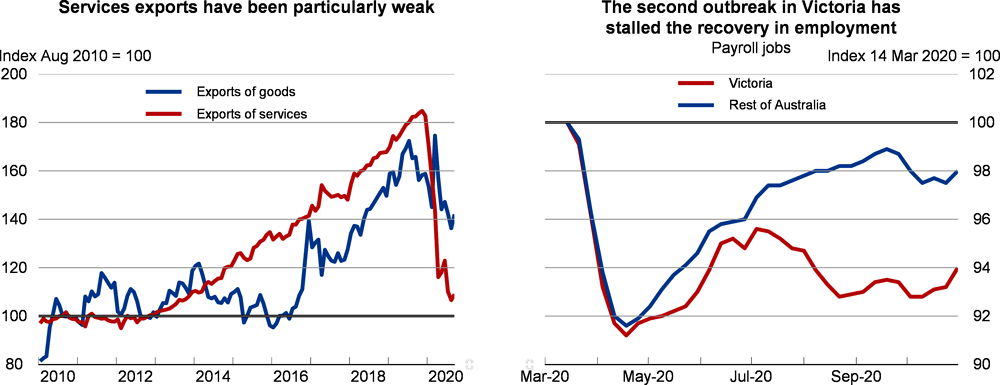

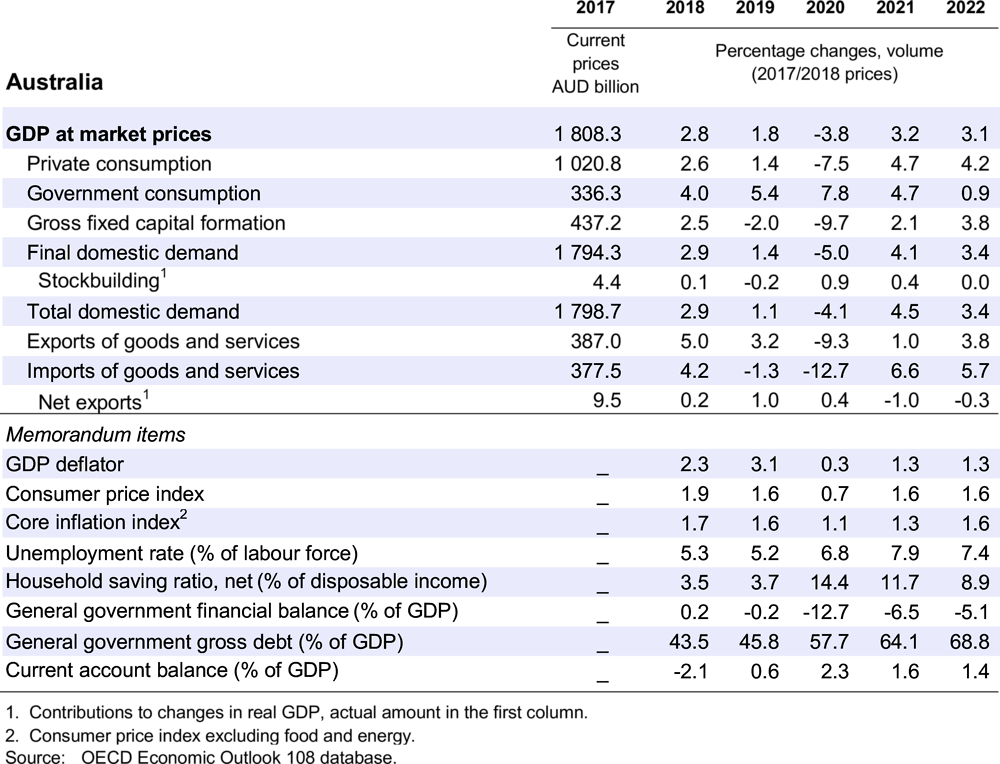

Australia has been hit by the coronavirus pandemic less severely than other countries, although the state of Victoria experienced a significant surge in cases in the third quarter with corresponding lockdown orders. Real GDP is expected to contract by 3.8% in 2020, but is projected to grow by 3.2% in 2021 and 3.1% in 2022. The unemployment rate will rise initially as job retention schemes taper off in 2021 and will slowly decline thereafter. Household saving will gradually decrease and support private consumption. A risk is that the recovery in business and consumer sentiment is hampered by a rise in business insolvencies and renewed labour market weakness as policy support is scaled back in 2021.

Fiscal policy support will be reduced in 2021, but the impact will be offset by the recovery in private sector activity as containment restrictions ease further. Monetary policy will remain accommodative given below‑target inflation and significant labour market slack. Fiscal and monetary support should be maintained until the economic recovery is firmly entrenched. At the same time, replacing real‑estate stamp duty with a recurrent land tax would boost labour mobility and economic growth. Similarly, reducing interstate differences in education, training programmes and occupational licensing would enhance the potential for labour reallocation.