This chapter reviews the strategy and institutional structure for investment promotion in Georgia and makes recommendations to raise the effectiveness of investment promotion in Georgia, including on the role of Enterprise Georgia and how it interacts with other agencies.

OECD Investment Policy Reviews: Georgia

5. Promoting investment in Georgia

Abstract

Summary and recommendations

Georgia is one of the easiest countries in which to do business, according to several international rankings. Since 2005, it has moved from 112th place in the World Bank’s Doing Business indicators to 7th place worldwide, a remarkable achievement that many governments would like to emulate. As discussed in the Overview, this approach to reform relying on massive deregulation has reached its natural limits and has not yet yielded a well-diversified stock of inward investment through which to integrate in global value chains. Achieving this, along with broader goals of inclusiveness and sustainability, will require a more proactive approach which relies less on removing regulatory obstacles and more on building a coherent strategy and suitable institutional architecture. One key area in this respect is investment promotion.

A comprehensive scan of Georgia’s framework for investment promotion and facilitation reveals areas for improvement to ensure investments are targeted strategically in areas that can contribute sustainably to Georgia’s development. A look at the institutions promoting investment reveals a fragmented system, with different actors actively pursuing investors. While this in itself is not a weakness, the lack of strong co-ordination, starting with a single government focal point for investors leads to inefficiencies, duplication of efforts, and confusion for investors.

A central weakness in the overall system is the overlapping of investment promotion functions among various actors. Enterprise Georgia is Georgia’s investment promotion agency (IPA) and well known for its support to enterprise development and export promotion. Other actors active in investment promotion include the Georgia Innovation and Technology Agency (GITA) and the Georgian Chamber of Commerce, while the Investors Council provides a platform for public-private exchanges on issues critical to investment. The Ministry of Economy and Sustainable Development is the government’s line ministry in charge of investment and oversees Enterprise Georgia. Its recently created investment policy department should help address some of the co-ordination challenges. More generally, the strong Invest in Georgia brand inherited by Enterprise Georgia should be revived, which would strengthen the country’s investment promotion efforts.

Georgia is ripe for a comprehensive investment strategy. Aligning all actors behind a joint vision, fostering synergies between investment, export, enterprise and innovation promotion, would allow Georgia to significantly leverage its strong points. The past 15 years have helped to build a strong governance foundation for economic growth. Georgia now needs a policy push through an investment strategy to fully achieve its potential.

Policy recommendations

Develop a comprehensive investment policy statement

The significant investment-related reforms since 2003 have put Georgia on the map for investors, leading to numerous improvements in the business climate, taxation, innovation, financial markets and export development. Together, with the EU-Georgia Association Agreement and the associated regulatory reforms, Georgia requires a unified approach to ensure co-ordination of all these measures, as well as to align its investment objectives with efforts in other areas, such as export promotion, innovation and SME development. The Ministry of Economy and Sustainable Development and its recently created investment policy department is well placed to spearhead a new investment policy statement, one that would align all related policy and regulatory measures, while also sending a strong message to the business community that the government is a partner in advancing investment reforms. The Ministry’s strategy would provide the overall investment policy and direction, while Enterprise Georgia, could focus on co-ordinating the various investment promotion efforts. The subsequent recommendations will follow from the strategy.

Keep strengthening the investment promotion function in Georgia

Georgia’s administration and key business stakeholders, including the Chamber of Commerce and Industry, have proven their dynamism in pushing through investment and business related reforms. A number of groups active in the field of business regulation improvements and advocacy, as well as investment promotion has thus emerged over the years. Enterprise Georgia, as the official IPA, the Georgian Innovation and Technology Agency, and the Georgian Chamber of Commerce and Industry are but three major actors undertaking investment promotion. While multi-faceted initiatives to attract investment to Georgia should be encouraged, these activities need to be co-ordinated carefully. This entails clearly signalling to the business community – both domestic and international – which agency has the lead in investment promotion matters, as well as strengthening the investment promotion function and the agency’s capacity. While Enterprise Georgia has seen recent additions to its investment promotion team, these efforts need to be sustained to ensure the agency stays recognised as the lead agency for investment promotion. Where the investment promotion function is situated, whether as part of a Ministry, within the Prime Minister’s Office or as an independent IPA for example, is secondary to the need to equip it with the needed skills and resources.

Enhance the Invest in Georgia brand

The precursor to Enterprise Georgia was Invest in Georgia which was under the Prime Minister’s Office (which changed in 2017 with the merger of the IPA with Enterprise Georgia). The agency received significant recognition due to its position directly under the prime minister and Invest in Georgia became a well-known brand. While the name was kept and transformed into the country’s official investment portal within Enterprise Georgia, the IPA itself lost some visibility vis-à-vis investors and other relevant government agencies. The investment policy statement should reinvigorate and further support the marketing efforts undertaken by Enterprise Georgia to accentuate the Invest in Georgia brand, which is already well known to the international business community.

Strengthen the investment aftercare system and improve one-stop shop services

Aftercare services for investors are vital, especially in retaining investors. Attracting new investors is more challenging and costly compared to supporting reinvestment and expansion, which account for a significant share of all investments. Good aftercare and policy advocacy, including transmitting investors’ feedback for more effective policymaking, can be the determining factor in a decision to reinvest and help address investment climate challenges. While Enterprise Georgia has considerably intensified its activities to provide aftercare services for investors, it is limited in its mandate and resources to tackle some of the regulatory challenges investors face. This may require gaining additional political support to drive reforms that are beyond the IPA’s remit. The IPA should also consider enhancing its one-stop-shop services for investors. Georgia’s experience with its Public Service Hall would be informative in this regard.1The government also needs to play its role in supporting the IPA in this effort by clearly communicating to the business community that Enterprise Georgia is the main focal point in Georgia’s investment promotion system to deal with investor needs.

Link export, innovation and investment promotion

Investment promotion can enhance participation in the global economy. The attraction of export-oriented foreign direct investment (FDI) has enabled countries to shift quickly towards a model of economic growth driven by rapidly expanding exports. The opportunities presented by the Deep and Comprehensive Free Trade Area (DCFTA) with the EU as an export market should be part of Georgia’s investment promotion strategy. The efforts that Georgia has put into strengthening innovation within its business community should also be considered in the investment strategy.

Foster FDI-SME linkages

Anchoring investors through deep linkages with the local economy is an effective investment retention strategy and can usefully complement aftercare measures. Investor targeting and aftercare services can attract investors and help keep them satisfied, but it is the broader and more sophisticated, and hence more complex, effort to strengthen the investment ecosystem that will determine a country’s competitiveness. This includes providing investors with competitive local suppliers, facilitating linkages with local firms, developing the necessary hard and soft infrastructure, including institutional support, and keeping policy and macro-economic fundamentals in order. In turn, business linkages between MNEs and domestic companies, especially smaller suppliers, contribute significantly to local development. Linkages can be effective avenues for the transfer of technology, knowledge and managerial and technical skills, depending on the appropriate policy setting and absorptive capacity of domestic suppliers. Enterprise Georgia is strategically set up to support such linkages, hosting both investment and SME development functions, in addition to export development. However, given the complex task the agency already has at hand in terms of optimising the co-ordination across the functions, while strengthening each one in its own right, it should address priorities strategically. One way of starting to enhance linkages promotion would be to establish some linkages focal points in the investment promotion and enterprise promotion departments, which could identify and explore opportunities systematically. The role of the Strategic Development and Communication Division established in the beginning of 2020 includes fostering linkages and is clearly a step in the right direction.

Enhance the investment promotion oversight mechanism

Unlike most autonomous IPAs in OECD countries, Enterprise Georgia does not have a governing board. The role of boards can vary greatly from one agency to another, but they are often composed of high-level, experienced people who provide guidance and advice on strategic and management issues. They can have clear decision-making powers, such as appointing the head of the agency. A board can be a good mechanism to ensure the representation of different stakeholders in the governance of an IPA. Including senior representatives from the private sector is a good way to integrate experience and expertise from the private sector into strategic orientations. The government could envisage establishing a mechanism that would add such oversight and guidance for Enterprise Georgia. This would provide it with an outsider’s view to generate new ideas for collaboration and synergies within the agency, as well to identify and unlock opportunities for co-operation with other agencies and the private sector. One avenue to consider in this regard is to equip the Investors' Council of Georgia with an oversight function to help steer Enterprise Georgia’s activities, while also helping to address business climate concerns via a two-way dialogue between the government and the private sector.

Formalise strategic co-ordination for investment promotion

Overall, Enterprise Georgia would benefit from clearer terms of co-operation and mechanisms to work jointly with its key institutional partners. Currently, the agency operates on a rather ad hoc basis, without clear guidelines, shared protocols or tools, although this does not prevent the IPA from collaborating informally with GITA and the Chamber of Commerce, thanks to good relationships between agencies. Well-defined co-operation terms in strategic plans and dedicated tools such as shared information systems, processes and systematised protocols would nevertheless improve the quality of the co-operation while potentially reducing the workload thanks to efficiency gains. Enterprise Georgia is currently implementing a CRM system, Hubspot, and has started to extend it to other agencies. This is a decisive step towards enhancing and maximising synergies between investment promotion, SME development and export, and innovation promotion.

