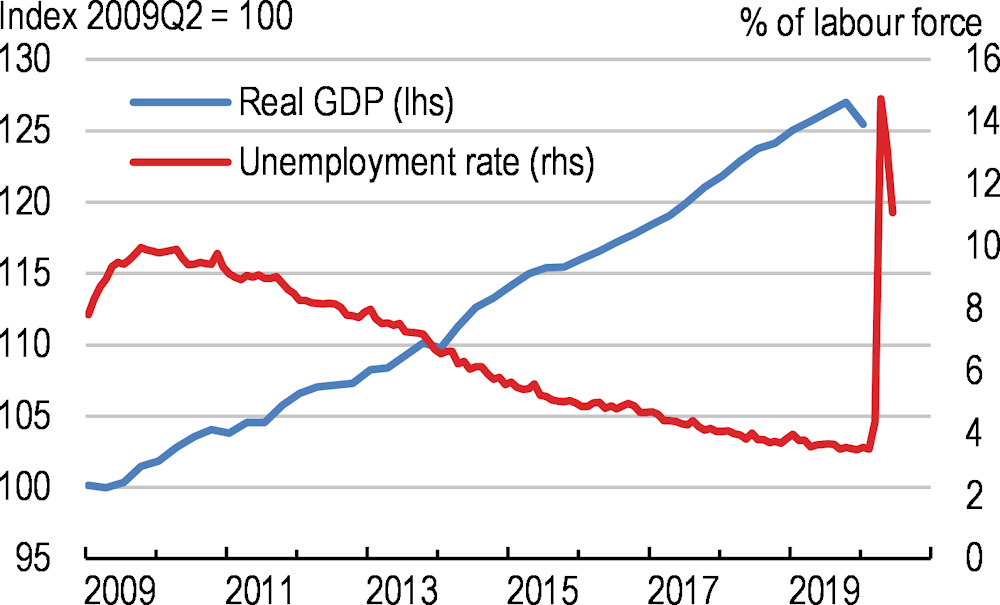

The coronavirus pandemic has hit the economy hard. Lockdown orders forced many businesses to shut down and activity dropped sharply (Figure 1). Large numbers of people became unemployed or dropped out of the labour market, unwinding a large part of the 10-year progress made to restore full employment. The downturn hit at a time when the economy was performing well, with wages gaining momentum, businesses generating large earnings, and banks posting healthy capital buffers.

OECD Economic Surveys: United States 2020

Executive summary

The economy has been hit hard

Figure 1. The expansion has stopped abruptly

Source: OECD Analytical database.

With cases of COVID-19 increasing steadily, efforts were made to control the pandemic. State-level shelter-in-place orders requiring households to remain at home and businesses to close have helped to flatten the curve of new cases, but the death toll has continued to mount. Progress was made to slow the contagion but, as in other countries, the outbreak will take a long time to stop.

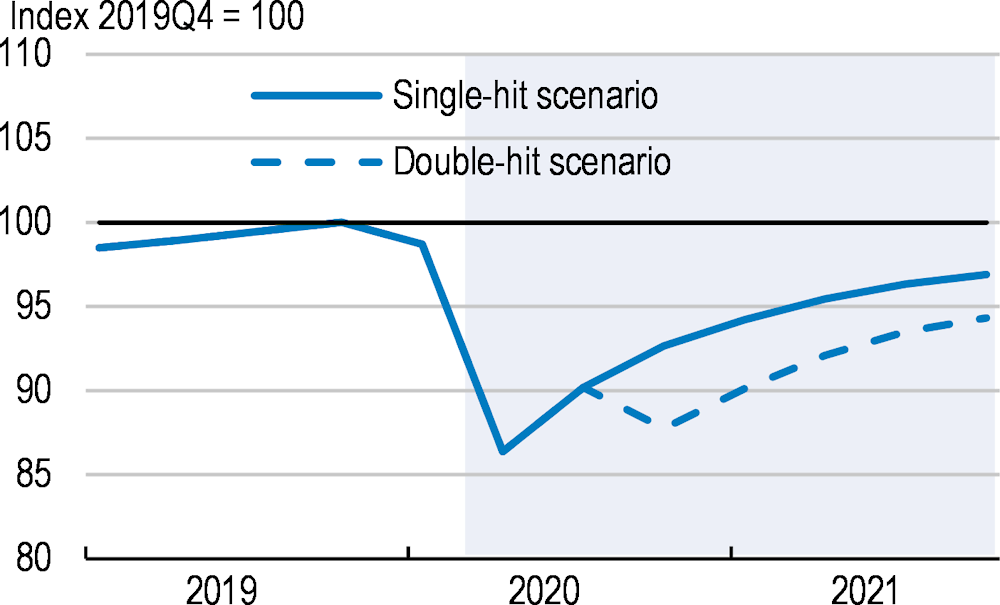

The economic impact of the coronavirus crisis is substantial. Output has slumped, and only a partial recovery is likely (Figure 2 and Table 1). Businesses that are sensitive to distancing will recover only gradually and to the extent that customers regain confidence sufficiently to return to their former consumption patterns.

