parameters of asset-backed pension arrangements are not gender neutral and tend to reduce women’s capacity to join a plan, to contribute or accrue their own rights, to earn good returns on their investments, and to receive sufficient retirement income. Key aspects include:

Sector of activity. Industries predominantly employing women are less likely to offer an occupational plan to their employees in some countries, thereby reducing women’s access to asset-backed pension arrangements. In the United States for example, men are more likely to work in industries with higher occupation plan coverage compared with women. In several European countries with voluntary occupational systems, such as Belgium, Germany and Ireland, the proportion of women working in a given sector is inversely correlated with the coverage rate of occupational plans in this sector (OECD, 2021[1]). Women tend to work in sectors such as education or human health and social work where fewer individuals are covered by an occupational plan, with one exception being the public sector where women are highly represented and usually have access to an occupational plan. By contrast, women are underrepresented in manufacturing activities where employers tend to provide wider access to occupational plans.

Eligibility criteria. Although asset-backed pension arrangements cannot discriminate plan access based on gender, certain eligibility criteria can have the effect of disadvantaging women compared to men. Since women are overrepresented among part-time workers, criteria based on a minimum number of working hours or on a minimum income threshold restrict women’s ability to join asset-backed pension plans more than men’s. These criteria exist for occupational plans in Canada, Japan, Switzerland and the United Kingdom (minimum income thresholds), as well as in Japan and Korea (minimum number of working hours).

Child-related leave. Contributions or pension right accruals stop during periods of maternity and parental leave in several countries. Women would need to contribute more upon returning to work if they wished to compensate for the loss. In Australia, Austria, New Zealand and the United States, employers generally stop contributing on behalf of mothers on maternity leave. Even when contributions continue during leave, the earnings base used to calculate these contributions is lower than past earnings in some countries (e.g. Estonia, Iceland and Poland). This reduces the level of contributions compared to a period of full activity.

Default investment options. In some countries (such as Italy and Latvia), the default investment option in asset-backed pension plans consists of a conservative investment strategy, thereby reinforcing women’s natural bias against risk. Given that women already tend to hold conservative investments, they are less likely to switch to an alternative investment option if the default already matches their risk aversion level. This reduces the expected return that women could get on their savings over the entire accumulation phase.

Marital and family status:

Retirement benefit entitlements are not always split automatically between former spouses upon divorce. If women take time off work or reduce their working hours to take care of the family, they will accumulate less in their own asset-backed pension plan. If retirement savings are considered as individual property, women who counted on their partner’s savings to live on during retirement will lose access to those retirement benefits if they divorce (e.g. in Austria, Finland, France, Iceland, Latvia, Mexico, the Slovak Republic, Slovenia and Sweden). Even when retirement benefit entitlements are considered as joint property, they may not be split automatically upon divorce and may be overlooked in divorce settlements, as is the case in 71% of the cases in the United Kingdom (Now: Pensions, 2020[4]).

A pay-out option offering survivor income may not always be available, particularly where annuity markets are less developed. In most defined contribution plans, the surviving spouse, most likely a woman, inherits the assets as a lump sum. This does not protect the surviving women from the risk of outliving those assets, unlike survivor pensions.

Indexation. There is no legal requirement for the indexation of asset-backed pensions in most OECD countries. Because of their longer lives, women are more exposed to the risk of losing purchasing power due to the compounding effects of inflation.

Policy makers can take actions to reduce the gender gap in asset-backed pension arrangements. The design of these arrangements alone cannot address and correct for all the drivers of the gender pension gap, particularly those stemming from the labour market. Nevertheless, it should strive to reduce the impact that these factors have on the retirement income of women or, at the very least, ensure that inequalities are not exacerbated. As such, asset-backed pension arrangements should aim to be gender neutral. The following policy guidelines, focusing on asset-backed pension arrangements, would contribute to reducing the gender pension gap. Meanwhile, it is also important to acknowledge that progress in public pensions (for instance, the equalisation of retirement ages of men and women) is also key to reduce the gender pension gap (OECD, 2021[5]; Lis and Bonthuis, 2019[6]).

Key actions to reduce the gender gap in asset-backed pension arrangements include:

Promoting women’s access to asset-backed pension arrangements. Increasing the availability of asset-backed pension arrangements in industries predominantly employing women and relaxing eligibility requirements to join a plan would improve women’s access to these arrangements.

