This chapter describes market developments and medium-term projections for world sugar markets for the period 2023-32. Projections cover consumption, production, trade and prices for sugar beet, sugar cane, sugar, molasses, and high-fructose corn syrup. The chapter concludes with a discussion of key risks and uncertainties which could have implications for world sugar markets over the next decade.

OECD-FAO Agricultural Outlook 2023-2032

5. Sugar

Copy link to 5. SugarAbstract

5.1. Projection highlights

Copy link to 5.1. Projection highlightsOver the next decade, world per-capita sugar consumption is projected to increase, mainly spurred by income growth in low and middle-income countries in Asia and Africa. The overall rise in sugar intake is expected to be mitigated by a modest decline in per capita consumption in high-income countries, reflecting rising health concerns among consumers, and measures implemented at country level to discourage sugar consumption. Despite the diverging trend, however, average per-capita consumption in low- and middle-income countries, notably in Sub-Sahara Africa, is anticipated to remain substantially lower than in high-income countries.

Sugar is projected to remain the most consumed caloric sweetener still accounting for 80% of the global sweetener utilization despite general efforts to find substitutes. The main alternative caloric sweetener, High Fructose Corn Syrup (HFCS), is anticipated to, at best, maintain its share at around 8% of total consumption, while the remaining balance is accounted for by low-caloric High Intensive Sweeteners (HIS), including saccharin, sucralose and aspartame.1

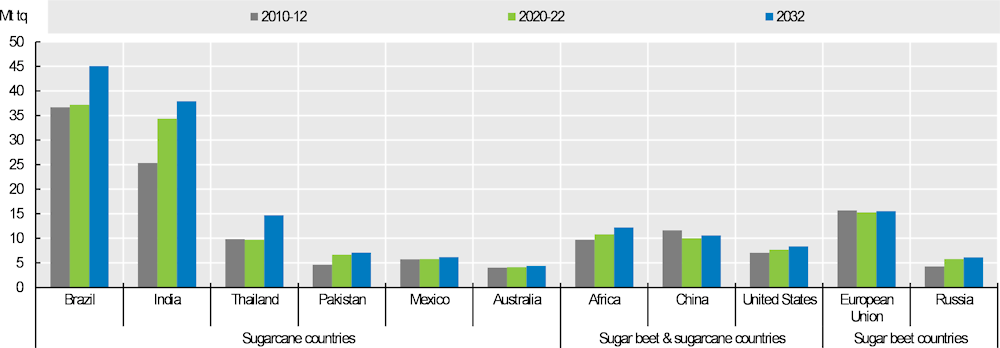

Over the outlook period, sugar production is expected to expand mainly in key sugarcane producing countries. Sugarcane, which grows mostly in tropical and sub-tropical regions, will continue to account for more than 85% of the aggregate sugar crops output. Brazilian production is expected to increase as a result of both area expansion and yield improvements, driven by remunerative prices. Productivity gains, including varietal improvements and higher extraction rates, will drive sugar production growth in India and Thailand, with acreage projected to remain relatively stable. In Africa, sugarcane production in the key producer, South Africa, is anticipated to expand on account of government support measures to the sector. Production of sugar beet, which grows mainly in the Northern Hemisphere, is foreseen to remain quite stable in the European Union, while increasing in Egypt, boosted by rising regional and industrial demand. The increase in sugar beet production in Egypt is projected to consolidate its position as the continent’s largest sugar producer by 2032.

Over the next decade, the supply of sugar will continue to be tempered by the use of sugar crops as a feedstock for ethanol. In Brazil, the ambitions of the Renovabio program encourage ethanol production and sugarcane will remain the main feedstuff for reaching the 2030 target. Constant real international crude oil prices will favour sugarcane-based ethanol production, while Brazilian sugar production will remain competitive in international markets, even if the Real is assumed to appreciate in real terms. Brazilian processors, who can easily switch between sugar or ethanol from sugarcane, will continue to arbitrate according to the relative profitability of the two products; over the next ten years, ethanol is projected to become more attractive relative to sugar. In some other countries, implementation of policies promoting the development of biofuels will also add some pressure to the availability of sugarcane for sugar production, especially in India, with the Ethanol Blended Petrol (EBP) Programme aimed at reaching a blending rate of 20% of ethanol in petrol (E20) by 2025/26.

In 2032, Brazil and India are foreseen to account for about 23% (45 Mt) and 19% (38 Mt) of the world's total sugar output respectively. Better growth prospects are expected in Brazil, supported by profitable sales on the international market while in India, despite an increase in the extraction rate, the increase is projected lower given the diversion of sugarcane to ethanol production. Elsewhere, the largest significant increase in production, in absolute terms compared to the base period, is anticipated in Thailand (+ 5 Mt).

