This Chapter focuses on several core investment policy issues – the non-discrimination principle, the degree of openness to foreign investment, protections for investors’ property rights and mechanisms for settling investment disputes – under Georgian law and Georgia’s investment treaties. It also addresses the government’s approach to data protection and cybersecurity. It takes stock of recent achievements, identifies remaining challenges and makes recommendations to address them. In terms of investment treaty policy, this Chapter provides an overview of Georgia’s investment treaties, analyses the main substantive protections and investor-state dispute settlement provisions in these treaties and identifies considerations for possible policy reforms.

OECD Investment Policy Reviews: Georgia

3. Domestic regulatory framework and investor protection

Abstract

Summary and policy recommendations

The legal framework for investment has undergone substantial remodelling in the past three decades. Formerly a Soviet republic, Georgia is now a thriving liberal market economy. Georgia is now open to foreign investment in most sectors. Limited restrictions remain, notably in the agricultural sector in light of a ban on foreign ownership of agricultural land. The remaining sectoral restrictions nonetheless fall within the same sectors as those found in both EaP and OECD countries.

With the vast majority of de jure barriers to FDI now removed, the government’s investment policy challenge lies in improving the overall climate for investment. Significant strides have been taken in this area too. The Law on Promotion and Guarantees of Investment Activity (Law No. 473-IS of 12 November 2006, as amended, hereafter the Investment Law) is a centrepiece of these developments. It seeks to establish a level playing field as between domestic and foreign investors. Together with several other investment-related laws, it sets out non-discrimination guarantees, protections from expropriation, rights to free transfer of funds abroad and a limited set of investor obligations. The country’s land laws provide a clear and predictable framework for property rights, which is another important pillar for the investment climate. Well-developed laws and institutions on data protection and cybersecurity, which are edging closer to alignment with EU rules in this area, are also noteworthy.

A number of important challenges remain. Foremost among these are the ongoing efforts to reinforce the independence, accountability and capacity of the country’s judiciary. Legislative amendments adopted by Parliament in December 2019 seek to address some of the remaining concerns but there is a need for sustained momentum for systemic judicial reform to build investor confidence in the court system. Other important challenges include ensuring that intellectual property rights are enforced effectively, realising universal land registration and continuing to improve the legal and institutional infrastructure that supports alternative dispute resolution services. Recommendations in each of these areas are set out in Box 2.1.

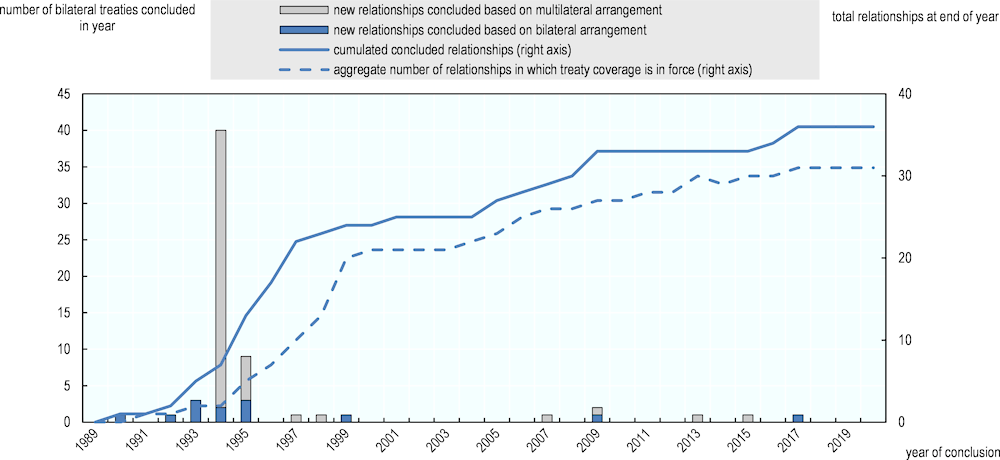

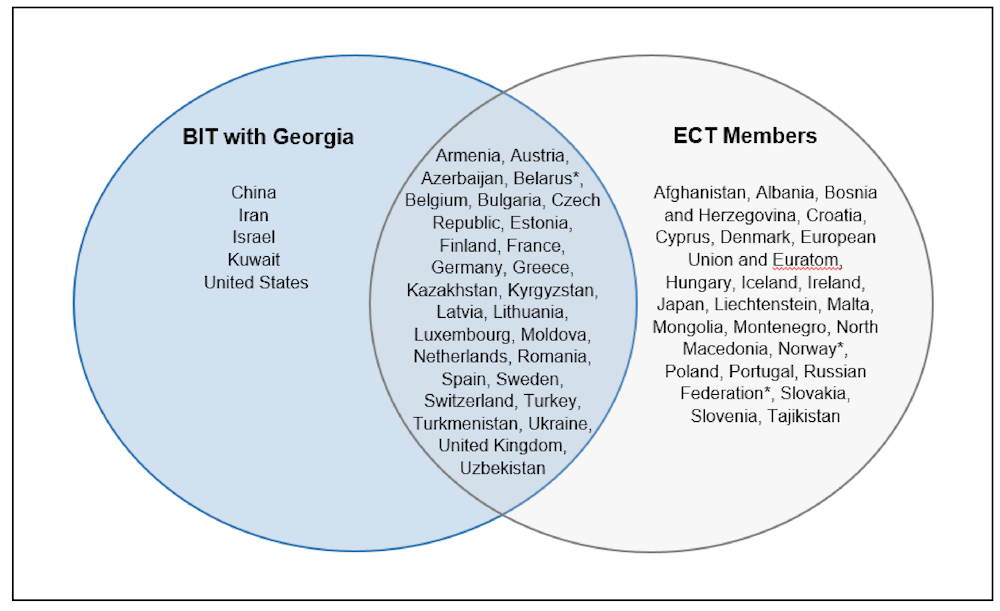

Protections afforded under Georgia’s investment treaties are another important part of the legal framework for investment. These treaties grant protections to certain foreign investors in addition to and independently from protections available under domestic law to all investors. Georgia is a party to 33 investment treaties in force today. Like investment treaties signed by many other countries, Georgia’s investment treaties typically protect investments made by treaty-covered investors against expropriation and discrimination. They also give covered investors access to investor-state dispute settlement (ISDS) procedures, including international arbitration, in cases where they claim that the government has infringed these protections.

