This chapter describes key trends and emerging issues facing the agricultural sector in the six FAO regions, i.e. Asia Pacific (which is split into Developed and East Asia and South and Southeast Asia), Sub-Saharan Africa, Near East and North Africa, Europe and Central Asia, North America, and Latin America and the Caribbean. It highlights the regional aspects of production, consumption, and trade projections for the period 2023-32, and provides background information on key regional issues.

OECD-FAO Agricultural Outlook 2023-2032

2. Regional briefs

Copy link to 2. Regional briefsAbstract

The regional briefs in the Outlook highlight broad trends for the regions defined by the FAO in the implementation of its global workplan. Recognising regional diversity, the intention is not to compare results across regions. Instead, they illustrate some of the latest regional developments, highlighting responses to global challenges and emerging trends, and relating these to the main messages of the Outlook. The assessments generally compare the end point of the Outlook’s projection (2032) to the base period of 2020-22. The large and diverse Asia Pacific region has been disaggregated into two separate parts: Developed and East Asia, and South and Southeast Asia.

Agriculture and food systems globally have faced multiple disruptions in recent years – first in the form of the COVID-19 pandemic, and subsequently the impact of Russia’s war against Ukraine. The subsequent rise in food prices has impacted affordability and food security in multiple regions. These briefs do not present a quantitative assessment of the impacts of these disruptions, though they do account for the latest expectations with respect to macro-economic developments as the world emerges from these disruptions. The trends and issues presented are those expected to underpin the Outlook in the medium term. They assume that the adverse effects on food, feed and fuel production, consumption and trade will gradually moderate, recognising that several uncertainties remain.

This chapter contains seven sections, with text, tabular and graphic information for each region following a similar template. A background section provides the key regional characteristics and provides the setting from which the projection is described in the subsequent sections for production, consumption, and trade. Each regional brief contains an annex providing common charts and tables outlining the key aspects for the region.

2.1. Regional Outlook: Developed and East Asia

Copy link to 2.1. Regional Outlook: Developed and East Asia2.1.1. Background

Rapid urbanisation driving demand preferences

The Developed and East Asia region,1 with its 1.6 billion people, is the second most populous of those covered in this Chapter, with the overwhelming majority living in The People’s Republic of China (hereafter “China”). It is also the only region where the population is expected to decline over the coming decade. The region encompasses a diverse range of countries, that play a central role in global markets. This includes China and Japan, the second and third largest economies in the world. Considered on a per capita basis, income levels range from USD 8 789 in China to USD 62 344 in Australia. The region has urbanized rapidly, and estimates suggest that by 2032, 74% of people will reside in urban settings, up from just 55% in 2010. Such urbanisation contributes to dietary change, including the associated rising consumption of higher value, processed and conveniently packaged food, and consequently contributes to rapid transformation of food systems.

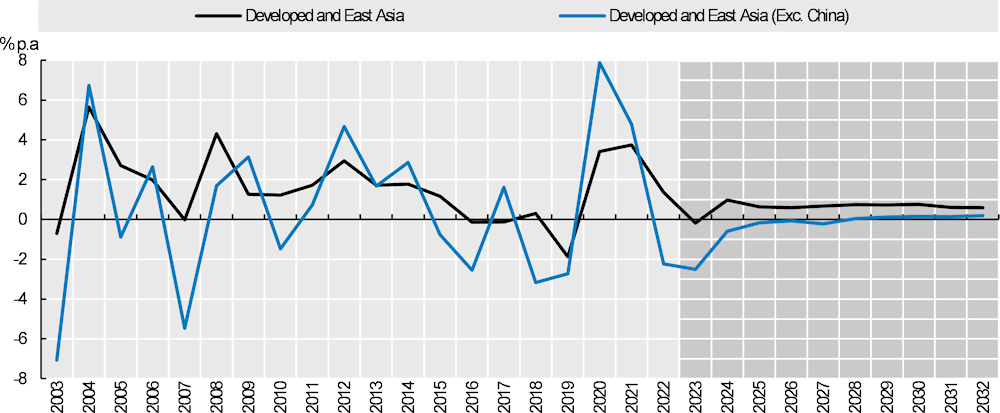

Income growth in the region has been resilient in the face of numerous exogenous shocks. The decline in per capita GDP of only 0.6% in 2020 makes it one of the least affected economically by the pandemic, though clear differences exist across countries, with sharp decreases Japan, Australia, and New Zealand, offset by continued growth in China of 2.0%. Its recovery was also one of the fastest. Regional growth rebounded by 5.7% in 2021, with broad recovery amongst all countries ‒ to the extent that average per capita income in 2021 was already 5.1% higher than in 2019. Despite ongoing war in Ukraine, the consequent increase in energy prices and spiralling inflation, per capita income expanded further by 2.9% in 2022 and is expected to rise by 3.5% in 2023 as China continues to lift pandemic related restrictions. While positive, this marks a sharp slowdown from historic norms and near-term growth prospects face many risks, including a more constrained global environment where demand is softer, commodity prices are falling, inflation is high and monetary policies are tightening. In the medium term, per capita incomes are projected to grow by 3.4% per year, implying incomes in 2032 that are 45% higher than the average of the base period. Rising income will be a key driver of demand in China, while consumer preferences may be more important in the high income developed countries.

The region’s agricultural resource base is as diverse as the countries included in it. Severe resource constraints in China, Korea and Japan are contrasted by abundance in both Australia and New Zealand. The share in the economy of primary agriculture and fish value added has declined to about 5% and is expected to fall further to 4% by 2032. Economic growth has been accompanied by a reduction in the share of food in total household expenditure to 14%, but it ranges in the region from 18% in China to 8% in Australia. Prevailing high prices and affordability challenges could have a notable impact on food security within the region, but global shocks may be muted to some degree by domestic protection in various countries.2

The region encompasses a range of important exporters and importers of agricultural and food products. China and Japan are the largest and second largest net food commodity importers in the world, while Korea is the sixth largest.3 These countries trade sufficiently to have a notable impact on global agricultural markets and value chains. New Zealand and Australia are among the top 10 global net exporters of food commodities in value terms, particularly for livestock and dairy products. Based on specialisation in the region, there is extensive and growing interregional trade. Apart from Australia and New Zealand, interventionist government policies are influential in local markets. Changes to such domestic policies have the potential to impact global markets significantly, due to the size and contribution to global trade from the countries in which they are imposed.

The challenges facing the region are as numerous as they are diverse. Natural resource constraints in China, Korea, and Japan have led to intensive application of purchased inputs, and growing sustainability concerns. In some areas, water resources have reached critically low levels and parts of the region are highly vulnerable to climate change. Increasingly severe droughts are occurring more frequently, particularly in Australia, a situation that will likely persist and possibly intensify due to climate change. Amongst the major threats specific to meat production are animal diseases such as ASF and Avian Influenza. The extent of impact from the ASF outbreak in China in 2018 serves to highlight the importance of improved measures required to manage these threats.

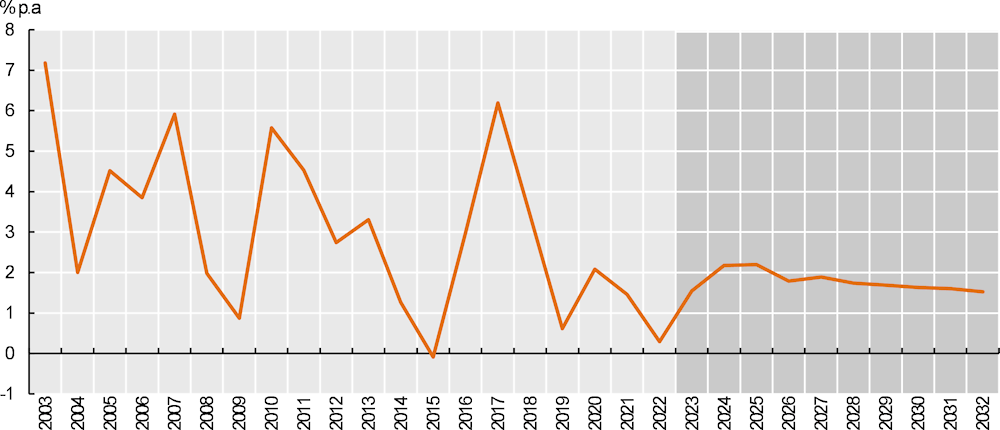

Despite these challenges, agricultural value addition per unit of land used for agricultural purposes continues to rise. Total factor productivity growth over the last decade is estimated at 1.6% p.a., down from 2% p.a. in the preceding decade.4 Considering resource constraints, continued investments in productivity growth in the region will be critical to future sustainability.

2.1.2. Production

China driving production growth

The region is the second largest global producer of agriculture and fish commodities, contributing almost a fifth of the value of global output in the 2020-22 base period. By 2032, 9% growth in the net value of production results in a modest decline in its share in global production. China is central in the region’s output. In the 2020-22 base period, it already accounted for almost 90% of total value and Figure 2.1 indicates that it is also the sole driver of growth over the outlook period. While China is expected to add 10% to its agriculture and fish production value by 2032, the rest of the region contracts by 3%, mainly due to reduced output in Australia and Japan. Aside from recovery in the livestock sector following African Swine Fever (ASF), growth in the region as a whole has slowed with maturing domestic markets, evolving policies, and strengthened trade competition.

The regions crop sector accounts for 38% of total agriculture and fish output in the base period, although accounting for fruits and vegetables would increase this contribution. Growth of only 4% implies that the share of crops in total agricultural value added could decline to 36% by 2032. Most of this decline is picked up by fish production, which could account for 27% of total value added by 2032, while the livestock sector sustains its share at 37%.

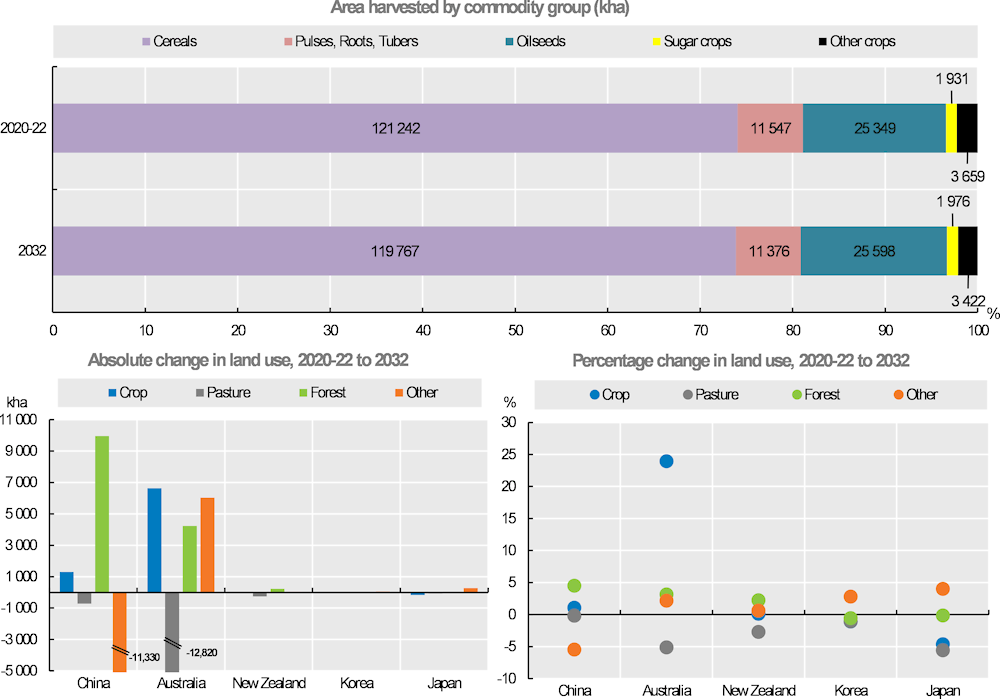

Total land used for agricultural purposes is expected to decline slightly by 2032, in line with historic trends. This reflects a reduction in pasture, as land used for crop production is expected to expand by 5%, almost exclusively in Australia. Resource constraints in the rest of the region suggest that productivity gains must be central to growth. The value generated per hectare of cropland is already higher in Developed and East Asia than any other region and is expected to remain fairly stable towards 2032. d While some yield gains are expected, due to progress in new seed varieties, improved production practices and expanded irrigation, these are generally slower than in the past. There are mounting environmental and food safety concerns, due to water scarcity, and the fact that synthetic fertiliser use, on a per hectare basis, is already the highest amongst all regions. Fertiliser application per hectare could rise further over the outlook period, albeit slowly, but the projected crop mix and productivity gains are such that the energy produced per unit of fertiliser applied is also expected to rise by 5%.

The region’s crop area is dominated by cereals. Its contribution to global production is notable for several crops, including rice, maize and wheat. Its processing sector also contributes a substantial share of protein meal and vegetable oil produced in the world, but it relies mostly on imported oilseeds. Almost all maize produced in the region is attributed to China, which also contributes 93% of its rice output and 80% of wheat. The balance of wheat production is almost exclusively from Australia. China is expected to expand its area under maize production by 2.3 Mha over the coming decade which, combined with yield gains of 0.7% p.a., fuels production growth of 12% by 2032. Conversely, the area cultivated to rice and wheat is expected to contract by 1.2 Mha and 1.3 Mha respectively. Yield gains are sufficient to induce a 2% expansion in rice production, and maintain wheat production at current levels, despite the area contraction. In Australia, the only other notable wheat producer in the region, production is expected to contract by 16% relative to the base period, reflecting a 5% reduction in area harvested, as well as a normalisation in yields from record levels attained in 2022. Almost all of the decline in regional wheat production is attributed to Australia.

