This chapter provides an overview of Georgia’s liberalisation reforms, socio-economic challenges, and investment climate constraints, and summarises the main findings and recommendations of the Investment Policy Review.

OECD Investment Policy Reviews: Georgia

1. Assessment and recommendations

Abstract

Georgia’s rapid transformation from Soviet republic to a liberal market economy is nothing short of remarkable. In a few years, the country implemented more structural, regulatory and economic reforms than most countries attempt to advance in decades. These “big bang” reforms, beginning in 2004, eased the business environment, drastically reduced corruption, and opened the economy to investors. Over the past decade, the government has continued to adopt a fast-paced approach to reforms to support private sector development. These efforts ushered in strong GDP growth, averaging 5.3% since 2004, and transformed Georgia from one of poorest post-Soviet states to an upper-middle income economy. Georgia now ranks among the top countries in the world to do business and has succeeded in substantially growing its FDI stock to over 100% of GDP.

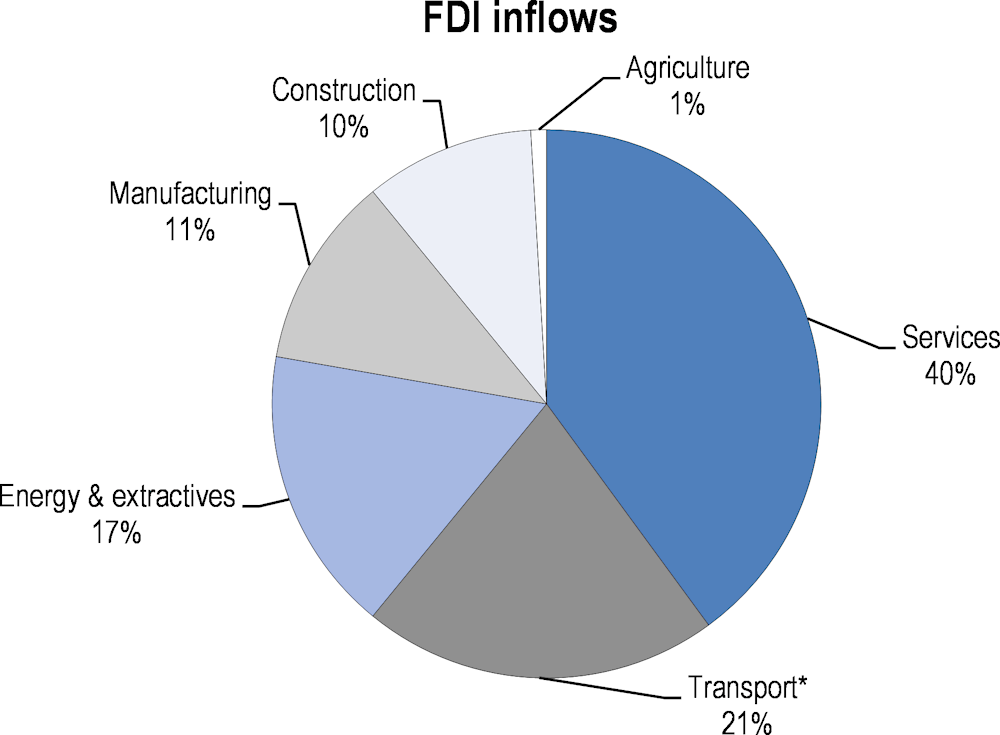

However, in recent years the Georgian government has reflected on why these reforms have not facilitated more broad-based economic growth. Despite important progress, productivity and exports remain low, and unemployment and poverty are still high. FDI attraction has been strong relative to the size of Georgia’s economy, but the positive benefits of investment have not been fully realised. The majority of FDI has gone to non-tradable sectors, including transport infrastructure, real estate, construction and financial services. These sectors are important contributors to economic growth, but have not sufficiently advanced job creation or productivity, and may be limited by Georgia’s relatively small domestic market. With the exception of recent growth in tourism and renewable energy, FDI in export-oriented sectors, including manufacturing and agriculture, has remained flat, and at 11% and 1% of total FDI since 2007, far below potential.

Georgia is now, like much of the world, facing the unprecedented health and economic consequences of the COVID-19 pandemic. The government took swift monetary and fiscal measures to support healthcare provision and liquidity, and assist at-risk firms and individuals (OECD, 2020[1]). A new insolvency law is an important step to promote resilience. Disruptions to business, travel, remittances and investment are nonetheless likely to have a severe near-term impact on the economy. Early projections suggest that GDP growth could contract by 4 to 5.5% (IMF, 2020[2]) (EBRD, 2020[3]). Private investment, both foreign and domestic, will be essential for Georgia’s economic recovery.

Georgia’s success in removing much of the de jure barriers to FDI is commendable, but its task is now to improve the overall enabling environment for investment. This includes addressing gaps in infrastructure and connectivity within the country, and upgrading the skills of the workforce. Improving not only regulatory constraints but the whole investment climate – including the wider legal framework, investment promotion strategy and institutions, policies to promote responsible business conduct, and impediments to growth of priority sectors – will help Georgia attract FDI that can have a positive impact on productivity and inclusive, sustainable growth.

Adopting a wide-angle approach based on the OECD Policy Framework for Investment (OECD, 2015[4]), this Investment Policy Review of Georgia looks at challenges to Georgia’s investment policy framework, and provides policy recommendations for the government to consider to strengthen its reform efforts. The review analyses FDI trends and their impact on sustainable development (Chapter 2), the legal and regulatory framework for investment and investor protection (Chapter 3), promoting sustainable investment in Georgia’s agri-food sector (Chapter 4), investment promotion (Chapter 5), and policies to promote and enable responsible business conduct (Chapter 6). The main findings and recommendations of this Investment Policy Review are summarised later in this overview chapter, which first presents the background to Georgia’s liberalisation reforms, socio-economic challenges, and investment climate constraints.

Box 1.1. The Policy Framework for Investment

The Policy Framework for Investment (PFI) helps governments to mobilise private investment in support of sustainable development, thus contributing to the prosperity of countries and their citizens and to the fight against poverty. It offers a list of key questions to be examined by any government seeking to create a favourable investment climate. The PFI was first developed in 2006 by representatives of 60 OECD and non-OECD governments in association with business, labour, civil society and other international organisations and endorsed by OECD ministers. Designed by governments to support international investment policy dialogue, co-operation, and reform, it has been extensively used by over 35 countries as well as regional bodies to assess and reform the investment climate. The PFI was updated in 2015 to take this experience and changes in the global economic landscape into account.

The PFI is a flexible instrument that allows countries to evaluate their progress and to identify priorities for action in 12 policy areas: investment policy; investment promotion and facilitation; trade; competition; tax; corporate governance; promoting responsible business conduct; human resource development; infrastructure; financing investment; public governance; and investment in support of green growth. Three principles apply throughout the PFI: policy coherence, transparency in policy formulation and implementation, and regular evaluation of the impact of existing and proposed policies.

The value added of the PFI is in bringing together the different policy strands and stressing the overarching issue of governance. The aim is not necessarily to break new ground in individual policy areas but to tie them together to ensure policy coherence. It does not provide ready-made reform agendas but rather helps to improve the effectiveness of any reforms that are ultimately undertaken. By encouraging a structured process for formulating and implementing policies at all levels of government, the PFI can be used in various ways and for various purposes by different constituencies, including for self-evaluation and reform design by governments and for peer reviews in regional or multilateral discussions.

The PFI looks at the investment climate from a broad perspective. It is not just about increasing investment but about maximising the economic and social returns. Quality matters as much as the quantity as far as investment in concerned. It also recognises that a good investment climate should be good for all firms – foreign and domestic, large and small. The objective of a good investment climate is also to improve the flexibility of the economy to respond to new opportunities as they arise – allowing productive firms to expand and uncompetitive ones (including state-owned enterprises) to close. The government needs to be nimble: responsive to the needs of firms and other stakeholders through systematic public consultation and able to change course quickly when a given policy fails to meet its objectives. It should also create a champion for reform within the government itself. Most importantly, it needs to ensure that the investment climate supports sustainable and inclusive development.

The PFI was created in response to this complexity, fostering a flexible, whole-of-government approach which recognises that investment climate improvements require not just policy reform but also changes in the way governments go about their business.

For more information on the Policy Framework for Investment, see: www.oecd.org/investment/pfi.htm.

Source: (OECD, 2015[4]).

Historical context

Liberalisation reforms have improved the business environment and propelled GDP growth

Georgia deserves accolades for its successive waves of reforms, which have propelled the country to an upper-middle income economy, halved the percentage of the population living in poverty and more than quadrupled GDP per capita since 2004. Beginning with the 2003 Rose Revolution, in which mass peaceful protests gave the new government a mandate to institute sweeping change, Georgia has been on a remarkable reform path. Initial reforms focused on: curbing rampant corruption, privatising state-owned enterprises, reducing regulations and barriers to business, reforming the tax system, and liberalising trade and investment, along with measures to improve Georgia’s macroeconomic standing. Though the scale and pace of reforms have varied over time, successive governments have continued efforts to improve the business and investment climate, with positive effects on economic growth.

