Álvaro Leandro

OECD Economic Surveys: Australia 2023

3. Achieving the transition to net zero in Australia

Abstract

Australia has committed to achieving net zero greenhouse gas emissions by 2050 and more recently outlined a more ambitious intermediate target for emission reductions by 2030. However, achieving these targets will be challenging given a historical reliance on coal generation and the presence of significant mining and agriculture sectors. It will require a rapid transformation of the electricity grid, significant emissions reductions in highly-polluting sectors such as industry and agriculture, and sufficient offsets generated by “negative emissions” technologies and practices to counterbalance any emissions that cannot be fully eliminated. At the same time, Australia is particularly vulnerable to the physical impacts of climate change, as the driest inhabited continent on the planet with the majority of the population living on the coasts. Further significant reforms are required to meet the emission reduction goals, support the reallocation of workers and adapt to climate change.

Introduction

Australia has committed to reduce net greenhouse gas (GHG) emissions to zero by 2050, with an intermediate target to reduce GHG emissions by 43% below 2005 levels by 2030. Achieving these targets will be challenging given a historical reliance on coal generation and the presence of significant mining and agriculture sectors. It will require a rapid transformation of the electricity sector, the reduction of GHG emissions across sectors in an efficient way, and sufficient offsets generated by “negative emissions” technologies and practices to counterbalance any emissions that cannot be fully eliminated. Achieving net zero emissions will entail deep structural changes and require the reallocation of economic activity and labour across sectors.

The green transition will provide benefits for Australia in addition to contributing to global efforts to reduce carbon emissions. Co-benefits include improved health and biodiversity. Australia is well-placed to become a major producer of renewable power given its large land mass, ocean access, some of the best wind and solar resources in the world (Wood and Dundas, 2020), and its abundance of minerals critical to the green transition, representing significant opportunities in terms of job creation and new trade activities.

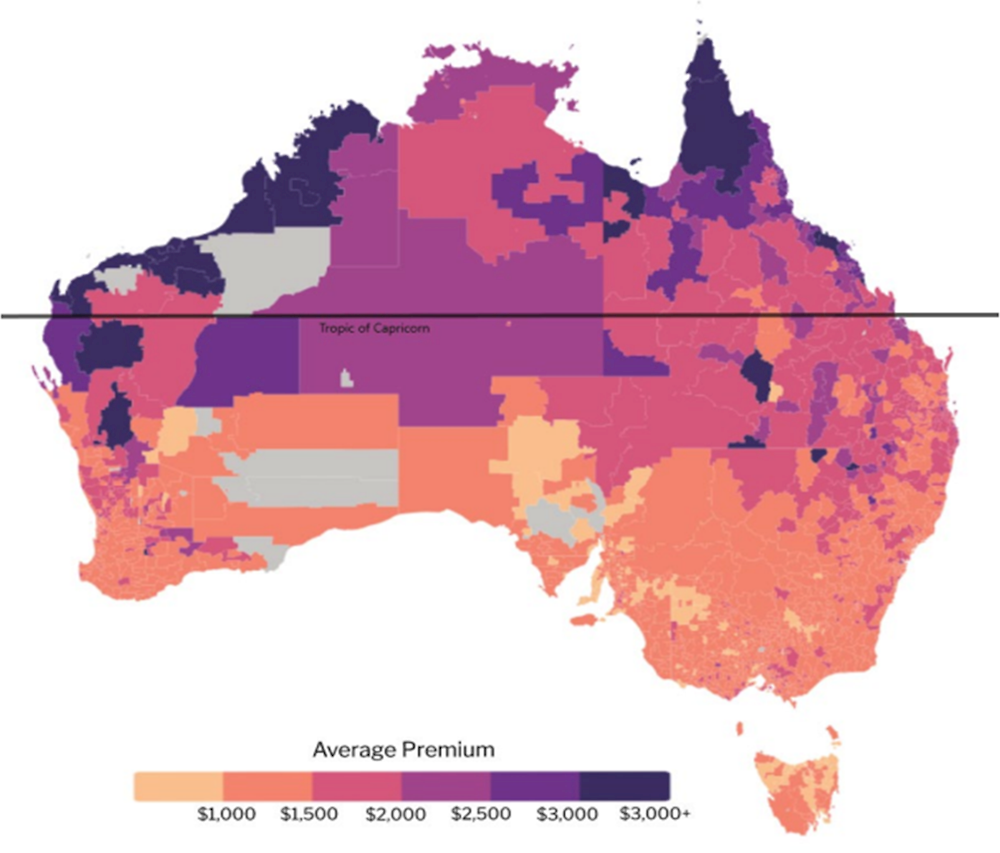

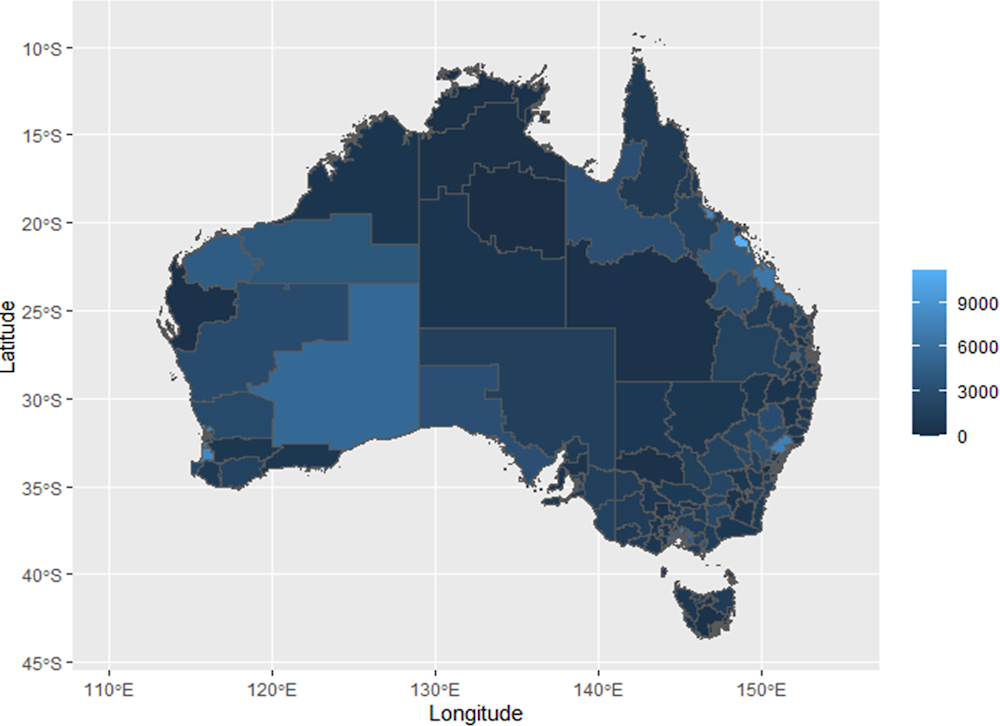

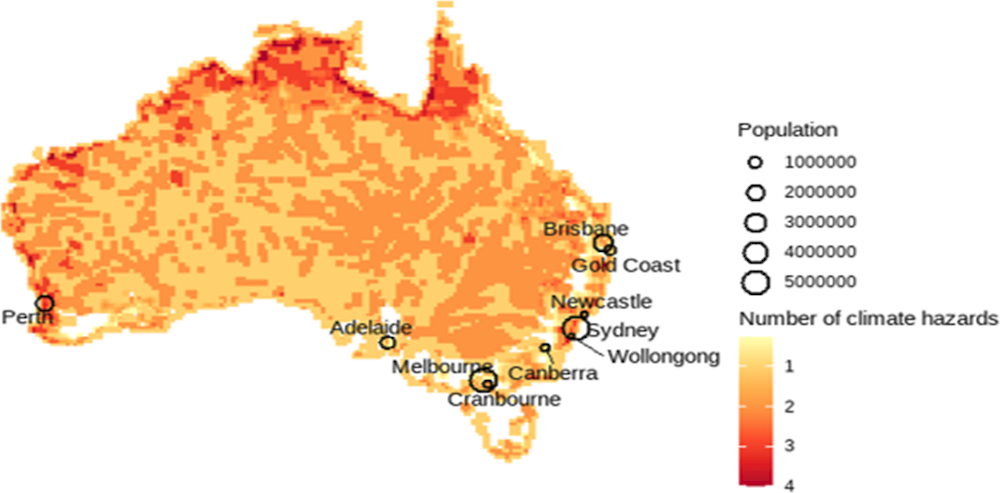

As the driest inhabited continent on the planet and with the majority of the population living on the coasts, Australia is highly vulnerable to climate change and related extreme events, such as extreme heat, heavy rainfall, coastal inundation, fire weather and drought. Australia will have to prepare and adapt for further global warming, which is already “locked-in” (Zhou et al., 2021), regardless of future actions to reduce global emissions.

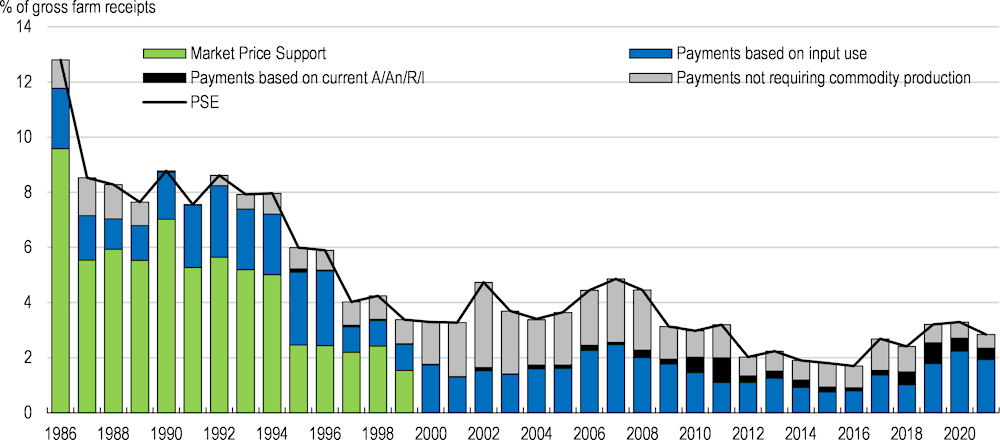

Net emissions have fallen over the past decade, but this has been in large part due to negative emissions from land use, land-use change and forestry (LULUCF), while total emissions excluding LULUCF only started falling in 2019. Achieving emissions targets will require significant further efforts. Under current policies, the electricity sector is the only sector where emissions are projected to fall significantly by 2030 from current levels, as renewable electricity replaces coal and gas-fired generation. Recent reforms have put Australia on the path to achieving its emissions reduction targets. As recommended in the previous Economic Survey, the Safeguard Mechanism, which regulates the emissions of Australia’s largest emitters, has recently been reformed and is set to materially contribute to the decarbonisation of the economy. The government also announced a target to increase the share of low-carbon power generation by 2030, with 82% to come from renewable energy. These reforms have the potential to bring emissions reductions by 2030 close to the 43% reduction target (DCCEEW, 2022), but further policies may be needed to ensure that targets are met.