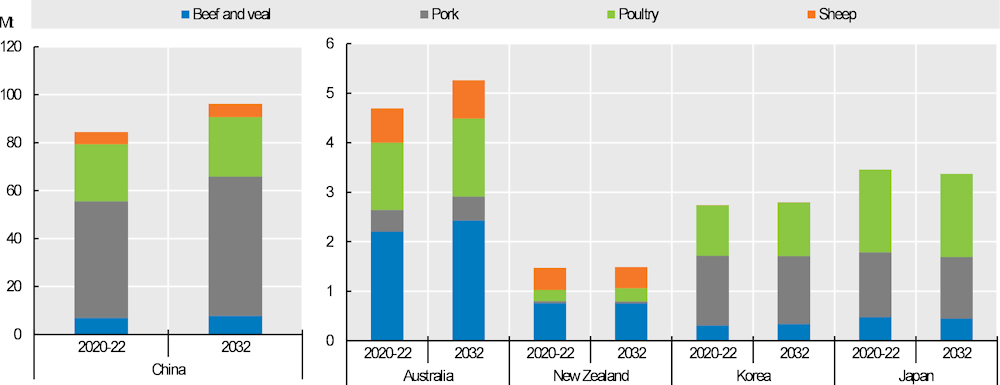

Livestock production constitutes 37% of the total value of agricultural and fish production and growth of 9% is sufficient to sustain this share by 2032. Growth emanates mainly from intensification and productivity gains, reflecting the contracting pasture land base in Australia, New Zealand, and Japan. More than three quarters of meat production growth from the region is expected to be pigmeat, with a further 11% attributed to poultry.

China remains the largest contributor to livestock production in the region, accounting for almost 80% of livestock production value. Pigmeat and poultry are the biggest sectors, constituting 58% and 28% of total Chinese meat production respectively. Meat production in China is expected to grow by 14% over the next ten years and 80% of the additional meat produced will be Pigmeat. Following the devastating impact of the 2018 African Swine Fever (ASF) outbreak, China’s pig herd has largely been rebuilt and in 2022, its pig herd inventory surpassed 2017 levels. Pigmeat production in 2032 is expected to be 8% higher than in 2022, reflecting large scale intensification in the sector as it recovered from ASF. Many smaller producers were replaced by large, commercial production units that prioritise biosecurity. The effects of ASF in the recent past also initiated growth in poultry production, which has a short production cycle and was able to respond the fastest to high meat prices in China at the height of ASF. From 2018 to 2022, poultry production expanded by 20%, but the recovery in pigmeat production and subsequent normalisation in prices results in further growth of only 4.5% by 2032.

Despite its much smaller share in total meat production from the Developed and East Asian region, Australia’s resource base is more conducive to bovine animals, which account for almost half of its total meat production. In turn, Australia contributes 20% of bovine meat production from the region. Growth of 0.8% per annum implies that it will also be a major driver of expanding regional bovine meat production.

The Developed and East Asian region contributes almost 40% of global fish production and 90% is sourced in China. China is also the major driver of fish production growth in the region, which is projected at 1.3% per annum. Growth is much faster in aquaculture, at 1.5% p.a. over the coming decade, compared to only 0.6% p.a. in captured fisheries. Consequently, aquaculture could account for almost 78% of total production from the region by 2032. Given its central role in regional production, the policy environment in China, which has increasingly prioritised sustainability in recent years, will guide fish market developments.

Total agricultural GHG emissions by the region are projected to increase by 5.1% by 2032. Emissions from animal sources are projected to rise by 5.1%, reflecting a 7% and 3% rise in bovine herds and sheep flocks respectively. Crop related emissions also rise by 4.6% over the ten-year period. Nevertheless, when considered relative to the value generated from agriculture and fisheries, the decline in GHG emissions per unit value produced is expected to continue, albeit at a slower rate.

2.1.3. Consumption

Dietary change in China driving increased meat consumption

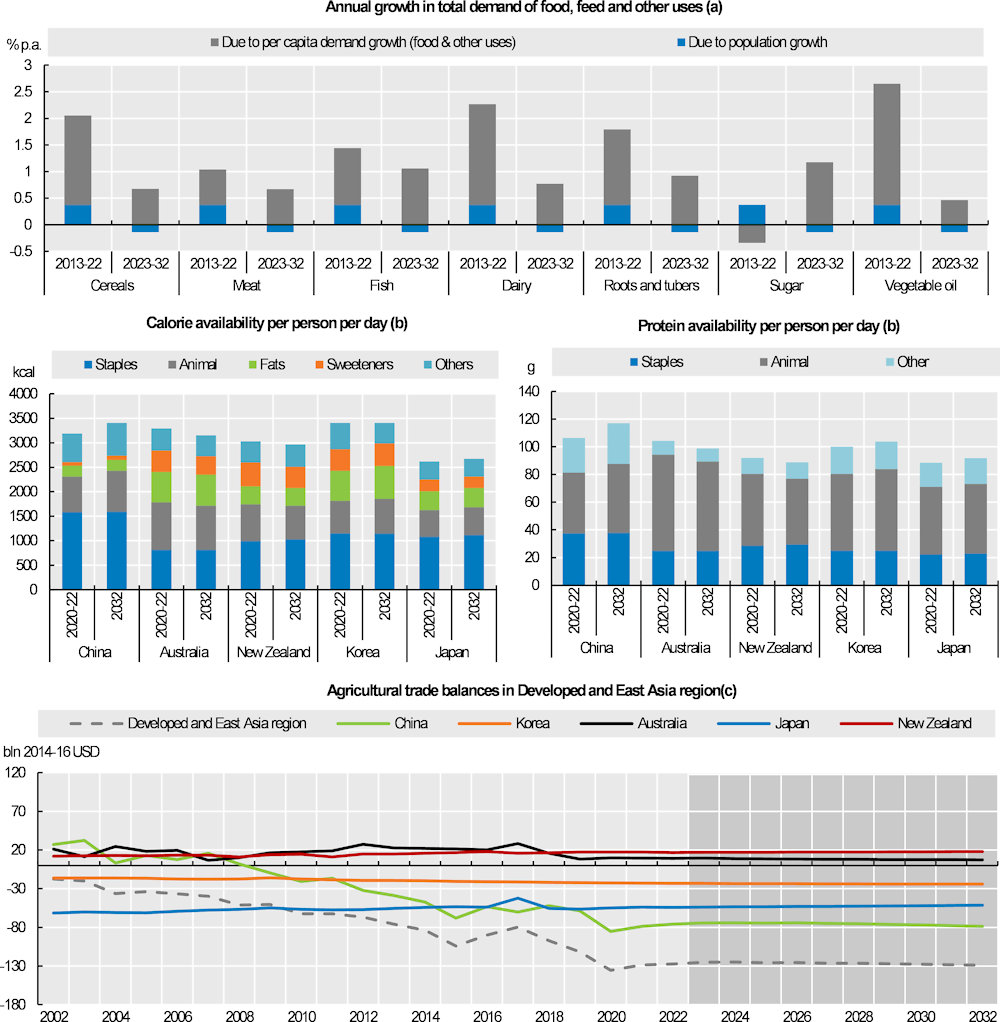

The East Asian region has made great strides in improving food security and the impact of the pandemic was smaller than in most other regions. While COVID-19 undoubtedly influenced consumer behaviour and agriculture supply chains, GDP performance was fairly resilient, particularly in China, and income support measures in developed countries further mitigated large scale impacts on food security. Despite the marginal increase in the prevalence of moderate to severe food insecurity in 2020, the recovery in 2021 was such that it reached its lowest level in five years, despite rising prices. Total calorie availability increased in 2022 and is expected to rise again in 2023, despite high inflation and the surging cost of living. By 2032, total calorie availability is expected to rise by 6%, around 200 kcal/person/day to reach 3473 kcal/person/day. This is the second highest among all regions and reflects the generally high per capita income levels in most countries. However, corrected for estimated household waste, total calorie intake is expected below 3239 kcal/person/day.

Various trends in population dynamics affect countries across the region. Populations in many parts of the region are aging, with dependency ratios5 in Japan and Korea already high and set to increase further by 2030 (UN DESA, 2020[1]). It is generally assumed that the aging population trend will have a dampening effect on overall food consumption growth rates in these countries. Conversely, rapid urbanisation, particularly in China, drives growing consumption of convenience foods, and meats, fats, and sugars, which will outpace most other food groups. Sugar consumption is expected to grow fastest among the various food groups and while vegetable oil consumption growth is slower, absolute levels are already high. By 2032, it is expected to approach 28 kg per capita, exceeding the global average by 70%.

Given the level of incomes, development, and maturity in most countries of the region, the greatest shift in dietary composition is set to occur in China. By 2032, per capita consumption of sugar products is expected to rise by 15%, whereas fish, meat and dairy consumption are set to expand by 14%, 12% and 12% respectively. These rates contrast with growth of less than 0.5% in cereal consumption, underscoring the extent of dietary change expected.

Increased meat consumption will also result in increased protein availability, with an expected gain of 10g/person/year by 2032. This brings total protein availability in the region to 118g/person/year – more than 30% above the global average. Most of this gain is expected in China, while small increases are also evident in Korea and Japan. In Australia and New Zealand, protein availability is expected to decline relative to 2020-22, mainly due to reduced dairy product consumption, but from high base levels.

At regional level, per capita fish consumption is also expected to grow by 13% or 5 kg per capita by 2032 relative to the base period. This includes strong growth of 14% in China, smaller gains of 6% in Australia, 5% in New Zealand and 4% in Korea, along with relative stability in Japan.

The region accounts for just over a quarter of global animal feed use. By 2032, the use of animal feed is expected to increase by 11%, sustaining the regions share in global use at current levels. Several factors combine to determine total feed use, including the intensity of feeding across different production systems and the efficiency of feed conversion by different species. Differences in production practices and predominant species are prevalent across countries. More than 85% of the feed used in the region is attributed to China, where total feed use is expected to rise by 13% by 2032. This encapsulates rising demand from increasingly intensive pigmeat and poultry operations. These large scale, fully commercial systems use feed more intensively than smaller, more traditional producers, but the combination of controlled environment and improved genetics also yields much improved feed conversion. Considering this combination of factors total animal feed use in China is expected to grow marginally slower than meat production. Conversely, dairy, beef and sheep production systems in Australia and New Zealand are more flexible in terms of feed use intensity and more reliant on pasture. Thus, growth in total feed use is slower.

In feed-intensive production systems, maize and protein meal remain the core ingredients in most pre-mixed feed rations and account for almost 70% of total feed raw material use between them. Their use in animal feed across the region is expected to grow by 15% and 11% respectively over the coming decade, with the slower rate in protein meal reflecting China’s efforts to reduce protein inclusion in rations. While wheat constitutes a much smaller share of total feed, its use is expected to grow by 21% over the coming decade.

The region accounts for roughly 10% of global ethanol use and almost 80% of this is attributed to China. In 2017, China announced an ambitious E10 mandate with targeted implementation across the country by 2020 and the aim of reducing excessive maize stocks. Stocks have since normalised, providing limited incentive to expand ethanol production. The Outlook therefore assumes that blending rates will increase to only 1.7% by 2032, an increase from the 1.2% average over the base period, but well below the ambitious 10% target. With total gasoline use expected to decline, the increased blending rate sustains China’s ethanol consumption growth at 1.1% p.a. over the ten-year period. By 2032, China will still only account for approximately 7% of global ethanol production.

2.1.4. Trade

Diverse group of net importers and exporters

The region’s trade deficit is foreseen to stabilise over the coming decade, but it remains the biggest net importer amongst those covered in the Outlook. This position mainly emanates from imports into East Asia, particularly China and Japan, and masks net exports from the Oceanic region. The major products imported into the East Asian region include soybeans, maize, barley, sorghum, wheat, vegetable oil and livestock products. The Oceanic region is a significant net exporter of wheat, barley, canola, sugar, meat, and dairy products.

The net value of imports into the region is expected to rise 7% by 2032 relative to the 2020-22 base period – a significant slowdown compared to the past decade. Almost three-quarters of the additional imports accrue to China, the largest soybean importer in the world. China’s soybean imports reached an all-time high in 2020, despite the logistical challenges associated with the COVID-19 pandemic. Import demand was driven by rapid growth in poultry production, as well as the recovery in its pig herd post ASF. Imports have subsequently slowed in the current high price environment, but by 2032 are expected to rise by a further 6% due to further livestock production growth and fewer trade related challenges. Despite the slowdown in growth relative to the past, China will still account for 60% of global soybean trade, with the bulk of products sourced from Brazil, the United States and Argentina. While growing animal feed use is also driving demand for maize, imports are set to decline because of strong domestic production growth. By 2032, China is expected to produce almost 95% of its total maize use yet will still account for 9% of global maize trade.

Meat imports into the region are set to decline by 14% over the next ten years, mainly due to the 25% reduction in imports into China, given that its own production has recovered from the impacts of ASF. Bovine and to a much lesser extent ovine are the only meat types where China is expected to increase imports. In the rest of the region, Korean meat imports are set to expand by 12%, but its contribution to total imports into the region is much smaller. Part of East Asia’s meat import requirement will likely be met by rising exports from Oceania, which is favourably located to supply Asian markets. Australia is already amongst the top 5 suppliers of bovine meat into China and bilateral trade relations have improved. Australia’s bovine exports are expected to grow by 19% to reach 1.8 Mt by 2032. The additional 290 Kt supplied from Australia by 2032, however, only equates to a third of China’s expected import growth for bovine meat.

The Oceanic region is a major exporter of numerous other products, but several of these are expected to contract over the coming decade. Wheat exports are expected to decline, but Australia remains an important global supplier, particularly amid the ongoing war in Ukraine, which has constrained exports from the Black Sea region. By 2032, Australia is still expected to constitute 10% of global wheat exports. Despite its small land area, New Zealand accounts for more than 30% of global sheepmeat exports and for 23% of the world’s dairy exports. With pastureland increasingly constrained and set to decline further by 2032, sheepmeat exports are projected to remain stable, while dairy exports grow by a modest 6%. Consequently, New Zealand’s share in global exports is expected to decline for both products.

