The PISA 2022 study offers an optional assessment of financial literacy for the fourth time. The revised framework proposed in this chapter takes into account changes in the socio-demographic and financial landscape that are relevant for students' financial literacy and decision making. It includes slight revisions to the PISA definition of financial literacy and to the description of the domain around the content, processes and contexts that are relevant for the assessment of 15-year-old students. As before, the framework discusses the relationship between financial literacy and non-cognitive skills, and between financial literacy and other domains of knowledge and skills.

PISA 2022 Assessment and Analytical Framework

3. PISA 2022 Financial Literacy Framework

Abstract

Background

PISA 2012 was the first large-scale international study to assess the financial literacy of young people. Since 2012, the PISA financial literacy assessment has provided a unique source of evidence on the increasing engagement of young people with financial issues and on their skills to address the challenges posed by an evolving financial landscape (OECD, 2014[1]).

The OECD conducted the PISA 2022 financial literacy assessment, ten years after the first exercise. In the meantime, technological innovations, global connectivity, demographic changes and other major trends shaped society and highlighted the continued need for individuals to acquire financial competencies.

In this context, it is important that the PISA financial literacy assessment continues to remain up-to-date and relevant. This requires a comprehensive review of the assessment and analytical framework, as the key document defining the construct being measured and its practical translation into the cognitive test.

The PISA financial literacy analytical and assessment framework was first developed for PISA 2012 and has undergone only minor editorial revisions for PISA 2015 and PISA 2018. This document presents a more thorough revision for PISA 2022, as described in Box 3.1.

This framework was used to guide the development of a small number of new questions for the PISA 2022 financial literacy assessment.

Box 3.1. Main revisions with respect to the PISA 2012-2018 financial literacy framework

The introduction has been substantially revised to take into account recent developments in the financial, economic and socio-demographic landscape that are relevant for the financial literacy of young people and that provide a motivation for this assessment; it also takes into account recent research on financial literacy and financial education.

Revision to the definition of financial literacy (replacing "motivation and confidence" with "attitudes", to take into account the role of a broader set of attitudes).

The descriptions of all content areas have been updated to incorporate new financial knowledge competencies needed by young people, reflecting the new trends described in the introduction.

The process category "analyse information in a financial context" has been renamed as "analyse financial information and situations" to take into account its broader scope;

The structure of other content, process and context categories remained the same, but the distribution of score points across the various categories has been slightly revised (Table 3.1), in order to:

Give slightly more weight to the "risk and reward" and "financial landscape" content areas, following the trends described in the introduction, and

Give slightly less weight to the process "apply financial knowledge and understanding" in order to reduce the emphasis on numerical skills in cognitive tasks.

The descriptions of non-cognitive factors has been revised to take into account:

New ways in which young people can access information and education (including digital tools and delivery channels developed using behavioural insights),

New ways in which young people can access money and financial products (notably through digital financial services),

A wider set of financial attitudes that may be related to cognitive aspects of financial literacy,

A wider set of financial behaviours that young people may engage in.

The section on "the interaction of financial literacy with knowledge and skills in other domains" was expanded to take into account possible future synergies with other cognitive assessments.

Introduction

PISA 2012 was the first large-scale international study to assess the financial literacy of young people, and indicated wide variations in levels of financial literacy within and across countries. The PISA 2015 and 2018 assessments provided information about trends, as well as data on additional countries joining the assessment.

The development of the PISA financial literacy assessment and analytical framework 2012 provided the first detailed guidance on the scope and operational definition of financial literacy. It provided a common language for discussion of the domain, it increased the understanding of what was being measured and promoted the analysis of knowledge and skills associated with competency in the domain, thus providing the groundwork for building the described proficiency scales that are used to interpret the results. The 2012 framework contributed to the development of national financial literacy frameworks, and offered a basis for the creation of the OECD/INFE core competencies framework on financial literacy for youth (OECD, 2015[2]) and the EU/OECD Financial competence framework for youth and children in the EU (forthcoming 2023).

The results of the existing PISA financial literacy assessments have encouraged policy makers to develop, revise or step up their financial education initiatives for young people. Some of these efforts use PISA results as a benchmark or encourage participation in the PISA financial literacy assessment as part of their national strategies for financial education, as is the case for instance in Australia, Brazil, Italy and the US (ASIC, 2017[3]; Federal Government of Brazil, 2017[4]; Italian Government, 2017[5]; Financial Literacy and Education Commission, 2016[6]). The importance of PISA financial literacy data for the policy agenda is also reflected in the EU work on sustainable finance (EU, 2018[7]).

Building on that first exercise and subsequent minor edits for the assessments in 2015 and 2018, the revised framework proposed in this document for the PISA 2022 assessment, takes into account changes in the socio-demographic and financial landscape that are relevant for students' financial literacy and decision making. It includes slight revisions to the definition of financial literacy for youth and to the description of the domain around the content, processes and contexts that are relevant for the assessment of 15-year-old students. As before, the framework discusses the relationship between financial literacy and non-cognitive skills and with other domains of knowledge and skills. Box 3.1 summarises the main revisions.

Growing policy relevance of financial literacy for young people

Over the past decades, developed and emerging economies have become increasingly aware of the importance of ensuring that their citizens are financially literate. This has stemmed in particular from shrinking public and private support systems, shifting demographic profiles including the ageing of the population, and wide-ranging developments in the financial marketplace including the increasing digitalisation of finance.

A lack of financial literacy leaves people ill-equipped to make appropriate financial decisions, which could, in turn, have tremendous adverse effects on both personal and, ultimately, global financial resilience (OECD, 2009[8]). As a result, financial literacy is now globally acknowledged as an essential life skill and targeted financial education policy is considered to be an important element of economic and financial stability and development.

This is reflected in the G20 endorsement of the OECD/INFE (International Network on Financial Education) High-level Principles on National Strategies for Financial Education (G20, 2012[9]; OECD/INFE, 2012[10]) and the OECD/INFE policy handbook on national strategies for financial education (OECD, 2015[11]). G20 leaders also recognised that this requires lifelong learning that starts in childhood, as indicated by their call for core competencies on financial literacy for young people and adults (OECD, 2015[2]; 2016[12]), and their statement supporting the widespread use of instruments to measure youth financial literacy including the PISA financial literacy assessment (G20, 2013[13]).

A series of tangible trends underpin the global interest in financial literacy as a key life skill, especially for young people. Some of these trends were relevant at the time the 2012 framework was drafted and continue to remain relevant; other trends – especially the digitalisation of finance – have become increasingly important in recent years. These are summarised below.

Trends in the financial landscape

Access to money and financial products and services from a young age

Greater financial inclusion in emerging economies, as well as worldwide developments in technology and deregulation, have resulted in widening access to all kinds of financial products. Growing numbers of consumers therefore have access to financial products and services from a variety of established and new providers delivered through traditional and digital channels, including traditional financial institutions, online banks and mobile phone companies. Whilst many of the products available bring advantages and help to improve financial well-being, many are also complex and pose new challenges or risks.

