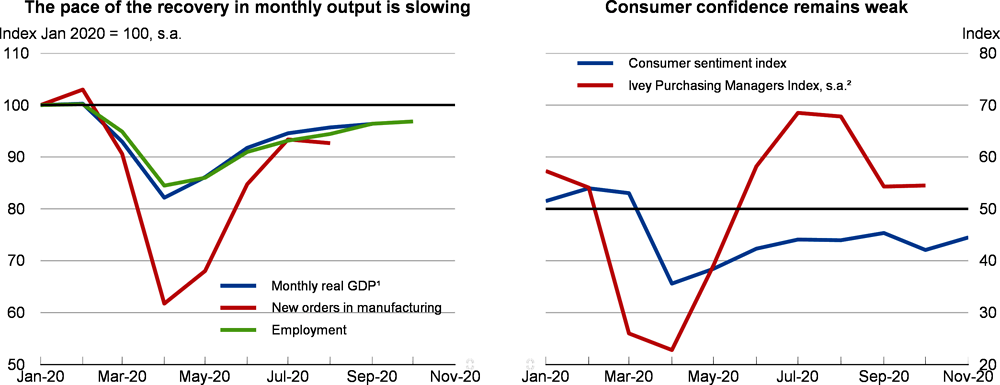

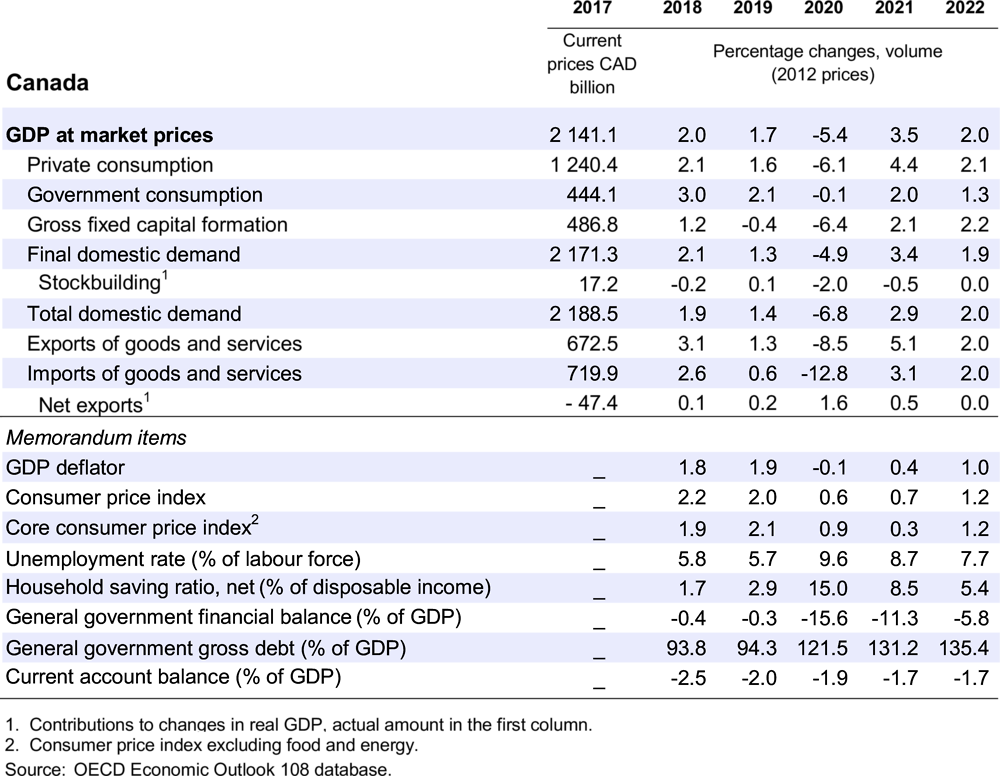

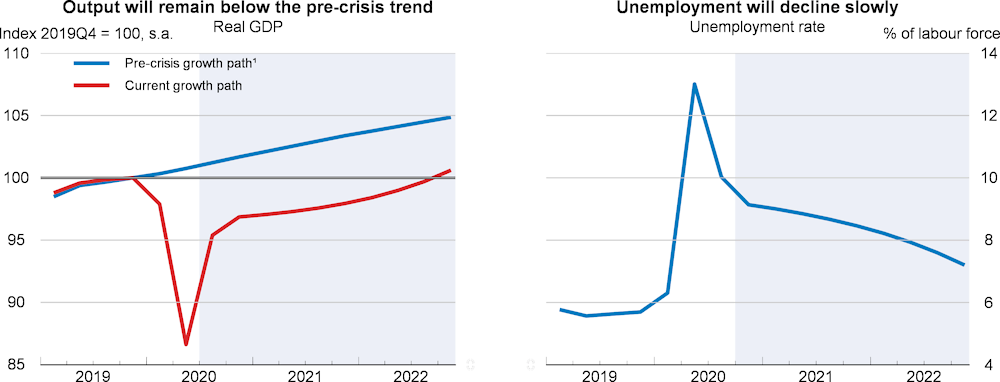

Recovery from an output decline of 5.4% in 2020 will be muted by drag from regional restrictions to combat COVID‑19 outbreaks and continued disruption to travel, hospitality and related sectors, leading to output growth of 3.5% in 2021. These developments will be echoed by a slow labour market recovery and low consumer price inflation. With vaccination against the virus set to become general in the latter half of 2021, diminished restrictions and a recovery in hard‑hit sectors will support growth in 2022. Growth of the public debt burden will slow.

Federal, provincial and territorial governments, along with the central bank, have been appropriately reactive to the evolving economic conditions. Going forward, governments need greater emphasis on encouraging employment and business recovery, including through green investment and through tackling long‑standing structural issues that impede Canada’s business sector. Ensuring that the enhancement of employment insurance is adequate following the termination of the Canada Emergency Response Benefit (CERB) also needs to be a priority. The Bank of Canada should stand ready to provide further liquidity support if required.