Martin Borowiecki

Joaquín Calvo

Federico Giovannelli

Francesco Vanni

Martin Borowiecki

Joaquín Calvo

Federico Giovannelli

Francesco Vanni

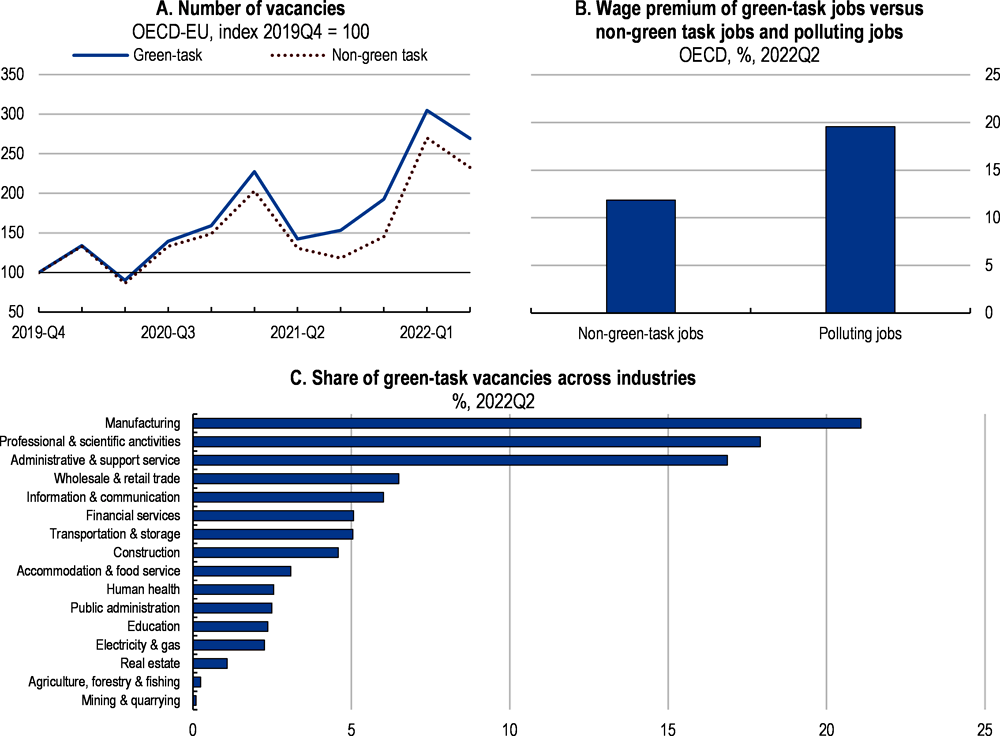

The EU’s ambitious Green Deal aims at achieving net zero emissions by 2050. The EU is starting from a relatively good position. It has successfully reduced greenhouse gas emissions over the past decade. But further efforts are needed to reach the net zero target. These include an extension of emission trading to agriculture and the phase-out of generous subsidies for fossil fuels. Such efforts should be complemented by additional measures to shift to clean energy, notably more integrated electricity markets and deeper capital markets that provide the necessary investment in new technologies. Accelerating the green transition will also involve costs for displaced workers. Bolstering workers’ mobility and training will help improve labour reallocation and reduce transition costs.

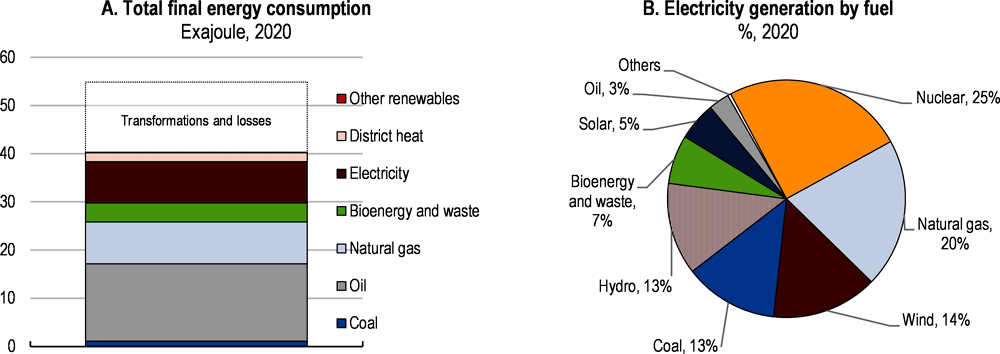

Over the past decade, the European Union (EU) has reduced greenhouse gas (GHG) emissions through improvements in energy efficiency, and a gradual switch to less polluting energy sources, including an expansion of renewables. However, emission reduction happened mostly in energy and industrial sectors covered by the EU’s Emission Trading System (ETS). This also reflects lower abatement costs in these carbon-intensive sectors. Sectors not covered by the ETS, notably agriculture, buildings, and transportation, have contributed little to the overall emission reduction. Looking ahead, further efforts are needed across all sectors, but particularly in non-ETS sectors, to reach the ambitious net zero emission target by 2050. This entails using the entire toolbox of mitigation policies, including stronger carbon pricing, subsidies for new technologies, and regulatory measures.

This chapter provides recommendations to achieve emission reductions effectively and equitably. The transition to a low-carbon economy will have to overcome challenges at the Member State, EU, and international level. But there are also opportunities, as Russia’s war of aggression against Ukraine increased the impetus to speed up investments in clean energy to secure energy supply. This chapter focuses on the internal market reforms needed to achieve the EU’s climate change mitigation objectives. A discussion of climate change adaptation in EU countries can be found in OECD Environmental Performance Reviews.

The remainder of the chapter is structured as follows. The first section reviews progress towards the new emission reduction targets. An overview of the main mitigation policies to reach the new emission reduction targets follows. The third section discusses mitigation policies to reach the net zero emission target by 2050 in a more cost-effective way, including the expansion of the ETS. The fourth section focuses on policies for the three main emitting sectors: agriculture, energy, and transportation. The final section concludes with a discussion of policies to reduce reallocation costs for workers affected by the green transition.

The main objective of the EU’s climate policy is to achieve net zero GHG emissions by 2050 (European Commission, 2020[1]). In addition, there is an intermediate target of reducing GHG emissions by 55% in 2030 (compared to 1990). Other targets include increasing the share of renewables to 42.5% of final energy consumption by 2030, provided that the agreement on a revised Renewable Energy Directive is adopted, and reducing final energy consumption by at least 11.7% by 2030 (compared with the energy consumption forecasts for 2030 made in 2020).

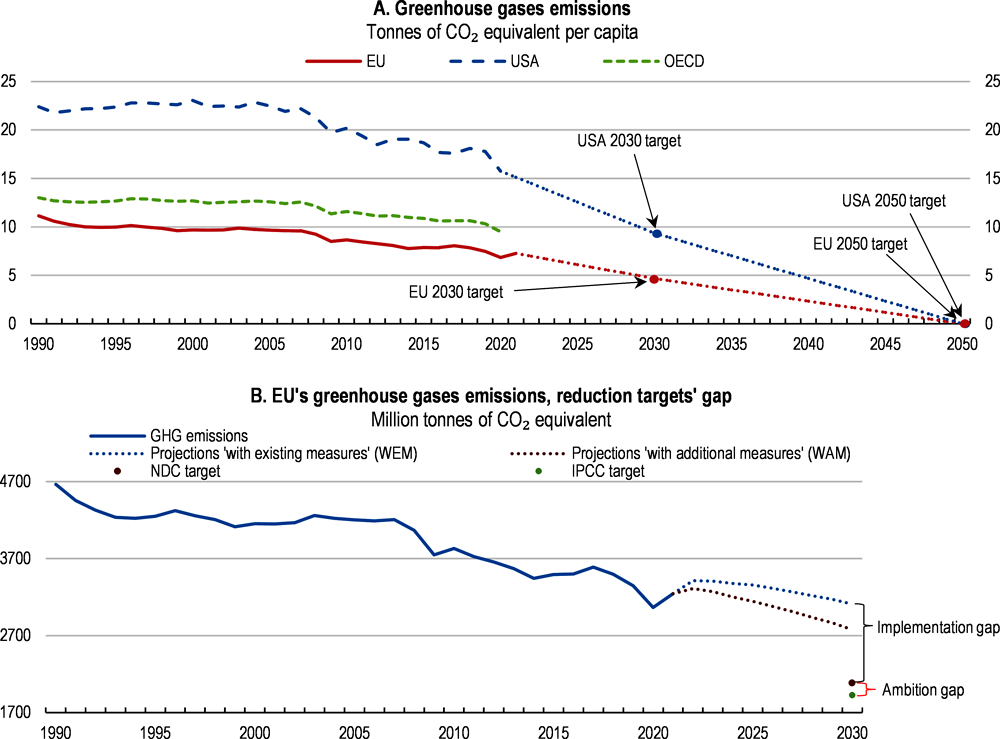

The EU is starting from a relatively good position to reduce emissions: it has reached its previous climate targets for 2020, including the targets for GHG emissions reductions and the share of renewable energy in final energy consumption. GHG emissions were reduced by 34% between 1990 and 2020, well above the 20% reduction target (EEA, 2021[2]). Similarly, the share of renewables in energy consumption stood at 21.3% in 2020, above the 20% target. Nonetheless, the EU’s new and more ambitious target of a 55% reduction in GHG emissions by 2030 (relative to 1990) will require a significant acceleration of emission reduction efforts (Figure 2.1). To illustrate the challenges ahead, reaching the 2030 target requires a doubling of the rate of emission reductions relative to 1990 and 2020 (European Environment Agency, 2022[3]). Similarly, the rate of deployment of renewables would need to triple compared to the period 1990 to 2020 to reach the new target of 42.5% of renewables in the energy mix by 2030 (IEA, 2022[4]).

Net greenhouse gases emissions, tonnes of CO₂ equivalent per capita

Note: Greenhouse gas (GHG) emissions include those from the land use/land use change and forestry sector (LULUCF). Data on the EU's GHG emissions for 2021 are taken from the European Environment Agency (2022). In Panel B, projections “with existing measures” (WEM) refer to 2019 EU policies and “with additional measures” (WAM) to new policies under the more ambitious FIT for 55 package. GHG emissions as projected by the respective country. NDC stands for Nationally Determined Contributions under the 2015 Paris Agreement. IPCC stands for the Intergovernmental Panel on Climate Change. The IPCC target is equivalent to a 43% reduction compared to 2019 emissions, which is needed to limit global warming to around 1.5°C according to the IPCC (2022).