Figure 2.1. China a major driver of growth in agriculture and fish output in the Developed and East Asia region

Copy link to Figure 2.1. China a major driver of growth in agriculture and fish output in the Developed and East Asia region

Note: Estimates are based on historical time series from the FAOSTAT Value of Agricultural Production domain which are extended with the Outlook database. Remaining products are trend-extended. The Net Value of Production uses own estimates for internal seed and feed use. Values are measured in constant 2014-2016 USD.

Source: FAO (2023). FAOSTAT Value of Agricultural Production Database, http://www.fao.org/faostat/en/#data/QV; OECD/FAO (2023) “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Figure 2.2. Change in area harvested and land use in Developed and East Asia

Copy link to Figure 2.2. Change in area harvested and land use in Developed and East Asia

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Figure 2.3. Livestock production in Developed and East Asia

Copy link to Figure 2.3. Livestock production in Developed and East Asia

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Figure 2.4. Demand for key commodities, food availability and agricultural trade balances in Developed and East Asia

Copy link to Figure 2.4. Demand for key commodities, food availability and agricultural trade balances in Developed and East Asia

Notes: Estimates are based on historical time series from the FAOSTAT Food Balance Sheets and trade indices databases and include products not covered by the Outlook. a) Population growth is calculated by assuming per capita demand constant at the level of the year preceding the decade. b) Fats: butter and oils; Animal: egg, fish, meat and dairy except for butter; Staples: cereals, oilseeds, pulses and roots. c) Include processed products, fisheries (not covered in the FAOSTAT trade index) based on outlook data.

Source: FAO (2023). FAOSTAT Value of Agricultural Production Database, http://www.fao.org/faostat/en/#data/QV ; OECD/FAO (2023) “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Table 2.1. Regional Indicators: Developed and East Asia

Copy link to Table 2.1. Regional Indicators: Developed and East Asia|

Average |

% |

Growth2 |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

2010-12 |

2020-22 (base) |

2032 |

Base to 2032 |

2013-22 |

2023-32 |

|||||

|

Macro assumptions |

||||||||||

|

Population (‘000) |

1 561 225 |

1 633 052 |

1 612 371 |

-1.27 |

0.37 |

-0.14 |

||||

|

Per capita GDP1 (kUSD) |

9.65 |

13.42 |

19.48 |

45.10 |

3.22 |

3.42 |

||||

|

Production (bln 2014-16 USD) |

||||||||||

|

Net value of agricultural and fisheries3 |

693.6 |

778.5 |

845.1 |

8.56 |

0.80 |

0.69 |

||||

|

Net value of crop production3 |

249.8 |

293.3 |

304.3 |

3.74 |

1.61 |

0.47 |

||||

|

Net value of livestock production3 |

277.2 |

287.8 |

312.6 |

8.61 |

-0.12 |

0.48 |

||||

|

Net value of fish production3 |

166.6 |

197.4 |

228.2 |

15.65 |

1.06 |

1.31 |

||||

|

Quantity produced (kt) |

||||||||||

|

Cereals |

530 611 |

631 947 |

656 970 |

3.96 |

0.94 |

0.58 |

||||

|

Pulses |

7 698 |

7 997 |

8 954 |

11.96 |

1.49 |

0.96 |

||||

|

Roots and tubers |

39 781 |

46 356 |

48 490 |

4.60 |

1.62 |

0.29 |

||||

|

Oilseeds4 |

29 227 |

42 359 |

45 285 |

6.91 |

4.15 |

0.24 |

||||

|

Meat |

90 627 |

96 787 |

109 126 |

12.75 |

-0.03 |

0.60 |

||||

|

Dairy5 |

9 454 |

10 536 |

11 447 |

8.64 |

1.05 |

0.71 |

||||

|

Fish |

59 227 |

70 199 |

81 153 |

15.60 |

1.08 |

1.31 |

||||

|

Sugar |

16 334 |

14 888 |

15 612 |

4.86 |

-1.65 |

0.51 |

||||

|

Vegetable oil |

22 025 |

30 655 |

34 679 |

13.13 |

2.57 |

0.83 |

||||

|

Biofuel production (mln L) |

||||||||||

|

Biodiesel |

1 220 |

2 648 |

2 627 |

-0.80 |

6.16 |

-1.76 |

||||

|

Ethanol |

8 952 |

10 406 |

11 678 |

12.23 |

0.63 |

0.99 |

||||

|

Land use (kha) |

||||||||||

|

Total agricultural land use |

933 488 |

901 336 |

891 156 |

-1.13 |

-0.14 |

-0.11 |

||||

|

Total land use for crop production6 |

158 208 |

154 968 |

162 724 |

5.01 |

-0.50 |

0.61 |

||||

|

Total pasture land use7 |

775 280 |

746 368 |

728 432 |

-2.40 |

-0.06 |

-0.26 |

||||

|

GHG Emissions (Mt CO2-eq) |

||||||||||

|

Total |

967 |

887 |

932 |

5.08 |

-0.68 |

0.34 |

||||

|

Crop |

455 |

378 |

395 |

4.57 |

-1.61 |

0.51 |

||||

|

Animal |

500 |

498 |

525 |

5.42 |

0.08 |

0.20 |

||||

|

Demand and food security |

||||||||||

|

Daily per capita caloric food consumption8 (kcal) |

2 948 |

3 154 |

3 351 |

6.25 |

0.65 |

0.43 |

||||

|

Daily per capita protein food consumption8(g) |

94.5 |

104.7 |

114.3 |

9.21 |

1.11 |

0.61 |

||||

|

Per capita food consumption (kg/year) |

||||||||||

|

Staples9 |

156.3 |

156.3 |

157.1 |

0.54 |

0.06 |

0.02 |

||||

|

Meat |

40.3 |

43.2 |

48.1 |

11.41 |

0.84 |

0.65 |

||||

|

Dairy5 |

4.7 |

5.4 |

5.9 |

9.00 |

1.97 |

0.72 |

||||

|

Fish |

36.0 |

41.0 |

46.2 |

12.55 |

0.81 |

1.07 |

||||

|

Sugar |

11.9 |

12.0 |

13.3 |

10.81 |

-0.37 |

1.17 |

||||

|

Vegetable oil |

20.4 |

25.1 |

26.2 |

4.59 |

1.65 |

0.52 |

||||

|

Trade (bln 2014-16 USD) |

||||||||||

|

Net trade3 |

- 64 |

- 130 |

- 129 |

-1.10 |

.. |

.. |

||||

|

Value of exports3 |

109 |

119 |

138 |

16.35 |

0.25 |

1.46 |

||||

|

Value of imports3 |

173 |

249 |

267 |

7.21 |

2.94 |

0.92 |

||||

|

Self-sufficiency ratio10 |

||||||||||

|

Cereals |

96.1 |

91.2 |

91.8 |

0.64 |

-0.34 |

-0.04 |

||||

|

Meat |

98.8 |

91.0 |

93.7 |

2.96 |

-1.07 |

0.07 |

||||

|

Sugar |

79.9 |

70.0 |

70.0 |

0.09 |

-1.45 |

-0.70 |

||||

|

Vegetable oil |

66.0 |

72.0 |

78.5 |

9.11 |

0.01 |

0.50 |

||||

Notes: 1 Per capita GDP in constant 2010 US dollars. 2. Least square growth rates (see glossary). 3. Net value of agricultural and fisheries data follows FAOSTAT methodology, based on the set of commodities represented in the Aglink-Cosimo model valued at average international reference prices for 2014-16. 4. Oilseeds represent soybeans and other oilseeds. 5. Dairy includes butter, cheese, milk powders and fresh dairy products, expressed in milk solid equivalent units. 6. Crop Land use area accounts for multiple harvests of arable crops. 7. Pasture land use represents land available for grazing by ruminant animals. 8. Daily per capita calories/protein represent food consumption per capita per day, not intake. 9. Staples represent cereals, oilseeds, pulses, roots and tubers. 10. Self-sufficiency ratio calculated as Production / (Production + Imports - Exports)*100.

Sources: FAO (2023). FAOSTAT Food Balance Sheets and trade indices databases, http://www.fao.org/faostat/en/#data ; OECD/FAO (2023), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

2.2. Regional outlook: South and Southeast Asia

Copy link to 2.2. Regional outlook: South and Southeast Asia2.2.1. Background

Population and robust income growth support strong demand, putting pressure on resources

The South and Southeast Asia region is home to 34% of the global population, making it the most populous region amongst those covered in this Chapter. Just over half of its 2.7 billion people reside in India. Urbanisation is rising across the region and the share of population residing in urban areas is expected to surpass 46% by 2032, from an average of 41% in 2020-22. On average, income levels amount to USD 3 157 per capita, which is at the lower end of the global spectrum, but it includes a diverse range of countries. Amongst its least developed nations, income levels average USD 1 345 per capita, whereas in Singapore, they are above USD 60 000 per capita.

Growth in per capita income, at 3.8% p.a., is expected to outpace all other regions in the coming decade. It has been robust in the past, rebounding quickly from the COVID-19 related contraction in 2020. By 2022, average per capita income levels exceeded those of 2019 by more than 3%. In several countries endowed with energy or commodity reserves, the rebound benefitted from the higher commodity price cycle. Given historic growth, the share of primary agriculture, fish and forestry is anticipated to continue its longer-term decline from a share of about 13% in the base period, to around 9% by 2032.

With strong economic growth, the average share of food in household expenditures in the region has fallen to below 17%. However, for the least developed countries this share is 30%6 and consequently the rise in food prices over the past two years impacted considerably on the food security of many in these countries. This is evident in the rise in moderate to severe food insecurity in both Southern and Southeast Asia – both regions that have made rapid progress in reducing hunger in the past.

The region has increased its positive trade surplus with respect to agricultural goods, although resources are increasingly strained. It encompasses some 580 Mha of agricultural land, which amounts to just 0.2 ha/person, compared to the world average of around 0.6 ha/person. With population growth expected at 0.9% p.a., resource pressures will only intensify, which means productivity gains are of paramount importance. At 2% p.a., total factor productivity growth exceeded the global average of 1.4% p.a. in the last decade, which was a key factor that facilitated economic growth.7 Given existing pressure on its resource base, sustainability will need to be at the core of future productivity gains.

Rising income and a growing, increasingly urbanised population imply strong demand growth for food products, but the evolution of consumer preferences remains somewhat uncertain, particularly with respect to animal sourced products. Urbanisation typically leads to rising consumption of higher value, more processed and convenience food products. However large parts of the region are either vegetarian (particularly in India), averse to pigmeat consumption, or lactose intolerant, suggesting that diets may evolve differently to many other parts of the world. At the same time, the heterogeneity across the region implies that demand preferences may evolve differently across it and in some countries, the demand for meat products is growing rapidly.

The region has a fairly small positive trade balance but within it are several important importers and exporters of a range of agricultural and food products. It typically exports almost a quarter of agriculture and fish production. Exports are dominated by plant-based products, particularly rice and vegetable oil, where the region has an 81% and 61% share in global exports respectively. The Southeast Asia region is considered a major player in may global value chains, such as fisheries, cassava, or those involving vegetable oils and their further processed products.8

The main challenges facing the region relate to its ability to sustainably increase productivity and innovation, particularly in the face of resource limitations, climate change risks and its growing population. Despite historic progress, the region still accounts for about one-third of the world’s undernourished population. To continue improving food security, it will need to sustain income growth in a less supportive global environment, amid high inflation and ongoing affordability challenges. Thus, key policy considerations include the nature and extent of market intervention schemes and how they affect global market interactions.

2.2.2. Production

Sustainable productivity gains are paramount to offset resource constraints

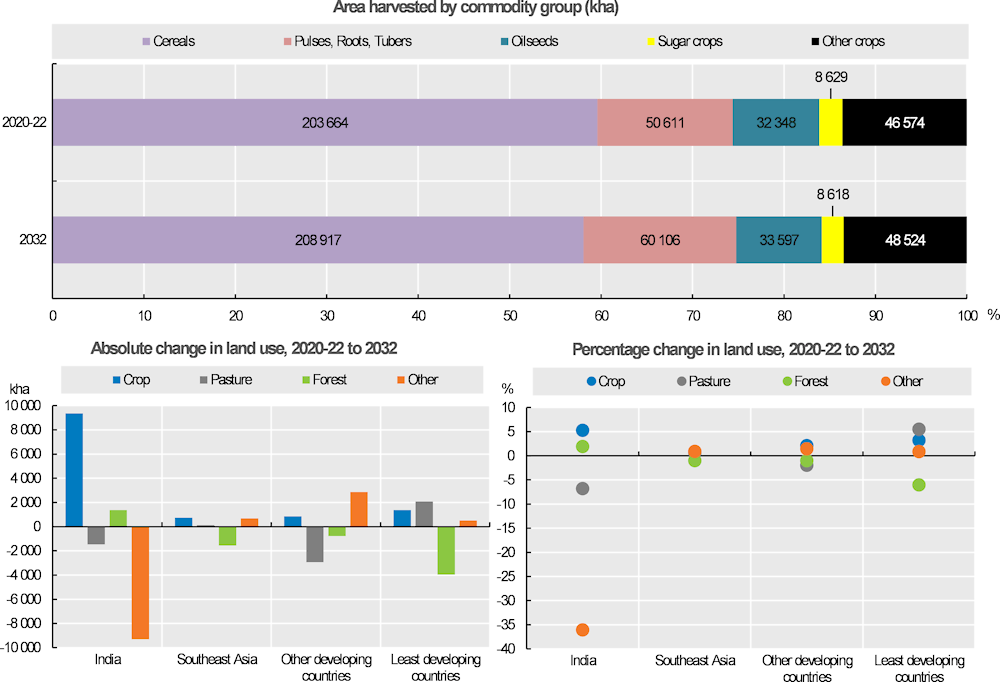

The South and Southeast Asian region is the largest contributor to the total value of global output from agriculture and fisheries. Crop production accounts for the biggest share, at 52%, but livestock production is growing faster. By 2032, agricultural output from the region is expected to expand by 20%, among the fastest of all regions and over the projection period, it will account for the biggest share of global output growth. The rate of agricultural production growth is almost double that of its population, suggesting that the value of agricultural output is also set to rise in per capita terms.

