Promoting sustainable investment in Georgia’s agri-food value chain is crucial to ensure broad-based economic growth, support rural development and maintain competitiveness in international markets. This chapter underlines the key challenges to be addressed to attract more and better investment in Georgia’s agri-food value chain, and offers policy recommendations to address these challenges.

OECD Investment Policy Reviews: Georgia

4. Promoting sustainable investment in Georgia’s agri-food value chain

Abstract

Summary and policy recommendations

The agriculture and food sectors play an essential role in Georgia’s economy, together accounting for 10% of GDP and 44% of employment in 2019. With favourable climatic and soil conditions and an abundance of water resources, Georgia has great potential to attract investment in the agri-food value chain, but FDI inflows are below potential and the majority of investment in the value chain originates from domestic sources. Agri-food exports have grown rapidly over the past two decades but remain highly concentrated in beverages. Attracting FDI can help to boost exports of high-value food products, leading to increases in wages and productivity.

Whilst Georgia has made enormous progress in improving its investment climate in recent years, the agri-food value chain presents a unique set of challenges for investors. Most food products are predominantly grown by small-scale family holdings, which are often subsistence-oriented, with surplus production frequently sold on local markets. The farm structure is highly fragmented, with an average farm size of 1.4 hectares in 2014, and 77% of farms operating on land holdings of less than 1 hectare. With FDI inflows projected to decline in 2020 as a result of the COVID-19 pandemic, addressing these structural deficiencies will be essential to promote investment and generate new growth opportunities for the sector. Recommendations to promote sustainable investment in Georgia’s agri-food value chain are outlined below.

Policy recommendations

Introduce a specific objective and activities relating to investment promotion and facilitation within the new Agriculture and Rural Development Strategy of Georgia 2021-2027 and the Action Plan for 2021-2023.

Provide a clear and predictable framework for prospective investors to submit investment plans and obtain government approvals to acquire agricultural land.

Ensure full completion of the land registration reform, by raising awareness of the reform in rural communities and undertaking a systematic approach to land registration if necessary. Continue with the registration of state-owned lands, whilst ensuring that adequate safeguards are in place to protect the legitimate tenure rights of small-scale producers and rural communities.

Strengthen the provision of credit guarantees to reduce lending risks and encourage greater commercial lending to agri-food SMEs. Consider providing targeted guarantees for exporters operating under long-term supply contracts.

Continue investing in transport and utility infrastructure, and focus on improving the quality of rural road networks and increasing rural-urban connectivity. Encourage greater private sector participation in infrastructure development, and introduce measures to improve the quality of logistics services.

Continue efforts to rehabilitate outdated irrigation infrastructure and drainage systems, and ensure access to affordable and reliable internet access in rural areas.

Carefully assess the effectiveness of the co-financing schemes administered by the Agricultural and Rural Development Agency (ARDA), and consider allocating financial resources to encourage the formation of supply chain linkages.

Offer targeted incentives to prospective investors, conditional on their engagement with small-scale producers and agricultural co-operatives. Provide assistance to food processors and retailers to build the capacities of their suppliers, by providing cash, inputs and technical assistance in exchange for product supply.

Ensure that agri-food SMEs are able to benefit from well-resourced and functioning agricultural training institutes, extension services and vocational training systems. Well-trained extension workers can provide technical advice to SMEs and support the dissemination of new technologies, improving their ability to respond to the needs of large agricultural investors.

Strengthen food safety and quality standards, and introduce measures to increase awareness and compliance by small-scale producers. Provide support to foreign investors that are willing to invest in upgrading the capacities of SMEs to comply with food safety and quality standards.

Trends in agri-food investment, trade and productivity

The agri-food value chain plays an essential role in Georgia’s economy

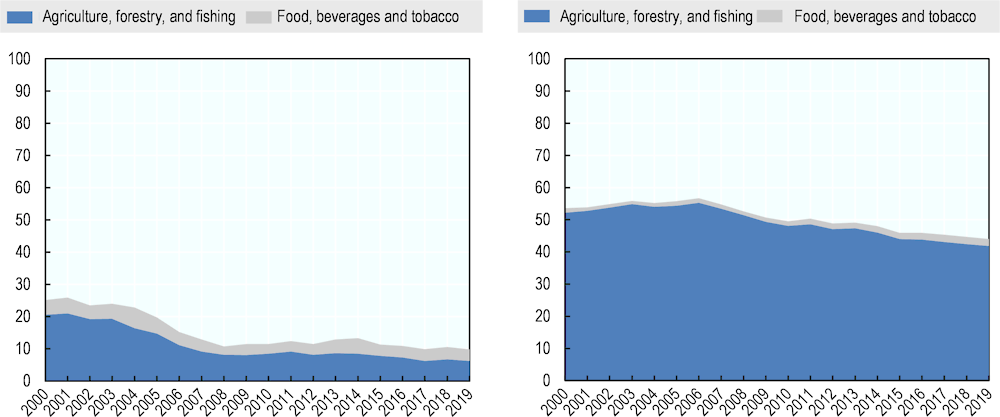

Georgia’s agricultural sector underwent a significant adjustment following the end of Soviet central planning in 1991. The collapse of collectivised agriculture, the removal of the former agricultural support system and the liberalisation of prices led to a sharp decline in agricultural output. The sector took some time to stabilise, with the transition enduring well into the mid-2000s. Nonetheless, the agri-food value chain still plays an essential role in Georgia’s economy. In 2019, primary agricultural production accounted for 6.2% of GDP and 42% of employment, while food, beverages and tobacco (food processing) accounted for 3.6% of GDP and 2.2% of employment (Figure 4.1). Food processing is also the largest manufacturing segment, representing 41% of value-added and 42% of employment in Georgia’s manufacturing sector in 2019.

With 41% of the population residing in rural areas, agriculture’s share of employment remains high (although it has declined slightly over the past decade). Nearly three-quarters of households involved in agriculture report producing mainly for their own consumption, and economic opportunities in non-agricultural activities are limited (World Bank, 2018). Thus, the sector provides an important safety net for much of the rural population, particularly subsistence-oriented households who may be more vulnerable to sharp economic contractions.

Figure 4.1. The agri-food value chain's role in the economy

Source: World Bank World Development Indicators (2019); Geostat (2019).

Foreign and domestic investment can support the development of Georgia’s agri-food value chain

Investment – both foreign and domestic – has the potential to generate substantial benefits for Georgia’s agriculture and food sectors. In addition to being an essential source of capital and job creation, investment can help to enhance productivity growth and drive improvements in the efficiency of agri-food value chains. Agricultural investment also plays a critical role in bolstering incomes, improving food security and supporting rural development. Furthermore, investment can generate positive spillovers for the local economy through business linkages, the transfer of knowledge, and the dissemination of new technologies (OECD, 2014).

Georgia has a number of favourable conditions for attracting investment in the agri-food value chain. It is strategically located at the crossroads of Europe and Asia, with important markets in the EU, Turkey, Russia and the Middle East at its doorstep. Georgia has a rich agricultural tradition and food is an integral part of the country’s culture and history. Rainfall and water resources are abundant, and high quality soils along with a wide variety of microclimates support the production of many high value crops and food products.

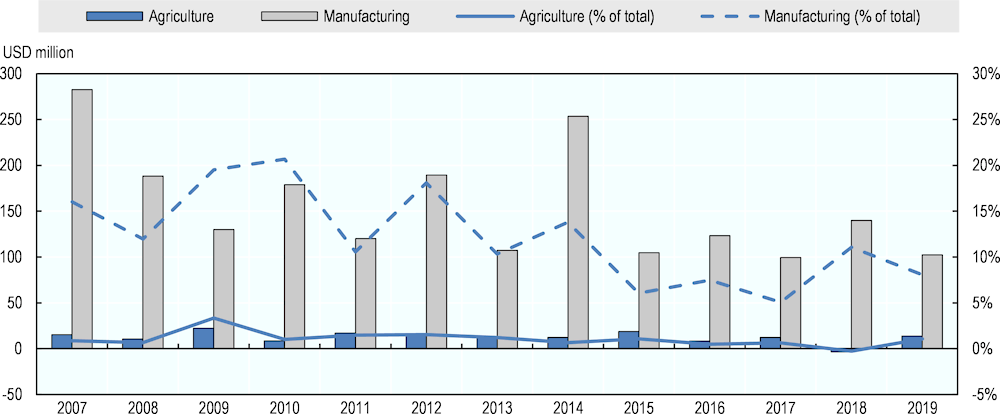

In spite of these advantageous circumstances, foreign direct investment (FDI) inflows in Georgia’s agricultural sector are low, particularly when compared with other sectors, such as manufacturing. FDI in agriculture fluctuates considerably from year to year and reached a high of USD 22 million in 2009 (or 3.3% of total FDI inflows). Agriculture recorded a small outflow of USD -3 million in 2018, but the sector has generally accounted for about 1% of total FDI inflows over the 13-year period covered in Figure 4.2. Unfortunately, detailed FDI data are not available for food processing and other manufacturing sub-sectors due to the confidentiality and sensitivity of business information, but, given food processing’s high share in manufacturing value-added, it is likely that the sector receives higher volumes of FDI inflows than primary agriculture.

Investment in Georgia’s agri-food value chain is likely to experience a sharp contraction in 2020, driven by the economic consequences of the COVID-19 pandemic and the projected drop in global FDI flows. Renewed efforts to attract FDI in the agriculture and food processing sectors can help to support the economic recovery by increasing productivity, supporting job creation and generating new opportunities for small-scale producers to participate in global value chains.

Figure 4.2. FDI in agriculture and manufacturing

Source: Geostat (2020).

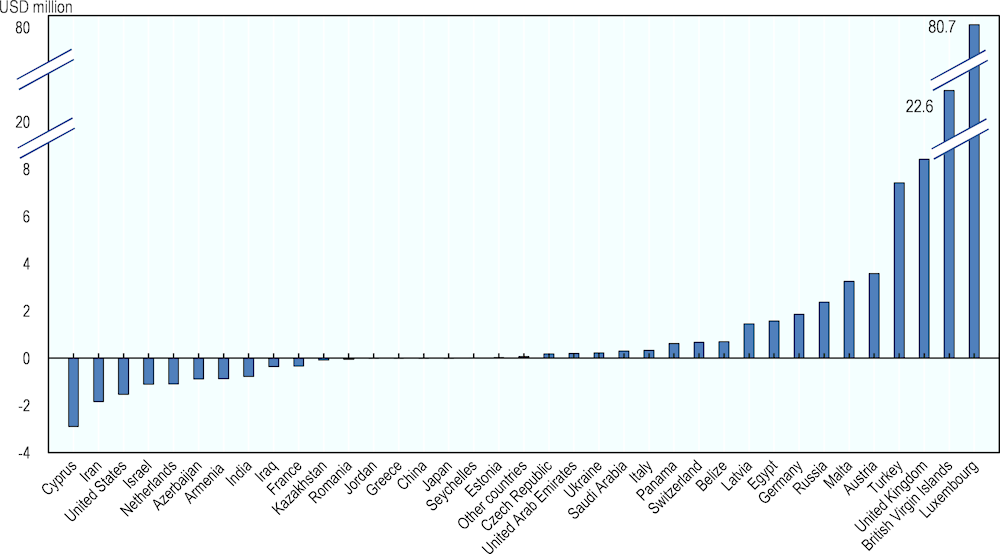

Figure 4.3 provides a breakdown of FDI in Georgia’s agricultural sector by country of origin. Over the ten-year period from 2009 to 2018, the four largest foreign investors were Luxembourg, the British Virgin Islands, the United Kingdom and Turkey. Together, these four countries accounted for USD 119 million (more than 95%) of net inflows of FDI in agriculture.