Strengthen investment promotion and facilitation at the sub-national level

Sub-national governments do not have formal mandates and roles in investment promotion and facilitation. According to local stakeholders, however, regional governors express their interest in attracting foreign capital in their territories, and Enterprise Georgia is accompanying them in this goal. While rolling out investment promotion and facilitation at the sub-national level is a complex endeavour, a next stage of the co-operation could include enhancing the capacity of officials in sub-national government divisions in investment promotion and facilitation matters.

1. Originating from a 2011 vision from the Ministry of Justice, the Public Service Hall has today become a highly effective and efficient single point of public services delivery, based on the one-stop shop principle. The majority of public agencies are represented in the Hall, with 20 000 customers per day receiving services from driver’s licence issuing to business registration in 24 Public Service Hall branches across the country. More information can be found on a dedicated website, available in various languages, including English: http://psh.gov.ge/.

Investment promotion and facilitation structure and actors involved

The strategic and institutional framework for investment promotion and facilitation

“Produce in Georgia”, the overall industrial development framework implemented by Enterprise Georgia.

Investment promotion strategies and their associated institutional arrangements, vary greatly from country to country, depending on broader economic and industrial development objectives as well as historical contexts. The degree of centralisation of the country’s governance, for example, can be one of the key drivers shaping the overall investment promotion strategy, along with economic characteristics such as, for example, the sectoral composition of GDP or the maturity of the local SME sector. The OECD-IDB survey of Investment Promotion Agencies (IPAs) (Box 5.1), and recent survey reports of countries from the OECD, Latin America and the Caribbean (LAC), the Middle East and North Africa (MENA) and Eurasia, illustrate this diversity well. The OECD administered the IPA survey in Georgia in 2019 in the framework of the Eurasia Competitiveness Programme and the project “EU4Business: From Policies to Action”1. This review uses the results to benchmark Georgia’s investment promotion strategy and institutional framework against peers from Eastern Partner countries, as well as selected OECD country agencies.

Georgia’s overarching investment promotion strategic framework supports its current industrial state programme “Produce in Georgia”, under the leadership of the Ministry of Economy and Sustainable Development. This programme, launched in 2014, aims to develop local production of agricultural and industrial goods and to decrease imports, particularly by supporting business creation in ten different industrial industries (e.g. pharmaceuticals, building materials and textile), five agro-food sectors (e.g. cattle and poultry farms and dairy processing plants), the filmmaking industry, and tourism. It entails three components on access to finance, access to infrastructure and real estate and technical assistance, with dedicated resources to support the development of private businesses, both domestic and foreign in targeted sectors. For example, the programme supports access to finance by co-financing interest rates of commercial loans and providing guarantees. From its inception until 2020, Produce in Georgia mobilised an estimated EUR 325 million in private investment (OECD, 2019[1]).

Enterprise Georgia is the main agency in charge of implementing the programme “Produce in Georgia” via its three main divisions: Business Development, Invest in Georgia and Export Support. The agency was created in February 2014 and its statutes were revised in May 2017 to integrate the investment promotion agency Invest in Georgia, which was formerly independent. According to its legal status, the agency now aims to improve the competitiveness of the local private sector, support entrepreneurship and the development of an entrepreneurial culture, export promotion, and investment promotion. The Invest division of Enterprise Georgia, also called “Invest in Georgia”, is the body acting as the country’s IPA. Details on its governance, resources and activities are discussed below.

Box 5.1. The OECD-IDB survey of investment promotion agencies

The OECD and the Inter-American Development Bank (IDB) have partnered to design a comprehensive survey of IPAs. The questionnaire provides detailed data that reflect the multiple recent policy developments as well as rich and comparable information on the work of national agencies in different countries.

In 2017-18, the survey was distributed to IPA representatives from 32 OECD and 19 Latin America and Caribbean countries and 10 national agencies from the Mediterranean region. In 2019, 10 countries from the Eastern Europe, South Caucasus and Central Asia regions participated in the same survey, which consisted of an online questionnaire, divided into nine parts:

Basic profile;

Budget; Personnel;

Offices (home and abroad);

Activities;

Prioritisation;

Monitoring and evaluation;

Institutional interactions; and

IPA perceptions on FDI.

The results of the survey are gathered and presented in comprehensive IPA mapping reports, which provide a full and comparative picture of IPAs in selected regions. The reports benchmark agencies against one another as well as the average IPA in a region against other regions.

“Produce in Georgia” does not explicitly refer to foreign investment, although it provides directions for developing the private sector. Government officials highlight that the programme applies to foreign and domestic investors alike, although in practice, domestic SMEs tend to make more use of the programme – partly because of the upper limit that applies to loans. Georgia is not short of strategies, but these could provide a more convincing vision for investment policy and promotion, as well in terms of linking domestic enterprises to foreign investment. The draft innovation strategy, which the OECD could consult during the review, for example, does take into account the need for investment to reach the country’s innovation goals, but does not provide concrete avenues for investment promotion. Georgia would benefit from having a clear, formal strategic framework specifically detailing the investment pillar of its industrial plan, and articulating it with other pillars, providing a unified vision for the industrial and economic development of the country.

A first, important step in this direction was taken with the “Foreign Direct Investments Attraction Strategy 2020–2021”, developed by Enterprise Georgia with the support of the IFC. The plan establishes a strategic direction, identifies a list of priority sectors for investment promotion and a list of strategic objectives for each investment promotion function of the IPA, as discussed below. It lays out the rationale for investment attraction in Georgia and for selecting six priority industries and formalises some of the key strategic features of Georgia’s current overarching approach, in particular the goal to attract efficiency-seeking FDI as opposed to resource- and market-seeking FDI. An investment policy statement would greatly help to further articulate the investment attraction effort with Georgia’s wider economic development agenda, and suggest avenues for policy reforms and cross-sectoral co-ordination.

According to OECD experience, establishing a clear overarching investment policy statement helps align stakeholders at all levels of the institutional framework and improves the efficiency of the investment promotion and facilitation effort. The first objective of an investment policy statement is to lay out the FDI attraction rationale, in connection with larger social and economic objectives. The second objective is to translate this vision into agency-level strategies and action plans including target objectives, means and key performance indicators (KPIs). Three broad types of strategic documents exist:

National policy statements on investment, presenting the investment landscape and the government’s strategic orientation;

Investment promotion strategies defining main targets, tools and KPIs to attract inward foreign investment; and

Detailed operational action plans with detailed objectives, associated resources, timelines and indicators.

Governments often prepare an overarching vision that is translated into a strategic plan at the IPA level, which, in turn, serves as a basis for operational plans in different teams (such as geographical, sectoral, marketing or servicing teams, depending on how agencies are structured). This was, by and large, done under the FDI attraction strategy. Other agencies contributing to investment promotion, such as innovation or export agencies, can also integrate elements of the vision in their strategic plan. Defining the different institutions’ roles and responsibilities in the vision facilitates this process.

Designing a similar framework in Georgia would allow for a clear, more coherent strategy for investment promotion. The business development/SME promotion pillar is well documented and detailed, as well as the export pillar, whereas the rationale for investment attraction lacks clarity and well-defined connections with SME and export development. Georgia could consider the example of Ireland’s 2014 FDI Policy Statement when developing an overarching vision for FDI attraction (Box 5.2).

Box 5.2. Ireland’s 2014 FDI Policy Statement

The Policy Statement on Foreign Direct Investment in Ireland was published by the Irish Department of Jobs, Enterprise and Innovation in July 2014 under the authority of the former minister. It was released halfway through the government’s term (2011-16).

The purpose of this document is to take stock of the foreign investment policy implemented during the past three years (and sometimes beyond) and to highlight recent achievements and ongoing reforms. It also presents the government’s strategic vision for 2014-20 by identifying areas for improvement, but without providing a detailed set of measures to be adopted. To justify these strategic choices, the statement brings to the fore some empirical research work on the impact of investment policies on the economy. An overview of this strategic vision is given through the minister’s foreword, which indicates that this policy was designed through a whole-of-government approach to create quality jobs and improve the quality of life of the Irish.

The Policy Statement includes an introduction that describes global investment trends, Ireland’s performance in attracting FDI and its contribution to the national economy. The overarching objectives of this FDI strategy are also presented and include the necessity to create employment and enhance national productivity. The strategy aims to contribute to the development of key industrial sectors through the creation of ecosystems and to enable access to global value chains for Irish-owned enterprises. Amongst its objectives, three strategic elements are identified in the strategy:

1. identifying promising sectors based on the Irish industry’s strengths;

2. identifying strategic FDI source markets; and

3. facilitating different modes of investment, including greenfield investments, mergers and acquisitions and partnerships with research institutions.

