Alessandro Paravano

Polytechnic University of Milan, Italy

Giorgio Locatelli

Polytechnic University of Milan, Italy

Paolo Trucco

Polytechnic University of Milan, Italy

Alessandro Paravano

Polytechnic University of Milan, Italy

Giorgio Locatelli

Polytechnic University of Milan, Italy

Paolo Trucco

Polytechnic University of Milan, Italy

New industrial dynamics are disrupting the space sector. Satellite infrastructure must be valuable for a wider set of end users, asking for economic returns and social and environmental benefits. This chapter aims to unveil the end users’ value perception of satellite infrastructure in the “new space” economy ecosystem. The authors contextualise their findings using value theory.

New industrial dynamics are disrupting the space sector. New players are increasingly interested in developing next-generation space infrastructure and services, bringing together experiences from industries such as finance, technology and others. Space projects should create value for a broader range of end users, requiring economic returns and long-term social and environmental advantages.

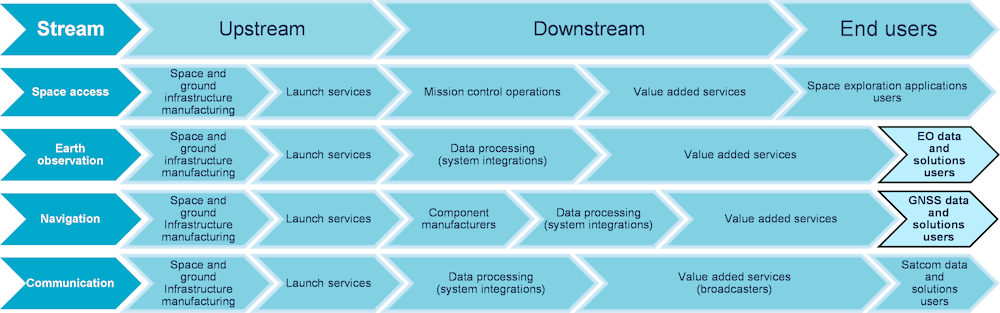

In the traditional space economy, space businesses (both upstream and downstream, as described in Figure 6.1) seek to create satellite constellations and design a satellite-based solution that is commissioned and paid for in advance by the client, who is often a space agency. In the “new space” economy, market liberalisation and access to satellite data have altered space organisations' value proposition to end users. Free access to space infrastructure, like global navigation satellite systems (GNSS), has accelerated the development of new products, services, enterprises and industries. For example, end users such as Uber, Ofo, and Deliveroo would not have been able to grow to such into such large enterprises without capitalising on the mobility provided by satellite navigation data. End users can additionally profit from satellite data to start new businesses. However, the complex uncertainties regarding the medium-to-long-term development of such businesses may restrict potential value enactment.

Furthermore, the variety of applications of space technologies in upstream and downstream sectors makes it difficult to identify end users, their needs and effective engagement techniques. Assessing the value created, distributed and captured by satellite infrastructure is challenging due to the wide variety of end users, potential conflict between stakeholders and lack of short-term benefits associated with space activities in terms of their market value. Consequently, this research aims to unveil end users’ value perception of satellite infrastructure in the “new space” economy ecosystem. Thus, this study seeks to determine how end users perceive the value of satellite infrastructure in the “new space” economy ecosystem.

The “new space” economy is defined as "the full range of activities and the use of resources that create value and benefits to human beings in the course of exploring, researching, understanding, managing and utilising space" (OECD, 2019[1]). It is a transitioning innovation ecosystem where stakeholders belonging to space and non-space sectors are increasingly working together to develop next-generation space programmes and satellite infrastructure (Paikowsky, 2017[2]). The authors define "satellite infrastructure" as public and private satellite infrastructure that generates data and satellite-based applications for end users. This study, alongside previous research, focuses on end users’ value perception of such infrastructure (Paravano, Locatelli and Trucco, 2023[3]). End users are companies and institutions in demand of new applications and services deriving from the combined use of space and digital technologies. In particular, the authors focus on the earth observation and satellite navigation segments. Figure 6.1 summarises the value streams and segments in the “new space” economy ecosystem in a comprehensive value chain. The segments of analysis considered by this study are highlighted in light blue.

Notes: EO=earth observation, GNSS=global navigation satellite system, Satcom=satellite communications. The highlighted light blue segments are those considered in this study.

Source: Space Economy Observatory website (2020[4]), https://www.osservatori.net/it/eventi/on-demand/convegni/space-economy-la-nuova-frontiera-dellinnovazi.

Upstream, downstream, and end-user stakeholders in the “new space” ecosystem create, distribute and capture value by designing, developing, operating and decommissioning satellite infrastructure. This section provides the reader with a comprehensive understanding of the conceptualisation of value mechanisms in the innovation ecosystems literature, grounding the basis for the discussion.

