A behavioural flowchart is a tool used in data science, and other related disciplines, to illustrate how a process unfolds in practice. This helps to identify how easy or hard it is for someone to go through a process by making evident the steps needed to complete it. Moreover, this tool can help policy makers design public policies that promote desired behaviours that are easy to enact. As a general principle in (Behavioural Insights Team, 2014[31]) behavioural science, a behaviour is more likely to occur when it is easier to enact than its alternative. This principle considers human resistance to burdensome processes and how, without oversight or heavy reinforcement, people are likely to desist if a process is seen as complex. This is true even for processes that are seen as socially desirable.

Flowcharts use a defined set of arrows and shapes to represent activities and relationships in a process. The goal of the diagram is to show how the steps in a process fit together by breaking it down into individual activities and illustrating the relationships between them, as well as the flow of the process (OECD, 2019[4]). Their simplicity makes them useful tools for understanding and sharing processes within teams, as well as for analysing them in an effort to identify crucial decision points, potential loose ends and friction points that inhibit the efficiency and reliability of the process (OECD, 2019[4]).

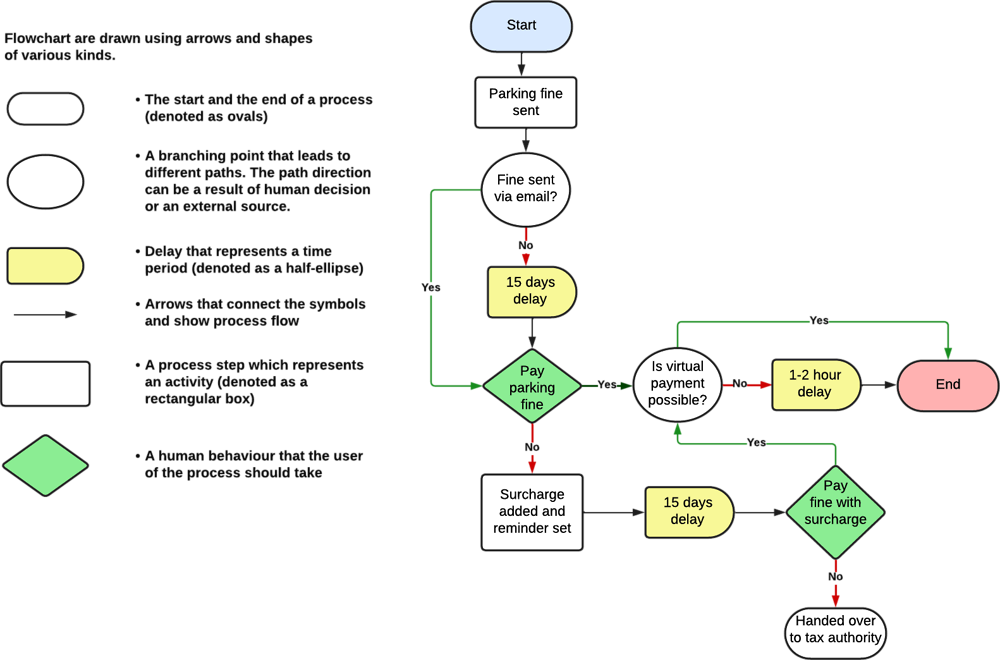

There is no single formula to create a flowchart and it is up to the user to choose how to represent the process. However, the BASIC toolkit for applied behavioural insights suggests using shapes to represent decision points, delays, and processes (OECD, 2019[4]). A useful convention is to use green rhombuses for human behaviours and describe them with verbs like 'Pay,' 'Collect,' 'Walk,' etc. Activities performed by someone other than the main user can have a different shape, such as a white rectangular box. To highlight how long a process takes, delays should also be shown. Finally, if there are different paths to follow, a circle can be added to explain why these diverse routes are possible. The flowchart can be as detailed as the designer wishes, but there should be an effort to illustrate all non-obvious activities, delays, and behaviours.

Flowcharts can serve both to create new processes from scratch or to analyse existing ones. For instance, in Figure 1.2 in Chapter 1, grey rectangles with consecutive numbers are employed to illustrate the 7 explicit steps proposed by Decision 599/2018 to manage corruption risk. The elements between these rectangles depict the implicit activities, delays and behaviours required to progress to the next step. Utilising a flowchart simplifies the identification of critical decision points and potential obstacles that make the process mentally taxing and time-consuming. This approach can help in understanding the challenges involved in its adoption and help to design simplified process that are more user friendly but achieve the same desired behaviours.

Figure A B.1 provides an example of a flowchart illustrating the process of paying a parking fine. The process begins with a blue ellipse and proceeds to an action carried out by an organisation responsible for issuing the parking fine. The white circle indicates a decision point where the process diverges based on the chosen delivery method. If the authority sends the fine via email, there is no delay. However, if it is sent through physical mail, a 15-day delay is expected. After receiving the fine, the individual must decide whether to pay it on time or not, leading to a new branch in the process. If the individual chooses to pay, another branch opens based on the availability of a virtual payment option. If virtual payment is not possible, the user must visit a tax office in person, dedicating some time to the process. If the individual fails to pay on time, the authority adds a surcharge and sends a reminder. Ultimately, the individual must decide whether to pay the fine along with the surcharge. If not, the authority forwards the case to a tax collection authority.