The breakdown by nationality in Figure 4.3 shows that a number of “offshore” low-tax jurisdictions feature prominently as sources of investment in Georgia’s agricultural sector. In addition to Luxembourg and the British Virgin Islands, it is worth noting that Cyprus1 and the Netherlands featured among the largest sources of divestment in Georgia’s agricultural sector over the past decade. One possible explanation for the outsized role of these jurisdictions is the use of “round-tripping” FDI – whereby some Georgian businesses may be channelling their investments through tax havens in order to re-invest in Georgia. Trans-shipping FDI transactions (for instance, Turkish investments channelled to Georgia through a low-tax jurisdiction) may also be an important contributing factor. In addition to the obvious fiscal advantages, round-tripping and trans-shipping FDI may be motivated by a desire to ensure confidentiality of the ultimate controlling investor, or to obtain coverage under an existing Georgian investment treaty. The exact share of round-tripping and trans-shipping in FDI between Georgia and these jurisdictions remains unknown.

Figure 4.3. FDI in agriculture by country of origin

Source: Geostat (2019).

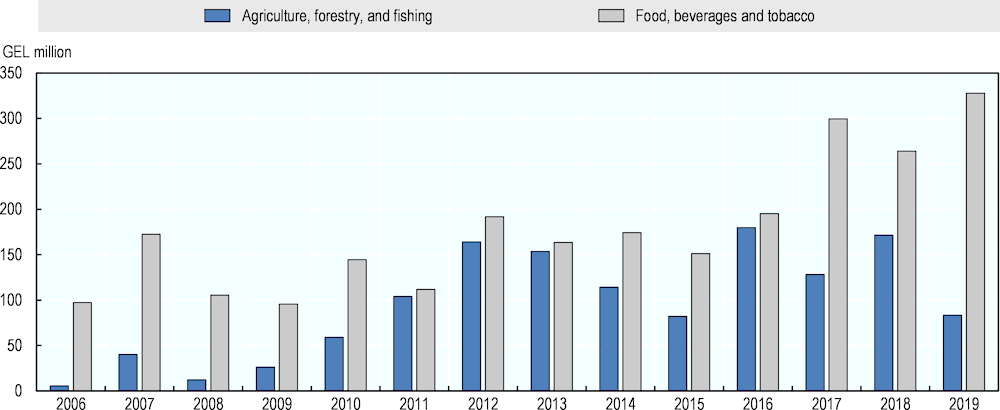

Fixed asset investment is a measure of capital spending on physical assets (e.g. real estate, infrastructure, machinery) that are held for more than one year. It can serve as a useful indicator for how much investment is occurring in a particular sector. Figure 4.4 illustrates the evolution of investments in fixed assets in the agriculture and food sectors. The data suggest that domestic investment in the agri-food value chain may exceed FDI inflows by a substantial margin. Furthermore, it is likely that an important share of agri-food FDI originates in the domestic economy (through round-tripping), suggesting that domestic investors provide an important source of capital for the sector’s growth and development.

Figure 4.4. Investments in fixed assets in agriculture and food processing

Source: Geostat (2019).

Trade is a crucial component of agri-food MNEs’ investment strategies

Trade is central to the operations of multinational enterprises (MNEs) in the agriculture and food sectors. Access to export markets is essential, as MNEs often invest with a view to exporting agri-food products. In addition, as MNEs increasingly spread their activities across countries in complex production chains, the availability of imported intermediate goods is increasingly necessary for firms to maintain their competitiveness in international markets (Greenville, Kawasaki and Jouanjean, 2019; OECD, 2019a). Increasing participation in agri-food global value chains (GVCs) is particularly relevant in the Georgian context, given the small size of the country’s land area and limited internal market.

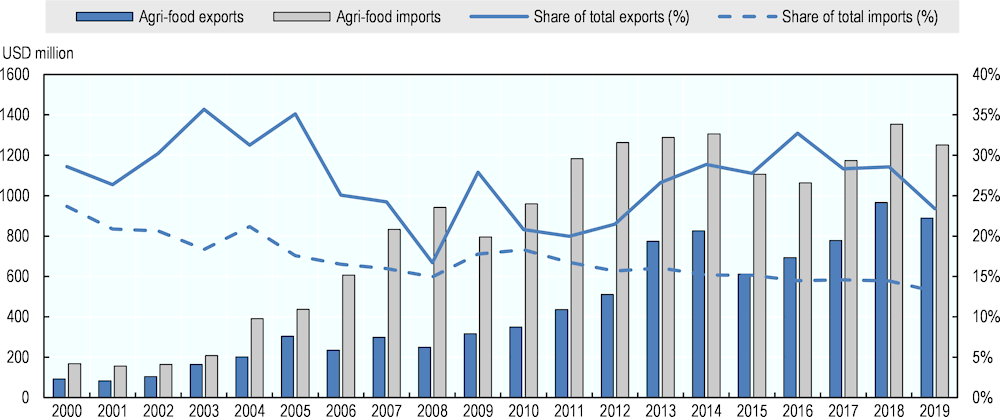

Georgia’s agri-food exports have grown substantially over the past two decades, from USD 93 million in 2000 to USD 889 million in 2019 (Figure 4.5). When viewed relative to total exports, however, the share of agri-food exports has fluctuated between 17% and 36%. Imports of agri-food products also grew rapidly, from USD 168 million in 2000 to USD 1.25 billion in 2019, while the sector’s share in total imports declined steadily, from 24% to 13%. Import growth was fuelled by improvements in incomes and living standards, which generated growing consumer demand for a wide variety of food products. As a result, Georgia remains a net importer of agri-food products.

Figure 4.5. Agri-food exports and imports

Note: Agri-food exports and imports are defined as the Harmonised System (HS) 2-digit commodity codes 01-24.

Source: Geostat (2020).

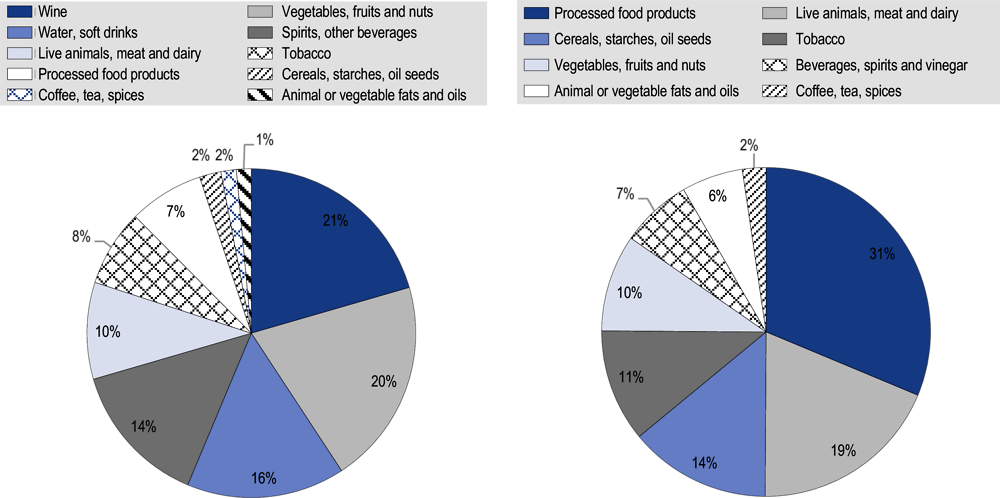

The composition of agri-food exports and imports over the 5-year period from 2015 to 2019 is shown in Figure 4.6. Beverages make up the majority of agri-food exports, with wine, spirits, mineral waters and soft drinks representing 50% of the total. Vegetables, fruits and nuts (including hazelnuts) are another major export category, accounting for 20% of agri-food exports. Georgia is highly dependent on imports to satisfy domestic demand for many staple food products. As a result, agri-food imports are more diversified, and include a broad range of processed food products, meat, dairy, cereals and tobacco.

Figure 4.6. Composition of agri-food exports and imports

Note: Agri-food exports and imports are defined as the Harmonised System (HS) 2-digit commodity codes 01-24.

Source: Geostat (2020).

Attracting FDI can boost productivity and wages in Georgia’s agri-food value chain

Recent OECD research finds that sectors receiving FDI are likely to experience stronger labour productivity growth, as foreign firms often outperform domestic firms. The performance premium of foreign multinationals can be explained by their access to advanced technologies and managerial expertise from their global branches, as well as their tendency to be larger and more capital-intensive than their domestic counterparts (OECD, 2019b).

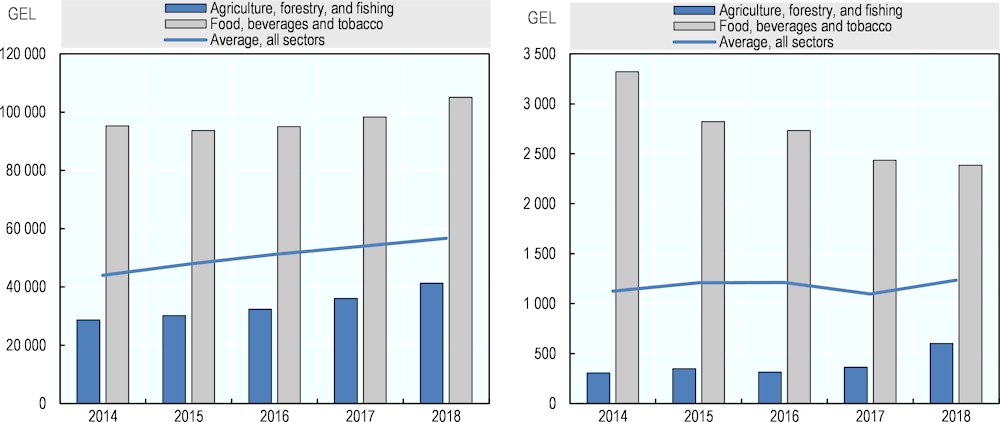

Productivity in Georgia’s agricultural sector is low when compared with the national average, reflecting its limited capacity to attract investment in recent years. Conversely, the food processing sector exhibits significantly higher levels of productivity. Labour productivity in Georgia’s agricultural and food sectors has increased steadily over the past five years. Capital productivity in agriculture has nearly doubled, while the productivity of capital in the food processing sector has decreased by nearly 30% (Figure 4.7).

Figure 4.7. Productivity in agriculture and food processing

Note: Labour productivity is calculated as output divided by the number of employees. Capital productivity is calculated as output per 1000 GEL of fixed capital.

Source: Geostat (2019a).

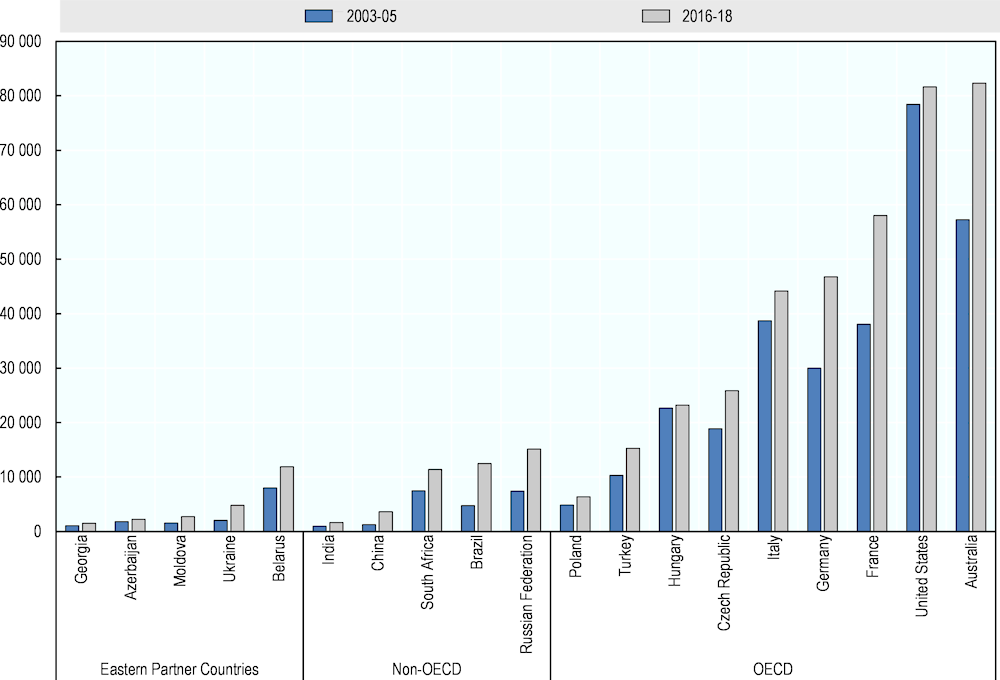

Labour productivity in Georgia’s agricultural sector (measured as agricultural value added per worker) is lower than comparable countries in the region, and several degrees of magnitude lower than the levels observed in a number of OECD and non-OECD countries (Figure 4.8). Low productivity levels in agriculture are a significant driver of rural poverty and are exacerbated by the lack of investment, limited financial resources, and inadequate information about markets and new technologies (WTO, 2016). Measures to attract investment (particularly FDI) in Georgia’s agricultural sector could therefore help to introduce more efficient production practices to the sector and reduce the productivity gap.