In innovation ecosystems and general management literature, the concept of value is widely discussed. In line with Gil and Fu (2022[5]), the authors define value as “the sum of the economic benefits and wider social gains to be accrued from a new large-scale technology development minus the capital costs to be incurred”. This definition of value presents three characteristics that are fundamental for this field of research. First, value is multi-dimensional and is characterised by both tangible and intangible elements (i.e. revenue and knowledge respectively). Triple-bottom-line accounting (Elkington, 1994[6]) is a common framework for conceptualising sustainability in this regard by incorporating economic, social, and environmental issues, and has been widely used in public planning and decision making (Wilhelm et al., 2015[7]; Martinsuo, Vuorinen and Killen, 2019[8]). Second, this definition of value considers change over time. Each project creates both short and long-term benefits, and consequently, satellite infrastructure may yield numerous advantages even decades after completion (Turner and Zolin, 2012[9]). Therefore, examining the expected long-term value is fundamental during the project's design phase (Liu et al., 2022[10]). Third, this definition of value is subjective and different stakeholders have different value perceptions (McGahan, 2020[11]). Satellite infrastructure (e.g. crop monitoring) can be evaluated as valuable if it fulfils the implicit or explicit needs of the individual or organisation demanding it (e.g. providing the means to monitor the crop field with a given revisit time and resolution) (Porter and Kramer, 2011[12]). Thus, any business strategy must consider environmental and social value if stakeholders expect it (Freudenreich, Lüdeke-Freund and Schaltegger, 2019[13]).

Understanding the nature of value mechanisms at the individual or organisational level requires making the fundamental premise that value is subjective. Value mechanisms are the processes that explain how value is created, distributed, and captured by the ecosystem (Lepak, Smith and Taylor, 2007[14]; Laursen and Svejvig, 2016[15]; Della Corte and Del Gaudio, 2014[16]). Scholars distinguish between value creation, distribution, and capture mechanisms (Lepak, Smith and Taylor, 2007[14]; Bowman and Ambrosini, 2000[17]; Laursen and Svejvig, 2016[15]; Zott and Amit, 2010[18]). Value creation involves co-producing offerings (i.e., products, services, and information relationships) in a mutually beneficial seller-buyer relationship (Normann and Ramírez, 1993[19]). Value distribution refers to transferring the value from the seller to the user (Bacq and Aguilera, 2021[20]). Value capture involves securing profits from value creation and distributing those profits among participating actors such as providers, end users and partners (Lepak, Smith and Taylor, 2007[14]). Value capture transcends monetary value and contractual obligations and entails actions that let suppliers and customers choose how to divide the extra value produced (Lepak, Smith and Taylor, 2007[14]).

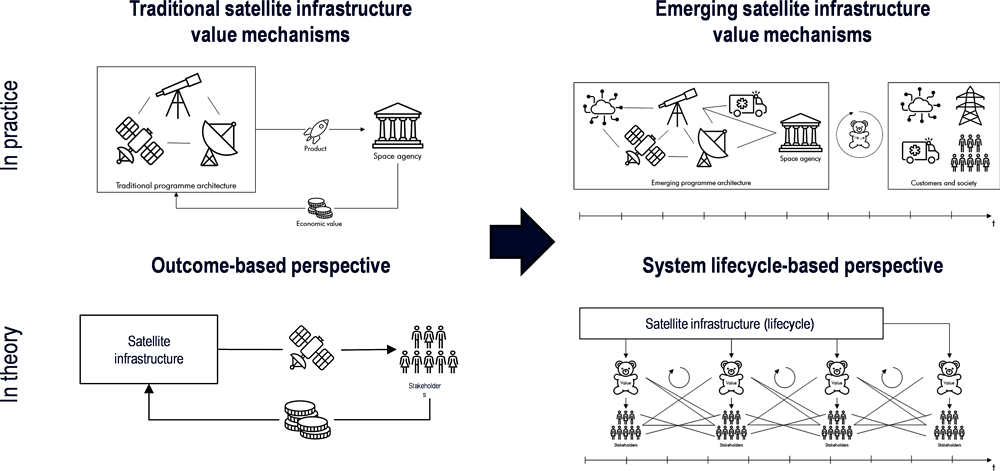

Taking stock from the previous sections, it appears clear that satellite infrastructure stakeholders create, distribute and capture value by aligning reciprocal goals and creating a clear strategic vision of the project's outcome (Ang, Sankaran and Killen, 2016[21]). Stakeholders should depict the value of multidimensionality, dynamicity and subjectivity in designing the next generation of satellite infrastructure. In this regard, project value mechanisms have been approached from outcome-based and system lifecycle-based perspectives. From the outcome-based perspective, a project only adds value to the primary stakeholders (Edkins et al., 2013[22]). The targeted outcomes are designed on the financial worth of the stakeholders’ engaged and short-term project success criteria, like adhering to schedule, budget and scope constraints. With the idea that the project must generate value for the project's sponsor, the outcome-based view highlights the sponsor's involvement (Eweje, Turner and Müller, 2012[23]). On the other hand, the system lifecycle perspective offers a more comprehensive value conceptualisation by examining the project value creation, distribution, and capture not only during the project but also during the operations phase, after it has finished (Artto, Ahola and Vartiainen, 2016[24]),. Value in this context covers both tangible and intangible values for secondary stakeholders and economic value for the primary stakeholders (Pollack et al., 2018[25]). This research adopts a system-thinking approach to assess the value mechanisms within a satellite infrastructure lifecycle, considering both primary and secondary stakeholders and their value perceptions. Figure 6.2 depicts the shifting paradigm from an outcome-based perspective toward a system lifecycle perspective in value mechanisms investigation.

The research design is composed of four steps. First, the authors review the extant body of knowledge of value in innovation ecosystems (including the body of knowledge from other sectors and areas of the economy), identifying the value dimensions. Second, the authors perform a series of interviews with managers belonging to end-user organisations of the “new space” ecosystem. Third, the authors perform a content analysis of the data by looking at value dimensions and their perceptions. Finally, the authors discuss and compare the value perception to assess the value expected and enacted of the selected satellite infrastructure.