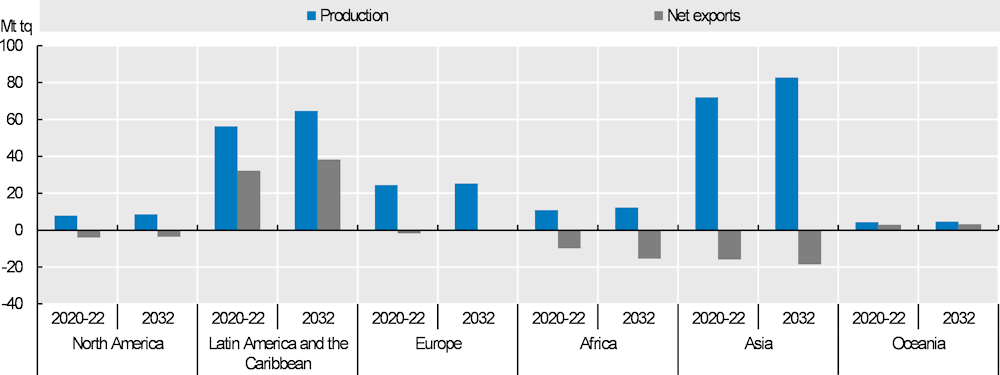

Figure 5.1. Sugar production and trade, by region

Copy link to Figure 5.1. Sugar production and trade, by region

Note: data are expressed on a tel quel basis (tq)

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

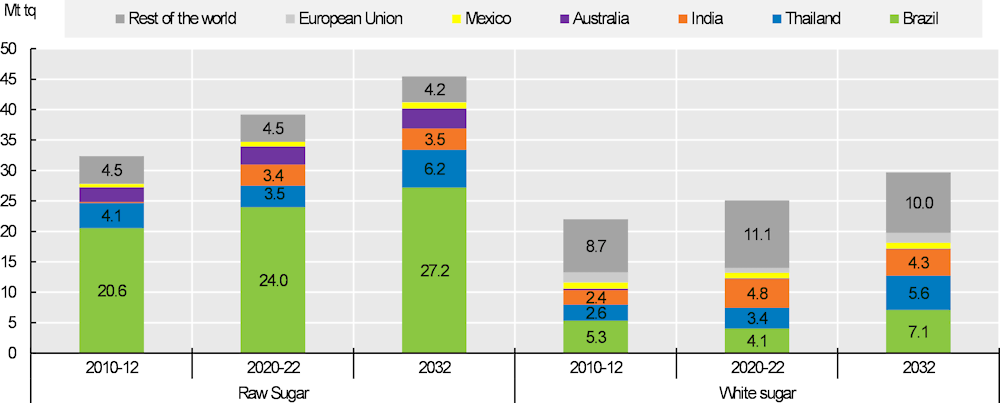

International trade will continue to grow, mainly reflecting expanding demand from deficit regions in low- and middle-income economies. Exports are anticipated to increase over the decade with shipments representing about 38% of global sugar production in 2032, up from 36% in the base period. Exports will continue to originate in a few countries, mainly in Brazil (46% of world trade), followed by Thailand and India. Imports are anticipated to remain less concentrated with the main increases projected in Asia and Africa, while the strongest declines in imports are foreseen in the United States, Russia and Japan, reflecting higher domestic production and a contraction in domestic demand for the latter. While the bulk of the sugar marketed worldwide will continue to be in the form of raw sugar from sugarcane, the share of white (refined) sugar from sugar cane and sugar beet is seen increasing moderately.

International sugar prices in real terms are foreseen to fall from the current high levels amid an improvement in global export availabilities and to decline during the projection period from productivity gains. The downward pressure on prices is expected to be partially offset by constant real international crude oil prices, encouraging the use of sugar crops for ethanol production. The white sugar premium (difference between white and raw sugar prices), which was particularly high (on average USD 101/t during the base period) due to tightness on the white sugar market, is anticipated to slightly increase in nominal terms over the outlook period, with the share of white sugar imports in total trade growing by 2032.

The dynamics of the sugar markets as presented in this Outlook are subject to many risks and uncertainties, including developments in the global macroeconomic context and implementation of new sugar-related policies. In addition, weather conditions, profitability of sugar vis-à-vis ethanol, and competition with other crops are sources of production uncertainty. On the demand side, developments in the global economy that affect consumers’ purchasing power, consumers’ preferences and inflation levels are key factors that could alter the consumption patterns presented in this Outlook.

5.2. Current market trends

Copy link to 5.2. Current market trendsAfter reaching a 16-month low in October 2022, international sugar prices rebounded sharply later in the year and in early 2023, mainly reflecting prevailing overall tight global sugar supplies amid strong global import demand. More recently, concerns over diminishing production prospects in key producing countries exerted further upward pressure on world sugar prices. Sugar production is forecast to decline in India and in the European Union, due to lower sugar beet plantings and yields. However, overall, world sugar production in the 2022/23 season is anticipated to increase from last year, on expectations of a significant recovery in Brazil’s production, the world’s largest sugar producer and exporter, and a larger crop in Thailand. On the demand side, world sugar consumption is seen increasing for a third successive season in 2022/23. However, the growth of global sugar consumption is anticipated to be moderate due to the projected deceleration in global economic growth in 2022/2023. The slower increase in consumption, compared to production, is expected to push the sugar market into a global surplus in 2022/23. Because of larger exportable availabilities, particularly from Brazil and Thailand, world sugar trade is predicted to expand compared to the previous season, which should match an anticipated higher global import demand in 2022/23, with the People’s Republic of China (hereafter “China”) and Indonesia continuing as the largest buyers of sugar, mainly in raw form for industrial use.

