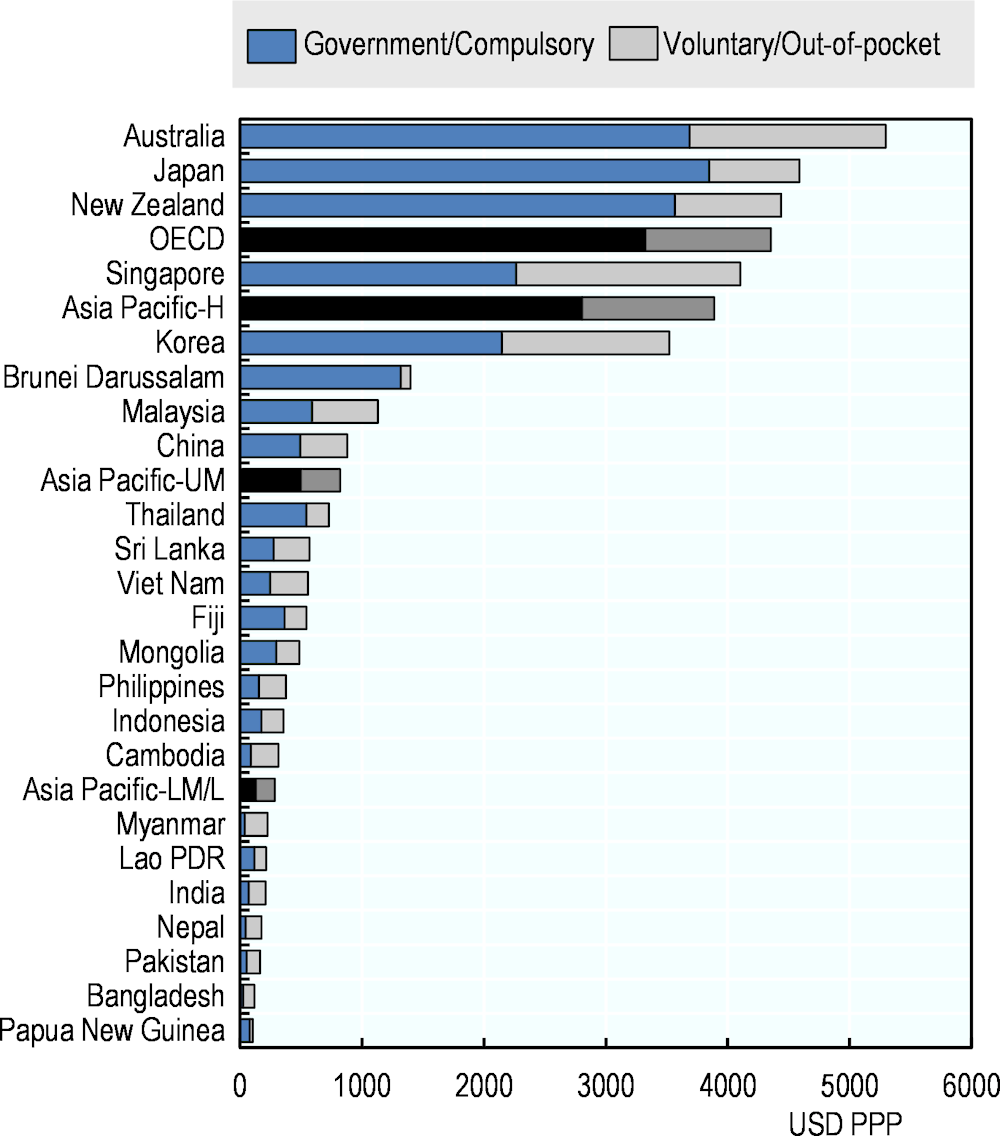

Across Asia-Pacific countries, per capita health spending continued to rise prior to the COVID‑19 pandemic. Low- and lower-middle‑income Asia-Pacific countries per capita health spending increased by 65% between 2010 and 2019, while in upper middle countries it grew by 76% during the same period; spending in high-income countries also grew, but more modestly at 33%. Despite this, huge differences in per capita health care spending remained in Asia-Pacific countries in 2019 (Figure 6.1), ranging from only 105 international dollars (USD PPPs) in Bangladesh to 5 294 international dollars (USD PPPs) in Australia. For comparison, average OECD current health spending per capita in 2019 was around 15 times that of the low-income countries in Asia-Pacific (4 353 versus 286 USD PPPs).