The empirical context of the research is the European “new space” economy ecosystem. The unit of analysis is the value perception of end-user stakeholders. The level of the analysis is the satellite infrastructure projects developed in the European “new space” economy ecosystem.

The authors identified value theory (Hart, 1971[26]) as the theory with the most explanatory power for the phenomenon under examination. This research leverages two key elements of value theory: i) “expected value” and ii) “enacted value” (Bowman and Ambrosini, 2000[17]). Expected value is the value a subject expects to gain from an object. Value arises in a relation between the object (e.g., satellite data) and the expected value of a subject (e.g., the expected value of a farmer in using satellite data to monitor s crop field) (Hart, 1971[26]). End users interested in adopting satellite data in their decision making consider expected value. Enacted value is the value a subject may (or may not) capture in employing the object (Bowman and Ambrosini, 2000[17]). For example, a farmer adopting satellite data to monitor a crop field may reduce operational costs and increase productivity, enacting the expected value provided by satellite data.

The study’s analysis is based on two kinds of data. The authors began with open interviews (Aguinis and Solarino, 2019[27]), and subsequently acquired internal records, publicly available data and continuing interaction for triangulation. Interviews can bring essential experts’ ideas closer to practice while identifying various problem-solving methods (Flick, 2009[28]), and the interviewer can ask clarifying questions (Saunders, Lewis and Thornhill, 2009[29]). These two data-gathering procedures are standard and acceptable for qualitative research, ensuring the depth of the findings and the aim of triangulation (Jick, 1979[30]).

The authors employed three sequential sampling strategies: one for the end-user sector sampling (i.e., insurance and finance, energy and utility, transportation and logistics), one for organisation sampling and one for manager sampling.

Following the principles outlined by Eisenhardt (1989[31]), the authors chose three distinct end-user sectors from within the European “space economy” ecosystem: insurance and finance, energy and utility and transportation and logistics. Three primary criteria guided this selection. Firstly, the authors emphasised diversity, as these sectors exhibit varying maturity levels in utilising satellite data and satellite-based solutions. Specifically, the transportation and logistics sector demonstrates a high level of maturity, with all end-user companies leveraging satellite data to optimise their logistical operations. The energy and utility sector possesses a moderate level of maturity, with a growing number of companies employing satellite data for infrastructure monitoring, albeit not universally. Conversely, the insurance and finance sector displays a lower maturity level, with only a handful of companies integrating satellite data into their operations. Incorporating these varying maturity levels contributes to the potential applicability of the findings to sectors sharing similar attributes. Secondly, the authors considered the significance of adopting EO and GNSS satellite data and satellite-based solutions, which yielded EUR 94 billion in global revenues in 2021. This figure is projected to surge to EUR 171 billion by 2031 (EUSPA, 2022[32]). Lastly, the authors emphasised data accessibility, as the authors gained direct access to company managers, and these organisations have published a wealth of secondary data pertinent to the research objectives. In summation, these three sectors are poised to be the forefront contenders in adopting satellite data and satellite-based solutions within their operations, imparting significant contributions to the growth of the European space economy ecosystem (OECD, 2022[33]).

To ensure the sample's representativeness, firms were picked using a theoretical sampling procedure, and end-user organisations from the sectors identified in the previous step were included. Interviewing end users allowed the authors to learn about their value perceptions and how they capture that value. Purposive sampling was used to choose managers based on job content and managers' direct connections with space projects and companies (Patton, 2014[34]; Palinkas, 2014[35]).

The authors interviewed 29 managers, each with an average of 15 years of experience. The interviews lasted 58 minutes on average. All talks took place online, and all interviewees and organisations were kept anonymous (Saunders, Kitzinger and Kitzinger, 2014[36]). In adherence to the principles of qualitative research, the authors carefully identify specific sectors, organisations, and managerial participants to attain theoretical saturation (Saunders et al., 2017[37]). The profiles of the interviewees are summarised in Table 6.1.

The authors leveraged the deep knowledge of two of the three authors with the empirical context, conducting open interviews initiated by the question, “how do you perceive the value of satellite-based data and/or infrastructure in your business?”. The discussion was an open interview to access the respondent’s point of view (Bryman, Alan; Bell, 2011). To triangulate the data, the authors looked for additional material from secondary sources (Jick, 1979[30]). For instance, the authors acquired relevant information on a project if an interviewee mentioned it. Secondary data consisted of information from public and private organisations, such as project reports, presentations, website news, company reports, in-depth plans, and newspaper articles that deal with finished or ongoing projects based on adopting satellite-based solutions in the end users’ industry. The data acquired was quantitative and qualitative (Harris, 2001[38]).