Young people and children increasingly have access to financial products and services. Data from the PISA 2012, 2015 and 2018 financial literacy assessments revealed that many 15-year-old students hold bank accounts and prepaid debits cards (as these students are minors cards and accounts are typically opened with the consent of a parent or guardian). In 2015, on average across the 10 participating OECD countries and economies, 56% of students held a bank account. In Australia, the Flemish Community of Belgium, the participating Canadian provinces and the Netherlands, more than seven in ten students held a bank account (OECD, 2017[14]). In some countries, like China, the Netherlands, Russia and the UK, children as young as five or six can use debit cards linked to their parents' accounts (Imaeva et al., 2017[15]). Such access could potentially provide young people with the opportunity to gain practical experience with parental oversight, assuming the basic prerequisite of a financial landscape with robust regulation and financial consumer protection.

Even when they do not formally have an account or card, many young people have access to money in the form of gifts, pocket money and wages from part time and/or informal jobs. PISA 2015 data shows that on average across 10 participating OECD countries and economies, 64% of students earn money from some formal or informal work activity, such as working outside school hours, working in a family business, or doing occasional informal jobs. More than one in three students, on average in each of the 15 participating countries and economies, reported that they receive money from an allowance or pocket money for regularly doing chores at home (OECD, 2017[14]).

PISA data also shows that in some countries access to a financial product is positively associated with financial literacy performance. According to PISA 2015 data, in Australia, the Flemish Community of Belgium, the participating Canadian provinces, Italy, the Netherlands, Spain and the United States, students who held a bank account performed better in financial literacy by over 20 score points than students of similar socio-economic status who did not have a bank account (OECD, 2017[14]). Evidence that there is a positive relationship between performance in financial literacy and holding a bank account or receiving gifts of money may suggest that some kind of experience with money or financial products could provide students with an opportunity to reinforce financial literacy, or that students who are more financially literate are more motivated to use financial products – and perhaps more confident in doing so. Parents are very likely to be involved in these experiences, as they may have given their children money through allowances or gifts, opened a bank account for them and taught them how to use it.

It is important that young people begin to know their rights and responsibilities as current or future financial consumers. They also need to start to understand the risks associated with the different products and services as well as their potential benefits when used appropriately, even before they acquire full legal rights to enter into financial contracts by themselves.

Widespread emergence of digital financial products and services

Recent years have seen a rapid increase in technological innovation and in the application of digital technology across a number of spheres. Internet access has grown around the world and smart phones provide ubiquitous connectivity. Large parts of the world's population are increasingly using digital technologies not only to communicate but also to access and use financial services.

Digital financial services include any financial operation using digital technology, such as electronic money, mobile financial services, online financial services, i-teller solutions, and branchless banking. They are a major global phenomenon and are widespread in both the developed and developing world (EY, 2017[16]; GSMA, 2018[17]). The share of digitally active adult consumers using FinTech services on a regular basis went from 16% in 2015 to 33% in 2017 on average in six economies (Australia, Canada, Hong Kong China, Singapore, UK, US) (EY, 2017[16]). Young people are particularly active users of digital financial services. On average in 20 economies, 37% of 18-24 year-olds and 48% of 25-34 year-olds who are digitally active use FinTech services on a regular basis (EY, 2017[16]). In Canada, one half of youth 25-34 years old conduct transactions on the Internet at least weekly, almost twice as many as older Canadians (Statistics Canada, 2018[18]).

Digital financial services offer great possibilities for integrating the poor and previously financially excluded populations into the formal financial system by overcoming physical infrastructure barriers, lowering costs, offering faster and timely transactions, and potentially providing a seamless experience tailored to individual needs. At the same time, however, the spread of digital innovation in finance has created new sources of risk for consumers, including new types of fraud and risks related to the security and confidentiality of data. Legitimate use of consumer data to create digital profiles may also make it more costly or difficult to access certain types of financial products or services as financial service providers seek to segment their consumer base and price or market their products accordingly. Moreover, digital channels and questionable digital market practices have made access to some products – like high-cost short-term credit – extremely rapid and may reinforce behavioural biases, like short-termism and lack of self-control (OECD, 2017[19]).

Some of these risks are particularly relevant for children and young people, typically stemming from the fact that they are at ease with digital technologies and are often users of social media and other digital tools, while at the same time potentially having low financial literacy and little experience with financial services. Recent evidence from the US shows that Millennials using mobile phones to make payments tend to display lower financial knowledge and more problematic financial behaviours (overdrawing their current accounts, using credit cards expensively, or using high-cost borrowing methods) than non-mobile-payment users (Lusardi, de Bassa Scheresberg and Avery, 2018[20]), suggesting that technology and ease of payments may attract disproportionately those who have low financial literacy and manage their finances poorly.

The rapid evolution of digital financial services also means that parents themselves may have little familiarity with them and limited ability to guide their children. Moreover, as young people are typically new entrants in traditional and digital financial markets, financial regulation may find it challenging to address their needs and protect them. As the financial landscape evolves, new types of institutions, services and products may emerge, making these challenges more acute.

The large availability of cashless purchasing options through online stores, interactive television, online and mobile games, social media, or with contactless cards may make money less real for users making their first spending decisions. As young people can feel under pressure to spend to keep up with their peers, many digital channels enable users to make instant purchases, which in turn makes it more difficult to control spending. In some digital contexts, young people may not even realise that they are spending real money, as in the case of in-app or in-game purchases that may be linked to automatic withdrawals through a monthly telephone or internet bill or a credit card account. While in many countries issues related to in-game expenses have been addressed by financial regulation, it is also important that parents and children are alert in their online behaviour.

Young people are the most active users of social media. Around 90% of 18-29 year olds in the US, and of people age 16-24 in the European Union, use some form of social media (EU, 2017[21]; Perrin, 2015[22]), potentially bringing them into contact with information, marketing and consumer opinions. They may have a hard time distinguishing the source and accuracy of information posted on such platforms, and may succumb to behavioural biases when reading the same (mis)information from numerous sources. They may also be unaware that their data can be used to create digital profiles that are then used or sold to third parties to promote products or price them according to their personal characteristics.

Many young people also fall victims of fraud and scams with financial implications via social media, such as becoming prey to identity theft, following fraudulent offers to invest, or even, knowingly or unknowingly, allowing their personal bank accounts to be used for illicit purposes (Cifas, 2018[23]; Startup, Cadywould and Laza, 2017[24]). A study conducted by the FCA in the UK found that those aged under 25 (13%) were six times more likely than over 55s (2%) to trust an investment offer they received via social media (FCA, 2018[25]).

Despite being digital natives, young people may be more likely to be victims of online fraud because they take risky behaviours online. A survey conducted in 17 countries in 2017 showed that young people are very likely to share personal information online. More than 60% of those aged 16-24 and 25-34 shared private and sensitive photos of themselves with others; two-fifths of young people shared their financial and payment details (42% of 16-24 year olds and 46% of 25-34 year olds) (Kaspersky, 2017[26]).

Young people are often the target of aggressive marketing practices promoting high-cost short-term online credit. For instance, in the UK and the US some online payday loans platforms target university students, in some cases offering loans secured against income from future student loan payments. Students are often not aware of the very high interest rates and possible late fees, and do not think about looking for cheaper alternatives. Some 6% of 18-24 year old people in the UK used one or more forms of high‑cost loan in 2017, and this age group accounted for about one in five of all those who had used payday lending or a pawnbroker (FCA, 2017[27]). While consumers of all ages should be adequately protected via financial regulation, it is clear, considering the pace of financial markets developments, that they also need to have the knowledge and skills to understand the products on offer, be alert to financial conditions that may be unfamiliar or not be clearly stated, and compare products and providers.