The current state of the transition to net zero emissions

Greenhouse gas emissions in Australia

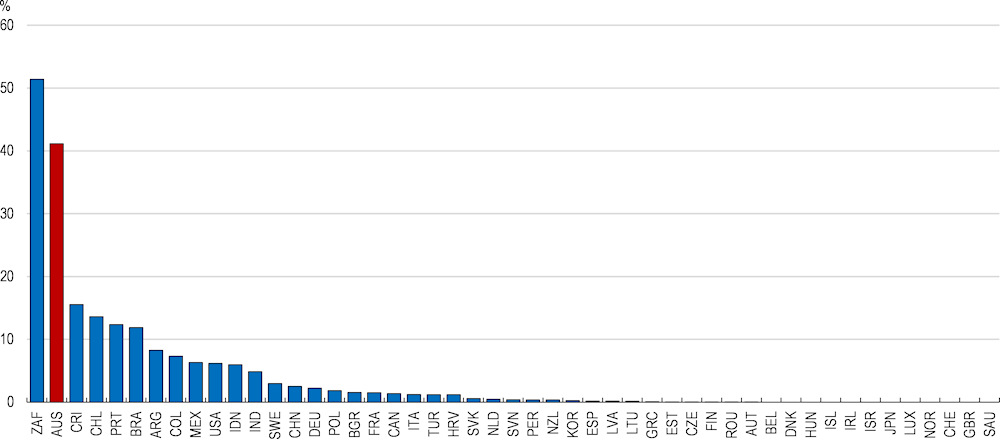

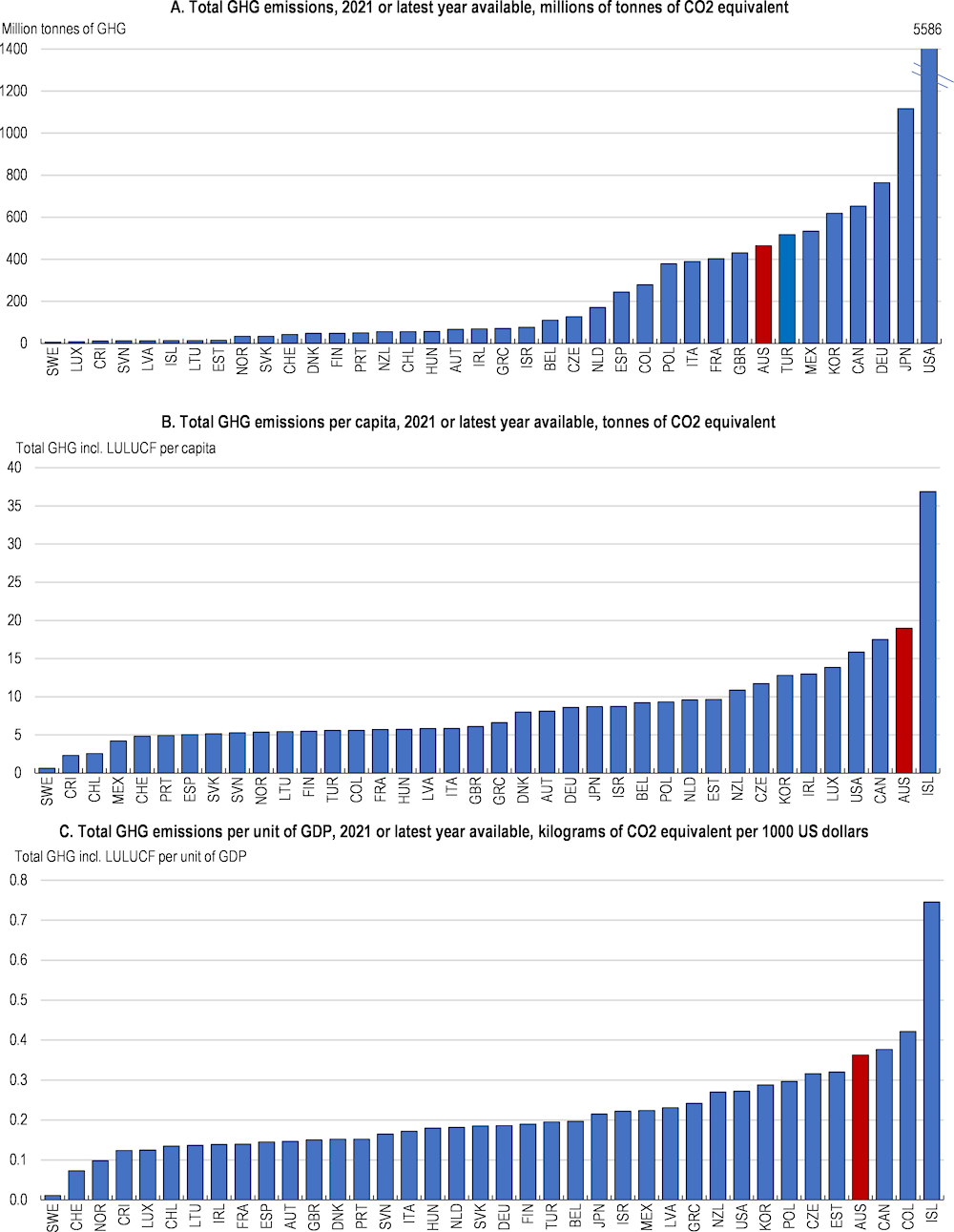

Despite recent progress, Australia is currently among the highest emitters of greenhouse gases (GHG) in the OECD, due to a historical reliance on coal generation, its role as a major global supplier of energy commodities (including thermal and metallurgical coal), and the presence of significant industrial and agriculture sectors. In terms of total emissions, Australia ranks seventh in the OECD (Figure 3.1, Panel A). After accounting for its population, Australia ranks second in GHG emissions, with 19 tonnes of GHG emissions per capita in 2020 (Figure 3.1, Panel B). While Australia has made progress in decoupling emissions from economic activity, total GHG emissions per unit of GDP also remain well above the OECD average (Figure 3.1, Panel C).

Figure 3.1. Australia is among the highest emitters of greenhouse gases in the OECD

Note: Including land-use, land-use change and forestry (LULUCF).

Source: OECD Environment Statistics database.

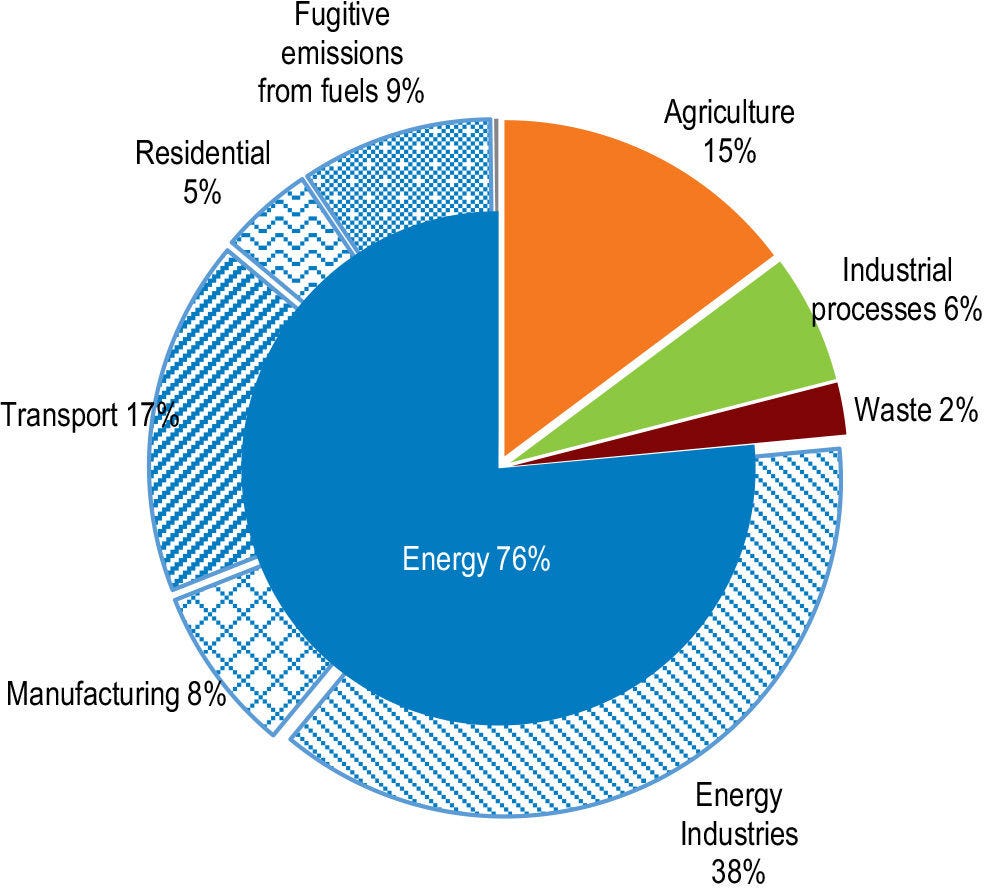

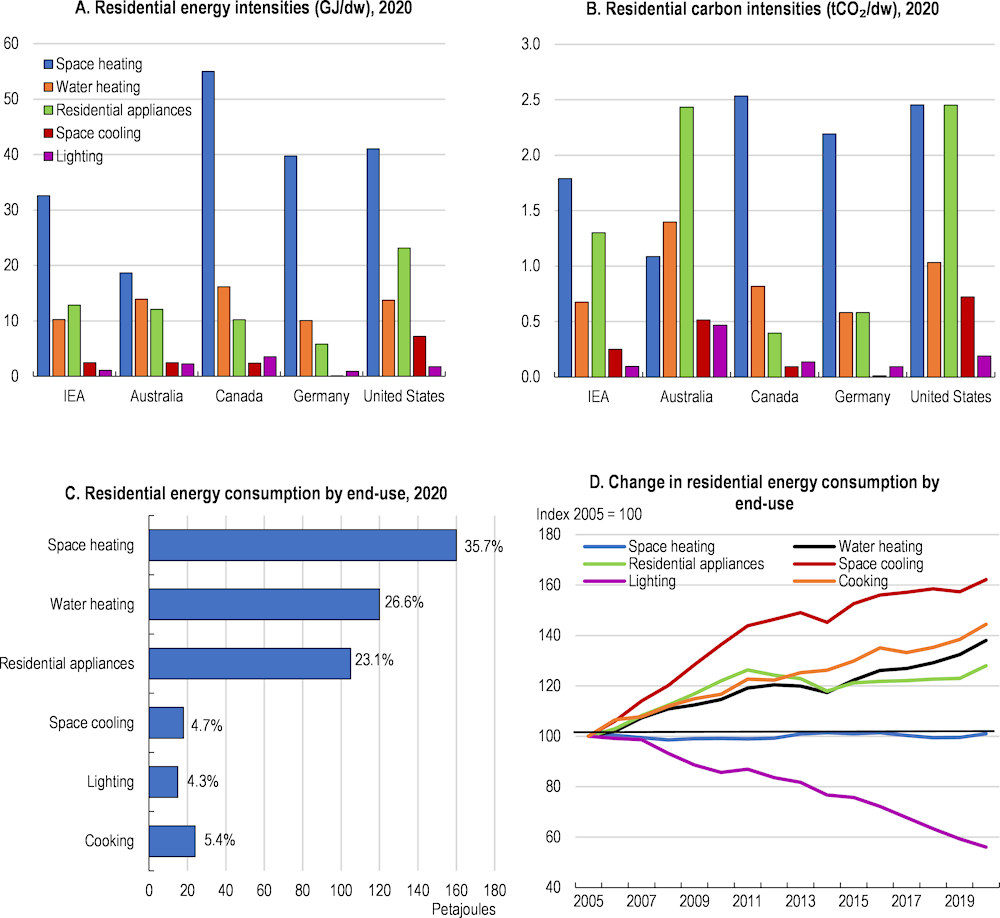

The energy sector is the main source of GHG emissions in Australia. In 2021, emissions from energy accounted for 76% of total emissions, followed by agriculture (15%), industrial processes (6%) and waste (2%) (Figure 3.2). Within the energy sector, electricity and heat generation account for the largest share of emissions (49%), followed by transport (22%), industry (22%) and buildings (6%). Emissions from electricity generation have fallen after a peak in 2016 as coal-based electricity generation has decreased (IEA 2023). Despite this decrease, almost half of GHG emissions from fuel combustion were due to coal in 2021 (45%), although this share has been decreasing since its peak in 2010 (IEA, 2023). GHG emissions from oil and gas, on the other hand, have been increasing, driven by rising energy consumption in the transport sector and the increasing role of gas in electricity generation.

Figure 3.2. Energy, transport and agriculture account for a large share of emissions

Share of emissions by sector, 2021 (%)

Australia’s net GHG emissions have steadily declined since 2005, but the vast majority of Australia’s decline in GHG emissions has been due to emission reductions in the land use sector as other emissions continued to rise. Between 2005 and 2020, annual emissions from land use, land use change and forestry declined by 123 million tonnes of CO2 equivalent, and the sector has become a net sink since 2015. This reflected reductions in native forest harvesting and primary forest clearing, improved soil carbon management, the fostering of native vegetation growth and retention and improved fire management in Australia's Top End savannas.

Declines in emissions from other sectors have been more limited. There have been increases in emissions from the transport sector and from fugitive emissions from fuels (largely deriving from the production of liquefied natural gas and coal for export) over the period. Emissions from agriculture declined by 13 million tonnes of CO2 equivalent during the same period, mainly due to declining cattle stocks induced by extreme heat, while emissions from waste have declined by around 3 million tonnes.

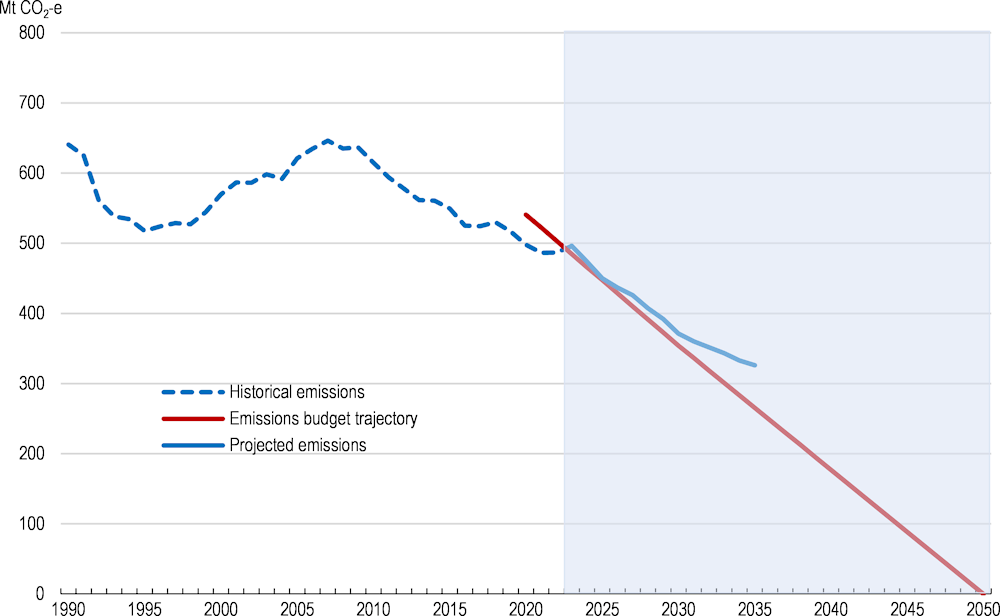

To achieve the emissions targets, net emissions will have to decline at a quick pace over the next 20 years, and significant reductions will be required in all sectors. However, under current projections and policies, Australia is expected to fall short of its targets and therefore additional policy measures will be needed. Agriculture emissions are expected to rise as cattle stocks recover after their recent decline due to extreme heat. Only emissions from electricity, industrial processes and waste are projected to significantly decline between 2020 and 2030 under current policies. Overall, the Department of Climate Change, Energy, the Environment and Water projects net GHG emissions to fall to 371 million tonnes of CO2-e by 2030 under current policies and assuming that the renewable electricity target of 82% by 2030 is met1, falling short of the 2030 target to reduce emissions by 43% below 2005 levels by 2030, which would require emissions to fall to 354 million tonnes by 2030 (Figure 3.3).