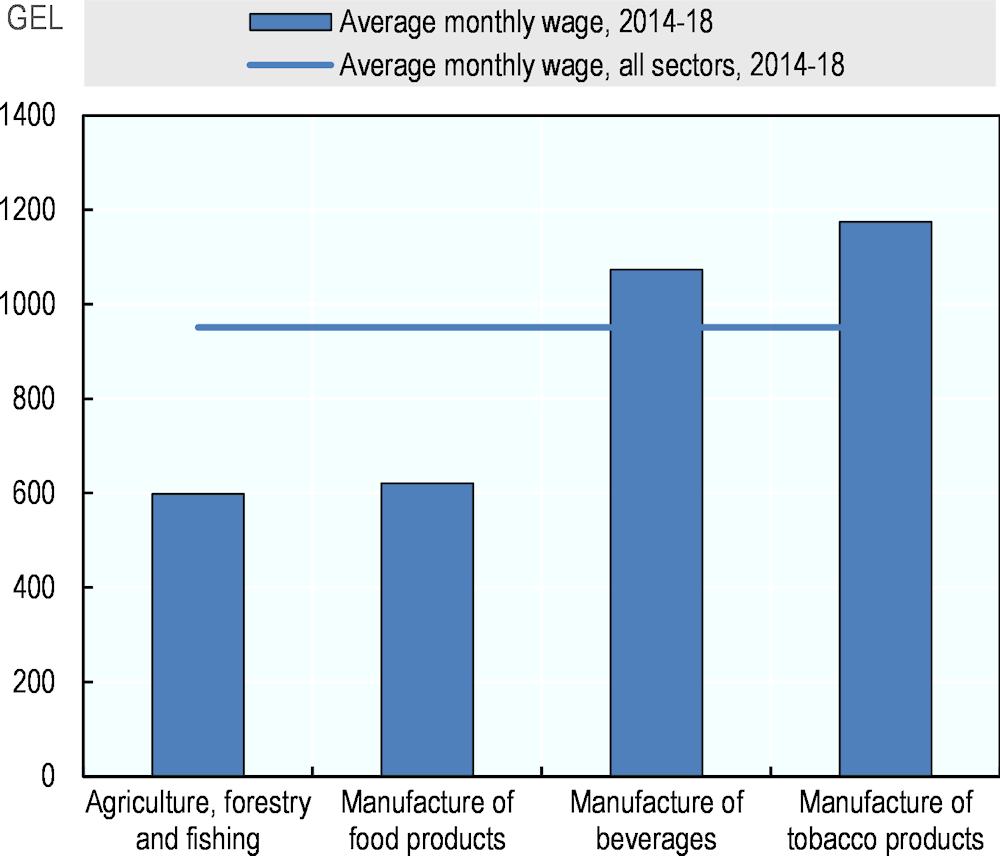

A similar picture emerges when looking at wages (Figure 4.9). Over the five-year period from 2014 to 2018, the average monthly wage of agricultural workers stood at GEL 599, 37% below the national average for the same period (GEL 951). Monthly wages in the “manufacture of food products” sector were also substantially lower than the national average, at GEL 620. On the other hand, wages in the beverage and tobacco manufacturing sectors were higher than the average for all sectors.

Evidence from the OECD (2019b) suggests that foreign affiliates pay higher wages than the average domestic business (although the extent of the foreign wage premium may vary considerably). Efforts to attract and retain FDI could potentially lead to important improvements in productivity and the creation of higher-paying jobs in Georgia’s agri-food value chain.

Figure 4.8. Labour productivity in agriculture: international comparisons

Source: World Bank World Development Indicators (2019).

Figure 4.9. Wages in the agri-food value chain

Source: Geostat (2019).

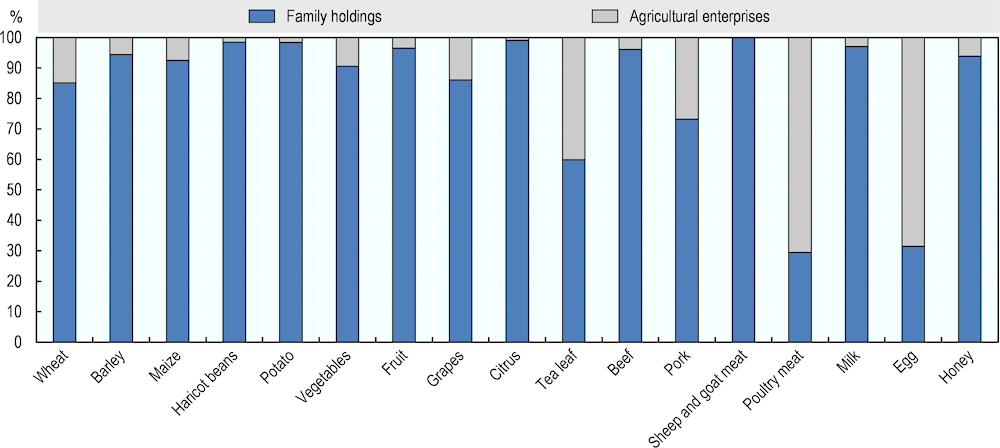

Low productivity in agriculture results from a confluence of factors. One of the most important reasons is that production is dominated by small-scale family holdings, which are often subsistence-oriented and only sell their surplus production in local markets. Family holdings account for more than 90% of the production of most agricultural commodities (Figure 4.10). Agricultural enterprises tend to be larger in size, and play a more substantial role in the production of wheat (15%), grapes (14%), tea leaves (40%), pork (27%), poultry meat (71%) and eggs (69%).

Figure 4.10. Production of agricultural commodities by farm type

Source: Geostat (2020a).

In spite of these challenges, a number of foreign MNEs have successfully invested in Georgia’s agri-food value chain in recent years. Some examples are listed in Table 4.1.

Table 4.1. Foreign investors in Georgia’s agri-food value chain

|

Company (Parent) |

Country of origin |

Year established |

Sector of production |

Land area (approx.) |

|---|---|---|---|---|

|

AgriGeorgia (Ferrero) |

Luxembourg |

2007 |

Hazelnuts |

4000 ha |

|

Agrowest Ltd. |

Egypt |

2012 |

Dryland cereals and pulses |

1650 ha |

|

Chateau Mukhrani |

Sweden |

2006 |

Wine |

160 ha |

|

Chirina |

Georgia/Russia |

2013 |

Chicken meat |

170 ha |

|

Foodland Ltd. |

Canada |

2010 |

Liquorice and herbs |

95 ha |

|

Georgian Wine and Spirits (Marussia Beverages) |

France |

2013 |

Wine |

400 ha |

|

Habibco Agriculture |

Egypt |

2012 |

Dryland cereals and pulses |

700 ha |

|

Hipp Georgia Ltd. (Hipp Switzerland) |

Switzerland |

2006 |

Organic apple processing |

Sources from local suppliers |

|

Landmark Ltd. |

Canada |

2012 |

Potatoes |

30 ha |

|

Marneuli Food Factory |

Georgia/Switzerland |

2007 |

Canned and bottled preserves |

1000 ha |

|

TR Georgia |

United Kingdom |

2011 |

Wheat, corn, barley, colza, soya, pomegranate, pistachio, hazelnuts |

7500 ha |

Source: USAID (2014), Transparency International Georgia (2014).

The policy environment for agri-food investment

The quality of a country’s investment climate can have an important influence on its ability to attract FDI. Foreign investors often have high expectations of the regulatory environment, infrastructure and support services provided by government bodies. By communicating their concerns to government agencies, foreign investors also play an important role in helping to improve regulatory approaches and modernise industry standards. This section reviews some of the relevant policy areas that influence investment (in particular FDI) in Georgia’s agri-food value chain.

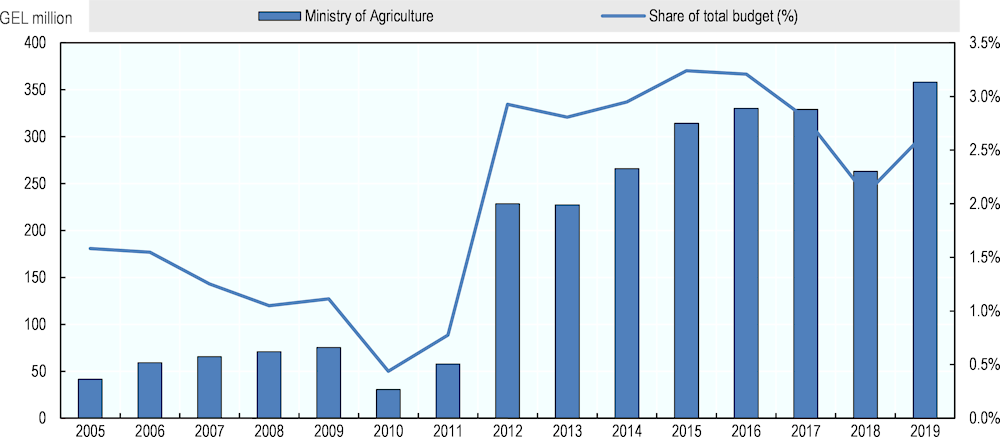

A broad range of policies and strategies have been developed to support Georgia’s agri-food value chain

Agriculture was largely neglected during the decade following the 2003 Rose Revolution. Beginning in 2012, the government demonstrated a renewed focus on agriculture, increasing budgetary allocations for the Ministry of Agriculture nearly fourfold from 0.8% to 2.9% of the total government budget (Figure 4.11). A number of new policy initiatives were also introduced, including the adoption of a new Law on Agricultural Co-operatives in 2013, the establishment of an Agricultural Co-operatives Development Agency, and investments to upgrade rural infrastructure and irrigation systems (USAID, 2014). The Agricultural Projects Management Agency (today known as the Agricultural and Rural Development Agency) was established in 2012, and provided subsidised loans and tax concessions to farmers through programmes such as the “Preferential Agrocredit Project”. Furthermore, the “Produce in Georgia” programme was introduced by Enterprise Georgia in 2014 to support local SMEs and stimulate food processing and industrial production (Agenda.ge, 2014). Until 2020, the programme allocated USD 43 million for the provision of financial support, free real estate and consulting services for prospective investors.

Figure 4.11. Budgetary allocations for the Ministry of Agriculture

Source: MAG (2015); Ministry of Finance of Georgia (2020).

The Ministry of Environmental Protection and Agriculture of Georgia (MEPA) has drafted a new Agriculture and Rural Development Strategy of Georgia 2021-2027, which was adopted by the government in December 2019. MEPA also developed the 2021-2023 Action Plan of the Agriculture and Rural Development Strategy 2021-2027, which is to be updated on an annual basis. The strategy and action plan were developed with financial support from the European Neighbourhood Programme for Agriculture and Rural Development (ENPARD), and technical advice provided by the United Nations Food and Agriculture Organisation (FAO) and the United Nations Development Programme (UNDP).