Eliminating corruption was one of the post-2003 government’s chief priorities, and its approach was drastic. It dissolved the entire traffic police force, considered one of the most corrupt government agencies, firing 16 000 employees in one day. The body was replaced by a much smaller, better-paid cadre of officers. Eighteen independent government departments and five ministries were either eliminated or restructured to reduce inefficiencies and dismiss corrupt officials (IMF, 2005[5]). These and other measures transformed Georgia from one of the most corrupt countries in the world, according to Transparency International’s Corruption Perceptions Index, to the least corrupt in Eastern Europe and Central Asia today (Transparency International, 2020[6]).

To advance Georgia’s transition to a market economy, the government accelerated privatisation of state-owned enterprises (SOEs), putting the majority of state assets up for open tenders. As a result, the share of the private sector in the economy rose to the highest in the region by 2010 (OECD, 2011[7]).

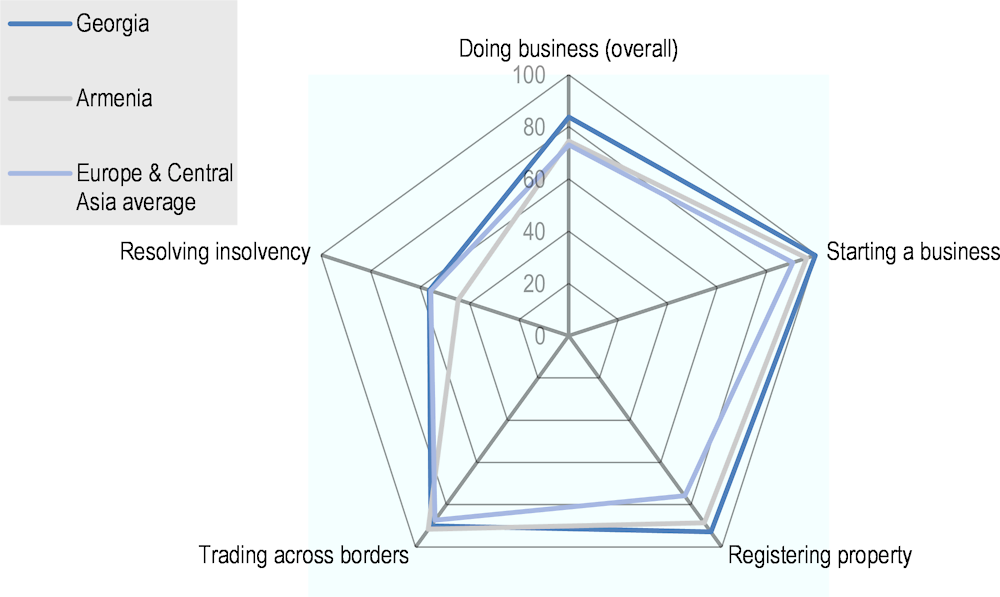

Other reforms have focused on improving the business environment and spurring international trade and investment. Licences and permits required to do business were systematically reduced from roughly 900 to fewer than 150 (Gugushvili, 2017[8]). In 2004 starting a business involved nine procedures and took 30 days; today it is one step and one day, making Georgia the second easiest country in the world to open a business, according to the World Bank’s Doing Business Indicators (Figure 1.2). A series of improvements to access to credit, protection of investors, provision of electricity, contract enforcement, and property registration propelled Georgia into the top 20 countries to do business in 2008, according to the World Bank’s index; today it ranks 7th in the world (World Bank, 2020[9]) (World Bank, 2004[10]) (World Bank, 2007[11]).

Early reforms also overhauled the tax system, reducing the overall number of taxes from more than 20 to 6, and cutting rates. The simplified system improved tax collection and substantially increased government revenue. Subsequent revisions to the tax code introduced favourable conditions for SMEs (OECD, 2011[7]). Most recently, in 2017, the government replaced corporate income tax (CIT) with a dividend tax of 15%, applied only to distributed profits. This so-called “Estonian model” exempts reinvested earnings from CIT. The government’s ability to implement changes to the tax code are limited however, following the 2011 Economic Liberty Act, which sets restrictions on fiscal policy, including a mandate that any new taxes or increased rates pass a national referendum.

To facilitate trade, successive reforms simplified customs procedures and reduced the number, rate and scope of tariffs. As of 2016, Georgia had one of the lowest tariff rates (MFN) in the world, and nearly 80% of imports were duty free (WTO, 2016[12]). Recent reforms have focused on approximating trade legislation and procedures with EU standards. Georgia signed an Association Agreement, including a preferential trade regime (DCFTA), with the European Union (EU) in 2014 (see Box 1.2 for a summary of Georgia’s commitments and reforms under the agreement). Georgia also has free trade agreements with the Commonwealth of Independent States (CIS), the European Free Trade Association (EFTA), and bilaterally with many countries, including Turkey, Hong Kong (China) and China, and a Generalised System of Preferences agreement with the US.

Policy changes have also reduced restrictions on international investors and enshrined in law free movement of capital. Due in part to its liberal trade and investment framework, Georgia ranks 12th in the world on the Heritage Foundation’s Economic Freedom Index – a measure of open markets and regulatory efficiency – and 6th in the Europe region (Heritage Foundation, 2020[13]). Georgia is also one of the most open economies to foreign investment based on the OECD FDI Regulatory Restrictiveness Index, which assesses and benchmarks market access and exceptions to national treatment for more than 70 economies (see Chapter 3). These reforms helped increase FDI inflows more than five-fold between 2003 and 2007, and in 2017 large-scale energy transport investments helped bring record levels of FDI to the country.

The government also continues to adopt reforms to support the private sector and sustainable growth. In the past two and half years alone, the parliament has approved legislation on competition policy, anti-dumping measures in trade, agricultural land ownership, public-private partnerships, public procurement, a new customs code and amendments to the country’s labour code, and is expected to approve new laws on insolvency and consumer protection.

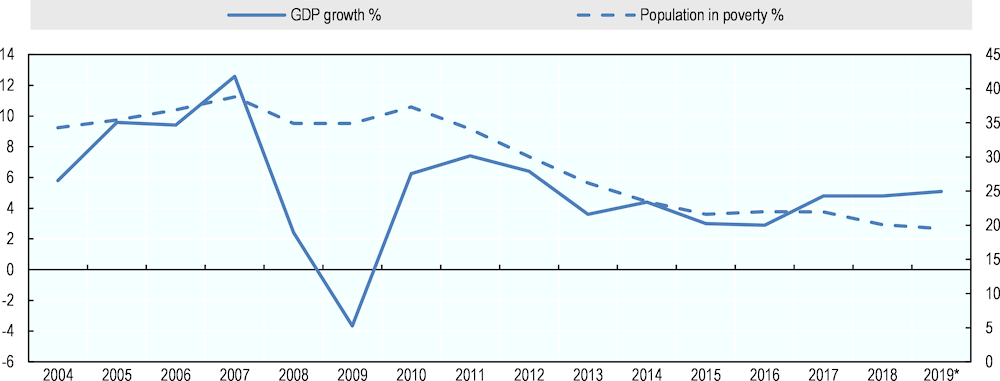

These waves of reforms have had a clear and positive effect on economic growth. GDP growth rates averaged 9% between 2004 and 2007, compared to -4% between independence and the Rose Revolution (Figure 1.1). Growth has been fairly resilient to substantial economic shocks, including a Russian trade embargo, the 2008 global financial crisis and Russia’s August 2008 invasion, recovering quickly after a brief contraction. In the past five years, GDP growth has been more moderate but still strong at an average of 4.1%.

Figure 1.1. Strong average GDP growth has helped halve poverty

Note: Right axis shows the share of population living under the absolute poverty line, as defined by the Georgian government, with 2015 as a base year for calculating the poverty line. GDP growth for 2019 provisional data.

Source: Geostat (for poverty rate) and World Bank Development Indicators Data (for GDP growth)

Figure 1.2. Georgia ranks among the top countries in the world to do business

Note: Score on a scale of 0 to 100, 0 represents the lowest performance and 100 the best performance.

Source: (World Bank, 2020[9]).

Box 1.2. Georgia’s free trade agreement with the EU (DCFTA) and related reforms

Central to Georgia’s socio-economic development strategy is future integration in the European Union (EU). In an important step toward closer political and economic ties, Georgia and the EU signed in 2014 an Association Agreement, which establishes the framework for closer co-operation. The Agreement introduces a preferential trade regime, the Deep and Comprehensive Free Trade Area (DCFTA). The DCFTA facilitates trade and investment between Georgia and the EU, in particular by removing all import duties on goods, providing mutual access to trade in services, and establishing the principle of non-discrimination (that businesses receive the same treatment as domestic companies) for investors. The Agreement also outlines reform priorities for Georgia to further align policies and legislation with EU standards. Commitments relate to democracy, rule of law, human rights, good governance, trade, market economy, and sustainable development.