Crop production is expected to expand by 16%, resulting in a slight reduction in its share of total agriculture and fisheries output by 2032. This growth is achieved despite a mere 3.5% increase in land used for crop production over the ten-year period. In fact, growth in value generated per hectare of cropland accelerates over the projection period, to 1.2% p.a., reflecting a combination of intensification, crop mix changes and enhanced productivity. Increased fertiliser use will contribute to achieving yield gains, as application per hectare is expected to increase 8% by 2032. The response rates are such that the number of calories produced per unit fertiliser applied is also foreseen to rise.

The region is a major contributor to global output for a variety of food products, including rice, wheat, vegetable oil, pulses, and sugar. Apart from vegetable oil, where it remains stable, the regions share in global production is expected to rise for all these products.

Cereal production in the region is concentrated in India, Indonesia, Pakistan and LDC’s such as Bangladesh, Cambodia, and Myanmar. India alone accounts for around 70% and 40% of the region’s wheat and rice production respectively. Growth in cereal production is also concentrated in India, which accounts for three quarters of additional wheat and 46% of additional rice production over the coming decade. Growth in rice production is exclusively yield based, with a 15% increase in India and a 14% increase in Least Developed Asia by 2032, on an almost unchanged area.

Sugar production is dominated by India and Thailand, which account for almost 60% and 17% of regional production respectively. Of the projected growth of 17% in regional sugar production, just over half is expected to come from Thailand, where varietal improvements and improved extraction rates are expected to drive growth, with a mere 3% expansion in area.

The region accounts for 44% of vegetable oil produced globally, owing primarily to palm oil output in Malaysia and Indonesia. This sector has faced numerous disruptions in recent years, including adverse weather conditions, severe labour shortages due to restrictions in mobility of foreign workers through the pandemic and a temporary ban on exports from Indonesia to safeguard domestic supply. These are additional to pre-existing structural constraints, such as aging oil palm plantations and increasing focus on sustainability concerns. Limited expansion of the mature oil palm area underpins a significant slowdown in palm oil production growth in the coming decade, particularly in Indonesia. Most of the additional production is expected to come from yield gains, due to increased mechanisation and renewal of old plantations.

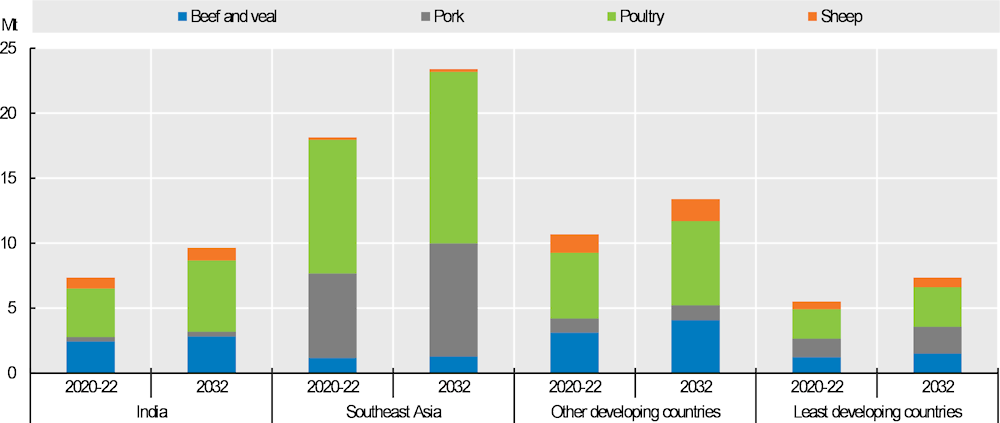

Livestock products currently account for 28% of the value of agriculture and fish output and growth of 2.6% p.a. will lead to an expansion of this share to 31% by 2032. India and Pakistan are the biggest contributors to this growth, which emanates mainly from dairy products. Milk production growth of 33% stems from a 23% expansion in cow numbers and an 8% improvement in milk yield per cow. Half of the expansion in the region’s cow inventory is attributed to India.

Poultry accounts for just over half of total meat production and for nearly 60% of additional meat production by 2032. Growth in this sector is largely a result of increased feed intensity and breeding improvements. Pigmeat production in the region is limited and concentrated mainly in Viet Nam and Thailand. Following sharp reductions in 2019 and 2020 because of African Swine Fever (ASF), pigmeat production in Viet Nam has rebounded strongly and by 2022, exceeded 2018 levels. In the medium term, it is expected to expand by an annual average of 1.8%, to exceed 4.7 Mt by 2032. Bovine meat production is expected to rise by 1.6% p.a., with India and Pakistan contributing more than 60% of total production.

Fish production is an important contributor to agricultural output in the region at 20% of total value. However, growth of 15% by 2032 is the slowest amongst the three subsectors, reducing its contribution over time. Whilst growth in captured fisheries is limited, reflecting resource limitations, growth of 2.3% p.a. in aquaculture implies that it will surpass captured fisheries by 2025, accounting for 54% of production by 2032.

Total direct GHG emissions from agriculture are set to rise by 11% by 2032 relative to 2020-22, driven predominantly by the livestock sector. While crop related emissions will rise by 4%, livestock related emissions, which reflect ruminant herd expansion, will increase at a rate marginally slower than the past decade at 1.2% p.a. By 2032, 29% of agriculture related GHG emissions globally will be attributable to the region.

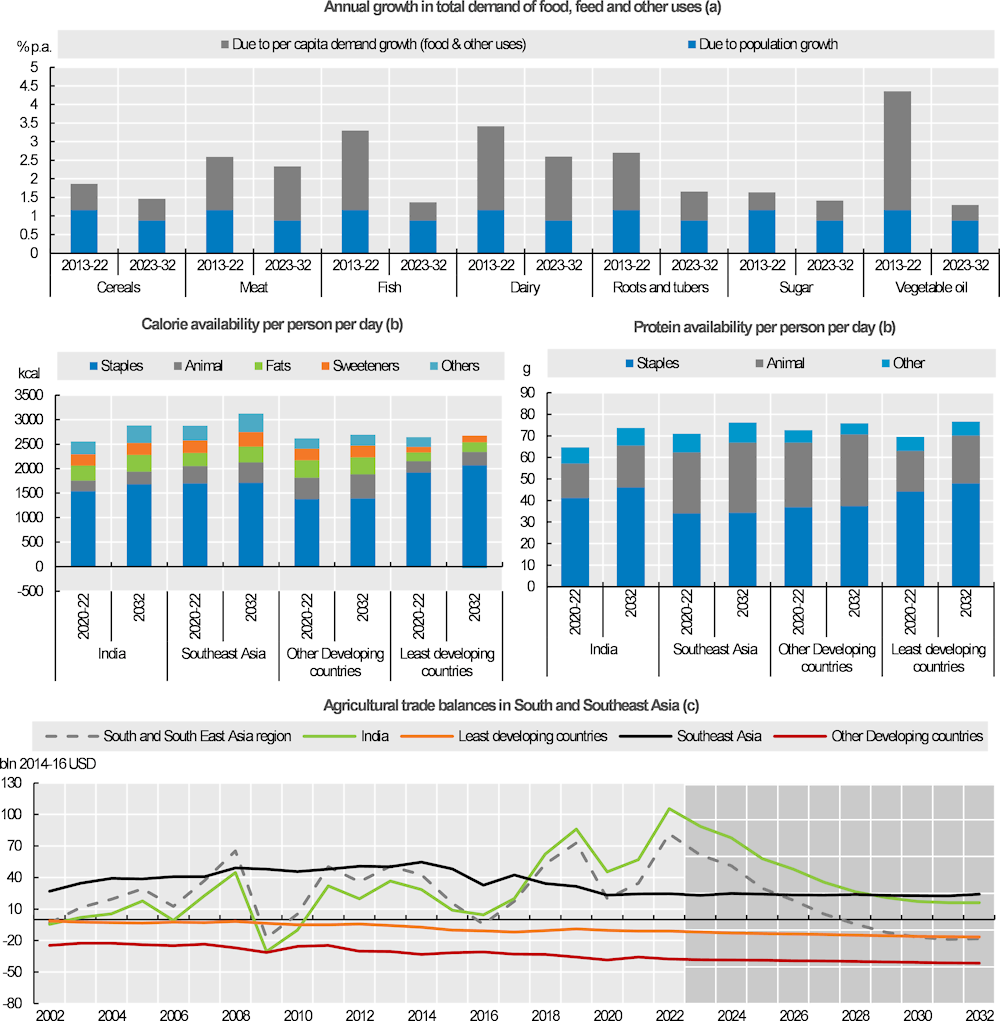

2.2.3. Consumption

Strong demand growth but with distinct regional preferences

After years of progress in reducing food insecurity and undernourishment, these trends in the South and Southeast Asian region have reversed, reflecting reduced income due to the pandemic in 2020, as well as subsequent rising food prices. These factors combined to impact significantly on food affordability and, particularly in East Asia, the prevalence of undernourishment rose above 15% for the first time in a decade. In both Southern and Southeast Asia, the prevalence of undernourishment rose further in 2021, despite the strong rebound in economic growth. Notwithstanding expectations of further income growth, the persistence of high food prices continues to constrain large scale improvements in food security in the short term and, having increased by less than 0.5% in 2022, improvements in calorie availability is again expected to be small in 2023. In the medium term, as food prices start to normalise, the combination of accelerated income growth, modest declines in population growth rates and consistent, albeit slow urbanisation, will support the continued evolution of dietary patterns, driving demand for calorie and nutrient dense foods (Law, Fraser and Piracha, 2020[2]; Kelly, 2016[3]; Reardon et al., 2014[4]). The type of products consumed are, however, also dictated by the region’s somewhat unique preferences, with a significant share of the population being vegetarian. By 2032, average calorie availability for consumption is projected to increase by 265 kcal/person/day to approach 2900 kcal, just 5% below the world average, predominantly derived from growth in consumption of wheat, pulses, rice, dairy products, and vegetable oils.

Cereals still account for more than half of the calories available for consumption in the region. By 2032, the share of cereals in total calories consumed is expected to decline to 51%. Rice still accounts for the biggest share of total cereal consumption, but wheat consumption is also rising. At regional level, per capita consumption of rice and wheat products are expected to rise by 0.4% and 0.7% p.a. towards 2032, but trends diverge across countries. In India, rice and wheat consumption are expected to rise at a similar rate. Conversely, in Indonesia and Vietnam, rice consumption per capita is expected to decline, replaced by a concomitant rise in wheat products.

Average protein intake remains well below the global level, but with gains of 9g/person/day by 2032, the deficit is expected to be close to 14%. This is underpinned by growing consumption of dairy and meat products. Dairy product consumption is already well above the world level and growth of 20% in per capita terms by 2032 will see it rise to almost 25% above the average level of consumption globally. The bulk of growth is attributed to fresh dairy products, which are expected to grow considerably in both India and Pakistan. Meat consumption is also expected to grow, but from a low base to reach just 12 kg per capita by 2032, but this regional average masks significant differences within it. In India, meat consumption is very limited and only expected to reach 3.3 kg per capita per year, whereas in Viet Nam, it is expected to rise by 7 kg per capita, to reach 52 kg by 2032. At the regional level, more than half of the growth in meat consumption is attributed to poultry, but in Viet Nam, it’s mainly driven by pigmeat.

As livestock and dairy production grow, the combination of herd expansion, rising feed use intensity and efficiency gains will support growth of 21% in feed use by 2032. This expansion is slower than that of meat and dairy production, reflecting the impact of improved feed conversion ratios across the region. In Viet Nam, growth in feed use is much faster, at 34%, due to increasing feed use intensity in its pigmeat sector. Maize and protein meal constitute the bulk of animal feed in the region. The use of maize and protein meal in animal feed is expected to expand by 27% and 23% respectively by 2032, implying that the share of maize in total feed use will continue to rise.

The region is foreseen to increase its share of global ethanol use to 12% by 2032, from less than 8% in 2020-22. This represents a significant gain in its global market share, which rests largely on increasing mandates, particularly in India, which now aims to achieve its ambitious E20 blending target by 2025. However, given limitations in feedstock supply, it is assumed to only reach this level by 2032. In Thailand, which has also developed blending targets as part of its Alternative Energy Development Plan, blending rates are expected to reach 14% by 2032. Ethanol production will add to the demand for agricultural products in these countries, particularly sugarcane, which is a major feedstock.

The region currently contributes a larger share of 22% in global biodiesel use, and this is expected to grow to 24% by 2032, mainly due to increases in Indonesia where implementation of a 30% biodiesel blend aims to reduce dependency on imported fossil fuels. Combined with support measures under its biodiesel programme, this is expected to direct domestic palm oil supplies to the biodiesel market, underpinning growth of 33% in its biodiesel use by 2032. The additional stability that the biodiesel sector provides to palm oil prices could help to encourage investment into the sector, resulting in increased renewal of oil palm plantations.

2.2.4. Trade

Export surplus sustained by India

The South and Southeast Asia region is a small net exporter of agricultural commodities, but this surplus is expected to decline and become a small deficit by 2032. The region’s aggregate position masks significant differences within it. India is by far the biggest net exporter, and historically drove increasing surpluses, but over the outlook is also the primary driver of the decline in exports. Southeast Asia is also a net exporter, but its surplus is small and remains fairly consistent by 2032. By contrast, net imports from the LDC’s and other developing countries of the region continue to rise. With the reduction in India’s surplus, the region reaches a net importing position by 2029.