5.3. Market projections

Copy link to 5.3. Market projections5.3.1. Consumption

Over the next ten years, global sugar consumption is projected to continue growing at around 1.1% p.a., reaching 193 Mt by 2032, driven by population and income growth. After experiencing a decline at the end of the 2010s, especially during the COVID-19 pandemic, world average per capita consumption is now expected to rebound and reach 22.5 kg/capita in 2032.

In general, sugar consumption over the next decade is projected to grow mainly where the level of per capita intake is currently low as, in all its forms, it represents a key source of energy in human diet. An opposite trend is foreseen where per capita consumption is high resulting in health concerns (risk of weight gain and tooth decay health). The WHO recommends reducing the daily intake of free sugars to less than 10% of the total energy intake for health reasons.

Development prospects are higher in Asia and Africa

Asia and Africa will be the regions that will contribute most to additional global demand compared to the reference period, accounting for 67% and 32% of the world total, respectively. Urbanization, a growing middle class, and a young demographic are expected to be the key drivers of the increase in per capita consumption in these regions. Despite the projected increase, which adds to the continuous expansion of the past years, per capita consumption by 2032 is anticipated to remain below the global average in both Asia and Africa.

In Asia, population and income growth as well as higher sugar-containing product consumption for industrial purposes, including sugar-rich confectionery products and soft drinks will drive sugar consumption. It is expected that India, followed by Indonesia and China, will provide the largest contribution to the overall increase in sugar consumption. In India and Indonesia, population growth, although slower than in the past decade, and income growth associated with stronger demand for processed food and beverage products is expected to sustain the increase in overall sugar consumption over the next decade. In China, consumption is emerging from a period of no real growth that started in 2016 with a period of high prices, followed by a three-year zero-Covid policy. With the reopening of the markets at the start of the projections, consumption is expected to rise again over the next ten years. Nevertheless, in terms of per capita consumption, it should remain well below the global average level in 2032 (12.6 kg/cap). Strong growth prospects are also expected in Least Developed Asian countries. Per capita consumption in Asia is expected to grow by 0.8% p.a. over the next decade compared with 0.3% in the last decade.

In Africa, sustained population and income growth, are projected to drive the overall increase in sugar consumption, mainly on account of higher direct consumption in urban areas. Least Developed Sub-Saharan countries are foreseen to record the highest growth rate in per capita consumption across the region. In addition, with Least Developed Sub-Saharan countries expected to record the world’s highest population growth, sugar consumption growth in these countries is projected to be the strongest globally. By contrast, in South Africa, where sugar consumption has recorded significant declines in recent years amid government measures to discourage its use, per capita intake is projected to weaken further in the next decade.

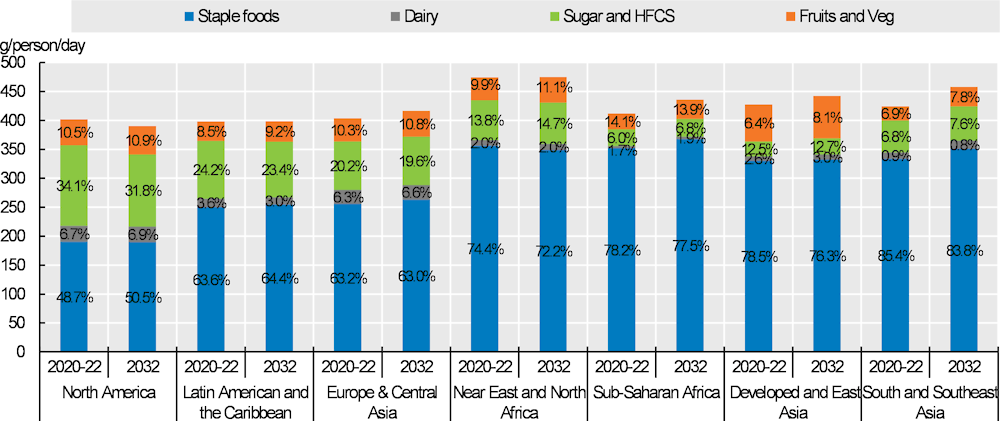

Over the coming decade, even if total daily carbohydrate intake in Asia and Africa will remain higher than in the rest of the world (particularly Northeast and North Africa), simple carbohydrates (glucose and fructose from sugar, high fructose sweeteners, fruits and vegetables and lactose) are expected to remain a small part of daily carbohydrate intake (Figure 5.2). In these two regions, in terms of carbohydrate intake, the increase in sugar consumption will not greatly affect the composition of the diet, as three-quarters of carbohydrate consumption is from staple foods.