By removing customs tariffs and quotas and harmonising relevant Georgian laws, norms and regulations in trade-related sectors to EU standards, the Agreement envisions increased trade and investment between Georgia and Europe, supporting the development of the Georgian economy. It is not clear, however, that the Agreement has yet led to a measurable increase in either trade or investment. Georgia previously benefited from EU market access under the Generalised System of Preferences (GSP+) regime. The Association Agreement has led to visa-free travel for Georgians to Schengen and Schengen-associated countries as of 2017.

Under the terms of the Association Agreement, Georgia has pledged to take a range of political, socio-economic and institutional reforms to move closer to EU standards. Reforms cover the following policy areas:

Trade in goods, services and e-commerce (including rules of origin)

Customs and trade facilitation, technical barriers to trade, standardisation, metrology, accreditation and conformity assessment

Sanitary and Phytosanitary measures (including food safety regulations)

Intellectual property rights

Competition policy

Trade and sustainable development (including labour rights, SME development and environmental protection)

Trade related energy provisions (including regulation of gas and electricity markets)

Public procurement

Dispute settlement

Transparency

The Georgian government’s major reforms to date include new legislation on customs procedures, company operations, and occupational health and safety, as well as the development of new strategies for labour market, agricultural and rural development, anti-corruption, and political decentralisation. Georgia has also made substantial progress on harmonising technical regulations on trade to EU standards, but ensuring compliance of businesses remains a challenge. For details on Georgia’s reforms to date see: http://www.dcfta.gov.ge/en/implementation.

Source: (EU, 2014[14]), (European Commission, 2020[15]), (Government of Georgia, 2020[16]).

But socio-economic challenges remain

Despite tremendous progress on a range of measures, reforms have not sufficiently advanced broad-based economic growth. While poverty reduction, particularly since 2012, has been notable, around 20% of the population still lives in poverty, according to the national poverty line, and half the population is at risk of falling below this line (World Bank, 2018[17]).1 Significant inequalities between rural and urban areas also exist. While urban poverty has more than halved since 2004, rural poverty increased following liberalisation reforms, only declining markedly since 2012. Today around one in four rural dwellers lives below the poverty line, compared to one in six urban residents (Geostat, 2020[18]). Rural poverty reduction appears primarily due to increases in state transfers and other social assistance, rather than job opportunities (Gugushvili, 2017[8]).

Overall unemployment has declined in recent years to around 11%, from an average of just under 20% after the 2008 global financial crisis and war with Russia. But this figure masks important differences within the country, geographically and by age group. Around one in six urban residents (active population) is unemployed, and one in four youths (aged 20-29). While the rural unemployment rate is lower, the vast majority of the rural labour force (70%) is self-employed or in unidentified work (Geostat, 2020[18]). Most rural residents work in agriculture, primarily as subsistence farmers. There are also substantial gaps in educational performance between urban and rural areas, with negative implications for skills development (Li et al., 2019[19]).

Actual unemployment or under-employment in Georgia is substantial when taking into account the self-employed or those in precarious work. According to one poll, more than half of working age respondents consider themselves unemployed. Among respondents who report having a job, only half consider it stable (NDI & CRRC, 2019[20]). Georgia has a large informal economy, estimated by the government to constitute 13% of GDP, though other estimates suggest it could be up to four times this figure (Medina and Schneider, 2018[21]). According to national data, around one-third of non-agricultural workers are in informal employment.

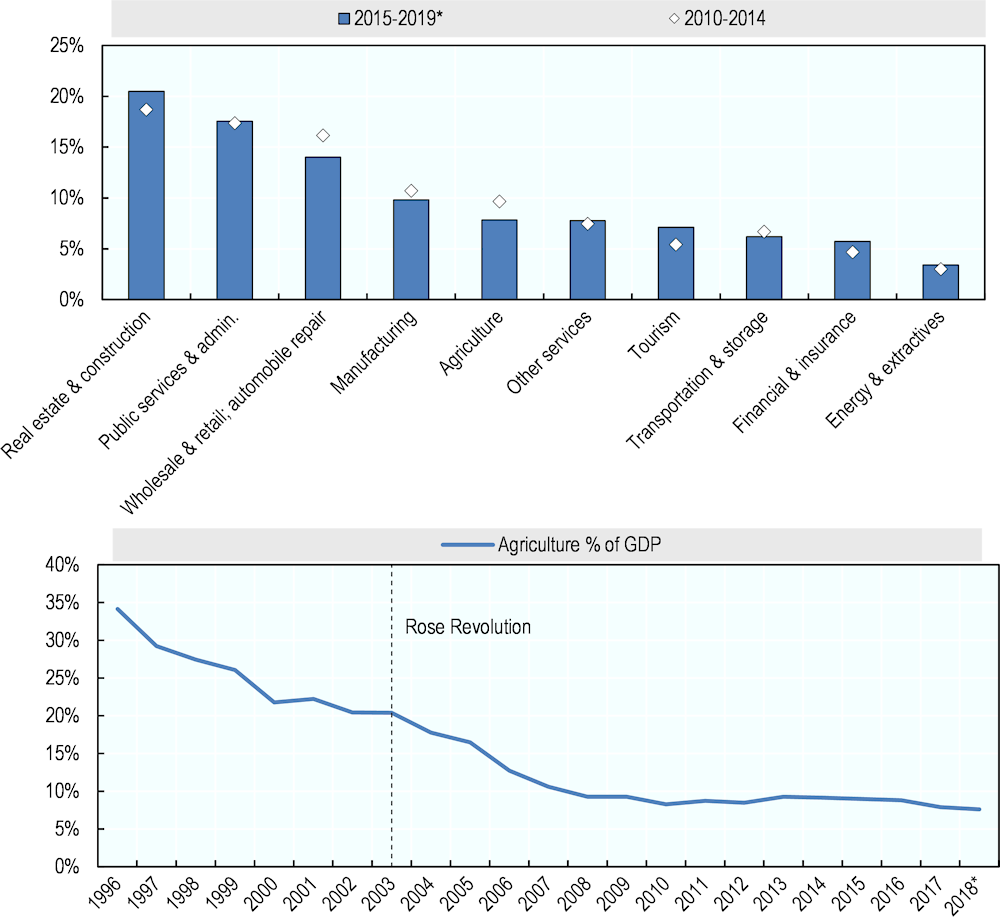

While successive reforms have improved livelihoods for many, they have not sufficiently increased economic opportunities for the majority of Georgians. GDP growth has not been accompanied by sustained growth in productivity, aside from initial gains following liberalisation. Over the past decade, economic growth has been driven largely by investment; total factor productivity has contributed little, and labour less (World Bank, 2018[17]). The past decade has also brought few changes to the structure of the Georgian economy, in terms of sectoral composition and drivers of growth. Service sectors, including real estate, construction, transport, financial services and wholesale trade, contribute the most, on average, to GDP (Figure 1.3). Many of these sectors attract significant capital (including FDI), but create relatively few jobs. Value added of export-oriented sectors, with the potential to advance productivity through integration in the global market, has been low.

The most significant structural change in Georgia’s economy since liberalisation is the decline in value added of agriculture (Figure 1.3, lower panel). Agriculture accounted for more than one-third of GDP following independence; it now contributes just 8%. Yet this decline was not accompanied by a re-allocation of labour. Agriculture remains the country’s largest employer, absorbing 42% of the workforce in 2019 (modelled ILO estimate).2

Figure 1.3. Contribution to GDP by economic sector

Note: Percentages calculated based on GDP at factor cost by economic activity. Agriculture data (lower panel) reflects 1993 System of National Accounts (SNA) methodology. Georgia now collects data based on SNA 2008 methodology, and has revised data for the years 2010-2019 accordingly. Upper panel figures reflect the SNA 2008 methodology.