Demographic and socio-economic trends

Risk shift and increased individual responsibility

A number of demographic, socio-economic and technological trends imply a transfer of risk to individuals, greater individual responsibility for many financial decisions, and greater economic insecurity for young people and future generations.

Economic trends following the global financial crisis, technological change and globalisation are likely to make economic and job prospects for future generations more uncertain (OECD, 2017[28]; Dolphin, 2012[29]). Youth unemployment rates rose substantially in most OECD countries and in a number of emerging economies after the global financial crisis, and in many cases they remain at high rates. The crisis exacerbated issues of labour market segmentation in some countries, with an increase in the proportion of employed youth working in temporary and precarious jobs as they are unable to find a permanent job. In the aftermath of the global financial crisis, disposable income has fallen more for young people than for adults and the elderly, and young people face higher poverty rates than other age groups (OECD, 2013[30]; 2017[31]; 2016[32]).

Moreover, continuing trends of increasing longevity, falling birth-rates, and shrinking public support systems in many countries have implications on people's income security during the active life and in old age.

Women's participation in the labour force and the proportion of people entering higher education are both increasing, and adults are less likely to continue to live in close proximity to their older family members than previous generations. The likely outcome of these shifts will be a greater need for financial security in retirement and professional care in old age, resulting in the need for direct financial support from family or additional government expenditure (Colombo et al., 2011[33]). Working-age adults will be expected to shoulder any tax burden to finance this expenditure whilst at the same time also saving for their own retirement, potentially repaying their own student loans, supporting their children’s education and managing increasingly varied working-life trajectories which may include periods of inactivity, self-employment or retraining.

In addition, there has been a widespread transfer of risk from both governments and employers to individuals, meaning that now many people face the financial risks associated with longevity, investment, out-of-pocket healthcare and long-term care. The number of financial decisions that individuals have to make, and the significance of these decisions, is increasing as a consequence of these changes in the market and the economy. For instance, individuals will need to accumulate savings to cover much longer periods of retirement than previous generations, while at the same time covering the heightened long-term health care needs of elderly relatives. Young people are now more likely to have several employers in the course of their working lives than their parents and to experience more precariousness in the labour market. This could make it more difficult for them not only to secure a steady income flow during their working lives but also to ensure that this translates into a stable retirement income.

Traditional pay-as-you-go (PAYG) public pension schemes tend to be shrinking in most countries and are increasingly supplemented by private funded schemes in which the individual may be responsible for making investment decisions, including the contribution rate, the investment allocation and the type of pay out product. Moreover, defined-contribution pension plans are quickly replacing defined-benefit pension plans for new entrants, shifting onto workers the risks of uncertain investment performance and of longer life expectancy. Surveys show that a majority of workers are unaware of the risks they now have to face, and have neither sufficient financial knowledge nor the skills to manage such risks adequately (OECD, 2016[34]).

In this panorama of increasingly difficult financial choices, consumers need to know when and where to seek professional help. But professional advisors are not an alternative to financial education. Even when individuals use the services of financial intermediaries and advisors, they need to understand what is being offered or advised, and they need the skills and knowledge to manage the products they choose. They should also be aware that some advisors may face a conflict of interest as they provide advice and at the same time sell products or receive commission, and that "robo advice" is not necessarily more independent than advice in person. Depending on the national legal framework for financial advice, individuals may be fully responsible for the financial product they decide to purchase, facing all the direct consequences of their choice.

Changes in individual financial responsibility and choices are also underpinned by the recent increasing interest at policy and individual level for sustainable development, responsible consumption and inequalities reduction (United Nations, 2015[35]). European governments are looking into ways to ensure that the financial systems contributes to sustainable and inclusive growth (EU, 2018[7])A growing number of consumers and investors have become concerned about the sustainability and ethics of their spending choices and focus on environmental, social and governance (ESG) factors in their investment decisions. In this context, it important that individuals understand the impact of their financial choices and investments on the economy, society and the environment, that they are aware of new products following ESG criteria and of any potential emerging risk associated with these products.

Financing higher education

Students nearing the end of compulsory education will soon be taking decisions that will have significant consequences for their adult lives, such as deciding whether to continue their studies or whether to enter the labour market. The gap in wages between college and non-college educated workers has widened in many economies (OECD, 2016[36]). In some countries, this decision also includes how to finance tertiary education and whether to take a student loan.

Financing higher education requires students and their families to consider and chose among various available options, including in which university and city to study and live, deciding whether to use savings, if any, understanding the advantages and disadvantages of working while studying, and potentially taking up a loan. In some countries, like the US, student loans are becoming a more important part of young people finances than in the past, with the combined federal and private student loan debt reaching roughly $1.4 trillion in 2016 (Ratcliffe and McKernan, 2013[37]; CFPB, 2017[38]).

Countries differ significantly in the extent to which student loans are offered and used, and in how they work. Depending on national student loans characteristics, students intending to take a loan may have to choose between public and private loans and between different repayment methods. Some loans may benefit from public guarantees, reduced interest rates, favourable repayment system or remission/forgiveness mechanisms. The take-up of student loans and extent of indebtedness at graduation are quite sizeable in some countries. Even looking only at public student loans, almost eight in ten students in Australia and more than nine in ten students in the UK at bachelor’s, master’s or doctoral levels had one in 2013/14; in the United States, 62% of bachelor’s-degree students had a public student loan in the same period (OECD, 2016[36]). As a result of taking loans, most students are in debt at graduation. Students with a loan graduate with an average debt of about USD 18 000 in the Netherlands, and of about USD 12 000 in Canada (OECD, 2016[36]). The US Consumer Financial Protection Bureau (CFPB) estimated that more than 1.2 million borrowers defaulted in 2016 (CFPB, 2017[38]).

The extent to which student loans can cause a problem mostly depends on the amount of debt, the uncertainty of graduates’ earnings and employment prospects, and the conditions for repayment of the loans. If they decide to take a loan, students and their families need to be proficient in financial literacy to select the best arrangement given the family/student situation and to avoid over-indebtedness from a young age.

In some countries, like Australia, greater student responsibility for funding one’s studies has been observed not only at university level but also in post-secondary vocational education (Noonan and Pilcher, 2018[39]). The recent Australian experience has seen a dramatic increase in vocational students’ debt, which can be attributable to a combination of legislative changes, aggressive course offering practices, and students’ lack of understanding of the debt obligations they were taking on (Commonwealth of Australia, 2016[40]).

Expected benefits of financial education and improved levels of financial literacy

Research shows that people form financial habits, skills and behaviours since childhood and adolescence, learning from their parents and others around them, indicating the importance of early interventions to help shape beneficial behaviours and attitudes (Whitebread and Bingham, 2013[41]; CFPB, 2016[42]). Furthermore, young people need financial knowledge and skills from an early age in order to operate within the complex financial landscape they are likely to find themselves in, often before reaching adulthood. Younger generations are not only likely to face complex financial products, services and markets, but as noted above, they are more likely to have to bear more financial risks in adulthood than their parents and may face new financial risks as they use digital financial service and digital tools more broadly.

