This chapter focuses on policies and institutions that have a potential impact on the labour market performance of the low-educated, including: minimum wages, collective bargaining, taxation, unemployment benefits, activation measures, training, and employment protection legislation, amongst others. The chapter focuses on comparisons between Belgium and neighbouring countries to identify areas where reforms offer promise for improving outcomes for the low-educated in Belgium. The chapter concludes that high labour costs and poor work incentives are likely to be barriers to better labour market outcomes for the low-educated in Belgium, and that further investments in education and lifelong learning will be required.

The Future for Low-Educated Workers in Belgium

4. The role of policy and institutions

Abstract

This chapter focuses on policies and institutions that have a potential impact on the labour market performance of the low-educated, including: minimum wages, collective bargaining, taxation, unemployment benefits, activation measures, training, and employment protection legislation, amongst others. The chapter focuses on comparisons between Belgium and neighbouring countries to identify areas where reforms offer promise for improving outcomes for the low-educated in Belgium.

The analysis suggests that the collective bargaining system in Belgium may contribute to wages that exceed productivity for some low-educated workers, resulting in lower employment. Particular aspects of the collective bargaining system that merit attention are: minimum wages set in sector collective agreements and their automatic indexation. Both on the demand and supply side, further reforms to taxes and social security contributions could also play a part in lifting the employment rates of low-educated workers. There is scope to improve work incentives, both by addressing generous out-of-work benefits for some groups and tightening requirements for continued receipt of unemployment benefits. Greater use of flexible work is unlikely to make a significant difference, however the gap in regulation between permanent and fixed-term contracts should be narrowed so as to encourage employers to hire low-pay workers on permanent contracts.

4.1. On average, labour costs in Belgium are high

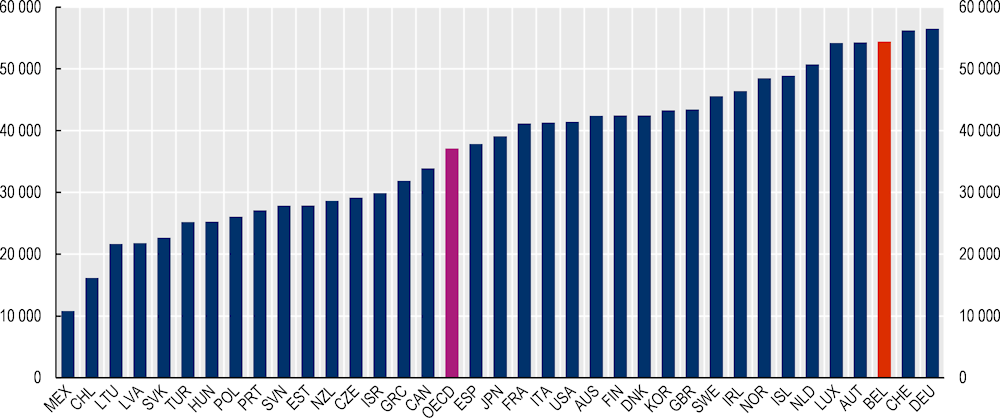

Labour costs in Belgium are amongst the highest in the OECD. Annual gross labour costs in Belgium for single workers earning 67% of the average wage1 were USD 54 408 in 2018 (with equal purchasing power). Only Germany and Switzerland had higher labour costs (USD 56 483 and USD 56 252, respectively). Labour costs for this group in Belgium were 7% higher than in the Netherlands, and 32% higher than in France. They were also higher than in the Nordic countries (Figure 4.1).

Figure 4.1. Labour costs are high in Belgium

4.1.1. High labour costs reflect high productivity

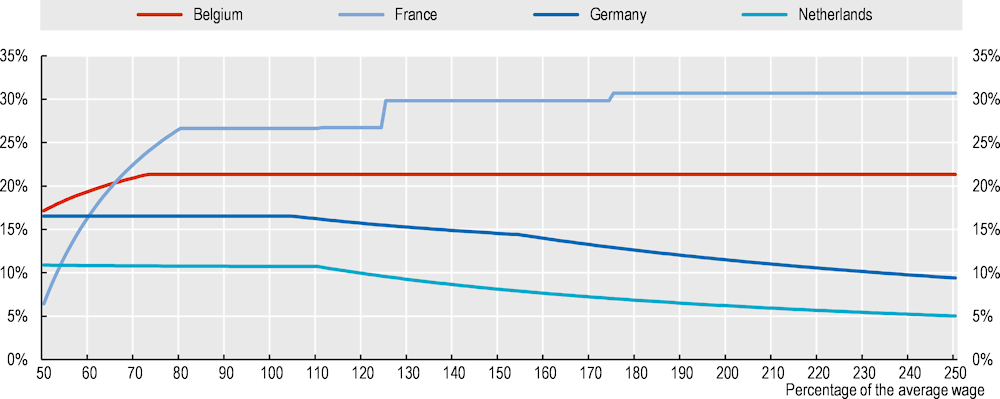

To a large extent, labour costs are higher in Belgium simply because productivity is higher, and this will be reflected in higher wages (see Chapter 2, Section 2.2). Indeed, Belgium is one of the most productive economies in the world (OECD, 2019[2]). Productivity in Belgium is higher than in neighbouring countries. Belgium’s productivity exceeds that of France by 11%, the Netherlands by 13% and Germany by 18%.2

However, there are important regional differences in productivity within Belgium. Of the three regions, the Brussels-Capital Region has the highest productivity, exceeding the overall average in Belgium by 25%.3 Productivity in Flanders is roughly equal to the Belgian average and it is 14% higher than in Wallonia. Wallonia’s productivity is on par with that of neighbouring countries France, the Netherlands and Germany (Figure 4.2).

Figure 4.2. Productivity is high in Belgium and in Flanders

Note: All values are the average of 2017 and 2018 for each entity expressed relative to Belgium overall. For 2017 and 2018 Belgium overall has equivalent productivity to Flanders. The Brussels-Capital Region not shown.

Source: OECD Regional Statistics, http://www.oecd.org/regional/regional-statistics/.

4.1.2. Labour costs may exceed productivity for some low-educated workers

Wages (and hence labour costs) are determined by complex wage-setting mechanisms that vary across countries. In addition to decentralised wage bargaining between individual workers and firms, these mechanisms include labour market institutions and laws such as the national minimum wage (Section 4.2.1) and collective bargaining agreements (Section 4.2.2). Particularly when these labour market institutions put strong pressure on wage-setting negotiations, the result may be wages that depart from productivity, at least for some groups of workers.

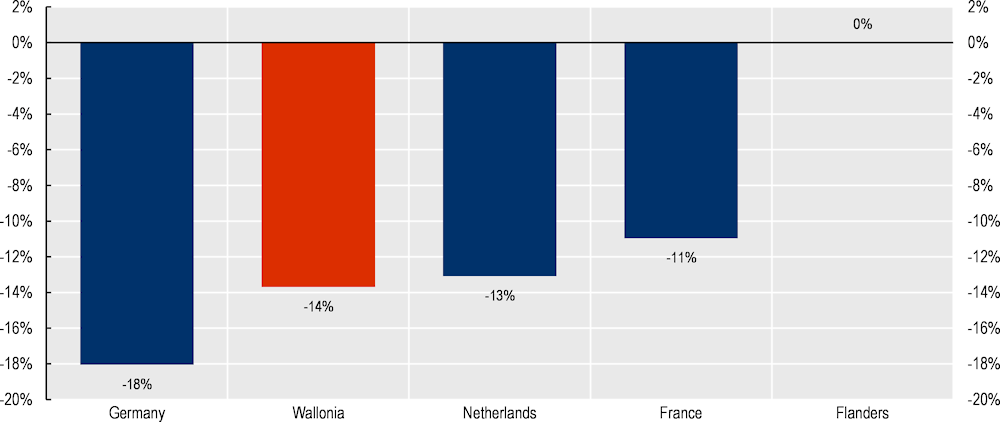

As shown in the main findings and policy pointers section of this report (Figure 7), low-educated workers in Belgium tend to have considerably higher wages than similar workers in neighbouring countries (and France and Germany in particular). Higher wages for low-educated workers may be justified in Flanders, where productivity is considerably higher than in neighbouring countries. In Wallonia, however, where productivity is 14% lower (and on par with neighbouring countries), earnings are quite similar to Flanders for the low-educated. The earnings distribution for the low-educated in Wallonia is more similar to Flanders (Figure 4.3) than to neighbouring countries.4 Higher wages than can be supported by the underlying productivity of workers may result in lower employment among these workers (Section 4.2.7).

Figure 4.3. The earnings distributions of the low-educated are virtually the same in Wallonia and Flanders

Note: Date cover dependent employees aged 20‑64 with a low-education (ISCED levels 0‑2). Earnings are real 2018 euros for years 2016‑18 pooled. The distribution is truncated at 10 000 EUR.

Source: OECD estimates based on EU statistics on Income and Living Conditions (EU-SILC), https://ec.europa.eu/eurostat/web/microdata/european-union-statistics-on-income-and-living-conditions.

4.2. Wage setting institutions contribute to high labour costs

4.2.1. The national minimum wage does not appear high in Belgium, but it is superseded by much higher sector minimum wages

At reasonable levels, minimum wages are unlikely to cause substantial job loss. The weight of the evidence suggests that moderate increases in a minimum wage set at reasonable levels are unlikely to have significant negative employment effects – although more vulnerable groups might be more adversely affected (OECD, 2015[3]).

The national minimum wage in Belgium5 is in line with that of Germany and the Netherlands. In 2018, the minimum wage in Belgium stood at 46% of median wages and 39% of average wages. This is comparable to Germany (46% and 40%) and the Netherlands (47% and 39%) (Figure 4.4). Only France has considerably higher minimum wages than Belgium (62% and 50% of median and average wages, respectively) – but wages overall are lower in France and there are also important rebates in social security contributions which mean that labour costs at the minimum wage are similar to Belgium, Germany and the Netherlands (see Annex 4.C).

Figure 4.4. The national minimum wage is not particularly high in Belgium

Source: OECD Minimum relative to average wages of full-time workers dataset https://stats.oecd.org/Index.aspx?DataSetCode=MIN2AVE.

In practice, the national minimum wage in Belgium only applies to a very small portion of workers. The OECD estimates that only around 1% of employees in Belgium earn at the national minimum wage. This is because the majority of sectoral bargaining agreements in Belgium set their own minimum wage and, on average, these sector minimum wages are around 20% higher than the national minimum wage (see Box 4.1) This is very different from the French system, for example, where collective agreements seldom raise the minimum wage above the national minimum (Plasman, 2015[4]).

Box 4.1. Sector minimum wages in Belgium

There are around 100 joint committees and 200 joint sub-committees in Belgium that decide on wages across the country. An analysis of the collective bargaining agreements reached by these committees suggests that nearly all set a minimum wage higher than the national minimum wage. On average, the sector minimum wages are around EUR 12 – which is 20% higher than the national minimum wage (which is just under EUR 10).

In some sectors, agreements set lower wages for new entrants. Most often, the full sector minimum wage will then be reached after a period of 3 to 24 months. The vast majority of collective bargaining agreements also set lower wages for young workers as well as for students. Many sectors have a full seniority pay structure (although the majority do not).