In rest of the world, the share of carbohydrates in daily intake should not change, except in North America, where a slight downward trend will be pronounced.

Figure 5.2. Carbohydrate consumption per capita and by type, in the different regions

Copy link to Figure 5.2. Carbohydrate consumption per capita and by type, in the different regions

Note: Staple foods include cereals, roots and tubers, and pulses.

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Downward trends will continue in other regions, high sugar consuming countries

Traditionally, the Americas, the Caribbean and European countries record the highest level of per capita sugar consumption although caloric sweeteners represent a small part of carbohydrates in the diet. Since 2010 globally, in those countries, caloric sweetener consumption has trended down with adverse health effects being highlighted. Over the next decade, the decline is projected further, although at a slower pace.

In Latin America, the world’s largest sugar supplier, high per capita consumption levels have raised concerns about the negative effects on health. Some countries during the last decade, including Chile, Ecuador, Mexico, Peru and more recently Colombia, have introduced a tax on sugar-sweetened beverages to try reducing soft drink intake. Measures to limit the sale and/or the promotion of sugary drinks or sweet products to children under 18 years were also taken, and some countries like Argentina have passed laws for mandatory front-of-package labelling with strict thresholds for healthier products. Per capita consumption, which already declined in the past few years, is projected to decrease further from 38.6 kg/capita during the base period to 37.1 kg/cap.

Europe was the second most sugar-consuming region, although far behind Asia, among the seven regions presented in this Outlook. Over the next decade, while remaining the third most populated region, it is expected to give way to Africa followed by Latin America and the Caribbean. In Europe, for two decades countries have sought to take measures to avoid excessive consumption of sugar. Taxing sugar is among the measures implemented. Recently, Italy and Poland introduced a sugar tax, and it is currently being voted in the Russian Federation (hereafter “Russia”) (to be implemented 1 July 2023). The industry has also been looking for solutions to tackle the problem of obesity by reducing the amount of sugar in products or use artificial sweeteners as substitutes. Per capita sugar consumption in Europe is expected to see a continued decline, albeit at a slower pace than in the previous decade. In Ukraine, per capita consumption of sugar dropped markedly following the outbreak of the war in February 2022. However, sugar intake is projected to recover over the next decade and reach the levels prior the war by 2032. Among the other high sugar consuming countries, the level of consumption is projected to decline in Australia and New Zealand. This trend will also be visible in Canada and the United States. However, the United States shows the highest per capita consumption of caloric sweeteners which include HFCS (48.1 kg/capita during the base period) and over the projection period, caloric sweeteners are expected to decrease the most in favour of greater consumption of fruit and vegetables.

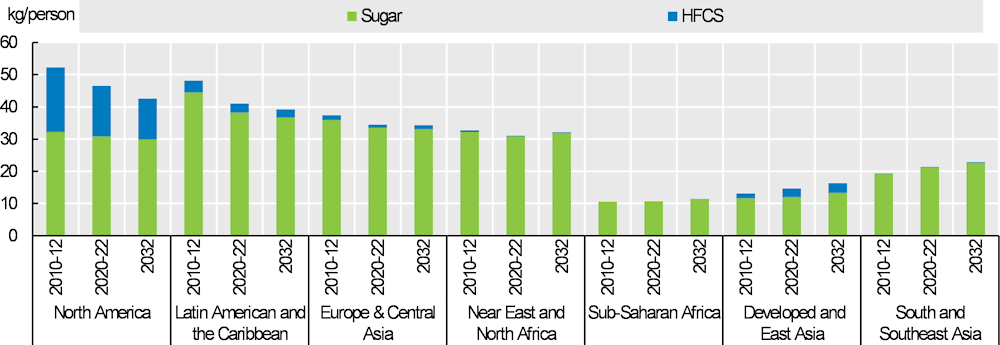

Figure 5.3. Carbohydrate consumption per capita, per type, in the different regions

Copy link to Figure 5.3. Carbohydrate consumption per capita, per type, in the different regions

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

The High Fructose Corn Syrup market will grow slowly

High Fructose Corn Syrup, the other caloric sweetener, is used primarily in beverages as a substitute to sugar. Unlike sugar, it is a liquid product and therefore less easily traded. Global consumption will remain the domain of a limited group of countries with no real development.

The leading producers, United States and Mexico, will remain the main consumers with respectively 13.7 kg and 9.2 kg per person in 2032. In the United States, since the mid-2000s, when it represented with sugar the two main caloric sweeteners in equal proportion, its share has decreased. This trend is expected to continue as the debate on the potential greater health hazard of HFCS over sugar is still ongoing. In 2032, both products are foreseen to represent respectively 31% and 69% of the caloric sweetener consumption in the United States by 2032. In Mexico, government efforts to reduce caloric sweetener consumption and the decline in per capita HFCS consumption is expected to continue over the next ten years. As a result, and because the demand in HFCS will not change much, the United States is foreseen to record a production decline (-13%) when compared to the base period and reach 6 Mt by 2032.

