COVID-19 triggered large declines in tourist stays, flights and tourism-related investment. The pandemic also prompted declines in international trade in many OECD regions. Across all sectors, FDI in OECD regions recovered quickly, yet longer-run trends of geographic concentration in FDI are persistent.

The emergence of COVID-19 around the globe led to travel bans and restrictions starting in March 2020 due to concerns over travellers contracting and transmitting the virus. While the tourism sector directly accounted for nearly 5% of GDP before 2020, it was severely curtailed by the pandemic (OECD, 2021). The fall in tourist activity had particularly adverse impacts on regions with large tourism sectors.

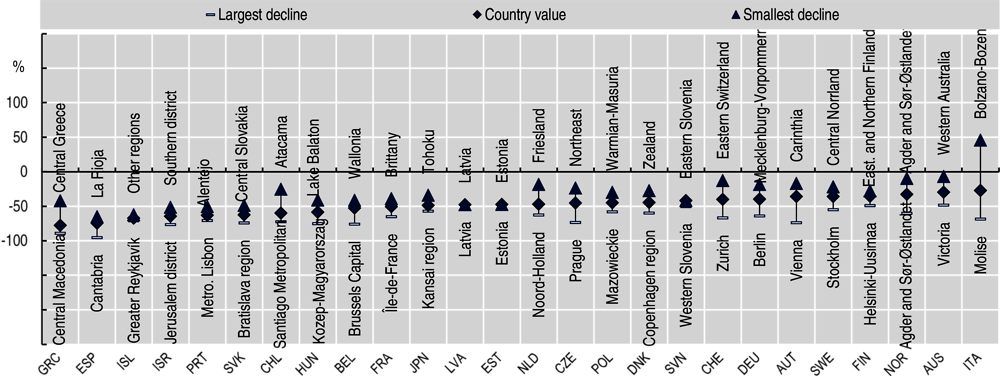

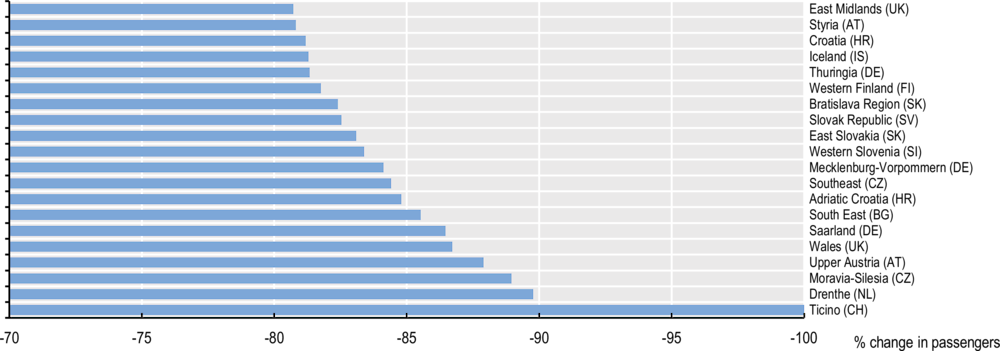

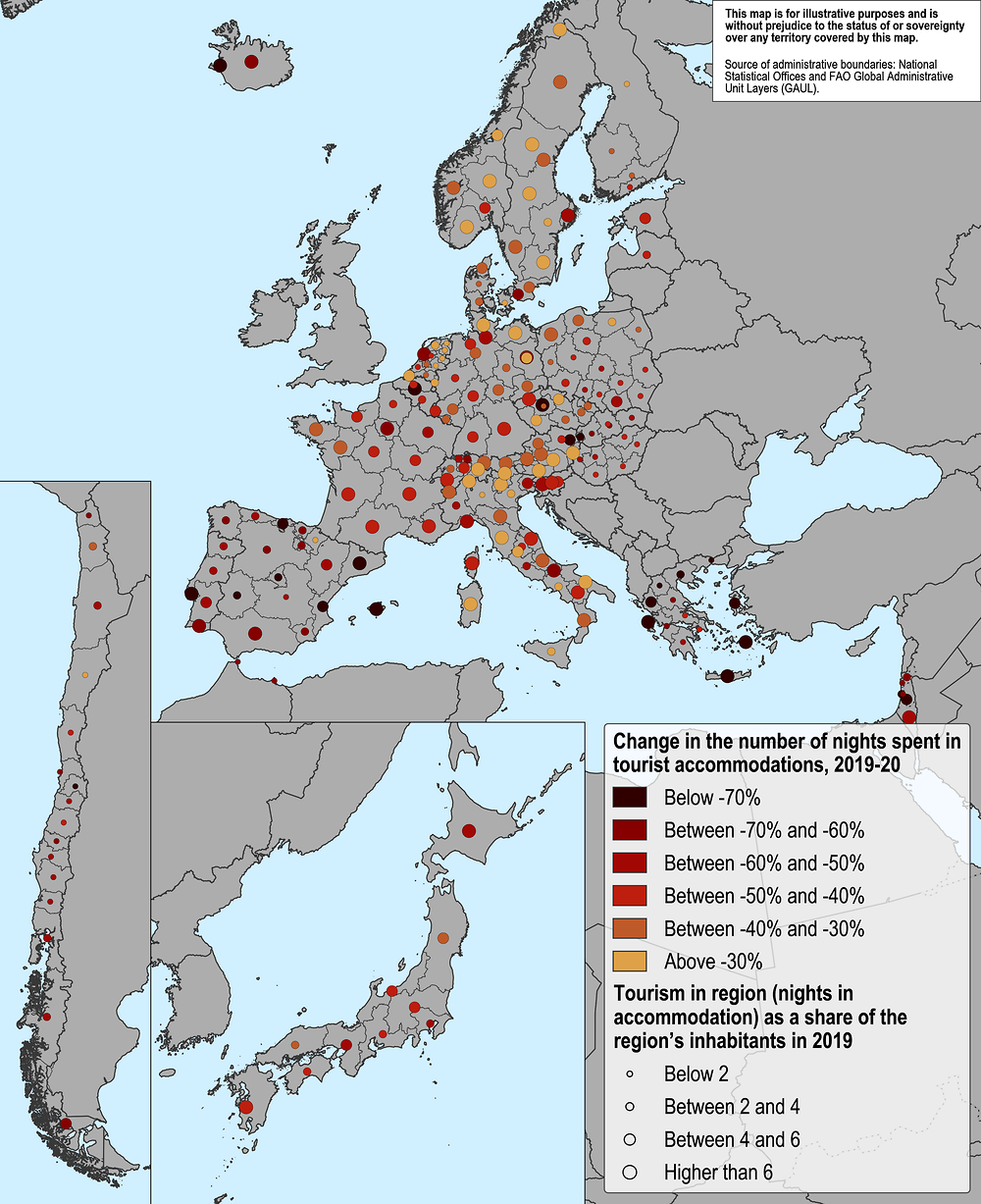

Across 25 OECD countries, all countries had at least 1 region in which tourist stays (number of nights spent in tourist accommodations) fell by half or more from 2019 to 2020, which includes the first 10 months of the COVID-19 pandemic (Figure 1.14). Island regions (e.g. Corsica in France, Greece’s Ionian Islands and Spain’s Balearic Islands), in addition to the Algarve region of Portugal, have the most tourist-centric economies in the OECD (OECD, 2020). These regions and many others in Greece and Spain had declines of more than 70% in tourist stays (Figure 1.16). Although larger cities have more diversified economies than tourist destinations, business travel and city stays also declined markedly during the pandemic. At least 5 metropolitan regions had 1-year declines of more than 70% in tourist stays: Brussels, Madrid, Prague, Santiago and Tel Aviv. The mean decline in air passengers was 70% and regions such as Drenthe (Netherlands), Moravia-Silesia (Czech Republic), Upper Austria and Wales experienced even larger declines (Figure 1.15).

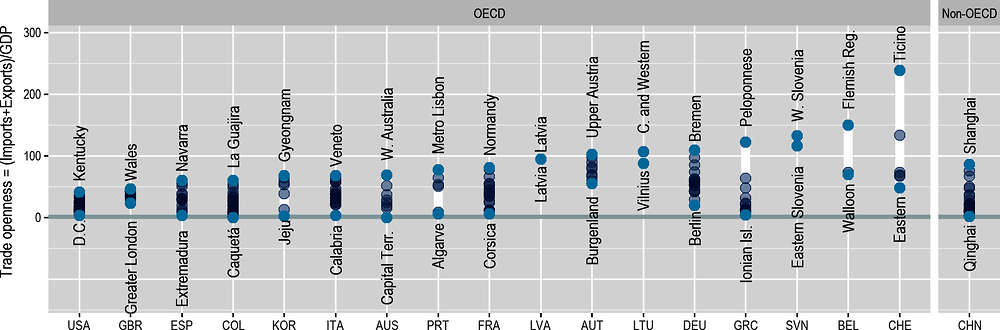