Total net exports from the region are expected to contract by 6.7% over the next ten years. Export products comprise mainly rice, roots and tubers, sugar, vegetable oil, and meat. Vegetable oil exports mainly accrue to Indonesia and Malaysia, the biggest palm oil exporters in the world. Growth in vegetable oil exports is limited, at just 0.3% p.a., resulting in a slight reduction in the region’s share of global exports. Conversely, rapid export growth for rice and sugar implies that the region will increase its global market share to 86% and 28% respectively. Almost a third of the growth in rice exports are expected to come from Thailand, whose exports could rise by an average of 1.9% p.a., with further significant contributions also coming from Viet Nam and LDC’s such as Myanmar and Cambodia. While the region is responsible for almost a quarter of global fish exports, this share is expected to decline, due to limited growth in fish exports amid rising domestic consumption. A significant share of fish trade will occur within the region.

The region is increasingly dependent on imports for several commodities, including wheat, maize, soybeans, protein meal. Import dependence for these commodities is expected to rise over the next ten years. While the region is expected to account for a growing share of global meat and dairy product imports, these comprise a small share of total consumption and self-sufficiency rates remain fairly stable by 2032. In several individual countries, the role of imports are more pronounced.

Figure 2.5. Slowing growth of agriculture and fish output in South and Southeast Asia region

Copy link to Figure 2.5. Slowing growth of agriculture and fish output in South and Southeast Asia region

Note: Estimates are based on historical time series from the FAOSTAT Value of Agricultural Production domain which are extended with the Outlook database. Remaining products are trend-extended. The Net Value of Production uses own estimates for internal seed and feed use. Values are measured in constant 2014-2016 USD.

Source: FAO (2023). FAOSTAT Value of Agricultural Production Database, http://www.fao.org/faostat/en/#data/QV ; OECD/FAO (2023) “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Figure 2.6. Change in area harvested and land use in South and Southeast Asia

Copy link to Figure 2.6. Change in area harvested and land use in South and Southeast Asia

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Figure 2.7. Livestock production in South and Southeast Asia

Copy link to Figure 2.7. Livestock production in South and Southeast Asia

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Figure 2.8. Demand for key commodities, food availability and agricultural trade balances in South and Southeast Asia

Copy link to Figure 2.8. Demand for key commodities, food availability and agricultural trade balances in South and Southeast Asia

Notes: Estimates are based on historical time series from the FAOSTAT Food Balance Sheets and trade indices databases and include products not covered by the Outlook. a) Population growth is calculated by assuming per capita demand constant at the level of the year preceding the decade. b) Fats: butter and oils; Animal: egg, fish, meat and dairy except for butter; Staples: cereals, oilseeds, pulses and roots. c) Include processed products, fisheries (not covered in the FAOSTAT trade index) based on outlook data.

Source: FAO (2023). FAOSTAT Value of Agricultural Production Database, http://www.fao.org/faostat/en/#data/QV; OECD/FAO (2023) “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Table 2.2. Regional Indicators: South and Southeast Asia

Copy link to Table 2.2. Regional Indicators: South and Southeast Asia|

Average |

% |

Growth2 |

||||||

|---|---|---|---|---|---|---|---|---|

|

2010-12 |

2020-22 (base) |

2032 |

Base to 2032 |

2013-22 |

2023-32 |

|||

|

Macro assumptions |

||||||||

|

Population (‘000) |

2 383 748 |

2 684 329 |

2 966 152 |

10.50 |

1.16 |

0.88 |

||

|

Per capita GDP1 (kUSD) |

2.38 |

3.16 |

4.75 |

50.43 |

2.68 |

3.76 |

||

|

Production (bln 2014-16 USD) |

||||||||

|

Net value of agricultural and fisheries3 |

629.4 |

797.7 |

957.7 |

20.06 |

2.35 |

1.79 |

||

|

Net value of crop production3 |

359.1 |

416.5 |

485.1 |

16.47 |

1.50 |

1.50 |

||

|

Net value of livestock production3 |

154.9 |

223.8 |

292.1 |

30.51 |

3.68 |

2.58 |

||

|

Net value of fish production3 |

115.4 |

157.3 |

180.5 |

14.70 |

2.89 |

1.36 |

||

|

Quantity produced (kt) |

||||||||

|

Cereals |

504 777 |

584 230 |

681 730 |

16.69 |

1.51 |

1.53 |

||

|

Pulses |

26 682 |

30 403 |

43 320 |

42.49 |

1.59 |

2.73 |

||

|

Roots and tubers |

38 474 |

52 751 |

64 465 |

22.21 |

2.91 |

1.93 |

||

|

Oilseeds4 |

16 030 |

20 723 |

23 666 |

14.20 |

4.40 |

0.96 |

||

|

Meat |

31 371 |

41 689 |

53 783 |

29.01 |

2.57 |

2.44 |

||

|

Dairy5 |

29 084 |

43 441 |

57 657 |

32.73 |

3.44 |

2.58 |

||

|

Fish |

40 966 |

55 368 |

63 491 |

14.67 |

2.77 |

1.36 |

||

|

Sugar |

47 908 |

58 418 |

68 157 |

16.67 |

2.06 |

0.83 |

||

|

Vegetable oil |

69 621 |

96 029 |

107 361 |

11.80 |

3.11 |

0.83 |

||

|

Biofuel production (mln L) |

||||||||

|

Biodiesel |

2992.03 |

13573.36 |

17767.39 |

30.90 |

13.43 |

1.84 |

||

|

Ethanol |

4 122 |

9 241 |

18 040 |

95.22 |

8.08 |

3.41 |

||

|

Land use (kha) |

||||||||

|

Total agricultural land use |

557 782 |

576 986 |

587 154 |

1.76 |

0.39 |

0.15 |

||

|

Total land use for crop production6 |

324 090 |

348 184 |

360 525 |

3.54 |

0.73 |

0.29 |

||

|

Total pasture land use7 |

233 692 |

228 802 |

226 629 |

-0.95 |

-0.12 |

-0.06 |

||

|

GHG Emissions (Mt CO2-eq) |

||||||||

|

Total |

1 564 |

1 705 |

1 890 |

10.85 |

1.07 |

0.90 |

||

|

Crop |

661 |

689 |

713 |

3.59 |

0.55 |

0.49 |

||

|

Animal |

891 |

1 002 |

1 163 |

16.07 |

1.42 |

1.16 |

||

|

Demand and food security |

||||||||

|

Daily per capita caloric food consumption8 (kcal) |

2 419 |

2 541 |

2 788 |

9.73 |

0.49 |

0.98 |

||

|

Daily per capita protein food consumption8(g) |

60.0 |

64.7 |

72.8 |

12.52 |

0.7 |

1.2 |

||

|

Per capita food consumption (kg/year) |

||||||||

|

Staples9 |

171.7 |

172.7 |

183.4 |

6.16 |

0.03 |

0.58 |

||

|

Meat |

8.8 |

9.8 |

11.3 |

15.76 |

0.81 |

1.35 |

||

|

Dairy5 |

13.1 |

16.5 |

19.9 |

20.32 |

1.86 |

1.69 |

||

|

Fish |

14.4 |

17.1 |

18.4 |

7.56 |

1.54 |

0.65 |

||

|

Sugar |

19.8 |

21.2 |

22.7 |

7.12 |

0.51 |

0.51 |

||

|

Vegetable oil |

8.3 |

9.6 |

10.6 |

11.05 |

0.65 |

0.93 |

||

|

Trade (bln 2014-16 USD) |

||||||||

|

Net trade3 |

30 |

45 |

-18 |

-139.97 |

.. |

.. |

||

|

Value of exports3 |

179 |

246 |

230 |

-6.70 |

4.00 |

-2.16 |

||

|

Value of imports3 |

148 |

201 |

248 |

23.36 |

3.40 |

1.73 |

||

|

Self-sufficiency ratio10 |

||||||||

|

Cereals |

97.2 |

92.6 |

92.4 |

-0.19 |

-0.45 |

0.11 |

||

|

Meat |

94.6 |

96.6 |

97.2 |

0.70 |

-0.03 |

0.10 |

||

|

Sugar |

98.9 |

99.9 |

99.0 |

-0.87 |

0.63 |

-0.26 |

||

|

Vegetable oil |

146.3 |

126.8 |

119.9 |

-5.43 |

-1.23 |

-0.46 |

||

Notes: 1 Per capita GDP in constant 2010 US dollars. 2. Least square growth rates (see glossary). 3. Net value of agricultural and fisheries data follows FAOSTAT methodology, based on the set of commodities represented in the Aglink-Cosimo model valued at average international reference prices for 2014-16. 4. Oilseed represents soybeans and other oilseeds. 5. Dairy includes butter, cheese, milk powders and fresh dairy products, expressed in milk solid equivalent units. 6. Crop Land use area accounts for multiple harvests of arable crops. 7. Pasture land use represents land available for grazing by ruminant animals. 8. Daily per capita calories/protein represent food consumption per capita per day, not intake. 9. Staples represent cereals, oilseeds, pulses, roots and tubers. 10. Self-sufficiency ratio calculated as Production / (Production + Imports - Exports)*100.

Sources: FAO (2023). FAOSTAT Food Balance Sheets and trade indices databases, http://www.fao.org/faostat/en/#data ; OECD/FAO (2023), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

2.3. Regional outlook: Sub Saharan Africa

Copy link to 2.3. Regional outlook: Sub Saharan Africa2.3.1. Background

Food security for a growing population remains a big challenge

Sub-Saharan Africa (SSA) is a vast and diverse region that comprises 19% of the world’s agricultural land and home to 1.1 billion people, 14% of the global population. Amongst the regions covered in this chapter, SSA has a distinct and striking demographic profile. Its population is the youngest, its rate of population growth is the fastest and its urbanisation rate is the slowest. By 2032, SSA’s 1.45 billion inhabitants are expected to account for 17% of the world’s population. While urbanisation is occurring, it is one of only two regions (the other being Near East and North Africa) where the absolute size of the rural population is still increasing and the only region where more than half of the total population is still expected to reside in rural areas by 2032.

Average per capita income levels in the region are the lowest globally, at USD 1 706 in constant 2010 terms. However, levels vary considerably within the region, with incomes of less than USD 1 000 per capita in the Least Developed Countries, to USD 7 810 in South Africa. Economies typically depend strongly on resource based commodities, such as agriculture, oils and mining, with agriculture (including fisheries and forestry) accounting for 15% of economic output between 2020 and 2022. In some countries, this share is much higher. Despite high commodity prices, per capita GDP growth in the region only recovered by 1.9% in 2021, following the 5% contraction in 2020 amid the COVID-19 pandemic. Further recovery momentum has been constrained by the global slowdown, tighter financial conditions across the world, limited funds to support recovery and surging inflation. Amid rising uncertainty in the global economy, exchange rates in many of the developing countries in the region depreciated sharply, accelerating inflation and in some instances leading to concerns over foreign currency reserves. In per capita terms, income growth amounted to less than 1% in 2022 and is expected to be similar in 2023, before averaging 1.2% over the remainder of the projection period. This will enable average income levels per capita to reach USD 1 930 by 2032, but current projected growth rates imply that the region will only surpass pre-pandemic income levels by 2025.

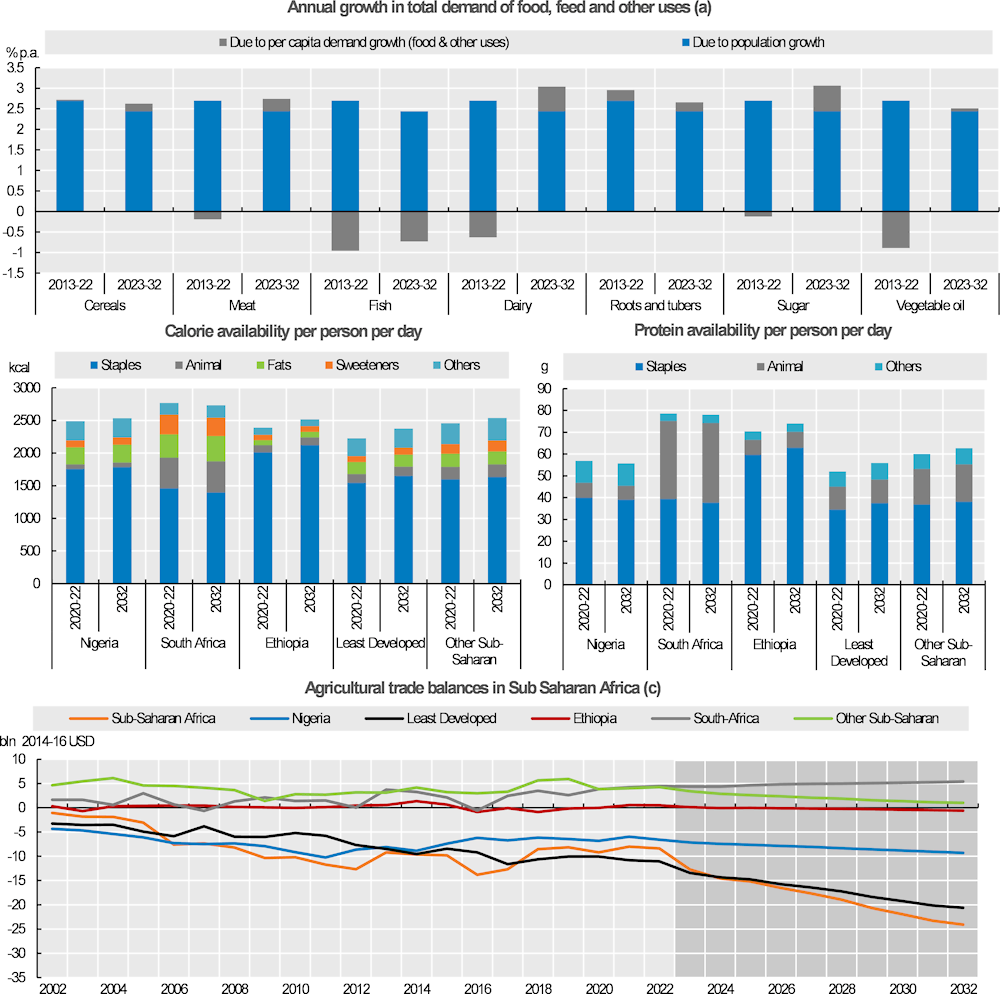

Consistent with low absolute income levels, households in SSA spend a bigger share of total income on food than any other region covered in this chapter. On average, across SSA, this share is 23%, but it varies amongst countries, with the LDCs in the region spending on average 31%.9 Per capita calorie intake is already amongst the lowest in the world and the large share of total income spent on food heightens the region’s vulnerability to the persistently high food prices evident over the past two years. Amid a myriad of external shocks, such as the pandemic and the ongoing war in Ukraine, food affordability, and consequently food security, has become increasingly strained. The FAO’s State of Food Security and Nutrition (2022) notes that the recovery in GDP growth in 2021 did not translate to improvements in food security, as the prevalence of undernourishment rose further to 23.2%, having already increased from 20.1% in 2019 to 22.7% through the pandemic in 2020. The absolute number of undernourished people in the region increased by 12 million in 2021, which was less than half the 34 million additional undernourished in 2020. While the prevalence of undernourishment in the region has been rising since 2018, the pandemic in 2020 induced a sharp acceleration that is proving difficult to turn around in the current environment. The combination of surging inflation, weaker economic growth, and high prices in 2022 will likely have led to further deterioration, with relief only likely when prices start to normalise.