Only a handful of agreements vary by region. This is the case in some of the quarries and ports, but it is most visible in the metal works industry where wages vary by province and range between EUR 12.29 and EUR 13.07. In the plastics processing industry, there is also up to a EUR 1 difference in minimum wages between the provinces of Limburg and West-Flanders.

Regional minimum wages are quite common in some of the social and public sectors (e.g. education, care for the disabled, the socio-cultural sector, health and well-being, social housing) – which is related to the fact that regional authorities are competent in these fields. There are also a handful of agreements that allow minimum wages to vary according to firm size (with lower minimum wages in smaller firms).

Source: OECD analysis based on the Sector Minimum Wage Database maintained by the Ministry for Employment, Labour and Social Dialogue (https://werk.belgie.be/nl/themas/verloning/minimumlonen-paritair-subcomite/databank-minimumlonen).

4.2.2. Wage bargaining in Belgium is highly centralised and co-ordinated, which can promote good macroeconomic performance and reduce inequality

Wage-setting in Belgium is highly centralised and coordinated. While sector-level bargaining is in many ways the most important bargaining level in Belgium, it is framed by a number of centralised instruments and is characterised by a high level of coordination. First, there is the national minimum wage (see above). In addition, a national-level, cross-industry agreement covering the entire economy is concluded between social partners every two years within the National Labour Council. This national agreement sets an upper limit for wage growth at all levels which must be respected by social partners (see below). Within this framework defined at national level, lower levels are free to negotiate collective agreements on wages. However, in principle, lower-level agreements can only improve (from the employees’ perspective) what has been negotiated at a higher level.

Collective bargaining in Belgium is highly inclusive and achieves a high level of coverage. At the sector level, there are 100 joint committees and 200 joint subcommittees deciding on pay levels, working time arrangements, training and other work place amenities. These sectoral collective agreements apply to all employers and employees covered by the joint committees or subcommittees concerned. Every company and employee is assigned to a sectoral joint committee. This is done almost automatically when the employee is registered within the company for the social security system. Collective bargaining in Belgium covers around 95% of workers in the labour market, making it, besides Austria and France, the country with the highest collective bargaining coverage in the OECD area. Belgium has high union density and is also one of the only OECD countries where this union density has been increasing. Also unusual is that employees in small firms represent a larger share of trade union members in Belgium than those in large firms. Finally, Belgium has very high employer organisation density: 80% of employees in the private sector work in firms associated with an employer organisation.

Centralised and co-ordinated bargaining systems, like the one in Belgium, have many advantages. Combined with high collective bargaining coverage, such systems have been found to be associated with many good economic outcomes: they tend to be correlated with higher employment, lower unemployment, lower wage inequality and a higher-quality work environment (OECD, 2018[5]). This is because co‑ordination helps the social partners to account for the business-cycle situation and the macroeconomic effects of wage agreements on competitiveness.

4.2.3. Automatic wage indexation has some advantages, but may also contribute to the problem

Belgium is quite unique among developed economies in that wages are automatically indexed to inflation. In Europe, only Cyprus and Luxembourg have similar systems. Wage indexation was popular in the past during times of high inflation (e.g. the 1970s), but neighbouring countries the Netherlands and France abandoned it in 1982. France still maintains some form of indexation, but it only applies to the national minimum wage.

There are some advantages to wage indexation. For example, it can, in theory, contribute to peace in industrial relations. Also, there is an automatic stabiliser argument for wage indexation: even in an economic downturn, wage increases linked to indexation will support consumption. However, it comes at a potentially high cost. In the past, the OECD has warned numerous times that wage indexation can cause wages to grow faster than domestic productivity (OECD, 2015[6]) and that it reduces adjustment to real shocks that would require internal devaluations, important in a currency union. Other organisations (e.g. the European Central Bank) have raised similar concerns, pointing out that wage indexation involves the risk of upward shocks to inflation lasting longer and potentially leading to a wage-price spiral (ECB, 2008[7]). In addition, there is little evidence that purchasing power cannot be maintained in the absence of indexation (De Schryder, Peersman and Wauters, 2019[8]).

4.2.4. Seniority pay structures are unlikely to have a large negative impact on the employment outcomes of low-educated workers

Many collective agreements in Belgium, though not all, contain a seniority-based pay structure. Such pay structures have both advantages and disadvantages. On the one hand, productivity tends to increase with experience (up to a certain level) and therefore there might be an argument for automatic wage adjustments to reflect this. In addition, increasing wages with seniority might also be a way for firms to strengthen worker loyalty and/or motivation (Zwick, 2009[9]). However, if wages increase too steeply, a seniority-based pay structure may dampen professional mobility (due to its effect on reservation wages) and decrease employment opportunities of older workers as their wages and productivity levels diverge.

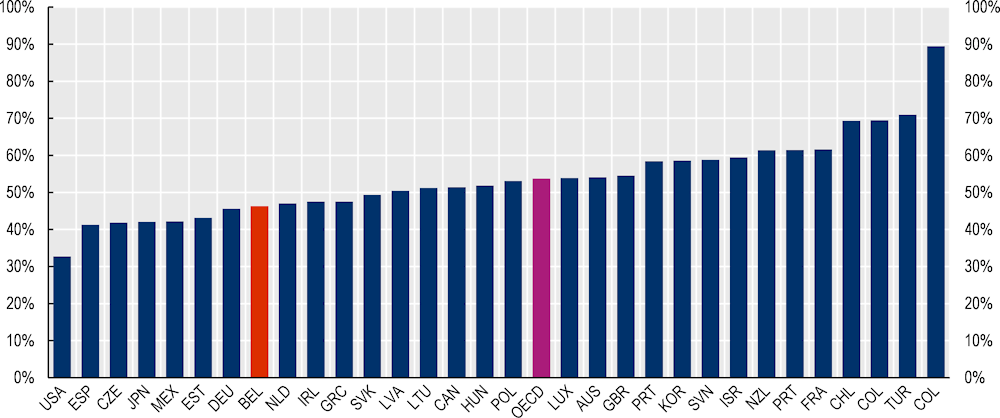

It is unlikely that seniority pay structures have a strong negative impact on the employment rates of the low-educated in Belgium. While it is true that Belgium has the lowest recruitment rate of older workers (aged 55‑64) in the OECD (Figure 4.5), research has demonstrated that there are other, more important barriers to the employment of older workers in Belgium than seniority pay structures, including: early retirement, low participation in lifelong learning, and limited occupational mobility (HRW, 2014[10]). Similarly, the OECD has shown that there is little relation between pay policies and the retention rates of older workers across EU Member States (OECD, 2017[11]). Finally, seniority wages are less likely to affect the employment outcomes of low-educated workers, since an analysis of collective bargaining agreements has shown that seniority pay structures are most common in white-collar (and therefore more high-skill) occupations (HRW, 2014[10]).

While seniority pay structures may not be a major barrier to the employment outcomes of low-educated workers in Belgium, they may still contribute to overall high wage costs and, therefore, affect the employment of low-educated workers indirectly. The Belgian government has, in the past, led by example and adjusted pay structures for public employees. One direct option would be to ban seniority wages given their close connection which age and that age discrimination is illegal (the fact that seniority in Belgium is transferrable within or even beyond sectors confirms this close link). A more indirect option would be to encourage the social partners to give consideration to this issue as part of their wage negotiations. Pay structures which limit seniority pay to a certain number of years, and then give an increasing weight to performance-related pay, operate successfully in other OECD countries (e.g. Netherlands and the United Kingdom) and could serve as a model (HRW, 2014[10]).

Figure 4.5. Belgium has the lowest hiring rate of older workers in the OECD

Note: The OECD average excludes Colombia.

Source: OECD Scoreboard on older workers, 2008 and 2018, https://www.oecd.org/employment/ageingandemploymentpolicies.htm.

4.2.5. The government has had to intervene to maintain competitiveness

Without government intervention, the wage-setting system in Belgium has had a tendency to result in wages rising faster than productivity and, therefore, in unit labour costs rising faster than in neighbouring countries. This happened, for example, between 2006 and 2012. The government then stepped in with a range of measures to try and maintain competitiveness with its main trading partners, France, Germany and the Netherlands. First, there was the “wage moderation” (loonmatiging / moderation salariale) which blocked any wage increases over and above inflation for the period 2013‑14. Then, the government temporarily suspended wage indexation for the years 2015‑16 (indexsprong / saut d’index). Third, the government launched the “tax shift” in 2016 (see below) which gradually reduced non-wage costs over a period of four years. Finally, the government revised the wage norm (loonnorm / norme salariale) legislation. The wage norm is set every two years at the national level and determines the margin for wage negotiations at the sector level. It takes into account expected inflation in Belgium as well as expected wage developments in neighbouring countries over the coming two years. Since 2017, the calculation of the wage norm has included an ex ante “correction term” (correctieterm / terme de correction) as well as a “safety margin” (veiligheidsmarge / marge de sécurité). The correction term takes into account the historical wage handicap between Belgium and its main trading partners. If the wage handicap is negative (i.e. Belgium is less competitive than its neighbours) then the margin for wage negotiations is reduced accordingly. The safety margin is there to allow for situations where inflation might have been underestimated or wage growth in the neighbouring countries overestimated. The safety margin therefore further reduces the remaining margin for negotiation, to make sure that wage developments in Belgium stay in line with those of the neighbouring countries.

4.2.6. The wage-setting system leaves little room for adjusting wages in line with productivity

Once the wage norm is set, sectoral bargaining takes place within the margin agreed at national level. This margin allowed for a 1.1% increase in wages over and above inflation in each of the periods 2017‑18 and 2019‑20, which is limited. Minimum wages and pay scales are adjusted within sector collective bargaining agreements and, while firm-level agreements can in theory be struck as well, there will be very little left to negotiate at firm-level. Most sector collective agreements contain very detailed pay scales that set pay by seniority, occupation, etc.

The Belgian wage-setting system has previously attracted criticism from the OECD in the context of slow productivity growth and there have been calls for increased flexibility at the firm-level to set wages in line with productivity (OECD, 2019[2]). Indeed, research has shown that hourly productivity is higher in firms in Belgium that have a firm-level agreement (complementing the sector-level agreement) (Garnero, Rycx and Terraz, 2020[12]). While this result on its own should be taken with some caution (the study does not establish causality), it goes in the same direction and adds to the other evidence in OECD (2018[5]).

That being said, there is some flexibility in the Belgian system to allow wages to reflect productivity, and this appears to be growing over time. A relatively old estimate suggests that around 25‑30% of private sector workers in Belgium see their working conditions collectively renegotiated at the firm level (Du Caju, Rycx and Tojerow, 2012[13]). In addition, variable/performance-related pay has been on the rise in the form of “bonus plans” (bonusplannen / plans bonus) and the “profit bonus” (winstpremie / Prime bénéficiaire) (Box 4.2). A recent study confirmed that a considerable share of employees in Flanders benefit from variable pay. A survey of 3 600 employees showed that 45% received some form of variable pay – including 72% of managers, 50% of specialists, 25% of blue-collar workers, and 37% of “uitvoerende bedienden / employés exécutants” (executive clerks) (Baeten and De Ruyck, 2018[14]). Blue-collar workers are more likely to benefit from a collective bonus, while managers and specialists benefit more from an individual bonus.