The document identifies strategic policy enablers to reach these objectives: fostering Ireland’s key differentiators (human resources, R&D and urban planning); developing sectoral ecosystems; preserving a competitive tax system and maintaining business cost levels; developing infrastructure; and guaranteeing the access to real-estate. For all dimensions, a stocktaking of reforms is made. Actions to be implemented are also identified for each area, although they remain rather general, as they do not provide precise details on the way these actions should be put into effect.

Finally, the Policy Statement briefly presents IDA Ireland, the Irish IPA. It describes its mandate and those from related national agencies such as Enterprise Ireland and the Science Foundation Ireland. It recommends the development of a new strategy in line with this FDI Policy Statement.

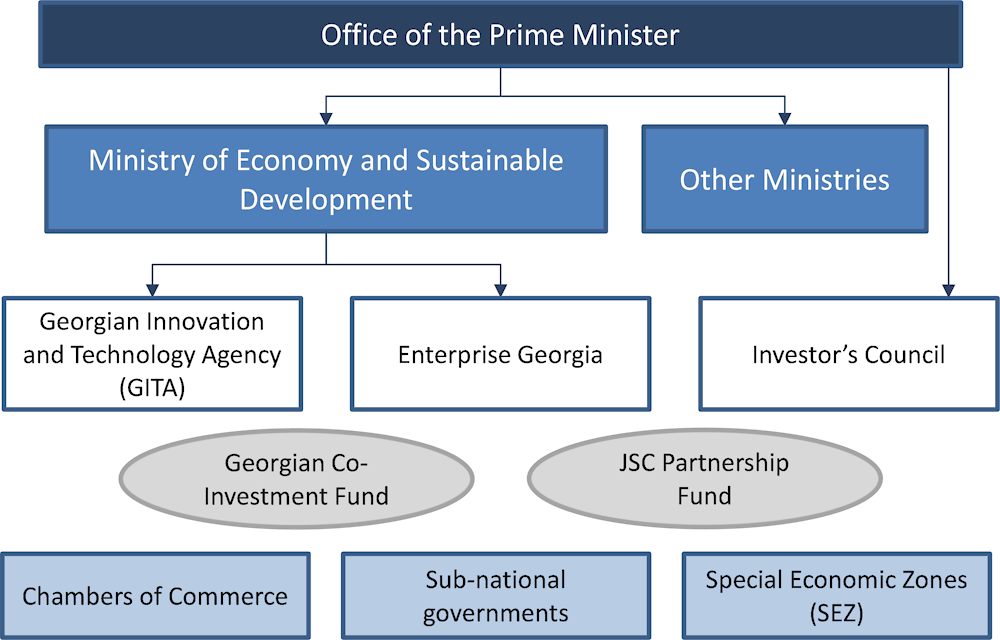

A fragmented institutional framework for investment promotion and a need to strengthen Enterprise Georgia’s Invest branch

Institutional frameworks for investment promotion and attraction often include a number of institutions, in which the IPA plays a central role. In Georgia, the institutional ecosystem, beyond Enterprise Georgia, is composed of ministries, other public agencies and bodies, sub-national governments, special economic zones and chambers of commerce (Figure 5.1).

Figure 5.1. Georgia’s institutional framework for investment promotion

Source: OECD (2019)

The Georgian Innovation and Technological Agency (GITA) plays a prominent role in promoting and supporting the development of innovative sectors of the economy, including through the attraction of foreign investment. Like Enterprise Georgia, GITA is sponsored by the Ministry of Economy and Sustainable Development. Its aim is to stimulate the development of innovation capabilities in Georgia, including research and innovation (R&D), innovation commercialisation and export. Although most of its actions target start-ups and SMEs, its work also entails the attraction of FDI to support Georgia’s innovation system, and notably its information and communication technology (ICT) sector. The agency carries out its own work to attract FDI and could thus benefit from more formal co-operation with Enterprise Georgia when it comes to sizeable investment projects or the attraction of large MNEs. These are some of the elements that an investment policy statement mentioned above would set out.

Georgia established an Investor’s Council in 2015 as a platform for government-investor dialogue, with the support of the EBRD. The Prime Minister chairs the Council and several relevant ministries are represented, along with local and international chambers of commerce and financial institutions such as the EBRD and the IFC (on a temporary basis). Such forums exist in many other countries and can be a good way to promote and maintain an ongoing dialogue with investors to inform policy-making. According to local stakeholders from the private sector, the quarterly meetings of the Council have been useful to discuss issues critical to the promotion of foreign investment, such as the new land law. Enterprise Georgia is invited to attend the Council’s meetings as a guest, but not on a regular basis.

Georgia’s Partnership Fund also participates in investment promotion as it provides a tool to co-invest in private projects. The Fund is state-owned and manages large state assets (state-owned enterprises or SOEs in the railway, energy and oil and gas sectors). It uses dividends from SOEs to invest equity of up to 49% in private investment projects according to a list of priority sectors (agribusiness, energy, infrastructure and logistics, manufacturing, real estate and tourism). Investors can buy out the fund’s shares at any time at a pre-defined price, or the Fund can sell its shares on the market. The Partnership Fund has already co-financed 25 projects and is currently managing a project portfolio of USD 2.5 billion. The Fund works closely with the Invest division of Enterprise Georgia, and its co-financing scheme can serve as a guarantee for investors. In its last report however, the IMF points out that the government should reassess the Partnership Fund’s role, because contrary to its original mandate, some of its investments do not follow commercial objectives and are not limited to minority shares (IMF, 2019[2]). Moreover, the state assets managed by the Fund do not generate many dividends, and some of them are even losing money. These are some elements that have led to the ongoing reform of the Partnership Fund.

The Georgian Chamber of Commerce plays an active role in investment attraction. The Chamber has a strong presence in the Georgian economy, with its network of 1 500 member SMEs, not only in Tbilisi but also in the regions. Its president is experienced in the field of investment, as former ombudsman and former head of the Georgian IPA, before it was part of Enterprise Georgia. The Chamber actively seeks foreign investors to involve them as partners in projects together with its members. To this end, it provides matchmaking and project modelling services, working closely with Enterprise Georgia.

Foreign investments, although they generally enter the country through institutions in capitals and are registered in major business hubs, are mostly undertaken outside capitals. In Georgia, sub-national governments do not have formal mandates and roles in investment promotion and facilitation. But, according to local stakeholders, regional governors express their interest in attracting foreign capital in their territories, and Enterprise Georgia is accompanying them in this goal. Sub-national stakeholders are also sometimes best-placed to provide the necessary information and support to facilitate project implementation, such as finding a suitable land lot. Setting up broad and well-coordinated investment promotion and facilitation activities at the sub-national levels is a complex undertaking, as it depends greatly on the capacity in the regions to implement specific tasks. A next stage of the co-operation could thus include enhancing the capacity of officials in sub-national government divisions in investment promotion and facilitation matters.

Four special economic zones (SEZs) in Georgia seek to attract investment and provide export platforms for businesses. Their main tools consist in tax holidays, which bear the risk of being costly and inefficient if not well-designed and managed (OECD, 2019[3]). Each SEZ is managed by a private company in charge of its infrastructure and promotion.

Overall, the institutional framework appears to be fragmented, with many actors undertaking their own investment promotion activities, while the main IPA’s investment promotion efforts, notwithstanding its well-established SME and export promotion activities, currently lack the clout to lead the investment promotion mandate vis-à-vis stakeholders. The absence of a clear investment policy statement, as highlighted above, contributed to this, and the fact that other agencies are involved in foreign investment attraction (GITA and the Chamber of Commerce notably) also adds to this fragmentation. As a result, the investment promotion mandate of Enterprise Georgia has recently lacked the necessary visibility to cement its position in the investment promotion and facilitation landscape. The change in status and reporting line of the IPA in 2014, and its level of resources, although recently increased, have been further contributing to this situation. Although the Office of the Prime Minister does support the IPA in direct communication with companies, a clear strategic framework and additional measures are needed to make sure that the Invest division of Enterprise Georgia is the go-to partner of foreign investors, including clarifying mandates and the distribution of roles in the broader institutional framework of investment promotion. Once this is established, effective co-operation and collaboration mechanisms among the different agencies can help maximise the outcome.

Enterprise Georgia’s mandate, governance and resources

Governments can adopt a wide array of investment promotion and facilitation structures, either concentrating mandates within one dedicated agency, or choosing to involve other, already existing structures (OECD, 2015[4]). In many countries however, governments have set up dedicated organisations or teams in charge of promoting and attracting foreign investment at the national level, known as investment promotion agencies (IPAs). This practice started in a small number of OECD countries at the beginning of the 20th century, becoming a global trend in the 1990s: in the OECD and in Latin America and Caribbean for example, the number of IPAs have quadrupled in the last 30 years (Volpe Martincus and Sztajerowska, 2019[5]).