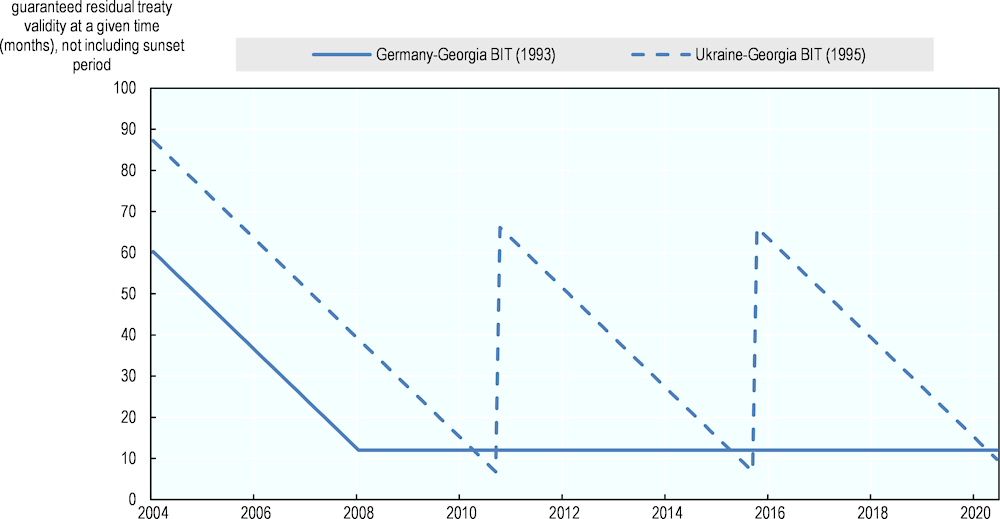

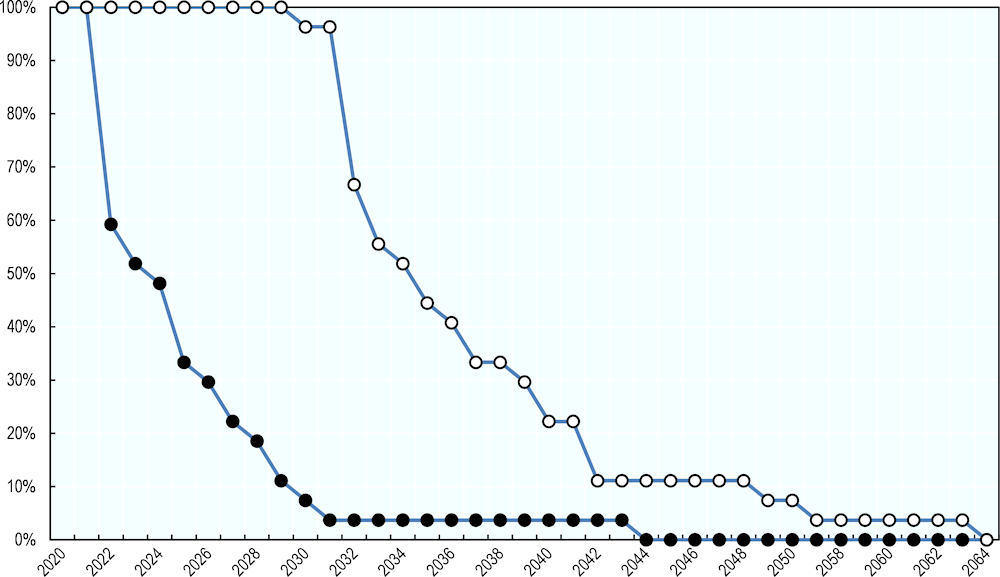

Georgia is participating actively in various inter-governmental discussions regarding possible reforms of investment treaties, including UNCITRAL’s Working Group III on ISDS Reform and the modernisation process for the Energy Charter Treaty, a prominent multilateral treaty to which Georgia is a party. Like many other countries, however, Georgia still has a significant number of older investment treaties in force with vague investment protections and ISDS provisions that may create unintended consequences in ISDS cases and ultimately undermine reform efforts. Many countries have substantially revised their investment treaty policies in recent years in response to these concerns as well as increased public questioning about the appropriate balance between investment protection and sovereign rights to regulate in the public interest and the costs and outcomes of ISDS. Recommendations to reconsider several aspects of the government’s approach to investment treaties in this context are set out in Box 2.1. Whatever approach the government takes towards investment treaty making, these treaties should not be seen as a substitute for long-term improvements in the domestic business environment including through measures to improve the capacity, efficiency and independence of the domestic court system, the quality of the legal framework, and the strength of national institutions responsible for implementing and enforcing such legislation.

Policy recommendations

Assess the impact of foreign ownership restrictions on agricultural land on investment in the agri-business sector and on participation of that sector in global value chains (as described in Chapter 4). In light of those findings, reconsider whether such restrictions fulfil their role and whether other non-discriminatory measures could instead be used to protect small landholders and other stakeholders.

Consider the merits of consolidating and harmonising the various laws that address expropriation. Expropriation protections are spread across several laws that include varying levels of detail for the scope of these protections. The government may also wish to consider whether there are good policy reasons for providing different standards of protection from expropriation for certain foreign investors under its investment treaties than for other investors under its domestic laws.

Continue to prioritise efforts to improve the regime for intellectual property (IP) rights, especially enforcement measures. Investors continue to report concerns with widespread software piracy and unlicensed online content, as well as the level of technical capacity among local judges, lawyers, prosecutors, police officers and customs officers responsible for IP enforcement. The government is well aware of these concerns and designs initiatives to address them. Improving investor confidence with IP enforcement in the country is a precondition for attracting further investment in R&D, new technologies and innovation.

Sustain momentum for systemic judicial reform. Concerns regarding the integrity of the judicial appointment process and the capacity of the courts to deliver quality outcomes continue to affect investor confidence in the court system. The government should continue to work closely with a wide range of stakeholders, including civil society organisations and international partners, to address persisting concerns. Low levels of trust in the judiciary affect the overall investment climate in a number of ways, not only the use of court services to adjudicate investment disputes but also perceptions about the integrity of court assistance with IP enforcement, arbitration and mediation, among other areas.

Evaluate potential amendments to the Arbitration Law (Law No. 1280-IS of 19 June 2009, as amended). Areas for possible legislative clarification include the scope of the “public order” ground for refusing enforcement of an arbitral award under Article 44 of the Law. It may also be prudent for the government to take stock of court decisions and user experiences under the Law over the past decade to assess the merits of these potential amendments to improve legal certainty, user experiences and the attractiveness of arbitration in Georgia.

Support initiatives to improve public perceptions and awareness of arbitration and mediation as credible alternative dispute resolution options. Negative public perceptions of arbitration institutions, arbitrators and courts that harken back to experiences under earlier arbitration laws is hindering the development of arbitration in the country. Existing arbitration institutions may be able to complement the government’s own efforts to foster a stronger culture of independence, competence and integrity in this sector.

Strengthen land administration services by completing and, if possible, expediting the universal land registration reform and improving options to resolve land disputes, including the framework for mediation introduced as part of the 2016 land reforms.

Maintain data protection and cybersecurity as a national policy priority. Georgia has relatively well-developed laws and institutions in these areas of increasing importance for all investors. It is nonetheless important to build on recent achievements by monitoring the effectiveness of the new State Inspector Service, seeking new opportunities to collaborate with international partners to exchange best practices and boost the government’s in-house technical capacity in these areas, and ensuring that existing laws evolve to align with international standards such as the Budapest Convention on Cybercrime.

Continue to reassess the government’s priorities for investment treaty policy and consider possibilities for introducing further clarification of key provisions in older investment treaties. These treaties should be calibrated to reflect an appropriate balance between investment protection and preserving the government’s right to regulate while also contributing to Georgia’s efforts to attract FDI. Georgia may wish to consider whether provisions in its existing investment treaties appropriately safeguard the government’s right to regulate and avoid unintended interpretations in ISDS disputes. Clearer specification of key provisions, where needed, would help to reflect government intent and ensure policy space for government regulation.

Continue to participate actively in and follow closely government and other action on investment treaty reforms at the OECD, UNCITRAL and ECT modernisation process. Consideration of reforms and policy discussions on frequently-invoked provisions in ISDS cases and whether investment treaties are achieving their intended purposes are of particular importance in current investment treaty policy. Emerging issues such as the possible role for trade and investment treaties in fostering responsible business conduct as well as ongoing discussions about treaties and sustainable development also merit close attention and participation.

Georgia is open to foreign investment, with limited exceptions

An open and non-discriminatory investment environment is a central tenet of an attractive investment climate. It helps to ensure that all investors are treated alike in like circumstances, irrespective of their ownership. One of the concepts derived from the principle of non-discrimination in the context of foreign investment is that of national treatment, which requires that governments treat foreign-owned or foreign-controlled enterprises no less favourably than domestic enterprises in like situations (OECD, 2015[1]).

No economy, including Eastern Partner (EaP) and OECD economies, accords market access or national treatment to foreign-owned enterprises in their territories across the board. Despite the potential benefits of FDI being generally accepted, and FDI attraction having become an important policy tool to finance development in many economies, concerns over the loss of national sovereignty and the protection of national interests continue to lead governments to discriminate or impose statutory restrictions on foreign direct investments. While there have been great FDI liberalisation efforts in manufacturing industries, where governments have more readily accepted the benefits of FDI, some services and primary sectors still remain partly off limits to foreign investors, although this varies greatly across economies.

The following analysis uses the OECD FDI Regulatory Restrictiveness Index (the FDI Index) to assess and benchmark market access and exceptions to national treatment (Box 3.1). This index gauges the level of restrictiveness of an economy’s statutory measures on FDI by looking at four main types of restrictions: 1) foreign equity limitations; 2) discriminatory screening and approval mechanisms for foreign investment; 3) restrictions on the employment of key foreign personnel; and 4) other operational restrictions (e.g. restrictions on branching and capital repatriation or land ownership). The index is not a full measure of investment climate attractiveness – a range of other factors come into play, including how FDI rules are implemented. Nonetheless, FDI rules are a critical determinant of an economy’s attractiveness to foreign investors: removing restrictions may not always lead to the hoped-for surge in FDI inflows, but high levels of restrictions are almost certainly likely to deter investors. Benchmarking FDI restrictions helps governments to see how they compare with their peers in terms of the restrictiveness of their FDI regimes.

Box 3.1. The OECD FDI Regulatory Restrictiveness Index

The OECD FDI Regulatory Restrictiveness Index seeks to gauge the restrictiveness of an economy’s FDI rules. The FDI Index is currently available for more than 60 economies, including all OECD and G20 members, allowing one to compare FDI policies and identify potential areas for reform. It is commonly used on a stand-alone basis to assess the restrictiveness of FDI policies when reviewing candidates for OECD accession and in OECD Investment Policy Reviews, including reviews of new adherent countries to the OECD Declaration on International Investment and Multinational Enterprises. The index does not provide a full measure of an economy’s investment climate as it does not score the actual implementation of formal restrictions and does not take into account other aspects of the investment regulatory framework, such as the extent of state ownership, and other institutional and informal restrictions which may also impinge on the FDI climate. Nonetheless, FDI rules are a critical determinant of an economy’s attractiveness to foreign investors; and the index, used in combination with other indicators measuring the various aspects of the FDI climate, may help to explain variations among economies in attracting FDI.

The FDI Index covers 22 sectors, including agriculture, mining, electricity, manufacturing and main services (transport, construction, distribution, communications, real estate, and financial and professional services). For each sector, the scoring is based on the following elements:

the level of foreign equity ownership permitted;

the screening and approval procedures applied to inward foreign direct investment;

restrictions on key foreign personnel (e.g. CEO, technical expert); and

other operational restrictions (e.g. land ownership, branching, profit repatriation).

Restrictions are evaluated on a 0 (open) to 1 (closed) scale. The overall restrictiveness index is the average of the 22 individual sectoral scores. The discriminatory nature of measures, i.e. when they only apply to foreign investors, is the central criterion for scoring a measure. State ownership and state monopolies, to the extent they are not discriminatory towards foreigners, are not scored.