Young people may learn beneficial behaviours from their friends and family, such as prioritising their expenditure or putting money aside for a rainy day, but the recent changes in the financial marketplace and social welfare systems mean it is unlikely that they can gain sufficient information, knowledge or skills from such people unless they work in related fields1. Moreover, not all families are equally equipped to transmit financial literacy skills to their children (Lusardi, Mitchell and Curto, 2010[43]). The PISA 2015 assessment showed that, on average across the participating OECD countries and economies, socio-economically advantaged students score 89 points higher than disadvantaged students, equivalent to more than one proficiency level (OECD, 2017[14]). Large variations in financial literacy related to socio-economic status, intended as a combination of parents' education, parents' occupations, home possessions and educational resources available in the home, mean that families with high socio-economic status are providing students better opportunities to acquire financial literacy skills than socio-economically disadvantaged families.

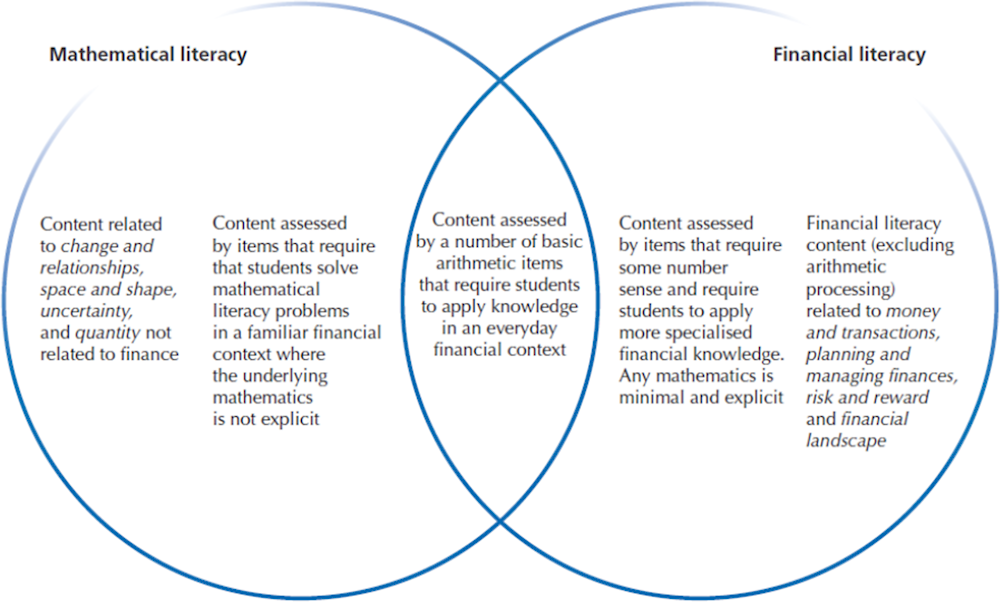

In order to provide equality of opportunity, it is important to offer financial education to those who would not otherwise have access to it. Schools are well positioned to advance financial literacy among all demographic groups and reduce financial literacy gaps and inequalities (including across generations). Financial literacy performance is strongly correlated with performance in mathematics and reading, suggesting that, whilst not sufficient, a good basic education in core subjects will benefit students when dealing with financial matters (OECD, 2017[14]). Nevertheless, basic mathematics and reading literacy does not provide the specific content knowledge, and students should be helped to improve their financial literacy with more specific financial literacy content. Several countries have started integrating some financial literacy topics into existing subjects, such as mathematics or social sciences. While dedicated financial literacy approaches are relatively new and more evidence on effective approaches would be beneficial, it is important to provide early opportunities for establishing the foundations of financial literacy, as efforts to improve the financial knowledge and skills of adults in the workplace or in other settings can be severely limited by a lack of early exposure to financial education and by a lack of awareness of the benefits of continuing financial education.

Existing empirical evidence shows that young people and adults in both developed and emerging economies who have been exposed to good quality financial education are subsequently more likely than others to plan ahead, save and engage in other responsible financial behaviours (Atkinson et al., 2015[44]; Bruhn et al., 2016[45]; Kaiser and Menkhoff, 2016[46]; Miller et al., 2014[47]; Amagir et al., 2018[48]). Results from a meta-analysis of 126 studies looking at the impact of a variety of financial education interventions on financial literacy show an effect size of 0.26 on average (Kaiser and Menkhoff, 2016[46]). Another systematic literature review of the effectiveness of financial education programmes for children and adolescent shows that school-based financial-education can improve children’s and adolescents’ financial knowledge and attitudes, but studies looking at the impact on actual financial behaviour are scarce (Amagir et al., 2018[48]).

This evidence suggests a possible causal link between financial education and financial literacy levels and indicates that improved levels of financial literacy can lead to improved financial outcomes.

Other research indicates a number of potential benefits of being financially literate. There is evidence that in developed countries those with higher financial literacy are better able to manage their money, participate in the stock market and perform better on their portfolio choice, and that they are more likely to choose mutual funds with lower fees (Clark, Lusardi and Mitchell, 2017[49]; Hastings and Tejeda-Ashton, 2008[50]; van Rooij, Lusardi and Alessie, 2011[51]; Gaudecker, 2015[52]). In emerging economies, financial literacy is shown to be correlated with holding basic financial products like bank accounts and insurance (Grohmann, Kluhs and Menkhoff, 2017[53]; Xu and Zia, 2012[54]); similarly, bank account holding among 15-year-old students is associated with higher levels of financial literacy on average across the OECD countries participating in the 2012 and 2015 PISA exercise (OECD, 2014[1]; 2017[14]). Moreover, adults who have greater financial knowledge are more likely to accumulate higher amounts of wealth (Behrman et al., 2012[55]; van Rooij, Lusardi and Alessie, 2012[56]).

Financial literacy has also been found to be related to debt choices and debt management, with more financially literate individuals opting for less costly and less complex mortgages, and avoiding high interest payments and additional fees (Disney and Gathergood, 2013[57]; Lusardi and Tufano, 2015[58]; Gathergood and Weber, 2017[59]).

In addition to the benefits identified for individuals, widespread financial literacy can be expected to improve economic and financial stability, as well as to support sustainable and inclusive growth (OECD, 2006[60]; EU, 2018[7]). Financially literate consumers can make more informed decisions, shop around for products and demand higher quality services, which can, in turn, encourage competition and innovation in the market. As financially literate people can protect themselves to a greater extent against the negative consequences of income or expenditure shocks, are more likely to take appropriate steps to manage the risks transferred to them, and are less likely to default on credit commitments, they can better face macro level shocks and become more financially resilient. Improving financial literacy among vulnerable populations may especially contribute to reducing wealth inequalities. Financially literate consumers are more likely to have long-term financial attitudes and to understand the implications of personal financial decisions on the society, the economy and the environment.