Sub-Saharan Africa is an agro-ecologically diverse, land abundant region that accounts for 16% of global crop land and 20% of pasture. Despite the region’s land abundance, significant differences exist among countries in terms of land availability and farm structures. In some regions, there is clear evidence that more medium scale farmers are emerging (Jayne et al., 2016[5]), whereas in others, the agricultural sector is facing pressures from land shortages and declining plot sizes. Large parts of available arable land are concentrated in few countries and is often under forest cover (Chamberlin, Jayne and Headey, 2014[6])), whereas in others it sits in remote areas poorly connected to markets and infrastructure. Despite its high share of land use globally, production practices are often less intensive in nature and the SSA region produced only 5% of the global value of agricultural and fish production in 2020-22. The regions share in global consumption is significantly higher, underpinned by its large population. Dietary composition is still highly staple-dependant and from 2020-22 SSA accounted for 42% of global roots and tuber consumption and 12% of cereals, compared to only 7% of sugar consumption and 6% of global vegetable oil consumption. Protein intake is comparatively low, reflecting weaker purchasing power, with only 6% of global fish consumption, 5% of dairy product consumption and 4% of meat consumption attributed to the region. Despite significant variation across countries, self-sufficiency rates for SSA overall are decreasing for most major food commodities, as domestic supply growth has failed to keep up with the rate of population expansion.

Amongst the greatest challenges facing the region in the near and medium term will be reducing hunger and improving food security in a persistently low-income environment, amid increasingly volatile weather conditions resulting from climate change. Despite improvements and success stories in selected countries, productivity in most of the region remains stubbornly low. Concentration of land abundance in a few countries implies that substantial opportunities may arise to expand intra-regional trade, particularly considering tariff reductions contained in the African Continental Free Trade Area (AfCFTA) agreement, but trade-related costs need to be reduced to improve competitiveness. Over the outlook period, imports into the region are therefore expected to rise further. In an increasingly volatile and fragmented global market, the region’s greatest opportunity to supply more affordable food to its growing population and improve food security rests in closing the productivity gap, improving market access, and reducing the costs of transportation and regional trade.

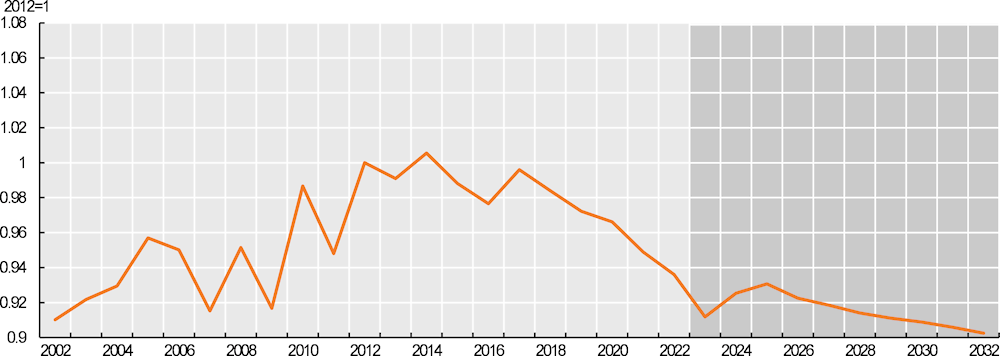

2.3.2. Production

Raising productivity is critical

Over the coming decade, agriculture and fish production in the region is projected to expand by 24% in net value-added terms. This average annual gain of 2.2% remains slower than the expected population growth in the region and hence, the value of production per capita is set to decline further, in line with the trend observed since 2015 (Figure 2.5). The bulk of growth in total value is expected to come from crop production, which will account for more than 70% of total agricultural value by 2032, a slight increase from the base period. While the rate of growth in livestock production is marginally higher than crops, it occurs from a smaller base and its share in total value added is expected to rise only modestly from 19.5% in 2020-22 to 19.8% in 2032. The contribution from fish production to total value is set to decline to 10%. Cereals, roots, and tubers constitute the bulk of crop production in the region and, for many crop types, SSA’s share in global production is set to rise. By 2032, the SSA region is expected to contribute 42% of global production of roots and tubers, 22% of pulses, 6.5% of cereals, 2% of oilseeds and 6% of cotton. LDC’s account for around 65% of the region’s cotton production, mostly situated in West Africa where Benin and Burkina Faso are major contributors. Cotton production from Sub Saharan Africa’s LDC’s is expected to grow by only 1.5% per annum on average, mostly due to yield gains as a small decline is projected in the area planted to cotton.

Growth of 27% in food crop production over the coming decade will be underpinned by a combination of intensification, productivity gains and changes to the crop mix. The real value of crop production, expressed per unit of cropland used, is expected to rise by 1.7% p.a., accelerating from the past decade. This reflects some intensification, combined with a 7% expansion in land used for crop production by 2032. Double cropping is prevalent in many of the tropical regions with bimodal rainfall, as well as irrigated regions in Southern Africa, where soybeans and wheat are often produced consecutively in a single year. The expansion of rice cultivation, notably in Nigeria, is also expected to benefit from rising prevalence of multiple annual harvests. Further to the intensification, area expansion is also expected in several crops, with increases in roots and tubers, maize, rice, pulses, and other coarse grains only partly offset by reductions in wheat and cotton.

The relatively small expansion in total land use of 0.2% p.a. over the outlook period represents a significant slowdown, at merely half the rate observed over the past decade. The region is mostly considered land abundant, but Chamberlain et al. already noted in 2014 that almost 65% of the available land for expansion is concentrated in only ten countries (Sudan, Madagascar, Democratic Republic of Congo, Mozambique, Angola, Congo Republic, Central African Republic, Ethiopia, and Zambia). Elsewhere, the ongoing expansion of agricultural land use is constrained by land fragmentation, land degradation challenges, conflict in some land abundant countries, and the presence of other competing uses such as mining and urban sprawl. This accentuates the importance of achieving productivity gains to expand production in the region.

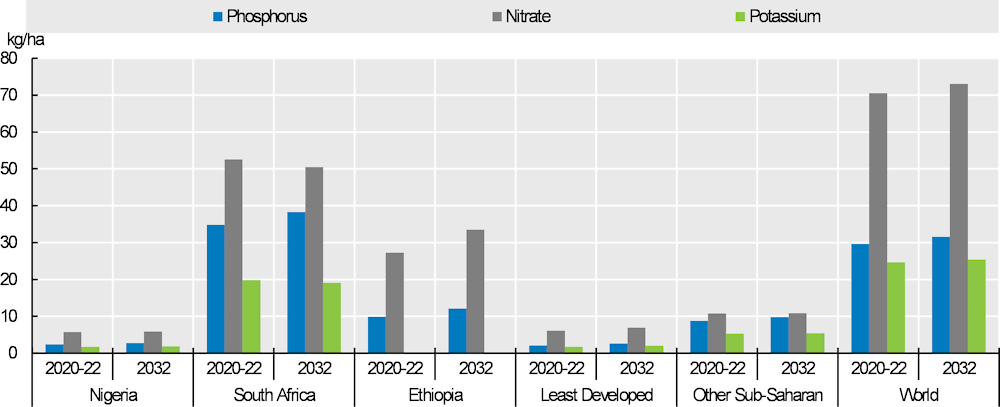

Average cereal yields are projected to grow by 1.9% p.a. over the outlook period, marginally faster than the past decade. Continued yield gains for most major crops stem from investments in locally adapted, improved crop varieties, and better management practices. While yield growth for most crops exceeds the rates projected at a global level, this occurs from a base which is often less than half the global average. Consequently, although the region’s substantial gap relative to yields achieved in the rest of the world will narrow it will remain substantial by 2032. Efforts to fully close the yield gap are constrained by the limited use of inputs, irrigation, and infrastructure. Despite widespread implementation of fertiliser subsidy programs in many countries, fertiliser use is the lowest of all regions and, as a net importer of fertilisers, sharp cost increases in 2022 dampened purchases further. In many instances, this resulted in later, suboptimal application. Over the outlook period, fertiliser use is projected to increase by 9%, but application per hectare is still expected to be less than 20% of the global average (Figure 2.6). This increase is faster in LDC’s, where base period application rates are lower, but closure of the gap in fertiliser use remains constrained by affordability, partly due to the high cost of imported fertiliser in the region.

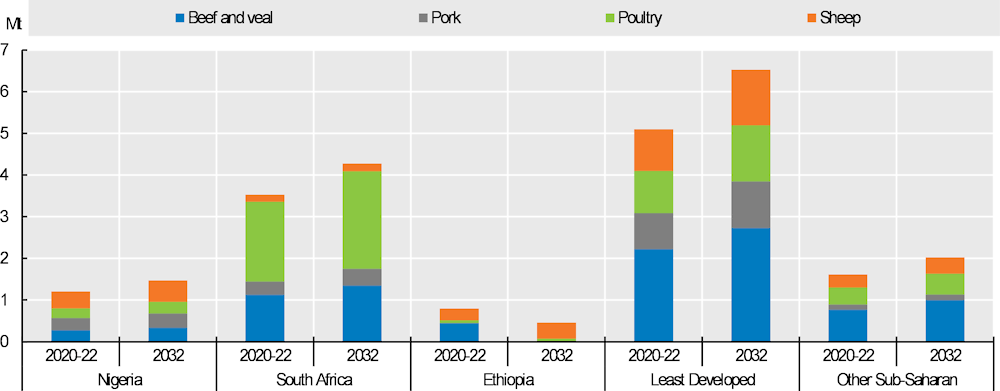

The net value of livestock production is expected expand by 27% over the coming decade, marginally faster than crops. Much of this growth is led by the dairy sector, with the region expected to add 10 Mt of milk and almost 3 Mt of meat by 2032. Bovine meat is currently the largest among the different meat sectors in SSA and along with poultry is expected to account the biggest share of additional meat production, with 1 Mt of bovine meat and 916 Kt of poultry added by 2032. This is further supplemented by 622 Kt of ovine meat and almost 400 Kt of pigmeat. Most meat production growth is expected to occur in the region’s LDC’s (Figure 2.12).

Bovine and ovine production systems in the region are typically extensive and growth in the coming decade is fuelled by herd expansion more than productivity gains. In 2020-22, the region accounted for only 7% of global bovine meat output yet almost 17% of the global bovine herd. The region’s share in the global bovine herd has increased steadily over the past decade and is projected to expand to almost 19% by 2032, yet its share in global beef production will remain just below 8%. Similarly, the region constitutes 13% of global ovine meat output, with 25% of the global ovine flock. Ovine meat production is expected to increase by 29% in the coming decade, with the region increasing its global share to 15%, but will graze 29% of the global flock. The extensive nature of production systems also implies that a substantial share of production is reliant on natural grazing, which is influenced by weather conditions. Consequently, extreme weather conditions such as the prolonged drought in the Horn of Africa has resulted in large scale losses due to limited availability of grazing. Such pressures could increase in the coming decade, as the projected herd expansion will occur on an area of almost unchanged pastureland and climate change could have severe impacts on the frequency and intensity of extreme weather events.

While extensive poultry production systems, reliant on indigenous, dual-purpose breeds are still common in the region, a greater degree of intensification is also emerging, particularly in countries that produce surplus feed grains, such as South Africa. Albeit from a small base, feed intensity is expected to continue increasing in the region as supply chains modernise in countries such as Zambia, Tanzania, and Nigeria, but many smaller producers still continue to use non-grain, often informally procured feed inputs. In countries that already use feed more intensively, genetic improvements and better feed conversion over time will reduce the amount of feed required per animal. Overall, in the region, the net effect results in feed use growing at a marginally slower rate than poultry production, but this difference is bigger in Ethiopia and other LDC where intensification is still slower.

Fish production in the SSA region is still mostly based on captured fisheries, which constituted more than 90% of total fish production in the 2020-22 base period. Aquaculture is growing and is expected to expand by almost 20% by 2032, but from a small base and is still expected to account for just under 10% of total fish production by 2032, compared with 8.7% in the base period. Growth in captured fisheries is slower, at 11% for the ten-year period to 2032, reflecting the finite nature of fisheries resources.

These projections imply that the region’s direct greenhouse gas (GHG) emissions from agriculture are expected to rise by 19% in 2032 compared to the base period. This is largely underpinned by further growth in extensive livestock, often in semi-arid areas where crop production is not viable and, by 2032, Sub-Saharan Africa will account for 16% of the total direct agriculture emissions globally. However, agricultural emissions per USD value of production in the region are expected to continue a declining trend.

