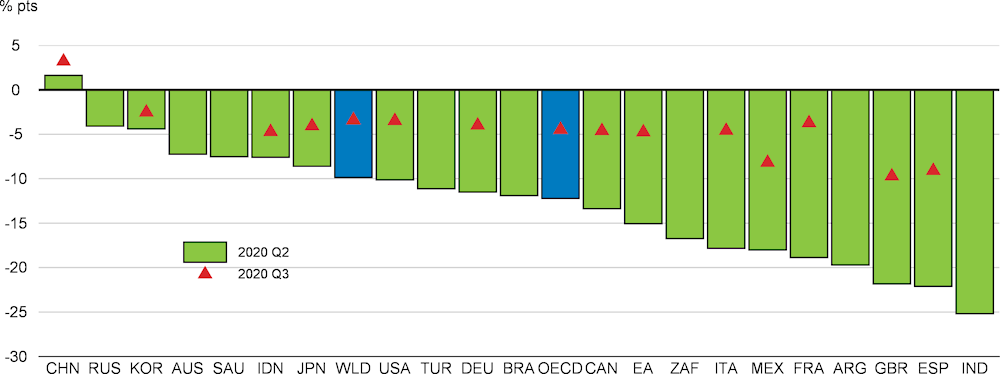

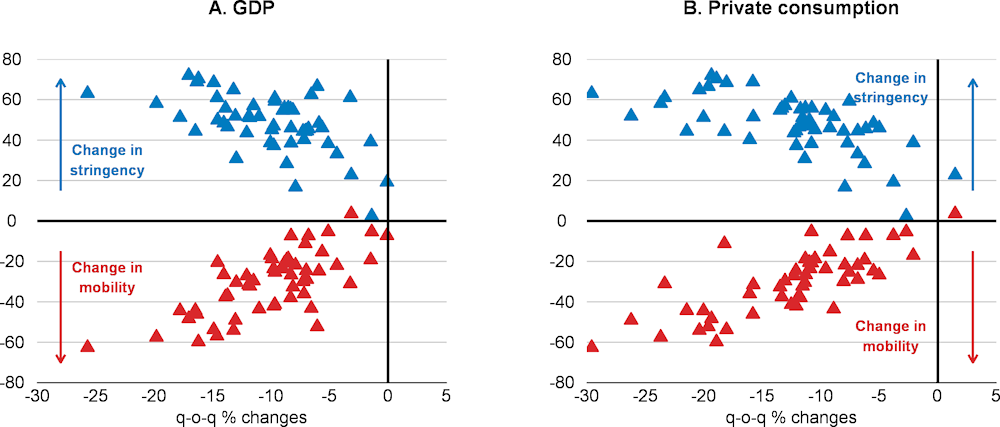

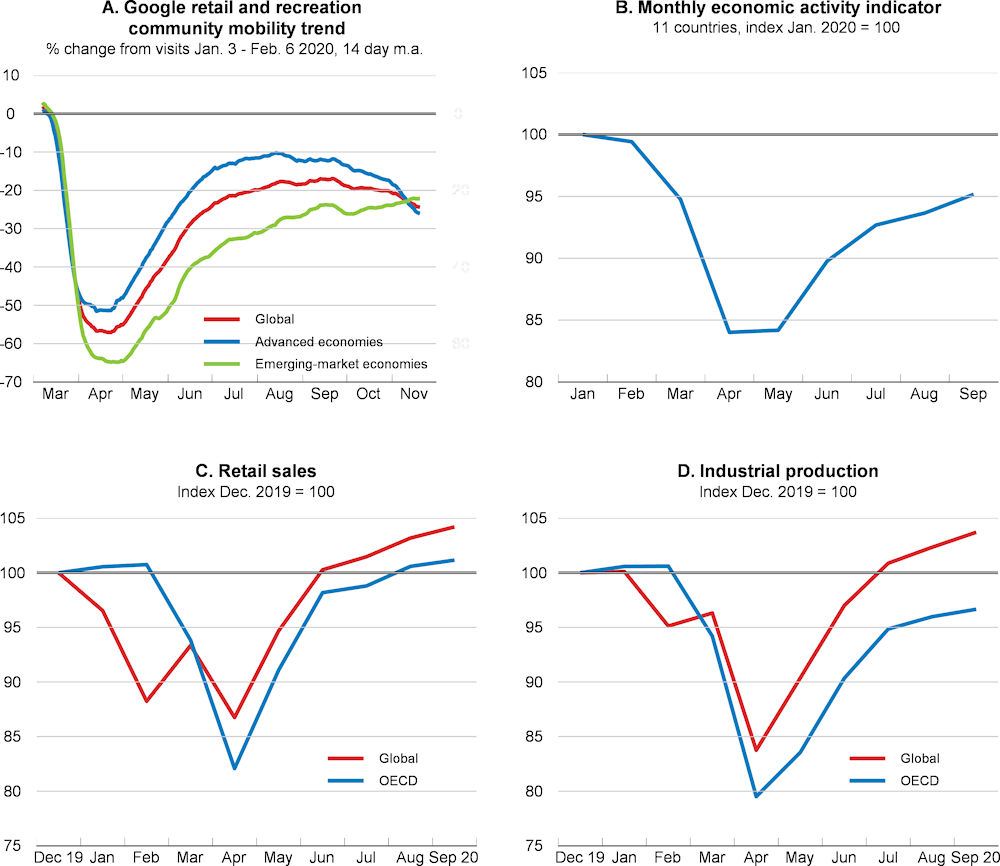

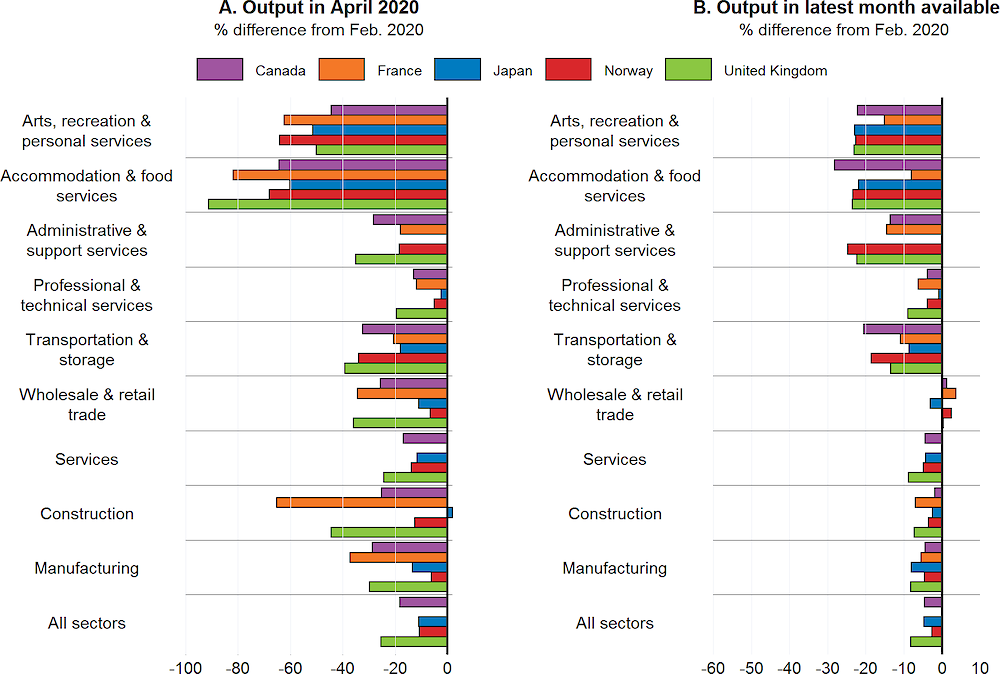

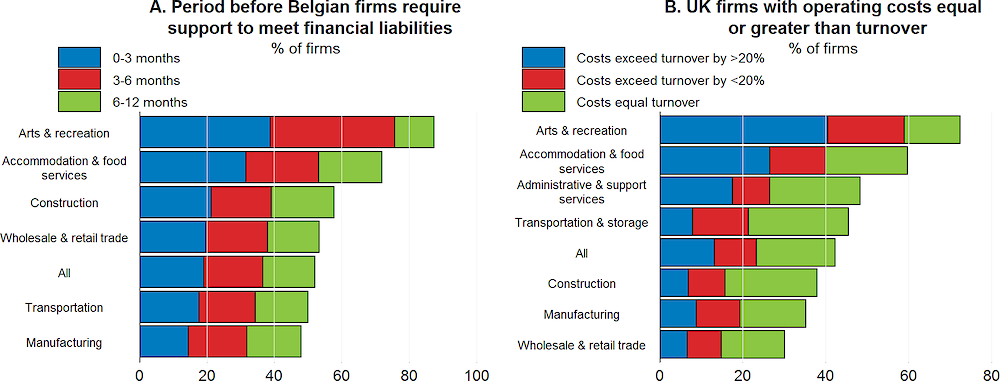

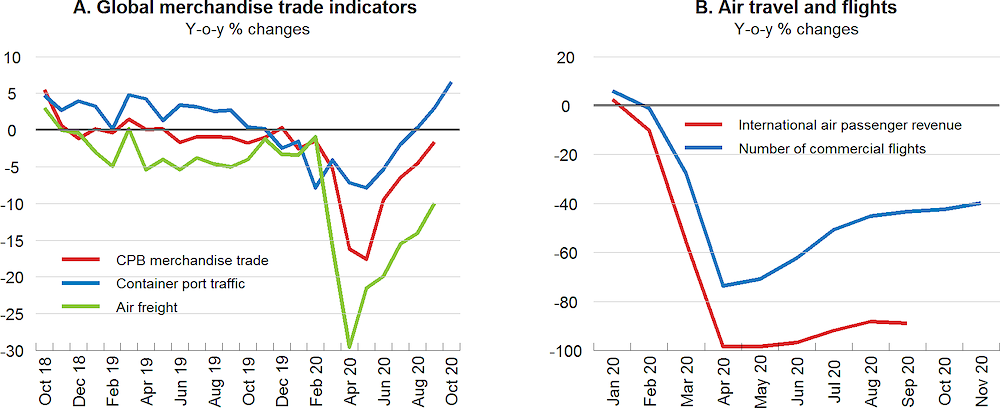

The COVID-19 pandemic continues to exert a substantial toll on economies and societies. Prospects for an eventual path out of the crisis have improved, with encouraging news about progress in developing an effective vaccine, but the near-term outlook remains very uncertain. Renewed virus outbreaks in many economies, and the containment measures being introduced, have checked the pace of the global rebound from the output collapse in the first half of 2020, and are likely to result in further near-term output declines, particularly in many European economies. This pattern is likely to persist for some time, given the significant development and logistical challenges in deploying a vaccine widely around the world. Living with the virus for at least another six to nine months will prove challenging. Local outbreaks are likely to continue and will have to be addressed with targeted containment measures if possible, or full economy-wide lockdowns if necessary, which will hold down growth. Some businesses in the sectors most exposed to these continued containment measures may not be able to survive for an extended period without additional support, raising the risk of further job losses and insolvencies that hit demand throughout the economy.

