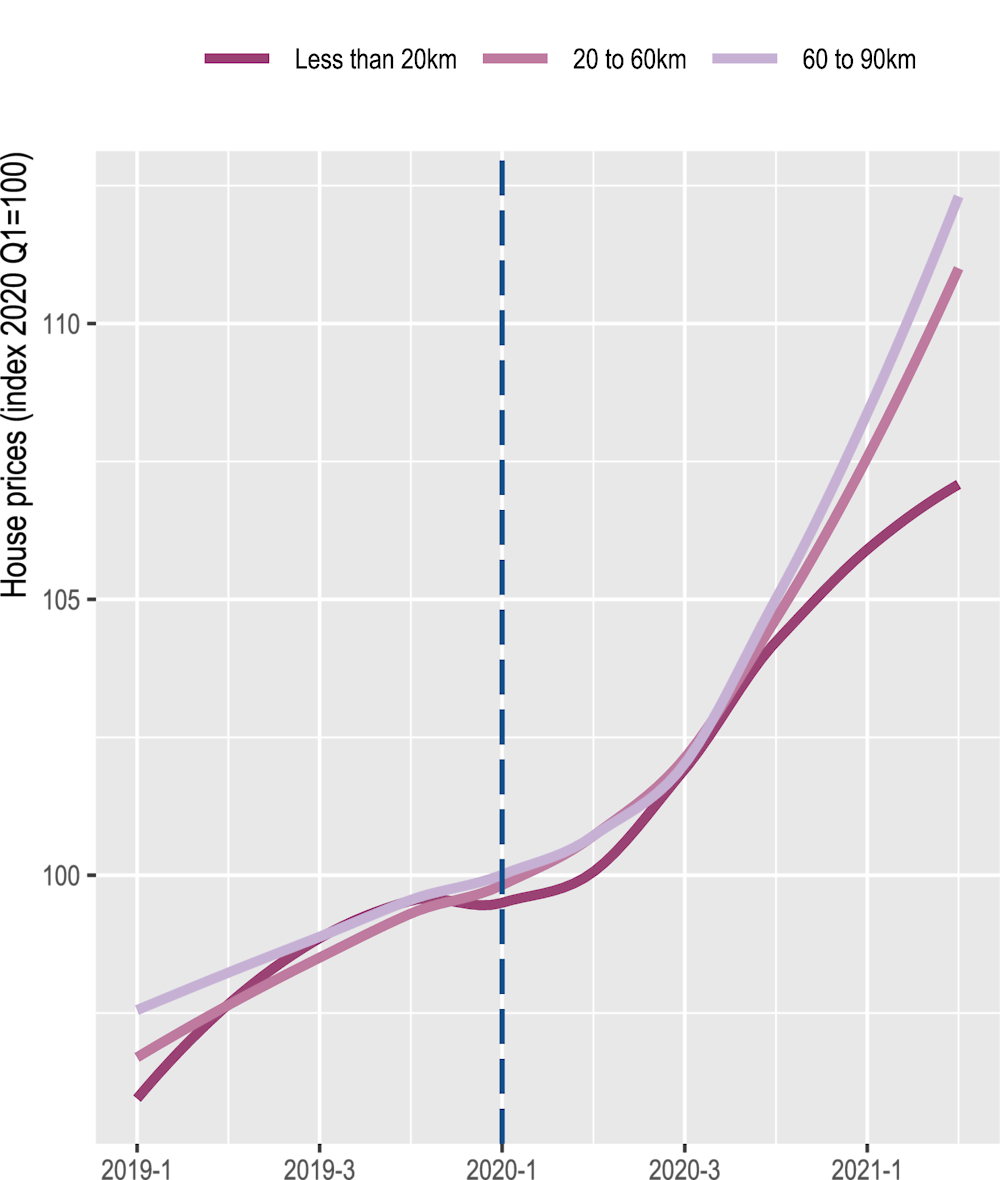

In metropolitan areas, buying a house in the city centre is 30% more expensive than in the suburbs, on average. However, after the COVID-19 outbreak and the rise of teleworking, house prices have been growing faster in the suburbs relative to the central neighbourhoods.

Adequate and affordable housing is key for well-being and inclusive and resilient societies. A lack of affordable housing can also limit economic opportunities linked to residential mobility and contribute to labour shortages in some places. In the 15 years before the COVID-19 pandemic, house prices increased dramatically in most OECD countries. Such a trend makes it hard for people, especially those living in large and dense agglomerations, to access sufficient-size and good-quality housing. Fast-growing house prices and overall housing costs also put extra pressure on the budgets and quality of life of people. Housing costs have increased constantly since 2005 and they account for the largest share of household expenditure (OECD, 2021).