Source: Geostat

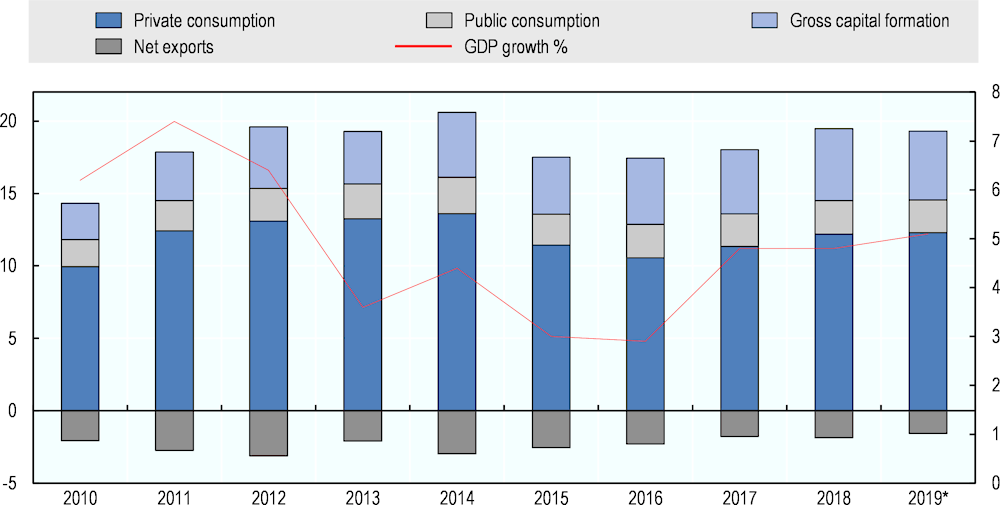

GDP growth in the past ten years has been driven by domestic consumption and investment (Figure 1.4). But Georgia’s small domestic market and declining population make this formula unstable. Increasing exports will be key to long-term economic growth (World Bank, 2018[17]). While the volume of exports has increased more than eight-fold since 2003, imports have grown faster (Geostat, 2020[18]). Georgia has run an average current account deficit of 9% of GDP since 2010. Though this has improved considerably in recent years, reaching an historical low of 5% in 2019, early projections suggest that the deficit will double in 2020, due to a sharp drop in exports precipitated by the COVID-19 pandemic (IMF, 2020[2]). Georgia’s basket of exports remains relatively undiversified. Motor vehicles (primarily re-exports), copper ore and ferro-alloys made up nearly half of exports in 2019 (Geostat, 2020[18]). Georgia’s trade agreements with the EU and China have helped diversify its trading partners, but many markets remain untapped.

Figure 1.4. GDP growth dependent on domestic consumption

Note: GDP % growth for year 2010 based on World Bank Development Indicators Data.

Source: Adapted from Geostat.

In addition to hindering productivity gains, Georgia’s external imbalances are a source of macroeconomic risk, as it relies heavily on remittances and FDI to finance its current account deficit. Georgia also has high external debt (at 105% of GDP in 2019 according to the Central Bank), more than half of which is private sector debt (public debt is primarily held by multilateral creditors with favourable terms) (IMF, 2020[2]). Most public and private debt is denominated in US dollars, making borrowers vulnerable to exchange rate risks. Due to these risks, credit rating agencies rate Georgia just below investment grade. Though rating agencies had noted some improvements in 2019, aided by progress in an IMF-supported programme, in April 2020 Fitch revised down its outlook for Georgia from stable to negative in light of new macroeconomic pressures propelled by the COVID-19 pandemic; it reaffirmed this position in August (Fitch, 2020[22]).

The government is well aware of these challenges. Many are clearly outlined in its Socio-Economic Development Strategy (Georgia 2020), adopted in 2014. The strategy sets out plans to support export growth, improve infrastructure, enhance skills of the workforce and mobilise investment (Government of Georgia, 2014[23]). Significant progress has been made in these areas, including continued efforts to improve the business climate, but many of the challenges outlined in 2014 persist.

Boosting investment and economic growth requires more than doing business reforms

Georgia’s reform experience is in many ways an example to which other former Soviet republics in the region look for inspiration. These reforms have delivered growth and transformed parts of the economy, but they have not adequately addressed the lack of productivity growth and persistent under- or unemployment, or led to broad-based improvements in living standards across the whole territory. This is not to pass judgement on the nature of Georgian reforms; dire circumstances sometimes require drastic measures. Rather, it is to argue that such reforms do not by themselves bring about inclusive and sustainable development. Removing impediments to business and sources of irredeemable corruption is often a necessary first step, particularly when such a radical transformation of the economy is called for. But bringing about inclusive and sustainable outcomes will require a more hands-on approach.

The government has been moving toward a more comprehensive approach to sustainable economic development for quite some time, at least since the launch of the Georgia 2020 Socio-Economic Development Plan in 2014 and the Association Agreement with the European Union in the same year (Box 1.2). Some of the recent changes have come through external pressure, as trading partners push for improved governance in Georgia as a condition for market access, but the limitations of the post-2004 approach are also widely acknowledged within the government. The Doing Business reforms described in Chapters 3 and 5, as impressive as they have been in Georgia, can only achieve so much. They have been a useful signalling device to potential investors, but by themselves neither equate with a suitable investment climate nor assure a steady inflow of FDI. Following initial strong FDI growth after 2004, FDI inflows have declined in the past couple of years, though relative to GDP FDI inflows have been higher than regional peers. Non-tradable sectors, including financial services, transport, real estate and construction, have consistently attracted the most FDI, but they have not sufficiently contributed to productivity or employment (Figure 1.5).

The Georgian experience with Doing Business reforms provides a cautionary tale for the many countries seeking to attract FDI through rank-seeking reforms (Box 1.3). Attracting FDI that can advance sustainable growth requires a wider approach. Georgia has removed nearly all policy and legal barriers to investment and trade. But exporters are still physically hampered by poor transport and storage infrastructure, limited connectivity within the country, and as a result, high transport costs and frequent delays (UNECE, 2018[24]). Despite growing investment in infrastructure, according to one survey, around one in five firms report that transport is a major constraint to doing business (World Bank, 2020[25]). ICT infrastructure has improved but internet connectivity is not widespread in rural regions. Well aware of these challenges, the government is currently developing a national strategy to improve broadband infrastructure, particularly in rural areas. Rail and airport capacity, particularly for cargo flights, remains low (World Bank, 2018[17]).

Investors are also constrained by a lack of skilled workers and local partners producing to international standards. Most firms in Georgia are small, without the capacity to produce at the scale and standards international partners often seek. Much of the working-age population has not received sufficient education in soft-skills demanded by growing service sectors such as tourism, or in vocational training specific to modern manufacturing (WTO, 2015[26]). More than 40% of firms surveyed by the World Bank in 2019 reported an inadequately educated workforce as a major constraint (World Bank, 2020[25]). The government is taking steps in an effort to address these challenges; certain line ministries and sectoral agencies have provided training and technical assistance opportunities. A 2020 survey on skills demands by businesses, issued by the Ministry of Economy and Sustainable Development, showed improvements of workers’ IT skills compared to 2017. However, very few enterprises (8%) provide training for employees (MOESD, 2020[27]).

More broadly, deregulation in Georgia resulted in low regulatory standards, such as in the areas of labour markets and the environment, which are only slowly being redressed, in part as a result of commitments under the DCFTA with the EU. Arguably many pre-existing regulations were already rendered ineffective through rampant corruption at the time. Examples of recent changes include the 2020 amendments to the Labour Code and approval of the Law on the Labour Inspectorate, the 2019 amendments to the Law on Occupational Health and Safety, the re-establishment of the Labour Conditions Inspection Department in 2015, the establishment of the National Agency of Mines in 2017, and the 2017 Environmental Impact Assessment Code. These reforms will help to ensure that future growth does not come at the expense of worker safety or the country’s environment and biodiversity.

As in all economies, an attractive and predictable investment environment also depends on macroeconomic and political stability. These goals are not static; they require continuous work by governments to improve sustainability of finance, public governance, and impartiality of the judiciary. According to the 2019 World Bank Enterprise Survey, around 30% of firms queried in Georgia report political instability as the most important obstacle to doing business, highlighting the importance of continuing efforts to ensure rule of law and sound public governance (World Bank, 2020[25]).

Figure 1.5. Non-tradable sectors attract the most FDI

Note: Data on FDI inflows in transport were combined with FDI in communications until 2015. Services includes financial services, hotels & restaurants, communications (after 2015), trade, education, R&D, health & social, and other community, social and personal service activities. 2019 data preliminary.

Source: Geostat.

Box 1.3. Doing Business rankings do not always reflect a suitable business climate

The shortcomings of Doing Business indicators have been widely discussed, including within the World Bank itself (Thomsen, 2019[28]). In spite of their unparalleled success in encouraging regulatory reform, they have not always generated the expected benefits for the host country. In Georgia, for example, the much-vaunted success in reaching 7th place worldwide in the overall ease of doing business ranking reflects notable improvements to many procedures relevant for investors, but it has not yielded a steady stream of diversified FDI inflows or done much to reduce levels of informality in the country. The reasons why this might be the case are numerous, but one important factor is likely to be the narrow scope of the indicators themselves, which though they reflect progress in some areas, do not necessarily reflect broad-based improvements, as can be seen in the following examples:

Georgia ranks 5th in the ease of registering property (down from 1st place in 2014), but only a small share of land outside Tbilisi is officially titled, property rights are not properly observed, and disputes concerning property are not easily resolved. It should be noted that improving protection of property rights is a priority for the government.

In terms of enforcing contracts, Georgia ranks 7th, indicative of notable improvements such as electronic filing systems and random assignment of judges to cases, but dispute resolution remains a frequent problem for investors.

Georgia does reasonably well in getting electricity, and the government has taken steps to make electricity more affordable and reliable. Yet over half of all firms in the latest World Bank Enterprise Survey report issues with electricity outages.

Source: (World Bank, 2020[9]), (World Bank, 2020[25]).