Figure 3.3. Projected net emissions fall short of reduction targets

Historical and projected GHG emissions, Mt CO2-e

Climate mitigation policies in Australia

Australia adopted the Climate Change Act in September 2022, which legislates a target of a 43% reduction in GHG emissions from 2005 levels by 2030, and net zero by 2050. These new targets are more ambitious than the previous emissions reduction target of 26%-28% between 2005 and 2030. The legislation also requires the Minister for Climate Change and Energy to prepare an Annual Climate Change Statement, informing the Parliament of progress on achieving emissions reductions, recent climate change policies, their effectiveness and their impacts, and the risks of climate change to Australia. These Statements must also take into account the advice of the Climate Change Authority, an independent body established in 2011 to provide expert advice to the government and conduct reviews and climate change research, which was given additional funding in the 2022-23 Budget. Finally, the Climate Change Act also provides for periodic reviews of the operation of the Act. The Department of Climate Change, Energy, the Environment and Water (DCCEEW) was established in July 2022 to deliver the climate change and energy agenda and protect Australia’s environment. This new department took over the energy functions from the Department of Industry, Science, and Resources.

Australia’s climate mitigation policies are chiefly organised under the Powering Australia plan. The main components of this plan include: an 82% Renewable Electricity Target by 2030, the reform of the Safeguard Mechanism which regulates the emissions of the country’s major industrial polluters (see Box 3.1 in the following section), the Powering the Regions Fund offering financial support for the decarbonisation in industry, the National Electric Vehicle Strategy aiming to encourage the uptake of Electric Vehicles (EVs), and the National Energy Performance Strategy, which focuses on increasing the energy efficiency and performance of the economy. The National Energy Transformation Partnership sets out how the government will collaborate with Australian jurisdictions, industry, communities, and unions.

The government announced in July 2023 that it will update Australia’s Net Zero 2050 plan and underpin it with sectoral decarbonisation plans for the transport, agriculture and land, resources, industry, built environment and electricity and energy sectors. Such a long-term national strategy will provide greater certainty, with interim and sectoral emissions reduction targets, milestones and concrete actions. This will help Australians and Australian businesses make long-term decisions and could propel innovation in low carbon technologies and incentivise their adoption (Berestycki et al, 2022). Importantly, the updated Net Zero 2050 plan will also have to carefully consider the optimal sequencing of sectoral transition paths. For example, the decarbonisation and scaling up of the electricity network will need to be rapid enough to manage the pace of electrification of other sectors such as buildings and transportation, ensuring that network capacity and reliability are sufficient and that overall emissions fall in line with national targets.

Table 3.1. All states and territories have adopted climate targets

|

State or territory |

Net zero commitments |

Emissions reduction targets |

Renewable energy targets |

|---|---|---|---|

|

Australian Capital Territory |

By 2045 |

50-60% by 2025 65-75% by 2030 90-95% by 2040 compared to 1990 levels |

100% electricity since 2020 Transition away from gas by 2045 |

|

New South Wales |

By 2050 |

50% by 2030 compared to 2005 levels |

12 GW of renewable energy by 2030 |

|

Northern Territory |

By 2050 |

No interim targets |

50% by 2030 70% renewable electricity for Indigenous Essential Services communities by 2030 |

|

Queensland |

By 2050 |

30% by 2030 compared to 2005 levels |

50% by 2030 70% by 2032 80% by 2050 |

|

South Australia |

By 2050 |

50% by 2030 compared to 2005 levels |

100% by 2030 500% by 2050 |

|

Tasmania |

By 2030 |

No interim targets |

100% renewable electricity since 2020 150% by 2030 200% by 2040 |

|

Victoria |

By 2045 |

28-33% by 2025 45-50% by 2030 75-80% by 2035 compared to 2005 levels |

65% and 2.6 GW of storage planned by 2030 90% and 6.3 GW of storage planned by 2025 |

|

Western Australia |

By 2050 |

80% emissions reduction target below 2020 levels for government operations No state-wide interim targets |

State-owned coal-fired power stations, under Synergy, will be retired by 2030 |

Source: Department of Climate Change, Energy, the Environment and Water (2022).

Australian states and territories also set their own emissions reduction targets and policies. All states and territories currently have net zero commitments, ranging from 2030 in Tasmania to 2050 in New South Wales, the Northern Territory, Queensland, South Australia and Western Australia. All but the Northern Territory, Tasmania and Western Australia also have interim emissions reduction targets, and most states and territories have announced complementary renewable energy targets of differing ambitions (Table 3.1). In Tasmania, electricity generation is already 100% renewable and the state plans to further increase capacity in order to export electricity to the mainland. While state-level targets ultimately raise the level of ambition, the variety of emissions reduction targets and policies at the state and territory level implies different costs of emissions abatement. Strong coordination between the federal government and states and territories would help: the National Cabinet, established in response to the COVID-19 pandemic and composed of the prime minister and state and territory premiers and chief ministers, could be an appropriate setting for this coordination to occur.

Achieving Australia’s emissions reduction targets

Meeting Australia’s emissions reduction targets will be challenging, and additional measures are needed to achieve them according to the Department of Climate Change, Energy, the Environment and Water's current projections. A comprehensive policy mix will be required to achieve the transition in the most effective way, including emission pricing instruments, standards and regulations, and complementary policies to facilitate the reallocation of capital and labour towards low-carbon activities, to spur innovation and to offset any adverse distributional effects (D’Arcangelo et al., 2022). The current approach in Australia is based on limited carbon pricing, particularly through the taxation of fuels, and a comprehensive set of regulations, standards, and public investment tailored to specific sectors. One major tool to reduce emissions is the Safeguard Mechanism, which regulates the emissions of large emitters particularly in the industrial sector and which was recently reformed.

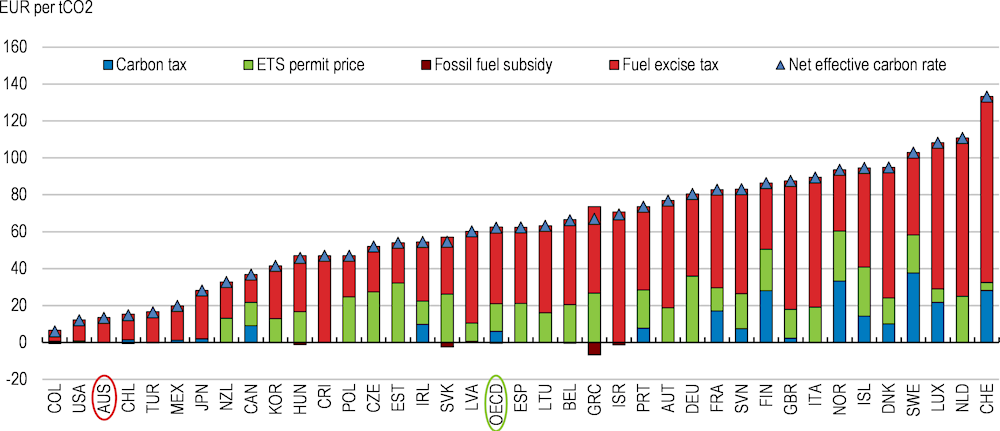

Cross-sectoral abatement policies

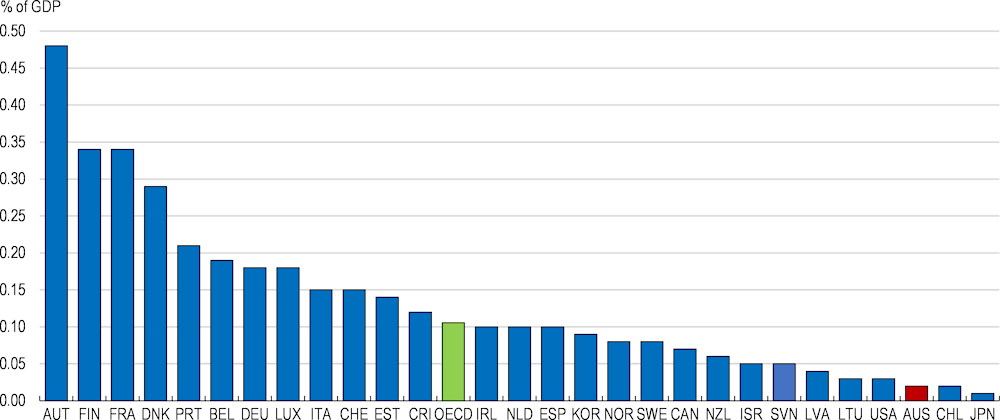

Carbon pricing can be an effective cross-sectoral measure to reduce GHG emissions by making low- or zero-carbon energy more competitive compared to high-carbon activities, incentivising shifts in production and consumption towards lower-carbon options, reducing demand for carbon-intensive fuels (D’Arcangelo et al., 2022; Arlinghaus, 2015; Martin et al., 2016), and mobilising private investment in low-emissions technologies (IMF/OECD, 2021). Effective carbon pricing can arise from fuel excise taxes, direct carbon taxes, or the use of tradeable carbon emission permits. Australia’s carbon emissions were priced lower than in most other OECD countries in 2021, but similar to some other commodity exporters such as Chile, with the totality of carbon pricing arising from the fuel excise tax (Figure 3.4). The recent reforms of the Safeguard Mechanism, however, which introduce the possibility to generate tradeable carbon credits (see below and Box 3.2 for details), will effectively introduce further pricing of emissions in the covered sectors.

While economy-wide carbon prices can be a cost-effective tool to reduce emissions, effective decarbonisation strategies must balance cost-effectiveness with fairness and public acceptability. Carbon pricing has proven politically unpopular in Australia, although a cross-country OECD survey suggests that support for a carbon tax crucially depends on how revenues are used, with a majority of survey respondents (58-60%) supporting a carbon tax if revenue were used to subsidise low-carbon technology or to fund environmental infrastructure (Box 3.1). A carbon pricing mechanism was introduced in Australia in 2012, covering emissions from electricity generation, stationary energy, landfills, wastewater, industrial processes and fugitive emissions. Under the mechanism, liable entities were required to surrender one emissions unit for every tonne of carbon dioxide equivalent (CO2-e) that they produced. The carbon pricing mechanism was repealed in 2014, and successive governments have ruled out further use of carbon pricing, opting for sectoral policies. In the absence of carbon pricing, sectoral policies should target the lowest-cost abatement opportunities in each sector to maximise their efficiency.

Figure 3.4. Carbon pricing has been limited in Australia

Note: Data are for 2021. Net effective average carbon rates are calculated as weighted average carbon prices across sectors net of fossil fuel support.

Source: OECD Net Effective Carbon Rates database.

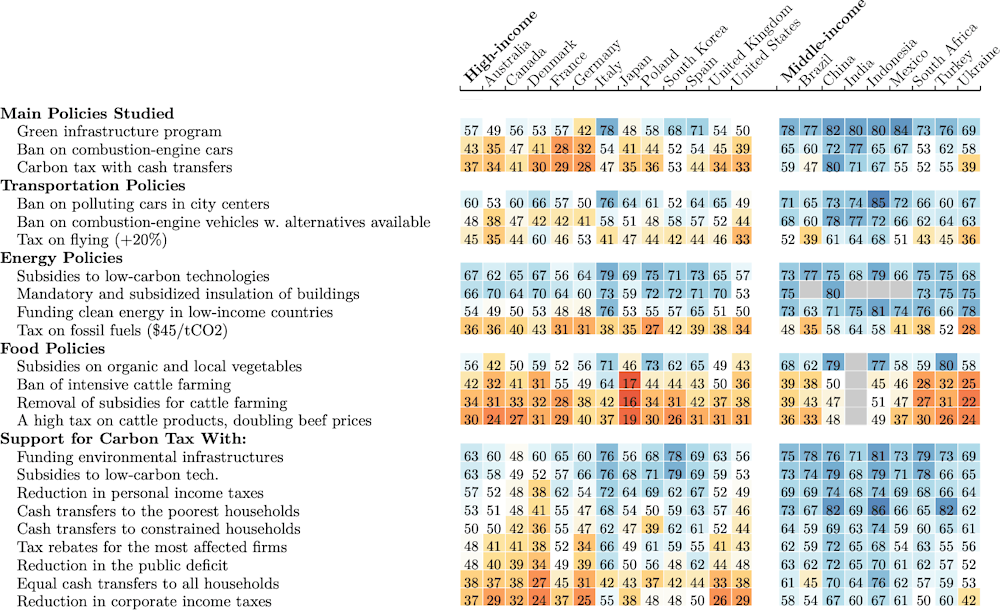

Box 3.1. Australian attitudes towards Climate Policies

The OECD led a survey in 2022 on the acceptability of climate policies, surveying over 40,000 respondents across twenty countries, including Australia. The survey sample includes 1,978 respondents from Australia and was designed to be nationally representative along the dimensions of gender, age, income, region, and area of residence (urban versus rural). Overall, the survey found that support for climate policies in the twenty covered countries is very dependent on their perceived distributional impacts and their perceived effectiveness. It also shows that information that specifically addresses these key concerns can substantially increase the support for climate policies in many countries.

In Australia, 77% of respondents agreed (somewhat to strongly) that “climate change is an important problem”, and 76% agreed that Australia “should take measures to fight climate change”. These proportions are only somewhat lower than in other high-income countries covered in the survey, where the average corresponding proportions were 84% and 81% respectively.