Source: (Kalinova, Palerm and Thomsen, 2010[2]) .

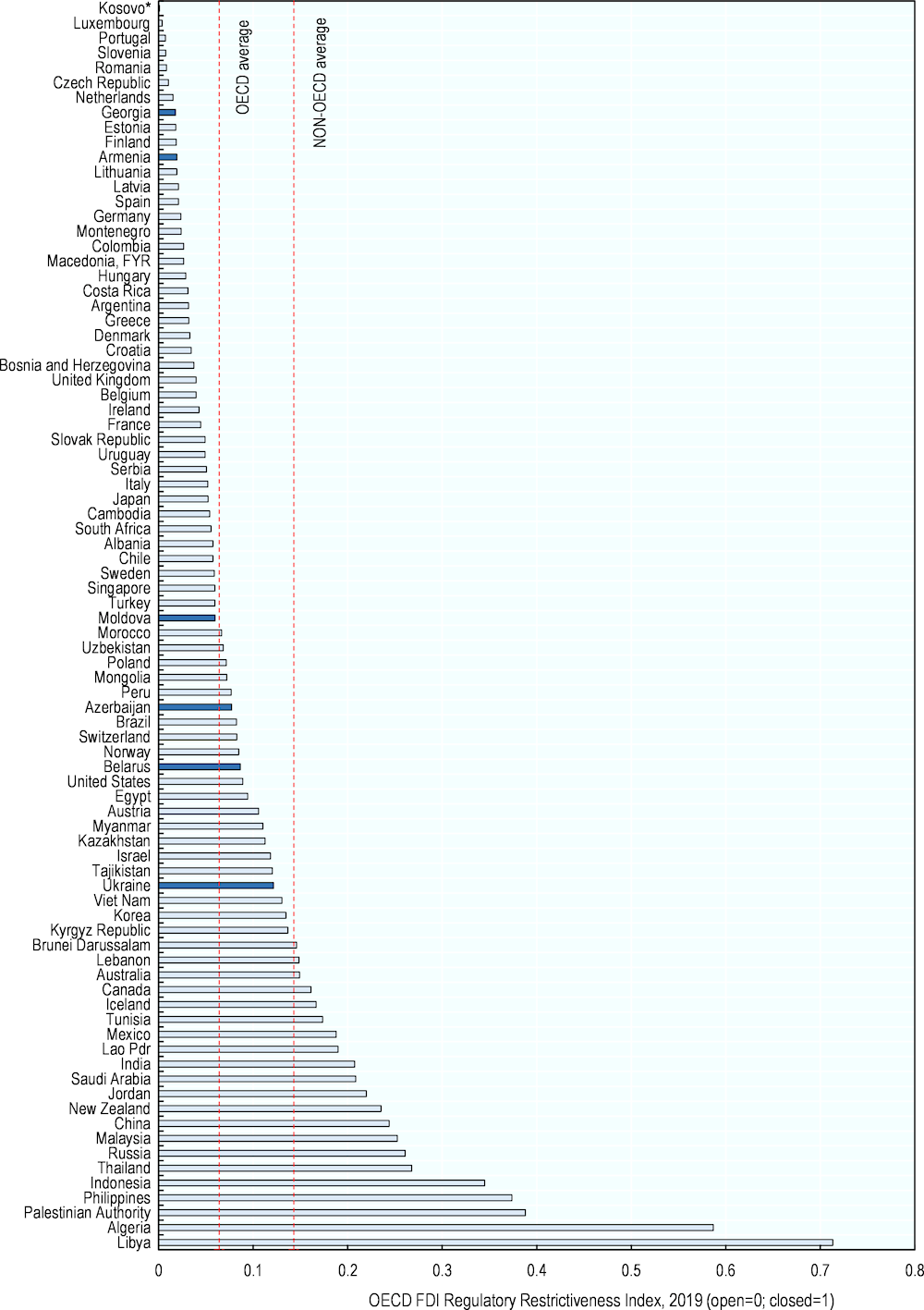

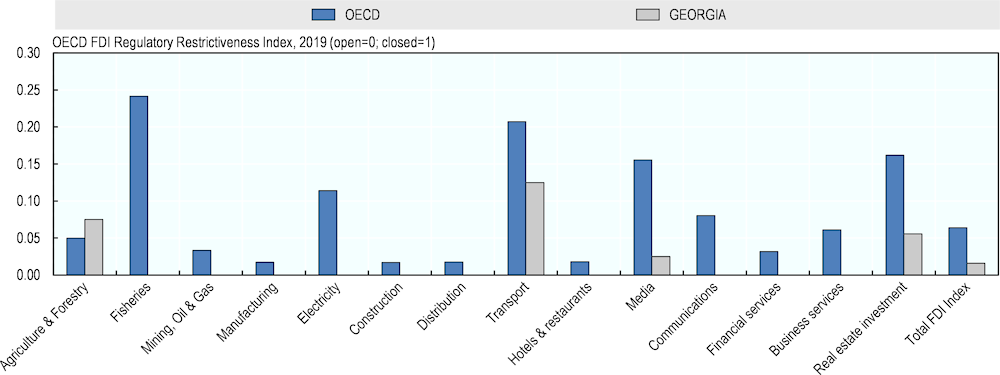

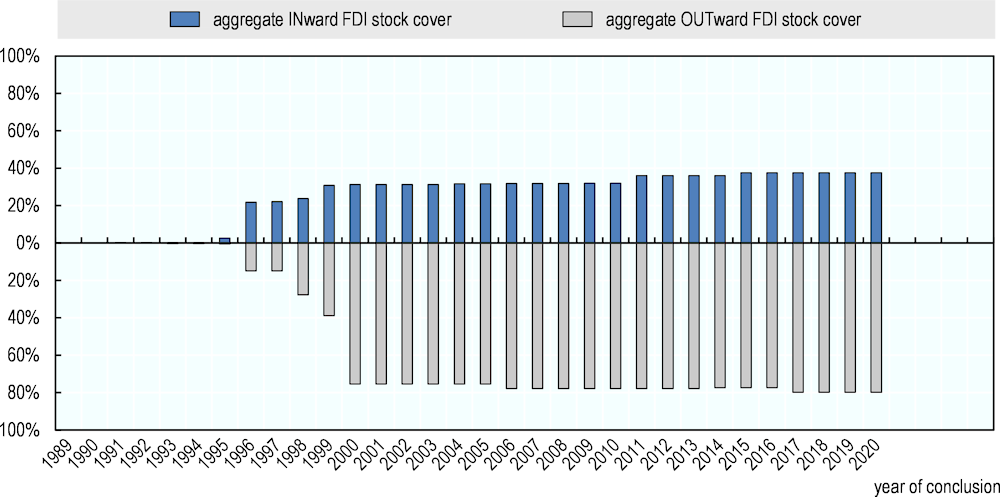

Overall, openness to FDI varies greatly across economies and regions (Figure 3.1). Larger economies and those in the Asia-Pacific region tend to be more restrictive on average. Smaller European economies tend to the most open to FDI as measured by the FDI Index. Substantial variation is observed across EaP countries, with Georgia and Armenia among the most open. Georgia is particularly restrictive in agriculture and forestry, given the ban on foreign ownership of agricultural land (Figure 3.2). Foreign-controlled locally established enterprises are, nevertheless allowed to lease land for agricultural use or to obtain special permission from the government to purchase agricultural land on the basis of an investment plan. In Georgia, foreign ownership of agricultural land is restricted to 50% of equity. Overall, Georgia’s sectoral restrictions fall within the same sectors as those found in both EaP and OECD countries.

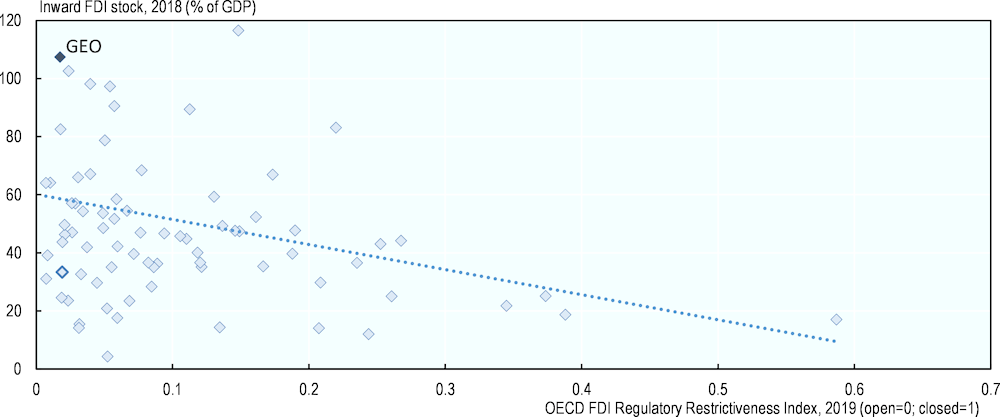

Relative to the size of its economy, Georgia attracts more investment than many other countries at a similar level of openness (Figure 3.3), although this performance is less pronounced when FDI stocks are measured on a per capita basis. Remaining restrictions may nevertheless be impeding investment into key sectors for structural transformation and economic development, particularly for agricultural land.