The new strategy provides a coherent and co-ordinated approach to agricultural and rural development (previously, the government had developed two separate strategies: the Strategy for Agricultural Development in Georgia 2015-2020 and the Rural Development Strategy of Georgia 2017-2020). The new strategy for 2021-2027 outlines three strategic goals: 1) competitive agricultural and non-agricultural sectors; 2) sustainable usage of natural resources, retaining the eco-system, adaptation to climate change; and 3) effective systems of food/feed safety, veterinary and plant protection. The three goals are then broken down into a number of specific objectives, and ten results-based indicators are listed with the baseline level as of 2018, and target levels to be achieved by 2027. Furthermore, the action plan lists more than fifty specific activities to be implemented, along with “implementation indicators” to measure and monitor progress. Responsible institutions are listed alongside each activity, with annual allocations of budgetary resources for 2021-2023 (MEPA, 2020a, 2020b). This marks a significant improvement from the previous strategies, which were lacking in quantitative, time-bound targets with clear delegation of responsibilities.

The new strategy and action plan contain a broad range of measures that, if implemented correctly, would undoubtedly strengthen the investment climate. However, there is no specific mention of “investment” amongst the current list of strategic goals, objectives, activities and implementation indicators. Introducing a specific objective and activities relating to investment promotion and facilitation could strengthen Georgia’s ability to attract and retain FDI in the agri-food value chain.

Investors in the agri-food value chain benefit from a relatively liberal trade policy regime

The government recognises that open, transparent and predictable trade policies play an important role in reducing transaction costs and increasing rates of return on investment. Georgia joined the World Trade Organization (WTO) in June 2000 and has since benefited from Most-Favoured-Nation (MFN) treatment by all WTO members. In addition, the country has established GSP arrangements with Canada, the EU, Japan, Switzerland, Turkey and the United States. Georgia has also signed bilateral and regional trade agreements with China, Turkey, the EFTA member states (Iceland, Liechtenstein, Norway and Switzerland) and eight countries of the former Soviet Union (Armenia, Azerbaijan, Kazakhstan, the Republic of Moldova, the Russian Federation, Turkmenistan, Ukraine and Uzbekistan).

Access to a competitive and diverse set of imports can generate growth in the agri-food value chain by allowing countries to leverage their comparative advantage in different stages of production (Greenville, Kawasaki and Jouanjean, 2019; OECD, 2019a). Georgia’s MFN tariff rate of 1.5% is among the lowest in the world, and more than 80% of Georgia’s imports are duty-free. While imports of agricultural products are subject to tariffs and SPS measures, the simple average MFN tariff rate for agricultural products (WTO definition) has fallen steadily, from 7.2% in 2009 to 6.5% in 2018 (WTO, 2019).

Agri-food exports fell sharply in 2006, when Russia introduced a trade embargo on Georgian agricultural products. The embargo was eventually lifted and Russia reopened the border to Georgian freight in 2013, resulting in the resumption of Georgian exports of wine and mineral water.

The EU is one of Georgia’s largest trade partners, accounting for 13% of agri-food exports and 23% of agri-food imports in 2019. In 2012, the government embarked on a series of reforms seeking to approximate EU standards and legislation across a range of different areas. These efforts culminated with the signing of an Association Agreement between the EU and Georgia in June 2014. As part of the Association Agreement, a Deep and Comprehensive Free Trade Area (DCFTA) was set up in September 2014, resulting in the removal of all import duties on agricultural products by both parties. The increased market access led to a sharp increase in the exports of some Georgian agri-food products: exports of hazelnuts and fruit juices more than doubled in the six-month period following the introduction of the DCFTA (European Commission, 2015).

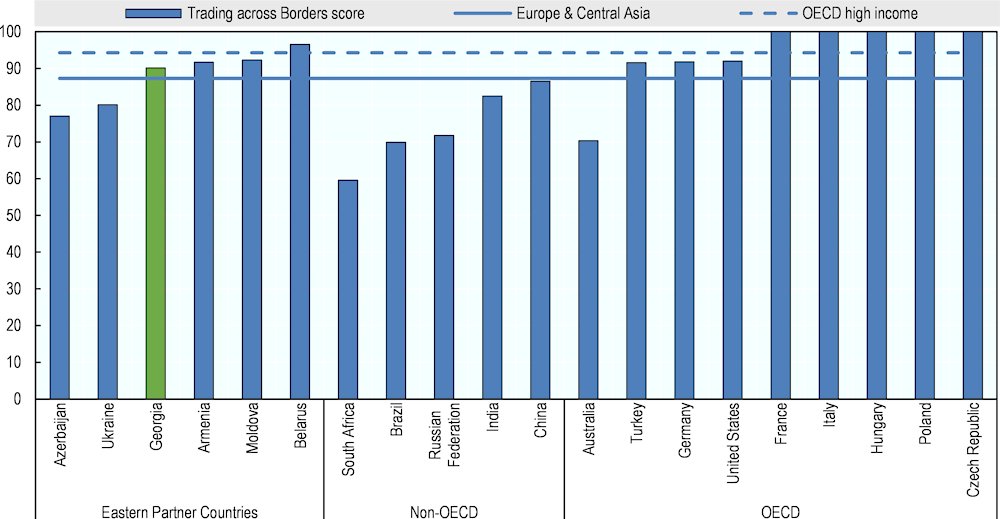

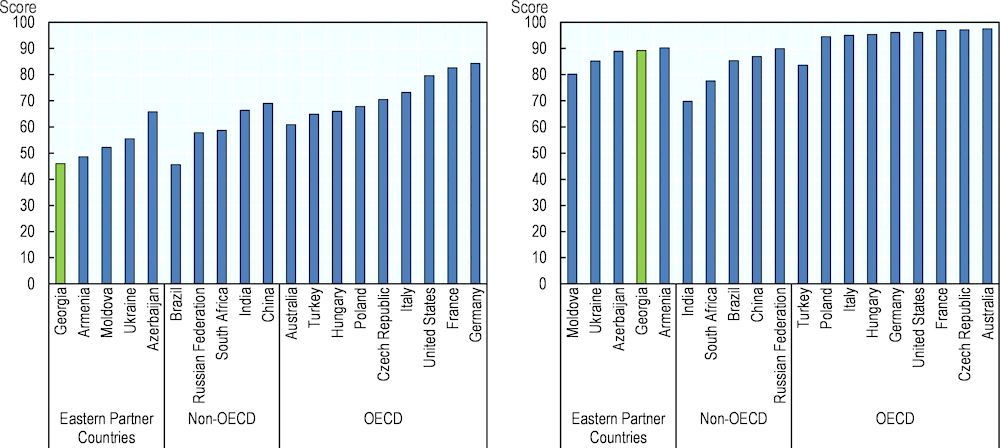

Georgia has undertaken an impressive range of reform initiatives to streamline, liberalise and simplify trade regulations and their implementation. Customs regulations and trade facilitation measures have improved steadily over the past decade, helping to position the country as a regional logistics and transit hub linking Europe and Asia via the Caucasus. In addition to reducing the time and cost of importing and exporting, the government has opened several customs clearance zones to support businesses with filling out customs declarations, customs clearance, examination and inspection services, issuing certificates and permits, and other trade facilitation services. Georgia ranked 45th out of 190 economies in the World Bank’s Doing Business assessment of Trading across Borders in 2020. The country’s score is above the average for the Europe and Central Asia region, but below the average for OECD high-income countries (Figure 4.12). The government also adhered to the WTO Trade Facilitation Agreement in 2016, which should help to improve the movement of goods across borders and ultimately, to facilitate Georgia’s integration in agri-food GVCs.

Figure 4.12. Trading across borders: international comparisons

Note: A score of 100 represents the best regulatory performance.

Source: World Bank Doing Business (2020).

Investment restrictions in the agriculture and food sectors are low by international standards

Georgia offers a relatively open and liberal environment for investors in the agriculture and food sectors. Apart from restrictions on foreign ownership of agricultural land (discussed below), the law secures equal treatment and rights for both foreign and Georgian investors. The government does not screen foreign investment in the agriculture and food sectors; registration is the only requirement. Licenses are not mandatory for agricultural and food processing firms, as the government has eliminated licensing requirements in nearly all sectors, with the exception of those that may affect public health, national security and the financial sector (WTO, 2016).

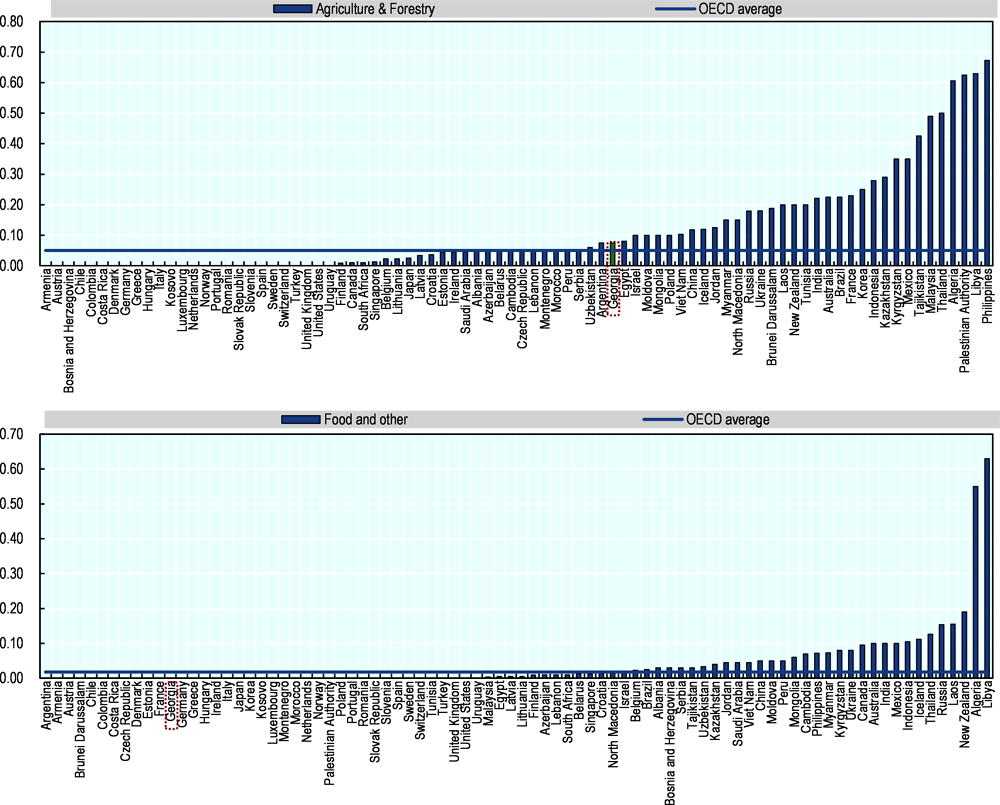

Investment restrictions in agriculture and forestry, when measured using the OECD’s FDI Regulatory Restrictiveness Index, are slightly higher than the OECD average, but still significantly lower than the restrictions observed in many non-OECD countries. The food processing sector is open for foreign investment and not subject to any statutory restrictions (Figure 4.13).

Figure 4.13. FDI restrictions in agriculture and food

Note: Open = 0; Closed = 1.

Source: OECD.Stat (2020).

Reforms restricting foreign ownership of agricultural land in Georgia have sparked considerable controversy in recent years. In June 2013, the Parliament introduced a temporary legal ban restricting foreigners (and Georgian entities with foreign minority shareholders) from purchasing or inheriting agricultural land. The ban, which was due to last until December 2014, was declared unconstitutional and suspended by the Constitutional Court in June 2014. The government also passed amendments to the land legislation in February 2014, establishing a government-appointed commission to screen foreign purchases of agricultural land on a case-by-case basis.