Box 4.2. Variable pay in Belgium: The Bonus Plan and the Profit Bonus

The Bonus Plan

Since 2007, firms have been allowed to pay (some of) their employees a bonus if pre-agreed (but uncertain) collective performance targets are achieved. This “bonus plan” receives favourable tax treatment as long as the bonus does not exceed EUR 3 413 per year and per worker. One study showed that in 2005, only 5% of employees benefited from bonus plans, but that the share had risen to 20% in 2011 and to 40% in 2014 (Hudson, 2014[15]).

The Profit Bonus

Another mechanism is the “profit bonus”, which was substantially revised in 2017 and allows firms to share (part of) its profits in a particular year with (all of) its employees. Again, this bonus benefits from a favourable tax treatment (for both the employer and the employee). The firm can choose to give all its employees the same amount, or to give them a bonus proportionate to their wage. The former can be attributed following a simple decision taken through majority voting at a general meeting at the firm-level, while the latter requires a collective agreement. Estimates show that, while in 2017, only 54 firms let their employees participate in their profits, that number had risen to 738 in 2018. In 2018, firms paid out EUR 92.5 million in bonuses under this scheme and 50 000 employees benefited, primarily in smaller firms (more than half the firms who made use of the scheme had fewer than 10 employees). The average employee received EUR 920.54 gross (or EUR 744.21 net) (Vanoost, 2019[16]). The difference between the “profit bonus” and the “bonus plan”, is that the former has to be paid to all employees of the firm and that it depends on growth and profitability, rather than on achieving certain targets (as the bonus plan does).

4.2.7. Bargained wages vary little across regions, which could result in a disconnect with local productivity and hence lower employment

Wages for low-educated workers differ little between Flanders and Wallonia (see Figure 4.3), despite a 14% difference in productivity. This regional discrepancy between wages and productivity has been demonstrated by a number of researchers to date (Konings and Marcolin, 2014[17]; Nautet, 2918[18]; IMF, 2019[19]). As a result, labour costs are likely to exceed productivity for some low-educated workers (particularly in Wallonia), and this may hurt their employment prospects.

There is some evidence in Belgium of this misalignment between productivity and earnings, and the effect it has on employment rates. Figure 4.6 shows productivity and employment rates at the NUTS 3 level (arrondissement) in 2016 for all workers, regardless of education. There is a positive correlation between productivity and employment rates in Belgium even though, in theory, there is no reason why employment rates should be correlated with productivity. In a decentralised wage bargaining economy with free movement of workers, firms and workers will, in theory, bargain wages in line with the underlying productivity in a given region. This, in turn, should result in wages adjusting across regions until employment rates equalise. If institutional factors align to set wages equally across regions failing to take into account productivity differences, wages may be set too high relative to productivity in some lower productivity regions causing firms to demand fewer workers and driving down employment rates. A positive regional correlation between productivity and employment rates often characterises countries with large regional productivity differences and little margin in the wage setting system to reflect these productivity differences in wages (Boeri et al., 2020[20]).6

Figure 4.6. Employment rates are positively correlated with productivity

Note: The level of analysis is the arrondissement (NUTS 3). Employment rates are defined for the whole population aged 15‑64. Productivity is the average gross value added per worker in thousands of constant euros. Productivity and employment rates are averaged over 2015 and 2016.

Source: OECD Regional Statistics, http://www.oecd.org/regional/regional-statistics/.

Some sector collective agreements in Belgium have tried to address the discrepancy between wages and productivity by setting minimum wages or pay scales that vary by region/province (Van der Linden, 2008[21]). These are few, however, and the regional differences in wages tend to be very small (see also Box 4.1). One option going forward would be for the government to consider the administrative extension of collective bargaining agreements only in cases where there is clear evidence that regional differences in productivity have been considered and, where appropriate, have been reflected in wages.

At an aggregate level, more firm-level bargaining may help reduce regional discrepancies in wages and productivity, but it is unlikely that this would do much for low-wage workers unless derogation from sector minimum wages and automatic indexation is possible. Rusinek and Tojerow (2014[22]) find that the more the firm level plays a role in wage setting in Belgium, the more regional differences in productivity translate into wage differences. However, this is only true at the high end of the wage distribution, where wages can be increased in line with productivity. At the bottom of the wage distribution, firms cannot negotiate wages down from what has been agreed in sector collective agreements.

Allowing firms greater flexibility to further negotiate sector-level agreements would likely help disparities in regional employment rates. If firms were allowed to derogate from sector agreements and/or automatic indexation under certain circumstances, it would be possible to achieve a closer alignment between productivity and wages in cases where these were not well aligned. Both Germany and the Netherlands make wide use of general opening clauses which allow firm-level agreements to deviate from the minima or the standards set in higher-level agreements, as long as there is agreement with unions. While Belgium could encourage the use of such opt-out clauses in sector agreements (e.g. by not extending agreements unless they contain such clauses, as France did in its reform of 2017 (Carcillo et al., 2019[23])), three challenges remain. First, any opt-out clauses need to be closely regulated (otherwise they risk leading to downward competition between firms and even undermine the regulatory capacity of collective agreements). Second, larger firms tend to use such clauses more than smaller ones, since the latter often lack the capacity and/or worker representation to take advantage of such clauses. Third, in Belgium, it is only the representative from the national trade union, not the local trade unionists, who can sign a collective agreement (even at enterprise level).

Another possible reform would be to move towards a system of organised decentralisation. In particular, sector collective agreements in Belgium tend to set very detailed pay scales which, in combination with indexation, leave little room for wages to be set at the firm-level. A system which works relatively well in some countries (e.g. Denmark) is to have “corridor agreements”, which only set minimum and maximum levels for wage levels/growth at the sector level, allowing more room for negotiation at the firm-level.

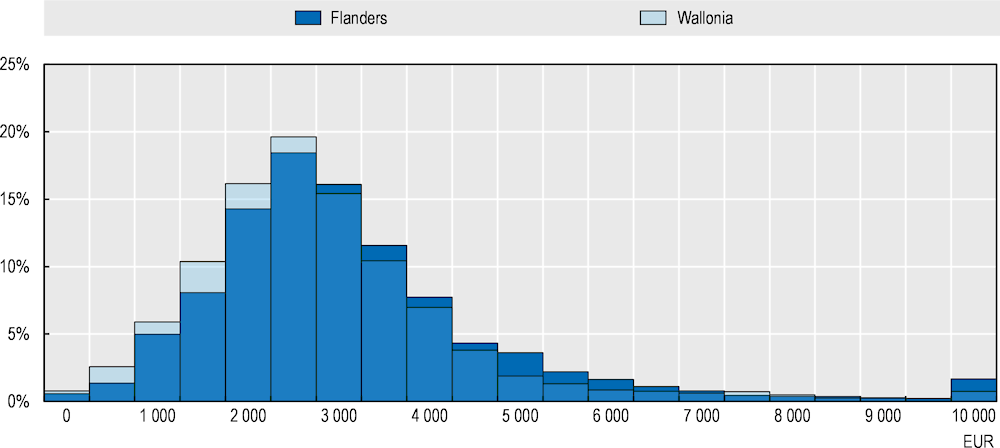

4.3. High labour costs in Belgium also reflect high taxes

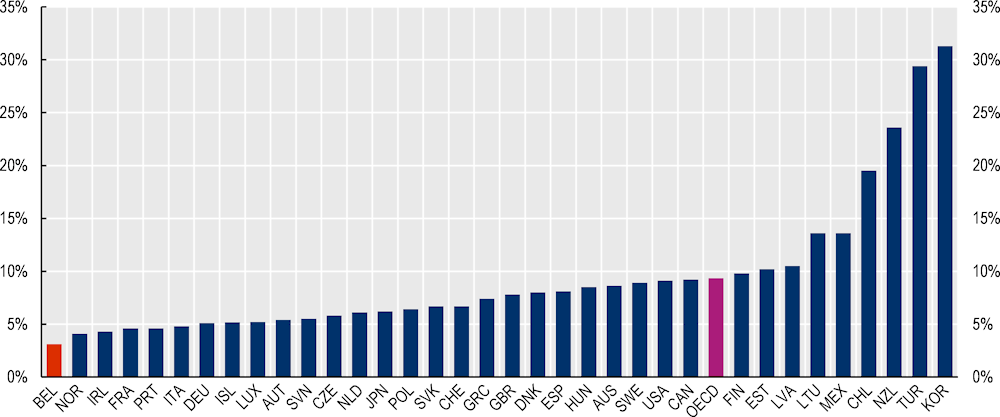

Higher labour costs in Belgium also reflect the fact that taxes and social security contributions tend to be quite high. At 45.4%, Belgium has the highest tax wedge7 in the OECD for single workers with no children earning 67% of the average wage. Recent reforms (the “Tax Shift” – see below) have brought the tax wedge in Belgium closer to that of Germany. However, it remains 6.5 percentage points above the tax wedge in France, and more than 15 percentage points above the tax wedge in the Netherlands (and the OECD average) (Figure 4.7). High taxes will increase the cost of hiring to employers. It will also reduce take-home pay for workers and work incentives. Both of these issues are discussed in turn.

Figure 4.7. Despite recent reforms, the tax wedge in Belgium remains very high

4.3.1. Employers in Belgium face high social security contributions, despite recent reforms

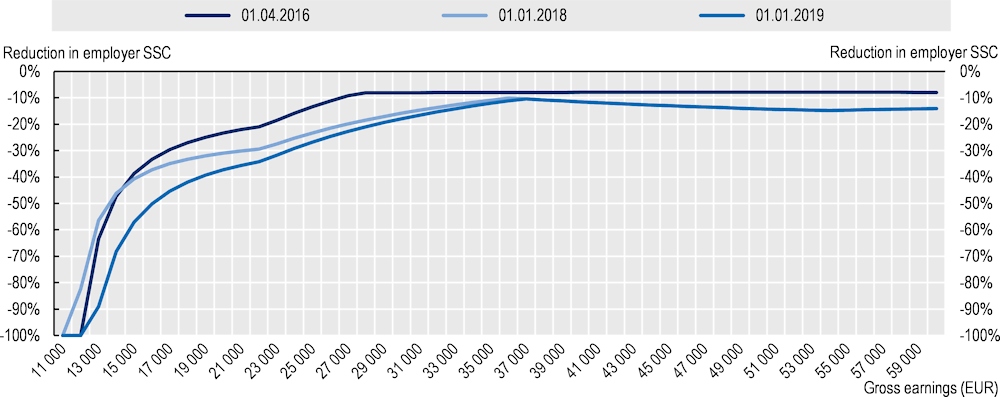

Recent reforms in Belgium have reduced taxes on labour payable by both employers and workers. On 10 October 2015, the Belgian government announced a “Tax Shift” with the key aim of boosting job creation as well as take-home pay. The changes, voted in on 18 December, were to be implemented over a period of four years, starting 1 April 2016, and covered: personal income tax, social security contributions, corporate tax, VAT, excise duties, amongst others. The basic idea was to lower taxes on labour and make up the shortfall by increasing taxes on capital, as well as through taxes on ‘environmental unfriendly activities’ and ‘unhealthy activities’. Annex 4.A provides a detailed overview of the changes that happened to the calculation of employer social security contributions as a result of the tax shift. In sum, the basic rate for employer social security contributions was reduced from 34.79% of gross earnings before the reform to 26.69% on 1 January 2019. However, this was accompanied and counterbalanced by a decrease in the fixed reduction (i.e. the reduction applicable to all workers, regardless of their earnings) and, then, its abolition. The variable amount of deduction (i.e. the reduction that depends on earnings) was abolished for higher earners. For lower earners, the income threshold was increased so that more workers would become eligible for the reduction, but the employer SSC rate was reduced from 16.2% to 12.8% in 2018, and then increased again to 14% in 2019.