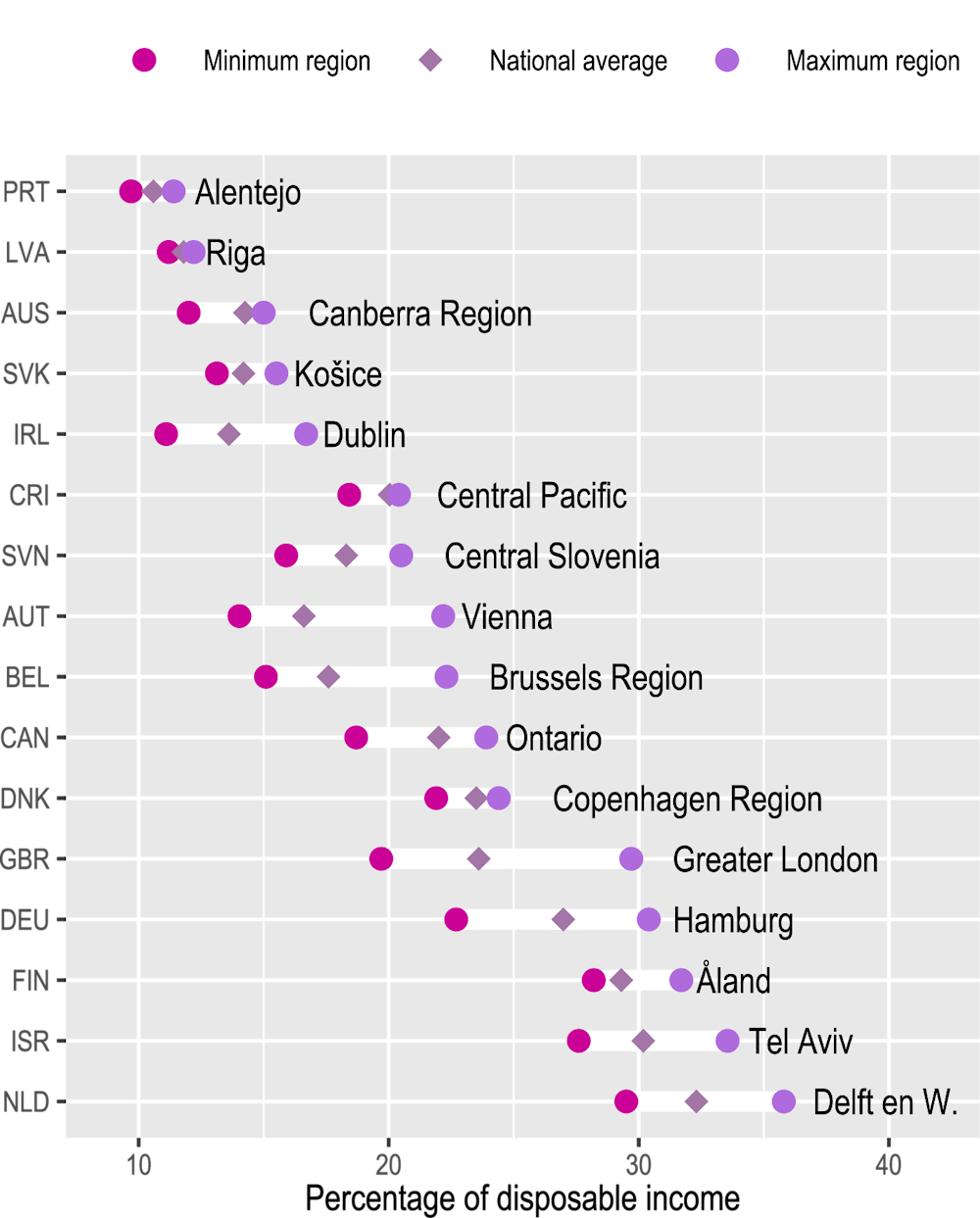

Households spend from one-tenth to one‑third of their disposable income on housing (including rent and maintenance), depending on the region and country where they live. Differences within countries suggest that households living in capital regions and, more generally, in metropolitan regions struggle the most to afford housing. Indeed, in half of the OECD countries with available data, capital-city regions are the most expensive in terms of housing. In those regions, households spend on average one-fifth of their disposable income on housing. Regional gaps in housing affordability are the highest in Austria, Belgium, Germany and the UK, where the share of household income spent on housing is 7 pp higher in the most expensive regions than in the least expensive ones (Figure 4.9).