Parliamentary debate on the issue continued and in June 2017, an amendment was made to the Law on Agricultural Land Ownership re-introducing the ban preventing foreigners, legal entities registered abroad, and legal entities registered by foreigners in Georgia from purchasing agricultural land. The amendment was designed as a temporary measure, to be put in place until a new Constitution entered into force. The new Constitution was adopted in December 2018, specifying under Article 19 that “agricultural land may be owned only by the State, a self-governing unit, a citizen of Georgia or an association of citizens of Georgia” (Parliament of Georgia, 2018). The new Constitution also states, “Exceptional cases may be determined by the organic law, which shall be adopted by a majority of at least two thirds of the total number of the Members of Parliament.” This clause paved the way for the preparation of a new law on agricultural land ownership.

After much deliberation, the Organic Law of Georgia on Agricultural Land Ownership was adopted on 25 June 2019. While the new law does not allow foreign-registered legal entities to own agricultural land in Georgia, it does specify two exceptional circumstances under which foreigners may be entitled to own agricultural land. The first allows foreign citizens to receive agricultural land as an inheritance. The second applies to legal entities registered in Georgia, whose “dominant partner”2 is owned and controlled by a foreigner. In such cases, the foreign-owned or foreign-controlled Georgian company may be granted permission by the government to purchase agricultural land on the basis of an investment plan. According to the new law, an investment plan should specify how an agricultural land parcel would be used to support agricultural production, new innovative activities, tourism infrastructure, or important projects that help to protect national security or support job creation (Parliament of Georgia, 2019a).

The law On Determination of the Designated Purpose of Land and on Sustainable Management of Agricultural Land was also adopted on 25 June 2019. Article 14 of the law outlines plans for the adoption of regulations on “the procedure for the submission of investment plans and for making decisions in relation to investment plans”, and “the procedure for making decisions on transferring a plot of agricultural land into state ownership and on the determination and payment of the cost of land” (Parliament of Georgia, 2019b). A rapid adoption of these regulations would help prospective investors to operate within a clear and predictable framework when seeking to acquire agricultural land for new investment projects.

Restrictions on foreign ownership of agricultural land have been a contentious topic in recent years, partly because they had the unintended consequence of reducing access to finance for small-scale farmers. With the largest banks in Georgia being mostly foreign-owned, the restrictions prevented them from seizing mortgaged land from borrowers that had defaulted on their loans. As a result, many smallholders were unable to obtain financing, as banks refused to accept their land holdings as collateral.3 The new organic law helps to assuage some of these concerns, by stating that the restrictions do not apply to banks and other financial institutions that obtain ownership rights for agricultural land by undertaking activities permitted by Georgian legislation, “including in case of acquisition of collateral by a creditor” (Parliament of Georgia, 2019a).

During previous reforms to the legislation on land ownership, a number of groups expressed concerns that the restrictions might affect Georgia’s ability to attract FDI in the agri-food value chain. The reforms were seen as an impediment to the operations of foreign businesses, with the added uncertainty having a negative impact on investor sentiment (Transparency International Georgia, 2014; Lomsadze, 2017; Bacchi, 2019). A stable policy framework was therefore necessary to encourage foreign investment and reap the full benefits of the finance, skills and training provided by foreign companies.

Evidence suggests that secure and well-defined land rights (either ownership or lease rights) have a positive influence on the foreign investment decisions of agri-food MNEs (Punthakey, 2020). In particular, strong protection of land tenure and land rights can provide businesses with the confidence to make long-term investments to improve the productivity and sustainability of their land holdings. At the same time, adequate safeguards are needed to protect the legitimate tenure rights of small-scale producers and rural communities. The Voluntary Guidelines on the Responsible Governance of Tenure of Land, Fisheries and Forests in the Context of National Food Security provide guidance for policy makers to promote secure tenure rights and equitable access to land, fisheries and forests (FAO, 2012).

A well-functioning market for agricultural land could help to encourage investment

Georgia is endowed with 6.9 million hectares of land, of which 2.4 million hectares (about 34%) is classified as agricultural. However, only a portion of this land is currently in use: according to the 2014 Agricultural Census, there were 571 900 households and 2 200 legal entities operating on 787 700 hectares of agricultural land. The average farm size was 1.4 hectares in October 2014, with 77% of farms operating on land holdings less than 1 hectare in size (utilising 21.5% of the total area of operated agricultural land) (Geostat, 2016).

Fragmentation of land holdings is one of the root causes of low productivity and a key issue faced by both domestic and foreign investors in the agri-food value chain. As a result, there are very few large-scale FDI projects in Georgia’s agri-food value chain. In 2014, two investors (Ferrero/Agri Georgia and TR Georgia) collectively owned about 11 000 hectares of land, accounting for two-thirds of the total area of foreign-owned agricultural land (Transparency International Georgia, 2014). Furthermore, many of the micro-sized land plots in Georgia are cultivated using outdated methods, and a significant number of plots are not cultivated at all. Some degree of consolidation is therefore necessary to allow farm holdings to benefit from economies of scale, attract investment in the value chain and foster the development of commercial agriculture.

The fragmented farm structure dates back to Georgia’s transition from the Soviet Union. In 1992 and 1993, agricultural land was divided into micro-sized plots and distributed amongst the rural population, with approximately 760 000 hectares of agricultural land transferred into private ownership (Millns, 2013). However, much of this land was unregistered and land property rights in rural areas remained largely informal for many years. A first attempt at land registration began in the late 1990s, but encountered substantial difficulties due to the lack of a functioning land cadastre and heavy reliance on outdated maps of villages and municipalities. A more formal land registration process based on a new cadastre began a decade later, registering over 1.2 million hectares of land between 2008 and 2016 (Kochlamazashvili, 2019; NAPR, 2019).

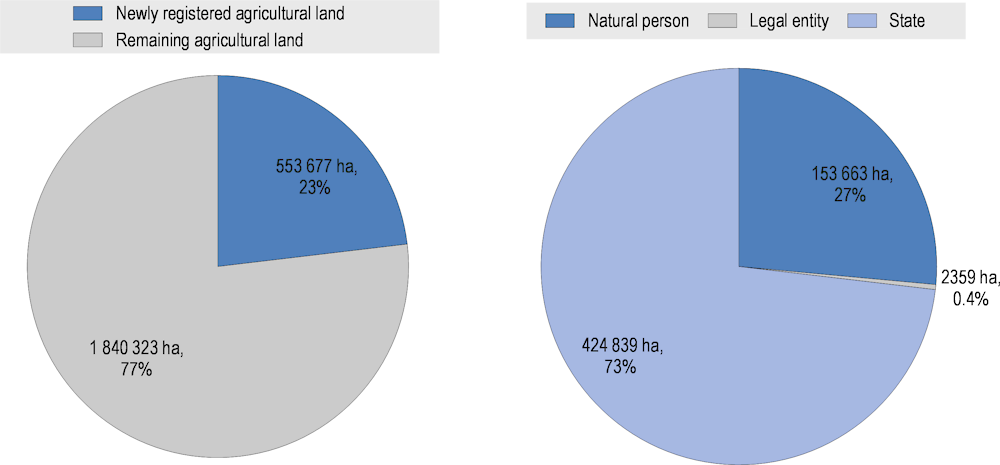

A new land registration reform commenced in 2016, led by the National Agency of Public Registry (NAPR) under the Ministry of Justice. The reform aims to achieve full coverage of the country’s land resources, improved accuracy and quality of data, and clear land titles guaranteeing property rights. The Land Registration Reform Act was adopted on 1 August 2016, simplifying procedures and making land registration more accessible to citizens. In particular, NAPR developed a “one-stop-shop” to provide landowners with free access to a variety of registration services upon submission of the relevant documents pertaining to their land plots (NAPR, 2019). Between August 2016 and September 2019, over 550 000 hectares, or 23% of Georgia’s total stock of agricultural land, was registered by NAPR. Looking at the ownership structure of this land, however, it becomes apparent that the vast majority (73%) of newly registered agricultural land is state-owned (Figure 4.14). The National Agency of State Property (NASP) is responsible for privatising state-owned lands and leasing agricultural land belonging to the state. Initially, measures taken by the NASP to register state-owned land triggered some disputes with rural landowners. To avoid the risk of further disputes, the NASP has decided to wait until all privately owned land plots are registered, before continuing with the registration of state-owned land.

Figure 4.14. Progress in the registration of agricultural land

Note: Includes land registered between August 2016 and September 2019.

Source: NAPR (2019).

The reform undertaken by the NAPR relies primarily on a sporadic approach to land registration, with voluntary participation by landowners. A systematic approach, whereby the government directly approaches landowners to register their parcels, has also been piloted in twelve settlements across Georgia, although a recent study by the ISET Policy Institute found that many small-scale farmers do not wish to register their land plots (Kochlamazashvili, 2019). A number of the surveyed farmers were afraid that registration would lead to the loss of social benefits, being subject to taxation, or disputes over the boundaries of their land. Furthermore, some overly indebted landowners expressed fears that registration could result in their land holdings being seized by creditors. The study also observed a general lack of awareness and understanding of the reform amongst rural inhabitants.

A comprehensive land register can facilitate land consolidation and support the development of a transparent and well-functioning market for agricultural land. The study conducted by the ISET Policy Institute suggests that a systematic approach may be needed to ensure completion of the land registration reform. Such an approach could be combined with information campaigns to raise awareness in rural communities and improve the public’s understanding of the importance of the reform (Kochlamazashvili, Kakulia and Deisadze, 2018). Greater progress on the registration of state-owned lands may also be necessary, particularly if the pace of sporadic (i.e. voluntary) land registration slows considerably.

In 2020, MEPA plans to spend GEL 2.4 million on establishing a National Agency for Sustainable Land Management and Land Use Monitoring. The agency will employ 70 people and will be in charge of developing an agricultural land policy, collecting data on agricultural land use, and establishing a unified land database (Georgia Today, 2019). Having a complete land register could improve the security of land tenure, strengthen spatial land-use planning and the management of state-owned lands, and help the government to identify new land plots for prospective investors (World Bank, 2018). Furthermore, increased investment in agricultural land can lead to higher land valuations, providing small-scale producers with opportunities to use their land as collateral and to lease, sell or invest in their land.

There is scope to enhance access to finance in the agri-food value chain

Investors in the agri-food value chain can benefit from well-functioning financial markets with adequate competition in financial services. A transparent regulatory framework with clearly defined and well-enforced rights of borrowers, creditors and shareholders is essential to encourage lending by financial intermediaries. Microfinance organisations and other non-bank financial institutions can complement the formal banking sector, by providing credit to smallholders in remote areas that do not meet banks’ lending requirements. Other supply-side measures, such as leasing contracts, factoring, and credit guarantee schemes, can also improve access to finance. On the demand side, financial literacy programmes can help small-scale producers to evaluate available financing options more effectively, leading to increased uptake of financial services (OECD, 2014).

Georgia has made important progress in strengthening access to finance in recent years. The legal and regulatory framework is well developed with adequate protection of creditors’ rights, and capital requirement regulations are in line with Basel III. Efforts have also been made to strengthen minority shareholder rights and insolvency procedures. The coverage of the private credit information bureau has expanded to cover 100% of Georgia’s population, and now includes data on non-bank financial institutions, retailers and utility providers (OECD et al., 2020). The new law on agricultural land ownership adopted on 25 June 2019 (described above) allows for the use of land as collateral, which should facilitate access to credit from formal financial institutions.