Forceful macroeconomic support

Fiscal space and room for monetary policy easing were available when the crisis hit and rapidly deployed to support the economy. Fiscal policy has responded forcefully to the crisis and provided welcome financial relief to unemployed workers and struggling businesses during the first phase of confinement. With the exit from confinement well underway, policy actions should now focus on reviving the economy.

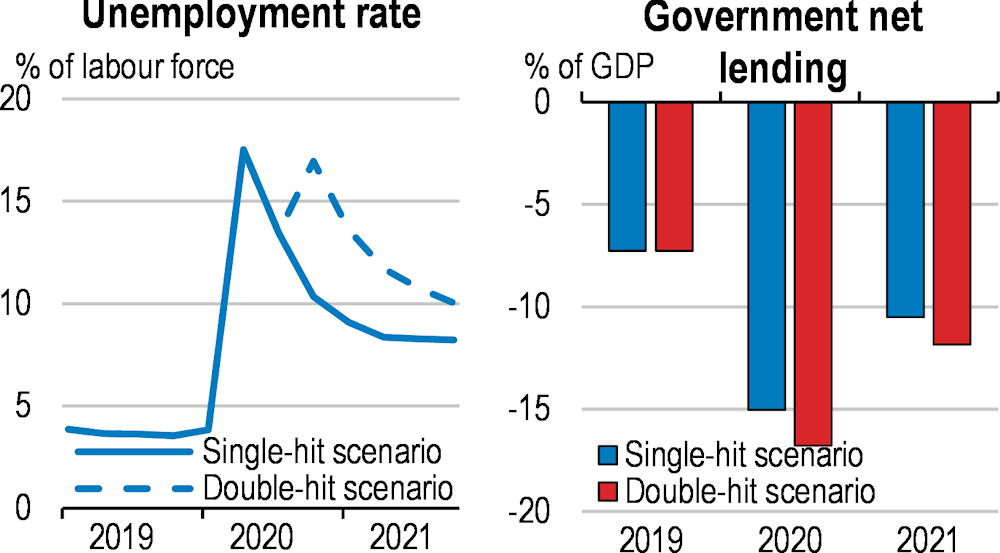

This fiscal support should be extended as needed, including in case of a second wave, which will cause budget deficits to swell (Figure 3). These deficits have been easily financed thanks to abundant liquidity and bond purchases by the Federal Reserve. However, they will add to debt challenges in the long run as ageing will put mounting pressure on pension and healthcare spending. Concrete action to reform these entitlements and raise revenue will be needed to ensure long-run sustainability.

Table 1. A gradual recovery is projected

|

Double-hit scenario |

2019 |

2020 |

2021 |

|---|---|---|---|

|

Gross domestic product |

2.3 |

-8.5 |

1.9 |

|

Unemployment rate |

3.7 |

12.9 |

11.5 |

|

Fiscal balance (% of GDP) |

-7.3 |

-16.8 |

-11.5 |

|

Public debt (gross, % of GDP) |

108.5 |

131.8 |

139.9 |

|

Single-hit scenario |

2019 |

2020 |

2021 |

|

Gross domestic product |

2.3 |

-7.3 |

4.1 |

|

Unemployment rate |

3.7 |

11.3 |

8.5 |

|

Fiscal balance (% of GDP) |

-7.3 |

-15.0 |

-10.5 |

|

Public debt (gross, % of GDP) |

108.5 |

128.8 |

133.1 |

Figure 2. Output will recover gradually

Source: OECD Economic Outlook 107 database. The “single-hit” scenario assumes that the pandemic is brought under control before the Summer; the “double-hit” scenario assumes a second wave of contagion and lockdown measures after the Summer.

Monetary policy also responded quickly and forcefully. Interest rates were reduced to 0-0.25%, quantitative easing and forward guidance were restarted, and massive Fed lending programmes were created to provide cash relief to businesses. In the case of a further weakening, monetary policy can react by augmenting forward guidance and expanding asset purchases. The outlook is uncertain for inflation although in the short run it is likely to continue to undershoot the Fed’s target.