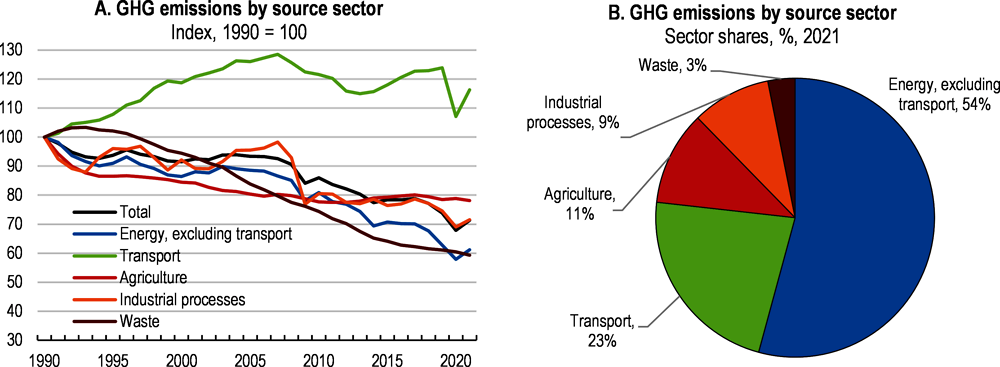

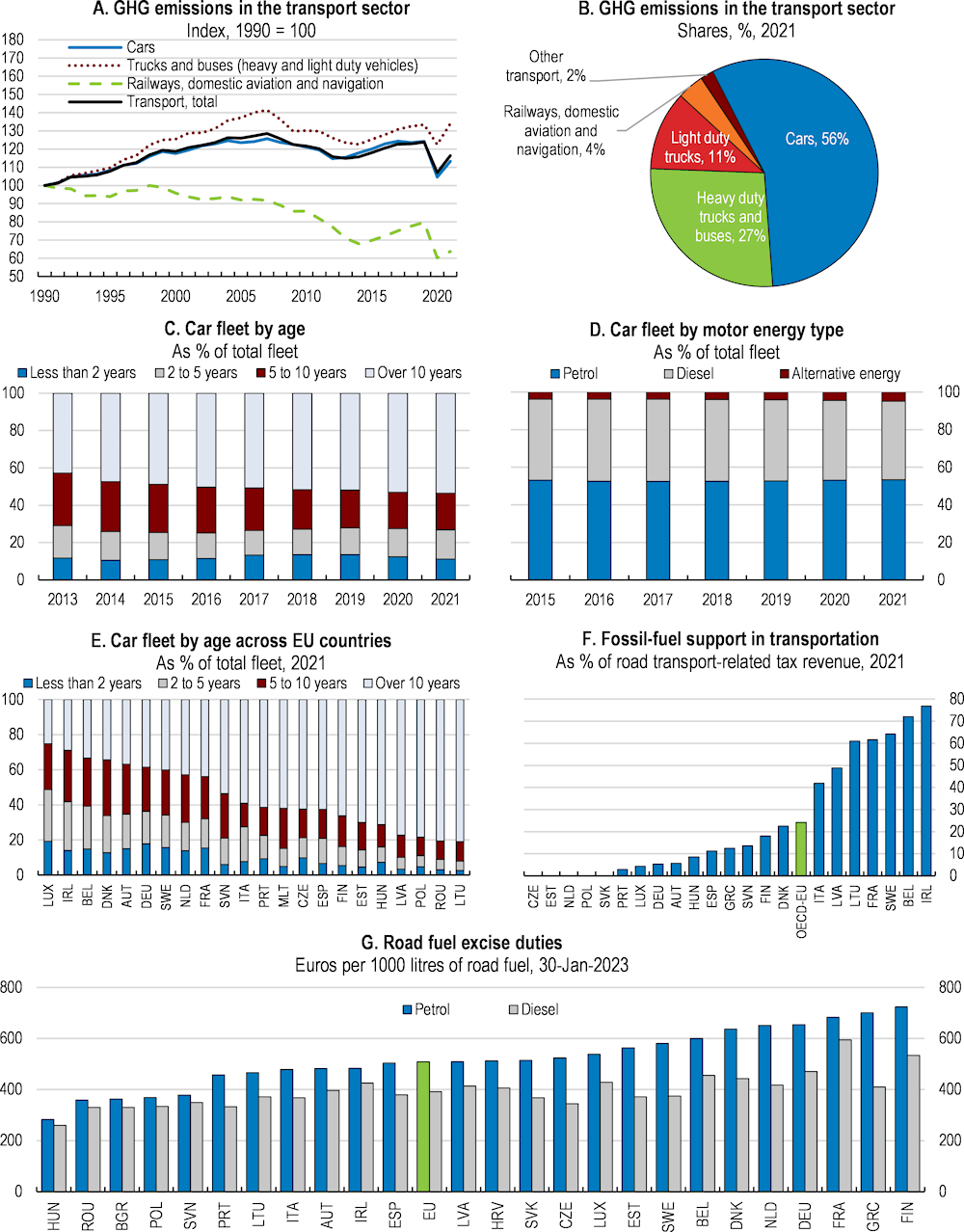

The sectors that produce the most emissions are energy (power and heat generation, including in industry and buildings), transport and agriculture, accounting for nearly 90% of total EU GHG emissions (Figure 2.2). Over the past two decades, the most notable emission reductions happened in sectors covered by the ETS, which includes energy-intensive industry and power generation. GHG emissions declined by 41% in these sectors between 2005 and 2020, driven mainly by power generation. This also reflects lower abatement costs of these carbon-intensive sectors. In contrast, emissions in transportation increased (except during the pandemic), while they remained flat in agriculture (EEA, 2021[7]). Achieving emission targets will require all sectors to reduce their emissions and can be reached with a substantial acceleration of emission reductions in agriculture, buildings, and transportation. Such an acceleration of emission reductions could prove much more difficult due to the higher abatement costs in in agriculture, buildings, and transportation.

Note: Excluding land-use, land-use change and forestry (LULUCF).

Source: OECD Environment Statistics database.

The EU decided on a set of more ambitious climate mitigation policies in 2023 (Box 2.1). The EU has been a frontrunner in mitigation policies and introduced in 2005 the world’s first and so far, the largest emission trading system. Apart from emission trading, climate objectives are pursued through a toolbox of mitigation policies, including subsidies as well as regulatory measures. The latter include stricter minimum energy efficiency standards for buildings, and more stringent emissions standards for cars. Taxation is mainly the domain of EU countries, although the EU sets minimum tax rates for energy, including transportation and heating fuels.

The ‘Fit for 55’ package is a set of proposals to revise the EU’s climate-related legislation in order to achieve at least 55% emissions reductions by 2030 (relative to 1990, against a previous target of 40%), and net zero emissions by 2050 (European Council, 2023[8]). The 2050 net zero emission target is set at the EU level, but the Effort Sharing Regulation sets 2030 emission reduction targets for EU countries to help the EU reach net zero CO2 emissions by 2050. The ‘Fit for 55’ package includes, among other things, the following policies:

Extension of the EU’s emissions trading system (ETS) to maritime transport. The ETS will apply to intra-European Economic Area (EEA) voyages and to half of the emissions on voyages from and to the EEA from third countries. The ETS already covers power generation, energy‑intensive industry, and intra-European aviation.

A more ambitious emission-reduction target for ETS sectors and emission sources, amounting to a 62% reduction of emissions in 2030 (compared to 2005 levels), against the previous 43% target.

Creation of a separate new emission trading system for fuel combustion in buildings, road transport and industry (ETS 2). The objective is to reduce emissions in road transportation, buildings and industrial heating processes by 42% in 2030 (compared to 2005 levels). The carbon price is expected to be lower in the new ETS than in the traditional ETS. A potential merger of the new ETS with the traditional ETS will be reviewed in 2031.

More ambitious emission reduction targets for non-ETS sectors: The Effort Sharing Regulation (ESR) sets legally binding 2030 emissions reduction targets for each Member State for sectors not covered by emission trading. These current non-ETS sectors are responsible for nearly 60% of the EU’s total emissions and include road transport, buildings, agriculture, waste management and small industry, although emission trading will be expanded to fossil fuel producers in transport and buildings (see above). The EU-level emission reduction target for 2030 for these sectors was increased from 29% to 40% (compared to 2005 levels), with updates for national targets. However, there is no target for emission reductions in these sectors beyond 2030.

More ambitious targets for net CO2 removals from the land use, land-use change and forestry (LULUCF) sector. CO2 removals by the LULUCF sector are accounted for in the overall 2030 emission reduction target. The target for net CO2 removals from the LULUCF sector was increased from 225 million tonnes (Mt) of CO2 equivalent to 310 Mt CO2 equivalent in 2030. This translates into higher national targets for 2030 for the increase of CO2 removals.

Starting in 2026, a carbon border adjustment mechanism (CBAM) will impose a charge on the emissions embodied in specific carbon-intensive EU imports, including aluminium, cement, electricity, fertilisers, hydrogen, iron, and steel, based on their carbon content. The importer will be charged the EU ETS price, deducting any carbon price effectively paid in the country of origin. CBAM will be based on the actual emission content of goods, declared by importers and verified by experts, thus allowing to take into account the effect of non-pricing policies on the emission content.

Phasing out of the free allocation of emission allowances to aviation by 2026. Free emission allowances will also be phased out for sectors covered by the CBAM over a nine-year period (from 2026 to 2034). In industry and transport, a decision has yet to be taken on the phase-out of free ETS allowances.

A revised Energy Taxation Directive will broaden the energy tax base. Tax exemptions and reduced rates, including for biomass and gas heating, will be phased out and the tax base will be expanded to include fuels for intra-EU aviation and maritime transport by 2033. It will also set minimum energy tax rates for transportation and heating fuels based on energy content and environmental performance, with fossil fuels being taxed most heavily. So far, energy taxation was based on volume (see below). Discussions are still ongoing in the Council and any change to the Energy Tax Directive will require unanimity.

More stringent emission standards for new vehicles foresee a complete halt to the sale of combustion engines from 2035, except for internal combustion engine cars running on e-fuels. This means that permitted emissions would be gradually lowered so that after 2035 new vehicles would be only allowed to emit zero CO2.

The RePowerEU plan is a response to Russia’s war of aggression against Ukraine and aims at making the EU independent from Russian fossil fuels before 2030 and strengthen energy security. The plan proposes to revise the Recovery and Resilience Facility to make available EUR 225 bn in unused loans and 20 bn in unused grants. Its main elements include:

An increase of renewable energy sources in the overall energy mix to at least 42.5% by 2030. This should be accomplished via the tripling of the level of solar photovoltaic and wind capacity from 350 GW in 2021 to 1080 GW by 2030 (600 GW of solar and 480 GW of wind).

Additional investments of EUR 245 billion in energy security, including 210 billion in gas pipelines, LNG terminals and the power grid by 2030.

Source: European Council (2023[8]).

Meeting the more ambitious emission targets will require higher carbon pricing, together with more stringent regulations. Based on model simulations conducted for this Survey, and with the assumed regulatory changes, the ETS carbon price would need to increase roughly five-fold to reduce GHG emissions by 55% in 2030 (relative to 1990 levels), compared to the previous target of 40% emission reductions in 2030. This translates into an ETS price of roughly EUR 210 per CO2 tonne in 2030 (in 2023 prices), up from around EUR 90 per CO2 tonne in mid-June 2023 (Figure 2.3). The higher ETS carbon price reflects that additional emission reduction efforts in sectors covered by the ETS will need to happen in activities with higher abatement costs, now that cheaper abatement options have already been exhausted. Such an increase in the carbon price will also lead to economic costs in terms of real incomes and competitiveness (Box 2.2). Still, these costs are necessary to avoid the potentially much higher economic costs from failure to reduce global emissions and limit climate change, which are not considered in the simulations.

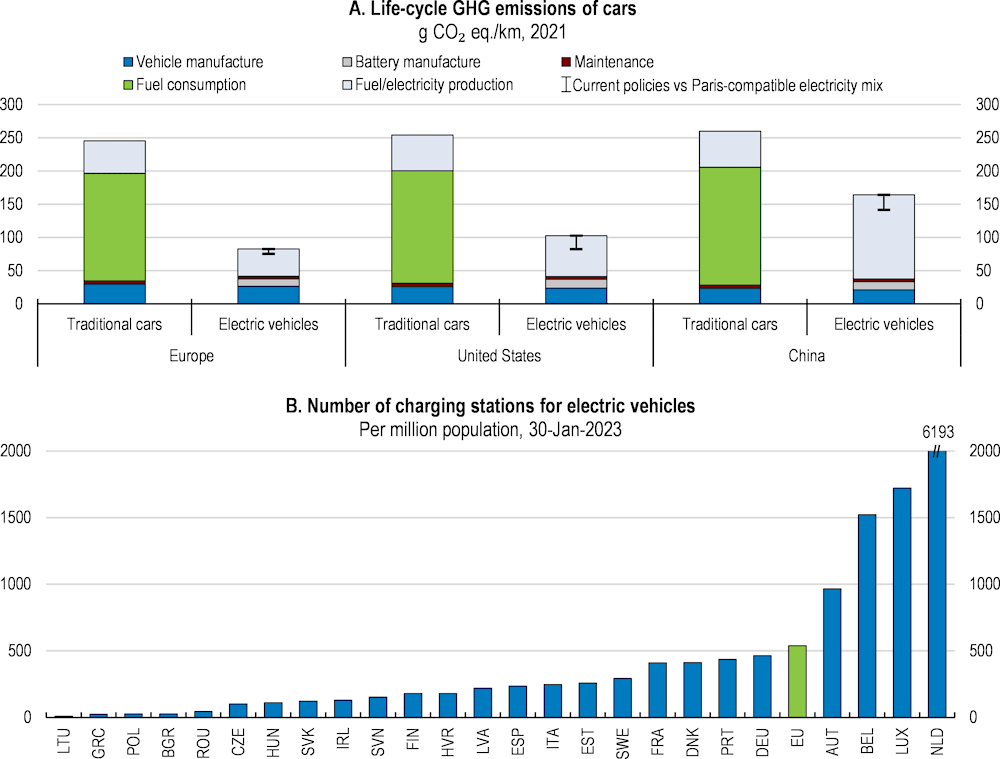

ETS carbon price, Euro per CO2 tonne

Carbon pricing is the first best and the most efficient measure to reduce emissions. In this regard, it is welcome that the EU is extending carbon pricing to maritime transport, road transport and heating fuels (see below). To address the impacts of higher carbon prices on households most affected by the green transition, ETS revenues are being given back to countries, including via the Social Climate Fund (see below). However, given the need to accelerate the green transition, carbon pricing alone will not be sufficient to reach net-zero emissions by mid-century (D’Arcangelo et al., 2022[9]). Simulations conducted for this Survey show that reaching the more ambitious 2030 emission reduction target will also require more stringent emission standards for vehicles, improvements to energy storage, and a more integrated European electricity market. This needs to be complemented by national policies such as the coal phase out (Chateau, Miho and Borowiecki, 2023[10]). Reducing barriers to the deployment of clean energy, including lengthy permitting processes, may have a strong impact in the short term. In addition, subsidies can help lower the costs of new low-emission technologies and accelerate their adoption, although they can be costly and inefficient. Also, carbon pricing can have potentially important social repercussions and there are concerns that higher carbon pricing will lead to a political backlash. Ways to increase public acceptance of carbon pricing include using carbon pricing revenues for income tax reductions, for example (Dechezleprêtre et al., 2022[11]).