Survey results suggest that support for climate policies in Australia is generally lower than the average of high-income countries covered in the survey, and that support varies considerably depending on the climate policies considered. For example, Australians show relatively strong support for subsidies to low-carbon technologies (62% of respondents support it somewhat to strongly), mandatory and subsidised buildings insulation (70%), bans on polluting cars in city centres (53%), and green infrastructure programs (49%). On the other hand, they strongly oppose high taxes on cattle products (24% somewhat to strong support), taxing fossil fuels without revenue earmarking (36%), and a carbon tax with lump-sum cash transfers to all households (34%).

In Australia as in other countries in the survey, support for carbon taxes without revenue earmarking is low compared to other climate policies, but support rises depending on the proposed use of revenue. While only 29-34% of respondents support carbon taxes with revenue used to reduce corporate income taxes or provide equal cash transfers to all households, support for carbon taxes increases to 58-60% if revenue is used to subsidise low-carbon technology or to fund environmental infrastructure. Majority support also exists in Australia for a carbon tax with revenues being recycled to low-income households or to lower personal income tax.

Figure 3.5. Support for different climate policies varies greatly

Share of respondents who support climate change policies (somewhat to strongly)

Source: Dechezleprêtre, A. et al. (2022), “Fighting climate change: International attitudes toward climate policies”, OECD Economics Department Working Papers, No. 1714, OECD Publishing, Paris, https://doi.org/10.1787/3406f29a-en.

The main policy tool in Australia to reduce GHG emissions from large industrial facilities is the Safeguard Mechanism. The Mechanism sets limits (called baselines) on the emissions intensity of industrial facilities that emit more than 100,000 tonnes of CO2-e per year, of which there are more than 200 and which are responsible for close to 28% of Australia’s total emissions. In comparison, the European Union’s Emissions Trading System covers facilities emitting more than 25,000 tonnes of CO2-e per year. The Safeguard Mechanism covers facilities in the extractive industries sector, such as coal and iron ore mines, and in the industrial processes sector, including manufacturing and chemical plants. It also applies to the electricity sector, although a single baseline is set for the whole sector (as opposed to individual generators).

The Safeguard Mechanism was recently reformed to be more consistent with Australia’s revised emission reduction targets (see Box 3.2 for details on this reform). This reform introduces a number of fundamental changes. First, it introduces below-baseline crediting, so that firms that do not use their full allowance earn a Safeguard Mechanism Credit that can be traded with other members of the scheme or used in later years to exceed baselines. This incentivises the reduction of emissions beyond site-specific baselines and helps to equalise marginal abatement costs with other producers. Second, the reform has reset the baselines, eliminating all the current headroom under them, which in many cases had been set well above facilities’ emissions intensities. These baselines will now decline steadily each year. Finally, the reforms also introduced special considerations for new facilities entering the Safeguard Mechanism, which will be treated at a higher standard than existing facilities, and for facilities that are both highly emissions-intensive and trade-exposed, which will be able to apply for slower baseline decline rates. These reforms are welcome and could deliver significant emissions reductions. DCCEEW projections estimate that they will deliver around 46 Mt CO2-e in additional emissions reductions by 2030 compared to the baseline scenario.

Box 3.2. The 2023 reform of the Safeguard Mechanism

The Safeguard Mechanism is a set of regulations that apply to all industrial facilities in Australia that emit more than 100,000 tonnes of CO2-e per year. It sets individual limits, known as baselines, on the net emissions of the more than 200 industrial facilities that it covers, which together emit close to 28% of Australia’s total GHG emissions. It covers a broad range of industrial sectors, including electricity generation, mining, oil and gas extraction, manufacturing, transport, and waste. The Safeguard Mechanism was legislated in 2014 and has been in place since 2016. It was recently reformed following a period of consultation, culminating in the passage of The Safeguard Mechanism (Crediting) Amendment Bill 2023 in March 2023. The reforms became effective in July 2023.

How the Safeguard Mechanism works

The Safeguard Mechanism limits industrial emissions by establishing emissions baselines (or ceilings) for every individual facility it covers. Baselines are set in terms of facilities’ emissions intensities (emissions per unit of output), therefore on any given year the effective ceiling on an individual facility’s absolute emissions is calculated as the emissions intensity baseline (or ceiling) multiplied by the facility’s output. This means that covered facilities can raise their emissions by producing a larger volume, as long as the emissions intensity of the product is below the baseline.

Facilities that exceed their baselines must purchase and surrender domestic carbon offsets – Australian Carbon Credit Units (ACCUs) generated by Australia’s carbon crediting scheme (ACCU Scheme)– for the exceeding amount.

To date, baselines set by the Clean Energy Regulator have generally been set higher than facilities’ emissions and have therefore had little effect on emissions.

The electricity sector is treated differently than other sectors covered by the Safeguard Mechanism. Because electricity production is centrally coordinated, the Safeguard Mechanism applies a common baseline for the whole electricity sector.

The reformed Safeguard Mechanism

The Safeguard Mechanism (Crediting) Amendment Bill 2023 enacted a number of reforms to the Safeguard Mechanism, which have been in place since 1 July 2023. These reforms were made with the objective of requiring the large industrial facilities covered under the Safeguard Mechanism to deliver a proportional share of Australia’s new emissions reduction targets.

New baselines

The reform of the Safeguard Mechanism retains the current framework of emissions intensity baselines for each covered facility, as opposed to absolute emissions baselines.

Baselines for existing facilities will initially be set using site-specific emissions intensity values, which will eliminate the current headroom in the system. The emissions intensity values used to calculate site-specific baselines will then gradually transition towards industry average emissions intensity values by 2030. This is meant to incentivise production to occur in facilities with below-average emissions intensity.

Baselines will decline at a rate of 4.9% each year to 2030. A reserve has also been built into baseline decline rate calculations to ensure the 2030 target is met. The reserve accounts for any higher-than-expected production growth at new and existing facilities and any higher-than-expected use of the trade exposed baseline adjustments.

Post-2030 decline rates would be set in predictable five-year blocks, after updates to Australia’s Nationally Determined Contribution (NDC) under the Paris Agreement. Periodic baseline setting would involve consultation and take advice from the CCA and the latest Annual Climate Change Statements to Parliament.

Safeguard Mechanism Credits (SMCs)

The reform introduces Safeguard Mechanism Credits (SMCs), which facilities will automatically generate when their emissions are below their baseline. These new credits can be held, sold, or used to offset above-baseline emissions under the Safeguard Mechanism. They come in addition to the already-existing Australian Carbon Credit Units generated by the ACCU Scheme which remain eligible under the Safeguard Mechanism

If a facility uses ACCUs equal to more than 30% of its baseline, it must submit a statement to the Clean Energy Regulator setting out why onsite abatement hasn’t been undertaken.

Facilities will also be able to bank and borrow SMCs until 2030 in order to provide flexibility on the speed of abatement.

Treatment of new facilities

The baselines for new industrial facilities will be set at international best practice levels and will decline at the same rate as existing facilities. This is meant to take into account that new facilities will have access to the latest technologies and can achieve higher levels of emissions performance than existing facilities using legacy technologies.

Treatment of emissions-intensive, trade-exposed (EITE) facilities

Facilities that are both highly emissions-intensive and trade-exposed will be eligible to access the AUD 1.9 billion Powering the Regions Fund (PRF). Within the PRF, the Government will support trade-exposed Safeguard facilities to invest in low emissions technology through the AUD 600 million Safeguard Transformation Stream, and will also support industries providing critical inputs to clean energy industries (including steel, cement, lime, aluminium and alumina) through the AUD 400 million Critical Inputs Fund.

Trade-exposed facilities facing an especially elevated risk of carbon leakage will be able to apply for a slower baseline decline rate.

Review in 2026-2027

The policy settings of the Safeguard Mechanism will be reviewed in 2026-27. The review will consider a number of issues including the setting of baselines and their decline rates, the suitability of the differential treatment of emissions-intensive, trade-exposed activities, and the suitability of the various flexibility mechanisms in the system. The CCA will be required to advise the Government on the impact of the reforms on abatement and whether additional changes are required.

Source: Department of Climate Change, Energy, the Environment and Water.

While these reforms go in the right direction, further reforms to the Safeguard Mechanism may be needed to achieve emission reduction targets. First, the 2023 reform maintained baselines in terms of emissions intensity as opposed to total emissions. This means that covered facilities can raise their total emissions if they produce a larger volume, as long as the emissions intensity of the product is below the baseline. Industrial emissions are therefore not guaranteed to fall in line with national emissions reduction targets, which are set in terms of the absolute quantity of emissions, although regular reviews might lead to a tightening of the baselines if required. Second, baselines set in terms of emissions intensity combined with below-baseline crediting could also provide incentives for facilities with below-baselines emissions intensity to increase their production to generate Safeguard Mechanism Credits, which could eventually lead to an over-supply of these Credits.

The Safeguard Mechanism (Crediting) Amendment Bill 2023 provides for another review of the functioning of the Mechanism in 2026-27. This would be an appropriate time to further assess the impact of recent reforms. In particular, if industrial emissions do not fall in line with emissions reduction targets and Australia’s commitments under the Paris Agreement, baselines under the Safeguard Mechanism should be switched to baselines defined in terms of absolute emissions (as opposed to emissions intensity), which combined with below-baseline crediting, would bring the Safeguard Mechanism closer to a cap-and-trade system and be better aligned to policy objectives set in terms of the overall level of emissions. This review could also consider whether to set a floor on the price of ACCUs and Safeguard Mechanism Credits, as in the United Kingdom, which could reinforce incentives and increase certainty, and whether to broaden the coverage of the Safeguard Mechanism to other sectors. It will also be important to assess whether the baseline decline rates are appropriate, and whether the special treatment of emissions-intensive, trade-exposed activities and new facilities should not be tightened. It is important to ensure that the Safeguard Mechanism requirements are properly enforced and that penalties for exceeding baselines provide a sufficient deterrent.

Given that industrial facilities under the Safeguard Mechanism can meet their baselines by using carbon offsets (Box 3.2), it is imperative to ensure their credibility, integrity and additionality. In addition to Safeguard Mechanism Credits generated by industrial facilities that overachieve their Safeguard Mechanism emissions baselines, projects in other sectors that generate abatement with methodologies recognised by Australia’s Clean Energy Regulator can earn Australian Carbon Credit Units (ACCUs). ACCU prices have increased somewhat since the Safeguard Mechanism was reformed, and traded at around AUD 32 in August 2023, roughly in line with carbon credit prices in California but around a third of the price of European Union Carbon Permits. There has been criticism of the ACCU generation process as regards to the effectiveness and additionality (that is, whether projects result in carbon abatement that is unlikely to occur in the ordinary course of events) of the abatement projects it credits (Australian National University, 2022; Macintosh, 2022). A recent independent Review of Australian Carbon Credit Units highlighted these issues and produced a list of 16 recommendations to improve the integrity of the scheme, which the government has supported in principle. These include recommendations to improve transparency and remove restrictions on data sharing, and to improve the process of defining new methods that would be eligible for carbon credits. While the recent reform of the Safeguard Mechanism included 3 amendments to the ACCU scheme, the government should proceed with the full implementation of the recommendations in the Review of ACCUs. This should strengthen confidence in the transparency and integrity of ACCUs. In the latest Federal Budget, the government provided AUD 18.1 million over two years to implement priority reforms to the ACCU, including the establishment of the Carbon Abatement Integrity Committee to ensure the integrity of methods covered by the system.

The rest of this section covers policies to reduce emissions in Australia’s main polluting sectors: electricity generation, extractive industries, industrial processes, transport, agriculture and buildings. In the case of the extractive industries and industrial processes sectors, the Safeguard Mechanism already discussed in this section is the main policy tool to reduce emissions from large facilities, but further policies will be needed to achieve emissions reductions in smaller facilities not covered by the mechanism.

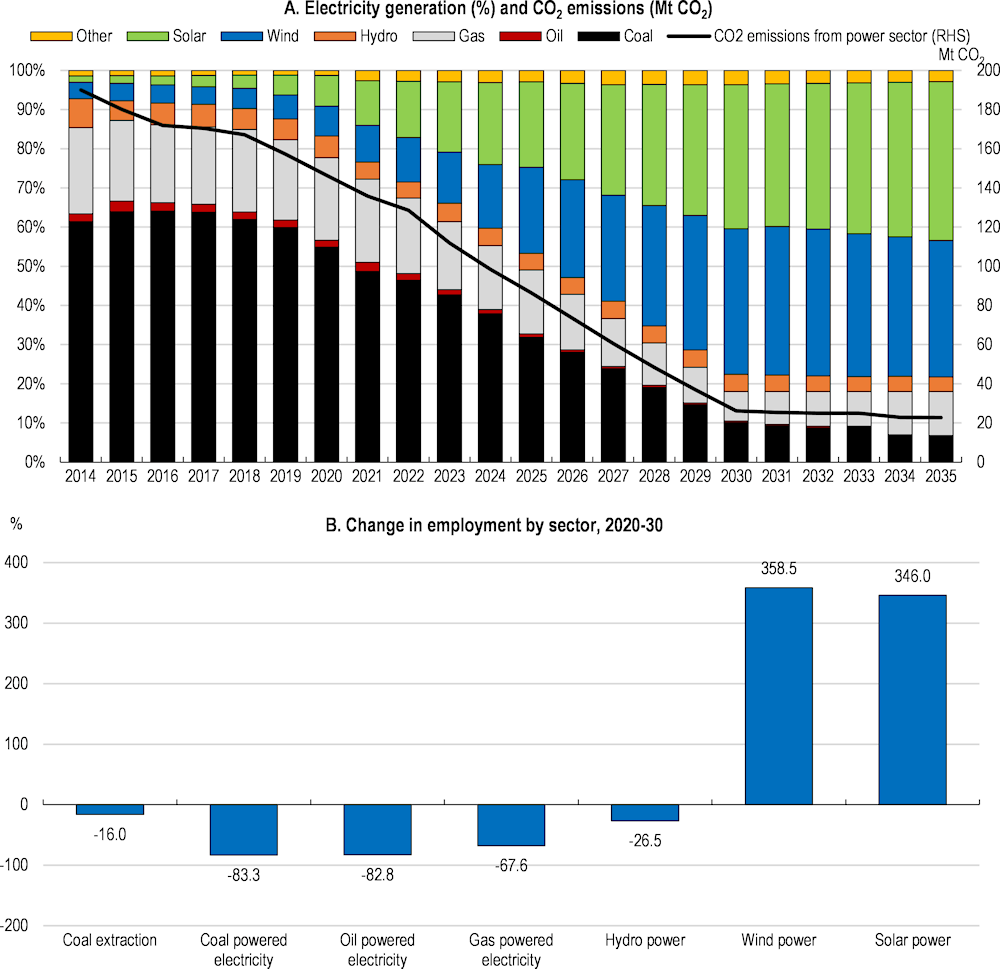

Electricity generation

Australia’s energy sector is at the heart of the transition to net zero. Energy production is responsible for the majority of Australia’s GHG emissions, and the power sector will be key to reduce emissions in other sectors such as transport and industry through electrification. Achieving the transition to net zero will require increasing total electricity generation capacity to satisfy increased demand from the electrification of certain sectors, large investments in transmission infrastructure, and a quick transition towards a majority of renewable electricity generation. The scale and urgency of these transformations will require careful planning and coordination across policymakers and levels of government, strong policies in the energy sector and large investments in electricity generation capacity and transmission to manage higher electricity use and more variable output from renewables. The abundance of sun, wind and land means Australia can generate large volumes of renewable electricity. The abundance of critical minerals also provides an opportunity for Australia to play a key role in supply chains for net zero technologies like batteries.