Figure 3. Unemployment and budget deficits will remain elevated

Source: OECD Economic Outlook 107 database.

The banking sector appears to have withstood the initial shock. A number of vulnerabilities have emerged and credit markets experienced considerable stress, but this was quickly brought under control. Nonetheless, high corporate leverage creates a risk for the banking system, which will become more visible as government support is withdrawn. Continued support could be considered if liquidity and solvency problems emerge swamping the bankruptcy system.

The labour market has experienced an unprecedented shock

With the shuttering of many businesses, unemployment has surged and many have left the labour force. The unemployment rate jumped to almost 15% in April before declining and the employment to population ratio fell to the lowest level on record. The prime age participation rate has fallen back to levels last seen in the 1980s. While many workers appear to have retained an attachment to their former firms, many have not.

Bringing people back into work quickly is important. Not only would this help households recover, but also preserve the positive gains from the long expansion in sharing the benefits more widely. A robust recovery from the current downturn will limit the damage to the labour market, but additional effort will be needed to make sure groups often on the margins of the labour force are not left behind. Sustained high levels of unemployment and the drop in prime age participation can be difficult to reverse. Government policies to help workers re-enter employment quickly will be crucial.

Regulatory reforms will support the recovery

The recession risks leaving behind a long-lasting negative economic impact. Reforms are essential to lift productivity growth and ensure that all benefit from future growth. Productivity has been sluggish for a variety of reasons. Policies are needed to support labour mobility and competition to help workers and businesses avoid scarring effects and fully recover from the crisis.

The regulatory process in the United States has a large state and local element. This can be a strength but in some cases this has led to uncoordinated policies, contributing to weaker labour market dynamism. When regulations impede the ability of workers to change jobs, which have large payoffs for workers with low incomes or skills, these policies can have important distributional impacts.

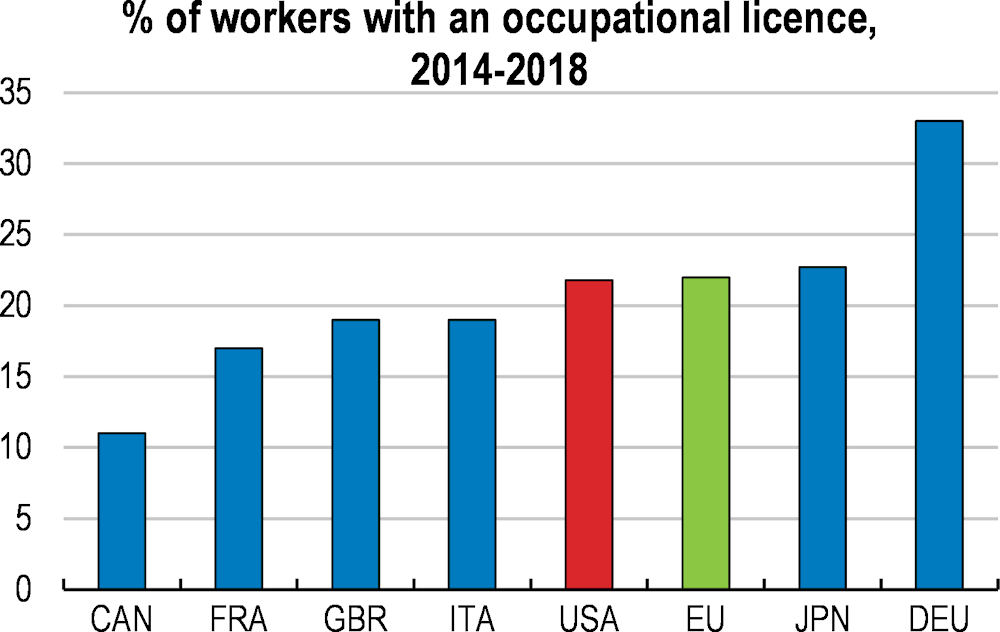

Occupational licensing and non-compete agreements are impediments to moving to new employers. They also hinder workers finding good jobs. These types of labour market regulations both cover around one fifth of workers (Figure 4). Regulation is needed to protect safety and ensure quality of services, but it also creates entry barriers and reduces competition with important costs for job mobility, earnings and productivity growth.

Figure 4. Licensing restrictions are comparable with many other countries, but not all

Source: BLS; Koumenta and Pagliero (2017); Morikawa (2018); Zhang (2019).