What these reforms meant in practice is that workers with the lowest earnings benefited from the largest reductions in employer social security contributions. The net effect of the reforms on labour costs can be more easily observed in Figure 4.8, which shows the percentage reduction in absolute employer social security contributions due at each level of gross earnings (in comparison to what would have been due in April 2014). In addition to the reductions in social security contributions for low-pay workers, there were some reductions for higher earners as well. The workers who benefited least from the reform (i.e. saw the smallest reductions in employer SSCs) were workers earning around EUR 37 000.

Figure 4.8. Reductions in employer social security contributions were greatest for workers with the lowest earnings

Note: All reductions shown as percentage of employer social security contributions due in April 2014.

Source: OECD estimates based on data from OECD Taxing Wages, https://dx.doi.org/10.1787/047072cd-en.

Despite the reform, employers in Belgium still pay high social security contributions compared to employers in neighbouring countries. For a single worker without children earning 67% of the average wage, employer social security contributions in Belgium represented 20.6% of total labour costs in 2018. While employer SSCs are even higher in France (24.2% of total labour costs), they are significantly lower in both Germany and the Netherlands (16.2% and 10.5%, respectively).8 Moreover, on very low earners (<58% of the average wage), employer SSCs are also lower in France than in Belgium. While there are few differences between Belgium and its neighbouring countries in terms of the costs of hiring a worker at the national minimum wage (see Annex 4.C), very few workers in Belgium earn the minimum wage. The average earnings of low-educated workers are considerably higher than the minimum wage and much closer to 67% of the average wage (in fact, they are slightly above 67% of the average wage).

Figure 4.9. Employer social security contributions in Belgium are high

The evidence suggests that lower taxes can increase employment, particularly when they are targeted

Using data for 21 OECD countries over the period 1982‑2003, Bassanini and Duval, (2006[24]) found that lower labour taxes raise employment. Their baseline specification implies that a 10 percentage point reduction in the tax wedge in an average OECD country would increase the employment rate by 3.7 percentage points. A review of the literature by Ramos et al., (2017[25]) concluded that the employment effects from lower employer social contribution rates (or functional equivalents such as hiring subsidies) tended to be modest – although policies targeted at a specific group were more effective than general or non-targeted ones.

Most studies evaluating the impact of labour taxes on employment in Belgium also find that reductions in taxes increase employment. Many of these studies are based on models which estimate the potential/theoretical impact. For example, (Joyeux and Stockman, (2003[26]) use a macroeconomic labour market model to estimate the employment impact of reductions in employer social security contributions in 1995 and 2000. According to their estimates, at least 12 200 new jobs were created in 1995 and 35 700 in 2000 as a result of the reductions. Goos and Konings, (2007[27]) is an exception in that it is a proper evaluation of past reforms. They use a panel of firm-level data to estimate the effects of reductions in social security contributions aimed at manual workers in the late 1990s and find that these increased full-time manual employment and (to a lesser extent) pre-tax wages of manual workers. In an ex ante assessment of the Tax Shift, Bijnens and Konings, (2020[28]) estimated that a reduction in non-wage costs of 1% would result in an increase in employment of around 0.50% in the first year of the reduction, and an additional 40% of the previous year impact in each subsequent year. In addition, the “service voucher” scheme in Belgium, which subsidises the hiring of domestic workers by private households, has also shown that it can promote (formal) employment (Box 4.3).

The OECD’s own analysis of the Tax Shift suggests that, even though it was not necessarily the provinces with the highest shares of low-educated individuals that benefited most from the Tax Shift, there was an increase in the relative employment rate of low-educated workers in the provinces that benefited most from the Tax Shift (Box 4.4).

Box 4.3. Service Vouchers and the employment of low-skilled workers

“Service vouchers” (dienstencheques / titres-services) in Belgium are subsidies for private households purchasing domestic services (e.g. cleaning, laundry, ironing, shopping, cooking, etc.). The domestic workers officially work for a service voucher company (where they have an open-ended contract). Private households purchase vouchers (up to a certain ceiling, depending on household characteristics) and they can subsequently deduct part of this cost from their taxes. For example, in 2020, a service voucher in Flanders costs EUR 9.00, of which 20% is tax-deductible, so that the individual will end up paying EUR 7.20 per voucher. The cost of service vouchers and the amount that is tax deductible has varied over time and across regions. In addition, the service voucher company receives EUR 14.60 from the government per voucher.

The service voucher system was introduced in 2004. The primary objective was to tackle undeclared work. By making formalisation of domestic work more financially attractive, the hope was that more private households would declare such work. The scheme was hugely successful if judged by the number of workers involved. In 2018, there were around 150 000 workers employed by service voucher companies. These workers are primarily low-skilled and female (only 2% of workers are male) and are also disproportionately from an immigrant background. An evaluation of the scheme showed that the scheme raised the employment rate of low- and medium-educated women: each new service voucher employee created a new job for 0.87 low- and medium-skilled women (Desiere and Goesaert, 2019[29]). However, the scheme does come at a huge cost to government. There is also evidence that the size of the subsidies matter, and that demand fell in Wallonia when the tax deduction was substantially reduced (Goffin et al., 2018[30]).

Belgium is not the only country that subsidises the purchase of low-skilled services by private households (Goffin et al., 2018[30]). France has the Chèque emploi service universe (Cesu), Sweden the ROT-avdrag, and Finland the Kotitalousvähennys. One difference between those countries and Belgium, is that their subsidies are available for more than just domestic work, and can often also be used for small maintenance and repair work, gardening, study aids, child and elderly care, amongst others. Extending the service voucher scheme to such activities should also be considered in Belgium – although the cost of doing so is likely to be a major barrier.

Box 4.4. OECD Estimates of the Impact of the Tax Shift (Reductions in Employer SSCs)

The reductions in employer social security contributions as part of the Tax Shift in Belgium should, in theory, have encouraged employers to hire more workers. Moreover, this hiring should have benefited low-wage workers more since the relative reduction in employer security contributions was greater for them.

Evaluating the impact of this reform is not straightforward, however, because the changes were implemented nation-wide and applied to all workers and firms at the same time, so there is no control group which would allow to check what would have happened in the counterfactual situation where the employer social security contributions had not changed.

That being said, the reductions in social security contributions were larger for some workers than for others. Firms that are more reliant on low-wage workers may, therefore, have benefited more from the reform and hired more new workers than firms that rely more on high-wage labour. Exploiting such variation, however, would require firm-level data, which was not available for this analysis.

Instead, this box provides some descriptive evidence on how the reductions in social security contributions benefited various provinces in Belgium differently, and what relationship exists with (changes in) the employment rate of the low-educated over time.

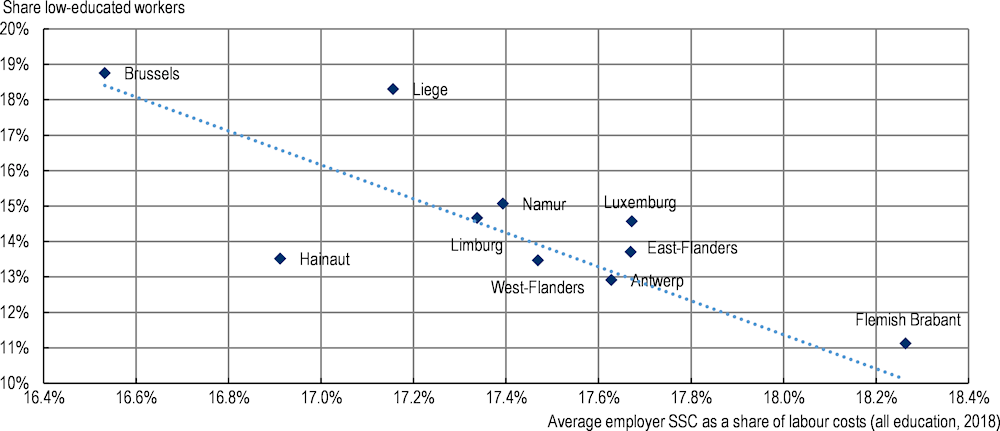

The first point to note is that, in provinces with a higher share of low-educated individuals, the average social security contributions per employee (regardless of education) paid by employers (as a share of total labour costs) tend to be lower. This makes sense, since social security contributions tend to be lower for low-wage workers (who tend to be disproportionately low-educated) (Figure 4.10).

Figure 4.10. Average social security contributions (as a share of labour costs) tend to be lower in provinces with a higher share of low-educated workers

Source: OECD analysis of Belgian Labour Force Survey and OECD Tax-Benefit model, http://www.oecd.org/social/benefits-and-wages/.

The average employer SSC are calculated using data on net earnings from the Belgian Labour Force Survey combined with the OECD’s Tax-Benefit model (some simplifying assumptions had to be made with regards to family type). The OECD Tax-Benefit model also allows the calculation of gross earnings (i.e. net earnings plus income tax and employer and employee social security contributions). This information, in turn, can be used to calculate what employer social security contributions would have been paid under the rules applicable in 2014.

A variable is then calculated which shows the average percentage difference in employer security contributions paid (per worker and as a percentage of labour costs) by province in 2018 compared to what would have been paid under the old 2014 rules. In essence, this shows the savings, per worker, of hiring the 2018 workforce compared to what employers would have paid under the old rules for that same workforce. It is not a direct measure of the reduction in employer social security contributions as a result of the tax shift, because it also measures changes in hiring as a result of the tax shift. Nonetheless, it allows one to see which provinces benefited most (in monetary terms) from the Tax Shift. Figure 4.11 shows that, while the relationship is weak, provinces with lower shares of low‑educated individuals have tended to benefit slightly more, on average, from the Tax Shift.

Figure 4.11. Provinces with a lower share of low-educated individuals tended to benefit slightly more from the reduction in employer social security contributions

Source: OECD analysis of Belgian Labour Force Survey and OECD Tax-Benefit model, http://www.oecd.org/social/benefits-and-wages/.

Finally, Figure 4.12 shows that provinces that saw the largest average savings in employer SSC compared to what they would have paid in 2014 also saw a larger increase in the share of employment that is low-educated. In other words: even though it was not necessarily the provinces with the highest shares of low-educated individuals that benefited most from the Tax Shift, there was an increase in the relative employment rate of low-educated workers in the provinces that benefited most from the Tax Shift.

Figure 4.12. Provinces that benefited most from the tax shift saw greater growth in the share of employment that is low educated

Source: OECD analysis of Belgian Labour Force Survey and OECD Tax-Benefit model, http://www.oecd.org/social/benefits-and-wages/.