Setting-up an IPA can be an important aspect of a country’s investment promotion tools and strategies. The work of the OECD and the IDB shows that IPAs’ organisational models can vary greatly across countries, depending on their legal status, governance model, structure and resources (OECD, 2018[6]) (Volpe Martincus and Sztajerowska, 2019[5]). These characteristics largely reflect a government’s policy objectives. For instance, a multi-mandate agency with strong co-operation links will likely signal that the government is pursuing a linkage strategy, such as between investment and export or investment and innovation. An IPA’s set-up will also inevitably influence its ability to fulfil its mission and deliver on its objectives; pursuing an active targeting strategy to attract investors from specific countries without offices or staff abroad can be a challenging task. The alignment between an IPA’s organisational model and resources and its assigned role in attracting foreign investors is therefore an important condition for a sound investment promotion strategy.

Allocating more resources to investment promotion would raise its visibility and hence effectiveness

The location of investment promotion activities within Enterprise Georgia is recent and is the last of a series of IPA reforms. Before 2012, when it was merged with the Partnership Fund, the Georgian National Investment Promotion Agency was part of the Ministry of Economy and Sustainable Development. In 2015, the IPA was separated from the Fund and became a standalone agency, under the direct supervision of the prime minister. The IPA was later integrated as a division of Enterprise Georgia in 2017. Overall, it has undergone four reforms in the past seven years; although a high pace of reform is common for IPAs, the average for OECD IPAs is 2.2 reforms over the past 10 years.

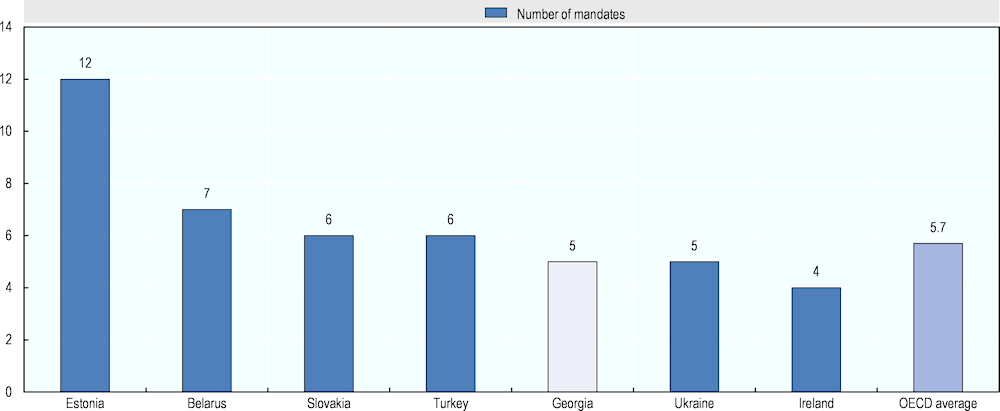

Figure 5.2. Number of mandates of Enterprise Georgia and selected other IPAs

Source: Author’s elaboration based on (OECD, 2018[6]) and (OECD, 2020[7]).

Cumulating several mandates is very common among IPAs, and Enterprise Georgia is not an exception. The agency has five formal mandates in total (out of a list of 18 possible mandates). This number is close to the OECD average of 5.7 and to the average of the selected benchmarks for this review (Figure 5.2). This number reflects the broader mandate of Enterprise Georgia to encourage local enterprise development, beyond investing foreign firms in the country.

Export promotion;

Inward foreign investment promotion;

Domestic investment promotion;

Promotion of regional development, and

Granting financial incentives

Among these five mandates, export promotion is one of the most frequent additional mandates of OECD IPAs, along with innovation promotion. The granting of financial incentives, on the other hand, is not a widespread mandate in the OECD (only 9% of IPAs do it), which reflects international best practice to have the tax authorities deal with fiscal issues (although not necessarily other financial incentives such as grants). This looks different in other regions; in MENA, for example, 50% of IPAs are responsible for fiscal incentives.

Under the right framework conditions, combining several mandates such as investment and export promotion can generate synergies. For example, FDI can lead to the integration of local SMEs into global GVCs when MNEs source locally and can contribute to the diffusion of new knowledge and technology to and among domestic SMEs. The resulting potential business growth and upgrading may, in turn, enable local SMEs to compete better on international markets, and ultimately to directly export their products (OECD-UNIDO, 2019[8]). Similarly, FDI may also contribute to regional development in the areas where foreign firms operate, although realising such synergies is far from automatic and requires a sound enabling environment that is conducive to effective cluster development. This includes providing platforms and mechanisms for engaging dedicated agencies, e.g. SME promotion, regional development or innovation agencies, with the IPA in a shared national vision on investment.

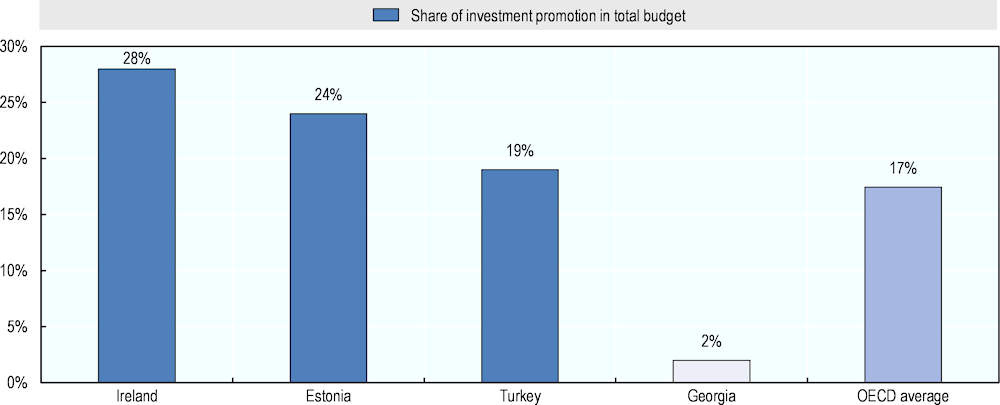

Figure 5.3. Share of investment promotion in total budget

Note: 2016 data for OECD average and OECD countries; 2018 data for Georgia

Source: Author’s elaboration based on (OECD, 2018[6]) and (OECD, 2020[7]).

Compared with peer agencies in other countries, Enterprise Georgia’s share of budget allocated to the four core functions of investment promotion (image building, investment generation, facilitation and aftercare, and policy advocacy) appears limited, although it should be noted that resources for the investment promotion mandate have increased in the past year. According to the OECD-IDB IPA survey, 2% of the total budget of Enterprise Georgia goes to the investment promotion mandate in its narrow definition (Figure 5.3), while this share is 17% in the OECD2. The survey does not take into account resources from other agencies’ departments or other institutions carrying out horizontal activities benefitting foreign investors. In the case of Enterprise Georgia, a large share of the agency’s budget is dedicated to financial and support services that are accessible to both domestic and foreign entrepreneurs, via its Business Department. More broadly, an investment promotion function as part of a large, multi-mandate agency can generate synergies and contribute to more impact, under the right circumstances and with the proper tools and mechanisms.

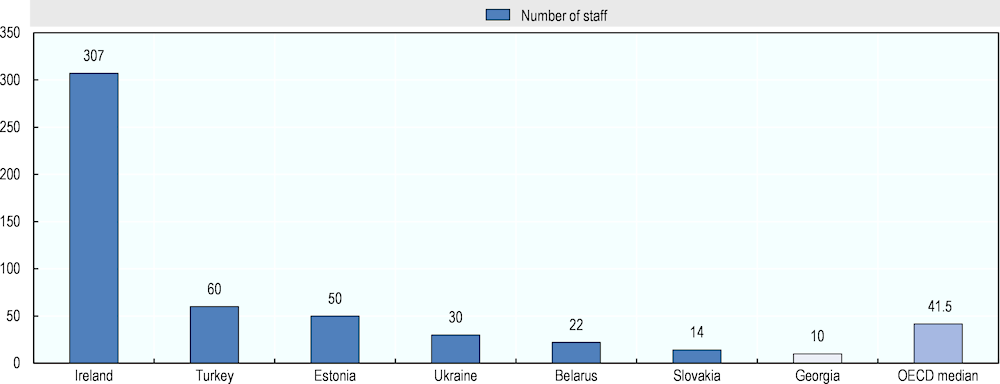

By OECD standards and in comparison with regional peers, financial and human resource figures also appear low. The budget allocated to investment promotion core functions is lower than the median budget of OECD and LAC IPAs, although when compared to a group of six countries with similar levels of GDP per capita,3 it is very close to the average. The IPA team is smaller than teams in peer agencies (Figure 5.4). These results suggest that the IPA might not be able to fully engage in a large portfolio of investment promotion activities. Although there have been recent additions to the team, including the arrival of a new Deputy CEO, more could be done to ensure that Enterprise Georgia has the adequate resources to effectively fulfil its core investment promotion mandate to attract new investors, effectively support the implementation of projects, encourage reinvestment and engage in policy advocacy activities. A clear strategic framework and plan for the IPA can greatly contribute to aligning objectives, means and resources, and the recently developed “Foreign Direct Investments Attraction Strategy 2020–2021” is a stepping-stone in this respect.