The ETS is the cornerstone of the EU’s climate mitigation policy as it determines a market-based carbon price and maintains a level playing field across countries consistent with the Single Market. A carbon price should in principle apply to all polluting activities in line with their environmental impacts to equalise burden sharing and align marginal abatement incentives. Currently, the ETS covers the main emitting sectors power generation, energy-intensive industry, and intra-European aviation. The ETS will be extended to all domestic shipping emissions and half of emissions from international shipping, and a new emission trading system will be established for road transport and heating fuel suppliers as well as fuels for industrial heating processes currently not covered by the ETS, which is welcome (Box 2.1). The current limitation of emissions trading to industry and energy has historical reasons and no large country in the world currently employs uniform carbon pricing. When the ETS was set up in 2005, only large industrial enterprises and utility companies had emission monitoring and reporting systems in place to verify and price emissions. Since then, the ETS has been successful in reducing emissions (Dechezleprêtre, Nachtigall and Venmans, 2018[12]; Bayer and Aklin, 2020[13]).

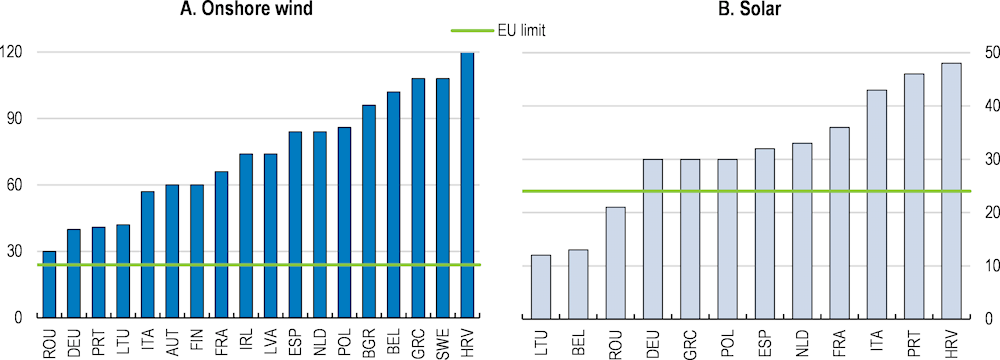

The ETS is now well-established and widely accepted, suggesting it can be extended to shipping, transport and heating fuels but also to other sectors such as agriculture. The expansion of emission trading will require setting up systems for monitoring and reporting emissions. Pilots are already in place for agricultural emissions from livestock, peatland-rewetting, and agroforestry (European Commission, 2021[14]). These could serve as a starting point and be subsequently scaled up, although they are technically not easy to implement on a bigger scale. Moreover, expanding carbon pricing will take time. Other approaches to remove bottlenecks for the implementation of the transition, such as reducing barriers to the deployment of clean energy, may have a stronger impact in the short term.

The extension of emission trading will also involve costs. This reflects that sectors such as agriculture, transportation and buildings are difficult to integrate into emission trading. An exception is suppliers of transportation and heating fuels for which ETS 2 will apply from 2027 (see Box 2.1). There are many smaller producers involved that may have difficulties affording abatement technologies. Households would be affected by higher agricultural and fuel prices, although they will not be directly involved in emission trading. Moreover, monitoring costs are high as these sectors do not have systems in place for emission reporting and verification. Another issue is that emission reductions in current ETS sectors also reflect lower abatements costs of carbon-intensive power generation and energy-intensive industry. Achieving emission reductions in the agriculture and transport sectors could prove much more difficult due to their higher abatement costs. And finally, higher carbon pricing in these sectors will also have an impact on their competitiveness.

Setting legally binding emission targets can strengthen government accountability (D’Arcangelo et al., 2022[9]). In this regard, the overall net zero emission target by mid-century is welcome as it provides a clear long-term objective for governments, households, and businesses. However, the system of complex and overlapping medium-level climate targets may hamper the EU’s progress towards emission reductions (see below). For example, achieving the 2030 renewable energy target (achieving 42.5% renewable energy production by 2030) relies on burning biomass, although biomass can be emission-intensive (Figure 2.4). Burning woody biomass immediately releases CO2 in the atmosphere, while reforestation takes time. This means that the emission intensity of biomass depends on the time needed for reforestation and the type of feedstock (Brack, Birdsey and Walker, 2021[15]; Schnorf et al., 2021[16]).

The OECD ENV-Linkages model, a dynamic global Computable General Equilibrium (CGE) model, is used to analyse the economic effects of implementing the EU’s ‘Fit for 55’ climate mitigation policies (Chateau, Dellink and Lanzi, 2014[17]). A ‘Fit for 55’ scenario, where GHG emissions are reduced by at least 55% in 2030 (compared to 1990 levels), is compared to an “EU reference scenario 2020” based on 2019 policies, i.e., a reduction of GHGs emission by 40% in 2030 (compared to 1990 levels). Another comparison is made to a scenario without any climate policy action. The model projects macroeconomic, sectoral, energy and emission trends for the EU as a whole, and for five larger EU economies separately (France, Germany, Italy, Poland and Spain), up to 2035. The policies implemented are based on the EU’s ‘Fit for 55’ policies and national level policies, as described in National Energy and Climate Plans. The model also includes the effects of Russia’s war of aggression against Ukraine on fossil fuel demand and prices in the EU. Other model assumptions include rising energy efficiency, although the model does not assume major technological innovations that reduce the costs of clean energy. Labour is uniform in the model, with workers having one type of skill, and labour reallocation from declining sectors (e.g., fossil fuel power generation) to growing sectors (e.g., renewable power generation) is assumed to be frictionless. The results are presented in more detail in the technical background paper for this Survey (Chateau, Miho and Borowiecki, 2023[10]).

The reference scenario is calibrated to achieve the same emission reductions and carbon price as the EU Reference Scenario 2020 (European Commission, 2021[18]). It implies an EU-wide GHG emission reduction of 42.5% in 2030 (relative to 1990 values) in net terms, i.e., including emissions from the land use and forestry (LULUCF) sector. This translates into a 40% gross emission reduction (relative to 1990), i.e., excluding emissions from the LULUCF sector.

The ‘Fit for 55’ scenario assumes a more ambitious 2030 GHG emission reduction target for sectors covered by the ETS, rising to 62% from 43% in the reference scenario (relative to 2005). It also includes an increase in the emissions reduction target in 2030 for non-ETS sectors, up to 40% from 29% in the reference scenario. Final energy consumption decreases by 11% relative to 2023 and the share of renewables in the energy mix goes from 32.5% in 2023 to 42.5% in 2030. To achieve these targets, multiple policy instruments are implemented in the model to reflect new EU policies: i) the extension of the EU ETS system to maritime transport, ii) the creation of a carbon border adjustment mechanism (CBAM) for EU ETS sectors from 2026, iii) a new ETS 2 for fuel combustion in buildings, road transport and industry, as well as iv) national policies such as the Effort Sharing Regulation for non-ETS sectors (see above) and coal phase-outs in Germany, France, Italy, and Spain. The scenario also assumes that one third of ETS carbon price revenues are used to finance investment in the electricity grid, with the remaining two thirds given back to households as lump sum payments and subsidies for the take-up of electric vehicles and building renovations to make them more energy efficient.

Under the ‘Fit for 55’ scenario, the EU is projected to reach its target and reduce GHG emissions by 55% in 2030 (relative to 1990) (Table 2.1). This reflects, among other things, stronger abatement in the power sector, driven by a faster rollout of renewables, together with stronger energy saving efforts across all sectors. A key assumption is that the need for conventional backup capacity for renewable generation, notably gas, will fall significantly from about 40%-50% to 7% of total electricity generation on the back of improved energy storage and electricity transmission and distribution across the EU. Emission reductions are achieved in large part due to a stronger shift to renewables in Germany and Spain. In contrast, the electricity mix remains more carbon intensive in Poland, where emission reductions are driven by improvements in energy efficiency (Table 2.2).

|

Reference scenario |

Fit for 55 scenario |

Percentage change compared to reference scenario (in %) |

|

|---|---|---|---|

|

Emissions and energy mix |

|||

|

Total GHG emissions percent reduction vs 1990 (excluding LULUCF) |

-42.4 |

-53.6 |

-11.2* |

|

Total GHG emissions percent reduction vs 1990 (including LULUCF) |

-45.4 |

-57.2 |

-11.8* |

|

GHG emissions percent reduction in the ETS sectors vs 2005 |

-44.3 |

-59.1 |

-14.8* |

|

GHG emissions percent reduction in the ETS 2 sectors vs 2005 |

-33.0 |

-42.2 |

-9.2* |

|

GHG emissions percent reduction in the ESR sectors vs 2005 |

-29.7 |

-37.5 |

-7.8* |

|

GHG per capita |

5.6 |

4.4 |

-21.5 |

|

Total final energy consumption (million tons of oil equivalent) |

1011.6 |

955.5 |

-5.5 |

|

Electricity generation (terawatt hour) |

3063.7 |

3650.7 |

19.2 |

|

Share of renewables in electricity generation |

57.1 |

70.3 |

13.2* |

|

Share of fossil fuels in electricity generation |

24.3 |

10.2 |

-14.1* |

|

Macroeconomic effects |

|||

|

Carbon price (EUR at 2020 prices) for EU-ETS |

30.4 |

177.8 |

485.6 |

|

Real GDP per capita (EUR at 2014 prices) |

32493.2 |

32157.3 |

-1.0 |

|

Real gross fixed investment (billion EUR at 2014 prices) |

2.3 |

2.3 |

-0.5 |

|

Real private consumption (billion EUR at 2014 prices) |

9.2 |

9.2 |

-0.5 |

|

Employment (million) |

212.2 |

211.7 |

-0.2 |

Note: * denotes percentage point. Simulations are conducted using the OECD ENV-Linkages model. The table shows results from a scenario introducing the EU ‘Fit for 55’ targets, which means that the EU reduces net GHG emissions by 55% in 2030 (relative to 1990). Results are shown relative to the reference scenario, which is based on 2019 policies, meaning that the EU reduces its net GHG emissions by at least 42.5% in 2030 (relative to 1990). Non-EU countries are assumed to reduce emissions as in the reference scenario.

Source: Chateau et al., forthcoming.

Comparison of economic costs under ‘Fit for 55’ vs. the scenario without climate action. Overall, the economic costs of climate policies are higher when compared to a scenario of no policy action taken. In such a scenario, there is no emission trading in the power sector and energy-intensive industries and no regulatory measures to reduce emissions in transport and buildings sectors. Compared to such a scenario of no policy action, ‘Fit for 55’ policies are projected to lead to a loss in GDP per capita of 1.2% in 2030. As ‘Fit for 55’ policies are being implemented gradually until 2030, higher economic effects are projected to materialise only after 2030, leading to a loss in GDP per capita of 2.3% in 2035 (compared to the scenario of no policy action).