2.3.3. Consumption

Dietary diversification remains sluggish

The region is home to the highest concentration of poor and undernourished people in the world. Total calorie availability per capita is the lowest amongst the regions covered in this chapter. Pre-existing food security challenges in SSA were exacerbated in recent years by the prolonged effects of COVID-19 and the restrictions imposed to contain it, along with the ongoing war in Ukraine, surging inflation, and slow economic recovery. The initial shock from the pandemic was twofold, through supply chain disruptions, particularly in informal markets that abound in the region, as well as income and employment shocks which inhibited affordability of foods. While economies have opened post COVID-19, the effects of the war in Ukraine prolonged many of the supply chain challenges, particularly for commodities such as wheat, which are mostly imported into the region. The combination of persistently high food prices, slower economic growth in the short term and surging inflation will only perpetuate affordability constraints. Consequently, food security and undernourishment will likely remain challenges and even as income levels start to rise, a sustained recovery will require improvements in the availability, accessibility, affordability, and utilisation of food supplies in the future.

The combination of economic contraction in 2020 and high prices since has led to reduced calorie availability per capita in the region for successive years. Stubbornly high inflation and the slow projected recovery in income levels further implies that per capita gains in calorie availability will be slow, suggesting that population growth will remain the major driver of rising food consumption in the region. In fact, the rate of population growth is such that, despite a mere 5% gain in total calorie availability per capita by 2032, SSA will still be one of the largest sources of additional food demand. Consequently, the region’s share of total food calorie consumption in the world is expected to rise from 12% in the 2020-22 base period to 14% by 2032.