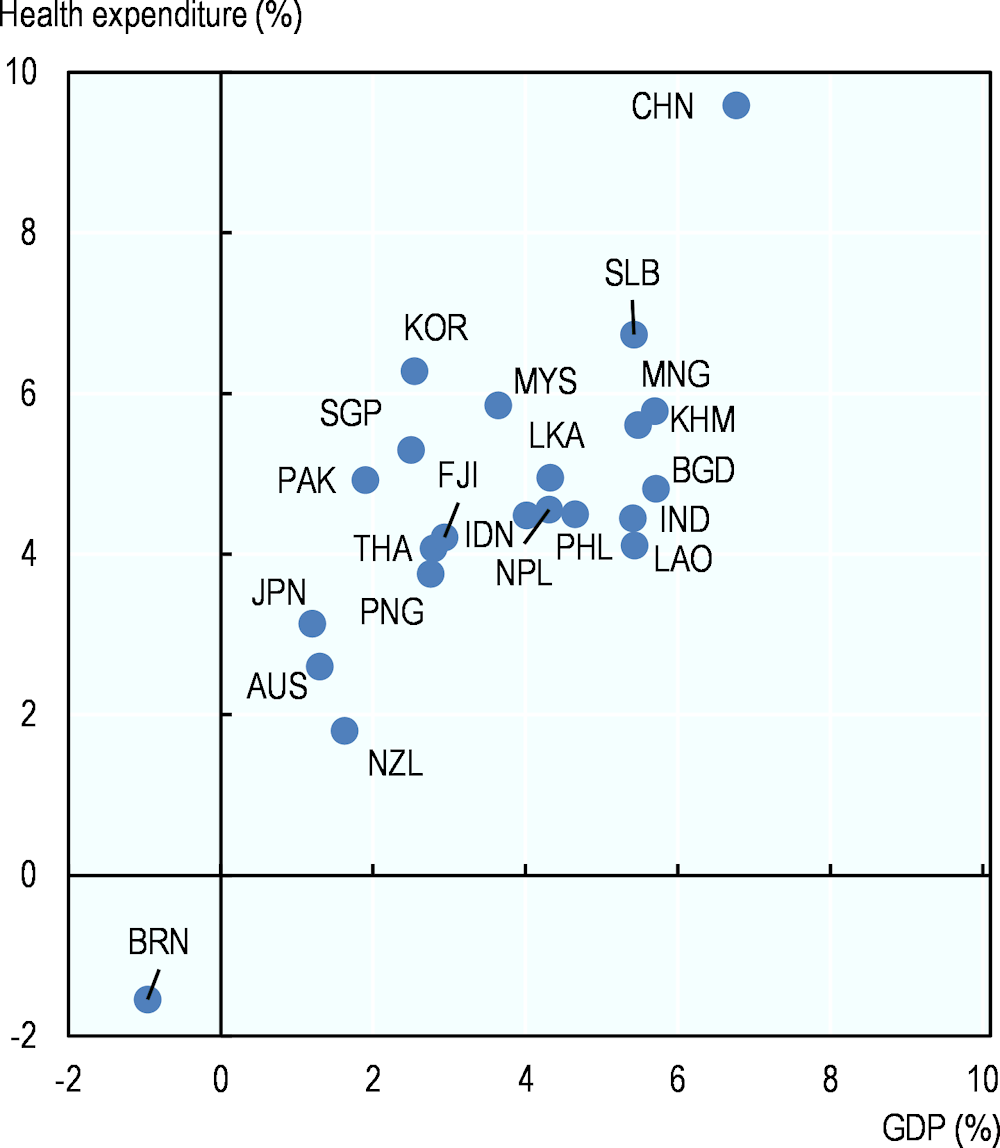

How much countries spend on health care as a share of GDP over time can be ascribed to both changes in health spending and economic performance. The health care sector continued to expand faster than the overall economy in Asia-Pacific, resulting in an increasing share of the economy devoted to health. On average, between 2010 and 2019, the growth rate in per capita health spending in real terms was 4.7% per year; higher than the 3.6% observed for gross domestic product (GDP) (Figure 6.2). All countries above the diagonal line in Figure 6.2 reported that health expenditure has grown faster than the economy. This means that the share of health care expenditure in all GDP expenditure has continued to increase. For both health spending and overall economic activity, growth in China was the strongest in the region – more than twice the average rate. By contrast, Brunei Darussalam was the only country to report a decrease in both per capita health spending and GDP in real terms between 2010 and 2019.