China, the world’s largest starch producer, is expected to see the biggest changes as its per capita caloric sweetener consumption is very low compared to the rest of the world. Since 2020, corn prices have increased, and this was passed on the cost of producing/consuming HFCS, leading to some substitution with sugar or some other alternative sweeteners in soft drinks (erythritol), depending on the profitability of products. Over the next decade, with more competitive corn prices, China HFCS production is projected to increase to meet some growth in domestic demand (2.8 kg/capita in 2032). No increase is foreseen in Japan and Korea with a consumption of about 6 kg/capita. In the European Union, HFCS will remain uncompetitive with sugar over the next decade, accounting for only 1.6 kg/capita in 2032.

Market developments in the rest of the world will not be significant. Overall, 80% of the overall amount consumed will remain sugar and less than 8% HFCS, the leading alternative product. The rest will come from high-intensity (low-calorie) sweeteners which are not covered in the Outlook.

5.3.2. Production

Assuming normal weather conditions, world sugar production is expected to slightly increase over the outlook period although high input costs and competition from other agricultural crops are likely to moderate the magnitude. Being a capital-intensive sector, remunerative domestic prices are foreseen to be high enough to support investments and developments, both in crops and in sugar factories.

Sugarcane is the main sugar crop. It grows mainly in tropical and sub-tropical regions. As a perennial crop, the same plants can be harvested after 12 to 18 months for about five years as cane can be self-propagated, although yields decline over time. Apart from sugar, sugarcane is also used as feedstock to produce ethanol (with a certain flexibility in Brazil). In addition to sugar and ethanol, sugarcane can produce molasses, a thick juice, and the residue from cane milling (bagasse, the fibre left after extracting the thick juice) is burned to supply energy (cogeneration feedstock for electricity). Conversely, sugar beet is an annual crop, more dependent on the variability of input costs. It is cultivated mostly in temperate zones; its thick juice is used for sugar or ethanol production; it has two derivative products: beet pulp which is used in animal feed and molasses. Moreover, molasses can be further processed to extract crystal sugar which generates molasses by-product again. Sugar crops are used to produce a wide range of products, including food (sugar), feed, bio-based products for industry (pharmaceuticals, plastics, textiles, and chemicals) and ethanol. Also, the by-product molasses from these two sugar crops can be further processed to produce sugar or ethanol. Over the next ten years, the profitability of the two main sub-products of the sugar crops, sugar and ethanol, are projected to expand slightly, which will result in an increase in sugar crop production.

Sugarcane will maintain its position as major main sugar crop

Sugarcane will continue to account for around 87% of sugar crops. Over the outlook period, global sugarcane production is projected to grow by 1% p.a. and reach 1 905 Mt by 2032, with Brazil, India and Thailand anticipated to contribute the most to the change in global output volume (+142 Mt, +31 Mt and +6 Mt respectively). This mainly reflects relative higher crop yields notably in India as well as, although from a lower base, in Argentina; while area expansion is mainly expected in Brazil (+1.6 Mha).

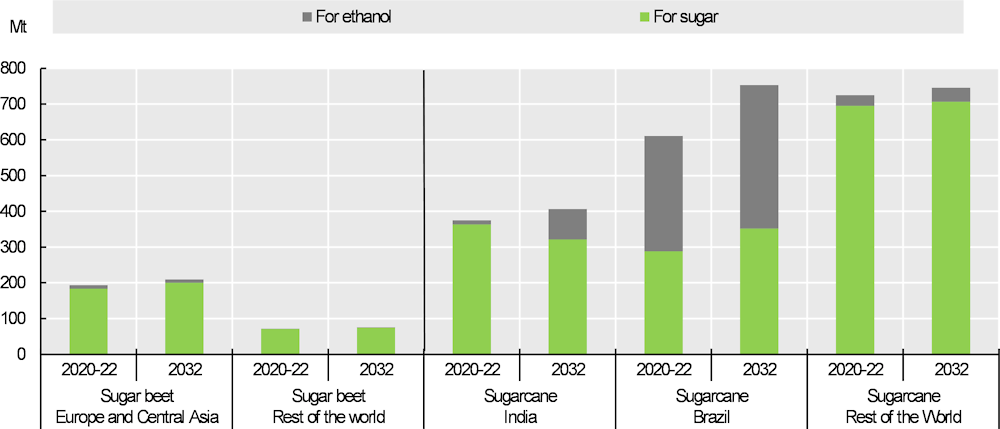

Figure 5.4. World production of sugar crops classified according to their end product

Copy link to Figure 5.4. World production of sugar crops classified according to their end product

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Brazil is the biggest sugarcane producing country, more than half of which is used to produce ethanol. Over the next ten years, the growth in demand as well as the expected profitability of the two products, sugar and ethanol, will encourage the sector to respond to market needs. Investments aimed at developing mechanisation and more sustainable production practices should make it possible, among other things, to reduce the effects of the drought encountered in recent years. Some area expansion is foreseen and the share of area cultivated with sugarcane in total arable land availability (12.8% during the base period) will increase to 14.4% in 2032, while little improvement in yields is foreseen due to drier climatic conditions compare to the past.