Reductions in employer social security contributions could be better targeted

In addition to the standard reductions in employer social security contributions outlined above, Belgium has many targeted reductions in social security contributions aimed at specific sub-groups (which are not reflected in Figure 4.8). All of these reductions used to be federal initiatives but, following the sixth constitutional reform in 2014, some responsibility for labour market policy was devolved to the regions, including several of these targeted reductions in social security contributions. This reform was effective from 1 July 2016 onwards. Some reductions are still federal (e.g. reductions for new hires, reductions for permanent employees in the Hotels, Restaurants and Cafes sector) but many are now regional, including those for older workers and, in Flanders, for disadvantaged youth. Reductions in social security contributions for the long-term unemployed were abandoned in all regions (although the regions did maintain wage subsidies in the form of the continued receipt of a partial unemployment benefit). Annex 4.A contains a detailed description of these targeted reductions and how they have changed over time.

The targeted reductions in employer social security contributions may benefit low-educated workers more than more educated workers. For example, reductions for employees in the Hotels, Restaurants and Cafes sector are likely to benefit primarily low-educated workers since 22% of cooks, waiters and bartenders who are permanent employees are low-educated, compared to 12% on average across all occupations. Similarly, older workers are more likely to be low-educated than younger workers (Chapter 1). All regions have tended to increase the targeting of social security contributions on older age groups as well as means testing them. In addition, Flanders only allows reductions for new hires. For the remaining workers, the amount of support has been increased.

There is scope to further improve the targeting of these subsidies and reduce potential deadweight losses. In general, even though employment subsidies can help promote employment, they have tended to suffer from a high level of deadweight loss (i.e. the subsidisation of jobs which would have been created anyway in the absence of the subsidy). There is also a risk of substitution effects (the hiring of subsidised workers instead of non-subsidised ones, with no net employment effect). Previous evaluations of wage subsidies in Australia, Belgium, Ireland and the Netherlands have suggested combined deadweight and substitution effects amounting to around 90% (Martin, 2001[31]). Similarly, Bartik, (2001[32]) estimates that the share of hiring that would have happened in the absence of the employment subsidy frequently exceeds 90%.

Deadweight and substitution losses cannot be eliminated entirely, however they can be reduced by better targeting. For example, in Belgium, the reductions for new hires could be restricted to low-wage workers only. Similarly, only 35% of older workers are low-educated, yet the subsidies are available for older workers regardless of education. Wallonia and the Brussels-Capital Region may wish to consider restricting reductions to new hires only, as is done in Flanders. Finally, both the Brussels-Capital Region and Wallonia have abandoned reductions for youth (which used to benefit the low-educated in particular). Only Flanders has maintained a measure targeted at youth. At first, this was less generous than the federal measure, but this has now been increased and has become targeted on low-educated youth only (middle‑educated are no longer eligible since 2020).

4.3.2. High taxes also harm work incentives

The Tax Shift also reduced income tax and employee social security contributions

In addition to reductions in non-wage costs for employers, the Tax Shift included a number of measures that aimed to increase the net incomes for working families (and improve their work incentives) – particularly at the bottom and the middle of the income distribution. Among the measures taken were: i) the abolition of the 30% tax bracket and its replacement by a wider 25% bracket; ii) the introduction of higher deductions for work-related expenses, particularly for those on lower incomes; iii) the raising of the income threshold for eligibility to the fixed amount of exempt income; iv) an increase in the refundable tax credit for low-income workers (employment bonus). A full description of these changes can be found in Annex 4.C.

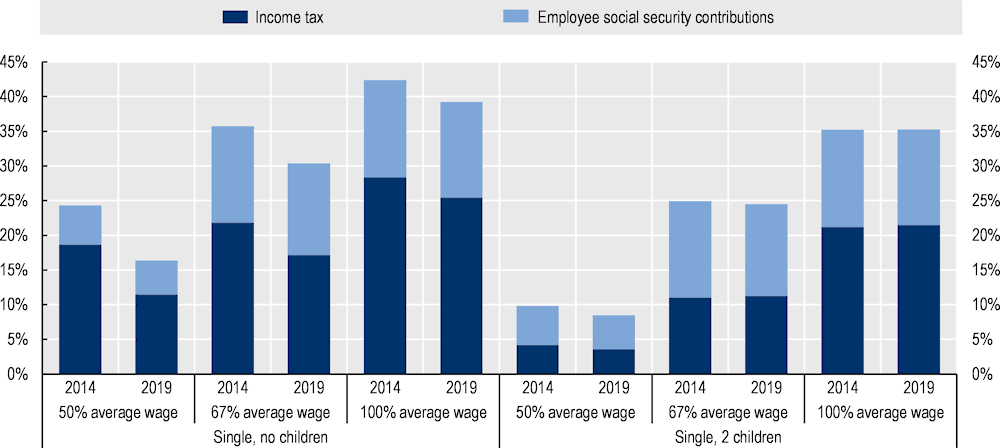

These reforms led to reductions in income tax and social security contributions (Figure 4.13). For single individuals with no children working full-time at 50% of the average wage, taxes and social security contributions reduced from 24% to 16% of gross wages – i.e. a 33% reduction. For similar individuals, earnings 67% and 100% of the average wage, the equivalent reductions were 15% and 7%, respectively. Single parents already paid lower taxes prior to the reform, and further reductions introduced by the reform were much smaller in comparison. The reductions were 14%, 1.8% and 0.2% at 50%, 67% and 100% of the average wage, respectively (Figure 4.13).

Figure 4.13. The Tax Shift reduced income taxes and employee social security contributions, particularly for those on low incomes

Note: Simulations are for a single adult aged 40, working full-time.

Source: OECD Tax-Benefit Model, http://www.oecd.org/social/benefits-and-wages/.

While take-home pay increased, the impact on purchasing power and work incentives were limited

The impact of the tax shift on purchasing power was more limited because of the increase in indirect (consumption) taxes that compensated for the lowering in labour taxes. On balance, it is estimated that those on middle and high incomes actually gained most from the reforms (Capéau et al., 2018[33]). The OECD (2017[34]) has previously pointed out that there may be room to raise taxes on household capital income instead. The OECD has also suggested that federal authorities could raise the official, registered values (revenu cadastrale / kadastraal inkomen) of dwellings to make them better reflect market values, while regional authorities could reduce the tax deductibility of mortgage debt.

In addition, while the lower income tax liabilities strengthened incentives to move into work, this was partly offset by higher social assistance payments (rates increased by 7% between 2016 and 2018) and/or increased family benefits for those out of work (gewaarborgde gezinsbijslag / prestations familiales garanties – increased by up to 20% depending on the age of the children and family size) (OECD, 2019[35]). By contrast, the incomes of those eligible for unemployment benefits did not change significantly, as there were no significant policy reforms in this area (see Section 4.4). These changes increased out-of-work incomes of those eligible to guaranteed-minimum income benefits. Individuals moving into work thus lost more benefit entitlement, but lost less of their earnings to income tax. These offsetting effects meant that increases in participation tax rates (PTR) were fairly modest.

Some groups still face poor work incentives

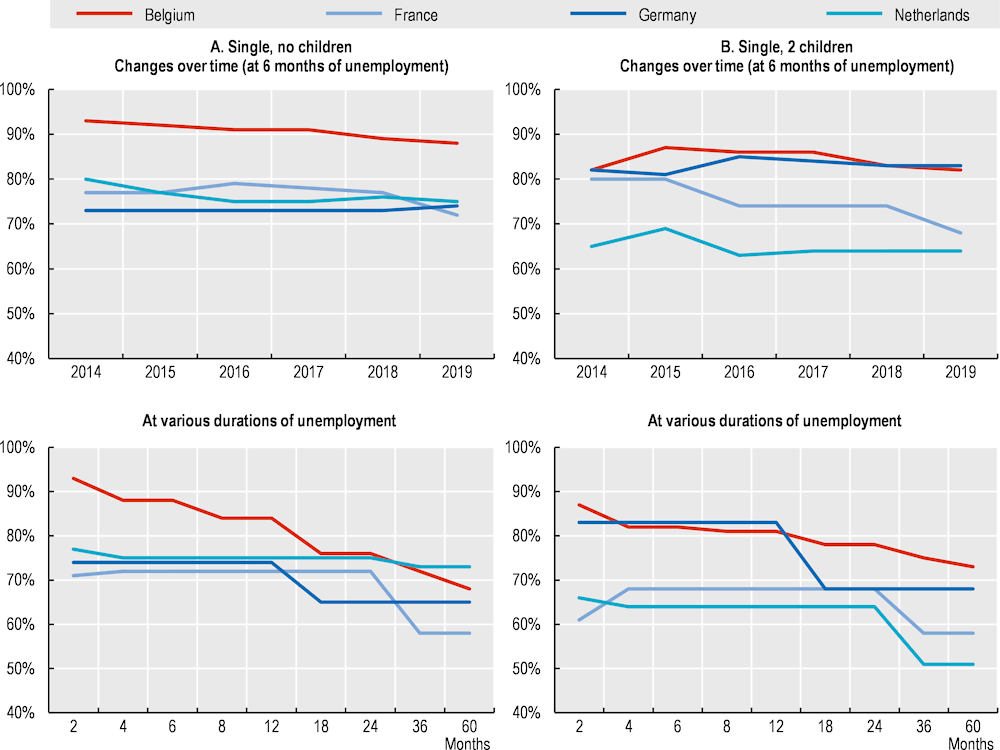

Participation tax rates in Belgium are high for individuals earning 67% of the average wage in their new job, regardless of whether they have children or not. Figure 4.14 illustrates this point by comparing single adults with no children to single adults with two children. The figure makes comparisons to neighbouring countries France, Germany and the Netherlands, as well as over time (for an individual unemployed for six months). The metric presented is the Participation Tax Rate (PRT), which measures the proportion of earnings that are lost to either higher taxes or lower benefit entitlements when a jobless person takes up employment – i.e. the financial disincentives to participate in the labour market. The PRT is almost always higher in Belgium than in neighbouring countries, and is particularly high for single individuals with no children in the first year of unemployment.

Figure 4.14. Participation tax rates in Belgium are high

Note: The Participation Tax Rate (PRT) measures the proportion of earnings that are lost to either higher taxes or lower benefit entitlements when a jobless person takes up. Panel A shows the participation tax rate for single individuals with no children: i) over time (2014‑19) and ii) at various points in the unemployment spell (from zero to 60 months). Panel B does the same form single parents with two children.

Source: OECD Benefits, Taxes and Wages Database, http://www.oecd.org/social/benefits-and-wages/.