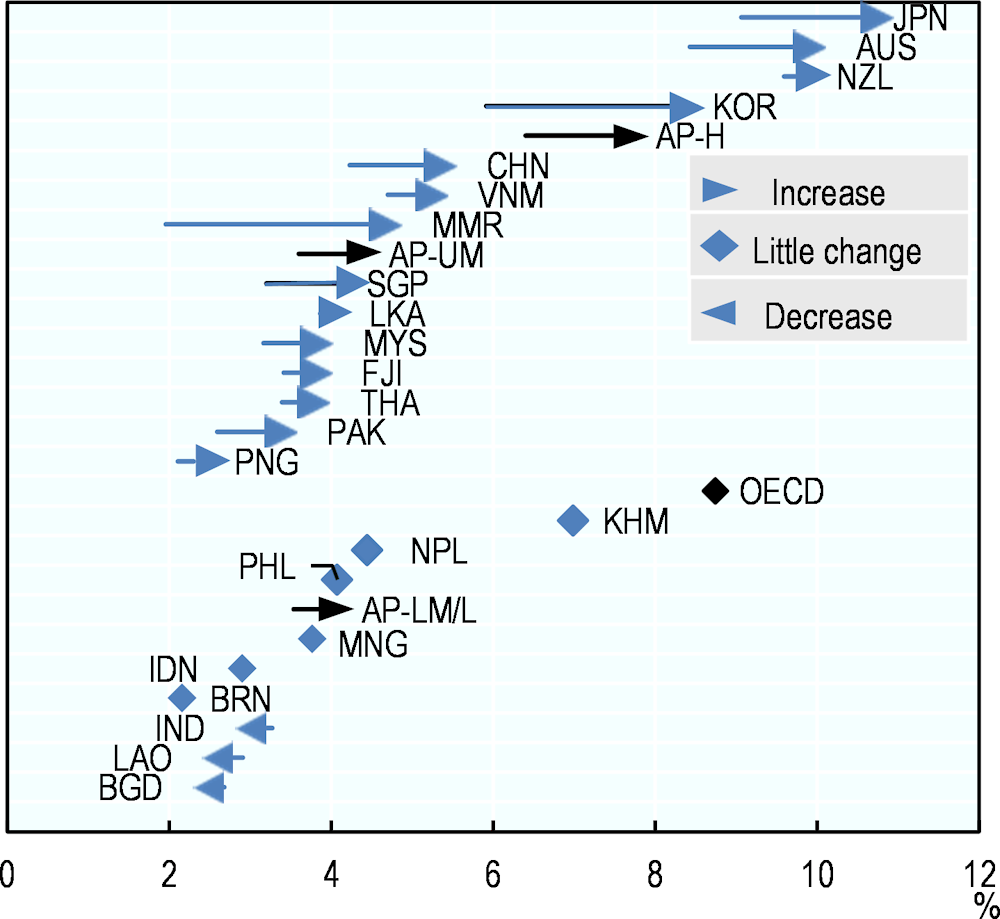

Health expenditure accounted for 3.9% of GDP in low- and lower-middle‑income countries in 2019, unchanged from 2010. Health expenditure accounted for 4.2% and 7.5% of GDP in upper-middle‑income and high-income Asia-Pacific countries respectively in 2019, an increase of 0.6 and 1 percentage point compared to 2010. In 2019, the share of GDP varied from a low of 2.2% in Brunei Darussalam up to 10.7% in Japan (Figure 6.3). Generally, the richer a country is, the greater the share of their income devoted to health care. The percentage of GDP spent on health across OECD countries is – on average – more than twice that of the Asia-Pacific low- and middle‑income countries (8.7% versus 4%) and 1 percentage point higher than that in high-income countries. Between 2010 and 2019, the share of health in relation to GDP declined by more than 3 percentage points in Solomon Islands, whereas it increased in Myanmar, China, Korea, Australia and Japan1 by more than 1 percentage point (Figure 6.3).