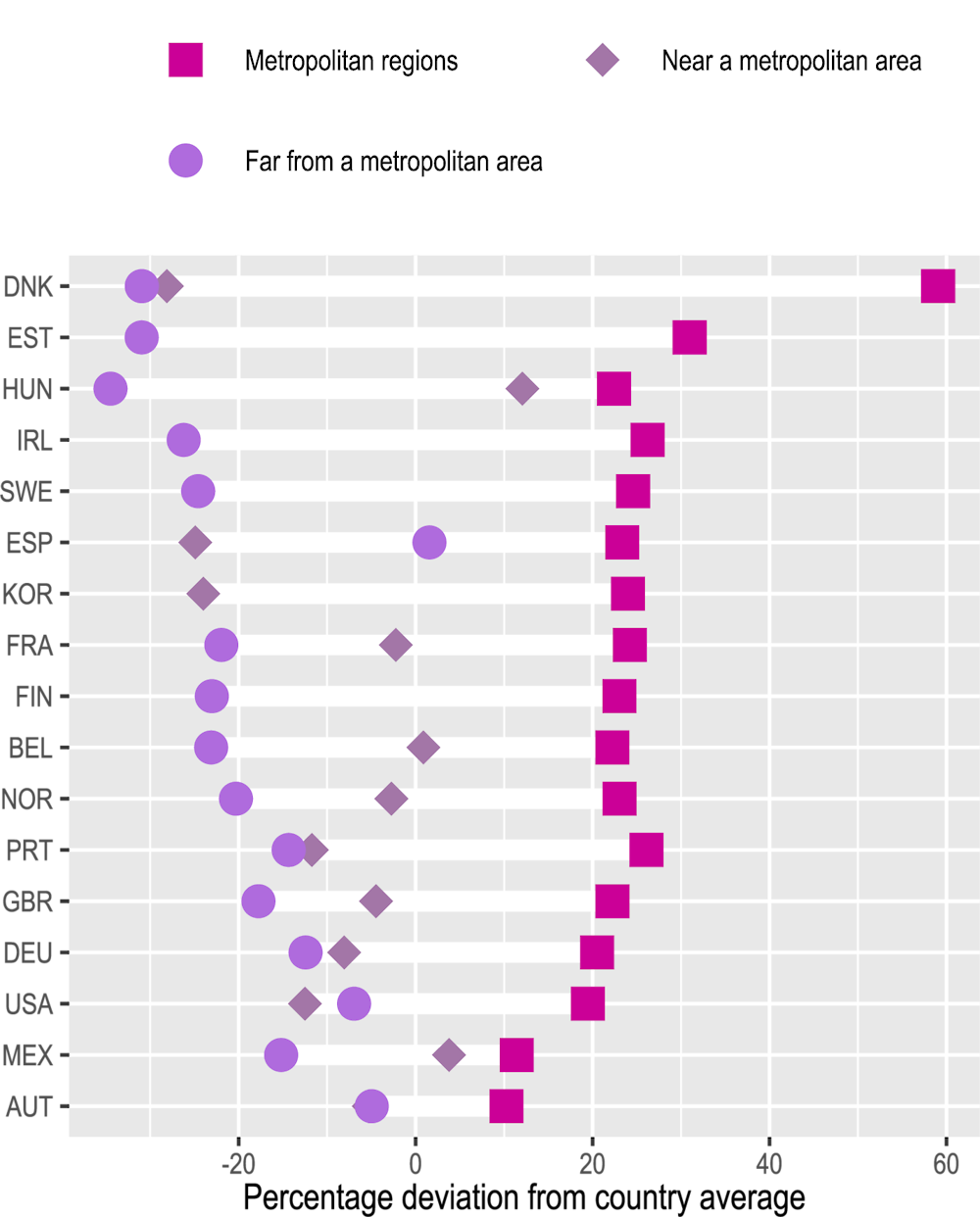

Stark differences in house prices across types of regions can also limit home ownership. The lack of possibility of buying a dwelling is associated with lower economic security and social mobility for households, as well as higher wealth inequality for societies (OECD, 2021). In 2021, for 17 OECD countries with available data, buying a house in a metropolitan region was 40 pp more expensive than in a region far from a metropolitan area, on average. The largest gaps between types of regions were in Denmark, Estonia, Hungary and Ireland (above 50 pp) (Figure 4.10).