Comparison of economic costs between the two scenarios with climate action. The ‘Fit for 55’ policies are projected to lead to a moderate loss in GDP per capita of 1% in 2030 compared to the reference scenario, reflecting increasing production costs on the back of higher carbon pricing. Countries with a current larger emission intensity of production are projected to see higher income losses, notably Poland. Overall, employment will slightly decrease but this hides differences across countries.

The economic effects already consider benefits from using carbon pricing revenues to raise investment in the energy transition, notably in electricity grids. Without such growth-enhancing measures, the negative effect of climate policies on GDP would be higher. Other downside risks to the projections include higher-than-expected inflation, continued supply chain problems and skill shortages, as well as a slower-than-expected energy transition. Similarly, labour market rigidities are likely to raise the costs of labour reallocation across countries and sectors, adding to the costs of the green transition.

Under ‘Fit for 55’ policies, higher carbon pricing will lead to a loss of competitiveness of energy-intensive industries, as measured by losses in market share of energy-intensive industries on world markets, and losses to their gross output (compared to the reference scenario). Additional projections show that CBAM may mitigate only partly the loss of competitiveness of energy-intensive industries in the EU (Chateau, Miho and Borowiecki, 2023[10]).

Percentage changes compared to the reference scenario (in %)

|

EU |

DEU |

ESP |

FRA |

ITA |

POL |

|

|---|---|---|---|---|---|---|

|

Total GHG emissions reduction |

-11.2* |

-10.5* |

-14.2* |

-4.9* |

-10.0* |

-21.5* |

|

GHG per capita |

-21.5 |

-26.6 |

-19.9 |

-9.4 |

-18.4 |

-33.3 |

|

Total final energy consumption |

-5.5 |

-5.6 |

-8.0 |

-2.0 |

-5.0 |

-11.0 |

|

Electricity generation |

19.2 |

29.9 |

7.9 |

17.4 |

16.1 |

31.8 |

|

Share of renewables in electricity generation |

70.3 |

87.2 |

87.4 |

44.2 |

73.9 |

73.0 |

|

Share of fossil fuels in electricity generation |

10.2 |

12.8 |

3.5 |

2.3 |

26.1 |

27.0 |

|

Share of renewables in electricity generation, percentage point change compared to the reference scenario |

13.2* |

24.9* |

4.9* |

1.1* |

19.9* |

43.2* |

|

Share of fossil fuels in electricity generation, percentage point change compared to the reference scenario |

-14.1* |

-24.9* |

-5.3* |

-2.5* |

-19.9* |

-43.2* |

|

Real GDP per capita |

-1.0 |

-1.1 |

-1.1 |

-0.6 |

-1.0 |

-3.0 |

|

Real gross fixed investment |

-0.5 |

-0.5 |

-0.5 |

-0.3 |

-0.6 |

-0.8 |

|

Real private consumption |

-0.5 |

-0.6 |

-0.3 |

-0.3 |

-0.6 |

-1.8 |

|

Employment |

-0.2 |

-0.2 |

-0.2 |

-0.1 |

-0.2 |

-0.8 |

|

Market share of energy-intensive industries** |

-1.0* |

-0.2* |

-0.1* |

0.1* |

0.0* |

-0.1* |

|

Real gross output of energy-intensive industries** |

-3.9 |

-2.6 |

-4.9 |

-2.3 |

-2.6 |

-8.7 |

Note: * denotes percentage point. ** Energy-intensive industries are iron and steel, chemicals, pulp and paper, non-metallic minerals and non-ferrous metals. Simulations are conducted using the OECD ENV-Linkages model. The table shows results from a scenario introducing the EU ‘Fit for 55’ targets, which means that the EU reduces emissions by 55% in 2030 (relative to 1990). Results are shown relative to a reference scenario, which is based on 2019 policies, meaning that the EU reduces its emissions by 42.5% in 2030 (relative to 1990). Non-EU countries are assumed to reduce emissions as in the reference scenario.

Source: Chateau et al., forthcoming.

The analysis also studies the effect of Russia’s war against Ukraine on reaching emission reduction targets. Without the war, the EU would have had access to cheaper Russian fossil fuels, resulting in 0.6% higher GDP per capita in 2030. But lower fossil fuel prices also lead to higher demand for fossil fuels. Such initially higher fossil fuel demand implies higher mitigation costs under the ‘Fit for 55’ scenario, leading to a loss in GDP per capita of 1.2% (relative to the no-war reference scenario), compared to a loss in GDP per capita of 1% under the ‘Fit for 55’ scenario with war in Ukraine (relative to its respective reference scenario). This reveals important costs from postponing climate change mitigation.

Biomass as a share of renewables total energy supply, %, 2021

The structure of medium-level targets with multiple objectives makes it difficult to find market-based solutions that minimise abatement costs. For instance, if countries are not on track to meet the renewable energy target for 2030, additional investment in renewables will be needed. Such investment will not be driven by abatement cost considerations, but by the impetus to expand renewables to reach the target. Such an investment boost may lead to shortages of labour and key component and raw materials, including lithium, nickel and cobalt needed for renewables. In principle, a more cost-efficient approach would entail pricing all emissions and letting market forces determine the appropriate technology mix with lowest abatement costs to reduce emissions. Carbon pricing leaves the decision on when and where to cut emissions to those who know best about their abatement costs (OECD, 2005[19]).

But carbon pricing alone will not be sufficient to reach emission targets. Multiple market failures call for comprehensive mitigation strategies relying on a policy mix involving pricing and non-pricing policies. For instance, new technologies that are not yet cost competitive may require subsidies, including carbon capture and green hydrogen. The EU’s flagship research and development programme Horizon Europe provides funding of EUR 95.5 billion (or 4.7% of the 2021-27 EU budget) for such technologies. Moreover, revenues from the ETS are used to support innovation, including EUR 40 billion (or 2% of the EU budget) for low-carbon technologies under the Innovation Fund (assuming an ETS price of EUR 75 per tonne of CO2). Despite these efforts, the pace of climate-related innovation as measured by patent filings and venture capital funding going to climate-related start-ups has decreased over the past half decade (Cervantes et al., 2023[20]). This also reflects that EU countries’ support for renewables mainly benefits mature technologies such as biomass, solar and wind energy (see below). This is despite the EU’s state-aid framework, which encourages EU countries to steer subsidies towards new technologies that are not yet competitive.

Frequent policy changes may increase the costs of achieving environmental objectives. The EU has recently set more ambitious emission reduction targets for 2050, which is welcome as it provides a clear path for emission reductions going forward. However, the overall 2050 target is complemented by more stringent intermediate 2030 targets for emissions, renewables, and energy efficiency (European Council, 2023[8]). All these changes to intermediate targets have been further compounded by the global energy crisis, which prompted the European Commission to call for a diversification of fossil fuel supplies and additional investments in gas pipelines and LNG terminals under the RePowerEU plan. These measures were taken by the EU Member States with a due regard to securing energy supplies and preventing a deterioration of their competitiveness. The EU is trying to accelerate the pace of the transition, which is welcome. Nonetheless, frequent policy changes may lead to adverse social consequences, undermining social acceptance of climate policy. They may also lock in sub-optimal technology, making the transition more costly. Such contradictions and frequent alterations may come at the expense of the stability and predictability of climate policy. Policy stability is crucial to attract the private investment necessary to make the green transition.