|

# |

Industry |

Job role |

Experience |

|

Int 1 |

Insurance and finance |

Data scientist |

12 years |

|

Int 2 |

Insurance and finance |

Head of portfolio management |

14 years |

|

Int 3 |

Energy and utilities |

Head of assets co-ordination |

18 years |

|

Int 4 |

Energy and utilities |

Innovation and partnerships manager |

22 years |

|

Int 5 |

Transportation and logistics |

Head of technical department |

10 years |

|

Int 6 |

Insurance and finance |

Head of space |

25 years |

|

Int 7 |

Energy and utilities |

Head of venture building and scouting |

12 years |

|

Int 8 |

Transportation and logistics |

Head of marketing, communication and strategic business |

28 years |

|

Int 9 |

Energy and utilities |

Geodynamics dept. Engineer |

11 years |

|

Int 10 |

Insurance and finance |

Leading expert space insurance underwriting |

24 years |

|

Int 11 |

Energy and utilities |

Head of innovation |

18 years |

|

Int 12 |

Energy and utilities |

Head of open innovation |

14 years |

|

Int 13 |

Insurance and finance |

Head of innovation |

13 years |

|

Int 14 |

Energy and utilities |

Head of innovation |

14 years |

|

Int 15 |

Insurance and finance |

Head of business development |

13 years |

|

Int 16 |

Insurance and finance |

President |

31 years |

|

Int 17 |

Insurance and finance |

Senior project manager |

11 years |

|

Int 18 |

Transportation and logistics |

Account manager |

12 years |

|

Int 19 |

Energy and utilities |

Senior manager |

14 years |

|

Int 20 |

Energy and utilities |

Head of digital services |

19 years |

|

Int 21 |

Insurance and finance |

Data scientist |

13 years |

|

Int 22 |

Transportation and logistics |

Head of innovation |

14 years |

|

Int 23 |

Transportation and logistics |

Data scientist |

8 years |

|

Int 24 |

Energy and utilities |

Data scientist |

12 years |

|

Int 25 |

Insurance and finance |

Business development vice president |

15 years |

|

Int 26 |

Transportation and logistics |

Senior manager |

12 years |

|

Int 27 |

Insurance and finance |

Head of venture building and scouting |

16 years |

|

Int 28 |

Transportation and logistics |

Innovation manager |

13 years |

|

Int 29 |

Transportation and logistics |

Head of data analytics |

16 years |

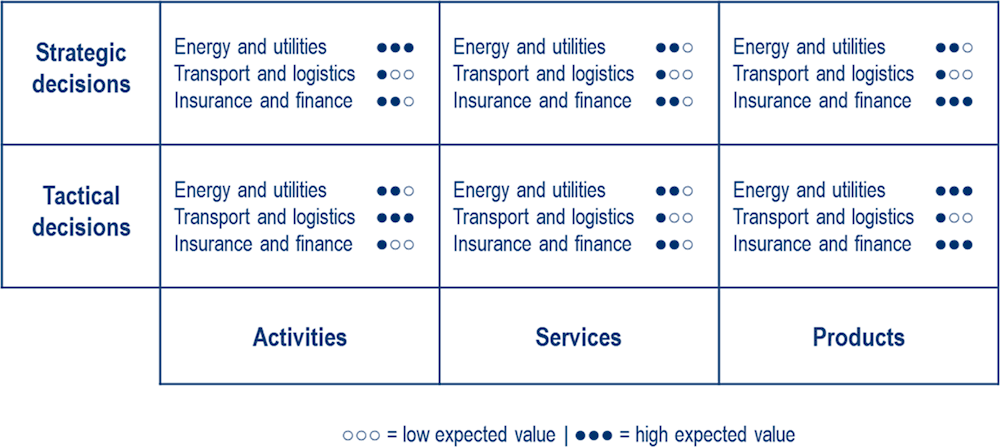

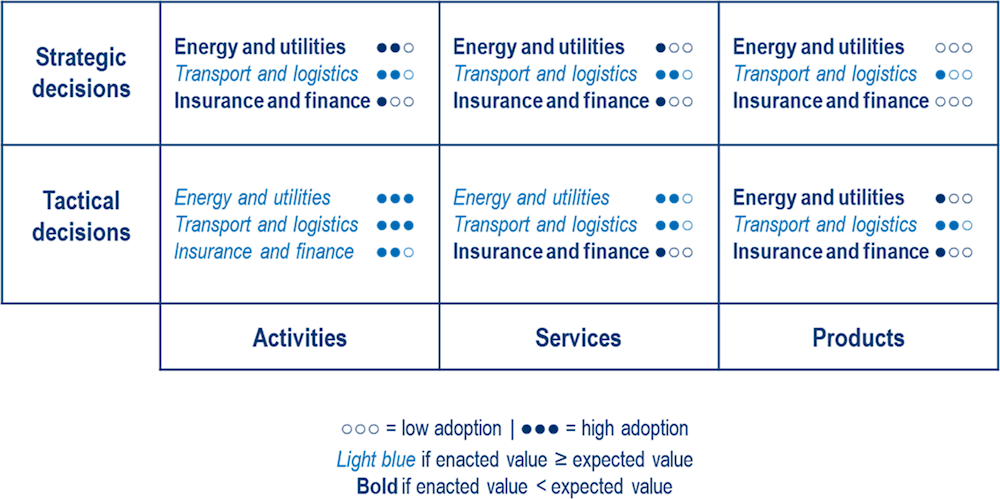

The authors used an abductive coding method to analyse their data using Atlas.ti software and the guidelines of Hsieh and Shannon (2005[39]). The authors created a framework (Figure 6.3) using existing knowledge and populated it with information about the expected and enacted values of satellite data adoption in decision making, as reported by interviewees. The authors discussed and finalised the coding, thoroughly examining and summarising the transcribed information in the framework (Figures 6.4 and 6.5) (Harris, 2001[38]; Hsieh and Shannon, 2005[39]). The authors also applied value theory (Hart, 1971[26]) in the analysis.

Source: Paravano, Locatelli and Trucco (2023[3]), “What is value in the New Space Economy? The end-users’ perspective on satellite data and solutions”, Acta Astronautica, https://doi.org/10.1016/j.actaastro.2023.05.001.