Main recommendations

Successive Georgian governments have demonstrated their commitment to advancing bold and meaningful reforms. Georgia has removed much of the de jure barriers to FDI, but more could be done to improve the overall enabling environment for investment. This includes addressing gaps in infrastructure and connectivity and upgrading the skills of the workforce. Improving not only regulatory constraints but the whole investment climate – including the wider legal framework, investment promotion strategy and institutions, policies to promote responsible business conduct, and impediments to growth of priority sectors – will help Georgia attract FDI that can have a positive impact on productivity and inclusive, sustainable growth.

Mobilising FDI will be essential to respond to the economic and social challenges of the COVID-19 pandemic. Supply disruptions, demand contractions and the pessimistic outlook of economic actors will have a significant negative effect on investment and economic growth. The OECD projects that in the most optimistic scenario, global FDI flows will drop by 30% and world economic output by 6% in 2020 (OECD, 2020[29]) (OECD, 2020[30]). In Georgia, an abrupt halt to tourism, exports and remittances will have a disruptive effect on economic activity and, potentially, macroeconomic stability. In the first two months of the crisis (March and April), a majority of Georgian firms reported revenue declines of more than 50%, acute liquidity challenges, and personnel reductions, according to a survey of around 2 000 companies. Firms in accommodation and food services have been most affected (PwC, 2020[31]). Tourism accounts for 7% of GDP (according to national statistics), but according to one estimate, the indirect contribution of tourism and travel to GDP could be as high as 26% (World Travel and Tourism Council, 2020[32]).

The government now has an opportunity to further strengthen its efforts to build a sound and transparent investment environment that supports sustainable economic growth. The section that follows presents the main findings and recommendations of this Investment Policy Review. The numerous policy options mix concrete measures that can be implemented relatively quickly with more aspirational recommendations. Some measures can only be implemented over a long time horizon, while the government is already considering others. The aim is to provide a list of policy options across a range of areas for the Georgian government to consider as it reforms its investment climate.

Legal framework and regulations on investor entry

The legal framework for investment has undergone substantial remodelling in the past three decades. Formerly a Soviet republic, it is now a blossoming liberal market economy. A series of reforms, starting in the early 2000s, have significantly improved the investment climate. Georgia is now open to foreign investment in most sectors. Limited restrictions remain, notably in the agricultural sector in light of a ban on foreign ownership of agricultural land. The remaining sectoral restrictions nonetheless fall within the same sectors as those found in both EaP and OECD countries.

With the vast majority of de jure barriers to FDI now removed, the government’s task on investment policy lies in improving the overall climate for investment. Significant strides have been taken in this area, too. The Law on Promotion and Guarantees of Investment Activity (Law No. 3425 of 30 June 2006, as amended, hereafter the Investment Law) is a centrepiece of these developments. It seeks to establish a level playing field between domestic and foreign investors. Together with several other investment-related laws, it sets out non-discrimination guarantees, protections from expropriation, rights to free transfer of funds abroad and a limited set of investor obligations. The country’s land laws provide a clear and predictable framework for property rights, which is another important pillar for the investment climate. Well-developed laws and institutions on data protection and cybersecurity, which are edging closer to alignment with EU rules in this area, are also noteworthy.

A number of important challenges remain despite these achievements. Foremost among these are the ongoing efforts to reinforce the independence, accountability and capacity of the country’s judiciary. Legislative amendments adopted by Parliament in December 2019 seek to address some of the remaining concerns but there is a need for sustained momentum for systemic judicial reform to build investor confidence in the court system. Other important challenges include ensuring that intellectual property rights are enforced effectively, realising universal land registration and continuing to improve the legal and institutional infrastructure that supports alternative dispute resolution services. Recommendations in each of these areas are set out below.

Protections afforded under Georgia’s investment treaties are another important part of the legal framework for investment. These treaties grant protections to certain foreign investors in addition to and independently from protections available under domestic law to all investors. Georgia is a party to 33 investment treaties in force today. Like investment treaties signed by many other countries, Georgia’s investment treaties typically protect investments made by treaty-covered investors against expropriation and discrimination. They also give covered investors access to investor-state dispute settlement (ISDS) procedures, including international arbitration, in cases where they claim that the government has infringed these protections.

Georgia is participating actively in various inter-governmental discussions regarding possible reforms of investment treaties, including UNCITRAL’s Working Group III on ISDS Reform and the modernisation process for the Energy Charter Treaty, a prominent multilateral treaty to which Georgia is a party. Like many other countries, however, Georgia still has a significant number of older investment treaties in force with vague investment protections and ISDS provisions that may create unintended consequences in ISDS cases and ultimately undermine reform efforts. Many countries have substantially revised their investment treaty policies in recent years in response to these concerns, as well as increased public questioning about the appropriate balance between investment protection and sovereign rights to regulate in the public interest and the costs and outcomes of ISDS. Recommendations to reconsider several aspects of the government’s approach to investment treaties in this context are set out below.

Investment policy recommendations

To signal Georgia’s commitment to providing an open and transparent environment for international investment, the government could consider requesting to adhere to the OECD Declaration on International Investment and Multinational Enterprises. The Declaration, a non-binding policy commitment, consists of OECD instruments designed to promote international investment in a transparent and responsible manner. Adhering governments commit to enforce a balanced set of rights and obligations for foreign investors through the National Treatment Instrument, a pledge to treat foreign-owned or –controlled enterprises no less favourably than domestic enterprises in like situations, and the Guidelines for Multinational Enterprises, standards on responsible business conduct. Adherence would allow the Georgian government to improve transparency of the investment regime and the international reputation and impact of domestic firms as responsible actors. The government would also benefit from participation in the work of the OECD Investment Committee, a leading forum for international co-operation, policy analysis and advice to governments on how best to enhance the positive impact on foreign direct investment (FDI) on development.

Assess the impact of foreign ownership restrictions on agricultural land on investment in the agri-business sector and on participation of that sector in global value chains (as described in Chapter 4). In light of those findings, reconsider whether such restrictions fulfil their role and whether other non-discriminatory measures could instead be used to protect small landholders and other stakeholders.

The government should consider the merits of consolidating and harmonising the various laws that address expropriation. Expropriation protections are spread across several laws that include varying levels of detail for the scope of these protections. The government may also wish to consider whether there are good policy reasons for providing different standards of protection from expropriation for certain foreign investors under its investment treaties than for other investors under its domestic laws.

Continue to prioritise efforts to improve the regime for intellectual property (IP) rights, especially enforcement measures. Investors continue to report concerns with widespread software piracy and unlicensed online content, as well as the level of technical capacity among local judges, lawyers, prosecutors, police officers and customs officers responsible for IP enforcement. The government is well aware of these concerns and designs initiatives to address them. Improving investor confidence with IP enforcement in the country is a precondition for attracting further investment in R&D, new technologies and innovation.

Sustain momentum for systemic judicial reform. Concerns regarding the integrity of the judicial appointment process and the capacity of the courts to deliver quality outcomes continue to affect investor confidence in the court system. The government should continue to work closely with a wide range of stakeholders, including civil society organisations and international partners, to address persisting concerns. Low levels of trust in the judiciary affect the overall investment climate in a number of ways, not only the use of court services to adjudicate investment disputes but also perceptions about the integrity of court assistance with IP enforcement, arbitration and mediation, among other areas.

Evaluate potential amendments to the Arbitration Law (Law No. 1280 of 2009, as amended). Areas for possible legislative clarification include the scope of the “public order” ground for refusing enforcement of an arbitral award under Article 44 of the Law. It may also be prudent for the government to take stock of court decisions and user experiences under the Law over the past decade to assess the merits of these potential amendments to improve legal certainty, user experiences and the attractiveness of arbitration in Georgia.

Support initiatives to improve public perceptions and awareness of arbitration and mediation as credible alternative dispute resolution options. Negative public perceptions of arbitration institutions, arbitrators and courts that harken back to experiences under earlier arbitration laws is hindering the development of arbitration in the country. Existing arbitration institutions may be able to complement the government’s own efforts to foster a stronger culture of independence, competence and integrity in this sector.

Strengthen land administration services by completing and, if possible, expediting the universal land registration reform and improving options to resolve land disputes, including the framework for mediation introduced as part of the 2016 land reforms.

Maintain data protection and cybersecurity as a national policy priority. Georgia has relatively well-developed laws and institutions in these areas of increasing importance for all investors. It is nonetheless important to build on recent achievements by monitoring the effectiveness of the new State Inspector Service, seeking new opportunities to collaborate with international partners to exchange best practices and boost the government’s in-house technical capacity in these areas, and ensuring that existing laws evolve to align with international standards such as the Budapest Convention on Cybercrime.

Continue to reassess the government’s priorities for investment treaty policy and consider possibilities for introducing further clarification of key provisions in older investment treaties. These treaties should be calibrated to reflect an appropriate balance between investment protection and preserving the government’s right to regulate while also contributing to Georgia’s efforts to attract FDI. Georgia may wish to consider whether provisions in its existing investment treaties appropriately safeguard the government’s right to regulate and avoid unintended interpretations in ISDS disputes. Clearer specification of key provisions, where needed, would help to reflect government intent and ensure policy space for government regulation.