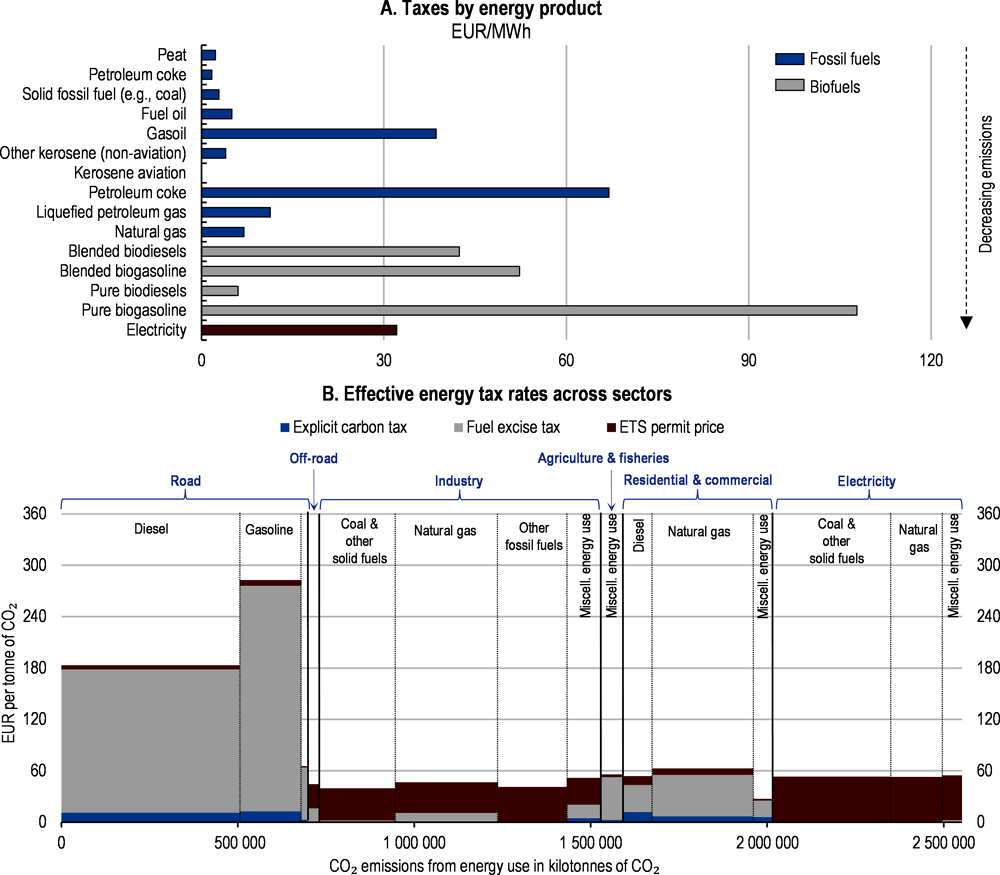

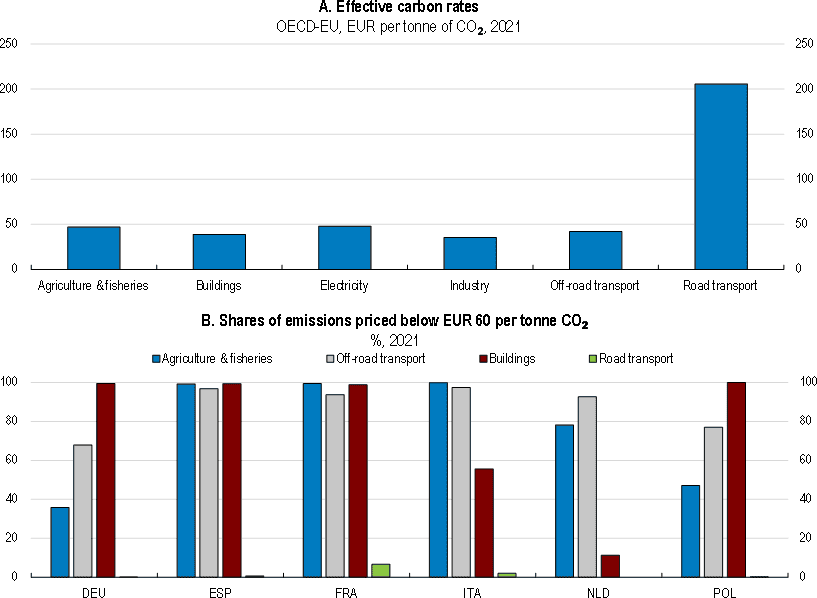

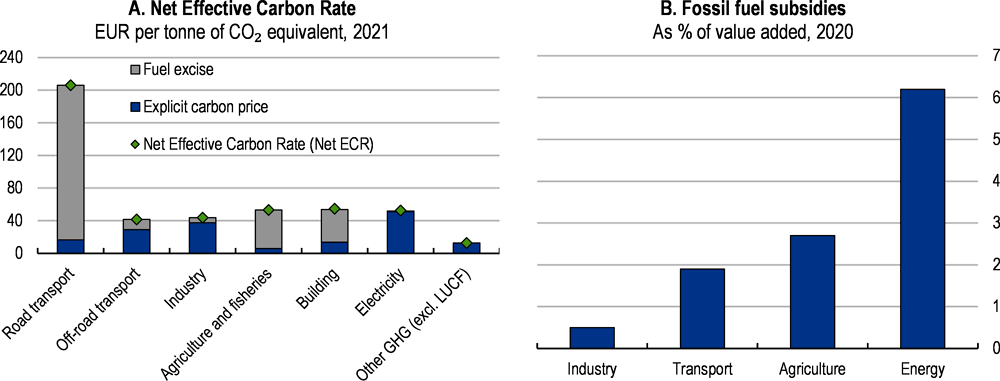

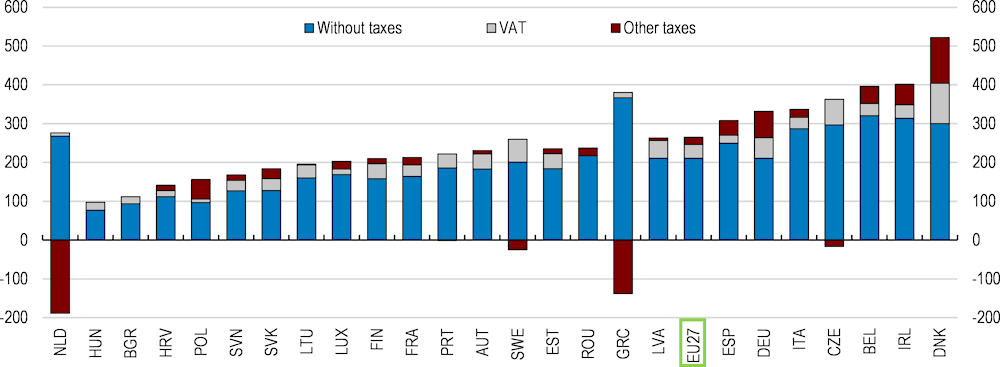

Policy consistency is missing as national support for fossil fuels contradicts EU-wide decarbonisation efforts. Fossil fuels continue to benefit from tax reductions and exemptions, such as exemptions on aviation and maritime fuel as well as reduced rates for heating gas (Figure 2.5, Panel A). The EU Commission proposed to reform EU-wide minimum energy tax rates for energy products, including for fossil fuels, to encourage energy efficiency and the use of sustainable fuels. According to the proposal, exemptions, and reduced rates for fossil fuel should be phased out, and taxation of fuel would no longer be based on volume but on energy content and environmental performance, with fossil fuels being taxed most heavily. This would also include extending the energy tax base to fuels for aviation and maritime navigation, as well as to biomass. However, the proposal foresees only a gradual phase-out of reduced rates and exemptions for natural gas, maritime and aviation fuels until 2033, which is too late to help meet ambitious emission reduction and energy efficiency targets for 2030. Meanwhile, tax exemptions and reduced rates for fossil fuels reduce their effective carbon price (European Court of Auditors, 2022[21]) (Figure 2.5, Panel B). This is particularly a concern in cases when such exemptions and reduced rates lead to a lower effective carbon price than the ETS price. First, the EU should broaden the energy tax base by phasing out reduced rates and exemptions to make taxation of fossil fuels uniform across sectors and different uses of energy. Second, minimum tax rates for fossil fuels should be introduced that are based on energy content and environmental performance, as proposed by the Commission. Such minimum tax rates should be the same for all non-ETS sectors to ensure equal burden sharing and efficiency. Thereafter, these minimum tax rates can be gradually increased to the ETS price level where this is not the case yet. Such changes will be difficult to adopt as changes to energy taxation require unanimity among EU countries.

Apart from carbon pricing and subsidies, the EU also sets regulations and standards for agriculture, transportation, and buildings, among other things. In agriculture, the Nitrate Directive and the Water Framework Directive set stringent standards for water quality and nitrous oxide emissions from fertiliser use. In transportation, the EU announced a complete halt to the sale of combustion engines from 2035, with potential exceptions for vehicles powered exclusively by e-fuels. Another area is the insulation of buildings, where the EU Commission proposed minimum energy performance standards to increase energy savings, which will be key to reduce emissions from buildings (European Council, 2023[8]).

Note for Panel B: Data refers to EU member countries that are also members of the OECD (22 countries). Effective carbon rates (ECRs) have been averaged by sector and energy category. Year of coverage is 2021, taxes as of 1st April 2021. ETS coverage estimates are based on OECD (2021[22]), with adjustments to account for recent coverage changes. Instrument coverage: specific fuel excise taxes, explicit carbon taxes, ETS (Emission Trading System) permit price includes German National ETS besides EU-ETS. No fossil fuel subsidies or other GHG are accounted for. The ETS permit price is the price of tradable emission permits in mandatory emissions trading and cap-and-trade systems representing the opportunity cost of emitting an extra unit of CO₂ equivalent, regardless of the permit allocation method. "Off-road" and the third portion of "Road" refer to "Miscellaneous energy use".

Source: European Court of Auditors (2022[21]), and OECD (2022), Pricing Greenhouse Gas Emissions: Turning Climate Targets into Climate Action, OECD Series on Carbon Pricing and Energy Taxation, OECD Publishing, Paris, https://doi.org/10.1787/e9778969-en.

Phasing out free allowances could improve the effectiveness of the ETS carbon pricing. Likewise, aligning effective carbon rates across non-ETS sectors and countries would improve cost-efficiency of policy and lead to a more equal burden sharing between sectors and countries. Moreover, the EU could use an internal carbon price (or shadow carbon price or value) for budgeting and planning purposes to improve cost-efficiency of budgetary measures with environmental impact. But mitigation policy is not alone about carbon pricing. Equally, the mitigation policy toolbox includes regulations and standards. In the financial sector, for instance, reducing overly restrictive regulations could help steer private finance towards sustainable investment.

In principle, there is a unified carbon price in ETS sectors. Under the ETS, producers need to purchase emission allowances covering their carbon emissions via auctions or on the carbon market, where an ETS carbon price is set. However, the free allocation of allowances to industry reduces the effective carbon price compared to the energy sector where no free allocation takes place, muting the price signal. Specifically, industry receives free emission permits, covering 94% of the sectoral emissions in 2021. Such a system of free allowances reduces incentives to innovate and invest in cleaner production processes (Dechezleprêtre, Nachtigall and Venmans, 2018[12]; European Commission, 2019[23]; Pellerin-Carlin et al., 2022[24]). In contrast, the energy sector must buy all its emissions permits via auctions. The EU already announced a gradual phase-out of free ETS allowances over a nine-year period to 2034 for sectors covered by its Carbon Border Adjustment Mechanism, including aluminium, cement, hydrogen, electricity, fertilisers, iron, and steel. Installations that will still benefit from free ETS allowances will need to comply with conditionality requirements, including in the form of energy audits and climate neutrality plans for certain installations. Phasing out free allowances to industry would align effective carbon prices in the ETS system.

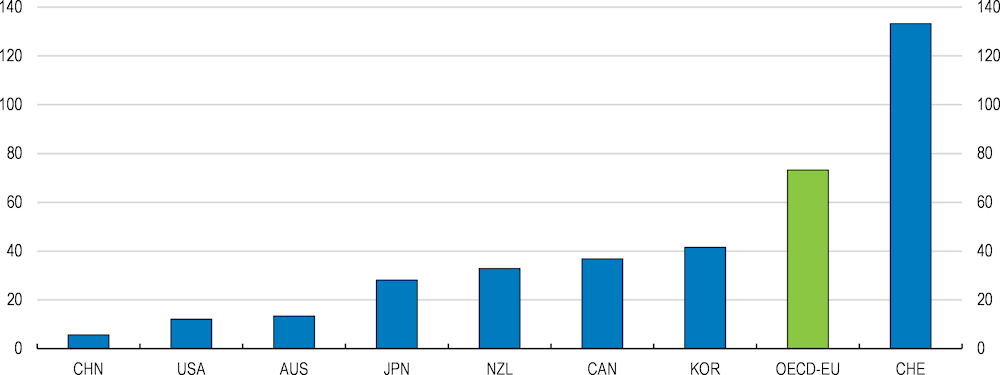

The rationale for free allowances has been that industry faces higher international competition than energy generation and could easily relocate production outside the EU, where carbon pricing is lower (Figure 2.6). Such a situation could result in an increase in global greenhouse gas emissions (so-called carbon leakage). Free allowances imply that most efficient EU firms do not face higher carbon costs compared to international competitors, while at the same time having marginal incentives to reduce emissions from the sale of the credits. The coverage of free allowances in the EU ETS is narrower compared to some other emission trading systems, with free allowances accounting for 43% of annual ETS emission allowances in 2019 (European Commission, 2023[25]; European Court of Auditors, 2020[26]). For example, the emission trading systems of South Korea and the metropolitan region of Tokyo allocate almost all emissions allowances for free (International Carbon Action Partnership, 2023[27]; Korean Ministry of Environment, 2018[28]). The lower share of free allowances reflects that the allocation of free allowances in the EU ETS is based on the risk of carbon leakage. However, the EU ETS treats equally all sectors that are deemed to be at risk of carbon leakage. This means that all sectors included in the carbon leakage list benefit from free allocation, irrespective of their emission intensity or trade exposure. In contrast, the US state of California and the Canadian province of Québec base free allowances on a more nuanced approach to the risk of carbon leakage, resulting in fewer free allowances (California Air Resources Board, 2023[29]; Quebecois Ministry for Environment, 2023[30]). Sectors are divided into low, medium, and high leakage risk based on their levels of emissions intensity and trade exposure. As a result, free allowances covered roughly 25% of total annual emission allowances in California in 2019, while they accounted for 30% of total annual emission allowances in Québec (Galdi et al., 2020[31]). The lower share of free allowances also reflects that both the ETS in California and Québec have a higher coverage of overall GHG emissions, with 75% and 80% of state GHG emissions covered, respectively. This compares to 40% of EU GHG emissions covered by the EU ETS.

Average net effective carbon rates, EUR per tonne of CO₂ equivalent, 2021

Note: Effective carbon prices are averaged across all GHG emissions, excl. LULUCF, including those emissions that are not covered by any carbon pricing instrument. 2021 Fossil fuel subsidy estimates (component of net ECR).

Source: OECD (2022), Pricing Greenhouse Gas Emissions: Turning Climate Targets into Climate Action, OECD Series on Carbon Pricing and Energy Taxation, OECD Publishing, Paris, https://doi.org/10.1787/e9778969-en.

To avoid carbon leakage, the EU Commission proposed to gradually replace the system of free ETS allowances with a carbon border adjustment mechanism (CBAM) (Box 2.3). Such a mechanism aims at equalising the carbon price of imports with those of domestic production, by charging the importer the EU ETS price deducting any carbon price paid in the country of origin. This system would apply to imports of aluminium, cement, hydrogen, electricity, fertilisers, iron, and steel. An alternative to CBAM would be better targeting of free allowances based on the risk of carbon leakage, for example by classifying sectors as highly exposed, moderately exposed, or lightly exposed, as done in the United States and Canada (see above).

From 2026, the carbon border adjustment mechanism (CBAM) will impose a charge on the emissions embodied in specific carbon-intensive goods imported by the EU and most at risk of carbon leakage. These include aluminium, cement, electricity, fertilisers, hydrogen, iron, and steel. The importer will be charged the EU ETS price, deducting any carbon price effectively paid in the country of origin. In practice, EU importers of goods covered by CBAM will have to purchase CBAM certificates, the price of which will be based on the weekly average auction price of EU ETS allowances. CBAM will be based on the actual emission content of certain goods, declared by importers and verified by experts, thus also allowing to take into account the effect of non-pricing policies in the country of origin on the emission content.