In India, the growth in sugarcane production is projected to stem mostly from higher crop yields, as acreage is not expected to expand given competition from other agricultural crops. In Thailand, sugarcane production over the next decade is also expected to come mainly from higher yields. In recent years, lower returns compared to alternative crops, higher fertiliser prices and stricter government measures limiting burning practices during harvest and adverse weather conditions contributed to a decline in area, but over the next decade, area is therefore not projected to expand significantly. In China, for a couple of years, regional authorities will continue to support farmers and millers to modernize and maximize their yields. But with the end of the zero COVID policy at the start of the projections, only moderate growth is expected as rising input costs, competition for land with other crops and comparatively cheaper sugar imports will slow efforts and efficiency.

Prospects are less robust for sugar beet, the other sugar crop, as it is sensitive to high input costs. Some improvement in yields will contribute to a slight increase in production. It is projected to reach 284 Mt by 2032, with slower annual growth rate (0.4% p.a.) than during the past decade (0.5% p.a.) (Figure 5.4). Compared to the base period, expansion is expected in Russia (+8.1 Mt, from a low base), Türkiye, Egypt, China, the United States and Ukraine. During the last decade, Egypt and China were contributing the most to the global increase in sugar beet.

Global sugar beet area is expected to decline, because of higher fertiliser prices as well as energy prices (beet mills need to buy energy to be able to operate unlike cane mills which can operate from bagasse), which negatively impact profit margins. Only higher yields will help the crop to keep market share. This should notably be the case in the United States, where both sugar crops are cultivated in almost equal proportion, 55% of sugar continuing to be produced from sugar beet. In the European Union, production is projected to stagnate due notably to high input costs compare to other crops, and stricter environmental legislation;2 yields are not expected to improve, and some farmers will turn to other crops.

In Egypt, remunerative procurement prices are expected to boost plantings of sugar beet, while efforts are also being made for the adoption of improved seed varieties. Government efforts to boost domestic agricultural production are underway and are projected to contribute to the overall increase in sugar beet area and crop yields.

If during the last decade, 81% of world sugar crops were used to produce sugar, this share is expected to decline to 76% by 2032 over the outlook period (72% in the case of sugarcane and 97% in the case of sugar beet), due to growing competition of sugar crops for ethanol production, because mills often easily have the option of switching to one or the other. Brazil will continue to be the main producer of sugar and sugarcane-based ethanol, producing 40% of the world's sugarcane by 2032. Its sugarcane will account for 23% of global sugar production and 76% of global sugarcane-based ethanol production (compared to 21% and 88% during the base period).

Global sugar production is set to increase

Global sugar production is expected to grow from 175 Mt during the base period to 198 Mt by 2032, 23% of which will be sourced in Brazil who is expected to meet the growing needs of the international market, especially in the second half of the decade.

Asia will remain the leading producing region producing about 42% of the world global output. Thailand is foreseen to provide the largest share of the sugar supply to the world market after Brazil, increasing its sugar production by +5 Mt by 2032 compared to the base period. The production increase is in line with higher sugarcane production and with sugar extraction rates projected to remain at the high level of the past few years. In India, the world’s second largest sugar producer, the growth rate in sugar production is expected to be lower than in the past decade, reflecting a slower growth in sugarcane production and greater diversion to ethanol.

Figure 5.5. Main sugar producing countries/regions classified by sugar crops

Copy link to Figure 5.5. Main sugar producing countries/regions classified by sugar crops

Note: data are expressed on a tel quel basis (tq)

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Brazil, the world’s largest sugar producer makes Latin America the second largest sugar producing region. Recovering from a long financial crisis and episode of drought, higher investments are expected in the sector. Considering the profitability of international sugar markets, sugar production is expected to increase by 5.2 Mt over the next decade.

Africa is expected to improve its share in the global market mainly on account of Sub-Saharan African countries, where government support measures and foreign investments are expected to contribute to the increase in sugar production over the next years. In addition, suitable conditions for growing sugarcane, including potential for area expansion and lower costs of production, are expected to favour the increase in production.