Low-skilled workers and disadvantaged groups tend to be particularly affected by these barriers. The states are mainly responsible for regulation concerning occupational licensing and non-compete agreements and the variation across states is similar to the variation across the European Union. The requirements vary widely by state both in whether an occupation is covered at all and in how restrictive the requirements are. Reducing the restrictive impact of occupational licensing and the use of non-competition covenants could help to circumvent the secular decline in dynamism. However, attempts to reform often face stiff opposition from associations of professionals.

A further barrier to labour mobility is the housing market. Housing supply has barely kept pace with population growth and lags other OECD countries . This is partly the result of restrictive land use policies at the local level making it difficult to expand housing supply, particularly in and around successful cities. Cities where land use policies are less restrictive also tend to be cities where productivity growth is stronger and where people change jobs more frequently. Better coordination of housing, land use and transport policies are needed to help cities and their surrounding areas realise their potential and grow sustainably.

Ensuring competition is a priority for promoting productivity growth. While competition remains intense in some markets, such as retail trade, there are some concerns in other industries, notably information technology, media and health. In some cases, regulatory barriers appear to contribute to sluggish firm entry. Trade policy has the potential to reduce barriers to competition and to support the recovery. In particular, barriers to trade in services appear to hold back the economy.

Emissions have begun to fall, but further reductions will be more challenging

Environmental performance and energy security has continued to improve along some dimensions. These include high air quality and a large reduction of greenhouse gas emissions notably with growing production and use of natural gas, rising renewable energy capacity, steady nuclear generation and the decline of coal.

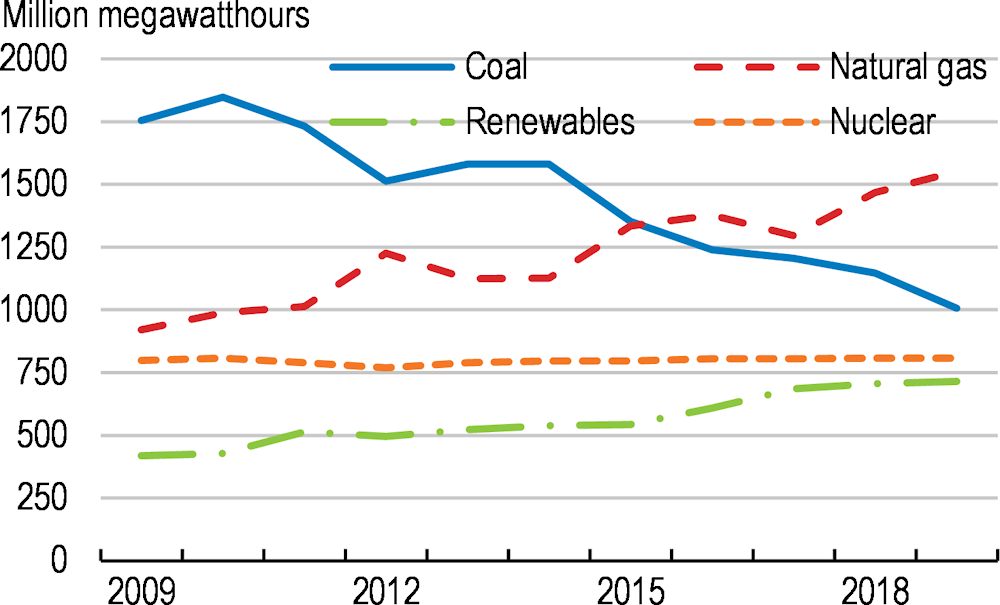

Greenhouse gas emissions have been falling since 2005. Emissions declined by around 12% by 2018. Improvements in technology, increased supply of natural gas as well as state and local policies have begun to reduce greenhouse gas emissions. A switch in electricity production from coal to natural gas and renewables has made an important contribution to emission reductions (Figure 6). Recently, electricity production by renewables over a month outpaced coal for the first time, although overall for the year coal remains a more important source of generation capacity. As this process runs its course further reductions will be difficult to attain without policy support, which should prioritise the most cost-efficient ways to reduce emissions as part of the Administration’s all fuels and technologies approach.