The EU indicates that measures were designed to make CBAM compatible with World Trade Organisation rules (European Commission, 2023[32]). It will be introduced gradually starting in 2026 to allow third countries to adjust to the new EU trade framework. So that EU importers are not at a disadvantage compared to EU producers, free emission allowances will be phased out for sectors covered by the CBAM over a nine-year period from 2026 to 2034. This means that until free allowances are completely phased out in 2035, the CBAM will apply only to the share of emissions not covered by free allowances under the EU ETS.

Source: European Commission (2023[32])

There is no EU-level emission trading yet in non-ETS sectors such as transportation and buildings, although these sectors accounted for about 60% of EU emissions in 2021 (European Environment Agency, 2022[33]). According to the EU’s Climate Law, in years when Member States are not on target to meet their annual emission limit in non-ETS sectors, they can borrow a limited amount of emission permits (annual emission allocations) from the following year, use a surplus of ETS emission allowances or the surplus of CO2 removals generated in their land and forest sector. Countries that still miss their national emission reduction target for non-ETS sectors are obliged to purchase annual emission allocations bilaterally from countries that overfulfill their targets. However, there is no EU-wide mechanism in place for trading of annual emission allocations. So far only Malta and Germany had to buy allocations to fulfil their obligations and did so in bilateral deals with Bulgaria, the Czech Republic and Hungary. In contrast, Sweden cancelled its surplus emission allocations in 2015, meaning these could not be transferred to underachieving countries (Appunn, 2019[34]). The very limited amount of trade and the surplus of annual emission allocations during the period up to 2020 has kept prices of annual emission allowances low. During the period up to 2030, costs per ton of CO2 could be significantly higher than those in the ETS with annual emissions allocations in short supply as more countries may fall short of their more ambitious 2030 targets (Gores and Graichen, 2021[35]). Without emission trading, these countries might need to drastically reduce emissions in a very short time span, potentially leading to economic and social disruptions. Looking ahead, the expansion of emission trading into road transportation and buildings in 2027 will reduce the need for such bilateral agreements. Until then, the EU should encourage countries to trade their annual emission allocations in non-ETS sectors, by setting up a market for annual emission allocations covering non-ETS sectors. Another option to encourage emissions reductions in non-ETS sectors is trade of international emission credits, but the EU has opted for a different approach with its Climate Law.

The EU also has penalties and sanctions at its disposal to encourage Member States to fulfil their emission reduction obligations in non-ETS sectors. If, in a given year, despite the above-mentioned flexibilities, a Member State does not meet its GHG emission reduction target in non-ETS sectors, the amount of GHG emissions in excess will be computed in that Member States’ account of GHG emissions of the subsequent year, multiplied by a factor of 1.08. Hence, Member States have a strong incentive to avoid the application of the multiplication factor, as it will render the annual emission limit in non-ETS sectors of the subsequent year more difficult to achieve. In addition, the Commission may ask a Member State that is not on track to present a correction action plan setting out additional polices and measures to avoid excessive emissions in the future. Ultimately, if non-compliance remains, the European Commission may take an infringement legal action against the Member State before the Court of Justice of the European Union, which could result in financial sanctions.

The EU already announced the establishment of a new emission trading system (ETS 2) for transportation and heating fuels as of 2027. However, the system is estimated to have a different ETS carbon price than the traditional ETS system (see below). A unified ETS carbon price for all sectors covered by emission trading would align marginal abatement incentives. Such a uniform ETS carbon price should then be extended to large producers in non-ETS sectors such as agriculture.

Non-ETS carbon prices vary across countries and sectors, leading to varying abatement incentives and reducing the effectiveness of the EU’s climate policy. Taxation of carbon, such as fossil fuels, affects the effective carbon price (Figure 2.7). But in general, fossil fuel taxation imperfectly mirrors carbon-content. This reflects that exemptions and reduced rates lead to a lower effective energy tax rates for aviation and maritime fuels as well as heating gas, among others. There is scope to increase the effectiveness of the climate policy mix by aligning carbon prices and taxing polluting activities in line with their environmental impacts. The establishment of the ETS 2 for transport and heating fuels means that a uniform carbon price will be established in these sectors, although it will be lower than in the traditional ETS sectors (see above). In addition, the EU Commission has proposed to broaden the energy tax base by phasing out tax exemptions and reduced rates and to introduce EU-wide minimum energy tax rates based on energy content and environmental performance, with fossil fuels being taxed most heavily. Currently, minimum tax rates are based on volume and do not consider environmental performance. As discussed above, the broadening of the energy tax base and minimum tax rates for fossil fuels based on environmental performance should be adopted, preferably the same for all sectors to ensure an equal burden sharing. Thereafter, minimum tax rates can be gradually increased. Ideally, the EU should announce clear time paths for the evolution of minimum tax rates to allow households and producers to adjust to the new energy tax framework. However, a concern is the interaction with the new emission trading system for transportation fuels, which will add to transport fuel prices (see below).

Note: Data includes CO2 emissions from the combustion of biofuels. In Panel A, the effective carbon rate is a weighted average of the 22 OECD EU countries (plus Cyprus).

Source: OECD Effective Carbon Rates database.

The EU budget for the current period 2021-27 has a 30% spending target for climate objectives. In practice, the EU follows a scaled approach to determine whether budgetary items are helpful or harmful to reach climate objectives (OECD, 2016[36]; European Commission, 2011[37]). However, this approach has been criticised for overstating the budget’s true contribution to emission reductions, particularly in the case of the Common Agricultural Policy (European Court of Auditors, 2022[38]). Notably, there is no accounting for spending with negative climate impacts. For example, direct payments to farmers support the agricultural use of drained peatlands, which is associated with 20% of all agricultural emissions (see below). Moreover, the EU’s approach does not allow to identify abatement costs across EU funded programmes and their cost-efficiency. To improve cost-efficiency, the EU could apply an internal carbon price (or shadow carbon price or value) to all public budgeting, planning, procurement and cost benefit analysis of EU-funded projects with a carbon impact, as done in the United Kingdom (Department for Business, 2021[39]). Ideally, such an internal carbon price should apply to all emissions resulting from EU spending and regulations, including agricultural funds and the pandemic recovery funds.

To promote green budgeting practices among Member States, the European Commission has developed an EU Green Budgeting Reference Framework (GBRF). The GBRF is currently used by 12 Member States. In addition, the Commission provides technical support on green budgeting to 23 Member States. However, countries that implement green budgeting differ in the way they identify the environmental impacts of their budgets. This reflects different budgetary frameworks with different underlying concepts and methodologies regarding environmental costs and benefits (Box 2.4). National budgetary frameworks are difficult to change, which has led the Commission to propose common guidelines instead. Nonetheless, to promote green budgeting practices, the EU should introduce a common methodology for countries assessing environmental impacts of public spending, including an EU-wide internal carbon price.

The EU adopted a taxonomy of environmentally sustainable activities in 2020, which pursues multiple environmental objectives, including climate change mitigation. It includes low-carbon technologies such as solar and wind power, but also carbon-intensive forms of biomass. This reflects that the criteria for inclusion in the taxonomy do not follow a single approach based on carbon-intensity of economic activities. It results in activities equally included in the taxonomy despite significant differences in their contribution to decarbonisation. More recently, the Complementary Climate Delegated Act extended the taxonomy in 2022 to include nuclear energy and gas as interim solutions (European Commission, 2023[40]). Since 2023, large EU companies must report whether their business activities are aligned with the taxonomy of sustainable activities. This requirement will be extended to financial companies from 1 January 2024. However, the existing Non-Financial Reporting Directive, despite being mandatory, has proven inadequate to provide comparable and reliable information on the environmental impact of companies. This means that in most cases investors do not have the necessary information on the environmental impact of companies, potentially obscuring future costs and leading to unintended consequences of investment decisions. To tackle this problem of information asymmetry, the EU is currently working on extending sustainability disclosure requirements from 2024 to all large EU companies, as well as listed small and medium-sized enterprises. This will be done gradually and, in several stages, mandating larger companies to comply with the reporting standards first, followed by listed small and medium-sized enterprises.

Another issue is the lack of uniform reporting standards, which leaves scope for greenwashing in finance. For instance, roughly 40% of funds classified as sustainable invested at least 5% in fossil fuels in 2022 (EUROSIF, 2022[41]). This reflects that the sustainable finance framework is still under development. The EU has already adopted sustainability disclosure and reporting requirements for companies and investors active in financial markets, as well as for manufacturers of financial products and financial advisers. In 2020, the Platform on Sustainable Finance was established, which advises the European Commission on issues related to the implementation of the sustainable finance framework. Furthermore, the EU Commission requested in 2022 the European Supervisory Authorities to advise on issues relating to greenwashing in financial markets. In 2022, the EFRAG (formerly European Financial Reporting Advisory Group) developed common reporting standards for companies’ GHG emissions and climate-related risks, as well as environmental and social standards (EFRAG, 2022[42]). Such reporting standards for corporates should be gradually introduced to allow them to adjust to the new compliance framework. To reduce compliance costs, the EU should ensure the consistency and close interoperability of EU standards with international standards. This will require cooperation with stakeholders (e.g., international accounting bodies and credit rating agencies) within and outside the EU, including the International Sustainability Standards Board (ISSB).

Green budgeting refers to the use of budgetary tools to help achieve climate and other environmental objectives. Across the OECD, 24 of 36 countries had implemented green budgeting measures in 2022 according to the 2022 OECD Green Budgeting Survey (OECD, 2023[43]). Effective green budgeting depends on strategic and fiscal frameworks and clear institutional arrangements:

Green budgeting is used by twelve countries, and it is part of the fiscal framework by law in eleven countries (i.e., Austria, Chile, France, Italy, Korea, Luxembourg, Mexico, the Netherlands, the Slovak Republic, Spain, and Sweden). Italy, a country with a longstanding tradition in this field, included specific environmental reporting requirements on budget spending in 2009.

National strategies for decarbonisation are important for an effective green budgeting framework. Twenty OECD countries have developed strategies in the past years to inform green budgeting.

A clear institutional arrangement is key. In several countries, the central budget authority has a leading role (e.g., in Denmark, Ireland and Mexico), while in other countries this responsibility is shared with other actors, such as the Ministry of Environment, or other government agencies (e.g., in Canada, which has a strong culture of cross-government collaboration). Eighteen countries established specialised entities (e.g., funds or green investment banks) to inform governments with an environmental perspective.

The most common methods for the execution of green budgeting are:

Environmental cost-benefit analyses inform budget decision-making. In the United Kingdom, the Treasury provides the government with an overall assessment of climate-related impacts of all government programmes (the so-called Green Book).

Ex-ante/ex-post environmental assessments are useful for in-year adjustments and to improve scrutiny of budget execution. In Italy, budget decisions are supported by reporting on environmental programmes in relation to both budget execution and final accounts.

Carbon budgets set carbon emission ceilings for a specific period. France has adopted three carbon budgets since 2015. Similarly, Ireland adopted a five-year carbon budget in 2021.

Carbon assessments provide estimates of GHG emissions associated with budget measures. Several OECD countries provide such carbon assessments (Austria, Canada, Denmark, Finland, Ireland, Korea, Lithuania, New Zealand, Norway, Sweden, and the United Kingdom).

Green budgeting tagging assesses whether budget items are helpful or harmful to green objectives. For example, Ireland follows a binary approach, where the entire cost of a measure is tagged as green or not, while the EU, France and Italy use a scaled approach to determine the green content of budgetary items.

Internal carbon price: Few countries use carbon pricing to assess cost-efficiency of budgetary measures. For instance, the United Kingdom uses an internal carbon price (or carbon value) to assess impacts on GHG emissions resulting from all public spending, taxation, or regulations.

Other instruments are green budget statements, as in France and Italy, and reporting on emission impacts of budget measures as in Denmark. Training organised by the central budget authority (e.g., in Austria, Canada, Colombia, Denmark, Mexico, and Portugal), detailed instructions in the annual budget circular (e.g., in France, Italy, Luxembourg, Mexico, Norway, Portugal and Sweden), and inter-agency groups to ensure coordination across the government and stakeholders (e.g., in Canada, Colombia, Denmark, France and Mexico) can support green budgeting activities.

While much progress has been made in green budgeting, challenges remain. Countries often lack adequate resources and methodologies to implement green budgeting. The EU’s Green Deal and the related technical support on green budgeting offered to 23 Member States will likely encourage the use of green budgeting among EU countries. Moreover, the OECD Paris Collaborative on Green Budgeting is a helpful forum for countries to share best practices and foster their harmonisation in this area.