Table 3.2. Australia’s state and territory renewable energy targets and policies up to 2030

|

State |

% of demand |

Renewable energy target |

Policy measure(s) |

|---|---|---|---|

|

New South Wales |

|

24 600 GWh by 2030 |

Net Zero Plan Stage 1: 2020-2030 Electricity Infrastructure Roadmap |

|

Queensland (large-scale) |

18% of electricity generated by renewables |

70% of renewables by 2032 and 80% by 2035 (announced in September 2022) |

Plans to convert coal-fired power plants to renewable hubs by 2035 under a AUD 62 billion clean energy plan, including through reverse auctions. |

|

Victoria |

26% of electricity generated by renewables |

25% by 2020, 40% by 2025 (committed in 2017) 50% by 2030 (committed in 2019) 65% by 2030, 95% by 2035 (announced in 2022) |

Climate Change Strategy Reverse auction to fund renewable energy generation projects (>900 MW in total) and successful bidders enter into contracts for the difference. |

|

South Australia |

Demand covered 100% by renewables on 180 days in 2021 |

100% net renewables by 2030 500% by 2050 (become exporter |

Climate Change Action Plan 2021-2025 No market mechanism. Government funding for renewables and storage |

|

Northern Territory |

50% by 2030 announced in 2017 |

Climate Change Response: Towards 2050 In January 2019, the Northern Territory Government entered into power purchase agreements to buy electricity from two new solar farms. |

|

|

Australian Capital Territory |

Achieved 100% renewables in 2020 |

100% by 2020 (committed in 2016) |

Climate Change Strategy 2019-2025 Reverse auction to fund renewable energy generation projects (650 MW in total) and successful bidders enter into contracts for the difference. |

|

Tasmania |

Achieved 100% renewables in 2020 |

15 750 GWh by 2030, 21 000 GWh by 2040 =200% announced in 2020 |

Climate Change Action Plan 2017-2021 No market mechanism. A range of complementary measures, including government investment in existing hydropower assets. |

|

Western Australia |

None (80% of emissions reductions by 2030, coal retirements by 2030, AUD 3.8 billion investment plan in renewable power) |

Note: GWH = gigawatt hour; MW = megawatt.

Source: CCA, (2020) IEA updates.

The Australian government has announced a target of 82% renewable electricity generation by 2030. In addition, state and territory renewable energy targets and related policy measures including reverse auctions, feed-in premiums and power purchase agreements have been upgraded in recent years and have been an important driver of increased renewable generation (see Table 3.2). In August 2022, federal, state and territory energy ministers established a National Energy Transformation Partnership (NETP) to coordinate action and identify priorities for the transformation of the Australian energy sector. A first action of the NETP will be to introduce an emissions reduction objective into the national energy objectives, which will serve as a basis for further policies and regulations by Australia’s three energy market bodies – the Australian Energy Market Commission (AEMC), the Australian Energy Market Operator (AEMO) and the Australian Energy Regulator (AER). The NETP also aims to help speed up the deployment of transmission lines by identifying critical transmission projects to speed up their delivery and ensure community consultation.

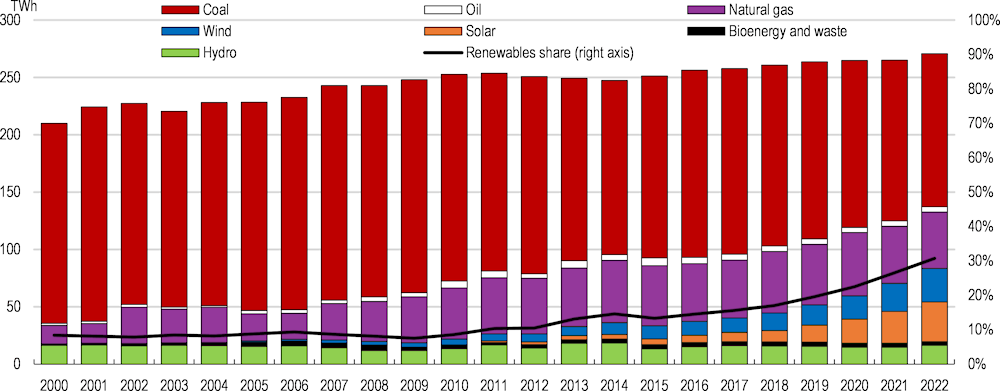

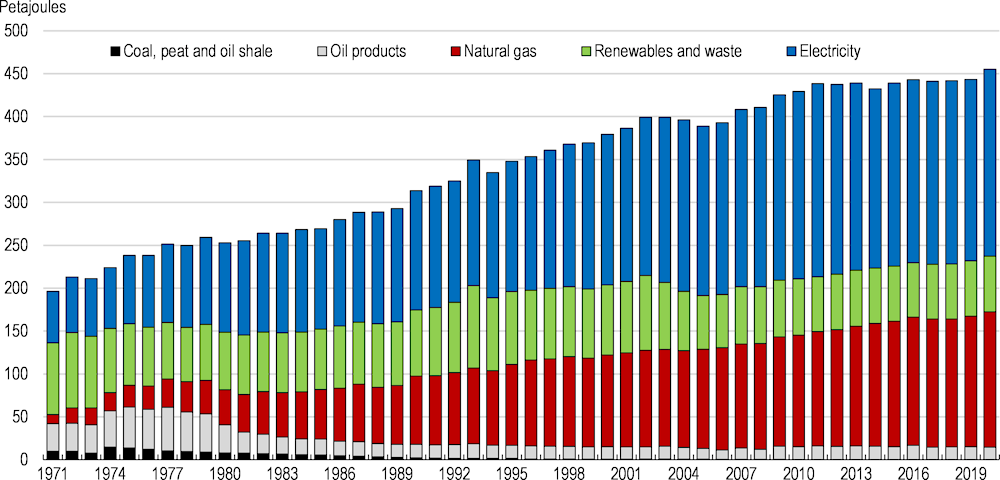

Renewable electricity generation has greatly increased in recent years, quadrupling between 2000 and 2021 (albeit from low levels), mainly driven by strong increases in solar and wind electricity generation, which in 2022 accounted for 12.8% and 10.7% of total electricity generation respectively (Figure 3.6; IEA, 2023). One in three households in Australia have rooftop solar photovoltaic installations, the highest share in the world, and these households can receive feed-in tariffs for any unused electricity sent back to the grid. Nevertheless, the share of all renewables in total electricity generation remains below the OECD average, at 30.8%. Achieving the national target of 82% renewable electricity generation by 2030 and managing the fluctuations in renewable generation will require further reforms in the National Energy Market, one of the largest interconnected electricity markets in the world which connects the six eastern and southern states and territories and delivers around 80% of all electricity consumption in Australia. Given that states have constitutional power with regard to the electricity generation mix, strong cooperation and coordination of federal, state and territory policies will be essential. State-based investment schemes and incentives programmes should be carefully coordinated, informed by a national plan providing greater clarity on the timing of capacity additions and the retirement of coal generation.

Figure 3.6. The share of renewable electricity generation has risen but more progress is needed

Electricity generation in Australia by source, TWh

Despite its potential, offshore wind electricity generation remains a nascent industry in Australia, with costs remaining high (IEA, 2023). Both Victoria and South Australia are currently promoting offshore wind areas, and Victoria has set offshore wind capacity targets (2 GW by 2032, 4 GW by 2035 and 9 GW by 2040). The government has put in place a number of policies to fast-track the development of the offshore wind industry including the Offshore Electricity Infrastructure Act 2021, which provides the legal framework to enable the construction, installation, commissioning, operation, maintenance and decommissioning of offshore electricity infrastructure, and the Offshore Electricity Infrastructure Regulations 2022. The experience of countries that have achieved significant offshore wind capacity, such as Denmark, where 18% of electricity demand is met by offshore wind generation, suggest that careful spatial planning, including of grid connections, and a streamlined licensing system are important for the development of the offshore wind industry (Box 3.3).

Box 3.3. The development of offshore wind capacity in Denmark

The world’s first offshore wind farm was commissioned in Denmark in 1991, but it took three decades of sustained support to get to the point where it met 18% of Danish electricity demand in 2019. Policy measures have been central in increasing deployment and bringing down costs.

Sustained support for wind research, development and deployment, with significant subsidies in the late 1970s and 1980s and increasing funding throughout the 2000s, peaking at DKK 618 million in 2013.

Quantitative targets for wind energy in energy plans for 2000, 2005 and 2020, all exceeded.

A spatial planning committee for offshore wind was established in 1995 to ensure coordinated development. Grid connection for large offshore wind farms is planned, procured, operated and paid for by the transmission system operator and can contribute to the broader network and interconnection.

The Danish Energy Agency is the single body responsible for issuing all required licenses. The average consent processing time of 16 months is considerably shorter than in the Netherlands, Spain or Germany.

Feed-in tariffs determined by competitive tender, which peaked at DKK 1.05/kWh for the Anholt wind farm in 2013, falling to DKK 0.372/kWh for the Kriegers Flak project scheduled to be operational in 2021.

Development sites for government-run tenders are de-risked: prior to tender there is a fully approved Environmental Impact Assessment of the offshore area and possible grid solutions.

Source: OECD (2021c).

Australian authorities have in recent years enacted a series of reforms to support electricity security and the integration of rising shares of variable renewables into the electricity system (IEA, 2023). These include the introduction of an integrated system plan with renewable energy zones and transmission priority projects, adjustments to short-term trading, the introduction of the five-minute settlement (which allows for changes to metering, settlement and bidding processes), and a formal demand response at the wholesale level. The deployment of batteries has also reinforced the stability of the National Energy Market, and additional 1 700 MW of battery capacity is committed to enter the NEM by 2025. Pumped hydro storage is also expected to play an important role, and the Snowy Hydro scheme is set to be expanded over the next few years. The 2016 South Australia blackout and the June 2022 electricity crisis illustrate the need for system stabilisation mechanisms. The Australian Energy Market Operator forecasts that more than 300% of additional investment in utility-scale storage will be required to manage real-time power system stabilisation more efficiently and support cost-effective load shifting compared to current levels.

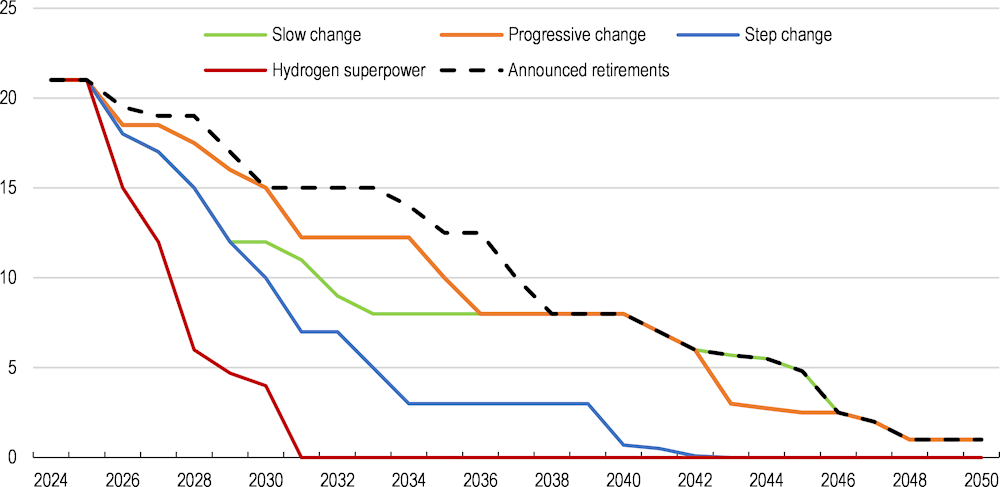

Australia’s renewable electricity targets also imply a fast decline in coal power generation. However, uncertainty remains over the speed of retirement of coal generation. Announced coal plant retirements by coal plant owners are currently not in line with the Australian Energy Market Operator’s (AEMO) ambitious step change scenario under the Integrated System Plan 2022, under which 16 GW of thermal coal generation would be retired over the next two decades (Figure 3.7). Australia has also not joined more than 40 other countries committing to phase out coal power at the 2021 COP26 summit, including large coal power using countries such as South Korea, Indonesia, Vietnam, and Poland, Greater certainty is required to plan for the retirement of thermal coal generation, address its impact on the reliability of the power sector, and spur investment in power generation from other sources. The Australian government currently requires a 3.5-year notice period for coal-fired power plant owners to notify the government of a plant closure. Greater coordination between states, the AEMO and power plant operators will be necessary to ensure an orderly retirement of coal power generation.