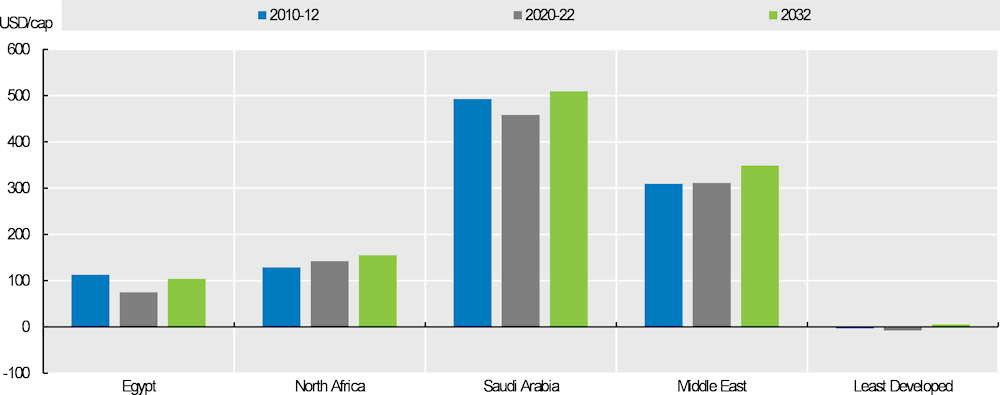

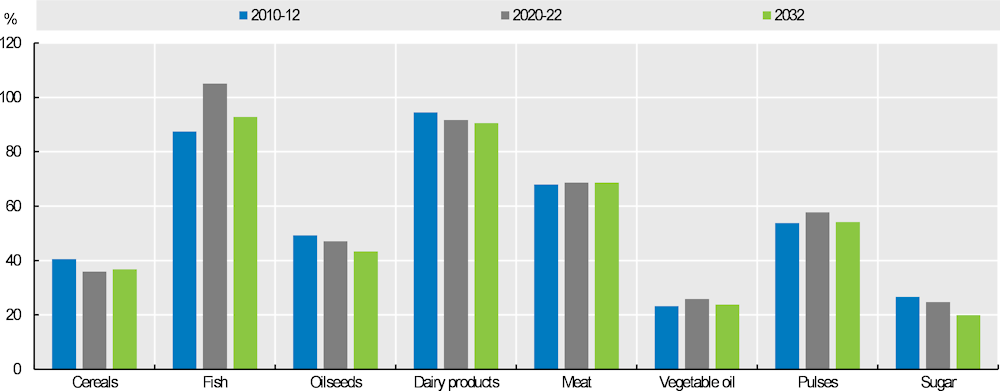

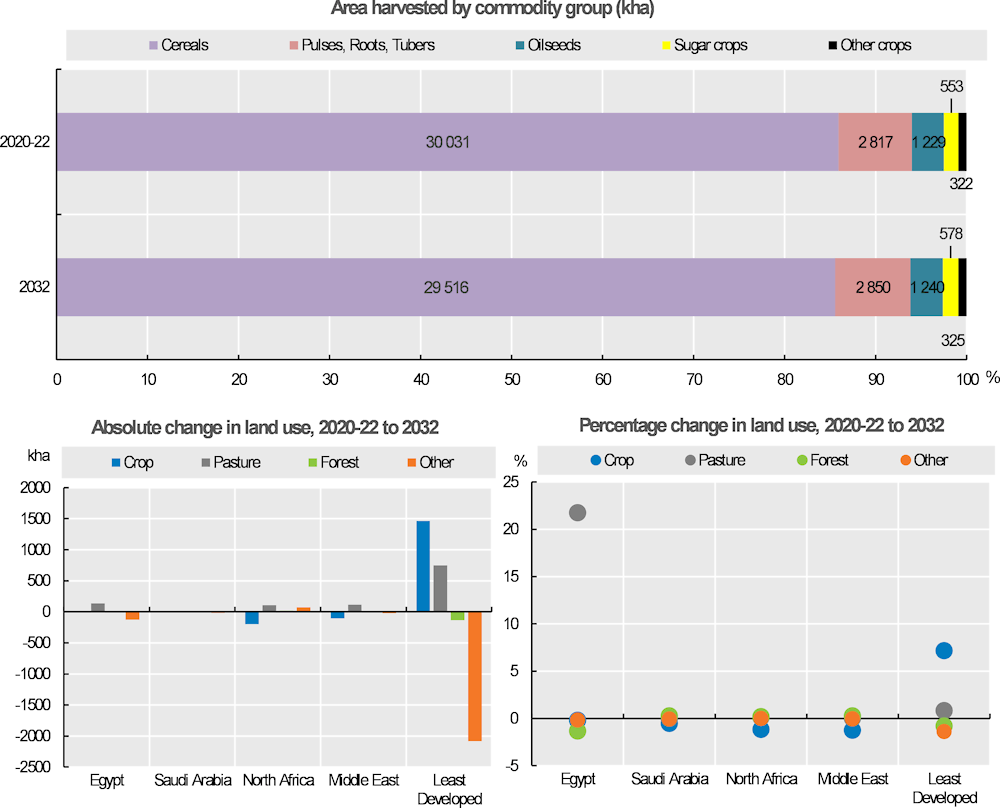

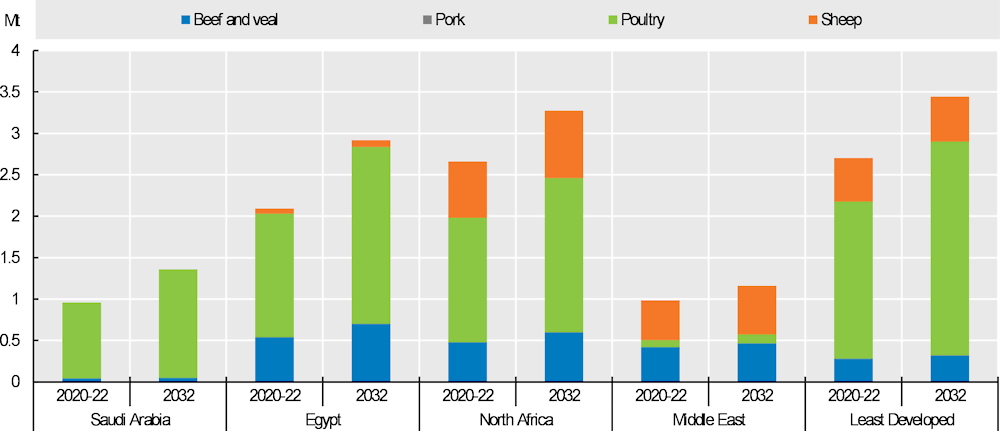

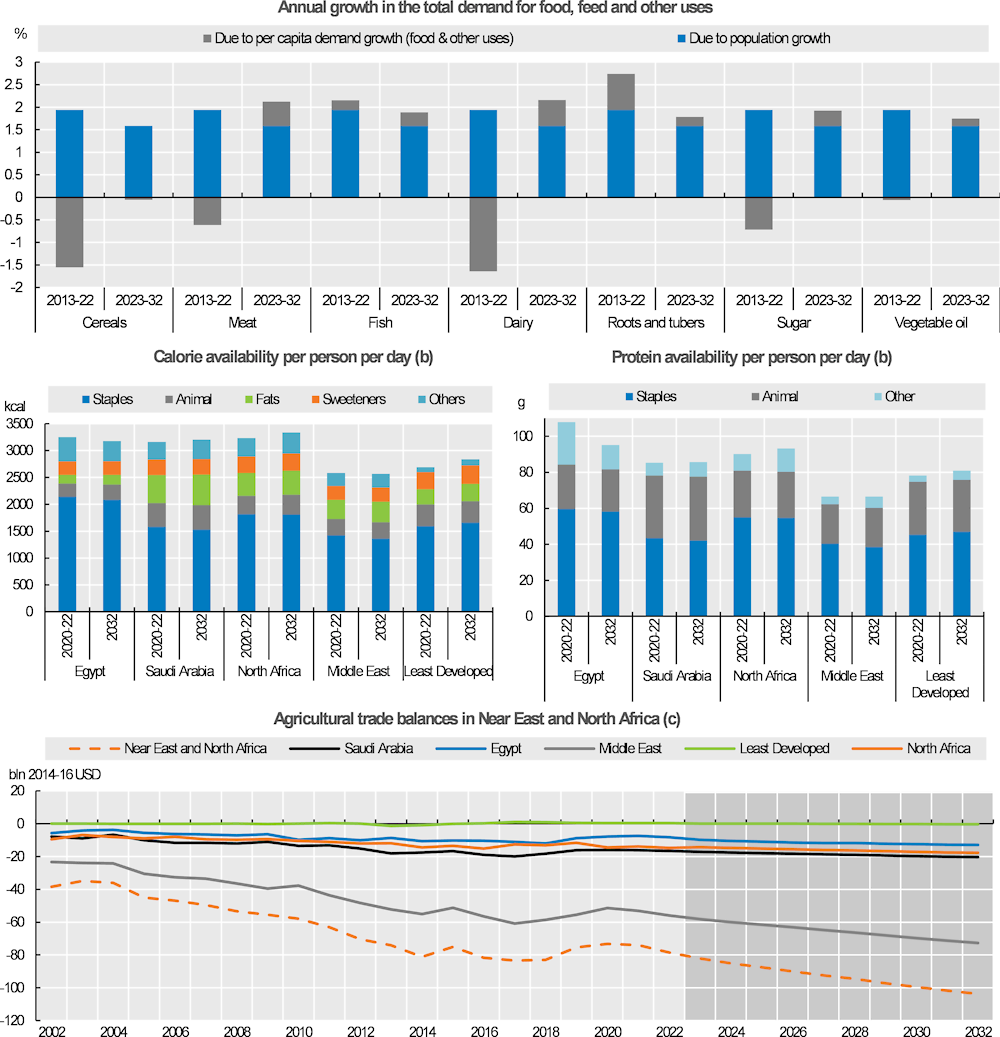

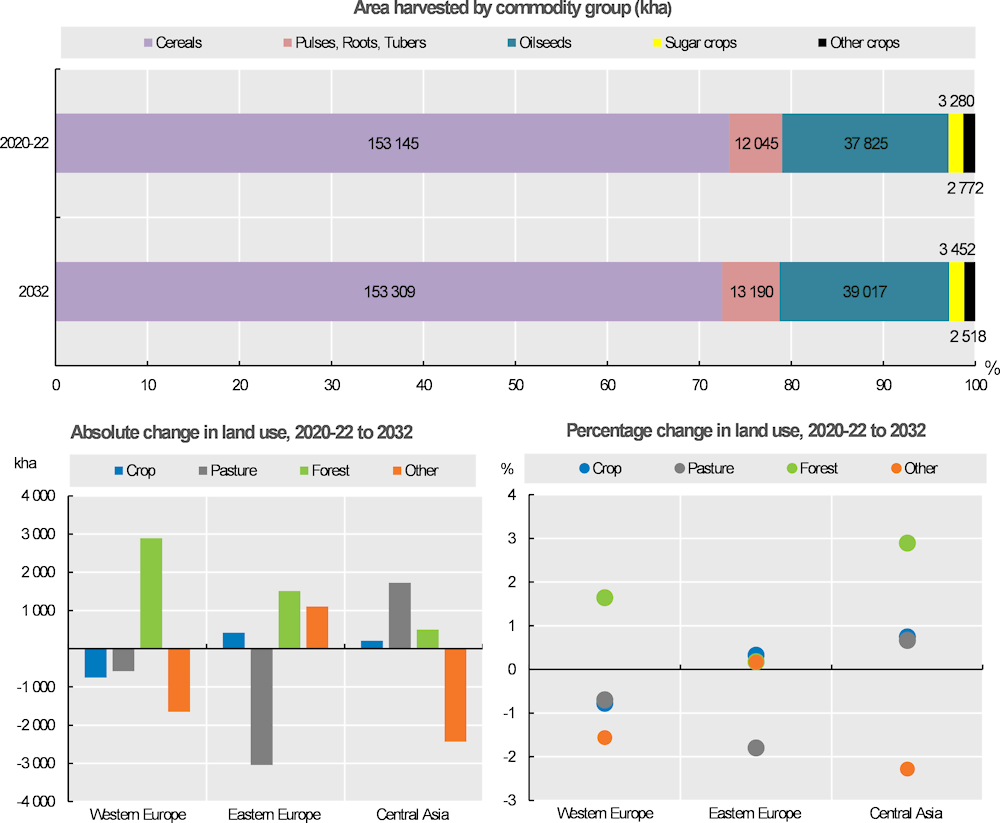

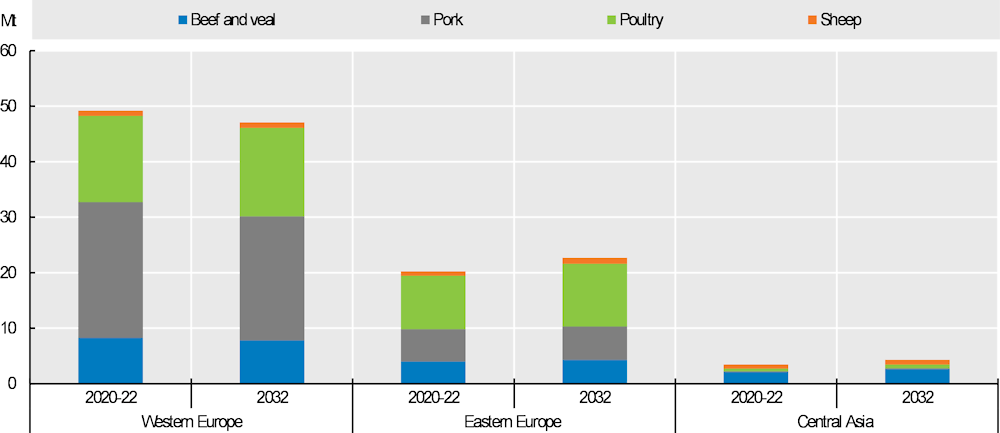

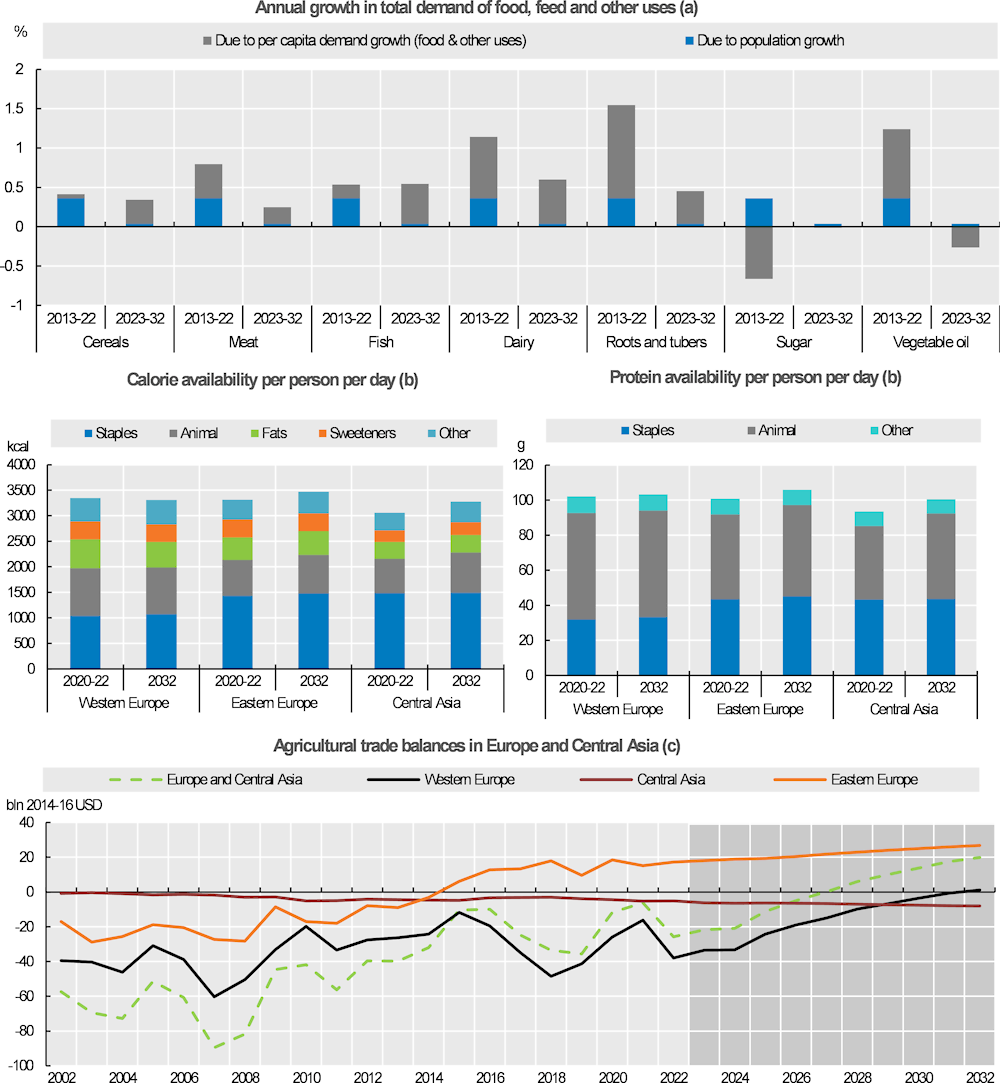

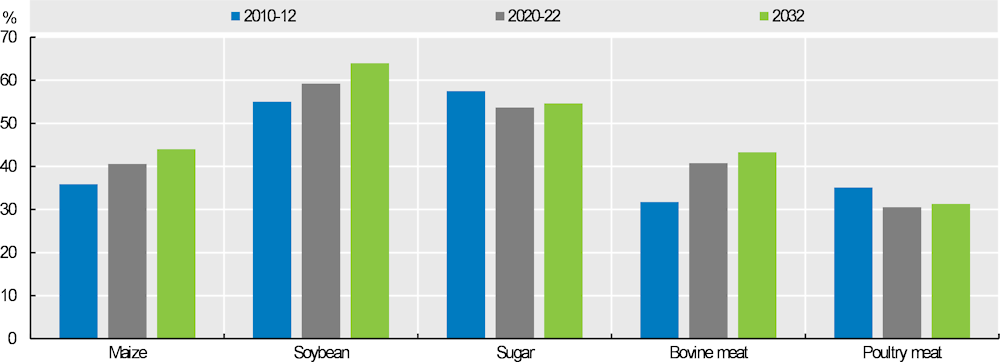

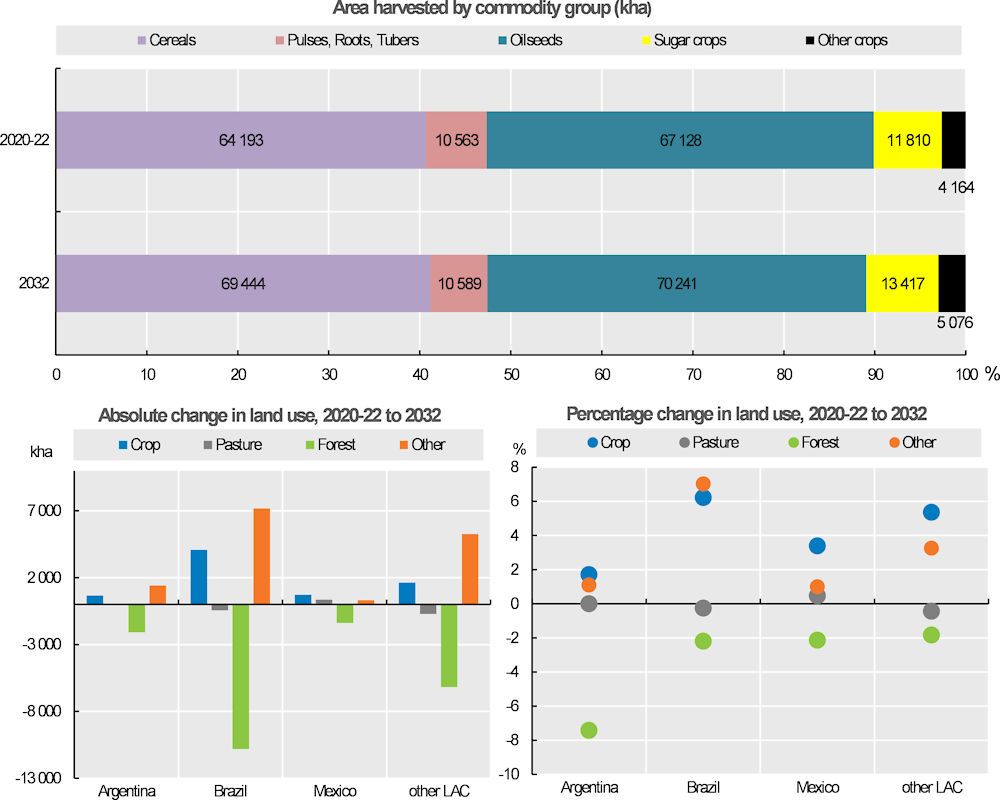

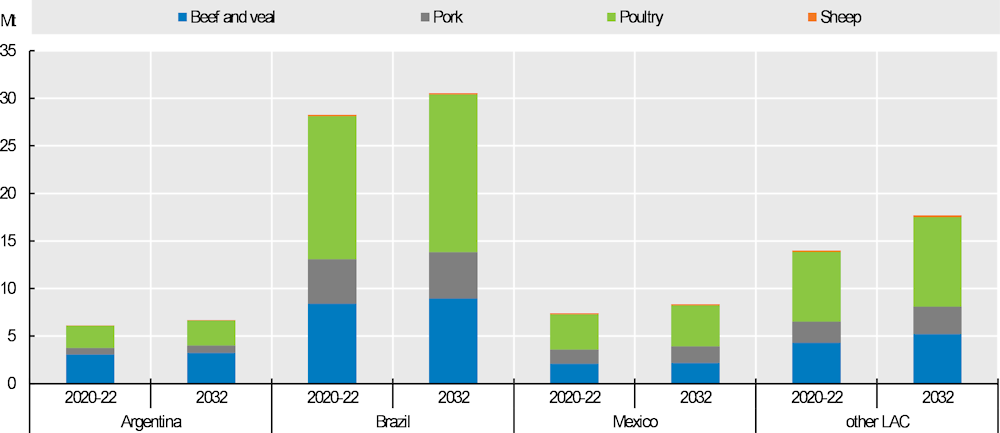

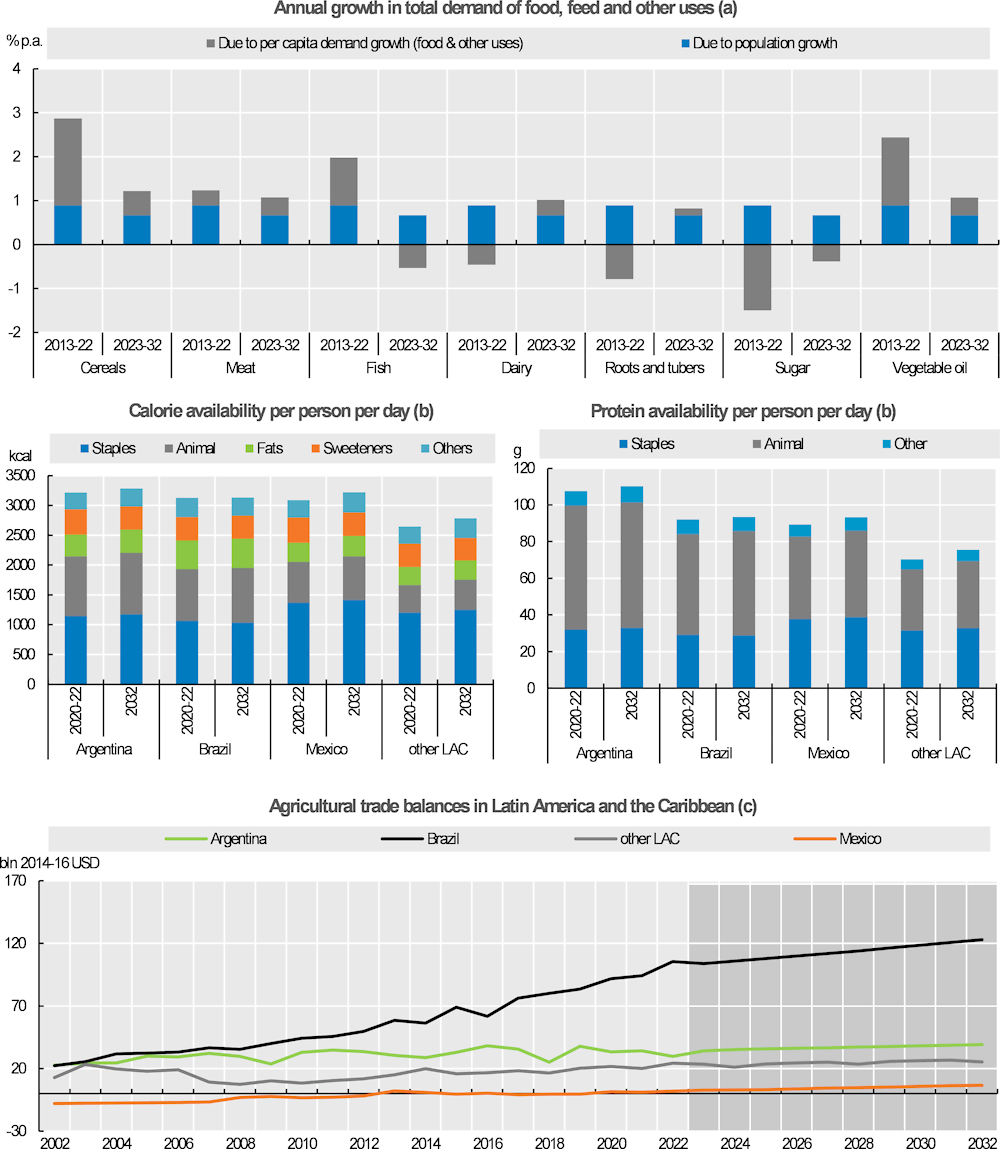

Increases of 124 kcal/day over the outlook period will enable average calorie availability in the region to exceed 2555 kcal/capita per day by 2032. Adjusting for estimated household food waste, however, reduces the total intake to 2450 kcal/capita per day. Regardless of adjustments for household waste, total calorie availability in the region is 17% below the global average and still anticipated to be the lowest in the world by 2032.