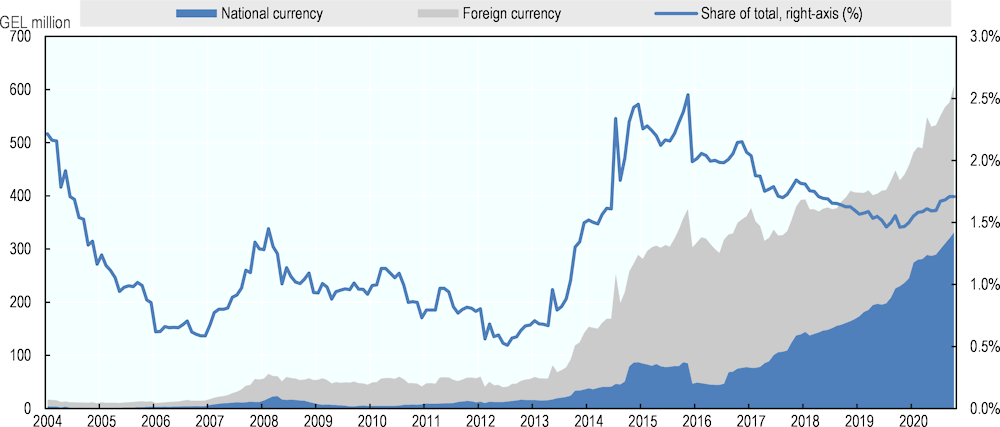

Commercial lending to agriculture has expanded significantly since 2013, albeit from a low base (Figure 4.15). Fast growth in domestic currency lending led to a substantial reduction in the share of foreign currency loans, from 85% in July 2016 to 45% in October 2020. The agricultural sector’s share of total bank lending has fluctuated between 0.5% and 2.5% over the past two decades, which is substantially lower than its contribution to GDP. This reflects an overall reluctance on the part of the banking sector to lend to agricultural enterprises.

Figure 4.15. Commercial lending to the agricultural sector

Note: “Share of total” represents the share of “Agriculture, forestry and fishing” in total commercial bank lending.

Source: National Bank of Georgia (2020).

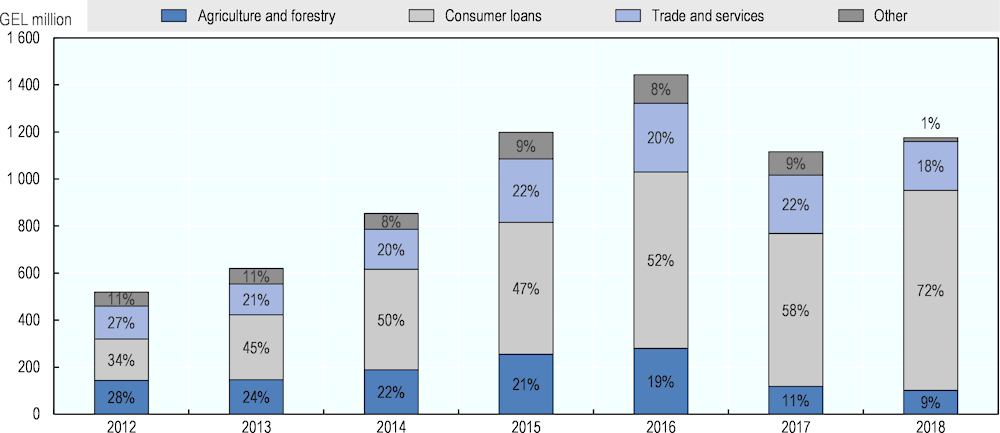

The non-bank financial sector includes 48 microfinance organisations and one credit union (as of 31 December 2019). Microfinance organisations provided GEL 104 million of loans to agriculture and forestry in 2019, which amounted to 9.2% of the total credit portfolio. This represents a significant reduction from the levels observed in 2012, when the sector attracted GEL 143 million of loans and accounted for 28% of lending (Figure 4.16). The National Bank of Georgia has strengthened the regulation and supervision of the non-bank financial sector, by introducing more stringent registration requirements for microfinance organisations and by making it mandatory for them to provide information about their sources of capital (National Bank of Georgia, 2019). Whilst regulatory standards should facilitate the provision of small-scale rural financial services, policies should also ensure that the sector has sufficient capabilities to limit systemic risk (OECD, 2014).

Figure 4.16. Lending by microfinance organisations

Source: National Bank of Georgia (2019).

In spite of fast credit growth and ample liquidity in the banking and non-bank financial sectors, the level of dollarisation remains significant, which can be problematic for smallholders and agri-food SMEs, as they are unlikely to be hedged against foreign exchange risks. To help alleviate financial difficulties associated with currency fluctuations, the government introduced a programme to support the “larisation” of loans in January 2017. Citizens were given an opportunity to convert their US Dollar denominated loans to Georgian Lari at a preferential rate, and the government decreed that all loans of less than GEL 100 000 could no longer be issued in foreign currency (the ceiling was later increased to GEL 200 000 in 2019). Consequently, the dollarisation rate of the microfinance credit portfolio fell from 54% in 2016 to 16% in 2018 (National Bank of Georgia, 2019).

Public financial support programmes are mostly channelled through the Agricultural and Rural Development Agency (ARDA), an implementing agency under the Ministry of Environmental Protection and Agriculture (MEPA). ARDA receives the largest share of MEPA’s funding: in 2020, the agency will be allocated GEL 143 million, or 41% of the Ministry’s total budget4 (Georgia Today, 2019). Box 4.1 outlines the main financial support programmes provided by ARDA to farmers and companies in the agri-food value chain. The majority of funding goes to the Preferential Agrocredit Project, which was allocated GEL 74 million in 2020 (about 52% of ARDA’s budget).

Box 4.1. The Agricultural and Rural Development Agency (ARDA)

The Agricultural and Rural Development Agency (ARDA) is an implementing agency under the Ministry of Environmental Protection and Agriculture of Georgia (MEPA). Some of the main support programmes provided by ARDA include:

Plant the Future: Financial and technical assistance is provided to growers of perennial crops (e.g. berries, fruits, nuts) and nursery gardens. Co-financing is provided for purchases of saplings of perennial plants and the installation of modern drip irrigation systems.

Georgian Tea Plantation Rehabilitation Programme: Co-financing is available for rehabilitation works on tea plantations.

Improving Rural Development in Georgia: Implemented with funding from the EU’s ENPARD programme, this programme provides co-financing to businesses for non-agricultural activities that support economic diversification and job creation in rural municipalities.

Programmes to Support the Development of Agricultural Co-operatives: Includes co-financing of equipment, machinery, branding, and other expenses of agricultural co-operatives.

Young Entrepreneur: Implemented with support from the Danish International Development Agency (DANIDA), a combination of financial support (co-financing) and technical assistance is provided to young entrepreneurs in rural areas, primarily for agricultural business activities.

Co-financing of Agro Processing and Storage Enterprises: Co-financing and preferential lending/leasing is provided for new food processing plants and storage enterprises.

Programme of Agro-production Promotion: Co-financing is provided to individual farmers, food processing plants and agricultural co-operatives, to support productivity and quality improvements, the expansion and modernisation of facilities, and the implementation of international standards. The programme is funded by the International Fund for Agricultural Development (IFAD) and the Global Environment Facility (GEF).

Preferential Agrocredit Project: Provides preferential loans or leasing to finance working capital or fixed assets for primary agricultural production, processing and storage companies.

Agroinsurance: This programme aims to develop a market for agricultural insurance in Georgia, by providing farmers with subsidised insurance premiums.

Source: ARDA (2020).

Enterprise Georgia provides support to agri-food SMEs via the “Produce in Georgia” programme. Launched in 2014, the programme provides financing, real estate, and consulting services to prospective investors. Enterprise Georgia works with the NASP to identify available state-owned land plots, and transfers them to prospective investors free of charge (conditional on their meeting certain investment obligations). Between May 2014 and May 2020, the programme provided financing for 67 food processing enterprises, generating GEL 200 million of investment (including loans issued by commercial banks and additional investments made by beneficiaries). Enterprise Georgia also launched a credit guarantee scheme in 2019, together with 14 of the largest Georgian banks. The scheme is available to firms in a number of sectors including food processing, and provides up to 90% loan security on loans ranging from GEL 20 000 to GEL 5 000 000, with a maximum maturity of 10 years.

The EU is a major donor providing financial and technical assistance to the agri-food value chain through ENPARD. With a budget of EUR 180 million over the period 2013-2022, the programme has allocated significant resources to finance rural development projects and local business initiatives across Georgia. An important objective of ENPARD is to strengthen co-operation amongst small farmers, and the programme has provided more than 280 co-operatives with direct funding and technical assistance.

The Partnership Fund is a state-run investment fund established in 2011 to facilitate private investment in Georgia by providing co-financing for new projects in key strategic sectors (including agriculture, energy, manufacturing, real estate, tourism, infrastructure and logistics). To date, the Partnership Fund has supported five projects in the agri-food value chain (Table 4.2).

Table 4.2. The Partnership Fund: support for agri-food investment projects

|

Project |

Description |

Partner |

Date/Status |

Cost |

|---|---|---|---|---|

|

Georgian Mountain Pig Breeding Farm |

Construction of a pig breeding farm and modern meat processing plant |

DeRaza ibérico (Spain) |

Ongoing, 5-7 years |

USD 700 000 |

|

Greenhouse “Imereti Greener” |

Production of lettuce and high quality vegetables with modern Dutch technology |

FoodVentures BV (Netherlands) |

June 2016 |

USD 4.8 million |

|

Blueberry plantation |

Largest blueberry plantation in Georgia |

Vanrik Agro (Georgia) |

February 2015 |

USD 6.7 million |

|

Livestock complex “Kalanda” |

Pig breeding farm equipped with modern machinery |

Geopharm (Georgia) |

June 2013 |

USD 10.3 million |

|

Georgian Tea Rehabilitation Project |

Establishment and restoration of tea plantations |

Beijing Jinfenghengye Agricultural Development Co. Ltd. (China) |

Ongoing, 12 years |

USD 500 million |

Source: Georgia Today (2018); Partnership Fund (2020).

Whilst the government has established the foundations for lending in the agri-food value chain, more can be done to address underlying weaknesses in financial markets. Beyond the provision of co-financing and concessional loans, a greater emphasis on supply chain linkages (explored in detail in the next section) could provide a more sustainable solution to existing credit constraints in the sector. In addition, measures to reduce some of the risks inherent in agriculture are necessary to encourage greater engagement between financial institutions and the agri-food value chain. Market-based instruments such as Enterprise Georgia’s credit guarantee scheme could be strengthened and targeted to exporters operating under long-term supply contracts, helping to reduce lending risks to commercially acceptable levels. Greater investment in early warning and prevention systems could help to mitigate weather-related risks (World Bank, 2018). Finally, capital market financing remains underdeveloped in Georgia. Over the long run, the government should work to establish transparent and liquid capital markets that can act as a financing channel for medium and large-scale agri-food investors.

Further improvements to infrastructure and logistics services are needed

Investors require well-developed infrastructure, including access to reliable road networks, energy supplies, and information and communication technologies (ICTs). In the agri-food value chain, rural road networks play an essential role in connecting farmers to markets and supporting integration in GVCs. Reliable transport and storage infrastructure can facilitate the development of value chains, by reducing post-harvest losses and linking agricultural production in remote rural areas with domestic and international markets. Well-maintained and efficient irrigation networks can reduce the risks of chronic water shortages and provide an important channel for agricultural productivity improvements (OECD, 2014). Furthermore, ensuring affordable access to ICTs in rural areas can provide farmers with real-time information on food prices and weather conditions, improve the reach of early-warning systems, and facilitate the adoption of new digital technologies and innovations in the agri-food value chain.

The quality of Georgia’s existing infrastructure varies significantly. Transport infrastructure ranks amongst the poorest in the region, whilst utility infrastructure is relatively well developed (Figure 4.17). Improvements to the major road and railway routes have helped to strengthen transport connectivity, but substantial deficiencies remain. Major transport corridors have limited capacity to allow for increased traffic, and seasonal port congestion is a recurring issue. Internal connectivity is also weak, with one third of secondary and half of local roads in poor condition (World Bank, 2018). Underdeveloped rural road networks prevent farmers from connecting with local and regional markets and are a significant constraint for investors in the agri-food value chain. Improving transport connections between urban and rural areas can foster both agricultural and non-agricultural activities, generating improved living standards in rural areas.

Figure 4.17. Quality of infrastructure: international comparisons

Source: WEF (2019).