Figure 5. Natural gas and renewables are becoming more important for electricity

Source: EIA – Electricity data (2019)).

|

MAIN FINDINGS |

KEY RECOMMENDATIONS |

|---|---|

|

Improving macroeconomic and international trade policies |

|

|

The federal government has reacted quickly to shield households and businesses from the brunt of the shock. As a result the budget deficit is large and public debt has risen, but debt service remains moderate thanks to low interest rates, In the longer term, entitlement spending is projected to increase reflecting ageing and healthcare costs. |

Continue to provide exceptional fiscal support to help unemployed workers and support the recovery. When the situation normalizes, reform entitlement spending, reduce spending inefficiencies in the healthcare sector, close loopholes and broaden the tax base to ensure long-term debt sustainability. |

|

The Federal Reserve has responded robustly to the crisis, moving quickly to support the economy as it was hit by the coronavirus and ensuring that financial markets continued to operate. |

In case of a further slowdown be ready to augment forward guidance and quantitative easing. Update the monetary policy framework as intended, retaining discretion in meeting the inflation target symmetrically. |

|

Financial market risks have mounted with some firms entering the crisis with elevated debt loads and other firms facing a very uncertain future. |

Continue providing temporary liquidity support to firms as long as needed to avoid widespread bankruptcies. |

|

Trade in services is growing but regulatory barriers tend to be more restrictive than tariffs on goods. |

Put more emphasis on lowering regulatory barriers to trade in services. Abolish or provide permanent waivers for the most restrictive rules, in particular maritime transport between U.S. maritime ports. |

|

Strengthening the response to future health shocks |

|

|

The pandemic proved difficult to control and the virus quickly spread across the country, causing loss of life and provoking distancing measures that caused a sharp contraction in economic activity. The prospects for future health shocks cannot be ruled out. |

Improve public health policy coordination across levels of government and reduce regulatory barriers that hinder an effective response. Ensure that the suite of policies that support health insurance coverage do not let large population groups fall through the gaps. |

|

Helping workers find jobs, including by moving across the country |

|

|

Restrictive land use regulations are slowing the supply of new housing and workers moving across the country to new job opportunities. |

Provide fiscal incentives for states and localities to relax land use restrictions and promote multi-use zoning. |

|

States and localities are responsible for land use planning, transportation and housing policies. When these policies are not co-ordinated inefficiencies arise that can reduce productivity. |

Help states and localities better co-ordinate land-use, transportation and housing policies. Require metro mass transit fund recipients to integrate transport policy with land-use and housing policy. |

|

Infrastructure investment has been sluggish since the early 2000s. Failure to invest hinders productivity growth and reduces the accessibility of cities. |

Invest in new telecommunication infrastructure where supported by appropriate evaluation such as cost benefit analysis. Improve the maintenance of the road network. |

|

Reducing anti-competitive and regulatory barriers in the labour market |

|

|

In some markets, particularly in technology sectors, dominant firms have the ability to exercise market power. |

Anti-trust policy should police markets vigorously to ensure competition remains healthy. |

|

Less than 50 occupations are licensed in all states, while more than 400 occupations are licensed in at least one State. Empirical analysis suggest that larger coverage of licensing is associated with lower job mobility. |

Encourage states to delicense occupations with very limited concerns for public health and safety and act against anticompetitive behaviour. |

|

Licensures obtained in one state are not automatically recognised in other states. Procedures to implement mutual recognition across states can be cumbersome. |

Use federal law to impose recognition of out-of-State licensures, allowing States to set stricter requirements only if they can prove it is necessary to protect the public. |

|

Some population groups are particularly exposed to excessive licensing requirements, such as individuals with a criminal record, and immigrants with foreign credentials. |

Address excessive employment barriers that create obstacles for ethnic minorities and foreign nationals. |

|

Evidence suggest that non-competes cause anti-competitive harm in the form of lower wages to workers. Usage of non-competes have become more widespread, including among low-skilled and low-income workers, who are unlikely to have access to protectable interests of the employer. |

Outlaw the use of non-competes except where employers can prove benefit to workers. Set a minimum earning or minimum skill threshold for using non-competes to protect low-income workers. |

|

Strengthening green growth |

|

|

Greenhouse gas emissions have been declining, with the all-fuels all-technologies approach, but there are still opportunities for further reductions. Financial institutions hold large amounts of assets linked to activities that are exposed to climate risks, such as mortgages of properties in floodable and costal zones |

Invest in extreme weather and climate-resilient infrastructure. Continue support for fuels and technologies, including nuclear and carbon capture, utilisation and storage, where cost efficient, to achieve further emissions reductions. Ensure harmful emissions are priced appropriately. Systematically assess financial institutions’ exposures to climate-related risks such as rising sea levels, flooding, wild fires, and tighter energy efficiency. |