Figure 3.1. Georgia is one of the most open economies to foreign investment

Note: The OECD FDI Regulatory Restrictiveness Index only covers statutory measures discriminating against foreign investors. The implementation of regulations, restrictions related to national security, state monopolies, preferential treatment for export-oriented investors and special economic zone regimes are not considered. Data reflect regulatory restrictions as of end-December each year.

Source: OECD FDI Regulatory Restrictiveness Index (database), www.oecd.org/investment/fdiindex.htm.

Figure 3.2. FDI restrictions by sector broadly match those found in OECD countries

Note: The OECD FDI Regulatory Restrictiveness Index only covers statutory measures discriminating against foreign investors. The implementation of regulations, restrictions related to national security, state monopolies, preferential treatment for export-oriented investors and special economic zone regimes are not considered. Data reflect regulatory restrictions as of end-December each year.

Source: OECD FDI Regulatory Restrictiveness Index (database), www.oecd.org/investment/fdiindex.htm

Figure 3.3. As a small, open economy, Georgia performs relatively well in attracting FDI overall

Source: OECD and UNCTAD

Competition policy is still a work in progress

Many areas of Georgia’s policy framework influence the attractiveness for investors as well as the potential benefits investment can bring to its economy. While this Chapter provides an in-depth assessment of investment policies, other aspects of domestic market regulation can also have a significant impact on the investment climate. This is notably the case for competition policy. A full assessment of the regime for competition would go beyond the scope of this review and could merit a separate competition assessment by the OECD. This section provides an overview of some of the issues that were identified by stakeholders and in discussions with Georgian authorities concerning competition.

Effective competition is essential for a dynamic business environment, in which firms are willing to invest and take risks. Creating and maintaining a competitive environment requires a sound and well-structured competition law, an effective competition authority that enforces this law, and, more widely, economic policies that respect the principles of competition and avoid unnecessarily restricting it.

Unlike the progress made in other areas affecting the investment climate, Georgia’s framework for competition remains underdeveloped. The size and structure of the economy plays a role, since it is often harder to prevent dominance in a small market with fewer players. The World Economic Forum’s 2019 Global Competitiveness Index notes that, while Georgia is very open externally, it scores poorly on the extent of market dominance internally and, in particular, on competition in services (World Economic Forum, 2019). When a few players dominate many sectors of a relatively small economy, cartels can be expected to be a pervasive problem. This comes at a high cost to Georgia’s consumers, who will pay 10-20% higher prices for goods and services (OECD et al., 2020). As cartels often target public procurement, public services also come at a much higher cost to taxpayers. In Georgia, long-term concession projects are frequently granted without any competitive process. This is detrimental to attracting the best provider of a required service. The principles of fair and effective competition should inform how the public sector procures its goods and services and awards concessions for the provision of services using public resources. Planned amendments to the Law on Public Procurement make some improvements to the procurement process but oversight could be strengthened (Transparency International, 2020a).

Notwithstanding these, notable advancements to competition policy have been made recently. In September 2020, the parliament approved important amendments to the 2014 Law on Competition, addressing key gaps in the previous law and moving closer to relevant EU legislation. Notably, the amendments expand the scope of the law to cover nearly all sectors, and give the Competition Agency of Georgia (GCA) more authority to implement and enforce competition policy. This is in line with Georgia’s commitments under the Association Agreement with the EU to maintain comprehensive competition laws and an authority responsible and appropriately equipped for effective enforcement of these laws (EU, 2014).

One impediment to competition has been non-uniform application of relevant regulations and procedures. Enforcement of competition policy in regulated sectors (including energy and water supply, banking, and telecommunications) falls to sector regulators (rather than the GCA), which previously were not bound by the competition law, relying instead on limited provisions on competition in sector-specific laws. Sector regulators will now be guided by the amended Law on Competition. The amendments also clarify which cases fall under the authority of the sector regulator or the GCA, reducing previous uncertainties. The amendments also expand the coverage of the law to include securities market relations, but the law still does not apply to labour and intellectual property relations (Government of Georgia, 2020).

While the basic legal provisions on prohibited agreements, abusive conduct, and merger control are in place, the GCA was unable to exercise its mandate effectively as it lacked the powers to undertake key activities. This resulted in very limited enforcement. The GCA reviewed only seven mergers and conducted 15 investigations of antitrust infringements in 2016-18 (OECD et al., 2020). The competition agency should have the necessary power and tools to uncover illegal practices and to impose sanctions for infringements, so as to ensure a reasonable level of deterrence, while being proportionate.

The amended Law on Competition makes important improvements to the GCA’s enforcement capabilities, authorising new tools and sanctions for non-compliance. Undertakings are now obliged to provide the GCA with all relevant information for the agency to conduct evaluations and monitoring, and the GCA has the authority to impose fines if the requested information is not provided within the designated timeframe. The GCA can now also conduct unannounced on-site inspections (“dawn raids”) following court decisions. Effective dawn raid powers are an indispensable tool for uncovering illegal cartels. Cartel agreements cannot be established based on parallel conduct observations or other indirect evidence alone. They require direct proof of communication or agreement. The GCA now also has the authority to apply financial penalties in merger cases, if not informed of the merger or if undertakings do not implement mandated structural or behavioural measures within the relevant period (Government of Georgia, 2020). Concerns about the GCA’s possible abuse of these powers seem to lack a realistic foundation and should in any case be managed – as in other jurisdictions – by having proper oversight and recourse mechanisms in place.

All enforcement instruments would benefit from more flexible, and, when necessary, longer legal deadlines. The length of investigations was extended in the amended law from three to six months (with an extension for complicated cases of 18 months, up from 10 months). Even the extended period is very short by international standards. When necessary, longer timelines would enable better enforcement cases based on international best practice.

Other changes in the amended Law on Competition include the formation of an independent elected board for the agency, and the expansion of the GCA’s mandate to include enforcement of a new law on anti-dumping (passed in July 2020). The GCA is also expected to be the enforcement body for consumer protection (see below). Amendments of the public procurement act foresee that the staff of the dispute council will be subordinated to the GCA.

Notwithstanding the previous limitations on its authority, the GCA is very active in competition advocacy. The agency regularly conducts trainings, seminars and conferences across all target groups, including the private sector, public officials, media, lawyers, judges, and carries out market studies. It also actively comments on draft laws and regulations, with the aim of reducing or abolishing unnecessary restrictions on competition, and its enforcement action addresses state actors when they commit competition law violations. In all these investigations, the GCA is acknowledged by the legal community as a fair and transparent actor that strictly adheres to the rule of law.

Effective enforcement requires an adequately resourced, skilled and independent competition authority, which fulfils its mandate free from any political interference. This requires highly qualified enforcers who act in an institutional environment that assures independence from political or private stakeholder interventions. The GCA needs to further establish its reputation for impartial and neutral enforcement against public and private restrictions to competition. Its resource constraints, including finances to support competitive salaries and to procure the needed IT and office equipment, need to be addressed for it to attract and retain highly qualified staff.

The extension of responsibilities not only for competition enforcement, but also for public procurement, anti-dumping and consumer protection may lead to a dilution of the competition mandate. Adequate staffing, funding and training for these additional tasks would need to assured (OECD et al., 2020).

Consumer protection

A competitive market economy is key to maximising consumer welfare, but complementary policies are often needed to make markets work better for consumers. Empowered consumers can, in turn, play an important role in improving economic performance and driving innovation, productivity and competition (OECD, 2014). Georgia’s Association Agreement (AA) with the EU includes commitments to achieve compatibility with European legislation and instruments on consumer protection. This is important for fostering cross-border transactions, by assuring consumers that their rights related to health, safety, and economic interests are guaranteed. In particular, the AA specifies gradual approximation to a number of EU guidelines on product safety, marketing, contract law, financial services (in particular distance of marketing), consumer credit, redress, and enforcement. It also includes commitments to improve cooperation among relevant national authorities responsible for enforcement of laws on consumer protection (EU, 2014).

No specific law currently regulates consumer protection issues in Georgia. A previous law on consumer protection, adopted in 1996, has been invalid since 2012, but ceased to be enforced several years prior. In line with its commitments under the AA, the government has been working on a new draft Law on Consumer Protection, which will mandate the GCA with enforcement of consumer rights. Parliament has received technical support from the EU and the German Development Agency (GIZ) in drafting the law (European Commission, 2018). There have been repeated delays to its adoption by the parliament however.

Once the law is adopted, capacity building for GCA staff will be key to ensuring proper enforcement of consumer protection. EU directives on consumer protection include technical regulations on, for example, a consumers’ right of withdrawal in distance and off-premise contracts, and specific requirements on consumers’ rights to information, and classifications of misleading or aggressive commercial practices. As the GCA has not previously worked on consumer protection, comprehensive training will be required for the agency to be able to identify and sanction non-compliance. Ensuring effective enforcement will also require wider outreach to raise public awareness on consumer rights. It is important that the GCA continue and deepen initial work already begun to improve its capacity in this field (European Commission, 2020b; Government of Georgia, 2019).

As with wider competition policy, ensuring effective coordination between the GCA and other government agencies involved in consumer protection will be central to proper enforcement. This includes with the Central Bank, which has taken several steps under the AA obligations to ensure effective protection of consumers in financial services. These include outreach to consumers on financial education and risks related to financial imprudence, over-indebtedness and foreign currency borrowing (European Commission, 2019).