Continue to participate actively in and follow closely government and other action on investment treaty reforms at the OECD, UNCITRAL and ECT modernisation process. Consideration of reforms and policy discussions on frequently-invoked provisions in ISDS cases and whether investment treaties are achieving their intended purposes are of particular importance in current investment treaty policy. Emerging issues such as the possible role for trade and investment treaties in fostering responsible business conduct as well as ongoing discussions about treaties and sustainable development also merit close attention and participation.

Promoting sustainable investment in Georgia’s agri-food value chain

Promoting sustainable investment in Georgia’s agri-food value chain is crucial to ensure broad-based economic growth, support rural development and maintain competitiveness in international markets. The agriculture and food sectors play an essential role in Georgia’s economy, collectively accounting for 10% of GDP and 44% of employment in 2019. With favourable soil conditions and climate, and an abundance of water resources, Georgia has strong potential to attract investment in the agri-food value chain. However, FDI inflows are below potential and the majority of investment in the value chain originates from domestic sources. Agri-food exports have grown at a rapid pace over the past two decades, but remain highly concentrated in beverages. Attracting FDI can help to boost exports of high-value food products, leading to increases in wages and productivity.

While Georgia has made enormous progress improving its investment climate in recent years, the agri-food value chain presents a unique set of challenges for investors. Most food products are predominantly grown by small-scale family holdings, which are often subsistence-oriented and with surplus production frequently sold on local markets. The farm structure is highly fragmented, with an average farm size of 1.4 hectares in 2014, and 77% of farms operating on land holdings of less than 1 hectare. Addressing these structural deficiencies is essential to promote investment and generate new growth opportunities for the sector.

Investment in agri-food value chain recommendations

Introduce a specific objective and activities relating to investment promotion and facilitation within the new Agriculture and Rural Development Strategy of Georgia 2021-2027 and the Action Plan for 2021-2023.

Provide a clear and predictable framework for prospective investors to submit investment plans and obtain government approvals to acquire agricultural land.

Ensure full completion of the land registration reform, by raising awareness of the reform in rural communities and undertaking a systematic approach to land registration if necessary. Continue with the registration of state-owned lands, whilst ensuring that adequate safeguards are in place to protect the legitimate tenure rights of small-scale producers and rural communities.

Strengthen the provision of credit guarantees to reduce lending risks and encourage greater commercial lending to agri-food SMEs. Consider providing targeted guarantees for exporters operating under long-term supply contracts.

Continue investing in transport and utility infrastructure, and focus on improving the quality of rural road networks and increasing rural-urban connectivity. Encourage greater private sector participation in infrastructure development, and introduce measures to improve the quality of logistics services.

Continue efforts to rehabilitate outdated irrigation infrastructure and drainage systems, and ensure access to affordable and reliable internet access in rural areas.

Carefully assess the effectiveness of the co-financing schemes administered by the Agricultural and Rural Development Agency (ARDA), and consider allocating financial resources to encourage the formation of supply chain linkages.

Offer targeted incentives to prospective investors, conditional on their engagement with small-scale producers and agricultural co-operatives. Provide assistance to food processors and retailers to build the capacities of their suppliers, by providing cash, inputs and technical assistance in exchange for product supply.

Ensure that agri-food SMEs are able to benefit from well-resourced and functioning agricultural training institutes, extension services and vocational training systems. Well-trained extension workers can provide technical advice to SMEs and support the dissemination of new technologies, improving their ability to respond to the needs of large agricultural investors.

Strengthen food safety and quality standards, and introduce measures to increase awareness and compliance by small-scale producers. Provide support to foreign investors that are willing to invest in upgrading the capacities of SMEs to comply with food safety and quality standards.

Investment promotion

Georgia is one of the easiest countries in which to do business, according to several international rankings. Since 2005, it has moved from 112th place in the World Bank’s Doing Business indicators to 7th place worldwide, a remarkable achievement that many governments would like to emulate. As discussed in the previous section, this approach to reform relying on massive deregulation has reached its natural limits and has not yet yielded a well-diversified stock of inward investment through which to integrate in global value chains. Achieving this, along with broader goals of inclusiveness and sustainability, will require a more proactive approach which relies less on removing regulatory obstacles and more on building a coherent strategy and suitable institutional architecture. One key area in this respect is investment promotion.

A comprehensive scan of Georgia’s framework for investment promotion and facilitation reveals areas for improvement to ensure investments are targeted strategically in areas that can contribute sustainably to Georgia’s development. A look at the institutions promoting investment reveals a fragmented system, with different actors actively pursuing investors. While this in itself is not a weakness, the lack of strong co-ordination, starting with a single government focal point for investors leads to inefficiencies, duplication of efforts, and confusion for investors.

A central weakness in the overall system is the overlapping of investment promotion functions among various actors. Enterprise Georgia is the country’s investment promotion agency (IPA) and well known for its support to enterprise development and export promotion. Other actors active in investment promotion include the Georgia Innovation and Technology Agency (GITA) and the Georgian Chamber of Commerce, while the Investors Council provides a platform for public-private exchanges on issues critical to investment. The Ministry of Economy and Sustainable Development is the government’s line ministry in charge of investment and oversees Enterprise Georgia. Its recently created investment policy department should help address some of the co-ordination challenges. More generally, the strong “Invest in Georgia” brand inherited by Enterprise Georgia should be revived, which would strengthen the country’s investment promotion efforts.

Georgia is ripe for a comprehensive investment policy statement. Aligning all actors behind a joint vision, fostering synergies between investment, export, enterprise and innovation promotion, would allow Georgia to significantly leverage its strong points. The past 15 years have helped to build a strong governance foundation for economic growth. Georgia now needs a policy push through an investment strategy to fully achieve its potential.

Policy recommendations on investment promotion

Develop a comprehensive investment policy statement

The significant investment-related reforms since 2003 have put Georgia on the map for investors, leading to numerous improvements in the business climate, taxation, innovation, financial markets and export development. Together, with the EU-Georgia Association Agreement and the associated regulatory reforms, Georgia requires a unified approach to ensure co-ordination of all these measures, as well as to align its investment objectives with efforts in other areas, such as export promotion, innovation and SME development. The Ministry of Economy and Sustainable Development and its recently created investment policy department is well placed to spearhead an investment policy statement, one that would align all related policy and regulatory measures, while also sending a strong message to the business community that the government is a partner in advancing investment reforms. The Ministry’s strategy would provide the overall investment policy and direction, while Enterprise Georgia could focus on co-ordinating the various investment promotion efforts. The subsequent recommendations will follow from the statement.

Keep strengthening the investment promotion function in Georgia

Georgia’s administration and key business stakeholders, including the Chamber of Commerce and Industry, have proven their dynamism in pushing through investment and business related reforms. A number of groups active in the field of business regulation improvements and advocacy, as well as investment promotion, have thus emerged over the years. Enterprise Georgia, as the official IPA, the Georgian Innovation and Technology Agency, and the Georgian Chamber of Commerce and Industry are but three major actors undertaking investment promotion. While multi-faceted initiatives to attract investment to Georgia should be encouraged, these activities need to be co-ordinated carefully. This entails clearly signalling to the business community – both domestic and international – which agency has the lead in investment promotion matters, as well as strengthening the investment promotion function and the agency’s capacity. While Enterprise Georgia has seen recent additions to its investment promotion team, these efforts need to be sustained if the agency is to be the lead agency for investment promotion. Where the investment promotion function is situated, whether as part of a Ministry or as within an independent IPA for example, is secondary to the need to equip it with the needed skills and resources.

Enhance the “Invest in Georgia” brand

The precursor to Enterprise Georgia was Invest in Georgia which was under the Prime Minister’s Office (this changed in 2017 with the merger of the IPA with Enterprise Georgia). The agency received significant recognition due to its position directly under the prime minister and Invest in Georgia became a well-known brand. While the name was kept and transformed into the country’s official investment portal within Enterprise Georgia, the IPA itself lost some visibility vis-à-vis investors and other relevant government agencies. The investment policy statement should entail a marketing effort to accentuate the “Invest in Georgia” brand, which is already well known to the international business community.

Strengthen the investment aftercare system and improve one-stop shop services

Aftercare services for investors are vital, especially in retaining investors. Attracting new investors is more challenging and costly compared to supporting reinvestment and expansion, which account for a significant share of all investments. Enterprise Georgia could improve its aftercare services for investors. The government also needs to play its role in supporting the IPA in this effort by clearly communicating to the business community that Enterprise Georgia is the main focal point in Georgia’s investment promotion system to deal with investor needs. Good aftercare and policy advocacy, including transmitting investors’ feedback for more effective policy making, can be the determining factor in a decision to reinvest and help address investment climate challenges. This may require gaining additional political support to drive reforms that are beyond the IPA’s remit. The IPA should also consider enhancing its one-stop-shop services for investors. Georgia’s experience with its Public Service Hall would be informative in this regard.