Encouraging women’s participation in asset-backed pension arrangements. Measures should also encourage women who have access to an asset-backed pension arrangement to join one and contribute to it. This can be done by nudging (e.g. automatic enrolment) and providing financial incentives to participate, as well as engaging women in retirement planning with tailored educational workshops and communication that convey the importance of having their own savings for retirement.

Improving the level and frequency of women’s contributions to asset-backed pension arrangements. This can be addressed through contributions from employers or spouses, financial incentives to contribute that target groups with large female representation (e.g. low-income group), subsidies for maternity and caregiving, allowance for catch-up contributions, and targeted communication to educate women about the importance of regular contributions.

Adapting the design of asset-backed pension arrangements to the career patterns of women. The design of asset-backed pension arrangements could better accommodate the career patterns of women by being more flexible with respect to contribution levels, improving the portability of occupational plans and adapting the fee structure to avoid disadvantaging lower balances.

Improving investment returns on women’s retirement savings. Non-conservative default investment strategies and objective assessments of individual risk tolerance can help women overcome their conservative bias and take on a reasonable level of risk for the long-term horizon when saving for retirement.

Increasing women’s own retirement benefit entitlements. To ensure that women share a part of their spouse’s retirement benefit accrual as well as their income, entitlements can be split either while the spouse accumulates them or upon the divorce of the couple. Communication around the options available should increase women’s awareness of the possibility and importance of splitting retirement assets upon divorce.

Increasing the level of retirement income that women receive. Women can expect to spend a longer period in retirement, and will therefore have to rely on their retirement savings for longer than men. For defined contribution plans, this often translates into a lower monthly retirement income for the same account value, and an increased risk of a loss in purchasing power. Options to help to address this inequality include equalising retirement ages between genders, calculating retirement income based on unisex mortality rates where appropriate, providing an explicit subsidy to women, promoting survivor income benefits, and encouraging the availability of pay-out options that increase retirement benefits over time.

While the design of asset-backed pension arrangements cannot correct for all the factors driving the gender pension gap, particularly those stemming from the labour market, it should not put women at a further disadvantage. As such, it should aim to be gender neutral.

Reducing the gender pension gap in asset-backed pension arrangements can be achieved by increasing women’s access to, and participation in asset-backed pension plans, raising women’s level and frequency of contributions, accommodating contribution schedules, plan portability and fee structures to the career patterns of women, improving women’s expected investment returns, facilitating the split of retirement benefit entitlements between spouses or ex-spouses, and accounting for women’s longer life expectancy in the design of the pay-out phase.

[3] Agnew, J. et al. (2008), “Who Chooses Annuities? An Experimental Investigation of the Role of Gender, Framing, and Defaults”, American Economic Review, Vol. 98/2, pp. 418-422, https://doi.org/10.1257/aer.98.2.418.

[6] Lis, M. and B. Bonthuis (2019), “Drivers of the Gender Gap in Pensions: Evidence from EU-SILC and the OECD Pension Models”, in Progress and Challenges of Nonfinancial Defined Contribution Pension Schemes: Volume 2. Addressing Gender, Administration, and Communication, The World Bank, https://doi.org/10.1596/978-1-4648-1455-6_ch18.

[4] Now: Pensions (2020), Divorced women reach retirement with just £26,100, half of the average woman’s savings, find NOW: Pensions and Pensions Policy Institute (PPI), https://www.nowpensions.com/press/divorced-women-reach-retirement-with-just-26100-half-of-the-average-womans-savings-find-now-pensions-and-pensions-policy-institute-ppi/.

[5] OECD (2021), Pensions at a Glance 2021: OECD and G20 Indicators, OECD Publishing, Paris, https://doi.org/10.1787/ca401ebd-en.

[1] OECD (2021), Towards Improved Retirement Savings Outcomes for Women, OECD Publishing, Paris, https://doi.org/10.1787/f7b48808-en.

[2] OECD (2020), OECD/INFE 2020 International Survey of Adult Financial Literacy, https://www.oecd.org/financial/education/launchoftheoecdinfeglobalfinancialliteracysurveyreport.htm (accessed on 13 March 2023).