Compared to the base period, production in OECD countries is foreseen to account for less than 10% of the global increase. In 2032, the region will represent 21.2% of the global market, compared to 22.7% in the base period. Although it will retain its position as the main producer of this regional market (37%), the European Union's sugar production is expected to stabilize. The higher sugar supply increase, when compared to the base period, is foreseen in the United States (+0.7 Mt) as production will continue to benefit from several government policies that support the domestic industry including the Sugar Loan Program that supports prices paid to farmers; the Sugar Marketing Allotments that aim for domestic production to cover up to 85% of domestic consumption; the Feedstock Flexibility Program that diverts any sugar surplus to ethanol production, rather than sugar loan forfeitures to the USDA’s Commodity Credit Corporation; and trade barriers that limit imports to meet domestic needs (through tariff rate quotas, regional agreements, and the Suspension Agreements on Sugar with Mexico).

5.3.3. Trade

Sugar remains heavily traded over the outlook period

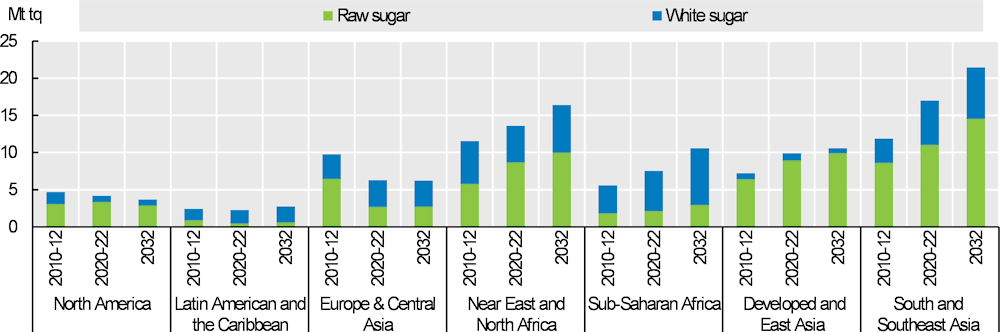

Sugar will remain a highly traded product. Most of it will continue to be raw sugar (60%). However, the share of white sugar imports that includes a premium will increase relatively more (Figure 5.6).

Imports are foreseen to account for 37% of global consumption in 2032 with Asia and Africa remaining net-importing regions. However, in Africa, efforts to boost domestic production capacities will reduce its share of dependence on imports, which will still represent 72% of consumption in 2032. The growth in consumption in Least Developed Sub-Saharan countries is expected to drive an increase in the share of imported white sugar for direct consumption. In Asia no significant changes are expected in terms of dependence: imports will continue to represent 42% of consumption and the share of imported raw sugar for industrial use will continue to increase, mainly driven by key buyers, China and Indonesia. By 2032, Africa and Asia will account respectively for 28% and 59% of global imports.

In the past decade, South and Southeast Asia, Europe and Near East and North Africa regions were the major importing regions. Over the next decade, with the end of the zero Covid policy and a strong growth in consumption, South and Southeast Asia is projected to take the position as the leading sugar importing region by 2032, with Indonesia the world's largest importer. Strong growth is also foreseen for Near East and North Africa region as well as in Sub-Saharan Africa, although from a lower base.

Figure 5.6. Raw and white sugar imports, by regions

Copy link to Figure 5.6. Raw and white sugar imports, by regions

Note: data are expressed on a tel quel basis (tq)

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Over the coming decade, sugar imports are expected to continue to decline mainly in the United-States, and the Russian Federation due to improving supply prospects while in Japan, this will be due to reduced population. The United States is traditionally a sugar-deficit country where national policies will continue to foster domestic production and limit imports. Tariff rate quota (TRQ) allocations under WTO or free trade agreements (FTAs), as well as limited imports from Mexico due to the US Export Limit (set by the US Department of Commerce) will govern import flows. Given the relatively higher sugar prices in the United States, Mexico will continue to export its sugar primarily to fulfil United States needs. Mexico is expected to continue resorting to US HFCS to meet national demand for sweeteners. In the European Union, sugar imports are foreseen to decrease to 1.9 Mt by 2032 because of the lower demand.

On the export side, sugar markets are projected to remain highly concentrated (Figure 5.7). Four main countries will continue to account for more than 88% of the market share for raw sugar by 2032: Brazil (60%), Thailand (14%), India (8%) and Australia (7%). For white sugar, Brazil (24%), Thailand (19%), India (15%) and the European Union (5%) will supply about 63% of the market.

Brazil will remain the leading exporter (46% in 2032) (Figure 5.7). Millers should benefit from attractive incentives to produce sugar for exports. Favourable returns for sugarcane-based ethanol production will continue to play a key role, but the expected growth in sugarcane production for sugar is higher than for ethanol which frees up more sugar for exports. Brazilian sugar exports are expected to reach 34 Mt in 2032, +6 Mt over the outlook period, mainly under the form of raw sugar although the share of white sugar is foreseen to increase, from 14% to 21% by 2032.

In Thailand, the world’s second largest sugar exporter, very little ethanol is produced directly from sugarcane (less than 2%) because molasses or cassava are mainly used. By 2032, the share of sugar exports is expected to increase to 16% and reach 11.8 Mt. This compares to a share of 11% and a volume of 6.9 Mt during the base period, which is due to the drop in production in 2020. In India, sugar exports are not expected to grow significantly amid government’s continued efforts to promote ethanol. In Australia, another export-oriented country, sugar exports are expected to continue to account for about three-quarters of production.