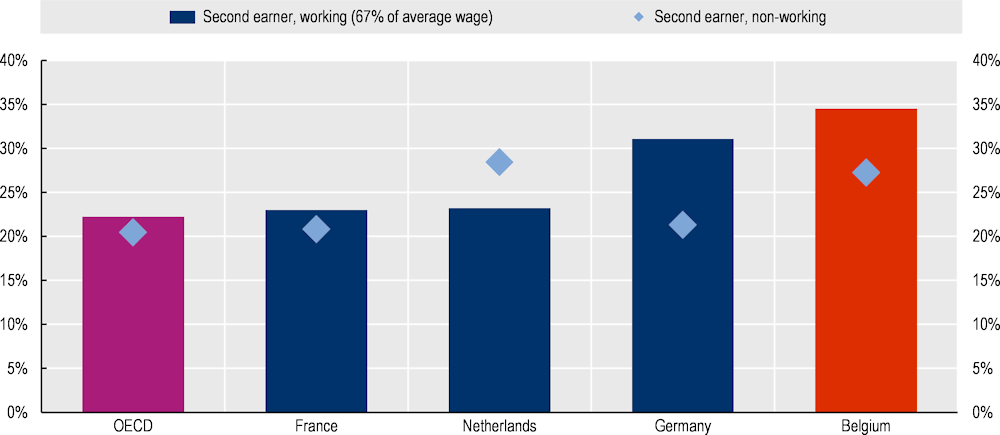

Previous OECD work (2020[36]) has shown that second earners also face strong tax disincentives to work, which can lower female labour force participation in particular (Figure 4.15). In general, family-based tax systems create work disincentives for second earners, when marginal tax rates are progressive (OECD, 2018[37]). While the Belgian system is based on individual taxation, it uses a partial splitting system where a notional amount of income can be transferred between spouses if one earns 30% or less of the total family income. With the employment of the second earner, the part of the primary earner’s income that had been attributed to the spouse reverts to the primary earner (Thomas and O’Reilly, 2016[38]). While about half of the beneficiaries of this system are already retired or close to retirement, it could be a barrier to the employment of certain vulnerable groups of female workers. Such tax disincentives could be lowered or abolished.

Figure 4.15. Tax disincentives for second earners in Belgium are high

Note: The chart shows income tax and employee social security contributions as a percentage of gross wage earnings: i) for a married family with two children, where the first earner earning 100% of the average wage and the second earner earning 67% of the average wage; and ii) for a married family with two children, with only one earner earning 100% of the average wage. Taxes in Belgium are assessed on a household bases, so the chart shows how much more a household would pay in taxes if the second person moved into work.

Source: OECD (2019[35]), OECD Taxing Wages 2019, https://dx.doi.org/10.1787/tax_wages-2019-en.

4.4. The unemployment benefit system could be reformed to strengthen work incentives

Work incentives are also determined by the unemployment benefit system. The challenge is to put in place a system which, on the one hand, provides adequate protection to the unemployed, and on the other, maintains incentives to look for work throughout the unemployment spell. Key factors in determining this balance include ease of access to unemployment benefits, their duration, the net replacement rate of income, as well as how wages are taxed when people enter work (see Section 4.3.2).

It is relatively difficult to access unemployment benefits in Belgium. However, once individuals are in receipt, there are fewer conditions imposed on individuals to continue receiving them. In particular, availability requirements (i.e. requirements around people’s availability to start work should a job offer be made) are not particularly stringent and individuals have more leeway than in other countries for refusing job offers. While benefit duration is unlimited in Belgium, this is de facto also the case in neighbouring countries where unemployment assistance is offered once unemployment insurance runs out – although unemployment assistance in those countries tends to be less generous than unemployment insurance. More generally, in Belgium, the generosity of unemployment benefits is somewhat higher than in neighbouring countries. In neighbouring countries, the starting replacement rate tends to be lower, and there is also a sharp drop when individuals move on to unemployment assistance.

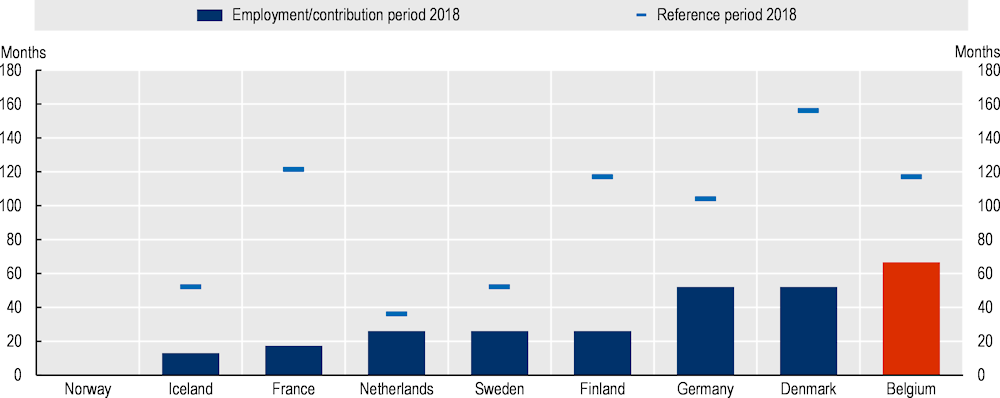

4.4.1. It is relatively difficult to access unemployment benefits in Belgium

The ease of access to unemployment insurance (UI) is determined both by the employment/contribution requirements as well as by the reference period over which these contributions are calculated. In Belgium, the employment/contribution period is relatively long (468 days, or approximately 67 weeks) compared to other countries (e.g. 17 weeks in France, 26 in the Netherlands, and 52 in Germany) (Figure 4.16). This makes UI more difficult to access in Belgium. By contrast, the reference period over which these contributions are calculated is also relatively long (27 months, or approximately 117 weeks), which makes it easier to access unemployment insurance. In some ways, Belgium’s system is more similar to that of Germany’s, while unemployment insurance is considerably easier to access in France, and more difficult to access in the Netherlands.

Figure 4.16. It is relatively difficult to access unemployment benefits in Belgium

Note: In some countries, eligibility depends on employment only, in others it depends on contributions, while in others still it depends on both. Not all countries express previous employment/contribution conditions in weeks, and therefore the figures presented above are approximate only. Assumptions made for the conversion to weeks include: 1 year = 12 months = 52 weeks. For the Netherlands, the calculation is based on eligibility for the short-term benefit. In Sweden, the individual also needs to have been a member of an insurance fund in the last 12 months. In Finland, one week equals a minimum of 18 hours only. In Denmark, an additional requirement is the payment of a membership fee and the work needs to have been full-time. In Norway, prior work income needs to have been 24% of the average wage in the preceding calendar year, or 49% in the three preceding years.

Source: OECD Comparative Tax-Benefit Policy Tables.

4.4.2. Once an individual is entitled to unemployment insurance, recipients in Belgium face fewer conditions and responsibilities to keep their benefit than in other countries

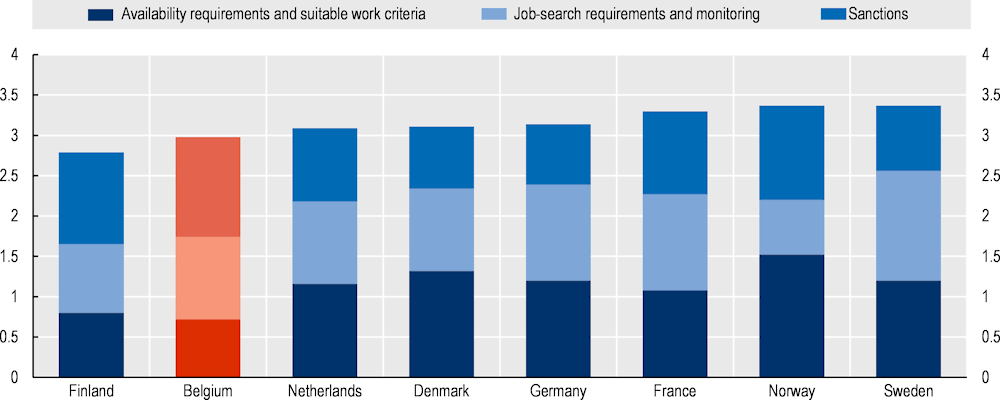

Unemployment benefits are not available unconditionally. Instead, a range of provisions tie benefit receipt to past or current behaviour of benefit claimants (availability requirements, job-search conditions and sanctions). These conditions are a central design feature of “rights and responsibilities” approaches and of activation strategies that link support to individuals’ own effort to re-establish self-sufficiency. In Belgium, such eligibility criteria are, overall, less strict than in other countries (Figure 4.17).

Figure 4.17. Eligibility criteria for unemployment insurance are relatively less strict in Belgium

Source: Immervoll and Knotz (2018[39]), “How demanding are activation requirements for jobseekers?”, https://doi.org/10.1787/2bdfecca-en.

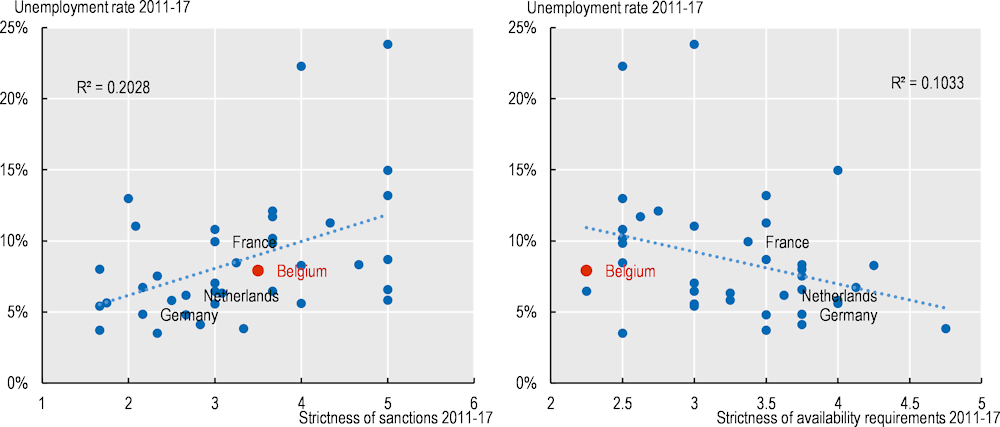

Relative to other countries, availability requirements in Belgium are not particularly stringent and could be tightened. Availability requirements include: availability for work during participation in ALMPs, demands on occupational mobility, demands on geographical mobility, and other valid reasons for refusing job offers. It is particularly on the latter (other valid reasons for refusing job offers) that the Belgian system is not very strict. Yet there is evidence that countries that have strict availability requirements have lower unemployment rates (Figure 4.18) – although this is a mere correlation and does not strictly prove causation.

By contrast, the strictness of sanctions in Belgium tends to be quite high compared to other countries – in particular sanctions for repeated refusal of job offers and sanctions for first/repeated refusals/failures of ALMP participation/PES interventions. Yet countries that have strict sanctions do not tend to have lower unemployment rates (Figure 4.18). Of course, these indicators only relate to the theoretical strictness of sanctions, and say nothing about whether they are applied in practice.

Figure 4.18. The unemployment rate is positively correlated with the strictness of sanctions, but negatively correlated with the strictness of availability requirements

Note: The 2017 data on eligibility criteria are from (Immervoll and Knotz, 2018[39]), the 2011 and 2014 data are from (Venn, 2012[40]) and (Langenbucher, 2015[41]), respectively. Data on unemployment rates for 2017 are for Q1‑3 as taken from the EC AMECO database and OECD Short-Term Labour Market Data.

Source: Adapted from Immervoll and Knotz (2018[39]), “How demanding are activation requirements for jobseekers?”, https://doi.org/10.1787/2bdfecca-en.