Link export, innovation and investment promotion

Investment promotion can enhance participation in the global economy. The attraction of export-oriented FDI has enabled countries to shift quickly towards a model of economic growth driven by rapidly expanding exports. The opportunities presented by the Deep and Comprehensive Free Trade Area (DCFTA) with the EU as an export market should be part of Georgia’s investment promotion strategy. The efforts that Georgia has put into strengthening innovation within its business community should also be considered in the investment strategy.

Foster FDI-SME linkages

Anchoring investors through deep linkages with the local economy is an effective investment retention strategy and can usefully complement aftercare measures. Investor targeting and aftercare services can attract investors and help keep them satisfied, but it is the broader and more sophisticated, and hence more complex, efforts to strengthen the investment ecosystem that will determine a country’s competitiveness. This includes providing investors with competitive local suppliers, facilitating linkages with local firms, developing the necessary hard and soft infrastructure, including institutional support, and keeping policy and macro-economic fundamentals in order. In turn, business linkages between MNEs and domestic companies, especially smaller suppliers, contribute significantly to local development. Linkages can be effective avenues for the transfer of technology, knowledge and managerial and technical skills, depending on the appropriate policy setting and absorptive capacity of domestic suppliers. Enterprise Georgia is strategically set up to support such linkages, hosting both investment and SME development functions, in addition to export development. However, given the complex task the agency already has at hand in terms of optimising the co-ordination across the functions, while strengthening each one in its own right, it should address priorities strategically. One way of starting to enhance linkages promotion would be to establish some linkages focal points in the investment promotion and enterprise promotion departments, which could identify and explore opportunities systematically.

Enhance the investment promotion oversight mechanism

Unlike most autonomous IPAs in OECD countries, Enterprise Georgia does not have a governing board. The role of boards can vary greatly from one agency to another, but they are often composed of high-level, experienced people who provide guidance and advice on strategic and management issues. They can have clear decision-making powers, such as appointing the head of the agency. A board can be a good mechanism to ensure the representation of different stakeholders in the governance of an IPA. Including senior representatives from the private sector is a good way to integrate experience and expertise from the private sector into strategic orientations. The government could envisage establishing a mechanism that would add such oversight and guidance for Enterprise Georgia. This would provide it with an outsider’s view to generate new ideas for collaboration and synergies within the agency, as well to identify and unlock opportunities for co-operation with other agencies and the private sector.

Formalise strategic co-ordination for investment promotion

Overall, Enterprise Georgia would benefit from clearer terms of co-operation and mechanisms to work jointly with its key institutional partners. Currently, the agency operates on a rather ad hoc basis, without clear guidelines, shared protocols or tools, although this does not prevent the IPA from collaborating informally with GITA and the Chamber of Commerce, thanks to good relationships between agencies. Well-defined co-operation terms in strategic plans and dedicated tools such as shared information systems, processes and systematised protocols would nevertheless improve the quality of the co-operation while potentially reducing the workload thanks to efficiency gains. Enterprise Georgia is currently implementing a CRM tool and aims to share it with other agencies. This could be a decisive step to enhance the co-operation and maximise synergies between investment promotion, SME development and export, and innovation promotion.

Strengthen investment promotion and facilitation at the sub-national level

Sub-national governments do not have formal mandates and roles in investment promotion and facilitation. According to local stakeholders however, regional governors express their interest in attracting foreign capital in their territories, and Enterprise Georgia is accompanying them in this goal. While rolling out investment promotion and facilitation at the sub-national level is a complex endeavour, a next stage of the co-operation with the regions could be to establish dedicated focal points.

Responsible business conduct

In recent years, Georgia has made significant strides to establish and implement a regulatory and institutional framework that underpins and promotes sustainable development and RBC. In the context of its broader reform programme, the government has adopted a range of legislative and administrative measures to strengthen labour rights and environmental protection, amongst other issues relevant to RBC, and has included a separate chapter on RBC business and human rights in its 2018-2020 National Human Rights plan. Awareness of RBC principles and standards in Georgia, while still modest, is also on the rise, thanks to new initiatives by government, civil society and business associations. A continued focus on awareness-raising, particularly for small and medium-sized enterprises and sectors identified as high-risk, would be beneficial.

Taking into account these policy developments, this chapter identifies policy opportunities which Georgia could seize to bolster RBC and send a stronger signal to businesses of the importance of RBC for the country. The implementation of the EU Association and Partnership Agreements and the development of the National Human Rights Strategy and its Action Plan have been and will continue to be important opportunities to consolidate existing efforts and promote RBC principles and standards in a more explicit and comprehensive manner. The challenge will be in implementation.

The government could also demonstrate its commitment through its activities as an economic actor. Indeed, following best practices and pursuant to international standards such as the OECD Policy Framework for Investment (PFI), the UN Guiding Principles for Business and Human Rights, and the OECD Guidelines on Corporate Governance of State-owned Enterprises, governments are expected to lead by example and should demonstrate RBC in their activities. Public procurement, investment promotion and state-owned enterprises (SOEs) can serve as levers to foster RBC, and so far Georgia has yet to define and communicate the RBC standards it expects and applies in these areas.

Further opportunities to promote and strengthen RBC exist. While Georgia’s system of human rights protection is well-established, further measures would be welcome to strengthen the independence of the judiciary and enhance access to both state-based and non-state based remedy, and fully ensure that civil society can operate freely – issues that underpin many aspects of RBC. Georgia has made important achievements in reforming and strengthening labour protection, including occupational health and safety and the re-establishment of labour inspection. Additional steps could be taken to ensure the effective implementation of these reforms. This is particularly important in those sectors marred by inadequate working conditions and occupational hazards, such as mining.

While significant improvements have been made over the years to strengthen environmental governance, comprehensive and swift enforcement of the new legislation, with enhanced public access to information and participation in decision-making, is warranted. This would help enhance responsible business practices in sectors with reported high risks, such as mining and hydropower. RBC could be given a prominent role in the ongoing reforms of the mining sector.

Although Georgia’s progress in preventing and combating corruption is internationally recognised, there remains scope for additional progress in relation to enforcing regulations and in launching initiatives targeting the private sector to prevent and address bribery and corruption. The promotion of business integrity through training and the development of codes of conduct is one area where stronger efforts by both government and businesses would be welcome.

Policy recommendations on responsible business conduct

Clearly communicate expectations that all businesses operating in and from Georgia respect RBC standards. Engage further in awareness-raising and capacity-building activities for both employers and workers, particularly in small and medium-sized enterprises and sectors identified as high-risk, including mining, construction and hydropower. This includes promoting the implementation of available guidance, such as the OECD Due Diligence Guidance for Responsible Business Conduct.

Promote policy coherence and alignment on RBC among government institutions. Consider developing a self-standing National Action Plan (NAP) on RBC/BHR (business and human rights), with the active participation of stakeholders and in line with international good practices, which would greatly help ensure effective design, co-ordination and implementation of RBC policies. At a minimum, strengthening RBC/BHR commitments in the National Human Rights Strategy for 2021-30 and its subsequent Action Plan would be, building upon the 2018-2020 NAP, a welcome step. RBC commitments could also be more deeply and broadly mainstreamed into national sectoral strategies and plans.

As an economic actor in its own right, the government should seize the opportunity to lead by example and establish clear expectations and objectives to respect and promote RBC standards in public procurement and through SOEs. In relation to SOEs, Georgia should look at ways to improve further its policy framework for state ownership in line with international best practices, including the OECD Guidelines for Multinational Enterprises, the OECD Guidelines on Corporate Governance of State-owned Enterprises, and the UN Guiding Principles on Business and Human Rights, and set clear expectations that SOEs comply with RBC standards, particularly on information disclosure, transparency and labour rights.

Continue on-going reform efforts aimed at improving the legislative framework and its enforcement related to ensuring adequate working conditions, particularly occupational health and safety. Further strengthen data reporting on violations of legislation, including on occupational safety and health. Also, continue efforts to guarantee non-discrimination in practice in the workplace.

Together with business associations, raise awareness about the importance of establishing effective company-based grievance mechanisms to prevent and address adverse impacts. Such grievance mechanisms would strengthen the ability of communities and workers to voice concerns.

Promote stronger compliance with internationally recognised environmental standards as a competitive advantage that can open up opportunities for international investment and trade. Strengthen the quality of environmental impact assessment (EIAs), the public’s access to them and participation in decision-making, and overall compliance with EIAs. Set clear expectations that businesses report on environmental risks and impacts of specific operations.

Given the saliency of risks associated with the mining and hydropower sectors, promote and ensure enhanced implementation of RBC standards (particularly on human rights, environment, and labour) through existing reforms and other measures. Ensure that meaningful consultations with workers and potentially affected stakeholders, as well as RBC due diligence, are effectively carried out, in line with the OECD MNE Guidelines and the UN Guiding Principles.

Continue ongoing promising reforms to combat corruption in the public and private sectors. Assist companies in combating corruption, including through developing and implementing preventive measures such as codes of conduct, internal controls, and compliance programmes. Differential approaches may be used with SMEs, based on capacity and needs.