Figure 3.7. Announced retirements of coal-fired generators are not consistent with climate goals

Scheduled closure profile of coal-fired generators in Australia by scenario, available coal capacity (GW)

The Australian Government has committed around AUD 23 billion (1% of GDP) until the end of 2025 towards transforming the country’s energy system, including AUD 20 billion for the Rewiring the Nation programme to increase renewable energy capacity and to invest in key transmission projects through the Clean Energy Finance Corporation. Under the program, the government will provide AUD 1.5 billion in concessional financing for renewable projects in Renewable Energy Zones, with fast-track regulatory processes to support their quick deployment. The government also recently announced a Capacity Investment Scheme, a guarantee scheme to support the development of renewable generation and storage which is expected to unlock AUD 10 billion in investment. Increased clean energy funding, the use of power purchase agreements and projects announced in Renewable Energy Zones could expand Australia’s renewable energy capacity by at least 85% according to the IEA (2023). Australia should stand ready to provide further policy support and accelerate the planning and implementation of renewable energy projects to ensure that renewable energy targets are met.

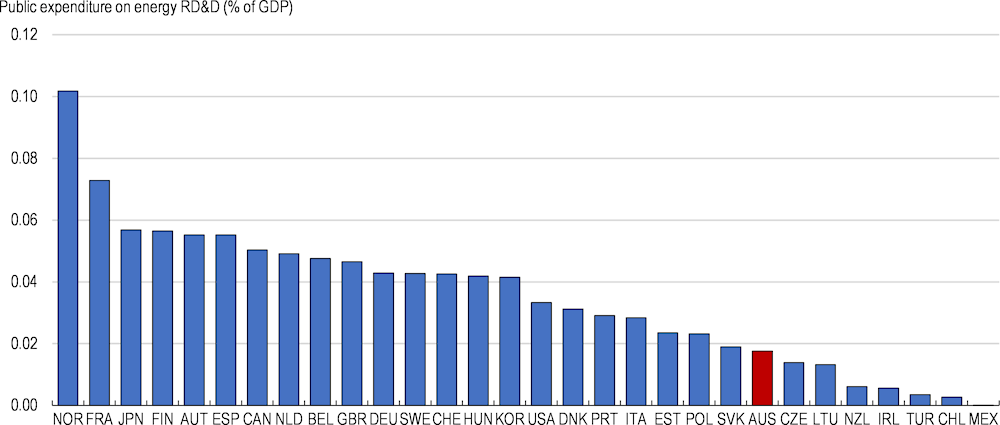

The government has identified the development of clean energy technologies as a key component of the transition to net zero. One important aspect is the development and deployment of carbon capture, utilisation and storage to reduce emissions from coal power generation. Strong institutions are already in place to support these aims. The Australian Renewable Energy Agency provides grants for research, development, demonstration, deployment and early-stage commercialisation of renewables technology. The Clean Energy Finance Corporation facilitates the financing of clean energy projects through a variety of instruments including co-financing, project finance, corporate loans, climate bonds and equities. However, Australia’s public spending on energy RD&D, at 0.018% of GDP in 2023, is significantly smaller than the IEA average (Figure 3.8). Most of this public expenditure was on commercialisation (72%), while only 23% was on R&D and 6% for demonstration (IEA, 2023c). To date, carbon capture and storage technologies have received the highest amount of public support but have yet to demonstrate their effectiveness in reducing emissions at scale (Browne and Swann, 2017; Productivity Commission, 2023). Australia also provides a volume-based R&D tax credit to incentivise private investment in R&D (not only energy-related), for which there is significant uptake by SMEs (OECD, 2021). Despite this tax relief measure, total government support to business R&D in Australia, at 0.15% of GDP, is below the OECD average. According to the IEA, energy R&D funding in Australia does not yet match the ambition for reaching net zero by 2050 (IEA, 2023). In the absence of wider carbon pricing, more investment is needed in the development and demonstration of critical net zero technologies, particularly in hard-to-abate sectors. The government should consider scaling up and refocussing its RD&D funding programs towards the development and demonstration of clean energy and energy-efficiency technologies.

Figure 3.8. Public spending on energy RD&D is low in Australia

Extractive industries

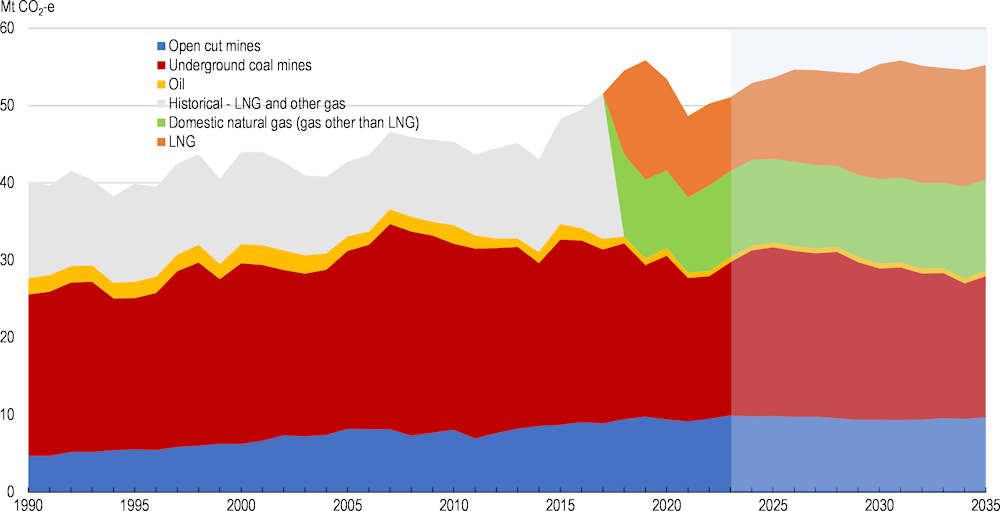

After combining direct and indirect GHG emissions from purchased electricity, mining is by far the economic sector with the largest percentage increase in emissions since 1990. Combined emissions from mining rose steadily by 138% between 1990 and 2020. According to DCCEEW’s baseline projections, these mining emissions are expected to decline by 8% between 2020 and 2030 as coal production falls, mining equipment is electrified (displacing diesel) and the electric power grid is greened. Fugitive emissions are released during the extraction, processing, and transport of fossil fuels. These emissions have steadily increased since the 1990s to reach 53 Mt CO2-e in 2020, and mainly arise from coal, which accounted for 57% of all fugitive emissions (Figure 3.9). Fugitive emissions from coal are driven by coal production, mining emissions intensity and the quantity of methane capture: in 2020, 52% of the methane generated from underground coal mines was captured for flaring and electricity generation (Department of Industry, Science Energy and Resources, 2022). Fugitive emissions from oil and gas extraction are the second major source of fugitive emissions in Australia, accounting for 22.9 Mt CO2-e in 2020, or 43% of fugitive emissions. Fugitive emissions associated with LNG production have grown strongly in the last two decades as the LNG export industry has expanded.

Figure 3.9. Fugitive emissions are projected to rise

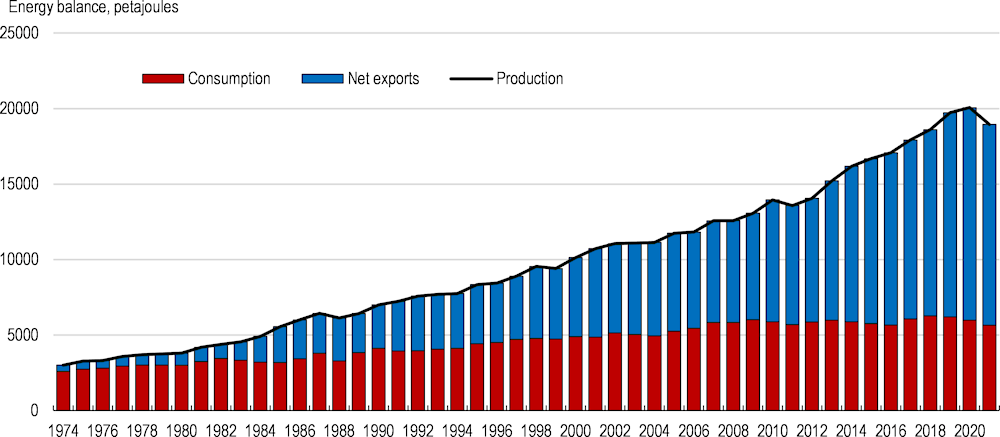

As a major energy exporter, emissions generated in the production of energy exports account for a very significant part of Australian GHG emissions. Energy exports, which are dominated by coal, have more than doubled since 2000, with natural gas exports growing almost tenfold during that period. Total energy production in Australia is currently more than three times higher than the country’s energy needs (Figure 3.10). In particular, domestic coal production is almost 8 times higher than the country’s needs, and natural gas production is more than 3 times larger than the country’s use of natural gas. Part of the natural gas produced in Australia is consumed domestically in the residential, commercial and industrial sectors, while liquid natural gas (LNG) is exported. As a result, export-oriented sectors were responsible for 41% of Australia’s total GHG emissions in 2021 (which does not account for the emissions arising from the use of these exports in destination countries, such as the burning of thermal coal exports). Japan was the main destination of coal exports between 2000 and 2010, when exports to Japan accounted for more than half of Australian coal exports. Since then, China has grown into a major destination of Australian coal exports, accounting for roughly 26% of coal exports in 2020 (coal exports to China dropped significantly in 2021 following trade restrictions). Exports to Korea, India and Chinese Taipei also grew steadily during this period, but exports to Japan remain significant despite a decline in their share of total coal exports. Natural gas exports have also grown rapidly. Japan was virtually the sole destination of natural gas exports between 2000 and 2010, but China’s share had grown rapidly to around 41% by 2021. Natural gas exports to Korea and Chinese Taipei have also grown significantly since 2010, but their total share remains small.

Figure 3.10. Australia is a major energy exporter

Emissions from natural gas production are set to become a major driver of emissions in the future, most of which will be driven by export demand as domestic demand for gas diminishes through electrification. Future emissions from natural gas production will therefore depend greatly on transition policies abroad. In 2020, 85% of LNG exports went to countries with net zero commitments (Grattan Institute, 2021b).

Under the IEA’s net zero scenario, Australia’s fossil fuel exports would shrink dramatically, especially coal exports given that global coal demand would fall by 45% to 2030 and by 90% to 2050, initially driven by declining coal use in the power sector, followed by reductions in coal use in industry (IEA, 2022g). While the government expects coal exports to continue through to 2050, it will be important to develop a roadmap for this sector that takes into account the emissions reduction commitments of Australia’s main trading partners and the likely significant fall in demand for coal. Such a roadmap would provide greater clarity for actors in this sector on where to focus efforts and resources.

If this scenario does not materialise, however, significant reductions in emissions intensity will be necessary to meaningfully reduce emissions from this sector, combined with the use of offsets to compensate for unabatable emissions. Emissions intensity in the extractive industries can be improved through the use of renewables, improvements in combustion efficiency, and carbon capture and storage, which will require significant improvements in available technology. The reformed Safeguard Mechanism (explained in Table 3.2) is Australia’s main policy tool to reduce emissions from extractive industries. To comply with the Mechanism, mining facilities will have to reduce their emissions intensity every year in line with their baselines, or purchase Safeguard Mechanism Credits or ACCUs if they exceed them. Additionally, new mining facilities, which could include new mines for critical minerals such as lithium and cobalt, will face stricter baselines than already-existing mining facilities. The recent reforms of the Safeguard Mechanism provide that baselines for these new facilities will be set according to “international best practice levels”, which will have to be carefully defined.

Given the abundance of renewable energy resources and a large wealth of critical minerals, Australia has the opportunity to secure the energy transition while remaining a key player in international energy markets. As the global energy system shifts to clean energy, demand for critical minerals is set to hugely increase, quadrupling by 2050 (IEA, 2022). Lithium, nickel, cobalt, manganese and graphite are crucial to battery performance, longevity and energy density (IEA, 2021). Rare earth elements are essential for permanent magnets that are vital for wind turbines and EV motors. Electricity networks need a large amount of copper and aluminium. Australia has particularly large reserves of some of these critical minerals, with 27% of the world’s estimated lithium reserves located in Australia, 22% of the world’s nickel reserves, 21% of cobalt, 11% of copper and 10% of manganese ore (Grattan, 2023). Australia is already a dominant producer of some of these minerals: In 2021, it retained its position as the world’s top lithium producer (53%) and was also a top five producer for antimony (3%), cobalt (3%), magnesite (3%), manganese ore (11%), rare earths (8%), rutile (26%), tantalum (5%), and zircon (30%) (Hughes et al., 2023).