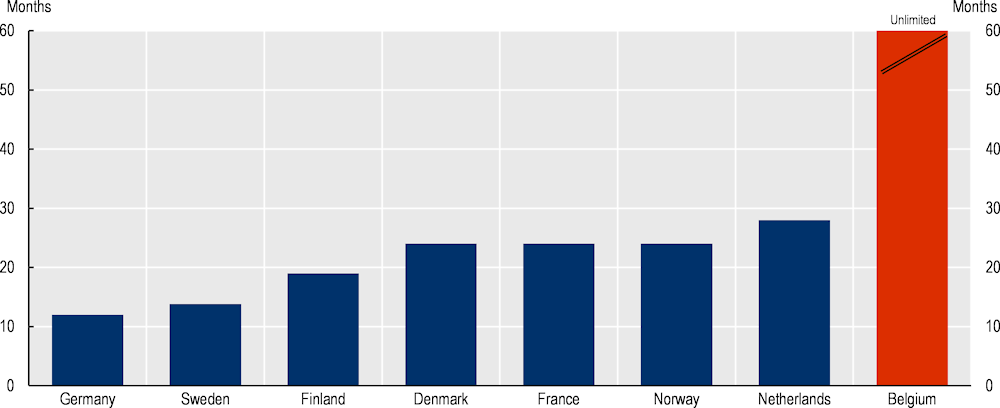

4.4.3. Belgium is the only OECD country with unlimited duration unemployment benefits, but in other countries individuals continue to receive means-tested unemployment assistance

Across OECD countries, the median maximum duration of unemployment insurance is 12 months (Figure 4.19). While Belgium is the only country where the duration of unemployment insurance is unlimited, it is important to point out that in many countries the duration of unemployment benefits is de facto unlimited because, once individuals run out of unemployment insurance, they are moved onto unemployment assistance which often can be claimed indefinitely (albeit with lower replacement rates and subject to a means test, so that coverage will be much lower).

Figure 4.19. Belgium is the only OECD country with unlimited duration unemployment benefits

Source: OECD Comparative Tax-Benefit policy tables, 2018, https://www.oecd.org/social/benefits-and-wages/.

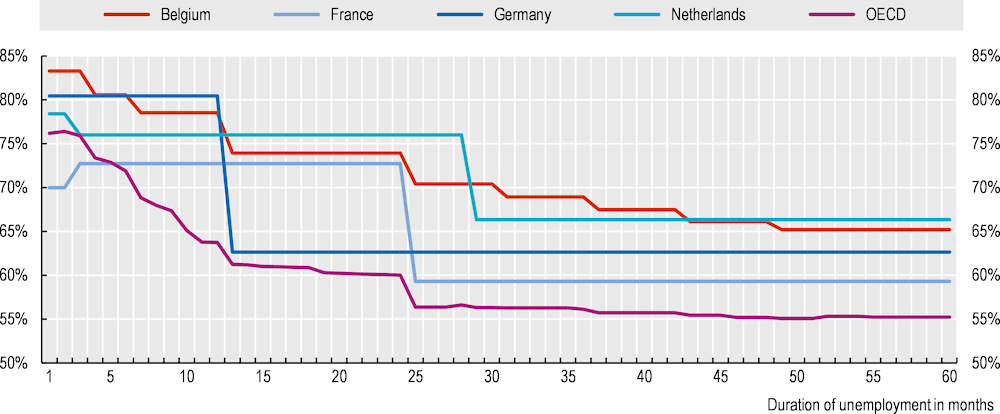

4.4.4. Compared to neighbouring countries, replacement rates in Belgium are on the high side, particularly for low-paid workers

Net replacement rates (i.e. the proportion of previous in-work income that is maintained in unemployment) for low-paid workers are higher in Belgium than on average in the OECD, with the difference growing over the first year of unemployment (Figure 4.20). This partly reflects the time-unlimited access to unemployment benefits in Belgium, but also a higher starting point. Compared with neighbouring countries, the Belgian system is on the generous side. Both Belgium and Germany have generous replacement rates in the first year of unemployment but, after that, the replacement rate drops significantly in Germany (as unemployment insurance runs out), while Belgium’s schedule starts following that of the Netherlands more closely (albeit with more steps). In France, replacement rates also drop significantly when unemployment insurance runs out (i.e. after two years of unemployment).

Figure 4.20. Replacement rates in Belgium are on the high side, particularly for low-paid workers

Note: Net replacement rates refer to the net household income during unemployment as a fraction of total net household income before unemployment. Household income during unemployment includes unemployment insurance, unemployment assistance, family benefits, social assistance and housing benefits. The net replacement rates are computed for households where one adult aged 41 and with full working history becomes unemployed and their previous earnings equal 67% of the average wage. They are an average across six family types: single, single earner couple and dual earner couple (all with and without children).

Source: OECD (2020[36]), OECD Economic Surveys: Belgium 2020, https://dx.doi.org/10.1787/1327040c-en.

The replacement rate schedule reflects a reform which Belgium undertook in 2012 to strengthen work incentives for the long-term unemployed. It extended the number of workers facing declining unemployment benefit (UB) schedules and made the decline steeper. For many workers, this was achieved by increasing the replacement rate for the first few months (from 60% to 65% of recent earnings), while decreasing the effective replacement rates later in the spell. The reform made the long-term level of UB independent of previous earnings for all unemployed (before the reform, this was only the case for long‑term cohabitants), therefore moving towards a system aiming to provide a minimum level of income over the long-term, rather than smoothing income variations per se. As pointed out before, despite these reforms, the participation tax rate in Belgium (i.e. the share of additional earnings from work that is lost due to reduced benefits and increased taxes) for some household types remains on the high side compared to neighbouring countries.

According to a recent OECD (Hijzen and Salvatori, 2020[42]) assessment, there is further scope for Belgium to reduce work disincentives, in particular for the long-term unemployed, while maintaining or even increasing the current level of income support. For example, to ensure that the long-term level of support for the unemployed reflects household needs more closely, most OECD countries limit the duration of unemployment insurance benefits, while allowing the unemployed to move to either means-tested unemployment assistance or social-assistance programmes after their expiration. Similarly, Belgium could switch from flat benefits to means-tested benefits for the long-term unemployed.

4.5. Activation measures should be better targeted and give more weight to training

Work incentives, job-search requirements and benefit sanctions can strengthen people’s motivations to look for work. In addition, countries provide a range of activation measures that help workers overcome employment barriers (e.g. training and employment rehabilitation) and expand the set of earnings opportunities that are available and accessible to them (labour market intermediation and programmes that support labour demand through wage subsidies or direct job creation).

Activation strategies, which were generally launched in OECD countries in the 1990s with the aim of combatting high and often persistent unemployment, vary significantly across countries, depending on underlying labour market conditions and the capacity of public employment services. Evidence suggests that, if well-designed, such strategies have contributed to better labour market outcomes, by ensuring that benefit recipients have a better chance of obtaining employment and minimising the risks that high and/or long-lasting benefits significantly damage work incentives.

Belgium spends a relatively large share of its GDP on active labour market policies. In 2017, Belgium dedicated 0.88% of GDP to active measures (i.e. excluding spending on passive measures such as out‑of‑work income maintenance and support, as well as early retirement). This is higher than in France (0.87%), Germany (0.65%) and the Netherlands (0.64%). To some extent, this will reflect higher unemployment in Belgium, but even per unemployed person Belgium spends more than in neighbouring countries (EUR 10 900, compared to 10 800 in the Netherlands and EUR 7 140 in France). But some countries with strong labour market outcomes spend even more than Belgium: Finland (0.99%), Sweden (1.25%) and Denmark (1.96%).

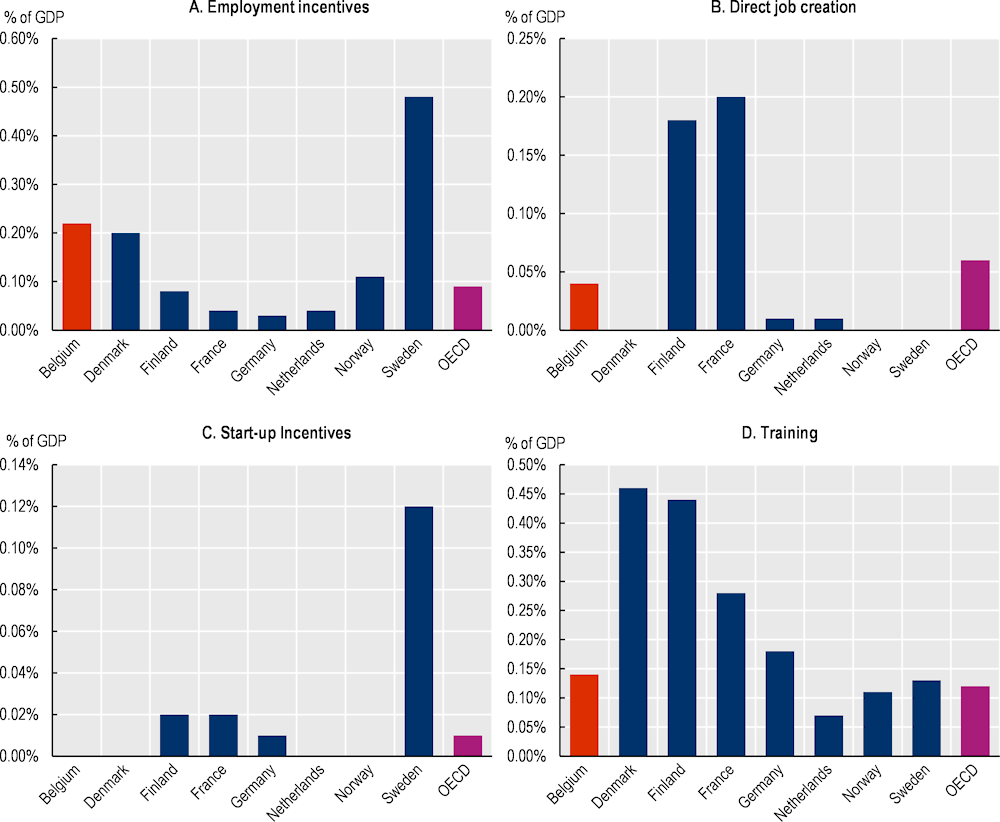

Belgium’s spending on active policies is heavily skewed towards measures that are more likely to be suffering from large deadweight losses. A significant share of the budget for active labour market policies is devoted to employment incentives (Sweden is also an outlier in this) (Figure 4.21). As pointed out previously, Belgium should ensure that employment incentives are targeted only on the most vulnerable groups so as to reduce such deadweight loss.

Another difference between Belgium and other countries is that Belgium spends comparatively less on training. Yet training can improve employability and could also help address the skills mismatch that exists today. Evaluations from OECD countries that have tracked employment outcomes for five years or more after entry to training programmes find evidence that they have a long-term positive impact on participants’ employment and earnings (OECD, 2015[43]). Ideally programmes are focused on identified employer needs, but there is also some evidence in favour of classroom and preparatory programmes. So some re‑balancing of activation measures towards more training would appear to be desirable in the Belgian context.

The effectiveness of active labour market policies could also be improved by extending the use of statistical tools for the profiling of individualised risk (OECD, 2020[36]). This would help target more costly and intensive services at jobseekers who are more at risk of becoming long-term unemployed. Statistical profiling tools rely on a statistical model to predict labour market disadvantage as opposed to rule-based profiling, which uses eligibility criteria, or caseworker-based profiling, which relies more on judgement, to classify jobseekers into client groups. Statistical profiling tools are not widely used in Belgium. However, as part of a new contact strategy that has been rolled out in October 2018, the Flemish Public Employment Service has developed a statistical profiling model, called “Next Steps” (Hijzen and Salvatori, 2020[42]). Greater use of such tools should be made in all regions in Belgium.