Currently, 100% of Enterprise Georgia’s annual budget envelope is allocated through national budgets. The agency could envisage charging foreign investors for some of its services as a way to increase its resources, although few IPAs actually do it (fees only represent 2.2% of IPAs’ total budgets on average). Public agencies tend to charge more for export services than for services to foreign investors, probably because in most countries, foreign investors often have higher bargaining power than exporting SMEs and are seen as “clients” rather than “service users”.

Figure 5.4. Georgia has relatively few staff dedicated to investment promotion

Note: In number of full time equivalents (FTEs)

Source: Author’s elaboration based on (OECD, 2018[6]) and (OECD, 2020[7]).

Besides increasing the resources – and hence the impact and visibility – of the investment promotion mandate, the government and Enterprise Georgia would benefit from encouraging more collaboration among the different divisions of the agency. Currently, teams could benefit from using potential synergies more and gain from the full integration of investment promotion into Enterprise Georgia, a process that is, naturally, still evolving. The recently established department in charge of strategic development and communication will certainly help in strengthening the synergies among the business development, export and Invest divisions of Enterprise Georgia. In a recent case study developed with Business France, the OECD highlights that shared tools, such as SME databases, and joint initiatives such as commonly developed programmes and staff rotation, can help make the most of a being multi-mandate agency (OECD, 2019[9]). Once again, clearly articulating the different pillars of Georgia’s economic and industrial development into a single vision can help in bridging mandates and creating synergies among the different areas of competence within Enterprise Georgia and with other agencies.

An enhanced oversight function for Enterprise Georgia’s could further empower the agency and support its investment promotion functions

Like most OECD IPAs (60%), Enterprise Georgia is an autonomous public agency that reports to a single Ministry. A department in charge of investment policy and its co-ordination was also set up in September 2019 within the Ministry of Economy and Sustainable Development. Locating the IPA under the Ministry in charge of investment can contribute to facilitate coherence and exchanges between the investment policy-making and the investment promotion functions. It can notably facilitate the policy advocacy process thanks to the proximity of the functions and direct links between investment policy and promotion.

As mentioned, the current arrangement is relatively recent, as before 2017 the investment division of Enterprise Georgia was an independent agency under the authority of the Prime Minister. This recent change has led to the perception among stakeholders that the IPA has lost visibility on investment promotion matters, and that whole-of-government co-ordination on investment might thus become more of a challenge. In that sense, the creation of an investment co-ordination function within the lead ministry is welcome, but the long term perspective should be to strengthen the IPA’s capacity to undertake investment promotion.

An IPA’s governance system can greatly affect its ability to support and service foreign investors, especially in countries where business processes can be complex and powers are relatively centralised. Striking a balance between granting access to higher levels of governments and ensuring the availability of sponsoring authorities in such cases can be a tricky challenge. Multiple reporting lines can offer a viable solution. In the OECD, 38% of IPAs have more than one reporting line within the government, and among them, four IPAs have a reporting line to the Head of Government (OECD, 2018[6]). Two of these IPAs have an autonomous status and two are part of the government. Having a reporting line to the Head of Government in addition to their other reporting lines can enable these IPAs to get support from the highest level when facing strategic decisions or complex problems. To avoid overlaps and redundancies, roles should be well-defined in the case of multiple reporting lines. The key is to make sure the IPA has enough institutional support, leverage and visibility to carry out its mission.

Enterprise Georgia’s reporting authority should be careful to keep the volume of supporting and reporting activities manageable, considering the agency’s limited resources. Data from OECD-IDB survey of investment promotion agencies show that Enterprise Georgia reports on its activity at a higher frequency than the majority of IPAs in other regions. It has also recently established a new Analysis, Monitoring and Evaluation Department. In the OECD region, 89% of IPAs report annually or less frequently. In Eastern Europe, South Caucasus and Central Asia region, the proportion is 77% as states of the region tend to report more frequently, given more centralised models of governance. Enterprise Georgia reports more than quarterly on its activities and financials. Considering its small number of staff, this could be a burden, even if monitoring the IPA is legitimate. When agencies have limited resources, the constraints of supporting and reporting to ministries in charge should be carefully assessed and kept at a level that is compatible with the IPA’s objective and resources to deliver on its core mandate.

Contrary to most autonomous OECD IPAs, Enterprise Georgia does not have a board (Box 5.3). The role of a board can vary greatly from one agency to another, but they are often composed of high-level, experienced experts who provide guidance and advice on strategic and management issues. They can sometimes have significant decision-making powers, such as appointing the head of the agency. A board and other forms of oversight can be good mechanisms to ensure the representation of different stakeholders in the governance of an organisation. Having senior profiles from the private sector in the governance model of IPAs is a good way to integrate experience and expertise from the private sector into strategic orientations. The government could envisage establishing a mechanism that would add such oversight and guidance for Enterprise Georgia. An outsider’s view would further help to generate new ideas for collaboration and synergies within the agency, help with co-ordination, as well as to identify and unlock opportunities for co-operation with other agencies and the private sector.

Box 5.3. Boards in OECD IPAs

Over two-thirds of OECD IPAs have a board. They can be either supervisory boards that oversee and approve the work of IPAs, or they can be of an advisory nature and provide strategic guidance to the management. The presence of a board is higher among IPAs that have an autonomous legal status than those that are part of a governmental body.

OECD IPA boards are typically composed of representatives of the private and public sectors (respectively 40.5% and 37.6% of board members in the average OECD IPA). Representatives from research, academia and the civil society sometimes participate to a lesser extent.

Source: Author based on OECD (2018a), “Mapping of OECD Investment Promotion Agencies”.

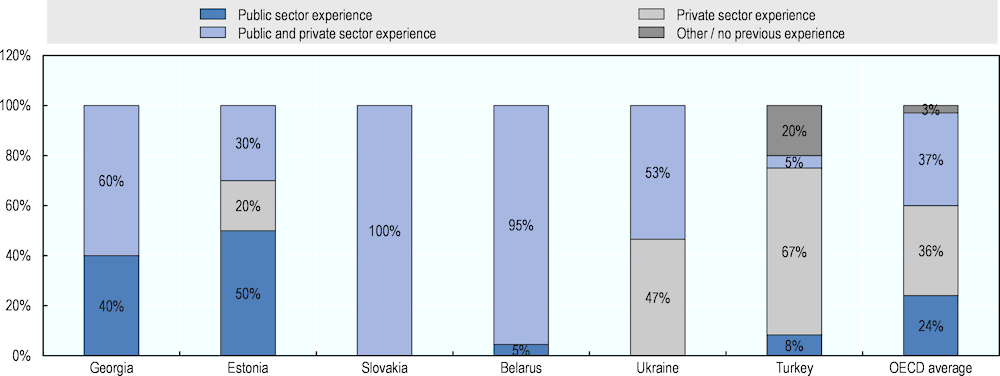

Enterprise Georgia would benefit from recruiting more staff from the private sector

Like all organisations, an IPA’s success relies on its ability to attract suitable and motivated staff. Given the nature of IPA work, the staff should include public and private sector profiles, as well as analytical, marketing and managerial skills. Enterprise Georgia is composed of staff coming from the public sector and people with mixed public and private sector experience (Figure 5.5). The agency is already considering hiring experienced people from the private sector to work on proactive investor targeting in specific activities. More generally, this also helps to address the human resource challenge alluded to earlier.

Figure 5.5. Staff profiles in Enterprise Georgia and in other selected IPAs

Note: Percentage of total staff

Source: Authors’ elaboration based on (OECD, 2018[6]) and (OECD, 2020[7]).