Box 3.2. OECD activities in relation to financial literacy

In 2002, the OECD initiated a far-reaching financial education project to address governments’ emerging concerns about the potential consequences of low levels of financial literacy. This project is serviced by the OECD Committee on Financial Markets and the Insurance and Private Pensions Committee, in coordination with other relevant bodies including the PISA Governing Board and the Education Policy Committee on issues related to schools. The project takes a holistic approach to financial-consumer issues that highlights how, alongside improved financial access, adequate consumer protection and regulatory frameworks, financial education has a complementary role to play in promoting financial well-being.

Recognising the increasingly global nature of financial literacy and education issues, in 2008 the OECD created the International Network on Financial Education (INFE) to benefit from and encompass the experience and expertise of developed and emerging economies. More than 280 public institutions from more than 130 countries are economies are members of the INFE as of 2023. Members meet twice yearly to discuss the latest developments in their country, share their expertise, and collect evidence, as well as to develop analytical and comparative studies, methodologies, good practice, policy instruments and practical guidance on key priority areas.

Important milestones included the endorsement by G20 leaders of the OECD/INFE High-level Principles on National Strategies for Financial Education in 2012 (OECD/INFE, 2012[10]) and the adoption of the Recommendation on Financial Literacy by the OECD Council in 2020 (OECD, 2020[61]).

The 2020 OECD Recommendation advised to “take measures to develop financial literacy from the earliest possible age” (OECD, 2020[61]). Two main reasons underpin the OECD recommendation: the importance of focusing on youth in order to provide them with key life skills before they start to become active financial consumers, and the relative efficiency of providing financial education in schools rather than attempting remedial actions in adulthood.

The OECD/INFE developed a dedicated publication on Financial Education for Youth: The Role of Schools, which was welcomed by G20 leaders in 2013 (OECD, 2014[62]). The publication includes case studies and guidelines on teaching financial literacy in school, which have also been supported by the Ministers of Finance of the Asia-Pacific Economic Cooperation (APEC) in 2012 (APEC, 2012[63]). More case studies on the development of financial education programme for children and young people, in and outside of schools, are included in subsequent publications (OECD, 2019[64]; 2021[65]).

Following a G20 call in 2013, the OECD/INFE developed a Core competencies framework on financial literacy for youth, which describes the financial literacy outcomes that are likely to be important for 15 to 18 year olds and provides a tool for policy makers to develop national learning and assessment frameworks. This was followed by the EU/OECD Financial competence framework for youth and children in the EU, to be published in 2023. Both frameworks build on the lessons learned from developing the PISA 2012 financial literacy assessment framework and analysing the PISA financial literacy data (OECD, 2015[2]; 2020[66]; 2013[30]).

The three volumes collecting the results of the PISA 2012, 2015 and 2018 financial literacy assessments provide not only international evidence on the distribution of financial literacy among 15-year old students with and across countries, but also policy suggestions on how policy makers can improve it (OECD, 2014[1]; 2017[14]; 2020[66]).

The continued need for data

PISA 2012 was the first large-scale international study to assess the financial literacy of young people. Followed by two similar assessments in 2015 and 2018, the PISA financial literacy assessment has regularly provided evidence not only on countries' average levels of financial literacy of their 15-year-old students, but also valuable insights into how financial competencies are distributed along socio-demographic characteristics and about the correlation with mathematics and reading abilities. PISA financial literacy assessments have also provided internationally comparable data on students' experience with money matters, on how they would approach saving and spending decisions, and on their access to basic financial products.

Policy makers, educators and researchers continue to need high-quality data on levels of financial literacy in order to inform financial education strategies and the implementation of financial education programmes in schools. Over 70 countries around the world are developing or implementing national strategies for financial education, following OECD/INFE guidance, and most of them include young people and students as primary target groups (OECD, 2015[11]). As recalled above, more and more countries have started introducing financial literacy content into school curricula at various levels, typically as part of existing subjects. Up-to-date evidence on the financial literacy of students is crucial in the development of these policies.

A robust measure of financial literacy amongst young people provides information at a national level that can indicate whether the current approach to financial education is effective. In particular, it can help to identify issues that need addressing through schools or extra-curricular activities or programmes that will enable young people to be properly and equitably equipped to make financial decisions in adulthood. It can also be used as a baseline from which to measure success and review school and other programmes in future years.

An international study provides additional benefits to policy makers and other stakeholders. Comparing levels of financial literacy across countries makes it possible to see which ones have the highest levels of financial literacy and begin to identify particularly effective national strategies and good practices. It also makes it possible to recognise common challenges and explore the possibility of finding international solutions to the issues faced.

Defining financial literacy

PISA focuses on young people’s ability to use their knowledge and skills to meet real-life challenges, rather than merely on the extent to which they have mastered specific curricular content. PISA conceives of literacy in general as the capacity of students to apply knowledge and skills in key subject areas and to analyse, reason and communicate effectively as they pose, solve and interpret problems in a variety of situations.

The OECD defines financial education as “the process by which financial consumers/investors improve their understanding of financial products, concepts and risks and, through information, instruction and/or objective advice, develop the skills and confidence to become more aware of financial risks and opportunities, to make informed choices, to know where to go for help, and to take other effective actions to improve their financial well-being” (OECD/INFE, 2012[10]).

The 2020 Recommendation on Financial Literacy defines financial literacy as "a combination of awareness, knowledge, skill, attitude and behaviour necessary to make sound financial decisions and ultimately achieve individual financial well-being".

The financial literacy definition created in the context of PISA 2012 is considered to be still relevant and appropriate, and only a minor change is suggested with respect to previous versions of the framework. In practice, the words "motivation and confidence" have been replaced with "attitudes" as a way of taking into account that a broad set of attitudes is related to cognitive aspects of financial literacy and is important for financial behaviour.

The revised definition is as follows:

Financial literacy is knowledge and understanding of financial concepts and risks, as well as the skills and attitudes to apply such knowledge and understanding in order to make effective decisions across a range of financial contexts, to improve the financial well-being of individuals and society, and to enable participation in economic life.

This definition, like other PISA domain definitions, has two parts. The first part refers to the kind of thinking and behaviour that characterises the domain. The second part refers to the purposes for developing the particular literacy.

In the following paragraphs, each part of the definition of financial literacy is considered in turn to help clarify its meaning in relation to the assessment.

Financial literacy…

Literacy is viewed as an expanding set of knowledge, skills and strategies, which individuals build on from a young age and throughout life, rather than as a fixed quantity, a line to be crossed, with illiteracy on one side and literacy on the other. Literacy involves more than the reproduction of accumulated knowledge and it involves a mobilisation of cognitive and practical skills, and other resources such as attitudes, motivation and values. The PISA assessment of financial literacy draws on a range of knowledge and skills associated with the development of the capacity to deal with the financial demands of everyday life and uncertain futures within contemporary society.

Some national and international institutions refer to “financial capability” instead of “financial literacy” in order to put more emphasis on people’s ability to make financial decisions. In most cases the definitions of the two concepts overlap to a large extent, as they both encompass the knowledge, attitudes, skills, and behaviours of consumers. The PISA assessment will continue to refer to financial literacy as its definition is now internationally acknowledged, and for consistency with previous assessments and existing OECD and G20 work.