While critical minerals provide an opportunity for Australia to remain a critical player in energy markets, it will be crucial to ensure that the environmental impacts resulting from their extraction, processing and manufacturing are minimised. Environmental damages can include air pollution, the destruction of habitats such as forests, or pollution of water sources. As part of the Critical Minerals Strategy 2023-30, Australia is working on further developing international standards in this sector, including by participating in technical standard-setting committees and advocacy for internationally aligned critical minerals standards. Work is also underway on a Certification and Life Cycle Analysis for Australian Battery Materials and a Battery Material Provenance Authentication pilot, which will help improve the traceability of minerals provenance. Additionally, the government is also pursuing a reform agenda to strengthen its cultural heritage and environmental protection legislation to ensure that First Nation Peoples can also benefit from the opportunities provided by critical minerals, the deposits of which are often located on land covered by a Native Title claim or determination. In particular, a National Environmental Standard for First Nations Engagement and Participation in Decision-Making is being developed through a co-design process with First Nations peoples.

In addition to producing these critical minerals, Australia also has the opportunity to move up the value chain and participate in the production of end-products, such as batteries for EVs and energy storage, and address supply chain bottlenecks in these technologies. While Australia is a major producer of the input materials, most battery manufacturing occurs overseas. The government has recently conducted a consultation to establish a National Battery Strategy to support a competitive battery industry in Australia. The Strategy will build on AUD 100 million in equity funding to deliver a Battery Manufacturing Precinct in partnership with the Queensland government. Further ramping up the production of critical minerals and downstream processing and manufacturing will require streamlining permitting procedures to reduce lead times and increasing government support through grants to early- and mid-stage projects such as the Modern Manufacturing Initiative. Promoting high environmental, social and governance standards (ESG) in this sector will also be crucial to ensure that the production and processing of critical minerals does not result in higher emissions and other environmental damage.

Industrial processes

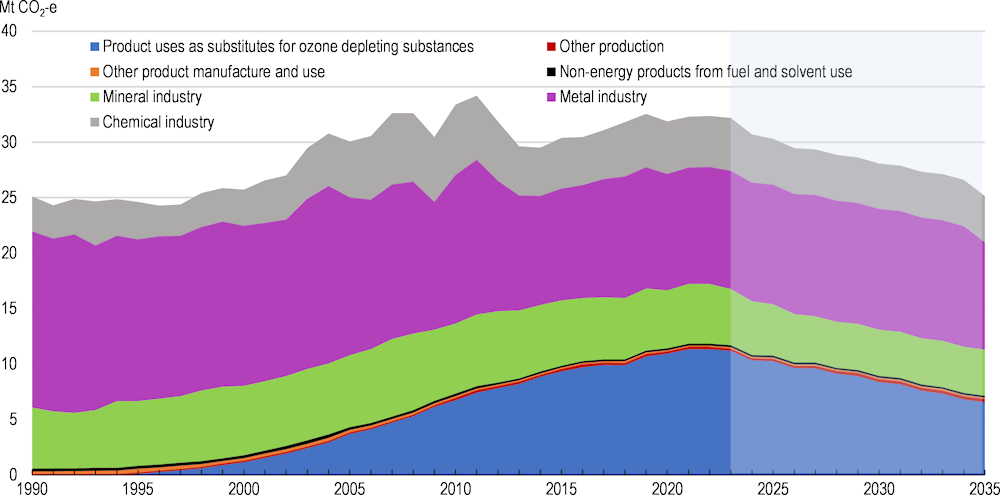

Australia’s manufacturing sector accounts for 8% of value added, with greatest contributions from primary metal and metal product manufacturing, and basic chemical and chemical product manufacturing. Direct emissions from industrial processes arise from process emissions and emissions from combustion. As in other sectors, indirect emissions also arise from the use of electricity in industry. Emissions from industrial processes and product use, which arise from production processes such as iron and steel production, accounted for 6.4% of total net emissions in Australia in 2020, two-thirds of which from the metal, mineral, and chemical industries (Figure 3.11). Under the DCCEEW’s baseline projections, only HFC emissions (refrigerants) are set to significantly decline over the next decade, as a result of the implementation of the Ozone Protection and Synthetic Greenhouse Gas Management Act 1989, while emissions from metal, mineral and chemical industries are projected to decrease only slightly. Additionally, these projections do not take into account a possible significant increase in mining and processing of critical minerals in Australia, or the production of batteries, which would entail a ramp-up in emissions from these sources unless technologies are developed and implemented to significantly limit these emissions, which is unlikely in the near term.

Figure 3.11. Emissions from industrial processes will remain high

Industrial processes and product use emissions in the baseline scenario, 1990 to 2035, Mt CO2-e

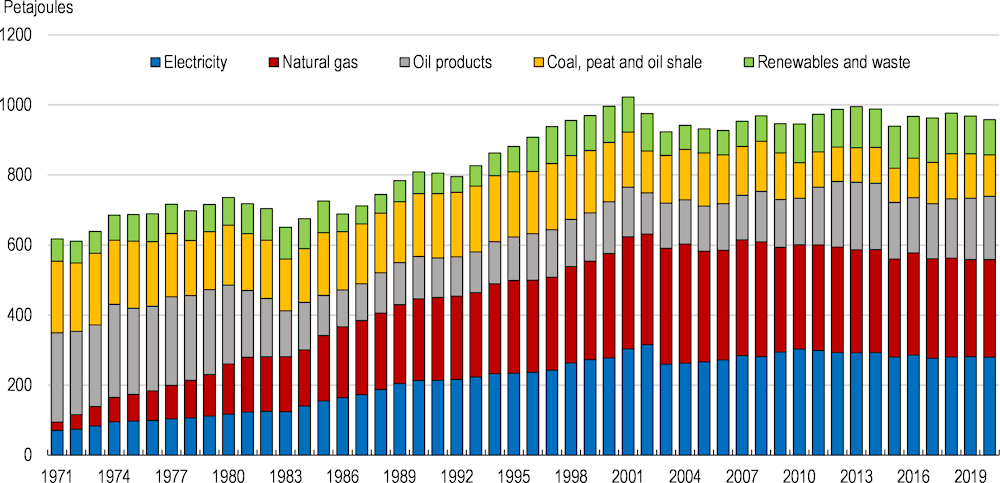

The industrial sector is also responsible for emissions from the generation of the energy it uses, either directly by fuel combustion (or stationary energy) or indirectly by the use of electricity. Manufacturing was responsible for 29 Mt CO2-e in stationary energy emissions in 2020, most of which are related to the manufacture of non-ferrous metals such as alumina, and chemicals manufacturing. Industry is the sector with the second-highest share of Total Final Consumption of energy in Australia, at 28%, below transport (39%) (IEA World Energy Balances 2022). While there was growing electrification in the sector between 1970 and 2000, the share of electricity in energy consumption has remained broadly constant since then. In 2020, the main sources of energy in industry were electricity (29%) and natural gas (29%), followed by oil (19%), coal (12%), and bioenergy and waste (11%) (Figure 3.12). Combined emissions from manufacturing peaked in 2008 and were 17% below 1990 levels in 2020. They are projected to fall further by 25% between 2020 and 2030, largely driven by lower indirect emissions from electricity use, but also lower direct emissions from the take-up of cleaner fuels and technologies.

While large facilities in the industrial processes industry will be covered by the Safeguard Mechanism, there are many smaller facilities in Australia that together are responsible for about 30 Mt CO2-e in emissions, most of which arising from fuel combustion and production processes (Grattan Institute, 2021b). Emissions from these smaller facilities are currently unregulated and will have to fall to contribute to the national emissions reduction goals. Existing energy efficiency certificates, such as the New South Wales Energy Savings Scheme, have seen little take up from industry (IPART, 2021). This is in part due to the fact that plant-specific efficiency measures are difficult to standardise and compare across facilities (as opposed to household efficiency measures based on replacing standard equipment, for example). Energy savings schemes in industry could therefore focus on energy savings from common industrial equipment (Grattan Institute, 2021b). Existing state energy savings schemes could be expanded along these lines, or a new federal energy savings scheme could be introduced.

Figure 3.12. Electricity and natural gas dominate energy consumption in industry

Total Final Consumption of Energy in Industry by source (PJ)

Transport

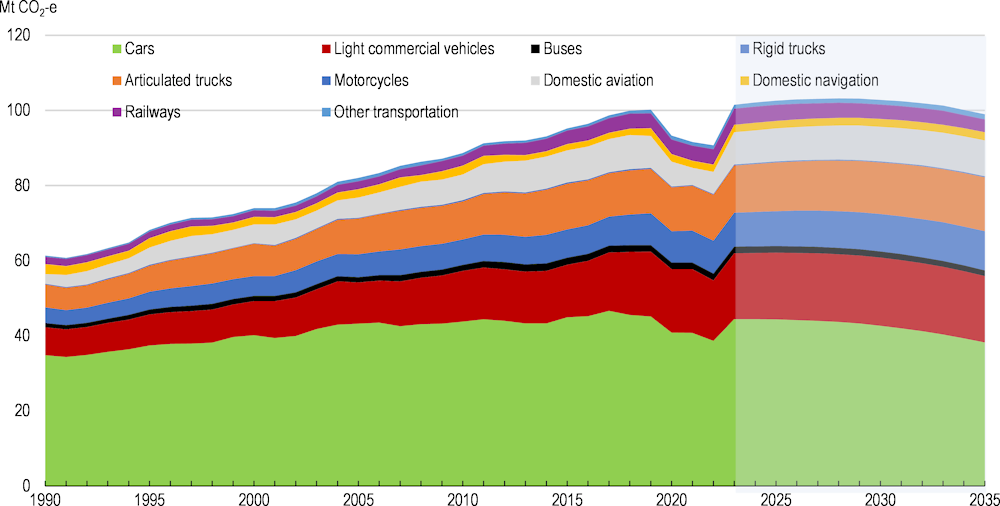

The transport sector is responsible for roughly 19% of total net GHG emissions in Australia, mostly arising from the combustion of oil products (mostly diesel and gasoline). Road transport plays a large role, accounting for 85% of transport emissions. Light duty vehicles, which include passenger cars and light commercial vehicles such as vans, accounted for 62% of transport emissions in 2020, with freight transport accounting for a further 28%, and domestic aviation accounting for 6% (Figure 3.13). Transport emissions are projected by the DCCEEW to recover from the pandemic, grow in line with population, and start declining around 2027 as the uptake of electric and hybrid vehicles increases. By 2035, transport is projected to become the largest source of emissions in Australia under current policies. To date, fossil fuels account for more than 95% of total final consumption of energy in transport, with electricity accounting for just 1.7% of consumption, up from 1.1% in 2005 (IEA, 2023). Electricity is currently used mainly in rail transport (where it accounts for 20% of energy demand), whereas the electricity share in road transport is still very small at 0.008% despite a tenfold increase since 2013. Natural gas accounts for 1.5% of energy consumption in the sector, and biofuels account for another 0.3%.

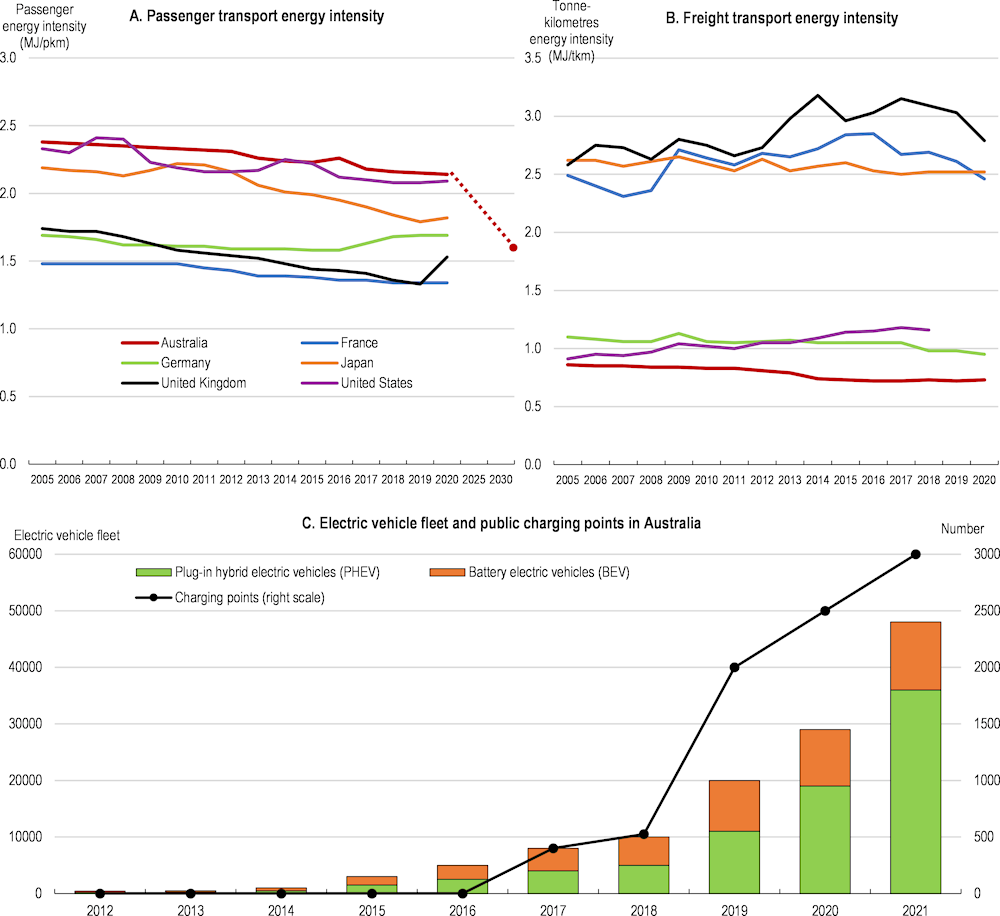

The average fuel efficiency of passenger cars is very low in Australia compared with many other OECD countries (Figure 3.14 Panels A and B), partly due to the prevalence of large cars such as utility vehicles and SUVs. With road transport accounting for 85% of transport emissions in Australia, significantly increasing vehicle fuel efficiency and a quick transition to electric vehicles (EVs) will be necessary to materially reduce transport emissions. The number of EVs has risen strongly in recent years (EV sales tripled from 2020 to 2021), but EV market penetration in Australia still lags other large western countries. The total EV fleet was close to 50,000 in 2021 (Figure 3.14 Panel C), compared to Australia’s almost 20 million vehicles, of which 15 million are passenger cars and 3.5 million light commercial vehicles. EV sales were 3.8% of total car sales in 2022, below the IEA average of 9% (IEA, 2023; Federal Chamber of Automotive Industries, 2023). EV charging points have also risen in number in recent years, reaching more than 3000 in 2021.