The framework differentiates between strategic and tactical decisions. Strategic decisions have a medium-long time horizon, require a large investment of resources, have a cross-functional impact on the organisation and are often irreversible. Tactical decisions have a short time horizon, require limited resources, have a vertical impact on the organisation and are often reversible. End users make strategic and tactical decisions in three main areas: activities, services and products. Activities are internal processes necessary for delivering services and products. Services are the application of competencies to benefit one another. Products are tangible goods sold to satisfy needs. The data is analysed by evaluating the expected and enacted value using a three-dimensional scale, ranging from "low" to "high". The authors also qualitatively compare the expected and enacted value of satellite data adoption. Sectors where the enacted value is equal to or greater than the expected value are in light blue italics, and those where it is less than the expected value are in darker and bold blue (Figures 6.4 and 6.5).

The expected value of incorporating satellite data into decision making processes varies among sectors: energy and utilities, insurance and finance and transportation and logistics. These sectors expect substantial value in their activities, services and products, as shown in Figure 6.4. Specifically, energy and utilities hold high hopes for strategic activity-related decisions, while insurance and finance place strong value expectations on strategic and tactical decision making for their offerings. In contrast, transportation and logistics emphasise tactical decision making regarding their operations. Subsequent analysis of the practical benefits of using satellite data indicates that various end users are utilising this data to refine their activities, services and products at both tactical and strategic levels.

However, as shown in Figure 6.5, adoption levels differ across sectors, and the emphasis remains largely on tactical decisions for improving activities. Notably, energy and utilities and insurance and finance experience a shortfall in enacted value compared to their expected value (in bold), particularly concerning strategic decisions about services and products. Findings show that the enacted value of satellite data in making tactical decisions regarding the activities is more or equal to the expected value for all the end users (in light blue).

The general inclination among end users is to incorporate satellite data primarily in tactical decision making processes, yielding enacted value that exceeds initial expectations. Adopting satellite data is particularly favoured for low-risk, short-term investments, with end users adept at gauging the expected value and exploiting the practical benefits in decision making. As an energy sector participant aptly states, "space is very far from our daily base. We start to explore the value of satellite data for our activities, looking for efficiency improvement that requires small and low-risk investments." The emphasis is placed on enhancing the efficiency of business activities rather than the quality of services and products delivered. For instance, an energy industry expert emphasises the value of earth observation imagery in infrastructure monitoring, noting that "the cost-saving is easy to calculate."

Source: Paravano, Locatelli and Trucco (2023[3]), “What is value in the New Space Economy? The end-users’ perspective on satellite data and solutions”, Acta Astronautica, https://doi.org/10.1016/j.actaastro.2023.05.001.

Managers appreciate the real-time information provided by satellite positioning data, particularly in transportation and logistics, with one participant stating, "satellite data improves efficiency." Adopting satellite data is regarded to be a means to experiment and innovate internally before introducing new services or products. A participant from the insurance sector articulates this strategic approach: "We prefer first to experience and learn from the benefits of satellites internally. The easy way is to experiment with the adoption of satellite imagery to increase the efficiency of our internal processes before selling a new satellite-based service or product."

However, while satellite data proves valuable in improving activities and services, there is a disparity in its adoption for product-related decisions. End users in the energy and utilities and insurance and finance sectors have high value expectations for tactical product decisions but often find the enacted value lacking. Challenges arise due to the need for specialised competencies in interpreting and integrating satellite data into product design, as another energy sector participant highlighted: "I think we lack the competencies to leverage satellite data to develop our product and meet the expected value."

Additionally, end-user managers express scepticism when available solutions don't align with their product development needs and expectations, with an insurance industry manager stating, "earth observation offers many smart solutions for whom we are unwilling to pay. Why do I have to invest in satellite information when they do not answer my needs, or I can use other sources that provide less expensive solutions?"

Despite the expected value, the adoption of satellite data in strategic decisions remains limited among managers. End users predominantly integrate satellite data into strategic decisions concerning their activities rather than their services or products. Whilst recognising the potential long-term value, managers currently struggle to translate this into enacted value due to the perceived risks and complexities. The uncertainty surrounding the cost-benefit ratio deters them from deeming satellite data suitable for foundational strategic choices. As articulated by an energy sector participant, "satellites will revolutionise our decision making, but nowadays, I can’t build my business on information when I don’t understand where it comes from. Besides, satellite data requires huge resources and competencies."

In the context of activities, managers underscore the strategic significance of satellite data for tasks like infrastructure planning and climate change mitigation. These insights are especially vital for industries like energy, where "modelling and predicting climate evolution are very important." Whilst end users invest significantly in satellite data to predict environmental changes, realising the expected value is lagging, particularly in the insurance sector. This delay is attributed to the complexity of strategic decisions that require diverse data sources and integration capabilities, areas where end users are currently lacking.

Regarding services, satellite data hold relatively low enacted value, particularly in the insurance sector, due to the centrality of intangible assets. Insurers increasingly leverage satellite data to enhance services and make informed investment decisions in specific markets, such as insuring agriculture in developing countries. Yet, a lack of clarity surrounding the long-term value of satellite data hampers its practical application, leaving end users hesitant to invest significantly in strategic service-related choices.