…is knowledge and understanding of financial concepts and risks…

Financial literacy is thus contingent on some knowledge and understanding of fundamental elements of the financial world, including key financial concepts as well as the purpose and basic features of financial products. Some students already have experience of financial products and commitments through a bank account or a mobile phone contract. A grasp of concepts such as interest, inflation, and value for money are soon going to be, if they are not already, important for their financial well-being.

Adolescents are beginning to acquire financial knowledge and skills, and gain experience of the financial environment that they and their families inhabit (CFPB, 2016[42]; Whitebread and Bingham, 2013[41]). Fifteen-year-old students are likely to have been shopping to buy household goods or personal items; some will have taken part in family discussions about money and whether what is wanted is actually needed or affordable; and a sizeable proportion of them will have already begun to earn and save money; many of them will have access to payment facilities on line or though mobile phones.

Knowledge and understanding of risks that may threaten their financial well-being, including those arising from new types of digital and traditional financial services is also important. At the same time, financially literate students would have an understanding of the purpose of products such as insurance policies and pensions that are intended to mitigate certain risks.

…as well as the skills…

These skills include generic cognitive processes such as accessing information, comparing and contrasting, extrapolating and evaluating – applied in a financial context. They include basic skills in mathematical literacy such as the ability to calculate a percentage, undertake basic mathematical operations or convert from one currency to another, and language skills such as the capacity to read and interpret advertising and basic contractual texts.

…and attitudes…

Financial literacy involves not only the knowledge, understanding and skills to deal with financial issues, but also non-cognitive attributes: the motivation to seek information and advice in order to engage in financial activities, the confidence to approach various types of financial providers and to engage in financial decisions, the ability to focus on the long-term, and the ability to exercise self-control and manage other emotional and psychological factors that influence financial decision making. These attributes are considered as a goal of financial education, as well as being instrumental in building financial knowledge and skills.

…to apply such knowledge and understanding in order to make effective decisions…

PISA focuses on the ability to activate and apply knowledge and understanding in real-life situations rather than the reproduction of knowledge. In assessing financial literacy, this translates into a measure of young people’s ability to transfer and apply what they have learnt about personal finance into effective decision-making. The term “effective decisions” refers to informed and responsible decisions that satisfy a given need.

…across a range of financial contexts…

Effective financial decisions apply to a range of financial contexts that relate to young people’s present daily life and experience, but also to steps they are likely to take in the near future as adults. For example, young people may currently make relatively simple decisions such as how they will use their pocket money or which mobile phone contract they will choose; but they may soon be faced with major decisions about education and work options with long-term financial consequences.

…to improve the financial well-being of individuals and society…

Financial literacy in PISA is primarily conceived of as literacy around personal or household finance, distinguished from economic literacy, which covers concepts such as the theories of demand and supply and market structures. Financial literacy is concerned with the way individuals understand, manage and plan their own and their households’ – which often means their families’ – financial affairs. It is recognised, however, that good financial understanding, management and planning on the part of individuals has some collective impact on the wider society, in contributing to local prosperity as well as national and even global stability, productivity, sustainability and development.

…and to enable participation in economic life.

Like the other PISA literacy definitions, the definition of financial literacy implies the importance of the individual’s role as a thoughtful and engaged member of society. Individuals with a high level of financial literacy are better equipped to make decisions that are of benefit to themselves and their family or community, and also to constructively support and critique the economic world in which they live.

Organising the domain

The representation and organisation of a domain within PISA determines the assessment design and the conceptual structure for the development of cognitive questions (PISA refers to the questions used in the cognitive test as ‘items’). The concept of financial literacy includes many elements, not all of which can be incorporated in an assessment such as PISA. It is therefore necessary to select the most relevant elements across the domain to develop assessment items at various levels of difficulty that are appropriate for 15-year-old students.

A review of approaches and rationales adopted in previous large-scale studies, and particularly in PISA, shows that most specify what they wish to assess in terms of the relevant content, processes and contexts for assessment. Content, processes and contexts can be thought of as three different perspectives on the area to be assessed.

Content comprises the areas of knowledge and understanding that are essential in the area of literacy in question.

Processes describes the mental strategies or approaches that are called upon to negotiate the material.

Contexts refers to the situations in which the domain knowledge, skills and understandings are applied, ranging from the personal to the global.

The steps of identifying and weighting the different categories within each perspective, and then ensuring that the set of tasks in the assessment adequately reflects these categories, are used to ensure the coverage and validity of the assessment. The three perspectives are also helpful in thinking about how achievement is to be reported.

The following section presents a discussion of each of the three perspectives and the framework categories into which they are divided. For each perspective, the framework presents lists of sub-topics and examples of what the items can ask students to show; however, these details should not be interpreted as a checklist of tasks included in any one assessment. Given that only one hour of financial literacy assessment material is being administered in PISA, there is not enough space to cover every detail of each variable.

Content

The content of financial literacy is conceived of as the areas of knowledge and understanding that must be drawn upon in order to perform a particular task. A review of the content of existing financial literacy learning frameworks indicated that there is some consensus on the financial literacy content areas (OECD, 2014[67]; OECD, 2015[2]). The review showed that the content of financial education for young people and in schools was – albeit with cultural differences – relatively similar, and that it was possible to identify a series of topics commonly included in these frameworks. These form the four content areas for PISA financial literacy: money and transactions, planning and managing finances, risk and reward, and financial landscape. The work undertaken by the OECD/INFE to develop a core competencies framework on financial literacy for youth provides additional guidance on how these content areas map to desired financial literacy outcomes (OECD, 2015[2]).

Money and transactions

This content area includes awareness of the different forms and purposes of money and managing monetary transactions, which may include being aware of digital and foreign currencies, spending or making payments using a variety of available tools including mobile or online ones, using bank cards, cheques, bank accounts. It also covers practices such as taking care of cash and other valuables, calculating value for money, and filing documents and receipts, including those received electronically.

Tasks in this content area can, for example, ask students to show that they:

Are aware of the different forms and purposes of money:

recognise bank notes and coins;

understand that money can be exchanged for goods and services;

understand that money spent on something is not available to be spent on something else;

recognise that money can be stored in various ways, including at home, in a bank, in a post office or in other financial institutions, in cash or electronically;

understand that money held in cash may lose value in real terms over time if there is inflation;

recognise that there are various ways of paying for items purchased, receiving money from other people, and transferring money between people or organisations such as cash, cheques, card payments in person or online, electronic transfers online or via SMS or contactless payments with smartphones, and that new ones continue to be developed;

understand that money can be borrowed or lent, and the purpose of interest (taking into account that the payment and receipt of interest is forbidden in some religions);

are aware that other countries may use different currency from their own, and that exchange rates may change over time; and

are aware of digital currencies.

Are confident and capable at handling and monitoring transactions:

can use cash, cards and payment methods through computers and mobile phones to purchase items;

can use cash machines to withdraw cash;

can check an account balance over the internet or through cash machines;

can check receipts after making purchases, and can calculate the correct change if the transaction is made in cash;

can work out which of two consumer items of different sizes would give better value for money, and understand that this may vary depending on the specific needs and circumstances of the consumer;

can use common tools, such as paper-and-pen, spreadsheets, online platforms or mobile applications to monitor their transactions and support budget calculations; and

can check transactions listed on a bank statement provided on paper or digitally, and note any irregularities.