Investment protections under the Investment Law and related legislation

Georgian law provides a number of core protections to investors. Most of them appear in the Law on Promotion and Guarantees of Investment Activity (Law No. 473-IS of 12 November 1996, as amended, hereafter the Investment Law) with several other laws providing additional content to the scope of these protections.

Like many other countries, Georgia has enshrined in its domestic law a principle of non-discriminatory treatment as between foreign and domestic investors. Article 3(1) of the Investment Law provides that foreign investors will enjoy the same rights and guarantees as Georgian nationals “except for cases defined by legislation”. This basic rule establishes Georgia’s commitment to a level playing field for all investors and send positive signals regarding an open investment policy, without prejudice to the possibility for the government to adopt limited exceptions through its laws in order to pursue specific policy objectives. This provision in the Investment Law reinforces an equality guarantee in Article 11 of the Constitution. This and other constitutional rights apply equally to Georgian nationals and foreign nationals living in Georgia. The Law of Georgia on the Elimination of All Forms of Discrimination (Law No. 2391-IIs of 2 May 2014) also prohibits all forms of discrimination, including based on race, language, citizenship, origin, place of birth or residence. Some stakeholders indicate that anti-discrimination laws are enforced unevenly, especially with respect to women and LGBTI people in the workplace (Freedom House, 2020). Formal exceptions to these rules on non-discrimination, however, are relatively rare. They include restrictions on foreign ownership of agricultural land (discussed further in Chapter 4) and market access restrictions in sectors listed in Article 9 of the Investment Law.

Another important legal protection for investors is the government’s guarantee of protection from expropriation. Article 7 of the Investment Law provides that investors may only be “deprived” of their investments “in cases directly determined by law, by court decision and upon urgency determined by the organic law and only with appropriate compensation”. It provides an avenue for investors to appeal decisions on “deprivation” to the Georgian courts in cases where investors are not covered by an applicable investment treaty. Article 8 provides that compensation for deprived investments shall be the equivalent of “real market value” immediately before the taking and shall be freely transferable abroad.

Several other laws affect investors’ rights with respect to expropriation. The Constitution protects rights to own and inherit private property (Article 19). It provides that expropriation of private property shall only be possible “in cases of pressing social need as directly provided for by law, based on a court decision or in the case of urgent necessity”. Compensation for expropriation shall be “preliminary, full and fair” and exempt from taxes and fees. It also requires the government to provide compensation to investors if it expropriates their property. Compensation should reflect the market value of the property. Disagreements regarding the valuation of expropriated property may be settled through arbitration, if the parties agree, or through domestic courts.

The Law on the Expropriation of Property for Pressing Social Needs (Law No. No 2349-რს of 23 July 1999, as amended) provides clarifications regarding the expropriation powers in the Constitution. The Law sets out an exhaustive list of public works for which the government may seek to expropriate private property (Article 2). Many of the listed categories relate to public infrastructure works (building roads, highways, pipelines and railways; laying communications or transmission cables). More general categories include works required for national security, extraction of natural resources or building other “structures and facilities for pressing social needs”. The Law sets out in detail the procedures for carrying out an expropriation, including publication requirements, preconditions, valuation and payment of compensation and court review of disputed valuations. A separate law enacted in 1997 covers the rules for expropriations in situations of urgent necessity such as natural disasters and epidemics (see Law on the Procedure for Expropriation of Property upon the Urgent Necessity of Ensuring Public Needs, Law No. 1054-Iს of 11 November 1997).

Sectoral laws also refer to government powers to take property. The Oil and Gas Law (Law No. 1892-IIs of 16 April 1999, as amended), for example, allows the State Agency for Oil and Gas to apply to Georgian courts to “alienate” private property from landowners for the benefit of investors in oil and gas reserve areas (Articles 1(a.i.), 20(3)-(5)). This power applies in cases of “public necessity” and subject to “appropriate compensation”. It provides that this process shall take place “according to the Constitution”.

These various laws provide a relatively high degree of clarity for investors on rights in the event of an expropriation and the procedures that will apply. They also identify specific situations where expropriation by ministerial order or court judgment can occur, which further promotes legal certainty. Amendments to these laws in the past two decades have gradually increased the level of specificity and addressed issues with interpretation. Some stakeholders have also reported that disputes regarding expropriation are relatively uncommon (US Department of State, 2019).

The government may nonetheless wish to consider whether further clarifications could be made to expropriation regimes in these laws through legislative amendments or changes to related by-laws, policy documents or guidelines. Expropriation regimes that Georgia has established for some foreign investors under its investment treaties and expropriation regimes under investment laws in other countries – including in Myanmar and Egypt – are more specific in some areas including:

whether investors are protected from indirect expropriation in the form of government measures that have an effect equivalent to direct expropriation without formal transfer of title, ministerial order or court decision and, if so, how indirect expropriation is defined and whether there are any exceptions (e.g. for non-discriminatory regulatory actions designed to achieve legitimate public welfare objectives);

the valuation methodology for determining market value, including the valuation date, and whether any specific factors should be taken into account when determining this value such as the investor’s conduct, the reason for the expropriation or the profits made by the investor during the lifetime of investment;

whether compensation for expropriation includes interest and, if so, how that interest should be calculated; and

the distinction between compensable and non-compensable expropriations, if appropriate, to establish a minimum level of policy space for the government to implement public policy objectives without being constrained by obligations to compensate affected investors.

The government may also wish to consider whether there are good policy justifications for treating certain foreign investors that may benefit from expropriation provisions in Georgia’s investment treaties differently to other investors under its domestic laws.

Further harmonisation or consolidation of the various laws that address expropriation should also be considered. The Georgia 2020 strategy describes the Investment Law as “outdated and disconnected from reality”, noting that investor protections are “scattered among several normative acts”. It signals the government’s plan to update the Investment Law to address these and other concerns.

Another area for possible clarification is the interaction between the Law on the Expropriation of Property for Pressing Social Needs and the Investment Law. While the former Law provides clarifications on expropriation rights and procedures with reference to the Constitution, it does not refer to the expropriation regime in the Investment Law. The government should consider consolidating all relevant provisions on expropriation into the Investment Law or directly cross-referring to specific laws on expropriation in the Investment Law to reduce the scope for confusion and improve legal certainty. Consistent terminology should also be adopted. While the Investment Law refers to “deprivation” of property, most other laws refer to “expropriation” and Georgia’s investment treaties often refer to “nationalisation”. Confusion on terminology may also arise in sectoral laws. For example, the Oil and Gas Law appears to use the term “alienate” as a synonym for expropriation while the Law on Agricultural Land Ownership (Law No. 4848-IIს of 25 June 2019, as amended) uses “alienate” to refer to a landowner’s rights to sell, transfer or otherwise dispose of land.

Aside from expropriation and non-discrimination, the Investment Law also guarantees that investors may freely transfer and repatriate in foreign currency profits and other funds associated with their investment activities (Article 3(6)). Repatriation is subject to obligations to pay taxes and other government income associated with investment activities. The Law also guarantees that investors may open bank accounts, take out loans and own various forms of real and intangible property (Article 3).

Investor rights under the Investment Law are subject to a general obligation for investors to comply with Georgian law. This is a common feature of investment laws in other countries and Georgia’s investment treaties. Some investment laws in other countries have gone further in terms of investor obligations in areas such as responsible business conduct, corporate governance expectations and contributions of investment activities to sustainable development goals. Consideration of further specification on investor obligations in the Investment Law may align with the government’s aims to achieve Georgia’s climate change and green growth targets, including under the OECD Declaration on Green Growth. Chapter 6 on responsible business conduct address some of these issues in further detail.

Strengthening the protection and enforcement of intellectual property rights

An effective regime for registering, protecting and enforcing intellectual property (IP) rights is a crucial concern for many investors. As recognised in the Georgia 2020 strategy, strong IP rights provide investors with an incentive to invest in research and development (R&D) for innovative products and processes. These rights also instil confidence in investors sharing new technologies, for instance through joint ventures and licensing agreements. Successful innovations may be suffused within and across economies in this way, and contribute to elevating productivity and growth. This is a key goal of promoting innovation and R&D by small and medium-sized enterprises under the government’s SME Development Strategy 2016-2020. At the same time, IP rights entitle their holders to the exclusive right to market their innovation for a certain period. The protection granted to intellectual property therefore needs to strike a balance between the need to foster innovation and society’s interest in having certain products, such as pharmaceutical products, priced affordably and widely available.

Georgia has a relatively extensive legal framework for IP rights protection that generally complies with international standards in at least six main areas: trademarks, patents, industrial designs, copyright, geographical indications and plant varieties. Amendments to laws in all of these areas came into effect in 2018. The Constitution (Article 20) also recognises the protection of intellectual property rights as a constitutional guarantee.