The quality of a country’s logistics services, and its efficiency in moving physical goods both across and within its borders, are key determinants of its ability to participate in agri-food GVCs. Georgia performs poorly in the World Bank’s Logistics Performance Index, reflecting the limited capacity of its transport infrastructure and low efficiency of logistics providers (Figure 4.18). Georgia’s scores were lower than the average for the Europe & Central Asia region across all sub-dimensions of the index, and significantly lower than Germany, which was the top performer in 2018. The areas where Georgia has the greatest room for improvement include the ability to track and trace consignments (ranked 139th), the competence and quality of logistics services, such as transport operators and customs brokers (132nd), and the ease of arranging competitively priced international shipments (124th). Addressing these “soft” constraints is a necessary precondition for Georgia to realise the benefits of greater investments in physical infrastructure.

Figure 4.18. Logistics Performance

Source: World Bank Logistics Performance Index (2018).

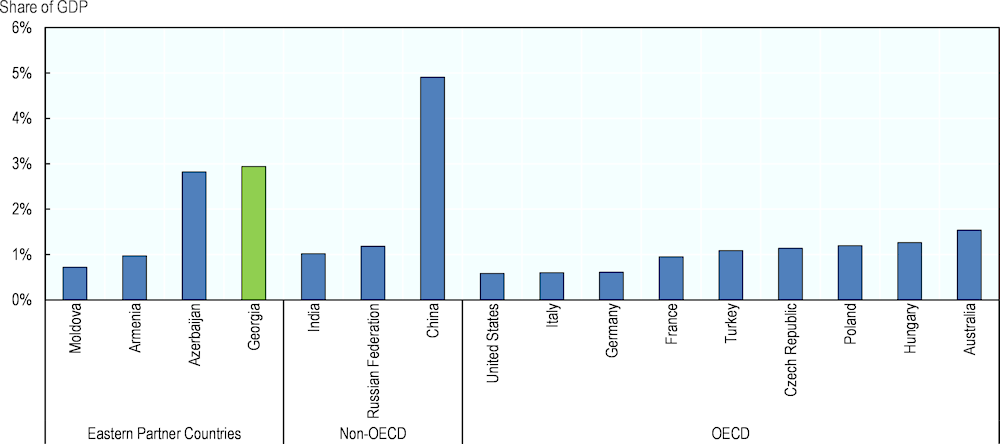

Georgia’s total investment in inland transport infrastructure averaged 2.9% of GDP over the decade from 2008 to 2017 (Figure 4.19). This was comparable with neighbouring Azerbaijan, but three times higher than Armenia and four times higher than the levels recorded in Moldova. Georgia’s infrastructure investment as a share of GDP also surpassed the levels observed in a number of OECD member and non-member countries. The only exception was China, where infrastructure investment averaged 4.9% of GDP.

These figures take account of all sources of financing and mask the growing financing gap in Georgia’s infrastructure sector. Around 75% of road infrastructure investment is financed by development partners, and there is little to no participation from the private sector. According to the World Bank (2018), the government currently spends about half of what is needed to support the maintenance and rehabilitation of secondary and local roads. The additional costs and delays resulting from weak internal connectivity also limit Georgia’s potential to realise the gains from larger-scale infrastructure investments.

Attracting private investment could therefore be an effective way to address fiscal constraints, improve the provision of transport infrastructure, and support the maintenance of rural road networks. In addition to developing new financing mechanisms, institutional capacities to plan and manage infrastructure projects could be strengthened significantly. When implementing public-private partnerships (PPPs), the government can play an important role in developing projects, analysing risks and returns, bringing projects to market and supervising their implementation. A strong regulatory framework that effectively balances risks between the public and private sectors is crucial to minimise potential contingent liabilities for the public sector (World Bank, 2018).

Figure 4.19. Transport infrastructure investment: international comparisons

Note: Inland infrastructure investment covers spending on new transport construction and improvements to the existing network of road, rail, inland waterways, maritime ports and airports. 2017 data not available for Armenia, India and Italy. 2015-2017 data not available for Moldova.

Source: ITF (2019).

Further investments in irrigation and drainage systems are necessary to support the growing production of high-value food products, such as fruits and vegetables. The total area of irrigated lands amounted to 400 000 hectares during the Soviet period, but declined precipitously to 160 000 hectares by 2000. A lack of resources and poor management by inexperienced government-owned corporations led to further declines, with the total irrigated area dropping to 40 000 hectares in 2014.

A new reform effort began in late 2012, resulting in a significant increase in government funding for the rehabilitation of irrigation infrastructure. The Georgian Amelioration Company, which owns and manages the public irrigation infrastructure in Georgia, developed an Irrigation Strategy for Georgia 2017-2025 with support from the World Bank. The strategy aims to modernise the irrigation infrastructure and boost the area of irrigated lands to 200 000 hectares by 2025. Furthermore, it plans to remodel the Georgian Amelioration Company into a professional and financially sustainable irrigation service provider, with data-based management and decision-making, a new irrigation tariff system, and local-level management entities as its clients. A formal system for water resource allocation is currently lacking in Georgia (Georgian Amelioration Company, 2017). A new law was drafted in 2015 with the aim of re-establishing a water permitting system in the country, but its adoption has been delayed.

Investors in Georgia’s agri-food value chain also face an acute shortage of storage infrastructure and sorting facilities. The lack of functioning cold chains, specialised food industry logistics and other forms of value chain infrastructure generates added costs for businesses. PPPs in value chain infrastructure are currently not commercially viable, but could become feasible with improvements to irrigation infrastructure and other supporting services (World Bank, 2018).

Access to affordable and reliable ICT infrastructure has improved substantially in recent years, but many rural areas are still poorly connected, preventing the diffusion of knowledge and the adoption of new productivity-enhancing production practices. Improving mobile phone coverage and internet access in rural areas can play an essential role in improving the competitiveness and resilience of Georgia’s agri-food value chain, by providing farmers with real-time information on food prices and weather conditions, improving the reach of early-warning systems, and facilitating the adoption of new digital technologies and innovative production practices.

Strengthening supply chain linkages in the agri-food value chain

Investors in the agri-food value chain often build close relationships with local suppliers, bringing new technologies and improved production practices to local farmers and SMEs. As the production of agri-food products becomes increasingly distributed across the globe, SMEs have greater opportunities to participate in agri-food GVCs, by establishing supply chain linkages with foreign investors. Countries can encourage these positive spillovers from agri-food MNEs by introducing a comprehensive regulatory framework for contract farming and system of contract enforcement, ensuring strong capabilities amongst domestic firms, building highly integrated domestic supply chains, and developing an organised base of local suppliers (Punthakey, 2020).

Georgian farmers and agricultural SMEs face difficulties establishing supply chain linkages, and tend to prefer spot market transactions to the establishment of longer-term supplier relationships with large-scale food processing and retail enterprises. This is reflected in the World Economic Forum’s Global Competitiveness Report 2017-2018, which ranked Georgia at 129th out of 137 economies in local supplier quantity, 115th in local supplier quality, and 127th in the state of cluster development (WEF, 2017). Furthermore, USAID (2014) conducted a survey of eight foreign investors in Georgia’s agri-food value chain, and identified the “quality and range of suppliers and business services” as the most binding challenge and constraint in the local business environment. According to the authors of the study, the issue is so severe that many investors are forced to vertically integrate and become self-sufficient in input supply and distribution. The study nonetheless cites some examples of foreign investors that have successfully established supply chain linkages with agri-food SMEs:

Ferrero and its subsidiary AgriGeorgia trained thousands of hazelnut growers in the Samegrelo region, promoting modern cultivation and post-harvest handling methods. The programme was implemented with support from USAID, and resulted in the establishment of the Georgian Association of Hazelnut Growers.

Hipp Georgia developed a supply chain of over 1000 certified small-scale apple growers adhering to a rigorous organic quality assurance regime.

Marneuli Food Factory, through its sister company Marneuli Agro, has established long-term supplier relationships with more than 150 small and medium-sized farmers. The firm helps to improve the productivity of its suppliers by recommending seeds and providing technical support to its suppliers.

In 2017-18, the UK’s Good Governance Fund initiated a pilot project with Enterprise Georgia to establish linkages between MNEs and SMEs operating in the hotels, restaurants and catering sector. The project began with an assessment phase to identify MNEs that were willing to deepen their engagement with local SMEs, and select SMEs with relevant products and the potential to act as suppliers for MNEs. During the pilot implementation phase, training and coaching programmes were designed to boost the capacities of eligible SMEs, and a matchmaking event was organised to facilitate business meetings between SMEs and MNEs. The pilot project demonstrated some initial success in establishing linkages in the agri-food value chain. As a result, the project team recommended that the government provide specialised training to SMEs, organise exhibitions and matchmaking events, and develop an online database of SMEs with the potential to supply MNEs (Good Governance Fund, 2019).

Efforts to establish linkages with food processors and retailers can be particularly beneficial for small-scale producers of high-value food products. Box 4.2 provides an insight into the importance of supply chain linkages in Georgia’s hazelnut value chain.

Box 4.2. The Hazelnut Value Chain in Georgia

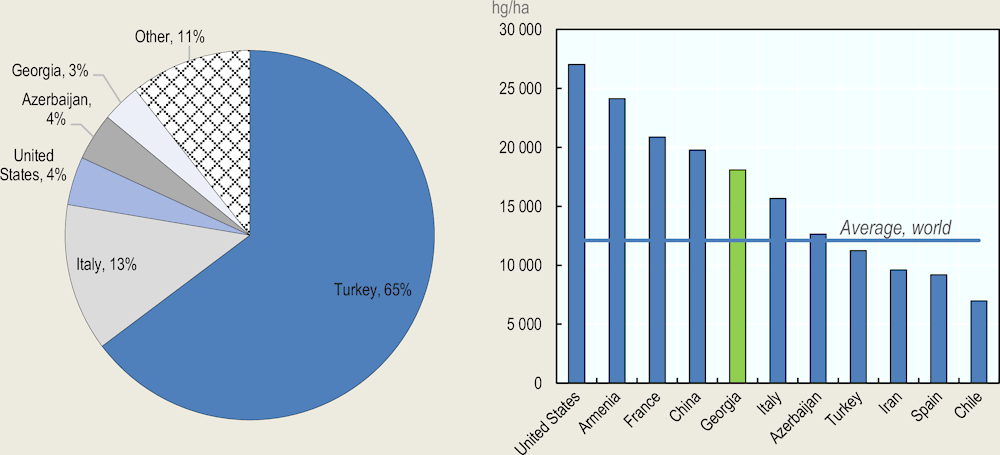

Georgia is the 5th largest producer of hazelnuts in the world, accounting for 3% of global production between 2009 and 2018. Yields are higher than neighbouring Turkey and well above the global average, but still show considerable room for improvement (Figure 4.20). According to the 2014 Agricultural Census, approximately 107 000 Georgian households are involved in the production of hazelnuts.

Most of Georgia’s hazelnuts are destined for export markets in the EU. Hazelnut exports have dropped sharply in recent years, from USD 179 million in 2016 to USD 57 million in 2018 (Geostat, 2019b). This was primarily due to a series of bad harvests caused by unfavourable weather conditions, the onset of various fungal diseases, and the Brown Marmorated Stink Bug (Halyamorpha halys) invasion.

Figure 4.20. Global production and yield of hazelnuts

Source: FAOSTAT (2020).

The ISET Policy Institute recently conducted a “Study on Private Service Providers in the Organic Hazelnut Value Chain in Georgia”. The study identified a number of challenges for the sector, including limited awareness amongst farmers of the importance of laboratory services, soil analysis and pruning practices, a lack of machinery services, limited access to finance, a lack of qualified agronomists and consultants, and a lack of trust between different actors in the value chain. Three key recommendations were provided:

Increase trust between value chain actors (e.g. by hiring qualified agronomists in each village, establishing drying and storage centres).

Enhance value chain financing (e.g. through contract farming and linkages between processing companies, farmers, extension providers and microfinance institutions).

Create partnerships and strengthen the dual education system to create a pool of knowledgeable and skilled young farmers and agronomists.