The value expected for adopting satellite data in strategic product decisions is high among managers. However, these aspirations contrast with their current usage practices. Managers express dissatisfaction with the mismatch between the potential of satellite data and their actual ability to address specific needs. For instance, one energy sector manager states, "providers offer very interesting tools that lack in answering our real needs." Internal approval processes and the perceived risk hinder the adoption process for such data in strategic decisions. Managers' risk aversion and the current immaturity of satellite data and applications contribute to a hesitancy to fully embrace satellite data for product-related strategic choices.

In essence, whilst the potential value of satellite data in strategic decision making is recognised and expected to be transformative, challenges related to perceived risk, reliability and alignment with specific needs are hampering their practical adoption and enactment. As one participant aptly puts it, "We can’t bet in our business, we see the potential value of satellite data in our business, but nowadays, it is still too risky and not mature enough."

End users predominantly favour adopting satellite data for tactical rather than strategic decisions due to lower resource requirements and associated risks. This approach allows for a more accurate assessment of expected value before implementation, resulting in relatively attainable enacted value in tactical contexts (Eweje, Turner and Müller, 2012[23]). There are notable obstacles to adopting satellite data in strategic decision making. Firstly, end users often perceive promising satellite data and space technologies as distant from their core operations, lacking a comprehensive understanding of the space ecosystem. The perceived resource gap between expected and enacted value impedes adoption (Bacq and Aguilera, 2021[20]). Secondly, managers recognise the potential of satellite data but believe it necessitates radical organisational transformation rather than incremental change, further complicated by existing resource dependencies (Grant, 1991[40])). Lastly, assessing the expected value of satellite solutions requires specialised knowledge, and the lack thereof leads to over-optimism. While transportation and logistics have gained competencies in enacting the value of satellite infrastructure, many end users lack the instruments to evaluate long-term value accurately, leading them to prefer tactical adoption due to lower resource demands and reversibility (Freudenreich, Lüdeke-Freund and Schaltegger, 2019[13]).

End users hold positive expectations regarding the value of satellite data, recognising its novelty and appropriateness for tactical and strategic decisions concerning their activities, services and products. The momentum of the “new space” economy, marked by new technologies, funding opportunities and policies, fuels these value expectations. However, enacting the expected value proves challenging for several reasons. Firstly, adoption hinges on organisational structures and transaction costs between satellite data providers and end users (Martinsuo, Vuorinen and Killen, 2019[8]). High transaction costs contribute to a considerable gap between expected and enacted value (Gil and Fu, 2022[5]). Lowering satellite data management costs characteristic of the “new space” economy could facilitate adoption by minimising transaction costs. To this end, data providers could collaborate with end users to find solutions that reduce such costs and enhance strategic adoption. Second, end users regret limited adoption due to resource and competency constraints (Liu et al., 2022[10]). Data providers should prioritise equipping end users with the necessary resources and competencies, fostering the enactment of expected value. Lastly, while end users perceive the expected value of satellite data, they lack a clear roadmap for enacting the value of satellite infrastructure. This is partly due to the mismatch between solutions offered by satellite data providers and end-user needs. Direct engagement between providers and end users can enhance providers' understanding of end users’ needs (Lehtinen, Aaltonen and Rajala, 2019[41]), leading to tailored solutions that properly activate expected value.

This study sheds light on the end users’ value perception of satellite infrastructure in the “new space” economy ecosystem. In summary, providers, users and policy makers should consider the following key takeaways to enact the value of satellite infrastructure. At the moment, end users adopt satellite data for tactical decisions, focusing on activities rather than strategic choices. This approach stems from the lower resource requirements and risks associated with tactical decisions, which allows for better assessment of both expected and enacted value. Particularly, end users in the insurance and finance and energy and utility sectors exhibit high expected value but encounter challenges in enacting it. Moreover, satellite infrastructure services are embraced by end users as complementary resources for decision making but are perceived as distanced from core business operations, and their associated risks inhibit full adoption. Despite recognising the potential of satellite data, end users face difficulties fully enacting the expected value over the long term due to a lack of literacy and competencies.

This research makes three main contributions. First, policy makers can utilise our findings within the European space ecosystem, including the European Commission and space agencies such as the European Space Agency (ESA) and the European Union Agency for the Space Programme (EUSPA). These stakeholders have the opportunity to shape their endeavours to advance satellite data and solutions derived from satellites within the specific sectors that have been examined. The authors show considerable expected value within the energy and utilities and insurance and finance sectors. However, these benefits have not yet been fully realised due to a deficiency in the knowledge and skills of end users. To address this limitation, policy makers have the option to champion novel undertakings or enhance existing ones. This could involve focusing on intermediary entities like, for example, Copernicus Relays, Copernicus Academy and ESA BICs, all while prioritising enhancing end users’ proficiency and abilities in this domain.

Second, satellite infrastructure providers are encouraged to collaborate with end users, negotiating solutions that reduce transaction costs and thus promote the adoption of satellite data in strategic decisions concerning services and products. They should shift their focus from offering mere solutions to providing end users with essential resources and competencies, thereby enacting the expected value of end users. Moreover, direct engagement between data providers and end users is pivotal. This engagement can enhance providers' understanding of end users’ needs, paving the way for tailored data and solutions that adequately address these requirements and enable the proper enactment of expected value.

Third, end users in the selected sectors may adopt our framework (Figure 6.5) to self-assess the current level of adoption of satellite data in their activities, services and products.