At the international level, Georgia joined the World Intellectual Property Organisation (WIPO) in 1979 and the World Trade Organisation (WTO) in 2000. It is an active participant in the WTO Council for Trade-Related Aspects of Intellectual Rights. It has acceded to several key WIPO-administered IP treaties and made declarations regarding the continuing application of others originally signed by the USSR.1

The Georgian National Intellectual Property Centre (Sakpatenti) is responsible for defining the national agenda on IP policies. Sakpatenti is an independent legal entity with special status under Georgian public law. It has contributed to drafting and enacting over 30 laws, by-laws and guidelines for IP rights in various areas since its establishment in 1992. In its first 25 years of operation, Sakpatenti issued 8621 patents and registered more than 60,000 trademarks, 2254 applications for design and 208 applications for new plant varieties (Sakapenti, 2017). Sakpatenti also ensures the deposit of copyrighted works and registers Georgian geographical indications and appellations of origin. It has been a key driving force behind the considerable progress made in the past two decades to bring Georgia’s IP rights regime into line with international standards.

Another important driver of this progress has been Georgia’s co-operation with international partners. Georgia undertook to improve various aspects of its IP rights regime as part of the Deep and Comprehensive Free Trade Agreement (DCFTA) with the European Union, which it signed in June 2014 and brought into force in January 2016. The DCFTA attests to Georgia’s commitment to implement international IP agreements effectively, provides for international co-operation on a range of issues including customs powers related to IP enforcement and sets a range of substantive and procedural standards for the treaty partners to meet. Commitments in the DCFTA prompted a suite of amendments to Georgian IP laws that came into force in January 2018 aimed largely at improving the scope of certain IP rights and suppressing IP infringements. These commitments have also prompted Georgia’s accession in 2018 to the TRIPS amendment on measures to ensure better access to essential medicines that arose from the Doha Declaration.

Alongside DCFTA, Georgia has concluded a number of bilateral agreements with other countries on IP issues such as simplifying patent validation and mutual recognition of geographical indications. Protection for geographical indications and appellations of origin abroad is a particularly important issue for investors in the Georgian wine industry and other parts of the country’s agricultural sector. Sakpatenti co-operates actively with IP agencies from the European Union and the United States, among others, as well as WIPO, to build in-house technical capacity, conduct awareness-raising activities, develop quality control tools and improve its e-filing system and electronic database for IP applications and other procedures.

These efforts over the past two decades have greatly improved the transparency, legal certainty and quality of outcomes under the Georgian IP rights regime for the benefit of all users, including investors. This appears to be having a positive impact on investor engagement. A study in 2011 by WIPO on IP trends in 23 transition economies including Georgia noted that Georgia had witnessed an increase in the number of applications for patents filed by foreign applicants, which suggested that more foreign investors were preparing or had recently entered the Georgian market when compared to other markets in the study (WIPO, 2011). More recent data published by WIPO for the period 2009-2018 indicates that patent activity remains relatively regular despite some decline since a peak in 2010, but trademark and industrial design filings have seen steady increases over the same period, especially by foreign applicants (WIPO, 2020).

Some issues nonetheless remain for improvement, most notably the effectiveness of enforcement measures for IP infringements. Georgia is not listed as a priority country for IP enforcement issues in the USTR’s Special 301 Report or the EU Commission’s annual report on IP protection in third countries. But some stakeholders have reported concerns with the availability of unlicensed software and other pirated content online, as well as the level of technical capacity among local judges, lawyers, prosecutors, police officers and customs officers responsible for IP enforcement (US Department of State, 2019; USAID, 2011a; USAID, 2011b; UNDP, 2010). Counterfeiting and software piracy can have real economic consequences through reduced sales and profitability for manufacturers of branded goods, depreciation of brand image, increased costs for brand protection and disincentives for investment in IP-intensive sectors. These concerns are partly reflected in Georgia’s international rankings in this area. Georgia ranks 94th out of 141 countries in terms of IP Protection in the World Economic Forum’s 2019 Global Competitiveness Report, well below its aggregated rank of 74th across all 103 indicators in the Report. It ranks 48th out of 129 economies in the Global Innovation Index 2019 prepared by WIPO, INSEAD and Cornell University.

The government is aware of these issues and seeks to address them. Legislative amendments mandated under the DCFTA have tightened sanctions for IP infringements and given new powers to rights holders (licencees and owners of IP rights) to apply to Georgian courts for the removal or destruction of offending objects together with compensation for damage suffered. These amendments take enforcement powers in Georgia beyond the TRIPS Agreement and bring them in line with the EU’s IP Enforcement Directive No. 2004/48/EC (Centre for European Policy Studies, 2016). New provisions on liability for intermediary service providers (e.g. online service providers) align with the EU’s E-Commerce Directive No. 2000/31/EC. The new amendments have also strengthened powers for customs officials to seize and detain suspected infringing goods at the border in line with similar powers in EU Regulation No. 608/2013 on customs enforcement of IP rights (see the Law on Border Measures related to Intellectual Property, Law No. N1723-Iს of 13 December 2017).

Sakpatenti works with government agencies and international partners to step up training and international co-operation as part of efforts to implement these new laws (Sakpatenti, 2018, 2019). Since 2015, Sakpatenti has hosted an annual conference on “Georgia against Counterfeiting and Piracy” with assistance from the Commercial Law Development Program (CLDP) of the US Department of Commerce and funding from the EU4Business Program. This annual event is a platform for national and international experts to discuss developments in the global fight against counterfeiting and piracy. CLDP arranges annual training workshops conducted by US judges for Georgian judges on adjudicating civil IP infringement cases. Sakpatenti offers distance learning and in-person training sessions to supplement these annual workshops. WIPO holds annual workshops to “train the trainers” in Sakpatenti’s IP Training Centre. Further IP training and awareness-raising activities are scheduled in 2020 under the government’s Action Plan for the Implementation of DCFTA.

The Revenue Service of the Ministry of Finance, which is responsible for customs enforcement at the border, works closely with the World Customs Organisation (WCO) to share experiences and best practices with customs officials from other countries in the International Customs Co-operation Council. It contributes to the WCO’s interactive database of goods specifications to assist customs agents in distinguishing genuine and counterfeit goods. Customs agents participate in regular training sessions held by WCO, as well as EU and US customs officials, on IP border enforcement, counterfeiting and fraud.

The government should continue to prioritise efforts to strengthen IP rights protections and enforcement as an important part of its goal to improve the overall investment climate. Building on the success of the DCFTA, the government should consider IP rights commitments in future trade and investment agreements as avenues for impetus to continually improving the domestic framework. The government should continue to support a wide range of international collaboration and co-operation in this field. It could also consider developing roadmaps for future implementation of additional WIPO-administered treaties such as the Trademark Law Treaty, the Singapore Treaty on the Law of Trademarks, the Patent Law Treaty, the Nairobi Treaty and the Marrakesh Treaty to Facilitate Access to Published Works for Persons Who Are Blind, Visually Impaired, or Otherwise Print Disabled.

Software piracy and unlicensed online content remains an important challenge to tackle. Around 95% of software for sale in Georgia as of 2010 was pirated and illegal (UNDP, 2010). The government has since sought to lead by example through its agreement with Microsoft in 2014 for the use of genuine Microsoft software licences for all Georgian government workstations (WIPO, 2016). It should also support the passage of legislation on e-commerce and amendments to the Copyright Law (Law No. 2112 of 1999, as amended) to address liability for internet service providers, drafts of which have already been prepared by Sakpatenti and the Ministry of Economy and Sustainable Development. Other initiatives could also be considered. IP agencies in other countries have reported encouraging outcomes with infringing website lists, which seek to encourage advertising brokers and networks to avoid placing advertisements on websites that infringe copyrights on a commercial scale. Sakpatenti or the Ministry of Internal Affairs, as the responsible entity for enforcing IP rights within the country along with the Financial Police, could be given powers to order copyright-infringing websites to be blocked. Sakpatenti should continue to explore such initiatives to tackle software piracy as part of its existing dialogues with international partners.

Sustained momentum is needed to build on recent improvements for the independence, accountability and capacity of the judiciary

The ability to make and enforce contracts and resolve disputes efficiently is fundamental if markets are to function properly. Good enforcement procedures enhance predictability in commercial relationships by assuring investors that their contractual rights will be upheld promptly by local courts. When procedures for enforcing contracts are overly bureaucratic and cumbersome or when contract disputes cannot be resolved in a timely and cost effective manner, companies may restrict their activities. Uncertainty about the enforceability of lawful rights and obligations raises the cost of capital, thereby weakening firms’ competitiveness and reducing investment. It can also foster corruption in the court system.

The government identifies its efforts to strengthen the judiciary as a key priority under the Georgia 2020 strategy, which notes that “a strong and independent judiciary is essential to efforts to improve the country’s business and investment environment, especially in terms of protecting property rights”. Four reform packages over the past decade have targeted various aspects of justice system reform. A key outcome of these reforms has been the increased level of independence and de-politicisation of the High Council of Justice (HCOJ). The HCOJ is a consultative body on the country’s justice system that is responsible for, among other things, appointing and dismissing judges, recruiting judges, developing policy recommendations and defending the interests of the judiciary. Established in 1997 under the Organic Law on Common Courts (Law No. 767IIs of 1997), power in the HCOJ resided in the hands of a few. Appointees from the executive branch dominated the HCOJ’s activities in practice. One individual – the Chairperson of the Supreme Court – was responsible for nominating judicial members of the HCOJ rather than the self-governing Conference of Judges as envisaged by the previous Constitution. Part of Georgia’s constitutional reform in 2017, which culminated in the adoption of a new Constitution in 2018, introduced new procedures for the selection and appointment of the Supreme Court judges that vested Parliament with the final decision, established selection criteria for judicial candidates and increased public-facing transparency.