Source: European Commission (2022[44]); OECD (2021[45]); OECD and European Commission (2020[46]); EC-OECD-IMF (2021[47]); OECD (2021[48]); Braendle (2021[49]); and Blazey, A. and M. Lelong (2022[50]).

EU companies rely heavily on debt-based funding, highlighting the importance of banking for raising investment in the green transition (Carradori et al., 2023[51]). This is especially important for small and medium-sized companies as well as the housing sector, where bank lending constitutes an important source of financing of investment in abatement. The EU already adopted reporting and disclosure requirements for banks. The Capital Requirements Regulation and the Capital Requirements Directive require lenders to disclose their exposure to transition risk from 2023. This includes the amount of loans to, as well as bonds and equity holdings in, carbon-intensive industries and the fossil fuel sector, and the extent to which lenders finance their direct and indirect emissions. For mortgages, banks must report the energy performance of their real estate portfolios. The new regulatory disclosure requirements for banks aim at creating a wedge in financing costs between fossil fuel projects and sustainable investment, making the latter more attractive.

Investment needs in the insulation and renovation of buildings to reach energy efficiency targets are massive (see below). So far, such investments rely heavily on bank lending, often supported by government support schemes. To increase the role of financial markets, the European Commission proposed to introduce EU-wide mortgage portfolio standards to support the securitisation of mortgage portfolios. Such standards would reflect the energy efficiency performance of buildings and get more stringent over time, mirroring more stringent EU-wide minimum efficiency standards for buildings for 2033. Importantly, common standards would also ease securitisation, or the issuance of financial and debt instruments based on mortgage portfolios. However, a lack of common guidelines on how these standards are defined could result in a fragmented landscape of mortgage portfolio standards across the EU. Such a fragmentation would hamper securitisation and cross-border investments into the renovation and insulation of buildings (European Central Bank, 2023[52]). To make securitisation work to its full potential, the EU should harmonise minimum requirements for mortgage portfolio standards. Such harmonisation could facilitate cross-border investments by institutional investors in buildings’ renovation in the context of the Capital Markets Union. Raising the contribution of financial markets to energy efficiency improvements of buildings would also reduce the reliance on bank lending and government support schemes.

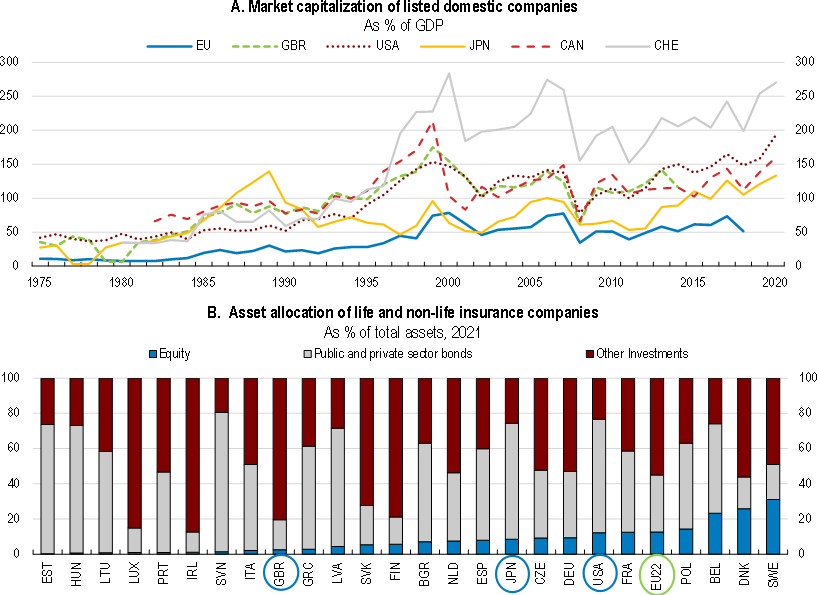

A deeper Capital Markets Union can boost private investment needed for the green transition. Stock market capitalisation in the EU is lower than in peer economies (World Bank, 2022[53]) (Figure 2.8, Panel A). A factor behind shallower capital markets is the limited role of institutional investors, notably insurance companies. This is despite the well-developed insurance market in the EU. Insurers invest mostly in low-risk government and corporate bonds. Investment in equity by insurance companies, especially non-life insurers, is lower than in the United States (Figure 2.8, Panel B). This notably reflects more restrictive EU rules for insurers that encourage them to move into risk-free government bonds and other high-rated bonds. For instance, equity capital charges ranging between 22% and 49% add to the solvency requirement for insurers. There is a lower capital charge of 22% for long-term equity, although overly restrictive criteria mean that only an estimated 2% of all insurers’ equity investment meets the criteria (High Level Forum on the Capital Markets Union, 2020[54]). The European Commission is reviewing the solvency rules, including the treatment of equity capital charges to ensure they better reflect the long-term nature of investment by institutional investors. There are prudential risks associated with this. In some cases, the risks may be lower if climate change risks are explicitly incorporated. The European Insurance and Pensions Authority is analysing those aspects (European Insurance and Occupational Pensions Authority, 2023[55]). Nonetheless, prudential regulation should ensure that risk in the insurance sector is properly managed.

Note: In Panel B, the "Others" category includes investments in private equity funds, hedge funds, structured products, collective investment schemes, cash and deposits, loans, and land and buildings. The EU22 aggregate includes 22 EU countries (all EU27 member countries except Austria, Cyprus, Croatia, Malta, and Romania for which data is unavailable).

Source: World Bank; and OECD Global Insurance Statistics database.

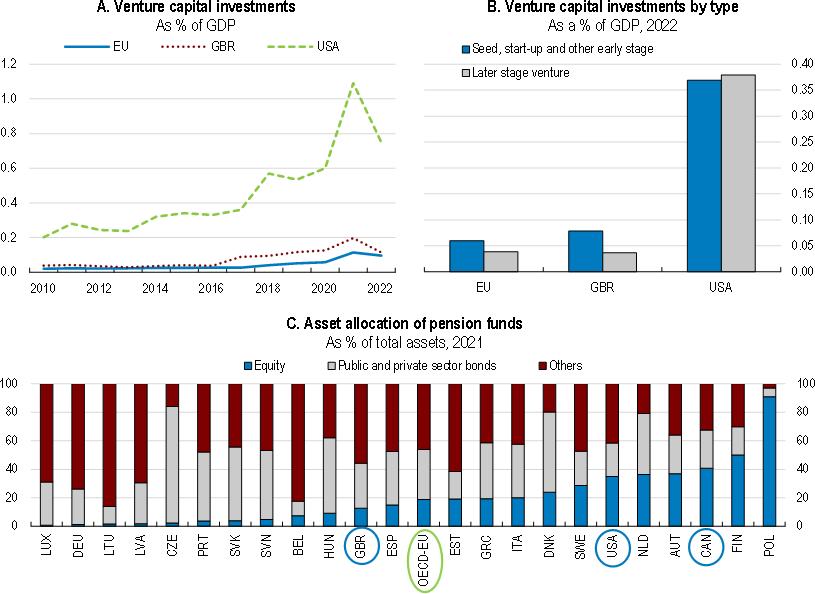

The mobilization of household savings can support investment. For instance, the pensions system, and particularly capital-based pensions systems, can contribute to providing sufficient long-term-risk capital to support the green transition. Many EU countries have quantitative restrictions on pension funds in place that limit investment in private equity and venture capital (OECD, 2022[56]). Existing restrictions reduce funding options for start-ups. Limited financing contributes to slowing the development and commercialisation of new technologies. A particular concern is low funding for the scale-up of innovative start-ups (Figure 2.9). Prudent regulations are important to protect pensioners’ contributions. However, quantitative restrictions may currently be too restrictive to make greater use of pension funds for raising private finance for the green transition (OECD, 2022[57]). Hence, easing quantitative restrictions on pensions funds could unleash investment in green technologies. There are prudential risks associated with relaxing rules. Safeguards and appropriate investment regulations need to be in place to ensure that pension providers continue acting in the best interest of members (OECD, 2022[57]). In the longer term, bolstering capital markets could be achieved through a stronger take-up of capital-funded pensions. This could entail auto-enrolment in occupational pension schemes, although this is under the responsibility of EU countries (High Level Forum on the Capital Markets Union, 2020[54]).

Note: EU corresponds to the average of EU OECD countries, according to data availability. In Panel B, 2019 data for USA. In Panel C, the "Others" category includes cash and deposits (including those of mutual funds), land and buildings (including those of mutual funds), loans, hedge funds, structured products, unallocated insurance contracts, derivatives, commodities, trade credits and advances and other accounts receivables and payables. OECD-EU is an average of the OECD-EU countries presented in the graph.

Source: OECD Enterprise Statistics database; and OECD calculations.

Achieving the ambitious emission targets requires a comprehensive strategy to tackle a broad range of sectors. A key challenge remains the decarbonisation of the energy sector. A significant acceleration of emission reductions is also necessary in agriculture and transportation, which have contributed little to emission reduction targets so far.

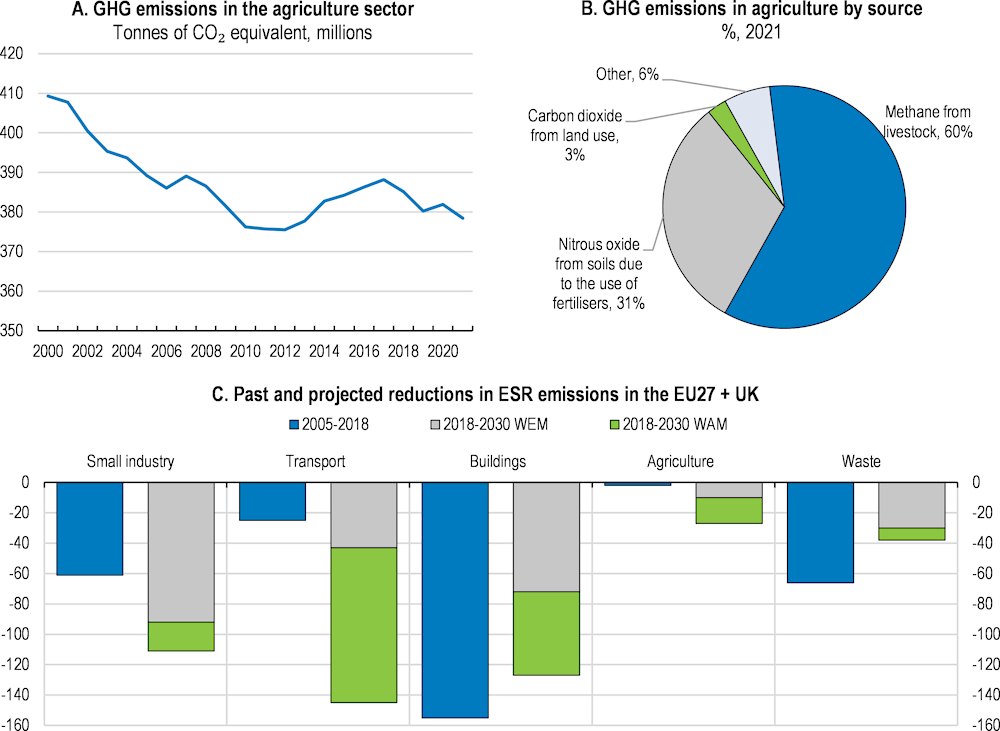

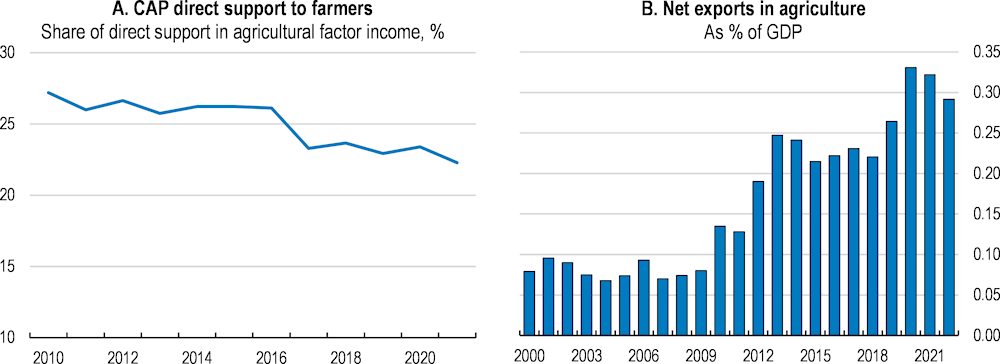

The EU has successfully reduced its emission intensity in agriculture since 1990 as agricultural emissions grew slower than agricultural output, reflecting a decoupling of emissions from production. Emission reductions happened in the 1990s and 2000s due to falling cattle livestock numbers, but also better use of fertilisers (OECD, 2023[58]). More recently, however, progress has stalled. Carbon emissions in agriculture have hardly been reduced over the last decade, pointing to inconsistencies between the EU’s climate policy and agricultural policy. This is despite climate action being a core objective of the Common Agricultural Policy (CAP) since 2013 (Box 2.5). In 2014-20, a quarter of CAP spending was deemed to contribute to climate mitigation and adaptation according to the European Commission (2019[59]). However, an assessment of the European Court of Auditors (2021[60]) found that CAP funds attributed to climate action have contributed little to emission reductions, which have not changed significantly since 2010. Moreover, EU countries are not projecting significant emissions reduction in the agricultural sector by 2030, choosing instead to focus on other sectors (Figure 2.10). Apart from emission reductions, there are other important environmental challenges in agriculture, including biodiversity, water, air, and soil quality, which are discussed in more detail in the OECD Economic Surveys of Denmark, France, Germany, Sweden, and the United Kingdom for example (OECD, 2021[61]; OECD, 2021[62]; OECD, 2022[63]; OECD, 2023[64]; OECD, 2023[65]).