As outlined in the Introduction, this study is exploratory, serving as a foundation for forthcoming qualitative and quantitative research endeavours. Four limitations temper the extent to which our findings can be generalised. Firstly, our analysis centres on three specific sectors: insurance and finance, energy and utility and transportation and logistics. Future investigations might adopt our research protocol and framework to explore additional sectors. Secondly, our interviews were conducted with managers affiliated with European organisations. Future research has the potential to delve into and juxtapose findings from different geographical areas. Thirdly, the authors focused on private commercial organisations adopting satellite infrastructure exclusively for commercial purposes. Subsequent research could enrich the authors’ findings by considering defence, public institutions or private companies employing satellites for non-commercial objectives. Lastly, this chapter predominantly reflects the perspective of end-user managers. Subsequent research could build upon this foundation by interviewing managers responsible for providing data and presenting an additional complementary viewpoint.

In conclusion, while the “new space” economy's promise of satellite data presents vast potential, there are challenges to be addressed in aligning this potential with practical value. By focusing on strategic engagement, reduced transaction costs, enhanced competencies and tailored solutions, the journey from expected to enacted value can be navigated more effectively, ensuring the transformative impact of satellite data in decision making processes.

[27] Aguinis, H. and A. Solarino (2019), “Transparency and replicability in qualitative research: The case of interviews with elite informants”, Strategic Management Journal, Vol. 40/8, pp. 1291-1315, https://doi.org/10.1002/smj.3015.

[21] Ang, K., S. Sankaran and C. Killen (2016), “‘Value for Whom, by Whom’: Investigating Value Constructs in Non-Profit Project Portfolios”, Project Management Research and Practice, Vol. 3, p. 5038, https://doi.org/10.5130/pmrp.v3i0.5038.

[24] Artto, K., T. Ahola and V. Vartiainen (2016), “From the front end of projects to the back end of operations: Managing projects for value creation throughout the system lifecycle”, International Journal of Project Management, Vol. 34/2, pp. 258-270, https://doi.org/10.1016/j.ijproman.2015.05.003.

[20] Bacq, S. and R. Aguilera (2021), “Stakeholder Governance for Responsible Innovation: A Theory of Value Creation, Appropriation, and Distribution”, Journal of Management Studies, Vol. 59/1, pp. 29-60, https://doi.org/10.1111/joms.12746.

[17] Bowman, C. and V. Ambrosini (2000), “Value Creation Versus Value Capture: Towards a Coherent Definition of Value in Strategy”, British Journal of Management, Vol. 11/1, pp. 1-15, https://doi.org/10.1111/1467-8551.00147.

[16] Della Corte, V. and G. Del Gaudio (2014), “A literature review on value creation and value capturing in strategic management studies”, Corporate Ownership and Control, Vol. 11/2, pp. 328-346, https://doi.org/10.22495/cocv11i2c3p2.

[22] Edkins, A. et al. (2013), “Exploring the front-end of project management”, Engineering Project Organization Journal, Vol. 3/2, pp. 71-85, https://doi.org/10.1080/21573727.2013.775942.

[31] Eisenhardt, K. (1989), “Building Theories from Case Study Research”, Academy of Management Review, Vol. 14/4, pp. 532-550, https://doi.org/10.5465/amr.1989.4308385.

[6] Elkington, J. (1994), “Towards the Sustainable Corporation: Win-Win-Win Business Strategies for Sustainable Development”, California Management Review, Vol. 36/2, pp. 90-100, https://doi.org/10.2307/41165746.

[32] EUSPA (2022), “EUSPA EO and GNSS Market Report”, https://doi.org/10.2878/94903.

[23] Eweje, J., R. Turner and R. Müller (2012), “Maximizing strategic value from megaprojects: The influence of information-feed on decision-making by the project manager”, International Journal of Project Management, Vol. 30/6, pp. 639-651, https://doi.org/10.1016/j.ijproman.2012.01.004.

[28] Flick, U. (2009), An Introduction to Qualitative Research, 4th edition, Sage Publications Ltd, London.

[13] Freudenreich, B., F. Lüdeke-Freund and S. Schaltegger (2019), “A Stakeholder Theory Perspective on Business Models: Value Creation for Sustainability”, Journal of Business Ethics, Vol. 166/1, pp. 3-18, https://doi.org/10.1007/s10551-019-04112-z.

[5] Gil, N. and Y. Fu (2022), “Megaproject Performance, Value Creation, and Value Distribution: An Organizational Governance Perspective”, Academy of Management Discoveries, Vol. 8/2, pp. 224-251, https://doi.org/10.5465/amd.2020.0029.

[40] Grant, R. (1991), “The Resource-Based Theory of Competitive Advantage: Implications for Strategy Formulation”, California Management Review, Vol. 33/3, pp. 114-135, https://doi.org/10.2307/41166664.

[38] Harris, H. (2001), , Journal of Business Ethics, Vol. 34/3/4, pp. 191-208, https://doi.org/10.1023/a:1012534014727.

[26] Hart, S. (1971), “Axiology--Theory of Values”, Philosophy and Phenomenological Research, Vol. 32/1, p. 29, https://doi.org/10.2307/2105883.

[39] Hsieh, H. and S. Shannon (2005), “Three Approaches to Qualitative Content Analysis”, Qualitative Health Research, Vol. 15/9, pp. 1277-1288, https://doi.org/10.1177/1049732305276687.

[30] Jick, T. (1979), “Mixing Qualitative and Quantitative Methods: Triangulation in Action”, Administrative Science Quarterly, Vol. 24/4, p. 602, https://doi.org/10.2307/2392366.