Figure 4.21. Belgium’s spending on activation policies could be rebalanced towards training

Note: Employment incentives include: recruitment incentives, employment maintenance incentives and job rotation and job sharing. Training includes institutional as well as workplace training. For further information, consult: http://www.oecd.org/els/emp/Coverage-and-classification-of-OECD-data-2015.pdf.

Source: OECD Labour Market Programmes Database, https://www.oecd.org/employment/emp/employmentdatabase-labourmarketpoliciesandinstitutions.htm.

4.6. Educational attainment and participation in lifelong learning need to be boosted

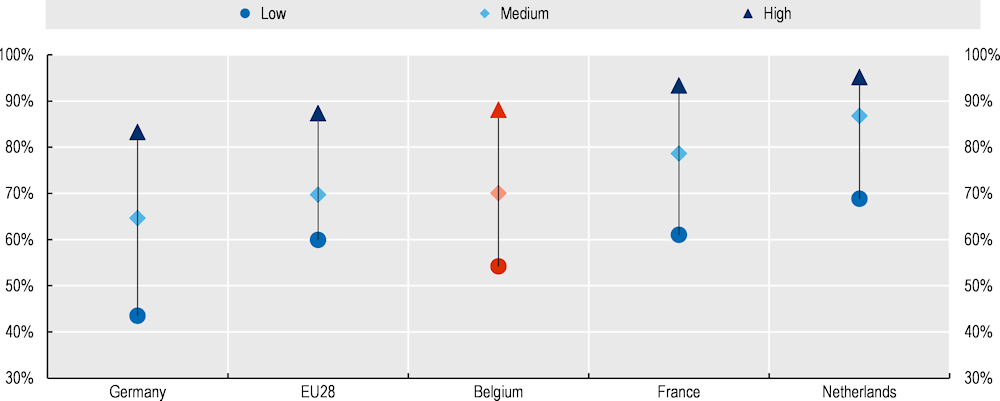

Any increase in public expenditures on training should go hand in hand with measures to boost educational attainment overall and to encourage lifelong learning. As shown in the main findings and policy pointers section of this report, Belgium has a higher share of low-educated workers than its neighbouring countries. While the share of low-educated workers in Flanders is around the European average (and similar to that in both Norway and Denmark), the share in both the Brussels-Capital Region and Wallonia is among the highest in Europe. Participation in adult learning in Belgium (70%) is similar to the EU‑28 average, and below participation in France (79%) and the Netherlands (87%). Among low-educated workers, participation in adult learning in Belgium (54%) is below the EU‑28 average (60%) (Figure 4.22). While a discussion of how educational attainment and participation in lifelong learning should be boosted in Belgium is beyond the scope of this report, previous OECD analysis has already shed light on this issue (OECD, 2019[44]; OECD, 2020[45]; OECD, 2020[36]). The main findings and policy pointers section of this report repeat some of the recommendations made in those publications.

Figure 4.22. Participation in adult learning among the low-educated in Belgium is low

Note: EU28 is a weighted average.

Source: Eurostat, Adult Education Survey, 2016, https://ec.europa.eu/eurostat/web/microdata/adult-education-survey.

4.7. Belgium’s Employment Protection Legislation risks permanently trapping many low-educated workers in less stable contract types

Adjusting the level and composition of the workforce to adapt to changing demand conditions and technology is vital for effective businesses operation, and therefore for productivity and economic growth. But job displacement entails significant costs for the workers concerned in terms of earning losses and the possible obsolescence of their job-specific skills and experience. In addition, social costs can also be important (e.g. benefit payments, and expenditure on job-search assistance and active labour market programmes).

Employment protection legislation (EPL), that is the rules governing the hiring and firing of workers, has typically been designed to protect jobs and increase job stability, with the aim of preserving the individual worker and society from some of the above-mentioned costs. A related objective of EPL is to make employers internalise the social cost of dismissing workers – without which the level of turnover would be inefficiently high. However, in some cases, constraints imposed on firms might be excessive, hindering the effectiveness of labour market flows and the allocation of labour to the most productive jobs, thereby harming productivity and growth.

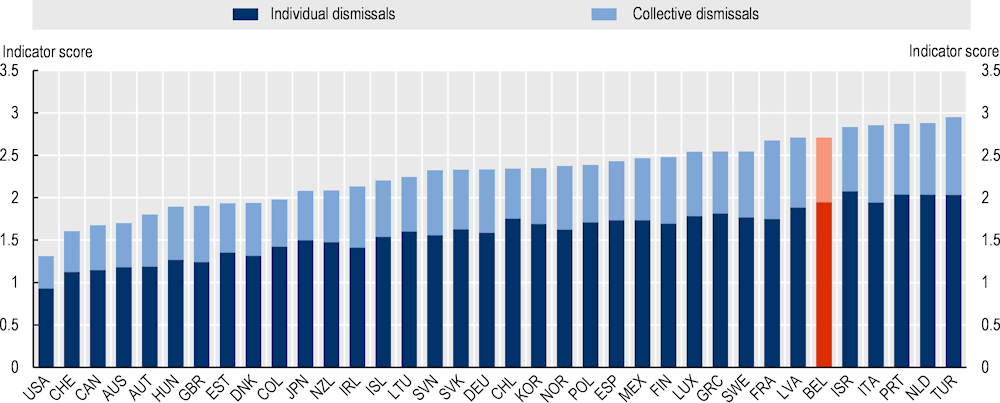

The regulation of individual dismissals of regular workers in Belgium is among the strictest in the OECD, along with the Netherlands and France (Figure 4.23). Employment protection legislation in Germany is less strict than in Belgium. What is particularly striking in Belgium is the high level of severance pay. At nine months, severance pay in Belgium equates to 0.81 months of pay, compared to 0 in both Germany and the Netherlands, and 0.20 months in France. Germany does not have any severance pay at all, even at long tenure, while in France and the Netherlands severance pay increases steeply with tenure. At 20 years, severance pay equals 7.16 months in Belgium compared to 6.90 in France and 10.83 in the Netherlands. With regards to the enforcement of unfair dismissal, workers in Belgium have a very long time to make a claim: one year, compared to two months on average across OECD countries (in France, it is also one year, but it is only three weeks in Germany and two months in the Netherlands) – which can create uncertainty for employers.9 Regulations on collective dismissals in Belgium are also relatively strict by OECD standards, although not as stringent as in France or in the Netherlands.

Some have argued that these reforms have led to an increase in temporary employment in Belgium (and Chapter 2, Section 2.2.1 does indeed show a small but steady increase in the share of workers on fixed‑term contracts). Nautet and Piton, (2019[46]) say that “up until 2014, the proportion of [fixed-term contracts] within total salaried employment in Belgium hardly changed at all, oscillating around 8%. Since then, however, it has been rising, reaching 10% in 2017 […] The start of this increase coincided with the abolition of the “trial period” clause, which about as part of the legislative move to unify the legal status of blue-collar and white-collar workers in Belgium. At the same time, the financial conditions for terminating a permanent contract were eased as regards terminating white-collar employment but rendered more stringent for the dismissal of blue-collar workers. From that moment, many employers came to prefer to hire new employees on fixed-term contracts, in order to assess whether they match the required profile.”

To counter some of this effect and to encourage hiring on permanent contracts, the notice period applicable at the start of an employment contract was reduced in May 2018. The notice period for new employees who have been in the job for three months or less was reduced to just one week. This reform is not taken into account in the OECD EPL indicators since they only assess notice periods at nine months, four years and 20 years of tenure, respectively.

Figure 4.23. The regulation of individual dismissals of regular workers in Belgium is among the strictest in the OECD

Note: Aggregate indicators assign a weight of 5/7 to individual dismissals and 2/7 to collective dismissals.

Source: OECD Employment Protection Database, https://www.oecd.org/employment/emp/oecdindicatorsofemploymentprotection.htm.

High employment protection on permanent contracts is unlikely to affect the employment rate of low‑educated workers in Belgium. However, if there are large disparities in protection across contract or types, this could lead to persistent divides between different types of workers and contribute to labour market segmentation or duality. It could permanently trap low-educated workers in less stable contract types.

In Belgium, there used to be differences in employment protection legislation between blue-collar (arbeiders / ouvriers) and white-collar (bedienden / employés) workers. A reform in January 2014 introduced a single status to abolish regulatory differences between the two types of workers, which is to be welcomed. At the same time, however, these regulatory changes increased the strictness of dismissal rules for permanent contracts and, therefore, the gap with temporary workers – particularly for blue-collar workers (who are disproportionately low-educated). Following the reform, the burden of proof for an unfair dismissal is now always shared between the parties (it was previously with the individual for cases involving white-collar workers) and the compensation awarded is now the same for both types of workers (it increased for blue-collar workers, while it decreased for white-collar ones). The reform also abolished the trial period and expanded the use of outplacement regimes10 following an individual dismissal, which was previously restricted to older workers only.

Later reforms made employment protection against individual dismissal even more stringent. Since April 2014, the reason for the dismissal needs to be provided upon request of the employee and, in December 2016, employers need to put in place a “reintegration programme” for workers who have been on long‑term leave of absence and to find suitable work that they can do. At the same time, Belgium somewhat lowered restrictions on the hiring of temporary workers. In particular, in 2013, Belgium extended the reasons for the use of temporary work agency employment by allowing firms to hire TWA workers with the view to offer them permanent employment at the end of the temporary posting.

In sum, while stringent dismissal rules for permanent employees may not reduce overall employment for low-educated workers in Belgium, it is likely to encourage employers to hire such workers on fixed-term contacts. This is particularly so since there are relatively few restrictions on hiring on fixed-term contracts in Belgium – particularly compared to France. In France, the valid use of fixed-term contracts is limited to specific cases (there are no such restrictions in Belgium) and also their maximum duration is limited to 18 months (unlimited for the first contract in Belgium). As Figure 4.24 shows, Belgium combines stringent regulation on the dismissal of regular works with average restrictions on hiring workers on fixed-term contracts. By comparison, Germany is right on the OECD average for both, while France has stringent regulations for both. The Netherlands, on the other hand, combines stringent regulation on the dismissal of permanent employees with relatively light regulation for hiring on fixed-term contracts, which partly helps to explain duality in the Dutch labour market (OECD, 2019[47]). Going forward, Belgium may wish to consider easing regulation on the dismissal of regular workers (e.g. through lowering severance pay or reducing the time individuals have to claim for unfair dismissal). Such reforms would make employers less reluctant to take workers on permanent contracts and could help improve working life stability of low‑educated workers.

Figure 4.24. Belgium combines stringent dismissal rules for permanent employees with few restrictions for hiring on fixed-term contracts

Note: Range of indicator scores: 0‑6. The indicator for dismissals of regular workers is for individual dismissals only, as the hiring indicator for temporary workers is also based on hiring one worker.

Source: OECD Employment Protection Database, https://www.oecd.org/employment/emp/oecdindicatorsofemploymentprotection.htm.

References