A region’s integration in global markets is related to trade openness, the ratio of its international trade (imports plus exports) to regional GDP. Trade openness has generally been expanding over the last decade (OECD, 2020). Some countries like Belgium, Slovenia and Switzerland have 1 or more regions in which trade openness exceeds 100%, leading to large within-country differences (Figure 1.16). However, the pandemic caused trade openness to fall in more than half of TL2 regions (of the 17 OECD countries with regional data for 2020). Regional data in 2021 is only available for a few countries but global trade data shows a sizeable recovery in 2021, despite continued supply-chain and transport disruptions along with climate and geopolitical concerns.

The pandemic also led to large falls in tourism-related FDI into OECD regions. FDI in accommodation and travel arrangement services fell by more than half, whereas overall FDI into OECD regions was only slightly weaker in 2020-21 compared to previous years. Similar to the pre-pandemic period, overall FDI inflows were highly concentrated geographically: around 15% of FDI in 2021 went to just 5 OECD regions: Chūgoku and Kyushu (Japan), North East and South East United Kingdom (UK), and Texas, United States (US). In a typical year, a handful of destination regions account for 15% or more of incoming investment into the OECD, partly because FDI flows often include some large transactions in which a single company makes a multi-billion-dollar investment (e.g. semiconductor project) in one place. Although the set of OECD destination regions receiving FDI changes over time, most regions that receive large inflows are those with already-high (top 30%) levels of GDP. Australia, Canada, the UK and the US are popular destinations, with some of their regions receiving very large FDI inflows in multiple years (especially Queensland, Australia; Ontario, Canada; Scotland and South East England, UK; California, New York and Texas, US).