In many PISA questions, the unit of currency is the imaginary Zed. PISA questions often refer to situations that take place in the fictional country of Zedland, where the Zed is the unit of currency. This artifice (about which students are informed at the beginning of the testing session) has been introduced to enhance comparability across countries.

Planning and managing finances

Income, expenditure and wealth need planning and managing over both the short term and long term. This content area therefore reflects the process of monitoring, managing, and planning income and expenses, and understanding ways of enhancing wealth and financial well-being. It includes content related to credit use as well as savings and wealth creation.

This content area includes:

Knowledge and ability to monitor and control income and expenses:

identify various types of income relevant for young people and for adults (e.g. pocket money, allowances, salary, commission, benefits),

be aware that rules for engaging in gainful employment may be different across young people and adults;

understand different ways of discussing income (such as hourly wage and gross or net annual income) and that some factors that may affect income (such as different education or career paths);

draw up a budget to plan regular spending and saving and stay within it; and

be aware of factors that impact on living standards for any given income, including location, number of dependents and existing commitments.

Knowledge and ability to make use of income and other available resources in the short and long terms to enhance financial well-being:

understand the difference between needs and wants and the idea of living within one's means;

understand how to manipulate various elements of a budget, such as thinking about different options for spending money, identifying priorities if income does not meet planned expenses, or finding ways to increase savings, such as reducing expenses or increasing income;

assess the impact of different spending plans and be able to set spending priorities in the short and long term, also in the context of external spending pressure;

understand the benefits of a financial plan for future events and plan ahead to pay future expenses: for example, working out how much money needs to be saved each month to make a particular purchase or pay a bill;

understand that expenditure can be adjusted over time through borrowing or saving;

understand the reasons why people may use credit, that borrowing money entails a responsibility to repay it, and that the amount to be repaid is usually larger than the amount borrowed due to interest payments (taking into account that the payment and receipt of interest is forbidden in some religions);

understand the idea of building wealth, the impact of compound interest on savings, and the reasons why some people use investment products;

understand the benefits of saving for long term goals or anticipated changes in circumstances (such as living independently);

understand the risks of saving in cash, including the fact that money can be lost, stolen or may lose part of its value in real terms due to inflation; and

understand how government taxes and benefits impact on personal and household finances.

Risk and reward

Risk and reward is a key area of financial literacy, incorporating the ability to identify ways of balancing and covering risks and managing finances in uncertainty and an understanding of the potential for financial gains or losses across a range of financial contexts. Various types of risk are important in this domain. The first relates to the risk of financial losses that an individual cannot directly predict, and could not realistically cover from personal resources, such as those caused by catastrophic incidents; these are typically insurable risks. The second comes from changes in circumstances that impact on ability to maintain the same standard of living; which may or may not be insurable. The third is the risk inherent in financial products, such as the risk of facing an increase in repayments on a credit agreement with variable interest rates, or the risk of loss or insufficient returns on investment products. This content area therefore includes knowledge of the main risks inherent in certain products, and the behaviours, strategies and types of products that may help people to protect themselves from the consequences of negative outcomes, such as insurance and savings.

This content category includes:

Identifying those risks that - should the incident occur - are most likely to have a serious negative affect on a particular person, such as:

accident or injury,

theft of personal property, passwords or data and digital assets,

damage or loss of personal property,

man-made and/or natural catastrophes.

Identifying and managing risks and rewards associated with life events or the economy, such as the potential impact of:

job loss, birth or adoption of a child, deteriorating health or mobility;

fluctuations in interest rates and exchange rates; and

other market changes.

Recognising that certain financial products (including insurance) and processes (such as saving) can be used to manage and offset various risks (depending on different needs and circumstances):

understand the benefits of saving for unanticipated changes in circumstances; and

knowing how to assess whether certain insurance policies may be of benefit, and the level of cover needed.

Understanding the risk inherent in certain credit and investment products, such as risk of capital loss, variability of returns, and the implications of variable interest rates on loan repayments.

Understanding the benefits of contingency planning and diversification to limit the risk to personal capital.

Applying knowledge of the benefits of contingency planning, diversification and the dangers of default on payment of bills and credit agreements to decisions about:

various types of investment, savings and insurance products, where relevant; and

various forms of credit, including informal and formal credit, unsecured and secured, rotating and fixed term, and those with fixed or variable interest rates.

Knowing and being cautious about the risks and rewards associated with substitutes for financial products, such as:

saving in cash or in unregulated digital financial instruments (which may include crypto-currencies, depending on national regulation), or buying property, livestock or gold as a store of wealth; and

taking credit or borrowing money from informal lenders.

Knowing that there may be unidentified risks and rewards associated with new financial products (such as mobile payment products and online credit).

Financial landscape

This content area relates to both the character and features of the existing financial world, and the ways in which a wide variety of factors, including technology, innovation, government policy and global sustainable growth measures, can change this landscape over time. It covers awareness of the role of regulation and protection for financial consumers, knowing the rights and responsibilities of consumers in the financial marketplace and within the general financial environment, and the main implications of financial contracts that they may enter into in with parental consent, or alone in the near future. A focus on the financial landscape also takes into account the wide variety of information available on financial matters, from education to advertising. In its broadest sense, financial landscape also incorporates an understanding of the consequences of changes in economic conditions and public policies, such as changes in interest rates, inflation, taxation, sustainability and environmental targets, or welfare benefits for individuals, households and society. The implications of financial service provision for the environment, sustainability and inclusion are also relevant within this content area.

Tasks associated with this content area include:

Awareness of the role of regulation and consumer protection

Knowledge of rights and responsibilities, and the ability to apply it to:

understand that buyers and sellers have rights, such as being able to apply for redress;

understand that buyers and sellers have responsibilities, such as:

consumers/investors giving accurate information when applying for financial products;

providers disclosing all material facts; and

consumers/investors being aware of the implications of one of the parties not doing so.

recognise the financial implications of contracts;

recognise the importance of the legal documentation provided when purchasing financial products or services and the importance of understanding the content.

Knowledge and understanding of the financial environment, including:

Understanding that different people and organisations may have incentives to provide certain financial information, products or services;

Being able to identify trusted sources of financial information and advice, and to distinguish marketing and ads from genuine and official information and educational messages;

Being alert to ‘fake news’ in the financial domain or with financial implications;

identifying which providers are trustworthy, and which products and services are protected through regulation or consumer protection laws;

identifying whom to ask for advice when choosing financial products, understanding that financial advice may be biased, and knowing where to go for help or guidance in relation to financial matters; and

Awareness of the financial risks and implications of sharing personal financial data, awareness that personal data may be used to create a person's digital profile which can be used by companies to offer products and services based on personal factors, and awareness of existing financial crimes such as identity theft and data theft;

Applying an understanding of the financial risks of a lack of data protection to:

take appropriate precautions to protect personal data and avoid scams,

conduct online transactions safely,

know rights and responsibilities under the applicable regulation, including in the event of being a victim.