[15] Laursen, M. and P. Svejvig (2016), “Taking stock of project value creation: A structured literature review with future directions for research and practice”, International Journal of Project Management, Vol. 34/4, pp. 736-747, https://doi.org/10.1016/j.ijproman.2015.06.007.

[41] Lehtinen, J., K. Aaltonen and R. Rajala (2019), “Stakeholder management in complex product systems: Practices and rationales for engagement and disengagement”, Industrial Marketing Management, Vol. 79, pp. 58-70, https://doi.org/10.1016/j.indmarman.2018.08.011.

[14] Lepak, D., K. Smith and M. Taylor (2007), “Introduction to Special Topic Forum Value Creation and Value Capture: A Multilevel Perspective”, The Academy of Management Review, Vol. 32/1, pp. 180-194, https://www.jstor.org/stable/20159287.

[10] Liu, J. et al. (2022), “The coevolution of innovation ecosystems and the strategic growth paths of knowledge-intensive enterprises: The case of China’s integrated circuit design industry”, Journal of Business Research, Vol. 144, pp. 428-439, https://doi.org/10.1016/j.jbusres.2022.02.008.

[8] Martinsuo, M., L. Vuorinen and C. Killen (2019), “Lifecycle-oriented framing of value at the front end of infrastructure projects”, International Journal of Managing Projects in Business, Vol. 12/3, pp. 617-643, https://doi.org/10.1108/ijmpb-09-2018-0172.

[11] McGahan, A. (2020), “Where Does an Organization’s Responsibility End?: Identifying the Boundaries on Stakeholder Claims”, Academy of Management Discoveries, Vol. 6/1, pp. 8-11, https://doi.org/10.5465/amd.2018.0218.

[19] Normann, R. and R. Ramírez (1993), “From Value Chain to Value Constellation: Designing Interactive Strategy”, Harvard Business Review, Vol. 71/4, pp. 65-77, https://hbr.org/1993/07/designing-interactive-strategy.

[33] OECD (2022), OECD Handbook on Measuring the Space Economy, OECD Publishing, Paris, France, https://doi.org/10.1787/8bfef437-en.

[1] OECD (2019), The Space Economy in Figures: How Space Contributes to the Global Economy, OECD Publishing, Paris, https://doi.org/10.1787/c5996201-en.

[2] Paikowsky, D. (2017), “What Is New Space? The Changing Ecosystem of Global Space Activity”, New Space, Vol. 5/2, pp. 84-88, https://doi.org/10.1089/space.2016.0027.

[35] Palinkas, L. (2014), “Qualitative and Mixed Methods in Mental Health Services and Implementation Research”, Journal of Clinical Child & Adolescent Psychology, Vol. 43/6, pp. 851-861, https://doi.org/10.1080/15374416.2014.910791.

[3] Paravano, A., G. Locatelli and P. Trucco (2023), “What is value in the New Space Economy? The end-users’ perspective on satellite data and solutions”, Acta Astronautica, Vol. 210, pp. 554-563, https://doi.org/10.1016/j.actaastro.2023.05.001.

[34] Patton, M. (2014), Qualitative Research & Evaluation Methods: Integrating Theory and Practice, 4th Edition, Sage Publications Inc., New York.

[25] Pollack, J. et al. (2018), “Classics in megaproject management: A structured analysis of three major works”, International Journal of Project Management, Vol. 36/2, pp. 372-384, https://doi.org/10.1016/j.ijproman.2017.01.003.

[12] Porter, M. and M. Kramer (2011), “The Big Idea: Creating Shared Value”, Harvard Business Review, Vol. 89/1-2, pp. 62-77, https://hbr.org/2011/01/the-big-idea-creating-shared-value.

[36] Saunders, B., J. Kitzinger and C. Kitzinger (2014), “Anonymising interview data: challenges and compromise in practice”, Qualitative Research, Vol. 15/5, pp. 616-632, https://doi.org/10.1177/1468794114550439.

[37] Saunders, B. et al. (2017), “Saturation in qualitative research: exploring its conceptualization and operationalization”, Quality & Quantity, Vol. 52/4, pp. 1893-1907, https://doi.org/10.1007/s11135-017-0574-8.

[29] Saunders, M., P. Lewis and A. Thornhill (2009), Research Methods for Business Students, Pearson Education, New York.

[4] Space Economy Observatory (2020), “Space Economy: La nuova frontiera dell’Innovazione si presenta!”, webpage, https://www.osservatori.net/it/eventi/on-demand/convegni/space-economy-la-nuova-frontiera-dellinnovazi.

[9] Turner, R. and R. Zolin (2012), “Forecasting Success on Large Projects: Developing Reliable Scales to Predict Multiple Perspectives by Multiple Stakeholders over Multiple Time Frames”, Project Management Journal, Vol. 43/5, pp. 87-99, https://doi.org/10.1002/pmj.21289.

[7] Wilhelm, M. et al. (2015), “Sustainability in multi‐tier supply chains: Understanding the double agency role of the first‐tier supplier”, Journal of Operations Management, Vol. 41/1, pp. 42-60, https://doi.org/10.1016/j.jom.2015.11.001.

[18] Zott, C. and R. Amit (2010), “Business Model Design: An Activity System Perspective”, Long Range Planning, Vol. 43/2-3, pp. 216-226, https://doi.org/10.1016/j.lrp.2009.07.004.