The existing framework for adjudication of civil disputes in Georgian courts nonetheless continues to suffer from a number of significant problems despite the recent reforms. Foremost of these are persisting concerns with the independence, accountability and capacity of the HCOJ and the judiciary (European Commission, 2020b; Georgian Young Lawyers’ Association, 2020; US Department of State, 2020 and 2019; Council of Europe, 2019; Public Defender, 2019b; Coalition, 2017; Transparency International, 2015; EU Commissioner for Human Rights, 2014; see also Chapter 6 on responsible business conduct). Survey feedback collected in 2018 from over 2,000 Georgian citizens from all parts of the country suggests that trust in judges is low; many participants considered that judges are not free from political pressure (EMC, CRRC and IDFI, 2018). Stakeholder interviews conducted by the OECD Secretariat in Tbilisi for this Review also indicated that many investors in the country continue to perceive court processes as slow, inefficient, lacking in transparency and hampered by a lack of technical expertise. All of these issues affect public trust in the judicial system. They are among the most pressing concerns for investors in their assessments of the investment climate in Georgia.

The government is aware of these challenges and tackles them head on with backing from the highest political levels. Amendments under the fourth wave of judicial reform were finalised and adopted by Parliament in December 2019. The amendments have introduced changes to improve procedures for appointing judges, managing caseloads for individual judges and adjudicating disciplinary breaches by judges who communicate improperly with third parties with a view to influencing the outcome of a case. The Ministry of Justice has also drafted legislative amendments to address issues in the criminal justice system including the independence of prosecutors. Various stakeholders including civil society organisations and international partners including the Council of Europe, the European Union and the United States have supported the government on justice reforms over several decades and have broadly welcomed the progress made to date.

It will be crucial for the government to sustain the momentum for systemic judicial reform. This starts with the full implementation of the fourth wave of judicial reforms adopted by Parliament in December 2019 but must extend to addressing a number of remaining issues, especially regarding the integrity of the judicial appointment process. Several global indicators attest to these persisting concerns. Georgia ranks, for instance, 42nd of 126 countries in the 2020 edition of the World Justice Project Rule of Law Index. Despite ranking first among 14 countries in the Eastern Europe and Central Asia region and 7th of 42 countries in the Upper Middle Income category in the Index, Georgia’s performance is well below the Upper Middle Income category median score for “no improper government influence” in the civil and criminal justice system indicators. The World Economic Forum’s Global Competitiveness Index 2019, in which Georgia ranks 80th out of 141 economies on independence of the judiciary, also highlights this issue. According to Freedom House’s 2020 Freedom in the World Report, “despite ongoing judicial reforms, executive and legislative interference in the courts remains a substantial problem, as does a lack of transparency and professionalism surrounding judicial proceedings.” The Heritage Foundation’s 2020 Index of Economic Freedom also cites concerns about judicial independence as the main factor holding back progress in Georgia on the rule of law and greater economic freedom, prosperity and opportunity.

The government should continue to work closely with stakeholders to address persisting concerns. Various stakeholders are following closely the implementation of the recent reforms, especially those relating the HCOJ (Georgian Young Lawyers’ Association, 2020; OSCE, 2019 and 2020; EMC and IDFI, 2019a and 2019b; Venice Commission, 2019; Coalition, 2017). The government should continue to strive towards a truly fair, transparent and merit-based appointment process for judges in line with the detailed recommendations made by the Council of Europe’s Venice Commission and several civil society organisations. These observers have raised concerns that cronyism and a lack of transparency still plagues the culture surrounding judicial appointments despite recent legislative reforms. In particular, in December 2019 the Parliament appointed 14 candidates for life tenures to the Supreme Court through a process that lacked transparency. Events such as these continue to degrade public trust in the judiciary. Aside from setting rules that prevent events like this from happening in the future, changes to legal education and public awareness are key determinants in the success of these legal-institutional reforms. They may also be the only way to invert deep-seated attitudes regarding fairness and efficiency in the Georgian justice system for future generations of judges, prosecutors, lawyers, police officials and members of parliament. Another aspect of this culture is the availability of equal opportunities for women in the justice system. A recent study prepared for the Council of Europe suggests that transparent selection criteria for judges may have a positive effect on overcoming existing gender segregations in this field (ACT, 2019).

The government should continue to explore ways to improve the efficiency of court procedures to address concerns that routine cases take too long to resolve and judges lack sufficient technical capacity to deliver quality outcomes consistently. Stakeholders have welcomed a new electronic system for case distribution adopted by the HCOJ as part of the third wave of justice reforms but note that its usefulness may be limited by a lack of judges able to handle certain cases and have called on amendments to the system to address perceived deficiencies (EME and IDFI, 2019a; Coalition, 2017). These and other e-court services should be progressively designed, introduced and refined as ways to reduce the scope for corruption and cronyism in case allocation, increase access to court judgments, improve accuracy and reduce processing times.

Another issue under consideration in this regard is the merit of developing specialised judges or courts in certain areas. Georgia has a three-tiered court system consisting of over 25 first instance courts, two appellate courts and the Supreme Court together with a separate Constitutional Court. Investors have raised concerns with the absence of specialised courts or judges in this system with the government during consultations chaired by the Prime Minister in the Investors’ Council of Georgia. Establishing specialised courts or judges to deal with commercial, tax and small claims matters, among others, is conducive to improving the quality and consistency of decisions with potential knock-on effects for the speed with which judges can resolve cases within their area of specialisation. Increased judicial specialisation can also entail certain pitfalls linked to the separation of specialist judges from the general body of judges (Consultative Council of European Judges, 2012). The Ministry should bear these competing considerations in mind when designing models for specialised judges or courts and tools to allocate cases to specialised judges.

Strong legal framework for arbitration and mediation but some challenges remain in becoming an attractive place for alternative dispute resolution

Commercial disputes may arise for investors with joint venture partners, employees, local suppliers or contractors, or government agencies. The cheapest and quickest way to resolve disputes is by negotiation or mediation whenever possible, but if the parties cannot reach an amicable settlement by these means, then they have no choice but to pursue the issue in the courts or arbitration. Arbitration is possible only if the parties agree to it in an underlying contract or after a dispute has arisen between them.

Article 16 of the Investment Law provides that investors can rely on Georgian courts, arbitration proceedings under applicable investment treaties or other procedures agreed by the parties to settle disputes that may arise with the government or its subsidiary entities. The Law does not specifically mention arbitration or mediation. The default option for all investors is court proceedings in the absence of any other agreed dispute resolution procedures.

The Arbitration Law (Law No. 1280 of 2009, as amended) governs domestic and international arbitrations in Georgia as well as the enforcement of foreign arbitral awards in line with the 1958 New York Convention on the Recognition and Enforcement of Foreign Arbitral Awards (the New York Convention). The Law provides a robust framework for arbitration in Georgia. It follows closely the Model Law published by the United Nations Commission on International Trade Law (UNCITRAL) in 1985 and amended in 2006, which is designed to assist states in reforming and modernising their laws on arbitral procedure. The Law replaced an earlier arbitration law enacted in 1997 and sought to address a number of gaps and other concerns with the earlier law regarding the powers and competence of arbitral tribunals, finality of awards and the role of the courts in assisting arbitrations taking place in Georgia (Caucuses Research Resource Centre, 2018; Gogadze, 2018).

While the Arbitration Law and recent amendments to it have greatly improved the framework for arbitration in Georgia, the government may nonetheless wish to consider further amendments at an appropriate time in the future to clarify certain aspects of it. One such issue relates to enforcement of arbitral awards. Article 44 of the Arbitration Law does not provide guidance on when the court should refuse to enforce an award that “conflict[s] with public order”. It is silent on whether it refers to Georgian or international “public order”. By contrast, Article 42 on the powers of courts to set aside arbitral awards refers to the concept of “public order in Georgia” while the Model Law and the New York Convention refer to “public policy” of the country in which enforcement is sought. Ambiguities such as these can lead to uncertainty. Guidance for practitioners and judges or clarification in the Law would help to reduce inconsistency in judicial interpretations and dissuade award debtors from filing frivolous defences to delay enforcement through costly and lengthy court procedures. A study published in 2018 for the EU4Justice programme and UNDP sets out a range of other recommendations for possible amendments to the Law, mostly on technical or minor procedural issues, which the government may also wish to consider (Caucuses Research Resource Centre, 2018).

Improving the legal framework for arbitration is an important aspect of improving legal certainty and predictability but its success also depends on user experiences with the courts and arbitration institutions in Georgia. A recent study found that Georgian courts have interpreted several aspects of the Arbitration Law inconsistently across several decades of court practice including in respect of their powers to intervene in arbitration proceedings, the role of arbitral tribunals and the grounds for refusing enforcement of arbitral awards (Caucuses Research Resource Centre, 2018). Some stakeholders have also reported some delays with court procedures to enforce arbitral awards in Georgian courts. Courts that act in aid of arbitrations taking place in Georgia must have the capacity to deal with enforcement and other applications efficiently. Mistrust of arbitration institutions and courts built on shortcomings in earlier arbitration legislation, perceptions about the integrity of arbitrators, the profit incentives for many Georgian arbitration institutions and low levels of public awareness about arbitration are also seen as major hindrances for the development of arbitration in Georgia.