Knowledge and understanding of the (short- and long-term) impact of their own financial decisions on themselves, on others, and on the environment:

understand that individuals have choices in spending, saving and investing and each action can have consequences for the individual, for society and possibly for the environment; and

recognise how personal financial habits, actions and decisions impact at an individual, community, national and international level

understand the financial implications on society of ethics, sustainability and integrity and related behaviours (including for instance donations to non-profits/charities, green investments, corruption).

Knowledge of the influence of economic and external factors:

aware of the economic climate and understand the impact of policy changes such as reforms related to the funding of post-school training or compulsory savings for retirement;

understand how the ability to build wealth or access credit depends on economic factors such as interest rates, inflation and credit scores; and

understand that a range of external factors, such as advertising and pressure from family, friends and society, can affect individuals' financial choices and outcomes.

Processes

The process categories relate to the cognitive processes that students apply to respond to the assessment. They are used to describe students’ ability to recognise and apply concepts relevant to the domain, and to understand, analyse, reason about, evaluate and suggest solutions. In PISA financial literacy, four process categories have been defined: identify financial information, analyse financial information and situations, evaluate financial issues and apply financial knowledge and understanding. While the verbs used here bear some resemblance to those in Bloom’s taxonomy of educational objectives (Bloom, 1956), an important distinction is that the processes in the financial literacy construct are not intended as a hierarchy of skills. They are, instead, parallel essential cognitive approaches, all of which are part of the financially literate individual’s repertoire. The order in which the processes are presented here relates to a typical sequence of thought processes and actions, rather than to an order of difficulty or challenge. At the same time, it is recognised that financial thinking, decisions and actions are most often dependent on a recursive and interactive blend of the processes described in this section. For the purposes of the assessment, each task is identified with the process that is judged most central to its completion.

Identify financial information

This process is engaged when the individual searches and accesses sources of financial information, and identifies or recognises its relevance. In PISA the information is in the form of texts such as contracts, advertisements, charts, tables, forms and instructions displayed on screen. A typical task might ask students to identify the features of a purchase invoice, or recognise the balance on a bank statement. A more difficult task might involve searching through a contract that uses complex legal language to locate information that explains the consequences of defaulting on loan repayments. This process category is also reflected in tasks that involve recognising financial terminology, such as identifying “inflation” as the term used to describe increasing prices over time.

Analyse financial information and situations

This process focuses on analysing financial information to recognise relationships in financial contexts, like recognising how loan repayments and interest are affected by the loan period, or recognising which factors affect insurance premiums. It also involves identifying the underlying assumptions or implications of an issue in a financial context, extrapolating from information that is provided, and recognising something that is not explicit, such as comparing the terms offered by different mobile phone contracts, or working out whether an advertisement for a loan is likely to include unstated conditions. In order to do this, the process category requires the use of a wide range of cognitive activities in financial contexts, including interpreting, comparing and contrasting, and synthesising.

Evaluate financial issues

In this process the focus is on recognising or constructing financial justifications and explanations, drawing on financial knowledge and understanding applied in specified contexts, such as explaining advantages and disadvantages of certain financial decisions, or explaining why a certain financial decision may be good or bad for someone given their personal situation. It involves such cognitive activities as explaining, reasoning, assessing and generalising. Critical thinking is brought into play in this process, when students must draw on knowledge, logic and plausible reasoning to make sense of and form a view about a finance-related problem, such as understanding the incentives that different people or institutions may have when they provide financial information or products. The information that is required to deal with such a problem may be partly provided in the stimulus of the task, but students will need to connect such information with their own prior financial knowledge and understandings. In the PISA context, any information that is required to understand the problem is intended to be within the expected range of experiences of a 15-year-old – either direct experiences or those that can be readily imagined and understood. For example, it is assumed that 15-year-olds are likely to be able identify with the experience of wanting something that is not essential (such as a music player or games console). A task based on this scenario could ask about the factors that might be considered in deciding on the relative financial merits of making a purchase or deferring it, given specified financial circumstances.

Apply financial knowledge and understanding

This process focuses on taking effective action in a financial setting by using knowledge of financial concepts and products and applying them in across a variety of financial contexts. This process is reflected in tasks that involve solving problems, including performing simple calculations and taking into account multiple conditions. An example of this kind of task is calculating the interest on a loan over two years. This process is also reflected in tasks that require recognition of the relevance of prior knowledge in a specific context. For example, a task might require the student to work out whether purchasing power will decline or increase over time when prices are changing at a given rate. In this case, knowledge about inflation needs to be applied.

Contexts

In building a framework, and developing and selecting assessment items based on this framework, attention is given to the breadth of contexts in which the domain literacy is exercised. Decisions about financial issues are often dependent on the contexts or situations in which they are presented. By situating tasks in a variety of contexts the assessment offers the possibility of connecting with the broadest possible range of individual interests across a variety of situations in which individuals need to function in the 21st century.

Certain situations will be more familiar to 15-year-olds than others. In PISA, assessment tasks are framed in situations of general life, which may include but are not confined to school contexts. The focus may be on the individual, family or peer group, on the wider community, or even more widely on a global scale.

The contexts identified for the PISA financial literacy assessment are, then, education and work, home and family, individual and societal.

Education and work

The context of education and work is of great importance to young people. Virtually all 15-year-olds will be starting to think about financial matters related to both education and work, whether they are spending existing earnings, considering future education options or planning their working life.

The educational context is obviously relevant to PISA students, since they are by definition a sample of the school-based population; indeed, many of them will continue in education or training for some time. However, many 15-year-old students are also already engaged in some form of paid work outside school hours making the work context equally valid. Furthermore, many will move from education into some form of employment, including self-employment, before reaching their twenties.

Typical tasks within this context could include understanding payslips, planning to save for tertiary education, investigating the benefits and risks of taking out a student loan, and participating in workplace savings schemes.

Home and family

Home and family includes financial issues relating to the costs involved in running a household. Family is the most likely household circumstance for 15-year-olds; however, this category also encompasses households that are not based on family relationships, such as the kind of shared accommodation that young people often use shortly after leaving the family home. Tasks within this context may include buying household items or family groceries, keeping records of family spending and making plans for family events. Decisions about budgeting and prioritising spending may also be framed within this context.

Individual

The context of the individual is important within personal finance since there are many decisions that a person takes entirely for personal benefit or gratification, and many risks and responsibilities that must be borne by individuals. These decisions span essential personal needs, as well as leisure and recreation. They include choosing personal products and services such as clothing, toiletries or haircuts, or buying consumer goods such as electronic or sports equipment, as well as commitments such as season tickets or a gym membership. They also cover the process of making personal decisions and the importance of ensuring individual financial security such as keeping personal information safe and being cautious about unfamiliar products.

Although the decisions made by an individual – especially at 15 – may be influenced by the family and society (and may impact society), when it comes to opening a bank account, buying shares or getting a loan it is typically the individual who has the legal responsibility and ownership. This context includes also financial behaviours that are typically carried out at the individual level, such as making purchases online or through mobile applications, even though they may be influenced by or have an impact on others such as parents and friends. The context individual therefore includes contractual issues around events such as opening a bank account or holding a payment card, purchasing consumer goods and paying for recreational activities through a variety of traditional and digital channels, and dealing with relevant financial services that are often associated with larger consumption items, such as credit and insurance.

Societal