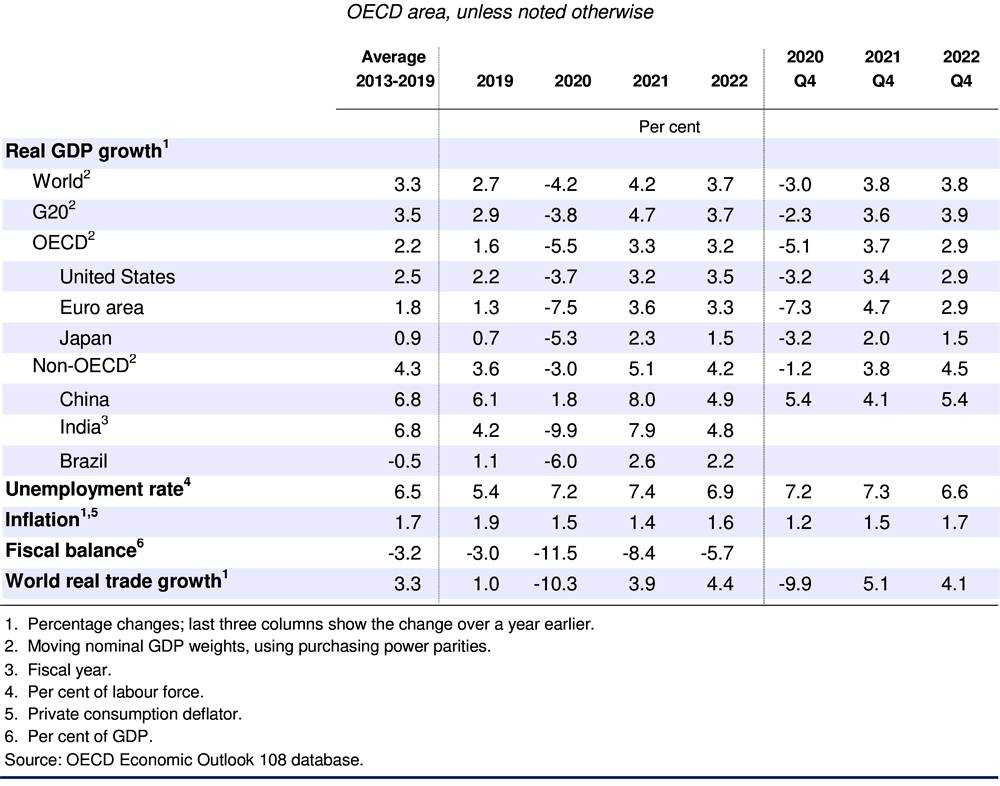

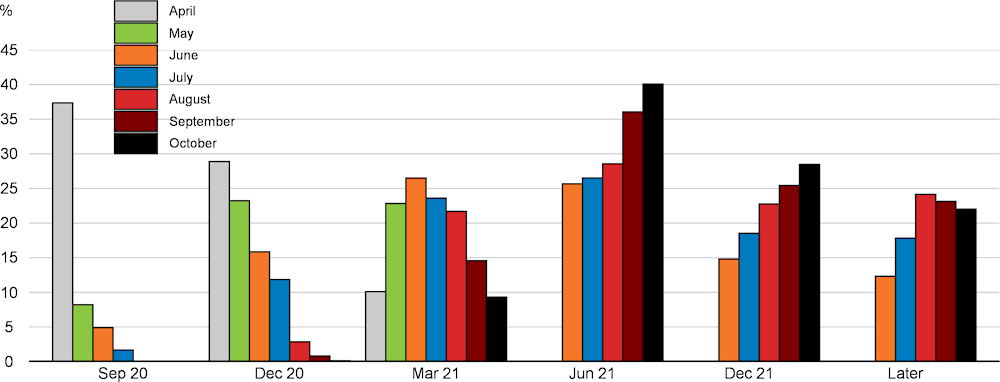

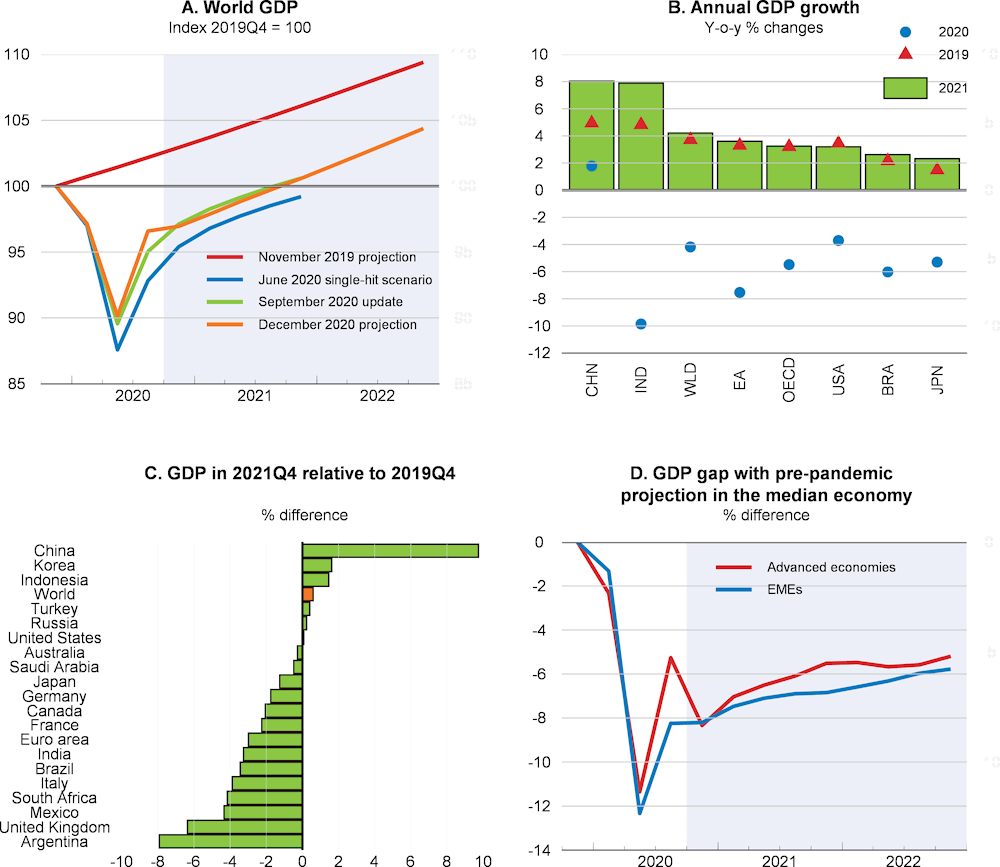

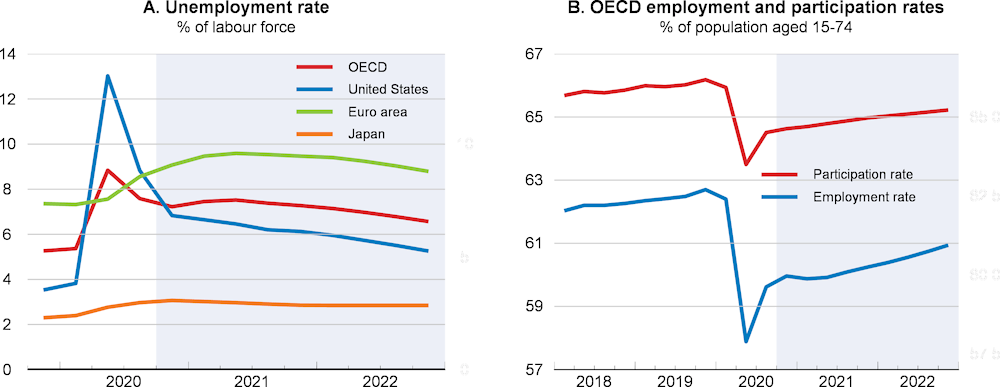

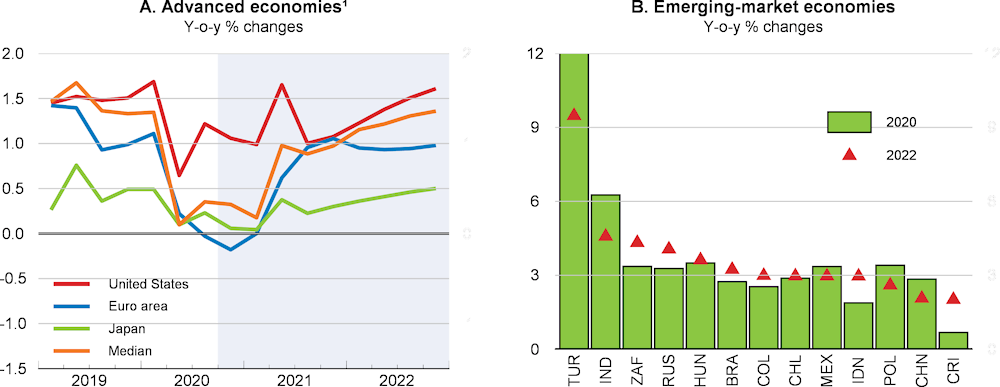

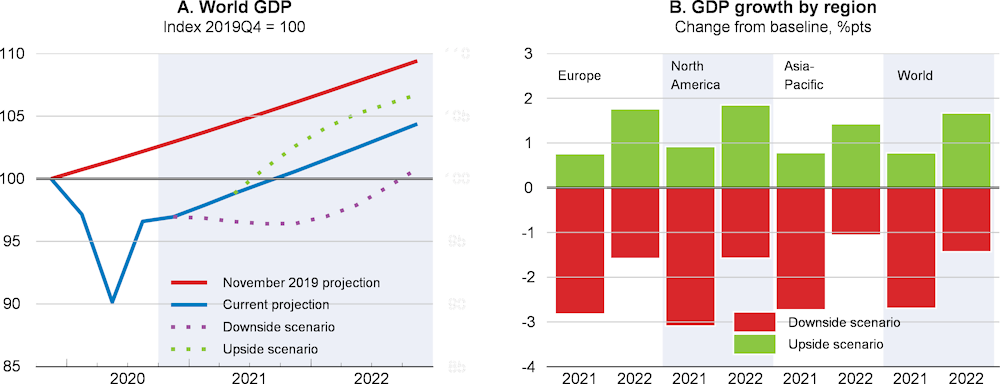

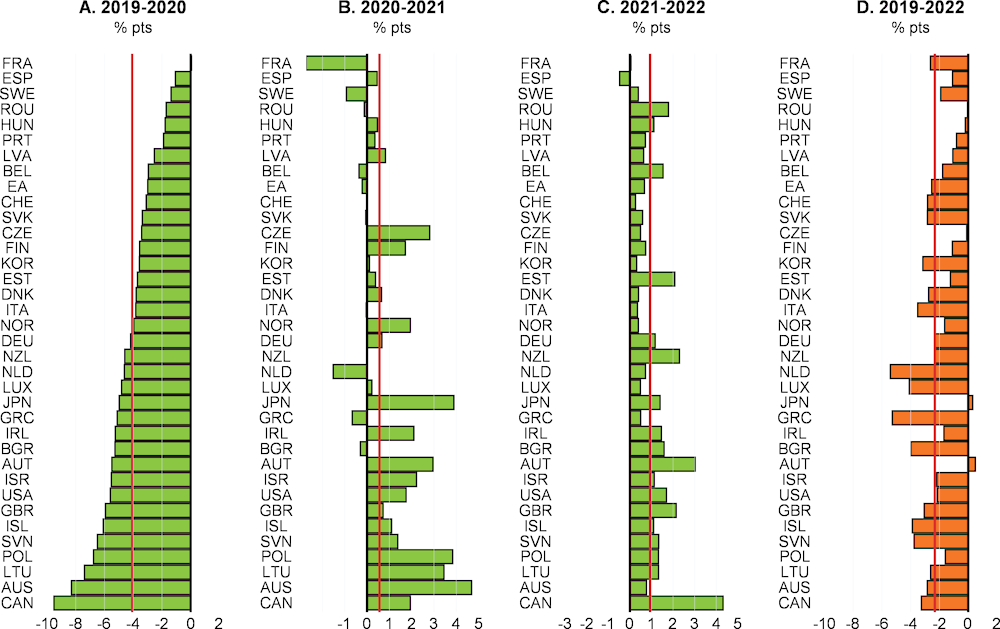

On the assumption that renewed virus outbreaks remain contained, and that the prospect of a widely available vaccine towards the end of 2021 helps to support confidence, a gradual but uneven recovery in the global economy should occur in the next two years (Table 1.1). After a strong decline this year, global GDP is projected to rise by around 4¼ per cent in 2021, and a further 3¾ per cent in 2022. Overall, by the end of 2021, global GDP would be at pre-crisis levels, helped by the strong recovery in China, but performance