The Georgian International Arbitration Centre (GIAC) may have an important role to play in addressing some of these concerns. The Georgian Chamber of Commerce and Industry established GIAC in Tbilisi in 2013 as a not-for-profit institution. GIAC aspires to serve as a leading arbitration institution in the country and wider Caucuses region by leveraging its independent status to promote arbitration as a credible method for resolving commercial disputes. It has developed a modern set of arbitration rules with a competitive fee structure. It contributes to awareness-raising efforts through an annual arbitration conference, co-operation agreements with other arbitration institutions, various publications and training activities. It co-operates with the Georgian Association of Arbitrators, which published in 2014 a draft Code of Ethics for Arbitrators. Together with amendments to the Arbitration Law regarding appointment criteria and procedures for challenging arbitrators, these developments should help gradually to overcome entrenched scepticism regarding arbitrator integrity.

A number of other local institutions besides GIAC administer arbitrations and provide a range of alternative dispute resolution (ADR) services. Although it is difficult to be precise due to the lack of public information regarding these institutions, there appears to be around 35 such institutions operating in Georgia (Caucuses Research Resource Centre, 2018). All of these institutions except GIAC appear to be registered as limited liability companies under Georgian company laws. The Investors’ Council of Georgia and the Business Association of Georgia have discussed an initiative whereby the government could grant these companies a limited time to convert themselves to non-commercial entities as a way of removing profit-based incentives and seeking to redress negative public perceptions. Four of these institutions – GIAC, the Dispute Resolution Center, the Mediation and Arbitration Center of the European Business Association and the arbitration centre of the Chamber of Commerce and Industry of the Ajara Autonomous Republic – signed a memorandum of understanding in July 2020 agreeing to comply with the GAA’s Code of Ethics.

Mediation has seen relatively little uptake in the local market to date but new legislation may prompt increased awareness and demand. The new Mediation Law (Law No. 4954 of 2019) enacted in September 2019 and effective as of January 2020 aims to promote mediation services in Georgia by providing a clear legal framework to regulate mediations. The Law sets rules for court-ordered and private mediations, including on the appointment of mediators, selection criteria, the efficient conduct of mediations, mediator remuneration, enforcement of mediator decisions and confidentiality. Importantly, it emphasises independence and impartiality as core principles. It establishes a self-regulated body, the Georgian Association of Mediators, to maintain a public register of certified mediators from which all court-appointed mediators must be selected. The new Law requires the Association to offer training for mediators, conduct awareness raising activities and providing recommendations to the government on future policy directions in this area. Aside from encouraging the creation of new mediation institutions, the Law may also open up opportunities for existing arbitral institutions to expand their offerings to provide mediation services and contribute to the Association’s awareness-raising activities.

These are encouraging developments for the future of ADR services in Georgia but further efforts may be needed to overcome public perceptions that continue to hamper user uptake in this sector. Given these lingering public perceptions, the government may wish to evaluate the costs and benefits of regulating – possibly on a temporary or trial basis with a defined end point – the organisational structure, ethical standards or activities of ADR service providers to foster a stronger culture of independence, competence and integrity in this sector. The Mediation and Arbitration Laws currently do not perform this role. This appears to align with the Georgia 2020 strategy, which identifies the development arbitration courts, the competence of arbitrators and independence of arbitration institutions as a priority for the government. These are vital priorities for the future of the ADR services in Georgia. In the meantime, many foreign investors are likely to prefer institutions based in established ADR hubs like Geneva, London, Paris or Stockholm.

The success of recent land reforms should provide a base for continual improvement of land tenure rules and land administration services

Secure rights for land tenure and an efficient, reliable system for land administration are key components of a sound investment climate. This requires a clear legal framework for acquiring, registering and disposing of land rights, as well as proactive land use plans at all levels of government.

Land tenure rules in Georgia are set out in the Constitution, several dedicated land laws and various sectoral laws. These rules provide a clear and predictable framework of property rights for all investors. The Constitution affirms the rights of individuals to own and inherit property (Article 19). Books 2 and 3 of the Civil Code clarify the conditions for land ownership, transfer of ownership and the permissible rights and claims over land including leases, mortgages and easements. Several other dedicated land laws and sectoral laws supplement this overarching framework.

The Law on Recognition of Property Rights of the Parcels of Land Possessed (Used) by Natural Persons and Legal Entities under Private Law (Law No. 5274-ES of 11 July 2007, as amended) clarifies the rights of individuals to use or squat in state-owned land lawfully.

The Law on State Property (Law No. 3512-რს of 21 July 2010, as amended) regulates the privatisation of state-owned property, including land, and the conditions under which investors may acquire it.

The Law on Oil and Gas (Law No. 1892-IIს of 16 April 1999, as amended) addresses state ownership of natural resources that exist in the subsoil and sets out investors’ rights and obligations under land allotments to exploit natural resources.

The Organic Law on Agricultural Land Ownership (Law No. 4848-IIს of 25 June 2019) regulates the right to own and use agricultural land.

The Law on Determination of the Designated Purpose of Land and on Sustainable Management of Agricultural Land (Law No. 4849-II of 25 June 2019) provides pre-emptive rights for the state to acquire agricultural land.

Rules on ownership and rights over non-agricultural land apply equally to Georgian and foreign nationals. This means that unlike many other jurisdictions, foreign investors can own and transfer most types of residential or commercial property without any extra conditions or restrictions when compared to domestic investors. Restrictions exist, however, for foreign investors seeking to acquire agricultural land. The Constitution generally prohibits foreign nationals from owning agricultural land except in “exceptional cases” determined by other laws (Article 19(4)). The Law on Agricultural Land Ownership envisages two such exceptions to the general rule: where foreigners inherit agricultural land and where Georgian companies with foreign shareholders obtain the government’s consent to buy agricultural land in accordance with an approved investment plan (Article 4). Chapter 4 on promoting sustainable investment in Georgia’s agri-food value chain addresses these restrictions and the public debate surrounding them in further detail.

The government has taken significant strides in recent years towards ensuring streamlined, transparent and reliable land administration services to support legal rules on land tenure. Land reforms introduced in 2016 under the Law on the Improvement of Cadastral Data and the Systemic and Sporadic Registration of Rights to Plots of Land (Law No. 5153-რს of 3 June 2016) aim to register all available parcels of land in Georgia and improve the accuracy, quality and public accessibility of cadastral data.

The National Agency of Public Registry (NAPR), a sub-entity of the Ministry of Justice, is responsible for carrying out the land registration reforms. It reports that between August 2016 and February 2019 it registered over 300 000 hectares of land, taking the overall percentage of registered land in Georgia to 45% of the country’s territory (Agenda, 2019). In May 2020, the Minister of Justice announced the government’s plans to register a further 1.2 million hectares over the next three years (Agenda, 2020a and 2020b). These most recent plans appear to address stakeholder concerns regarding the massive resources needed to implement the reforms (for which financing has been secured from international donors) and the need to focus on systemic rather than sporadic land registration campaigns (with renewed focus on systemic land registration) (Transparency International, 2016). As of July 2020, NAPR has registered over 850 000 plots of land since August 2016. It is working with the Norwegian government and the World Bank to implement its systemic land registration programme and improve its digital land maps. The National Agency of State Property (NASP) has also started to register state-owned land but these efforts are currently on hold pending comprehensive registration of privately owned land. Chapter 4 on promoting sustainable investment in Georgia’s agri-food value chain addresses issues relating to the registration of agricultural land in further detail.

The government’s land reforms have also sought to simplify registration procedures, increase the availability of land information and reduce fraud in the titling process. NAPR has accepted and processed over 600 000 requests from private landholders to register their property, free of charge, under the new reforms. It has also created a “one-stop-shop” to provide landowners with free access to a variety of registration services upon submission of the relevant documents pertaining to their land plots (NAPR, 2019). NAPR reports that it can register property within one business day of receiving a registration application, which takes the form of a single document that can be lodged electronically. It has made an impressive amount of land data publicly available online. NAPR maintains electronic registers of pending registration applications, mortgages, leases, liens, debtors, public notifications and property seizures, as well as up-to-date statistical information on land registration, all of which are accessible to the public on its website. It accepts requests for information regarding other registered land titles through an online request form. New land titling information and a growing portion of pre-2016 land title data is stored electronically in a single database maintained by NAPR. Information stored in the database is encrypted using blockchain technology in order to reduce its vulnerability to fraudulent tampering (Agenda, 2019 and 2017).

International indicators partly reflect these achievements. Georgia ranks 5th out of 190 countries included in the 2020 edition of the World Bank’s Doing Business indicators (down from 1st in 2014) in terms of the time and number of procedures needed to register property. Notwithstanding this overall ranking, Georgia ranks slightly lower on the quality measures for registering property in several comparator economies such as Armenia, Belarus and Moldova. The overview in Chapter 1 addresses some general concerns regarding these indicators. Georgia also ranks 41st out of 141 countries in terms of quality of land administration in the World Economic Forum’s 2019 Global Competitiveness Report.