Figure 3.13. Transport is projected to be the largest source of emissions in Australia by 2035

Transport emissions by source, Mt CO2-e

The federal and state governments have put in place a number of policies to incentivise the up-take of EVs. Several states have set electric vehicle targets, either on the proportion of EV sales by a specified date or on government fleets. Some of these states have also introduced policies to incentivise EV purchases, including rebates, stamp duty exemptions, and free registrations, among other policies (see details on these state targets and policies in Table 3.3). Under the Powering Australia plan, the federal government has introduced a government fleet target to ensure its fleet purchases and leases will be 75% electric by 2025. It has also provided AUD 500 million over 6 years for the Driving the Nation Fund, to fund EV charging infrastructure and hydrogen highways, and passed the Electric Car Discount Bill, exempting eligible electric cars from fringe benefits tax (FBT) and the 5% import tariff. Finally, the federal government is developing a National Electric Vehicle Strategy to scale up efforts to increase demand and supply of EVs by 2030, including by considering the introduction of a federal fuel economy standard.

Figure 3.14. The energy intensity of Australian vehicles needs to come down significantly to achieve climate targets

Note: The dashed red line illustrates the reduction needed to achieve global net zero emissions target. BEV = battery electric vehicles; PHEV = plug-in hybrid electric vehicles. Charging points include fast and slow chargers.

Source: IEA (2022).

Table 3.3. Australia’s electric vehicle targets by state

|

State |

Strategy |

% of electric vehicles in vehicle sales (2022) |

Electric vehicle targets |

Incentives |

COP26 declaration pledge |

|---|---|---|---|---|---|

|

New South Wales |

3.7% |

52% of sales will be electric vehicles (EVs) by 2030-31 |

AUD 3 000 rebates for first 25 000 EVs purchased for less than AUD 68 750 Stamp duty exemptions for EVs purchased for under AUD 78 000 |

Yes |

|

|

Australian Capital Territory |

9.5% |

No official target but going toward all new sales are zero emissions by 2030 |

Free vehicle registration for two years Stamp duty exemption AUD 15 000 interest-free loan |

Yes |

|

|

Tasmania |

No strategy |

3.3% |

100% EV fleet by 2030 for the government |

Stamp duty exemption for EVs for the next two years Free registration for car rental companies and coach operators for two years |

No |

|

Victoria |

3.4% |

50% of sales will be EVs by 2030 |

AUD 3 000 rebates for first 4 000 EVs purchased for less than AUD 68 740 Incentive amount for 20 000 additional EVs remains to be determined |

Yes |

|

|

Queensland |

Queensland’s Zero Emissions Vehicle Strategy and Action Plan 2022-2032 |

3.3% |

50% of sales will be EVs by 2030 and 100% by 2036 |

AUD 3 000 incentive for 15 000 cars under AUD 58 000 EVs are registered in the lowest fee segment (min. saving approximately AUD 70) |

No |

|

Western Australia |

2.8% |

No target |

EVs are exempt from the On-demand Passenger Transport Levy |

No |

|

|

South Australia |

2.3% |

50% of sales will be EVs by 2030 100% of sales will be EVs by 2035 |

AUD 3 000 subsidies for 7 000 new battery electric vehicle sales under AUD 68 750 Three-year registration fee exemption for new BEVs until 1 July 2025 |

Yes |

|

|

Northern Territory |

The Northern Territory Electric Vehicle and Implementation Plan 2021-2026 |

0.8% |

No target |

Free registration for five years from 2022 AUD 1 500 stamp duty reduction for five years from 2022 |

No |

Source: Electric Vehicle Council (2022), State of EVs 2022.

Demand subsidies can be effective in increasing demand for EVs, but they can come at a high fiscal cost and impose a high implicit carbon price, especially while the decarbonisation of the electricity grid is still ongoing (Productivity Commission, 2023). While fuel taxes can be more efficient (for example, they impose a price on marginal miles driven), fuel economy standards appear to be more acceptable to the public in many countries (Anderson et al, 2011). Aligning the various uncoordinated state subsidy programmes and introducing stringent federal fuel economy standards, which Australia is currently considering, would provide strong incentives to reduce emissions in personal transport at a lower implicit carbon cost. Stringent fuel economy standards would also increase the supply of EVs in Australia, which appears to have limited EV take-up according to widespread reports of extended waiting times for EVs (Productivity Commission, 2023). A relaxation of import restrictions on low- and zero-emissions vehicles would also be desirable to increase the potential supply. While the government is currently considering fuel economy standards for light vehicles, it should also consider introducing standards for trucks and other heavy vehicles, which are responsible for more than 4% of total GHG emissions in Australia.

Existing fuel tax credits are expensive and limit incentives to reduce fuel use. On-road heavy vehicles are currently eligible for a reduced fuel tax in Australia, and businesses pay no fuel tax on fuels used for off-road vehicles, such as trucks in mining sites or for heavy machinery, industrial heating and cooling. These fuel tax credits and exemptions currently cost the government AUD 8 billion per year in lost fuel tax revenues (Terrill, 2023). Fuel taxes for on-road heavy vehicles should be brought in line with fuel taxes on other on-road vehicles such as cars and vans, and the government should consider reducing the generosity of fuel tax credits for off-road vehicles and machinery.

While EV charging needs are currently mostly met by home charging, further increasing demand for EVs will require drastically increasing the number of public charging points. As part of the Driving the Nation Fund, the government will provide AUD 40 million to deliver 117 EV chargers on key highway routes and AUD 130 million to co-fund other charging initiatives through the Australian Renewable Energy Agency. While this additional public funding for charging infrastructure is welcome, further measures will be needed. Despite the low number of EVs currently owned by Australians, Australia has among the lowest amount of charging points per EV compared to other countries covered in the IEA’s Global EV Outlook (IEA 2023b). Given the importance of home charging, the National Construction Code could also be updated to require all new buildings to be pre-wired so that they are ready for charging EVs.

The shift to EVs could have revenue consequences for the federal government. As of July 2023, motorists with internal combustion engine (ICE) cars pay 47.7 cents in fuel excise per litre of petroleum, which amounted to AUD 18.3 billion in public revenue in 2021-22 (3.1% of total 2021-22 Budget revenue). As vehicles become more fuel efficient and the take-up of EVs rises, revenues from the fuel excise will fall significantly. Road user charges could provide an alternative source of public revenues and could be charged on EVs and ICE vehicles alike. While such road user charges would somewhat blunt the incentives to purchase EVs over ICE vehicles, they would provide revenues towards maintaining road safety and maintenance and well-funded transport systems. Road user charges could be defined as a function of distance travelled, which similarly to the fuel excise would discourage travelling by road for longer distances, which even with a 100% EV fleet would increase demand for energy. The state of Victoria was the first state to introduce a distance-based road user charge for EVs in 2021, which the High Court ruled unconstitutional in October 2023, arguing that states do not have the power to impose excise taxes on consumption.

While important, electrification and fuel efficiency improvements in vehicles will be insufficient to meet Australia’s emission reduction targets. Widespread adoption of sustainable modes of transport, a shift from car dependency, and travel reductions can also contribute to reduce transport emissions. Investing in public transportation can encourage its adoption and reduce the use of greenhouse gas-emitting cars. However, public transport is generally a realistic alternative to cars only in compact urban areas with a high density of infrastructure services and shorter trip distances. Therefore, land use management and regulations can be an important tool to reduce transportation emissions by encouraging higher population density and building near public sector routes, avoiding urban sprawl.

Agriculture

Climate change is a significant challenge for agriculture, particularly in Australia. Australian farms are vulnerable to the effects of climate change, and they are already facing a greater frequency of extreme weather events and higher volatility in rainfall and temperatures. Agriculture is also a sector where it is technically difficult to achieve large reductions in emissions through abatement In particular, methane emissions from livestock, which are high in Australia given its extensive production of beef and sheep meat, are especially hard to eliminate.

Australia has included the agricultural sector in its economy-wide emissions targets, as opposed to many other countries who exclude agriculture on the grounds that abatement in the sector is too challenging. The inclusion of agricultural emissions is welcome. Australia, however, does not have a specific emissions reduction target for the agriculture sector, unlike many other OECD countries including France, Germany, Denmark, Portugal, Belgium, the United Kingdom, Japan, Korea and New Zealand (OECD, 2022). Such a target can be helpful to focus mitigation efforts, measure progress and send an important signal to the industry. The upcoming sectoral decarbonisation plan announced in July 2023 will provide an opportunity to send such a signal. Australia also joined the Global Methane Pledge in October 2022, a voluntary commitment by 123 countries to collectively reduce global methane emissions across all sectors by at least 30% below 2020 levels by 2030. While this is a welcome signal, this pledge is non-binding and achieving Australia’s contribution will require strong policies and planning.

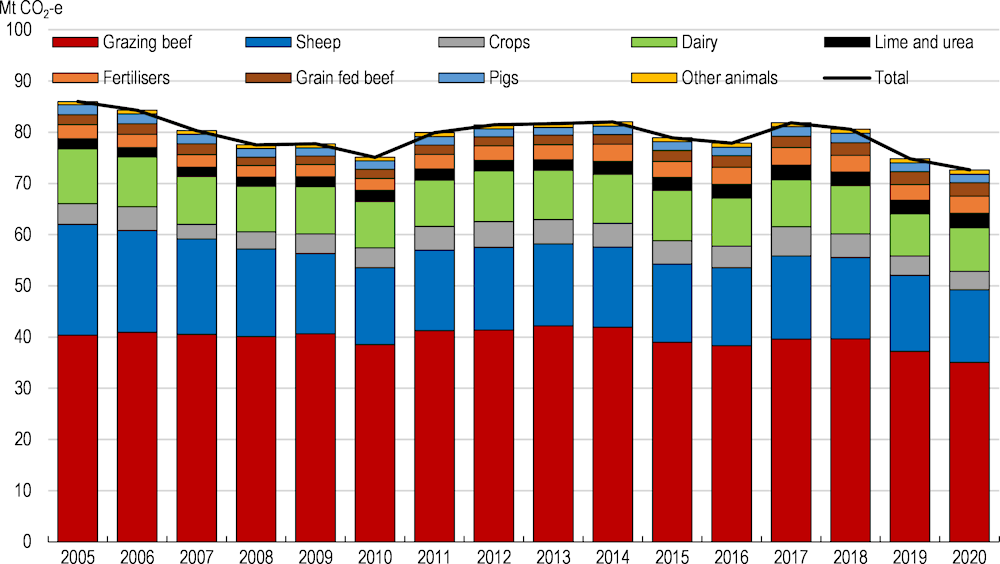

The agriculture sector was directly responsible for 72.6 Mt CO2-e of GHG emissions in 2020, or 14.7% of total Australian GHG emissions. More than two-thirds of these direct emissions from agriculture are due to enteric fermentation (OECD, 2022), a digestive process of cattle, sheep, goats and other ruminant livestock which generates methane. Australia’s large beef grazing industry is primarily responsible for emissions from enteric fermentation, with another sizeable contribution from sheep. Agricultural soils, a principal driver of nitrous oxide emissions, are another major source of agricultural emissions, accounting for 18% of direct emissions from agriculture in Australia, while manure management accounted for 9%. Fuel combustion in agriculture, used for transportation/traction, power, and heating, is responsible for an additional 5.6 Mt CO2-e of GHG emissions, 99% of which arise from the combustion of oil (mostly diesel), and 1% from natural gas (IEA, 2022). In addition to these direct GHG emissions, agriculture is also indirectly responsible for the emissions arising from the generation of the energy used in the sector, which accounts for 7% of total final consumption of energy (IEA, 2023).

Given the preponderance of methane emissions from livestock, total emissions from agriculture are closely linked to livestock numbers. Methane emissions from enteric fermentation have fallen substantially from 64.3 Mt CO2-e in 1990 to 51.8 Mt CO2-e in 2020. Recently, declines in cattle numbers due to drought conditions drove a fall in GHG emissions between 2017 and 2020 (Figure 3.15). However, cattle numbers have started to recover and emissions from agriculture are projected to remain broadly constant until 2030 under current policies (DCCEEW, 2022b).

It is especially challenging to tax emissions or establish emissions trading schemes in the agriculture sector, in particular given the difficulty of measuring emissions that do not arise from fossil fuel use, such as methane emissions from livestock. For this reason, countries have excluded agriculture from existing carbon taxing or emissions trading schemes (OECD, 2022), although New Zealand has been considering the introduction of emissions pricing in the sector. Australia is among a small number of countries with a voluntary scheme to issue carbon credits for emissions reduction and carbon sequestration projects in agriculture, through the ACCU Scheme. Japan also introduced a similar scheme in 2013 to provide certified carbon credits for emissions reductions and carbon sequestration activities. In Korea, while agriculture is not covered by the Korean Emissions Trading Scheme, farmers can obtain certified offset credits for emissions reduction projects and sell these in the emissions trading market.