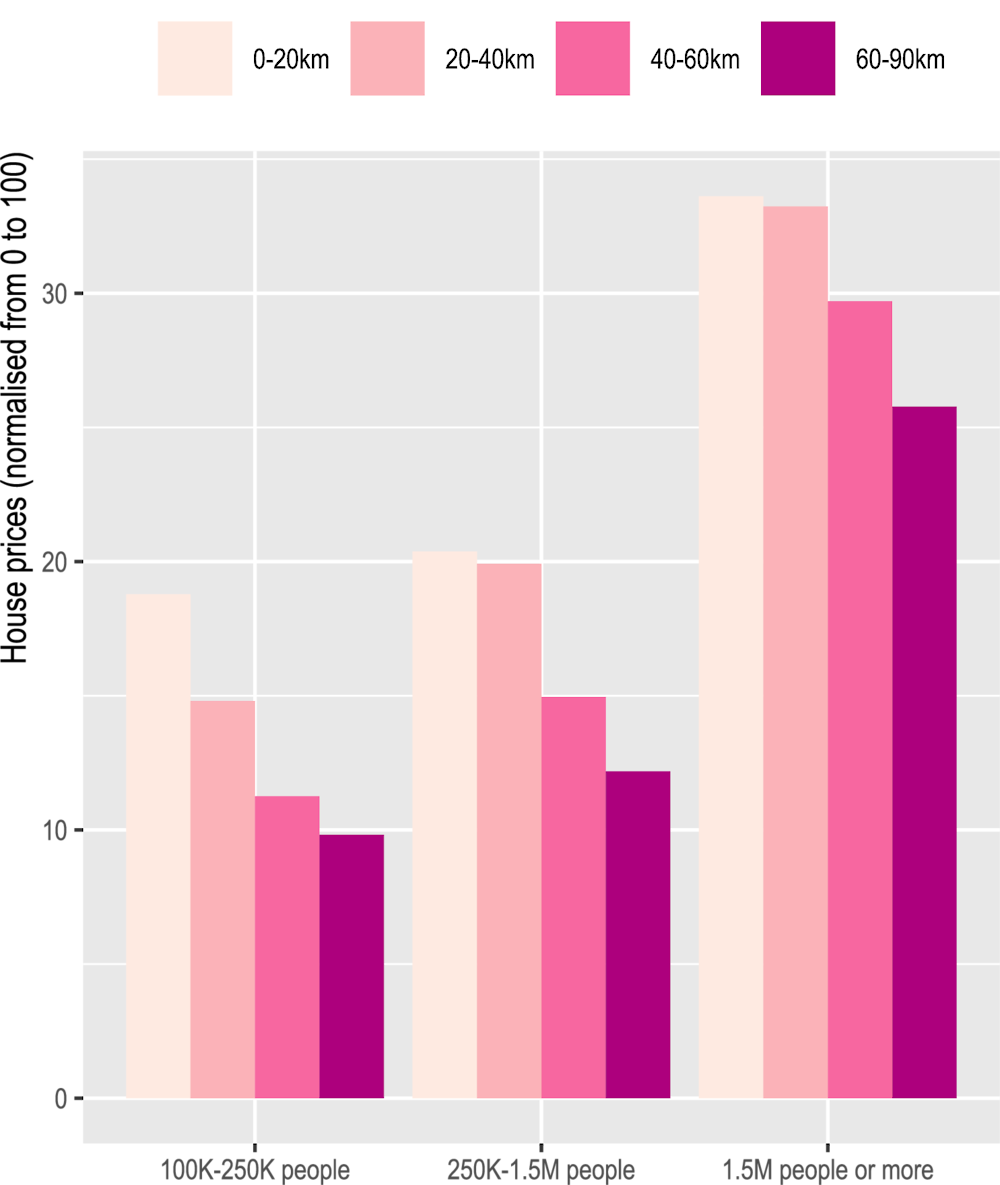

Beyond the type of regions, house prices are also very unequal between and within cities (functional urban areas, FUAs, of 100 thousand people or more). House prices increase with city size and proximity to the city centre. On average, house prices per square metre in large metropolitan areas are twice the prices in small- or medium-sized cities. In addition, within large metropolitan areas (FUAs of 1.5 million people or more), house prices are 30% higher in the city centre compared to suburban neighbourhoods (Figure 4.11).

Nevertheless, the COVID-19 pandemic and the rise of teleworking might be reshaping the demand for housing in metropolitan areas (Ahrend, et al., 2022). Based on new and granular data from 14 OECD countries, house price inflation within metropolitan areas was lower in central neighbourhoods, relative to the suburbs, after the COVID-19 outbreak. From 2020 Q1 to 2021 Q2, house prices increased by 7% in central neighbourhoods, while they increased by more than 12% in areas farther away from the city centres (60 km and more) (Figure 4.12).