The strategy and instruments of investment promotion

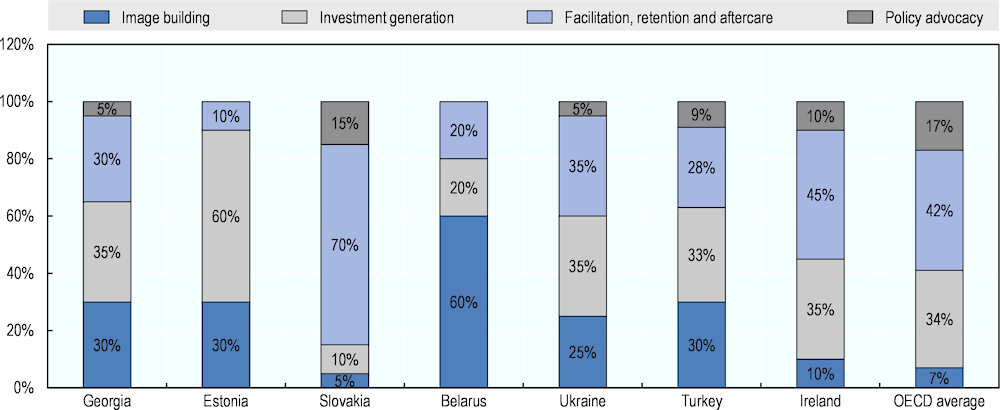

Enterprise Georgia’s activity mix is balanced overall, but with less investment facilitation and aftercare services than peers

IPAs typically carry out four core functions within their investment promotion and facilitation mandate:

image building: general marketing activities to raise awareness and create positive perceptions about a country as an investment destination;

investment generation: outreach and targeted marketing activities to convince foreign investors to locate their investment projects in the host country;

investment facilitation, retention and aftercare: services and actions to facilitate implementation of investment projects, maximise their local economic benefits and generate follow-up investment; and

policy advocacy: monitoring investors’ perceptions of the investment climate and suggesting changes to the government to improve the investment policy.

Enterprise Georgia’s investment team has yet to establish a formal division of labour, because of its relatively small size. The team members all carry out tasks related to the four core functions (image building, investment promotion, investment facilitation and aftercare and policy advocacy). The result is an overall human resource split that is almost equally divided among image building, investment generation and investment facilitation and aftercare, while the policy advocacy function only represents 5% of the total, less than the 17% on average on the OECD (Figure 5.6).

Figure 5.6. Staff allocation in Enterprise Georgia and selected IPAs

Note: Percentage of full-time equivalents

Source: Authors’ elaboration based on (OECD, 2018[6]) and (OECD, 2020[7]).

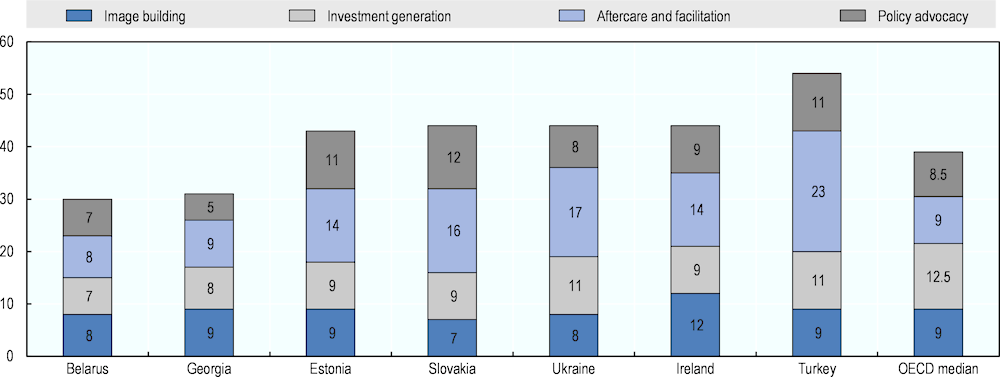

Overall, the number of activities carried out by Enterprise Georgia is lower than the OECD median (Figure 5.7), especially in investment facilitation and aftercare, and policy advocacy. The number of facilitation and aftercare activities is low compared to peers from Estonia, Slovakia, Ukraine, Ireland and Turkey, which is not surprising, considering the limited staff of the Georgian IPA and fits with the allocation of human resources to the four functions described above. As part of its monitoring and evaluation efforts, Enterprise Georgia should regularly review its staff and budget allocation for the various IPA functions. It has to be noted, nevertheless, that pro-active aftercare efforts have increased in recent times, with 10 of 15 company cases having been resolved. This function, if coupled with appropriate investment facilitation remedy measures in areas outside of the IPA’s remits, is thus likely to be further developed in the near future.

Figure 5.7. Enterprise Georgia carries out fewer activities than other selected IPAs

Note: Number of investment promotion activities performed out of a list of 67 choices

Source: Authors’ elaboration based on (OECD, 2018[6]) and (OECD, 2020[7]).

Enterprise Georgia’s restructuring can give renewed emphasis to investment attraction

The core promotion functions of an IPA are image building and investment generation, which, together, aim to promote a country or region as an attractive investment destination. Truly effective investment promotion “leverages the strong points of a country’s investment environment [and] highlights profitable investment opportunities” (OECD, 2015, p. 39[4]). OECD IPAs typically use a wide array of tools and initiatives to conduct image building and investment campaigns, the most common being a dedicated website, promotion materials and general promotion events and missions, as well as market studies, request handling services, and sector- or investor-specific events and meetings (OECD, 2018[6]). To focus their efforts and maximise their desired outcomes, a large majority of them also use prioritisation strategies, targeting countries, sectors, and to a lesser extent, projects.

In the framework of its new “FDI attraction strategy 2020-2021”, Enterprise Georgia is notably working on a new marketing campaign including pro-active targeting of companies within a list of six priority industries. An exhaustive analysis of industries and their potential, based on a methodology developed by the IFC, helped to identify six priority sectors: business process outsourcing (BPO), hospitality and tourism-related infrastructure, apparel and footwear, automobile and aircraft industries, and manufacturing of computers, electronic and electrical equipment. The methodology for the selection of priority sectors involved assessments of domestic capacities, global demand and competitiveness analyses, and consultations with a range of stakeholders including experts, domestic companies and foreign investors. The agency identified 220 companies for outreach activities, based on a list of 3 000 potential investing MNEs and is now working to put up a new webpage for its marketing campaign. The FDI attraction strategy also provides strategic directions beyond investment promotion, although these considerations remain relatively broad at this stage. The plan is nevertheless a stepping-stone for further strategic planning, as Enterprise Georgia evolves in its IPA role.

Enterprise Georgia is currently working on consolidating its overarching promotion narrative, which should contribute to enhancing the investment promotion effort in Georgia. Available public resources and stakeholder consultations converge towards a number of key features of Georgia’s vision for investment promotion. Foreign investment is considered a means to move up value chains and support export-led development. Some stakeholders refer to the strategy of Ireland as a leading example, notably the way that it started attracting investment in low-added business services to move up the value chain and develop high-value added industries such as financial services and software development. The current vision relies on the BPO industry as a starting point, as well as tourism, to develop the image of the country and generate FDI. Another key feature of the promotion narrative is access to export markets. Georgia’s domestic market is limited, but thanks to its location and foreign trade agreements, it is marketing itself as a good destination for export-led businesses, giving access to 2.3 billion consumers without customs duties, including the EU, China, Turkey, Ukraine, CIS and EFTA countries4.

Providing a clear strategic framework via an overarching policy statement, as recommended earlier, requires a clear vision for investment promotion. The framework should ideally further articulate linkages with policy objectives related to innovation, entrepreneurship and SMEs. It is important that stakeholders share and support the vision at all levels, as beyond the alignment of interests, speaking with one voice contributes to strengthening the message with potential investors and giving it more visibility.

An enhanced investment narrative would also support Enterprise Georgia’s current outreach activities. Stakeholders agree that Georgia has made great progress in investment facilitation by streamlining its investment procedures, which already constitutes a major step. This work has contributed to establishing the image of Georgia as an open economy. It now needs to strengthen its approach to identify and communicate its economic strengths and business opportunities. Not only can this process enable Georgia to foster more domestic and foreign private investment, it will also help identify areas where cross-cutting policies are needed to support the development of the private sector, such as for example education and skills development, and labour market policies. With its new 2020-21 strategic plan, Enterprise Georgia has already made a step in this direction, by identifying a list of priority sectors and by planning detailed surveys aimed at assessing and qualifying within-sector opportunities for development and investment projects. If well implemented, this effort will contribute to a stronger narrative for foreign investment attraction in Georgia.

Investment facilitation, aftercare and policy advocacy activities

Investment facilitation-aftercare and policy advocacy functions consist of securing the implementation of new foreign investment projects, retaining foreign investors and contributing to improving the overall investment climate as well as the investment promotion approach. Facilitation services aim to accompany foreign investors in implementing their projects by helping them refine their understanding of the local business environment and navigate the local administration. Aftercare focuses on conflict and problem resolution and on programmes to link foreign investors with the local economy according to their needs, to encourage them to remain in the country and expand their activities further. Policy advocacy is the function through which IPAs can inform investment policy-making on what works and what would need to change from the perspective of foreign investors.

Investment facilitation-aftercare and policy advocacy are also the most heterogeneous functions across IPAs, as highlighted in the 2018 OECD IPA Mapping report. Activity mixes vary widely among IPAs in these two functions, in contrast with promotion functions. Several factors can explain this heterogeneity. First, the core mandates of IPAs often focus more on promotion than on investor servicing. Second, the labour intensive nature of these activities often leads to weaknesses in the facilitation and aftercare functions. Lastly, the existence of other agencies in charge of business facilitation and the degree to which business processes are already streamlined can influence the way that IPAs carry out investment facilitation and facilitation services.