Overall, keep encouraging businesses and industry associations to play a more proactive role in promoting RBC.

References

[3] EBRD (2020), Responding to the Coronavirus Crisis: Update on GeorgiaResponding to the Coronavirus Crisis Update on Georgia (13/05/20), EBRD.

[14] EU (2014), Association Agreement between the EU and Georgia, https://eeas.europa.eu/sites/eeas/files/association_agreement.pdf (accessed on 24 July 2020).

[15] European Commission (2020), Association Implementation Report on Georgia, European Commission, Brussels, https://eeas.europa.eu/sites/eeas/files/1_en_document_travail_service_conjoint_part1_v4.pdf (accessed on 24 July 2020).

[22] Fitch (2020), Rating Action Commentary: Fitch Revises Georgia’s Outlook to Negative; Affirms at ’BB’, Fitch Ratings, https://www.fitchratings.com/research/sovereigns/correct-fitch-revises-georgia-outlook-to-negative-affirms-at-bb-27-04-2020 (accessed on 5 July 2020).

[18] Geostat (2020), National Statistics, National Statistics Office of Georgia, Tbilisi, https://www.geostat.ge/en/modules/categories/22/national-accounts.

[16] Government of Georgia (2020), Implementation - DCFTA, http://www.dcfta.gov.ge/en/implementation (accessed on 24 July 2020).

[23] Government of Georgia (2014), Georgia 2020: Socio-economic Development Strategy of Georgia, https://www.adb.org/sites/default/files/linked-documents/cps-geo-2014-2018-sd-01.pdf.

[8] Gugushvili, D. (2017), “Lessons from Georgia’s neoliberal experiment: A rising tide does not necessarily lift all boats”, Communist and Post-Communist Studies, Vol. 50/1, pp. 1-14, http://dx.doi.org/10.1016/j.postcomstud.2016.11.001.

[13] Heritage Foundation (2020), Georgia: 2020 Index of Economic Freedom, https://www.heritage.org/index/country/georgia (accessed on 5 July 2020).

[2] IMF (2020), Georgia: Sixth Review Under the Extended Arrangement and Requests for a Waiver of Nonobservance of Performance Criterion, Modification of Performance Criteria, and Augmentation of Access-Press Release; Staff Report; and Statement by the Executive Director for Georgia, IMF, Washington DC, https://www.imf.org/en/Publications/CR/Issues/2020/05/05/Georgia-Sixth-Review-Under-the-Extended-Arrangement-and-Requests-for-a-Waiver-of-49394 (accessed on 12 June 2020).

[5] IMF (2005), Georgia: Poverty Reduction Strategy Paper Progress Report, IMF, Washington, DC, https://www.imf.org/external/pubs/ft/scr/2005/cr05113.pdf (accessed on 27 July 2020).

[19] Li, R. et al. (2019), OECD Reviews of Evaluation and Assessment in Education: Georgia, OECD Reviews of Evaluation and Assessment in Education, OECD Publishing, Paris, https://dx.doi.org/10.1787/94dc370e-en.

[21] Medina, L. and F. Schneider (2018), “Shadow Economies Around the World: What Did We Learn Over the Last 20 Years?”, IMF Working Papers, No. 18/17, IMF, Washington, DC, https://www.imf.org/en/Publications/WP/Issues/2018/01/25/Shadow-Economies-Around-the-World-What-Did-We-Learn-Over-the-Last-20-Years-45583 (accessed on 17 June 2020).

[27] MOESD (2020), Survey of Business Demand on Skills, http://www.lmis.gov.ge/Lmis/Lmis.Portal.Web/Handlers/GetFile.ashx?Type=Content&ID=cfaa802f-c54e-4607-9875-69abaa284777.

[20] NDI & CRRC (2019), Public Attitudes in Georgia: Results of July 2019 Survey, National Democratic Institute & Caucasus Research Resource Center, https://www.ndi.org/sites/default/files/NDI%20July%202019%20poll-Issues_ENG_For%20distribution_VF.pdf (accessed on 3 July 2020).

[1] OECD (2020), COVID-19 crisis response in Eastern Partner countries: OECD Policy Responses to Coronavirus (COVID-19), OECD, http://www.oecd.org/coronavirus/policy-responses/covid-19-crisis-response-in-eu-eastern-partner-countries-7759afa3/ (accessed on 4 July 2020).

[29] OECD (2020), Foreign direct investment flows in the time of COVID-19, OECD Policy Responses to Coronavirus (COVID-19), https://www.oecd.org/coronavirus/policy-responses/foreign-direct-investment-flows-in-the-time-of-covid-19-a2fa20c4/ (accessed on 9 July 2020).

[30] OECD (2020), OECD Economic Outlook, Volume 2020 Issue 1, OECD Publishing, Paris, https://dx.doi.org/10.1787/0d1d1e2e-en.

[4] OECD (2015), Policy Framework for Investment, 2015 Edition, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264208667-en.

[7] OECD (2011), “Georgia: Country Review”, in Development in Eastern Europe and the South Caucasus: Armenia, Azerbaijan, Georgia, Republic of Moldova and Ukraine, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264113039-8-en.

[31] PwC (2020), Georgian Business in the face of the Covid-19 Pandemic, PwC in cooperation with the Georgian Investors Council, https://www.pwc.com/ge/en/assets/pdf/may-2020/Georgia_Covid-19_survey_Report_Final_English_21.05.20.pdf (accessed on 27 July 2020).

[28] Thomsen, S. (2019), How much difference do the Doing Business indicators make?, On the Level: OECD, https://oecdonthelevel.com/2019/01/15/how-much-difference-do-the-doing-business-indicators-make/ (accessed on 27 July 2020).

[6] Transparency International (2020), CPI 2019: Eastern Europe & Central Asia, https://www.transparency.org/en/news/cpi-2019-eastern-europe-central-asia (accessed on 1 July 2020).

[24] UNECE (2018), Regulatory and Procedural Barriers to Trade in Georgia: Needs Assessment, United Nations Economic Commission for Europe, Geneva, https://www.unece.org/fileadmin/DAM/trade/Publications/ECE_TRADE_443E_Georgia.pdf (accessed on 27 July 2020).

[9] World Bank (2020), Economy Profile of Georgia: Doing Business 2020, World Bank Group, Washington DC, https://www.doingbusiness.org/content/dam/doingBusiness/country/g/georgia/GEO.pdf (accessed on 1 July 2020).

[25] World Bank (2020), Georgia 2019 Enterprise Surveys Data, https://www.enterprisesurveys.org (accessed on 3 July 2020).

[33] World Bank (2019), Poverty and Equity Brief: Georgia, World Bank, http://documents1.worldbank.org/curated/en/328091559890248187/pdf/Georgia-Poverty-and-Equity-Brief-Spring-2019.pdf.

[17] World Bank (2018), Georgia: From Reformer to Performer. Systematic Country Diagnostic, World Bank, Washington, DC, https://openknowledge.worldbank.org/handle/10986/29790 (accessed on 25 June 2020).

[11] World Bank (2007), Doing Business 2008, World Bank, Washington DC, https://www.doingbusiness.org/content/dam/doingBusiness/media/Annual-Reports/English/DB08-FullReport.pdf (accessed on 24 July 2020).

[10] World Bank (2004), Doing Business in 2004: Understanding Regulation, World Bank, Washington DC, https://www.doingbusiness.org/content/dam/doingBusiness/media/Annual-Reports/English/DB04-FullReport.pdf (accessed on 1 July 2020).

[32] World Travel and Tourism Council (2020), Georgia: 2020 Annual Research Key Highlights, World Travel and Tourism Council, https://wttc.org/Research/Economic-Impact.

[12] WTO (2016), Concluding Remarks by the Chairperson: Trade Policy Review of Georgia, https://www.wto.org/english/tratop_e/tpr_e/tp428_crc_e.htm (accessed on 2 July 2020).

[26] WTO (2015), Trade Policy Review of Georgia, World Trade Organisation , Geneva, https://www.wto.org/english/tratop_e/tpr_e/s328_e.pdf (accessed on 4 July 2020).

Notes

← 1. The absolute poverty line set by the Georgian government is based on a cost of basic needs methodology that sets the line higher than the World Bank’s definition of poverty for low-income countries at USD 1.90 per day. Based on this latter measure, the poverty rate in Georgia was only 4.5% in 2018, down from 10.7% in 2003. However, using the World Bank’s measure of poverty for upper-middle income countries (which Georgia has been classified as since 2018) of USD 5.50 per day, the poverty rate was 43% in 2018. All measures reveal similar trend lines for poverty in Georgia. For more on the Georgian government and World Bank poverty measures, see (World Bank, 2019[33]).

← 2. Figure for agricultural employment based on ILO modelled estimate differs slightly from Georgian government figures, which estimate that 38% of the employed population works in agriculture, forestry and fishing (Geostat, 2020[18]). This figure is subject to change as Geostat is in the process of revising its methodology for agricultural employment.