Figure 5.7. Sugar exports for major countries and regions

Copy link to Figure 5.7. Sugar exports for major countries and regions

Note: data are expressed on a tel quel basis (tq).

Source: OECD/FAO (2023), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

5.3.4. Prices

Prices expected to fall in real terms

At the start of the outlook period, despite indications of a return to a global surplus, and a Brazilian domestic gasoline policy (lower price but tax resumption at the end of February) tending to favour sugar over ethanol, international sugar prices are expected to ease only slightly, due to high input costs.

Figure 5.8. Evolution of world sugar prices

Copy link to Figure 5.8. Evolution of world sugar pricesNote: Raw sugar world price, Intercontinental Exchange contract No.11 nearby futures price; Refined sugar world price, Euronext Liffe, Futures Contract No. 407, London. Real sugar prices are nominal world prices deflated by the US GDP deflator (2022=1).

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

International sugar prices, in real terms, are foreseen to fall from the current high levels amid an improvement in global export availabilities and to decline during the projection period on account of productivity gains. The downward pressure on prices is expected to be partially offset by constant real international crude oil prices, as this would encourage the use of sugar crops for ethanol production (Figure 5.8). Overall, real prices should fall below the average level of the last 20 years, when prices were under upward pressure due to competition from biofuels (ethanol).

Nominal prices are projected to follow a moderate upward trend, as demand is foreseen to return to pre-COVID-19 pandemic levels, assuming little change in relative ethanol and sugar prices.

The white sugar premium (difference between white and raw sugar prices), which was particularly high (on average USD 101/t during the base period) due to increasing energy costs and tightness on the white sugar market, is anticipated to slightly increase in nominal terms over the outlook period, with the increase in the share of white sugar exports in total trade by 2032.

5.4. Risks and uncertainties

Copy link to 5.4. Risks and uncertaintiesThis Outlook assumes normal climatic conditions which gives favourable prospect for sugar crop production. But unfavourable weather events, such as those linked to climate change, could have a marked impact on output and prices, considering the relatively high market concentration for export. A change in the price ratio between crops could also influence planting decisions in favour of more profitable crops.

The fluctuation of crude oil and sugar relative prices affects the competitiveness and profitability of sugar production versus sugar crop-based ethanol production, and remains a major source of uncertainty. This fluctuation plays an important role in the decisions of the sugarcane millers as to the profitability of sugar vis-à-vis ethanol, which in turn impacts the sugar quantity produced for the international market. In Brazil, additionally, the fuel prices for refined petroleum products can be set freely, although consideration must be given to the influence of the Brazilian state-owned petroleum industry Petrobras. Its decision on when and how to react to the international crude oil price could have some influence on the level of the national gasoline price. In India, the implementation of policies promoting the development of biofuels will add pressure on the availability of sugarcane for sugar, with the Ethanol Blended Petrol (EBP) Programme aimed at reaching a blending rate of 20% of ethanol in petrol (E20) by 2025/26. While this Outlook already accounts for the above-mentioned policy, any further policy development could have a consequential effect on sugar production.

Domestic policies may also cause market variability. In this Outlook, the risk that Mexico imposed a ban on genetically modified corn to be activated in 2025 is not taken into account. If implemented, it could affect Mexico HFCS imports from the United States and by repercussion, US sugar imports from Mexico, which are foreseen to account for about 40% of the highly regulated American imports.

In countries with high levels of consumption, if a sugar tax is implemented in an attempt to curb consumption for health reasons, this could also lead to effects that are enhanced as the price elasticity of the demand is high. Consumers’ preferences towards low- and no-sugar products could also contribute to curb consumption projections. Similarly, if the market for alternative lower calorie sugar substitutes expands, in response to increasing health concerns, this will have implications on sugar demand.

On the supply side, the dominance of few exporters over the next ten years is also a source of uncertainty for sugar markets. About 60% of sugar is traded under the form of raw in-bulk vessels. Given the growing demand for imports of white sugar, investments are expected to increase the export capacity of refined sugar, which is much more delicate due to the risks of contamination, drying out and clumping. According to the outlook, the white sugar premium should be attractive enough for Brazil, a traditional exporter of raw sugar, and Thailand to invest in their white sugar delivery capacity. However, refining capacity in destination countries could also develop, which would change the situation.

New investments in research and development in the sector (new breeding techniques for sugar crops such as gene editing), new diversification opportunities for the sugar industry (bioethanol, bioplastics and biogas) could also influence the dynamic of the market.

Notes

Copy link to Notes← 1. Projections in this report only refer to caloric sweeteners, sugar and high fructose syrup (HFCS).

← 2. Neonicotinoid, used in the coating of beet seeds to combat Virus Yellows Disease, were banned in 2019; some emergency authorisations were granted to a limited number of member states and for selected years.