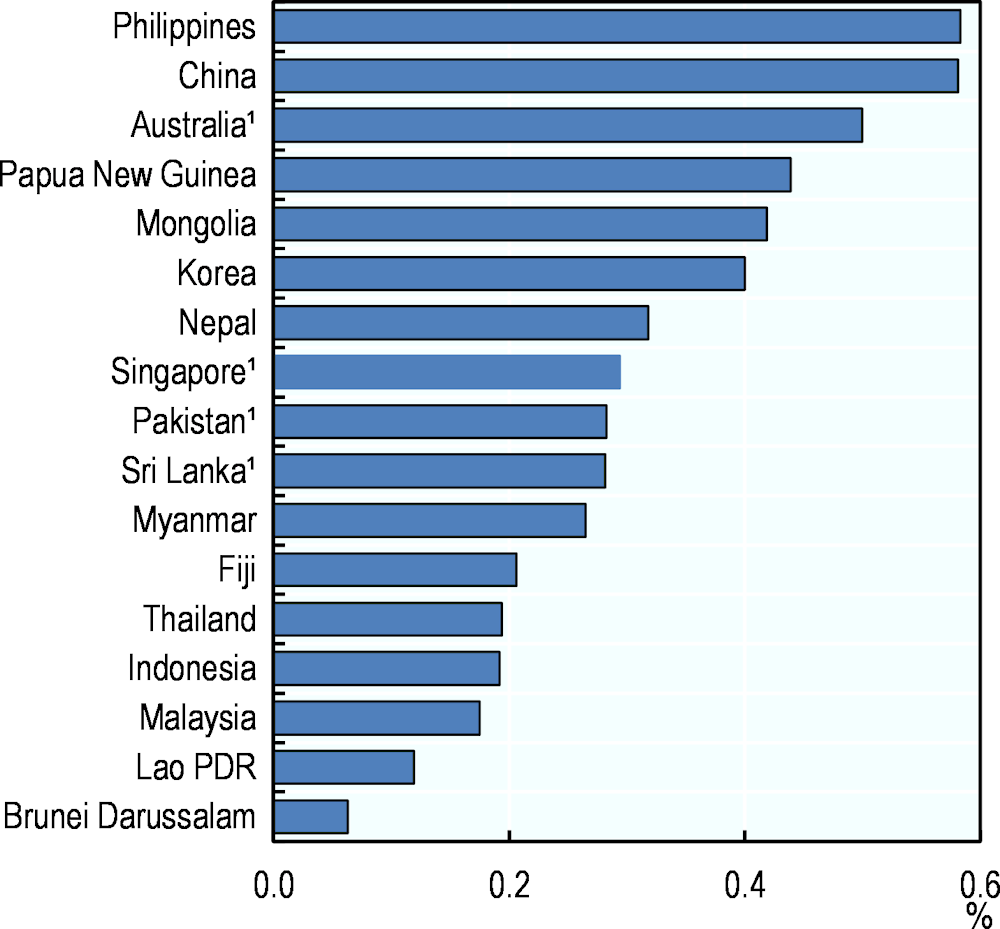

Although health systems remain a highly labour-intensive sector, capital has become an increasingly important factor of production of health services over recent decades, as reflected, for example, by the growing importance of diagnostic and therapeutic equipment or the expansion of information and communications technology in health care. However, capital investments in health tend to be more susceptible to economic cycles than current spending on health care. As a proportion of GDP, Philippines, China and Australia were the highest spenders on capital investment in 2019 with more than 0.5% of their GDP going on construction, equipment and technology in the health sector (Figure 6.4), whereas less than 0.1% of GDP was spent in capital investment in health in Brunei Darussalam in 2019.