Georgia has established itself as an easy place to do business since 2003

Georgia has considerably improved its overall business environment over almost two decades, starting in the early 2000s when the government undertook a series of reforms to establish a sound regulatory framework for businesses and tackle corruption – an area that receives more attention, even today. Among other measures, the government considerably streamlined its tax system with the introduction of a new tax code and abolished many business licences and permit requirements. The government also worked on improving its ranking in the World Bank Doing Business indicators which gave Georgia a credible reputation of a place in which it is easy to do business. A challenge going forward will be to make sure that the regulations in place still meet development objectives and are assessed ex post and ex ante as reforms are being advanced. More recently, Georgia has further strengthened its relationship with the EU through the EU Georgia Association Agreement (AA) including a Deep and Comprehensive Free Trade Area (DCFTA) (see Assessment and Recommendations section). The deepening of Georgia’s economic integration with the EU is expected to drive further reforms, as the AA and DCTFA include provisions on the country’s alignment with EU legislative standards in areas such as public procurement, intellectual property rights and competition rules.

As a result of its past reforms, Georgia is now the most open economy in the region, and one of the countries where establishing a company is the easiest. In the World Bank’s Doing Business rankings, Georgia now ranks 7th in terms of the ease of doing business out of 190 countries (Table 5.1), and in the world’s top ten for three categories: starting a business (2nd), protecting minority investors (7th), registering property (5th). Georgia also ranks 16th out of 180 countries worldwide in the 2018 Index of Economic Reforms (Heritage Foundation) (OECD, 2019[1]).

Table 5.1. Doing Business in Georgia and selected countries

Ranking out of 190 countries in 2020 and 189 in 2014

|

|

|

Georgia |

Estonia |

Slovak Republic |

Belarus |

Ukraine |

Turkey |

Ireland |

|---|---|---|---|---|---|---|---|---|

|

Ease of doing business |

2020 |

7 |

18 |

45 |

49 |

64 |

33 |

24 |

|

2014 |

8 |

22 |

49 |

63 |

112 |

69 |

15 |

|

|

Starting a business |

2020 |

2 |

14 |

118 |

30 |

61 |

77 |

23 |

Note: The Doing Business methodology changed between 2014 and 2020 which can partly explain some of the changes in rankings.

Source: World Bank

Georgia has successfully led business facilitation reforms and achieved the status of the most open economy in a region where countries have transitioned to a market economy only recently, but some challenges persist. Specific investment facilitation measures are currently in place to resolve potential conflicts. Georgia first established the role of ombudsman for the private sector in 2011 through a government decree. Its initial functions focused on tax issues and were based on article 42 of the Georgia Tax Code. In 2015, its remits were widened and the function was renamed to become the Business Ombudsman of Georgia. The number of applications recorded by the Ombudsman increased from 192 in 2013 to 338 in 2016, down to 257 in 2017.5 The increase of applications from regions outside the capital is a positive sign of the importance of the functions. The office requires more budgetary resources to further enhance its impact, including by more pro-actively reaching out to the business community, rather than passively awaiting applications. Also, so far, the support of the Prime Minister has been critical for an Ombudsman’s recommendation to be accepted. Reviewing the system so that the Ombudsman’s recommendation forms part of a systematic dispute resolution system could help improve the impact of the function.

The government also recently set up a “trouble-shooting group” composed of representatives of the Ministry of Economy and Sustainable Development and Enterprise Georgia, with weekly meetings to discuss ongoing problems and potential remedies. This new setting could alleviate the risk of foreign investors going directly to the prime minister to solve their problems, as some have done in the recent past. This phenomenon poses governance challenges as it can encourage investors to bypass regulations or mechanisms in place. It also weakens the IPA’s position as a go-to partner of businesses.

In the longer term, Enterprise Georgia could strengthen aftercare and policy advocacy

Enterprise Georgia provides most of the same facilitation activities delivered by other IPAs in the OECD and in other regions (Table 5.2). The IPA currently focuses on the provision of information and organisation of meetings, including site visits and working meetings with officials and potential local business partners, providing information about the local business environment, and assisting investors in obtaining visas and work permits, as well as in other administrative processes such as obtaining licences and access to utilities.

In the areas of aftercare and policy advocacy, on the other hand, Enterprise Georgia performs fewer activities than most IPAs. Enterprise Georgia only carries out two formal aftercare activities (structured troubleshooting and database of local suppliers), while the average is 4.7 among OECD IPAs, and 5 among IPAs of the Eastern Europe, South Caucasus and Central Asia (OECD, 2020[7]). As regards policy advocacy, the agency performs five activities, while the OECD median is nine.

Table 5.2. Provision of facilitation and aftercare services by Enterprise Georgia and selected IPAs

|

|

Georgia |

Estonia |

Slovakia |

Belarus |

Ukraine |

Turkey |

Ireland |

Share of OECD IPAs* |

|---|---|---|---|---|---|---|---|---|

|

Provision of information on local suppliers / clients |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

94% |

|

Site visits |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

94% |

|

Working meetings (with officials, potential suppliers, etc.) |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

90% |

|

Structured trouble-shooting with individual investors |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

81% |

|

|

Assistance to obtain visas and work permits |

✓ |

✓ |

✓ |

✓ |

✓ |

71% |

||

|

Assistance in obtaining financing |

✓ |

✓ |

✓ |

71% |

||||

|

Database of local suppliers |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

65% |

|

|

Matchmaking service between investors and local firms |

✓ |

✓ |

✓ |

✓ |

✓ |

65% |

||

|

Assistance to obtain land and construction approvals |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

58% |

|

Assistance with legal issues |

✓ |

✓ |

✓ |

✓ |

58% |

|||

|

Airport pick-ups |

✓ |

✓ |

✓ |

✓ |

✓ |

58% |

||

|

Assistance with business/tax registration |

✓ |

✓ |

✓ |

✓ |

✓ |

58% |

||

|

Assistance with utilities |

✓ |

✓ |

✓ |

✓ |

✓ |

55% |

||

|

Assistance to obtain licenses (e.g. sectoral) |

✓ |

✓ |

✓ |

✓ |

✓ |

52% |

||

|

Cluster programmes |

✓ |

✓ |

✓ |

48% |

||||

|

Mitigation of conflicts |

✓ |

✓ |

✓ |

45% |

||||

|

Capacity-building support for local firms |

✓ |

✓ |

39% |

|||||

|

Assistance in recruiting local staff |

✓ |

✓ |

39% |

|||||

|

Assistance with other business matters |

✓ |

✓ |

✓ |

33% |

||||

|

Ombudsman intervention |

✓ |

✓ |

26% |

|||||

|

Training or educational programmes for local staff |

✓ |

✓ |

19% |

Note: *share of OECD IPAs providing the service

Source: Author’s elaboration based on (OECD, 2018[6]) and (OECD, 2020[7]).

Both aftercare and policy advocacy are important functions. Aftercare is vital for re-investment and expansion, which account for a significant share of all investments. In its FDI attraction strategy 2020-2021, Enterprise Georgia underscores that the share of reinvestment in total FDI increased in Georgia in the past few years to reach 35% in 2018. Retaining existing investors is also significantly less costly than attracting new ones, while being particularly crucial when seeking investment in higher value-added activities (OECD, 2015[4]). A strong aftercare function relies on maintaining an ongoing dialogue with foreign investors. Policy advocacy, on the other hand, provides opportunities to integrate feedback from foreign investors to enhance the policy framework, address structural investment climate challenges, and ultimately potentially reduce the number of complaints.

In the longer run, once Georgian policymakers have addressed the more pressing challenges of establishing an overarching strategic framework and launched the new marketing programme, the IPA could seek to strengthen its aftercare and policy advocacy approaches. This may require gaining additional political support to drive reforms that are beyond the IPA’s remit. Although the FDI attraction strategy 2020-2021 states the importance of the IPA’s contribution to investment policymaking, it does not yet provide a roadmap for doing so. In particular, Enterprise Georgia would benefit from clarifying and structuring its approach, including tools and mechanisms through which the dialogue with existing investors is maintained (e.g. through a key account management approach). It would also gain from establishing clear channels for relevant information from the IPA’s first-hand experience with investment projects to feed into policymaking. The example of Business France can provide some guidance, although the approach needs to be tailored according to specific needs and available resources (Box 5.4). Currently, Enterprise Georgia has a good overview of the issues that foreign investors face and has developed mechanisms to track complaints, such as through their new CRM system. However, the agency cannot tackle all the issues investors face on its own and would thus need to strengthen its avenues for investment facilitation and aftercare in areas beyond its remit. One way to do so could be to have the Ministry of Economy and Sustainable Development make sure to include Enterprise Georgia in relevant investment policy discussions. Granting the IPA a permanent seat at the Investor’s Council could be considered in this regard. Also, the “troubleshooting group” mentioned earlier could form a good basis for enhancing the much need aftercare services.