would differ markedly across the main economies. Output is projected to remain around 5% below pre‑crisis expectations in many countries in 2022, raising the risk of substantial permanent costs from the pandemic. Countries and regions with effective test, track and isolate systems are likely to perform relatively well, as they have done since the onset of the pandemic, but will still be held back by the overall weakness of global demand. These output prospects would allow only gradual declines in unemployment, and damp near-term incentives for companies to invest. Persistent slack would also temper increases in wage and price inflation.

The outlook would be brighter if faster progress towards developing and distributing an effective vaccine reduces uncertainty and the need for precautionary saving. This would point the way towards a stronger recovery, especially in 2022, and a more sustained pick-up in investment and consumer spending. On the downside, growth would be weaker if virus outbreaks were to intensify more widely, as is already the case in Europe, or if the challenges in ensuring widespread deployment of a vaccine proved to be greater than currently expected. This would imply an extended period in which containment measures were deployed to control the spread of the virus, and weaken growth prospects substantially. Confidence is still fragile, and further setbacks could remove any GDP growth in large parts of the world through 2021 or longer, deepening the already inflicted scars from the crisis.

Policies can play a pivotal role in supporting the economy while the health crisis persists and in easing the adjustment to a post‑COVID‑19 environment and governments need to react further if the recovery falters. Effective and well‑resourced healthcare policies, as well as supportive and flexible macroeconomic and structural measures, are essential both to contain the impact of the virus and to minimise the potential long-run costs of the pandemic on living standards.

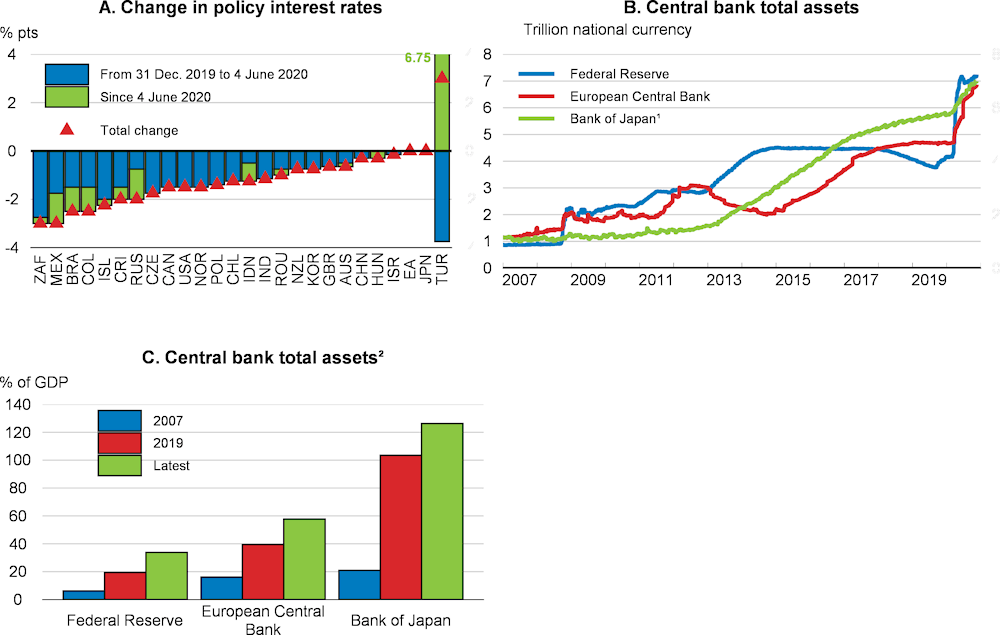

The current accommodative monetary policy stance needs to be continued, as planned, by key central banks in the advanced economies. Central banks should also continue to provide a backstop to credit markets, and ensure that low and stable interest rates are maintained. If economic weakness deepens, or appears likely to persist for longer than expected, the remaining limited scope to ease monetary conditions should be used.