Note: In Panel C, ESR refers to Effort Sharing Regulation, which sets national emission reductions targets for EU countries. The bars represent changes in emissions between 2005-2018 and 2018-2030 based on inventories, approximated estimates for 2018 (proxy) and projections “with existing measures” (WEM) and “with additional measures” (WAM) under more ambitious FIT for 55 targets.

Source: Eurostat; and EEA (2021), Effort Sharing targets 2021-2030 (Effort Sharing Regulation, ESR).

For the 2021-27 financing period, EUR 387 billion in funding has been allocated to the CAP (or 19% of the EU budget including Next Generation EU funding), of which 75% are allocated to Pillar 1, and the remaining 25% to Pillar 2:

Pillar 1 mainly provides direct income support to agricultural producers. A small share of 5% of Pillar 1 funds is also used to intervene in certain agricultural markets in case of adverse shocks to food prices. The underlying rationale is that the agricultural sector is crucial for the food supply for the EU. Until 2003, direct payments to farmers were based on production volumes. Since then, such payments based on production were reduced and replaced by payments based on eligible hectares.

Pillar 2 finances rural development activities as well as increasingly environmental and climate objectives. It requires co-financing of 40% by Member States.

The EU Commission monitors the work of national agencies and is accountable for the use of EU funds, while EU countries are responsible for making payments and carrying out checks on recipients.

Climate action is a core objective of the CAP since 2013, complementing the other objectives of maintaining agricultural incomes and rural development (European Parliament and the Council of the European Union, 2013[66]). For the period 2021-27, about 40% of CAP funding is dedicated to climate action, corresponding to 28% of overall spending on climate action under the EU budget for 2021-27 (European Commission, 2022[67]).

Since 2015, a third of all direct payments to agricultural producers under Pillar 1 (or 24% of the CAP budget) have been subject to compulsory agricultural practices that are beneficial for the climate and the environment (green direct payments). Such practices include the maintenance of permanent grassland, crop diversification, and practices to safeguard and improve biodiversity of arable land (such as nitrogen-fixing crops, fallow land and catch crops).

In addition, all direct payments to farmers are subject to meeting certain environmental and public health standards (cross-compliance provisions).

As of 2023, a quarter of the direct payments will be dedicated to eco-schemes to provide stronger incentives for environment-friendly farming practices, including organic farming.

About 13% of rural development funds (or 3.3% of the CAP budget) pay farmers for achieving certain environmental objectives that go beyond the compulsory green direct payment and cross-compliance requirements. The more ambitious environmental objectives relate mostly to biodiversity, organic farming, and the conservation of landscape features.

Spending directly related to GHG emissions reduction and carbon conservation is considerably smaller, with 0.9% of the CAP budget, according to latest available data for 2014-20 (European Network for Rural Development, 2021[68]).

Source: OECD (2023[58]), Policies for the Future of Farming and Food in the European Union, OECD Agriculture and Food Policy Reviews, OECD Publishing, Paris.

The polluter-pays principle rarely applies to emissions from agricultural activities. Carbon taxation is little used, as reflected in a low explicit carbon price. Fuel excise taxes, indirectly pricing emissions, cover less than 10% of the sector’s GHG emissions, mainly stemming from farm vehicles which in large part run on diesel (Figure 2.11). However, large fossil fuel subsidies in the form of reduced rates and exemptions for diesel in agriculture reduce the effective carbon price (European Commission, 2022[69]; European Court of Auditors, 2022[21]). Moreover, agricultural emissions do not fall under the EU’s emission trading system. As a result, carbon pricing does not apply to most of the sector’s GHG emissions, which consist of methane mostly from livestock, nitrous oxide from soils due to the use of fertilisers, and carbon dioxide from land use. Without stronger price incentives to reduce emissions, agriculture is set to become one of the biggest emitting sectors in the EU by 2030 (Chateau, Miho and Borowiecki, 2023[10]). To make polluters pay for their emissions, environmentally harmful fossil fuel subsidies should be phased out (see above).

Note: In Panel A, the net effective carbon rate and its components are averaged across all GHG emissions of the 22 OECD EU countries (plus Cyprus), including those emissions that are not covered by any carbon pricing instrument. LULUCF refers to land use change and forestry. Data excludes CO2 emissions from the combustion of biofuels. In Panel B, fossil-fuel subsidies (in the form of fuel consumption support, such as reduction or exemption of fuel taxes) refers to the EU27 aggregate and are based on estimates from the EC's 2022 Report on Energy Subsidies in the EU and on value added data by sector sourced from Eurostat's database.

Source: OECD Net Effective Carbon Rates database; European Commission (2022[69]); Eurostat National Accounts database; and OECD calculations.

Bringing agricultural emissions on a downward track will require, first, phasing out environmentally harmful fossil fuel subsidies, and second, higher carbon pricing. Higher carbon pricing could entail expanding emission trading to include agriculture, as announced for transportation and housing. Extending emission trading is a gradual process that should eventually lead to the extension of emission trading to agriculture. An alternative to emission trading is a carbon tax on agricultural emissions, as planned in Denmark and New Zealand (OECD, 2022[70]). However, carbon pricing in agriculture comes with challenges as it is technically not easy to implement. Farm-level emissions for inclusion in emission trading are challenging to calculate. Nonetheless, there are already pilot monitoring systems in place for emissions from livestock, peatland-rewetting, and agroforestry. Before emission trading is extended to agriculture, such monitoring systems could be scaled up and introduced more broadly in agriculture, although emission reductions from improved agricultural practices for soil management are more challenging to measure (European Commission, 2021[14]). The extension of emission trading will require stronger support for farmers to set up systems to monitor and report emissions, by diverting agricultural funds to support low-income farmers most vulnerable to higher mitigation costs as these often cannot pass on higher costs to consumers (see below). Lessons could be learned from New Zealand, where the government and the agricultural sector are working towards a system for farm-level carbon pricing for emissions from livestock and fertiliser use (Box 2.6). Several safeguards aim to ensure that farmers are not overburdened with the new carbon pricing framework, including a gradual phase-in and free allowances. However, policies are still experimental, and it is not yet clear what works. In addition, it will be more difficult to replicate emission monitoring and reporting for small agricultural producers and part-time farmers, which are often family-run and lacking the expertise to implement such approaches. Another challenge to carbon pricing is strong resistance from companies in the sector that needs to be overcome (D’Arcangelo et al., 2022[9]).

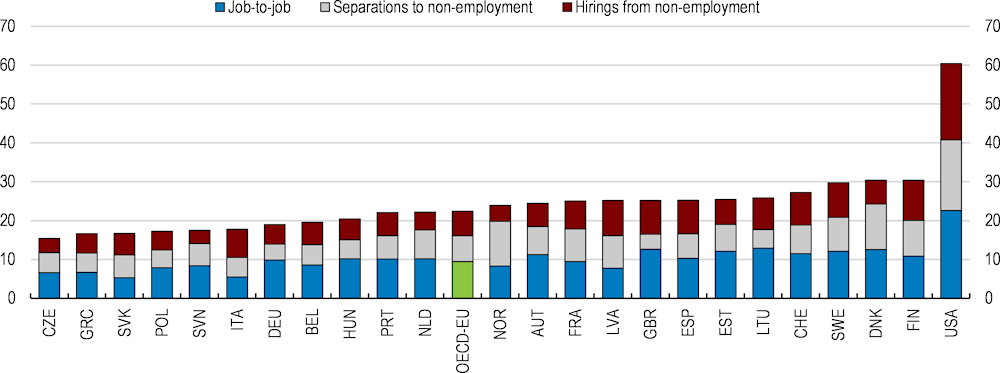

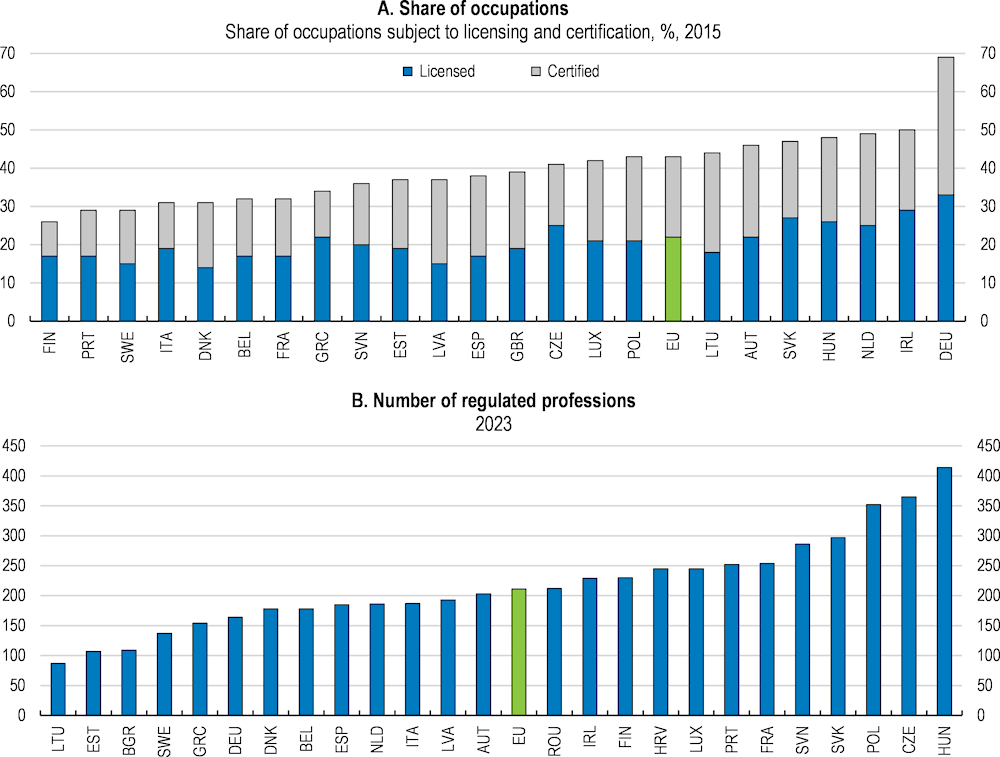

The extension of emission trading to agriculture will also involve costs. Achieving emission reductions in agriculture could prove much more difficult than in power and industrial sectors due to higher abatement costs. For instance, many smaller agricultural producers may not be able to afford abatement technologies and practices. The EU supports carbon mitigation activities of farmers, but funding is limited, with 0.9% of the CAP budget for 2014-2020 (see above). At the same time, there will be social costs as households will be affected by higher agricultural prices.