Source: Kakulia and Deisadze (2018); Katsia and Deisadze (2018).

Boosting the capacities of agri-food SMEs could help to facilitate linkages

Georgia has progressed in the Enforcing Contracts indicator of the World Bank’s Doing Business assessment, ranking 12th in 2020 (vs. 23rd in 2015). This suggests that the regulatory framework for resolving commercial disputes is well developed, with a relatively fast and cost-effective court system. However, farmers rarely enter into formal contracts with large-scale processors and retailers and often renege on supply contracts when higher prices are offered on local markets, sacrificing long-term relationships for short-term gains. Food processors in turn complain that local producers are unable to meet their strict quality requirements, produce in sufficient volumes, or deliver produce in a timely fashion. Further assistance is therefore needed to encourage large-scale processors to build the capacities of their suppliers, for instance by providing cash, inputs and technical assistance in exchange for product supply.

Co-operatives can help to connect small-scale producers with larger players in the value chain, whilst mitigating some of the challenges associated with Georgia’s highly fragmented farm structure. An Agricultural Co-operatives Development Agency was established with support from the FAO in 20135 and placed under the management of ARDA. Most agricultural co-operatives are eligible for the concessional loans and co-financing programmes provided by ARDA. The government can play an important role in encouraging food processors and retailers to establish supply chain linkages, by offering land or tax concessions to prospective investors conditional on their engagement with small-scale producers and co-operatives. Well-structured PPPs can also help to integrate farmers in agri-food value chains, whilst taking full advantages of the economic opportunities offered by investors.

Agri-food SMEs in Georgia suffer from a lack of specialised human capital (e.g. skilled agronomists, veterinarians, food safety specialists, laboratory technicians and other specialists). The government should ensure that agri-food SMEs are able to benefit from well-resourced and functioning agricultural training institutes, extension services and vocational training systems. Well-trained extension workers can provide technical advice to SMEs and support the dissemination of new technologies, improving their ability to respond to the needs of large agricultural investors. Targeted incentives for supplier engagement can be an effective tool, but must be accompanied by credible efforts to develop SME skills and capabilities in areas such as cultivation, post-harvest treatment, packaging and transportation.

More can be done to improve food safety and quality standards

The inability of Georgian farmers to provide a stable supply of high-quality products contributes to the lack of trust between actors in the agri-food value chain. Producers often lack the necessary skills and resources to comply with stringent food safety and quality standards, such as those imposed by the EU. As part of the EU Association Agreement and DCFTA, the EU has provided support for reforms to Georgia’s rules on animal and plant health and hygiene. These initiatives have helped to improve the safety of Georgian food products and open up new export opportunities in the EU and other markets with strict food safety regulations (European Commission, 2015).

The government has taken steps to build the capacity of the National Food Agency, harmonise food safety legislation with EU legislation, and develop disease control strategies, although ensuring compliance with food safety and quality standards is an ongoing challenge. Measures are needed to increase Georgian farmers’ awareness of food safety, veterinary and phytosanitary issues, as well as the specific requirements imposed by the EU and other international markets.

Foreign investors in Georgia’s agri-food value chain can play an important role in supporting local SMEs to adopt the necessary standards and certifications required to operate in international markets. Georgian subsidiaries of large-scale multinationals can benefit from access to new technologies and advanced production and management practices, allowing them to meet stringent food safety and certification requirements. Improvements in food safety and quality could have a transformative effect on Georgia’s agri-food value chain, opening up new opportunities for trade and investment in international markets.

References

Agenda.ge (2014), “Produce in Georgia: Gov’t offers helping hand to boost country’s production sector”, https://agenda.ge/en/article/2014/118

ARDA (2020), “Projects”, Agricultural and Rural Development Agency, http://arda.gov.ge/projects

Bacchi, U. (2019), “Georgia's ban on foreign landowners leaves farmers in limbo”, Thomson Reuters Foundation, published 17 April 2019, http://news.trust.org//item/20190416234722-smljs/

European Commission (2015), “EU-Georgia Trade: Deep and Comprehensive Free Trade Area (DCFTA)”, http://trade.ec.europa.eu/doclib/docs/2015/may/tradoc_153435.pdf

FAO (2012), Voluntary Guidelines on the Responsible Governance of Tenure of Land, Fisheries and Forests in the Context of National Food Security, Food and Agriculture Organization of the United Nations, Rome, http://www.fao.org/3/a-i2801e.pdf

Georgia Today (2018), “Chinese Investors to Restore Tea Plantations in Georgia”, 5 March 2018, http://georgiatoday.ge/news/9338/Chinese-Investors-to-Restore-Tea-Plantations-in-Georgia

Georgia Today (2019), “Agri Review December 2019 – The Sector at a Glance”, 29 December 2019, http://georgiatoday.ge/news/18878/Agri-Review-December-2019-%E2%80%93-The-Sector-at-a-Glance

Georgian Amelioration Company (2017), “Irrigation Strategy for Georgia 2017-2025”, Ministry of Agriculture of Georgia LTD “Georgian Amelioration”, http://www.ag.ge/Download/Files/260

Geostat (2016), “Census of Agriculture 2014”, National Statistics Office of Georgia, Tbilisi, http://census.ge/files/results/agriculture/AG%20Census%20Release_ENG.pdf

Geostat (2019a), “Business sector in Georgia, 2018”, Statistical Publication, National Statistics Office of Georgia, Tbilisi.

Geostat (2019b), “External trade of Georgia, 2018”, Statistical Publication, National Statistics Office of Georgia, Tbilisi.

Geostat (2020a), “Agriculture of Georgia, 2019”, Statistical Publication, National Statistics Office of Georgia, Tbilisi.

Good Governance Fund (2019), “Roll-Out Plan for SMEs Linkages in Georgia”, March 2019.

Greenville, J., K. Kawasaki and M. Jouanjean (2019), “Dynamic Changes and Effects of Agro-Food GVCS”, OECD Food, Agriculture and Fisheries Papers, No. 119, OECD Publishing, Paris. http://dx.doi.org/10.1787/43b7bcec-en

ITF (2019), Transport Performance Indicators, International Transport Forum, https://doi.org/10.1787/2122fa17-en

Kakulia, N. and S. Deisadze (2018), “Great Expectations: Does the DCFTA Really Boost Georgia’s Economic and Export Potential?”, ISET Economist Blog, https://iset-pi.ge/index.php/en/iset-economist-blog-2/entry/great-expectations-does-the-dcfta-really-boost-georgia-s-economic-and-export-potential

Katsia, I. and S. Deisadze (2018), “What Does Not Kill you… or the Story of Hazelnuts”, ISET Economist Blog, https://iset-pi.ge/index.php/en/iset-economist-blog-2/entry/what-does-not-kill-you-or-the-story-of-hazelnuts

Kochlamazashvili, I., N. Kakulia, S. Deisadze (2018), “Policy Paper: Agricultural Land Registration Reform in Georgia”, https://iset-pi.ge/images/Projects_of_APRC/Policy_Paper_-_Agricultural_Land_Registration_Reform_in_Georgia_GEO.pdf

Kochlamazashvili, I. (2019), “The “Achilles’ Heel” of Georgia’s Agriculture – Incomplete Land Registration”, ISET Economist Blog, https://iset-pi.ge/index.php/en/iset-economist-blog-2/entry/the-achilles-heel-of-georgia-s-agriculture-incomplete-land-registration

Lomsadze, G. (2017), “Georgia Keeping Its Land Off-Limits for Foreigners”, EurasiaNet.org, published 26 October 2017, https://eurasianet.org/georgia-keeping-its-land-off-limits-for-foreigners

MEPA (2019), “On the Approval of the Statute of the Legal Entity under Public Law called the National Agency for Sustainable Land Management and Land Use Monitoring”, Order No 2-1258, Ministry of Environmental Protection and Agriculture of Georgia, 26 December 2019, https://matsne.gov.ge/en/document/view/4748388?publication=0

MEPA (2020a), “Agriculture and Rural Development Strategy 2021-2027”, Ministry of Environmental Protection and Agriculture of Georgia, https://mepa.gov.ge/Ge/Files/Download/27243

MEPA (2020b) “2021-2023 Action Plan of the Agriculture and Rural Development Strategy 2021-2027”, Ministry of Environmental Protection and Agriculture of Georgia, https://mepa.gov.ge/Ge/Files/Download/27244

Millns, J. (2013), “Agriculture and Rural Cooperation: Examples from Armenia, Georgia and Moldova”, Policy Studies on Rural Transition, No. 2013-2, FAO Regional Office for Europe and Central Asia, Budapest.

NAPR (2019), “Land Registration Reform”, National Agency of Public Registry, Presentation delivered on 9 September 2019 in Tbilisi, Georgia.

National Bank of Georgia (2019), “Annual Report 2018”, https://www.nbg.gov.ge/uploads/publications/annualreport/2019/annualengfor_web.pdf

OECD (2014), Policy Framework for Investment in Agriculture, OECD Publishing. http://dx.doi.org/10.1787/9789264212725-en

OECD (2019a), “The changing landscape of agricultural markets and trade: prospects for future reforms”, OECD Food, Agriculture and Fisheries Papers, No. 118, OECD Publishing, Paris. http://dx.doi.org/10.1787/7dec9074-en

OECD (2019b), FDI Qualities Indicators: Measuring the sustainable development impacts of investment, Paris. www.oecd.org/fr/investissement/fdi-qualities-indicators.htm

OECD et al. (2020), SME Policy Index: Eastern Partner Countries 2020: Assessing the Implementation of the Small Business Act for Europe, SME Policy Index, European Union, Brussels/OECD Publishing, Paris, https://doi.org/10.1787/8b45614b-en

OECD.Stat (2019), OECD FDI Regulatory Restrictiveness Index, https://stats.oecd.org/Index.aspx?datasetcode=FDIINDEX#

Parliament of Georgia (2018), “Constitution of Georgia”, Document No. 786, issued 24 August 1995, https://matsne.gov.ge/en/document/view/30346

Parliament of Georgia (2019a), “Organic Law of Georgia on Agricultural Land Ownership”, Law of Georgia No. 4848-II, issued 25 June 2019, https://matsne.gov.ge/en/document/view/4596123

Parliament of Georgia (2019b), “On Determination of the Designated Purpose of Land and on Sustainable Management of Agricultural Land”, Law of Georgia No. 4849-II, issued 25 June 2019, https://matsne.gov.ge/en/document/view/4596113

Punthakey, J. (2020), “Foreign direct investment and trade in agro-food global value chains”, OECD Food, Agriculture and Fisheries Papers, No. 142, OECD Publishing, Paris, https://doi.org/10.1787/993f0fdc-en.

Transparency International Georgia (2014), “Ban on land sales – stories from large foreign farmers”, published 24 February 2014, https://www.transparency.ge/en/blog/ban-land-sales-stories-large-foreign-farmers

USAID (2014), “Competitiveness of Georgian Agriculture: Investment Case Studies – Concluding Policy Paper”, USAID Economic Prosperity Initiative, 25 September 2014.

World Bank (2018), “Georgia: from reformer to performer – a systematic country diagnostic”, World Bank Group, http://documents.worldbank.org/curated/en/496731525097717444/pdf/GEO-SCD-04-24-04272018.pdf

World Bank Doing Business (2020), “Trading across borders”, https://www.doingbusiness.org/en/data/exploretopics/trading-across-borders

WEF (2017), The Global Competitiveness Report 2017-2018, World Economic Forum, http://www3.weforum.org/docs/GCR2017-2018/05FullReport/TheGlobalCompetitivenessReport2017%E2%80%932018.pdf

WEF (2019), The Global Competitiveness Report 2019, World Economic Forum, http://www3.weforum.org/docs/WEF_TheGlobalCompetitivenessReport2019.pdf

WTO (2016), “Trade Policy Review of Georgia”, WT/TPR/S/328, https://www.wto.org/english/tratop_e/tpr_e/s328_e.pdf.