Box 5.4. A structured approach to aftercare: the example of Business France

Re-investment projects account for 40-50% of all FDI in France. In recognising this opportunity, Business France has set up a dedicated aftercare team to identify new leads, trigger re-investment, and establish and strengthen the relationship with international companies in France over the medium to long term.

The agency follows a structured approach using a key account management system, through which the aftercare service team maintains an ongoing dialogue with established investors. It also attends VIP networking events to foster relationships with high-level decision makers, including cabinet ministers, among others. The agency provides services at both the operational level, helping investors deal with administrative issues, and the strategic level, supporting investment/reinvestment decisions. Customer satisfaction surveys, annual meetings with key accounts, customer satisfaction calls, and annual FDI surveys are all means that Business France uses to measure the impact of aftercare services.

Source: Business France (2019), OECD workshop on investment promotion practices in Eurasia (2019)

Enterprise Georgia could also gradually engage in an FDI-SME linkage programme. Such programmes are designed to support MNEs’ engagement with domestic companies through contracting arrangements, such as supplier or, more rarely, buyer contracts. IPAs are often well positioned to fill information gaps and help MNEs identify reliable, technology-ready local business partners. Enterprise Georgia could use its current database of local suppliers, based on the SME database of Georgia’s national office of statistics Geostat, as a first step to develop such a programme. Ideally, the agency could establish co-operation processes between its different divisions and with GITA to identify opportunities.

Formal co-ordination and co-operation terms and mechanisms would improve investment promotion and encourage synergies

The OECD’s framework for institutional co-operation and co-ordination in investment promotion shows that IPAs are often required to co-ordinate both vertically and horizontally to carry out their mandates (Table 5.3). Although co-ordination poses a number of challenges to most IPAs, some tools and mechanisms can help.

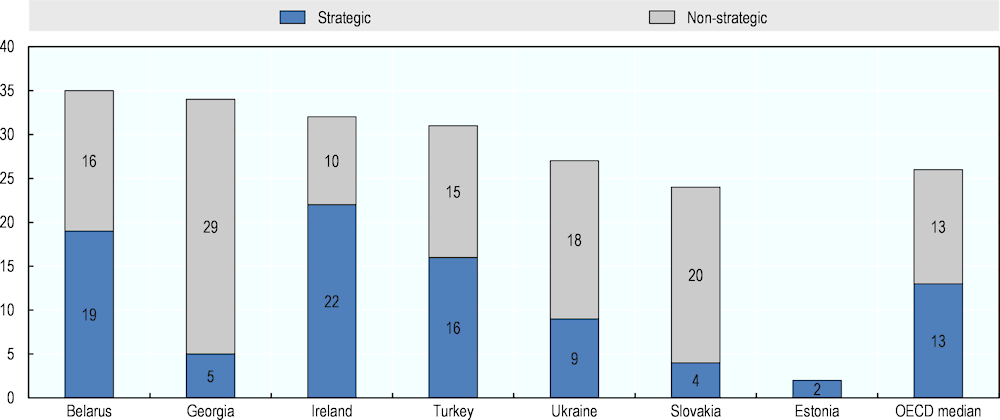

Overall, the comparison between Enterprise Georgia and selected peers shows that the Georgian IPA deals with a high number of organisations, although its number of strategic relationships is limited (Figure 5.8). Enterprise Georgia’s network is composed of 34 different organisations, while the OECD median IPA’s is 26. When taking into account the limited resources of the Enterprise Georgia, this figure appears even more challenging. The strategic relationships are concentrated around five stakeholders including the Ministry of Economic and Sustainable Development, agencies in charge of investment incentives and SEZ, and the inter-ministerial investment committee (Table 5.3). The new Strategic Development and Communication Department within Enterprise Georgia will help to manage the network of stakeholders.

Table 5.3. General framework of institutional co-operation and co-ordination for IPAs

|

|

Strategic alignment |

Operational co-operation and co-ordination |

|---|---|---|

|

International level (representation abroad) |

Strategic marketing alignment (“one voice” / clear messaging) with authorities abroad |

Investment promotion co-ordination with diplomatic missions and governmental missions abroad |

|

National level (central government and other national agencies and administrations) |

Overarching national investment policy and other national economic policies (e.g. industrial development policies) National branding strategy Strategic reporting and planning to the Head of Government and Sponsor authorities |

Co-ordination with other national promotion agencies (e.g. innovation and export promotion agencies) and with industry-specific initiatives Co-ordination with national administrative bodies for facilitation services Co-operation and co-ordination for troubleshooting (can require strong interactions with different Ministries) |

|

Sub-national level (sub-national authorities and agencies) |

Attraction and promotion strategy formulation / offering definition Strategic marketing alignment (“one voice” / clear messaging) |

Investment promotion at sub-national level Investment facilitation services (e.g. site visits) Aftercare (e.g. local cluster programmes) Local administrative procedures (e.g. for local incentives) Troubleshooting at sub-national level |

Source: (OECD, 2018[6]).

Figure 5.8. Enterprise Georgia has more institutional relationships than many other IPAs

Source: Author’s elaboration based on (OECD, 2018[6]) and (OECD, 2020[7]).

In the OECD, 69% of IPAs consider embassies and consulates as strategic partners, even among those that have affiliated offices abroad. The nature of these relationships can vary from joint promotion plans to co-ordination on facilitation issues such as visa delivery. The same goes for subnational governments and agencies, considered as strategic partners by more than half of OECD IPAs. While Enterprise Georgia does not have a network of affiliated offices abroad, embassies and consulates have recently begun to be more active in reaching out to target companies and in undertaking promotional activities. The IPA has also developed some guidelines for embassies for their outreach activities. These measures could provide considerable further reach to the IPA as it seeks to roll out its marketing efforts.

Table 5.4. Institutional relations of Enterprise Georgia

|

|

Strategic |

Non-strategic |

|---|---|---|

|

More than weekly |

Sponsor Ministry Agency in charge of investment incentives |

Ministry of Finance Ministry of Foreign Affairs Embassies and consulates Foreign Embassies Agency in charge of tourism promotion Agency in charge of land allocation Industry groups / associations |

|

3 times a month to weekly |

Other national IPAs Agencies in charge of Special Economic Zones |

Ministry of Education Subnational governments Agency in charge of innovation promotion (GITA) Tax agency Immigration agency National statistical office Sectoral or other regulatory bodies (e.g. registrations, licensing) Chambers of Commerce Individual private firms (e.g. consulting or legal firms) Influencers International organisations |

|

once or twice a month |

Inter-ministerial Investment Committee |

President / Presidential Administration or Prime Minister Ministry of Infrastructure Customs Financial institutions Universities Other academic or scientific organisations |

|

3 to 11 times a year |

- |

Border regulatory agency NGOs |

|

once or twice a year |

- |

Competition authority Central Bank Workers' associations |

Overall, Enterprise Georgia would benefit from clearer terms of co-operation and mechanisms to work jointly with its key institutional partners. Currently, the agency operates on a rather ad hoc basis, without clear guidelines, shared protocol or tools. This does not prevent the IPA from collaborating informally with GITA and the Chamber of Commerce, thanks to good relationships between agencies. Well-defined co-operation terms in strategic plans and dedicated tools such as shared information systems and systematised protocols could nevertheless improve the quality of the co-operation while potentially reducing the workload thanks to efficiency gains. Enterprise Georgia is currently implementing a CRM tool and aims to share it with other agencies. This could enhance co-operation and maximise synergies between investment promotion, SME development and export, and innovation promotion.

References

[2] IMF (2019), IMF Country Report No. 19/171.

[7] OECD (2020), Investment Promotion in Eurasia, a Mapping of Investment Promotion Agencies.

[9] OECD (2019), Mapping of Investment Promotion Agencies: Middle East and North Africa.

[1] OECD (2019), Monitoring Georgia’s SME Developement Strategy.

[3] OECD (2019), OCED Investment Policy Reviews: Southeast Asia.

[6] OECD (2018), Mapping of Investment Promotion Agencies in OECD countries.

[4] OECD (2015), Policy Framework for Investment, 2015 Edition, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264208667-en.

[8] OECD-UNIDO (2019), Integrating Southeast Asian SMEs in Global Value Chains: Enabling Linkages with Foreign Investors.

[5] Volpe Martincus, C. and M. Sztajerowska (2019), How to Solve the Investment Promotion Puzzle: A Mapping of Investment Promotion Agencies in Latin America and the Caribbean and OECD Countries, Inter-American Development Bank, http://dx.doi.org/10.18235/0001767.

Notes

← 1. With the financial support of the European Union’s EU4Business initiative.